Abstract

Despite the fact that growth theories suggest that natural disasters should have an impact on economic growth, parametric empirical studies have provided little to no evidence supporting that prediction. On the other hand, pure nonparametric regression analysis would be an extremely difficult task due to the curse of dimensionality. We therefore re-investigate the impact of natural disasters on economic growth, applying a semiparametric smooth coefficient panel data model that takes into account fixed effects. Our study finds evidence that the coefficient curve of investment is a U-shaped function of the severity of the natural disasters. Thus, for relatively small disasters, marginal returns to investment decrease on the severity of natural disasters. However, after a certain threshold, the coefficient of investment starts increasing as natural disasters become more severe.

JEL Classification:

O31; O44; Q47; Q54

1. Introduction

Since the seminal work of Solow (1957) who revolutionises the theory of economic growth by introducing the Solow growth model, over the last three decades, many economists have been devoted to the search of the determinants of economic growth. Among many contributions, Barro (1991), Barro (1996), Sala-i Martin (1997) and Barro (2003) are some of the most innovative and prominent studies in the subject. Barro (1996) empirically investigates the dynamics of growth for 100 countries for the years from 1960 to 1990 and finds that the main determinants of economic growth include an initial level of real per capita GDP, inflation, population growth, investment in both human and physical capital, fertility, terms of trade and political freedom. Even if empirical studies, until that point, found no evidence of a possible effect of natural disasters on economic growth, an indirect prediction of the Solow growth model, regarding the destruction of capital followed by a natural disaster, arises. That is, that the occurrence of a disastrous event would push the economy away from its balanced growth path in the short-run, resulting in a reduction of income per capita.

Even though models of exogenous growth (such as the Solow model) would predict a reduction of income per capita, the same argument does not hold true for models of endogenous economic growth featuring creative destruction (e.g., Aghion and Howitt 1990). Such a model would predict that the destruction of both physical and human capital that would follow a natural disaster, might even have a positive effect on income per capita because of the creation of additional incentives to invest (lower capital stock would result in higher marginal returns to capital).

These two conflicting theoretical results have created a new stream in the literature of Economic Growth, which attempts to assess the impact of natural disasters on Economic Growth empirically. This would highlight the importance of sustainable growth, a point that is emphasized by Daly (1996). Dell et al. (2012) empirically investigate the relationship between temperature shocks and economic growth. Although their paper does not directly address the issue of how natural disasters affect economic growth, we can argue that it is indirectly related to the literature because rising ocean temperatures increase the frequency and severity of hurricanes (a fairly common natural disaster). Their study finds evidence that higher temperatures affect economic growth in a negative manner.

In addition to the presence of studies that imply some kind of indirect relationship between natural disasters and economic growth, several studies investigate the possibility of a direct effect of disasters on growth. Using a dataset of 196 countries for the time span between 1970 and 2008, Cavallo et al. (2013) find evidence that extremely large disasters have a negative effect on income both on the long-run and the short-run. However, the significance of the disaster variable tends to vanish when political changes are taken into account. Lima and Barbosa (2019) study the same effect through a natural experiment (a flood that occurred in Brazil, 2008) and show that regions that were hit by a disaster, suffered a massive reduction of their GDP per capita growth. However, that effect was temporary, as their economies bounced back shortly after. Last but not least, Strobl (2012), Bergholt and Lujala (2012), and McDermott et al. (2013) also report a negative relationship.

Despite the presence of several studies suggesting that natural disasters affect economic growth negatively, there is a substantial part of the literature suggesting otherwise. Loayza et al. (2012), employing a dynamic GMM panel estimator (cross-country panels for 1961–2005), find that natural disasters are indeed affecting economic growth. However, both the sign and magnitude of the coefficient varies across different types of disasters as well as different economic sectors. In addition, Fomby et al. (2013) build a VARX model to examine if four different types of natural disasters (namely droughts, floods, earthquakes and storms) affect growth. They find that some disasters might even have positive effect on growth. Their results suggest that not only the sign but also the magnitude of the effect, is heavily dependent on the level of economic development a country has as well as on the severity of the disasters.

As we have already mentioned, the literature on the subject is far from giving us a definitive answer on how disasters affect growth. In addition, most of the studies have focused on linear and/or parametric specifications. This study attempts to fill that void in the literature, as we investigate how the intensity of natural disasters affect the marginal effects of major growth factors on the economic growth (as opposed to estimate a unique constant coefficient for the direct effect of natural disasters on economic growth). We are able to do so by using a varying coefficient panel data model that takes fixed effects into account, which was originally proposed by Sun et al. (2009). We motivate the use of this specific model on the following grounds. Parametric models may feature misspecification problems. In addition, pure nonparametric models can incur the curse-of-dimensionality problem. Thus a semiparametric model is proposed to avoid the parametric model misspecification problem, as well as mitigating the nonparametric curse-of-dimensionality problem.

The remaining of the paper is structured as follows. Section 2 describes our data and in Section 3 we present our varying coefficient fixed-effects panel data model and explain how to estimate the model. Section 4 illustrates our empirical findings and lastly, Section 5 provides our concluding remarks.

2. Data

A sizable portion of several more recent empirical literature, attempts to establish the main factors that determine the main drivers of the highly observed cross-country growth differences, with more recent studies focusing on the Bayesian model averaging (BMA) method (e.g., Masanjala and Papageorgiou 2008; Feldkircher and Zeugner 2012; Rockey and Temple 2016). According to Durlauf et al. (2008), the model averaging method is applied to mitigate the model uncertainty with respect to the correct theoretical growth model. Last but not least, using a dataset of 37 growth determinants over the time span from 1960 to 2010 and applying the Bayesian model averaging method, Bruns and Ioannidis (2020) find that there are huge variations on the relevance of growth determinants across different time periods.

In this paper, we choose to use the investment levels, population growth, inflation rate, initial GDP per capita, as out main determinants of economic growth. These four regressors are selected because they are not only part of the main growth determinants according to Barro (1996) but also present in more recent papers of the empirical literature focusing on linear parametric models (e.g., Bergholt and Lujala 2012). We restrict our analysis to these four variables mainly because of the fact that the inclusion of additional growth determinants would drastically reduce our degrees of freedom. That would make our attempt of examining the effect of natural disasters on growth via already well-established channels impossible, as we would again face the curse of dimensionality. We later discuss the potential impact of this restriction of our model, as well as offer some ideas on how future research could further investigate potential additional channels(through the addition of several other variables).

The four variables and the growth rates are extracted from the World Bank Indicators Database (https://data.worldbank.org/indicator). More specifically, we use the Gross Fixed Capital Formation as the indicator of the investment ratio, annual Population growth (annual %), Inflation, GDP per capita, PPP (current international $) as the indicator of GDP per capita in US dollars, and GDP per capita growth (annual %). All our variables are five-year averages, for 110 countries (70 for the smaller dataset) and for the period 1990–2017. This yields six chronological observations for every country, where our 6th observation would be an average over three years (2015, 2016, and 2017). However, even when we drop the 6th chronological observation our results remain unchanged.

We are also exporting our data regarding the natural disaster variables from the Our World in Data database (https://ourworldindata.org). We use two alternative indicators of natural disasters: the Deaths—Exposure to forces of nature and the Number of deaths from earthquakes, where the variable, Deaths—Exposure to forces of nature, includes deaths caused by wildfires, volcanic activity, storms, floods, droughts, extreme temperatures as well as earthquakes. The number of deaths caused by earthquakes can be thought to be strictly exogenous to economic development. On the other hand, the number of deaths caused by other natural disasters may not be strictly exogenous as several natural disasters, according to Cantelmo et al. (2019), are becoming more frequent as well as more severe due to climate change. To be more precise, the natural disaster variable (hereafter variable Z), will be allowed to affect the marginal effects of the main independent variables in a growth regression. The choice of the alternative indicators for Z is far from coincidental, as it serves the purpose of identifying if any possible effect of natural disasters on the marginal effects of our main growth regression variables, can be accounted to the part of natural disasters that is caused by the human presence (anthropogenic causes).

Note that we transform our Z variables as . That is because scaling would be impossible otherwise, due to the nature of these variables (we observe a high concentration on zero). Later, we discuss briefly how this can affect our results. Table 1 presents our summary statistics for the two alternative datasets we are using(different for the two alternative choices of Z as we require a balanced panel). The first six rows in Table 1 present the summary statistics for the dataset we use when Z is the number of deaths due to exposure to forces of nature, whereas the bottom six rows represent the dataset we use when Z is the number of deaths caused by earthquakes. Note that the last row in each sub-table illustrates the summary statistics for our Z, before scaling it to .

Table 1.

Summary statistics.

3. The Model

We assume that the growth rate of GDP per capita is affected by a set of variables which are commonly used in growth regressions. The most common parametric specification as in Barro (1996) is the following:

for and , where is the five-year average GDP per capita growth rate, is the initial GDP per capita (in order to capture the convergence hypothesis), represents the investment ratio, is the inflation rate, the population growth, are the country specific fixed effects, and is an i.i.d. error. Note that all the variables are averages over five-year intervals, so that we do not have to worry about our results depending on any possible business cycle effects.

We now depart from this analysis, by allowing that the marginal effects for each of the control variables are not constant as a function of the natural disaster severity. So our model becomes:

where . Rewritten above model in matrix form yields

where Y is an (nm) × 1 vector of the GDP per capita growth rates which is sorted by country first, X is an (nm) × 4 matrix that consists of the initial GDP per capita, population growth, the investment ratio and the inflation rate, and V is an (nm)×1 vector. , is an vector of ones and is the identity matrix, “⊗” denote the Kronecker product operator, and is an vector of country specific fixed effects as we assume the summation over all the country fixed effects to zero for identification purpose.

Sun et al. introduce the local linear estimator for in model (2) as follows:

where , , , , and is the kernel function and h is the bandwidth. , , and .

Under certain conditions Sun et al. (2009) show that the limiting distribution of the estimator is:

In order to construct the confidence interval for , we construct a consistent estimator for as follows:

where , contains the residuals, and equals the first five rows of .

4. Results

This section gives our estimation results. As a point of reference, we first report the estimation results from several parametric panel data fixed effects models built upon model (1). We then present our results for the semi-parametric smooth coefficient panel data model with fixed effects. Note that robust standard errors are included in the parentheses in Table 2.

Table 2.

Estimated results from parametric panel data models with fixed effects.

The inclusion of z does not affect the results derived from the linear model specification. The coefficient of initial GDP per capita is negative and weakly statistically significant (at 10% level of significance). Investment affects positively our growth rate, inflation negatively, while population growth seems to have no effect. The results derived from the linear specification are robust as they are invariant to the change of z. Thus, using the parametric alternative specification of our model we would have concluded that the severity of natural disasters has no effect on economic growth.

That result not only is counter-intuitive but also does not accord with the theoretical predictions of neither endogenous nor exogenous Economic Growth models. However, as our semiparametric estimation results show this is far from being true. The following figures illustrate our results for the semi-parametric smooth Coefficient with fixed effects specification. The confidence intervals (for different variables of interest) have been calculated using as follows:

where is calculated using which is the optimal bandwidth selected via the cross-validation method, and the undersmoothing technique is used to calculate the standard error, , from a different bandwidth , which is much smaller than . Note that is the k-th diagonal element of .

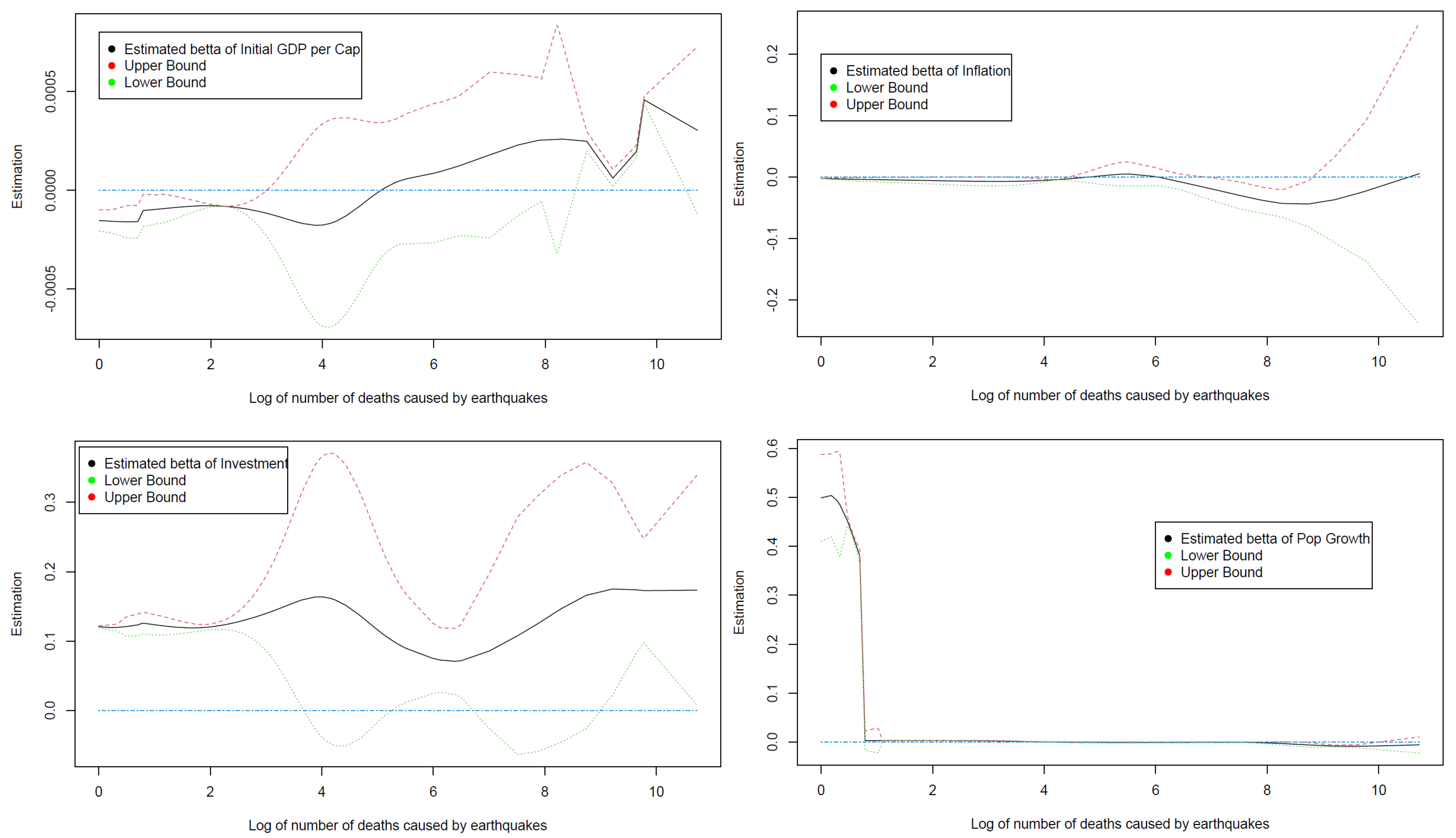

Figure 1 presents our results when Z is the number of deaths caused by earthquakes. Firstly, we find evidence that the marginal effect of the inflation rate does not depend on z. The same occurs for the most part, for our results regarding population growth, as it is statistically zero for the greater part of the distribution of z (however, it seems to be positive for low values of z). Investment affects positively economic growth, with its coefficient is almost invariant to the choice z, whereas initial GDP per capita does not appear to be statistically significant.

Figure 1.

Smooth coefficient with fixed effects model using earthquake deaths.

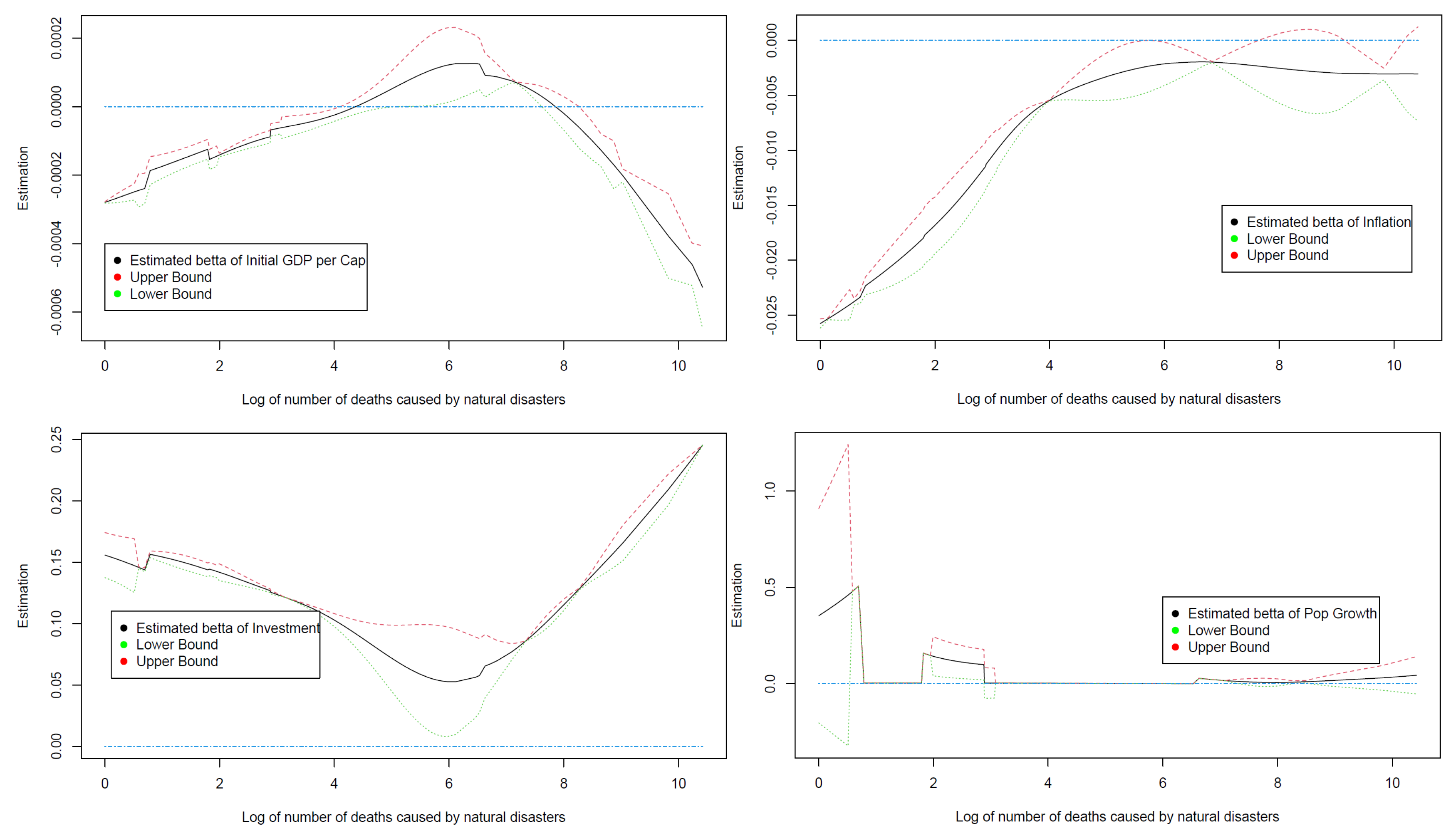

Our results regarding the severity of earthquakes appear to be as expected (but relatively weak in terms of capturing the theoretical predictions). However, the same is not true when Z represents the severity of a wider range of natural disasters. Figure 2 illustrates our results regarding deaths due to exposure to forces of nature being our z. Even though our prediction regarding the marginal effect of population growth is invariant of the choice of z, our results for the marginal effects of the other three variables of interest are drastically different. Firstly, the inflation rate affects negatively economic growth (as we would expect), but this effect tends to be weaker as z increases. A potential explanation of this result is that according to Klomp (2020), the occurrence of natural disasters might affect the decisions made by Central Banks. Since, as a reaction to a severe natural disaster, authorities tend to lower interest rates, the introduction of higher inflation might be even boosting growth (as it would help the economy to bounce back). So, the fact that the generally accepted negative effect of inflation tends to be weaker as the magnitude of natural disasters is increasing, is far from surprising. Investment not only affects economic growth positively (as expected) but also seems to be a U-shaped function of z. That is, for small disasters, the marginal returns of investment are decreasing, but they become increasing for severe disasters. This result is in accordance with the “Creative destruction” stream of the growth literature. Last but not least, our results for the coefficient of the initial GDP per capita are validating the convergence hypothesis, as it is negative for the part that it is statistically significant. The shape of the curve indicates that countries that were hit by more severe disasters would catch up faster, validating the theoretical predictions of the Solow Growth model (destruction of capital typically drives the economy away from the balanced growth path).

Figure 2.

Smooth coefficient with fixed effects model using deaths due to exposure to forces of nature.

5. Conclusions

Theoretical predictions suggest that the severity of natural disasters should affect Economic Growth. However, empirical studies have provided little to no evidence supporting those predictions. In addition, most of the studies have focused on parametric specifications. Attempting to estimate a possible relationship using a non-parametric setup would be an incredibly difficult task due to the Curse of Dimensionality (lack of large datasets firstly due to the low frequency of Macro data and secondly due to the need of averaging-too many functions to estimate). This study attempts to fill that gap in the literature, by studying how the intensity of natural disasters affect the marginal effects of several major factors in a growth regression.

The fact that our results are not invariant of the choice of z (earthquakes vs various natural disasters), can be thought as a clear indication that the literature needs to differentiate between anthropogenic and non-anthropogenic natural disasters. Our findings suggest that the variable that really affects the coefficients of a standard growth regression isn’t an exogenous natural disaster like earthquakes (exogenous at least for the scale of our data), but a combination of various natural disasters (both anthropogenic and exogenous natural disasters).

Thus, our study finds evidence that for relatively small disasters, marginal returns to investment are decreasing as the severity of anthropogenic natural disasters increase. However, after a certain threshold of severity, the coefficient of investment starts increasing as anthropogenic natural disasters become more severe. This result can be an indirectly positive prediction for economic growth in the future. Ibarrarán et al. (2009) and Cantelmo et al. (2019) argue that climate change has increased (and will continue doing so) both the frequency and the severity of natural disasters. Hence, our results imply that the coefficient of investment, not only is a U-shaped function of the severity of natural disasters, but also is (indirectly) a U-shaped function of Climate change.

Even though our results appear to be robust and significant, there are some potential pitfalls that we have to take into account. As we have already mentioned, our results might be relying on the nature of our z variables, as it is natural for the number of deaths to have a great concentration of data on zero. In addition, the choice of only two different z variables, as well as data unavailability can also be thought as weaknesses. However, the exploration of additional indicators such as losses due to natural disasters, would be infeasible due to the lack of data availability, as we would have to control for the quality of infrastructure in a given country. Last but not least, the rich literature that focuses on the determinants of economic growth, finds evidence that several other indicators should be considered. However, the non-parametric nature of our study makes such a task (of adding multiple additional variables in our specification) impossible, due to the curse of dimensionality. Thus, our research can be extended in several directions. For example, one would use more natural disasters indices (especially for the anthropogenic natural disasters), as well as several additional growth indicators (such as government consumption, investment in human capital etc.).

Author Contributions

Both authors contributed to the project formulation and paper preparation. All authors read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aghion, Philippe, and Peter Howitt. 1990. A Model of Growth through Creative Destruction. Technical Report. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Barro, Robert J. 1991. Economic growth in a cross section of countries. The Quarterly Journal of Economics 106: 407–43. [Google Scholar] [CrossRef]

- Barro, Robert J. 1996. Determinants of Economic Growth: A Cross-Country Empirical Study. Technical Report. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Barro, Robert J. 2003. Determinants of economic growth in a panel of countries. Annals of Economics and Finance 4: 231–74. [Google Scholar]

- Bergholt, Drago, and Päivi Lujala. 2012. Climate-related natural disasters, economic growth, and armed civil conflict. Journal of Peace Research 49: 147–62. [Google Scholar] [CrossRef]

- Bruns, Stephan B., and John P. A. Ioannidis. 2020. Determinants of economic growth: Different time different answer? Journal of Macroeconomics 63: 103185. [Google Scholar] [CrossRef]

- Cantelmo, Alessandro, Giovanni Melina, and Chris Papageorgiou. 2019. Macroeconomic Outcomes in Disaster-Prone Countries. Washington: International Monetary Fund. [Google Scholar]

- Cavallo, Eduardo, Sebastian Galiani, Ilan Noy, and Juan Pantano. 2013. Catastrophic natural disasters and economic growth. Review of Economics and Statistics 95: 1549–61. [Google Scholar] [CrossRef]

- Daly, Herman E. 1996. Beyond Growth: The Economics of Sustainable Development. Boston: Beacon Press. [Google Scholar]

- Dell, Melissa, Benjamin F. Jones, and Benjamin A. Olken. 2012. Temperature shocks and economic growth: Evidence from the last half century. American Economic Journal: Macroeconomics 4: 66–95. [Google Scholar] [CrossRef]

- Durlauf, Steven N., Andros Kourtellos, and Chih Ming Tan. 2008. Are any growth theories robust? The Economic Journal 118: 329–46. [Google Scholar] [CrossRef]

- Feldkircher, Martin, and Stefan Zeugner. 2012. The impact of data revisions on the robustness of growth determinants—A note on ‘determinants of economic growth: Will data tell?’. Journal of Applied Econometrics 27: 686–94. [Google Scholar] [CrossRef]

- Fomby, Thomas, Yuki Ikeda, and Norman V. Loayza. 2013. The growth aftermath of natural disasters. Journal of Applied Econometrics 28: 412–34. [Google Scholar] [CrossRef]

- Ibarrarán, María Eugenia, Matthias Ruth, Sanjana Ahmad, and Marisa London. 2009. Climate change and natural disasters: Macroeconomic performance and distributional impacts. Environment, Development and Sustainability 11: 549–69. [Google Scholar] [CrossRef]

- Klomp, Jeroen. 2020. Do natural disasters affect monetary policy? A quasi-experiment of earthquakes. Journal of Macroeconomics 64: 103164. [Google Scholar] [CrossRef]

- Lima, Ricardo Carvalho de Andrade, and Antonio Vinícius Barros Barbosa. 2019. Natural disasters, economic growth and spatial spillovers: Evidence from a flash flood in brazil. Papers in Regional Science 98: 905–24. [Google Scholar] [CrossRef]

- Loayza, Norman V., Eduardo Olaberria, Jamele Rigolini, and Luc Christiaensen. 2012. Natural disasters and growth: Going beyond the averages. World Development 40: 1317–36. [Google Scholar] [CrossRef]

- Masanjala, Winford H., and Chris Papageorgiou. 2008. Rough and lonely road to prosperity: A reexamination of the sources of growth in africa using bayesian model averaging. Journal of applied Econometrics 23: 671–82. [Google Scholar] [CrossRef]

- McDermott, Thomas K. J., Frank Barry, and Richard S. J. Tol. 2013. Disasters and development: Natural disasters, credit constraints, and economic growth. Oxford Economic Papers 66: 750–73. [Google Scholar] [CrossRef]

- Rockey, James, and Jonathan Temple. 2016. Growth econometrics for agnostics and true believers. European Economic Review 81: 86–102. [Google Scholar] [CrossRef]

- Sala-i Martin, Xavier X. 1997. I Just Ran Four Million Regressions. Technical Report. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Solow, Robert M. 1957. Technical change and the aggregate production function. The Review of Economics and Statistics 39: 312–20. [Google Scholar] [CrossRef]

- Strobl, Eric. 2012. The economic growth impact of natural disasters in developing countries: Evidence from hurricane strikes in the central american and caribbean regions. Journal of Development economics 97: 130–41. [Google Scholar] [CrossRef]

- Sun, Yiguo, Raymond J. Carroll, and Dingding Li. 2009. Semiparametric estimation of fixed-effects panel data varying coefficient models. In Nonparametric Econometric Methods. Bingley: Emerald Group Publishing Limited, pp. 101–29. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).