1. Introduction

Since 2001, when the term ‘BRIC’ was coined by

Jim O’Neill (

2001), the world’s largest middle income and emerging economies of Brazil, Russia, India and China have taken increasingly distinct paths to economic growth. As the BRIC developed relatively distinct investment markets in terms of their institutional maturity, market depth and breadth, after the Global Financial Crisis (GFC), the idea of the BRIC being synchronized engines of global growth has faded (

Myles 2020). With this, BRIC stock markets portfolio risk diversification properties changed as well (

Mensi et al. 2017). Yet, owing significantly to the emergence of the risks of bi-directional spillovers between mature and emerging markets (

Yellen 2016), BRIC markets continue to influence the global financial stability environment. These spillovers appear to analysts and policymakers alike to be significantly heterogeneous. On one side of this spectrum, China potentially leads global markets and has stronger contagion channels to the global financial markets. On the other side of the spectrum, Russia has appeared to significantly decouple from international financial flows volatility and trends, especially the rapid deterioration in the U.S.–Russia geopolitical relations starting in 2011. While these observations are common in media and political science literature, they are yet to be examined robustly in volatility and risk spillovers literature in finance.

The purpose of this paper is to capture how individual BRIC markets and advanced economies markets are coupled or interconnected in terms of risk spillover channels, and how this interconnectedness is evolving over time and across periods of general markets uncertainty (crises) and recoveries. In this context, we present two major innovations to the literature on the dynamic analysis of contagion channels between BRIC markets and advanced economies. Firstly, we look at each individual market pair (individual BRIC market versus individual advanced economy market) in our analysis of contagion. As detailed in the Literature Review section below, wavelet analysis literature on such contagion channels is mostly focused on portfolio analysis that creates relatively ad hoc portfolios of emerging markets equities (BRIC equities) and looks for contagion channels between such portfolio and the advanced economies portfolio. Secondly, we look at all major financial markets shocks, global and BRIC-specific, over the period of 2000–2016. Currently, there is no existent research that combines these two features of analysis while deploying wavelet methodology.

Stock market contagion and interdependence literature traces its origins to periods of significant volatility of the late 1980s. In particular, the Latin American, Russian and Asian crises of the 1990s form the backdrop to the beginnings of the literature on contagion or spillovers of risks across the markets.

Forbes and Rigobon (

2002) observed that the shocks of the US 1987 stock market crash, the Tequila Crisis in 1994 and the Asian Crisis in 1997 reverberated beyond domestic borders. In their view, this contagion put a question mark around the idea of the internationally diversified portfolio, the cornerstone of the mainstream investment literature. As the result, in more recent years, we have seen the emergence of a wealth of literature on spillovers of uncertainty in monetary policy particularly surrounding Taper Tantrum in 2013 and 2014 (

BIS 2021). This literature largely focuses on advanced economies’ markets and ignores the BRICs’.

Today, shocks emanating from emerging markets are equally important and influence advanced economies’ monetary policy consideration (

Yellen 2016). Central banks and global institutions such as the IMF increasingly reference analysis of the coupling between advanced and emerging markets in their decisions on monetary policy, systemic risks monitoring and crises prevention (see, for example,

IMF 2016,

2020;

Ozkan and Unsal 2012). Multiple foreign exchange swap lines opened during and post-GFC by the major central banks in the advanced economies stand as a testament to the importance of such risk contagion/spillover channels (for a good survey of recent literature on this subject, see

Eguren-Martin 2020).

To this point, academic and central banking/prudential regulation literature explored linkages between stock market risks over the period of 1995 to 2016. Yet, this literature has substantial gaps in methodological quality and scope of research.

Firstly, it is evident from our review of the literature that the wavelet methodology—the modern workhorse for investigating contagion channels and risk spillovers (

Gallegati 2012)—has not been utilized in cited literature to investigate the potential contagion channels that exist between advanced economies and the BRICs in the period following the GFC. Even in the case of the world’s second-largest economy, China, studies using wavelet methodology to uncover the existence of risk contagion channels between the advanced economies financial markets and their Chinese counterparts are scarce (

Youssef et al. 2021).

Cărăuşu et al. (

2018) provide a survey of literature on the advantages of the wavelet methodology in their analysis of emerging markets contagion.

Secondly, prior literature on risk contagion between the advanced economies’ stock markets and those of the BRIC economies has relied exclusively on daily or weekly data analysis. Such analysis only captures the behavior and trading environment of relevance to a subset of markets participants and does not allow for a scale-by-scale analysis (

Gallegati and Gallegati 2007;

Gallegati 2012;

Cărăuşu et al. 2018), which can help identify diversification opportunities open to both long-term and short-term investors simultaneously.

To contribute to the existing body of knowledge on the subject of financial risk contagion channels that exist between the advanced economies’ markets and the markets of the BRIC economies, our study will deploy wavelet analysis on the data from 2000 through 2016. This allows us not only to provide comprehensive coverage of the topic across the four largest middle-income economies but also capture nine major periods of amplified markets volatility: the dot.com bubble, the events of 9/11, the U.S. subprime mortgage crisis, the subsequent GFC, the European Sovereign Debt Crisis, the U.S. sovereign debt downgrade, the Taper Tantrum, the 2015 Chinese Stock market crash and the subsequent Chinese circuit break in January 2016. To keep our analysis focused on major markets events, we end our data span following the Chinese circuit break that started in January 2016. From the end of the first quarter of 2016 through 2019, there were no systemic financial market shocks that can be viewed as potentially transmittable across the global financial markets until the start of 2020 when the COVID-19 pandemic led to major markets’ upheaval.

We deploy continuous wavelet transform methodology to test the directionality and strength of contagion channels from the BRIC economies’ stock markets to the advanced economies’ markets and the reverse direction of risk spillovers. This methodology also allows us to look at the contagion channels from the long-term and the short-term investors’ perspectives, simultaneously, as detailed in

Gallegati (

2012), without imposing specific scales on the time–frequency of our analysis. In doing so, we also test the proposition that BRIC markets and the U.S. markets are linked by high order contagion channels for risk transmission as indicated in

Yellen (

2016).

To achieve the aforementioned objectives this paper explores prior literature in

Section 2. This allows us to position our hypotheses, methodology and key study objectives in relation to prior studies. We discuss the advantages of using continuous wavelet transform methodology in

Section 3, which also describes the data utilized in this study, followed by a brief discussion of data used in our study in

Section 4. Results obtained from the wavelet transform are presented and analyzed in

Section 5, while the main conclusions of the study and their implications to the broader literature are covered in

Section 6.

3. Methodology

Aguiar-Conraria and Soares (

2010) and

Gallegati (

2012) highlight the major advantages of wavelet analysis methodology in capturing varying objectives of financial markets participants that, optimally, should be considered in tandem. For example, across a range of popular investment strategies, fund managers split portfolios under management into passively held, longer-term investments and actively traded funds with shorter investment horizons. Wavelet analysis offers researchers the ability to study the spectral characteristics of time series to capture the relationship between time series at varying frequencies. Thus, wavelet analysis allows for the integration of different time perspectives in research—covering investor types ranging from day traders to pension fund managers. Another useful feature of the wavelets is their ability to analyze non-stationary data without requiring data adjustments (

Aguiar-Conraria et al. 2008;

Cărăuşu et al. 2018). These advantages have led researchers to deploy wavelet methodologies across a wide range of studies of the interlinkages between stock markets (e.g.,

Madaleno and Pinho 2012;

Aguiar-Conraria et al. 2008;

Rua and Nunes 2009;

Loh 2013;

Lehkonen and Heimonen 2014, to name just a few).

The continuous wavelet transform is a more recent addition to the wavelet analysis toolbox that improves the empirical power of the wavelet analysis relative to the discrete wavelet transform. Subsequently, we use continuous Morlet wavelet transform owing to its superior pattern extraction capabilities (

Grinsted et al. 2004;

Barunik et al. 2011) and ability to produce representations in the time–frequency domain, which enable us to capture both transient and long-term patterns between and within time-series. With this in mind, we use the wavelet power spectrum, cross wavelet coherence and phase difference analysis tools, as discussed below. Technical details of our specifications are provided in

Appendix C and closely follow

Barunik et al. (

2011).

The wavelet power spectrum captures the local variance of a time series in a time–frequency domain. This results in a representation of the variance of the time-series over time for frequencies ranging between 1 day to over 1000 days without the need to impose prior restrictions on frequencies used in the analysis. The wavelet power spectrum tests for significance against a null hypothesis that the underlying time-series is stationary, with statistical significance derived from Monte Carlo simulations (

Grinsted et al. 2004;

Aguiar-Conraria et al. 2008).

The wavelet power spectrum allows us to identify nine significant periods of volatility in BRIC and mature stock markets. These periods are later utilized in the wavelet coherence analysis to distinguish between crisis contagion and interdependence. Consistent with

Claessens et al. (

2001), increases in correlation or coherence following a crisis indicate a contagion effect, while a consistently high correlation between markets is noted as interdependence.

Wavelet coherence can be interpreted as the squared correlation coefficient between two variables at varying frequencies with the values ranging from zero, signifying no coherence, to a perfect coherence value of 1. A potential drawback of the wavelet coherence analysis conducted in isolation is the failure to differentiate between negative and positive variations. However, this limitation is corrected via the phase difference analysis. In addition,

Conlon et al. (

2018) note that the Monte Carlo simulation should be applied to determine the significance level for wavelet coherence due to the indefinite distribution of the wavelet coherence tool.

In the wavelet analysis below, the phase arrows indicate the differentiation between positive and negative relationships, comparable to a positive and negative correlation (

Madaleno and Pinho 2012). In addition, leading and lagging relationships are distinguished by determining the dominant variable in the positive or negative relationship. Arrows pointing to the right indicate a positive synchronization (an in-phase relationship), while arrows facing to the left indicate a negative synchronization (an out-of-phase relationship). Arrows pointing upward indicate that variable

y leads variable

x, and the reverse holds for arrows facing downward.

4. Data

Our dataset comprises of daily continuously compounded returns from January 2000 to April 2016 for the following stock markets: Ibovespa (Brazil), Micex (Russia), Sensex (India), Hang Seng (China), EuroStoxx 50 (Europe), S&P 500 (the U.S.) and Nikkei (Japan). The VIX index was included as a fear gauge and potential spillover source to the BRIC stock markets which proved effective in

Gurdgiev and Trueick (

2016). It should be noted that continuously compounded returns do not require to be tested for stationarity, given wavelet tools’ flexibility and their ability to compress and expand to capture relationships at high and low frequencies (

Aguiar-Conraria and Soares 2010). Some papers, e.g.,

Madaleno and Pinho (

2012), utilize level prices data in their analysis via wavelet methodology. We chose to utilize returns for completeness and comparison purposes while correcting for the difference in time zones, trading days and local currencies.

As noted earlier, our data includes nine identifiable bouts of volatility detected via the wavelet power spectrum. These are: the dot.com bubble, the events of 9/11, the U.S. subprime mortgage crisis, the subsequent Global Financial Crisis, the European Sovereign Debt Crisis, the U.S. sovereign debt downgrade, the U.S. Taper Tantrums of 2013 and 2014, the 2015 Chinese Stock market crash and the subsequent Chinese circuit break in January 2016. The time period of our study, therefore, covers multiple periods of high and low liquidity, which is a major addition to the volatility spillover literature (

Beirne et al. 2013;

Gurdgiev and Trueick 2016).

From

Table 1, all BRIC stock markets have positive mean returns. Interestingly, the stock markets with the highest returns exhibit the highest Sharpe Ratio.

Gurdgiev and Trueick (

2016) note that Russia experienced the most volatile returns in the BRIC due to the economy’s dependence on the oil and gas sector and the large percentage of banking equities within the Micex. Consequently, Russia’s Sharpe Ratio is the highest, at 0.025, with India’s Sharpe ratio of 0.024 being a proximate second, followed by Brazil (0.015) and China (0.004). All BRIC stock markets are negatively skewed, as discussed in

Brooks (

2014) and

Galagedera and Brooks (

2007). This observation is amplified by the leptokurtic distribution of stock market returns found in all BRIC cases, which implies ‘black swan’ events are more likely and hence these assets are more risky than assets with normally distributed returns.

From

Table 2, the advanced economy stock markets all have lower average returns than their BRIC counterparts and all, bar the S&P500, offer inferior expected returns per unit of risk. In fact, both EuroStoxx and Nikkei have on average negative returns. The Nikkei and EuroStoxx suffered in the aftermath of the dot.com bubble similar to other stock exchanges. However, both markets exhibited more volatile returns post-GFC, with the subsequent European Sovereign Debt Crisis leading to heightened uncertainty in the EuroStoxx. By contrast, the Nikkei recovered quicker post-GFC following the introduction of Abenomics in December 2012. Europe is the only stock market to possess positive skew in returns. All stock exchanges exhibit leptokurtic distributions, which amplify the effects of negative skew.

From

Table 3, the stock markets with the highest correlations between advanced and emerging markets appear to be geographically close, i.e., Brazil–US and Japan–China with unconditional correlations over 0.5. Interestingly, Europe appears to have the highest correlation on average with the BRIC with all unconditional correlation coefficients over 0.3. Japan–Brazil has an extremely low correlation of 0.15. In addition, the U.S. has a quite low correlation with Russia, India and China. All correlations are statistically significant at 5% confidence levels or better.

In line with

Zhang et al. (

2013),

Table 4 shows that advanced economies and BRIC stock markets are becoming increasingly integrated post-GFC and that the crisis potentially acted as a structural break to the prior relationship. This integration is not as relevant for Japan and the BRIC stock markets, with India and Japan actually having a lower correlation since the GFC. Generally, of the advanced economies, Japan shows the lowest increases in correlations with the BRIC markets, compared to both the U.S. and Europe. This is probably related to the distinct nature of Japanese economic development following the GFC. Similarly, of all the BRIC economies, Brazil shows the lowest range of changes in correlations with the advanced economies’ markets. While analysis of causality for this phenomenon is outside the scope of the present study, this feature of the data likely reflects the fact that Brazil endured a lengthy period of political and economic instability post-GFC, not present in other BRIC economies. Overall, descriptive statistics point towards a time-varying relationship between mature and BRIC stock markets and the imperfect integration of the BRIC markets into the global financial system.

5. Results

5.1. Continuous Wavelet Power Spectrum

As noted in

Section 3 above, we use a continuous wavelet power spectrum to identify significant periods of volatility in the BRIC and mature stock markets. These periods are subsequently used in the wavelet coherence analysis to distinguish between crisis contagion and interdependence between the markets. Increases in correlation or coherence following a crisis indicate a contagion effect, while a consistently high correlation between markets is noted as interdependence.

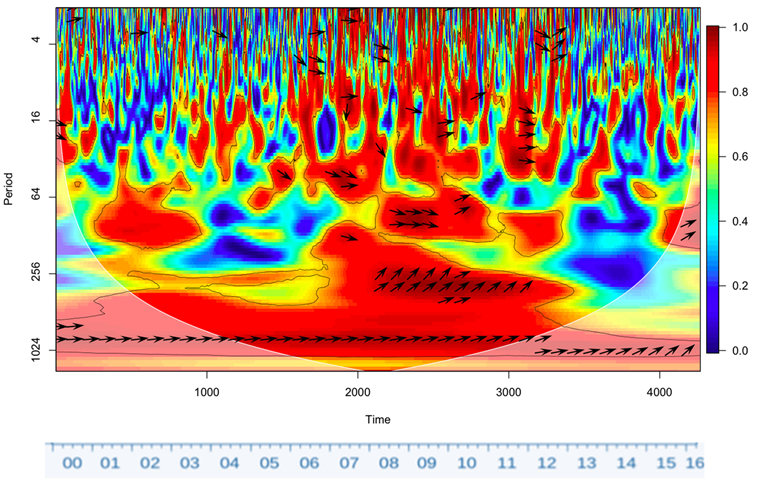

Before we begin the discussion of results, we provide a brief introduction on how the following charts can be interpreted. The wavelet power spectrum allows for the characterization of the spectral energy (variance) of a time series across both time and frequency. High levels of coherency or correlation are represented by warm colors (e.g., orange and red) while low coherency is depicted by cooler colors (e.g., blue and green). Significant results are framed in black and their significance level is determined via a Monte-Carlo simulation. In the related continuous wavelet charts (presented in

Appendix A,

Appendix B and

Appendix C), phase-difference arrows in an upward direction indicate that a specific BRIC market leads a specific mature market, or put differently, a BRIC market dominates the BRIC–mature stock market relationship. Conversely, an arrow pointing in a downward direction indicates a mature stock market is leading the BRIC–advanced stock markets relationship. Arrows facing to the left indicate an out-of-phase or negative relationship between the two markets, while arrows facing to the right indicate an in-phase or positive relationship.

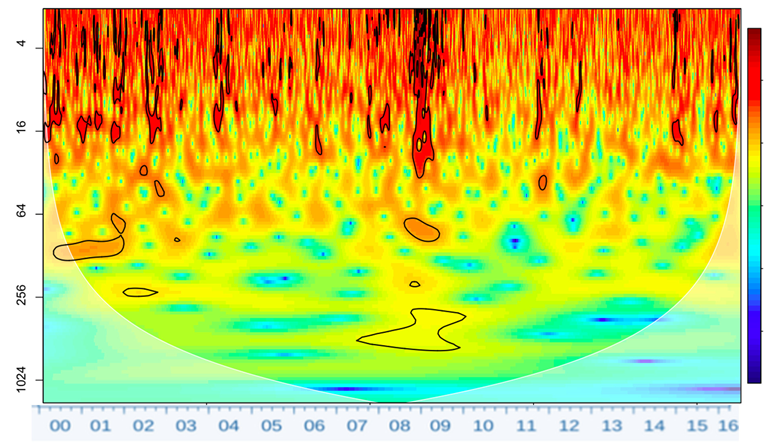

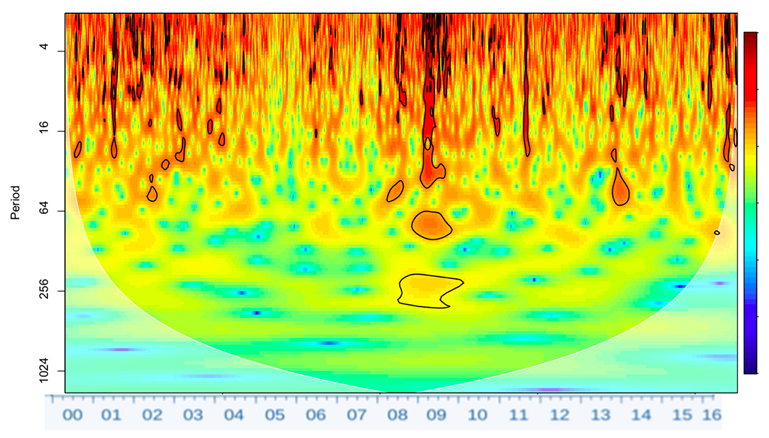

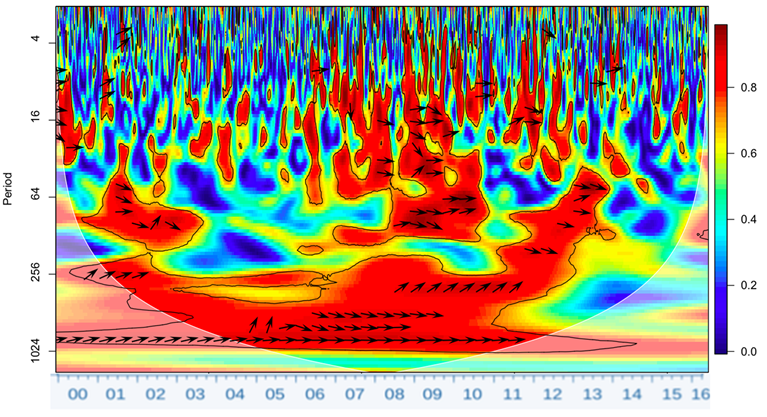

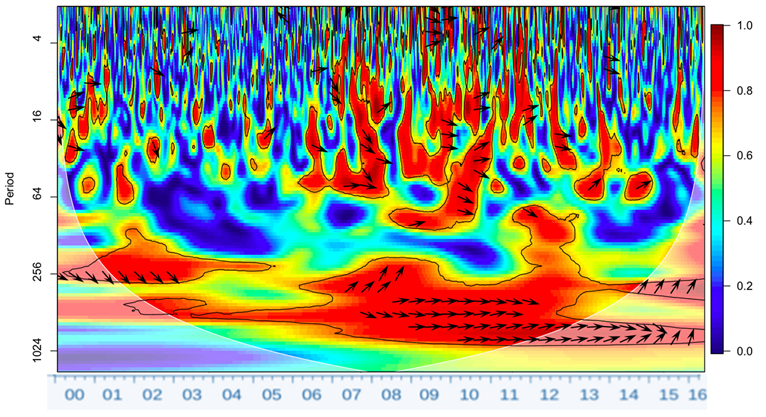

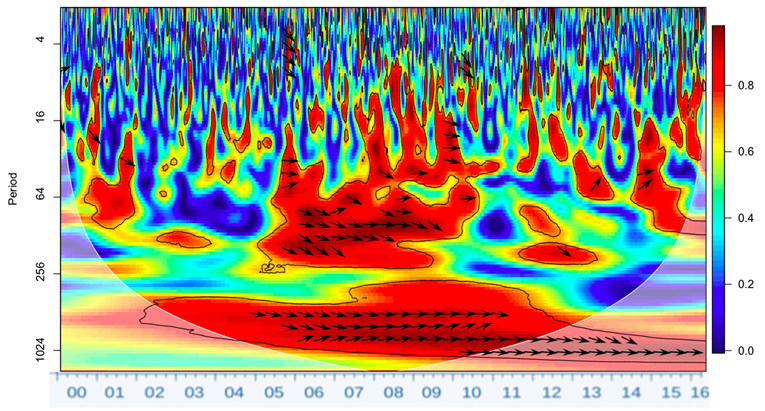

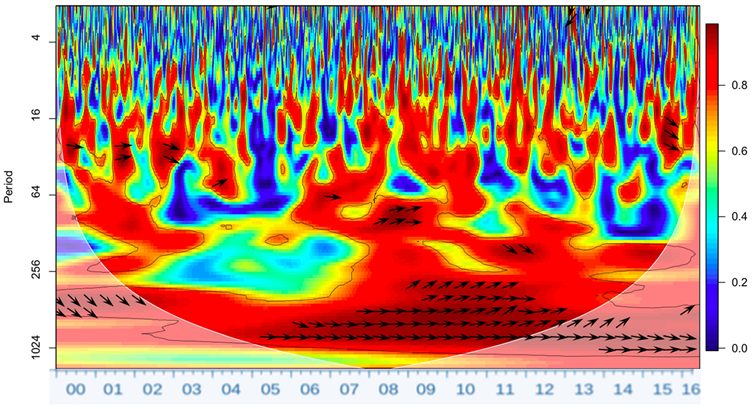

Figure 1 shows a continuous wavelet spectrum analysis of S&P500 compounded returns. Time is captured on the horizontal axis and frequency is shown on the vertical axis. We cover frequencies from one day to over 1000 days. Volatility (spectrum power) ranges in color from blue to red, representing low to high volatility. Results inside the shaded white region should not be included in the analysis due to potentially spurious correlations, deriving from edge effects mentioned in

Section 3 above.

Across all frequencies, nine significant bouts of volatility are identified via the wavelet power spectrum: the dot.com bubble, 9/11, the U.S. subprime mortgage crisis, the subsequent GFC, the European Sovereign Debt Crisis, the U.S. sovereign debt downgrade, the Taper Tantrum initiation in May 2013, the 2015 Chinese Stock market collapse and the subsequent Chinese circuit break in January 2016.

The first immediately identifiable crisis lies at the start of the sample period, March 2000. This was the period of explosive volatility associated with the dot.com bubble. This increased volatility is detectable at frequencies between 1 day and 16 days over the first year, leading up to 64 days of significantly high power in 2002 and 2003. 9/11 effects are also evident between 2002 and 2003. The September 2001 terrorist attacks on the U.S. resulted in a spike in volatility which lasted up to 65 days.

Following 2003, the recovery from the dot.com-related recession and subsequent boom underpinned by the rapid financialization of the global economy demonstrated no significant bouts of volatility up until the subprime mortgage crisis that started in August 2007 and the subsequent Global Financial Crisis of September 2008. In comparison to the dot.com bubble, which exhibits periods of highly significant volatility followed by a rapid calming of the markets, the GFC resulted in 18 months of persistently high and significant volatility. In addition, the GFC period shows phases of significant volatility at frequencies of 250 to 1000 trading days, further highlighting the scale of the crisis.

In May 2010, the European Sovereign Debt Crisis spread uncertainty and fear regarding the future of the world’s largest economic union, and this uncertainty spilled over to the S&P500. In contrast to the GFC, this bout of volatility, despite reaching a significant frequency of 64 days, was not persistent and shows a shorter duration.

The next period of high volatility arose from the Standard and Poor’s downgrade of the U.S. sovereign debt from AAA to AA+ and Moody’s altering their ratings to incorporate a negative outlook for the U.S., triggered by the failure of the U.S. Congress to raise the U.S. debt ceiling. Generally, however,

Figure 1 shows the U.S. markets to be relatively free of significant volatility at frequencies above 64 days outside the global crises (dot.com crisis and the GFC).

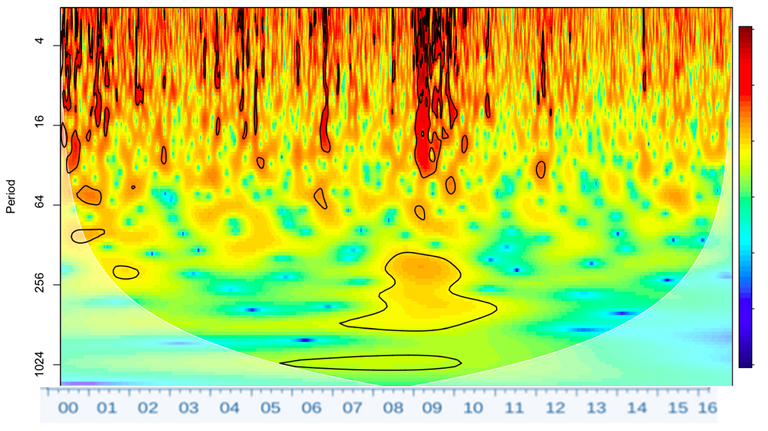

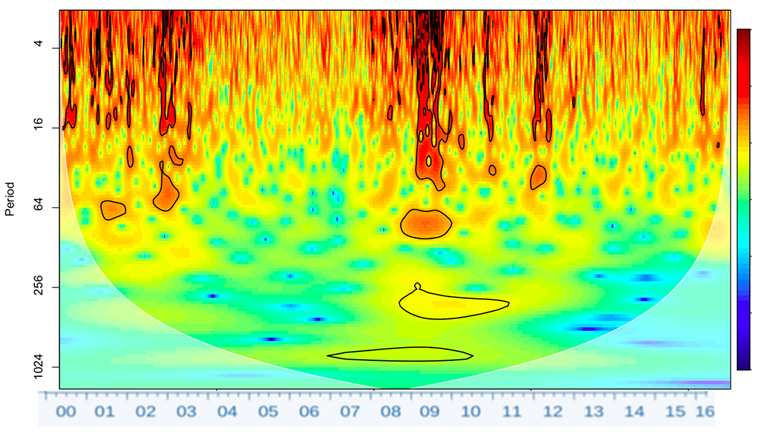

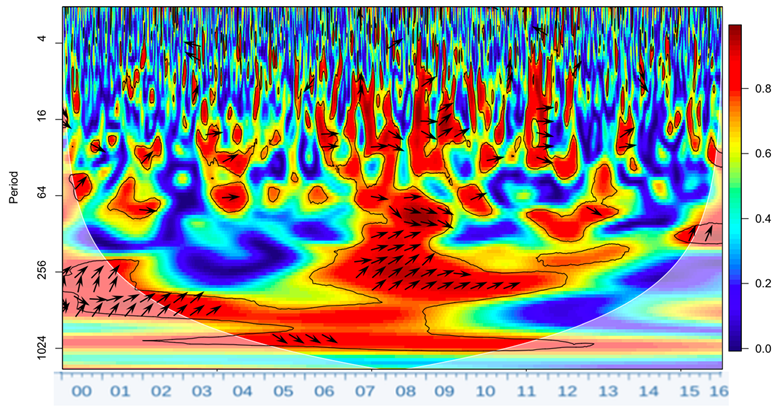

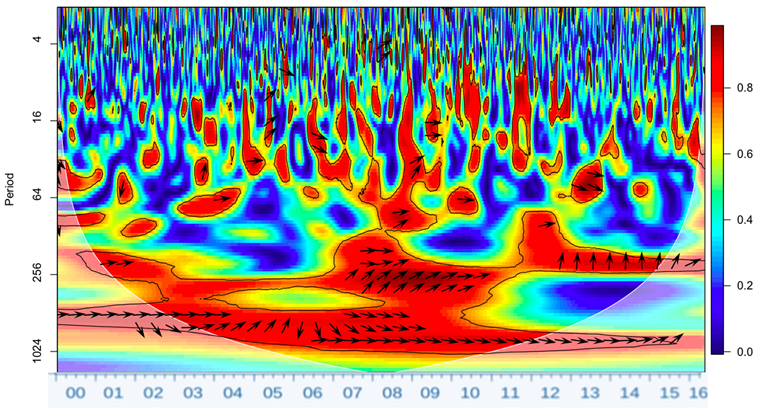

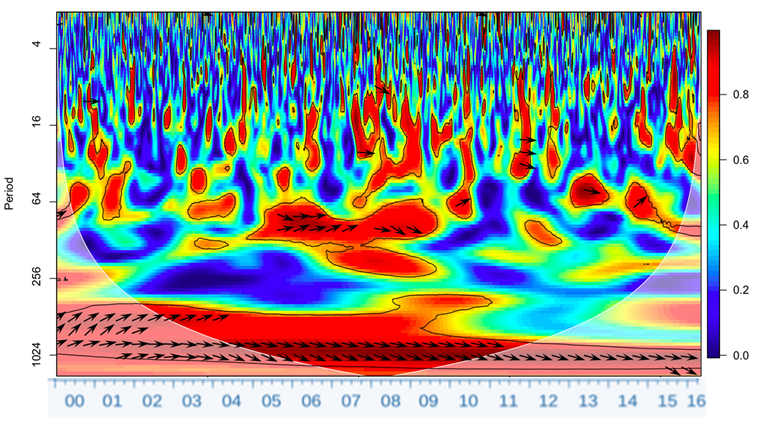

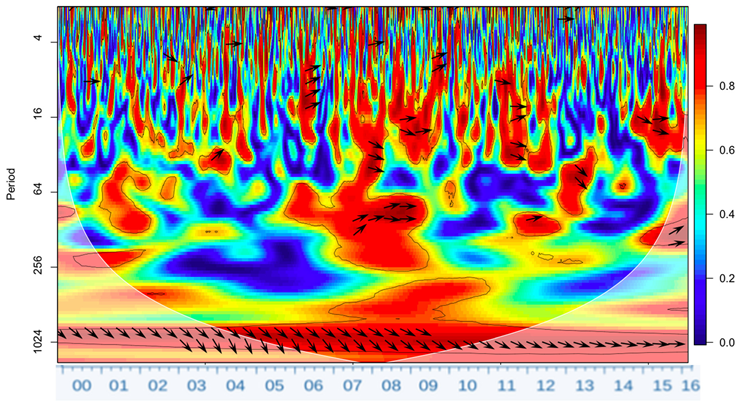

Figure 2 demonstrates that the dot.com bubble implosion in the early 2000s was more short-lived in the BRIC markets and significant levels of volatility ceased in early 2002 compared to 2003 for Europe and the U.S. Volatility is evident in all BRIC markets between 1 and 64-day frequencies. However, in addition, in earlier years of the sample, all of the BRIC markets exhibited significant volatility at up to the 100-day frequency. Most likely, this result in part stems from the extremely high levels of volatility emerging markets were exposed to during the late 1990s.

The subprime mortgage crisis of 2007 and subsequent GFC are highly significant in all BRIC markets and their continuous wavelet power spectrums closely resemble that of the U.S. wavelet power spectrum (

Figure 1 and

Appendix B). Additionally, India and China appear more volatile than the other BRIC. This result is potentially due to the high commodity prices persisting during the period, which provided a cushion for the commodities-exporting Brazil and Russia.

From

Figure 2, it is clear that the bouts of volatility identified in the U.S. are similarly shared in emerging and advanced economies—indicating that crisis contagion is present in international stock markets. However, China was relatively immune to the European sovereign debt crisis. In addition, European, Japanese and Chinese stock markets were the only stock markets to show a significant reaction up to a 16-day frequency to the commencement of the Taper Tantrum in 2013. The Brazilian and Chinese stock markets exhibited a shorter frequency reaction, significant for two to four days. Russia exhibited no evidence of crisis contagion.

The most interesting volatility bouts in this study are in fact those originating from emerging markets, in particular China. The 2015 Chinese stock market crash and the 2016 circuit break are isolated and highlighted by white dashed lines. These periods of volatility are highly significant in the advanced stock markets. This result implies that spillovers between the BRICs’ and the advanced economies’ markets are becoming increasingly bidirectional and that the BRIC markets have now reached both depth and scale that enables BRIC economies to originate contagion to the advanced economies. Since the GFC, China and Brazil appear to be more integrated in the global financial system in terms of significant shared bouts of volatility. However, China acted as a potential strong diversifier to advanced economies’ markets during the European Sovereign Debt crisis and Russia during the Taper Tantrum.

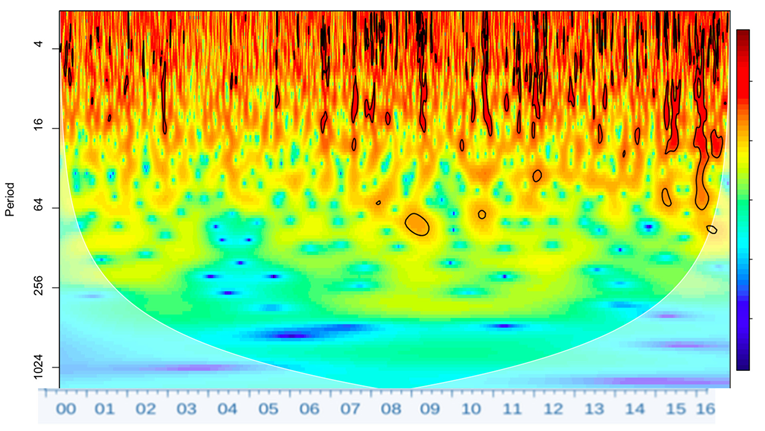

5.2. Wavelet Coherence and Phase Difference

Continuous wavelet coherence and phase difference are captured in one graph which displays the relationship between the U.S., Europe, Japan, the VIX and each BRIC stock market. This analysis enables further study of crisis contagion and the levels of integration between emerging and advanced economies. Hence, this section will determine the benefits of international diversification and test

Zhang et al.’s (

2013) hypothesis that the financial crisis was a structural break that increased the integration between the BRIC and advanced economies.

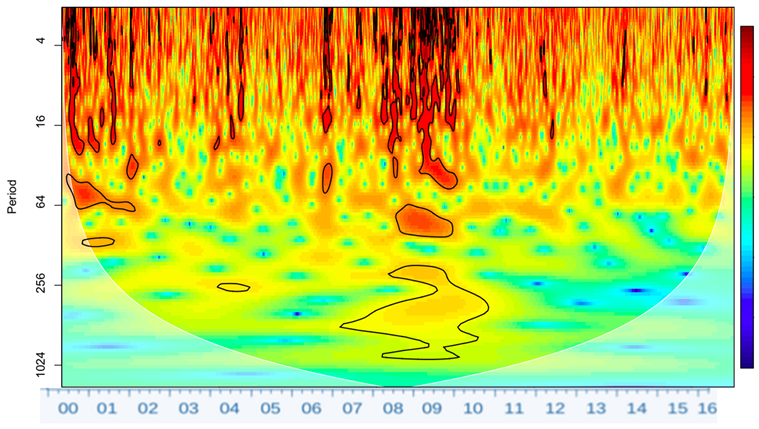

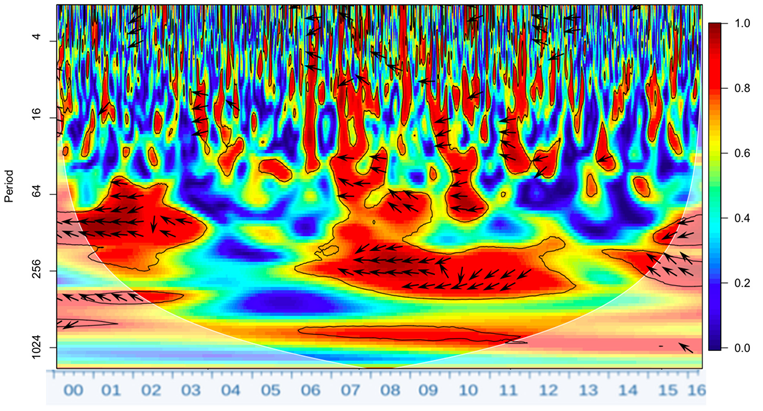

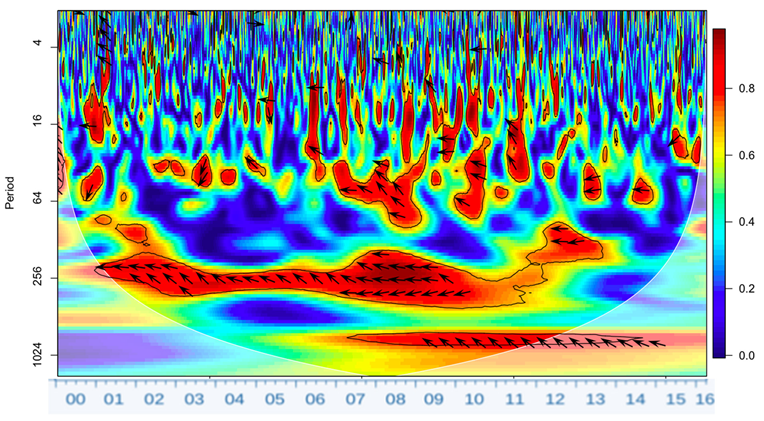

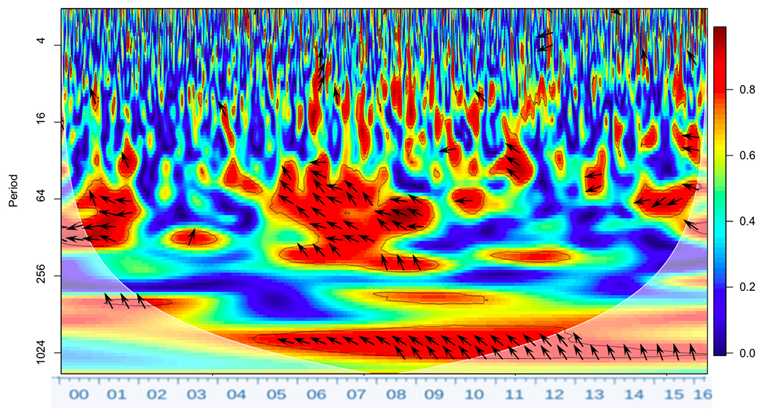

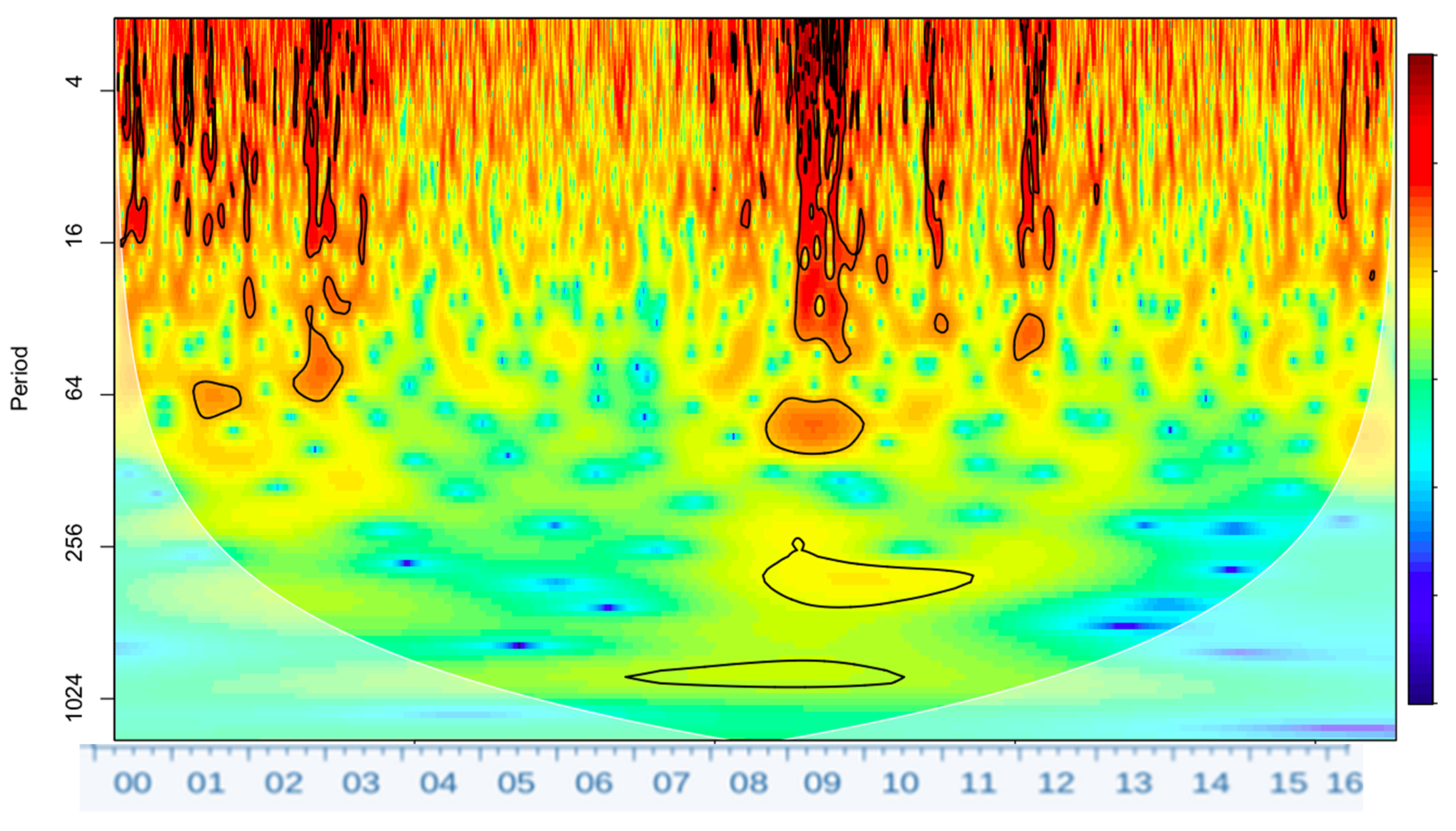

Appendix A presents wavelet coherency plots. High levels of coherency or correlation are represented by warm colors while low coherency is depicted by cooler colors such as blue and green. Significant results are framed in black and their significance level is determined via a Monte-Carlo simulation. Similar to the wavelet power spectrum, results in the white shaded area, the cone of influence, should be ignored as their interpretation may lead to spurious results. Phase difference arrows in an upward direction indicate that a BRIC leads or dominates the BRIC-mature stock market relationship. Conversely, an arrow pointing in a downward direction indicates that a mature stock market is leading the BRIC-advanced economy stock market relationship. Arrows facing to the left indicate an out-of-phase or negative relationship, while arrows facing to the right indicate an in-phase or positive relationship.

5.2.1. The U.S. and the BRIC

In

Appendix B, in the figures covering continuous wavelet transforms between the U.S. and the BRIC, the most noticeable relationship common between the U.S., Brazil, India and China is the black-boarded (statistically significant) relationship between the U.S. and the aforementioned BRIC in the long run at low frequencies. This relationship is significant at the 500-day frequency level and higher for the entire sample period. In this, the U.S, stock market leads as evidenced by the downward-right direction of the phase arrows in

Appendix B. The Russian index is the least correlated with the U.S., as indicated by the large blue regions present especially prior to 2007 and particularly at high frequencies.

In addition, crisis contagion is quite evident: in each crisis, there appears to be an increase in coherence between stocks markets. The dot.com bubble and 9/11 caused increases in the correlation between the U.S. and both Brazil and China. Prior to the GFC, Russia and India appear less correlated during crises. From a U.S. investor perspective, this suggests that pre-2008, these emerging markets were a good source of diversification, particularly at shorter frequencies up to 16 days. Prior to 2007, China was the most integrated market vis-à-vis the advanced economies, followed by Brazil, India and Russia. Post-2007, all BRIC markets became increasingly more strongly correlated with the U.S., albeit to a varying degree, indicating growing global stock markets integration. From 2007-on, the subprime mortgage crisis, the subsequent GFC, European Sovereign Debt Crisis and U.S. sovereign debt downgrade lead to five years of increased interdependency at lower frequencies and evident stock market contagion. During and post the GFC, Brazil was the most integrated of the BRIC markets with the U.S., echoing

Zhang et al.’s (

2013) findings of the GFC as a structural break in global market integration trends. Interestingly, despite the increased integration of all of the BRIC, the aforementioned arbitrage opportunity for international portfolio holders at high frequencies remained evident for the Indian and Russian stock markets. However, the opportunity window decreased to 10 days from 16 days in the prior periods.

The Chinese stock market crash in 2015 presented an example of stock market contagion that mirrors

Yellen’s (

2016) observations and skepticism about an increasingly globalized nature of the financial markets, where the U.S. is no longer the only originator of contagion. Hence, bi-directional contagion is found in this paper originating from China to the U.S. and it is highly significant, particularly in the 6-day to 70-day frequency range.

From the above, we can conclude that there is evidence of interdependence between the BRIC and the U.S. in the long run and significant crisis contagion at higher frequencies from 1 day up to 64 days during most crises excluding the GFC, which was significant at all frequencies. This interdependence is not perfect: India and Russia are less interlinked with the U.S. stock markets. In addition, emerging markets now have the ability to originate contagion and policymakers and investors can no longer ignore this channel for global shocks transmission.

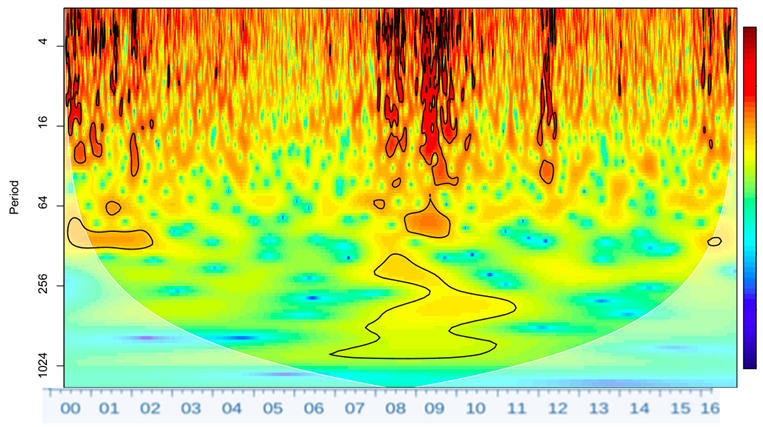

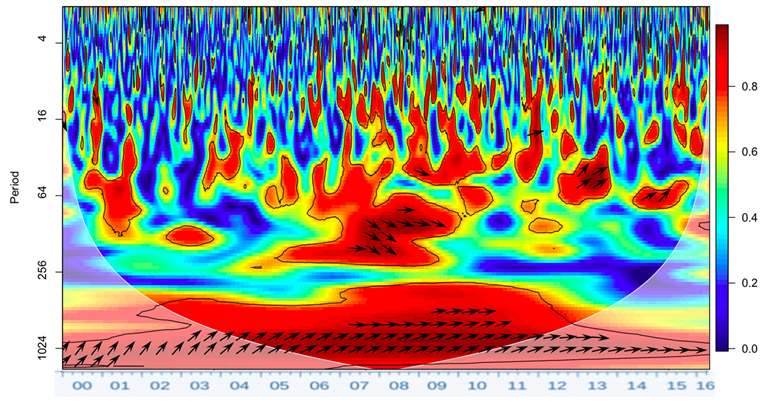

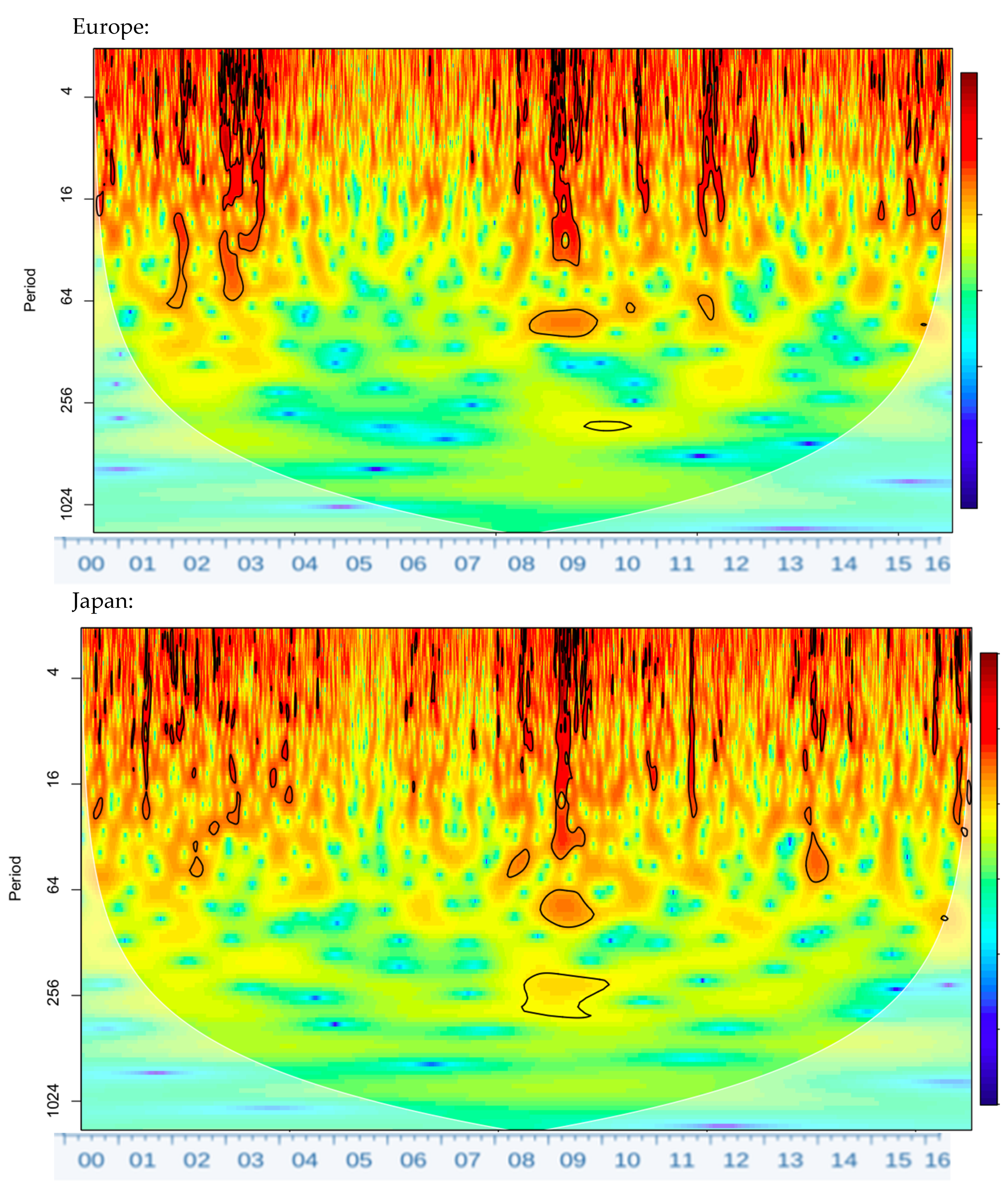

5.2.2. Europe and the BRIC

Similar to the findings relating to the U.S. markets, India and Russia are also the least integrated markets with respect to Europe, as indicated by the smaller areas of significant correlations (black-framed regions) and lower strength of correlations (blue regions) in figures covering continuous wavelet transforms between Europe and the BRIC, as shown in

Appendix B. In the opposite direction of spillovers, Europe appears less correlated with the BRICs. However, the European Sovereign Debt Crisis resulted in contagion to both Russia and India. Likewise, the Chinese stock market implosion in 2015 and the circuit break episode in 2016 transmitted volatility to Europe. In terms of

Zhang et al.’s (

2013) proposition that the GFC resulted in a structural break in the prior regime of contagion, Russia and Brazil appear less integrated with Europe, particularly at frequencies under 30 days.

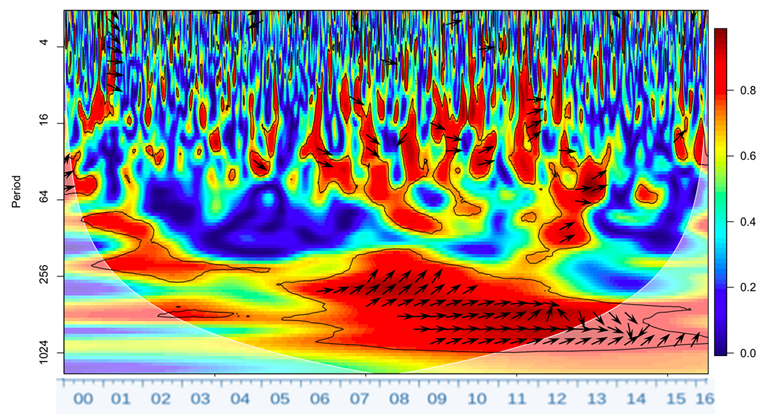

5.2.3. Japan and the BRIC

Figures covering continuous wavelet transforms between Japan and the BRICs in

Appendix B show the relationship between Japan and the BRIC that strongly contrasts with the U.S. and European perspectives. Over a five-year period following the GFC, the Japanese and Russian stock markets were negatively correlated, with Japan leading this relationship, as indicated by the downward phase-difference arrows. There is no coherent relationship at shorter frequencies, and hence the Russian stock market presented an excellent diversification addition to Nikkei. In addition, China leads the relationship between the Hang Seng and Nikkei at low frequencies. Following the initiation of Abenomics in December 2012, there appears to be little integration in the short run between both stock markets. However, Japan was strongly affected by the Chinese stock market crash in 2015.

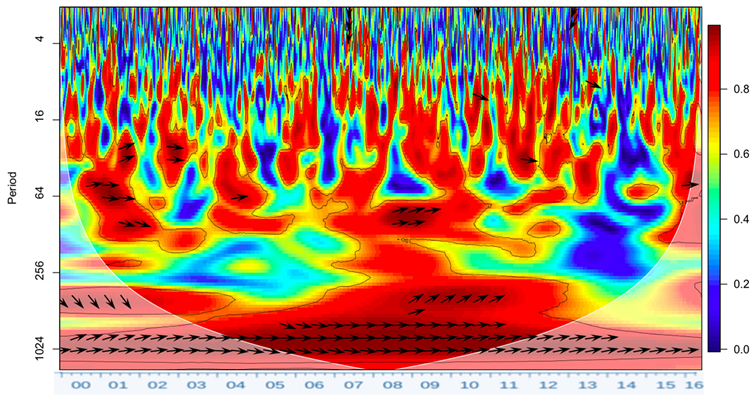

5.2.4. The VIX and the BRIC

The VIX is utilized in this study as a fear gauge and provides a database for the analysis of forward-looking volatility spillovers from the U.S. to BRIC stock markets. Based on the literature reviewed earlier and intuitively, we should expect that an increase in the S&P 500 futures volatility would translate into lower returns in BRIC markets. This expectation is confirmed in the figures covering continuous wavelet transforms between VIX and the BRIC in

Appendix B, which show an out-of-phase relationship between VIX and the BRIC, particularly for Brazil and China. This is also consistent with our findings regarding U.S.–BRIC market contagion channels. From a wavelet perspective, there is a strong and time-varying relationship between VIX and Indian stock markets that was particularly significant in the GFC period and in 2013 at low frequencies. At higher frequencies, the VIX –India relationship is significant, particularly at frequencies greater than seven trading days.

6. Conclusions

Our findings show that following the GFC, volatility spillovers between BRIC markets and advanced economies became bidirectional in nature. This new nature of volatility contagion is confirmed in our analysis of spillovers in reaction to the Chinese stock market collapse in August 2015 and the subsequent circuit break in January 2016. In addition, strong volatility spillovers from advanced economies were documented in the dot.com bubble crisis, during the GFC, the European Sovereign Debt Crisis and the U.S. sovereign debt downgrade. The Chinese stock market acted as a strong diversifier to advanced economies’ markets during the European Sovereign Debt Crisis. Despite the increasingly integrated nature of the BRIC stock markets with respect to global markets, arbitrage opportunities based on the BRIC markets’ correlations with the advanced economies’ markets continue to exist during major crises and market shocks. When a crisis emanates from the U.S. or Europe, it can take up to 16 trading days to transmit volatility from the crisis source to the BRIC stock markets, implying potential opportunities for investors to liquidate BRIC portions at minimum cost. In addition, it appears Russian and Indian stock markets remain the least integrated in the global financial system and have the potential to provide diversification benefits in international portfolios. In particular, from a Japanese investors’ perspective, the Russian stock market has had a negative volatility spillover relationship with the Nikkei market post-2012.

Overall, arbitrage and diversification benefits, including BRIC stocks, are evident for international stocks portfolios with a bias toward the U.S., European and Japanese equities. However, these benefits are time-varying and heterogeneously distributed across the BRIC, as channels for contagion and volatility transmission from the advanced economies to the BRIC and vice versa grow stronger over time. The equity home bias in advanced economies investors’ portfolios is becoming more justified.