Corporate Green Bond Issuances: An International Evidence

Abstract

1. Introduction

2. Literature Review

2.1. Issuances Effect on Bond Market

2.2. Green Bond Market

3. Data and Variables

3.1. Green Bond Data

Data Aggregation

3.2. Firm-Level Data

3.3. Descriptive Statistics

4. Model and Results

4.1. Event Study Methodology

4.2. Event Study Results

5. Additional Analysis and Robustness Tests

6. Conclusions and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Definitions and Sources of Variables

Appendix A.1. Overview of the Different Green Bond Data Sources

- -

- Announcement date: date on which the bond issue was officially announced by the issuer in the financial market platforms (e.g., Bloomberg),

- -

- Issuance date: date on which the bond has been issued on the primary bond market,

- -

- Maturity type: nature of the maturity of the bond determined by the issuer,

- -

- Maturity date: date on which the principal of the bond becomes due and is repaid to the bondholder,

- -

- Amount issued: amount of money raised by the issuer in the primary market through the bond issuance,

- -

- Amount issued (USD equivalent): amount of money raised by the entity in the primary market through the bond issuance, expressed in USD with the exchange rate at the time of the issuance,

- -

- Coupon: annual coupon payments paid by the issuer relative to the bond’s face or par value,

- -

- Currency: currency used by the issuer to raise funds on the primary market.

Appendix A.2. Financial Characteristics

- -

- Issuer name: name of the entity that issued the Green Bond,

- -

- Issuer type: nature of the issuer (it can be either a non-financial corporate, a financial institution or a SSA (Sovereign, Supranational and Agencies),

- -

- Sector and sub-sector: sector and sub-sector (if relevant) to which the issuer belongs, according to Bloomberg’s categorization,

- -

- Credit rating: rating that a rating agency assigns to a borrower after assessing its ability to repay the principal and interest on any or all of its debts,

- -

- Issuer’s country: country to which the issuer belongs, identified with its Alpha-2 code, a two-letters country code defined by the International Organization for Standardization (ISO).

Appendix A.3. Extra-Financials Characteristics

- o Green Bond Framework: public document, released at the time of the issuance by the issuer, disclosing what are the expected use of proceeds, process for project selection and evaluation, management of proceeds and way of reporting. The framework also contains other relevant information related to the issuance or the issuer, such as the review from a second party opinion and/or a third-party verification, the sustainability objectives and practices of the issuer, some examples of potential projects to be financed, etc. This document is mandatory in respect of the ICMA’s Green Bond Principles.

- o Second Opinion Report: public document, released at the time of the issuance by the issuer itself or the entity that realized the second opinion, that certify the compliance of the issuer’s framework with the ICMA’s Green Bond Principles. Such document is usually realized through a collaborative work between the issuer and an entity specialized on ESG and/or environmental analysis. This document is mandatory in respect of the ICMA’s Green Bond Principles.

- o Investor Presentation: public or private document, released by the issuer before the time of the issuance and (usually) to potential investors, presenting both financial and extra-financial relevant information associated with the entity’s activity and the upcoming bond issuance. This document is encouraged to be disclosed in respect of the ICMA’s Green Bond Principles but is not mandatory.

- o Green Bond Reporting: public document, released periodically (usually annually at the Green Bond issuance birthday) by the issuer, to report to investors on the allocation and on the environmental impact of the use of proceeds. This document is mandatory in respect of the ICMA’s Green Bond Principles.

- o Environmental Impact Calculation Methodology: public or private document, usually incorporated into the Green Bond reporting, released by the issuer into which it explains how the environmental impact of the use of proceeds has been calculated. This document is encouraged but not mandatory in respect of the ICMA’s Green Bond Principles.

References

- Agliardi, Elettra, and Rossella Agliardi. 2019. Financing environmentally-sustainable projects with green bonds. Environment and Development Economics 24: 608–23. [Google Scholar] [CrossRef]

- Ammann, Manuel, Martin Fehr, and Ralf Seiz. 2004. New Evidence on the Announcement Effect of Convertible and Exchangeable Bonds. Academic Journal of Multinational Financial Management 16: 43–63. [Google Scholar] [CrossRef]

- Baker, Malcolm, Daniel Bergstresser, George Serafeim, and Jeffrey Wurgler. 2018. Financing the Response to Climate Change: The Pricing and Ownership of U.S Green Bonds. Rochester: SSRN. [Google Scholar]

- Carhart, Mark. 1997. On Persistence in Mutual Fund Performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Dann, Larry Y., and Wayne H. Mikkelson. 1984. Convertible Debt Issuance, Capital Structure Change and Financing-Related Information: Some New Evidence. Journal of Financial Economics 13: 157–86. [Google Scholar] [CrossRef]

- de Roon, Frans, and Chris Veld. 1995. Announcement Effects of Convertible Bond Loans and Warrant-Bond Loans: An Empirical Analysis for the Dutch Market. Journal of Banking and Finance 22: 1485–506. [Google Scholar] [CrossRef]

- Dupont, Carolyn, James Levitt, and Linda Bilmes. 2015. Green Bonds and Land Conservation: The Evolution of a New Financing Tool. Rochester: SSRN. [Google Scholar]

- Fama, Eugene Francis, and Kenneth French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fatemi, Ali, and Iraj Fooladi. 2013. Sustainable finance: A new paradigm. Global Finance Journal 24: 101–13. [Google Scholar] [CrossRef]

- Flammer, Carolyn. 2018. Corporate Green Bonds. Rochester: SSRN. [Google Scholar]

- Glavas, Dejean, and Franck Bancel. 2018. Are Agency Problems a Determinant of Green Bond Issuance? Munich: Munich Personal RePEc Archive. [Google Scholar]

- Hachenberg, Britta, and Dirk Schierech. 2018. Are Green Bonds Priced Differently from Conventional bonds? Journal of Asset Management 19: 371–83. [Google Scholar] [CrossRef]

- Hemmingson, Carl, and Robert Ydenius. 2017. The Convertible Bond Announcement Effect: An Event Study on the Nordic Markets. Rochester: SSRN. [Google Scholar]

- Karpf, Andreas, and Antoine Mandel. 2017. Does It Pay to Be Green? Rochester: SSRN. [Google Scholar]

- Karpf, Andreas, and Antoine Mandel. 2018. The changing value of the “green” label on the US municipal bond market. Nature Climate Change 8: 161–65. [Google Scholar] [CrossRef]

- Katori, Tsuyoshi. 2018. The Financial Potential of Green Bonds: Comparing the Three Issuing Schemes. Rochester: SSRN. [Google Scholar]

- Kila, Kikelomo. 2019. Green Bonds and the Role of the Financial Sector in Tackling Global Climate Change. Rochester: SSRN. [Google Scholar]

- Larcker, David, and Edward Watts. 2019. Where’s the Greenium? Working Paper. Stanford: Stanford University. [Google Scholar]

- Park, Stephen. 2018. Investors as regulators: Green Bonds and the governance challenges of the sustainable finance revolution. Standford Journal of International Law 54: 1. [Google Scholar]

- Partridge, Candace, and Francesca Romana Medda. 2018. The Creation and Benchmarking of a Green Municipal Bond Index. Rochester: SSRN. [Google Scholar]

- Reed, Patrick, Roca Cort, and Logan Yonavjak. 2017. Data-Driven Green Bond Ratings: A Market Catalyst. Journal of Investing. Forthcoming. [Google Scholar]

- Revelli, Christophe, and Bernard Paranque. 2017. Ethico-Economic Analysis of Impact Finance: The Case of Green Bonds. Rochester: SSRN. [Google Scholar]

- Rose, Paul. 2018. Certifying the ‘Climate’ in Climate Bonds. Rochester: SSRN. [Google Scholar]

- Sze, Chin Kim, and Abdullah Nur Adiana Hiau. 2013. Announcements Effect of Corporate Bond Issuance and Its Determinants. Warsaw: Contemporary Economics. [Google Scholar]

- Tang, Dragon Yongjun, and Yupu Zhang. 2018. Do Shareholders Benefit from Green Bonds? Rochester: SSRN. [Google Scholar]

- Wulandari, Febi, Dorothea Schaefer, Andreas Stephan, and Chen Sun. 2018. Liquidity Risk and Yield Spreads of Green Bonds. DIW Berlin Discussion Paper No. 1728. Kiel: ZWB Leibniz-Informationszentrum Wirtschaft, Leibniz Information Centre for Economics. [Google Scholar]

- Zerbib, Olivier David. 2019. The Effect of Pro-Environmental Preferences on Bond Prices: Evidence from green Bonds. Journal of Banking and Finance 98: 39–60. [Google Scholar] [CrossRef]

| 1 | |

| 2 | We identified 20 sustainable bonds into the final sample and removed them to keep only pure Green Bonds. |

| 3 | Our sample of green bonds is quite large since, as mentioned above, we took advantage of access to a more comprehensive number of databases relative to the commonly-used ones to trace green bond issues. For example, the obtained merged dataset of Tang and Zhang (2018) includes 1510 green bonds relative to 2079 in our study. |

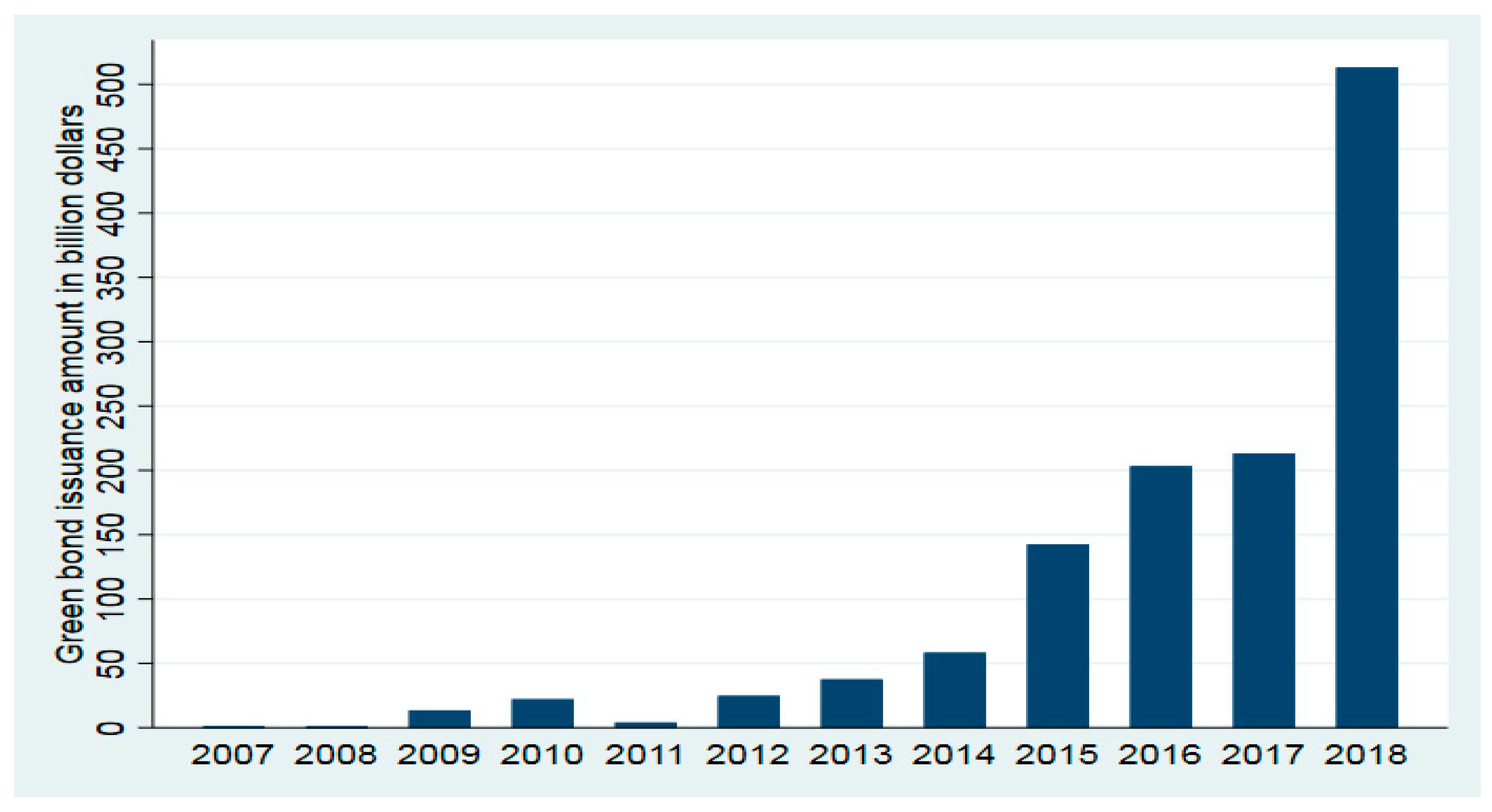

| 4 | The great surge in the green bond market is due to both the release of the ICMA’s Green Bond Principles, which helped define a strong market standard used by issuers and investors, and the entry of financial and non-financial corporations. Such corporations accounted for about 80% of the total number of issued green bonds in 2017 as opposed to less than 20% in 2010. These statistics are based on our total sample of green bonds. |

| 5 | To identify publicly-listed issuers, we first selected those that are listed in a stock exchange. For the remaining issuers, we checked whether their parent company is publicly-listed. |

| 6 | If the stock is listed in the same country where the green bond has been issued, we considered the leading stock market index of the issuance country. Otherwise, we considered the leading stock market index of the country in which the stock is listed. |

| 7 | The decrease in the number of events from 476 to 475 is due to the fact that, for one green bond issuer, the security data are not available until 1 day after the event date. |

| Panel A. Green Bonds by Country | ||

| Country | Full Sample | # of Bonds Issued by Public Issuers |

| SNAT | 348 | N.A. |

| China | 677 | 173 |

| France | 191 | 119 |

| Japan | 46 | 29 |

| United States | 164 | 27 |

| Sweden | 197 | 26 |

| India | 34 | 13 |

| Spain | 23 | 10 |

| Australia | 20 | 8 |

| Brazil | 13 | 8 |

| Taiwan | 13 | 8 |

| Norway | 31 | 7 |

| Canada | 31 | 4 |

| Hong Kong | 13 | 4 |

| Italy | 13 | 4 |

| The Netherlands | 37 | 4 |

| New Zealand | 5 | 4 |

| Austria | 5 | 3 |

| Germany | 50 | 3 |

| United Kingdom | 17 | 3 |

| Korea | 16 | 3 |

| Mexico | 11 | 3 |

| South Africa | 4 | 3 |

| Belgium | 4 | 2 |

| Denmark | 7 | 2 |

| United Arab Emirates | 1 | 1 |

| Switzerland | 7 | 1 |

| Finland | 11 | 1 |

| Greece | 1 | 1 |

| Turkey | 1 | 1 |

| Others | 37 | 0 |

| Total | 2079 | 475 |

| Panel B. Green Bonds by Industry | ||

| Industry | Amount for the Full Sample ($B) | Amount for the Public Issuers’ Sample ($B) |

| Government | 686.119 | |

| Municipal | 62.2863 | |

| Multi-National | 373.3085 | |

| Sovereign | 79.2216 | |

| Regional (state/province) | 171.3026 | |

| Financial | 236.823 | 89.161 |

| Banks | 210.477 | |

| Investment Companies | 1.721 | 79.707 |

| REITS | 6.572 | 4.283 |

| Insurance | 1.117 | 1.117 |

| Private Equity | 0.798 | |

| Diversified Financial Services | 5.265 | 1.043 |

| Industrial | 225.710 | 182.673 |

| Environmental Control | 3.406 | 0.531 |

| Packaging and Containers | 0.037 | 0.037 |

| Machinery-Diversified | 0.200 | |

| Electronics | 0.300 | 0.300 |

| Electrical Components and Equipment | 1.026 | 0.337 |

| Transportation | 193.809 | 180.152 |

| Miscellaneous Manufacturing | 0.248 | 0.030 |

| Engineering and Construction | 26.535 | 1.136 |

| Metal Fabricate/Hardware | 0.149 | 0.149 |

| Utilities | 99.541 | |

| Water | 3.827 | |

| Electric | 95.023 | |

| Gas | 0.691 | |

| Energy | 17.944 | 6.895 |

| Energy-Alternate Sources | 12.947 | 3.465 |

| Oil and Gas | 0.742 | 0.089 |

| Coal | 4.255 | 3.341 |

| Consumer, Non-cyclical | 8.550 | 1.124 |

| Agriculture | 0.119 | |

| Healthcare-Services | 0.689 | |

| Commercial Services | 6.409 | |

| Food | 1.171 | 1.124 |

| Cosmetics/Personal Care | 0.161 | |

| Basic Materials | 5.777 | 2.972 |

| Iron/Steel | 0.242 | 0.104 |

| Forest Products and Paper | 5.536 | 2.868 |

| Consumer, Cyclical | 4.348 | 3.017 |

| Home Furnishings | 0.107 | |

| Airlines | 0.089 | 0.089 |

| Textiles | 0.097 | 0.097 |

| Home Builders | 0.980 | 0.980 |

| Retail | 0.089 | 0.089 |

| Distribution/Wholesale | 0.045 | 0.045 |

| Auto Manufacturers | 2.939 | 1.716 |

| Technology | 2.589 | 2.589 |

| Computers | 2.589 | 2.589 |

| Communications | 2.182 | |

| Telecommunications | 2.182 | |

| Diversified | 0.373 | |

| Holding companies divers | 0.373 | |

| Panel A. Bond Characteristics | ||||||

| Mean | Median | STD | Min | Max | N | |

| All green bonds | ||||||

| Coupon (percent) | 3.307 | 3.422 | 2.145 | −0.070 | 15.5 | 2062 |

| Maturity (year) | 6.878 | 5 | 4.638 | 1 | 60 | 2039 |

| Amount (million$) | 619 | 149 | 3460 | 0.01 | 142,000 | 2079 |

| Public issuers’ green bonds | ||||||

| Coupon (percent) | 3.624 | 3.855 | 2.266 | 0 | 15.5 | 466 |

| Maturity (year) | 6.259 | 5 | 3.478 | 1 | 30 | 467 |

| Amount (million) | 658 | 179 | 885 | 0.095 | 4470 | 475 |

| Panel B. Firm Characteristics | ||||||

| Variables Names | Mean | Median | STD | Min | Max | N |

| Size | 12.298 | 12.399 | 2.561 | 6.411 | 19.556 | 138 |

| Leverage | 0.347 | 0.331 | 0.197 | 0.018 | 0.839 | 131 |

| ROA | 0.056 | 0.054 | 0.041 | −0.147 | 0.215 | 134 |

| TobinQ | 1.151 | 1.010 | 0.756 | 0.622 | 13.287 | 137 |

| MTB | 1.583 | 1.054 | 2.885 | 0.042 | 37.395 | 137 |

| Tangibility | 0.297 | 0.144 | 0.330 | 0.0004 | 1.075 | 115 |

| Loss | 0.007 | 0 | 0.086 | 0 | 1 | 134 |

| Age | 23.164 | 17 | 18.214 | 1 | 69 | 67 |

| Panel A. CAPM Model | ||||

| Event Time | CAR | T-Statistic | T-Sign | Nb. of Events |

| [−20, 20] | −0.019867 ** | −2.31450 | −2.416 | 476 |

| [−5, 5] | −0.005821007 | −1.57239 | −2.052 | 476 |

| [−3, 3] | −0.00361935 | −1.29487 | −1.596 | 476 |

| [−1, 1] | −0.003317903 ** | −2.24850 | −1.596 | 476 |

| [0, 1] | −0.005497024 ** | −2.26048 | −2.781 | 4757 |

| Panel B. Fama and French 3-Factor Model | ||||

| Event Time | CAR | T-Statistic | T-Sign | Nb. of Events |

| [−20, 20] | −0.011333 | −1.50595 | −1.505 | 476 |

| [−5, 5] | −0.002768966 | −0.78462 | −1.049 | 476 |

| [−3, 3] | −0.002740928 | −0.99945 | −0.866 | 476 |

| [−1, 1] | −0.002193704 | −1.44537 | −1.687 | 476 |

| [0, 1] | −0.001956103 | −1.58730 | −2.234 | 475 |

| Panel C. Carhart 4-Factor Model | ||||

| Event Time | CAR | T-Statistic | T-Sign | Nb. of Events |

| [−20, 20] | −0.015206 | −1.83223 | −1.687 | 476 |

| [−5, 5] | −0.00424799 | −1.13864 | −0.593 | 476 |

| [−3, 3] | −0.003435731 | −1.17983 | −0.228 | 476 |

| [−1, 1] | −0.003305522 | −1.81886 | −0.501 | 476 |

| [0, 1] | −0.002663986 * | −1.87312 | −1.687 | 475 |

| Panel A. First-Time vs. Subsequent Issues | ||||||

| First-Time Issues | Subsequent Issues | |||||

| CAR | T-statistic | T-sign | CAR | T-statistic | T-sign | |

| CAPM_CAR | −0.0040104 ** | −2.10324 | −1.897 | −0.001692872 | −1.18377 | −2.027 |

| Observations | 145 | 330 | ||||

| FF3_CAR | −0.00409096 * | −2.01943454 | −1.732 | −0.00101805 | −0.66391258 | −1.479 |

| Observations | 145 | 330 | ||||

| Carhart_CAR | −0.0066863 ** | −2.22176705 | −1.237 | −0.00089659 | −0.57614642 | −1.151 |

| Observations | 145 | 330 | ||||

| Panel B. Developed vs. Emerging Markets | ||||||

| Developed Markets | Emerging Markets | |||||

| CAR | T-Statistic | T-Sign | CAR | T-Statistic | T-Sign | |

| CAPM_CAR | −0.003737 *** | −2.87087 | −2.560 | −0.00002293 | −0.01041771 | −1.147 |

| Observations | 304 | 171 | ||||

| FF3_CAR | −0.0030181 ** | −2.23464787 | −1.763 | −0.00006799 | −0.0278764 | −1.300 |

| Observations | 304 | 171 | ||||

| Carhart_CAR | −0.0039601 ** | −2.28320298 | −2.219 | −0.000359677 | −0.145812474 | 0.229 |

| Observations | 304 | 171 | ||||

| Panel C. Corporate vs. Financials | ||||||

| Financials | Corporate | |||||

| CAR | T-Statistic | T-Sign | CAR | T-Statistic | T-Sign | |

| CAPM_CAR | −0.0033980 ** | −2.07315 | −1.651 | −0.00246644 | −1.18979287 | −2.232 |

| Observations | 248 | 227 | ||||

| FF3_CAR | −0.0018248 | −1.57094675 | −1.524 | −0.0020994 | −0.93391138 | −1.576 |

| Observations | 248 | 227 | ||||

| Carhart_CAR | −0.001817879 | −1.54027974 | −1.397 | −0.003588366 | −1.336693404 | −0.919 |

| Observations | 248 | 227 | ||||

| Variables | CAR |

|---|---|

| ROA | 0.182 |

| (0.29) | |

| LEVERAGE | 0.142 * |

| (1.86) | |

| MARKET_VALUE | 0.000 |

| (0.22) | |

| MTB | 0.006 *** |

| (3.36) | |

| SALES_GROWTH | 0.040 ** |

| (2.13) | |

| TANGIBLE | −0.003 |

| (0.15) | |

| Intercept | −0.023 |

| (1.22) | |

| Year fixed effects | Yes |

| Industry fixed effects | Yes |

| Firm fixed effects | Yes |

| Country fixed effects | Yes |

| Observations | 411 |

| Adjusted R2 | 0.08 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lebelle, M.; Lajili Jarjir, S.; Sassi, S. Corporate Green Bond Issuances: An International Evidence. J. Risk Financial Manag. 2020, 13, 25. https://doi.org/10.3390/jrfm13020025

Lebelle M, Lajili Jarjir S, Sassi S. Corporate Green Bond Issuances: An International Evidence. Journal of Risk and Financial Management. 2020; 13(2):25. https://doi.org/10.3390/jrfm13020025

Chicago/Turabian StyleLebelle, Martin, Souad Lajili Jarjir, and Syrine Sassi. 2020. "Corporate Green Bond Issuances: An International Evidence" Journal of Risk and Financial Management 13, no. 2: 25. https://doi.org/10.3390/jrfm13020025

APA StyleLebelle, M., Lajili Jarjir, S., & Sassi, S. (2020). Corporate Green Bond Issuances: An International Evidence. Journal of Risk and Financial Management, 13(2), 25. https://doi.org/10.3390/jrfm13020025