Machine Learning and Financial Literacy: An Exploration of Factors Influencing Financial Knowledge in Italy

Abstract

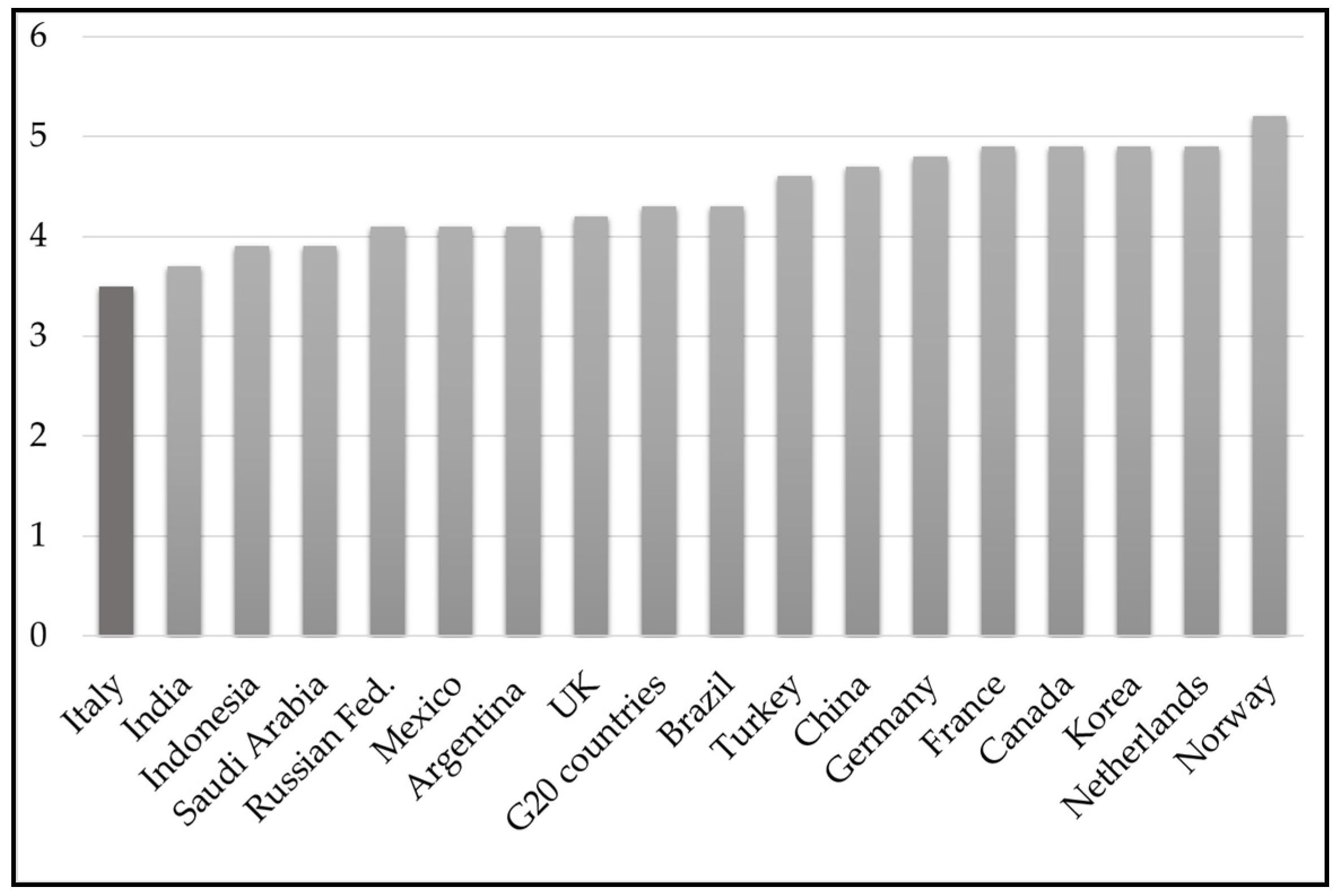

1. Introduction

2. Factors Influencing Financial Knowledge: A Literature Review

- Gender: One of the main common results in the literature is that women have lower FL than men. In fact, in 2011 the OECD found a gender gap in FL in 13 countries, with Hungary the only exception (Atkinson and Messy 2012). Bucher-Koenen et al. (2017), extending the evidence for other countries, found that only ex-Soviet countries (Russia, Romania, and East Germany) have an equal distribution of financial knowledge between sexes. However, recent literature stresses how, when asked to answer questions that measure knowledge of basic financial concepts, women are less likely than men to indicate that they do not know the answer (Bucher-Koenen et al. 2017; Kim and Mountain 2019; Ooi 2020). Therefore, the lower scores of women compared to men in financial literacy surveys reflects more the differences in the genders’ self-reported confidence than the gender differences in their actual level of financial knowledge. Al-Bahrani et al. (2020) found the origins of the gender-based financial literacy gap early in life (early college age), before individuals have the opportunity to develop financial skills through experience or specialization in household roles. Jappelli and Padula (2013) explain the gender gap in the fact that women generally have less wealth than men and therefore fewer incentives to invest in FL.

- Education: Higher education is usually reported as one of the most important factors in ensuring an adequate understanding of financial concepts. Many studies have shown that individuals with higher levels of education, i.e., who completed a university or college degree, are the most likely to be financially literate (Lusardi and Mitchell 2008; Cole et al. 2011). In addition, Mandell (2008) and Al-Bahrani et al. (2020) have shown that the correlation between financial literacy and education is present at the early stages of lifecycle, and is highly correlated with mathematics ability. Morgan and Trinh (2019), using the OECD/INFE data for Cambodia and Viet Nam, found that both financial literacy and general education levels are found to be positively and significantly related to savings behavior and financial inclusion, also controlling for possible endogeneity of financial literacy.

- Financial fragility: Financial knowledge is usually associated with household’s income levels and financial fragility. The concept of financial fragility is of paramount importance in the period of crises (such as the COVID-19 pandemic) to understand whether households lack capacity to face shocks. The concept, as defined in Demertzis et al. (2020), encompasses the state of household balance sheets, including indebtedness, and also relies on individual perceptions of the ability to rely on family and friends and other methods to deal with shocks. Previati et al. (2020) examined financial fragility in Italy using pre-COVID-19 data, and documented the strong link between financial fragility and financial literacy: almost 45% of low financial educated Italian households do not have sufficient financial resources to cover a lack of income even for short periods (2 months or less). Therefore, households with a low level of financial education are also less resilient.

- Age: The impact of age is controversial, even if the age effect is widely described as an inverse U-shaped pattern (Kadoya and Khan 2019; Klapper and Panos 2011; Fornero and Monticone 2011; Boisclair et al. 2017). In fact, younger and older respondents usually have a lower share of correct answers about financial issues in contrast to the working age class. Jappelli and Padula (2013) stressed how financial knowledge changes over people’s life cycle and that early-life cognition and schooling are strongly correlated with late-life FL.

- Employment status: This is also an important determinant of financial knowledge, with the lowest level of FL usually recorded among those who are not in the formal paid labor markets (Kadoya and Khan 2019). However, retired people have higher levels of financial knowledge, perhaps due to the increasing privatization of national pension systems, which implies a personal choice among different pension investment plans and solutions for retirement.

- Family status: Mixed effects are reported in the literature with reference to marital status and family size. According to Jappelli and Padula (2013) and Klapper and Panos (2011), singles have a significant propensity for lower financial literacy levels compared those who are married. In contrast, Bianchi (2018), for France, finds that financial knowledge is negatively correlated with marital status. Moreover, Jappelli and Padula (2013) report a significant negative correlation between financial literacy and family size, whereas Klapper and Panos (2011), for Russia, find a positive but not significant relation.

- Geography: In addition to personal characteristics, recent literature demonstrates how different cultural backgrounds and embedded social norms can impact on financial knowledge and skills, and thus the importance of analyzing data disaggregated by different geographical contexts (Brown et al. 2018; De Beckker et al. 2020). For Italy, Fornero and Monticone (2011), exploiting data from the Bank of Italy’s Survey on Household Income and Wealth, found evidence of main differences within the same national territory: they identified a significant difference in FL among residents of different regions, with North-Central Italian residents having higher literacy levels than those of the South of Italy. They also reported a positive correlation between individual FL and the household level of digital alphabetization (measured by the presence of at least one member of the household using a computer).

3. Estimation Techniques: Machine Learning

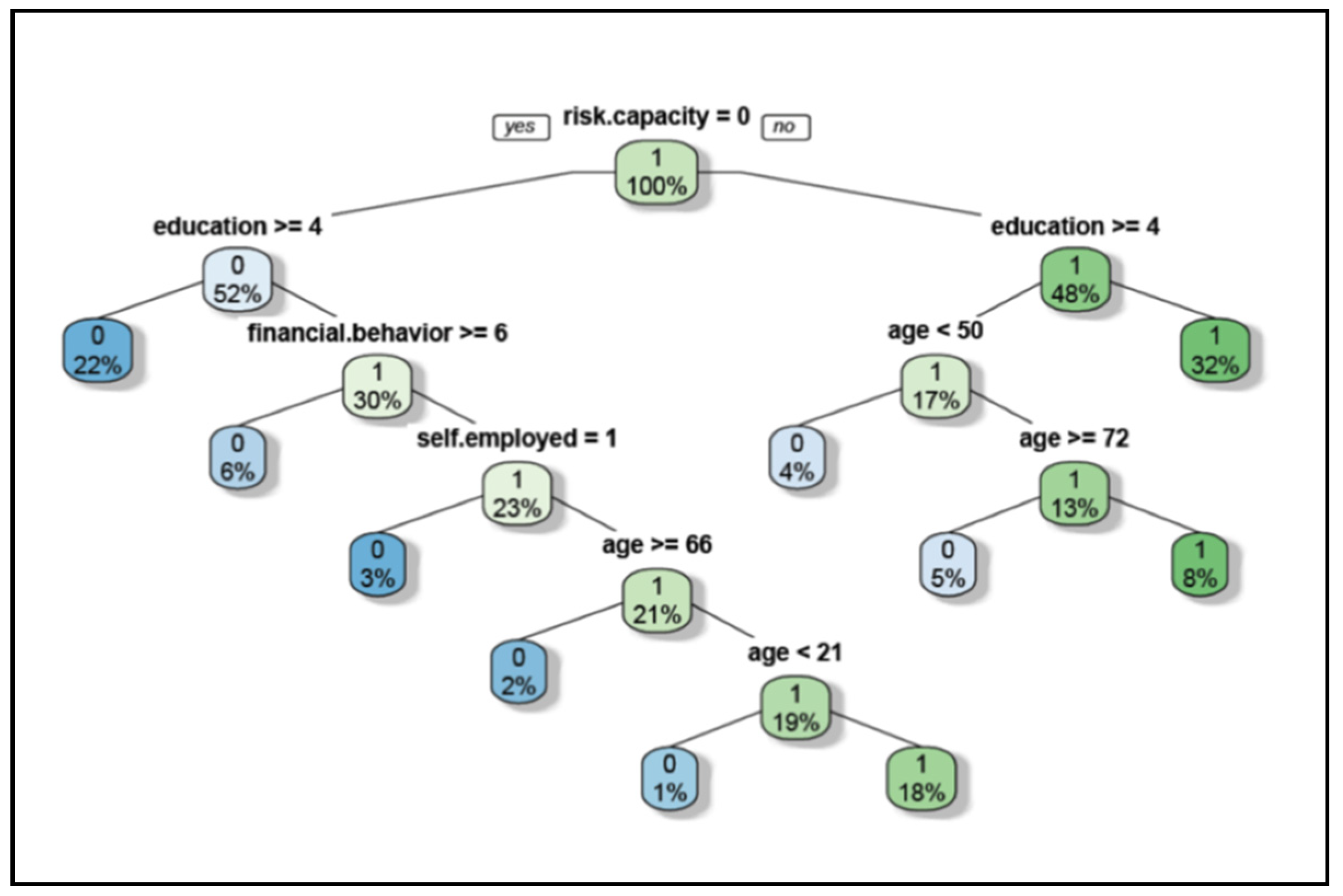

3.1. Decision Tree

3.2. Random Forest

3.3. Gradient Boosting Machine

4. Data and Methods

- -

- Saving, financial assets, and long-term planning: a set of questions is used to understand if individuals purchased financial assets in the two years before the survey, therefore, if they are actively saving or borrowing, and whether they set themselves long-term financial goals.

- -

- Making considered purchases: there are questions that explore if individuals make informed decisions before making a purchase of financial products and services.

- -

- Keeping track of cash flow: some questions are asked to understand if individuals keep a watch of financial affairs, and if they pay their bills on time. The ability to manage financial resources properly was measured, as for the OECD INFE (2011), on a scale of 0 to 9. Financial attitude instead evaluated personal traits such as preferences, beliefs, and non-cognitive skills, which are likely to affect personal well-being, on a scale from 0 to 5; the main driver of the index is a positive saving orientation, mainly for the long term. Because Di Salvatore et al. (2018) found that “the response behavior of Italian respondents appears to be influenced by the survey mode” (p. 8), we also included in our estimates a dummy variable to identify if the responder had a face-to-face interview or used a tablet to record their responses (in Appendix A, Table A1 provides a full description of the variables considered). It is clear from the first descriptive statistics in Table 1 that the level of FL is not uniform throughout the population in Italy. Although small, there are gender gaps in financial knowledge, with men slightly more financially literate than women. In addition, we find the above-cited reverse U-shaped curve for age, because financial knowledge increases with age but decreases for older adults, with a peak for the working age group 40–49 years old. FL is higher for those employed in paid work but lower among those in unpaid domestic work and those unemployed or seeking their first employment. FL is higher in the North Western regions of Italy. However, on average a low share of Italians (8%) rates their financial knowledge as being high. Finally, among financial literates, the average levels of good financial behaviours and attitudes are still low (4.5 on a scale of 0–9 and 2.1 on a scale of 0–5, respectively), but their ability to cope with unexpected expenses without asking for formal or informal loans or to cover monthly expenses is quite high, a peculiar characteristic of Italians, who achieve, on average, a high level of savings.

household.composition + geographic.area + native + financial.behavior + financial.attitude + FL.self.assessment +

pension.savings + pension products in the last 2 years (PP.in.the.last.year)+ pension.fund +interview.type

5. Results

5.1. Predictive Quality: Models’ Validation, Accuracy and Performance Evaluation

- Accuracy (acc):

- True Positive Rate (TPR), also called sensitivity:

- False Positive Rate (FPR):

- True Negative Rate (TNR), also called specificity (or 1-FPR):

- Precision:

5.2. Variable Importance and Partial Dependence

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables Used | Description | Minimum Value | Maximum Value | Mean (%) | Standard Deviation |

|---|---|---|---|---|---|

| Dependent Variable: Higher financial literacy | Responder who correctly answered at least 4 questions out of 7 questions about financial knowledge (three topics: understanding simple and compound interest, inflation and the benefits of portfolio diversification) | 0 | 1 | 53.49 | 0.5 |

| 1. Gender | 0 (woman) | 1 (man) | 49 | 0.5 | |

| 2. Education | 7-levels | 1 university degree or more | 7 no complited education | 3.03 | 1.26 |

| 3. Financial fragility | |||||

| (a) Household economic stress | In the past 12 months household income was not sufficient to cover monthly expenses? | 0 (no) | 1 (yes) | 28 | 0.45 |

| (b) Risk capacity | Ability to sustain unexpected expenses without asking for formal or informal loans | 0 (no) | 1 (yes) | 48 | 0.5 |

| 4. Age (normalized) | 18 | 80 more | 50.34 | 17.09 | |

| 5. Employment status | |||||

| (a) selfemployed | dummy variable | 0 (no) | 1 (yes) | 11 | 0.31 |

| (b) employee | dummy variable | 0 (no) | 1 (yes) | 36 | 0.48 |

| (c) housekeeper | dummy variable | 0 (no) | 1 (yes) | 11 | 0.31 |

| (d) unemployed | dummy variable | 0 (no) | 1 (yes) | 10 | 0.29 |

| (e) pensioner | dummy variable | 0 (no) | 1 (yes) | 24 | 0.43 |

| 6. Family status | |||||

| Household composition | 6 classes | 1 (1 member) | 6 (6 or more) | 2.95 | 1.22 |

| 7. Geography | |||||

| area 1 | North-West | 0 (no) | 1 (yes) | 27 | 0.44 |

| area 2 | North-East | 0 (no) | 1 (yes) | 20 | 0.4 |

| area 3 | Centre | 0 (no) | 1 (yes) | 19 | 0.39 |

| area 4 | South | 0 (no) | 1 (yes) | 22 | 0.42 |

| area 5 | Islands | 0 (no) | 1 (yes) | 11 | 0.32 |

| 8. Native | dummy variableBorn: | 0 Not in Italy | 1 In Italy | 97 | 0.16 |

| 9. Financial variables | |||||

| FL self-assessment | Respondent’s high level of self-assigned financial knowledge (well above average and above the average). | 0 (no) | 1 (yes) | 7 | 0.25 |

| Pension savings | Responder is confident that she/he has done a good job of making financial plans for her/his retirement. | 0 (no) | 1 (yes) | 11 | 0.32 |

| Pension products in the last 2 years | In the last two years the responder has bought a pension or retirement product. | 0 (no) | 1 (yes) | 25 | 0.16 |

| Pension fund | Responder is funding her/his retirement with a private pension plan. | 0 (no) | 1 (yes) | 10 | 0.3 |

| Financial behavior | 9 questions assessing whether people are able to formulate a budget, to pay their debts and utilities with no concerns, and acquire information before making investments. | 0 | 9 | 4.48 | 1.71 |

| Financial attitude | 5 questions about personal attitude towards precautionary saving and long run savings. | 0 | 5 | 1.92 | 1.36 |

| 9. Interview type | Survey mode | 0 (tablet) | 1 (ftf) | 40 | 0.49 |

| Parameter Description | Optimal Tuning Parameter | |

|---|---|---|

| DT | Complexity parameter | cp = 0.006 |

| RF | Number of trees | ntree = 300 |

| Minimum number of observations in a terminal node | nodesize = 11 | |

| Number of input variables in each node | mtry = 2 | |

| GBM | Number of trees | ntree = 500 |

| Maximum nodes for each tree | interaction.depth = 3 | |

| Learning rate | shrinkage = 0.1 |

References

- Al-Bahrani, Abdullah, Buser Whitney, and Darshak Patel. 2020. Early Causes of Financial Disquiet and the Gender Gap in Financial Literacy: Evidence from College Students in the Southeastern United States. Journal of Family and Economic Issues 41: 558–71. [Google Scholar] [CrossRef]

- Ameriks, John, Caplin Andrew, and John Leahy. 2003. Wealth accumulation and the propensity to plan. Quarterly Journal of Economics 118: 1007–47. [Google Scholar] [CrossRef]

- Atkinson, Adele, and Flore-Anne Messy. 2012. Measuring Financial Literacy: Results of the OECD/International Network on Financial Education (INFE) Pilot Study. In OECD Working Papers on Finance, Insurance and Private Pensions. No. 15. Paris: OECD Publishing. [Google Scholar]

- Ayyadevara, V. Kishore. 2018. Pro Machine Learning Algorithms. Berkeley: Apress. [Google Scholar]

- Banks, James, and Zoe Oldfield. 2007. Understanding pensions: Cognitive function, numerical ability and retirement saving. Fiscal Studies 28: 143–70. [Google Scholar] [CrossRef]

- Bazarbash, Majid. 2019. FinTech in Financial Inclusion: Machine Learning Applications in Assessing Credit Risk. In IMF Working Paper 19/109. Washington, DC: IMF. [Google Scholar]

- Behrman, Jere R. Mitchell Olivia S., Soo Cindy K, and David Bravo. 2012. How financial literacy affects household wealth accumulation. American Economic Review 102: 300–4. [Google Scholar] [CrossRef]

- Bianchi, Milo. 2018. Financial literacy and portfolio dynamics. The Journal of Finance 73: 831–59. [Google Scholar] [CrossRef]

- Boisclair, David, Lusardi AnnaMaria, and Pierre Carl Michaud. 2017. Financial literacy and retirement planning in Canada. Journal of Pension Economics & Finance 16: 277–96. [Google Scholar]

- Bracke, Philippe, Datta Anupam, Jung Carsten, and Shayak Sen. 2019. Machine learning explainability in finance: An application to default risk analysis. In Bank of England Staff Working Paper; No. 816; London: Bank of England. [Google Scholar]

- Breiman, Leo, Friedman Jerome, R. Olshen, and Charles J. Stone. 1984. Classification and Regression Trees. Boca Raton: Chapman & Hall/CRC. [Google Scholar]

- Breiman, Leo. 2001. Random forests. Machine Learning 45: 5–32. [Google Scholar] [CrossRef]

- Brown, Martin, Guin Benjamin, and Stefan Morkoetter. 2016. Deposit withdrawals from distressed commercial banks: The importance of switching costs. In University of St. Gallen, School of Finance Research Paper. St. Gallen: University of St. Gallen, pp. 2013–19. [Google Scholar]

- Brown, Martin, Henchoz Caroline, and Thomas Spycher. 2018. Culture and financial literacy: Evidence from a within-country language border. Journal of Economic Behavior and Organization 150: 62–85. [Google Scholar] [CrossRef]

- Bucher-Koenen, Tabea, Lusardi Annamaria, Alessie Rob, and Maarten Van Rooij. 2017. How financially literate are women? An overview and new insights. Journal of Consumer Affairs 51: 255–83. [Google Scholar] [CrossRef]

- Chaulagain, Ramesh Prasad. 2017. Relationship between Financial Literacy and Behavior of Small Borrowers. NRB Economic Review 29: 33–53. [Google Scholar]

- Chen, Jia, Jiang Jiajun, and Yu-jane Liu. 2018. Financial literacy and gender difference in loan performance. Journal of Empirical Finance 48: 307–20. [Google Scholar] [CrossRef]

- Christelis, Dimitrios, Jappelli Tullio, and Mario Padula. 2010. Cognitive abilities and portfolio choice. European Economic Review 54: 18–38. [Google Scholar] [CrossRef]

- Clark, Robert L., Lusardi Annamaria, and Olivia S. Mitchell. 2015. Financial knowledge and 401 (k) investment performance: A case study. Journal of Pension Economics and Finance 16: 1–24. [Google Scholar] [CrossRef]

- Cole, Shawn, Sampson Thomas, and Bilal Zia. 2011. Prices or Knowledge? What Drives Demand for Financial Services in Emerging Markets? The Journal of Finance 66: 1933–67. [Google Scholar] [CrossRef]

- De Beckker, Kenneth, De Witte Kristof, and Geert Van Campenhout. 2020. The role of national culture in financial literacy: Cross-country evidence. Journal of Consumer Affairs 54: 912–30. [Google Scholar] [CrossRef]

- Demertzis, Maria, Domínguez-Jiménez Marta, and Anna Maria Lusardi. 2020. The financial fragility of European households in the time of COVID-19. In Policy Contribution 2020/15. Brussels: Bruegel. [Google Scholar]

- Deuflhard, Florian, Georgarakos Dimitris, and Roman Inderst. 2019. Financial Literacy and Savings Account Returns. Journal of the European Economic Association 17: 131–64. [Google Scholar] [CrossRef]

- Di Salvatore, Antonietta, Franceschi Francesco, Neri Andrea, and Francesca Zanichelli. 2018. Measuring the financial literacy of the adult population: The experience of the Bank of Italy. IFC Bulletins 47: 1–35. [Google Scholar] [CrossRef]

- Dixon, Matthew F., Halperin Igor, and Bilokon Paul. 2020. Machine Learning in Finance. Berlin: Springer International. [Google Scholar]

- Feng, Xiangnan, Bin Lu, Xinyuan Song, and Shuang Mad. 2019. Financial Literacy and Household Finances: A Bayesian Two-Part Latent Variable Modeling Approach. Journal of Empirical Finance 51: 119–37. [Google Scholar] [CrossRef]

- Fornero, Elsa, and Chiara Monticone. 2011. Financial literacy and pension plan participation in Italy. Journal of Pension Economics and Finance 10: 547–64. [Google Scholar] [CrossRef]

- Fornero, Elsa, and Anna Lo Prete. 2019. Voting in the aftermath of a pension reform: The role of financial literacy. Journal of Pension Economics and Finance 18: 1–30. [Google Scholar] [CrossRef]

- Friedman, Jerome H. 2001. Greedy function approximation: A Gradient Boosting Machine. Annals of Statistics 29: 1189–232. [Google Scholar] [CrossRef]

- Frijns, Bart, Gilbert Aaron, and Tourani-Rad Alireza. 2014. Learning by doing: The role of financial experience in financial literacy. Journal of Public Policy 34: 123–54. [Google Scholar] [CrossRef]

- Gathergood, John, and Jorg Weber. 2017. Financial literacy, present bias and alternative mortgage products. Journal of Banking and Finance 78: 58–83. [Google Scholar] [CrossRef]

- Gerardi, Kristopher, Goette Lorenz, and Stephan Meier. 2010. Financial Literacy and Subprime Mortgage Delinquency: Evidence From a Survey Matched to Administrative Data. In Federal Reserve of Atlanta WP 2010-10. Darby: DIANE Publishing. [Google Scholar]

- Goda, Shah Gopi, Levy Matthew R, Manchester Colleen Flaherty, Sojourner Aaron, and Joshua Tasoff. 2020. Who is a passive saver under opt-in and auto-enrollment? Journal of Economic Behavior and Organization 173: 301–21. [Google Scholar] [CrossRef]

- Goyal, Kirty, and Satish Kumar. 2020. Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies 45: 80–105. [Google Scholar] [CrossRef]

- Grohmann, Antonio, Klühs Theres, and Lukas Menkhoff. 2018. Does financial literacy improve financial inclusion? Cross country evidence. World Development 111: 84–96. [Google Scholar] [CrossRef]

- Gu, Shihao, Bryan Kelly, and Dacheng Xiu. 2020. Empirical Asset Pricing via Machine Learning. The Review of Financial Studies 33: 2223–73. [Google Scholar] [CrossRef]

- Guiso, Luigi, and Eliana Viviano. 2015. How much can financial literacy help? Review of Finance 19: 1347–82. [Google Scholar] [CrossRef]

- Guiso, Luigi, and Tullio Jappelli. 2008. Financial literacy and portfolio diversification. In EUI Working Paper (ECO 2008/31). Florence: European University Institute. [Google Scholar]

- Hasler, Andrea, Lusardi Annamaria, and Noemi Oggero. 2018. Financial fragility in the US: Evidence and implications. In GFLEC working Paper n. 2018-1. Washington, DC: Global Financial Literacy Excellence Center, The George Washington University School of Business. [Google Scholar]

- Hastie, Trevor, Tibshirani Robert, and Jerome Friedman. 2016. The Elements of Statistical Learning. Data Mining, Inference, and Prediction. New York: Springer, ISBN 10: 0387848576. [Google Scholar]

- Hastings, Justine S., and Lydia Tejeda-Ashton. 2008. Financial Literacy, Information, and Demand Elasticity: Survey and Experimental Evidence from Mexico; NBER Working Papers 14538; Cambridge: National Bureau of Economic Research.

- Hsiao, Yu-Jen, and Wei-Che Tsai. 2018. Financial literacy and participation in the derivatives markets. Journal of Banking & Finance 88: 15–29. [Google Scholar]

- Jain, Prayut, and Shashi Jain. 2019. Can machine learning-based portfolios outperform traditional risk-based portfolios? The need to account for covariance misspecification. Risks 7: 74. [Google Scholar] [CrossRef]

- James, Gareth, Witten Daniela, Hastie Trevor, and Robert Tibshirani. 2017. An Introduction to Statistical Learning: With Applications in R. Springer Texts in Statistics.

- Jappelli, Tullio, and Mario Padula. 2013. Investment in financial literacy and saving decisions. Journal of Banking & Finance 37: 2779–92. [Google Scholar]

- Kadoya, Yoshihiko, and Mostafa Khan. 2019. What determines financial literacy in Japan? Journal of Pension Economics and Finance, 1–19. [Google Scholar]

- Kim, Namhoon, and Travis P. Mountain. 2019. Financial Knowledge and “Don’t Know” Response. Journal of Consumer Affairs 53: 1948–69. [Google Scholar] [CrossRef]

- Klapper, Leora, and Georgios A. Panos. 2011. Financial literacy and retirement planning: The Russian case. Journal of Pension Economics & Finance 10: 599–618. [Google Scholar]

- Klapper, Leora, Lusardi Annamaria, and Peter Van Oudheusden. 2015. Financial Literacy around the World: Insights from The Standard & Poor’s Ratings Services. In Global Financial Literacy Survey. Washington, DC: Global Financial Literacy Excellence Center, the George Washington University. [Google Scholar]

- Liaw, Andy. 2018. Package Randomforest. Available online: https://cran.r-project.org/web/packages/randomForest/randomForest.pdf (accessed on 15 February 2021).

- Lo Prete, Anna. 2013. Economic literacy, inequality, and financial development. Economics Letters 118: 74–76. [Google Scholar] [CrossRef]

- Lo Prete, Anna. 2018. Inequality and the finance you know: Does economic literacy matter? Economia Politica 35: 183–205. [Google Scholar] [CrossRef]

- López de Prado, Marcos. 2019. Beyond Econometrics: A Roadmap Towards Financial Machine Learning. SSRN. Available online: https://ssrn.com/abstract=3365282 (accessed on 10 October 2020). [CrossRef]

- Lusardi, Annamaria, and Carlo de Bassa Scheresberg. 2013. Financial literacy and high-cost borrowing in the United States. In NBER Working Paper; Cambridge: National Bureau of Economic Research. [Google Scholar]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2008. Planning and financial literacy: How do women fare? American Economic Review 98: 413–17. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011. Financial literacy around the world: An overview. Journal of Pension Economics & Finance 10: 497–508. [Google Scholar]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature 52: 5–44. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Peter Tufano. 2009. Debt Literacy, Financial Experience and Over-Indebtedness. In NBER Working Paper, 14808; Cambridge: National Bureau of Economic Research. [Google Scholar]

- Lusardi, Annamaria, de Bassa Scheresberg Carlo, and Oggero Noemi. 2016. Student loan debt in the US: An analysis of the 2015 NFCS Data. GFLEC Policy Brief, November 14. [Google Scholar]

- Lusardi, Annamaria, Michaud Pierre-Carl, and Olivia S. Mitchell. 2017. Optimal financial knowledge and wealth inequality. Journal of Political Economy 125: 431–77. [Google Scholar] [CrossRef] [PubMed]

- Lusardi, Annamaria. 2019. Financial literacy and the need for financial education: Evidence and implications. Swiss Journal of Economics and Statistics 155: 1–8. [Google Scholar] [CrossRef]

- Mandell, Lewis. 2008. The Financial Literacy of Young American Adults: Results of the 2008 National Jumpstart Coalition Survey of High School Seniors and College Students. Seattle: University of Washington and the Aspen Institute. [Google Scholar]

- Morgan, Peter J., and Long Q. Trinh. 2019. Determinants and Impacts of Financial Literacy in Cambodia and Viet Nam. Journal of Risk and Financial Management 12: 19. [Google Scholar] [CrossRef]

- Moritz, Benjamin, and Tom Zimmermann. 2016. Tree-Based Conditional Portfolio Sorts: The Relation between Past and Future Stock Returns. SSRN. Available online: https://ssrn.com/abstract=2740751 (accessed on 15 January 2021).

- OECD INFE. 2011. Measuring Financial Literacy: Core Questionnaire in Measuring Financial Literacy: Questionnaire and Guidance Notes for conducting an Internationally Comparable Survey of Financial literacy. Paris: OECD. [Google Scholar]

- OECD. 2017. G20/OECD INFE Report on Adult Financial Literacy in G20 Countries. Paris: OECD. [Google Scholar]

- OECD. 2020. Recommendation of the Council on Financial Literacy. OECD/LEGAL/0461. Paris: OECD. [Google Scholar]

- Ooi, Elizabeth. 2020. Give mind to the gap: Measuring gender differences in financial knowledge. Journal of Consumer Affairs 54: 931–50. [Google Scholar] [CrossRef]

- Previati, Daniele A., Ricci Ornella, and Lopes Stentella Lopes. 2020. La capacità delle famiglie italiane di assorbire lo shock pandemico: Il ruolo dell’alfabetizzazione finanziaria. In L’Italia ai Tempi del Covid-19. Edited by Paoloni Mauro and Marco Tudino. Toronto: Wolters Kluwer Italia srl, vol. 2. [Google Scholar]

- Probst, Phillipp, and Anne-Laure Boulesteix. 2018. To Tune or Not to Tune the Number of Trees in Random Forest. Journal of Machine Learning Research 18: 1–18. [Google Scholar]

- Ridgeway, Greg. 2007. Generalized Boosted Models: A Guide to the gbm Package. Available online: https://cran.r-project.org/web/packages/gbm/gbm.pdf (accessed on 21 May 2018).

- Rieger, Marc Oliver. 2020. How to Measure Financial Literacy? Journal of Risk and Financial Management 13: 324. [Google Scholar] [CrossRef]

- Therneau, Terry M., Elizabeth J. Atkinson, and Mayo Foundation. 2017. An Introduction to Recursive Partitioning Using the RPART Routines. Available online: https://cran.r-project.org/web/packages/rpart/vignettes/longintro.pdf (accessed on 16 September 2020).

- Trunk, Ales, Kocar Sergeja, and Nada Trunk. 2017. Education and training for financial literacy: The role of banks case study Slovenia. International Journal of Innovation and Learning. Inderscience Enterprises 22: 385–406. [Google Scholar]

- Van Rooij, Maarten, Lusardi Annamaria, and Rob Alessie. 2011. Financial literacy and stock market participation. Journal of Financial Economics 101: 449–72. [Google Scholar] [CrossRef]

- Von Gaudecker, Hans-Martin. 2015. How does household portfolio diversification vary with financial literacy and financial advice? Journal of Finance 70: 489–507. [Google Scholar] [CrossRef]

- Xiao, Jing Jian, Serido Joyce, and Soyeon Shim. 2011. Financial education, financial knowledge, and risky credit behaviour of college students. In Financial Decisions Across the Lifespan: Problems, Programs, and Prospects. Edited by Douglas J. Lamdin. New York: Springer, pp. 113–28. [Google Scholar]

- Yoong, Joanne. 2011. Financial illiteracy and stock market participation: Evidence from the RAND American Life Panel. In Financial Literacy: Implications for Retirement Security and the Financial Marketplace. Edited by Olivia S. Mitchell and Lusardi Annamaria. Oxford: Oxford University Press, pp. 76–100. [Google Scholar]

| 1 | Our results are obtained from special R packages suitably implemented for tree-based ML algorithms: the rpart package developed by Therneau et al. (2017) for DT, the randomForest package developed by Liaw (2018) for RF, and the gbm package developed by Ridgeway (2007) for GBM. A brief description of the parameters and their optimal tuning for the different ML algorithms is provided in Table A2 in the Appendix A. |

| Personal Characteristics | % | Personal Characteristics | % |

|---|---|---|---|

| 1. Gender | 5. Employment status | ||

| Men | 51% | Employee | 39% |

| 2. Education | Self-employed | 12% | |

| University degree/some university studies | 26.7% | Unemployed | 9% |

| Secondary school (completed) | 42.4% | Unpaid domestic work | 9% |

| Some secondary school | 25.3% | Retired | 23% |

| Primary school (completed) | 5.2% | 6. Family status | |

| Some primary school | 0.4% | Single | 11% |

| 3. Financial fragility | 7. Geography | ||

| Household economic stress (HE.stress) | 26% | Centre | 19% |

| Risk capacity | 57% | South | 21% |

| 4. Age | North-West | 27% | |

| <30 | 13% | North-East | 21% |

| 30–39 | 15% | Islands | 11% |

| 40–49 | 22% | Other | |

| 50–59 | 20% | Native | 98% |

| 60–69 | 17% | Financial behavior (mean) | 4.5 |

| 70–79 | 10% | Financial attitude (mean) | 2,1 |

| >80 | 4% | FL self-assessment | 8% |

| Predicted Negative | Predicted Positive | |

|---|---|---|

| Actual negative | True negatives (TN) | False positives (FP) |

| Actual positive | False negatives (FN) | True positives (TP) |

| Model | Sensitivity | Specificity | Precision | Accuracy | AUC |

|---|---|---|---|---|---|

| DT | 0.6250 | 0.6462 | 0.7172 | 0.6337 | 0.6313 |

| RF | 0.6478 | 0.7184 | 0.7992 | 0.6737 | 0.6702 |

| GBM | 0.7225 | 0.6268 | 0.5656 | 0.6653 | 0.7231 |

| Logit | 0.6092 | 0.6283 | 0.7090 | 0.6168 | 0.6908 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Levantesi, S.; Zacchia, G. Machine Learning and Financial Literacy: An Exploration of Factors Influencing Financial Knowledge in Italy. J. Risk Financial Manag. 2021, 14, 120. https://doi.org/10.3390/jrfm14030120

Levantesi S, Zacchia G. Machine Learning and Financial Literacy: An Exploration of Factors Influencing Financial Knowledge in Italy. Journal of Risk and Financial Management. 2021; 14(3):120. https://doi.org/10.3390/jrfm14030120

Chicago/Turabian StyleLevantesi, Susanna, and Giulia Zacchia. 2021. "Machine Learning and Financial Literacy: An Exploration of Factors Influencing Financial Knowledge in Italy" Journal of Risk and Financial Management 14, no. 3: 120. https://doi.org/10.3390/jrfm14030120

APA StyleLevantesi, S., & Zacchia, G. (2021). Machine Learning and Financial Literacy: An Exploration of Factors Influencing Financial Knowledge in Italy. Journal of Risk and Financial Management, 14(3), 120. https://doi.org/10.3390/jrfm14030120