Post-Acquisition Performance of Emerging Market Firms: A Multi-Dimensional Analysis of Acquisitions in India †

Abstract

:1. Introduction

2. Literature Review and Research Questions

2.1. Value Creation through M&A in Emerging Markets

2.2. Measuring M&A Performance

2.3. Financial/Accounting Measures

2.4. Market Measures

2.5. Innovation Measures

3. Methodology

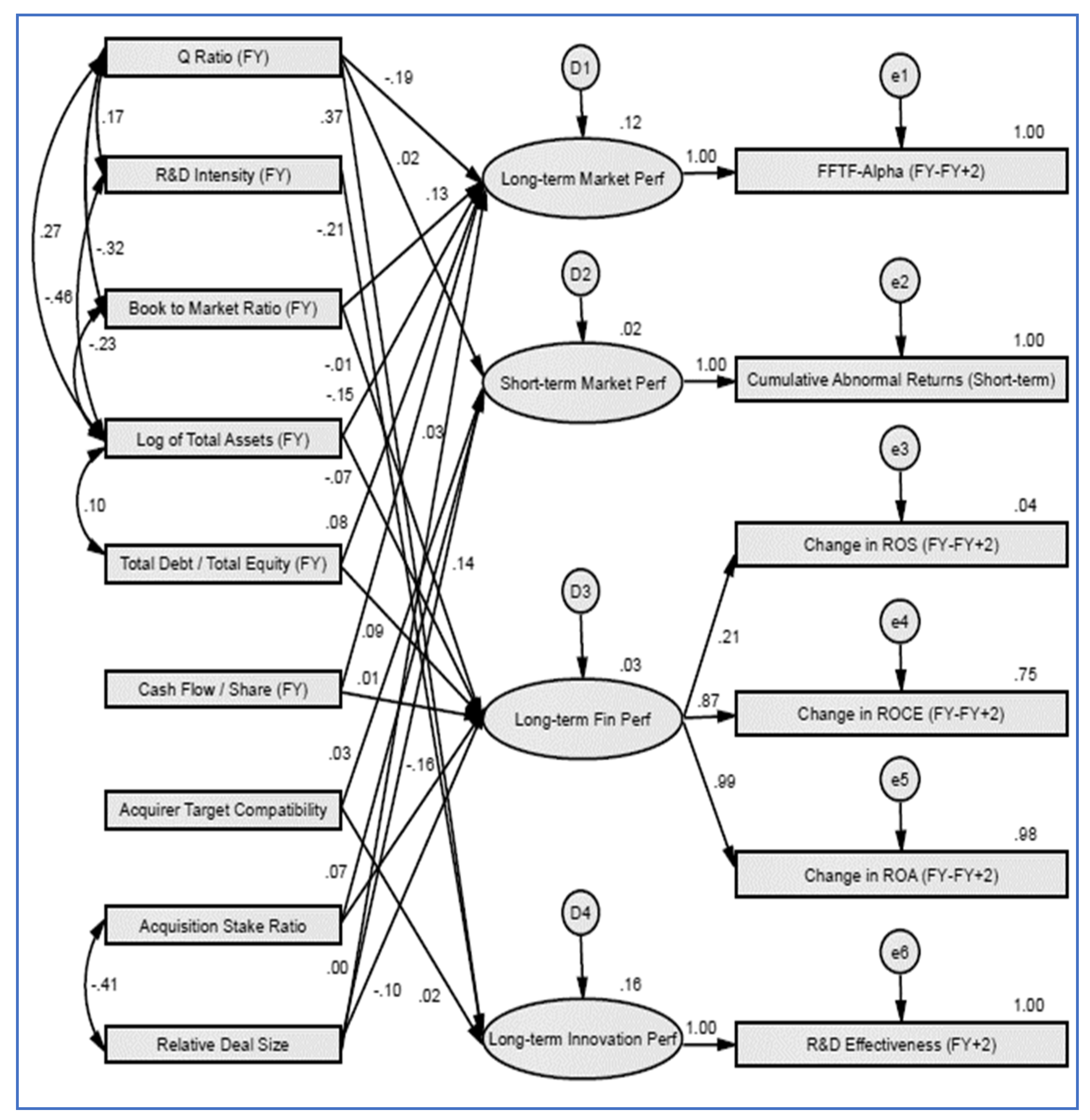

3.1. Applying SEM for M&A Performance Modeling

3.2. Variables

3.3. Calculation of FFTF Alpha

- Rat: Monthly stock return

- Rft: Risk-free return for the month from Reserve Bank of India (RBI) published data

- Rmt: Average market return for the month

- SMBt: Difference in return of small firms’ stock and big firms’ stock on BSE

- HMLt: Difference in return of high-book value firms’ stock and low book value firms’ stock on BSE.

3.4. Calculation of Cumulative Abnormal Returns (CAR)

3.5. Data Sample

4. Findings and Discussion

4.1. Explaining Long-Term Financial Performance

4.2. Explaining Market Performance

4.3. Explaining Long-Term Innovation Performance

5. Conclusions and Directions for Future Research

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahsan, Faisal Mohammad, Mohammad Fuad, and Ashutosh Kumar Sinha. 2021. Seeking strategic assets within cross-border acquisition waves: A study of Indian firms. Journal of International Management 27: 100875. [Google Scholar] [CrossRef]

- Alexandridis, George, Christos F. Mavrovitis, and Nickolaos G. Travlos. 2012. How have M&As changed? Evidence from the sixth merger wave. The European Journal of Finance 18: 663–88. [Google Scholar]

- Alexandridis, George, Kathleen P. Fuller, Lars Terhaar, and Nickolaos G. Travlos. 2013. Deal size, acquisition premia and shareholder gains. Journal of Corporate Finance 20: 1–13. [Google Scholar] [CrossRef]

- Alhenawi, Yasser, and Sudha Krishnaswami. 2015. Long-term impact of merger synergies on performance and value. The Quarterly Review of Economics and Finance 58: 93–118. [Google Scholar] [CrossRef]

- André, Paul, Maher Kooli, and Jean-François L’Her. 2004. The Long-Run Performance of Mergers and Acquisitions: Evidence from the Canadian Stock Market. Financial Management 33: 27–43. [Google Scholar]

- Ben-David, Itzhak, Utpal Bhattacharya, and Stacey E. Jacobsen. 2020. Do Acquirer Announcement Returns Reflect Value Creation? (No. w27976). National Bureau of Economic Research. Available online: https://www.nber.org/papers/w27976 (accessed on 15 October 2021).

- Bhabra, Harjeet S., and Jiayin Huang. 2013. An empirical investigation of mergers and acquisitions by Chinese listed companies, 1997–2007. Journal of Multinational Financial Management 23: 186–207. [Google Scholar] [CrossRef]

- Bouwman, Christa H., Kathleen Fuller, and Amrita S. Nain. 2009. Market valuation and acquisition quality: Empirical evidence. The Review of Financial Studies 22: 633–79. [Google Scholar] [CrossRef]

- Bower, Joseph. 2001. Not All M&A’s Are Alike—And That Matters. Harvard Business Review 79: 92. [Google Scholar]

- Busija, Edith C., Hugh M. O’Neill, and Carl P. Zeithaml. 1997. Diversification Strategy, Entry Mode, and Performance: Evidence of Choice and Constraints. Strategic Management Journal 18: 321–27. [Google Scholar] [CrossRef]

- Capon, Noel, John U. Farley, and Scott Hoenig. 1990. Determinants of Financial Performance—A Meta-analysis. Management Science 36: 1143–59. [Google Scholar] [CrossRef] [Green Version]

- Capron, Laurence. 1999. The Long-Term Performance of Horizontal Acquisitions. Strategic Management Journal 20: 987–1018. [Google Scholar] [CrossRef]

- Capron, Laurence, and Nathalie Pistre. 2002. When Do Acquirers Earn Abnormal Returns? Strategic Management Journal 23: 781–94. [Google Scholar] [CrossRef]

- Capron, Laurence, Will Mitchell, and Anand Swaminathan. 2001. Asset Divestiture Following Horizontal Acquisitions: A Dynamic View. Strategic Management Journal 22: 817–44. [Google Scholar] [CrossRef]

- Chidambaran, N. K., Dipali Krishnakumar, and Madhvi Sethi. 2018. Cross-border vs. domestic acquisitions: Evidence from India. Journal of Economics and Business 95: 3–25. [Google Scholar] [CrossRef]

- Cloodt, Myriam, John Hagedoorn, and Hans Van Kranenburg. 2006. Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Research Policy 35: 642–54. [Google Scholar] [CrossRef]

- Das, Arindam, and Sheeba Kapil. 2015. Inorganic growth of technology sector firms in emerging markets. International Journal of Emerging Markets 10: 52. [Google Scholar] [CrossRef]

- Devos, Erik, Palani Rajan Kadapakkam, and Srinivasan Krishnamurthy. 2009. How do mergers create value? A comparison of taxes, market power, and efficiency improvements as explanations for synergies. The Review of Financial Studies 22: 1179–211. [Google Scholar] [CrossRef]

- Doukas, John A., and L. H. Lang. 2003. Foreign Direct Investment, Diversification and Firm Performance. Journal of International Business Studies 34: 153–72. [Google Scholar] [CrossRef]

- Faccio, Mara, and Ronald W. Masulis. 2005. The choice of payment method in European mergers and acquisitions. The Journal of Finance 60: 1345–88. [Google Scholar] [CrossRef]

- Finkelstein, Sydney, and Jerayr Haleblian. 2002. Understanding Acquisition performance: The role of transfer effects. Organization Science 13: 36–47. [Google Scholar] [CrossRef]

- Fowler, Karen L., and Dennis R. Schmidt. 1989. Determinants of Tender Offer Post-Acquisition Financial Performance. Strategic Management Journal 10: 339–50. [Google Scholar] [CrossRef]

- Francoeur, Claude. 2006. The Long-Run Performance of Cross-Border Mergers and Acquisitions: The Canadian Evidence. Corporate Ownership & Control 4: 312–23. [Google Scholar]

- Gaur, Ajai S., and Vikas Kumar. 2009. International Diversification, Business Group Affiliation and Firm Performance: Empirical Evidence from India. British Journal of Management 20: 172–86. [Google Scholar] [CrossRef]

- Gerbaud, Ricardo Romero, and Anne S. York. 2007. Stock Market Reactions to Knowledge-Motivated Acquisitions. Advances in Mergers and Acquisitions 6: 127–56. [Google Scholar] [CrossRef]

- Hagedoorn, John, and Geert Duysters. 2002. The Effect of Mergers and Acquisitions on the Technological Performance of Companies in a High-tech Environment. Technology Analysis & Strategic Management 14: 67–85. [Google Scholar]

- Harford, Jarrad. 1999. Corporate cash reserves and acquisitions. The Journal of Finance 54: 1969–97. [Google Scholar] [CrossRef]

- Hayward, Mathew L. 2002. When Do Firms Learn from Their Acquisition Experience? Evidence from 1990–95. Strategic Management Journal 23: 21–39. [Google Scholar] [CrossRef]

- Hu, Nan, Lu Li, Hui Li, and Xing Wang. 2020. Do mega-mergers create value? The acquisition experience and mega-deal outcomes. Journal of Empirical Finance 55: 119–42. [Google Scholar] [CrossRef]

- IMAA, Institute for Mergers, Acquisitions and Alliances. 2021. M&A Statistics. Available online: https://imaa-institute.org/mergers-and-acquisitions-statistics/ (accessed on 16 September 2021).

- Kale, Prashant. 2004. Acquisition value creation in emerging markets: An empirical study of acquisitions in India. In Academy of Management Best Paper Proceedings 2004. New Orleans: Academy of Management, pp. H1–H6. [Google Scholar]

- Khanna, Tarun, and Krishna G. Palepu. 2010. Winning in Emerging Markets: A Road Map for Strategy and Execution. Boston: Harvard Business Press. [Google Scholar]

- Kim, Hyejun, and Jaeyong Song. 2017. Filling institutional voids in emerging economies: The impact of capital market development and business groups on M&A deal abandonment. Journal of International Business Studies 48: 308–23. [Google Scholar]

- King, David R., Dan R. Dalton, Catherine M. Daily, and Jeffrey G. Covin. 2004. Meta-analyses of Post-Acquisition Performance: Indications of Unidentified Moderators. Strategic Management Journal 25: 187–200. [Google Scholar] [CrossRef] [Green Version]

- Kumar, B. Rajesh, and S. Paneerselvam. 2009. Mergers, Acquisitions and Wealth Creation: A Comparative Study in the Indian Context. IIMB Management Review 21: 222–42. [Google Scholar]

- Lebedev, Sergey, Mike W. Peng, En Xie, and Charles E. Stevens. 2015. Mergers and acquisitions in and out of emerging economies. Journal of World Business 50: 651–62. [Google Scholar] [CrossRef]

- Lensink, Robert, Remco Van der Molen, and Shubashis Gangopadhyay. 2003. Business groups, financing constraints and investment: The case of India. The Journal of Development Studies 40: 93–119. [Google Scholar] [CrossRef]

- Lien, Lasses B., and Peter G. Klein. 2006. Relatedness and Acquirer Performance. Advances in Mergers and Acquisitions 5: 9–23. [Google Scholar]

- Lin, Bou-Wen, Yikuan Lee, and Shih-Chang Hung. 2006. R&D Intensity and Commercialization Orientation Efforts on Financial Performance. Journal of Business Research 59: 679–85. [Google Scholar]

- Lu, Jane W., and Paul W. Beamish. 2004. International Diversification and Firm Performance: The S-Curve Hypothesis. The Academy of Management Journal 47: 598–609. [Google Scholar]

- Lubatkin, Michael. 1987. Merger Strategies and Stockholder Value. Strategic Management Journal 8: 39–53. [Google Scholar] [CrossRef]

- Markides, Constantinos C. 1995. Diversification, Restructuring and Economic Performance. Strategic Management Journal 16: 101–18. [Google Scholar] [CrossRef]

- Meglio, Olimpia, and Annette Risberg. 2011. The (mis) measurement of M&A performance—A systematic narrative literature review. Scandinavian Journal of Management 27: 418–33. [Google Scholar]

- Nagano, Mamoru, and Yuan Yuan. 2007. Cross-Border Acquisitions in a Transition Economy: Recent Experiences of China and India. Available online: http://ssrn.com/abstract=1683895 (accessed on 16 September 2021).

- Peng, Mike W., Sergey Lebedev, Cristina O. Vlas, Joyce C. Wang, and Jason S. Shay. 2018. The growth of the firm in (and out of) emerging economies. Asia Pacific Journal of Management 35: 829–57. [Google Scholar] [CrossRef]

- Ramaswamy, Kannan. 1997. The Performance Impact of Strategic Similarity in Horizontal Mergers: Evidence from the US Banking Industry. The Academy of Management Journal 40: 697–715. [Google Scholar]

- Reddy, Krishna, Muhammad Qamar, and Noel Yahanpath. 2019. Do mergers and acquisitions create value?: The post-M&A performance of acquiring firms in China and India. Studies in Economics and Finance 36: 240–64. [Google Scholar]

- Renneboog, Luc, and Cara Vansteenkiste. 2019. Failure and success in mergers and acquisitions. Journal of Corporate Finance 58: 650–99. [Google Scholar] [CrossRef] [Green Version]

- Richard, Pierre J., Timothy M. Devinney, George S. Yip, and Gerry Johnson. 2009. Measuring Organizational Performance as a Dependent Variable: Towards Methodological Best Practice. Journal of Management 35: 718–804. [Google Scholar] [CrossRef] [Green Version]

- Seth, Anju, Kean P. Song, and R. Richardson Pettit. 2002. Value Creation and Destruction in Cross-Border Acquisitions: An Empirical Analysis of Foreign Acquisitions of U.S. Firms. Strategic Management Journal 23: 921–40. [Google Scholar] [CrossRef]

- Simerly, Roy L., and Mingfang Li. 2000. Environmental Dynamism, Capital Structure and Performance: A Theoretical Integration and an Empirical Test. Strategic Management Journal 21: 31–49. [Google Scholar] [CrossRef]

- Tichy, Gunther. 2001. What do we know about success and failure of mergers? Journal of Industry, Competition and Trade 1: 347–94. [Google Scholar] [CrossRef]

- Uhlenbruck, Klaus, and Julio O. Castro. 2000. Foreign Acquisitions in Central and Eastern Europe: Outcomes of Privatization in Transitional Economies. The Academy of Management Journal 43: 381–402. [Google Scholar]

- Vanhaverbeke, Wim, Geert Duysters, and Niels Noorderhaven. 2002. External Technology Sourcing Through Alliances or Acquisitions: An Analysis of the Application-Specific Integrated Circuits Industry. Organization Science 13: 714–33. [Google Scholar] [CrossRef] [Green Version]

- Vilas-Boas, Ricardo, and Isabel Suárez-González. 2007. Internationalization and Firm Performance: The S-Curve Hypothesis under the Eurozone Context. Available online: http://www.eco.uva.es/empresa/uploads/dt_15_07.pdf (accessed on 16 September 2021).

- Zhu, Hong, and Qi Zhu. 2016. Mergers and acquisitions by Chinese firms: A review and comparison with other mergers and acquisitions research in the leading journals. Asia Pacific Journal of Management 33: 1107–49. [Google Scholar] [CrossRef]

- Zollo, Maurizio, and Degenhard Meier. 2008. What Is M&A Performance? Academy of Management Perspectives 22: 55–77. [Google Scholar]

| Variable Category | Variable Name * | Explanation/Calculation/Values | Data Source |

|---|---|---|---|

| Latent Endogenous | Long-term market perf. | Long-term performance on stock market | NA |

| Endogenous Indicator | FFTF alpha (FY-FY+2) | Alpha from FF-TFPM over 2 years (see calculation for FFTF-Alpha) | CMIE Prowess, RBI Publications |

| Latent Endogenous | Short-term market perf. | Short-term performance in stock market | NA |

| Endogenous Indicator | Cumulative abnormal returns (short-term) | Short-term cumulative abnormal return over period −20 days to +1 day (see calculation for CAR) | CMIE Prowess |

| Latent Endogenous | Long-term financial perf. | Long-term performance of financial ratios | NA |

| Endogenous Indicator | Change in ROA (FY-FY+2) | Change in return on assets over 2 years | CMIE Prowess |

| Endogenous Indicator | Change in ROS (FY-FY+2) | Change in return on sales over 2 years | CMIE Prowess |

| Endogenous Indicator | Change in ROCE (FY-FY+2) | Change in return on capital employed over 2 years | CMIE Prowess |

| Latent Endogenous | Long-term innovation perf. | Long-term performance on innovation | NA |

| Endogenous Indicator | R&D effectiveness (FY+2) | R&D effectiveness = patent stock after 2 years of acquisition weighted by size (sales volume) | Worldwide patent database of European Patent Office, CMIE Prowess |

| Exogenous Indicator | Q ratio (FY) | Proxy for Tobin’s Q = market value of equity plus the book value of debt divided by the book value of assets | CMIE Prowess |

| Exogenous Indicator | R&D intensity (FY) | R&D intensity = R&D expense/total sales | CMIE Prowess |

| Exogenous Indicator | Log of total assets (FY) | Acquirer size = log (total assets in million rupees from balance sheet) | CMIE Prowess |

| Exogenous Indicator | Cash flow/share (FY) | Cash flow = net cash inflow for cash flow statement/number of shares outstanding | CMIE Prowess |

| Exogenous Indicator | Total debt/total equity (FY) | Leverage = total debt divided by shareholder equity | CMIE Prowess |

| Exogenous Indicator | Book to market ratio (FY) | Book to market ratio = book value divided by market cap | CMIE Prowess |

| Exogenous Indicator | Acquirer–target compatibility | Mapped on a scale of 0–1 based on relatedness between acquirer and target by their core area of operation | CMIE Prowess and EMIS |

| Exogenous Indicator | Relative deal size | Purchase price divided by market cap of acquirer at the time of purchase | CMIE Prowess and EMIS |

| Exogenous Indicator | Stake scale | Mapped on a scale of 0–1 based on acquired stake | CMIE Prowess and EMIS |

| Variable Name | Unit | N | Minimum | Maximum | Mean | Std. Deviation |

|---|---|---|---|---|---|---|

| FFTF alpha (FY-FY+2) | Number | 658 | −3.607 | 7.762 | −0.478 | 1.084 |

| Cumulative Abnormal Returns (Short-Term) | % | 677 | −92.956 | 116.243 | 0.837 | 20.298 |

| Change in ROA (FY-FY+2) | % | 530 | −1.099 | 2.241 | −0.004 | 0.200 |

| Change in ROS (FY-FY+2) | % | 519 | −116.069 | 728.492 | 0.774 | 32.764 |

| Change in ROCE (FY-FY+2) | % | 512 | −1.347 | 2.059 | −0.021 | 0.255 |

| R&D Effectiveness (FY+2) | Ratio | 580 | 0.000 | 2.344 | 0.105 | 0.314 |

| Q Ratio (FY) | Ratio | 391 | 1.031 | 98.162 | 3.830 | 7.449 |

| R&D Intensity (FY) | Ratio | 137 | 0.000 | 0.185 | 0.029 | 0.038 |

| Log of Total Assets (FY) | Number | 590 | 13.122 | 28.076 | 22.562 | 2.022 |

| Cash Flow/Share (FY) | Indian Rupee | 536 | −265.153 | 1508.000 | 9.661 | 95.457 |

| Total Debt/Total Equity (FY) | Ratio | 590 | 0.000 | 34.690 | 0.753 | 2.086 |

| Book to Market Ratio (FY) | Ratio | 391 | −0.202 | 17.648 | 0.766 | 1.400 |

| Acquirer Target Compatibility | Range [0–1] | 677 | 0.200 | 1.000 | 0.396 | 0.301 |

| Relative Deal Size | Number | 159 | 0.000 | 9.009 | 0.258 | 1.116 |

| Stake Scale | Range [0–1] | 677 | 0.200 | 1.000 | 0.662 | 0.272 |

| Parameter Estimate | Unstandardized | Standardized | p-Value | ||

|---|---|---|---|---|---|

| Long-Term Fin. Perf. | ← | Book to Market Ratio (FY) | −0.010 (0.036) | −0.014 | 0.783 |

| Long-Term Fin. Perf. | ← | Log of Total Assets (FY) | −0.036 (0.023) | −0.072 | 0.112 |

| Long-Term Fin. Perf. | ← | Total Debt/Total Equity (FY) | 0.043 (0.021) | 0.087 | 0.044 * |

| Long-Term Fin. Perf. | ← | Stake Scale | −0.608 (0.238) | −0.162 | 0.011 ** |

| Long-Term Fin. Perf. | ← | Relative Deal Size | −0.091 (0.095) | −0.105 | 0.334 |

| Long-Term Fin. Perf. | ← | Cash Flow/Share (FY) | 0.000 (0.000) | 0.014 | 0.750 |

| Long-Term Innovation Perf. | ← | Acquirer– Target Compatibility | 0.073 (0.147) | 0.020 | 0.621 |

| Long-Term Innovation Perf. | ← | R&D Intensity (FY) | −6.295 (1.733) | −0.210 | *** |

| Long-Term Innovation Perf. | ← | Q Ratio (FY) | 0.155 (0.024) | 0.374 | *** |

| Short-Term Market Perf. | ← | Stake Scale | 0.252 (0.202) | 0.068 | 0.213 |

| Short-Term Market Perf. | ← | Relative Deal Size | 0.123 (0.073) | 0.142 | 0.092 |

| Short-Term Market Perf | ← | Acquirer Target Compatibility | 0.099 (0.129) | 0.030 | 0.441 |

| Short-Term Market Perf. | ← | Q Ratio (FY) | 0.009 (0.017) | 0.023 | 0.606 |

| Long-Term Market Perf. | ← | Book to Market Ratio (FY) | 0.097 (0.040) | 0.129 | 0.015 ** |

| Long-Term Market Perf. | ← | Q Ratio (FY) | −0.076 (0.023) | −0.188 | *** |

| Long-Term Market Perf. | ← | Total Debt/Total Equity (FY) | 0.040 (0.021) | 0.078 | 0.055 |

| Long-Term Market Perf | ← | Cash Flow/Share (FY) | 0.000 (0.000) | 0.027 | 0.501 |

| Long-Term Market Perf | ← | Log of Total Assets (FY) | −0.078 (0.023) | −0.148 | *** |

| Long-Term Market Perf. | ← | Relative Deal Size | 0.001 (0.057) | 0.002 | 0.980 |

| FFTF Alpha (FY-FY+2) | ← | Long-Term Market Perf | 1.018 (0.030) | 1.000 | *** |

| Cumulative Abnormal Returns (Short-Term) | ← | Short-term Market Perf. | 20.093 (0.574) | 1.000 | *** |

| Change in ROA (FY-FY+2) | ← | Long-Term Fin. Perf. | 0.196 (0.012) | 0.989 | *** |

| Change in ROS (FY-FY+2) | ← | Long-Term Fin. Perf. | 1.000 (NA) | 0.207 | NA |

| Change in ROCE (FY-FY+2) | ← | Long-Term Fin. Perf. | 0.217 (0.014) | 0.868 | *** |

| R&D Effectiveness (FY+2) | ← | Long-Term Innovation Perf. | 0.502 (0.016) | 1.000 | *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Das, A. Post-Acquisition Performance of Emerging Market Firms: A Multi-Dimensional Analysis of Acquisitions in India. J. Risk Financial Manag. 2021, 14, 567. https://doi.org/10.3390/jrfm14120567

Das A. Post-Acquisition Performance of Emerging Market Firms: A Multi-Dimensional Analysis of Acquisitions in India. Journal of Risk and Financial Management. 2021; 14(12):567. https://doi.org/10.3390/jrfm14120567

Chicago/Turabian StyleDas, Arindam. 2021. "Post-Acquisition Performance of Emerging Market Firms: A Multi-Dimensional Analysis of Acquisitions in India" Journal of Risk and Financial Management 14, no. 12: 567. https://doi.org/10.3390/jrfm14120567

APA StyleDas, A. (2021). Post-Acquisition Performance of Emerging Market Firms: A Multi-Dimensional Analysis of Acquisitions in India. Journal of Risk and Financial Management, 14(12), 567. https://doi.org/10.3390/jrfm14120567