5.1. Access to Credit in Mauritania

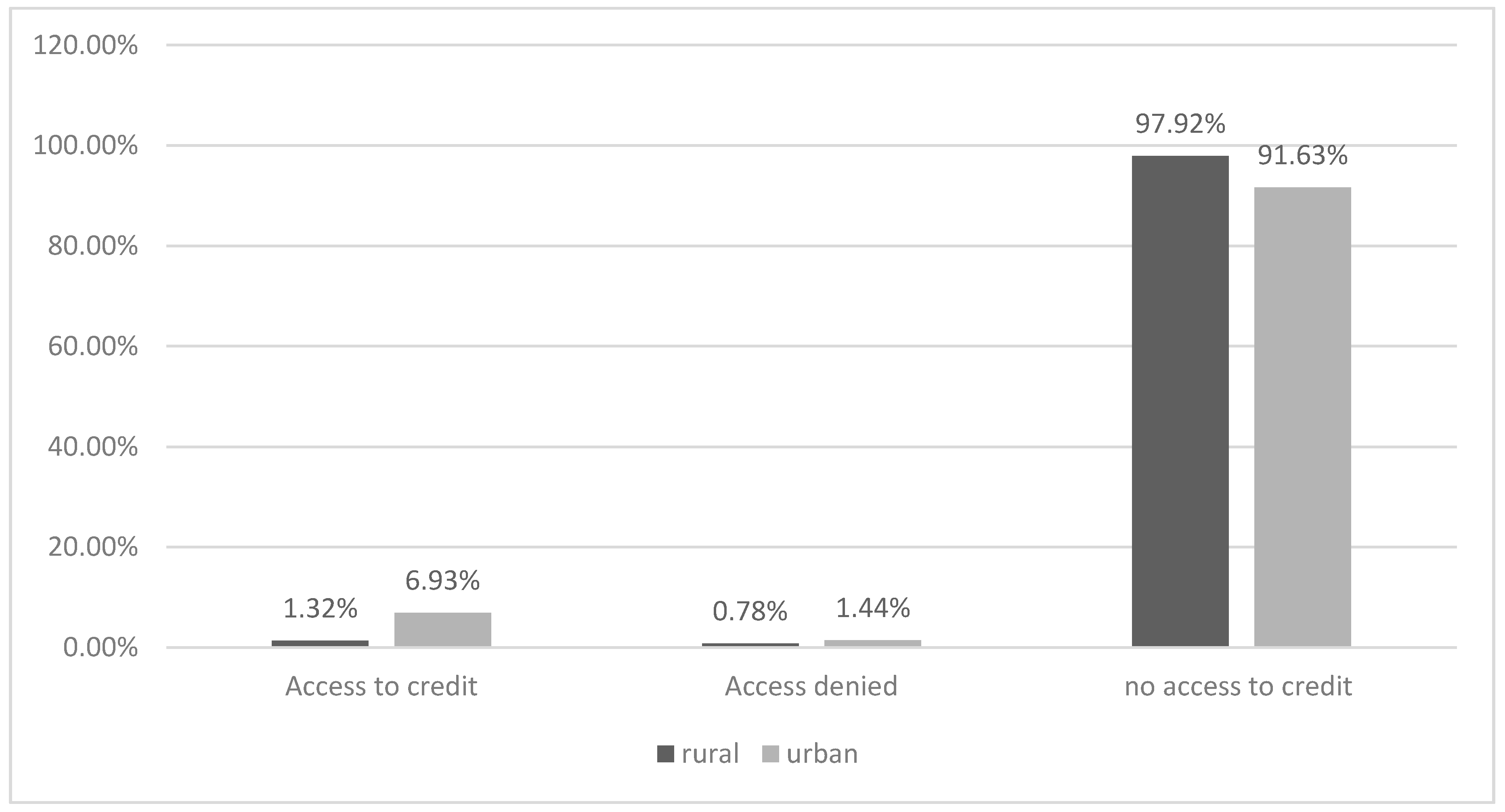

As stated earlier, we have data for 2014 with a sample of 9557 people indicating their access to credit and some demographic and geographical variables. An analysis of the odds of accessing credit provided the results shown in

Table 1. The results in columns (2), (4), and (6) show that some common factors and some different factors explain the access to credit in urban and rural environments. We tested for multicollinearity, as shown in

Table A2.

In Mauritania there is no significant difference between men and women for the odds of accessing credit nor is there any difference by being the head of the household. Therefore, Hypothesis 1 is not accepted since gender is not significant. It is often considered that microfinance is for the excluded and we should have expected that unemployed people, those on welfare, or inactive people would have higher odds of getting credit. However, we found that the only significant difference is that public sector employees have higher odds of access to credit, suggesting that consumer credit is a big part of the total loans being given. This is true for both urban and rural populations. Therefore, hypothesis 6 is accepted to a very small extent since the nature and sector of activity does not seem to influence access to credit.

Normally, we expect that education will provide greater access to financing (Hypothesis 2), so we compared illiterate people with different levels of education with respect to access to credit. We found that literacy alone does not make a difference except in rural areas. All other educational levels significantly increase the odds of getting access to credit. However, we found some curious results when we looked at rural and urban areas. In rural areas, literacy significantly increases the odds of getting credit but primary education is not significant. In urban areas, secondary technical education does not make a difference as compared to illiterate people for access to credit. Traditional education is not different from illiteracy for access to credit. Medium-size households (3 to 5 members) seem to have a higher chance of getting credit compared to single people or couples. However, as the number of members of the household increases further, the odds become the same as for single people or couples. The number of children is not significant, which confirms the results of

Amendola (

2017) and validates our Hypothesis 5. However, in our study, the age did not make any difference, contradicting the results of

Amendola (

2017) who found that older people get more credit. Therefore, our Hypothesis 3 is not accepted.

Normally, we expect greater access to credit in densely populated areas (Hypothesis 4). So, we compared the most populated region, Hodh Ech Chargui, with less-densely populated areas.

Table 2 shows that for four regions of the south with a fairly high density of population the odds of access to credit are not significantly different from Hodh Ech Chargui at 5%, for both rural and urban areas. As expected, Nouakchott, which is the densely populated capital, has significantly more access to credit. However, counterintuitively, we found that all the other regions have significantly higher odds of getting credit than Hodh Ech Chargui. This means that less-densely populated areas are getting more credit. This may be because of pockets of extremely dense population areas in these regions. Tiris Zemmour is a low-density region but with big mining areas and that can explain the high odds of getting credit in these areas. Therefore, Hypothesis 4 cannot stand alone.

5.2. The Evolution of Financial Inclusion in Mauritania

Historically, Mauritania is a vast desert inhabited by Bedouins. Each tribe had its way of financing the activities of its members but always according to the Islamic law where usury is forbidden. As a result, in addition to the formal financial system, each category of the population has its own culture, its own social mechanisms, and its own informal finance. For example, the different types of informal finance present in Mauritania include the piyés used by the Fulanis and the «lawha», or blood money, used by the Arabs. However, we did not have enough information on the Harratins’ practices of informal finance.

The piyé is organized by family members to help out one of their members who is facing a financial challenge (marriage, for example). There are different types of piyé. The piyé Lenol is a permanent kitty to help members of the family deal with unforeseen expenses. The piyé jokkere endam is used to reinforce the relationship between two families or clans.

In the Arab culture, they also have a form of informal finance called the «lawha». Traditionally, the lawha was collected to pay the «diya» (blood money) in case of accidental homicide. However, nowadays the lawha is used for marriages, elections, or reimbursing the state in case of misappropriation of public funds.

Tontines and money transfers are the most common informal financial practices in Mauritania. All three communities use these as a way to finance their activities. Tontines’ members are usually from the same neighborhood, social background, or tribe. The agreement between members remains verbal; there are few tontines that have written rules.

The existence of this tribal financial system, the dearth of trust in the administration, and the lack of a stable government may explain why most of the population is excluded from the financial system.

In this section, we will look at the financial inclusion in Mauritania compared to other African countries and the world. Financial inclusion definition by the World Bank is the offering of financial products and services to the whole population of a country (

World Bank 2014). This includes products and services offered by the formal financial sector (commercial banks and MFIs) and the informal financial sector (government programs, dealers, tontines, etc.). Even though the informal financial sector has still a large place and is one of the main challenges for the development of mobile banking in Mauritania, the formal sector should slowly but surely be increasing.

In

Table 3, we extracted data from the recent FINDEX report (

Demirgüç-Kunt et al. 2018). Here, we used the number of accounts as the proxy of the inclusion in the financial system. We were comparing Mauritania to Togo (a West African country that has about the same level of development of Mauritania), India (the developing country with the largest microfinance sector), and France (a developed country that provides a benchmark of what is possible). Developing country averages also provide benchmarks.

By looking at the number of bank accounts, we see that Mauritania has the lowest financial inclusion, with only 21% of its population having an account, compared to the average in the developing world, which is around 63%. Even if we look at a country like Togo, which is an African country, smaller in size than Mauritania and with fewer resources (lower per capita income), it has a better financial inclusion with an average of 45%. Moreover, 22% of those who have a bank account do not use it even once a year and only 7% take a loan from the financial institutions. In Mauritania, only 15% of women have an account. This exclusion of women can be explained by the fact that in the Mauritanian society, men must provide and women do not feel the need to engage in the financial system. Nevertheless, keeping everything in perspective, only 26% of men are included in the financial system.

Looking also at workers’ and nonworkers’ inclusion, we see that only 29% of workers have accounts. The principal reason is that only the government workers must mandatorily have an account, while private-sector workers have a choice of either receiving their salaries in cash or to have an account. However, there is an increase of banking penetration because more and more companies avoid giving cash to their workers and because a worker receiving his wages directly in a bank account is eligible for a loan.

Only 13% of the poorest 40% have an account, which is expected. When only 26% of your population is included, you can expect the poorest to be the most affected.

Often, when we talk about financial inclusion we have in mind the inclusion of the poorest of society. However, in Mauritania, even the rich (primarily in rural areas) are not in the financial system. This means that there are demand-side institutional barriers (norms, culture) that go beyond the supply-side economic barriers (income, guarantees).

The financial inclusion data from

Table 4 shows that only 6% of the respondents list religious reasons for not accessing credit. Indeed, in Islam charging interest rates on loans is forbidden. Having a bank account, in itself, is not prohibited. What is not permitted is to take a loan with interest, and this explains the increase in recent years of Islamic products like the Murabaha. Nevertheless, the banking law in Mauritania is not influenced by Islamic tenets and interest rates can be charged. Our interview with the director of microfinance promotion indicated that MFIs charged 20% and obtained refinancing from banks at 14%, leaving them a spread of only 6%. Cooperative networks are probably charging about 17%.

The reasons for not having a bank account are numerous, some voluntary on the demand side and some involuntarily created by supply conditions. In most cases, people justify their exclusion by the fact that they do not have sufficient funds, which is understandable. If you are consuming your entire daily earnings, there is little need to incur transaction costs of going to a distant bank and withdrawing money within banking hours. In Nouakchott, opening a bank account can cost between 2000 Mauritanian Ouguiya (5 euros) to 5000 Mauritanian Ouguiya (12, 5 euros), which can explain that 24% of the respondents find it too expensive for them to have a bank account.

In Mauritania, ATMs are a recent phenomenon and are present only in a few big cities. Placing your money in a bank would automatically convert it into a saving since you cannot withdraw it whenever you feel like it. Moreover, rare are the people who use a credit card to buy and limited are the stores where you can buy with a credit card. All of this makes it rational for someone to only have a bank account when they feel that they have sufficient funds.

According to the director of microfinance promotion in Mauritania, the fact that Mauritania is an Islamic country may also mean that some people may not take microfinance loans and we need to develop Islamic microfinance products as a complementary offering.

In many sub-Saharan African countries, financial inclusion is much higher than in Mauritania because microfinance started much earlier. For example, microfinance started in the 1960s in some of these countries (

Ashta et al. 2016;

Ouédraogo and Gentil 2008), but in Mauritania the history of microfinance is more recent. Our study is probably the first academic research on this country’s financial inclusion and microfinance.

5.3. The Evolution of Microfinance in Mauritania

5.3.1. Description of the Microfinance Sector

According to the director of microfinance in Mauritania, the evolution of microfinance in Mauritania can be divided into three phases: Experimental (1997–2011), crisis (2012–2016), and renewal (2016 onward).

The microfinance sector in Mauritania is quite young. The first microfinance activity began in 1990, with “association pour le credit à la micro et petite enterprise” (ACMPE) and “initiative pour le développement en Mauritanie (IDM).” These two programs received the green light from the Central Bank to help with employment integration and to assist emigrants who wished to come back.

The first MFI opened in 1997 (Caisses Populaires d’Epargnes et de Credit), because of the first real public policy toward the development of a microfinance sector. In 1998, the first regulation of this sector saw the light. This regulation (008/98) specifies the management procedures of credit and savings’ cooperatives and insurance companies. The last legal regulation was issued in 2007, specifying the control of credit institutions including microfinance establishments, in an optic of improving the legal settings and rules.

Although microfinance started rather late in 1990, the number of MFIs is quite high and estimated at around 142. However, many of these are very small and often they regroup in formal networks or federations. The four largest networks of cooperatives account for 111 members: PROCAPEC (Projet de Gestion des Caisses Populaires d’Épargne et de Crédit) has 51 MFIs, UNMICO (Union Nationale des mutuelles d’investissement de crédit oasien) has 30 MFIs, UNCECEL (Union Nationale des Coopératives d’Épargne et de Crédit pour l’Élevage) has 20 MFIs, and UNCECDM has 10 MFIs (

MEFPTIC 2014). Therefore, the other 20 licensees have about 31 members. The most recent information is probably that on the Central Bank of Mauritania’s website, which details 28 networks and 112 MFIS as of 29 July 2018.

The products and services offered by MFIs are restricted to loans, savings, cash transfers, and some Islamic products like the Murabaha.

Nominal interest rates vary from 15% to 24%. In reality, the effective interest yield (which takes into account additional fees applied to credit and the repayment plan) is often higher than the indicated nominal rate. However, such a lack of transparency is found in most countries (

Attuel-Mendes and Ashta 2013;

Waterfield 2012).

According to the director of microfinance promotion, the number of clients went from 94,000 in 2004 to 364,304 in 2010, which is an increase of almost 300%. However, official data are not readily available.

Table 5 provides outreach statistics for three networks and two MFIs. Their total outstanding loans are UM 15.4 billion (about 385 million Euros).

In 2013, the outstanding credit was at 15.4 billion UM, representing 7% of the total net credits of the banking system.

5.3.2. Evolution of the Microfinance Sector

An interesting observation of the director of microfinance in Mauritania was that culture influences microfinance development. Mauritania is a country of Arabs and Bedouins. These people may now have become sedentary but they still owe allegiances to their tribes and villages. The population is only 4 million people and everyone knows everybody. So, there is no risk in lending to people and the repayment rate is high.

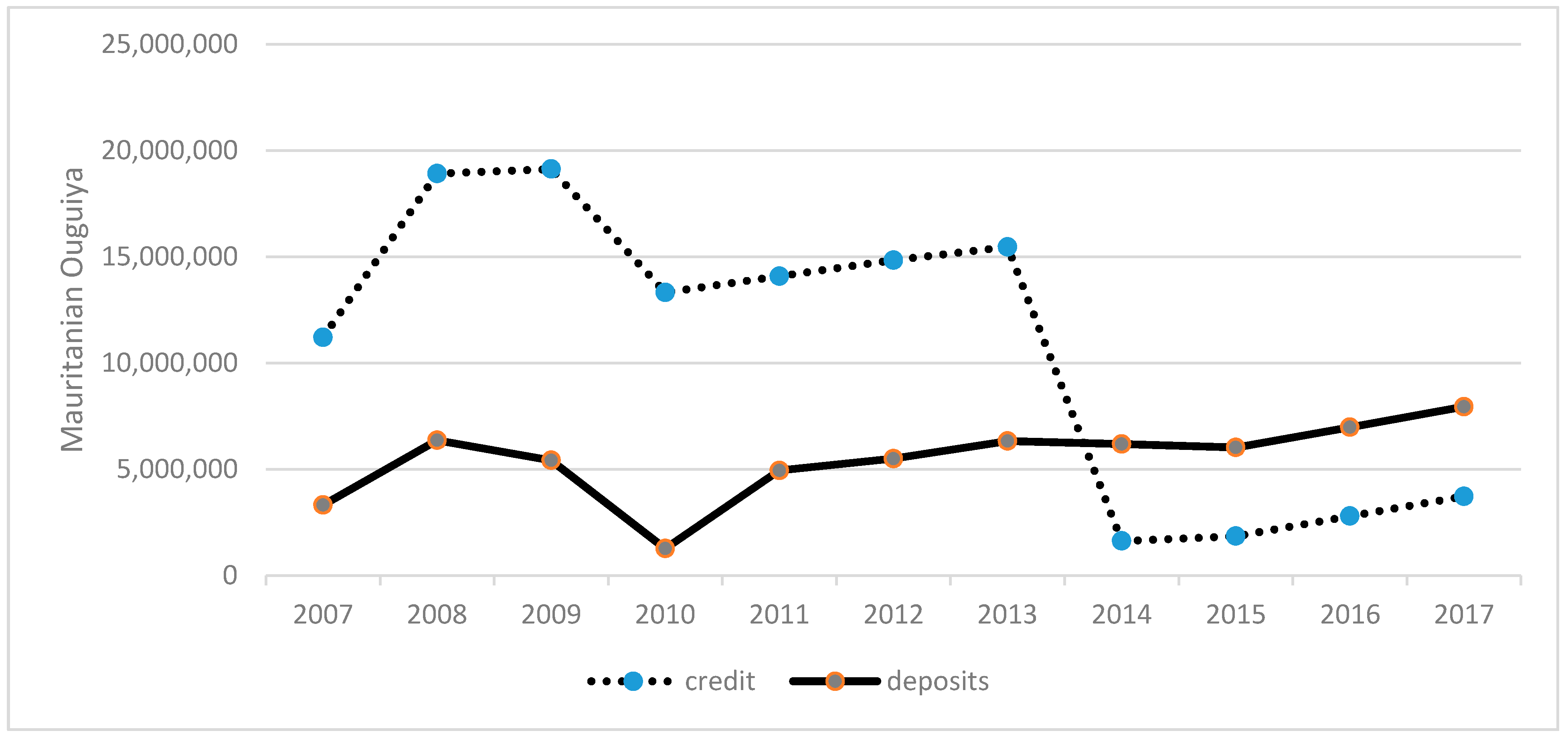

However, until 2012, the microfinance sector was still considered to be in a stage of development and principally based on subsidies and donations. Nevertheless, a major crisis came to the sector in 2014 and lasted for four years until 2017, as can be seen from

Figure 2.

This crisis, according to the director of microfinance in Mauritania, originated in the leading cooperative network CAPEC (Caisses Populaires d’Epargnes et de Credit), which had more than 200,000 clients. The principal reason was bad management linked to overstaffing, confirming

Hudon (

2010), who found that cooperatives tend to be poorly managed. This was coupled with fraud where loans were given to fictive clients to show growth. Evidently, these were not repaid, driving up the nonperforming loans. At the same time, there was also the collapse of UNCACEM (Union Nationale des Caisses Agricoles, de Crédit et d’Épargne de Mauritanie). This institution was mainly providing agricultural loans. So, in bad times, all farmers are affected, and this is, therefore, risky.

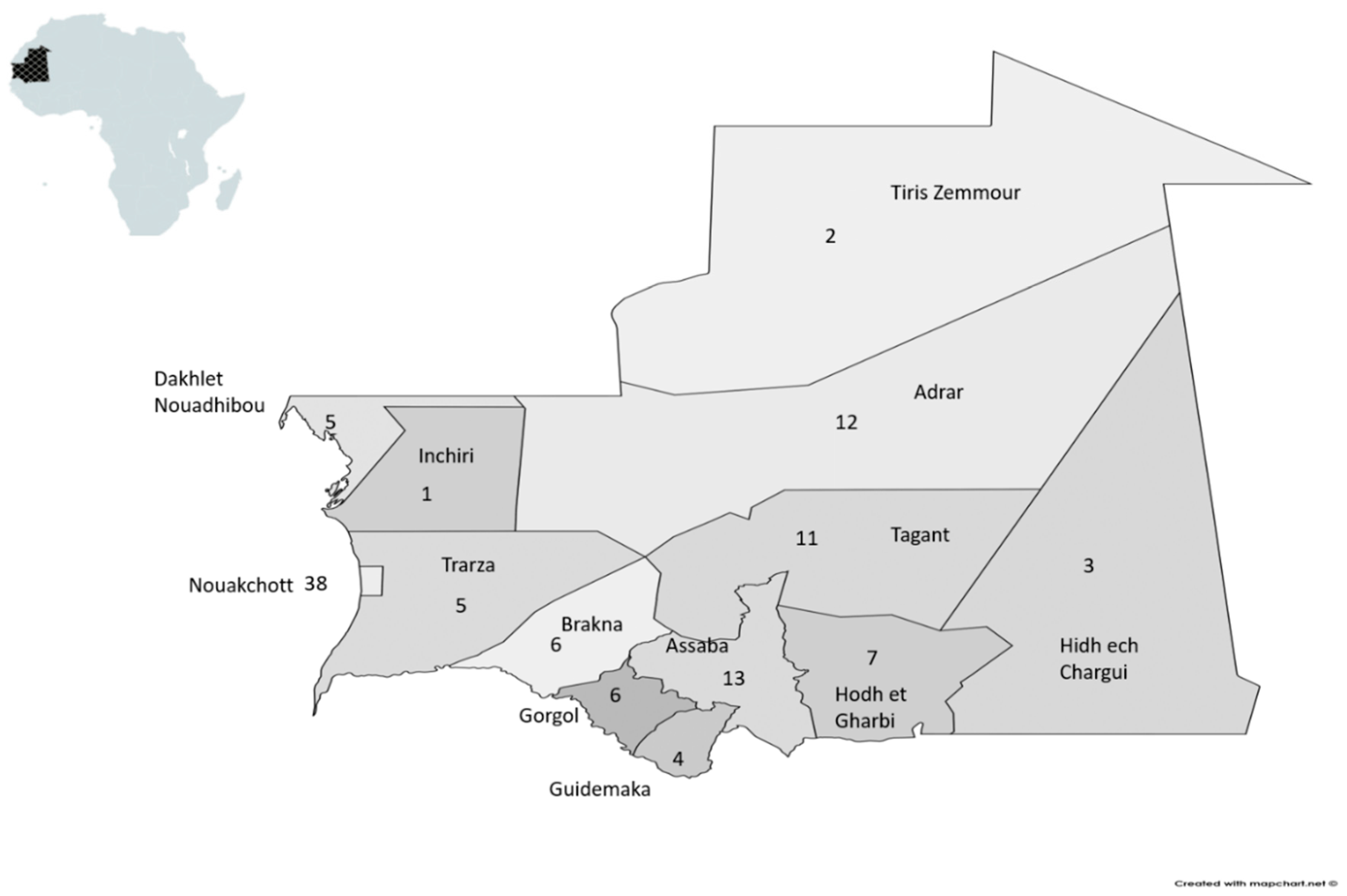

After two years (2014 and 2015), the crisis led to the intervention by the state and a plan for restructuring. A new phase started in 2016 with CAPEC becoming healthy again. The repayment rate rose back to 98%. The number of credit agents was reduced from 1000 to 273. All this helped the financial health of the institution. UNCACEM was replaced by a new institution. Now, the industry is growing year by year, but is spread disproportionately over the whole country, as shown in

Figure 3.

5.3.3. Regional Analysis of Microfinance Development

We would expect MFIs to go where access to credit was low due to population density, unemployment, or poverty, and to prefer educated entrepreneurs who would be more likely to be successful.

Table A3 provides data on some salient features of the different regions of Mauritania. It confirms that MFIs go to regions with high population density and high unemployment rate. Counterintuitively, in

Table 2, we found that people in low-density areas had a higher likelihood of getting credit. This means that the few MFIs that go to low-density areas attract a lot of clients. We note also that

Table 2 concerns all credit and not only microfinance. Using the data of

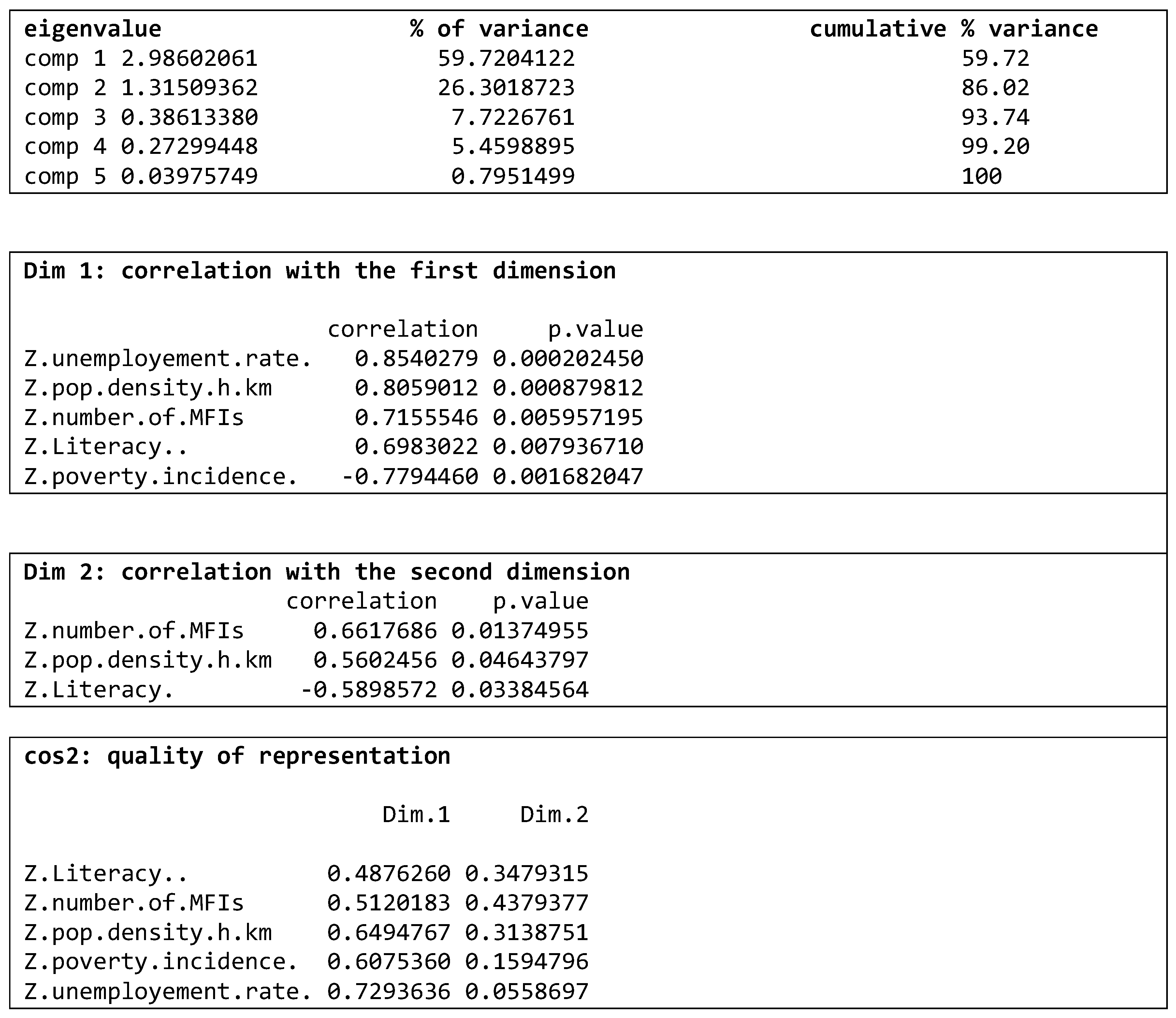

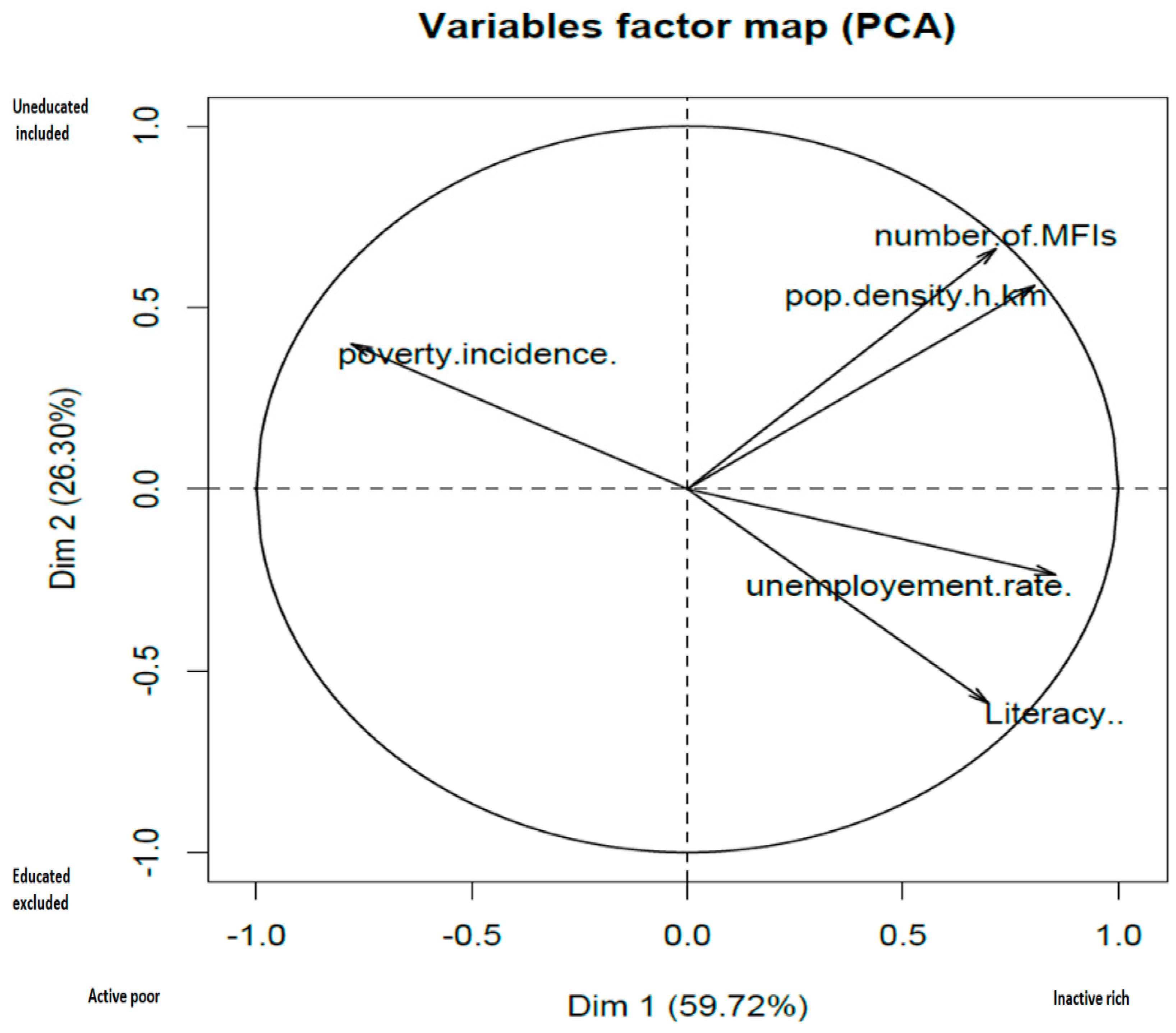

Table A3, we did a principal components’ analysis (PCA) using R software and the results are provided in

Figure A1.

PCA allows a large amount of information to be concentrated in a few broad dimensions. It consists of choosing the items that best represent each of the dimensions. PCA is a descriptive multivariate method. It consists of establishing two types of typologies from metric data (

Escofier and Pagès 1990;

Abdi and Williams 2010):

- ○

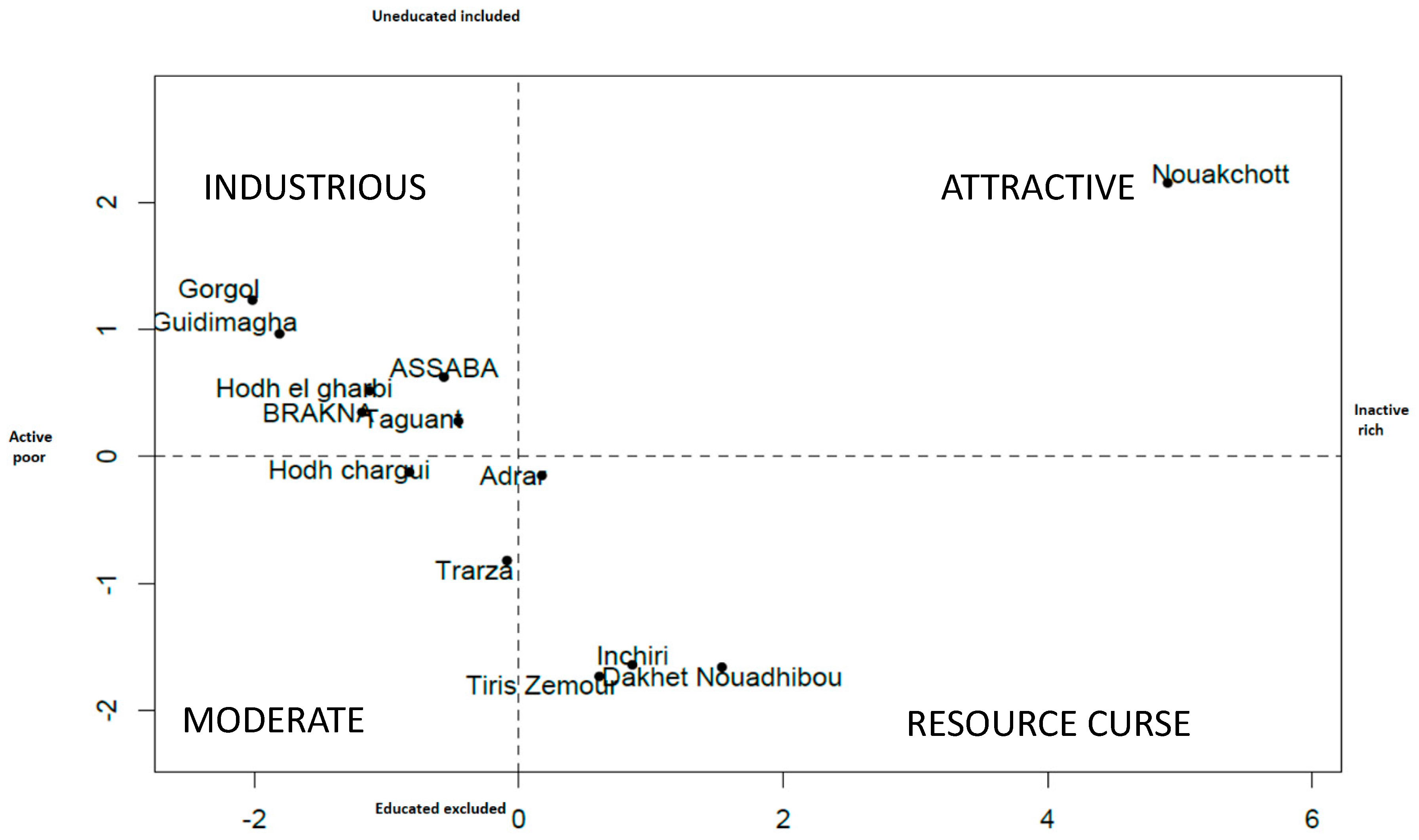

Typology of individuals in

Figure 4 (Are there homogeneous groups of individuals? Which individuals are alike?).

- ○

Typology of variables in

Figure 5 (Which variables are linked positively/negatively between them?). Another aspect of studying the relationships between variables is to summarize the set of variables by a small number of synthetic variables called principal components.

The PCA provided us with rich insights on how the 13 regions were different. As shown by

Figure 3 and

Figure 4, we found two principal dimensions that comprise 86.02% of the total inertia. From the

Figure A1, you can see that unemployment rate, high population density, and poverty are highly correlated with the first dimension. We call this dimension “Inactive rich” since most of the regions on this dimension have high unemployment rate and low poverty rate and the negative of this would be “Active poor”, as shown in

Figure 4. Again, from

Figure A1, we can see that the number of MFIs, literacy, and population density are correlated with the second dimension. In

Figure 4, we call this dimension the “Educated excluded” and the negative of this would be “Uneducated included”. Since population density had a high loading in both dimensions, we did not use it in the name of the dimensions.

At one end, we found active poor regions such as Gorgol and Guidimagha, which were uneducated and included (high implementation of MFIs), as shown by

Figure 5. More moderate were regions such as Hodh El Gharbi, Brakna, and Tagant, with less employment but more education than Gorgol. Assaba had less active poor and more uneducated included. Tagant has active poor with weak literacy and inclusion. Perhaps we can label this quadrant as INDUSTRIOUS.

On the other extreme, we found three regions with high literacy and exclusion but with more inactive rich (Dakhet Nouadhibou, Inchiri, and Tiris Zemour). This is explained by the resource curse since these are the northern regions with extensive deserts and rich in resources (gold, iron, oil, and gas). Clearly, for a financial inclusion viewpoint, this is the most difficult quadrant since the people do not need small loans. We can call this the RESOURCE CURSE.

There are three regions that seem to be in the active-poor and educated-excluded quadrant, but usually having only one dimension. Trarza has only one dimension: It is low on education and has exclusion. Another region, Hodh Ech Chargui, is only on one dimension: Active poor. We cannot say anything about Adrar. We can say that these regions are MODERATE (these results are based on the PCA analysis in

Figure A1).

Finally, we found that Nouakchott was an outlier with a considerable number of MFIs and, thus, high on uneducated included as well as inactive rich. We can call this quadrant ATTRACTIVE because it is attracting illiterate unemployed people because it is the biggest urban center.

5.3.4. Diagnosis: Results of the Qualitative Interview

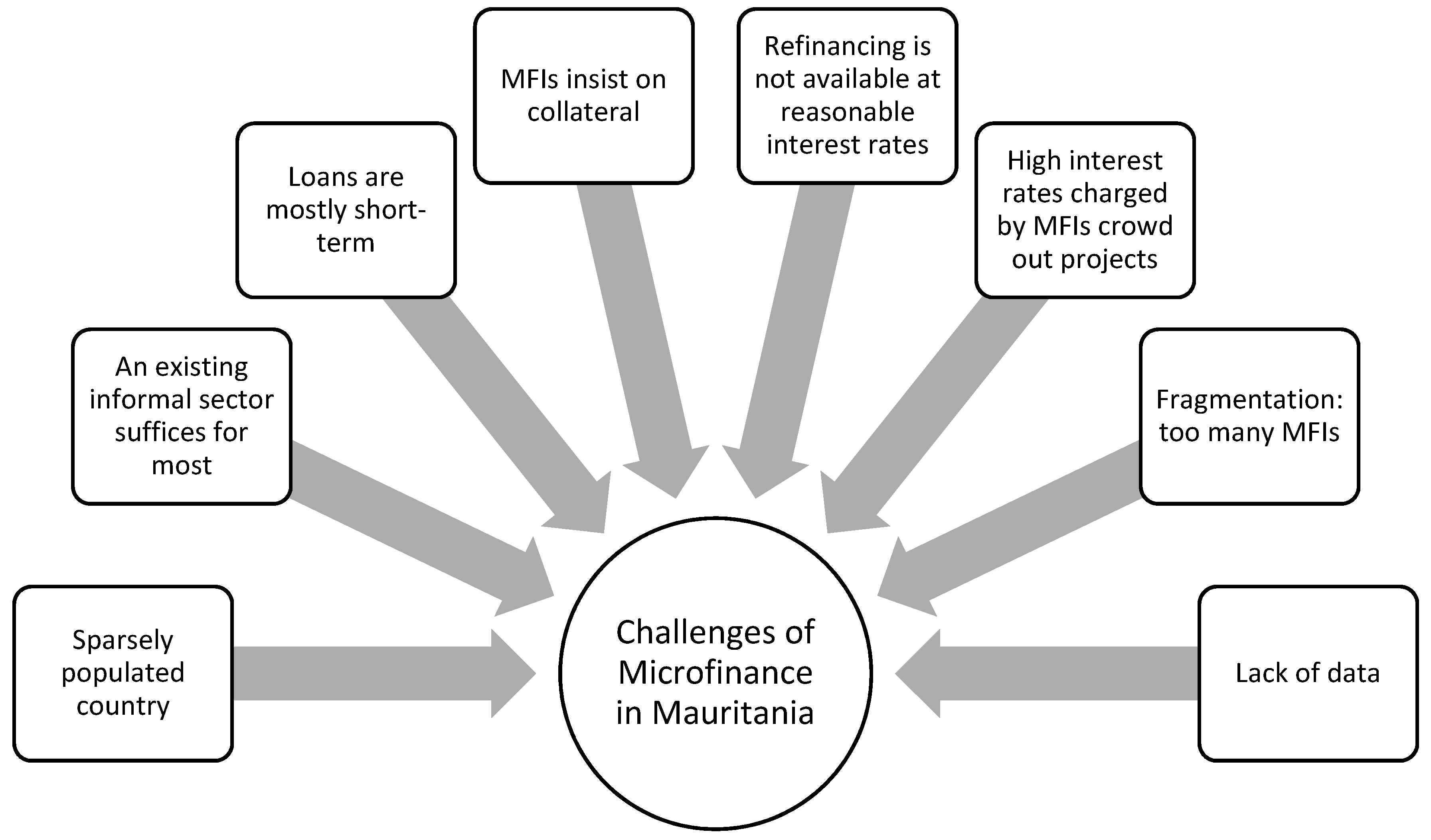

When asked for the key challenges impacting microfinance in Mauritania, the director of microfinance promotion mentioned a number of challenges, which are captured in

Figure 6.

The first major challenge is spreading the geographical coverage in a sparsely populated country. This is especially true of the negligible rural coverage.

Second, there is already an informal financial system composed of tributary family financing systems, tontines, usurers, and dealers. This seems to suffice for most people. Indeed, commercial banks have not been able to open up to the marginalized population, as in Cameroon or Togo (

Ashta et al. 2016;

Messomo Elle 2017).

Third, the majority of loans do not exceed a duration of 12 months, notably because of a lack of long-term financial resources that can allow the MFIs to provide medium-term credits. Mostly, these are business loans for the trade sector. However, some credits have been granted for social needs or consumption purposes.

Fourth, unlike other countries, MFIs in Mauritania ask for collaterals such as blocked savings, pledging (commitment of seizure), and collateral security (joint collateral). For some relatively important loans, MFIs ask for some material surety (jewelry, cars, etc.). This requirement reduces the demand for loans from the poor. However, MFIs justify the need for collateral because repayment rates are only about 95% on averagebut relatively low compared to microfinance in other parts of the world where the norm is closer to 99% (

Ashta 2016;

Cull et al. 2009;

Dowla and Barua 2006).

Fifth, banks intervene to refinance MFIs but they ask for important guarantees that exclude small MFIs. Therefore, young MFIs with a weak level of activity and weak administration are having difficulties in achieving self-sufficiency. As a result, government interventions have been increasing.

The sixth block could be that because of the high interest rates, the demand is lower and a number of useful projects get rationed out.

Seventh, there is fragmentation, owing to a tendency of creating more and more MFIs rather than merging or creating networks. This is a weakness of the sector because new MFIs have difficulties establishing themselves. This is especially because the government gives support to big players, such as PROCAPEC and UNCACEM. Indeed, these two networks have more than 50% of the sectors’ clients, and both are having difficulties. PROCAPEC has been in difficulties for almost 10 years due to bad management, but the government is still trying to redress it. As for UNCACEM, it went bankrupt because of its fragility and its dependence on external subsidies.

Finally, there is a lack of data on this sector, which makes it difficult to do a proper assessment of its performance.