Barriers to Green Entrepreneurship: An ISM-Based Investigation

Abstract

1. Introduction

2. Literature Review

2.1. Green Entrepreneurship (GE)

2.2. Interpretive Structural Modeling (ISM) and Barriers to Green Practices

3. Materials and Methods

- List the set of elements to be studied. This list can be a set of factors, barriers, or strategies, according to the nature of the ISM study.

- Identify the contextual relationships among the elements (i.e., among the barriers in this study) using four symbols:

- V: if barrier w leads to the existence of barrier z.

- A: if barrier z leads to the existence of barrier w.

- X: if both barrier w and barrier z lead to the existence of each other.

- O: if there is no relation among barrier w and barrier z.

- Construct the structural self-interaction matrix (SSIM) that shows the pair-wise contextual relationships between the investigated barriers.

- Use the data entries of the SSIM to form the initial reachability matrix (IRM) using the following replacement rules:

- If the (w, z) entry is V in SSIM, (w, z) entry in the IRM becomes 1 and the (z, w) entry becomes 0.

- If the (w, z) entry is A in SSIM, (w, z) entry in the IRM becomes 0 and the (z, w) entry becomes 1.

- If the (w, z) entry is X in SSIM, (w, z) entry in the IRM becomes 1 and the (z, w) entry becomes 1.

- If the (w, z) entry is O in SSIM, (w, z) entry in the IRM becomes 0 and the (z, w) entry becomes 0.

- To form the final reachability matrix (FRM), a transitivity test should be applied on the IRM to ensure that, for instance, if the 1st barrier leads to the existence of the 2nd barrier, and the 2nd barrier leads to the existence of the 3rd barrier, then consequently, the 1st barrier leads to the existence of the 3rd barrier. Accordingly, 0–1 entries can then be verified and the resulting matrix can be considered as the FRM. Then, levels of all barriers are determined iteratively through the development of the partition matrix (PM) in each iteration.

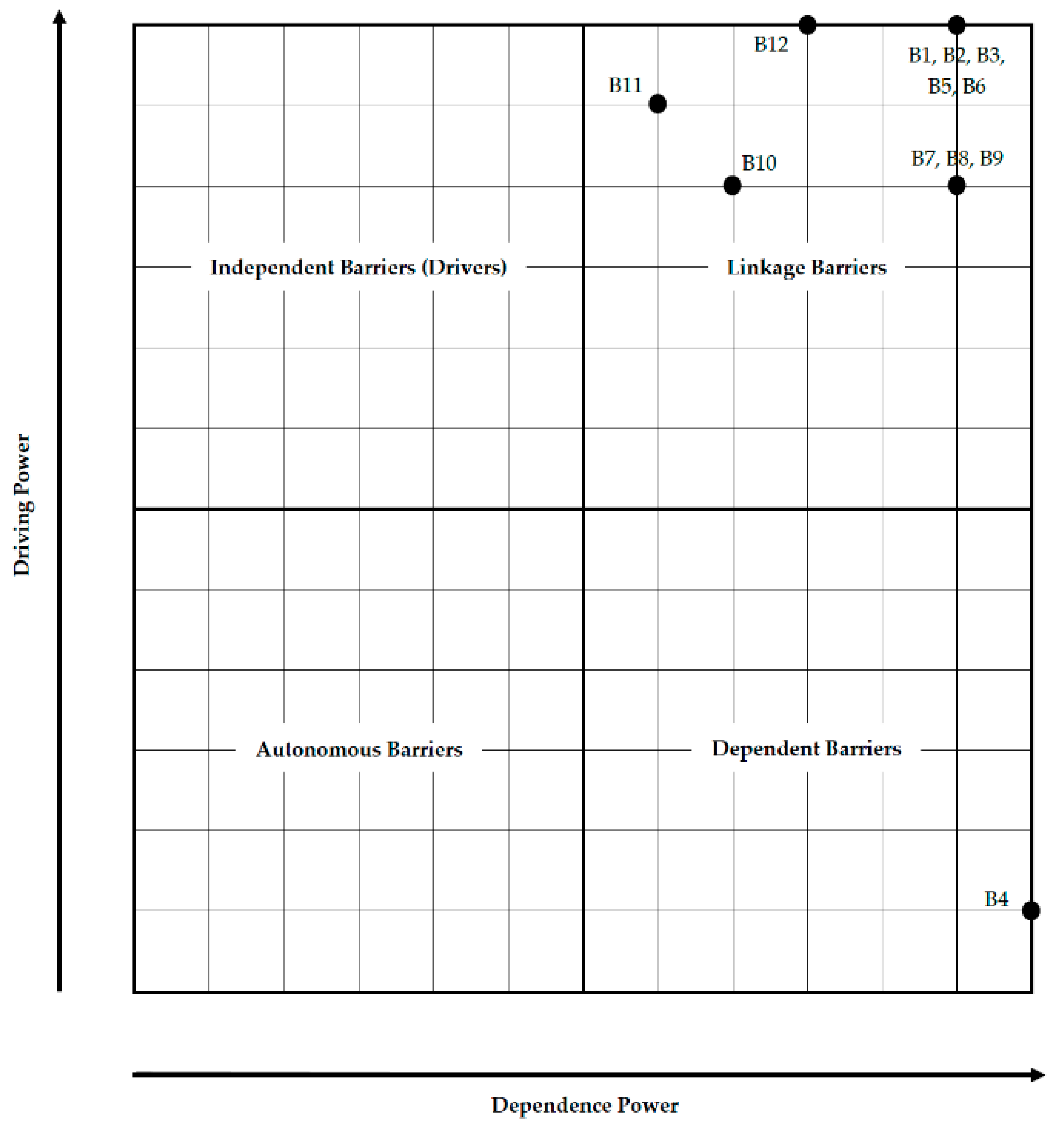

- According to the FRM, barriers can be divided into four categories: linkages, dependents, drivers, and autonomous.

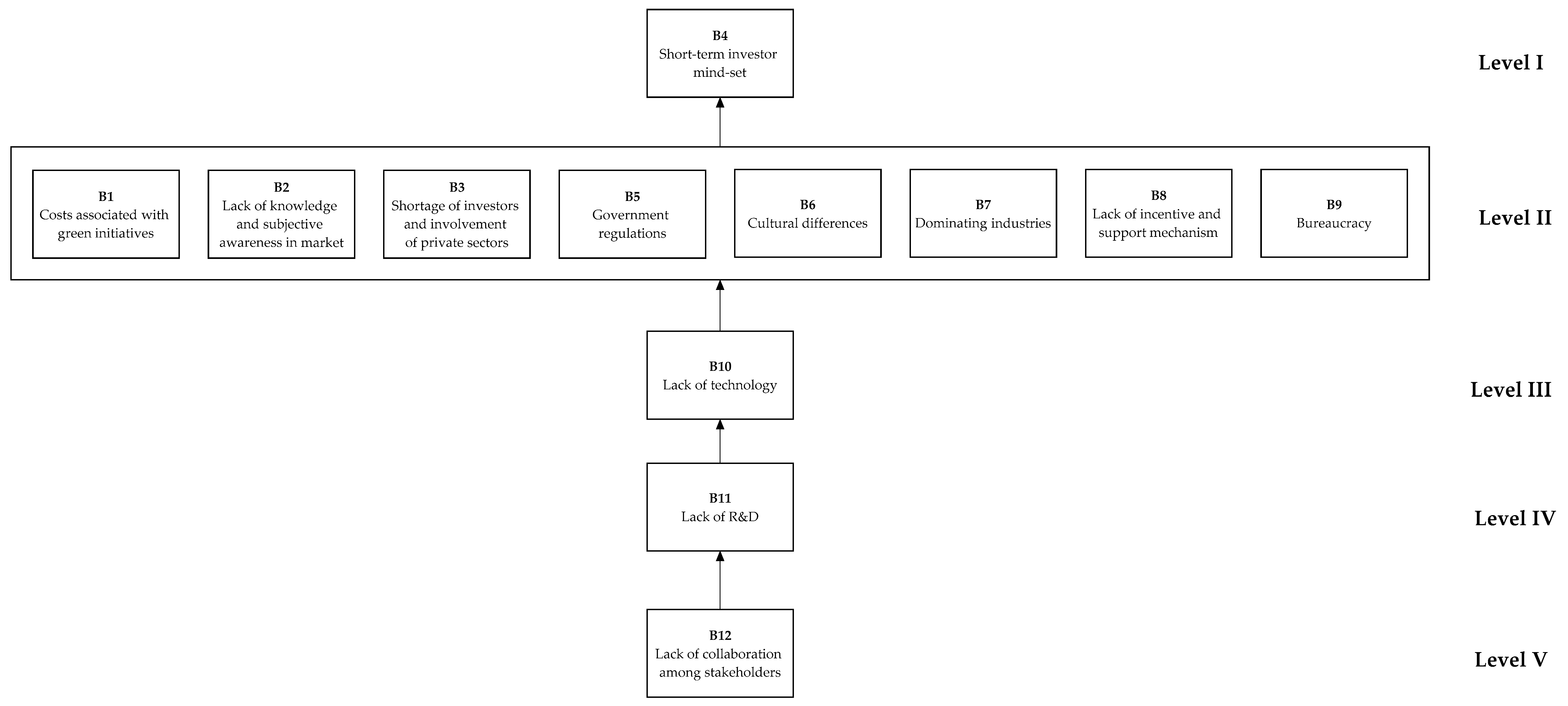

- In accordance with the FRM and the PM, barriers are prioritized into the determined and identified number of levels and the final ISM form can then be structured.

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Expert | Qualification | Occupation | Background | Experience (Years) |

|---|---|---|---|---|

| 1 | Ph.D. | Academic/Business Owner | Mechanical Engineering | 29 |

| 2 | Ph.D. | Academic/Business Owner | Mechanical Engineering | 10 |

| 3 | M.S. | Manager | Mechanical Engineering | 24 |

| 4 | B.S. | Manager | Mechanical Engineering | 7 |

| 5 | Ph.D. | Academic | Industrial Engineering | 27 |

| 6 | Ph.D. | Academic | Industrial Engineering | 20 |

| 7 | Ph.D. | Academic | Industrial Engineering | 20 |

| 8 | B.S. | Sales and Marketing | Operations Management | 21 |

| 9 | B.S. | Sales and Marketing | Operations Management | 10 |

| 10 | B.S. | Sales and Marketing | Operations Management | 7 |

| 11 | B.S. | Sales and Marketing | Operations Management | 5 |

| 12 | B.S. | Sales and Marketing | Operations Management | 2 |

| 13 | M.S. | Manager | Energy Engineering | 5 |

| 14 | B.S. | Manager | Energy Engineering | 3 |

| 15 | B.S. | Sales and Marketing | Energy Engineering | 3 |

| 16 | M.S. | Energy Efficiency Expert | Energy Engineering | 4 |

| 17 | B.S. | Energy Efficiency Expert | Energy Engineering | 3 |

| 18 | B.S. | Energy Efficiency Expert | Energy Engineering | 3 |

| 19 | B.S. | Energy Efficiency Expert | Energy Engineering | 2 |

| 20 | B.S. | Energy Efficiency Expert | Energy Engineering | 2 |

| 21 | B.S. | Energy Efficiency Expert | Energy Engineering | 1 |

| 22 | B.S. | Accountant | Accounting and Finance | 3 |

References

- Akinsemolu, Adenike A. 2020. Green Entrepreneurship. In The Principles of Green and Sustainability Science. Berlin/Heidelberg: Springer, pp. 305–34. [Google Scholar]

- Alwakid, Wafa, Sebastian Aparicio, and David Urbano. 2020. Cultural Antecedents of Green Entrepreneurship in Saudi Arabia: An Institutional Approach. Sustainability 12: 3673. [Google Scholar] [CrossRef]

- Bocken, Nancy M. P. 2015. Sustainable venture capital–catalyst for sustainable start-up success? Journal of Cleaner Production 108: 647–58. [Google Scholar] [CrossRef]

- Burton, Edward. 2016. Business and Entrepreneurship in Saudi Arabia: Opportunities for Partnering and Investing in Emerging Businesses. Hoboken: John Wiley & Sons. [Google Scholar]

- Demirel, Pelin, Qian Cher Li, Francesco Rentocchini, and J. Pawan Tamvada. 2019. Born to be green: New insights into the economics and management of green entrepreneurship. Small Business Economics 52: 759–71. [Google Scholar] [CrossRef]

- El-Khazindar Business Research and Case Center. 2016. Entrepreneurship in the Arab World: Ten Case Studies. Cairo: AUC Press. [Google Scholar]

- Farinelli, Fulvia, Marino Bottini, Sule Akkoyunlu, and Philipp Aerni. 2011. Green entrepreneurship: The missing link towards a greener economy. Atdf Journal 8: 42–48. [Google Scholar]

- Font, Xavier, Lluís Garay, and Steve Jones. 2016. Sustainability motivations and practices in small tourism enterprises in European protected areas. Journal of Cleaner Production 137: 1439–48. [Google Scholar] [CrossRef]

- Gibbs, David, and Kirstie O’Neill. 2012. Green entrepreneurship: Building a green economy?—Evidence from the UK. In Social and Sustainable Enterprise: Changing the Nature of Business. Bingley: Emerald Group Publishing Limited. [Google Scholar]

- Gibbs, David, and Kirstie O’Neill. 2014. Rethinking sociotechnical transitions and green entrepreneurship: The potential for transformative change in the green building sector. Environment and Planning A 46: 1088–107. [Google Scholar] [CrossRef]

- Glaser, Anna, Sonia Ben Slimane, Claire Auplat, and Regis Coeurderoy. 2016. Enabling nanotechnology entrepreneurship in a French context. Journal of Small Business and Enterprise Development 23: 1009–31. [Google Scholar] [CrossRef]

- Gliedt, Travis, and Paul Parker. 2007. Green community entrepreneurship: Creative destruction in the social economy. International Journal of Social Economics 34: 538–53. [Google Scholar] [CrossRef]

- Gliedt, Travis, and Paul Parker. 2014. Green community entrepreneurship 2.0. International Journal of Social Economics 41: 609–25. [Google Scholar] [CrossRef]

- Hall, Jeremy K., Gregory A. Daneke, and Michael J. Lenox. 2010. Sustainable development and entrepreneurship: Past contributions and future directions. Journal of Business Venturing 25: 439–48. [Google Scholar] [CrossRef]

- Harini, Varala, and D. Tripura Meenakshi. 2012. Green Entrepreneurship Alternative (Business) Solution to Save Environment. Asia Pacific Journal of Management & Entrepreneurship Research 1: 79. [Google Scholar]

- Isaak, Ronald. 2005. The making of the ecopreneur. In Making Ecopreneurs: Developing Sustainable Entrepreneurship. Surrey: Gower Publishing, p. 2. [Google Scholar]

- Jabarzadeh, Younis, Rahim Sarvari, and Negar Ahmadi Alghalandis. 2018. Exploring Socio-Economic Barriers of Green Entrepreneurship in Iran and Their Interactions Using Interpretive Structural Modeling. International Journal of Industrial and Systems Engineering 12: 392–97. [Google Scholar]

- Jabbour, Charbel José Chiappetta, Joseph Sarkis, Ana Beatriz Lopes de Sousa Jabbour, and Kannan Govindan. 2013. Understanding the process of greening of Brazilian business schools. Journal of Cleaner Production 61: 25–35. [Google Scholar] [CrossRef]

- Jawahir, I. S., and O. W. Dillon, Jr. 2007. Sustainable manufacturing processes: New challenges for developing predictive models and optimization techniques. Paper presented at the First International Conference on Sustainable Manufacturing, Montreal, QC, Canada, October 17. [Google Scholar]

- Jayal, A. D., F. Badurdeen, O. W. Dillon, Jr., and I. S. Jawahir. 2010. Sustainable manufacturing: Modeling and optimization challenges at the product, process and system levels. CIRP Journal of Manufacturing Science and Technology 2: 144–52. [Google Scholar] [CrossRef]

- Kannan, Govindan, A. Noorul Haq, P. Sasikumar, and Subramaniam Arunachalam. 2008. Analysis and selection of green suppliers using interpretative structural modelling and analytic hierarchy process. International Journal of Management and Decision Making 9: 163–82. [Google Scholar] [CrossRef]

- Karuppiah, Koppiahraj, Bathrinath Sankaranarayanan, Syed Mithun Ali, Priyabrata Chowdhury, and Sanjoy Kumar Paul. 2020. An integrated approach to modeling the barriers in implementing green manufacturing practices in SMEs. Journal of Cleaner Production 265: 121737. [Google Scholar] [CrossRef]

- Kearins, Kate, and Eva Collins. 2012. Making sense of ecopreneurs’ decisions to sell up. Business Strategy and the Environment 21: 71–85. [Google Scholar] [CrossRef]

- Kirkwood, Jodyanne, and Sara Walton. 2010. What motivates ecopreneurs to start businesses? International Journal of Entrepreneurial Behavior & Research 16: 204–28. [Google Scholar] [CrossRef]

- Luthra, Sunil, Vinod Kumar, Sanjay Kumar, and Abid Haleem. 2011. Barriers to implement green supply chain management in automobile industry using interpretive structural modeling technique: An Indian perspective. Journal of Industrial Engineering and Management (JIEM) 4: 231–57. [Google Scholar] [CrossRef]

- Mandal, Anukul, and S. G. Deshmukh. 1994. Vendor selection using interpretive structural modelling (ISM). International Journal of Operations & Production Management 14: 52–59. [Google Scholar] [CrossRef]

- Marin, Giovanni, Alberto Marzucchi, and Roberto Zoboli. 2015. SMEs and barriers to Eco-innovation in the EU: Exploring different firm profiles. Journal of Evolutionary Economics 25: 671–705. [Google Scholar] [CrossRef]

- Mathiyazhagan, Kaliyan, Kannan Govindan, A. NoorulHaq, and Yong Geng. 2013. An ISM approach for the barrier analysis in implementing green supply chain management. Journal of Cleaner Production 47: 283–97. [Google Scholar] [CrossRef]

- Migendt, Michael, Friedemann Polzin, Florian Schock, Florian A. Täube, and Paschen von Flotow. 2017. Beyond venture capital: An exploratory study of the finance-innovation-policy nexus in cleantech. Industrial and Corporate Change 26: 973–96. [Google Scholar] [CrossRef]

- Moon, Christopher. 2015. Green universities and eco-friendly learning: From league tables to eco-entrepreneurship education. Paper presented at the European Conference on Innovation and Entrepreneurship, Genoa, Italy, September 17–18. [Google Scholar]

- Mrkajic, Boris, Samuele Murtinu, and Vittoria G. Scalera. 2019. Is green the new gold? Venture capital and green entrepreneurship. Small Business Economics 52: 929–50. [Google Scholar] [CrossRef]

- Mukonza, Chipo. 2020. An analysis of factors influencing green entrepreneurship activities in South Africa. In Inclusive Green Growth. Berlin/Heidelberg: Springer, pp. 47–67. [Google Scholar]

- Musaad O, Almalki Sultan, Zhang Zhuo, Almalki Otaibi Musaad O, Zafar Ali Siyal, Hammad Hashmi, and Syed Ahsan Ali Shah. 2020. A Fuzzy Multi-Criteria Analysis of Barriers and Policy Strategies for Small and Medium Enterprises to Adopt Green Innovation. Symmetry 12: 116. [Google Scholar] [CrossRef]

- National-Geographic. n.d. Pictures: Ten Countries with the Biggest Footprints. Available online: https://www.nationalgeographic.com/environment/sustainable-earth/pictures-ten-countries-with-the-biggest-footprints/ (accessed on 23 September 2020).

- Ndubisi, Nelson Oly, and Sumesh R. Nair. 2009. Green entrepreneurship (GE) and green value added (GVA): A conceptual framework. International Journal of Entrepreneurship 13: 21. [Google Scholar]

- Neck, Heidi, Candida Brush, and Elaine Allen. 2009. The landscape of social entrepreneurship. Business Horizons 52: 13–19. [Google Scholar] [CrossRef]

- Palmer, C. P. 2014. Growing the Green Economy in Transition Economies: The Case of eco-Entrepreneurship for Born-Green Firms in Romania. Ph.D. dissertation, The Fletcher School of Law and Diplomacy, Medford, MA, USA. [Google Scholar]

- Potluri, Seema, and B. V. Phani. 2020. Incentivizing green entrepreneurship: A proposed policy prescription (a study of entrepreneurial insights from an emerging economy perspective). Journal of Cleaner Production 259: 120843. [Google Scholar] [CrossRef]

- Rahbauer, Sebastian, Luisa Menapace, Klaus Menrad, and Thomas Decker. 2016. Adoption of green electricity by small-and medium-sized enterprises in Germany. Renewable and Sustainable Energy Reviews 59: 1185–94. [Google Scholar] [CrossRef]

- Saint Paul, Therese. 2006. Green Business in Martinique: An Example in Postcolonial Entrepreneurship. The Journal of Language for International Business 17: 43. [Google Scholar]

- Santini, Cristina. 2017. Ecopreneurship and ecopreneurs: Limits, trends and characteristics. Sustainability 9: 492. [Google Scholar] [CrossRef]

- Sarkar, Richa, and Kingshuk Sarkar. 2014. An Elementary Approach on Awareness of Green Practices: In Indian Context. Journal of Asia Entrepreneurship and Sustainability 10: 89. [Google Scholar]

- Schaper, Michael. 2010. Understanding the green. In Making Ecopreneurs: Developing Sustainable Entrepreneurship. Surrey: Gower Publishing, p. 7. [Google Scholar]

- Silajdžić, Irem, Sanda Midžić Kurtagić, and Branko Vučijak. 2015. Green entrepreneurship in transition economies: A case study of Bosnia and Herzegovina. Journal of Cleaner Production 88: 376–84. [Google Scholar] [CrossRef]

- Steinz, Henk J., Frank J. Van Rijnsoever, and Frans Nauta. 2016. How to Green the red Dragon: A Start-ups’ Little Helper for Sustainable Development in China. Business Strategy and the Environment 25: 593–608. [Google Scholar] [CrossRef]

- Sushil, S. 2012. Interpreting the interpretive structural model. Global Journal of Flexible Systems Management 13: 87–106. [Google Scholar] [CrossRef]

- Taylor, David W., and Elizabeth E. Walley. 2004. The green entrepreneur: Opportunist, maverick or visionary? International Journal of Entrepreneurship and Small Business 1: 56–69. [Google Scholar] [CrossRef]

- Vatansever, Çigdem, and Korhan Arun. 2016. What color is the green entrepreneurship in Turkey? Journal of Entrepreneurship in Emerging Economies 8: 25–44. [Google Scholar] [CrossRef]

- Volery, Thierry. 2002. Ecopreneurship: Rationale, current issues and future challenges. Paper presented at the Conference Papers of Swiss Research Institute of Small Business and Entrepreneurship, St. Gallen, Switzerland. [Google Scholar]

- Walley, E. E., and David W. Taylor. 2002. Opportunists, champions, mavericks...? Greener Management International, 31–43. [Google Scholar] [CrossRef]

- Yang, Mengke, Mahmood Movahedipour, Jianqiu Zeng, Zhou Xiaoguang, and Ludi Wang. 2017. Analysis of success factors to implement sustainable supply chain management using interpretive structural modeling technique: A real case perspective. Mathematical Problems in Engineering 2017: 14. [Google Scholar] [CrossRef]

| Acronym | Barrier |

|---|---|

| B1 | Costs associated with green initiatives |

| B2 | Lack of knowledge and subjective awareness in the market |

| B3 | Shortage of investors and involvement of private sectors |

| B4 | Short-term investor mindset |

| B5 | Government regulations |

| B6 | Cultural differences |

| B7 | Dominating industries |

| B8 | Lack of incentive and support mechanism |

| B9 | Bureaucracy |

| B10 | Lack of technology |

| B11 | Lack of R&D |

| B12 | Lack of collaboration among stakeholders |

| Barrier | B1 | B2 | B3 | B4 | B5 | B6 | B7 | B8 | B9 | B10 | B11 | B12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | - | A | A | V | V | X | X | A | A | A | A | A |

| B2 | - | A | O | V | A | X | X | X | A | A | A | |

| B3 | - | V | V | X | X | A | A | A | A | A | ||

| B4 | - | O | O | O | O | A | O | A | A | |||

| B5 | - | O | O | V | V | V | V | V | ||||

| B6 | - | X | A | A | O | O | V | |||||

| B7 | - | A | A | A | A | A | ||||||

| B8 | - | A | A | A | A | |||||||

| B9 | - | A | A | A | ||||||||

| B10 | - | A | A | |||||||||

| B11 | - | A | ||||||||||

| B12 | - |

| Barrier | B1 | B2 | B3 | B4 | B5 | B6 | B7 | B8 | B9 | B10 | B11 | B12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| B2 | 1 | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 0 | 0 |

| B3 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| B4 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| B5 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 |

| B6 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 1 |

| B7 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| B8 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 0 |

| B9 | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 0 | 0 | 0 |

| B10 | 1 | 1 | 1 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 0 | 0 |

| B11 | 1 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 0 |

| B12 | 1 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 |

| Barrier | B1 | B2 | B3 | B4 | B5 | B6 | B7 | B8 | B9 | B10 | B11 | B12 | Driving Power |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | 1 | 1 * | 1 * | 1 | 1 | 1 | 1 | 1 * | 1 * | 1 * | 1 * | 1 * | 12 |

| B2 | 1 | 1 | 1 * | 1 * | 1 | 1 * | 1 | 1 | 1 | 1 * | 1 * | 1 * | 12 |

| B3 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 * | 1 * | 1 * | 1 * | 1 * | 12 |

| B4 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| B5 | 1 * | 1 * | 1 * | 1 * | 1 | 1 * | 1 * | 1 | 1 | 1 | 1 | 1 | 12 |

| B6 | 1 | 1 | 1 | 1 * | 1 * | 1 | 1 | 1 * | 1 * | 1 * | 1 * | 1 | 12 |

| B7 | 1 | 1 | 1 | 1 * | 1 * | 1 | 1 | 1 * | 1 * | 0 | 0 | 1 * | 10 |

| B8 | 1 | 1 | 1 | 1 * | 1 * | 1 | 1 | 1 | 1 * | 0 | 0 | 1 * | 10 |

| B9 | 1 | 1 | 1 | 1 | 1 * | 1 | 1 | 1 | 1 | 0 | 0 | 1 * | 10 |

| B10 | 1 | 1 | 1 | 1 * | 1 * | 1 * | 1 | 1 | 1 | 1 | 0 | 0 | 10 |

| B11 | 1 | 1 | 1 | 1 | 1 * | 1 * | 1 | 1 | 1 | 1 | 1 | 0 | 11 |

| B12 | 1 | 1 | 1 | 1 | 1 * | 1 * | 1 | 1 | 1 | 1 | 1 | 1 | 12 |

| Dependence Power | 11 | 11 | 11 | 12 | 11 | 11 | 11 | 11 | 11 | 8 | 7 | 9 |

| Barrier | Reachability Set | Antecedent Set | Intersection | Level |

|---|---|---|---|---|

| B1 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | |

| B2 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | |

| B3 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | |

| B4 | B4 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B4 | I |

| B5 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | |

| B6 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | |

| B7 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | |

| B8 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | |

| B9 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | |

| B10 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10 | B1, B2, B3, B5, B6, B10, B11, B12 | B1, B2, B3, B5, B6, B10 | |

| B11 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11 | B1, B2, B3, B5, B6, B11, B12 | B1, B2, B3, B5, B6, B11 | |

| B12 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 |

| Barrier | Reachability Set | Antecedent Set | Intersection | Level |

|---|---|---|---|---|

| B1 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B2 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B3 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B4 | B4 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B4 | I |

| B5 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B6 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B7 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B8 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B9 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B10 | B1, B2, B3, B5, B6, B7, B8, B9, B10 | B1, B2, B3, B5, B6, B10, B11, B12 | B1, B2, B3, B5, B6, B10 | |

| B11 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11 | B1, B2, B3, B5, B6, B11, B12 | B1, B2, B3, B5, B6, B11 | |

| B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 |

| Barrier | Reachability Set | Antecedent Set | Intersection | Level |

|---|---|---|---|---|

| B1 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B2 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B3 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B4 | B4 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B4 | I |

| B5 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B6 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B7 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B8 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B9 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B10 | B10 | B10, B11, B12 | B10 | III |

| B11 | B10, B11 | B11, B12 | B11 | |

| B12 | B10, B11, B12 | B12 | B12 |

| Barrier | Reachability Set | Antecedent Set | Intersection | Level |

|---|---|---|---|---|

| B1 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B2 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B3 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B4 | B4 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B4 | I |

| B5 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B6 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B7 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B8 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B9 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B10 | B10 | B10, B11, B12 | B10 | III |

| B11 | B11 | B11, B12 | B11 | IV |

| B12 | B11, B12 | B12 | B12 |

| Barrier | Reachability Set | Antecedent Set | Intersection | Level |

|---|---|---|---|---|

| B1 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B2 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B3 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B4 | B4 | B1, B2, B3, B4, B5, B6, B7, B8, B9, B10, B11, B12 | B4 | I |

| B5 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B6 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | II |

| B7 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B8 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B9 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B10, B11, B12 | B1, B2, B3, B5, B6, B7, B8, B9, B12 | II |

| B10 | B10 | B10, B11, B12 | B10 | III |

| B11 | B11 | B11, B12 | B11 | IV |

| B12 | B12 | B12 | B12 | V |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Makki, A.A.; Alidrisi, H.; Iqbal, A.; Al-Sasi, B.O. Barriers to Green Entrepreneurship: An ISM-Based Investigation. J. Risk Financial Manag. 2020, 13, 249. https://doi.org/10.3390/jrfm13110249

Makki AA, Alidrisi H, Iqbal A, Al-Sasi BO. Barriers to Green Entrepreneurship: An ISM-Based Investigation. Journal of Risk and Financial Management. 2020; 13(11):249. https://doi.org/10.3390/jrfm13110249

Chicago/Turabian StyleMakki, Anas A., Hisham Alidrisi, Asif Iqbal, and Basil O. Al-Sasi. 2020. "Barriers to Green Entrepreneurship: An ISM-Based Investigation" Journal of Risk and Financial Management 13, no. 11: 249. https://doi.org/10.3390/jrfm13110249

APA StyleMakki, A. A., Alidrisi, H., Iqbal, A., & Al-Sasi, B. O. (2020). Barriers to Green Entrepreneurship: An ISM-Based Investigation. Journal of Risk and Financial Management, 13(11), 249. https://doi.org/10.3390/jrfm13110249