1. Introduction

Both starting a business and running a business require financial resources to ensure the enterprise’s current functioning, using the company’s internal resources. Nevertheless, to ensure the company’s dynamic development by making investments in the form of purchasing fixed assets, external financing is needed. In the current economy, it is the capital market that creates opportunities for raising funds for development. The optimal situation in the capital market means aligning the volume of demand and supply. Entities provide demand with financial resources and supply for financing enterprises. In order to achieve the optimum equality of supply and demand, enterprises become issuers of securities. As a result, they are provided with financing and their customers’ needs are met.

Securities issued by a company are diversified in many aspects and should be selected according to the needs and goals. They should also be cost-optimized. Another essential aspect that is worth paying attention to is maintaining the company’s ownership structure. To save itself from forced restructuring, an enterprise has the option of getting into debt by taking a loan from a bank or a non-banking institutions of the financial market. It may also start issuing debt securities, i.e., bonds. The solution involving bonds is especially worthy of note because loans are granted only after a thorough assessment of a company’s solvency and they are a more expensive option than bond issuance. This market seems to be more important for investors (bondholders) than for companies issuing bonds.

Although in capitalist economies (such as the American one) bonds have been vital for financing companies’ operations for years, the regulated market has existed in Poland only since 2009. The creation of a platform facilitating trade in bonds and the development of new legislative provisions regulating its aspects contributed to the increase in the popularity of this instrument in Poland.

The aim of the study is to, firstly, present the structure of the Catalyst market where bond trading takes place and, secondly, to discuss its development and identify the factors that determine the development. The following research questions were posed to achieve the goal: what are corporate bonds and what elements are they characterized by? How does the law regulate the issue? What makes corporate bonds different from other financial instruments? What are the dynamics of the development of the Catalyst market and how is it structured? In what ways has the turnover changed over the years?

The first part of the paper presents a comparison of finance and economy-oriented literature with the legal treatment of bonds in Poland. The following part concerns the development of the administered market of corporate bonds in Poland, as well as the reasons it was created. The third part is dedicated to the role of rating in shaping of the transparency of the bond market. The last part is an empirical analysis of the corporate bond market in Poland. It also includes a development forecast for the current year, taking account of the pandemic.

2. Literature Review

2.1. Definitions of Bonds

The simplest definition of bonds is that they are securities issued by entities conducting business activity (

Poślad et al. 2006, p. 128). On the other hand, the bonds act defines a bond as “a security issued in a series in which the issuer states that it is a debtor of the bond owner, hereinafter referred to as the “bondholder” and undertakes to fulfill a specific performance towards him” (

Act 2015, Art. 4.1). Corporate bonds are defined similarly in the literature. They are treated as items issued by entities conducting economic activity (

Bajak 2019, p. 59;

Sierpińska and Bąk 2013). They are issued by an enterprise conducting economic activity in order to collect medium- and long-term loan funds securing the investment assets of the issuer of this instrument (

Pawłowski 2015, p. 28). Bearing in mind the purpose of the issue, bond is a security with a claim for a specified amount, together with an obligation to pay interest (

Rutkowski 2007;

Sopoćko 2010, p. 29).

Another definition indicates that a bond is a debt bond that embeds cash claims where the issuer states that they are a debtor to the owner of the bond to whom they will pay the amount of money and interest in a specific manner and onset dates (

Jajuga 2009, p. 28;

Sierpińska et al. 2020, p. 48;

Tarczyński 2001, p. 20). The extension of this definition states that “corporate bonds are debt securities issued in series by companies whose issuer is a debtor to their owner and undertakes to return the amount borrowed or perform a specific service, constituting the remuneration for the loan granted” (

Kołuda 2015, p. 8). This definition is particularly important because it emphasizes that bonds are issued in series that share common properties.

Saunders and Cornett (

2012, p. 176) explanation states that bonds are “long-term debt obligations issued by corporations and government units […] In return for the investor’s funds, bond issuers promise to pay a specified amount in the future on the maturity of the bond plus coupon interest on the borrowed funds. If the terms of the repayment are not met by the bond issuer, the bond holder (investor) has a claim on the assets of the bond issuer”.

Economists distinguish the following features of corporate bonds: maturity, nominal value, interest, interest payment date, issue price, bond price, the settlement price of bonds (

Jajuga 2009, p. 28;

Sierpińska et al. 2020, p. 48;

Tarczyński 2001, p. 21). The legislator also specified the terms of the issue that must contain information about the type of bonds, the issuer’s entity, the website address, the issuer’s decision to issue, the nominal value and the maximum number of bonds proposed for purchase, the description of the issuer’s benefits under the bonds, the amount of these benefits or how they will be determined, as well as the date, place, and manner of their fulfillment, the specification of days according to which the entitled to benefits are determined, information on optional security for claims, place and date of issue conditions and signatures of persons authorized to incur liabilities on behalf of the issuer (

Act 2015, Art. 6). Moreover, bonds cannot be in the form of a document and must be registered with the national depository for securities (

Act 2015, Art. 8). Bonds issued in Poland are divided into the treasury and non-treasury bonds (municipal, cooperative, and corporate) (

Bajak 2019, p. 63). All the mentioned types of bonds are traded on the Catalyst market.

2.2. The Beginning of the Corporate Bond Market in Poland and Its Development

The only reason the financial market performs an allocating function in the economy is that money acts as a real purchasing power.

Conklin (

1961) studied the U.S. bond market as a segment of the capital market already in 1961, and his analysis relates to previous years. The beginning of the bond market in Poland occurred with the introduction of the capitalist economy and is considered the threshold of the 1990s (

Pawłowski 2015, p. 7). Joining the European Union was an important step for increasing the Polish zloty’s credibility, accelerating the development of the capital market and expanding the possibilities of obtaining foreign capital was (

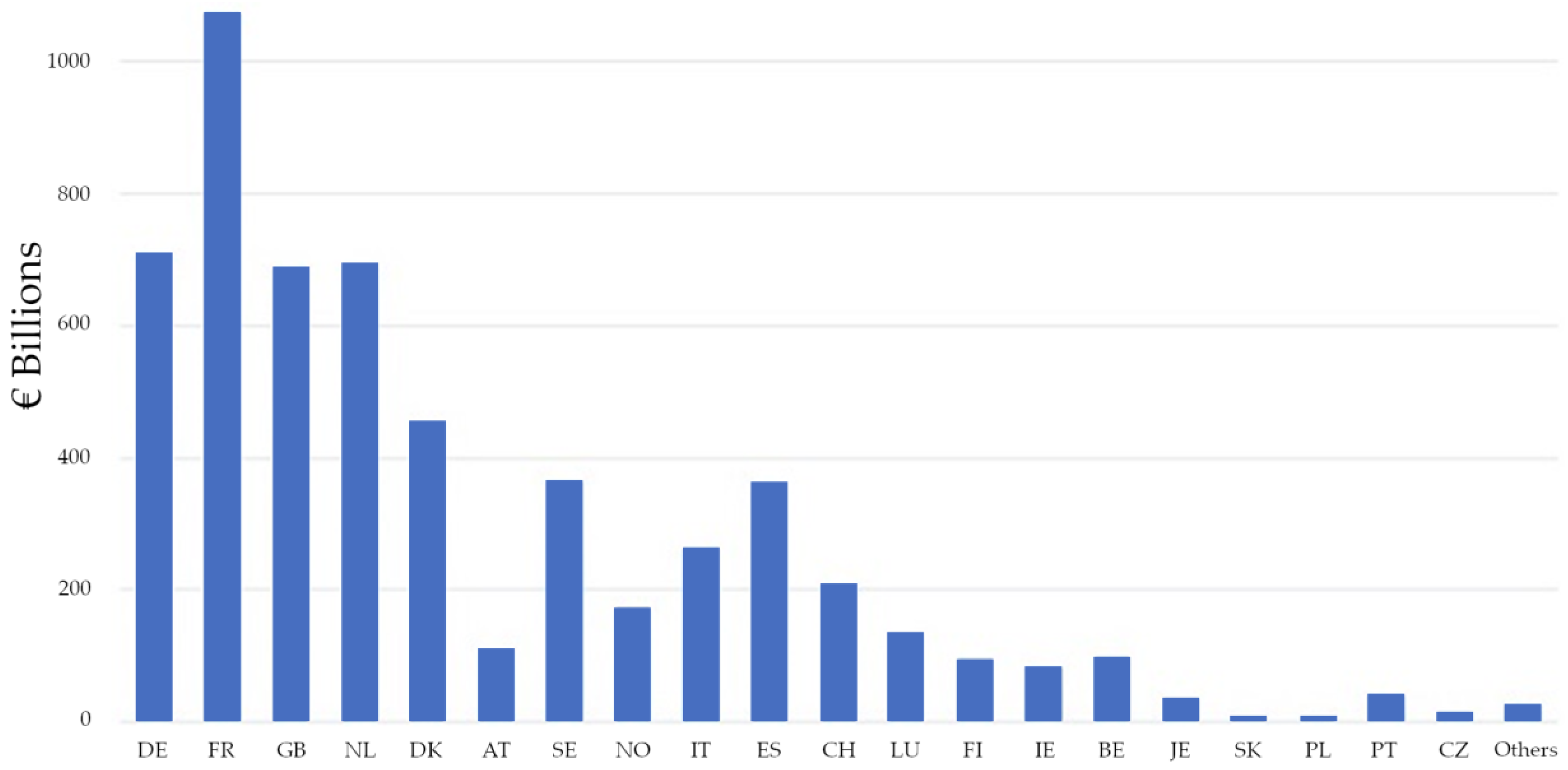

Czaja 2014). An interesting comparison of the European corporate bond market is presented in

Figure 1. As can be seen, companies with their headquarters in Western Europe issue significantly more corporate bonds than those which joined the European Union after 2004 and are registered in Central and Eastern Europe.

When analyzing the structure of the capital market, one should start by listing the determinants that influence entrepreneurs’ decisions concerning the choice of the source of capital (

Kowalik 2013;

Sierpińska et al. 2020, p. 18): capital cost, enterprise size and its stage of development, financial situation and creditworthiness, the procedure of raising capital (speed, efficiency, amount of formalities), as well as the situation of the entire economy (business cycle). Currently, bank loans are the largest group of external financing sources used in the conducted activity (

Bajak 2019, p. 63). The most considerable alternative to bank loans are corporate bonds which are still not a very popular source of Poland’s financing activities (

Bajak 2019, p. 87;

Borowski 2013;

Wilczyński 2013).

It should be noted that corporate bonds are particularly attractive to small and medium-sized enterprises that often face difficulties in obtaining a loan, regardless of their financial situation and development prospects (

Vytlacil 2015). In the case of these enterprises, it is not a single bank. Capital market investors are the only ones who could examine and assess the issuer’s condition and creditworthiness on an ongoing basis (

Kołosowska and Buszko 2012).

Moreover, if an enterprise decides to take out a loan but due to its ability does not receive the full amount, the issue of corporate bonds may supplement the financing (

Sierpińska et al. 2020, p. 7). In addition, given the limitation of loans given by banks (e.g., as a response to the central bank monetary policy), many companies choose to issue bonds instead of taking a more expensive bank loan (

Sierpińska and Bąk 2013).

Corporate bonds are the key component of the modern financial sector as they play a crucial role in the long-term financing of the economy (

Sensarma and Bhattacharyya 2016). Issues of corporate bonds can be used to obtain capital to finance a company’s development, current operations, and restructuration of its debt (

Kołosowska and Buszko 2012). The bonds can also be the basis for financing investments (

Janowicz 2018). From the point of view of the modern capital market, considerable opportunities to obtain the capital result from the demand for bonds as an alternative way of investing free cash (

Ranosz 2016). They are classified between stock and treasury bonds, and for investors they are also an alternative to banks (

Gradoń 2014;

Ranosz 2016;

Sierpińska et al. 2020, p. 8). On the other hand, banks’ bonds constitute a direct source of competition for corporate bonds (

Kołosowska and Buszko 2012).

A decisive advantage of the bond issue is that a company has a great deal of flexibility regarding the terms of the issue, while the terms of the bank loan are shaped by the bank (

Sierpińska et al. 2020, p. 7). This flexibility translates into the freedom to set the nominal value, the formula for the interest rate and interest payments, the maturity date, the issue price and the optional form of redemption security (

Gradoń 2014). A company issuing corporate bonds also avoids the bank’s supervisory activities concerning the expenditure (

Bajak 2019, p. 68;

Ranosz 2016, p. 168;

Zasępa 2013, p. 664). Unlike stocks, bonds do not reduce ownership rights by blurring their structure (

Sierpińska et al. 2020, p. 77). A comparison of corporate bonds and a bank loan in terms of essential criteria for an enterprise is presented in

Table 1.

Another aspect that may be discouraging when it comes to bond issuance is high transaction costs. A company’s corporate bonds, that are perceived to be solvent and therefore reliable, have lower unit transaction costs. The demand for them is greater, and with the increase in the trade size, the unit transaction costs decrease (

Edwards et al. 2007).

Companies with a low rating may have problems selling issued bonds, and their liquidity in the secondary market is also low. Length to maturity reduces their liquidity, while collateral increases it (

Bao et al. 2011). To liquidate them on the primary market, entrepreneurs offer a higher price, directly related to their rating.

The regulated market is transparent, and thanks to the continuous development of financed instruments adjustment of regulations, is one of the essential determinants shaping the modern capital market (

Wilczyński 2013).

Bessembinder and Maxwell (

2008) also draw attention to transparency. One of the factors shaping it is the obligatory publication of reports by issuers (

WSE 2019, pp. 7–8). As a result, investors can better assess the issuer’s financial position. This includes assessments of the possibility of meeting the obligation to redeem the bonds. Ensuring investors’ confidence and safety is particularly important in the corporate bond market (

Lepczyński and Pisarewicz 2018). Nevertheless, some of investors make decisions on the bond market emotionally (

Chen and Qin 2017;

Wei 2018).

2.3. Influence of Rating on Market Transparency

A bond rating is an assessment created by specialized institutions called rating agencies. It involves assigning a given bond into a class with a strictly defined default risk (

Wilczyński 2013). Thus, a rating can be understood as the entire algorithm for assessing the economic situation based on the most complete, objective, and up-to-date qualitative and quantitative research (

Pawłowski 2015, p. 42). To be credible, ratings must be prepared by an institution possessing the investors’ trust that results from the correctness and credibility of data and professional analysis (

Brylak 2011). It should be noted that due to the methodology, the rating of the same issuer, assigned by different research agencies, may differ despite the use of the same. Bonds with a long maturity have worse ratings (

Choudhry 2004, p. 496). Moreover, a given series of issued bonds may have a different rating than the issuer (

Elton et al. 2011).

Choudhry (

2004, p. 496) notes that in many cases the series themselves are rated the same by rating agencies when the ratings differ for the issuer.

Investors’ aversion to risk increased due to the financial crisis and made them expect an increase in the credibility of the issue (

Bajak 2019, p. 83). The rating from the investor’s point of view is very desirable because it offers increased transparency and optimization of capital allocation through effective management of the investment portfolio. It also offers a lower cost and shorter time of obtaining information (

Pawłowski 2015, p. 44). In other words, ratings are used as a benchmark for investors (

Pauka 2003, p. 76). It should be noted that institutional investors carry out their assessments of investment risk in a given financial instrument without feeling the need for rating agencies’ assessment because, for them, such agencies play an auxiliary role, verifying their internal assessments (

Lepczyński and Pisarewicz 2018).

A high rating makes a company seem reliable, allowing it to lower interest rates on its bonds and lower the cost of capital. It should be emphasized that having a rating is not mandatory. It may turn out to be beneficial for the issuer, as submitting to the rating may be a signal of readiness and professionalism in approaching the business

(Bajak 2019, pp. 83–84). Summing up, the rating is a vital instrument for diversifying investment risk on financial markets (

Pawłowski 2013). Enterprises issuing corporate bonds in Poland that are traded on the Catalyst market and have a rating are presented in

Table A1.

Nonetheless, it should be remembered that ratings are the result of a research algorithm and they are inconsistent with the issuer’s actual financial situation. Some believe that this low reliability of assessments was one of the main reasons for the outbreak and the deepening of the financial crisis of 2007–2009 (

Pawłowski 2013).

3. Materials and Methods

The assessment of Poland’s corporate bond market is based on secondary data published by the Warsaw Stock Exchange annual reports from 2010 to 2019 and the first nine months of 2020. In the first part of the analysis, the beginnings of the market and the premises of its creation are presented. Moreover, the dynamics of its development and the current structure are illustrated. Given the WSE report “10 years of the Catalyst market”, the added value of the work is data visualization, as well as forecasting with use of polynomial trend model. The form of polynomial trend model is as follows (for more detailed discussion of the method see (

Pollock 1999;

Wooldridge 2016, p. 178)):

The study compares the models for

i = 1,2,3, estimated using the ordinary least square (OLS) method. Then, their properties (residual autocorrelation and their heteroscedasticity) were checked using statistical tests (Durbin-Watson (DW) Test and White’s Test, respectively). In case of autocorrelation of residuals or their heteroscedasticity, the model was re-estimated using the generalized least squares (GLS) method. The best model was selected based on the adjusted R

2. The following measures were used for the assessment of the level the theoretical values match the data: R

2 and adjusted R

2, MAE (mean absolute error), mean percentage error (MPE), mean absolute percentage error (MAPE), root mean squared error (RMSE). A broad description of these can be found in (

Hyndman and Athanasopoulos 2018, pp. 62–70).

4. Results

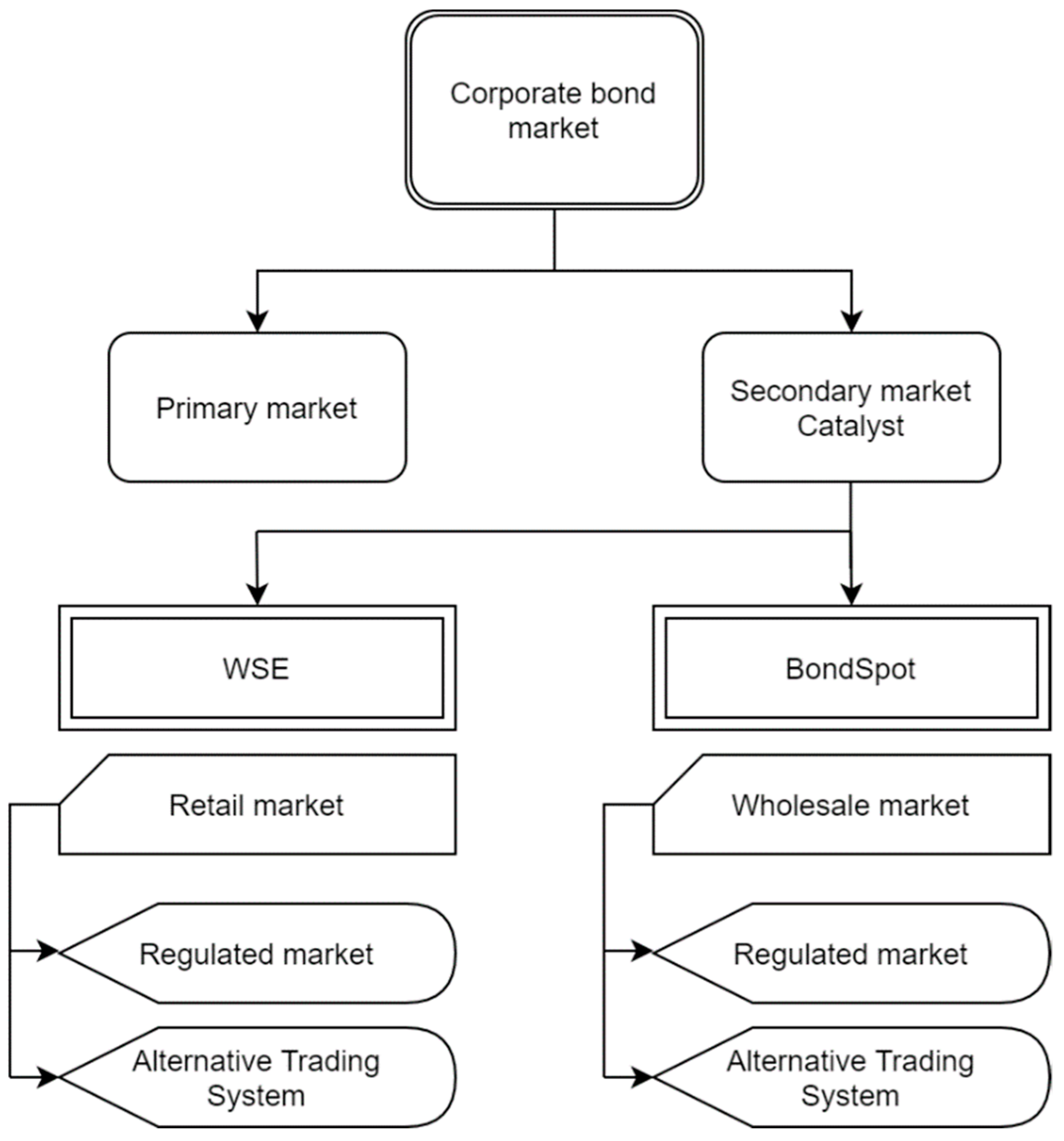

The Warsaw Stock Exchange (WSE) founded the Catalyst debt financial instruments market on 30 September 2009. Its creation’s basic premise was to enable issuers seeking funds to finance current operations and development with the help of investors who intended to invest funds. The Catalyst market’s creation was aimed at providing a significant group of its offer’s potential recipients and increasing the efficiency of issuing process which allowed to reduce the transaction costs of the issue. The current structure of the corporate bond market is shown in

Figure 2.

The

WSE report (

2019, p. 4) highlighted the following premises for the decision to create a Catalyst market: a noticeable increase in the demand of enterprises for non-bank financing resulting from the tightening of lending policy by banks (as a result of the financial crisis and increased restrictions in granting loans); the need to increase the competitiveness of the Polish capital market; the need to create a transparent, regulated and safe market for debt instruments.

Such a vision and quick adjustment of regulations to market needs have made the Polish Catalyst market one of the fastest-growing bond markets in Central and Eastern Europe. At the end of 2019, the Warsaw Stock Exchange listed over four times more debt instruments on the Polish market than on the neighboring Czech market (

WSE 2019, p. 4). In 2010–2019, 1530 series of bonds were issued. Additionally, private entities, through 4648 bond issues, raised capital of over PLN 674.50 billion. The list of transactions made in 2010 and 2019 is presented in

Table 2.

When analyzing the Catalyst market (2010 and 2019), it should be noted that in this period the trading volume at sessions increased by 265.2% compared to annual periods. On the other hand, the volume of session transactions concluded in 2019 was 1927.3% higher than in 2010. The number of listed issue series was 415.5% higher than it was in 2010, and value of the issues increased by as much as 3602.6%. Data on stock exchange transactions on the Catalyst market in individual years are presented in

Table 3.

During the first three full years of the exchange’s operation, the value of trading increased almost four times, while the number of transactions almost ten times. The largest number of transactions took place in 2018, while in financial terms, the largest turnover took place in 2013. It is worth noting that the number of transactions in corporate bonds increased year by year and the maximum turnover was 76,767 transactions in 2018. Drawing on the data presented in

Table 3, polynomial models for

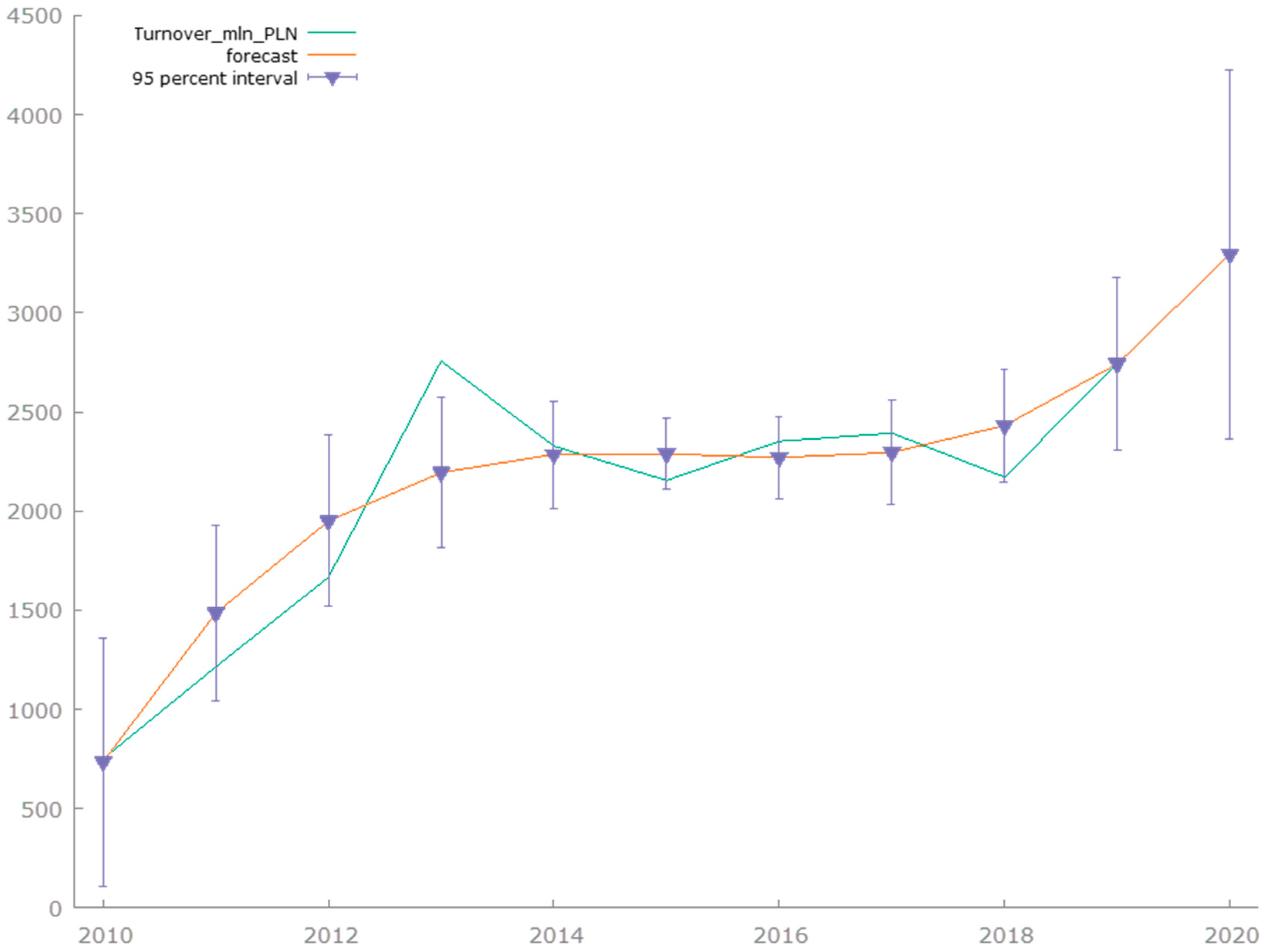

i = 1, 2, 3 were estimated.

Based on the adjusted

R2 (81.24%), the best polynomial model is for

i = 3. It takes the following form:

On the basis of the estimated polynomial model (3), a develop forecast for the current year was made, assuming ceteris paribus. Visualization of the theoretical model’s chart and the actual data presented in

Table 3 of the time series is shown in

Figure 3. The goodness of fit measures of polynomial trend model (

i = 3) are presented in

Table 4.

The forecast for 2020 is PLN 3295.27 million; the expected average deviations of the implementation of the forecast from the model amount to PLN 380.83 and constitute 11.56% of the forecast value. The probability that the predicted value will be in range 2363.40–4227.13 is 95%. It should be noted that in 2019 the value of trading on the Catalyst market was PLN 2742.89 million.

However, this year, the capital market was significantly affected by the SARS-CoV-2 pandemic which slowed economic growth on many global stock exchanges. To better define its development, it is worth looking at the session trading values in individual months in 2020.

Table 5 presents the values of session trading, with the distinction of transactions on corporate bonds.

From January to September 2020, the share of the value of session transactions in corporate bonds, in the total value of trading, remained in the range of 50–72%. Hence, it could be argued that corporate bonds are the most crucial segment of the Catalyst market. Moreover, looking at the turnover in individual months, it can be expected that the total annual turnover will remain at a level similar to that of the previous years. This observation suggests that the SARS-CoV-2 pandemic did not significantly affect the corporate bond market in Poland.

5. Discussion

A larger offer of corporate bonds may become a competition for government bonds, especially in cases where the issuer of the bond has high creditworthiness which is reflected in a high rating. Therefore, the introduction of the rating obligation will result in an increase in transparency which could boost a more dynamic development of the market. A large market creates greater opportunities for both individual and institutional investors. In turn, for entrepreneurs, a large market offers great opportunities to obtain capital. Moreover, the state will benefit from the development of the corporate bond market, as investors’ capital gains are the basis for taxation in Poland and thus, the source of state budget revenues, whereas the development of enterprises and their increased profits increase the state budget income from corporate income taxes (CIT).

Although the Polish Catalyst market is developing dynamically, due to the different specificity of the market in the form of a different size, legal system, and historical level, it cannot be compared to the American stock markets where corporate bonds are traded. However, comparing it with the markets in Central and Eastern Europe, where Poland is developing the most dynamically, is more reasonable.

The analysis of the dynamics of the corporate bond market in Poland, with the use of the polynomial model, allowed to conclude that the Catalyst market should continue to grow in the coming years. However, the relatively short time series, despite satisfying good goodness of fit, does not allow forecasting for several periods ahead. In addition, the outbreak of the SARS-CoV-2 pandemic made it difficult to predict anything, because in the face of a phenomenon with such a high reach, it is not possible to predict the behavior of all economic agents.

So far, the results (i.e., for the first three quarters of 2020) show that the pandemic slowed down the development of the Catalyst market, although no significant drops were recorded. The causes of this include that companies are looking for sources of capital to mitigate diminished revenues during the pandemic. Corporate bonds are also attractive to investors who are looking for safer forms of investment than stocks which, in the face of the pandemic, carry a high risk.

While incentives can be made through high-interest bond issues, this does not ensure the company’s stability and may result in the inability to pay investors back. This can cause business failures. There is, however, the other side of the coin: it can be assumed that conservative investors will want to wait until quieter times come, and those who are more dynamic, who want to make a quick profit, will speculate on more risky instruments. It can therefore be concluded that the basis for further development is adapting the regulation to the expectations and needs of the parties to the stock exchange, as well as protecting investors’ interests by further maximization of the transparency of the issue, sticking to rating requirements. On the one hand, it is a cost for the issuer. On the other, as confirmed by the literature, it increases the issuer’s credibility by determining the level of risk. Thanks to the use of such a procedure, investors are more likely to purchase such corporate bonds.

6. Conclusions

The capital market is the backbone of the capitalist economy. It should be remembered that the political and economic system (transformation from a centrally planned economy to a market economy) in Poland only changed in the 1990s. These changes resulted in an increase in the importance of private property and the granting of real purchasing power to money. The development of enterprises was associated with the possibility of obtaining financing for investment activities, and thus indirectly with the capital market development. The development of Poland’s capital market was accompanied not only by digitization, but also by internationalization, with particular emphasis on Poland’s accession to the European Union that took place in 2004. Although Poland is not in the euro area, the noticeable presence in major international agencies’ structures increased the credibility of both the state and the Polish zloty. It should be noted that digitization indicates a turnover that is not material (digital records).

Corporate bonds are an effective alternative to financing operations with a bank loan, providing the issuer with the so-called tax shield. Although corporate bonds are an attractive capital source, they are still not very popular as a financial instrument. The Catalyst market’s emergence made it easier to obtain funds through the issue of corporate bonds, and the upward trend is becoming more stable year by year. There has been a dynamic growth in these ten years (since the Catalyst market foundation), and the forecasts using the polynomial model based on the current trend allow the prediction that it is likely that in 2020 the market will continue to develop. Based on the analysis of monthly data for the current year (2020), it can be assumed that the pandemic caused this growth to slow down, although it did not result in significant shocks to the Catalyst market. One of the factors determining this development is market transparency that enhances when issuers publish their reports. The next step to increase transparency is to popularize the rating tool among bond issuers.