E.U. and China Trends in Trade in Challenging Times

Abstract

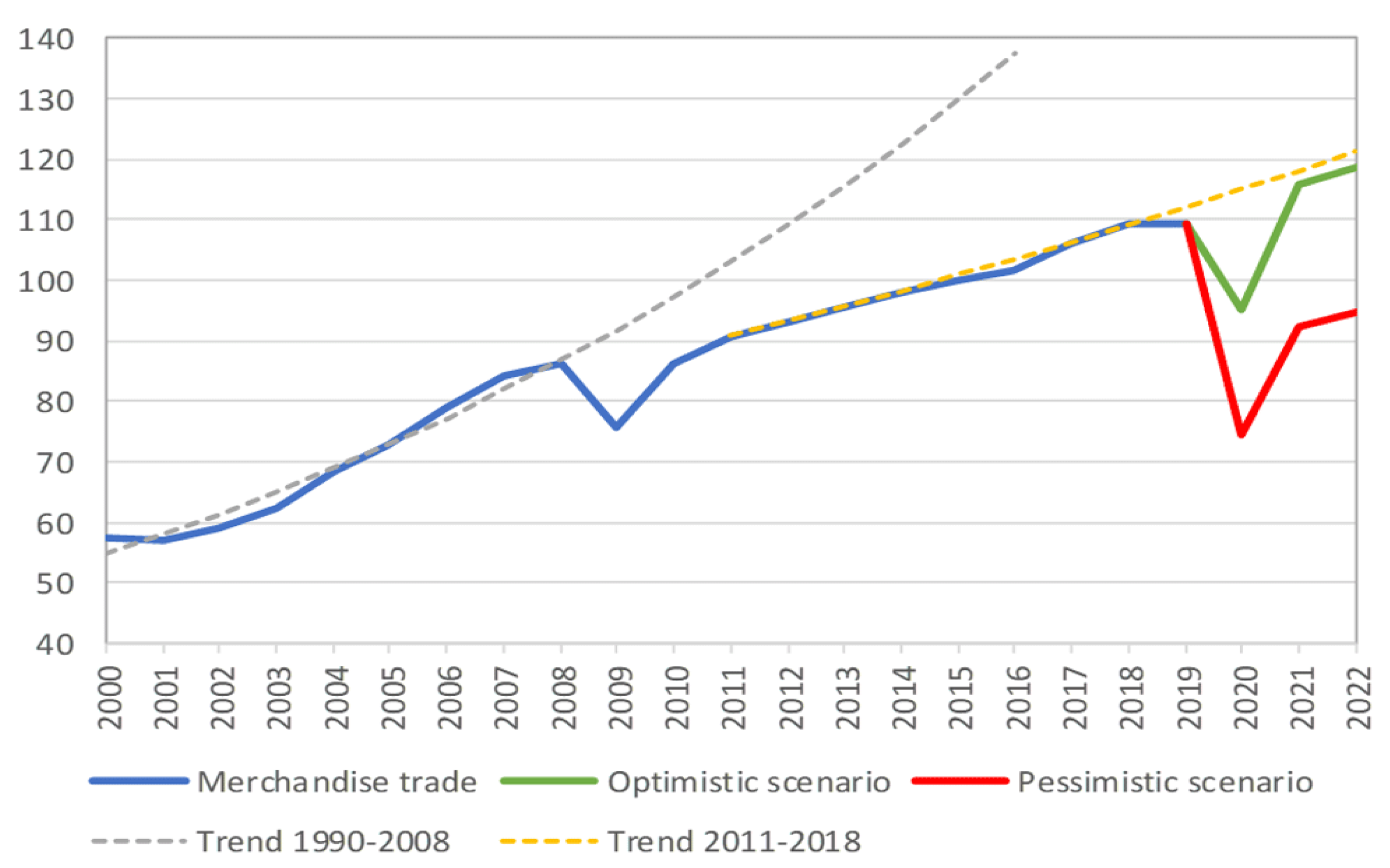

1. Introduction

2. Previous Literature

3. Background and Macroeconomic Conditions of China

4. Methodology and Data Limits

5. Data and Analysis

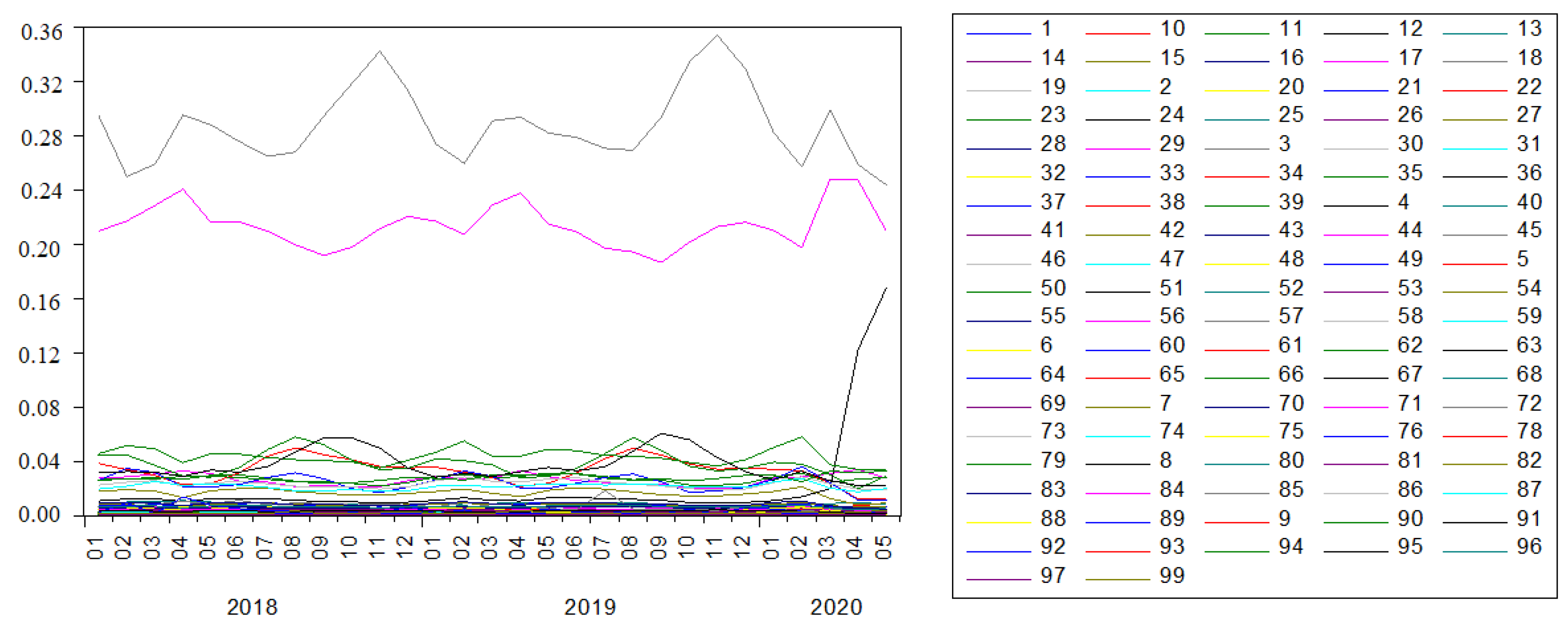

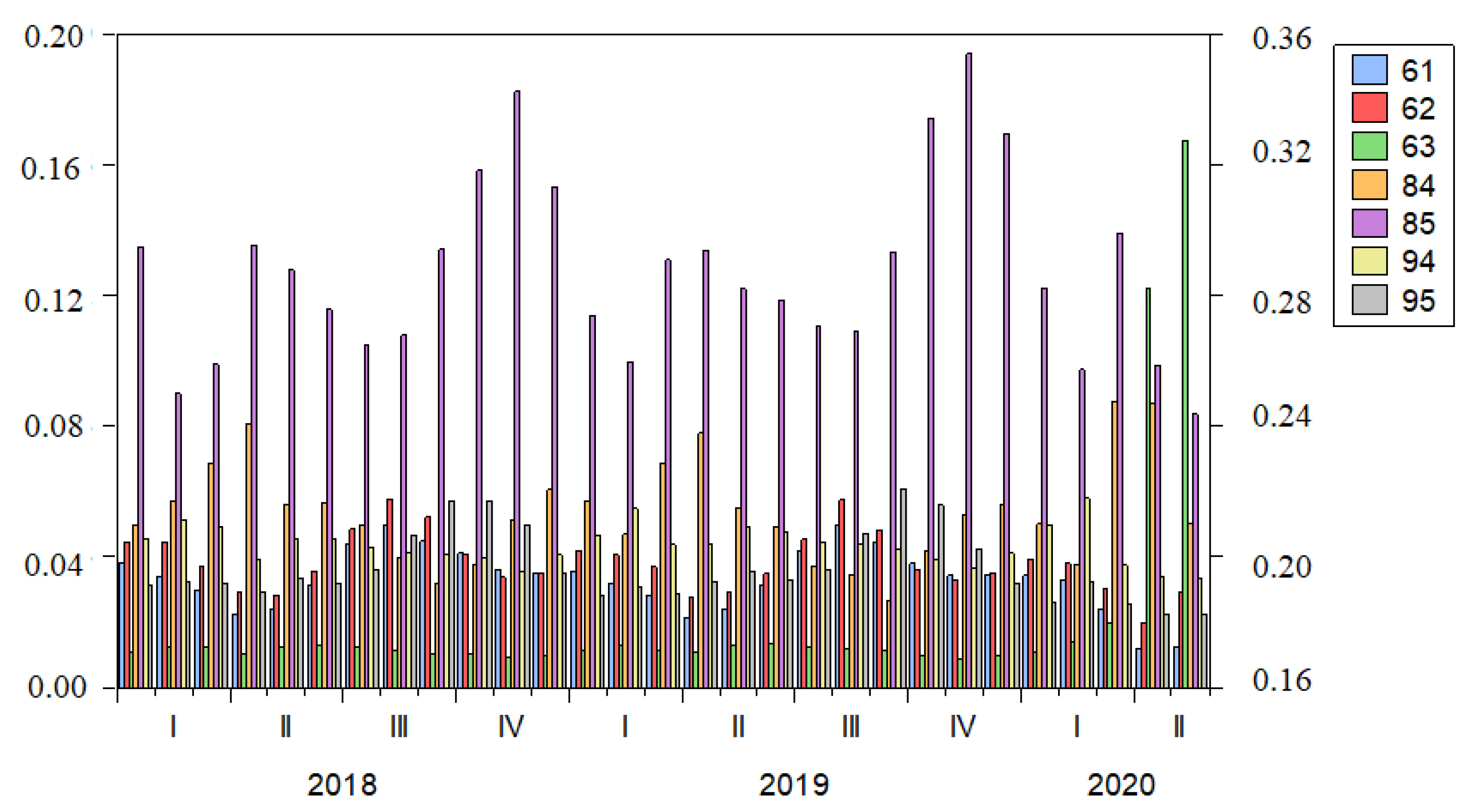

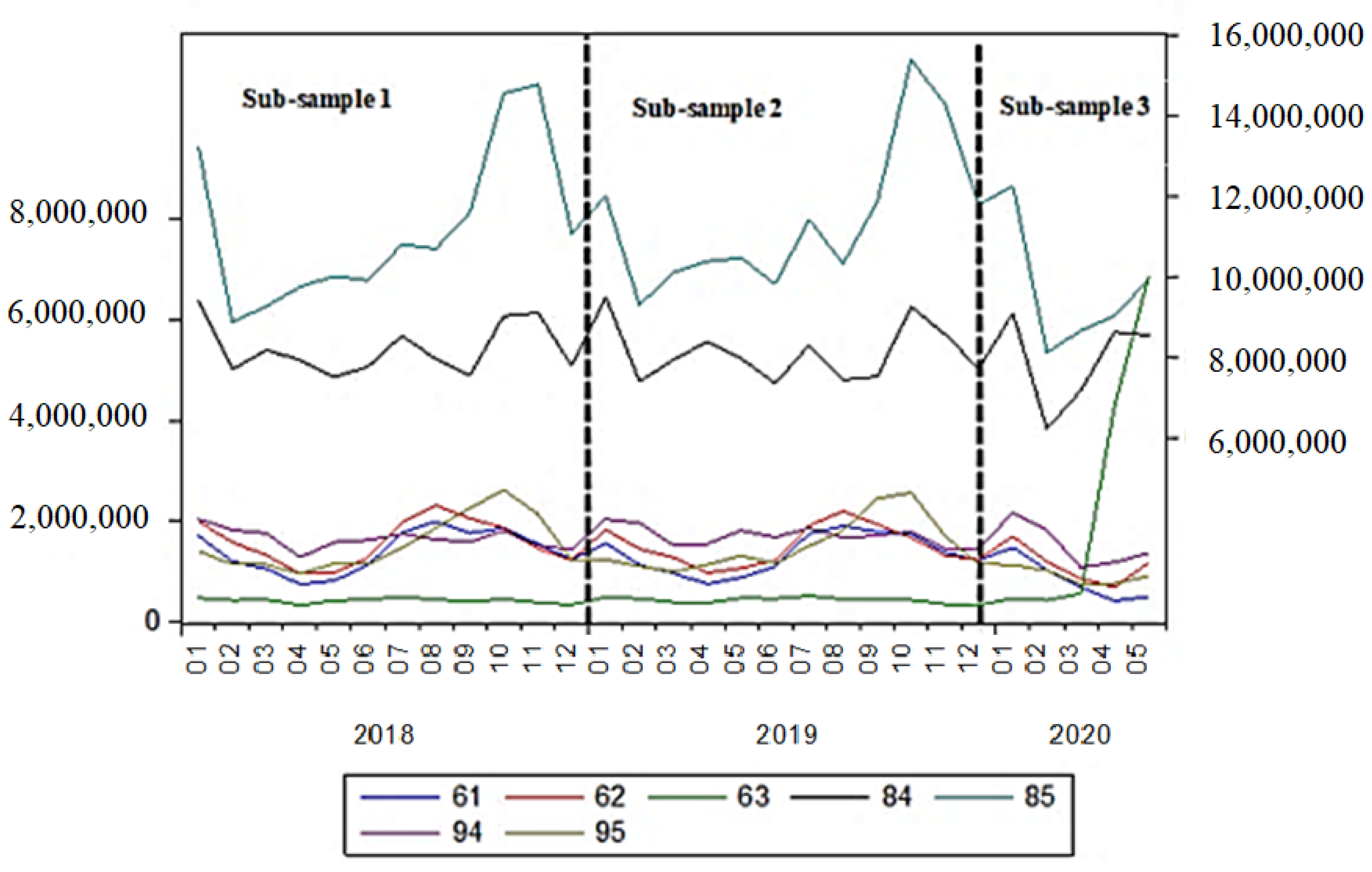

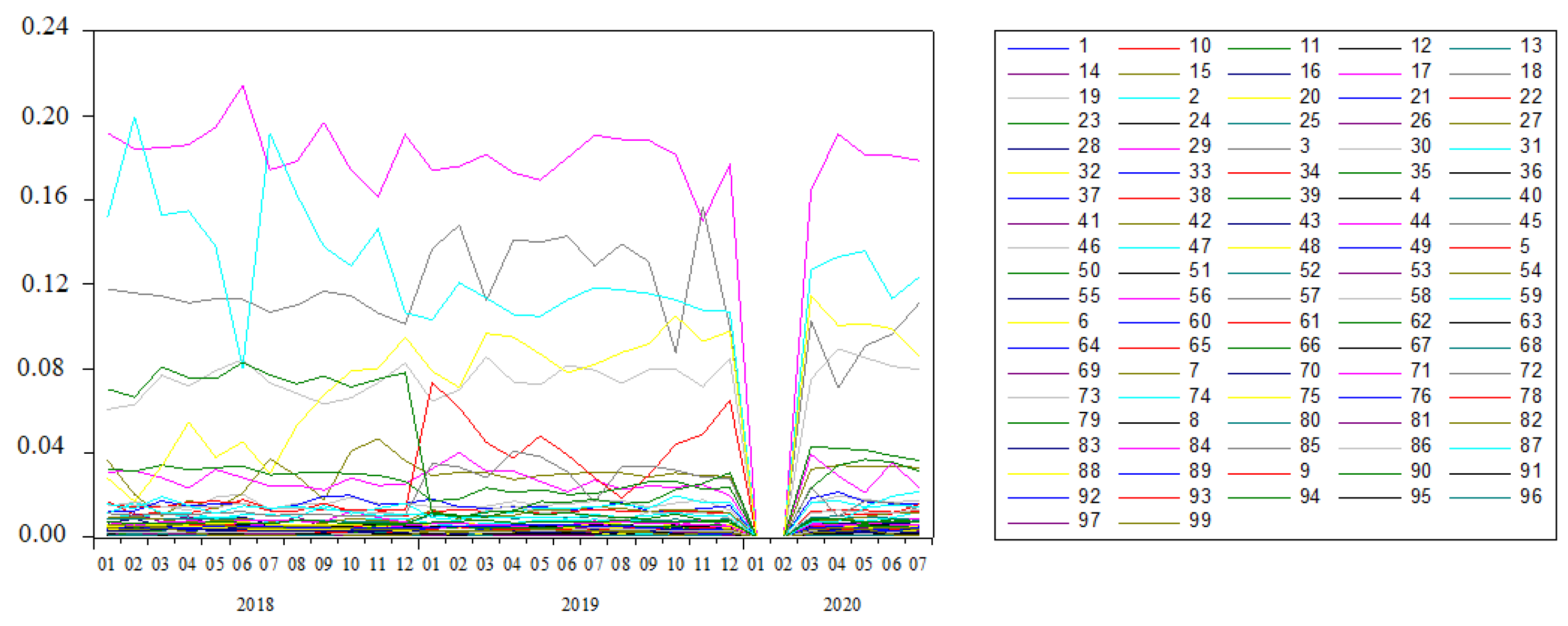

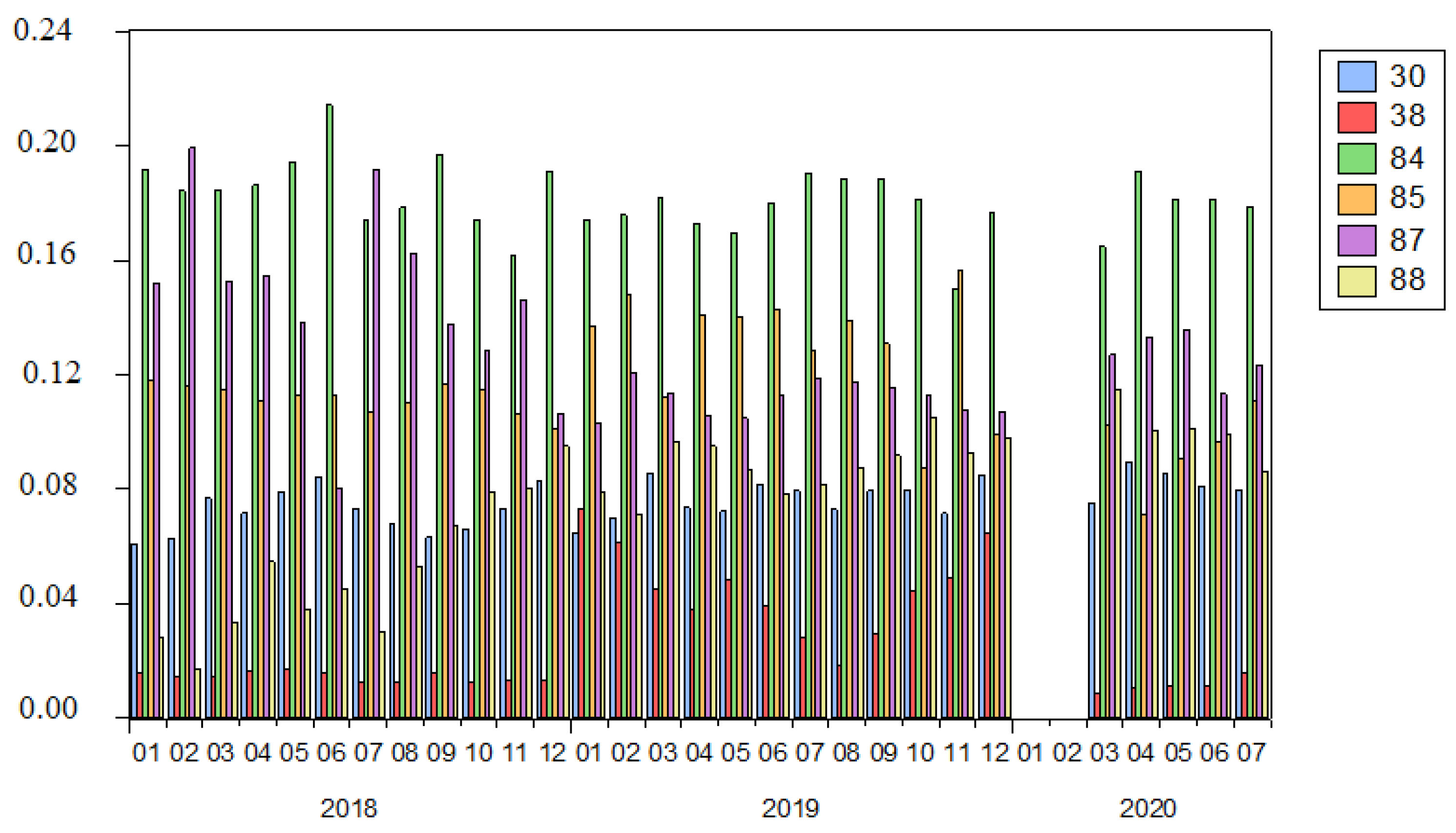

5.1. Import to Europe from China

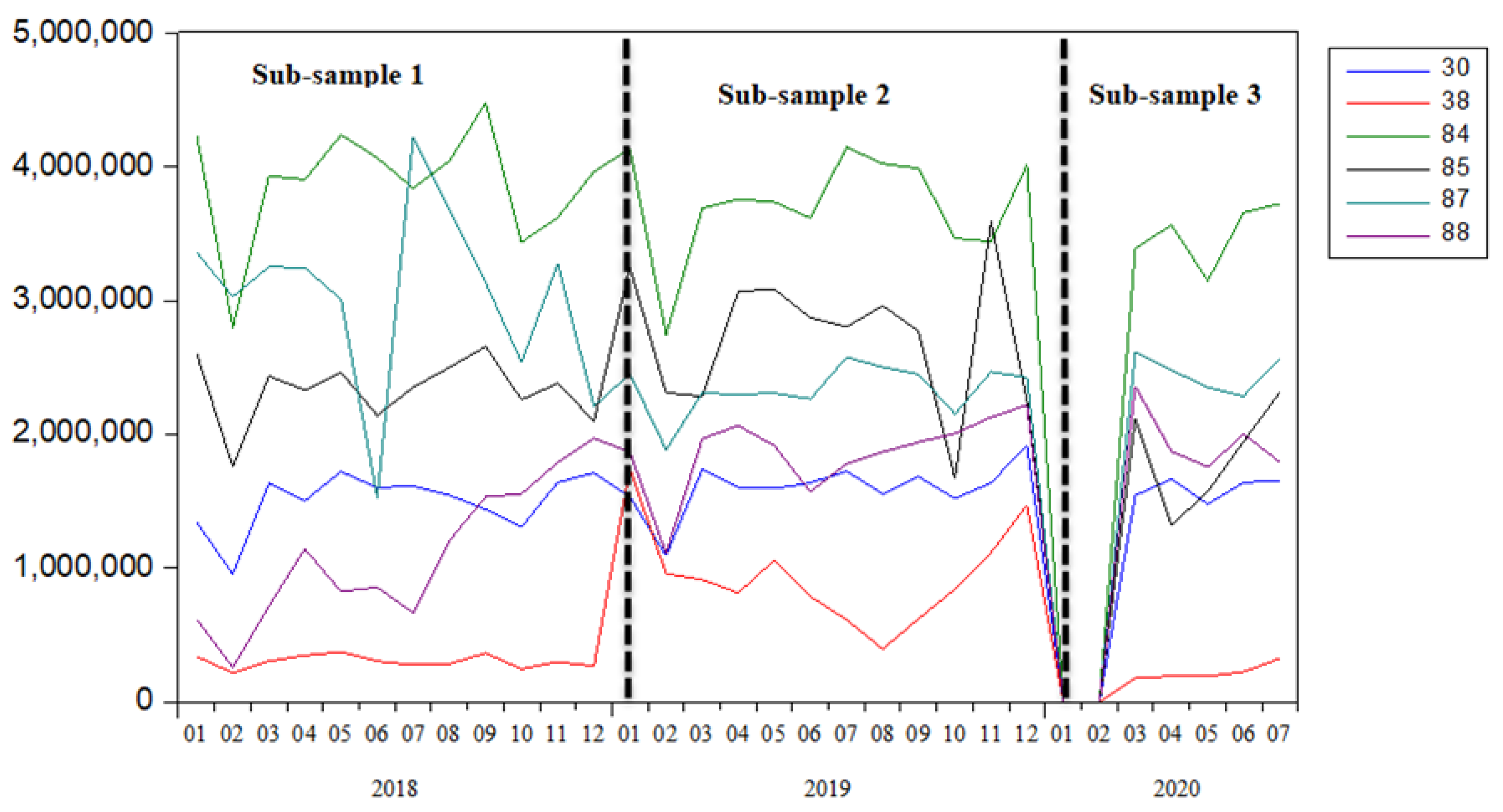

5.2. Imports to China from Europe

6. Conclusions, Limitations and Further Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| No | Article Definition |

|---|---|

| 1 | Live animals |

| 2 | Meat and edible meat offal |

| 3 | Fish and crustaceans, molluscs, and other aquatic invertebrates |

| 4 | Dairy produce; birds’ eggs; natural honey; edible products of animal origin, not elsewhere… |

| 5 | Products of animal origin, not elsewhere specified or included |

| 6 | Live trees and other plants; bulbs, roots, and the like; cut flowers and ornamental foliage |

| 7 | Edible vegetables and certain roots and tubers |

| 8 | Edible fruit and nuts; peel of citrus fruit or melons |

| 9 | Coffee, tea, maté and spices |

| 10 | Cereals |

| 11 | Products of the milling industry; malt; starches; inulin; wheat gluten |

| 12 | Oil seeds and oleaginous fruits; miscellaneous grains, seeds, and fruit; industrial or medicinal… |

| 13 | Lac; gums, resins and other vegetable saps and extracts |

| 14 | Vegetable plaiting materials: vegetable products not elsewhere specified or included |

| 15 | Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal… |

| 16 | Preparations of meat, of fish or of crustaceans, molluscs, or other aquatic invertebrates |

| 17 | Sugars and sugar confectionery |

| 18 | Cocoa and cocoa preparations |

| 19 | Preparations of cereals, flour, starch, or milk; pastrycooks products |

| 20 | Preparations of vegetables, fruit, nuts, or other parts of plants |

| 21 | Miscellaneous edible preparations |

| 22 | Beverages, spirits, and vinegar |

| 23 | Residues and waste from the food industries; prepared animal fodder |

| 24 | Tobacco and manufactured tobacco substitutes |

| 25 | Salt; sulphur; earths and stone; plastering materials, lime, and cement |

| 26 | Ores, slag, and ash |

| 27 | Mineral fuels, mineral oils, and products of their distillation; bituminous substances; mineral… |

| 28 | Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, … |

| 29 | Organic chemicals |

| 30 | Pharmaceutical products |

| 31 | Fertilizers |

| 32 | Tanning or dyeing extracts; tannins and their derivatives; dyes, pigments, and other colouring… |

| 33 | Essential oils and resinoids; perfumery, cosmetic or toilet preparations |

| 34 | Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial… |

| 35 | Albuminoidal substances; modified starches; glues; enzymes |

| 36 | Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations |

| 37 | Photographic or cinematographic goods |

| 38 | Miscellaneous chemical products |

| 39 | Plastics and articles thereof |

| 40 | Rubber and articles thereof |

| 41 | Raw hides and skins (other than furskins) and leather |

| 42 | Articles of leather; saddlery and harness; travel goods, handbags, and similar containers; articles… |

| 43 | Furskins and artificial fur; manufactures thereof |

| 44 | Wood and articles of wood; wood charcoal |

| 45 | Cork and articles of cork |

| 46 | Manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork |

| 47 | Pulp of wood or of other fibrous cellulosic material; recovered (waste and scrap) paper or… |

| 48 | Paper and paperboard; articles of paper pulp, of paper or of paperboard |

| 49 | Printed books, newspapers, pictures, and other products of the printing industry; manuscripts, … |

| 50 | Silk |

| 51 | Wool, fine, or coarse animal hair; horsehair yarn and woven fabric |

| 52 | Cotton |

| 53 | Other vegetable textile fibres; paper yarn and woven fabrics of paper yarn |

| 54 | Man-made filaments; strip and the like of man-made textile materials |

| 55 | Man-made staple fibres |

| 56 | Wadding, felt and nonwovens; special yarns; twine, cordage, ropes and cables and articles thereof |

| 57 | Carpets and other textile floor coverings |

| 58 | Special woven fabrics; tufted textile fabrics; lace; tapestries; trimmings; embroidery |

| 59 | Impregnated, coated, covered, or laminated textile fabrics; textile articles of a kind suitable… |

| 60 | Knitted or crocheted fabrics |

| 61 | Articles of apparel and clothing accessories, knitted or crocheted |

| 62 | Articles of apparel and clothing accessories, not knitted or crocheted |

| 63 | Other made-up textile articles; sets; worn clothing and worn textile articles; rags |

| 64 | Footwear, gaiters, and the like; parts of such articles |

| 65 | Headgear and parts thereof |

| 66 | Umbrellas, sun umbrellas, walking sticks, seat-sticks, whips, riding-crops, and parts thereof |

| 67 | Prepared feathers and down and articles made of feathers or of down; artificial flowers; articles… |

| 68 | Articles of stone, plaster, cement, asbestos, mica, or similar materials |

| 69 | Ceramic products |

| 70 | Glass and glassware |

| 71 | Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad… |

| 72 | Iron and steel |

| 73 | Articles of iron or steel |

| 74 | Copper and articles thereof |

| 75 | Nickel and articles thereof |

| 76 | Aluminium and articles thereof |

| 78 | Lead and articles thereof |

| 79 | Zinc and articles thereof |

| 80 | Tin and articles thereof |

| 81 | Other base metals; cermets; articles thereof |

| 82 | Tools, implements, cutlery, spoons, and forks, of base metal; parts thereof of base metal |

| 83 | Miscellaneous articles of base metal |

| 84 | Machinery, mechanical appliances, nuclear reactors, boilers; parts thereof |

| 85 | Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television… |

| 86 | Railway or tramway locomotives, rolling stock and parts thereof; railway or tramway track fixtures… |

| 87 | Vehicles other than railway or tramway rolling stock, and parts and accessories thereof |

| 88 | Aircraft, spacecraft, and parts thereof |

| 89 | Ships, boats, and floating structures |

| 90 | Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical… |

| 91 | Clocks and watches and parts thereof |

| 92 | Musical instruments; parts and accessories of such articles |

| 93 | Arms and ammunition; parts and accessories thereof |

| 94 | Furniture: bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; … |

| 95 | Toys, games, and sports requisites; parts and accessories thereof |

| 96 | Miscellaneous manufactured articles |

| 97 | Works of art, collectors’ pieces, and antiques |

| 99 | Commodities not elsewhere specified |

| 2018M1–2018M5 | |||||||

| NUM61 | NUM62 | NUM63 | NUM84 | NUM85 | NUM94 | NUM95 | |

| Mean | 1,109,953 | 1,370,011 | 423,097 | 8,158,951 | 10,237,934 | 1,700,424 | 1,164,220 |

| Median | 1,063,323 | 1,327,073 | 432,193 | 7,953,563 | 9,768,318 | 1,759,653 | 1,148,836 |

| Maximum | 1,717,022 | 1,993,574 | 478,563 | 9,396,193 | 13,214,381 | 2,042,685 | 1,404,459 |

| Minimum | 747,201 | 963,059 | 336,282 | 7,526,866 | 8,887,623 | 1,287,016 | 958,312 |

| 2019M1–2019M5 | |||||||

| Mean | 1,063,365 | 1,326,123 | 441,647.2 | 8,262,721 | 10,467,730 | 1,779,002 | 1,161,496 |

| Median | 973,579 | 1,288,951 | 465,476 | 7,991,856 | 10,396,900 | 1,820,083 | 1,143,198 |

| Maximum | 1,565,175 | 1,833,292 | 489,775 | 9,523,103 | 12,018,003 | 2,041,324 | 1,312,633 |

| Minimum | 754,189 | 980,167 | 380,832 | 7,422,726 | 9,315,948 | 1,517,852 | 1,000,972 |

| 63 | 630790 | 630790/63 | |

|---|---|---|---|

| 2019M01 | 489,775 | 153,409 | 0.313223 |

| 2019M02 | 465,476 | 134,854 | 0.289712 |

| 2019M03 | 391,869 | 115,517 | 0.294785 |

| 2019M04 | 380,832 | 111,539 | 0.292882 |

| 2019M05 | 480,284 | 136,707 | 0.284638 |

| 2019M06 | 466,901 | 134,050 | 0.287106 |

| 2019M07 | 522,960 | 163,014 | 0.311714 |

| 2019M08 | 455,069 | 152,969 | 0.336145 |

| 2019M09 | 452,994 | 157,314 | 0.347276 |

| 2019M10 | 439,513 | 145,793 | 0.331715 |

| 2019M11 | 358,262 | 120,512 | 0.336380 |

| 2019M12 | 339,827 | 115,992 | 0.341327 |

| 2020M01 | 472,108 | 153,868 | 0.325917 |

| 2020M02 | 433,576 | 127,763 | 0.294673 |

| 2020M03 | 569,370 | 396,780 | 0.696875 |

| 2020M04 | 4,280,354 | 4,109,009 | 0.959969 |

| 2020M05 | 6,848,965 | 6,660,971 | 0.972551 |

References

- Akcigit, Ufuk, and Sina T. Ates. 2019. What Happened to U.S. Business Dynamism? (No. w25756). National Bureau of Economic Research. Available online: https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_201956.pdf (accessed on 20 January 2021).

- Ang, Yuen Yuen. 2020. When COVID-19 Meets Centralized, Personalized Power. Nature Human Behaviour 4: 445–47. [Google Scholar] [CrossRef]

- Babenko, Vitalina, Oolga Pravotorova, Nataliia Yefremova, Svitlana Popova, Irina Kazanchuk, and Vladyslav Honcharenko. 2020. The innovation development in China in the context of globalization. WSEAS Transactions on Business and Economics 17: 523–31. [Google Scholar]

- Balassa, Bela. 1978. Exports and Economic Growth. Journal of Development Economics 5: 181–89. [Google Scholar] [CrossRef]

- Baldwin, Richard, and Rebecca Freeman. 2020. Trade Conflict in The Age Of COVID-19|VOX, CEPR Policy Portal. 2021. Voxeu.Org. Available online: https://voxeu.org/article/trade-conflict-age-COVID-19 (accessed on 10 January 2021).

- Baldwin, Richard, and Beatrice Weder di Mauro. 2020. Economics in the Time of COVID-19. Edited by R. Baldwin and B. di Mauro. In Thinking Ahead about the Trade Impact of COVID-19. London: CEPR Press, pp. 59–71. [Google Scholar]

- Bekkers, Eddy, Robert B. Koopman, and Carolina Lemos Rêgo. 2021. Structural Change in The Chinese Economy and Changing Trade Relations with the World. China Economic Review 65: 101573. [Google Scholar] [CrossRef]

- Bello, Walden. 2011. China and the Global Economy: The Persistence of Export-Led Growth. Journal für Entwicklungspolitik XXVII: 95–112. [Google Scholar] [CrossRef]

- Bencivelli, Lorenzo, and Flavia Tonelli. 2020. China in the Global Economy. In China’s International Projection in the Xi Jinping Era. Springer Briefs in Economics. Cham: Springer. Available online: https://doi.org/10.1007/978-3-030-54212-2_3 (accessed on 7 December 2020).

- Berry, Albert. 1984. Bela Balassa, the newly industrializing countries in the world economy: (Pergamon Press, New York, 1981) pp. xviii + 461, $45.00. Journal of International Economics, Elsevier 17: 188–94. [Google Scholar]

- Bodman, Philip M. 1996. On Export-Led Growth In Australia And Canada: Cointegration, Causality and Structural Stability. Australian Economic Papers 35: 282–99. [Google Scholar] [CrossRef]

- Carreño, Ignacio, Tobias Dolle, Lourdes Medina, and Moritz Brandenburger. 2021. Implications of COVID-19 Pandemic on the Global Trade Networks. Emerging Markets Finance and Trade. Available online: https://www.cambridge.org/core/journals/european-journal-of-risk-regulation/article/implications-of-the-covid19-pandemic-on-trade/83A8C947A5774E50C4C663C398996400 (accessed on 7 December 2020).

- Chen, Yulong, Jincai Zhao, Zhizhu Lai, Zheng Wang, and Haibin Xia. 2019. Exploring The Effects Of Economic Growth, And Renewable And Non-Renewable Energy Consumption On China’S CO2 Emissions: Evidence From A Regional Panel Analysis. Renewable Energy 140: 341–53. [Google Scholar] [CrossRef]

- Cheng, Ya, Usama Awan, Shabbir Ahmad, and Zhixiong Tan. 2021. How Do Technological Innovation and Fiscal Decentralization Affect The Environment? A Story of The Fourth Industrial Revolution and Sustainable Growth. Technological Forecasting and Social Change 162: 120398. [Google Scholar] [CrossRef]

- China-Economic Forecasts-2020–22 Outlook. 2020. Available online: https://tradingeconomics.com/china/forecast (accessed on 27 November 2020).

- Chong, Terence Tai Leung, Yueer Wu, and Jue Su. 2020. The Unusual Trading Volume And Earnings Surprises In China’S Market. Journal of Risk and Financial Management 13: 244. [Google Scholar] [CrossRef]

- Cimoli, Mario, Giovanni Dosi, and Joseph Stiglitz. 2020. The Future of Industrial Policies in The New Millennium: Toward A Knowledge-Centered Development Agenda. Oxford: Oxford University Press. Available online: https://oxford.universitypressscholarship.com/view/10.1093/acprof:oso/9780199235261.001.0001/acprof-9780199235261-chapter-20 (accessed on 20 January 2021).

- Civín, Lubomír, and Luboš Smutka. 2020. Vulnerability of European Union Economies in Agro Trade. Sustainability 12: 5210. [Google Scholar] [CrossRef]

- Del Rio Lopez, Pedro, and Esther Gordo Mora. 2019. World Economic Outlook For 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3401674 (accessed on 17 September 2020).

- Elia, Stefano, Mario Kafouros, and Peter J. Buckley. 2020. The Role of Internationalization in Enhancing the Innovation Performance of Chinese Emnes: A Geographic Relational Approach. Journal of International Management 26: 100801. [Google Scholar] [CrossRef]

- Fuchs, Andreas, Lennart C. Kaplan, Krisztina Kis-Katos, Sebastian Schmidt, Felix Turbanisch, and Feicheng Wang. 2020. Mask Wars: China’s Exports of Medical Goods in Times of COVID-19. cege Discussion Papers, No. 398. Göttingen: University of Göttingen, Center for European, Governance and Economic Development Research (cege). [Google Scholar]

- GACC. 2020. Imports and Exports by H.S. Section and Division, 1–2. Available online: http://english.customs.gov.cn/Statics/c64e11ba-2208-43a1-b9b9-a618bb419cb.html (accessed on 12 December 2020).

- Gouvea, Raul, Dimitri Kapelianis, and Shihong Li. 2019. Fostering Intra-BRICS Trade and Investment: The Increasing Role of China In The Brazilian And South African Economies. Thunderbird International Business Review 62: 17–26. [Google Scholar] [CrossRef]

- Gruszczynski, Lukasz. 2020. The COVID-19 Pandemic And International Trade: Temporary Turbulence or Paradigm Shift? European Journal of Risk Regulation 11: 337–42. [Google Scholar] [CrossRef]

- Halicioglu, Ferda, and Natalya Ketenci. 2018. Output, Renewable and Non-Renewable Energy Production, and International Trade: Evidence from EU-15 Countries. Energy 159: 995–1002. [Google Scholar] [CrossRef]

- IBIS World. 2020. Ibisworld-Industry Market Research, Reports, And Statistics. 2021. Ibisworld.com. Available online: https://www.ibisworld.com/china/industry-trends/fastest-growing-industries/ (accessed on 7 January 2021).

- Jin, Xingye, David Daokui Li, and Shuyu Wu. 2016. How Will China Shape The World Economy? China Economic Review 40: 272–80. [Google Scholar] [CrossRef]

- Jinjun, Xue. 1995. The Export-Led Growth Model and Its Applıcatıon in Chına. Hitotsubashi Journal of Economics 36: 189–206. Available online: http://www.jstor.org/stable/43295992 (accessed on 28 January 2021).

- Lee, Kwangwon. 2018. Quarterly National Accounts Manual (2017 Edition). International Monetary Fund. Available online: https://www.elibrary.imf.org/view/IMF069/24171-9781475589870/24171-9781475589870/24171-9781475589870.xml?language=en (accessed on 28 January 2021).

- Liu, Ming-Hua, Margaritis Dimitris, and Zhang Yang. 2019. The Global Financial Crisis and The Export-Led Economic Growth in China. The Chinese Economy 52: 232–48. [Google Scholar] [CrossRef]

- Lin, Justin Yifu. 2011. China and the global economy. China Economic Journal 4: 1–14. [Google Scholar] [CrossRef]

- McAleer, Michael. 2020. Prevention Is Better Than the Cure: Risk Management of COVID-19. Journal of Risk and Financial Management 13: 46. [Google Scholar] [CrossRef]

- Ojaghlou, Mortaza. 2019. Tourism-Led Growth and Risk of The Dutch Disease: Dutch Disease in Turkey. Papers. SSRN. com. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3648158 (accessed on 28 January 2021).

- Oravský, Róbert, Peter Tóth, and Anna Bánociová. 2020. The Ability Of Selected European Countries to Face The Impending Economic Crisis Caused by COVID-19 In The Context of The Global Economic Crisis of 2008. Journal of Risk and Financial Management 13: 179. [Google Scholar] [CrossRef]

- Paital, Biswaranjan, Kabita Das, and Sarat Kumar Parida. 2020. Inter Nation Social Lockdown Versus Medical Care Against COVID-19, A Mild Environmental Insight With Special Reference To India. Science of The Total Environment 728: 138914. [Google Scholar] [CrossRef] [PubMed]

- Palley, Thomas I. 2012. The Rise and Fall of Export-led Growth. Investigación Económica 71: 141–61. Available online: http://www.jstor.org/stable/42779592 (accessed on 27 January 2021).

- Park, Hun Myoung. 2009. Linear Regression Models for Panel Data Using SAS, Stata, LIMDEP, and SPSS. In Linear Regression Models for Panel Data 1. Bloomington: The Trustees of Indiana University. Available online: http://citeseerx.ist.psu.edu/viewdoc/download;jsessionid=7F9391315532D420BE5F2645BB1EC90D?doi=10.1.1.452.367andrep=rep1andtype=pdf (accessed on 12 December 2020).

- Rodríguez-Pose, Andrés, and Min Zhang. 2020. The Cost of Weak Institutions for Innovation in China. Technological Forecasting and Social Change 153: 119937. [Google Scholar] [CrossRef]

- Rosenberg, Justin, and Chris Boyle. 2019. Understanding 2016: China, Brexit and Trump in the History of Uneven and Combined Development. Journal of Historical Sociology 32: e32–e58. [Google Scholar] [CrossRef]

- Schumpeter, Joseph A. 1942. Capitalism, Socialism, and Democracy. London: Routledge, vol. xxii, 437p, ISBN1 0-585-46039-6. ISBN2 978-0-585-46039-0. [Google Scholar]

- Shan, Jordan, and Fiona Sun. 1998. On The Export-Led Growth Hypothesis: The Econometric Evidence From China. Applied Economics 30: 1055–65. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E. 2008. China: Towards a new model of development. China Economic Journal 1: 33–52. [Google Scholar] [CrossRef]

- The Economic Times News. 2018. Trump Threatens to Impose Tariffs on Countries. Available online: https://economictimes.indiatimes.com/news/international/world-news/trump-threatens-to-impose-tariffs-on-countries/articleshow/66338047.cms (accessed on 12 December 2020).

- Thorbecke, Willem. 2020. The Impact of The COVID-19 Pandemic on The U.S. Economy: Evidence from the Stock Market. Journal of Risk and Financial Management 13: 233. [Google Scholar] [CrossRef]

- Tian, Yuan, Yupei Wang, Xuemei Xie, Jie Jiao, and Hao Jiao. 2019. The Impact Of Business-Government Relations On Firms’ Innovation: Evidence From Chinese Manufacturing Industry. Technological Forecasting and Social Change 143: 1–8. [Google Scholar] [CrossRef]

- TradeMap. 2020. Trade Map User Guide Trade Statistics for International Business. Available online: https://www.TradeMap.org/Docs/TradeMap-Userguide-EN.pdf (accessed on 12 October 2020).

- Ugurlu, Erginbay, and Irena Jindrichovska. 2019. Estimating Gravity Model in the Czech Republic: Empirical Study of Impact of IFRS on Czech International Trade. European Research Studies Journal XXII: 265–81. [Google Scholar] [CrossRef]

- UNIDO. 2020. Coronavirus: The Economic Impact—10 July 2020|UNIDO. 2021. Unido.Org. Available online: https://www.unido.org/stories/coronavirus-economic-impact-10-july-2020 (accessed on 12 December 2020).

- Vlados, Charis. 2020. The dynamics of the current global restructuring and contemporary framework of the U.S.–China trade war. Global Journal of Emerging Market Economies 12: 4–23. [Google Scholar] [CrossRef]

- Wang, Chuanyi, Zhe Cheng, Xiao-Guang Yue, and Michael McAleer. 2020. Risk Management of COVID-19 by Universities in China. Journal of Risk and Financial Management 13: 36. [Google Scholar] [CrossRef]

- Wang, Qiang, and Min Su. 2020. A Preliminary Assessment of The Impact Of COVID-19 On Environment—A Case Study of China. Science of The Total Environment 728: 138915. [Google Scholar] [CrossRef] [PubMed]

- WCOOMD. 2020. H.S. Classification Reference for COVID-19 Medical Supplies 2.1 Edition. Available online: http://www.wcoomd.org/-/media/wco/public/global/pdf/topics/nomenclature/covid_19/hs-classification-reference_2_1-24_4_20_en.pdf?la=en (accessed on 12 December 2020).

- WTO. 2019. Available online: https://www.wto.org/english/res_e/statis_e/wts2019_e/wts19_toc_e.htm (accessed on 12 September 2020).

- Wu, Yi-Chi, Ching-Sung Chen, and Yu-Jiun Chan. 2020. The Outbreak of COVID-19: An Overview. Journal of the Chinese Medical Association 83: 217–20. [Google Scholar] [CrossRef] [PubMed]

- Xu, X. 2019. The Slowdown of China’s Economic Growth in Terms of Statistics. Frontiers of Economics in China 14: 72–79. [Google Scholar]

- Yüksel, Serhat, Hasan Dinçer, and Yurdagül Meral. 2019. Financial Analysis Of International Energy Trade: A Strategic Outlook For EU-15. Energies 12: 431. [Google Scholar] [CrossRef]

- Zambrano-Monserrate, Manuel A., María Alejandra Ruano, and Luis Sanchez-Alcalde. 2020. Indirect Effects of COVID-19 on the Environment. Science of The Total Environment 728: 138813. [Google Scholar] [CrossRef]

- Zhang, Wunong, Yuxin Wang, Lili Yang, and Chuanyi Wang. 2020. Suspending Classes Without Stopping Learning: China’s Education Emergency Management Policy in The COVID-19 Outbreak. Journal of Risk and Financial Management 13: 55. [Google Scholar] [CrossRef]

| 1 | 855PRESS RELEASE 8 April 2020. Trade Set to Plunge as COVID-19 Pandemic Upends Global Economy. Available online: https://www.wto.org/english/news_e/pres20_e/pr855_e.htm (accessed on 28 January 2021). |

| 2 | China Economic Outlook. Available online: https://www.focus-economics.com/countries/china (accessed on 31 December 2020). |

| 3 | Ensuring the Availability of Supplies and Equipment. Available online: https://ec.europa.eu/info/live-work-travel-eu/coronavirus-response/public-health_en#ensuring-the-availability-of-supplies-and-equipment (accessed on 12 December 2020). |

| 4 | http://english.customs.gov.cn/Statics/c64e11ba-2208-43a1-b9b9-a618b6b419cb.html (accessed on 27 September 2020). |

| 5 | See China January–February Imports and Exports Drop Dragged by Coronavirus Disruption CGTN 08-Mar-2020. Available online: https://news.cgtn.com/news/2020-03-07/China-Jan-Feb-imports-and-exports-drop-due-to-coronavirus-disruption-OEWZfoIWn6/index.html (accessed on 27 September 2020). |

| Variable | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|

| Economic growth of GDP intra year | 9.5 | 7.9 | 7.8 | 7.3 | 6.9 | 6.8 | 6.9 | 6.7 | 6.1 |

| GDP (USD billion) | 7.592 | 8.575 | 9.694 | 10.480 | 10.925 | 11.247 | 12.313 | 13.837 | 14.298 |

| Population in millions | 1.347 | 1.354 | 1.361 | 1.368 | 1.375 | 1.383 | 1.390 | 1.395 | 1.400 |

| GDP per capita | 5.635 | 6.333 | 7.124 | 7.662 | 7.948 | 8.134 | 8.858 | 9.916 | 10.212 |

| Export (USD billion) | 1.898 | 2.049 | 2.209 | 2.342 | 2.272 | 2.098 | 2.263 | 2.487 | 2.499 |

| Import (USD billion) | 1.744 | 1.819 | 1.952 | 1.959 | 1.681 | 1.588 | 1.844 | 2.136 | 2.078 |

| Balance (export/import) | 1.088 | 1.126 | 1.132 | 1.196 | 1.352 | 1.321 | 1.227 | 1.164 | 1.206 |

| Inflation rate (CPI) | 5.4 | 2.6 | 2.6 | 2.0 | 1.4 | 2.0 | 1.6 | 2.1 | 2.9 |

| Consumption (annual variation) | 11.0 | 9.1 | 7.3 | 7.7 | 7.5 | 8.6 | 6.8 | 9.5 | 6.8 |

| Public debt (% of GDP) | 14.7 | 14.4 | 14.6 | 14.9 | 15.5 | 16.1 | 16.2 | 16.3 | 17.0 |

| Article | 2020M01 | 2020M02 | 2020M03 | 2020M04 | 2020M05 |

|---|---|---|---|---|---|

| 61 | −0.054 | −0.090 | −0.283 | −0.440 | −0.426 |

| 62 | −0.070 | −0.174 | −0.324 | −0.295 | 0.101 |

| 63 | −0.036 | −0.069 | 0.453 | 10.239 | 13.260 |

| 84 | −0.042 | −0.158 | −0.097 | 0.027 | 0.073 |

| 85 | 0.020 | −0.126 | −0.142 | −0.130 | −0.051 |

| 94 | 0.062 | −0.069 | −0.284 | −0.233 | −0.248 |

| 95 | −0.081 | −0.074 | −0.254 | −0.326 | −0.301 |

| Full Sample: 2018M1–2020M5 | |||||||

| NUM61 | NUM62 | NUM63 | NUM84 | NUM85 | NUM94 | NUM95 | |

| Mean | 1,285,428 | 1,476,925 | 792,090.5 | 8,140,256 | 11,036,792 | 1,658,351 | 1,425,262 |

| Median | 1,229,408 | 1,327,073 | 452,994 | 7,975,091 | 10,487,219 | 1,677,890 | 1,164,118 |

| Maximum | 1,988,541 | 2,309,169 | 6,848,965 | 9,523,103 | 15,399,976 | 2,167,602 | 2,618,489 |

| Minimum | 422,081 | 691,252 | 336,282 | 6,251,098 | 8,141,200 | 1,087,124 | 746,971 |

| Subsample 1: 2018M1–2018M12 | |||||||

| Mean | 1,407,178 | 1,585,570 | 426,874.2 | 8,221,273 | 11,222,301 | 1,656,535 | 1,546,398 |

| Median | 1,396,908 | 1,519,353 | 437,501.5 | 7,964,327 | 10,761,701 | 1,636,406 | 1,318,125 |

| Maximum | 1,988,541 | 2,309,169 | 502,077 | 9,396,193 | 14,776,106 | 2,042,685 | 2,618,489 |

| Minimum | 747,201 | 963,059 | 336,282 | 7,526,866 | 8,887,623 | 1,287,016 | 958,312 |

| Subsample 2: 2019M1–2019M12 | |||||||

| Mean | 1,353,785 | 1,512,676 | 436,980.2 | 8,136,009 | 11,442,748 | 1,714,300 | 1,514,464 |

| Median | 1,302,985 | 1,386,272 | 454,031.5 | 7,975,481 | 10,960,053 | 1,696,231 | 1,275,664 |

| Maximum | 1,903,140 | 2,203,444 | 522,960 | 9,523,103 | 15,399,976 | 2,041,324 | 2,567,207 |

| Minimum | 754,189 | 980,167 | 339,827 | 7,372,026 | 9,315,948 | 1,468,159 | 1,000,972 |

| Subsample 3: 2020M1–2020M5 | |||||||

| Mean | 829,170.4 | 1,130,372 | 2,520,875 | 7,956,009 | 9,617,274 | 1,528,431 | 920,450.6 |

| Median | 697,866 | 1,184,598 | 569,370 | 8,574,588 | 9,048,216 | 1,369,158 | 917,360 |

| Maximum | 1,480,600 | 1,704,720 | 6,848,965 | 9,119,727 | 12,261,592 | 2,167,602 | 1,138,412 |

| Minimum | 422,081 | 691,252 | 433,576 | 6,251,098 | 8,141,200 | 1,087,124 | 746,971 |

| Full Sample: 2018M1–2020M5 | ||||||

| NUM30 | NUM38 | NUM84 | NUM85 | NUM87 | NUM88 | |

| Mean | 1,459,678 | 518,176.1 | 3,510,942 | 2,263,949 | 2,480,467 | 1,463,185 |

| Median | 1,601,644 | 339,343 | 3,737,261 | 2,331,764 | 2,468,119 | 1,780,512 |

| Maximum | 1,923,510 | 1,744,547 | 4,480,002 | 3,592,016 | 4,224,355 | 2,358,516 |

| Minimum | 0 | 0 | 0 | 0 | 0 | 0 |

| Subsample 1: 2018M1–2018M12 | ||||||

| Mean | 1,501,560 | 301,640.2 | 3,880,981 | 2,332,115 | 3,041,179 | 1,094,295 |

| Median | 1,574,215 | 300,993.5 | 3,948,032 | 2,368,840 | 3,190,941 | 1,000,459 |

| Maximum | 1,721,508 | 373,008 | 4,480,002 | 2,656,162 | 4,224,355 | 1,970,217 |

| Minimum | 955,347 | 218,077 | 2,798,245 | 1,759,266 | 1,526,977 | 256,271 |

| Subsample 2: 2019M1–2019M12 | ||||||

| Mean | 1,603,821 | 944,961.4 | 3,731,426 | 2,744,238 | 2,341,251 | 1,870,302 |

| Median | 1,619,598 | 878,009 | 3,748,640 | 2,837,042 | 2,368,507 | 1,929,143 |

| Maximum | 1,923,510 | 1,744,547 | 4,149,695 | 3,592,016 | 2,577,854 | 2,218,981 |

| Minimum | 1,091,655 | 395,332 | 2,746,431 | 1,672,875 | 1,884,365 | 1,108,927 |

| Subsample 3: 2020M1–2020M5 | ||||||

| Mean | 1,140,776 | 157,748.4 | 2,498,614 | 1,323,742 | 1,757,901 | 1,397,652 |

| Median | 1,543,766 | 189,105 | 3,391,672 | 1,572,577 | 2,354,924 | 1,793,891 |

| Maximum | 1,665,898 | 322,685 | 3,724,381 | 2,313,849 | 2,613,641 | 2,358,516 |

| Minimum | 0 | 0 | 0 | 0 | 0 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jindřichovská, I.; Uğurlu, E. E.U. and China Trends in Trade in Challenging Times. J. Risk Financial Manag. 2021, 14, 71. https://doi.org/10.3390/jrfm14020071

Jindřichovská I, Uğurlu E. E.U. and China Trends in Trade in Challenging Times. Journal of Risk and Financial Management. 2021; 14(2):71. https://doi.org/10.3390/jrfm14020071

Chicago/Turabian StyleJindřichovská, Irena, and Erginbay Uğurlu. 2021. "E.U. and China Trends in Trade in Challenging Times" Journal of Risk and Financial Management 14, no. 2: 71. https://doi.org/10.3390/jrfm14020071

APA StyleJindřichovská, I., & Uğurlu, E. (2021). E.U. and China Trends in Trade in Challenging Times. Journal of Risk and Financial Management, 14(2), 71. https://doi.org/10.3390/jrfm14020071