1. Introduction

The ongoing COVID-19 pandemic has already started to take a heavy toll on the global economy, and dramatic easing of the money supply worldwide has become the norm rather than the exception. This produces negative interest rates when inflation is accounted for. Here, our focus, however, is on negative interest rates at the point of issuance which represent a major assault on savers everywhere. They speak clearly about the limits of monetary policy as an economic policy tool. Lowering interest rates worked for a while, but it has been shown that the United States and other economies did hit what Keynes referred to as a “liquidity trap” or a “zero lower bound”, i.e., a point beyond which lowering interest rates will not affect economic growth. The central bankers were undeterred. In 2014, they introduced negative interest rates to rescue economies from deflationary spirals and to stimulate spending. Governments borrowed at very low to negative rates in order to sustain deficit spending, stimulate inflation, and possibly avoid insolvency. In general, negative interest rates affect exchange rates, economic growth, savings rates, and taxation as we shall demonstrate.

Negative interest rates hurt savers. They have been, thankfully, largely resisted by savers as they became understood. They continue to exist, however, because banking regulators continue to force their existence in the name of liquidity, solvency, reserve requirements, and safety. The basic intent is to discourage banks from holding excess reserves, make loans at advantageous rates, and stimulate the economy.

Examining the causes and consequences of negative interest rates,

Tokic (

2017) argued that central banks lower short-term rates sufficiently below the long-term rates in order to create an accommodative yield curve spread during recessions. The spread is usually ≥2.5 per cent for the USA. Thus, when long-term rates hover around 2%, short-term rates become negative nominal rates. A study by

Krishnamurthy and Vissing-Jorgensen (

2011) showed that the U.S. Federal’s quantitative easing dropped the long-term rates because the market anticipated lower future federal funds rates.

This paper is organized as follows: In

Section 2, we examine what negative interest rates really are; in

Section 3, we look at them from an investors’ view; in

Section 4, we look at them from the bankers’ view; in

Section 5, we look at them from the macro-policy view; in

Section 6, we discuss the theoretical basis to extricate the economy from the liquidity trap; and the case of Japan and

Section 6 presents our concluding remarks.

2. What Are Negative Interest Rates

Negative interest rates are a negative, nominal interest rate earned on any financial instrument. Negative interest rates are a reality in Japan, in at least five European countries, and used as a policy instrument by the European Central Bank (ECB).

Perhaps the example by

Mankiw (

2009) best explains what such a rate really means, “If you borrow

$100 at a –3% annual interest rate today, then you can well spend

$100 today but only owe

$97 a year from now.” In a way, then, this amounts to a “carry” tax on money, an idea that was first put forth by Silvio Gesell (

Gesell 1949) and considered approvingly by no less an authority than John Maynard Keynes. It was then expected to dissuade hoarding by currency holders but in the contemporary scene with hoarders of cash not knowing where to go, “how else can we explain the rise in stock prices at the time of stagnant wages and consumption? This may well discourage thrift.”

In essence, the bond buyer pays interest to the issuer of the bond. The depositor in a bank pays interest to the bank to keep their money on deposit in the bank. In effect, you are being paid to borrow someone else’s money, i.e., investors paying interest to the borrower. Translated, the buyer of a negative interest rate bond will never get the full value of the investment back. A mortgage borrower will, in effect, receive money from their loans instead of paying interest, as was witnessed in Denmark.

Historically, nominal interest rates have faced a zero lower bound which can only be breached through the taxation of paper money. Negative interest rates puncture this premise.

A negative real return on a financial asset can result when inflation exceeds even a positive nominal rate:

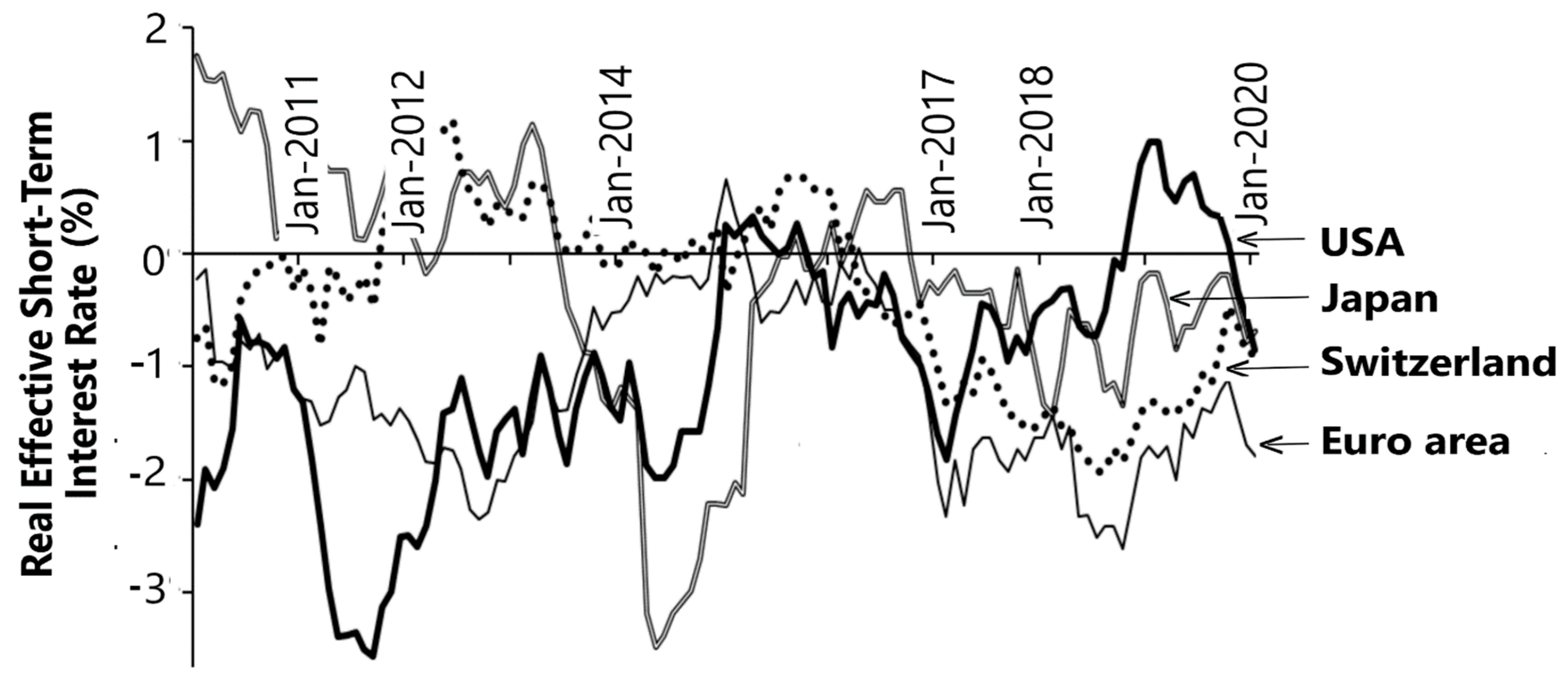

These real rates have been trending downwards in many developed countries, in the past decade.

Figure 1 shows the examples of Japan, Switzerland, the euro area, and the USA. Note, that the overall trend seems to have been upwards though the past decade in the USA, and for the past five years in the case of Japan. The data here show the short-term interest rates less the corresponding CPI (consumer price index) inflation rates. Demographics have contributed significantly to this downturn (

Carvalho et al. 2016), but the fact still remains that such negative rates can only hurt the income of the savers and pensioners whose increasing numbers are the main cause of economic slowdown in the developed economies in the first place. Also, as

Malkin and Nechio (

2012) have noted, the ECB determined rates ride over far greater disparities between the periphery and core parts of the Euro region than the disparities between different regions of the USA. Note further, that the USA is the only country shown in

Figure 1 where nominal short-term rates have remained positive.

This is not our main concern here because we are not dealing with traditional inflation, but rather with the possibility of deflation. After all, the simple logic behind negative nominal short-term rates is that if raising the short-term rate is the best tool for the central banks to combat inflation, then lowering the short-term rate would work just as well to combat deflation. The deflation factor could make the real yield on a negative coupon bond positive if it is high enough. This can affect economic growth and employment targets. The irony here is that savers in the country would be praying for the maximum negative inflation (deflation) so they would realize a positive rate of return on their savings.

The policy objective is to set interest rates very low, even negative, to discourage saving and encourage consumption, in the hope that the result is inflation caused by excess demand for goods and services. The effects on employment levels are expected to be positive.

The saver would earn a positive real rate if

The estimated size of the zero-coupon bond market, as of 2019, was USD 15 trillion. The ECB started the practice in 2014 by charging banks 0.4% to hold their cash overnight. By 2020, the Eurozone banks had paid 25 billion euros to the ECB (their central bank), since it cut rates below zero in June 2014.

3. An Investor’s View

Once negative interest rates are explained to a small investor the typical reaction is incredulity. Many seek the proverbial mattress or bought safety deposit boxes. Some decide to spend the money on goods and services. The intent of the policy is to spend money instead of saving it, or to lend it even at negative interest rates.

In Japan, the demand for large denomination yens and for family safes has gone sky high. Traditional savers have believed that saving (denying oneself current consumption) was a virtue and the interest income could be relied upon to supplement retirement income. Now the system is suddenly inverted.

The measures taken by savers to defend the value of their savings while assuming security and liquidity risks have contradicted the expectations of policy makers. They have siphoned money out of the banking system without spending it on consumption and cash has been the preferred asset for many. This did not produce the anticipated increase in economic growth. Paying money to banks (or accepting much lower rates on deposits) for holding your cash has ended up forcing banks to absorb some of the costs of funds (the tax represented by a negative interest rate in the federal funds market). Banks have needed to do this in order to retain their depositors.

Savers and investors in countries such as Sweden, Denmark, and Switzerland have seen their currencies fall in value as negative interest rates have encouraged them to invest elsewhere, where the returns are positive or significantly less negative.

Some investors act on their expectations. They view negative rates as the price of an insurance policy that transfers the protection of their money from a bank to the government. They bet that a positive return could ultimately result from a negative interest rate bond in a deflationary environment. They believe that if deflation takes hold and gets worse, they can actually make a capital gain on their investment. Some are betting that the currency in which the bond is denominated will likely rise producing a positive yield.

Those expecting doom decide that it is best to keep one’s assets with the government as the world falls apart. They fully understand that holding the bonds to maturity guarantees they will lose money, ceteris paribus.

The story of negative interest rates goes back to the 1970s and was decidedly linked to exchange rate volatility and the perceived safety of the Swiss banking system. The 1973 oil crisis led to a run on the dollar. Investors sought refuge in the Swiss franc. The flow of funds to Switzerland was massive enough to cause the Swiss franc to appreciate excessively. Swiss authorities imposed negative interest rates on non-domestic deposits in order to stem the flow. The rise in the Swiss franc produced a major decline in Swiss exports which had slowed economic growth, however, the financial flows continued at a much slower rate. Foreign depositors anticipated the rise in the value of the franc to more than make up for the negative interest rates on their deposits.

In short, negative interest rates were not instituted to expand the choices for savers. They were intended to force discipline on the financial sector and generate more lending. Sweden, faced with deflation, was the first to introduce what was then thought to be an unconventional monetary policy. It introduced negative interest rates to generate inflation and economic growth. It lowered its overnight deposit rate to –0.25% in July 2009. That move was later followed by the European Central Bank (ECB) almost five years later. The ECB lowered its deposit rate to –0.1% in June 2014. Governments could, consequently, continue using monetary policy to influence economic activity.

We now look at the view of bankers.

4. Banking and Negative Interest Rates

By May 2016, USD 8 trillion of government issued bonds were trading at negative interest rates, led by Japan (USD 5.6 trillion). These bonds are typically short-term maturity bonds, with a large and very liquid secondary market. They enjoyed full government guarantees.

The banking sector is one of the most regulated industries in the world. Banks are continuously monitored and are expected to abide by all regulations to maintain the safety and liquidity of the banking system. Banks are expected to manage risk within the prescribed methods even at the cost of lower, even negative returns. Holding reserves are always required.

Under Basel III and the solvency requirements, banks are discouraged from selling “bad” government bonds in the market. Many countries forbid the sale of negative interest bonds. Pension funds in Denmark, for example, are forbidden to deal with these bonds. Effectively, these bonds circulate within the financial system as banks use them to manage liquidity, meet regulatory reserve requirements, or use them as collateral or as a part of a more complicated financial arrangement such as swaps.

Central banks charge commercial banks to hold their cash overnight while offering premiums to those banks who are borrowing for the purpose of expanding their loan portfolios.

This is how negative interest rates are realized:

The central bank institutes a large-scale program of quantitative easing (printing money to buy debt obligations in the market). It is usually associated with buying long bonds to twist the yield curve.

The new money is deposited, theoretically, in banks. Those deposits constitute excess reserves held physically within the commercial bank, or on deposit, most likely, in the central bank.

A negative interest rate imposed by the central bank reduces excess reserves in principle. Banks could take the following actions, however:

- (a)

Accept the tax (the negative interest), thus, reducing profit margins (very unlikely);

- (b)

Pass the negative interest rate onto the depositors;

- (c)

Increase lending (or purchase assets). This eventually converts the excess reserves into required reserves, thus, eliminating the payment of a negative interest to the central bank. This was the intent of the policy. The net effects and costs will depend on what the borrower does with the money, i.e., keep it in the lending bank, transfer it to another bank, hold the money in cash, or simply invest the funds overseas.

It is clear, in this scenario, that negative interest rates are a tax on excess reserves. The genesis of this apparently illogical development is based on the following three factors:

Low inflation;

Weak economic growth;

The continuing belief by central bankers that monetary policy can still rescue economies no matter how far it must be stretched despite massive evidence to the contrary, as we show later. It appears that central bankers will do anything, contradictory as it may be, to get monetary policy to prevent deflation from taking hold.

In so doing, the central banks are pushing international investors out. The outflows have drastic effects on currency values, however, this is the policy objective.

5. The Macro Policy View

The intended consequences of negative rates are that there will be less saving and much more spending by consumers as negative interest rates discourage saving. Western economies depend on consumer spending to the tune of 65% of the GDP. Lower interest rates encourage the demand for loans and mortgages, thus, stimulating demand for housing starts and the purchase of cars and capital goods.

On the international level, an investor can realize a net positive return from the purchase of, say, a German government bond denominated in euros should the currency appreciate sufficiently.

The arbitrage in the foreign exchange (FOREX) market which influences spot exchange rates, as well as forward rates, may well be the full intent of the policy. Lower yen exchange rates, for example, allow Japan to make its products more competitive, and thus improve its current account and its economic performance. The dollar did fall in value against European currencies, however, the yen increased in value against the dollar. All of this can lead to competitive devaluation in the FOREX markets using interest rates as the trigger.

The manipulation of currency values takes place in many ways. In China, it is through the government Fiat. In Japan and other countries, it is realized through interest rate manipulations and often by dirty floats. Changing the international arbitrage margin between any two countries can have significant effects on the balance of payments. This is important for high export countries such as Japan where exports account for 12% of the GDP.

Domestic savers, however, may well decide to stay out of the game as they can be (and are) shifting to cash holdings, leaving the banking sector all together. This is not possible as the sums involved are massive. Even banks do not have large and secure warehouses for this cash level. Nevertheless, there was a massive level of purchases of safes in Japan and in Germany.

Furthermore, the government, as in the case of Japan, can allow or expect the central bank to purchase the bonds issued leaving the money supply unaffected. The Bank of Japan purchases about USD 722 billion a year in government bonds. It is noteworthy, however, that Japan’s largest lender, the Bank of Tokyo Mitsubishi UFJ, announced that it will no longer serve as a primary dealer of Japanese government bonds.

The central bank’s role in this universe is paramount. Its objective is achieved through the manipulation of the federal funds rate. The rate is determined by supply and demand in the interbank market as banks attempt to meet their reserve requirements. The federal rate is, then, transmitted throughout the economy to individual borrowers, industrial borrowers, etc. The rate is manipulated by the Federal Reserve Bank (Fed) which can print money to purchase government bonds through broker dealers. The sellers of the bonds are electronically credited through their deposit with the Fed.

Looking at negative interest rates from a government perspective, it appears that governments have found an effective tool for explicit taxation while allowing government spending to continue or even expand. They are constantly looking for new policy tools to dramatically change economic growth. Negative interest rates are an implicit tax on savers (to discourage saving and encourage consumption) with the government able to issue, what amounts to, a self-liquidating debt without any transfer payment to the saver (the buyer of the bonds). This will add to the debt nominally while indeed subtracting from the debt as negative interest rates reduce its value by the annual interest as it travels toward maturity.

This new form of taxation could explain why the Japanese government announced that the increase in sales taxes from 8% to 10% scheduled for October 2015 was postponed to October 2019. This is a recognition that the Japanese taxpayers are saturated with explicit taxes and that more flexibility exists on the monetary side.

The following are some of the issues that arise in the context of negative interest rates:

Bank stock values are likely to be negatively impacted, as margins shrink and as they are forced to keep reserves at negative interest rates.

Companies and households may not need to borrow. Reducing the standards for borrowers will be a repetition of the 2008 crisis. Many companies are flush with cash but may decide to borrow simply because the cost of funds is low. Look at Apple (almost USD 200 billion in cash reserves), Google, and many oil companies, despite falling oil prices. The cost of funds, however, is only one element in the decision to invest. There may be a shortage of ideas and with entrepreneurs, or excessive government intrusion of the private sector through regulations that dampen investments and employment.

Hoarding cash can indeed become a pattern. The Japanese demand for high denomination currency and for safe vaults has skyrocketed, as was pointed out earlier. Some countries such as France are putting limits on cash transactions in order to track transactions that may be suspect. Some are already speaking about eliminating currencies altogether.

Storing money is costly and risky. Nevertheless, the implicit rate on cash (zero) may well be worth the risk given the financial markets reality. This is another risk/return tradeoff for cash holders as follows:

Bank depositors are closing accounts and shifting funds overseas.

The duration of bond portfolios (a measure of when the investor gets their money back and a measure of the price volatility of the bond given a change in interest rates, i.e., dp/p = −(dk/k)) become higher and more difficult to calculate, as it is presumed in the traditional equation that the investor receives the face value of the bond upon maturity. The risk of long-term bonds is much higher as with negative interest rates one may never get their money back

Competition among nations in the interest rate domain may well lead to currency wars as the limits of interest rate changes are tested.

Interest rates the world over have been persistently declining for over 30 years now, plausibly reflecting the industrial world’s maturing economies and aging populations (e.g.,

Hördahl et al. 2016). Some argue, therefore, that the trend towards negative nominal rates is natural.

Hannoun (

2015) argued that a monetary stimulus, such as a near-zero to negative rate, lifts short-term growth as follows:

boosting credit to the real economy;

lifting asset prices;

forcing investors away from safe assets towards riskier ones;

lowering the exchange rate;

nudging inflation upwards so as to avert a prospective deflationary spiral.

Goodfriend (

2000) and

Buiter and Panigirtzoglou (

2003) have argued that the zero bound on nominal interest rates can be overcome by introducing the “carry tax”.

Krugman (

1999) suggested that, upon reaching the zero bound of interest rates, the inflation targeting by central banks should seek to turn the real interest rate negative.

Recently, the former Fed Chair, Ben Bernanke, discussed this issue of negative interest rates and related matters. In a series of posts in Ben Bernanke’s blogs on Brookings.edu (

Bernanke 2016) he argued that “Reducing the nominal federal funds rate to –0.5% in September 2011 would have lowered the real federal funds rate to –4.3% instead of the then existing –3.8%”. But he doubted if this extra stimulus of about two extra quarter-point rate cuts in the normal times would have really made any difference.

Stiglitz (

2016) has been even less sanguine on this issue. Writing in the British newspaper, The Guardian, he argued that “in none of the economies attempting the unorthodox experiment of negative interest rates has there been a return to growth and full employment”.

Hannoun’s optimistic forecasts have failed to materialize confirming Stiglitz’s and Bernanke’s view that negative interest rates have little or no consequence. But a recent rigorous analytical study of negative interest rates by

Eggertsson et al. (

2017) that included money storage costs and central bank reserves, showed that their negative effect on bank profits could make negative policy rates potentially contractionary. In contrast,

Altavilla et al. (

2019) have argued against any adverse effects of such rate cuts on the monetary policy.

6. Extricating from the Liquidity Trap: The Case of Japan

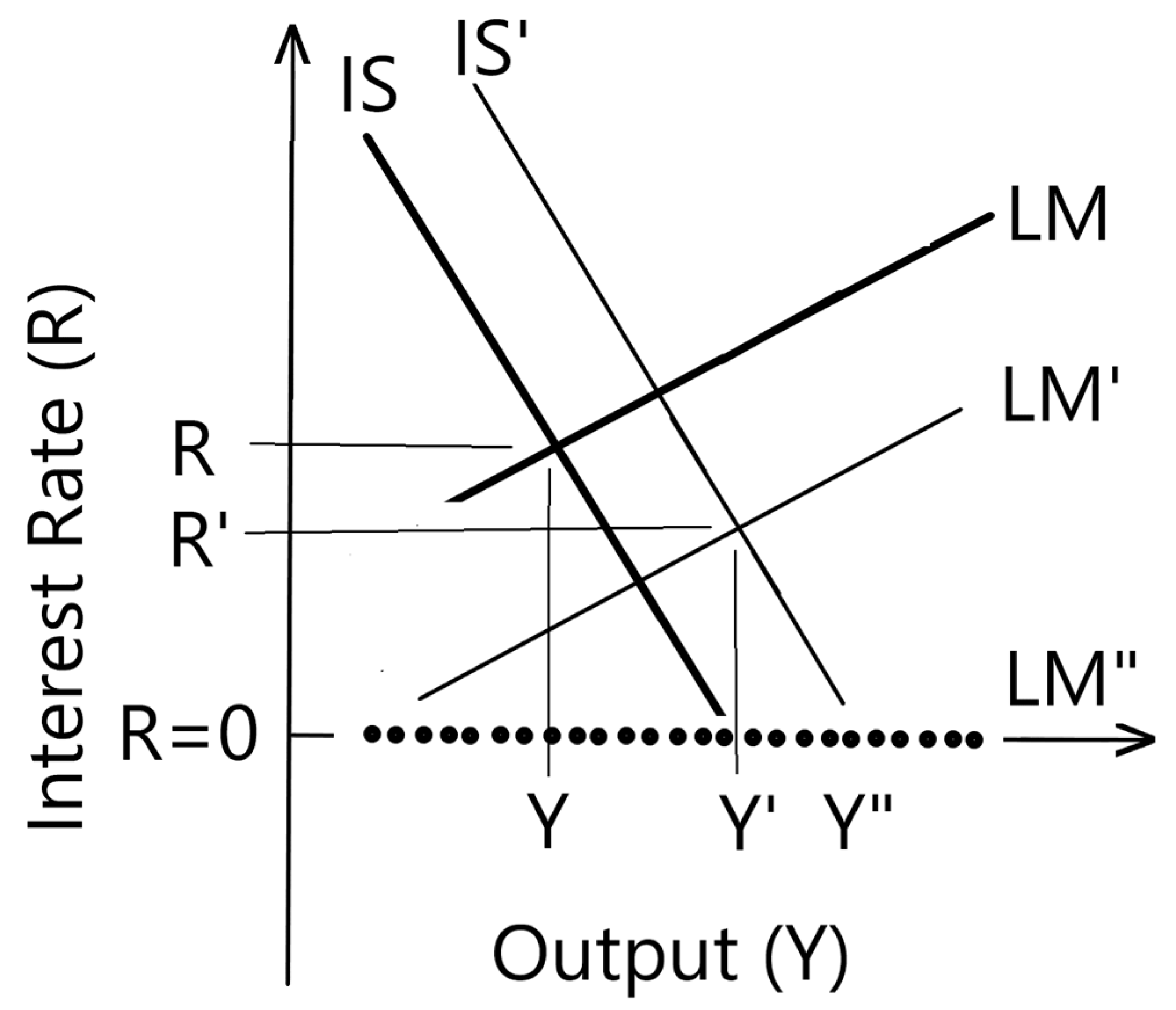

Japan’s recent efforts to extricate its economy from a liquidity trap suggest that remediation may well be possible. Conceptually, we can look here at the Keynesian IS-LM model to understand how interest rates (R) and output (Y) relate to one another. This model is schematically illustrated in

Figure 2 below. Here, IS denotes investments, i.e., savings, and LM the liquidity preference, money supply. As shown here, monetary expansion, brought about by the lowering of the interest rate from the initial level R, shifts the LM curve to LM’ and raises the output Y. Likewise, the effect of fiscal intervention, for example, by way of the government’s increased deficit spending, is to shift the IS curve to the right, towards IS’ here. This corresponds to increased output. Combining the two steps, the shifts in the LM curve to LM’ and the IS curve to IS’, produce a lower equilibrium interest rate ( R to R’) and raises the output from Y to Y’. The liquidity trap occurs when R ≤ 0 and the LM curve becomes horizontal, as LM”. Any changes in the interest rates, then, have no effect on output or, in other words, interest rates are an ineffective tool to change output.

Returning now to the case of Japan, note that most of the developed economies since the Great Recession of 2008 have been effectively mired in the liquidity trap, as

Bernanke et al. (

2019), who were the three Americans most intimately involved in helping the world through that crisis, have aptly described. Japan invites the most attention here, partly because the Japanese economy has been caught in a prolonged liquidity trap, and partly because of Abenomics, i.e., Prime Minister Shinzo Abe’s three-pronged strategy that combines fiscal expansion, monetary easing, and structural reform to extricate the Japanese economy from that trap. The results so far have been mixed. After suffering from over two decades of deflation, Japan has registered, since 2012, its longest period of meager economic expansion, with record corporate profits, record low unemployment rates, and robust female participation in the labor force. Jubilation would be premature, however, because Japan’s output gap has shrunk from –3.7 percent in 2012 to –0.3 percent in 2018. But there is little chance of a rise in inflation, and therefore interest rates.

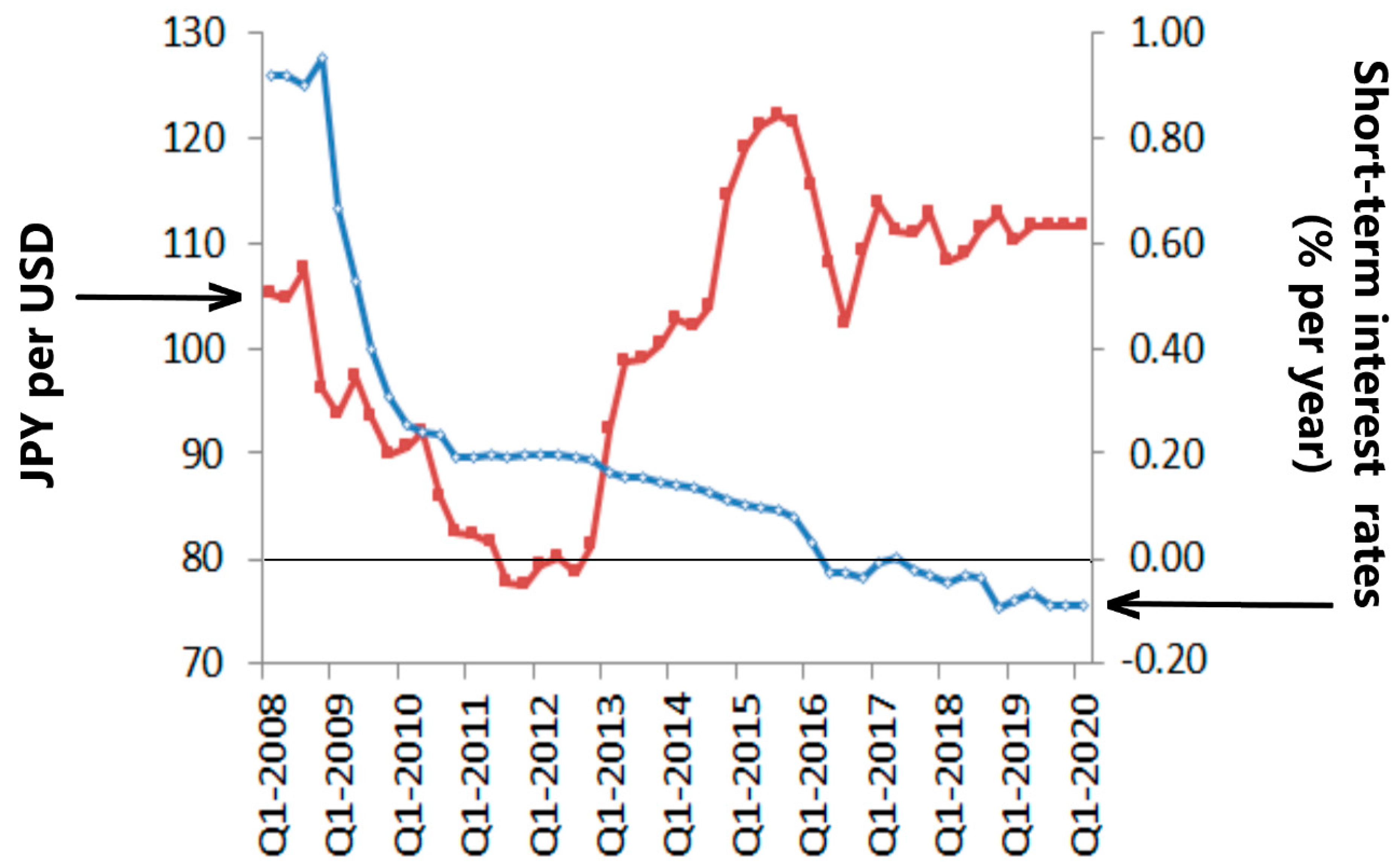

A cursory look at

Figure 3 shows that as interest rates fell and became negative in Japan, the exchange rate stabilized. This can be partially explained by the large trade surplus in Japan, however, the GDP growth in Japan has been stuck at about 0.5% for the last two years. In fact, the GDP growth in Japan was negative in the third and fourth quarters of 2015 and in the first and third quarters of 2018. Japan reported a negative growth rate in the last quarter of 2019 as well.

7. Concluding Remarks

Negative interest rates illustrate the limits of monetary policy and an extreme attempt to rescue the economy (prevent a recession) at the expense of retirees who have spent their working years saving for retirement assuming that interest rates would always be positive in nominal and real terms, giving them additional income in their retirement.

Negative interest rates, thus, constitute a hidden tax on savers (

Waller 2016).

Negative interest rates have had the exact opposite effects to those intended by policy makers. Swiss businesses hoarded cash and invested less. The Japanese yen rose by 15% in the first nine months of 2016 against the US dollar instead of falling as was anticipated. Saving rates in Denmark and Sweden rose. And saving rates even in the United Sates rose to 5.7% in 2016, up from 4.6% in 2013, and 2.5% in 2007. Faced with the new realities, central banks began to use “forward guidance”, i.e., announcing publicly how interest rates will be set in the future thus manipulating the public’s expectations about future short-term rates. This will have direct effects on long term rates. Additionally, as

Maddaloni and Peydró (

2011) have shown that low short-term rates soften lending standards and economies with such afflictions find it hard to recover when a financial crisis strikes.

Similarly, in a recent article,

Blundell-Wignall (

2020) argues that “quantitative easing (QE) policies have been pushed to extremes and extended well beyond their use-by dates to little plausible effect in achieving the goal of raising inflation and growth” and have hence added “to the risk of financial crises in the future and taking pressure off policy-makers to deal with the real causes of poor investment, growth and deflation pressure”. The recent analysis of economic development and inflation by

de Carvalho et al. (

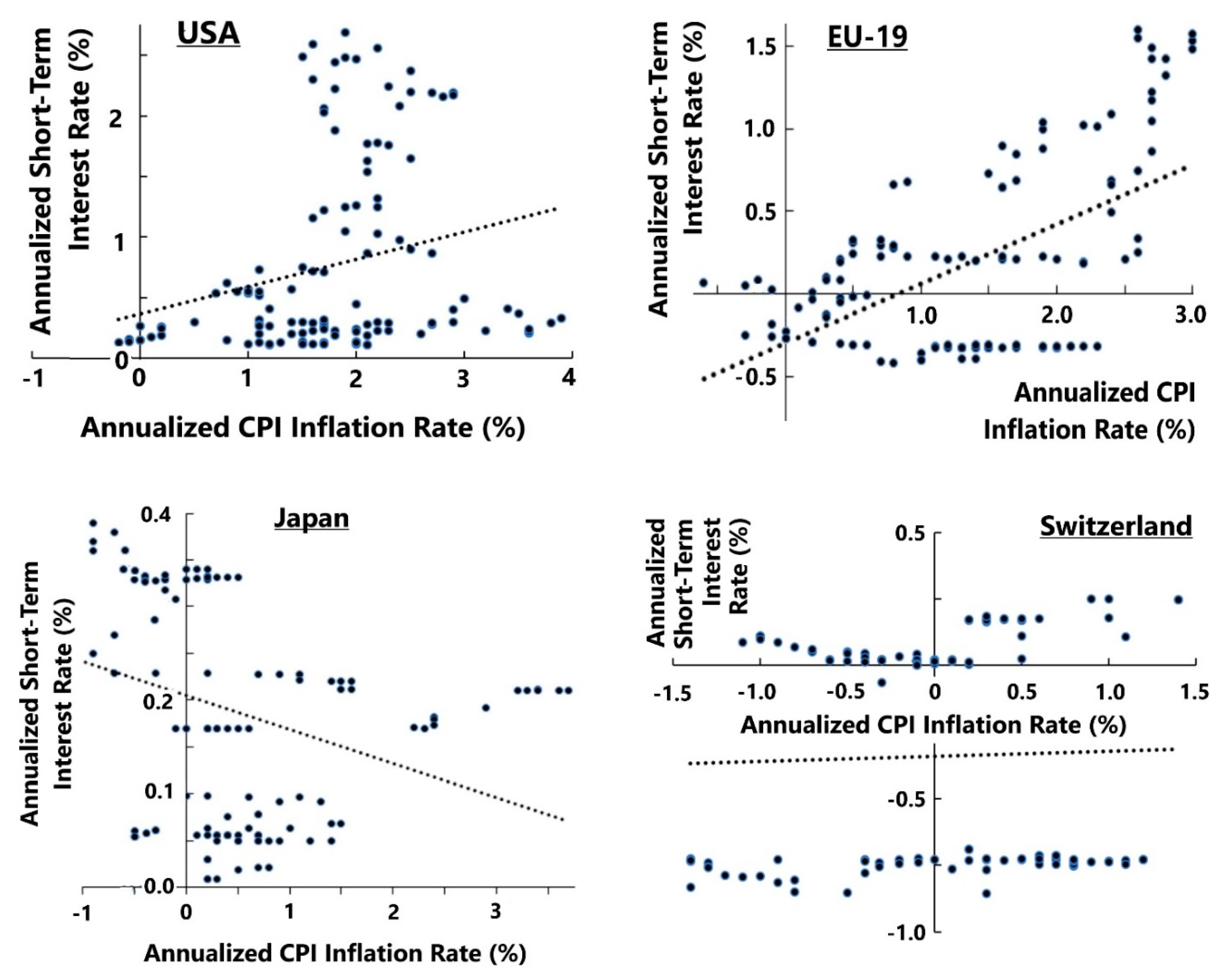

2018) also found that inflation control is not simply a matter of the central bank’s credibility and control. This is also what we notice in

Figure 4 which shows a comparison of the quarterly inflation and short-term interest rate data for the four economies that we considered earlier in

Figure 1. These four economies are all from the economically developed world typically characterized by low inflation levels. Note here that the U.S. and EU data show a slight positive relationship between inflation and interest rates, the Japanese data indicate a negative relationship, whereas the Swiss data show no discernible relationship, however, none of the relationships are statistically significant. This is reminiscent of

Lin and Ye’s (

2007) detailed study on the use of monetary policy for inflation targeting in industrially advanced economies. They found the average treatment effects of inflation targeting on inflation and inflation variability to be quantitatively small and statistically insignificant.

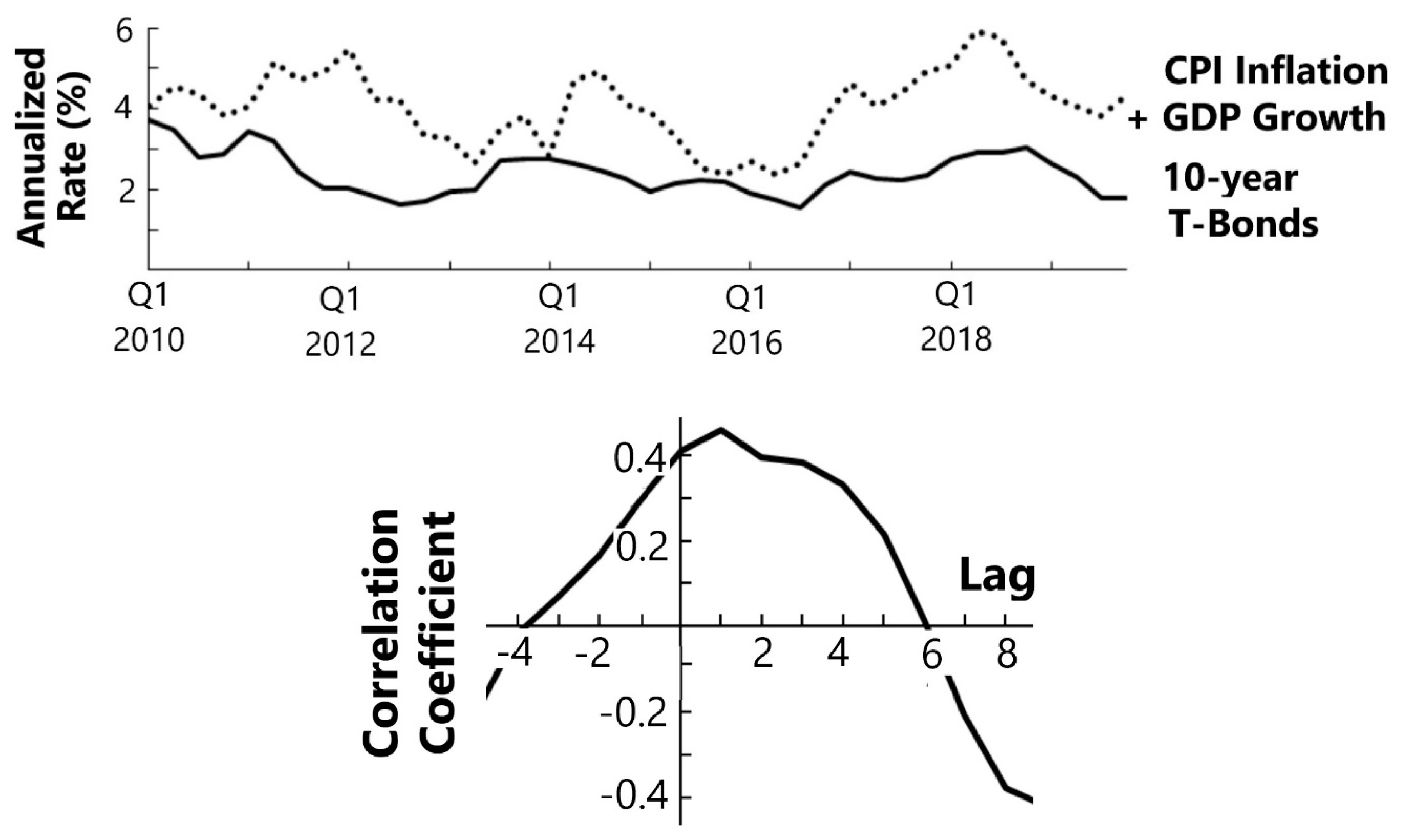

This leads to

Damodaran’s (

2016) findings that, as for the US, the Fed has little effect on forcing the rates to either become or remain low to ultra-low. He tracked the historical data on the federal funds rate with the sum of two proxy numbers, i.e., actual inflation rate and real growth rate, which are the numbers that add up to what the central bank needs to target to subdue inflation and foster economic growth. He found that the federal fund rates lag his proxy interest rate. The top panel in

Figure 5 updates Damodaran’s analysis for the 2010 Quarter 1 to 2019 Quarter 4 period and shows on the bottom right the result of cross-correlation analysis of the two time series data. Note that the maximum correlation here does not occur at the 0 lag that would signal instantaneous response of interest rates to the market’s needs. Instead, the federal fund rate follows the market’s needs by one quarter.

These are perhaps the kindest words we can use here. Central bankers watched rates move from low to negative interest rates driven by market forces. Central banks may as well have dropped money from helicopters if the supply of money matters that much. Alternatively, the Treasury departments in developed countries might consider tax rates, government spending and regulations imposed on business, productivity rates, the rate of innovation, etc. as solutions to the current global economic malaise. As

Maddaloni and Peydró (

2011) from their study of the Euro-area and the US bank lending standards, low (monetary policy) short-term interest rates soften standards for household and corporate loans, weak supervision for bank capital, and low monetary policy rates for an extended period.

It is not surprising that, as the Financial Times reported on February 19, 2020, Sweden has now “called a halt to its five-year trial with negative rates”, clearly reflecting Riksbank’s realization that rate cuts into the negative territory are increasingly ineffective. This is what

Eggertsson et al. (

2017) and

Eggertsson and Summers (

2019) discussed earlier.

Heider et al. (

2019) have also argued, albeit in the context of the European Central Bank’s negative policy rates, that this policy “leads to more risk taking and less lending by the banks with greater reliance on deposit funding”. Contrast these with the view of

Altavilla et al. (

2019) that zero lower bound has no adverse effect on the conventional monetary policy. Our above presentation favors the view of

Eggertsson and Summers (

2019) to understand the underlying reasons for the Swedish action.