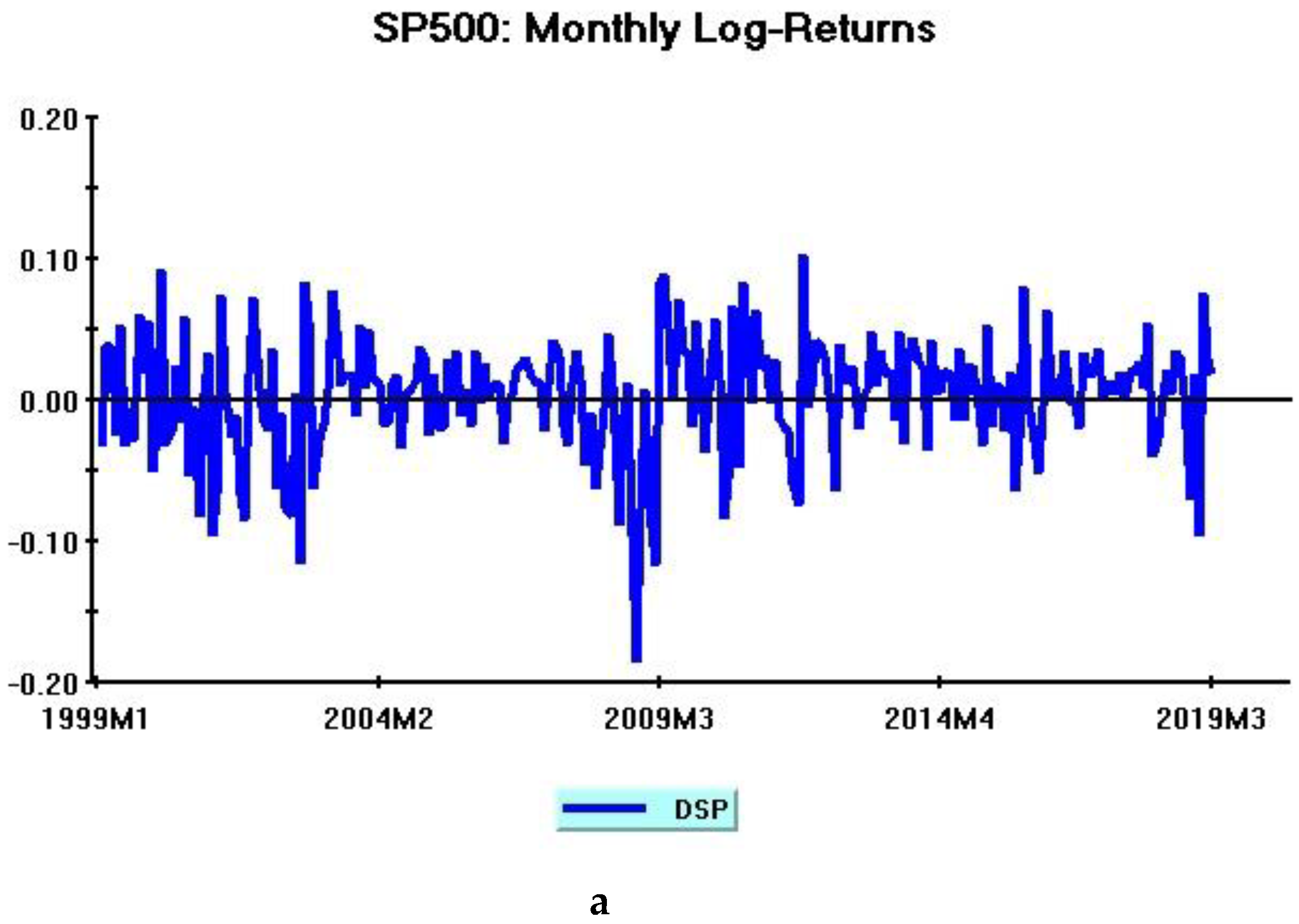

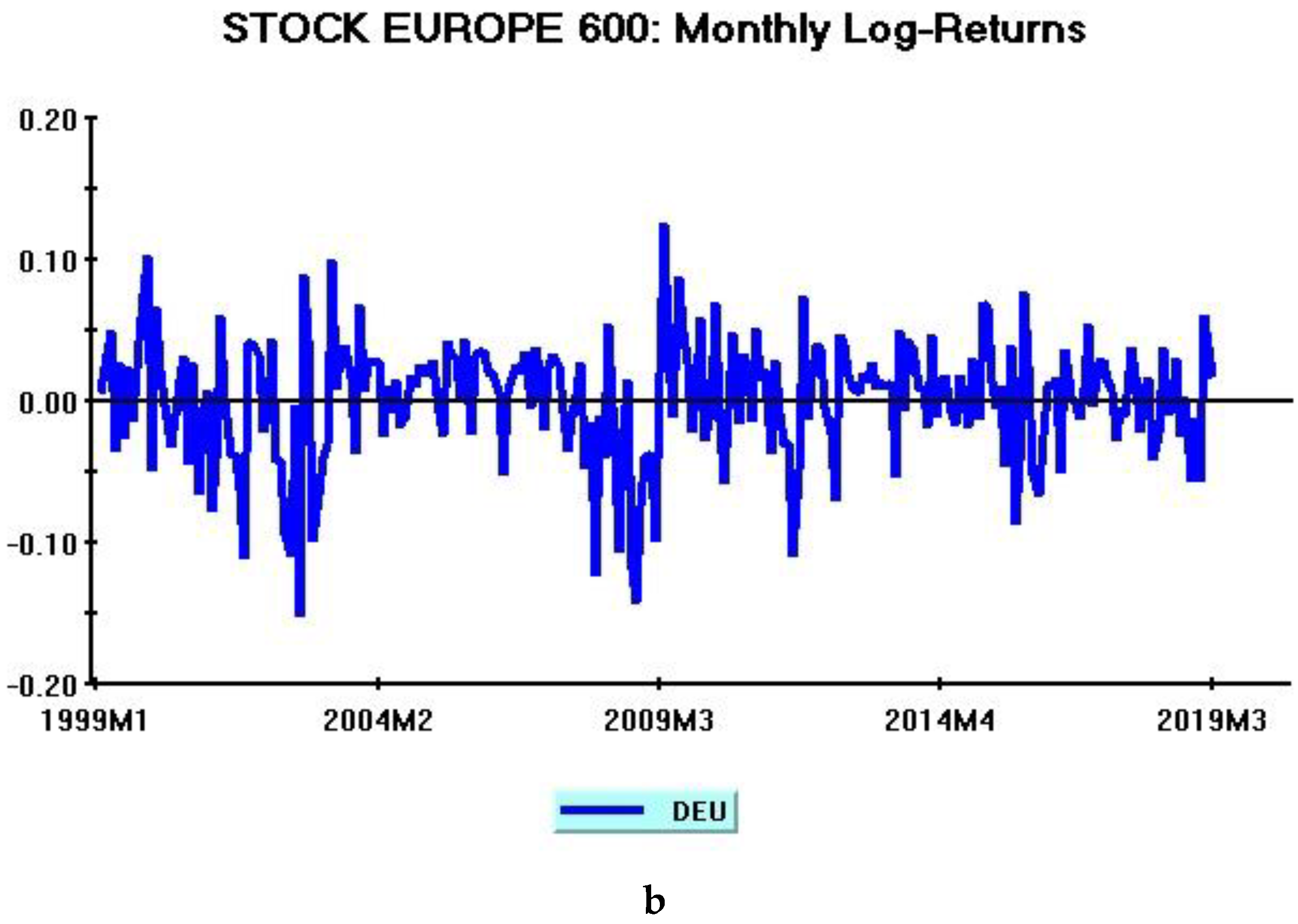

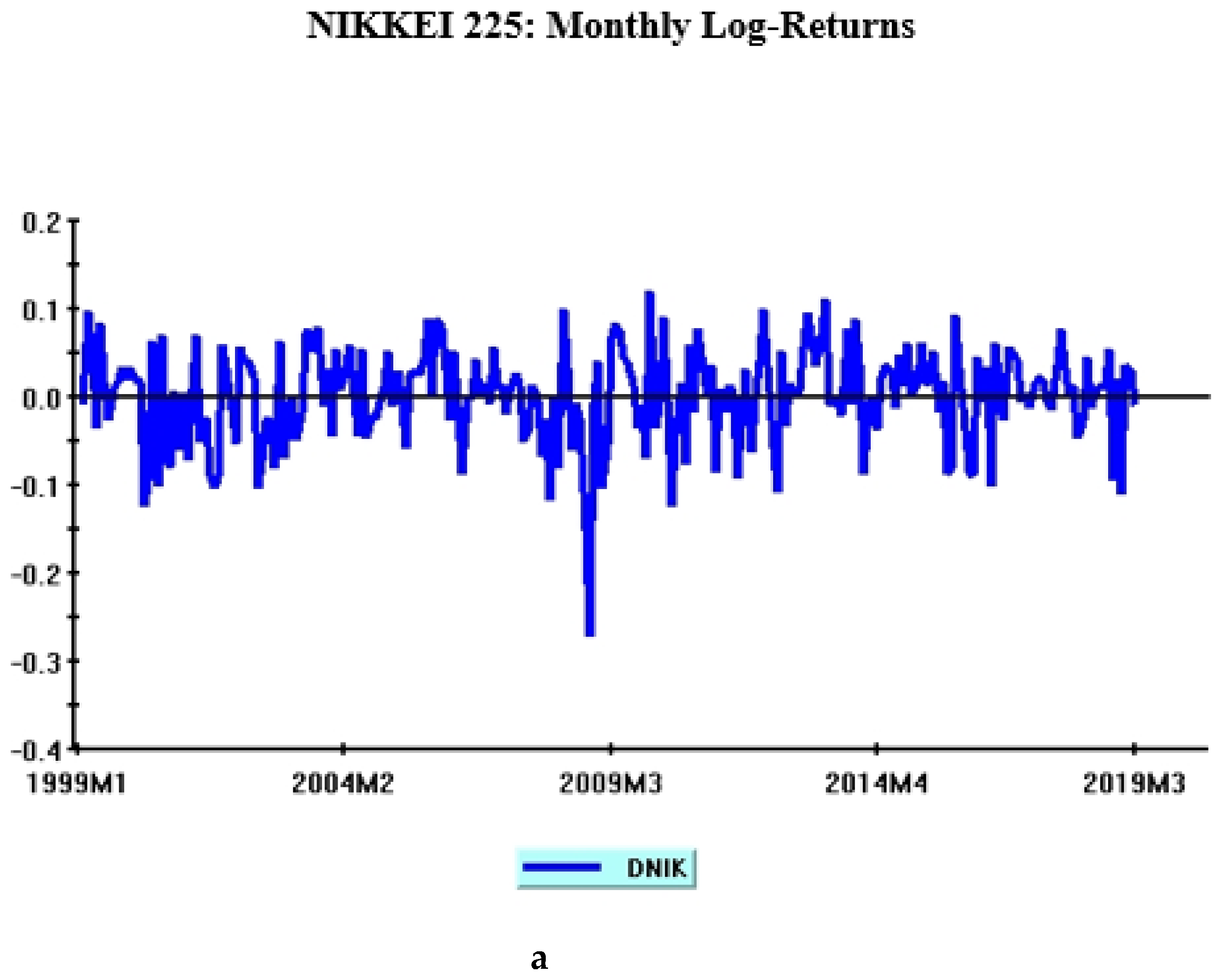

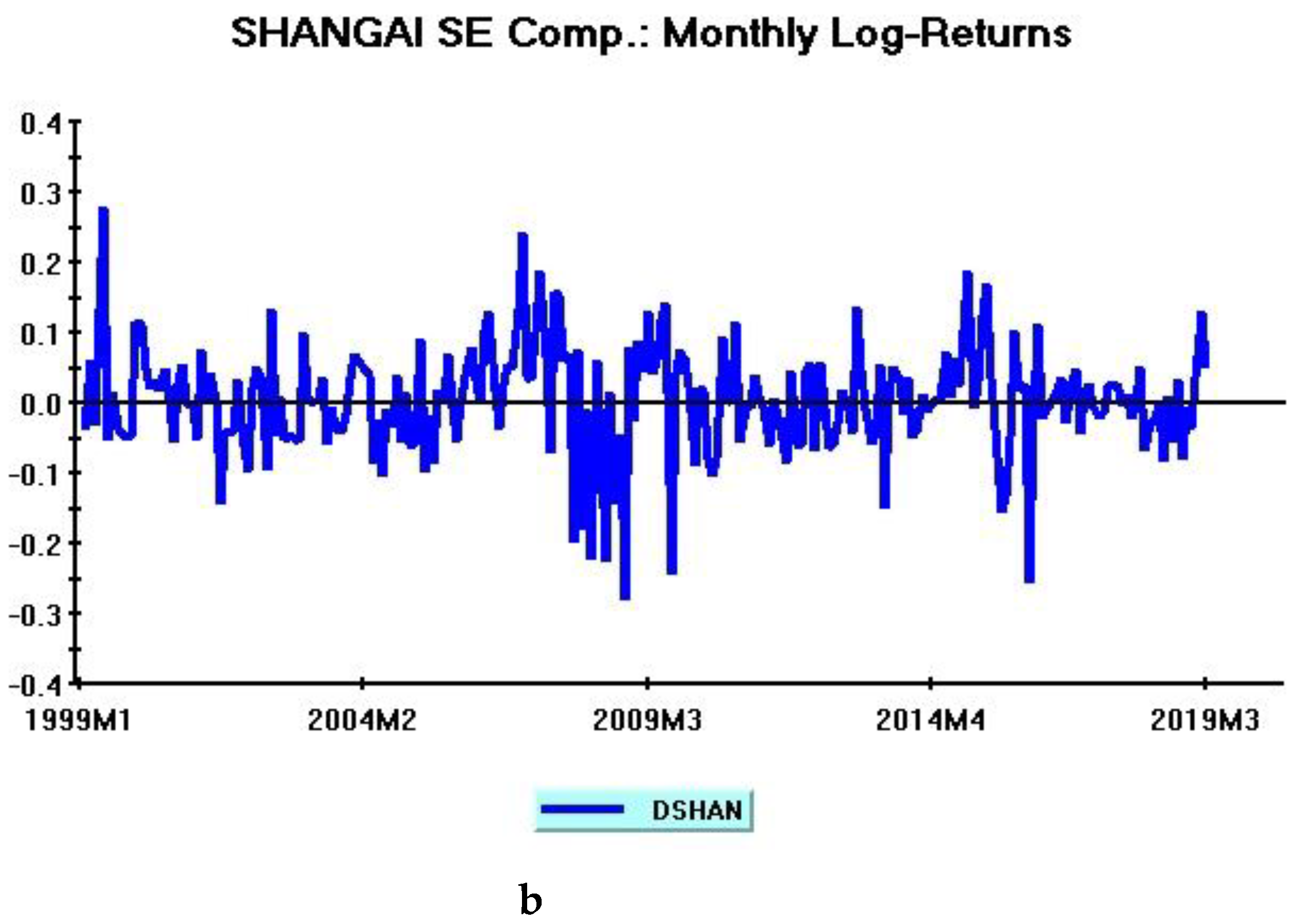

3.1. Dynamic Conditional Correlations and Financial Crises

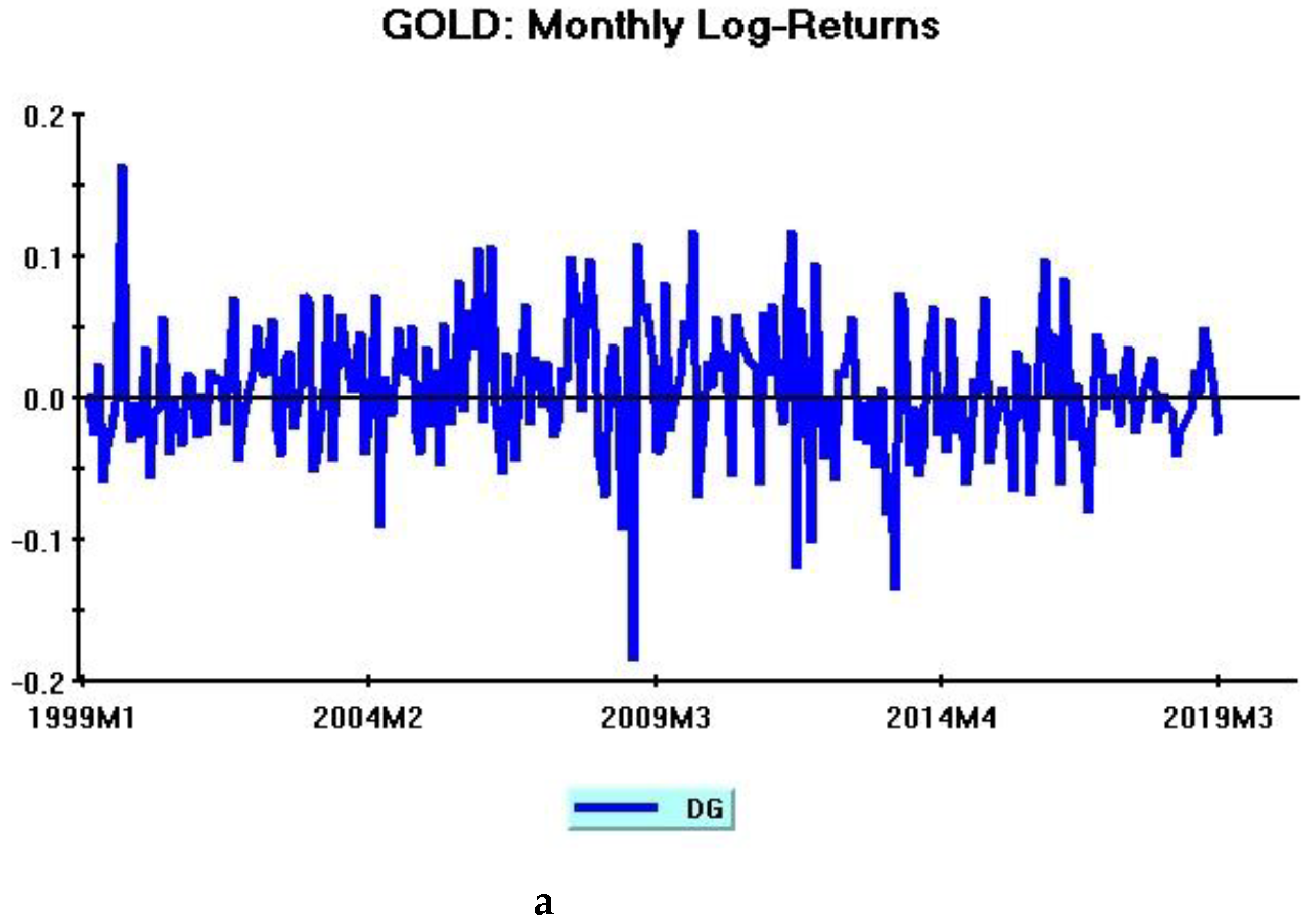

A first contribution of this paper is to provide a comprehensive analysis about the effects of financial crises on international stock returns correlations. Moreover, since the data set includes two “safe-haven” assets, this research is also informative about returns co-movements between “safe-haven” assets and stock market indexes. More specifically, it is interesting to assess if the above co-movements exhibit substantial differences during “tranquil” and “financial crisis” periods, a topic that has not yet been adequately explored in the existing literature.

Jones and O’Steen (

2018) apply a DCC–Garch model to multiple asset classes (including, among others, the SP500 stock market index, gold and oil spot prices) in order to evaluate Markovitz mean-variance portfolios and the effects of QE1 in the US. These authors conclude that oil and gold act as beneficial hedges to stocks and bonds during economic cycles. Their analysis, however, considers only one stock market index (SP500), does not explicitly discuss time-varying correlations between gold and stock returns, and omits all financial turmoil subsequent to the 2007–2008 Global financial crisis. Other recent contributions in this literature share analogous drawbacks as regards the limited number of crisis episodes and, more importantly, are exclusively focused on BRICS market indexes (

Chkili 2016;

Kang et al. 2016).

Intuitively, if gold and the Swiss Franc efficiently perform their hedging functions, I expect, during a financial crisis, either the persistence of almost zero correlations with traditional asset returns, or even a shift towards negative correlation values.

More formally, denoting with

ρi,j,t the time-varying returns correlation between asset (i) and asset (j) at time t, the following regression is estimated for each pairwise conditional correlation:

where 𝜛 and γ

k are parameters, Dum

k,t is a dummy variable referring to a specific financial crisis episode, and ε

i,j,t is a disturbance term. In line with the previous discussion, subscripts (i) and (j) refer to stock price indexes if the impact of financial crises on bilateral stock returns correlations is considered; alternatively, if the analysis focuses on co-movements between stocks and “safe-haven” assets, (i) refers either to gold or Swiss Franc returns and (j) to one of the four equity markets’ returns.

The selection of financial crisis episodes relies on

Tronzano (

2020), where I consider a similar time horizon with an exclusive focus on multiple “safe-haven” assets. This selection relies on references from the literature and the main events characterizing the beginning and end of these periods of financial turmoil.

The following crisis episodes may be identified during the last two decades: (1) Global financial crisis; (2) Eurozone debt crisis; (3) Russian financial crisis; (4) Chinese stock market crisis; (5) Turkish financial crisis.

Equation (4) includes, therefore, five dummy variables, taking values of 1 during each corresponding crisis period and 0 elsewhere.

The dummy variables included in Equation (4) are defined as follows:

Dum1: Global financial crisis (1 from 2007M8 to 2009M5; 0 elsewhere);

Dum2: Eurozone debt crisis (1 from 2010M1 to 2012M6; 0 elsewhere);

Dum3: Russian financial crisis (1 from 2014M12 to 2015M2; 0 elsewhere);

Dum4: Chinese stock market crisis (1 from 2015M6 to 2015M10; 0 elsewhere);

Dum5: Turkish financial crisis (1 from 2018M3 to 2018M8; 0 elsewhere).

The Global financial crisis and the Eurozone debt crisis attracted a major attention in the literature analysing asset returns co-movements, contagion effects and volatility spill-overs across financial markets. The former originated from the burst of the US real estate bubble, prompting dramatic financial effects worldwide and the worst global recession since the 1929/1930 Great Depression; the latter was a sovereign debt crisis, related to the inability of weakest EU members to refinance their public debts, and culminating in record levels of long-term interest rates spreads against Germany in 2010/2011.

Beyond these widely studied events, the second half of the last decade witnessed other important crisis episodes which severely affected international financial markets.

The Russian crisis, prompted by sharp oil price declines in the second half of 2014, was characterized by a huge Ruble devaluation, large foreign reserves declines and an all-time-low in the stock price index. The Chinese crisis, beginning with the burst of the domestic stock price bubble in June 2015, led to a one third fall of A-shares quoted on the Shanghai stock exchange within one month, followed by major aftershocks in summer. Overall, this stock market crash displays all key stages of market bubbles outlined in

Kindleberger (

1978) classical contribution. The Turkish crisis, finally, was a currency and balance of payments crisis caused by an excessive current account deficit and a large share of foreign currency denominated debt. These macroeconomic imbalances led to massive devaluation waves of the domestic currency, culminating in August 2018.

Before analysing the results, it is useful to briefly discuss the meaning of γk coefficients capturing the impact of crisis episodes.

Consider first the case of stock returns correlations. In this case, a positive and significant γ

k coefficient points out the existence of contagion effects on stock markets during a given crisis episode (k). The economic intuition is that, during particularly severe financial stress periods, stock markets are affected by “bad news”, leading to massive simultaneous sell-offs, concurrent equity returns drops, and consequent increases in returns correlations. This interpretation is related to

Forbes and Rigobon (

2002) definition of contagion and is commonly shared in the literature exploring the role of financial crises (see e.g.,

Syllignakis and Kouretas 2011;

Dua and Tuteja 2016). Drawing again on

Forbes and Rigobon (

2002) seminal contribution, an insignificant γ

k coefficient, associated with a positive and significant correlation during “tranquil” times, can be interpreted as stock markets “interdependence” (Note that, in the context of our econometric framework, the correlation coefficient among asset returns during “tranquil” periods is represented by the estimated constant term (𝜛) in Equation (4)). The last possibility is a negative and significant γ

k parameter which captures a falling correlation during a financial crisis. In line with the previous discussion, it is natural to interpret this case as a “flight-to-quality” episode (The existence of “flight-to-quality” episodes is quite rare in the applied literature analyzing stock returns correlations.

Dua and Tuteja (

2016) document some of these episodes during specific sub-periods relative to the Global financial crisis and the Eurozone debt crisis (see ib., § 5.3)).

Let us now turn to pairwise correlations involving “safe-haven” assets, and recall the standard definition of these assets as financial instruments providing portfolio protection in times of market stress. In this perspective, a not statistically significant γk parameter (hedging effect), or a negative and statistically significant γk parameter (“safe-haven” effect), point out that this asset effectively behaves as a defensive tool, improving the risk-return trade-off in times of financial stress through zero or increased de-correlation with more traditional financial instruments. Conversely, a positive and statistically significant γk estimate (i.e., a tendency towards increased co-movements with stock returns during turbulent periods) indicates that this asset does not perform a defensive role during a financial crisis.

All estimates are obtained applying the

Newey and West (

1987) consistent covariance matrix estimator, thus making parameters estimates robust to the existence of autocorrelation and heteroscedasticity in regression residuals.

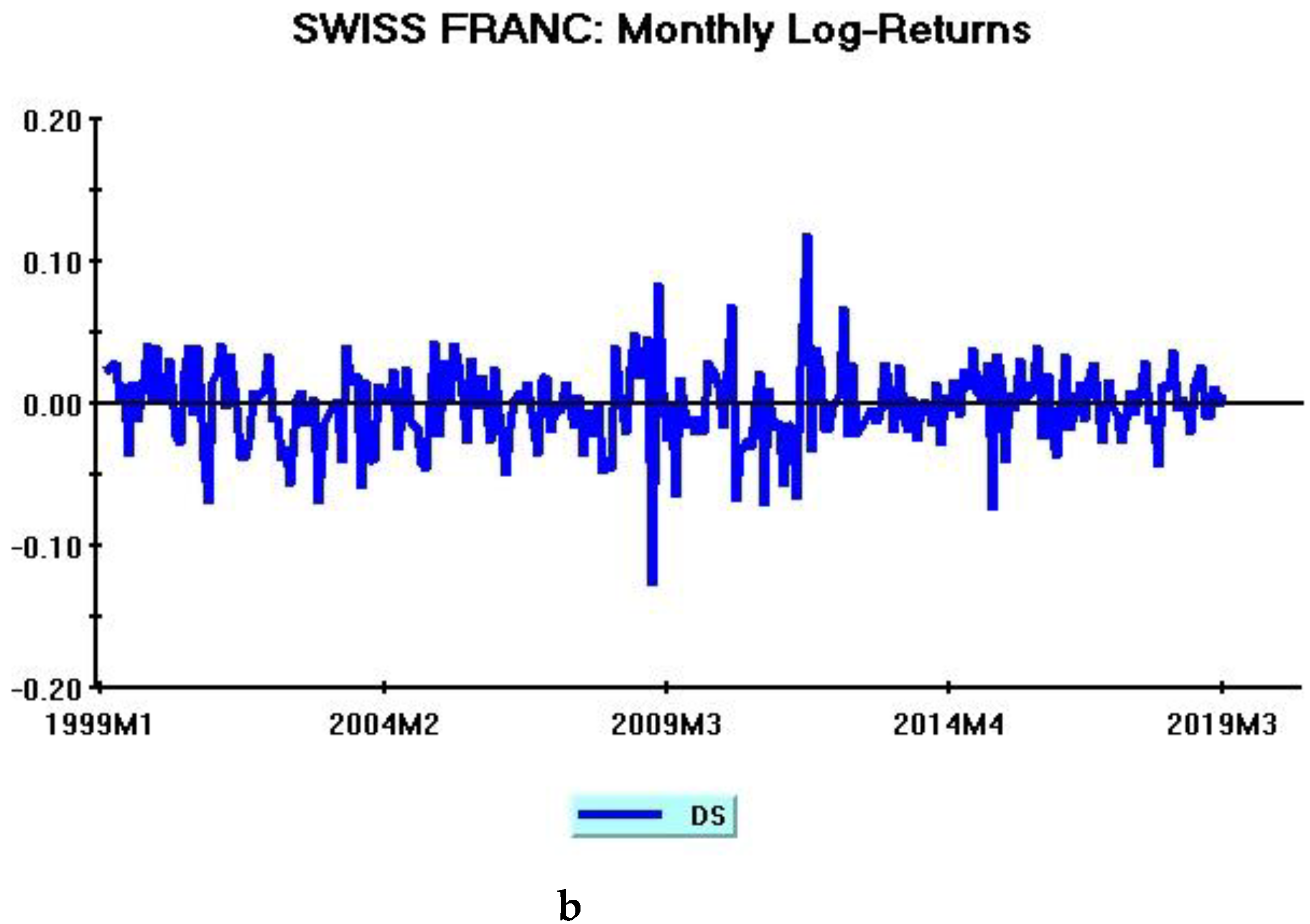

Table 4 summarizes the empirical evidence relative to the impact of financial crises on stock returns correlations.

Constant terms (ω) are always positive and highly significant, thus revealing positive returns co-movements during “normal” times. These estimates, moreover, are consistently lower than corresponding unconditional correlations reported in

Table 1. This result is driven by the existence of significant contagion effects during most financial crises, as I shall now explain in more detail.

Focusing on the effects of various financial crises, all γi parameters are either positive and highly significant or not statistically different from zero. Drawing on the previous discussion, this implies that, for all pairwise correlations, the empirical evidence pinpoints either contagion episodes or interdependence among stock markets. No flight-to-quality effect is instead documented.

The γ

1 and γ

2 coefficients are positive and significant at the 1% level for almost all stock market pairs. As regards the global financial crisis (γ

1), I confirm, therefore, the existence of strong contagion effects on equity markets in line with the existing literature (see, among others,

Syllignakis and Kouretas 2011;

Dimitriou and Simos 2014;

Dua and Tuteja 2016; and

Hemche et al. 2016). As regards the global financial crisis, the only relevant exception is represented by the absence of contagion effects for Asian stock market correlations.

As regards the Eurozone debt crisis (γ

2), huge contagion effects are observed, as witnessed by the strongly significant and quantitatively high values of γ

2 recorded for all pairwise correlations. These results are again in line with the existing evidence (see, e.g.,

Dua and Tuteja 2016;

Nitoi and Pochea 2019).

Proceeding with the analysis of

Table 4, the estimates reveal the existence of no contagion but only interdependence effects during the Russian financial crisis (see γ

3 results across all pairwise correlations). The latest financial crises, on the other hand, disclose new significant contagion episodes.

These latest crises (Chinese stock market crisis, Turkish financial crisis) originated in countries that either play a dominant role in the Asian continent (China), or have a strategic relevance in European/Asian economic and political relationships given their geographical position (Turkey). In this perspective, it is not surprising that these crises do not significantly impinge on bilateral stock returns correlations between European and US stock markets (DEU/DSP), while displaying significant contagion effects in most remaining cases involving pairwise correlations with Asian stock markets. It is finally worthwhile observing that notwithstanding the smaller dimension of Turkey’s economy, the financial contagion effects associated with the Turkish crisis (γ5 coefficients) are quantitatively stronger and more uniformly distributed than those produced by the Chinese stock market crisis (γ4 coefficients).

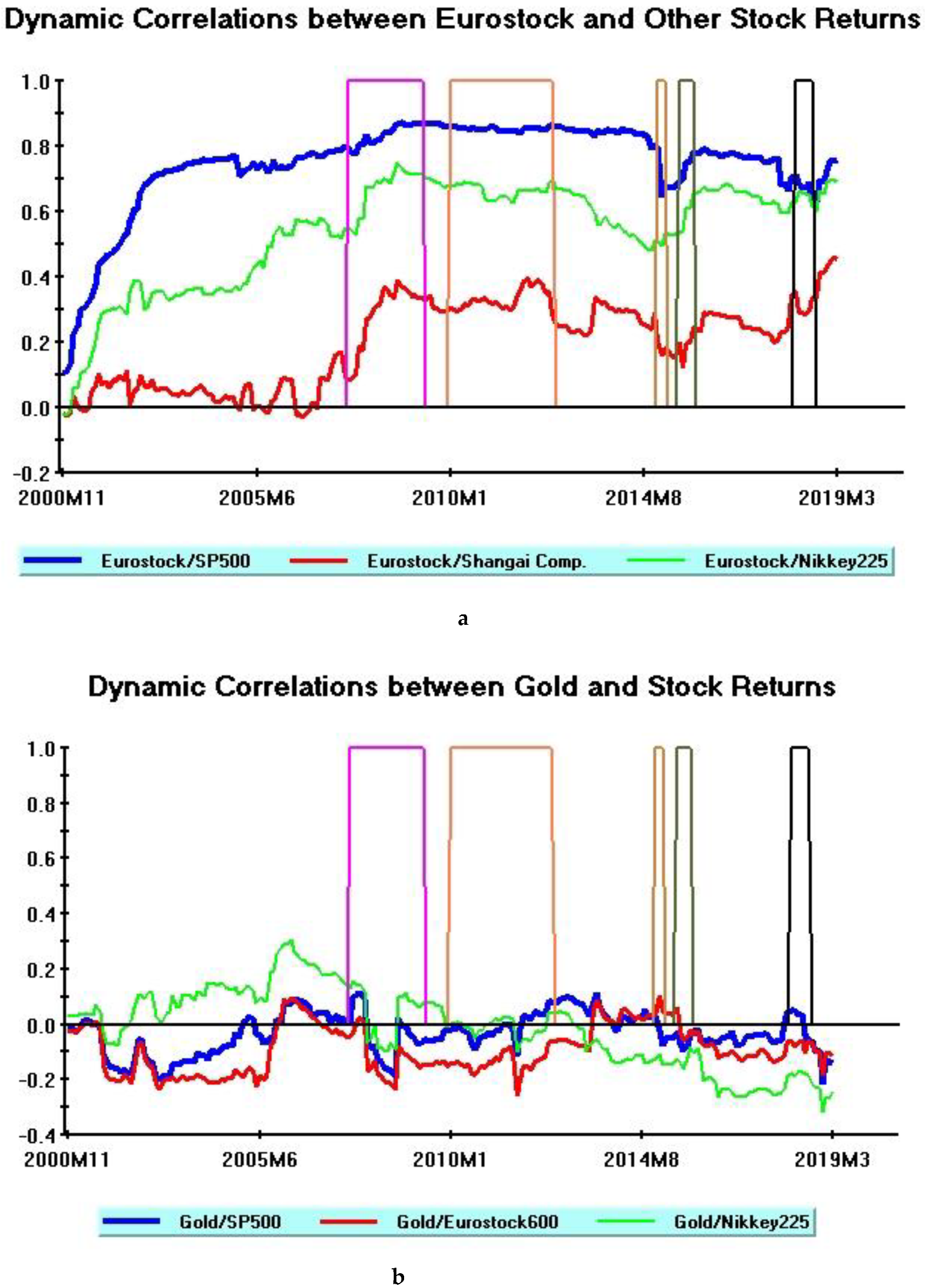

Let us now turn to the impact of financial crises on conditional correlations between “safe-haven” assets and stock returns.

Table 5 summarizes the results for the gold case.

I focus on (γ

i) coefficients, which assess the defensive role of gold in times of financial stress. The empirical evidence of

Table 5 is rather mixed and market-specific but, in most cases, the estimated γ

i parameters are either not significantly different from zero, or are negative and statistically significant. On the whole, therefore, these results support the defensive role of gold in assets portfolios, although this conclusion cannot be generalized across all stock markets and all crisis episodes.

The most favorable results are recorded for pairwise correlations involving Japanese and US stock markets. In the former case (DG/DNIK), all parameters are in line with expected signs, and a strong tendency towards de-correlations from stock returns is apparent during the latest financial crisis episodes (“safe-haven” effect). In the latter case (DG/DSP), all coefficients (except γ

5) are in line with expected values consistently supporting the absence of correlation with stock returns during the great majority of financial crisis episodes (hedging effect). The two remaining cases in

Table 5 (DG/DEU; DG/DSHAN) provide more mixed evidence since gold displays its defensive role in a reduced number of turmoil episodes. It is worthwhile mentioning, however, that while this role is notably limited as regards Chinese stock market returns, pairwise correlations with European stock returns yield a more favorable picture, with the yellow metal displaying its defensive properties both during the global financial crisis and during the Eurozone debt crisis.

The empirical evidence of

Table 5 is broadly in line with existing work about gold/stock market correlation patterns, which, on the whole, provides mixed results. The predominantly defensive role of gold during “tranquil” periods (see ω estimates for most correlation pairs in

Table 5) as opposed to more variegated results during turbulent periods is consistent with

Baur and Lucey’s (

2010) seminal paper, which finds that gold is a hedge against stocks on average and a safe-haven in extreme market conditions. Furthermore, the lack of homogeneous gold results across different stock markets, even for countries at the same level of economic development, is consistent with

Baur and McDermott’s (

2010) seminal contribution, investigating a sample of many industrial and emerging market economies along a thirty year period.

The evidence obtained in the case of bilateral stock correlations with the Swiss Franc is similar to these results (This empirical evidence is not presented in order to save space, and is available from the author upon request). Overall, although replicating rather mixed findings, expected signs of γi coefficients are in line with expected values in a reasonable number of cases, thus allowing to qualify the Swiss currency as an additional defensive instrument against financial turbulences occurring over the last two decades. The “safe-haven” role of the Swiss currency is best documented by parameters estimates relative to the Global financial crisis, when Swiss Franc returns disclose significant de-correlation increases with all stock market returns of industrialized countries (SP 500, Stock Europe 600, Nikkei 225).

To sum up, this section contributes to the literature extending to more recent financial crises the analysis of their impact on stock markets correlations. In line with existing work, I confirm strong contagion effects on major international equity markets during the Global financial crisis and the Eurozone debt crisis. Moreover, differently from existing contributions, I document further relevant contagion effects during the latest crisis episodes (Chinese stock market crisis, Turkish financial crisis). Finally, as regards the “safe-haven” status of gold and the Swiss Franc, I find that their defensive role has persisted during recent financial turbulences, although this does not involve either all stock correlations or all crisis episodes.

3.2. Dynamic Conditional Correlations and Macroeconomic Variables

This section explores the nature of dynamic conditional correlations from a different perspective. Instead of assessing the role of financial crises, distinguishing between “tranquil” and “turbulent” periods, I directly focus on the effects of some macroeconomic variables on stock returns correlations.

Applied research in this area is scant and yields mixed empirical findings. Analyzing Central and Eastern European emerging stock markets,

Syllignakis and Kouretas (

2011) document that macroeconomic fundamentals proxying business cycles, monetary policy, and inflationary convergence significantly affect time-varying correlations, although during some periods their influence appears limited. Other contributions addressing various emerging economies and the US stock market find significant macroeconomic effects on time-varying stock returns co-movements (

Hwang et al. 2013;

Cai et al. 2016); a major drawback of these analyses, however, is that the set of exogenous factors potentially affecting dynamic correlations is restricted to financial variables (VIX index, TED spread, CDS spread). Finally, focusing on a large number of European economies at different stages of economic growth,

Nitoi and Pochea (

2019) provide an accurate econometric analysis of many stock market co-movements. Global factors and economic similarities are found to be important drivers of conditional correlations, while some evidence of “pure contagion”, not explained by economic fundamentals, is documented. However, although these authors account for the influence of economic integration and institutional factors, their analysis could be further improved by including additional macroeconomic variables.

The above discussion makes it clear that the omission of potentially relevant macroeconomic variables represents one major shortcoming in this literature. In order to fill this gap, this section selects five macroeconomic variables never considered in previous work, and assesses their influence on stock markets correlations.

In line with

Tronzano (

2020), I focus on the following macroeconomic variables that could potentially display a significant influence under frequent financial turbulences. (All monthly series are from the Thomson Reuters Datastream. See

Tronzano (

2020), Section 4.2, for a detailed description of these series and their Thomson Reuters codes):

World equity risk premium;

World economic policy uncertainty;

US economic policy uncertainty;

ECB systemic stress composite indicator;

US consumer confidence index.

The equity risk premium represents a classical proxy to measure the degree of risk aversion; the world equity risk premium used in this paper represents an average measure for all major world economic areas. Economic policy uncertainty indexes reflect the degree of uncertainty surrounding future economic policy developments, either at a single- or multi-country level. The composite indicator of systemic stress is a new indicator of contemporaneous stress in the financial system introduced by the ECB with the aim of analyzing, monitoring and controlling systemic risk (

Holló et al. (

2012)). The US consumer confidence index, finally, is an economic indicator published by the Conference Board reflecting the degree of optimism about the state of the US economy.

Since the present section focuses on stock returns,

ρi,j,t now indicates the time-varying returns correlation between stock (i) and stock (j) at time (t). The regression equation is therefore specified as follows:

where 𝜛 is a constant term, and ϕ

k is a coefficient relative to the impact of each macro-variable (k) on dynamic correlations.

According to a preliminary data inspection, the correlation between macroeconomic variables examined in the present section is quite high, with correlation coefficients almost always exceeding 0.5. A regression equation jointly analyzing the impact of these macroeconomic variables would therefore raise serious multicollinearity problems, generating apparently insignificant parameter estimates and/or incorrect signs in the estimated coefficients. Note, moreover, that the purpose of the present analysis is not to test the validity of a specific relationship on the basis of a given theoretical model but, more simply, to assess the impact of some potentially relevant macroeconomic variables on conditional stock correlations. For these reasons, the specification outlined in Equation (5), i.e., a separate analysis of each macroeconomic variable, appears as the most promising research strategy in the present context.

Before analyzing the evidence from Equation (5), it is useful to briefly discuss how to interpret the movements of these macroeconomic variables and, consequently, the expected signs of estimated ϕk coefficients.

An increase in each of the first four variables negatively affects international financial markets. A higher world equity risk premium captures an increase in global investors’ degree of risk aversion. This lower risk appetite is likely to produce generalized portfolio shifts out of riskier assets, thus simultaneously lowering stock returns. For this reason, an increase in the world equity risk premium is expected to generate an increase in stock returns correlations (ϕ1 > 0).

An analogous effect can be posited as regards both economic policy uncertainty indicators. An increase in these indicators reflects greater uncertainty surrounding future economic policies. At the macroeconomic level, higher economic policy uncertainty foreshadows declines in aggregate investment, output and employment in major industrialized countries (

Baker et al. 2015). Anticipating a more negative future macroeconomic outlook, stock markets are thus expected to react through simultaneous portfolio shifts out of equities and towards safer financial assets. Therefore, once again, a concomitant drop in stock market returns will tend to increase all stock correlations (ϕ

2 > 0; ϕ

3 > 0).

An increase in the systemic stress indicator reflects a higher risk of financial system instability, with adverse macroeconomic implications for major industrial countries. In this case, simultaneous sell-offs on stock markets leading to increased stock returns correlations (ϕ4 > 0) could be further enhanced by the “flight-to-quality” emotional reactions of global investors in the presence of greater overall financial instability.

The expected signs of all ϕ

i parameters discussed in this section are obtained assuming that the “bad news” effect of macroeconomic variables is the main driver of stock returns correlations. In other words, I assume that “bad news” effects induced by these macroeconomic variables are (almost) immediately incorporated in current stock prices, producing simultaneous increases in stock returns correlations. The “good news” effects induced by these variables are instead assumed to lead to gradual portfolio adjustments among alternative financial assets (with negligible effects on stock returns correlations). This asymmetry assumption between “bad news” and “good news” effects appears quite reasonable in the context of the period examined, characterized by the occurrence of frequent financial crisis episodes. From a more general perspective, this assumption is consistent with the asset pricing model of

Aydemir (

2008), where market correlations rise in “bad times” as a result of higher time-varying risk aversion.

Consider, finally, the effects induced by the US consumer confidence index. Differently from previous cases, the “bad news” effects on stock markets are now associated with a decrease (and not an increase) of this variable. This indicator reflects the degree of confidence of US consumers towards future domestic economy developments. A decrease in this variable therefore captures a more pessimistic sentiment about the prospective US macroeconomic outlook, with negative spillover effects on major industrial countries. A decrease in the US consumer confidence index is therefore expected to produce simultaneous sell-offs on international stock markets, leading to increased stock returns correlations (ϕ5 < 0).

Table 6 summarizes the evidence from OLS estimates of Equation (5). In line with the previous section, I apply the robust

Newey and West (

1987) estimator accounting for autocorrelation and heteroscedasticity in regression residuals.

Overall, these results are very satisfactory. Almost all estimated coefficients are statistically significant, in most cases at a 1% confidence level. Moreover, all coefficients display their expected signs, suggesting that the economic intuition about the effects of these macroeconomic variables on time-varying correlations is correct.

The world equity risk premium is the most important variable affecting stock market correlations (

Table 6, first row). In this case, the explicative power of estimated regressions is notably higher than that obtained with other macro-variables, and all ϕ

1 parameters are highly significant.

These results document that global risk aversion has been the driving force behind stock returns co-movements during the last two decades. It is interesting to observe that this empirical evidence displays close analogies with

Tronzano (

2020). While in the present paper a rise in global risk aversion causes simultaneous sell-offs on equity markets leading to increased stock correlations,

Tronzano (

2020) documents how a rise in the same macro-variable causes simultaneous portfolio shifts towards “safe-haven” assets leading to increased “safe-haven” asset correlations.

Proceeding with the analysis of

Table 6, almost all remaining macro-variables display significant effects, although the explicative power of estimated equations is lower.

The ECB systemic stress indicator impacts on the co-movements of all stock returns (

Table 6, fourth row), with homogenous effects across various pairwise correlations. This result underlines the strong negative influence exerted by financial system imbalances on international stock markets and, ultimately, on real economic activity.

Quite interestingly, this evidence is closely in line with the findings reported in

Dua and Tuteja (

2016), investigating contagion across a representative sample of advanced and emerging countries.

Dua and Tuteja (

2016) analyze the impact of a different financial stress index, constructed by the Federal Reserve Bank of St. Louis, on time-varying correlation coefficients of various stock and currency markets. Their results are broadly in line with our empirical evidence, except for DSHAN/DEU and DSHAN/DNIK conditional correlations, where the impact of the financial stress index is not significant (see ibid, Section 6, Table 7, p. 259). These minor differences may be ascribed to the shorter sample period (ending in September 2014), and to the use of a different price index for the European stock market (SP Euro 75).

Further relevant effects on time-varying stock market co-movements stem from economic policy indicators (

Table 6, second and third rows). Quantitative values of estimated coefficients (ϕ

2, ϕ

3) are broadly similar, pointing out that stock market returns are homogeneously influenced by uncertainty related to global policy factors and by uncertainty related to the specific US policy stance. This empirical evidence contributes to the literature documenting how an increase in the degree of economic policy uncertainty negatively affects global portfolio choices, producing simultaneous waves of falling prices on international stock markets.

The US consumer confidence index (

Table 6, fifth row) exerts only minor effects on time-varying correlations. Although the estimated coefficients (ϕ

5) display the correct expected signs, in two cases (DSHAN/DNIK, DSHAN/DSP) they are not significant, while in three cases (DEU/DNIK, DNIK/DSP, DSHAN/DEU) they are significant only at the 10% level.

A decrease in this confidence indicator generates an appreciable negative economic effect only in the case of US–Europe stock market correlations (ϕ5 negative and significant at the 1% level in the case of DEU/DSP). The economic intuition, in this specific case, is that this result involves the US economy, to which the confidence indicator itself refers, and Europe, which represents the US’s most important trading partner. Focusing on the fifteen major US trading partners, Europe represents 17.7% of US trade in goods, according to latest US trade data, whereas the corresponding values for China and Japan are, respectively, 14.4% and 4.9% (see US, Census Bureau, Foreign Trade, Top Trading Partners, October 2020).

To sum up, this section provides a further original contribution to the current literature investigating the effects of five important macro-variables that were disregarded in previous research. All of these macro-variables, except the US consumer confidence index, exert pervasive effects on stock market co-movements, which are fully in line with economic intuition. The world equity risk premium has a prominent influence on all stock returns correlations. However, other indicators, measuring the degree of economic policy uncertainty or the degree of overall financial system stability, display a significant influence on time-varying stock market correlations.

3.3. Dynamic Conditional Correlations and Conditional Volatilities

The analysis of previous sections focused, respectively, on conditional correlations patterns during financial crises and on some macroeconomic determinants of time-varying correlations. The present section completes this empirical investigation examining the relationships between stock market returns correlations and conditional volatilities.

This topic deserves special attention, particularly from the perspective of optimal portfolio diversification strategies. If stocks volatilities and correlations move in the same direction, asset returns correlations are higher when the level of risk increases. A positive relationship between volatilities and correlations therefore represents a difficult situation for portfolio managers since the benefits from portfolio diversification during turbulent periods are damped by increased asset returns co-movements. To put it differently, if asset correlations and volatilities are positively related, long-run risks are higher than they might appear in the short run (

Cappiello et al. 2006). The risk of increasing returns correlations during turbulent periods must be properly accounted for by portfolio managers, and the corresponding hedging costs will be higher than expected.

Although research on the relationship between volatilities and correlations involves various financial assets (see, e.g.,

Charlot and Marimoutou (

2014) for an interesting application to exchange rates, oil, the SP 500 index and some precious metals relying on a Markov-switching approach), applied work concentrating on stock markets is scant.

The main conclusion from this literature is a positive association between volatilities and correlations.

Syllignakis and Kouretas (

2011) document positive co-movements during the October 2008 stock market crash, focusing on Central-Eastern European emerging markets and the German stock market. Analogous evidence is reported in

Gjika and Horvath (

2013) as regards Central European emerging markets and a representative index for the Euro area stock market (Stoxx 50), and in

Yang (

2005) focusing on Japan and the Asian Four Tigers equity markets (Taiwan, Singapore, Hong Kong, South Korea). Finally, considering a sample of 21 equity index returns and 13 bond index returns,

Cappiello et al. (

2006) find that, on average, volatilities and correlations move together, although this phenomenon is stronger for equities than bonds.

In line with previous sections, a standard regression approach is used to explore the relationship between conditional correlations and conditional volatilities. The estimated equation is therefore specified as follows:

where β

0 is a constant term, t is a linear time trend capturing potential long-run trends in conditional correlations, σ

i,t and σ

j,t are the conditional volatilities of asset (i) and asset (j) computed from the multivariate DCC model, and ε

i,j,t is an error term. The use of Equation (6) is quite common in the applied literature exploring the linkages between conditional volatilities and conditional correlations. See, for instance,

Yang (

2005),

Syllignakis and Kouretas (

2011), and

Gjika and Horvath (

2013) as regards empirical work focused on stock market indexes.

The crucial parameters in Equation (6) are β2 and β3. Positive and significant values of these parameters point out positive co-movements between volatilities and correlations. In this case, the usefulness of asset (i) and asset (j) as diversification tools decreases in turbulent periods, since their returns correlations increase as volatilities increase. The converse holds if β2 and β3 are not significant, or if these coefficients are negative and statistically significant.

OLS estimates of Equation (6) are again obtained applying the robust

Newey and West (

1987) covariance estimator.

Table 7 summarizes the results.

The long-run trend coefficients (β

1) are positive and highly significant across all stock returns correlations (

Table 7, second row). This result documents a general tendency towards increased correlations between stock returns, in line with the evidence obtained in

Yang (

2005) for Asian markets. Overall, this finding may be, at least partly, related to the financial globalization and deregulation process that has occurred over the last decades. Some caution is, however, required in proposing this interpretation, since recent work finds weak evidence of co-movement measures reacting to globalization and documents that other economic factors are equal or more important determinants of asset returns co-movements (

Bekaert et al. 2016).

Turning to β

2 and β

3 parameters, they are not statistically significant as regards the first three correlations (

Table 7, first three columns) (the only exception, in this case, is the β

2 coefficient in the case of Japan–US stock returns correlations (DNIK/DSP)), whereas they are positive and (almost) always statistically significant in the remaining cases (

Table 7, last three columns). The first three columns involve European, US, and Japanese stock markets; the last three columns refer instead to pairwise correlations with the Chinese aggregate stock price index (Shanghai composite).

This evidence documents that the relationships between volatilities and correlations are not alike across all correlation pairs. Focusing on the correlations between European, US, and Japanese stock market returns, no significant effect of conditional volatilities on conditional correlations is detected (except for β2 in the DNIK/DSP case). Turning to the results involving the Chinese stock market, positive and significant effects of conditional volatilities on conditional correlations are instead detected. Moreover, the impact of European, Japanese, and US stocks volatilities turns out to be much greater than that of Chinese stock market volatility.

Overall, in light of the previous discussion, this evidence discloses remarkable differences in terms of long-run risk. Stock returns correlations excluding the Chinese equity market are not negatively affected, in terms of increased returns correlations, by turbulent volatility phases, whereas the converse holds for returns correlations including this market. The benefits of portfolio diversification including the Chinese stock market are therefore significantly lowered during highly volatile periods, since asset returns co-movements tend to increase, thus generating consistent losses in case of “bear” stock market tendencies.

The implications of this evidence on optimal portfolio allocation strategies are clear. Since long-run risks are higher in asset allocations including Chinese stocks, portfolio managers should protect the higher degree of riskiness of these international portfolios. Given the higher long-run risk, portfolio insurance through options or credit derivatives will in turn be more expensive than expected (

Cappiello et al. 2006).

To sum up, the results presented in this section pinpoint some remarkable differences, in terms of long-run risk, between portfolio allocations excluding or including the Chinese stock market index. These differences had not been identified in previous work and represent, therefore, a further original feature of this research.

The regression approach outlined in Equation (6) can be reformulated with

ρi,j corresponding to returns correlations between each “safe-haven” asset (gold, Swiss Franc) and each stock price index. This specification allows the re-assessment of the defensive role of gold and the Swiss Franc during market turmoil discussed in

Section 3.1. The crucial parameter in this new specification is β

3, now capturing the impact of stock volatilities on pairwise correlations with “safe-haven” assets. If these assets perform their hedging roles during turbulent periods, β

3 is expected to be either negative and significant or not statistically different from zero. In the former case, increases in stock volatilities trigger a decrease in conditional correlations, as a consequence of portfolio shifts out of equities and into “safe-haven” assets. In the latter case, conditional correlations are unaffected by volatility increases. In empirical estimates along these lines (results not included in order to save space but available on request), β

3 is negative and significant for gold returns correlations with US and European stock markets and not significant for other stock markets. Moreover, as regards the Swiss Franc, β

3 is never statistically different from zero. Overall, this evidence confirms the defensive role of gold and the Swiss Franc during market turbulences, in line with the results obtained in

Section 3.1 and, from a more general perspective, in

Tronzano (

2020).