On the Moderating Effects of Country Governance on the Relationships between Corporate Governance and Firm Performance

Abstract

1. Introduction

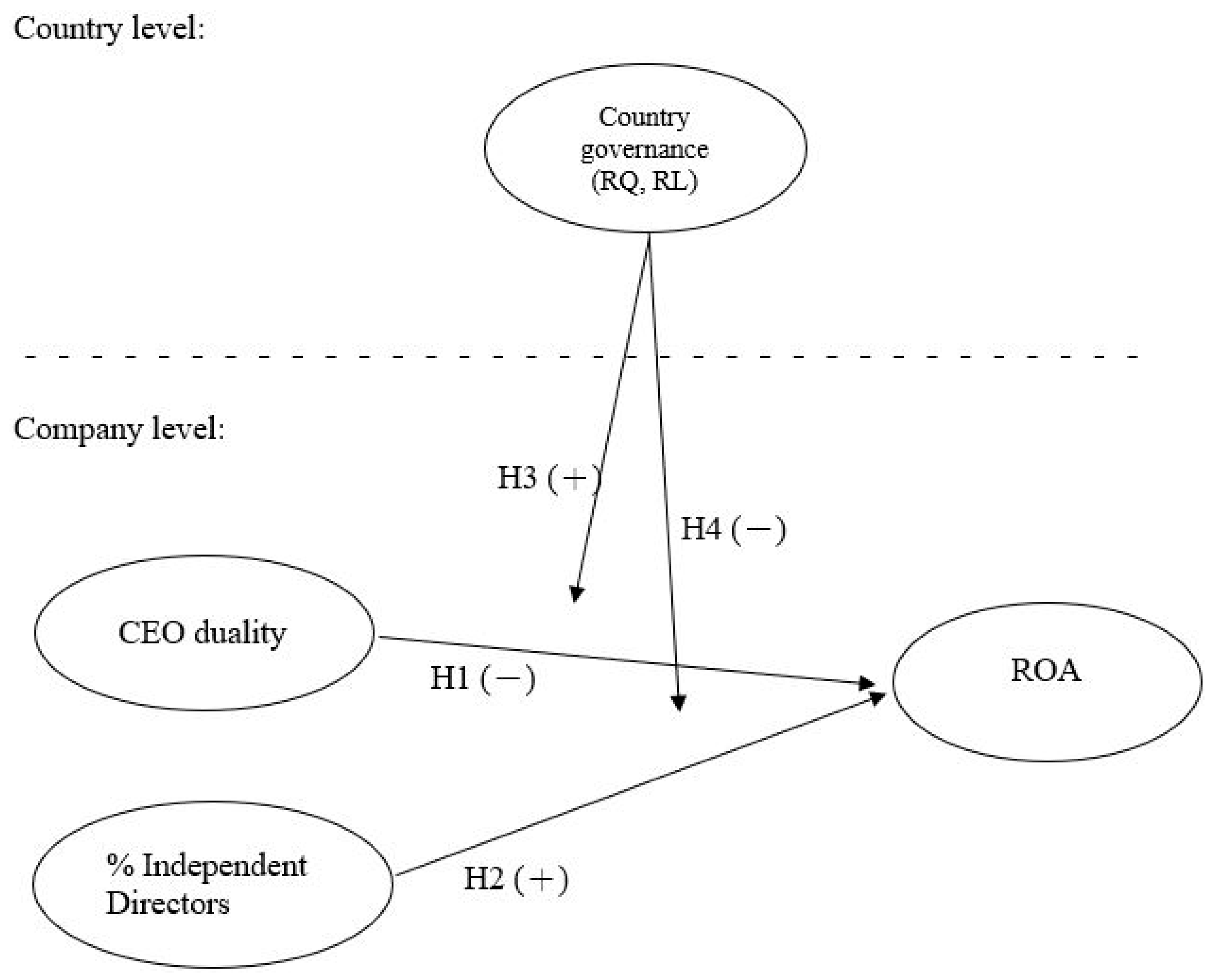

2. Hypothesis Development

2.1. Board Independence and Firm Performance

2.2. Country Governance, Corporate Governance, and Firm Performance

3. Methods

3.1. Measures and Data

3.2. Multi-Level Modeling

4. Results

4.1. Hypotheses Tests

4.2. Robustness Check

5. Discussion and Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Arora, Akshita, and Chandan Sharma. 2016. Corporate governance and firm performance in developing countries: Evidence from India. Corporate Governance 16: 420–36. [Google Scholar] [CrossRef]

- Barros, Carlos P., Sabri Boubaker, and Amal Hamrouni. 2013. Corporate governance and voluntary disclosure in France. Journal of Applied Business Research 29: 561–77. [Google Scholar] [CrossRef]

- Baysinger, Barry D., and Henry N. Butler. 1985. Corporate governance and board of directors: Performance effects of changes in board composition. Journal of Law Economics and Organization 1: 101–24. [Google Scholar]

- Belkhir, Mohamed, Boubaker Sabri, and Derouiche Imen. 2014. Control–ownership wedge, board of directors, and the value of excess cash. Economic Modelling 39: 110–22. [Google Scholar] [CrossRef]

- Beltratti, Andrea, and Rene M. Stulz. 2012. The credit crisis around the globe: Why did some banks perform better? Journal of Financial Economics 105: 1–17. [Google Scholar] [CrossRef]

- Berg, Sanford, and Stanley K. Smith. 1978. CEO and board chairman: A quantitative study of dual vs. unitary board leadership. Directors and Boards 3: 34–39. [Google Scholar]

- Bhagat, Sanjai, and Brian Bolton. 2008. Corporate governance and firm performance. Journal of Corporation Finance 14: 257–73. [Google Scholar] [CrossRef]

- Bhagat, Sanjai, and Brian Bolton. 2013. Director ownership, governance, and performance. Journal of Financial and Quantitative Analysis 48: 105–35. [Google Scholar] [CrossRef]

- Black, Bernard S., Jang Hasung, and Woochan Kim. 2006. Predicting firms’ corporate governance choices: Evidence from Korea. Journal of Corporate Finance 12: 660–91. [Google Scholar] [CrossRef]

- Bonn, Ingrid. 2004. Board structure and firm performance: Evidence from Australia. Journal of Management & Organization 10: 14–24. [Google Scholar]

- Boubaker, Sabri, Dang Rey, and Nguyen Duc Khuong. 2014. Does board gender diversity improve the performance of French listed firms? Gestion 2000 31: 259–69. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Dang Rey, and Nguyen Duc Khuong. 2015. Does the board of directors affect cash holdings? A study of French listed firms. Journal of Management & Governance 19: 341–70. [Google Scholar]

- Brickley, James A., Jeffrey L. Coles, and Gregg Jarrell. 1997. Leadership structure: Separating the CEO and chairman of the board. Journal of Corporate Finance 3: 189–220. [Google Scholar] [CrossRef]

- Bruno, Valentina, and Stijn Claessens. 2010. Corporate governance and regulation: Can there be too much of a good thing? Journal of Financial Intermediation 19: 461–82. [Google Scholar] [CrossRef]

- Calomiris, Charles W., and Mark Carlson. 2016. Corporate governance and risk management at unprotected banks: National banks in the 1890s. Journal of Financial Economics 119: 512–32. [Google Scholar] [CrossRef]

- Champoux, Jciseph E. 1978. Perceptions of work and nonwork: A reexamination of the compensatory and spillover models. Work and Occupations 5: 402–22. [Google Scholar] [CrossRef]

- Choi, Jongmoo Jay, Sae Woon Park, and Sean Sehyun Yoo. 2007. The value of outside directors: Evidence from corporate governance reform in Korea. Journal of Financial and Quantitative Analysis 42: 941–62. [Google Scholar] [CrossRef]

- Clacher, Iain, Elirehema Joshua Doriye, and David Hillier. 2008. Does Corporate Governance Matter? New Evidence from the United Kingdom. Available online: http://dx.doi.org/10.2139/ssrn.1293188 (accessed on 17 May 2019).

- Claessens, Stijn, and B. Burcin Yurtoglu. 2013. Corporate governance in emerging markets: A survey. Emerging Markets Review 15: 1–33. [Google Scholar] [CrossRef]

- Crifo, Patricia, Vanina D. Forget, and Sabrina Teyssier. 2015. The Price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. Journal of Corporate Finance 30: 168–94. [Google Scholar] [CrossRef]

- Dayton, Kenneth N. 1984. Corporate Governance: The Other Side of the Coin. Harvard Business Review 62: 34–37. [Google Scholar]

- Dey, Aiyesha. 2008. Corporate governance and agency conflicts. Journal of Accounting Research 46: 1143–81. [Google Scholar] [CrossRef]

- Dogan, Mesut, Bilge Leyli Elitas, Veysel Agca, and Serdar Ögel. 2013. The impact of CEO duality on firm performance: Evidence from Turkey. International Journal of Business and Social Science 4: 149–55. [Google Scholar]

- Doidge, Craig, G. Andrew Karolyi, and René M. Stulz. 2007. Why do countries matter so much for corporate governance? Journal of Financial Economics 86: 1–39. [Google Scholar] [CrossRef]

- Donnelly, Ray, and Mark Mulcahy. 2008. Board structure, ownership, and voluntary disclosure in Ireland. Corporate Governance an International Review 16: 416–29. [Google Scholar] [CrossRef]

- Durnev, Art, and E. Han Kim. 2005. To steal or not to steal: Firm attributes, legal environment, and valuation. Journal of Finance 60: 1461–93. [Google Scholar] [CrossRef]

- Duru, Augustine, Raghavan J. Iyengar, and Ernest M. Zampelli. 2016. The dynamic relationship between CEO duality and firm performance: The moderating role of board independence. Journal of Business Research 69: 4269–77. [Google Scholar] [CrossRef]

- Erondu, Emmanuel A., Alex Sharland, and John O. Okpara. 2004. Corporate ethics in Nigeria: A test of the concept of an ethical climate. Journal of Business Ethics 51: 349–57. [Google Scholar] [CrossRef]

- Essen, Marc van, Peter-Jan Engelen, and Michael Carney. 2013. Does “Good” corporate governance help in a crisis? The impact of country- and firm-level governance mechanisms in the European financial crisis. Corporate Governance: An International Review 21: 201–24. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1980. Agency problems and the theory of the firm. Journal of Political Economy 88: 288–307. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Michael C. Jensen. 1983. Separation of ownership and control. Journal of Law and Economics 26: 301–25. [Google Scholar] [CrossRef]

- Ferris, Stephen P., and Xuemin Yan. 2007. Do independent directors and chairmen matter? The role of boards of directors in mutual fund governance. Journal of Corporate Finance 13: 392–420. [Google Scholar] [CrossRef]

- Forker, John J. 2012. Corporate governance and disclosure quality. University of Bristol Accounting and Business Research 22: 111–24. [Google Scholar] [CrossRef]

- García-Meca, Emma, Isabel-María García-Sánchez, and Jennifer Martínez-Ferrero. 2015. Board diversity and its effects on bank performance: An international analysis. Journal of Banking & Finance 53: 202–14. [Google Scholar]

- Gorton, Gary, and Richard Rosen. 1995. Corporate control, portfolio choice, and the decline of banking. Journal of Finance 50: 1377–420. [Google Scholar] [CrossRef]

- Hallock, Kevin F. 1997. Reciprocally interlocking boards of directors and executive compensation. Journal of Financial and Quantitative Analysis 32: 331–44. [Google Scholar] [CrossRef]

- Harford, Jarrad, Sattar A. Mansi, and William F. Maxwell. 2012. Corporate governance and firm cash holdings in the U.S. Journal of Financial Economics 87: 535–55. [Google Scholar] [CrossRef]

- Harris, Dawn, and Constance E. Helfat. 1998. CEO duality, succession, capabilities and agency theory: Commentary and research agenda. Strategic Management Journal 19: 901–4. [Google Scholar] [CrossRef]

- Hermalin, Benjamin E., and Michael S. Weisbach. 1998. Endogenously chosen boards of directors and their monitoring of the CEO. American Economic Review 88: 96–118. [Google Scholar]

- Hermalin, Benjamin E., and Michael S. Weisbach. 2003. Boards of directors as an endogenously determined institution: A survey of the economic evidence. Economic Policy Review 9: 7–26. [Google Scholar]

- Hossain, Mahmud, Steven F. Cahan, and Michael B. Adams. 2020. The Investment opportunity set and the voluntary use of outside directors: New Zealand evidence. Accounting and Business Research 30: 263–73. [Google Scholar] [CrossRef]

- Huang, Chi-Jui. 2010. Corporate governance, corporate social responsibility and corporate performance. Journal of Management & Organization 16: 641–55. [Google Scholar]

- Hutchinson, Marion. 2002. An analysis of the association between firms’ investment opportunities, board composition and firm performance. Asia-Pacific Journal of Accounting & Economics 9: 17–38. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Johnson, Jonathan L., Catherine M. Daily, and Alan E. Ellstrand. 1996. Boards of directors: A review and research agenda. Journal of Management 22: 409–38. [Google Scholar] [CrossRef]

- Joseph, John, William Ocasio, and Mary-Hunter McDonnell. 2014. The structural elaboration of board independence: Executive power, institutional logics, and the adoption of CEO-only board structures in U.S. corporate governance. Academy of Management Journal 57: 1834–58. [Google Scholar] [CrossRef]

- Kallamu, Basiru Salisu. 2016. Ownership Structure, Independent directors and firm performance. Journal of Social and Administrative Sciences 3: 17–30. [Google Scholar] [CrossRef]

- Kasipillai, Jeyapalan, and Sakthi Mahenthiran. 2013. Deferred taxes, earnings management, and corporate governance: Malaysian evidence. Journal of Contemporary Accounting & Economics 9: 1–18. [Google Scholar]

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2009. Governance Matters VII: Aggregate and Individual Governance Indicators for 1996–2007. Washington, DC: World Bank. [Google Scholar]

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2010. The Worldwide Governance Indicators: A Summary of Methodology, Data and Analytical Issues. Washington, DC: World Bank. [Google Scholar]

- Koji, Kojima, Bishnu Kumar Adhikary, and Le Tram. 2020. Corporate governance and firm performance: A comparative analysis between listed family and non-family firms in Japan. Journal of Risk and Financial Management 13: 215. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, Andrei Shleifer, and Robert W. Vishny. 1998. Law and finance. Journal of Political Economy 106: 1113–55. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, Andrei Shleifer, and Robert W. Vishny. 2000. Investor protection and corporate governance. Journal of Financial Economics 58: 3–27. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, Andrei Shleifer, and Robert W. Vishny. 2002. Investor protection and corporate valuation. Journal of Finance 57: 1147–70. [Google Scholar] [CrossRef]

- Lemmon, Michael L, and Karl V. Lins. 2003. Ownership structure, corporate governance, and firm value: Evidence from the East Asian financial crisis. Journal of Finance 58: 1445–68. [Google Scholar] [CrossRef]

- Levy, Leslie. 1981. Reforming Board Reform. Harvard Business Review 59: 166–72. [Google Scholar]

- Littell, Ramon C., George A. Milliken, Walter W. Stroup, Russell D. Wolfinger, and Oliver Schabenberger O. 2006. SAS for Mixed Models, 2nd ed. Cary: SAS Institute. [Google Scholar]

- Liu, Yu, Wei Zuobao, and Xie Feixue. 2014. Do women directors improve firm performance in China? Journal of Corporate Finance 28: 169–84. [Google Scholar] [CrossRef]

- Luan, Chin-Jung, and Ming-Je Tang. 2007. Where is independent director efficacy? Corporate Governance: An International Review 15: 636–43. [Google Scholar] [CrossRef]

- Lukas, Stephanie, and B. Basuki. 2015. The implementation of good corporate governance and its impact on the financial performance of banking industry listed in IDX. The International Journal of Accounting and Business Society 23: 48–72. [Google Scholar]

- Masulis, Ronald W., and Shawn Mobbs. 2014. Independent director incentives: Where do talented directors spend their limited time and energy? Journal of Financial Economics 111: 406–29. [Google Scholar] [CrossRef]

- Mitton, Todd. 2002. A cross-firm analysis of the impact of corporate governance on the east Asian financial crisis. Journal of Financial Economics 64: 215–42. [Google Scholar] [CrossRef]

- Morey, Matthew, Aron Gottesman, Edward Baker, and Ben Godridge. 2009. Does better corporate governance result in higher valuations in emerging markets? Another examination using a new data set. Journal of Banking & Finance 33: 254–62. [Google Scholar]

- Mubeen, Riaqa, Dongping Han, Jaffar Abbas, and Iftikhar Hussain. 2020. The effects of market competition, capital structure, and ceo duality on firm performance: A mediation analysis by incorporating the GMM model technique. Sustainability 12: 3480. [Google Scholar] [CrossRef]

- Mukaddam, Shaa’ista, and Sibindi Athenia. 2020. Corporate governance quality and financial performance of retail firms: Evidence using South African data. Academy of Accounting and Financial Studies Journal 24: 1–15. [Google Scholar]

- Ngobo, Paul Valentin, and Maurice Fouda. 2012. Is ‘Good’ governance good for business? A cross-national analysis of firms in African countries. Journal of World Business 47: 435–49. [Google Scholar] [CrossRef]

- Peng, Mike W. 2004. Outside directors and firm performance during institutional transitions. Strategic Management Journal 25: 453–71. [Google Scholar] [CrossRef]

- Peugh, James, and Ronald H. Heck. 2017. Conducting three-level longitudinal analyses. Journal of Early Adolescence 37: 7–58. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1997. A survey of corporate governance. Journal of Finance 52: 737–83. [Google Scholar] [CrossRef]

- Singer, Judith D. 1998. Using SAS PROC MIXED to fit multilevel models, hierarchical models, and individual growth models. Journal of Educational and Behavioral Statistics 24: 323–55. [Google Scholar] [CrossRef]

- Singh, Satwinder, Naeem Tabassum, Tamer K. Darwish, and Georgios Batsakis. 2018. Corporate governance and Tobin’s Q as a measure of organizational performance. British Journal of Management 29: 171–90. [Google Scholar] [CrossRef]

- Staines, Graham L. 1980. Spillover versus compensation: A review of the literature on the relationship between work and nonwork. Human Relations 33: 111–29. [Google Scholar] [CrossRef]

- Sun, Sunny Li, Mike W. Peng, Ruby P. Lee, and Weiqiang Tan. 2015. Institutional open access at home and outward internationalization. Journal of World Business 50: 234–46. [Google Scholar] [CrossRef]

- Tang, Jianyun. 2017. CEO duality and firm performance: The moderating roles of other executives and blockholding outside directors. European Management Journal 35: 362–72. [Google Scholar] [CrossRef]

- Vafeas, Nikos, and Elena Theodorou. 1998. The relationship between board structure and firm performance in the UK. The British Accounting Review 30: 383–407. [Google Scholar] [CrossRef]

- Valukas, Anton R. 2010. Report of Anton R. Valukas in the Lehman Brothers Holdings Inc., et al., Debtors; Chapter 11 Case No. 08-13555 (JMP). New York: United States Bankruptcy Court, Southern District of New York.

- Westhead, Paul, and Carole Howorth. 2006. Ownership and management issues associated with family firm performance and company objectives. Family Business Review 19: 301–16. [Google Scholar] [CrossRef]

- Yermack, David. 1996. Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40: 185–211. [Google Scholar] [CrossRef]

- Zagorchev, Andrey, and Lei Gao. 2015. Corporate governance and performance of financial institutions. Journal of Economics and Business 82: 17–41. [Google Scholar] [CrossRef]

| Variable | Source of Data | Definition |

|---|---|---|

| Country Governance | ||

| Regulatory quality (RQ) | Kaufmann et al. (2010) | Measures ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development |

| Rule of Law (RL) | Durnev and Kim (2005) | Measures the extent to which “legal” is the product of anti-director and rule of law, although our measure is constructed using the updated version of anti-rights |

| Corporate governance | ||

| CEO duality (CEOD) | Bloomberg | The Chairman of the Board of Directors of the same firm |

| Percentage of independent directors (PID) | Bloomberg | Percentage of independent directors to the number of board directors |

| Firm Performance | ||

| ROA | Bloomberg | Return on assets, the net income after tax as a percentage of the average book value of total assets |

| Firm Size | ||

| ASSET (USD million) | Bloomberg | Logarithm of total assets |

| Sales Growth | ||

| SG | Bloomberg | One-year growth of sales |

| Country | Frequency | Country | Frequency |

|---|---|---|---|

| Argentina | 1 | Macau | 1 |

| Australia | 12 | Malaysia | 3 |

| Austria | 2 | Mexico | 4 |

| Belgium | 3 | Netherlands | 13 |

| Bermuda | 1 | Norway | 3 |

| Brazil | 11 | Peru | 2 |

| Canada | 32 | Philippines | 2 |

| China | 87 | Qatar | 2 |

| Colombia | 1 | Russia | 9 |

| Denmark | 4 | Saudi Arabia | 6 |

| Finland | 5 | Singapore | 5 |

| France | 31 | South Africa | 4 |

| Germany | 25 | South Korea | 10 |

| Hong Kong | 22 | Spain | 7 |

| India | 25 | Sweden | 13 |

| Indonesia | 6 | Switzerland | 24 |

| Ireland | 6 | Taiwan | 9 |

| Israel | 1 | Thailand | 5 |

| Italy | 7 | United Arab Emirates | 3 |

| Japan | 68 | United Kingdom | 37 |

| Kuwait | 1 | United States | 316 |

| Vietnam | 1 |

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Intercept | 6.6145 *** | 6.2525 *** | 6.3168 *** |

| CTA | −0.4274 * | –0.4342 * | –0.4353 * |

| CSG | 0.0018 *** | 0.0018 *** | 0.0018 *** |

| CTime | 0.1328 *** | 0.1192 *** | 0.1286 *** |

| CCEOD | −0.0186 *** | –0.0201 *** | –0.0200 *** |

| CPID | 0.0224 ** | 0.0270 ** | 0.0297 ** |

| CRQ | 0. 8037 ** | ||

| CCEOD × CRQ | 0.0046 * | ||

| CPID × CRQ | –0.0192 * | ||

| CRL | 0.6581 * | ||

| CCEOD × CRL | 0.0029 + | ||

| CPID × CRL | –0.0186 * | ||

| Variance estimate | |||

| 1.0376 | 0.168 | 0.442 | |

| 28.0174 *** | 28.446 *** | 28.342 *** | |

| 24.9741 *** | 24.746 *** | 24.761 *** | |

| 0.540 *** | 0.540 *** | 0.541 *** | |

| Fit index | |||

| AIC | 48,246.1 | 48,251.6 | 48,255.3 |

| BIC | 48,253.1 | 48,258.7 | 48,262.3 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, C.-H. On the Moderating Effects of Country Governance on the Relationships between Corporate Governance and Firm Performance. J. Risk Financial Manag. 2021, 14, 140. https://doi.org/10.3390/jrfm14030140

Wu C-H. On the Moderating Effects of Country Governance on the Relationships between Corporate Governance and Firm Performance. Journal of Risk and Financial Management. 2021; 14(3):140. https://doi.org/10.3390/jrfm14030140

Chicago/Turabian StyleWu, Chiu-Hui. 2021. "On the Moderating Effects of Country Governance on the Relationships between Corporate Governance and Firm Performance" Journal of Risk and Financial Management 14, no. 3: 140. https://doi.org/10.3390/jrfm14030140

APA StyleWu, C.-H. (2021). On the Moderating Effects of Country Governance on the Relationships between Corporate Governance and Firm Performance. Journal of Risk and Financial Management, 14(3), 140. https://doi.org/10.3390/jrfm14030140