The Effect of Diversification under Different Ownership Structures and Economic Conditions: Evidence from the Great Recession

Abstract

:1. Introduction

2. Previous Literature

3. Hypotheses Development

3.1. Ownership Structures under Normal Economic Conditions

3.2. Ownership Structures under Extreme Economic Conditions

4. Data and Methodology

4.1. Data

4.2. Performance Measures

4.3. Diversification Measure

4.4. Economic Activity Measure

4.5. Ownership Structure

4.6. Control Variables

4.7. Methodology

5. Results

5.1. Summary Statistics

5.2. Univariate Results

5.3. Regression Analysis

5.4. Robustness Tests4

5.4.1. Alternative Measure of Performance: ROE

5.4.2. Alternative Measure of Diversification: Business Herfindahl

5.4.3. Alternative Measure of Diversification: Number of Lines

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Benefits and Costs of Diversification

| Benefits | Costs |

|---|---|

| Debt Coinsurance (Lewellen 1971) | Inefficient Investment (Rajan et al. 2000) |

| Efficient Internal Capital Markets (Stein 1997) | Agency Problems: |

| Use of Non-Tradable Resources (Penrose 1959) | Manager’s Personal Risk Reduction (Amihud and Lev 1981) |

| Economies of Scope (Teece 1980, 1982) | Empire-building (Jensen 1986) |

| Increased Market Power (Tirole 1995) | Managerial Entrenchment (Shleifer and Vishny 1989) |

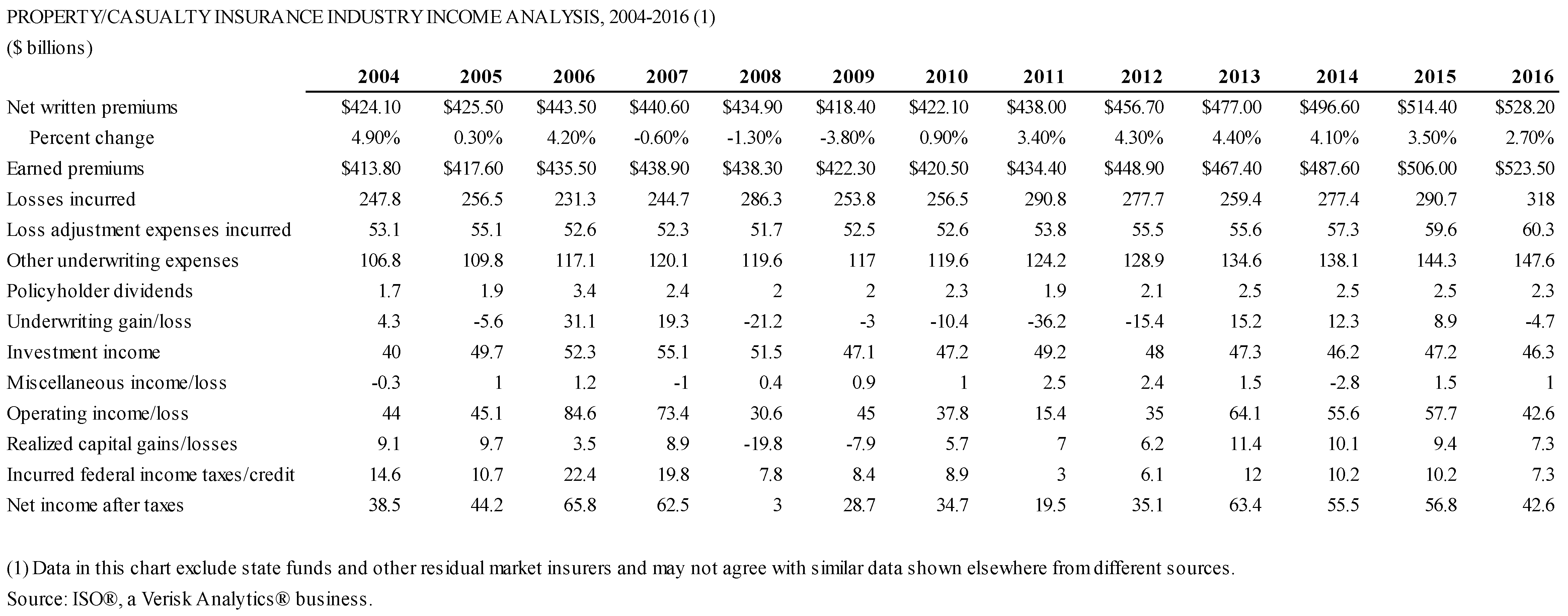

Appendix B. Property/Casualty Insurance Industry Income Analysis, 2004–2016 (1)

Appendix C. Business Lines Detail

- (a)

- Fire and Allied lines is defined as the sum of “Fire” (line 1) and “Allied lines” (line 2).

- (b)

- Accident and Health is defined as the sum of “Group Accident and Health” (line 13), “Credit Accident and Health” (line 14), and “Other Accident and Health” (line 15).

- (c)

- Medical Malpractice is defined as the sum of “Medical Malpractice–Occurrence” (line 11.1) and “Medical Malpractice–Claims Made” (line 11.2).

- (d)

- Products Liability is defined as the sum of “Products Liability–Occurrence” (line 18.1) and “Products Liability–Claims Made” (line 18.2).

- (e)

- Auto is defined as the sum of “Private Passenger Auto Liability” (line 19.1, 19.2), “Commercial Auto Liability” (line 19.3, 19.4), and Auto Physical Damage (line 21).

- (f)

- Other liability is defined as the sum of “Other liability–occurrence” (line 17.1) and “Other liability–claims-made” (line 17.2).

- (g)

- Other lines is defined as the sum of “Aggregate write-ins for other lines of business” (line 34), “Excess workers’ compensation” (line 17.3) and “Warranty” (line 30).

References

- Amihud, Yakov, and Baruch Lev. 1981. Risk reduction as a managerial motive for conglomerate mergers. The Bell Journal of Economics 12: 605–17. [Google Scholar] [CrossRef]

- Bascle, Guilhem. 2008. Controlling for endogeneity with instrumental variables in strategic management research. Strategic Organization 6: 285–327. [Google Scholar] [CrossRef]

- Berger, Philip G., and Eli Ofek. 1995. Diversification’s effect on firm value. Journal of Financial Economics 37: 39–65. [Google Scholar] [CrossRef]

- Campa, Jose Manuel, and Simi Kedia. 2002. Explaining the diversification discount. The Journal of Finance 57: 1731–62. [Google Scholar] [CrossRef]

- Campello, Murillo, Erasmo Giambona, John R. Graham, and Campbell R. Harvey. 2011. Liquidity management and corporate investment during a financial crisis. Review of Financial Studies 24: 1944–79. [Google Scholar] [CrossRef]

- Campello, Murillo, John R. Graham, and Campbell R. Harvey. 2008. The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics 97: 470–87. [Google Scholar] [CrossRef]

- Chakrabarti, Abhirup, Kulwant Singh, and Ishtiaq Mahmood. 2007. Diversification and performance: Evidence from East Asian firms. Strategic Management Journal 28: 101–20. [Google Scholar] [CrossRef]

- Chidambaran, N. K., Thomas A. Pugel, and Anthony Saunders. 1997. An investigation of the performance of the US property-liability insurance industry. Journal of Risk and Insurance 64: 371–82. [Google Scholar] [CrossRef]

- Colquitt, L. Lee, and David W. Sommer. 2003. An exploratory analysis of insurer groups. Risk Management and Insurance Review 6: 83–96. [Google Scholar] [CrossRef]

- Cummins, J. David, and Patricia M. Danzon. 1997. Price, financial quality, and capital flows in insurance markets. Journal of Financial Intermediation 6: 3–38. [Google Scholar] [CrossRef]

- Cummins, J. David, and Gregory P. Nini. 2002. Optimal capital utilization by financial firms: Evidence from the property-liability insurance industry. Journal of Financial Services Research 21: 15–53. [Google Scholar] [CrossRef]

- Cummins, J. David, and David W. Sommer. 1996. Capital and risk in property-liability insurance markets. Journal of Banking & Finance 20: 1069–92. [Google Scholar]

- Dang, Chongyu, Zhichuan Frank Li, and Chen Yang. 2018. Measuring Firm Size in Empirical Corporate Finance. Journal of Banking & Finance 86: 159–76. [Google Scholar]

- Denis, David J., Diane K. Denis, and Atulya Sarin. 1997. Agency problems, equity ownership, and corporate diversification. The Journal of Finance 52: 135–60. [Google Scholar] [CrossRef]

- Dimitrov, Valentin, and Sheri Tice. 2006. Corporate diversification and credit constraints: Real effects across the business cycle. The Review of Financial Studies 19: 1465–98. [Google Scholar] [CrossRef]

- Elango, B., Yu-Luen Ma, and Nat Pope. 2008. An investigation into the diversification–performance relationship in the US property–liability insurance industry. Journal of Risk and Insurance 75: 567–91. [Google Scholar] [CrossRef]

- Gardner, Lisa A., and Martin F. Grace. 1993. X-efficiency in the US life insurance industry. Journal of Banking & Finance 17: 497–510. [Google Scholar]

- Gorton, Gary. 2009. Information, liquidity, and the (ongoing) panic of 2007. American Economic Review 99: 567–72. [Google Scholar] [CrossRef]

- Graham, John R., Michael L. Lemmon, and Jack G. Wolf. 2002. Does corporate diversification destroy value? The Journal of Finance 57: 695–720. [Google Scholar] [CrossRef]

- Heckman, James J. 1979. Sample selection bias as a specification error. Econometrica: Journal of the Econometric Society 47: 153–61. [Google Scholar] [CrossRef]

- Hadlock, Charles J., Michael Ryngaert, and Shawn Thomas. 2001. Corporate structure and equity offerings: Are there benefits to diversification? The Journal of Business 74: 613–35. [Google Scholar] [CrossRef]

- Hamilton, R. T., and G. S. Shergill. 1993. Extent of diversification and company performance: The New Zealand evidence. Managerial and Decision Economics 14: 47–52. [Google Scholar] [CrossRef]

- Harrington, Scott E. 2005. Capital adequacy in insurance and reinsurance. In Capital Adequacy Beyond Basel: Banking, Securities, and Insurance. Oxford: Oxford Scholarship Online, vol. 87, pp. 88–89. [Google Scholar]

- Harrington, Scott E. 2009. The Financial Crisis, Systemic Risk, and the Future of Insurance Regulation. Journal of Risk and Insurance 76: 785–819. [Google Scholar] [CrossRef]

- Herring, Richard J., and Anthony M. Santomero. 1990. The corporate structure of financial conglomerates. In International Competitiveness in Financial Services. Dordrecht: Springer, pp. 213–39. [Google Scholar]

- Hoyt, Robert E., and James S. Trieschmann. 1991. Risk/return relationships for life-health, property-liability, and diversified insurers. Journal of Risk and Insurance 58: 322–30. [Google Scholar] [CrossRef]

- Ivashina, Victoria, and David Scharfstein. 2010. Bank lending during the financial crisis of 2008. Journal of Financial Economics 97: 319–38. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1986. Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review 76: 323–29. [Google Scholar]

- Johnson, Simon, Peter Boone, Alasdair Breach, and Eric Friedman. 2000. Corporate governance in the Asian financial crisis. Journal of Financial Economics 58: 141–86. [Google Scholar] [CrossRef]

- Kahle, Kathleen M., and René M. Stulz. 2010. Financial Policies and the Financial Crisis: How Important Was the Systemic Credit Contraction for Industrial Corporations? No. w16310. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Klein, Robert W., and Shaun Wang. 2009. Catastrophe risk financing in the United States and the European Union: A comparative analysis of alternative regulatory approaches. Journal of Risk and Insurance 76: 607–37. [Google Scholar] [CrossRef]

- Kuppuswamy, Venkat, and Belen Villalonga. 2015. Does diversification create value in the presence of external financing constraints? Evidence from the 2007–2009 financial crisis. Management Science 62: 905–23. [Google Scholar] [CrossRef]

- Laeven, Luc, and Ross Levine. 2007. Is there a diversification discount in financial conglomerates? Journal of Financial Economics 85: 331–67. [Google Scholar] [CrossRef]

- Lewellen, Wilbur G. 1971. A pure financial rationale for the conglomerate merger. The Journal of Finance 26: 521–37. [Google Scholar] [CrossRef]

- Li, Frank. 2016. Endogeneity in CEO power: A survey and experiment. Investment Analysts Journal 45: 149–62. [Google Scholar] [CrossRef]

- Liebenberg, Andre P., and David W. Sommer. 2008. Effects of corporate diversification: Evidence from the property–liability insurance industry. Journal of Risk and Insurance 75: 893–19. [Google Scholar] [CrossRef]

- Markides, Constantinos C. 1992. Consequences of corporate refocusing: Ex ante evidence. Academy of Management Journal 35: 398–412. [Google Scholar] [CrossRef]

- Matvos, Gregor, and Amit Seru. 2014. Resource allocation within firms and financial market dislocation: Evidence from diversified conglomerates. The Review of Financial Studies 27: 1143–89. [Google Scholar] [CrossRef]

- Mayer, Michael, and Richard Whittington. 2003. Diversification in context: A cross-national and cross-temporal extension. Strategic Management Journal 24: 773–81. [Google Scholar] [CrossRef]

- Mayers, David, and Clifford W. Smith Jr. 1981. Contractual provisions, organizational structure, and conflict control in insurance markets. Journal of Business, 407–34. [Google Scholar] [CrossRef]

- Mayers, David, and Clifford. W. Smith. 1982. On the corporate demand for insurance. In Foundations of Insurance Economics. Dordrecht: Springer, pp. 190–205. [Google Scholar]

- Mayers, David, and Clifford W. Smith Jr. 1988. Ownership structure across lines of property-casualty insurance. The Journal of Law and Economics 31: 351–78. [Google Scholar] [CrossRef]

- Mayers, David, and Clifford W. Smith Jr. 1994. Managerial Discretion and Stock Insurance Company Ownershi Structure. Journal of Risk and Insurance 61: 638–55. [Google Scholar] [CrossRef]

- McCullough, Kathleen, and Robert Hoyt. 2005. Characteristics of Property-Liability Insurance Acquisition Target. Journal of Insurance Issues 28: 61–87. [Google Scholar]

- McShane, Michael K., Larry A. Cox, and Richard J. Butler. 2010. Regulatory competition and forbearance: Evidence from the life insurance industry. Journal of Banking & Finance 34: 522–32. [Google Scholar]

- Mitton, Todd. 2002. A cross-firm analysis of the impact of corporate governance on the East Asian financial crisis. Journal of Financial Economics 64: 215–41. [Google Scholar] [CrossRef]

- Montgomery, Cynthia A. 1985. Product-market diversification and market power. Academy of Management Journal 28: 789–98. [Google Scholar]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Ozbas, Oguzhan, and David S. Scharfstein. 2009. Evidence on the dark side of internal capital markets. The Review of Financial Studies 23: 581–99. [Google Scholar] [CrossRef]

- Pottier, Steven W., and David W. Sommer. 1997. Agency theory and life insurer ownership structure. Journal of Risk and Insurance 64: 529–43. [Google Scholar] [CrossRef]

- Penrose, Edith. 1959. The Theory of the Growth of the Firm. New York: John Wiley. [Google Scholar]

- Rajan, Raghuram, Henri Servaes, and Luigi Zingales. 2000. The cost of diversity: The diversification discount and inefficient investment. The Journal of Finance 55: 35–80. [Google Scholar] [CrossRef]

- Rudolph, Christin, and Bernhard Schwetzler. 2013. Conglomerates on the rise again? A cross-regional study on the impact of the 2008–2009 financial crisis on the diversification discount. Journal of Corporate Finance 22: 153–65. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1989. Management entrenchment: The case of manager-specific investments. Journal of Financial Economics 25: 123–39. [Google Scholar] [CrossRef]

- Sommer, David. W. 1996. The impact of firm risk on property-liability insurance prices. Journal of Risk and Insurance 63: 501–14. [Google Scholar] [CrossRef]

- Stein, Jeremy. C. 1997. Internal capital markets and the competition for corporate resources. The Journal of Finance 52: 111–33. [Google Scholar] [CrossRef]

- Stein, Jeremy C. 2003. Agency, Information and Corporate Investment. In Handbook of the Economics of Finance. Edited by George M. Constantinides, Milton Harris and René M. Stulz. Amsterdam: Elsevier NH, vol. 1A, pp. 111–65. [Google Scholar]

- Teece, David. J. 1980. Economies of scope and the scope of the enterprise. Journal of Economic Behavior & Organization 1: 223–47. [Google Scholar]

- Teece, David. J. 1982. Towards an economic theory of the multiproduct firm. Journal of Economic Behavior & Organization 3: 39–63. [Google Scholar]

- Tirole, Jean. 1995. The Theory of Industrial Organization. Cambridge, MA: MIT Press. [Google Scholar]

- Tombs, Joseph W., and Robert E. Hoyt. 1994. The effect of product line focus on insurer stock returns. Proceedings of the International Insurance Society, 331–39. [Google Scholar]

- Villalonga, Belen. 2004. Diversification discount or premium? New evidence from the business information tracking series. The Journal of Finance 59: 479–506. [Google Scholar] [CrossRef]

- Weston, J. Fred. 1970. Diversification and merger trends. Business Economics, 50–57. [Google Scholar]

- Williamson, Oliver E. 1975. Markets and Hierarchies: Analysis and Antitrust Implications: A Study in the Economics of Internal Organization. Champaign: University of Illinois. [Google Scholar]

- Wooldridge, Jeffrey M. 2002. Econometric Analysis of Cross Section and Panel Data. Cambridge, MA: MIT Press. [Google Scholar]

- Yan, An. 2006. Value of conglomerates and capital market conditions. Financial Management 35: 5–30. [Google Scholar] [CrossRef]

| 1 | |

| 2 | |

| 3 | As a robustness test, we use two additional measures of diversification, the number of lines and a modified business Herfindahl index. In our sample, we have a total of 23 business lines (see Appendix C for the business lines detail), which are the same as those in Liebenberg and Sommer (2008). |

| 4 | These additional results are available from the authors upon request. |

| Variables | Definition | Full Sample | Liebenberg and Sommer (2008) | ||||

|---|---|---|---|---|---|---|---|

| (7470 Firm-Years) | (6290 Firm-Years) | ||||||

| Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | ||

| ROA | Net income/total admitted assets | 0.02 | 0.02 | 0.06 | 0.02 | 0.03 | 0.05 |

| ROE | Net income/policyholder surplus | 0.03 | 0.05 | 0.14 | 0.05 | 0.06 | 0.14 |

| LINES | Number of lines in which firm has positive direct premiums written (DPW) | 4.49 | 3.00 | 3.97 | 5.91 | 5.00 | 4.63 |

| MULTILINE | = 1 if LINES > 1, 0 otherwise | 0.66 | 1.00 | 0.48 | 0.79 | 1.00 | 0.41 |

| SIZE | Natural Logarithm of total admitted assets | 17.83 | 17.57 | 2.28 | 17.64 | 17.47 | 2.19 |

| CAPASSET | Policyholder surplus/total admitted assets | 0.49 | 0.46 | 0.20 | 0.49 | 0.44 | 0.21 |

| GEODIV | 1-Herfindahl index of DPW across 57 geographic areas | 0.30 | 0.02 | 0.36 | 0.33 | 0.11 | 0.37 |

| WCONC | Weighted sum of market share per line multiplied by line specific Herfindahl | 0.05 | 0.05 | 0.01 | 0.05 | 0.05 | 0.02 |

| MUTUAL | = 1 if firm is a mutual, 0 otherwise | 0.45 | 0.00 | 0.50 | 0.48 | 0.00 | 0.05 |

| GROUP | = 1 if firm is a group, 0 otherwise | 0.25 | 0.00 | 0.43 | 0.34 | 0.00 | 0.47 |

| PCTLH | Percentage of premiums from life-health insurance | 0.23 | 0.00 | 7.76 | 0.44 | 0.00 | 2.16 |

| PUBLIC | = 1 if firm is publicly traded, 0 otherwise | 0.05 | 0.00 | 0.21 | 0.08 | 0.00 | 0.47 |

| MBH | 1-business Herfindahl | 0.31 | 0.27 | 0.31 | |||

| Panel A: Mutual vs. stock | |||||||||||||

| Variables | Definition | Mutual Sample (3355 Firm-Years) | Stock Sample (4115 Firm-Years) | ||||||||||

| Crisis | Non-crisis | Crisis | Non-Crisis | ||||||||||

| Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | ||

| ROA | Net income/total admitted assets | 0.01 | 0.02 | 0.05 | 0.02 | 0.03 | 0.05 | 0.01 | 0.02 | 0.06 | 0.02 | 0.03 | 0.06 |

| ROE | Net income/policyholder surplus | 0.01 | 0.03 | 0.13 | 0.04 | 0.05 | 0.13 | 0.02 | 0.04 | 0.15 | 0.04 | 0.06 | 0.15 |

| LINES | Number of lines in which firm has positive direct premiums written (DPW) | 5.40 | 5.00 | 3.81 | 5.36 | 5.00 | 3.84 | 3.71 | 2.00 | 3.83 | 3.79 | 2.00 | 3.97 |

| MULTILINE | = 1 if LINES > 1, 0 otherwise | 0.76 | 1.00 | 0.43 | 0.76 | 1.00 | 0.43 | 0.58 | 1.00 | 0.49 | 0.57 | 1.00 | 0.50 |

| SIZE | Natural Logarithm of total admitted assets | 17.91 | 17.93 | 2.38 | 17.90 | 17.92 | 2.40 | 17.72 | 17.39 | 2.14 | 17.78 | 17.40 | 2.19 |

| CAPASSET | Policyholder surplus/total admitted assets | 0.51 | 0.49 | 0.20 | 0.51 | 0.48 | 0.20 | 0.49 | 0.44 | 0.21 | 0.47 | 0.43 | 0.20 |

| GEODIV | 1-Herfindahl index of DPW across 57 geographic areas | 0.24 | 0.00 | 0.34 | 0.25 | 0.00 | 0.34 | 0.34 | 0.18 | 0.37 | 0.35 | 0.18 | 0.37 |

| WCONC | Weighted sum of market share per line multiplied by line specific Herfindahl | 0.05 | 0.05 | 0.01 | 0.05 | 0.05 | 0.01 | 0.06 | 0.06 | 0.01 | 0.05 | 0.05 | 0.02 |

| GROUP | = 1 if firm is a group, 0 otherwise | 0.33 | 0.00 | 0.47 | 0.33 | 0.00 | 0.47 | 0.18 | 0.00 | 0.38 | 0.19 | 0.00 | 0.39 |

| PCTLH | Percentage of premiums from life-health insurance | 0.41 | 0.00 | 2.23 | 0.47 | 0.00 | 2.57 | 0.22 | 0.00 | 1.86 | 0.01 | 0.00 | 11.45 |

| PUBLIC | = 1 if firm is publicly traded, 0 otherwise | 0.02 | 0.00 | 0.14 | 0.02 | 0.00 | 0.14 | 0.07 | 0.00 | 0.25 | 0.07 | 0.00 | 0.25 |

| MBH | 1-business Herfindahl | 0.42 | 0.54 | 0.30 | 0.41 | 0.54 | 0.30 | 0.22 | 0.03 | 0.32 | 0.23 | 0.03 | 0.28 |

| Panel B: Group vs. non-group | |||||||||||||

| Variables | Definition | Group Sample (1876 Firm-Years) | Non-Group Sample (5594 Firm-Years) | ||||||||||

| Crisis | Non-crisis | Crisis | Non-crisis | ||||||||||

| Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | Mean | Median | Standard Deviation | ||

| ROA | Net income/total admitted assets | 0.01 | 0.02 | 0.04 | 0.03 | 0.03 | 0.04 | 0.01 | 0.02 | 0.06 | 0.02 | 0.03 | 0.06 |

| ROE | Net income/policyholder surplus | 0.03 | 0.05 | 0.09 | 0.06 | 0.06 | 0.10 | 0.01 | 0.03 | 0.15 | 0.03 | 0.05 | 0.15 |

| LINES | Number of lines in which firm has positive direct premiums written (DPW) | 8.03 | 8.00 | 4.60 | 8.16 | 8.00 | 4.68 | 3.30 | 2.00 | 2.82 | 3.26 | 2.00 | 2.80 |

| MULTILINE | = 1 if LINES > 1, 0 otherwise | 0.91 | 1.00 | 0.29 | 0.92 | 1.00 | 0.28 | 0.58 | 1.00 | 0.49 | 0.57 | 1.00 | 0.50 |

| SIZE | Natural Logarithm of total admitted assets | 20.46 | 20.32 | 1.65 | 20.47 | 20.35 | 1.66 | 16.95 | 16.84 | 1.68 | 16.94 | 16.84 | 1.71 |

| CAPASSET | Policyholder surplus/total admitted assets | 0.44 | 0.41 | 0.13 | 0.43 | 0.41 | 0.13 | 0.52 | 0.49 | 0.22 | 0.51 | 0.48 | 0.22 |

| GEODIV | 1-Herfindahl index of DPW across 57 geographic areas | 0.58 | 0.70 | 0.35 | 0.58 | 0.71 | 0.35 | 0.21 | 0.00 | 0.32 | 0.21 | 0.00 | 0.32 |

| WCONC | Weighted sum of market share per line multiplied by line specific Herfindahl | 0.05 | 0.05 | 0.01 | 0.05 | 0.05 | 0.01 | 0.05 | 0.05 | 0.01 | 0.05 | 0.05 | 0.02 |

| MUTUAL | = 1 if firm is a mutual, 0 otherwise | 0.59 | 1.00 | 0.49 | 0.58 | 1.00 | 0.49 | 0.39 | 0.00 | 0.49 | 0.41 | 0.00 | 0.49 |

| PUBLIC | = 1 if firm is publicly traded, 0 otherwise | 0.17 | 0.00 | 0.37 | 0.17 | 0.00 | 0.38 | 0.01 | 0.00 | 0.08 | 0.01 | 0.00 | 0.07 |

| MBH | 1-business Herfindahl | 0.47 | 0.57 | 0.37 | 0.49 | 0.58 | 0.28 | 0.25 | 0.04 | 0.29 | 0.25 | 0.04 | 0.29 |

| Panel A: Mutual | ||||||||||||

| Variable | Crisis | Non-crisis | ||||||||||

| Diversified Insurers | Single-Line Insurers | Differences Tests | Diversified Insurers | Single-Line Insurers | Differences Tests | |||||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| ROA | 0.005 | 0.016 | 0.016 | 0.017 | −0.011 ** | −0.001 | 0.023 | 0.029 | 0.016 | 0.021 | 0.007 *** | 0.008 *** |

| ROE | 0.003 | 0.032 | 0.046 | 0.038 | −0.043 *** | −0.006 *** | 0.043 | 0.057 | 0.028 | 0.041 | 0.015 *** | 0.015 *** |

| Panel B: Stock | ||||||||||||

| Variable | Crisis | Non-crisis | ||||||||||

| Diversified Insurers | Single-Line Insurers | Differences Tests | Diversified Insurers | Single-Line Insurers | Differences Tests | |||||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| ROA | 0.012 | 0.019 | 0.011 | 0.015 | 0.001 | 0.004 | 0.021 | 0.027 | 0.018 | 0.023 | 0.003 | 0.004 * |

| ROE | 0.022 | 0.045 | 0.010 | 0.032 | 0.012 | 0.014 | 0.045 | 0.063 | 0.033 | 0.051 | 0.012 ** | 0.011 *** |

| Panel C: Group | ||||||||||||

| Variable | Crisis | Non-crisis | ||||||||||

| Diversified Insurers | Single-Line Insurers | Differences Tests | Diversified Insurers | Single-Line Insurers | Differences Tests | |||||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| ROA | 0.013 | 0.020 | 0.016 | 0.023 | −0.003 | −0.003 | 0.025 | 0.028 | 0.027 | 0.024 | −0.002 | 0.004 |

| ROE | 0.029 | 0.045 | 0.049 | 0.072 | −0.020 | −0.027 | 0.056 | 0.064 | 0.077 | 0.064 | −0.022 ** | 0.000 |

| Panel D: Non-group | ||||||||||||

| Variable | Crisis | Non-crisis | ||||||||||

| Diversified Insurers | Single-Line Insurers | Differences Tests | Diversified Insurers | Single-Line Insurers | Differences Tests | |||||||

| Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | Mean | Median | |

| ROA | 0.006 | 0.017 | 0.012 | 0.016 | −0.006 * | 0.001 | 0.020 | 0.027 | 0.017 | 0.021 | 0.003 * | 0.006 *** |

| ROE | 0.004 | 0.032 | 0.019 | 0.033 | −0.015 * | −0.001 | 0.037 | 0.055 | 0.029 | 0.046 | 0.009 * | 0.009 ** |

| Model | Dependent Variable: ROA | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Full Sample | Mutual Sample | Stock Sample | |||||||

| OLS | 2SLS | HECKMAN | OLS | 2SLS | HECKMAN | OLS | 2SLS | HECKMAN | |

| MULTILINE | −0.00372 | −0.0564 | −0.0324 *** | −0.00179 | −0.0930 | −0.0145 | −0.00499 | 0.128 | −0.0144 |

| (0.00357) | (0.0545) | (0.00600) | (0.00552) | (0.0591) | (0.00964) | (0.00447) | (0.106) | (0.00878) | |

| MULTILINE * Crisis89 | −0.00634 * | 0.0147 | −0.00621 ** | −0.0111 *** | 0.0157 | −0.0108 ** | −0.00227 | −0.0575 | −0.00232 |

| (0.00330) | (0.0219) | (0.00309) | (0.00413) | (0.0176) | (0.00445) | (0.00457) | (0.0444) | (0.00430) | |

| Crisis89 | 0.0168 *** | −0.0140 | −0.000734 | 0.000182 | −0.0179 | 0.00253 | −0.00235 | 0.0279 | −0.00239 |

| (0.00347) | (0.0141) | (0.00335) | (0.00449) | (0.0144) | (0.00478) | (0.00469) | (0.0247) | (0.00463) | |

| size | 0.00794 *** | 0.00863 *** | 0.00782 *** | 0.0106 *** | 0.0105 *** | 0.0105 *** | 0.00576 *** | 0.00183 | 0.00589 *** |

| (0.00103) | (0.00133) | (0.000519) | (0.00121) | (0.00139) | (0.000723) | (0.00153) | (0.00365) | (0.000824) | |

| capasset | 0.0595 *** | 0.0559 *** | 0.0639 *** | 0.0687 *** | 0.0698 *** | 0.0706 *** | 0.0551 *** | 0.0638 *** | 0.0558 *** |

| (0.00698) | (0.00797) | (0.00398) | (0.0101) | (0.0117) | (0.00598) | (0.00986) | (0.0140) | (0.00575) | |

| wconc | −0.0874 | 0.0427 | −0.0926 | −0.209 | 0.325 | −0.199 ** | −0.0724 | −0.227 | −0.0706 |

| (0.0921) | (0.167) | (0.0586) | (0.153) | (0.403) | (0.0970) | (0.124) | (0.203) | (0.0819) | |

| geodiv | −0.00650 | −0.00527 | −0.00544 | 0.00328 | 0.0113 | 0.00355 | −0.0168 ** | −0.0131 | −0.0164 *** |

| (0.00531) | (0.00596) | (0.00345) | (0.00650) | (0.0104) | (0.00556) | (0.00764) | (0.0109) | (0.00512) | |

| group | −0.0180 *** | −0.0209 *** | −0.0192 *** | −0.0159 *** | −0.0155 *** | −0.0164 *** | −0.0182 *** | −0.00633 | −0.0185 *** |

| (0.00316) | (0.00480) | (0.00223) | (0.00355) | (0.00443) | (0.00286) | (0.00528) | (0.0130) | (0.00382) | |

| public | −0.00314 | −0.00683 | −0.00317 | −0.00517 | −0.0176 | −0.00504 | −0.00354 | 0.00719 | −0.00390 |

| (0.00393) | (0.00596) | (0.00347) | (0.00643) | (0.0126) | (0.00719) | (0.00497) | (0.0112) | (0.00446) | |

| percentagelh | 0.00245 | 0.00237 | 0.00262 | −0.0295 | −0.0675 | −0.0271 | 0.00840 *** | 0.00385 | 0.00850 |

| (0.00496) | (0.00690) | (0.00760) | (0.0492) | (0.0646) | (0.0412) | (0.00243) | (0.00531) | (0.00840) | |

| sdroa5 | −0.197 *** | −0.208 *** | −0.203 *** | −0.0871 | −0.103 | −0.0875 *** | −0.294 *** | −0.282 *** | −0.296 *** |

| (0.0592) | (0.0609) | (0.0160) | (0.0638) | (0.0644) | (0.0200) | (0.0561) | (0.0626) | (0.0252) | |

| Constant | −0.152 *** | −0.143 *** | −0.118 *** | −0.189 *** | −0.198 *** | −0.180 *** | −0.0903 *** | −0.0392 | −0.0878 *** |

| (0.0194) | (0.0220) | (0.0107) | (0.0238) | (0.0278) | (0.0155) | (0.0278) | (0.0526) | (0.0161) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| State FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Line FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Underidentification test | 7.293 * | 6.541 * | 3.772 | ||||||

| Overidentification test | 9.545 *** | 0.288 | 2.509 | ||||||

| Self-selection parameter | 0.0174 *** | 0.00721 | 0.00580 | ||||||

| (0.00334) | (0.00503) | (0.00502) | |||||||

| Number of observations | 6513 | 6513 | 6513 | 2970 | 2970 | 2970 | 3543 | 3543 | 3543 |

| Peseudo R square | 0.185 | 0.123 | 0.264 | 0.119 | 0.192 | −0.192 | |||

| Model | Dependent Variable: ROA | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Full Sample | Group Sample | Non-Group Sample | |||||||

| OLS | 2SLS | HECKMAN | OLS | 2SLS | HECKMAN | OLS | 2SLS | HECKMAN | |

| MULTILINE | −0.00315 | −0.000449 | −0.0223 *** | −0.00119 | −0.0471 | −0.0249 *** | −0.00874 ** | −0.238 | −0.0303 *** |

| (0.00359) | (0.0362) | (0.00607) | (0.00755) | (0.0617) | (0.00963) | (0.00406) | (0.214) | (0.00788) | |

| MULTILINE * Crisis89 | −0.00624 * | −0.00732 | −0.00616 ** | −0.00109 | 0.0205 | 0.000244 | −0.00803 ** | 0.0754 | −0.00796 ** |

| (0.00331) | (0.0148) | (0.00311) | (0.00590) | (0.0303) | (0.00588) | (0.00381) | (0.0778) | (0.00373) | |

| Crisis89 | 0.0165 *** | −0.000133 | −0.00100 | 0.000998 | −0.0164 | 0.00164 | 0.0140 *** | −0.0466 | −0.00195 |

| (0.00347) | (0.00975) | (0.00337) | (0.00637) | (0.0281) | (0.00622) | (0.00391) | (0.0419) | (0.00397) | |

| size | 0.00638 *** | 0.00635 *** | 0.00617 *** | 0.00545 *** | 0.00511 *** | 0.00523 *** | 0.00957 *** | 0.0139 *** | 0.00947 *** |

| (0.000885) | (0.000933) | (0.000477) | (0.00132) | (0.00135) | (0.000793) | (0.00137) | (0.00451) | (0.000661) | |

| capasset | 0.0575 *** | 0.0577 *** | 0.0602 *** | 0.0755 *** | 0.0762 *** | 0.0799 *** | 0.0605 *** | 0.0583 *** | 0.0632 *** |

| (0.00684) | (0.00727) | (0.00397) | (0.0133) | (0.0129) | (0.00747) | (0.00822) | (0.0142) | (0.00478) | |

| wconc | −0.113 | −0.119 | −0.111 * | −0.426 *** | −0.343 * | −0.394 *** | −0.0594 | 0.251 | −0.0696 |

| (0.0936) | (0.127) | (0.0593) | (0.157) | (0.195) | (0.0903) | (0.107) | (0.365) | (0.0748) | |

| geodiv | −0.00794 | −0.00799 | −0.00716 ** | −0.00705 | −0.00619 | −0.00755 * | −0.0169 ** | −0.0210 | −0.0160 *** |

| (0.00532) | (0.00527) | (0.00347) | (0.00667) | (0.00692) | (0.00423) | (0.00733) | (0.0154) | (0.00492) | |

| gmutual | −0.00717 *** | −0.00707 ** | −0.00584 *** | −0.00835 *** | −0.0103 ** | −0.00814 *** | −0.00449 | −0.0160 | −0.00220 |

| (0.00255) | (0.00303) | (0.00169) | (0.00294) | (0.00410) | (0.00214) | (0.00323) | (0.0128) | (0.00229) | |

| public | −0.00709 * | −0.00686 | −0.00700 ** | 0.00308 | 0.00161 | 0.00340 | −0.00108 | 0.0368 | −0.00127 |

| (0.00395) | (0.00490) | (0.00349) | (0.00398) | (0.00425) | (0.00255) | (0.00965) | (0.0496) | (0.0110) | |

| sdroa5 | −0.201 *** | −0.200 *** | −0.204 *** | −0.531 *** | −0.513 *** | −0.534 *** | −0.171 *** | −0.191 *** | −0.175 *** |

| (0.0601) | (0.0611) | (0.0161) | (0.130) | (0.138) | (0.0476) | (0.0580) | (0.0622) | (0.0181) | |

| Constant | −0.120 *** | −0.103 *** | −0.0900 *** | −0.0879 *** | −0.0565 | −0.0590 *** | −0.182 *** | −0.233 *** | −0.156 *** |

| (0.0169) | (0.0167) | (0.0102) | (0.0274) | (0.0385) | (0.0184) | (0.0251) | (0.0732) | (0.0136) | |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| State FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Line FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Underidentification test | 13.664 *** | 3.594 | 1.689 | ||||||

| Overidentification test | 6.524 *** | 4.649 * | 0.153 | ||||||

| Self−selection parameter | 0.0117 *** | 0.0127 *** | 0.0131 *** | ||||||

| (0.00342) | (0.00461) | (0.00444) | |||||||

| Number of observations | 6513 | 6513 | 6513 | 1668 | 1668 | 1668 | 4845 | 4845 | 4845 |

| Peseudo R square | 0.180 | 0.179 | 0.392 | 0.352 | 0.190 | −0.815 | |||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liebenberg, I.A.; Lin, Z. The Effect of Diversification under Different Ownership Structures and Economic Conditions: Evidence from the Great Recession. J. Risk Financial Manag. 2019, 12, 82. https://doi.org/10.3390/jrfm12020082

Liebenberg IA, Lin Z. The Effect of Diversification under Different Ownership Structures and Economic Conditions: Evidence from the Great Recession. Journal of Risk and Financial Management. 2019; 12(2):82. https://doi.org/10.3390/jrfm12020082

Chicago/Turabian StyleLiebenberg, Ivonne A., and Zhilu Lin. 2019. "The Effect of Diversification under Different Ownership Structures and Economic Conditions: Evidence from the Great Recession" Journal of Risk and Financial Management 12, no. 2: 82. https://doi.org/10.3390/jrfm12020082

APA StyleLiebenberg, I. A., & Lin, Z. (2019). The Effect of Diversification under Different Ownership Structures and Economic Conditions: Evidence from the Great Recession. Journal of Risk and Financial Management, 12(2), 82. https://doi.org/10.3390/jrfm12020082