Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data

Abstract

:1. Introduction

2. Review of Related Literature

2.1. Theoretical Literature

2.1.1. Shareholder Value Theory

2.1.2. Stakeholder Theory

2.1.3. Financial Performance Theory

2.2. Empirical Literature Review

3. Data and Methodology

3.1. Sample Description and Data Sources

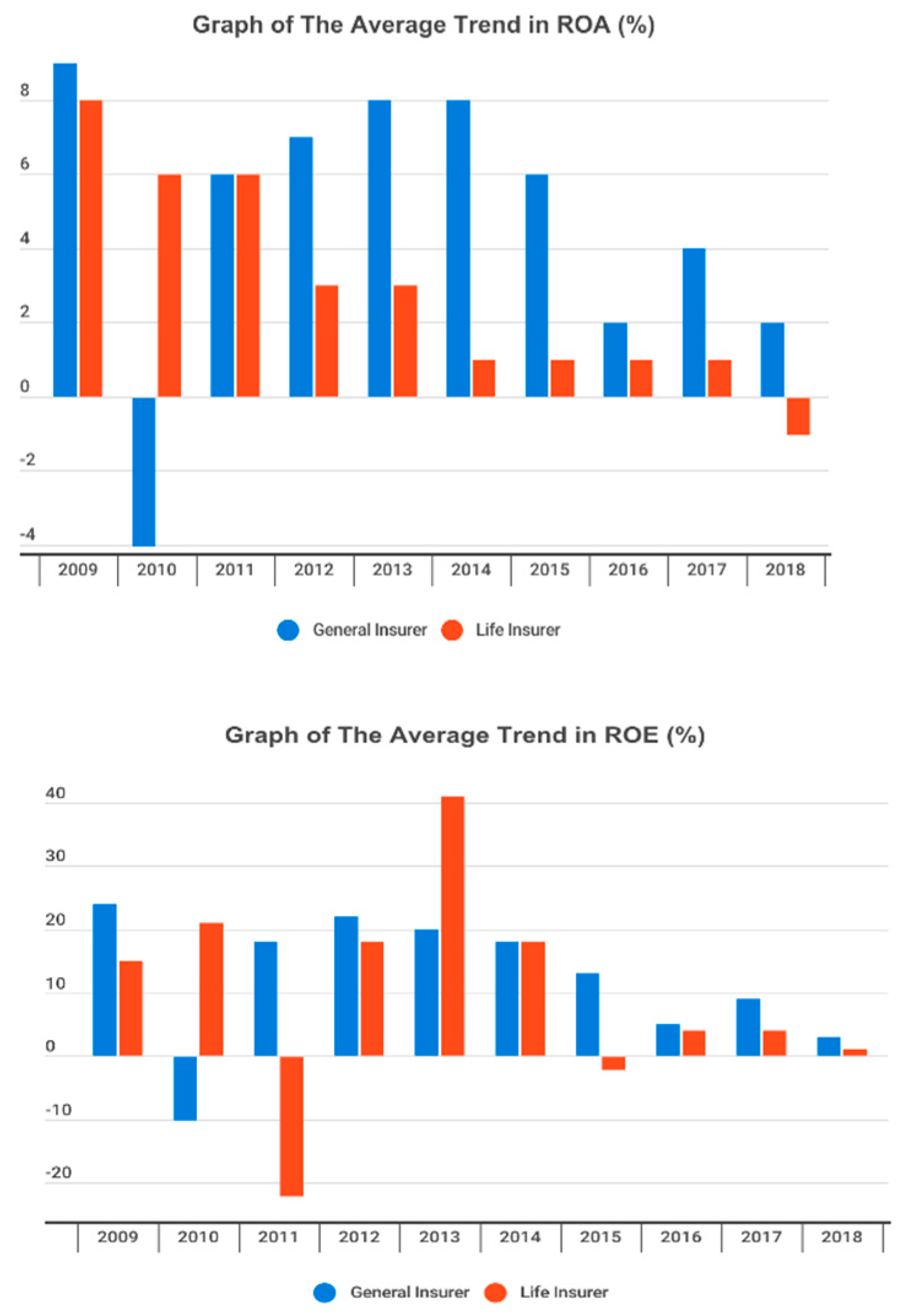

- Dependent Variables

- ➢

- Return on Assets (ROA)

- ➢

- Return on Equity (ROE)

- Independent Variables

- ➢

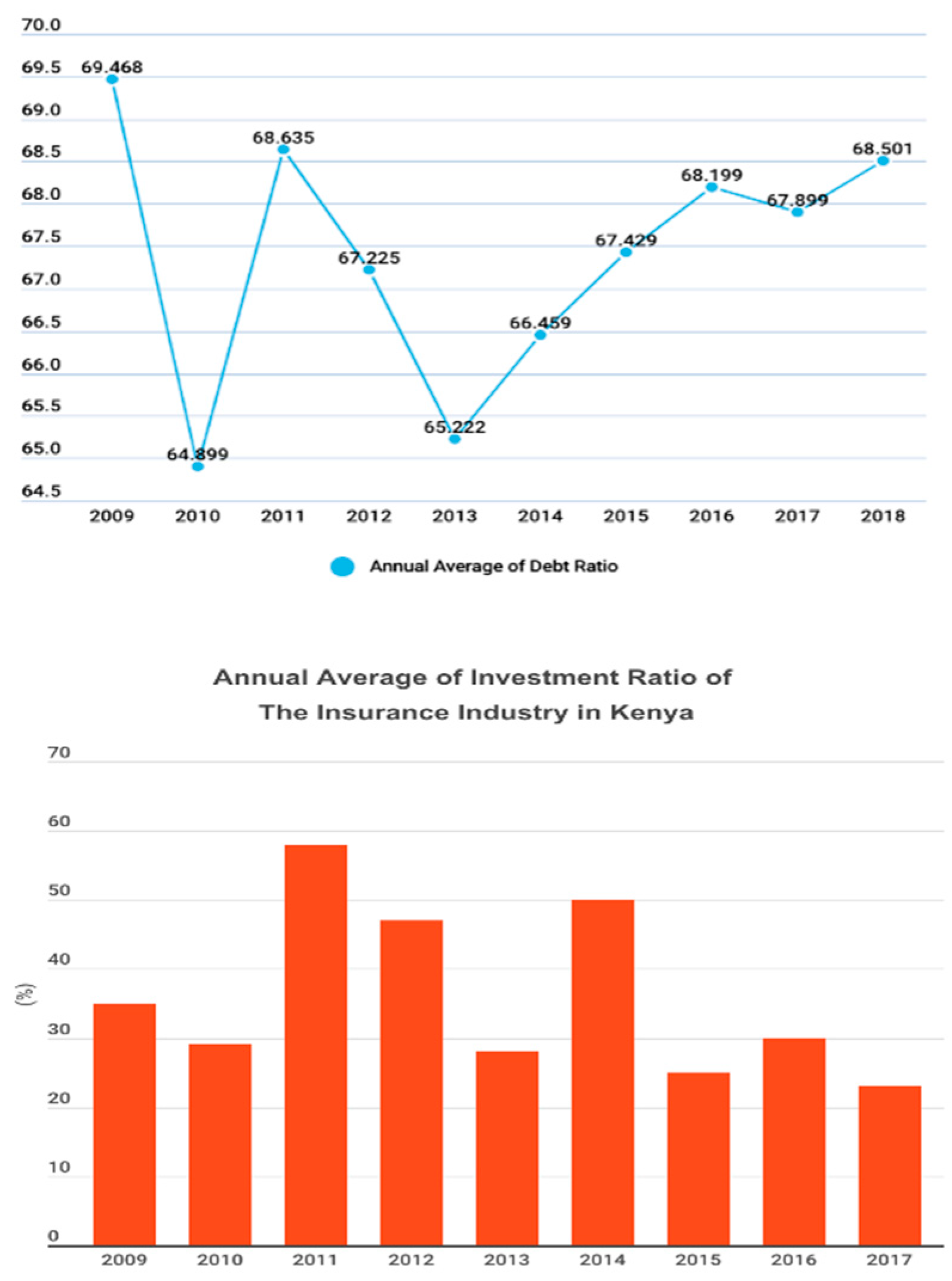

- Debt ratio

- ➢

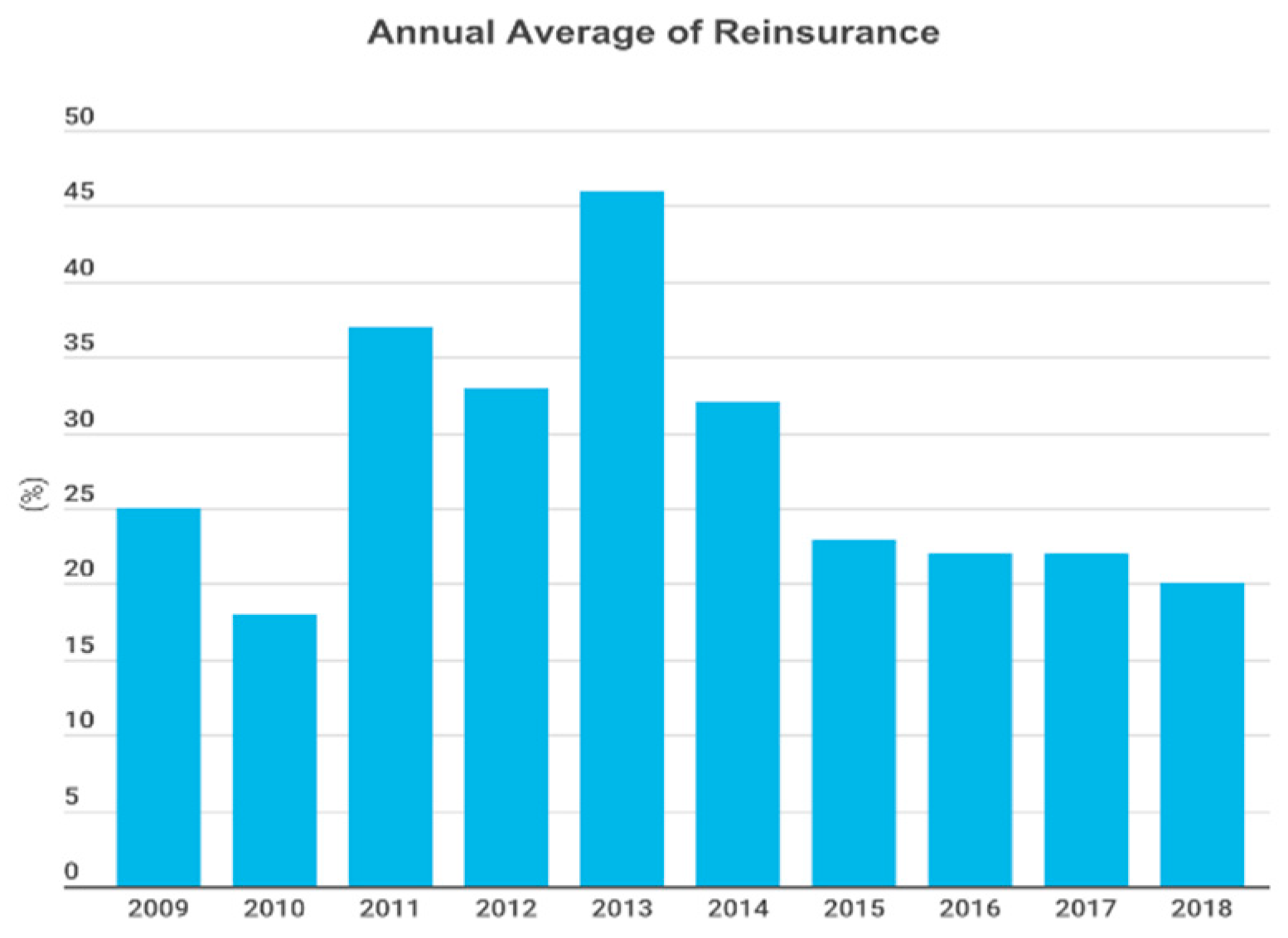

- Reinsurance ratio

- ➢

- Investment ratio

- ➢

- Size of insurer

- ➢

- Age

3.2. Model Specification

4. Empirical Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Panel Regression Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Armour, John, and Brian R. Cheffins. 2009. The Rise and Fall of Shareholder Activism by Hedge Funds (September 1, 2009). ECGI—Law Working Paper No. 136/2009. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1489336 (accessed on 22 September 2021).

- Barney, Jay. 1986. Strategic Factor Markets: Expectations, Luck and Business Strategy. Management Science 32: 1231–41. [Google Scholar] [CrossRef]

- Burca, Ana Maria, and Ghiorghe Batrinca. 2014. The determinants of financial performance in the Romanian insurance market. International Journal of Academic Research in Accounting, Finance and Management Sciences 4: 299–308. [Google Scholar] [CrossRef] [Green Version]

- Cornett, Marcia, and Anthony Saunders. 2003. Financial Institutions Management: A Risk Management Approach. Columbus: McGraw-Hill/Irwin, pp. 64–91. [Google Scholar]

- Derbali, Abdelkader. 2014. Determinants of Performance of Insurance Companies in Tunisia: The Case of Life Insurance. International Journal of Innovation and Applied Studies 6: 90–96. [Google Scholar]

- Engle, Carole. 2010. Aquaculture Economics and Financing: Management and Analysis. New York: John Wiley & Sons. [Google Scholar]

- Fligstein, Neil, and Taekjin Shin. 2007. Shareholder Value and the Transformation of the U.S. Economy, 1984–2000. Sociological Forum 22: 399–424. [Google Scholar]

- Freeman, R. Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Pitman. [Google Scholar]

- Freeman, R. Edward, and John McVea. 2001. A stakeholder approach to strategic management. In The Blackwell Handbook of Strategic Management. Hoboken: Wiley Online Library, pp. 189–207. [Google Scholar]

- Gompers, Paul, Joy Ishii, and Andrew Metrick. 2003. Corporate Governance and Equity Prices. Quarterly Journal of Economics 118: 107–55. [Google Scholar] [CrossRef] [Green Version]

- Insurance Regulatory Authority. 2018. Insurance Industry Annual Report for the Year Ended 31 December 2017. Nairobi: Insurance Regulatory Authority. [Google Scholar]

- Jadi, Diara. 2015. An Empirical Analysis of Determinants of Financial Performance of Insurance Companies in the United Kingdom. Ph.D. dissertation, University of Bradford, West Yorkshire, UK. [Google Scholar]

- Jelle, Hakima. 2015. Effect of Capital Structure of Financial Performance of Insurance Companies Listed at the Nairobi Securities Exchange. Nairobi: University of Nairobi. [Google Scholar]

- Jensen, Michael. 2001. Value Maximisation, Stakeholder Theory, and the Corporate Objective Function. European Financial Management 7: 297–317. [Google Scholar] [CrossRef] [Green Version]

- Kaya, E. Oner. 2015. The Effects of Firm-Specific Factors on the Profitability of Non-Life Insurance Companies in Turkey. International Journal of Financial Studies 3: 510–29. [Google Scholar] [CrossRef] [Green Version]

- Kollie, Grace. 2017. Determinants of Performance of Insurance Companies in Kenya. Nairobi: University of Nairobi. [Google Scholar]

- Lazonick, William, and Mary O’Sullivan. 2000. Maximizing Shareholder Value: A New Ideology for Corporate Governance. Economy and Society 29: 13–35. [Google Scholar] [CrossRef]

- Martin, Roderick, Peter Casson, and Tahir Nisar. 2007. Investor Engagement: Investors and Management Practice under Shareholder Value. Oxford: Oxford University Press. [Google Scholar]

- Mehari, Daniel, and Tilahun Aemiro. 2013. Firm Specific Factors that Determine Insurance Companies’ Performance in Ethiopia. European Scientific Journal 9: 245–55. [Google Scholar]

- Mwangi, Mirie, and Jane Murigu. 2015. The Determinants of Financial Performance in General Insurance Companies in Kenya. European Scientific Journal 11: 288–97. [Google Scholar]

- Nandan, Ruvendra. 2010. Management Accounting Needs of Companies and the Role of Professional Accountants: A Renewed Research Agenda. Journal of Applied Management Accounting Research 8: 65–78. [Google Scholar]

- Njiiri, Veronica. 2015. The Relationship between Investment and Financial Performance of Insurance Companies in Kenya. Nairobi: University of Nairobi. [Google Scholar]

- Nyongesa, Meshack. 2017. Effect of Financial Management Practices on Financial Performance of Insurance Companies in Kenya. Juja: Jomo Kenyatta University of Agriculture and Technology. [Google Scholar]

- Odira, Agar. 2018. Effect of Firm Specific Characteristics on Financial Performance of Firms; Evidence from General Insurance Companies in Kenya. Nairobi: University of Nairobi. [Google Scholar]

- Oncioiu, Ionica, Ania-Gabriela Petrescu, Florentina-Raluca Bîlcan, Marius Petrescu, Delia-Mioara Popescu, and Elena Anghel. 2020. Corporate Sustainability Reporting and Financial Performance. Sustainability 12: 4297. [Google Scholar] [CrossRef]

- Ponomareva, Yuliya. 2018. Shareholder Activism Is on the Rise: Caution Required. Forbes, December 10. [Google Scholar]

- PwC AWM Research Centre. 2017. Asset & Wealth Management Revolution: Embracing Exponential Change. London: PwC. [Google Scholar]

- Schwab, Klaus, and Hein Kroos. 1971. Modern Company Management in Mechanical Engineering. Frankfurt/Main-Niederrad: Verein Deutscher Maschinenbau-Anstalten. [Google Scholar]

| Insurance Companies in Kenya | |

|---|---|

| Life insurance | 16 |

| General Insurance | 27 |

| Composite (Both Life and General) | 9 |

| Total | 52 |

| Variables | Definition/Formula | Expected Sign |

|---|---|---|

| ROA | - | |

| ROE | - | |

| Solvency Ratio (SOL) | Positive | |

| Combined Ratio (COM) | Positive/Negative | |

| Debt Ratio (DEBT) | Positive | |

| Size (SIZ) | Positive | |

| Reinsurance Ratio (REIS) | Positive | |

| Investment Ratio (INV) | Positive/Negative | |

| Age (AGE) | Positive |

| ROA | ROE | DEBT | REIS | INV | SIZ | AGE | |

|---|---|---|---|---|---|---|---|

| ROA | 1 | ||||||

| ROE | 0.44 *** | 1 | |||||

| DEBT | −0.22 | −0.05 ** | 1 | ||||

| REIS | 0.15 | 0.051 ** | −0.25 | 1 | |||

| INV | 0.05 | 0.0323 | −0.07 | 0.24 *** | 1 | ||

| SIZ | −0.1 *** | 0.0436 ** | 0.516 | −0.1545 | −0.041 | 1 | |

| AGE | −0.09 ** | 0.0012 | 0.198 | −0.0859 | 0.002 *** | 0.36 ** | 1 |

| Issue | Name of Test | Probability Value | Deduction |

|---|---|---|---|

| Testing for individual/common effects and fixed effects H0: Common effects exist (p value > 5%) H1: Fixed effects exist (p value < 5%) | Chow Test | p = 0.0011 | Fixed effects are valid |

| Test for presence of random effects H0: Choose OLS (p value greater than 0.05) H1: Choose RE (p value less than 0.05) | Breusch Pagan LM test | p = 1.000 | Random effects are absent. Pooled OLS model is preferred. |

| Test for group wise heteroscedasticity | Modified Wald Test | p = 0.0000 | Heteroscedasticity exists. |

| Choosing between fixed effects and random effects model H0: RE present (p value > 5%) H1: FE present (p value < 5%) | Hausman Specification Test | p = 0.0036 | Fixed effects specification is valid. |

| Issue | Name of Test | Probability Value | Deduction |

|---|---|---|---|

| Testing for individual/common effects and fixed effects H0: Common effects exist (p value > 5%) H1: Fixed Effects present (p value < 5%) | Chow Test | p = 0.031 | Fixed effects are valid |

| Test for presence of random effects H0: Choose OLS (p value greater than 0.05) H1: Choose RE (p value less than 0.05) | Breusch Pagan LM test | p = 1.000 | Random effects are absent. Pooled OLS model is preferred. |

| Test for group wise heteroscedasticity | Modified Wald Test | p = 0.0000 | Heteroscedasticity exists |

| Choosing between fixed effects and random effects model H0: RE present (p value > 5%) H1: FE present (p value < 5%) | Hausman Specification Test | p = 0.0025 | Fixed effects specification is valid. |

| Pooled OLS | Random Effects | Fixed Effects | |

|---|---|---|---|

| DEBT | −0.000327 (−0.92) | −0.000327 (−0.92) | −0.00066 ** (−1.34) |

| REIS | 0.025230 *** (2.63) | 0.025230 *** (2.63) | 0.02525 *** (2.53) |

| INV | 0.000101 (0.02) | 0.000101 (0.02) | 0.00100 (0.19) |

| SIZ | −0.003198 ** (−0.25) | −0.003198 ** (−0.25) | −0.00771 * (−0.26) |

| AGE | −0.00223 (−0.79) | −0.00223 (−0.79) | −0.00233 (−1.0) |

| Constant | 0.095504 (1.27) | 0.095504 (1.27) | 0.23526 (1.84) |

| Pooled OLS | Random Effects | Fixed Effects | |

|---|---|---|---|

| DEBT | −0.0016 (−0.95) | −0.0016 (−0.95) | −0.0045116 * (−1.79) |

| REIS | 0.0405 (0.84) | 0.0405 (0.84) | 0.045416 (0.9) |

| INV | 0.0087 (0.34) | 0.0087 (0.34) | 0.0075469 (0.28) |

| SIZ | 0.0817 ** (1.4) | 0.0817 ** (1.4) | 0.3075387 ** (2.05) |

| AGE | −0.03 (−0.26) | −0.03 (−0.26) | −0.0262566 * (−2.21) |

| Constant | −0.2968 (−0.86) | −0.2968 (−0.86) | −0.506935 (−0.78) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morara, K.; Sibindi, A.B. Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data. J. Risk Financial Manag. 2021, 14, 566. https://doi.org/10.3390/jrfm14120566

Morara K, Sibindi AB. Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data. Journal of Risk and Financial Management. 2021; 14(12):566. https://doi.org/10.3390/jrfm14120566

Chicago/Turabian StyleMorara, Kamanda, and Athenia Bongani Sibindi. 2021. "Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data" Journal of Risk and Financial Management 14, no. 12: 566. https://doi.org/10.3390/jrfm14120566

APA StyleMorara, K., & Sibindi, A. B. (2021). Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data. Journal of Risk and Financial Management, 14(12), 566. https://doi.org/10.3390/jrfm14120566