The Effect of Exchange Rate Volatility on Economic Growth: Case of the CEE Countries

Abstract

1. Introduction

2. Literature Review

Does the exchange rate volatility influence economic growth in the fourteen chosen CEE countries?

Are there any factors contributing significantly in determining the degrees of this sensitivity on economic growth?

3. Methodology

3.1. Data Collection and Samples

3.2. Definition of Variables and Measurement

3.2.1. Economic Growth

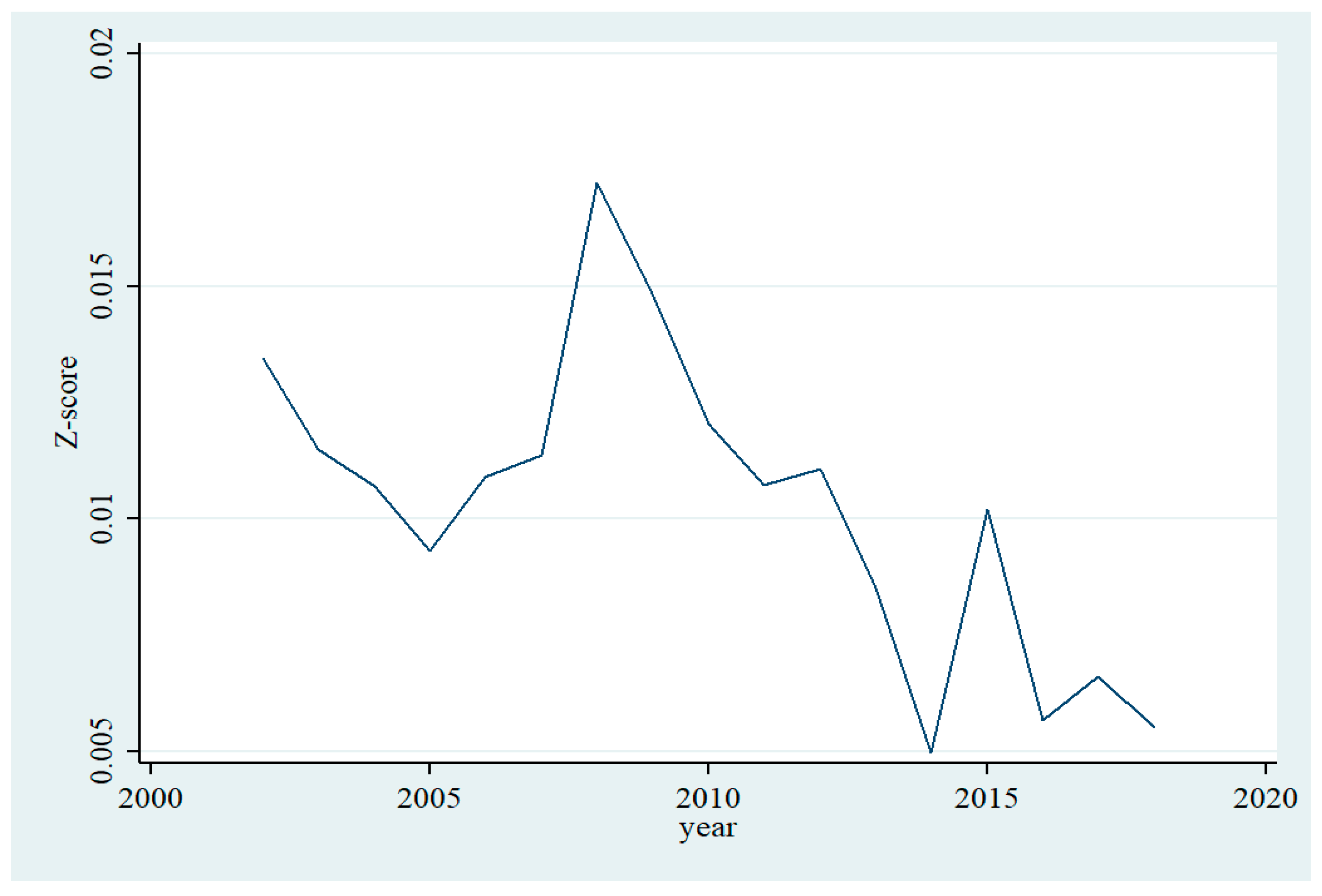

3.2.2. Volatility

3.2.3. Control Variables

3.3. Empirical Model

Fixed Effects Model

4. Results and Discussion

4.1. Descriptive Statistics

4.2. Regression Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Aghion, Philippe, Philippe Bacchetta, Romain Ranciere, and Kenneth Rogoff. 2009. Exchange rate volatility and productivity growth: The role of financial development. Journal of Monetary Economics 4: 494–513. [Google Scholar] [CrossRef]

- Aizenman, Joshua. 1992. Trade reforms, credibility, and development. Journal of Development Economics 39: 163–87. [Google Scholar] [CrossRef][Green Version]

- Alagidede, Paul, and Muazu Ibrahim. 2017. On the causes and effects of exchange rate volatility on economic growth: Evidence from Ghana. Journal of African Business 18: 169–93. [Google Scholar] [CrossRef]

- Allen, David E., Michael McAleer, Shelton Peiris, and Abhay K. Singh. 2016. Nonlinear time series and neural-network models of exchange rates between the US dollar and major currencies. Risks 4: 7. [Google Scholar] [CrossRef]

- Alper, Ali Eren. 2017. Exchange Rate Volatility and Trade Flows. Fiscaoeconomia 1: 1–26. [Google Scholar] [CrossRef]

- Anyanwu, Felicia, Amalachukwu Ananwude, and Ngozi Okoye-. 2017. Exchange rate policy and Nigeria’s economic growth: A granger causality impact assessment. International Journal of Applied Economics Finance and Accounting 1: 1–13. [Google Scholar] [CrossRef]

- Arratibel, Olga, Davide Furceri, Reiner Martin, and Aleksandra Zdzienicka. 2011. The effect of nominal exchange rate volatility on real macroeconomic performance in the CEE countries. Economic Systems 35: 261–77. [Google Scholar] [CrossRef]

- Bagella, Michele, Leonardo Becchetti, and Iftekhar Hasan. 2006. Real effective exchange rate volatility and growth: A framework to measure advantages of flexibility vs. costs of volatility. Journal of Banking Finance 30: 1149–69. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Abera Gelan. 2018. Exchange-rate volatility and international trade performance: Evidence from 12 African countries. Economic Analysis and Policy, 1–22. [Google Scholar] [CrossRef]

- Baltagi, Badi. 2008. Econometric Analysis of Panel Data. Hoboken: John Wiley & Sons. [Google Scholar]

- Bleaney, Michael, and David Greenaway. 2001. The impact of terms of trade and real exchange rate volatility on investment and growth in sub-Saharan Africa. Journal of Development Economics 65: 491–500. [Google Scholar] [CrossRef]

- Bostan, Ionel, and Bogdan-Narcis Firtescu. 2019. Exchange Rate Effects on International Commercial Trade Competitiveness. Journal of Risk and Financial Management 11: 19. [Google Scholar] [CrossRef]

- Bredin, Don, Stilianos Fountas, and Eithne Murphy. 2003. An empirical analysis of short-run and long-run Irish export functions: Does exchange rate volatility matter? International Review of Applied Economics 17: 193–208. [Google Scholar] [CrossRef]

- Campa, Jose, and Linda S. Goldberg. 1995. Investment in manufacturing, exchange rates and external exposure. Journal of International Economics 38: 297–320. [Google Scholar] [CrossRef]

- Clarida, Richard, and Jordi Gali. 1994. Sources of real exchange-rate fluctuations: How important are nominal shocks? Carnegie-Rochester Conference Series on Public Policy 41: 1–56. [Google Scholar] [CrossRef]

- Cushman, David O. 1986. Has exchange risk depressed international trade? The impact of third-country exchange risk. Journal of International Money and Finance 5: 361–79. [Google Scholar] [CrossRef]

- Dal Bianco, Silvia, and Nguyen Cong To Loan. 2017. FDI inflows, price and exchange rate volatility: New empirical evidence from Latin America. International Journal of Financial Studies 5: 6. [Google Scholar] [CrossRef]

- Darby, Julia, Andrew Hughes Hallett, Jonathan Ireland, and Laura Piscitelli. 1999. The impact of exchange rate uncertainty on the level of investment. The Economic Journal 109: 55–67. [Google Scholar] [CrossRef]

- Devereux, Michael B., and Charles Engel. 2003. Monetary policy in the open economy revisited: Price setting and exchange-rate flexibility. The Review of Economic Studies 70: 765–83. [Google Scholar] [CrossRef]

- Dixit, Avinash K., Robert K. Dixit, and Robert S. Pindyck. 1994. Investment under Uncertainty. Princeton: Princeton University Press. [Google Scholar] [CrossRef]

- Dollar, David. 1992. Outward-oriented developing economies really do grow more rapidly: Evidence from 95 LDCs, 1976–1985. Economic Development and Cultural Change 40: 523–44. [Google Scholar] [CrossRef]

- Eichengreen, Barry. 2008. The real exchange rate and economic growth. Commission on Growth and Development Working Paper 2: 1–48. [Google Scholar]

- Feruni, Nerajda, and Eglantina Hysa. 2020. Free Trade and Gravity Model: Albania as Part of Central European Free Trade Agreement (CEFTA). In Theoretical and Applied Mathematics in International Business. Hershey: IGI Global, pp. 60–90. [Google Scholar]

- Franke, Günter. 1991. Exchange rate volatility and international trading strategy. Journal of International Money and Finance 10: 292–307. [Google Scholar] [CrossRef]

- Frankel, Jeffrey, and Andrew Rose. 2002. An estimate of the effect of common currencies on trade and income. The Quarterly Journal of Economics 117: 437–66. [Google Scholar] [CrossRef]

- Ghosh, Atish R., Anne-Marie Gulde-Wolf, and Holger C. Wolf. 2003. Exchange Rate Regimes: Choices and Consequences. Cambridge: MIT Press. [Google Scholar] [CrossRef]

- Hatmanu, Mariana, Cristina Căutişanu, and Mihaela Ifrim. 2020. The Impact of Interest Rate, Exchange Rate and European Business Climate on Economic Growth in Romania: An ARDL Approach with Structural Breaks. Sustainability 12: 2798. [Google Scholar] [CrossRef]

- Ricardo, Hausmann, Jason Hwang, and Dani Rodrik. 2007. What you export matters. Journal of Economic Growth 12: 1–25. [Google Scholar] [CrossRef]

- Holland, Márcio, Flavio Vilela Vieira, Cleomar Gomes da Silva, and Luiz C. Bottecchia. 2011. Growth and exchange rate volatility: A panel data analysis. Applied Economics 45: 3733–41. [Google Scholar] [CrossRef]

- Hooper, Peter, and Steven W. Kohlhagen. 1978. The effect of exchange rate uncertainty on the prices and volume of international trade. Journal of International Economics 8: 483–511. [Google Scholar] [CrossRef]

- Imai, Hiroyuki. 2018. China’s rapid growth and real exchange rate appreciation: Measuring the Balassa-Samuelson effect. Journal of Asian Economics 54: 39–52. [Google Scholar] [CrossRef]

- Ioan, Batrancea, Rathnaswamy Malar Mozi, Gaban Lucian, Fatacean Gheorghe, Tulai Horia, Bircea Ioan, and Rus Mircea-Iosif. 2020. An Empirical Investigation on Determinants of Sustainable Economic Growth. Lessons from Central and Eastern European Countries. Journal of Risk and Financial Management 13: 146. [Google Scholar] [CrossRef]

- Jamil, Muhammad, Erich W. Streissler, and Robert M. Kunst. 2012. Exchange rate volatility and its impact on industrial production, before and after the introduction of common currency in Europe. International Journal of Economics and Financial Issues 2: 85–109. [Google Scholar]

- Janus, Thorsten, and Daniel Riera-Crichton. 2015. Real Exchange Rate Volatility, Economic Growth and the Euro. Journal of Economic Integration 30: 148–71. [Google Scholar] [CrossRef]

- Koop, Gary, and Ross Quinlivan. 2000. Analysis of Economic Data. Chichester: Wiley, vol. 2. [Google Scholar]

- Latief, Rashid, and Lin Lefen. 2018. The effect of exchange rate volatility on international trade and foreign direct investment (FDI) in developing countries along “one belt and one road”. International Journal of Financial Studies 6: 86. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and Chia-Shang James Chu. 2002. Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Levy-Yeyati, Eduardo, and Federico Sturzenegger. 2005. Classifying exchange rate regimes: Deeds vs. words. European Economic Review 49: 1603–35. [Google Scholar] [CrossRef]

- McKenzie, Michael D. 1999. The impact of exchange rate volatility on international trade flows. Journal of Economic Surveys 3: 71–106. [Google Scholar] [CrossRef]

- Obstfeld, Maurice, and Kenneth Rogoff. 1998. Risk and exchange rates. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Perée, Eric, and Alfred Steinherr. 1989. Exchange rate uncertainty and foreign trade. European Economic Review 33: 1241–64. [Google Scholar] [CrossRef]

- Rjoub, Husman. 2012. Stock prices and exchange rates dynamics: Evidence from emerging markets. African Journal of Business Management 6: 4728–33. [Google Scholar] [CrossRef]

- Rodrik, Dani. 1988. Imperfect competition, scale economies, and trade policy in developing countries. In Trade Policy Issues and Empirical Analysis. Chicago: University of Chicago Press, pp. 109–44. [Google Scholar]

- Romer, Paul M. 1986. Increasing returns and long-run growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Schnabl, Gunther. 2008. Exchange rate volatility and growth in small open economies at the EMU periphery. Economic Systems 32: 70–91. [Google Scholar] [CrossRef]

- Senadza, Bernardin, and Desmond Delali Diaba. 2018. Effect of exchange rate volatility on trade in Sub-Saharan Africa. Journal of African Trade 4: 20–36. [Google Scholar] [CrossRef]

- Vo, Duc Hong, and Zhaoyong Zhang. 2019. Exchange rate volatility and disaggregated manufacturing exports: Evidence from an emerging country. Journal of Risk and Financial Management 12: 12. [Google Scholar] [CrossRef]

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| GDP | 238 | 0.033 | 0.038 | −0.148 | 0.119 |

| lreer | 224 | 0.011 | 0.045 | −0.173 | 0.17 |

| GEXP | 238 | 0.18 | 0.026 | 0.104 | 0.229 |

| GFCF | 238 | 0.238 | 0.047 | 0.159 | 0.381 |

| INF | 238 | 0.034 | 0.035 | −0.015 | 0.225 |

| OPEN | 238 | 1.129 | 0.338 | 0.537 | 1.923 |

| DOMCR | 238 | 0.466 | 0.181 | 0.002 | 1.046 |

| INT | 210 | 0.047 | 0.047 | −0.125 | 0.287 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| (1) GDP | 1.000 | ||||||||

| (2) Vol | −0.110 | 1.000 | |||||||

| (3) z-score | −0.044 | 0.980 * | 1.000 | ||||||

| (4) GEXP | −0.172 * | 0.175 * | 0.170 * | 1.000 | |||||

| (5) GFCF | 0.291 * | −0.004 | 0.031 | −0.354 * | 1.000 | ||||

| (6) INF | 0.161 * | 0.304 * | 0.345 * | 0.053 | 0.169 * | 1.000 | |||

| (7) OPEN | −0.029 | −0.220 * | −0.247 * | 0.340 * | −0.095 | −0.277 * | 1.000 | ||

| (8) DOMCR | −0.393 * | −0.206 * | −0.232 * | 0.247 * | 0.002 | −0.131 * | 0.387 * | 1.000 | |

| (9) INT | −0.457 * | −0.010 | −0.047 | −0.229 * | −0.112 | −0.388 * | −0.124 | −0.011 | 1.000 |

| Variable | t-Statistic | Probability |

|---|---|---|

| Standard Deviation | −1.9732 | 0.0242 |

| Z-score | −3.7001 | 0.0001 |

| GEXP | −4.45342 | 0.0000 |

| GFCF | −1.95738 | 0.0252 |

| INF | −3.3485 | 0.0004 |

| OPEN | −2.63091 | 0.0043 |

| DOMCR | −6.57223 | 0.0000 |

| INT | −2.06466 | 0.0195 |

| Explanatory Variable | (Model 1) | (Model 2) | (Model 3) | (Model 4) |

|---|---|---|---|---|

| Standard Deviation | −0.398 ** | −0.273 | ||

| (0.141) | −(0.275) | |||

| Z−score | −0.862 * | −1.115 | ||

| (0.401) | −(1.179) | |||

| GEXP | −0.106 | −0.130 | −0.136 | −−0.150 |

| (0.209) | (0.210) | −(0.199) | −(0.204) | |

| GFCF | 0.458 *** | 0.452 *** | 0.150 | 0.162 |

| (0.128) | (0.133) | −(0.117) | −(0.121) | |

| INF | 0.169 ** | 0.159 ** | −0.380 *** | −0.409 ** |

| (0.0642) | (0.0637) | −(0.126) | (0.141) | |

| INT | −0545 *** | −0.521 *** | ||

| (0.0980) | (0.0721) | |||

| OPEN | 0.0693 *** | 0.0710 *** | −0.525 * | −0.0486 * |

| (0.0209) | (0.0219) | −(0.0248) | −(0.0267) | |

| DOMCR | −0.154 *** | −0.156 *** | −0.0736 *** | −0.0725 *** |

| (0.0235) | (0.0242) | −(0.0222) | −(0.0227) | |

| Standard Deviation *INF | 6.417 ** | |||

| (2.507) | ||||

| Standard Deviation *OPEN | −0.296 * | |||

| (0.141) | ||||

| Standard Deviation *INT | 5.856 ** | |||

| −(1.998) | ||||

| Z−score *INF | 24.16 ** | |||

| (10.44) | ||||

| Z−score *OPEN | −0.784 | |||

| −(0.506) | ||||

| Z−score *INT | 18.76 ** | |||

| (6.278) | ||||

| Constant | −0.0553 | −0.0548 | −0.0545 | −0.0561 |

| (0.0719) | (0.0739) | −(0.0698) | −(0.0722) | |

| Time fixed effects | No | No | Yes | Yes |

| Country fixed effects | Yes | Yes | Yes | Yes |

| Observations | 238 | 238 | 210 | 210 |

| Number of countries | 14 | 14 | 14 | 14 |

| R−squared | 0.475 | 0.457 | 0.562 | −0.778 |

| Wald test | chi2(14) = 118.79 *** | Chi2(14) = 62.57 *** | chi2(14) = 120.01 *** | Chi2(14) = 321.58 *** |

| Wooldridge test | F(1, 13) = 72.936 *** | F(1, 13) = 56.988 *** | F(1, 13) = 73.193 *** | F(1, 13) = 31.989 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morina, F.; Hysa, E.; Ergün, U.; Panait, M.; Voica, M.C. The Effect of Exchange Rate Volatility on Economic Growth: Case of the CEE Countries. J. Risk Financial Manag. 2020, 13, 177. https://doi.org/10.3390/jrfm13080177

Morina F, Hysa E, Ergün U, Panait M, Voica MC. The Effect of Exchange Rate Volatility on Economic Growth: Case of the CEE Countries. Journal of Risk and Financial Management. 2020; 13(8):177. https://doi.org/10.3390/jrfm13080177

Chicago/Turabian StyleMorina, Fatbardha, Eglantina Hysa, Uğur Ergün, Mirela Panait, and Marian Catalin Voica. 2020. "The Effect of Exchange Rate Volatility on Economic Growth: Case of the CEE Countries" Journal of Risk and Financial Management 13, no. 8: 177. https://doi.org/10.3390/jrfm13080177

APA StyleMorina, F., Hysa, E., Ergün, U., Panait, M., & Voica, M. C. (2020). The Effect of Exchange Rate Volatility on Economic Growth: Case of the CEE Countries. Journal of Risk and Financial Management, 13(8), 177. https://doi.org/10.3390/jrfm13080177