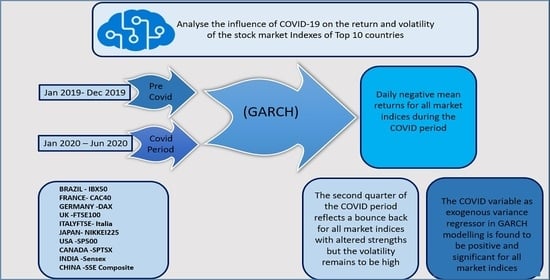

Volatility in International Stock Markets: An Empirical Study during COVID-19

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data Collection and Market Classification

3.2. Estimation Techniques

3.2.1. Descriptive Statistics

3.2.2. Unit Root Test

3.2.3. ARCH Effect Test

3.2.4. GARCH Model

3.2.5. GARCH Model with Exogenous Volatility Regressors

4. Empirical Results

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References and Note

- Ahmed, Rizwan Raheem, Jolita Vveinhardt, Dalia Streimikiene, and Zahid Ali Channar. 2018. Mean reversion in international markets: Evidence from GARCH and half-life volatility models. Economic Research-Ekonomska Istraživanja 31: 1198–217. [Google Scholar] [CrossRef]

- Akter, Nahida, and Ashadun Nobi. 2018. Investigation of the financial stability of s&p 500 using realized volatility and stock returns distribution. Journal of Risk and Financial Management 11: 22. [Google Scholar]

- Albulescu, Claudiu. 2020. Do COVID-19 and crude oil prices drive the US economic policy uncertainty? arXiv arXiv:2003.07591. [Google Scholar] [CrossRef]

- Alfaro, Laura, Anusha Chari, Andrew N. Greenland, and Peter K. Schott. 2020. Aggregate and Firm-Level Stock Returns during Pandemics, in Real Time. No. w26950. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Ang, Beng Wah, and Na Liu. 2007. Negative-value problems of the logarithmic mean Divisia index decomposition approach. Energy Policy 35: 739–42. [Google Scholar] [CrossRef]

- Anjorin, AbdulAzeez A. 2020. The coronavirus disease 2019 (COVID-19) pandemic: A review and an update on cases in Africa. Asian Pacific Journal of Tropical Medicine 13: 199. [Google Scholar] [CrossRef]

- Ayittey, Foster K., Matthew K. Ayittey, Nyasha B. Chiwero, Japhet S. Kamasah, and Christian Dzuvor. 2020. Economic impacts of Wuhan 2019-nCoV on China and the world. Journal of Medical Virology 92: 473–75. [Google Scholar] [CrossRef]

- Bakhshi, Priti, and Rashmi Chaudhary. 2020. Responsible Business Conduct for the Sustainable Development Goals: Lessons from Covid-19. International Journal of Disaster Recovery and Business Continuity 11: 2835–41. [Google Scholar]

- Bhowmik, Roni, and Shouyang Wang. 2020. Stock Market Volatility and Return Analysis: A Systematic Literature Review. Entropy 22: 522. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Brooks, Chris, and Alistair G. Rew. 2002. Testing for a unit root in a process exhibiting a structural break in the presence of GARCH errors. Computational Economics 20: 157–76. [Google Scholar] [CrossRef]

- Campbell, John Y., and Samuel B. Thompson. 2008. Predicting excess stock returns out of sample: Can anything beat the historical average? The Review of Financial Studies 21: 1509–31. [Google Scholar] [CrossRef]

- Chang, Bo Young, Peter Christoffersen, and Kris Jacobs. 2013. Market skewness risk and the cross section of stock returns. Journal of Financial Economics 107: 46–68. [Google Scholar] [CrossRef]

- Chaudhary, Rashmi, Dheeraj Misra, and Priti Bakhshi. 2020. Conditional relation between return and co-moments—An empirical study for emerging Indian stock market. Investment Management Financial Innovations 17: 308. [Google Scholar] [CrossRef]

- Cochrane, John H. 2008. The dog that did not bark: A defense of return predictability. The Review of Financial Studies 21: 1533–75. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society 49: 1057–72. [Google Scholar] [CrossRef]

- Engle, Robert. 1982. For Methods of Analyzing Economic Time Series With Time-Varying Volatility (ARCH). [Google Scholar]

- FAZ. 2020. Düstere Vorhersage des IWF: Die größte Krise seit der Großen Depression. Available online: https://www.faz.net/aktuell/wirtschaft/coronavirus-die-groesste-krise-seitder-grossen-depression-16724634.html (accessed on 9 September 2020).

- Feinstein, Max M., Joshua D. Niforatos, Insoo Hyun, Thomas V. Cunningham, Alexandra Reynolds, Daniel Brodie, and Adam Levine. 2020. Considerations for ventilator triage during the COVID-19 pandemic. The Lancet Respiratory Medicine. [Google Scholar] [CrossRef]

- Fernandes, Nuno. 2020. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. Available online: https://ssrn.com/abstract=3557504 (accessed on 11 August 2020).

- Fletcher, Jonathan, and Joseph Kihanda. 2005. An examination of alternative CAPM-based models in UK stock returns. Journal of Banking Finance 29: 2995–3014. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Gourinchas, Pierre-Olivier. 2020. Flattening the pandemic and recession curves. In Mitigating the COVID Economic Crisis: Act Fast and Do Whatever. London: CEPR Press, vol. 31. [Google Scholar]

- Green, T. Clifton, and Stephen Figlewski. 1999. Market risk and model risk for a financial institution writing options. The Journal of Finance 54: 1465–99. [Google Scholar] [CrossRef]

- Hoshi, Takeo, and Anil K. Kashyap. 2004. Japan’s financial crisis and economic stagnation. Journal of Economic Perspectives 18: 3–26. [Google Scholar] [CrossRef]

- Huyghebaert, Nancy, and Lihong Wang. 2010. The co-movement of stock markets in East Asia: Did the 1997–1998 Asian financial crisis really strengthen stock market integration? China Economic Review 21: 98–112. [Google Scholar] [CrossRef]

- Karmakar, Madhusudan. 2005. Modeling conditional volatility of the Indian stock markets. Vikalpa 30: 21–38. [Google Scholar] [CrossRef]

- Mei, Dexiang, Jing Liu, Feng Ma, and Wang Chen. 2017. Forecasting stock market volatility: Do realized skewness and kurtosis help? Physica A Statistical Mechanics and Its Applications 481: 153–59. [Google Scholar] [CrossRef]

- Michelsen, Claus, Guido Baldi, Geraldine Dany-Knedlik, Hella Engerer, Stefan Gebauer, and Malte Rieth. 2020. Coronavirus causing major economic shock to the global economy. DIW Weekly Report 10: 180–82. [Google Scholar]

- Mishra, Shraddha. 2017. Volatility and calendar anomaly through GARCH model: Evidence from the selected G20 stock exchanges. International Journal of Business and Globalisation 19: 126–44. [Google Scholar] [CrossRef]

- Okhuese, Alexander Victor. 2020. Estimation of the Probability of Reinfection with COVID-19 by the Susceptible-Exposed-Infectious-Removed-Undetectable-Susceptible Model. JMIR Public Health and Surveillance 6: e19097. [Google Scholar] [CrossRef]

- Onvista. 2020. MSCI World Index: Kurs, Chart News. Available online: https://www.onvista.de/index/MSCI-WORLD-Index-3193857 (accessed on 1 July 2020).

- Pástor, Ľuboš, and Robert F. Stambaugh. 2009. Predictive systems: Living with imperfect predictors. The Journal of Finance 64: 1583–628. [Google Scholar] [CrossRef]

- Rastogi, Shailesh. 2014. The financial crisis of 2008 and stock market volatility–analysis and impact on emerging economies pre and post crisis. Afro-Asian Journal of Finance and Accounting 4: 443–59. [Google Scholar] [CrossRef]

- Roll, Richard. 1989. Price volatility, international market links, and their implications for regulatory policies. In Regulatory Reform of Stock and Futures Markets. Dordrecht: Springer, pp. 113–48. [Google Scholar]

- Ruiz, Estrada, and Arturo Mario. 2020. Economic Waves: The Effect of the Wuhan COVID-19 on the World Economy (2019–2020). Available online: https://ssrn.com/abstract=3545758 (accessed on 5 July 2020).

- Schiller, Robert J. 2015. Irrational Exuberance. Revised and Expanded Third Edition. Princeton: Princeton University Press. [Google Scholar]

- Teplova, Tamara, and Evgeniya Shutova. 2011. A higher moment downside framework for conditional and unconditional CAPM in the Russian stock market. Eurasian Economic Review 1: 157–78. [Google Scholar]

- Thadewald, Thorsten, and Herbert Büning. 2007. Jarque–Bera test and its competitors for testing normality—A power comparison. Journal of Applied Statistics 34: 87–105. [Google Scholar] [CrossRef]

- Totir, Felix, and Ingrid-Mihaela Dragotă. 2011. Current Economic and Financial Crisis-New Issues or Returning to the Old Problems? Paradigms, Causes, Effects and Solutions Adopted. Theoretical Applied Economics 18: 129–50. [Google Scholar]

- Tripathy, Naliniprava. 2017. Do BRIC countries stock market volatility move together? An empirical analysis of using multivariate GARCH models. International Journal of Business and Emerging Markets 9: 104–23. [Google Scholar] [CrossRef]

- Van Binsbergen, Jules H., and Ralph S. J. Koijen. 2010. Predictive regressions: A present-value approach. The Journal of Finance 65: 1439–71. [Google Scholar] [CrossRef]

- Yousef, Ibrahim. 2020. The Impact of Coronavirus on Stock Market Volatility. Available online: https://www.researchgate.net/publication/341134119_Spillover_of_COVID19_Impact_on_Stock_Market_Volatility (accessed on 15 July 2020).

- Zahedi, Javad, and Mohammad Mahdi Rounaghi. 2015. Application of artificial neural network models and principal component analysis method in predicting stock prices on Tehran Stock Exchange. Physica A Statistical Mechanics and Its Applications 438: 178–87. [Google Scholar] [CrossRef]

| Particulars | SP500 | SSE Composite | NIKKEI225 | DAX | SENSEX | FTSE100 | CAC40 | FTSE Italia | IBX50 | SPTSX Composite |

|---|---|---|---|---|---|---|---|---|---|---|

| US | CHINA | JAPAN | GERMANY | INDIA | UK | FRANCE | ITALY | BRAZIL | CANADA | |

| (A). 12-month period before crisis (January 2019–December 2019) | ||||||||||

| Mean | 0.0010 | 0.0008 | 0.0007 | 0.0009 | 0.0005 | 0.0004 | 0.001 | 0.0009 | 0.0009 | 0.0007 |

| Median | 0.0009 | 0.0001 | 0.0005 | 0.0013 | 0.0001 | 0.0007 | 0.0016 | 0.001 | 0.0015 | 0.0007 |

| Maximum | 0.0338 | 0.0545 | 0.0258 | 0.0331 | 0.0519 | 0.0223 | 0.0269 | 0.0308 | 0.0286 | 0.0149 |

| Minimum | −0.0302 | −0.0575 | −0.0305 | −0.0316 | −0.0208 | −0.0328 | −0.0364 | −0.028 | −0.0386 | −0.0188 |

| Std. Dev. | 0.0078 | 0.0111 | 0.0085 | 0.0088 | 0.0084 | 0.0074 | 0.0084 | 0.0089 | 0.0112 | 0.0046 |

| Skewness | −0.6364 | −0.177 | −0.1006 | −0.353 | 1.2011 | −0.4429 | −0.7383 | −0.435 | −0.537 | −0.4928 |

| Kurtosis | 6.272 | 8.4057 | 4.4235 | 4.9843 | 9.0003 | 5.1677 | 5.5685 | 4.2787 | 3.9284 | 4.3354 |

| Jarque–Bera | 130.45 | 310.59 | 21.87 | 46.95 | 442.12 | 58.03 | 92.89 | 25.31 | 21.33 | 29.15 |

| Probability | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 254 | 254 | 254 | 254 | 254 | 254 | 254 | 254 | 254 | 254 |

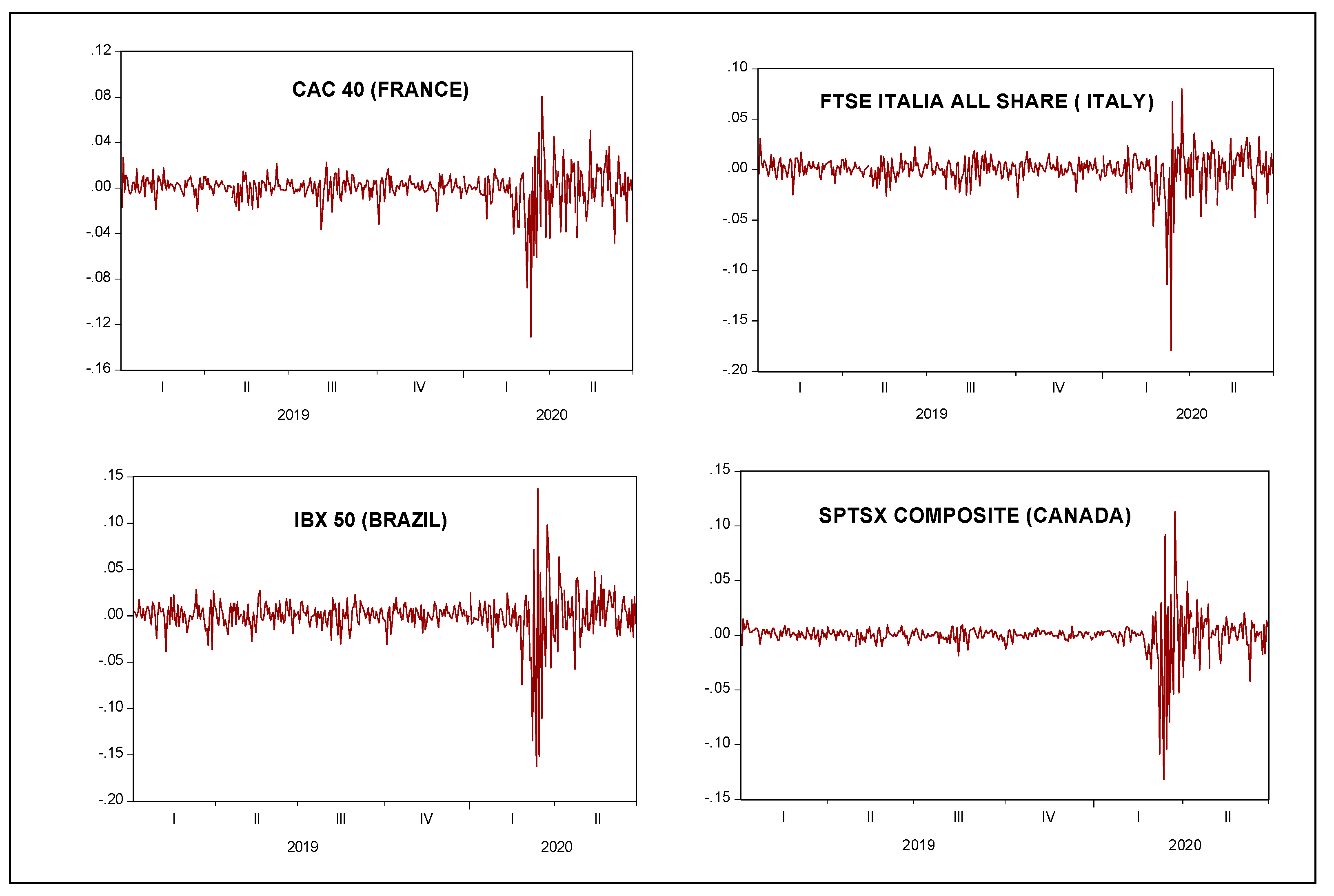

| (B). 6-month period during crisis (January 2020–June 2020) | ||||||||||

| Mean | −0.0003 | −0.0002 | −0.0005 | −0.0006 | −0.0013 | −0.0016 | −0.0015 | −0.0015 | −0.0016 | −0.0008 |

| Median | 0.0018 | 0.0002 | 0.0000 | 0.0006 | 0.0000 | 0.0007 | 0.0008 | 0.0025 | 0.0000 | 0.0021 |

| Maximum | 0.0897 | 0.0310 | 0.0773 | 0.1041 | 0.0859 | 0.0867 | 0.0806 | 0.0800 | 0.1371 | 0.1129 |

| Minimum | −0.1277 | −0.0804 | −0.0627 | −0.1305 | −0.1410 | −0.1151 | −0.1310 | −0.1791 | −0.1625 | −0.1318 |

| Std. Dev. | 0.0290 | 0.0132 | 0.0203 | 0.0265 | 0.0270 | 0.0235 | 0.0261 | 0.0280 | 0.0387 | 0.0287 |

| Skewness | −0.6235 | −2.0292 | 0.2865 | −0.7791 | −1.2375 | −0.9446 | −1.1542 | −2.4367 | −1.0127 | −1.0016 |

| Kurtosis | 7.2982 | 13.3265 | 5.6055 | 8.7433 | 9.6166 | 8.1969 | 8.0873 | 16.7166 | 8.3742 | 10.3186 |

| Jarque–Bera | 105.15 | 646.32 | 37.36 | 185.92 | 262.00 | 160.53 | 163.85 | 1112.45 | 173.17 | 302.26 |

| Probability | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 126 | 126 | 126 | 126 | 126 | 126 | 126 | 126 | 126 | 126 |

| Particulars | SP500 | SSE Composite | NIKKEI225 | DAX | SENSEX | FTSE100 | CAC40 | FTSE Italia | IBX50 | SPTSX Composite |

| US | CHINA | JAPAN | GERMANY | INDIA | UK | FRANCE | ITALY | BRAZIL | CANADA | |

| (C). First quarter during crisis (January 2020–March 2020) | ||||||||||

| Mean | −0.0035 | −0.0016 | −0.0035 | −0.0045 | −0.0053 | −0.0045 | −0.0048 | −0.0050 | −0.0074 | −0.0038 |

| Median | 0.0000 | 0.0000 | −0.0007 | −0.0003 | −0.0031 | 0.0000 | −0.0002 | 0.0011 | −0.0028 | 0.0014 |

| Maximum | 0.0897 | 0.0310 | 0.0773 | 0.1041 | 0.0675 | 0.0867 | 0.0806 | 0.0800 | 0.1371 | 0.1129 |

| Minimum | −0.1277 | −0.0804 | −0.0627 | −0.1305 | −0.1410 | −0.1151 | −0.1310 | −0.1791 | −0.1625 | −0.1318 |

| Std. Dev. | 0.0356 | 0.0171 | 0.0228 | 0.0294 | 0.0310 | 0.0272 | 0.0299 | 0.0342 | 0.0488 | 0.0369 |

| Skewness | −0.4411 | −1.6899 | 0.6256 | −0.9262 | −1.5319 | −0.9302 | −1.2645 | −2.3461 | −0.7253 | −0.7052 |

| Kurtosis | 5.7551 | 8.7859 | 6.1385 | 9.7816 | 8.6145 | 8.1518 | 8.0128 | 13.6953 | 5.9901 | 7.1198 |

| Jarque–Bera | 22.32 | 119.73 | 30.44 | 131.79 | 109.09 | 80.01 | 84.06 | 363.75 | 29.45 | 50.57 |

| Probability | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Observations | 64 | 64 | 64 | 64 | 64 | 64 | 64 | 64 | 64 | 64 |

| (D). Second quarter during crisis (April 2020–June 2020) | ||||||||||

| Mean | 0.0029 | 0.0013 | 0.0026 | 0.0035 | 0.0027 | 0.0014 | 0.0019 | 0.0021 | 0.0045 | 0.0024 |

| Median | 0.0045 | 0.0009 | 0.0000 | 0.0034 | 0.0031 | 0.0029 | 0.0035 | 0.0035 | 0.0044 | 0.0032 |

| Maximum | 0.0680 | 0.0219 | 0.0477 | 0.0561 | 0.0859 | 0.0420 | 0.0503 | 0.0363 | 0.0637 | 0.0493 |

| Minimum | −0.0608 | −0.0191 | −0.0461 | −0.0457 | −0.0612 | −0.0407 | −0.0482 | −0.0478 | −0.0575 | −0.0423 |

| Std. Dev. | 0.0199 | 0.0072 | 0.0170 | 0.0225 | 0.0215 | 0.0188 | 0.0212 | 0.0193 | 0.0230 | 0.0162 |

| Skewness | −0.2735 | 0.3682 | −0.1089 | −0.0788 | 0.3333 | −0.3842 | −0.2874 | −0.5957 | 0.0332 | −0.3855 |

| Kurtosis | 5.0503 | 4.2192 | 3.7746 | 2.9594 | 6.2074 | 2.7024 | 3.0523 | 2.9953 | 2.9517 | 4.2579 |

| Jarque–Bera | 11.63 | 5.24 | 1.67 | 0.07 | 27.72 | 1.75 | 0.86 | 3.67 | 0.02 | 5.62 |

| Probability | 0.003 | 0.073 | 0.433 | 0.966 | 0.000 | 0.416 | 0.650 | 0.160 | 0.991 | 0.060 |

| Observations | 62 | 62 | 62 | 62 | 62 | 62 | 62 | 62 | 62 | 62 |

| Indices | Periodic Returns (%) | ||||

|---|---|---|---|---|---|

| January–December 2019 | July–December 2019 | January–June 2020 | January–March 2020 | April–June 2020 | |

| (12 Months before Crisis) | (6 Months before Crisis) | (6 Months—During Crisis) | (First 3 Months (1st Quarter) during Crisis) | (Next 3 Months (2nd Quarter) during Crisis) | |

| SP500 (US) | 28.71 | 9.82 | 1.25 | −20.00 | 26.56 |

| SSE Composite (CHINA) | 23.72 | 2.39 | 8.52 | −9.83 | 20.35 |

| NIKKEI225 (JAPAN) | 18.20 | 11.19 | −8.23 | −20.04 | 14.76 |

| DAX (GERMANY) | 25.22 | 6.86 | −7.06 | −25.01 | 23.93 |

| SENSEX (INDIA) | 14.94 | 4.72 | −8.84 | −28.57 | 27.62 |

| FTSE100 (UK) | 12.00 | 1.57 | −21.81 | −24.80 | 3.98 |

| CAC40 (FRANCE) | 27.48 | 7.93 | −19.98 | −26.46 | 8.82 |

| FTSE Italia All Share (ITALY) | 27.02 | 10.66 | −18.49 | −27.54 | 12.49 |

| IBX50 (BRAZIL) | 24.74 | 13.17 | −11.06 | −37.60 | 42.53 |

| SPTSX Composite (CANADA) | 18.93 | 4.16 | −5.24 | −21.59 | 20.86 |

| (A): Correlation Matrix of Market Indices-Period (January 2019–31 December 2019) | ||||||||||

| BRAZIL IBX50 | FRANCE CAC40 | GERMANY DAX | UK FTSE100 | ITALY FTSE Italia | JAPAN NIKKEI225 | USA SP500 | CANADA SPTSX | INDIA Sensex | CHINA SSE Composite | |

| BRAZIL IBX50 | 1.000 | 0.330 | 0.305 | 0.294 | 0.263 | 0.010 | 0.470 | 0.363 | 0.040 | 0.010 |

| FRANCE CAC40 | 0.330 | 1.000 | 0.909 | 0.779 | 0.840 | 0.187 | 0.730 | 0.655 | 0.132 | 0.248 |

| GERMANY DAX | 0.305 | 0.909 | 1.000 | 0.704 | 0.822 | 0.189 | 0.691 | 0.607 | 0.118 | 0.280 |

| UK FTSE100 | 0.294 | 0.779 | 0.704 | 1.000 | 0.606 | 0.202 | 0.628 | 0.556 | 0.143 | 0.229 |

| ITALYFTSE Italia | 0.263 | 0.840 | 0.822 | 0.606 | 1.000 | 0.115 | 0.671 | 0.610 | 0.056 | 0.279 |

| JAPAN NIKKEI225 | 0.010 | 0.187 | 0.189 | 0.202 | 0.115 | 1.000 | 0.133 | 0.145 | 0.165 | 0.365 |

| USA SP500 | 0.470 | 0.730 | 0.691 | 0.628 | 0.671 | 0.133 | 1.000 | 0.735 | 0.108 | 0.181 |

| CANADA SPTSX | 0.363 | 0.655 | 0.607 | 0.556 | 0.610 | 0.145 | 0.735 | 1.000 | 0.104 | 0.156 |

| INDIA Sensex | 0.040 | 0.132 | 0.118 | 0.143 | 0.056 | 0.165 | 0.108 | 0.104 | 1.000 | 0.167 |

| CHINA SSE Composite | 0.010 | 0.248 | 0.280 | 0.229 | 0.279 | 0.365 | 0.181 | 0.156 | 0.167 | 1.000 |

| (B): Correlation Matrix of Market Indices-Period (January 2020–30 June 2020) | ||||||||||

| BRAZIL IBX50 | FRANCE CAC40 | GERMANY DAX | UK FTSE100 | ITALY FTSE Italia | JAPAN NIKKEI225 | USA SP500 | CANADA SPTSX | INDIA Sensex | CHINA SSE Composite | |

| BRAZIL IBX50 | 1.00 | 0.73 | 0.69 | 0.72 | 0.69 | 0.33 | 0.82 | 0.85 | 0.53 | 0.34 |

| FRANCE CAC40 | 0.73 | 1.00 | 0.97 | 0.95 | 0.91 | 0.51 | 0.74 | 0.81 | 0.63 | 0.39 |

| GERMANY DAX | 0.69 | 0.97 | 1.00 | 0.94 | 0.91 | 0.53 | 0.73 | 0.80 | 0.57 | 0.37 |

| UK FTSE100 | 0.72 | 0.95 | 0.94 | 1.00 | 0.89 | 0.48 | 0.75 | 0.84 | 0.62 | 0.39 |

| ITALY FTSE Italia | 0.69 | 0.91 | 0.91 | 0.89 | 1.00 | 0.42 | 0.72 | 0.79 | 0.56 | 0.29 |

| JAPAN NIKKEI225 | 0.33 | 0.51 | 0.53 | 0.48 | 0.42 | 1.00 | 0.33 | 0.40 | 0.35 | 0.49 |

| USA SP500 | 0.82 | 0.74 | 0.73 | 0.75 | 0.72 | 0.33 | 1.00 | 0.89 | 0.45 | 0.30 |

| CANADA SPTSX | 0.85 | 0.81 | 0.80 | 0.84 | 0.79 | 0.40 | 0.89 | 1.00 | 0.56 | 0.38 |

| INDIA Sensex | 0.53 | 0.63 | 0.57 | 0.62 | 0.56 | 0.35 | 0.45 | 0.56 | 1.00 | 0.53 |

| CHINA SSE Composite | 0.34 | 0.39 | 0.37 | 0.39 | 0.29 | 0.49 | 0.30 | 0.38 | 0.53 | 1.00 |

| Particulars | SP500 | SSE Composite | NIKKEI225 | DAX | SENSEX | FTSE100 | CAC40 | FTSE Italia | IBX50 | SPTSX Composite |

|---|---|---|---|---|---|---|---|---|---|---|

| US | CHINA | JAPAN | GERMANY | INDIA | UK | FRANCE | Italy | BRAZIL | CANADA | |

| ADF in Level T-Statistics | −5.12 * | −19.98 * | −17.89 * | −19.15 * | −7.81 * | −6.14 * | −6.07 * | −8.74 * | −24.94 * | −5.67 * |

| ARCH Effects Obs *R-squared | 97.02 * | 6.14 ** | 100.03 * | 3.08 *** | 11.15 * | 7.23 ** | 2.95 *** | 6.61 ** | 137.23 * | 68.10 * |

| Particulars | SP500 | SSE Composite | Nikkei 225 | DAX | SENSEX | FTSE100 | CAC40 | FTSE Italia All Share | IBX50 | SPTSX Composite |

|---|---|---|---|---|---|---|---|---|---|---|

| US | CHINA | JAPAN | GERMANY | INDIA | UK | FRANCE | Italy | BRAZIL | CANADA | |

| μ | 0.001421 (3.6670) * | 0.000597 (1.8898) *** | 0.000612 (1.9138) *** | 0.001209 (2.2218) ** | 0.000735 (1.6411) *** | 0.000434 (1.9809) ** | 0.001277 (2.5728) * | 0.001173 (2.0104) ** | 0.001295 (1.7518) *** | 0.000816 (3.1722) * |

| ω | 3.56 × 10−6 (2.7448) * | 5.65 × 10−6 (3.5623) * | 6.50 × 10−6 (2.4750) ** | 5.95 × 10−6 (3.4837) * | 4.34 × 10−6 (2.3893) ** | 4.38 × 10−6 (2.6213) * | 6.59 × 10−6 (4.0498) * | 7.37 × 10−6 (3.3056) * | 1.21 × 10−5 (3.6355) * | 1.69 × 10−6 (3.1080) * |

| α (ARCH Effect) | 0.33913 (6.8665) * | 0.054928 (3.1125) * | 0.104624 (4.3028) * | 0.219208 (6.0794) * | 0.181486 (5.6950) * | 0.248892 (4.9897) * | 0.291955 (5.7757) * | 0.238317 (6.3225) * | 0.143088 (6.4513) * | 0.375565 (8.0774) * |

| β (GARCH Effect) | 0.650143 (18.8833) * | 0.90837 (39.6550) * | 0.8499 (22.6152) * | 0.773193 (22.2517) * | 0.810802 (23.2662) * | 0.749362 (15.9746) * | 0.701376 (15.3047) * | 0.755434 (18.205) * | 0.822506 (32.1667) * | 0.622711 (16.9583) * |

| α + β | 0.989273 | 0.963298 | 0.954594 | 0.992401 | 0.992288 | 0.998254 | 0.993331 | 0.993751 | 0.965594 | 0.998276 |

| Log likelihood | 1210.105 | 1158.017 | 1167.572 | 1141.244 | 1169.975 | 1204.38 | 1168.252 | 1134.892 | 1048.493 | 1362.702 |

| Schwarz criterion | −6.306446 | −6.0323 | −6.08259 | −5.944018 | −6.09524 | −6.276312 | −6.08617 | −5.91059 | −5.455854 | −7.10959 |

| Particulars | SP500 | SSE Composite | NIKKEI225 | DAX | SENSEX | FTSE100 | CAC40 | FTSE Italia All Share | IBX50 | SPTSX Composite |

|---|---|---|---|---|---|---|---|---|---|---|

| US | CHINA | JAPAN | GERMANY | INDIA | UK | FRANCE | Italy | BRAZIL | CANADA | |

| Conditional Mean Equation | ||||||||||

| μ | 0.001358 (3.5688) * | 0.000661 (1.6108) *** | 0.000742 (1.6707) *** | 0.001077 (1.8806) ** | 0.000842 (1.8185) *** | 0.000523 (1.6348) *** | 0.001226 (2.1979) ** | 0.001020 (1.6587) ** | 0.001166 (1.6676) *** | 0.000670 (2.6169) * |

| λ (COVID) | −1.08 × 10−5 (−0.0068) | −0.000490 (−0.2773) | −0.000362 (−0.2085) | 8.89 × 10−5 (0.0462) | −0.000893 (−0.5862) | −0.000913 (−0.5622) | −0.000754 (−0.4362) | 0.000479 (0.2328) | 0.000230 (0.0942) | 0.000965 (1.0261) |

| Conditional Variance Equation | ||||||||||

| ω | 3.40 × 10−6 (2.4772) ** | 3.82 × 10−6 (2.5679) ** | 2.70 × 10−5 (3.0993) * | 5.73 × 10−6 (3.3089) * | 4.43 × 10−6 (2.3452) ** | 4.61 × 10−6 (2.6982) * | 6.14 × 10−6 (3.5652) * | 7.22 × 10−6 (2.4350) ** | 1.69 × 10−5 (2.5337) ** | 1.46 × 10−6 (2.7331) * |

| α (ARCH Effect) | 0.268420 (4.9082) * | 0.061352 (3.7319) * | 0.1444 (3.0515) * | 0.151716 (5.2980) * | 0.164587 (5.3907) * | 0.198332 (4.2870) * | 0.213614 (5.2521) * | 0.140363 (4.0843) * | 0.149000 (4.2739) * | 0.372955 (7.0550) * |

| β (GARCH Effect) | 0.705961 (14.7775) * | 0.905009 (48.2772) * | 0.506521 (3.6505) * | 0.791617 (21.6699) * | 0.803235 (20.7108) * | 0.757320 (13.0385) * | 0.737072 (14.6827) * | 0.789942 (13.6004) * | 0.743219 (10.4432) * | 0.625084 (15.4048) * |

| δ (COVID) | 1.77 × 10−5 (3.0597) * | 5.70 × 10−6 (4.5694) * | 8.33 × 10−5 (2.3764) ** | 2.57 × 10−5 (2.8049) * | 1.15 × 10−5 (2.1761) ** | 1.33 × 10−5 (2.0323) ** | 1.95 × 10−5 (2.8251) * | 2.98 × 10−5 (2.61102) * | 5.55 × 10−5 (2.7173) * | 1.98 × 10−6 (1.2939) |

| α + β | 0.974381 | 0.966361 | 0.650921 | 0.943333 | 0.967822 | 0.955652 | 0.950686 | 0.930305 | 0.892219 | 0.998039 |

| Log likelihood | 1215.082 | 1161.873 | 1177.034 | 1146.832 | 1173.180 | 1207.690 | 1172.123 | 1139.949 | 1058.405 | 1364.704 |

| Schwarz criterion | −6.301378 | −6.021327 | −6.101124 | −5.942166 | −6.080841 | −6.262469 | −6.075275 | −5.905938 | −5.476761 | −7.088860 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chaudhary, R.; Bakhshi, P.; Gupta, H. Volatility in International Stock Markets: An Empirical Study during COVID-19. J. Risk Financial Manag. 2020, 13, 208. https://doi.org/10.3390/jrfm13090208

Chaudhary R, Bakhshi P, Gupta H. Volatility in International Stock Markets: An Empirical Study during COVID-19. Journal of Risk and Financial Management. 2020; 13(9):208. https://doi.org/10.3390/jrfm13090208

Chicago/Turabian StyleChaudhary, Rashmi, Priti Bakhshi, and Hemendra Gupta. 2020. "Volatility in International Stock Markets: An Empirical Study during COVID-19" Journal of Risk and Financial Management 13, no. 9: 208. https://doi.org/10.3390/jrfm13090208

APA StyleChaudhary, R., Bakhshi, P., & Gupta, H. (2020). Volatility in International Stock Markets: An Empirical Study during COVID-19. Journal of Risk and Financial Management, 13(9), 208. https://doi.org/10.3390/jrfm13090208