Abstract

This paper examines the ongoing transition to the revised Organisation for the Harmonisation of Business Law in Africa Act on Accounting and Financial Reporting for companies in general and to the International Financial Reporting Standards for listed and group companies with a particular focus on recent institutional developments and corporate concerns. The study used 80 professional accountants, most of whom were members of the Institute of Chartered Accountants of Cameroon and academics. Using the descriptive statistics, the study shows that the transition to the revised OHADA brings about a high level of comparability and transparency of the financial statements, that the International Financial Reporting Standards can be implemented in Cameroon (but not fully), and that the benefit of the transition exceeds the cost.

XIX ENCUENTRO INTERNACIONAL AECA

THEMATIC AREAS

A) Financial Information and Accounting Standardisation

1. Introduction

The global wind of economic integration is at the doorstep of the accounting profession with intense pressure on nations and states to apply unified accounting standards. This effort could be seen as a century reform to the profession. The reform agenda was perceived as the way forward towards harmonising the accounting practice within the Organisation for the Harmonisation of Business Law in Africa (OHADA) Generally Accepted Accounting Principles with that of the rest of the world (The International Financial Reporting Standards), which for a long time experts had been advocating on the belief that financial accounting practises should be harmonised for ease of comparison (Dicko and Fortin 2014; Fossung 2016; Mayegle 2014; OHADA Uniform Acts 2016; AICPA 2019).

The effects of globalisation have posed the need for comparable, consistent and quality financial statements. The general expectations and advantages of the International Financial Reporting Standards (IFRS) are widely known, but due to the scarcity in the various economic resources, there is always a primary issue of implementation of the law, and then there is the question of whether the country would also benefit from the proclaimed advantages of the IFRS while considering the cost involved. It is therefore important to examine the perception of accounting practitioners on the transition to the revised OHADA Uniform Acts on Accounting and Financial Reporting, and particularly of the transition of both listed companies and group companies to IFRS as inscribed in the revised OHADA Uniform Acts. Hence, the study sets out to investigate the perceptions of Accountants in Cameroon on the transition to the International Financial Reporting Standards, since the clients who fall within this group were required to implement IFRS as of January 2019 (OHADA Uniform Acts 2016; AICPA 2019).

Therefore, the main research question is: what is the perception of Cameroon accounting practitioners on the transition to the Revised OHADA Act on Accounting and Financial Reporting? The following specific research questions will be answered:

- Would the implementation of the IFRS enhance comparability and transparency of financial statements produced by the concerned companies?

- To what extent can IFRS be fully implemented in Cameroon?

- Does the cost involved in transitioning to International Financial Reporting Standards supersede the benefits?

The recent transition to IFRS has been welcomed by many, while others still have lukewarm feelings on the decision to transit to the IFRS. As such, this study is aimed at investigating the perception of Cameroon accounting practitioners on the transition to the International Financial Reporting Standards. The specific objectives of the study are: (1) to investigate the extent to which the transition to IFRS would improve the transparency and comparability of financial statements; (2) to understand the extent to which the International Financial Reporting Standards can be completely implemented in Cameroon; (3) to assess the costs and benefits involved in transitioning from the previous (OHADA) Accounting System to IFRS.

Studies like Barth et al. (2012) analysed the difference between IFRS and US GAAP-based accounting. Exploring information from US companies with IFRS-based accounting and US-based accounting from 1995 and 2006 showed that IFRS firms’ accounting amounts had greater comparability with those of US firms when IFRS firms applied IFRS than when they applied non-domestic standards. They add that there was greater comparability for firms that adopted IFRS mandatory, common law firms and firms in countries with high enforcement. Furthermore, Armstrong et al. (2010) reported 16 events associated with the IFRS as a result of the European stock market reactions. Their study showed that there existed an incremental positive reaction for European firms with higher pre-adoption information quality and lower pre-adoption information asymmetry. Meanwhile, the study of Jeanjean and Stolowy (2008) revealed that the European Commission, the International Accounting Standard Board and the Security and Exchange Commission (SEC) should put more effort to promote institutional factors and incentives rather than harmonising accounting standards.

2. Literature Review

2.1. Background

In the early 60s, antecedent to the acquisition of independence by most African countries, accounting practices where still those inherited from colonial masters. The companies in the areas of the Economic and Monetary Union of West Africa (WAEMU) and the Customs and Economic Union of Central Africa (CACEU) continued to use the French accounting systems in 1947 and 1957 (Dicko and Fortin 2014; Fossung 2016; Mayegle 2014; AICPA 2019). It was only until the Africans conceived their unity in 1963 and decided to create the Common African and Mauritian Organisation (OCAM) accounting plan in 1965. This was before the convergence of the WAEMU and CACEU. OCAM lived for 15 years, but during those years there still existed many accounting standards; the legal framework was confused and as such it resulted in a very unfavourable business climate and sub-standard financial reporting. The effects of this on some sectors were inconsistent financial records and the mismatch of some accounting works. This led the African States and certain groups to develop new accounting information systems and specific accounting plans for the credit institutions (Central Africa Banking Commission (COBAC) chart of accounts and the insurance companies (Dicko and Fortin 2014; Riasi 2015; Riasi and Aghdaie 2013; Fossung 2016)).

In response to these challenges, the Organisation for the Harmonisation of Business Laws in Africa (OHADA) was established in Port Louis, Mauritius, on 17 October 1993. The fledgling entity was launched under the treaty for the Harmonisation of Business Law in Africa, a document signed by 16 African countries (and later became 17). The objective of OHADA was to develop modern business laws relevant to conditions in Africa, promote better economic integration across the continent and encourage its harmonious development. Before the adoption of OHADA, investors had to deal with different and sometimes confusing laws in each country (Fossung 2016; Dicko and Fortin 2014). Although OHADA was initially designed for countries in the Franc zone, it now welcomes any African state, irrespective of whether it is a Francophone African countries. OHADA’s primary goal is to improve the investment climate. Its Uniform Acts, including the Act on about accounting, are directly applied in all member states and supersede any existing legislation with conflicting provisions (Paillusseau 2004). Amongst the different OHADA Uniform Acts was the UNIFORM ACT of 24 MARCH 2000 on the harmonisation of the accounts of enterprises. After being in use for more than seventeen years, this Act was revised to converge with the IFRS in response to the global pressure of international accounting harmonisation.

2.2. Conceptual Framework

The concept of perception (generally referred to as social perception by most scholars) like many others in the social science disciplines has been defined in a variety of ways since it was first used. A lay man can see perception as “a particular way of viewing things that depends on one’s experience and personality.” Perception (from the Latin perception) is the organisation, identification, and interpretation of sensory information in order to represent and understand the presented information, or the environment (Schacter 2012). The perceived quality construct developed with its service quality instruments, is defined as the difference between perceptions and expectations. Perception is the “process by which an individual receives, selects and interprets stimuli to form a meaningful and coherent picture of the world”. In customer satisfaction and service quality dimensions, perceptions are defined as the consumer’s judgement of the services and an organisation’s performance. Many social psychologists have tended to develop the concept around one of its most essential characteristics: that the world around us is not psychologically uniform to all individuals. This is the fact, in all probability, that accounts for the difference in the opinions and actions of individuals/groups that are exposed to the same social phenomenon.

According to Jandt (1995), perception is unique to each person; it begins with a three-step process of selection, organisation and interpretation. It has also been found that perceptions differ with respect to the physical environment of the service settings, cultural background and differences in gender (Ndhlovu and Senguder 2002). These indicate that a clear understanding of how perceptions are formed is critical to any service business as it facilitates the formulation of strategies to manage customer perceptions of service performance. Rao and Narayana (1998) define perception as “the process whereby people select, organise, and interpret sensory stimulations into meaningful information about their work environment.” To Rao and Narayana, perception is the most critical determinant of human behaviour, which leads them to imply further that there can be no behaviour without perception. Though focusing on managers in work settings, they draw attention to the fact that since there are no specific strategies for understanding the perception of others, everyone appears to be “left with his inventiveness, innovative ability, sensitiveness and introspective skills to deal with perception.” Rao and Narayana (1998) share the main characteristics of the above definition. However, they emphasise that perception ranks among the “important cognitive factors of human behaviour” or psychological mechanisms that enable people to understand their environment. The details of the mental and environmental nature of perception are not of primordial important to this study. However, these literary definitions help to shed more light on the variances in perception and what may cause them.

2.3. Theoretical Framework

An objective of perception is to gauge genuine properties of the world. An objective of categorisation is to characterise its structure. Ages of development have formed our faculties to this end. These three presumptions inspire much work on human discernment. The interface theory of perception offers a system, roused by advancements, to control inquiries about in question order. The perceptions of an organism are like a user interface between that organism and the objective world. This theory addresses the natural question that if our perceptions are not accurate, then what good are they? The answer becomes evident for user interfaces. The colour, for instance, of an icon on a computer screen does not estimate or reconstruct the exact colour of the file that it represents in the computer. The conventionalist theory that our perceptions are reconstructions is, in precisely the same manner, equally naive. Colour is, of course, just one example among many: the shape of an icon does not reconstruct the exact shape of the file; the position of an icon does not reconstruct the exact position of the file in the computer. A user interface reconstructs nothing. Its predicates and the predicates required for reconstruction can be entirely disjointed. Files, for instance, have no colour, and yet a user interface is useful even though despite the fact that it is not a reconstruction. The conventional theory of perception gets evolution fundamentally wrong by conflating fitness and accuracy. This leads the conventional theory to the false claim that a primary goal of perception is a faithful depiction of the world. The idea of understanding the perceptions of accountants on the transition to IFRS was based on the understanding that the perception of accountants can depict the reality of the events that are altered by the transition.

2.3.1. Hypotheses

The hypotheses below would give various users of financial information insight into the costs involved in transitioning from the previous to the revised OHADA Accounting System (SYSCOHADA) and to IFRS by taking into consideration the views of fifty accountants in Cameroon. The findings are anticipated to provide useful and timely information to the Council of Ministers under the OHADA, to assist them in making decisions affecting accounting practices which, in turn, will support social and economic development in Cameroon and the other 16 African member countries. The evidence provided by this study is likely to be of interest to other countries or firms considering the adoption of the revised SYSCOHADA and the International Financial Reporting Standards.

Hypothesis 1 (H1).

Comparability and transparency of financial statements are enhanced under the revised SYSCOHADA.

Hypothesis 2 (H2).

IFRS can be fully implemented in Cameroon, given the available resources and time and within the stated time.

Hypothesis 3 (H3).

The cost involved in transitioning to International Financial Reporting Standards (IFRSs) does not supersede the benefits.

2.3.2. J.J Gibson’s Theory of Direct Perception

James Jerome Gibson (1979) believed that our cognitive apparatus was created and formed by a long evolutionary influence of the external environment, which is apparent in its structure and abilities. We learned to extract precisely the information which is necessary for our survival. By Darwin’s assumption, the pressures of the environment caused our receptors to be created and formed so that they became sensitive to relevant stimulus from the environment and they adapted to the environment. Such interpretation of perception is called the ecological one because it attributes the determinative role to the environment and to its influence on the whole process of perception. The basis of Gibson’s theory is the conviction that our perception is determined by optical flows—optic arrays—which Gibson regarded as some sort of structure or pattern of light in the environment. The visual terminology he was using is not crucial since, analogically, it can be used for auditory or tactile components of perception. J.J Gibson’s theory is quite relevant to this study because we believe that every individual perceives information depending on several different factors, as discussed in the theory, which gives us a reason to capture the opinion of a number of accountants on the recent decision to transit to the revised OHADA law on accounting and financial reporting (revised SYSCOHADA).

2.4. Empirical Literature

Several studies have been carried out in different parts of the world on the benefits of IFRS and on the perception of accounting practitioners on the transition and convergence to the IFRS (Mohamed et al. 2019; Dabbicco and Mattei 2020; Albu et al. 2020; Ntoung et al. 2020; Muraina 2020; Sharairi 2020; Joshi et al. 2008; Ionascu et al. 2014).

A study by Mohamed, Yasseen and Omarjee (Mohamed et al. 2019) on the perception of South African accounting practitioners on the post-implementation of the IFRS for SMEs in institutionalised environment suggests that the approval of the IFRSs was accepted by all SMEs, and significant advantages were uniformly associated with the IFRS for SMEs. Pallavi Gupta et al. (2015) add that accounting experts are optimistic towards the benefits associated with the implementation of the IFRS, while at the same time they are concerned about the significant costs and challenges such as inadequate training of staff, changes required to process, changes in information technology infrastructure and other costs that are associated with the implementation of the IFRS. This conclusion was arrived at using a closed-ended questionnaire to collect responses from 200 accounting experts. The objectives of the study were to identify the perception of accounting experts regarding the benefits and challenges of IFRS based the Kruskal–Wallis Test, and descriptive statistical tools were also used for data analysis.

Meanwhile, Dabbicco and Mattei (2020) carried out a comparative study of Italy and the UK. These authors claim that uniformity and aliment of practices in public finance reporting systems aids in the understanding of the relationship between financial reporting and budgeting processes. Albu et al. (2020) examined the impact of the IFRSs in the institutional context of the Central and Eastern European (CEE) with national or multinational regional insights both at the firm-level financial reporting benefits and country-level benefits, together with the cost-benefits relationship involved. Their study suggests that the accounting and auditing profession was the most valuable resource in the IFRS adoption process in CEE. A serious adoption process at the micro-level, signalled by high levels of perceived difficulties and regulatory impediments, along with resources available at the country-level and enforcement initiatives, is associated with financial reporting benefits. Country-level benefits are perceived to have materialised to a greater extent in countries with a lower quality of institutions, but with more organisational enablers available at the micro-institutional level. Benefits are perceived to exceed costs to a lesser extent in larger countries and those with more influential institutions.

A similar study was carried out by Muraina (2020) who examined the effects of the implementation of the International Public Sector Accounting Standards (IPSAS) on Nigeria’s financial reporting quality. The study employed a survey research design to determine the effects of the implementation of the IPSAS on Nigeria’s financial reporting quality. Partial Least Square 3 (SmartPLS 3) technique of analysis was applied to achieve the research objective. The study found that accountability positively and significantly affects the quality of financial reporting in Nigeria. Specifically, IPSAS has improved the level of accountability, which in turn improved Nigeria’s financial reporting quality. Sharairi (2020) investigated the factors that influenced the current adoption of the International Financial Reporting Standards (IFRS) by Islamic banks in the UAE. This paper examined the relationship between the theoretical aspects and practical components. This paper revealed that factors such as religion, culture and local investors might have limited influence on the current adoption of accounting standards in the Islamic banks. Furthermore, this paper uncovered a concern among respondents of issues that developed when Islamic banks commenced the adoption of IFRS.

P.L Joshi et al. (2008) studied the perception of accounting professionals on the adoption and implementation of a single set of global accounting standards in Bahrain. The data for the study were collected using a pre-tested survey plan containing demographic information and professional qualifications—the study aimed at examining the perceptions of accounting professionals on adopting a single set of global standards. The results of the study proved that the accountants were optimistic about the harmonisation of accounting standards, and they felt that it is worth the while. Despite the conclusion drawn, the study was limited in its number of respondents. This conclusion may have been altered if more accountants responded.

There has been much discussion on the relationship that exists between the accounting standards and accounting quality. A study by Barth et al. (2008) sought to examine whether the application of International Accounting Standards is associated with higher accounting quality. The study used accounting quality metrics for a broad sample of firms across 21 countries that adopted IAS from 1994 to 2003. The accounting quality was compared with that of the non-US firms that do not apply the IAS. The study used inferential statistical tools and arrived at the conclusions that the firms of 21 countries which were applying IAS showed evidence of less earnings management, more timely loss recognition and more value relevance of accounting amounts. The author also compared the accounting quality for IAS firms before and after they adopted the IAS and concluded that accounting quality improved between the pre- and post-adoption periods. The period before and after they adopted IAS found that accounting quality was enhanced between the pre- and post-adoption periods.

The perception of accountants on the implementation of IFRS is quite essential in the implementation of the IFRS. A study by (Ionascu et al. 2014) was carried out on the adoption of IFRS by developing countries in the case of Romania. The paper attempted to research the fundamental proof with respect to the advantages and costs of adopting IFRS in Romania. The outcomes acquired demonstrate that, regardless of consistency issues, the Romanian economic environment was open to IFRS and idealistic about their potential to an extent.

3. Methodology

3.1. Research Design

In order to realise the objectives of this paper, a survey research design was chosen given the nature of the population considered for the research as in prior studies (such as Dabbicco and Mattei 2020; Albu et al. 2020; Muraina 2020; Sharairi 2020). It is also likely to be beneficial to accounting standard-setting bodies like the IFRS Foundation, the International Federation of Accountants (IFAC) OHADA, professional accounting associations and public accounting firms in their efforts to promote the worldwide adoption of international standards. Finally, this research would be of importance to academicians as they try to understand the strengths and limitations of the implementation of revised SYSCOHADA and specifically the IFRS in the OHADA zone. Lastly, this study would help educate the stakeholders of listed companies and group companies operating within the OHADA zone.

3.2. Population and Sampling

The study population consisted of the all-professional accountants across the national territory of Cameroon. The reason for selecting Cameroon was because Cameroon is the ‘melting pot’ and a member of the OHADA zone where all economic and financial transactions are represented.

This population comprised of males and females from different cultural, geographical and social origins. As of 2018, there were two hundred and eight (208) chattered accountants in Cameroon. Our total sample was eighty (80) participants drawn mostly from the Institute of Chartered Accountants of Cameroon (ONECCA) list of chartered accountants in Cameroon. A random sampling technique was used. The specific reason for selecting 80 accountants, most of whom were members of ONECCA was due to the willingness and availability of participants and to provide us with specific explanation and clarification through open extended questions when the need arose during the survey. This involved the selection of respondents who were available and willing to participate in the study. The data for the research were all primary data collected on the field.

Consequently, we resorted to using a structured close-ended questionnaire. The questionnaires were made up of close-ended questions with the first part relating to demographics and the second part relating to the variables of the study. All questionnaires were administered by mail to the respondents. The question of the cost and benefits arising from the transition from the revised OHADA accounting system may have shown the culture and way of life which can be echoed by the differences between international, regional and national laws and how this affected the reporting decision of players with the confines of these conflicting laws. For example, there is conflict between the OHADA Uniform Acts and General Tax code regarding the deadline for filing company accounts and tax returns, and as such, companies need to extract cost in order to be compliant to both standards. Following the institution of the new accounting law in Cameroon, there was a need to investigate if transitioning from the revised OHADA was beneficiary to companies.

The data obtained were reported using descriptive statistical analysis represented by tables, graphs, charts and other tools to enable adequate interpretation for the required, resulting output. The statistical package for social sciences (SPSS) software version 20.0 was used to facilitate the analysis. The main portion of the questionnaire used a Likert scale where respondents were expected to respond, ranging from strongly disagree to agree strongly.

4. Data Analysis

4.1. Background Information of the Respondents

It was essential to find out the background information of the respondents as this allows the researcher to know the kind of respondents in terms of occupation and years of experience. This typically has implications in terms of how different people perceive different things. For example, the way auditors may recognise a certain IFRS element may be different from the way an accounting professional in a company, as well as an academician, may view the same.

Percentages and frequencies were used to present data on tables classified under four respond options: agree and strongly agree as Agree (A), Neutral (N) and Disagree and strongly disagree as Disagree (D). A cut off 2.5 on a scale of 5 was adopted for the analysis of close-ended items. This stipulates that items with a mean lower than 2.5 exclusively were considered to imply a negative perception on the transition to IFRS as per the SPSS analysis on the main objective. However, to achieve this aim, the information presented was guided by the study objectives. The first section covered the background information such as demographic characteristics of the respondents (that is, the occupation of the respondent and number of years of experience). The second part covered perceptions about the comparability and transparency of the financial statements, the effect of full IFRS implementation in Cameroon, the extent to which the transition to IFRS would improve the transparency and comparability of the reported financial statements, relationship between the dependent variable (transition to IFRS) and independent variables of the study and testing of the hypotheses. The last part focused on determining the best predictor variable for influencing the implementation of IFRS. The data is presented using tables, charts and graphs. Descriptive statistics analysis was used to analyse, interpret and discuss the results from the data collected in line with the study objectives so as to enable the researcher to report the results in detail.

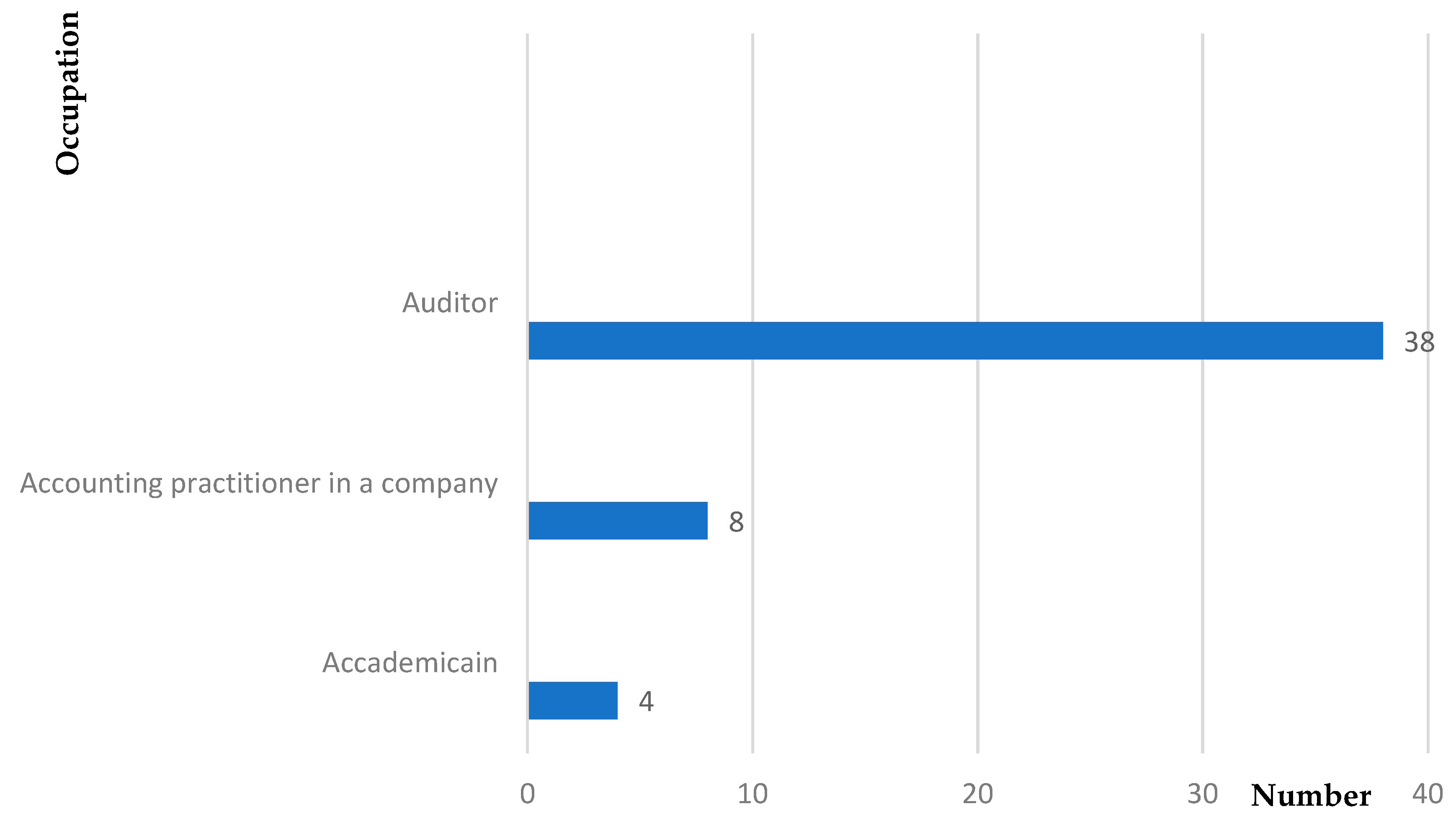

4.2. Occupation of the Respondents

The study sought to find out the various position of responsibility or occupation of the respondents who responded to the questionnaires. Our goal here was to look at those professionals who performed other duties than public practice. The results are presented in Figure 1 below.

Figure 1.

Occupation of the respondents (Source: developed purposely for this research).

The results presented in Figure 1 above show a total of fifty respondents. According to the data collected, 38 (76%) of the respondents were auditors, 16% (8) of the respondents were accounting practitioners in companies, and 8% (4) were academicians. The percentages imply that for the most part the respondents were auditors who audit clients and understand the difficulties or ease involved in their clients’ transition. Even though 80 respondents were anticipated, only 50 thoroughly completed the questionnaires. Those 30 respondents who did not complete the questionnaire correctly were eliminated.

4.3. Distribution of Respondents by Number of Years of Experience

The results in Table 1 indicate that the majority of the respondents (22 respondents) worked for 11–20 years which is 44.0%, and 17 respondents worked for 6–10 years, which comprises 34% of the total number, while seven worked 0–5 years (14%). The groups working from 21–30 years and 30 years and above had the same percentage (2%), respectively. This shows that most of the respondents were well experienced in financial reporting and have witnessed the transition and implementation of other financial reporting standards before the IFRS.

Table 1.

Distribution of respondents by number of years of experience.

4.4. Comparability and Transparency of Finance Statement

The first objective of this study was geared towards examining comparability and transparency of the financial statements. To effectively examine this, respondents were requested to indicate their opinion about the comparability and transparency of the financial statements concerning the IFRS. To reduce ambiguity, the results were collapsed from a five-point Likert scale to three-point Likert scale options and their mean values were stipulated.

Table 2 shows the respondents’ views on comparability and transparency of the financial statements. Of the respondents, 48 (96%) agreed that there was a higher quality of disclosure in financial statements presented under IFRS than under the former OHADA Uniform Accounting Act. There were no neutral views on this, while a minority of two respondents (4%) disagreed. However, the mean value of 4.61 on a scale of 5 showed there was a strong positive correlation as stipulated by the statement. Thus, we can conclude that there was a higher quality of disclosure in financial statements presented in accordance with IFRS than with the former OHADA Uniform Accounting Act. In terms of comparability, a significant percentage of respondents, 46 persons (92%), agreed that the financial statements were directly comparable to national and international companies. There was one neutral view (2%) and three persons (6.0%) who disagreed with the statement that the financial statements were directly comparable to national and international companies. This can be seen from the mean value of 4.35 on a scale of 5 which shows that there was a strong positive correlation.

Table 2.

Respondents’ views on comparability and transparency of financial statements.

Similarly, out of the 50 respondents sampled, 49 of them (98%) agreed that IFRS were appropriate for achieving a true and fair view of the financial statements. There was just one person (2%) who disagreed to the fact that the IFRS were appropriate for achieving a true and fair view of the financial statements. There was, therefore, a very strong indication that the IFRS were appropriate for achieving a true and fair view of the financial statements as stipulated by the mean value of 4.84 on a scale of 5, which shows the statement was in line. Furthermore, concerning the statement indicating that the financial statements prepared under the IFRS were more transparent than those prepared under the former OHADA Uniform Accounting Act, a vast majority of the respondents (47 persons) confirmed the assertion to be true. However, three persons differed with the claim. Going from the majority, it can be noted that the financial statements prepared following the IFRS were more transparent than those prepared under the former OHADA Uniform Accounting Act. Furthermore, the mean value of 4.39 on a scale of 5 tells us that there was a strong positive correlation in the statement.

Furthermore, 49 respondents agreed that the implementing of IFRS would increase the ability to understand financial statements. As well, 48 respondents (96%) strongly agreed that there was a higher quality of disclosure in financial statements presented in accordance with IFRS than under the former OHADA Unfirom Accounting Act. Forty-six people (92.0%) agreed that the financial statements were directly comparable to national and international companies, while 4 (8%) disagreed with this. In a nutshell, the mean value of 4.58 on a scale of 5 shows there was a strong positive correlation with the statement with the Cronbach alpha of 0.842 as shown in Table 3 below.

Table 3.

Reliability Statistics.

4.5. Examining the Possibility of Fully Implementing the International Financial Reporting Standards in Cameroon

Another aspect of the study was to examine the extent of the application of IFRS in the Cameroon accounting system.

As seen in Table 4, more than three quarters (84.0%) of the respondents strongly agreed that were aware of the International financial reporting standards; eight (16.0%) agreed, and none of the participants disagreed with this. This was closely supported by an understanding of the differences between the IFRS and SYSCOHADA. It was revealed that most of the respondents clearly knew the differences between the accounting reporting systems, as 39 (78.0%) strongly agreed to this, 10 (20.0%) agreed, while one person (2.0%) expressed a neutral view. However, their computed mean was greater than 2.5 and above, which shows that both statements were positively correlated.

Table 4.

Respondents’ view on the extent of the implementation of International Financial Reporting Standards (IFRS) in Cameroon.

From Table 4 above, the study also found that a majority of the respondents (52%) disagreed with the assertion that Cameroon has the structures needed to carry out a revaluation of fixed assets. Four neutral respondents comprised 8%, and as the mean value of 2.35 on a scale of 5 shows, there was a weak positive correlation. Furthermore, 40% of the respondents felt that Cameroon has the structures needed to carry out the revaluation of fixed assets. This depicts clearly that many of the respondents think that Cameroon does not have the necessary structures and infrastructures to implement the IFRS, as well as the revaluation of fixed assets.

50 respondents agreed with the assertion that the natures of fixed assets in most companies are such that they can be decomposed and recorded separately. Of the total respondents, 34% strongly agreed with that assertion, 42% agreed (giving a total of 76% for those who agreed), two respondents could not tell whether companies have fixed assets that can be decomposed and recorded separately, and 20% disagreed that companies have fixed assets that can be decomposed. This shows that most of the respondents hold the view that the natures of fixed assets in most companies are such that they can be decomposed and recorded separately. The computed mean value of 3.39 shows that the statement was in line.

Furthermore, 60% agreed that accountants understand the distinguishing factors in the IFRS for SME’s, and only 10% and 30% were neutral and strongly disagreed, respectively. The computed mean value of 4.00 shows there was a strong positive relationship. However, 78% agreed that accountants of SME’s who report internationally had been well trained to prepare their statements in accordance to the revised standards. In comparison only 8% and 14% were neutral and disagreed, respectively. In a nutshell, the mean value of 3.61 on a scale of 5 shows that the statement was positively correlated.

In addition to that, 11 respondents (22%) strongly agreed that the clients fully understand the IFRS and can prepare their statements for the 2018 financial year under the IFRS; 15 respondents (30%) supported this, while 6% of the respondents were indifferent. However, 10% of the total respondents disagreed with the assertion that their clients fully understand the IFRS and can prepare their statements for the 2018 financial year per the IFRS. Accountants understand the distinguishing factors in the IFRS for SMEs, and the mean value of 2.77 shows the statement was strongly correlated.

Equally, from those sampled in the study, less than half accepted that companies have understood the changes in the statistics and tax return filling, while few were indifferent. This was opposed to about 72% who disagreed that companies’ accountants understand the changes in tax return filing with the introduction of IFRS. The last aspect indicates that most of the respondents disagreed that their clients would be able to prepare their tax returns in accordance with the revised laws for the 2018 financial year. This was opposed to a few whom the study found could, and the mean value of 3.9 on a scale of 5 shows there was a strong positive correlation with the Cronbach’s alpha of 0.818 as shown in Table 5 below.

Table 5.

Reliability Statistic.

4.6. Perception on the Costs and Benefits Involved in Transitioning from the Former OHADA to IFRS

The last objective of this study sought an understanding of respondents’ perception on the costs and benefits involved in transitioning from the OHADA GAAP to IFRS as shown in the Table 6 below.

Table 6.

Respondents’ perceptions of the costs and benefits involved in transitioning from the Organisation for the Harmonisation of Business Laws in Africa (OHADA) GAAP to IFRS.

As seen in the Table 6 above, an evaluation of respondents’ opinions on the cost-benefit analysis of the implementation of IFRS found a strong confirmation by all respondents that implementing IFRS would increase the relevance of accounting information for decision making. About three-quarters of the respondents agreed that preparing financial statements under the IFRS would increase the opportunities of Cameroon companies for assessing global markets. This was supported by the remaining one quarter 13 (26%) of respondents. However, the mean values greater than 2.5 on a scale of 5 shows that there was a strong positive relationship in the stipulated statement.

Likewise, it was confirmed by 38 (76%) of the respondents that presenting financial statements per the IFRS would assure greater accessibility of funds for Cameroonian companies. While eight (16%) of the respondents supported this assertion, four (8%) significantly differed and four (5%) were indecisive.

In terms of cost of capital, the results proved that 34 (68%) of the respondents strongly agreed that transitioning to IFRS would lower the cost of capital; this was decided upon by 10 respondents (20%) of the respondents, while three respondents (6%) stayed neutral and three respondents (6%) disagreed. Conversely, 11 (22%) of the respondents held that transitioning to IFRS required the training of staff, which would be costly to organisations. Nevertheless, the majority of the respondents (72%) disagreed with the minority. This was confirmed by the mean value of 2.05 which was less than 2.5, showing there was a weak positive correlation.

On another dimension, 49 respondents (98%) held that transitioning to IFRS would provide professional opportunities to accounting professionals in Cameroon across the globe. Transitioning to IFRS would make the business climate more welcoming to investors according to 48 (96%) of the respondents. Likewise, transitioning to the IFRS would require a change in the accounting processes according to 35 (70%) of the respondents, although 13 (26%) of them opposed. In a nutshell, the mean value of 3.94 shows the statement was strongly in line.

In terms of technological change, the results recorded a significant confirmation by 31 (62%) respondents that implementing IFRS would require substantial information technology infrastructure of several organisations. This was opposed by 17 (34%) of the respondents, while two (4%) of them were uncertain. This was in accordance with the mean value of 3.57 which was greater than 2.5 on a scale of 5. This shows there was a strong positive correlation with and the Cronbach alpha of 0.825 as shown in Table 7 below.

Table 7.

Reliability Statistics.

Moreover, the IFRS requires too much disclosure of financial information, which was troublesome according to 25 (50%) respondents, besides the fact that implementation of IFRS would require significant changes in various existing laws. The mean value of 2.5 on a scale of 5 shows there was a positive correlation stipulated by the statement. IFRS recommends the application of the fair value concept, which is generally difficult to apply.

In terms of the effect on earnings, the study found that 30 (60%) of the respondents admitted that implementing IFRS would increase volatility in the company’s earnings. This is because financial statements presented under the IFRS are prone to manipulation since businesses can use the methods they wish. This was according to 13 respondents (23%), while the majority disdained. However, the result shows a weak positive correlation of 2.46 on a scale of 5 as stipulated by the statement.

4.7. Verification of Research Hypothesis

The first goal in analysing the results was to test if the findings were robust. In particular, this examines if individuals gave broadly similar answers to roughly similar questions (an essential test of reliability). Furthermore, the results using a 1% level of significance as our tested hypotheses under one sample test are computed on the Table 8 below:

Table 8.

Hypothesis testing results.

As analysed above from the presentation of results for the test of hypothesis on Table 8, it was noticed that the p-value for comparability and transparency was 0.000, which is less than 0.01 at 1% level of significance. We therefore reject the null hypothesis which says that the implementation of the IFRS would not improve the comparability and transparency of financial statements and accept the alternative hypothesis which says that the implementation of the IFRS would improve the comparability and transparency of financial statements. Therefore, we conclude that the International Financial Reporting Standards would have a significant effect on the comparability and transparency of financial statements.

Furthermore, the p-Value for Cameroon’s resources was greater than 1% level of significance (p-Value > 0.01) therefore, our study was insignificant. That is, we do not have enough evidence to reject the null hypothesis which says IFRS cannot be fully implemented given Cameroon’s resources and within the stated time, and conclude that the test was statistically insignificant at 1% level of significance. Lastly, the p-Value for transitioning to IFRS was less than 1% level of significance (p-Value < 0.01) therefore, our study was significant. That is, we then reject the null hypothesis which says that the costs involved in transitioning to IFRS supersedes the benefits and accept the alternative which says that the benefits involved in transitioning to IFRS supersede the cost of the transition. Therefore, we conclude that there is likely an overall effect of benefits and costs by transitioning to IFRS.

4.7.1. Discussion of Results on the Comparability and Transparency of the Financial Statements under the IFRS

The first objective of this study was geared towards examining comparability and transparency of the financial statements under the IFRS. Aspects of perception examined showed that majority of the respondents agreed that with the introduction of IFRS in the Cameroon accounting reporting system, there is a higher quality of disclosure in financial statements presented as per the IFRS than under OHADA. This means that the respondents perceive that IFRS enables greater transparency, as such disclosure in financial statements filed in accordance with IFRS can reveal more information about the financial situation of the business, which makes analysis easier. Furthermore, a significant percentage of respondents also agreed that the financial statements prepared in accordance with the IFRS would be more comparable to national and international companies than those prepared following the OHADA GAAP. Greater comparability lowers the cost of acquiring information and increases the overall quantity and quality of information available to analysts about the firm. In addition to that, the respondents were positive about the idea that reporting in accordance with the IFRS would result in financial statements that reflect a true and fair view of the financial situation of the company. According to some proponents of International Financial Reporting Standards (IFRS), IFRS increase financial comparability and usefulness of accounting information (Tweedie 2010).

The last aspect identified under this objective recorded great confirmation that there was more transparency of financial statements prepared in line with IFRS than those prepared in accordance with the OHADA GAAP. These findings align to an extent with those of Rachel Byers (2017), who found that a transition to IFRS would have significant effects on those accounting information sources, as this has been already adopted by over 100 countries because of its levels of transparency and comparability in international business environments spur by globalisation. Furthermore, P.L. Joshi et al. (2008), on the perception of accounting professionals on the adoption and implementation of a single set of global accounting standards in Bahrain, proved that the accountants were optimistic about the harmonisation of accounting standards and they feel that it is worth the while.

4.7.2. Discussion on the Findings of the Full Implementation of IFRS in Cameroon

The findings with respect to Cameroon’s ability to implement the IFRS revealed that accounting practitioners are actually positive about the IFRS implementation irrespective of the limited time for the law to take effect. However, the results were insignificant, indicating that most of those interviewed believe that Cameroon does not have the necessary infrastructure as well as proper accounting knowledge of IFRS to implement IIFSR in the system fully. This is unlike Barth et al. (2008), who found that the application of International Accounting standards was associated with higher accounting quality in 21 countries that adopted IAS from 1994 to 2003. The author also compared the accounting quality for IAS firms before and after they adopted the IAS and concluded that accounting quality has improved between the pre- and post-adoption periods. The period before and after they adopted IAS showed that accounting quality was enhanced between the pre- and post-adoption periods.

4.7.3. Discussion of Cost/Benefits of the Transition to IFRS

In line with Gupta et al. (2015), the conclusion generated from the descriptive and empirical analysis was that accounting experts are optimistic towards the benefits associated with the implementation of the IFRS, while at the same time they are concerned about the significant costs and challenges, such as inadequate training of staff, changes required in the process, changes in information technology infrastructure and other costs that are associated with the implementation of the IFRS. The low response rate below 50% makes the study limited. The number of responses used to arrive at the conclusion was quite small with respect to their target population. Perhaps if the response rate was higher, the results would have been different.

This, however, contradicted the works of others in the Swiss accounting system who found that a high percentage of firms voluntarily chose IAS in the 1990s, and switching to IAS was likely to be more costly for Swiss firms than for firms from countries with higher reporting standards; as such, voluntary adopters in Swiss firms should expect more advantages from IAS adoption (Dumontier and Raffournier 1998; Murphy 1999). While proponents of IFRS claim that IFRS increases financial comparability and usefulness of accounting information concord with the findings of this study, others believe worldwide adoption of IFRS by all firms is costly, complex and does not necessarily improve the quality of accounting reports. These study findings did not agree as there was significant evidence that the benefits of the transition to IFRS supersede cost.

5. Conclusions

This study aimed at investigating the perception of accounting practitioners on the transition from the former OHADA Uniform Accounting Act to the revised (now) OHADA Act on Accounting and Financial Reporting and to IFRS, taking into account their opinion on the extent to which the transition to IFRS would improve the transparency and comparability of the reported financial statements. Also, it looked at the extent to which the International Financial Reporting Standards can be completely implemented fully in the economy of Cameroon as a whole given its level of resources and within the stated time. Lastly an understanding of the costs and benefits involved in transitioning from SYCOHADA to IFRS was explored. The findings of this study are summarised as follows: with respect to the transparency and comparability of the financial statement, the results indicated that there would be a higher quality of disclosure in financial statements prepared following the International Financial Reporting Standards than under the previous OHADA Accounting Act. This is supported by the fact that the respondents believe that when reporting following the IFRS, financial statements of a company can be directly comparable with a similar company in the same industry both within and out of the country.

The study proved that financial statements prepared in accordance with the IFRS are more appropriate in presenting a true and fair view. This implies that the Cameroon accountants perceive IFRS to be a better reporting standard than the previous OHADA Uniform Accounting Act because financial statements are expected to present a true and fair picture of the company’s financial situation and be free from material misstatements. In addition to that, the study also proved that the understandability of the financial statements would be greatly improved when reporting under IFRS because a greater majority understands these standards as they are used in several countries already and they present a higher quality of disclosures than OHADA. All these prove that the accountants have a positive perception about the comparability, transparency and understandability of the financial statements. The investigation on the perception of practitioners regarding the complete implementation of International Financial Reporting Standards in the economy of Cameroon proved that Cameroon does not have the structures required to carry out the revaluation of fixed assets. Hence there is a need for an independent valuation body in Cameroon. However, the respondents attested to the fact that the nature of fixed assets in some companies is such that it can be decomposed and recorded separately.

The study also found out that the accountants in Cameroon understand the distinguishing factors in the IFRS for small and medium-size enterprises, and they would be able to prepare their financial statements for the year ending in December 2018 in accordance with the IFRS. However, though the accountants believe that they can prepare the financial reports in accordance with the International Financial Reporting Standards, there is still insufficient evidence to attest to the fact that companies in Cameroon have understood the changes in the statistics and tax return filling and that many clients would be able to prepare their tax returns in accordance with the laws for the 2018 financial year. It should be dully noted that Cameroon implemented just part of the IFRS, which is the reporting standards for publicly listed companies and group companies that report internationally. The IFRS for SME’s is still under review. The advantages and disadvantages of implementing IFRS are peculiar to respective countries based on the availability of resources. Cost and complex nature have been a cause of concern for implementing and adopting IFRS. There are of course positive gains regarding the implementation of IFRS. However, there are serious concerns about the cost and benefits associated with IFRS. All the respondents agreed that implementing IFRS would increase the relevance of accounting information for decision making and it would increase the opportunities of Cameroon companies for assessing global markets.

They also attested to the fact that presenting financial statements in accordance with the IFRS would assure greater accessibility of funds for Cameroonian companies, lower the cost of capital, provide professional opportunities to Cameroonian professionals and of course make the business climate more welcoming to investors. However, there are major concerns attributed to the transition, as the respondents supported the fact that the IFRS is a more complicated statute to adhere to than the OHADA. The transition does not come with previous knowledge, and as such, every company would have to train its staff on the new standards and these trainings and workshops are usually very costly and time-consuming. The transition would also require a change in the accounting process which may be attributed to the higher quality of disclosures when reporting under IFRS. It was also uncovered in the course of the study that the increase in the disclosure may tend to be troublesome because when too much information is made available, deciphering may become difficult for shareholders. In addition to that, the findings of the study also included the fact that implementing IFRS would require significant changes in the information technology infrastructure of several organisations and would also require significant changes in various existing laws.

In sum, this study on the perception of accounting practitioners on the transition from OHADA General Accepted Accounting Principles to IFRS in Cameroon sought specifically the respondents’ views pertaining to transparency and comparability of IFRS, the extent to which the IFRS can be implemented in the economy of Cameroon and the costs and benefits involved in transitioning from OHADA to IFRS. Data were collected using questionnaires administered to a sample of 50 respondents constituting accountants in Cameroon businesses. Accounting practitioners have a positive perception of the cost/benefits of IFRS transition in Cameroon. It was concluded that full IFRS could not be completely implemented in Cameroon given Cameroon’s resources, especially within the slated time. However, there is need for further research to be done in this area. Further studies should focus on investigating whether the perception of accountants is independent of their individual attributes like age, education, experience and qualification to bring about uniformity in the reporting structures. It is necessary to investigate the extent to which the IFRS was actually implemented in Cameroon and understand the challenges and opportunities that actually arose after the implementation of the new reporting standards. One of the limitations is that it is specific to Cameroon. We had as one of our principal objectives to widen the scope, but due to limited information we were restricted only to Cameroon. Further research will include other African countries that had adopted the OHADA Accounting System. Consistently, Tawiah and Boolaky (2019) shows that in most African Countries there is a very slow implementation process of the IFRS. His study suggests that amongst the African countries examined, 18 African nations required their companies to report financial statements according to IFRS, meanwhile, 23 did not permit their companies to report according to the IFRS. Thus, the above discussion shows that Cameroon needs the local institutional capacity and professional training to smoothen the path towards the transition of IFRS.

6. Recommendations of the Study

The first priority of the International Accounting Standards Board (IASB) is to improve financial reporting for the benefit of investors and other users of financial information. It is done by striving to set the highest-quality standards, which collectively are known as Generally Accepted Accounting Principles (GAAP). The IASB is a key participant in the development of the IFRS. The benefits of having internationally comparable financial statements are abound. However, the results from the study reveal that the respondents were not aware of whether the financial statements prepared in accordance with IFRS were comparable or not. This shows that their knowledge on IFRS was limited, hence seminars and focus group discussions should be organised to educate the experts on all the benefits of this transition.

It is necessary to revalue fixed assets to bring them to their proper fair value when reporting under the IFRS. However, the results from the study reveal that there are no proper structures in Cameroon to carry out the revaluation of fixed assets. Hence the ministry of finance and the government at large should ensure that such structures are put in place in order to reduce the level of material misstatement in fixed assets.

More so, results showed that clients do not fully understand the IFRS and were not certain if their clients would be able to prepare their financial statements in accordance with the IFRS. It is worth noting that the IFRS provides momentous changes to the manner of reporting financial transactions. Hence, there is an inexorable need to train the auditors and accountants on these changes. In view of this, it is worth proposing that the accounting body in Cameroon (ONECCA) should strive to ensure that all accountants have a proper understanding of the IFRS that guides the preparation of their financial statements in their sector of business. In line with the cost-benefit analysis of IFRS implementation, the findings showed that transitioning to IFRS requires the training of staff which is costly to organisations, and it also requires too much disclosure of financial information which is troublesome to businesses. Likewise, implementation of IFRS would require significant changes in various existing laws. To address these issues, it was recommended that businesses should evaluate the overwhelming benefits that IFRS have on their businesses such that the accompanying cost can be undermined. Considering that the trainings would have a ripple effect on several parties, the organisers should see into it that these trainings are very affordable for all and the both languages should be represented. The fundamental reason for utilising this research method was due to the fact that a qualitative survey is holistic, and it allowed us to develop an initial understanding of how people think and feel. It equally permitted a primary study of a large and diversified population with the possibility of adequately studying a sample while still maintaining the validity and reliability.

7. Limitation of Study

Our study is limited to the sociability of the respondents. This might be bias. However, this is because we were more concerned with examining the perceptions of professional accountants which might impose some incomplete information to the study.

Author Contributions

Data curation, M.F.F. and L.A.T.N.; Formal analysis, H.M.S.d.O. and C.M.F.P.; Methodology, S.A.M.C.B.; Writing—review & editing, L.M.P. All authors have read and agree to the published version of the manuscript.

Funding

The authors received no external funding for the research, authorship, and publication of this article.

Conflicts of Interest

The authors declared no potential conflicts of interest with respect to the research, authorship, and publication of this article.

References

- AICPA. 2019. American Institute of Certified Public Accountants. New York, NY 10036-8775. Available online: www.IFRS.com (accessed on 20 July 2019).

- Albu, Nadia, Cătălin N. Albu, and Sidney J. Gray. 2020. Institutional factors and the impact of international financial reporting standards: The Central and Eastern European experience. Accounting Forum, 1–31. [Google Scholar] [CrossRef]

- Armstrong, Christopher S., Mary E. Barth, Alan D. Jagolinzer, and Edward J. Riedl. 2010. Market reaction to the adoption of IFRS in Europe. The Accounting Review 85: 31–61. [Google Scholar] [CrossRef]

- Barth, Mary. E., Wayne R. Landsman, and Mark H. Lang. 2008. International Accounting Standards and Accounting Quality. Journal of Accounting and Research 46: 467–98. [Google Scholar] [CrossRef]

- Barth, Mary E., Wayne R. Landsman, Mark Lang, and Christopher Williams. 2012. Are IFRS-based and US GAAP-based accounting amounts comparable? Journal of Accounting and Economics 54: 68–93. [Google Scholar] [CrossRef]

- Byers, R. 2017. Implications of Transitioning to IFRS on Key Financial Indicators in the Oil and Gas Production Industry. Journal of Accounting and Finance 17. [Google Scholar]

- Dabbicco, Giovanna, and Giorgia Mattei. 2020. The reconciliation of budgeting with financial reporting: A comparative study of Italy and the UK. Public Money & Management, 1–11. [Google Scholar] [CrossRef]

- Dicko, Saidatou, and Anne Fortin. 2014. IFRS adoption and the opinion of OHADA accountants. Afro-Asian Journal of Finance and Accounting 4: 141–62. [Google Scholar] [CrossRef]

- Dumontier, Pascal, and Bernard Raffournier. 1998. Why firms comply voluntarily with IAS: An empirical analysis with Swiss data. Journal of International Financial Management & Accounting 9: 216–45. [Google Scholar]

- Fossung, Michael Forzeh. 2016. Assessment of Compliance with OHADA Uniform Accounting Act by Public Limited Companies. Journal of Accounting and Finance Research 5. [Google Scholar] [CrossRef]

- Gibson, James J. 1979. The Ecological Approach to Visual Perception. Boston: Houghton Mifflin. [Google Scholar]

- Gupta, Pallavi, Javaid Akhter, and Barnali Chaklader. 2015. An Empirical Study of Accounting Expert’s Perception for Implementation of International Financial Reporting Standards in India. Nitte Management Review 9: 35–53. [Google Scholar] [CrossRef]

- Ionascu, Mihaela, Ion Ionascu, Marian Sacarin, and Mihaela Minu. 2014. IFRS adoption in developing countries: The case of Romania. Accounting and Management Information Systems 13: 311. [Google Scholar]

- Jandt, F. E. 1995. Effective Interviewing for Paralegals. New York: Anderson Publishing Company. [Google Scholar]

- Jeanjean, Thomas, and Hervé Stolowy. 2008. Do accounting standards matter? An exploratory analysis of earnings management before and after IFRS adoption. Journal of Accounting and Public Policy 27: 480–94. [Google Scholar] [CrossRef]

- Joshi, P. L., Wayne G. Bremser, and Jasim Al-Ajmi. 2008. Perceptions of accounting professionals in the adoption and implementation of a single set of global accounting standards: Evidence from Bahrain. Advances in Accounting 24: 41–48. [Google Scholar] [CrossRef]

- Mayegle, François-Xavier. 2014. OHADA accounting system and sharmonisation of accounting practice in francophone sub-saharan africa. International Journal of Business and Social Science 5: 233–40. [Google Scholar]

- Mohamed, W., Y. Yasseen, and F. Z. Omarjee. 2019. The perceptions of South African accounting practitioners on the post-implementation of IFRS for SMEs in an institutionalised environment. Journal of Economic and Financial Sciences 12: 1–11. [Google Scholar] [CrossRef]

- Muraina, Saheed Adekunle. 2020. Effects of implementation of International Public Sector Accounting Standards on Nigeria’s financial reporting quality. International Journal of Public Sector Management 33: 323–38. [Google Scholar]

- Murphy, Kevin J. 1999. Executive compensation. In Handbook of Labor Economics. Amsterdam: Elsevier, vol. 3, pp. 2485–2563. [Google Scholar]

- Ndhlovu, J., and T. Senguder. 2002. Gender and perception of service quality in the hotel industry. Journal of American Academy of Business 1: 301–7. [Google Scholar]

- Ntoung, Lious Agbor Tabot, Helena Maria Santos de Oliveira, Benjamim Manuel Ferreira de Sousa, Liliana Marques Pimentel, and Susana Adelina Moreira Carvalho Bastos. 2020. Are Family Firms Financially Healthier Than Non-Family Firm? Journal of Risk and Financial Management 13: 5. [Google Scholar] [CrossRef]

- OHADA Uniform Acts. 2016. Organisation for the Harmonisation of Business Law in Africa, Official Bulletin, Special Edition Permanent Secretariat of P. Box: 10071 Yaounde Cameroon. Available online: https://www.ohada.org/attachments/article/1847/jo-ohada-se-nov2016-official-translation.pdf (accessed on 18 July 2019).

- Paillusseau, J. 2004. Le droit de l’OHADA; Un droit très important et original. Available online: https://www.ohada.org/attachments/article/1847/jo-ohada-se-nov2016-official-translation.pdf (accessed on 18 July 2019).

- Rao, V. S. P., and Pemmasani Sankara Narayana. 1998. Organisation Theory and Behaviour. Delhi: Konark Publishing Company, pp. 329–30. [Google Scholar]

- Riasi, Arash. 2015. Competitive Advantages of Shadow Banking Industry: An Analysis Using Porter Diamond Model. Business Management and Strategy 6: 15–27. [Google Scholar] [CrossRef]

- Riasi, Arash, and Seyed Fathollah Amiri Aghdaie. 2013. Effects of a Hypothetical Iranian Accession to the World Trade Organization on Iran’s Flower Industry. Consilience 10: 99–110. [Google Scholar] [CrossRef]

- Schacter, D. L. 2012. Adaptive constructive processes and the future of memory. American Psychologist 67: 603. [Google Scholar] [CrossRef]

- Sharairi, Mohammad Haroun. 2020. Factors that influenced the adoption of IFRS by Islamic banks in the UAE. Accounting Research Journal 33. [Google Scholar] [CrossRef]

- Tawiah, V., and P. Boolaky. 2019. Determinants of IFRS compliance in Africa: Analysis of stakeholder attributes. International Journal of Accounting & Information Management. [Google Scholar]

- Tweedie, D. 2010. IFRS in 2011 and beyond. Paper Presented at 2010 International Financial Reporting Standards (IF—RSs) Conference, Tokyo, Japan, July 28. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).