1. Introduction

Cryptocurrencies are digital currencies which can be used for direct retail purchases but also as financial assets in general. They are characterized by some features that make them different from other assets, namely the facts that they are not subject to any centralized institutional authority and that they do not have physical representation. Another important feature, which makes this kind of currency somewhat controversial, is the fact that they are not associated with any tangible assets (

Corbet et al. 2019).

Since the creation of Bitcoin in 2009, which was the first cryptocurrency, this particular market has increased its value exponentially, reaching about 260 billion USD of capitalization in May 2019. Bitcoin itself was responsible for about 55% of that capitalization, being by far the most important cryptocurrency. This evolution makes cryptocurrencies very interesting for investors, as well as for researchers, with a growing body of literature on several issues (

Urquhart 2018;

Corbet et al. 2019). These studies include topics more linked with financial issues like efficiency or the relationship with other assets (which is addressed in the next section), in addition to analysis issues like regulation or even linkages with possibly illicit activities (see, respectively, the works of

Chaffee (

2018) and

Campbell-Verduyn (

2018) as examples on each of those topics).

Despite the evolution of cryptocurrencies’ prices, during 2017 this market experienced a kind of bubble, with prices reaching maximum levels on 15 December 2017, followed by a sharp decrease. With such an episode, and considering Bitcoin as the most relevant cryptocurrency, we can evaluate the possibility of a contagion effect in this market. According to

Forbes and Rigobon (

2002), there is a certain pre-existing integration between assets and, after a given episode of instability, this relationship is intensified, i.e., correlations between those assets increase.

Based on the Detrended Cross-Correlation Analysis correlation coefficient (ρDCCA), we calculated this correlation both before and after that episode. Furthermore, we estimated the ΔρDCCA, which could be considered a measure of contagion. Although the literature on cryptocurrencies is growing rapidly, our paper extends the existing literature by focusing on a specific event, showing the importance of not only that event but also the role of Bitcoin in this particular market. Moreover, the employed methodology allowed us to conduct an analysis of contagion considering different time scales, which could be interesting because short-run impacts (lower time scales) could be different from long-run ones (higher time scales).

Our main results show the existence of a contagion effect between Bitcoin and the other cryptocurrencies studied, excepting Tether, which indicates a more interconnected market now than in the past. The remainder of the work is organized as follows:

Section 2 presents a literature review on work involving cryptocurrencies;

Section 3 describes the methodology and data;

Section 4 presents the results;

Section 5 concludes the paper.

2. Literature Review

As previously identified, there is a clear interest in the cryptocurrency market, not only among the general public and investors but also among researchers in several different areas.

Corbet et al. (

2019) made a very interesting survey of work involving cryptocurrencies, dividing research in non-quantitative and quantitative and dividing papers in five different areas: bubble dynamics, regulation, cybercrime, diversification and efficiency.

Regarding quantitative research, which is our focus, this kind of work seems to originate in 2013. For example,

Kristoufek (

2013) related the increased valuation of Bitcoin to the increased interest in that currency.

Gronwald (

2014) used a GARCH (Generalized Autoregressive Conditional Heteroskedasticity) approach and concluded that Bitcoin was marked by extreme price movements, probably because it was still an immature market.

Bornholdt and Sneppen (

2014) compared Bitcoin with other cryptocurrencies in terms of their importance, and concluded at that time that Bitcoin did not show special advantages over other cryptocurrencies. Using complex networks,

Kondor et al. (

2014) identified that cryptocurrencies in general were evolving and accumulating value owing to their increasing acceptance.

Kristoufek (

2015) studied the potential drivers of Bitcoin prices, identifying that it has properties of a standard financial asset as well as properties of a speculative asset.

These are some prior papers devoted to analyzing the quantitative aspects of cryptocurrencies. However, as mentioned, the literature on cryptocurrencies is constantly growing, and recently many studies have been found to analyze cryptocurrencies. One of the most researched issues concerns the efficiency of the cryptocurrency market (

Urquhart 2016;

Bariviera 2017;

Nadarajah and Chu 2017;

Tiwari et al. 2018, among others), with most studies concluding on the inefficiency of these assets (although with some evidence that the market is becoming more efficient—see, for example,

Khuntia and Pattanayak (

2018)). A comprehensive recent survey about the efficiency of cryptocurrencies is found in

Kyriazis (

2019).

We also found studies on the similarities of cryptocurrencies and other assets. For example,

Baumöhl (

2018) analyzed the connection between forex and cryptocurrencies and found evidence of a low connection between those markets.

Corbet et al. (

2018b) analyzed three different cryptocurrencies and other financial assets, and found some segmentation between them, concluding that investment in cryptocurrencies could offer diversification opportunities to investors, mainly in short time horizons.

Symitsi and Chalvatzis (

2018) analyzed the linkages between Bitcoin and energy and technology companies and also found some relationship between those markets.

Kristjanpoller and Bouri (

2019) also analyzed the cross-correlations between cryptocurrencies and conventional currencies, pointing out significant asymmetric characteristics in the cross-correlations.

Ji et al. (

2019a) applied network methodologies to analyze linkages between cryptocurrencies and other commodities, finding connections with some of those commodities.

Bouri et al. (

2019a) analyzed linkages between cryptocurrencies, focusing on the relationship between volatility measures and discriminating between transitory and permanent causalities. The authors concluded that permanent shocks are more important.

Ji et al. (

2019b) also analyzed the information interdependence between cryptocurrencies and commodities, with a time-varying approach, and concluded that cryptocurrencies are integrated within broadly defined commodity markets.

Previous work analyzed comovements between cryptocurrencies and other assets, while several studies analyzed comovements among different cryptocurrencies. For example,

Beneki et al. (

2019) centered their analysis on the relationship between Bitcoin and Ethereum, and determined that correlations exist, with each cryptocurrency influencing the other with a time-varying kind of influence.

Mensi et al. (

2019) used wavelet methodologies to study the comovements among major cryptocurrencies. Despite the existence of comovements, the authors concluded that mixed portfolios with different cryptocurrencies could be interesting for diversification purposes. Besides analyzing the linkages with commodities,

Ji et al. (

2019a) studied the connectedness of return and volatility in major cryptocurrencies, finding that Litecoin and Bitcoin are in the center of the connectedness in terms of returns, and that negative returns have larger effects than positive returns. In the case of volatility, Bitcoin is the cryptocurrency with greatest influence.

Bouri et al. (

2019b) analyzed the possibility of herding behavior in the cryptocurrency market. While with a static approach, the evidence does not confirm that effect, with a dynamic analysis, due to the existence of breaks and non-linearities in data, that effect seems to be found. In another study,

Bouri et al. (

2019c) analyzed whether explosivity in one cryptocurrency can lead to explosivity in other cryptocurrencies, finding evidence of connections between those assets.

These two studies could be considered as a starting point for our analysis, because they draw attention to the need to study contagion in the cryptocurrency market. Analyzing the existence of a contagion effect in the cryptocurrency market is also present in other studies. For example,

Antonakakis et al. (

2019) investigated the transmission mechanism among the top nine cryptocurrencies between 15 August 2015 and 31 May 2018, finding that periods of high (low) uncertainty were characterized by strong (low) connectivity, with Bitcoin affecting the market’s connectivity the most. In another analysis,

Silva et al. (

2019) analyzed 50 cryptocurrencies with greater liquidity, identifying the contagion effect of Bitcoin in almost all cases.

In this study, to analyze the possibility of a contagion effect, we used the ΔρDCCA proposed by

Da Silva et al. (

2016), based on

Zebende’s (

2011) cross-correlation coefficient. The main contribution of this work lies in the analysis of multiscale contagion applied to the cryptocurrency market. Moreover, and as mentioned by

Bouri et al. (

2019b), this market seems to suffer from non-linearities, so the use of the proposed methodology was appropriate. We employed the methodology proposed by

Guedes et al. (

2018a,

2018b) to test the statistical significance of the contagion effect.

3. Data and Methodology

Based on

https://coinmarketcap.com/, we retrieved data for the cryptocurrencies with greatest capitalization and with information from at least as far back as July 2016 to 23 May 2019. As we wanted to compare the ρDCCA before and after the crash of December 2017, and as the post-crash period comprised a total of 523 observations, we looked for cryptocurrencies that had the same number of observations in the pre-crash period. Besides Bitcoin, the 10 cryptocurrencies with greatest capitalization and with information for the time period under analysis were Ethereum, Ripple (XRP), Litecoin, Tether, Stellar, Monero, Dash, NEM, Dogecoin and Waves.

According to

Forbes and Rigobon (

2002), the contagion effect implies an increase in the correlation between financial assets after the occurrence of a given event. We followed the intuition of those authors, analyzing the correlation between Bitcoin and 10 other major cryptocurrencies, splitting the sample before and after the price decrease at the end of 2017 and using the coefficient of

Zebende (

2011) based on the DCCA proposed by

Podobnik and Stanley (

2008). Considering two different datasets,

and

, with

equidistant observations, the first step of DCCA consists of integrating both series and calculating

and

. After this, the whole samples are divided into boxes of equal length, with dimension

n, and are divided into

N-n overlapping boxes. With ordinary least squares, local trends are calculated (

and

) and used to detrend the original time series, calculating the difference between the original values and the trend. The expression

identifies the covariance of the residuals of each box. Then, summing those values for all boxes of size

n, we obtain the detrended covariance given by

. Repeating the process for all possible length boxes leads to obtaining the DCCA exponent from the relationship between the DCCA fluctuation function and

n. This results in the power law

, with λ being the parameter of interest of the DCCA, which quantifies the long-range power-law cross-correlations.

The DCCA identifies the type of cross-correlation (positive or negative) but does not quantify the level of cross-correlation. This quantification is made by the correlation coefficient proposed by

Zebende (

2011), which combines DCCA with DFA (Detrended Fluctuation Analysis), a methodology used to identify the level of dependence of each individual time series. That correlation coefficient is given by

.

This is a scale-dependent coefficient, and it is possible to analyze different behaviors considering different time scales. Moreover, it has desirable properties, as described by

Kristoufek (

2014) and

Zhao et al. (

2017), namely its efficiency and the fact that it ranges from −1 to 1. We used the procedure reported by

Podobnik et al. (

2011) to identify the critical values in order to test the significance of the correlation levels.

As previously mentioned, we intended to calculate contagion, so we obtained a correlation coefficient for the periods before and after the bubble episode at the end of 2017. Following the idea proposed by

Da Silva et al. (

2016), we calculated the

given by the difference between the correlation level after the bubble episode and that before the episode. If the value of ∆ρ is positive, the correlation coefficients increase and, according to

Forbes and Rigobon (

2002), contagion exists. We used the critical values of

Guedes et al. (

2018a,

2018b) to evaluate the statistical significance of the effect.

4. Results

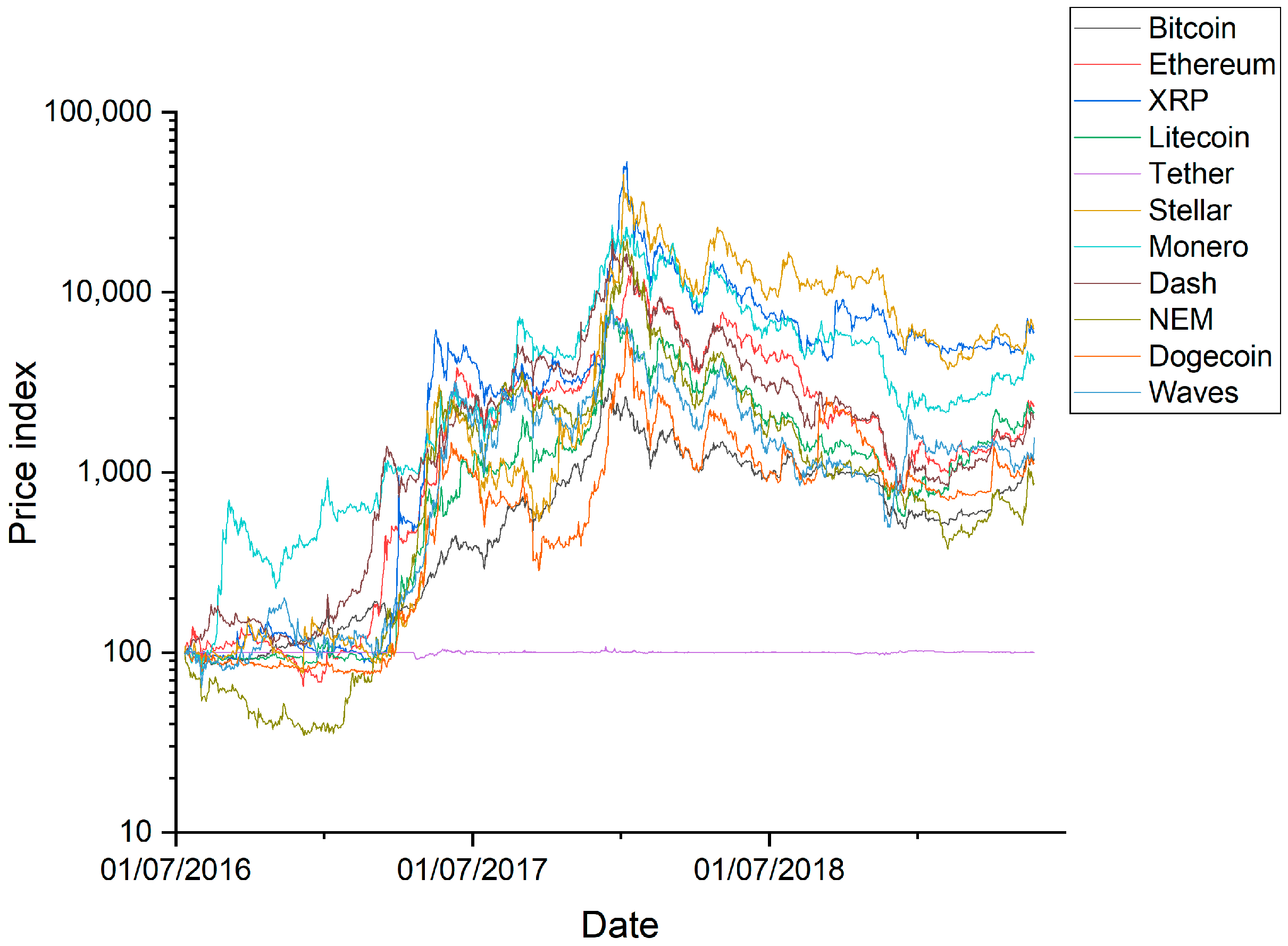

Figure 1 shows the evolution of prices in the cryptocurrencies and sample analyzed. Prices were transformed in an index for better comparison. The figure shows the constant increase in prices until December 2017. Except for Tether, whose price was relatively stable throughout the sample, the other cryptocurrencies seemed to have some similarities in their fluctuations.

The prices were then transformed in return rates, using the traditional difference of price logarithms between two consecutive moments, to calculate the correlations.

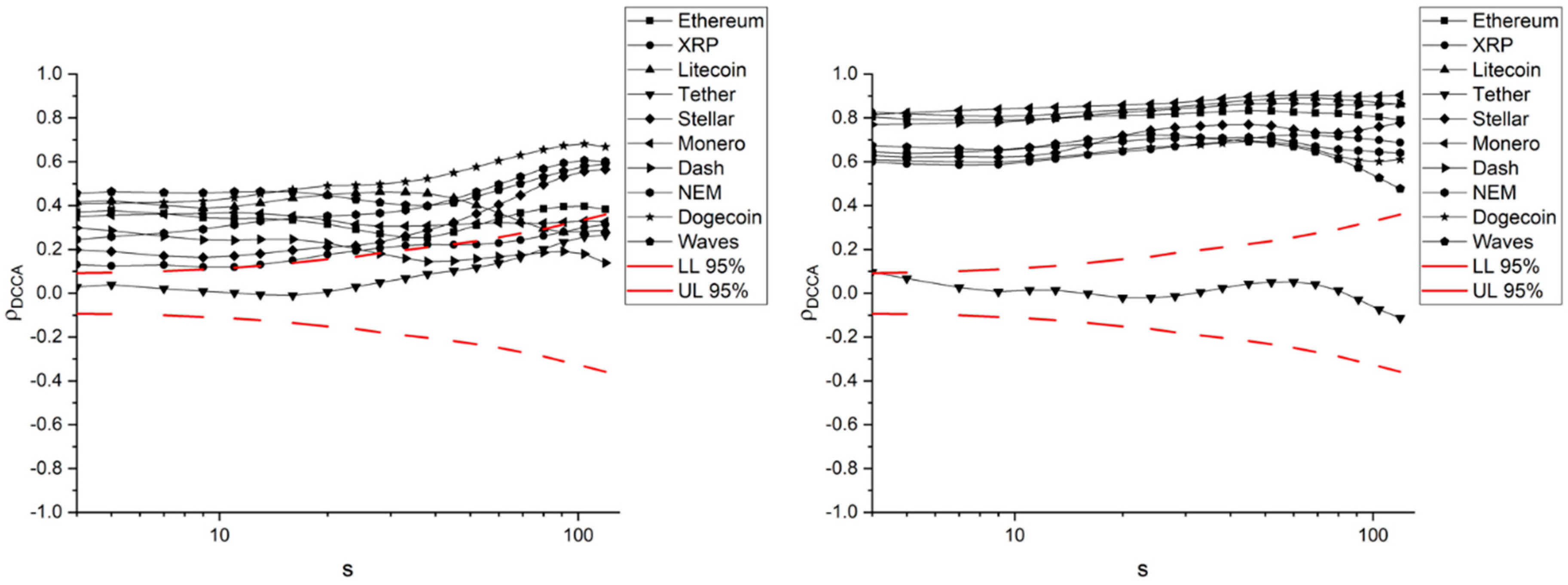

Figure 2 shows the correlation coefficient in both sub-periods. It is clear that the correlation pattern was generally higher in the post-crash than in the pre-crash period. Tether did not show a significant correlation with Bitcoin in either the pre or post-crash period, which is not surprising from analysis of

Figure 1 (which reinforces the robustness of the method). Besides this particular cryptocurrency, Dash (from 30 days), XRP (from 50 days) and Litecoin and Monero (for higher time scales) showed some evidence of a non-significant correlation with Bitcoin in the first period under analysis. In the second period, and once again except for Tether, all the cryptocurrencies showed significant correlations with Bitcoin, in some cases with a very high level of correlation.

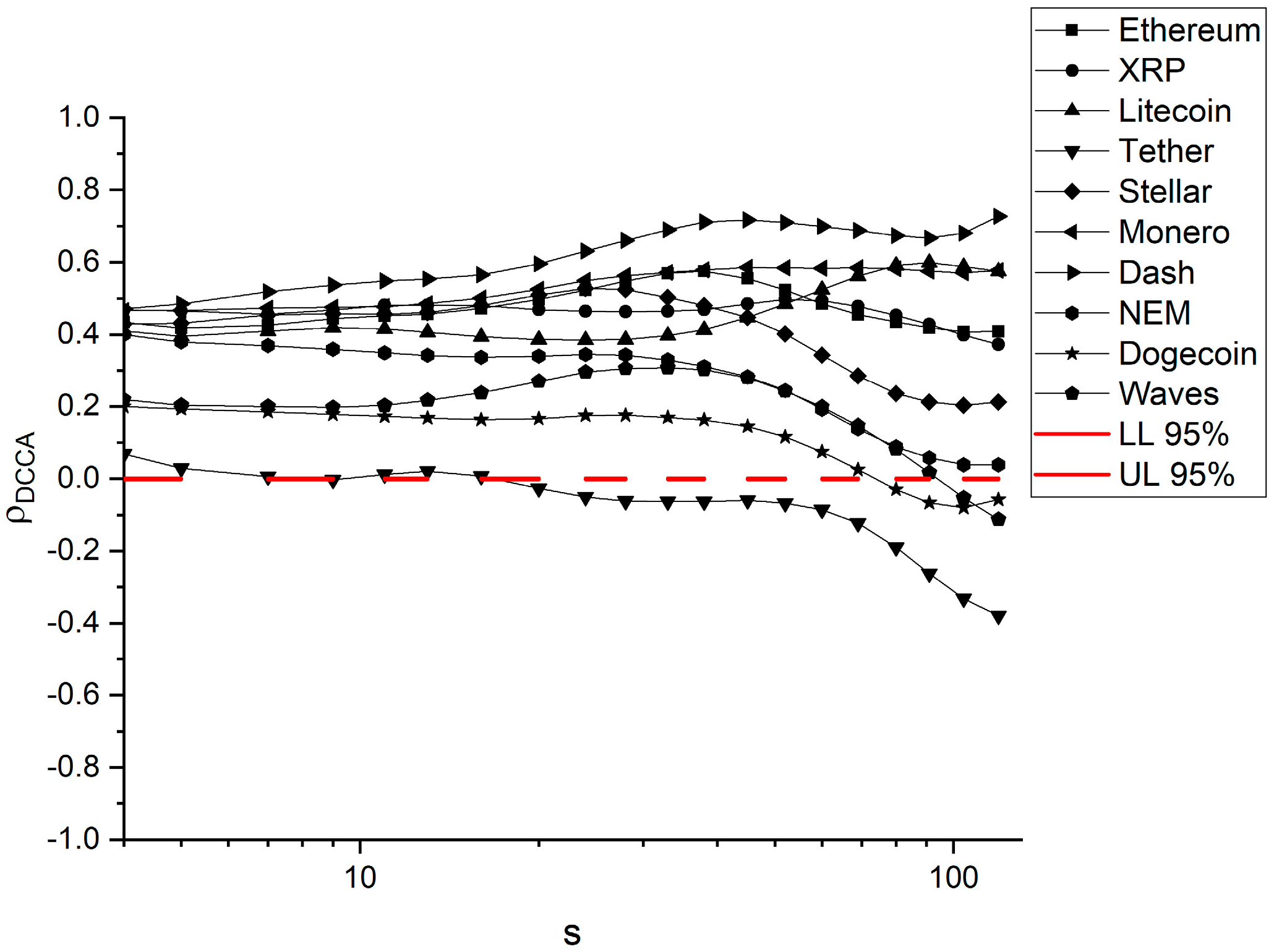

Figure 3 represents the difference in the correlation coefficients before and after the crash. If positive, this could be understood as a contagion effect, as described by

Forbes and Rigobon (

2002). Except for Tether, Dogecoin and Waves (the latter two just for higher time scales and relatively low absolute values), all the other cryptocurrencies exhibited an increased correlation with Bitcoin, with Dash, Litecoin and Monero having the highest increases. This contagion effect means that the cryptocurrency market as a whole is now more integrated than in the past, implying that cryptocurrencies are now more exposed to possible price shocks in the main cryptocurrency (Bitcoin).

The increased integration of this particular market ultimately means that most of the cryptocurrencies being studied are now more sensitive to changes in the price of Bitcoin, with all the risks that arise from this increased exposure. So, any shock in Bitcoin’s price could pass along to other cryptocurrencies, which could cause some degree of instability in the market. Moreover, due to the increase of the cryptocurrency market as a whole, those changes could also impact other financial markets, depending on their relationship with Bitcoin and other assets.

5. Concluding Remarks

Analysis of the contagion effect is an important instrument to observe how certain financial assets are related after extreme events such as crises or bubbles. Since the study of

Forbes and Rigobon (

2002), contagion effects have been identified in several markets, causing a wide and interesting debate in the world’s financial community. In the present analysis, we adapted this contagion concept to analyze the cryptocurrency market, since this is an important market due to both its financial volume and the growing interest shown in it.

This research identified a contagion effect between Bitcoin returns and the returns of most of the other cryptocurrencies analyzed. The exception is Tether, with no evidence of a significant contagion effect for any time scale. This analysis reveals that this market experienced increasing integration between the main cryptocurrencies after the bubble that occurred in December 2017.

Our results provide important information for current and potential investors when analyzing financial risk in the cryptocurrency market. In fact, in constructing portfolios, it could be risky to consider investing in several cryptocurrencies, since they seem to be more highly integrated now than in the past (although

Mensi et al. (

2019) identified the possibility of diversification using cryptocurrencies). Moreover, and considering that other recent studies identified linkages between this particular market and other assets, this may also affect the possibility of diversification. In fact, the possibility of increased integration between markets, in addition to the cryptocurrency market, is an important issue for future research so as to continuously monitor the possibility of using several markets and assets for diversification purposes. Moreover, the possibility of conducting this analysis with time-varying approaches is also a challenge for future research, which could provide historical information about the evolution of these relationships.