Plato as a Game Theorist towards an International Trade Policy

Abstract

1. Introduction

2. The Athenian Economy during the 4th Century BCE Period

“In the Classical period, Athens was obviously the greatest market in the Mediterranean world, the one that attracted all the merchants who wanted to sell a large cargo rapidly at a good price.”

3. Plato’s Game Theory of Justice: The Concept

“By nature, they say, to commit injustice is a good and to suffer it is an evil, but that the excess of evil in being wronged is greater than the excess of good in doing wrong. So that when men do wrong and are wronged by one another and taste of both, those who lack the power to avoid the one and take the other determine that it is for their profit to make a compact with one another neither to commit nor to suffer injustice; and that this is the beginning of legislation and covenants between men, and that they name the commandment of the law the lawful and the just, and that this is the genesis and essential nature of justice—a compromise between the best, which is to do wrong with impunity, and the worst, which is to be wronged and be impotent to get one’s revenge. Justice, they tell us, being mid-way between the two, is accepted and approved, not as a real good, but as a thing honored in the lack of vigor to do injustice, since anyone who had the power to do it and was in reality ‘a man’ would never make a compact with anybody either to wrong nor to be wronged; for he would be mad. The nature, then, of justice is this and such as this, Socrates, and such are the conditions in which it originates, according to the theory. If we grant to each, the just and the unjust, license and power to do whatever he pleases, and then accompany them in imagination and see whither his desire will conduct each. We should then catch the just man in the very act of resorting to the same conduct as the unjust man because of the self-advantage which every creature by its nature pursues as a good, while by the convention of law it is forcibly diverted to paying honor to equality…”

4. Plato’s Game Theory of Justice. A Fictional Scenario Based on Real Life Practices

4.1. A Fictional Case: Apollonius; A Merchant from Emporium

4.2. The Game

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Acknowledgments

Conflicts of Interest

References

Primary Sources

Aristophanes. 1994. Frogs, Engl. Trnsl. M. Dillon. New York: Routledge.Aristotle. 1944. Politics, Engl. Trnsl. H. Rackham. Cambridge: Harvard University Press; London: William Heinemann Ltd., Perseus Digital Library.Aristotle. 1952. Athenian Constitution, Engl. Trnsl. H. Rackham. Cambridge: Harvard University Press; London: William Heinemann Ltd., Perseus Digital Library.Demosthenes. 1939. Speeches: XXIV, Against Timocrates. Engl. Trnsl. A. T. Murray. Cambridge: Harvard University Press; London: William Heinemann Ltd., Perseus Digital Library.Isocrates. 1980. Speeches: Panegyricus, 4, Engl. Trnsl. G. Norlin. Cambridge: Harvard University Press; London: William Heinemann, Ltd., Perseus Digital Library.Lysias. 1930. Speeches, XII: Against Eratosthenes, Engl. Trnsl. W. R. M. Lamb. Cambridge: Harvard University Press; London: William Heinemann Ltd., Perseus Digital Library.Plato. 1969. Plato in Twelve Volumes, Vols. 5 & 6. Republic, Engl. Trnsl. P. Shorey. Cambridge: Harvard University Press; London: William Heinemann Ltd., Perseus Digital Library.Pseudo-Xenophon. 1984. Constitution of the Athenians, Engl. Trnsl. E. C. Marchant. Cambridge: Harvard University Press; London: William Heinemann, Ltd.Xenophon. 1914. Cyropaedia, Engl. Trnsl. W. Miller. Cambridge: Harvard University Press; London: William Heinemann, Ltd., Perseus Digital Library.Xenophon. 1923. Memorabilia. Cambridge: Harvard University Press; London: William Heinemann, Ltd., Perseus (Xenophon 1914) Digital Library.Xenophon. 1925. Minor Works: Ways and Means. Cambridge: Harvard University Press; London: William Heinemann, Ltd., Perseus Digital Library.Secondary Sources

- Acemoglu, Daron, and James Robinson. 2013. Why Nations Fail: The Origins of Power, Prosperity and Poverty. New York: Crown Business. [Google Scholar]

- Acton, Peter H. 2014. Poiesis: Manufacturing in Classical Athens. Oxford: Oxford University Press. [Google Scholar]

- Adler, Paul S. 2001. Market, Hierarchy and trust: The Knowledge Economy and the Future of Capitalism. Organisation Science 12: 215–34. [Google Scholar] [CrossRef]

- Akerlof, George A. 1970. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. The Quarterly Journal of Economics 84: 488–500. [Google Scholar] [CrossRef]

- Amemiya, Takeshi. 2004. The Economic Ideas of Classical Athens. The Kyoto Economic Review 73: 57–74. [Google Scholar]

- Arrow, Kenneth J. 1974. The Limits of Organization. New York: W. W. Norton & Company. [Google Scholar]

- Baloglou, Christos P. 2012. The Tradition of Economic Thought in the Mediterranean World from the Ancient Classical Times through the Hellenistic Times Until the Byzantine Times and the Arab Islamic World. In Handbook of History of Economic Thought. Insights of the Founders of Modern Economics. Edited by J. Georg Backhaus. New York, Heidelberg and London: Springer, pp. 7–92. [Google Scholar]

- Bingham, Tom. 2011. The Rule of Law. London: Penguin UK. [Google Scholar]

- Bitros, George C., and Anastassios Karayiannis. 2008. Values and Institutions as Determinants of Entrepreneurship in Ancient Athens. Journal of Institutional Economics 4: 205–30. [Google Scholar] [CrossRef]

- Bitros, George C., Emmanouil M. L. Economou, and Nicholas C. Kyriazis. 2020. Democracy and Money: Lessons for Today from Athens in Classical Times. London and New York: Routledge. [Google Scholar]

- Bresson, Alain. 2016a. The Making of the Ancient Greek Economy: Institutions, Markets, and Growth in the City-States. Princeton: Princeton University Press. [Google Scholar]

- Bresson, Alain. 2016b. Aristotle and Foreign Trade. In The Ancient Greek Economy: Markets, Households and City States. Edited by Edward M. Harris, David M. Lewis and Mark Woolmer. New York: Cambridge University Press, pp. 41–65. [Google Scholar]

- Coase, Ronald H. 1960. The Problem of Social Cost. Journal of Law and Economics 3: 1–44. [Google Scholar] [CrossRef]

- Cohen, Edward E. 1992. Athenian Economy and Society: A Banking Perspective. Princeton: Princeton University Press. [Google Scholar]

- Economou, Emmanouil M. L. 2020. The Achaean Federation in Ancient Greece. History, Political and Economic Organization, Warfare and Strategy. Cham: Springer. [Google Scholar]

- Economou, Emmanouil Μ. L., and Nicholas C. Κyriazis. 2017. The emergence and the evolution of property rights in ancient Greece. Journal of Institutional Economics 13: 53–77. [Google Scholar] [CrossRef]

- Economou, Emmanouil M. L., and Nicholas C. Κyriazis. 2019. Democracy and Economy: An Inseparable Relationship Since Ancient Times to Today. Newcastle Upon Tyne: Cambridge Scholars Publishing. [Google Scholar]

- Economou, Emmanouil Μ. L., Nicholas C. Kyriazis, and Nikolaos A. Kyriazis. 2021. Money Decentralization under Direct Democracy Procedures. The Case of Classical Athens. Journal of Risk and Financial Management 14: 30. [Google Scholar] [CrossRef]

- Elliot, Colin P. 2018. The Role of Money in the Economies of Ancient Greece and Rome. In Handbook of the History of Money and Currency. Edited by Stephano Battilossi, Youssef Cassis and Kazuhiko Yago. Singapore: Springer Nature Singapore Private Limited, pp. 1–20. [Google Scholar]

- Engen, Darel T. 2005. Ancient Greenbacks, Athenian Owls, the Law of Nicophon, and the Greek Economy. Historia 54: 359–81. [Google Scholar]

- Ferguson, Niall. 2008. The Ascent of Money: A Financial History of the World. New York: The Penguin Press. [Google Scholar]

- Figueira, T. J. 1998. The Power of Money: Coinage and Politics in the Athenian Empire. Philadelphia: University of Pennsylvania Press. [Google Scholar]

- Finley, Moses I. 1973. The Ancient Economy. Berkeley: University of California Press. [Google Scholar]

- Finley, Moses I. 1983. Economy and Society in Ancient Greece. New York: Penguin Non Classics. [Google Scholar]

- Fudenberg, Drew, and Jean Tirole. 1993. Game Theory. London: The MIT Press. [Google Scholar]

- Fukuyama, Francis. 1995. Trust: The Social Virtues and the Creation of Prosperity. New York: Free Press. [Google Scholar]

- Gibbons, Robert. 1992. A Primer in Game Theory. New York: Harvester Wheatsheaf. [Google Scholar]

- Gowder, Paul. 2016. The Rule of Law in the Real World. Cambridge: Cambridge University Press. [Google Scholar]

- Greif, Avner. 2006. Institutions and the Path to the Modern Economy: Lessons from Medieval Trade. Cambridge and New York: Cambridge University Press. [Google Scholar]

- Halkos, George E., and Nicholas C. Kyriazis. 2010. The Athenian Economy in the Age of Demosthenes. European Journal of Law and Economics 29: 255–77. [Google Scholar] [CrossRef]

- Halkos, George E., and Argyro Zisiadou. 2020. Is Investors’ Psychology Affected Due to a Potential Unexpected Environmental Disaster? Journal of Risk and Financial Management 13: 151. [Google Scholar] [CrossRef]

- Harris, Edward M., and David M. Lewis. 2016. Introduction: Markets in Classical and Hellenistic Greece. In The Ancient Greek Economy: Markets, Households and City States. New York: Cambridge University Press, pp. 1–40. [Google Scholar]

- Hodgson, Geoffrey M. 2015. Conceptualizing Capitalism: Institutions, Evolution, Future. Chicago: University of Chicago Press. [Google Scholar]

- Kramer, Roderick M. 1999. Trust and Distrust in Organisations: Emerging Perspectives, Enduring Questions. Annual Review of Psychology 50: 569–98. [Google Scholar] [CrossRef]

- O’Halloran, Barry. 2018. The Political Economy of Classical Athens. A Naval Perspective. Leiden and Boston: Brill. [Google Scholar]

- Ober, Josiah. 2008. Democracy and Knowledge. Innovation and Learning in Classical Athens. Princeton University Press: Princeton. [Google Scholar]

- Puga, Diego, and Daniel Trefler. 2014. International Trade and Institutional Change: Medieval Venice’s Response to Globalization. The Quarterly Journal of Economics 129: 753–821. [Google Scholar] [CrossRef]

- Ryan, John, and John Loughlin. 2018. Lessons from Historical Monetary Unions—Is the European Monetary Union Making the Same Mistakes? International Economics and Economic Policy 15: 709–25. [Google Scholar] [CrossRef]

- Stewart, Edmund, Harris Edward, and Lewis David. 2020. Specialization and the Division of Labour in the Ancient City. In Skilled Labour and Professionalism in Ancient Greece and Rome. Edited by Edmund Stewart, Edward Harris and David Lewis. Cambridge: Cambridge University Press, pp. 127–202. [Google Scholar]

- Tridimas, George. 2019. The Debate about the Nature of the Ancient Greek Economy: 19th Century German Scholarship and Modern Economic Theory. In German-Greek Yearbook of Political Economy. Edited by Manfred J. Holler and George Tridimas. München: Verlag Holler, vol. 2, pp. 4–25. [Google Scholar]

- van Alfen, Peter G. 2011. Hatching Owls: Athenian Public Finance and the Regulation of Coin Production. In Quantifying Monetary Supplies in Greco-Roman Times. Edited by François de Callatay. Bari: Edipuglia, pp. 127–49. [Google Scholar]

| Strategies | |||

|---|---|---|---|

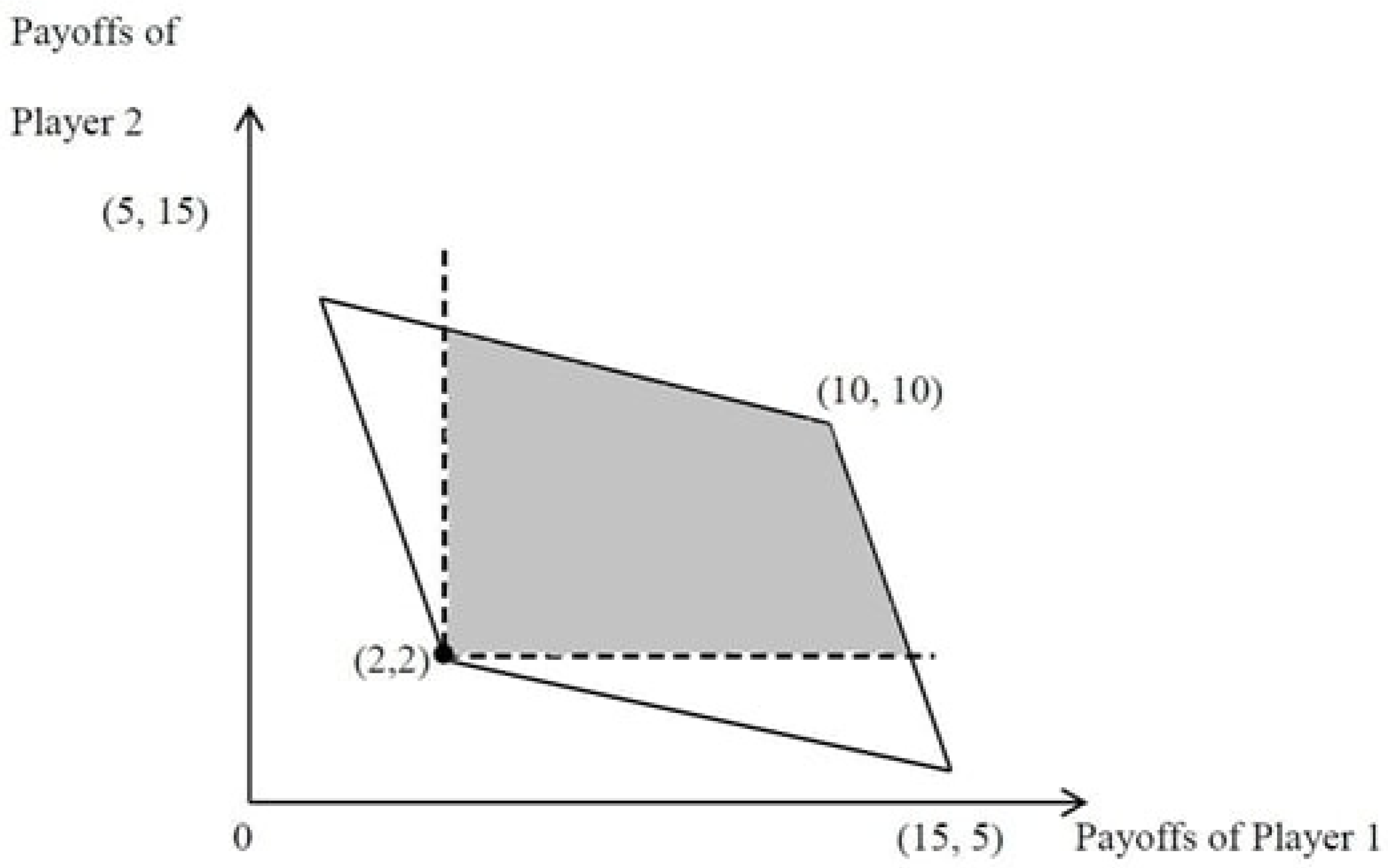

| Apollonius | Unjust (dishonest) | Just (honest) | |

| Heraiphon | |||

| Unjust (dishonest) | (2, 2) | (15, 5) | |

| Just (honest) | (5, 15) | (10, 10) | |

| Strategies | |||||

|---|---|---|---|---|---|

| Apollonius | |||||

| Haraiphon | Apollonius | Unjust (dishonest) | Just (honest) | State (inspection mechanisms) | |

| Heraiphon | |||||

| Unjust (dishonest) | (−1, −1) | (−1, 8) | (1, 0) | ||

| Just (honest) | (8, −1) | (10, 10) | (0, 0) | ||

| State (inspection mechanisms) | (0, 1) | (0, 0) | (1, 1) | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Halkos, G.E.; Kyriazis, N.C.; Economou, E.M.L. Plato as a Game Theorist towards an International Trade Policy. J. Risk Financial Manag. 2021, 14, 115. https://doi.org/10.3390/jrfm14030115

Halkos GE, Kyriazis NC, Economou EML. Plato as a Game Theorist towards an International Trade Policy. Journal of Risk and Financial Management. 2021; 14(3):115. https://doi.org/10.3390/jrfm14030115

Chicago/Turabian StyleHalkos, George E., Nicholas C. Kyriazis, and Emmanouil M. L. Economou. 2021. "Plato as a Game Theorist towards an International Trade Policy" Journal of Risk and Financial Management 14, no. 3: 115. https://doi.org/10.3390/jrfm14030115

APA StyleHalkos, G. E., Kyriazis, N. C., & Economou, E. M. L. (2021). Plato as a Game Theorist towards an International Trade Policy. Journal of Risk and Financial Management, 14(3), 115. https://doi.org/10.3390/jrfm14030115