Developments in Risk Management in Islamic Finance: A Review

Abstract

1. Introduction

2. Islamic Financial Institutions (IFIs)

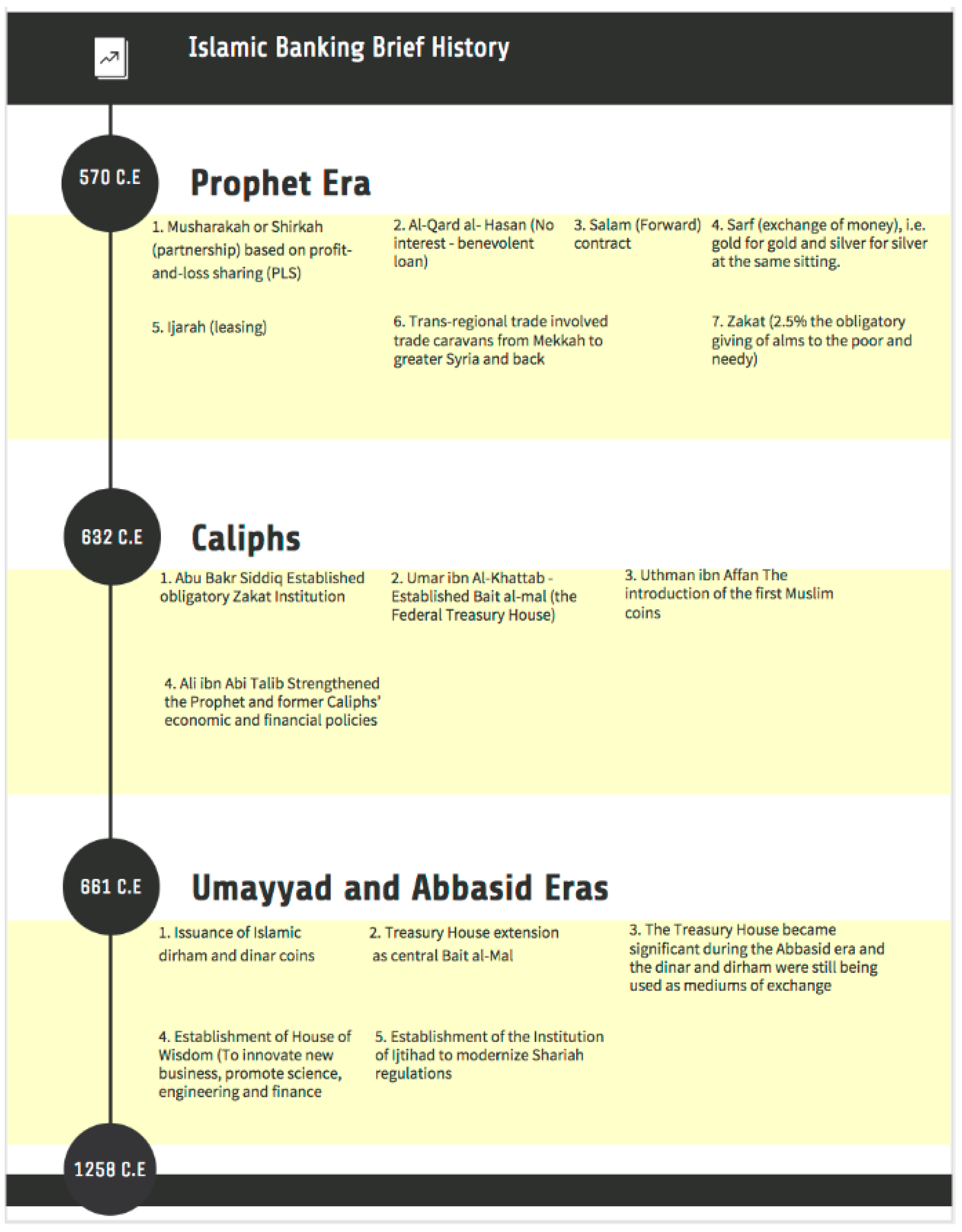

2.1. History of Islamic Financial Institutions (IFIs)

2.2. Definitions and Structure of IFIs

- Prohibition of Riba (interest): Under Shariah, Muslims are strictly prohibited from any involvement in Riba-based activities, whether in terms of paying interest or receiving it.

- Sharing of Equity Contribution: As Riba is prohibited in Shariah, IB operations are based on equity contributions. The supplier of a fund (investor) and the borrower (entrepreneur) are required to share the profit and risk arising from the transaction. This kind of PLS contract is at the heart of IFI.

- Money is considered a medium of exchange: In Islam, money cannot generate money on money. Instead, money should be treated as capital and any profit/loss must be shared between parties as per the proportion of their investments. All such transactions must be backed by assets.

- Gharar: Excessive uncertainty and speculation must be avoided because these lead to Maysir (gambling), which is prohibited.

- The purity of contract: Under Shariah, IFI contracts should have clear disclosure in order to reduce the risk of exposure to the contract. This means strict sanctity of contracts is required in IFI transections.

2.3. Conventional Banks vs. Islamic Banks

3. Risks in Banking

3.1. Risk in Islamic Banking

3.2. Unique Nature of Risk in Islamic Banks (IBs)

3.3. Risk Management of Islamic Banks (IBs)

4. Credit Risk of Islamic Banks (IBs)

CRit = β0 + β1 CRit−1 + β2 TLit + β3 LQit + β4 CBit + β5 CAPit + β6 FCOSTit +

β7 MGT EFFit + β8 Log (TA)it + β9 FOREIGNit + εit

5. Conclusions

- The operations of IBs must conform with Shariah principles. IBs differ from CBs in that IBs operate free from interest, uncertainty, and gambling (Khir et al. 2008).

- The five most important pillars of Islamic banking can be summarized as follows: prohibition of Riba, sharing of equity contributions, money as a medium of exchange (Gharar), and purity of contract. In IB operations, all products and services are offered based on three main types of contracts: trading contract, participation contract, and supporting contract (Khir et al. 2008).

- Although Islamic law in the Islamic banking system forbids an interest element, capital is not “costless.” Capital is recognized as a production input in Islamic law (Ariff 1988), and profit-sharing is a viable alternative to interest (Kahf 1999).

- There is a lack of Shariah expertise and a weak legal framework, which results in weak support for Shariah-based product development.

- The financial statements of IBs differ from those generated by CBs. For example, cash in IBs refers strictly to cash items, whereas cash in CBs usually consists of cash and other interest-bearing assets (AAOIFI and CB).

- Small IBs may face less risk than similar sized CBs (Abedifar et al. 2015).

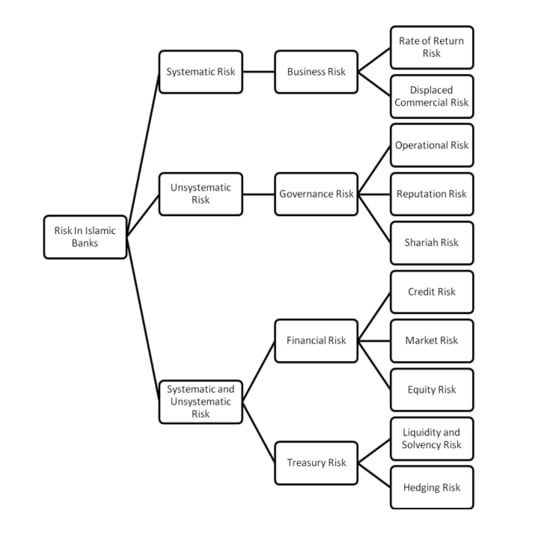

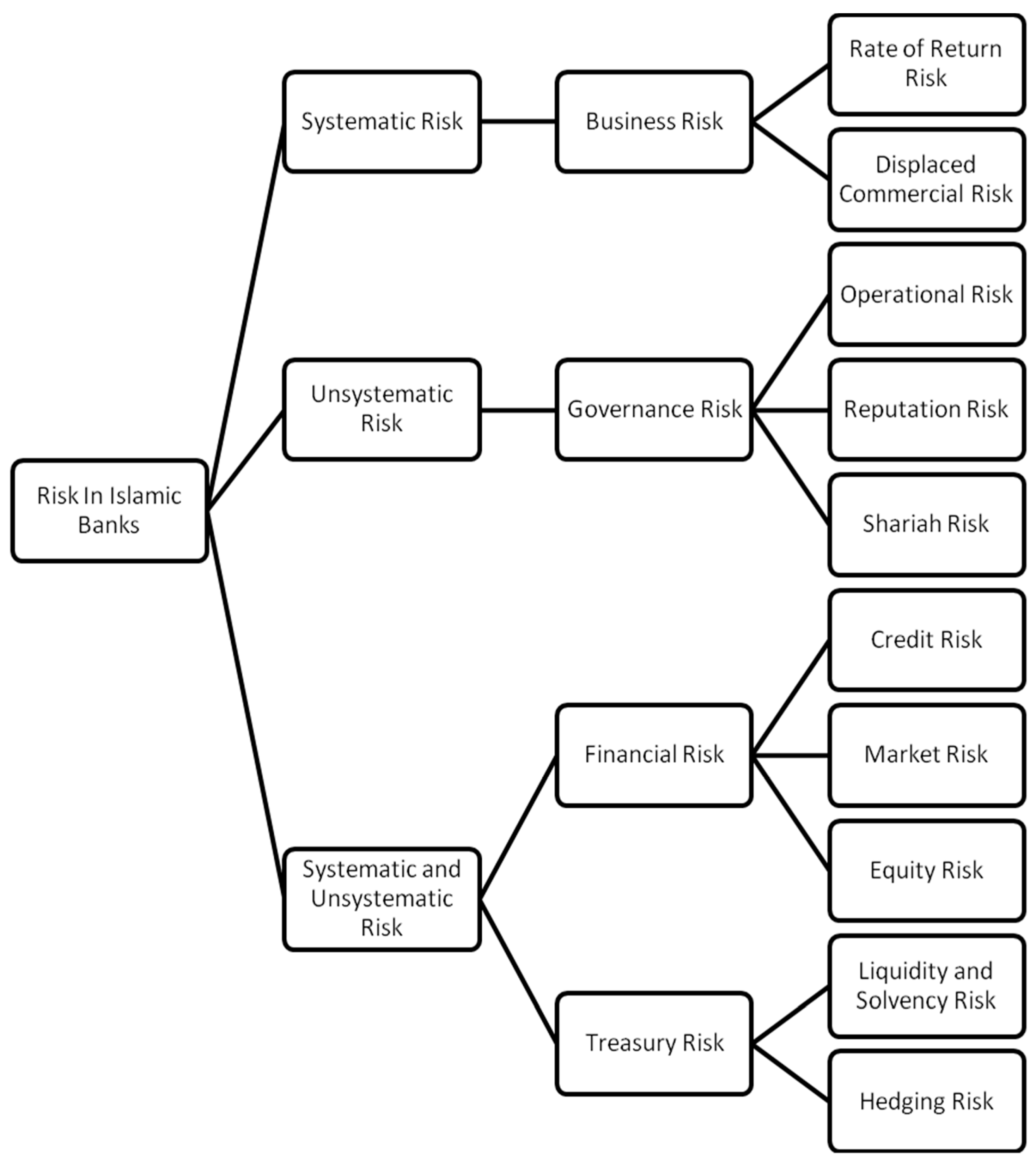

- Both IBs and CBs face risks in their daily operations. CBs face five types of risks: credit risk, interest rate risk, liquidity risk, underwriting risk, and operating risk (Saunders and Cornett 2006). IBs face financial risk, business risk, treasury risk, and governance risk (Iqbal and Mirakhor 2007).

- We propose a framework for grouping the risks faced by IBs by considering a systematic and unsystematic risk classification. In the proposed framework, only business risk is considered a systematic risk. Governance risk is classified under unsystematic risk, whereas financial risk and treasury risk are classified under SUR as having the ability to be either or un.

- IBs are unique in regard to risk-related issues. For example, IBs face two types of risks: risks similar to those faced by CBs and risks that are unique because IBs comply with Shariah (Ahmed and Khan 2007).

- The risk of compliance with Shariah entails two types of risks (Makiyan 2008): risk related to PLS contracts and risk relate to legal and corporate governance. Čihák and Hesse (2010) provide an explanation for the unique nature of risk in the Islamic banking context by asserting that IB risk derives not only from the specific nature of the PLS and NPLS contracts, but is also due to the legal, governance, and liquidity infrastructure of Islamic finance.

- The relationship between IBs and their customers is not just one between lender and borrower but also that of investor and entrepreneur. This relationship results in IBs hazarding more risk than CBs. For instance, Mudharabah financing as a default payment by the entrepreneur cannot be established until the contract has expired.

- Risk management became more important after the GFC. Rahman and Shahimi (2010) support the conclusion that a weak risk management system has a severe impact on profitability and will lead to bank collapse.

- Bank capital and financing expansion have a significant negative impact on the credit risk level of IBs in Malaysia. Further, financing quality (LQ), capital buffer (CB), size (TA), and lagged CR demonstrate a positive impact on credit risk regardless of regression specifications or estimation model.

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Credit risk (CR) | Non-performing loans to total financing outstanding |

| Financing expansion (TL) | Total loans to total assets |

| Quadratic term of financing expansion (TL2) | Squared value of TL |

| Loan quality (LQ) | Loan loss provisions to total assets |

| Capital buffer (CB) | Total equity to total assets |

| Capital ratio (CAP) | Total capital (Tier 1 and Tier 2 capital) to total assets ratio |

| Cost of funds (FCOST) | Interest expenses to total assets |

| Management efficiency (MGT EFF) | Earning assets to total assets |

| Size (TA) | Natural logarithm of total assets |

| FOREIGN dummy | Value = 1 for a foreign Islamic bank Value = 0 otherwise |

References

- Abedifar, Pejman, Philip Molyneux, and Amine Tarazi. 2013. Risk in Islamic banking. Review of Finance 17: 2035–96. [Google Scholar] [CrossRef]

- Abedifar, Pejman, Shahid M. Ebrahim, Philip Molyneux, and Amine Tarazi. 2015. Islamic banking and finance: Recent empirical literature and directions for future research. Journal of Economic Surveys 29: 637–70. [Google Scholar] [CrossRef]

- Abu Hussain, Hameeda, and Jasim Al-Ajmi. 2012. Risk management practices of conventional and Islamic banks in Bahrain. The Journal of Risk Finance 13: 215–39. [Google Scholar] [CrossRef]

- Ahmad, Nor Hayati, and Mohamed Ariff. 2007. Multi-country study of bank credit risk determinants. International Journal of Banking and Finance 5: 135–52. [Google Scholar]

- Ahmed, Habib. 2011. Risk Management Assessment Systems: An Application to Islamic Banks. Islamic Research & Training Institute (IRTI) 19: 63–86. [Google Scholar]

- Ahmed, Habib, and Tariqullah Khan. 2007. Risk Management in Islamic Banking. In Handbook of Islamic Banking. Edited by M. Kabir Hassan and Mervyn K. Lewis. Cheltenham: Edward Elgar Publishing Limited, pp. 144–58. [Google Scholar]

- Akguc, Serkan, and Naseem Al Rahahleh. 2018. Effect of Shariah Compliance on Operating Performance: Evidence from GCC Countries. Emerging Markets Finance and Trade 54: 1–23. [Google Scholar] [CrossRef]

- Akkizidis, Ioannis, and Sunil Kumar Khandelwal. 2008. Financial Risk Management for Islamic Banking and Finance. New York: Palgrave Macmillan. [Google Scholar]

- Al-Tamimi, Hussein A. Hassan, and Faris Mohammed Al-Mazrooei. 2007. Banks’ Risk Management: A Comparison Study of Uae National and Foreign Banks. The Journal of Risk Finance 8: 394–409. [Google Scholar] [CrossRef]

- Apostolik, Richard, Christopher Donohue, and Peter Wnet. 2009. Foundations of Banking Risk: An Overview of Banking, Banking Risks and Risk-Based Banking Regulation. Hoboken: John Wiley & Sons Inc. [Google Scholar]

- Archer, Simon, and Rifaat Ahmed Abdel Karim. 2009. Profit-Sharing Investment Accounts in Islamic Banks: Regulatory Problems and Possible Solutions. Journal of Banking Regulation 10: 300–6. [Google Scholar] [CrossRef]

- Ariff, Mohamed. 1988. Islamic Banking. Asian-Pacific Economic Literature 2: 48–64. [Google Scholar] [CrossRef]

- Ayub, Muhammad. 2007. Understanding Islamic Finance. Chichester: John Wiley &Sons Ltd. [Google Scholar]

- Basel. 1999. Principles for the Management of Credit Risk. Basel: Basel Committee on Banking Supervision. [Google Scholar]

- Basel. 2003. The New Basel Capital Accord. Basel: Basel Committee on Banking Supervision. [Google Scholar]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Ouarda Merrouche. 2013. Islamic vs. conventional banking: Business model, efficiency and stability. Journal of Banking and Finance 37: 433–47. [Google Scholar] [CrossRef]

- Carey, Mark, and Rene M. Stulz. 2005. The Risks of Financial Institutions. Working Paper No. 11442. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Cebenoyan, A. Sinan, and Philip E. Strahan. 2004. Risk management, capital structure and lending at banks. Journal of Banking & Finance 28: 19–43. [Google Scholar]

- Cerović, Ljerka, Stella Suljić Nikolaj, and Dario Maradin. 2017. Comparative analysis of conventional and Islamic banking: Importance of market regulation. Ekonomska Misao i Praksa 1: 241–63. [Google Scholar]

- Chong, Beng Soon, and Ming-Hua Liu. 2009. Islamic banking: interest-free or interest-based? Pacific-Basin Finance Journal 17: 125–44. [Google Scholar] [CrossRef]

- Čihák, Martin, and Heiko Hesse. 2010. Islamic Banks and Financial Stability: An Empirical Analysis. Journal of Financial Services Research 38: 95–113. [Google Scholar] [CrossRef]

- Coffin, Bill. 2009. The 2008 Financial Crisis: A Wake-up Call for Enterprise Risk Management. New York: Risk and Insurance Management Society, Inc. Available online: http//:www.community.rims.org/RIMS (accessed on 15 September 2018).

- El Massah, Suzanna, and Ola Al Sayed. 2015. Banking sector performance: Islamic and conventional banks in the UAE. International Journal of Information Technology and Business Management 36: 69–81. [Google Scholar]

- Galai, Dan, David Ruthenberg, Marshall Sarnat, and Ben Z. Schreiber, eds. 1999. Risk Management and Regulation in Banking. Boston: Kluwer Academic Publishers. [Google Scholar]

- Godlewski, Christophe J. 2005. Bank Capital and Credit Risk Taking in Emerging Market Economies. Journal of Banking Regulation 6: 128–45. [Google Scholar] [CrossRef]

- Greuning, Hennie Van, and Zamir Iqbal. 2008. Risk Analysis for Islamic Banks. Washington, DC: The World Bank. [Google Scholar]

- Hanif, Muhammad, and Abdullah Iqbal. 2010. Islamic Financing and Business Framework: A Survey. European Journal of Social Sciences 15: 475–89. [Google Scholar]

- Hassan, Abul. 2009. Risk Management Practices of Islamic Banks of Brunei Darussalam. The Journal of Risk Finance 10: 23–37. [Google Scholar] [CrossRef]

- Hassan, Wael Moustafa. 2011. Risk management practices: A comparative analysis between Islamic banks and conventional banks in the Middle East. International Journal of Academic Research 3: 288–95. [Google Scholar]

- Hassan, M. Kabir, and Sirajo Aliyu. 2018. A contemporary survey of Islamic banking literature. Journal of Financial Stability 34: 12–43. [Google Scholar]

- Hassan, M. Kabir, and Mehmet F. Dicle. 2005. Basel II and regulatory framework for Islamic banks. Journal of Islamic Economics, Banking and Finance 1: 1–16. [Google Scholar]

- Hassan, M. Kabir, and Sabur Mollah. 2014. Corporate Governance, Risk Taking and Firm Performance of Islamic Banks during Global Financial Crisis. Working Paper. New Orleans: University of New Orleans. [Google Scholar]

- Hassan, M. Kabir, Sirajo Aliyu, Andrea Paltrinieri, and Ashraf Khan. 2018. A Review of Islamic Investment Literature. Economic Papers: A Journal of Applied Economics and Policy. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, Ashraf Khan, and Andrea Paltrinieri. 2019. Liquidity risk, credit risk and stability in Islamic and conventional banks. Research in International Business and Finance 48: 17–31. [Google Scholar] [CrossRef]

- Iqbal, Munawar. 2011. Development, History and Prospects of Islamic Banking. In The Foundations of Islamic Banking: Theory, Practice and Education. Edited by Mohamed Arif and Munawar Iqbal. Cheltenham: Edward Elgar Publishing Limited. [Google Scholar]

- Iqbal, Zamir, and Abbas Mirakhor. 2007. An Introduction to Islamic Finance: Theory and Practice. Singapore: John Wiley & Son (Asia). [Google Scholar]

- Kahf, Monzer. 1999. Islamic Banks at the Threshold of the Third Millennium. Thunderbird International Business Review 41: 445–60. [Google Scholar] [CrossRef]

- Kalapodas, Evangelos, and Mary E. Thomson. 2006. Credit Risk Assessment: A Challenge for Financial Institutions. IMA Journal of Management Mathematics 17: 25–46. [Google Scholar] [CrossRef]

- Kayed, Rasem N, and M. Kabir Hassan. 2011. The Global Financial Crisis and Islamic Finance. Thunderbird International Business Review 53: 551–64. [Google Scholar] [CrossRef]

- Khalid, Sania, and Shehla Amjad. 2012. Risk management practices in Islamic banks of Pakistan. The Journal of Risk Finance 13: 148–59. [Google Scholar] [CrossRef]

- Khan, Tauseef, Waqar Ahmad, Muhammad Khalil Ur Rahman, and Fazal Haleem. 2018. An investigation of the performance of Islamic and interest based banking evidence from Pakistan. HOLISTICA–Journal of Business and Public Administration 9: 81–112. [Google Scholar] [CrossRef]

- Khir, Kamal, Lokesh Gupta, and Bala Shanmugam. 2008. Islamic Banking: A Practical Perspective. Kuala Lumpur: Pearson Longman. [Google Scholar]

- Laldin, Mohamad Akram. 2008. Islamic Financial System: The Malaysian Experience and the Way Foward. Humanomics 24: 217–38. [Google Scholar] [CrossRef]

- Lewis, Mervyn K. 2011. Ethical Principles in Islamic Business and Banking Transactions. In The Foundations of Islamic Banking: Theory, Practice and Education. Edited by Mohamed Ariff and Munawar Iqbal. Cheltenham: Edward Elgar Publishing Limited. [Google Scholar]

- Louzis, Dimitrios P., Angelos T. Vouldis, and Vasilios L. Metaxas. 2012. Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking & Finance 36: 1012–27. [Google Scholar]

- Lucia, Ray De, and John Peters. 1993. Commercial Bank Management: Functions and Objectives, 3rd ed. Hornsby: Serendip Publication. [Google Scholar]

- Makiyan, Seyed Nezamuddin. 2008. Risk Management and Challenges in Islamic Banks. Journal of Islamic Economics, Banking and Finance 4: 45–54. [Google Scholar]

- Masood, Omar, Hasan Al Suwaidi, and Priya Darshini Pun Thapa. 2012. Credit risk management: a case differentiating Islamic and non-Islamic banks in UAE. Qualitative Research in Financial Markets 4: 197–205. [Google Scholar] [CrossRef]

- Misman, Faridah Najuna, Ishaq Bhatti, Weifang Lou, Syamsyul Samsudin, and Nor Hadaliza Abd Rahman. 2015. Islamic banks credit risk: A panel study. Procedia Economics and Finance 31: 75–82. [Google Scholar] [CrossRef]

- Mokni, Rim Ben Selma, Abdelghani Echchabi, and Mohamed Taher Rajhi. 2015. Risk management practiced tools in the MENA region: A comparative study between islamic and conventional banks. International Journal of Business 20: 261. [Google Scholar]

- Oldfield, George S., and Anthony M. Santomero. 1997. Risk Management in Financial Institutions. Sloan Management Review 39: 33–47. [Google Scholar]

- Olson, Dennis, and Taisier Zoubi. 2017. Convergence in bank performance for commercial and Islamic banks during and after the Global Financial Crisis. The Quarterly Review of Economics and Finance 65: 71–87. [Google Scholar] [CrossRef]

- Pappas, Vasileios, Stephen Ongena, Marwan Izzeldin, and Ana-Maria Fuertes. 2014. Do Islamic Banks’ Live Free and Die Harder? Paper presented at the Seminar on Finance and Development in Muslim Economies, Bangor, UK, September 15. [Google Scholar]

- Rahman, Aisyah Abdul, and Shahida Shahimi. 2010. Credit Risk and Financing Structure of Malaysian Islamic Banks. Journal of Economic Cooperation and Development 31: 83–105. [Google Scholar]

- Ray, Nicholas Dylan. 1995. Arab Islamic Banking and the Renewal of Islamic Law. London and Boston: Graham & Trotman. [Google Scholar]

- Rosly, Saiful Azhar. 1999. Al Bay’bithaman Ajil Financing: Impacts on Islamic Banking Performance. Thunderbird International Business Review 41: 461–80. [Google Scholar] [CrossRef]

- Saeed, Momna, and Marwan Izzeldin. 2016. Examining the relationship between default risk and efficiency in Islamic and conventional banks. Journal of Economic Behavior & Organization 132: 127–54. [Google Scholar]

- Safiullah, Md, and Abul Shamsuddin. 2018. Risk in Islamic banking and corporate governance. Pacific-Basin Finance Journal 47: 129–49. [Google Scholar] [CrossRef]

- Salas, Vicente, and Jesus Saurina. 2002. Credit risk in two institutional regimes: Spanish commercial and savings banks. Journal of Financial Services Research 22: 203–24. [Google Scholar] [CrossRef]

- Salih, Abdalla, Mahieddine Adnan Ghecham, and Sameer Al-Barghouthi. 2018. The impact of global financial crisis on conventional and Islamic banks in the GCC countries. International Journal of Finance & Economics. [Google Scholar] [CrossRef]

- Samad, Abdus, Norman D. Gardner, and Bradley J. Cook. 2005. Islamic Banking and Finance in Theory and Practice: The Experience of Malaysia and Bahrain. The American Journal of Islamic Social Sciences 22: 69–86. [Google Scholar]

- Saunders, A., and Marcia Millon Cornett. 2006. Financial Institutions Management: A Risk Management Approach, 5th ed. New York: McGraw-Hill Irwin. [Google Scholar]

- Siddiqui, Anjum. 2008. Financial Contracts, Risk and Performance of Islamic Banking. Managerial Finance 34: 680–94. [Google Scholar] [CrossRef]

- Sun, Poi Hun, Shamsher Mohamad, and Mohamed Ariff. 2017. Determinants driving bank performance: A comparison of two types of banks in the OIC. Pacific-Basin Finance Journal 42: 193–203. [Google Scholar] [CrossRef]

- Sundararajan, V., and Luca Errico. 2002. Islamic Financial Institutions and Products in the Global Financial System: Key Issues in Risk Management and Challenges Ahead. IMF Working Paper 02. Washington, DC: IMF. [Google Scholar]

- Tafri, Fauziah Hanim, Rashidah Abdul Rahman, and Normah Omar. 2011. Empirical evidence on the risk management tools practised in Islamic and conventional banks. Qualitative Research in Financial Markets 3: 86–104. [Google Scholar] [CrossRef]

- Waring, Alan E., and A. Ian Glendon. 1998. Managing Risk. Andover: Cengage Learning EMEA. [Google Scholar]

- White, Halbert. 1980. A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48: 817–38. [Google Scholar] [CrossRef]

| 1 | Using a sample of 48 financial institutions in Malaysia for the period of 1995 to 2004, Chong and Liu (2009) examined whether Islamic banking is different from conventional banking. They found that Islamic banking is not very different from conventional banking in reference to the PLS paradigm, as financing is strictly PLS based in only a negligible portion of IBs in Malaysia. |

| 2 | Volatility is a measure of variations in the price of a financial instrument over a period of time. Interest rate volatility refers to the variability of interest rates on loans and savings over time. |

| Trading Contract | Participation Contract | Supporting Contract |

|---|---|---|

|

|

|

| Conventional Bank (CB) | Islamic Bank (IB) |

|---|---|

| Assets Cash and liquid assets (including treasury bills and notes) Investments & deposits Loan portfolios Fixed and other assets | Assets Cash and cash equivalents Sales receivable (Murabahah and others) Islamic financing assets including Mudharabah, Musharakah, Ijarah, Istisna, and Salam Fixed and other assets |

| Liabilities and Equity Deposit (current & saving accounts) Promissory notes Minority interest Borrowing and other liabilities Shareholders’ equity | Liabilities and Equity Saving and current accounts Salam and Istisna payables Other liabilities (Zakat and tax payable) Depositors’ share of profit |

| No. | Item | Conventional Bank (CB) | Islamic Bank (IB) |

|---|---|---|---|

| 1 | Principle | Based on fully artificial principles. | Based on Shariah principles. |

| 2 | Prohibited elements | Not applicable. | Free of the following prohibited elements:

|

| 3 | Risk sharing | Investor is certain to receive a predetermined rate of interest. | Islamic banking promotes risk sharing between the provider of capital (investor) and the recipient of capital (entrepreneur). |

| 4 | Products | Not applicable | Shariah-compliant products. |

| 5 | Asset-backed Financing | Banks and financial institutions deal in money and monetary papers only. | Does not recognize money as a subject-matter of trade. |

| 6 | Moral dimension | Not concerned about the moral implications of the activities financed and are not transparent. | Works within the moral values of Islam, cannot finance any projects that conflict with Islam and promotes transparency. |

| 7 | Zakat (religious tax) | Do not deal in Zakat. | It is compulsory to pay Zakat. |

| 8 | Penalty on default | Additional interest charged on default payment. | No extra charge on default payment. |

| 9 | Customer relationship | Relationship between a bank and its customers as a creditor and debtor. | Status of a bank is in relation to its customers as a partner, investor, and entrepreneur. |

| 10 | Shariah Supervisory Board (SSB) | Not applicable. | Each Islamic bank must have a Shariah Supervisory Board (SSB) to ensure all business activities are in line with Shariah. |

| Study | Methodology | Research Questions | Main Results |

|---|---|---|---|

| Hassan et al. (2019) | Simultaneous structural equation (SEM) approach |

|

|

| Mokni et al.(2015) | Descriptive statistics |

|

|

| Abedifar et al. (2013) | Regression analysis |

|

|

| Masood et al. (2012) | Logistic regression |

|

|

| Khalid and Amjad (2012) | Regression analysis |

|

|

| Abu Hussain and Al-Ajmi (2012) | Regression analysis |

|

|

| Hassan (2011) | Regression analysis and ANOVA |

|

|

| Tafri et al. (2011) | Descriptive statistics and ANOVA |

|

|

| Hassan (2009) | Descriptive statistics and regression analysis |

|

|

| Siddiqui (2008) | Literature review comparisons Ratio analysis |

|

|

| Al-Tamimi and Al-Mazrooei (2007) | Descriptive statistics and regression analysis |

|

|

| Ahmed and Khan (2007) | Qualitative |

|

|

| Independent Variables | (1) | (2) | (3) |

|---|---|---|---|

| Fixed Effect | OLS | GLS−Random Effect | |

| C | −25.514 *** | −15.213 *** | −19.546 *** |

| (−3.21) | (−2.17) | (−3.15) | |

| CRt−1 | 0.491 *** | 0.654 *** | 0.589 *** |

| (10.94) | (5.59) | (14.26) | |

| TL | −0.048 ** | −0.028 | −0.039 ** |

| (−2.36) | (−1.19) | (−2.11) | |

| LQ | 0.461 *** | 0.424 *** | 0.431 *** |

| (4.26) | (2.44) | (4.38) | |

| CB | 0.452 *** | 0.302 *** | 0.336 *** |

| (4.91) | (4.60) | (5.44) | |

| CAP | −0.127 *** | −0.048 | −0.077 * |

| (−3.04) | (−1.27) | (−1.94) | |

| FCOST | 0.065 | −0.023 | 0.021 |

| (0.42) | (−0.22) | (0.19) | |

| MGT EFF | 0.022 | 0.018 | 0.023 |

| (1.21) | (1.15) | (1.36) | |

| TA | 1.774 *** | 0.989 *** | 1.311 *** |

| (3.67) | (2.29) | (3.45) | |

| FOREIGN | −0.401 | −0.127 | 0.135 |

| (−0.23) | (−0.18) | (0.16) | |

| R2 | 0.604 | 0.736 | 0.745 |

| N | 203 | 203 | 203 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Al Rahahleh, N.; Ishaq Bhatti, M.; Najuna Misman, F. Developments in Risk Management in Islamic Finance: A Review. J. Risk Financial Manag. 2019, 12, 37. https://doi.org/10.3390/jrfm12010037

Al Rahahleh N, Ishaq Bhatti M, Najuna Misman F. Developments in Risk Management in Islamic Finance: A Review. Journal of Risk and Financial Management. 2019; 12(1):37. https://doi.org/10.3390/jrfm12010037

Chicago/Turabian StyleAl Rahahleh, Naseem, M. Ishaq Bhatti, and Faridah Najuna Misman. 2019. "Developments in Risk Management in Islamic Finance: A Review" Journal of Risk and Financial Management 12, no. 1: 37. https://doi.org/10.3390/jrfm12010037

APA StyleAl Rahahleh, N., Ishaq Bhatti, M., & Najuna Misman, F. (2019). Developments in Risk Management in Islamic Finance: A Review. Journal of Risk and Financial Management, 12(1), 37. https://doi.org/10.3390/jrfm12010037