GARCH (1,1) Models and Analysis of Stock Market Turmoil during COVID-19 Outbreak in an Emerging and Developed Economy

Abstract

:1. Introduction

2. Literature Review

2.1. COVID-19 Pandemic and Its Impact on Stock Market

2.2. COVID-19 and Stock Market Volatility

3. Data and Methodology

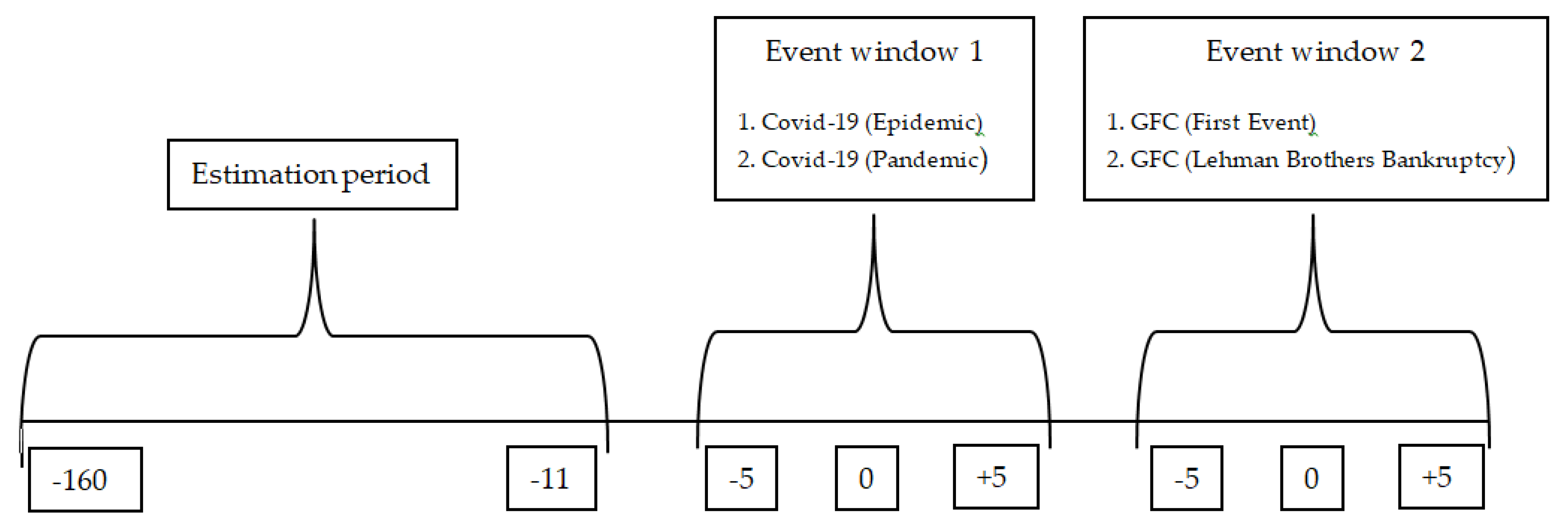

3.1. Event Study Set-Up

3.1.1. Identifying the Event

3.1.2. Selecting the Estimation and Events

3.1.3. Estimation Parameters

3.1.4. Data Analysis

3.2. Stock Market Volatility Set-Up

4. Results and Discussion

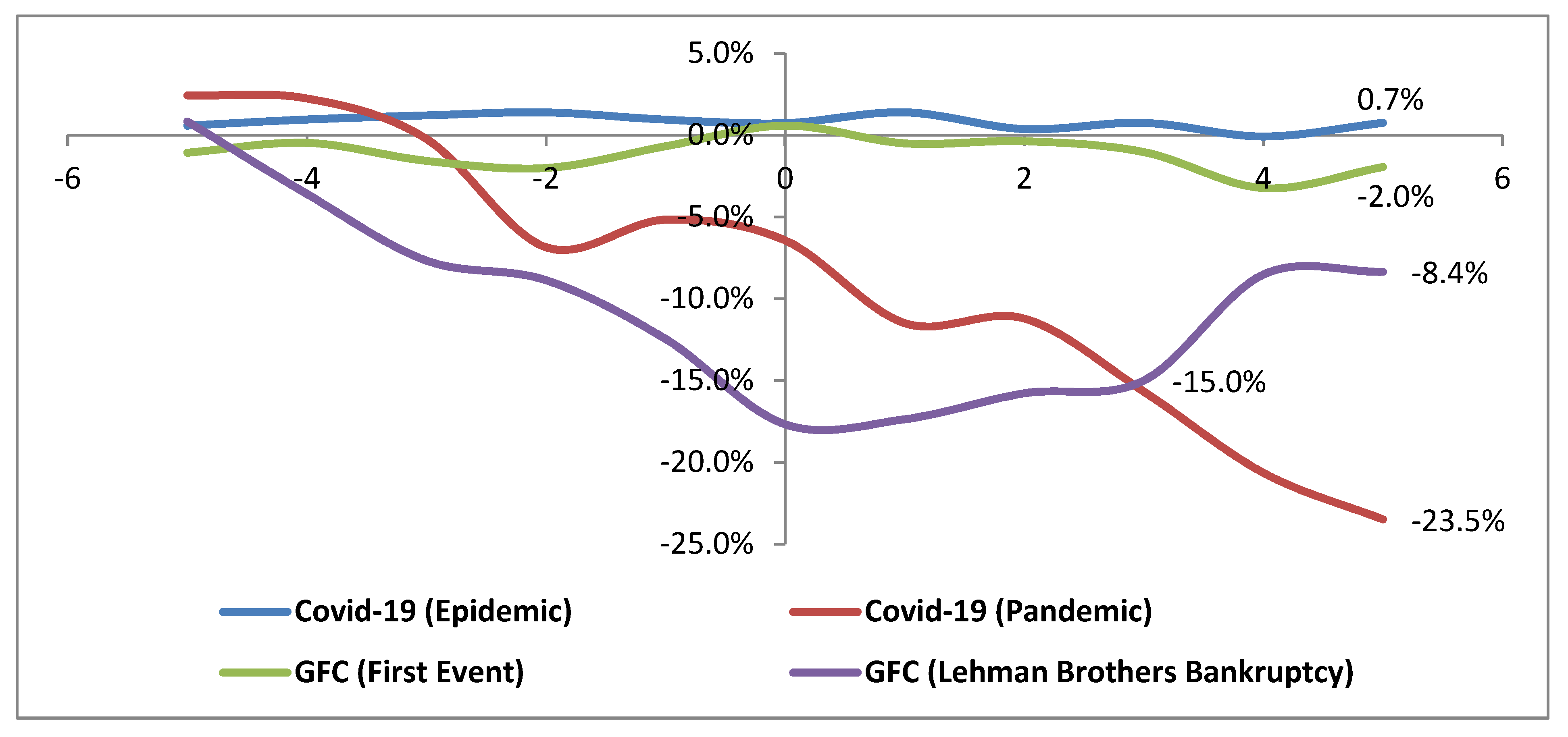

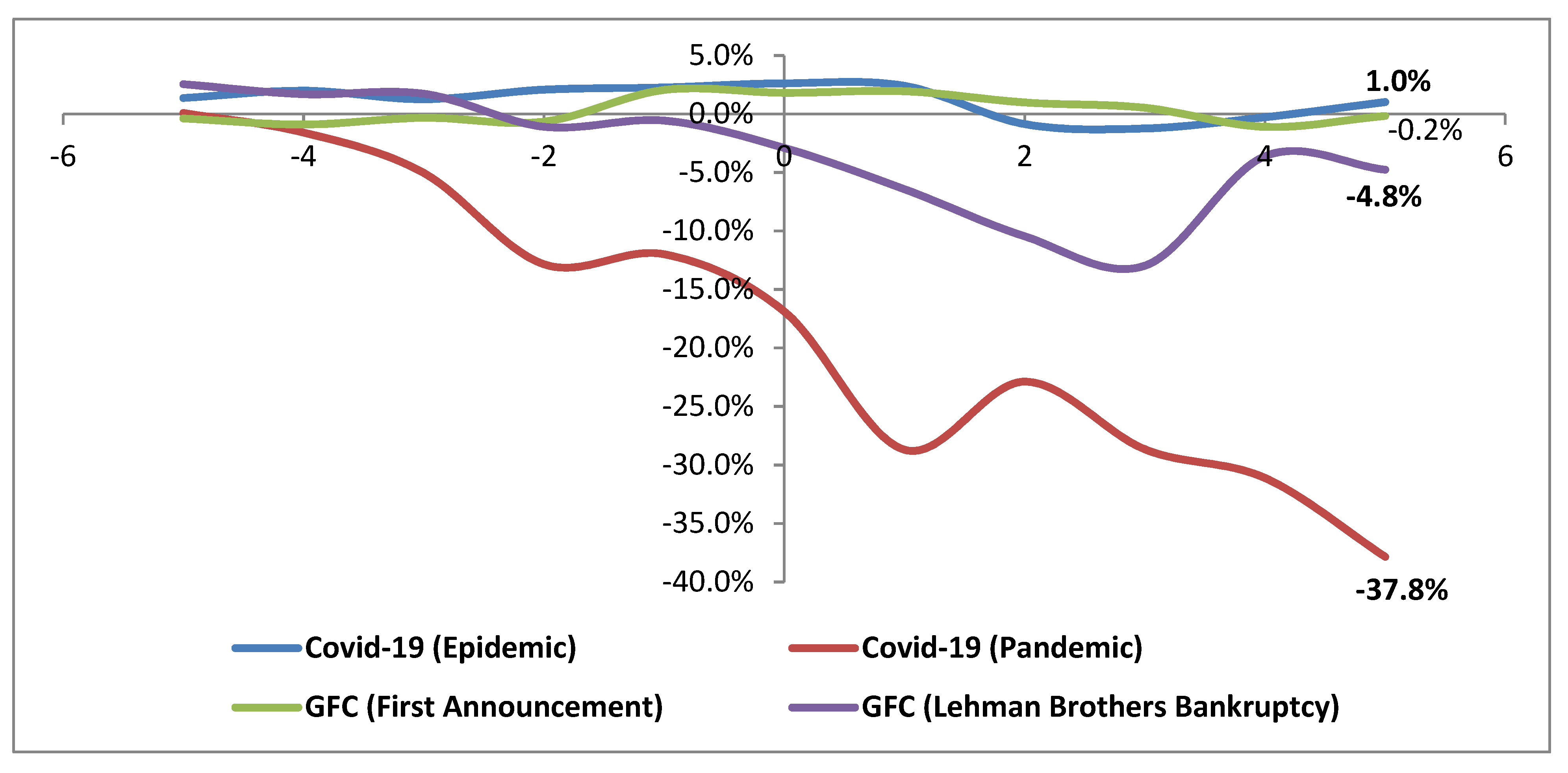

4.1. Event-Study Result

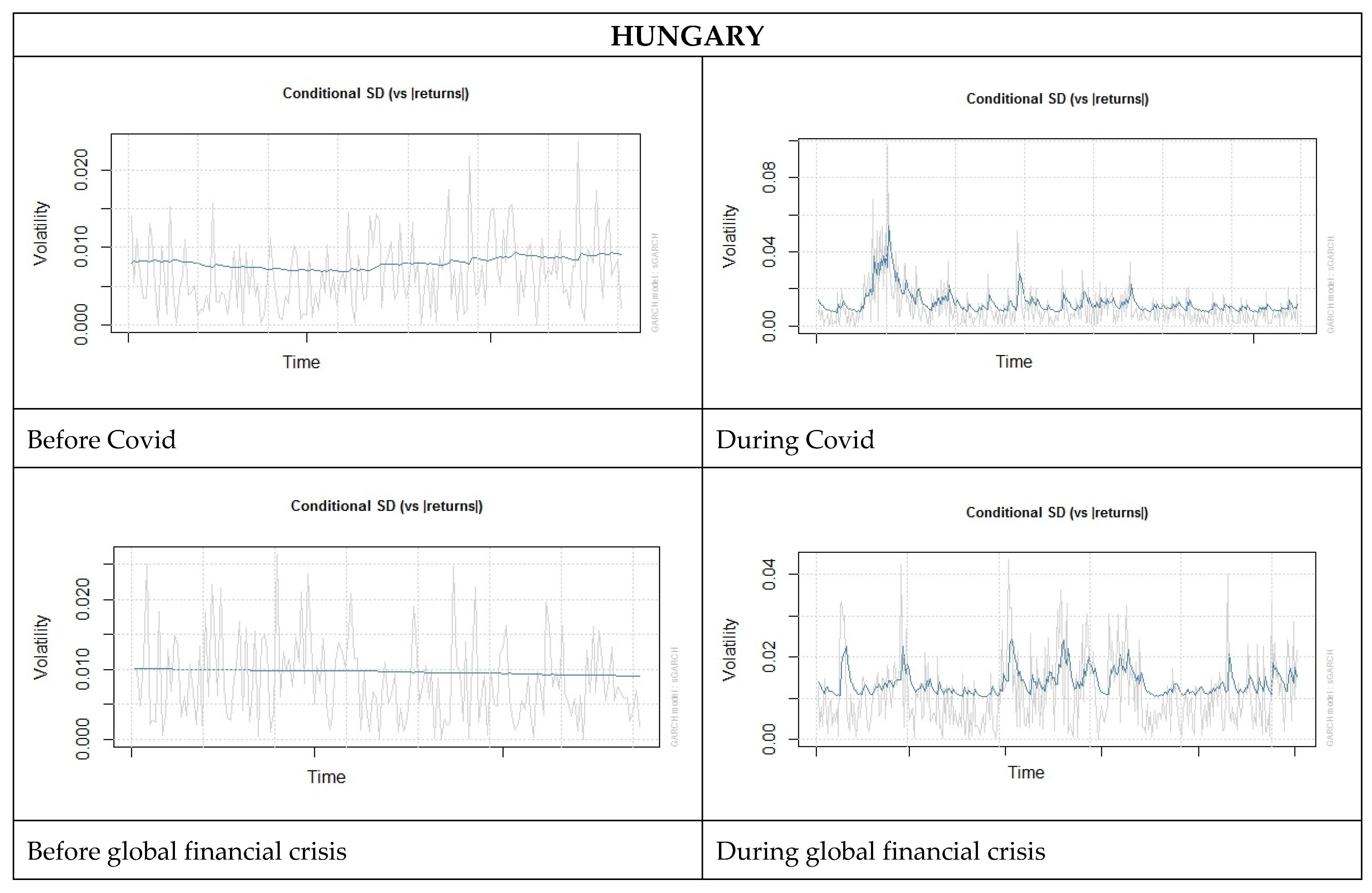

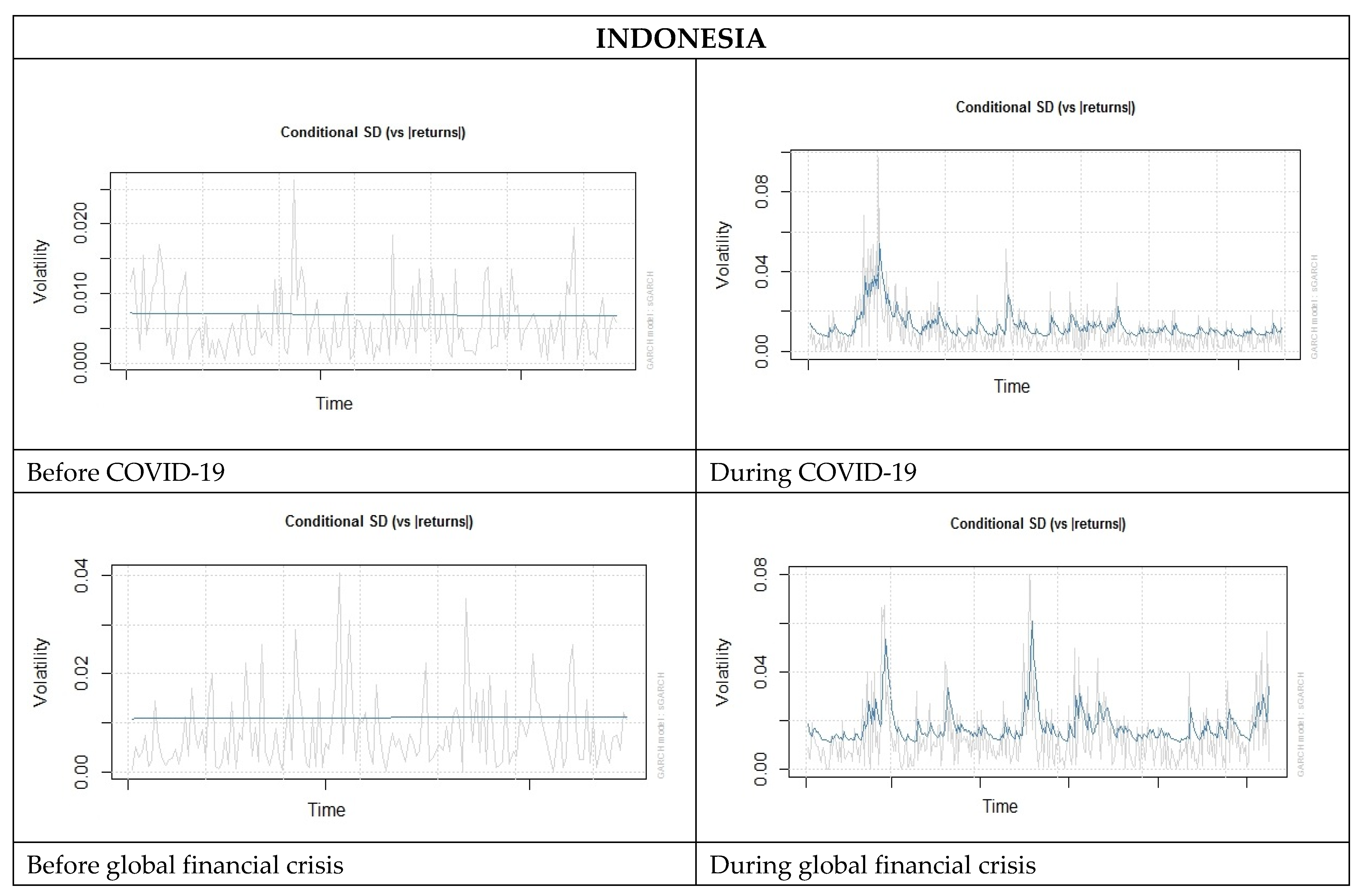

4.2. Stock Market Volatility Result

5. Conclusions

6. Limitations and Suggestions for Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aras, Serkan. 2021. Stacking hybrid GARCH models for forecasting Bitcoin volatility. Expert Systems with Applications 174: 114747. [Google Scholar] [CrossRef]

- Bai, Lan, Yu Wei, Guiwu Wei, Xiafei Li, and Songyun Zhang. 2021. Infectious disease pandemic and permanent volatility of international stock markets: A long-term perspective. Finance Research Letters 40: 101709. [Google Scholar] [CrossRef]

- Baker, Scott, Nicholas Bloom, Steven Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Impact of COVID-19. No. w26945. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Ben Abdallah, Marwa, Maria Fekete Farkas, and Zoltan Lakner. 2020. Analysis of meat price volatility and volatility spillovers in Finland. Agricultural Economics 66: 84–91. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef] [Green Version]

- Brav, Alon, and John Brian Heaton. 2015. Event studies in securities litigation: Low power, confounding effects, and bias. Washington University Law Review 93: 583. [Google Scholar] [CrossRef] [Green Version]

- Brooks, Chris. 2008. Introductory Econometrics for Finance, 2nd ed. Cambridge: Cambridge University Press. [Google Scholar]

- Can, Reyhan, and Hatice Isin Dizdarlar. 2021. Do Investors Overreact to Firm Merger and Acquisition Decisions? In Contemporary Issues in Social Science (Contemporary Studies in Economic and Financial Analysis). Edited by Simon Grima, Ercan Özen and Hakan Boz. Bingley: Emerald Publishing Limited, vol. 106, pp. 103–18. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, Michael McAleer, and Wing-Keung Wong. 2020. Risk and financial management of COVID-19 in business, economics and finance. Journal of Risk and Financial Management 13: 102. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, Shu-Han Hsu, and Michael McAleer. 2018. An event study analysis of political events, disasters, and accidents for Chinese tourists to Taiwan. Sustainability 10: 4307. [Google Scholar] [CrossRef] [Green Version]

- Charfeddine, Lanouar, Karim Ben Khediri, Goodness C. Aye, and Rangan Gupta. 2018. Time-varying efficiency of developed and emerging bond markets: Evidence from long-spans of historical data. Physica A 505: 632–47. [Google Scholar] [CrossRef] [Green Version]

- Chaudhary, Rashmi, Priti Bakhshi, and Hemendra Gupta. 2020. Volatility in International Stock Markets: An Empirical Study during COVID-19. Journal of Risk and Financial Management 13: 208. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang, SooCheong Shawn Jang, and Woo Gon Kim. 2007. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management 26: 200–12. [Google Scholar] [CrossRef]

- Chu, Jeffrey, Yuanyuan Zhang, and Stephen Chan. 2019. The adaptive market hypothesis in the high frequency cryptocurrency market. International Review of Financial Analysis 64: 221–31. [Google Scholar] [CrossRef]

- Cookson, J. Anthony, Joseph E. Engelberg, and William Mullins. 2020. Does partisanship shape investor beliefs? Evidence from the COVID-19 pandemic. The Review of Asset Pricing Studies 10: 863–93. [Google Scholar] [CrossRef]

- Czech, Katarzyna, Michał Wielechowski, Pavel Kotyza, Irena Benešová, and Adriana Laputková. 2020. Shaking stability: COVID-19 impact on the Visegrad Group countries’ financial markets. Sustainability 12: 6282. [Google Scholar] [CrossRef]

- Dungore, Parizad Phiroze, and Sarosh Hosi Patel. 2021. Analysis of Volatility Volume and Open Interest for Nifty Index Futures Using GARCH Analysis and VAR Model. International Journal of Financial Studie 9: 7. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar]

- Fama, Eugene. 1970. Efficient capital market: A review of theory and empirical work. Journal of Finance 25: 382–417. [Google Scholar] [CrossRef]

- Feria-Domínguez, José Manuel, Pilar Paneque, and Fanny de la Piedra. 2020. Are the Financial Markets Sensitive to Hydrological Risk? Evidence from the Bovespa. Water 12: 3011. [Google Scholar] [CrossRef]

- Fink, Holger, Yulia Klimova, Claudia Czado, and Jakob Stöber. 2017. Regime switching vine copula models for global equity and volatility indices. Econometrics 5: 3. [Google Scholar] [CrossRef] [Green Version]

- Goodell, John W. 2020. COVID-19 and finance: Agendas for future research. Finance Research Letters 35: 101512. [Google Scholar] [CrossRef]

- Gunay, Samet, Walid Bakry, and Somar Al-Mohamad. 2021. The Australian stock market’s reaction to the first wave of the COVID-19 pandemic and black summer bushfires: A sectoral analysis. Journal of Risk and Financial Management 14: 175. [Google Scholar] [CrossRef]

- Haas, Markus, Stefan Mittnik, and Marc S. Paolella. 2004. A new approach to Markov-switching GARCH models. Journal of Financial Econometrics 2: 493–530. [Google Scholar] [CrossRef]

- Hatch, Courtney Droms, Kurt Carlson, and William G. Droms. 2018. Effects of market returns and market volatility on investor risk tolerance. Journal of Financial Services Marketing 23: 77–90. [Google Scholar] [CrossRef]

- Hsing, Yu. 2011. Impacts of macroeconomic variables on the stock market in Bulgaria and policy implications. Journal of Economics and Business 14: 41–53. [Google Scholar]

- Khan, Abbas, Muhammad Yar Khan, Abdul Qayyum Khan, Majid Jamal Khan, and Zia Ur Rahman. 2021. Testing the weak form of efficient market hypothesis for socially responsible and Shariah indexes in the USA. Journal of Islamic Accounting and Business Research 12: 625–45. [Google Scholar] [CrossRef]

- Kothari, Sagar P., and Jerold B. Warner. 2006. Econometrics of event studies. In Handbook of Empirical Corporate Finance. Amsterdam: Elsevier, pp. 3–36. [Google Scholar]

- Kim, Jong-Min, Dong H. Kim, and Hojin Jung. 2021. Estimating yield spreads volatility using GARCH-type models. The North American Journal of Economics and Finance 57: 101396. [Google Scholar] [CrossRef]

- Klapper, Leora, Mayada El-Zoghbi, and Jake Hess. 2016. Achieving the Sustainable Development Goals: The Role of Financial Inclusion. Washington, DC: CGAP, Available online: http://www.cgap.org/publications/achieving-sustainabledevelopment-goals (accessed on 1 October 2021).

- Lee, Yu Lim, Minji Jung, Robert Jeyakumar Nathan, and Jae-Eun Chung. 2020. Cross-National Study on the Perception of the Korean Wave and Cultural Hybridity in Indonesia and Malaysia Using Discourse on Social Media. Sustainability 12: 6072. [Google Scholar] [CrossRef]

- Liu, HaiYue, Aqsa Manzoor, CangYu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Malkiel, Burton G. 2003. The Efficient Market Hypothesis and Its Critic. Journal of Economic Perspectives 17: 59–82. [Google Scholar] [CrossRef] [Green Version]

- Mazumder, Sharif. 2020. How important is social trust during the COVID-19 crisis period? Evidence from the Fed announcements. Journal of Behavioral and Experimental Finance 28: 100387. [Google Scholar] [CrossRef] [PubMed]

- Mazur, Mieszko, Man Dang, and Miguel Vega. 2021. COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Research Letters 38: 101690. [Google Scholar] [CrossRef]

- Mittnik, Stefan, Marc S. Paolella, and Svetlozar T. Rachev. 2002. Stationarity of stable power-GARCH processes. Journal of Econometrics 106: 97–107. [Google Scholar] [CrossRef]

- Mohsin, Muhammad, Li Naiwen, Muhammad Zia-UR-Rehman, Sobia Naseem, and Sajjad Ahmad Baig. 2020. The volatility of bank stock prices and macroeconomic fundamentals in the Pakistani context: An application of GARCH and EGARCH models. Oeconomia Copernicana 11: 609–36. [Google Scholar] [CrossRef]

- Nathan, Robert Jeyakumar, Vijay Victor, Chin Lay Gan, and Sebastian Kot. 2019. Electronic commerce for home-based businesses in emerging and developed economy. Eurasian Business Review 9: 463–83. [Google Scholar] [CrossRef]

- Nathan, Robert Jeyakumar, Vijay Victor, József Popp, Mária Fekete-Farkas, and Judit Oláh. 2021. Food Innovation Adoption and Organic Food Consumerism—A Cross National Study between Malaysia and Hungary. Foods 10: 363. [Google Scholar] [CrossRef]

- O’Donnell, Niall, Darren Shannon, and Barry Sheehan. 2021. Immune or at-risk? Stock markets and the significance of the COVID-19 pandemic. Journal of Behavioral and Experimental Finance 30: 100477. [Google Scholar] [CrossRef]

- Ramelli, Stefano, and Alexander F. Wagne. 2020. Feverish stock price reactions to COVID-19. The Review of Corporate Finance Studies 9: 622–55. [Google Scholar] [CrossRef]

- Saleem, Adil, Judit Bárczi, and Judit Sági. 2021. COVID-19 and Islamic Stock Index: Evidence of Market Behavior and Volatility Persistence. Journal of Risk and Financial Management 14: 389. [Google Scholar] [CrossRef]

- Schell, Daniel, Mei Wang, and Toan Luu Duc Huynh. 2020. This time is indeed different: A study on global market reactions to public health crisis. Journal of Behavioral and Experimental Finance 27: 100349. [Google Scholar] [CrossRef]

- Shiller, Robert James. 2003. From Efficient Market Theory to Behavioral Finance. Journal of Economic Perspectives 17: 83–104. [Google Scholar] [CrossRef] [Green Version]

- Thorbecke, Willem. 2021. The Exposure of French and South Korean Firm Stock Returns to Exchange Rates and the COVID-19 Pandemic. Journal of Risk and Financial Management 14: 154. [Google Scholar] [CrossRef]

- Tsay, Ruey S. 2005. Analysis of Financial Time Series. New York: John Wiley & Sons, vol. 543. [Google Scholar]

- Twerefou, Daniel Kwabena, and Michael K. Nimo. 2005. The Impact of Macroeconomic Risk on Asset Prices in Ghana, 1997–2002. African Development Review 17: 168–92. [Google Scholar] [CrossRef]

- Ullah, Subhan, Ghasem Zaefarian, Rizwan Ahmed, and Danson Kimani. 2021. How to apply the event study methodology in STATA: An overview and a step-by-step guide for authors. Industrial Marketing Management. in press. [Google Scholar] [CrossRef]

- World Bank. 2021. World Bank Country and Lending Groups. Available online: https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups%20/ (accessed on 1 October 2021).

- Xiao, Linlan, and Abdurrahman Aydemir. 2007. Volatility modelling and forecasting in finance. In Forecasting Volatility in the Financial Markets. Oxford: Butterworth-Heinemann, pp. 1–45. [Google Scholar]

- Yilmazkuday, Hakan. 2020. COVID-19 Effects on the S&P 500 inde. Applied Economics Letters, 1–7. [Google Scholar] [CrossRef]

| Country | Indonesia | Hungary | World |

|---|---|---|---|

| First case | 2 March 2020 | 4 March 2020 | 31 December 2020 |

| Number of cases | 1,662,868 | 776,983 | 150,333,988 |

| Number of cases/1M population | 6027 | 80,599 | 19,286 |

| Number of deaths | 45,334 | 27,358 | 3,166,814 |

| Number of deaths/1M population | 164 | 169 | 406 |

| Total tests | 14,487,396 | 5,349,792 | - |

| Total tests/1M population | 52,509 | 554,952 | - |

| Deaths/cases | 0.027 | 0.035 | 0.021 |

| Population | 274,463,879 | 9,652,245 | - |

| Trading Days | Mean | Median | Min | Max | Standard Deviation | |

|---|---|---|---|---|---|---|

| Panel A. JCI Statistical Summary | ||||||

| COVID-19 Outbreak | ||||||

| Estimation period | 150 | −0.03% | −0.03% | −2.59% | 1.97% | 0.007638 |

| COVID-19 (Epidemic) | 11 | −0.01% | 0.19% | −1.04% | 0.78% | 0.005860 |

| COVID-19 (Pandemic) | 11 | −2.14% | −2.48% | −6.58% | 2.38% | 0.028072 |

| Global Financial Crisis (GFC) | ||||||

| Estimation period | 150 | 0.21% | 0.23% | −3.96% | 3.12% | 0.010793 |

| GFC (First Announcement) | 11 | 0.03% | −0.16% | −1.8% | 1.44% | 0.010714 |

| GFC (Lehman Brothers Bankruptcy) | 11 | −0.53% | 0.30% | −4.70% | 5.82% | 0.030410 |

| Panel B. BUX Statistical Summary | ||||||

| COVID-19 Outbreak | ||||||

| Estimation period | 150 | 0.01% | 0.05% | −1.73% | 2.19% | 0.007672 |

| COVID-19 (Epidemic) | 11 | 0.10% | 0.32% | −3.21% | 1.38% | 0.012290 |

| COVID-19 (Pandemic) | 11 | −3.34% | −3.34% | −11.55% | 5.79% | 0.044508 |

| Global Financial Crisis (GFC) | ||||||

| Estimation period | 150 | 0.13% | 0.12% | −2.44% | 2.85% | 0.010679 |

| GFC (First Announcement) | 11 | 0.11% | −0.18% | −1.46% | 2.79% | 0.010630 |

| GFC (Lehman Brothers Bankruptcy) | 11 | −0.30% | −1.34% | −3.83% | 9.15% | 0.034804 |

| Trading Days | Average Stock Return | Average Stock Return vs. MSCIEM | ||||

|---|---|---|---|---|---|---|

| JCI | BUX | MSCIEM | JCI | BUX | ||

| COVID-19 Outbreak | ||||||

| Estimation period | 150 | −0.03% | 0.01% | 0.03% | −0.05% | −0.01% |

| COVID-19 (Epidemic) | 11 | −0.01% | 0.10% | 0.17% | −0.18% | −0.07% |

| COVID-19 (Pandemic) | 11 | −2.14% | −3.34% | −2.34% | 0.20% | −1.00% |

| Global Financial Crisis (GFC) | ||||||

| Estimation period | 150 | 0.21% | 0.13% | 0.16% | 0.05% | −0.02% |

| GFC (First Announcement) | 11 | 0.03% | 0.11% | 0.10% | −0.07% | 0.01% |

| GFC (Lehman Brothers Bankruptcy) | 11 | −0.53% | −0.30% | −0.12% | −0.41% | −0.17% |

| COVID-19 Outbreak | Days | Abnormal Return (AR) | t-Test | ||

|---|---|---|---|---|---|

| JCI | BUX | JCI | BUX | ||

| COVID-19 (Epidemic) | −5 | 0.6% | 1.4% | 0.754 | 1.771 |

| −4 | 0.4% | 0.6% | 0.487 | 0.813 | |

| −3 | 0.2% | −0.7% | 0.325 | −0.942 | |

| −2 | 0.2% | 0.8% | 0.240 | 1.056 | |

| −1 | −0.4% | 0.2% | −0.579 | 0.244 | |

| Event Date | −0.2% | 0.4% | −0.275 | 0.457 | |

| +1 | 0.7% | −0.2% | 0.858 | −0.284 | |

| +2 | −1.0% | −3.3% | −1.335 | −4.229 | |

| +3 | 0.4% | −0.4% | 0.498 | −0.489 | |

| +4 | −0.8% | 1.0% | −1.079 | 1.249 | |

| +5 | 0.8% | 1.3% | 1.079 | 1.681 | |

| Average Abnormal Return | 0.1% | 0.1% | 0.088 | 0.121 | |

| COVID-19 (Pandemic) | −5 | 2.4% | 0.1% | 3.150 | 0.111 |

| −4 | −0.2% | −1.7% | −0.237 | −2.162 | |

| −3 | −2.5% | −3.5% | −3.218 | −4.473 | |

| −2 | −6.6% | −7.8% | −8.605 | −10.113 | |

| −1 | 1.7% | 0.9% | 2.189 | 1.107 | |

| Event Date | −1.3% | −4.9% | −1.650 | −6.334 | |

| +1 | −5.1% | −11.8% | −6.574 | −15.307 | |

| +2 | 0.3% | 5.8% | 0.364 | 7.529 | |

| +3 | −4.5% | −5.8% | −5.800 | −7.481 | |

| +4 | −5.0% | −2.5% | −6.459 | −3.179 | |

| +5 | −2.8% | −6.7% | −3.706 | −8.721 | |

| Average Abnormal Return | −2.1% | −3.4% | −2.777 | −4.457 | |

| Global Financial Crisis (GFC) | Days | Abnormal Return (AR) | t-Test | ||

|---|---|---|---|---|---|

| JCI | BUX | JCI | BUX | ||

| GFC (First Announcement) | −5 | −1.1% | −0.4% | −0.993 | −0.359 |

| −4 | 0.6% | −0.5% | 0.556 | −0.489 | |

| −3 | −1.1% | 0.6% | −1.013 | 0.545 | |

| −2 | −0.4% | −0.3% | −0.402 | −0.312 | |

| −1 | 1.3% | 2.7% | 1.221 | 2.559 | |

| Event Date | 1.3% | −0.2% | 1.168 | −0.232 | |

| +1 | −1.1% | 0.1% | −1.004 | 0.129 | |

| +2 | 0.1% | −1.0% | 0.124 | −0.906 | |

| +3 | −0.7% | −0.5% | −0.611 | −0.432 | |

| +4 | −2.2% | −1.6% | −2.030 | −1.541 | |

| +5 | 1.3% | 0.9% | 1.186 | 0.887 | |

| Average Abnormal Return | −0.2% | 0.0% | −0.081 | −0.014 | |

| GFC (Lehman Brothers Bankruptcy) | −5 | 0.8% | 2.6% | 0.766 | 2.411 |

| −4 | −4.4% | −0.9% | −4.080 | −0.805 | |

| −3 | −4.1% | 0.0% | −3.754 | 0.033 | |

| −2 | −1.2% | −2.8% | −1.104 | −2.669 | |

| −1 | −3.6% | 0.5% | −3.307 | 0.498 | |

| Event Date | −5.2% | −2.3% | −4.180 | −2.207 | |

| +1 | 0.3% | −3.5% | 0.288 | −3.334 | |

| +2 | 1.6% | −4.0% | 1.462 | −3.809 | |

| +3 | 0.8% | −2.5% | 0.716 | −2.376 | |

| +4 | 6.5% | 9.4% | 5.968 | 8.845 | |

| +5 | 0.2% | −1.2% | 0.159 | −1.091 | |

| Average Abnormal Return | −0.8% | −0.4% | −0.700 | −0.409 | |

| Before COVID-19 | During COVID-19 | Before Global Financial Crisis | During Global Financial Crisis | ||

|---|---|---|---|---|---|

| JCI | ADF test at level | −3.68 (0.01) | −2.65 (0.303) | −0.737 (0.789) | −0.3671 (0.499) |

| ADF at first difference | −9.51 (0.01) | −7.05 (0.01) | −8.91 (0.01) | −12.3707 (0.01) | |

| PP at level | 0.0523 (0.701) | −8.16 (0.569) | −1.31 (0.845) | −4.94 (0.465) | |

| PP at first difference | −126 (0.01) | −393 (0.01) | −146 (0.01) | −288 (0.01) | |

| BUX | ADF test at level | −0.765 (0.963) | −2.57 (0.338) | −1.96 (0.588) | −3.35 (0.0626) |

| ADF at first difference | −5.13 (0.01) | −8.18 (0.01) | −6.07 (0.01) | −15.97 (0.01) | |

| PP at level | −2.73 (0.946) | −7.46 (0.621) | −10 (0.451) | 1.34 (0.843) | |

| PP at first difference | −130 (0.01) | −434 (0.01) | −154 (0.01) | −257 (0.01) |

| Variables | ARCH Test | |

|---|---|---|

| JCI | Before Financial crisis | 134.4 (0.00) |

| During Financial crisis | 297.71 (0.00) | |

| Before COVID-19 | 119.21(0.00) | |

| During COVID-19 | 385.87 (0.00) | |

| BUX | Before Financial crisis | 129.2 (0.00) |

| During Financial crisis | 288.95(0.00) | |

| Before COVID-19 | 133.89 (0.00) | |

| During COVID-19 | 401.89 (0.00) |

| Estimate | Std. Error | t Value | Pr (>|t|) | ||

|---|---|---|---|---|---|

| Before COVID-19 | Mu | 2.20249 | 3.884485 | 0.566997 | 0.570717 |

| Ar1 | −0.56856 | 0.341611 | −1.664355 | 0.096042 | |

| Ma1 | 0.66500 | 0.307256 | 2.164303 | 0.030441 | |

| Omega | 0.42851 | 26.474920 | 0.016185 | 0.987087 | |

| Alpha | 0.00000 | 0.011996 | 0.000000 | 1.000000 | |

| Beta | 0.99900 | 0.000195 | 5116.829081 | 0.000000 | |

| During COVID-19 | Mu | 3.10077 | 2.823291 | 1.0983 | 0.272081 |

| Ar1 | −0.69592 | 0.145174 | −4.7937 | 0.000002 | |

| Ma1 | 0.75763 | 0.127652 | 5.9351 | 0.000000 | |

| Omega | 452.22575 | 195.821571 | 2.3094 | 0.020923 | |

| Alpha | 0.19129 | 0.064769 | 2.9534 | 0.003143 | |

| Beta | 0.71935 | 0.082260 | 8.7449 | 0.000000 | |

| Before global financial crisis | Mu | 3.39230 | 1.623433 | 2.08959 | 0.036655 |

| Ar1 | −0.88641 | 0.038787 | −22.85346 | 0.000000 | |

| Ma1 | 0.98152 | 0.001339 | 732.94709 | 0.000000 | |

| Omega | 7.13077 | 9.378459 | 0.76033 | 0.447054 | |

| Alpha | 0.00000 | 0.003374 | 0.00000 | 1.000000 | |

| Beta | 0.98234 | 0.022756 | 43.16818 | 0.000000 | |

| During global financial crisis | Mu | 1.62639 | 2.521251 | 0.64506 | 0.518889 |

| Ar1 | 0.51944 | 0.372761 | 1.39350 | 0.163468 | |

| Ma1 | −0.38923 | 0.395670 | 0.98372 | 0.325253 | |

| Omega | 254.53845 | 100.466679 | 2.53356 | 0.011291 | |

| Alpha | 0.26742 | 0.074418 | 3.59344 | 0.000326 | |

| Beta | 0.60059 | 0.092359 | 6.50274 | 0.000000 |

| Estimate | Std. Error | t Value | Pr (>|t|) | ||

|---|---|---|---|---|---|

| Before COVID-19 | Mu | 25.255187 | 22.549 | 1.11999 | 0.262717 |

| Ar1 | 0.861833 | 0.26967 | 3.19586 | 0.001394 | |

| Ma1 | −0.883947 | 0.24857 | −3.55616 | 0.000376 | |

| Omega | 777.411716 | 3567.0 | 0.21795 | 0.827471 | |

| Alpha | 0.038306 | 0.029300 | 1.30738 | 0.191084 | |

| Beta | 0.960694 | 5.0516 × 10−2 | 19.01776 | 0.000000 | |

| During COVID-19 | Mu | 30.20324 | 25.065 | 1.20502 | 0.228196 |

| Ar1 | 0.67488 | 0.4.1974 | 1.60785 | 0.107869 | |

| Ma1 | −0.63907 | 0.4.3768 | −1.46012 | 0.14425 | |

| Omega | 369.99235 | 2716.3 | 0.13621 | 0.891653 | |

| Alpha | 0.10520 | 0.026811 | 3.92365 | 0.000087 | |

| Beta | 0.89380 | 0.024552 | 36.40422 | 0.000000 | |

| Before global financial crisis | Mu | 31.46149 | 19.787060 | 1.59000 | 0.111834 |

| Ar1 | 0.12656 | 0.469955 | 0.26930 | 0.787697 | |

| Ma1 | −0.17318 | 0.499280 | −0.34685 | 0.728703 | |

| Omega | 65.23314 | 520.133485 | 0.12542 | 0.900194 | |

| Alpha | 0.00000 | 0.009524 | 0.00000 | 1.000000 | |

| Beta | 0.99818 | 0.001445 | 690.77897 | 0.000000 | |

| During global financial crisis | Mu | −16.267006 | 19.171 | −0.84853 | 0.396145 |

| Ar1 | −0.081846 | 0.28927 | −0.28294 | 0.777223 | |

| Ma1 | 0.179979 | 0.2.8330 | 0.63531 | 0.525229 | |

| Omega | 3321.3054 | 2440.3 | 1.36105 | 0.173499 | |

| Alpha | 0.163004 | 0.077976 | 14.24504 | 0.036579 | |

| Beta | 0.835996 | 0.058687 | 14.24504 | 0.000000 |

| Statistic | P-Value | ||

|---|---|---|---|

| Before COVID-19 | Lag[1] | 0.4194 | 0.5172 |

| Lag[2∗(p+q)+(p+q)−1][5] | 1.6575 | 0.9936 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 5.2655 | 0.3952 | |

| During COVID-19 | Lag[1] | 0.1934 | 0.6601 |

| Lag[2∗(p+q)+(p+q)−1][5] | 3.7645 | 0.1174 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 5.7311 | 0.3030 | |

| Before Global Financial Crisis | Lag[1] | 0.4194 | 0.5172 |

| Lag[2∗(p+q)+(p+q)−1][5] | 1.6575 | 0.9936 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 5.2655 | 0.3952 | |

| During Global Financial Crisis | Lag[1] | 1.027 | 0.310857 |

| Lag[2∗(p+q)+(p+q)−1][5] | 4.991 | 0.003418 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 6.796 | 0.148820 | |

| Before COVID-19 | Lag[1] | 0.9386 | 0.332636 |

| Lag[2∗(p+q)+(p+q)−1][5] | 5.0039 | 0.003267 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 6.3308 | 0.206417 | |

| During COVID-19 | Lag[1] | 0.3465 | 0.5561 |

| Lag[2∗(p+q)+(p+q)−1][5] | 1.9047 | 0.9732 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 2.7144 | 0.9291 | |

| Before Global Financial Crisis | Lag[1] | 0.0005114 | 0.9820 |

| Lag[2∗(p+q)+(p+q)−1][5] | 1.2126727 | 0.9999 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 3.4269144 | 0.8159 | |

| During Global Financial Crisis | Lag[1] | 0.07964 | 0.7778 |

| Lag[2∗(p+q)+(p+q)−1][5] | 3.77620 | 0.1143 | |

| Lag[4∗(p+q)+(p+q)−1][9] | 5.64876 | 0.3183 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Setiawan, B.; Ben Abdallah, M.; Fekete-Farkas, M.; Nathan, R.J.; Zeman, Z. GARCH (1,1) Models and Analysis of Stock Market Turmoil during COVID-19 Outbreak in an Emerging and Developed Economy. J. Risk Financial Manag. 2021, 14, 576. https://doi.org/10.3390/jrfm14120576

Setiawan B, Ben Abdallah M, Fekete-Farkas M, Nathan RJ, Zeman Z. GARCH (1,1) Models and Analysis of Stock Market Turmoil during COVID-19 Outbreak in an Emerging and Developed Economy. Journal of Risk and Financial Management. 2021; 14(12):576. https://doi.org/10.3390/jrfm14120576

Chicago/Turabian StyleSetiawan, Budi, Marwa Ben Abdallah, Maria Fekete-Farkas, Robert Jeyakumar Nathan, and Zoltan Zeman. 2021. "GARCH (1,1) Models and Analysis of Stock Market Turmoil during COVID-19 Outbreak in an Emerging and Developed Economy" Journal of Risk and Financial Management 14, no. 12: 576. https://doi.org/10.3390/jrfm14120576

APA StyleSetiawan, B., Ben Abdallah, M., Fekete-Farkas, M., Nathan, R. J., & Zeman, Z. (2021). GARCH (1,1) Models and Analysis of Stock Market Turmoil during COVID-19 Outbreak in an Emerging and Developed Economy. Journal of Risk and Financial Management, 14(12), 576. https://doi.org/10.3390/jrfm14120576