The Determinants of Sovereign Risk Premium in African Countries

Abstract

:1. Introduction

2. Related Literature

3. The Model

4. Empirical Methodology

4.1. Panel Unit Root Tests: LLC and IPS

4.2. Residual-Based Panel Cointegration Test

5. Data Description

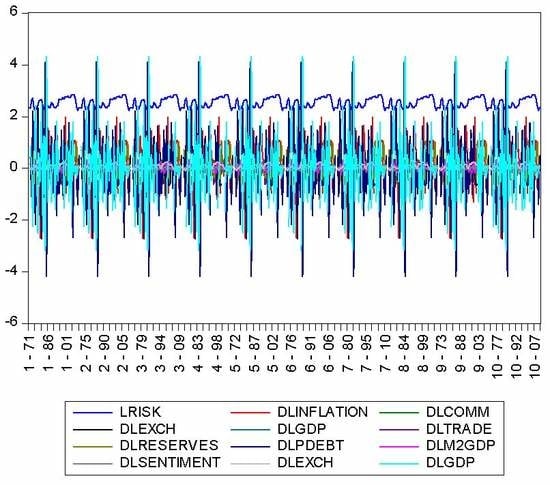

5.1. Stylized Facts

6. Empirical Results

6.1. IPS and LLC Unit Root Tests

6.2. Panel Residual-Based Cointegration Test

6.3. Dynamic Fixed Effects Estimation

6.4. Robustness Check: GMM

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Adjasi, Charles, and Nicholas Biekpe. 2006. Stock market development and economic growth: The case of selected African countries. African Development Bank 18: 144–61. [Google Scholar] [CrossRef]

- Alexeev, Michael, and Robert Conrad. 2009. The elusive curse of oil. Review of Economics and Statistics 91: 586–98. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Aristei, David, and Duccio Martelli. 2014. Sovereign bond yield spreads and market sentiment and expectations: Empirical evidence from Euro area countries. Journal of Economics and Business 76: 55–84. [Google Scholar] [CrossRef]

- Aron, Janine, and John Muellbauer. 2005. Monetary policy, macro-stability and growth: South Africa’s recent experience and lessons. World Economics 6: 123–47. [Google Scholar]

- Audzeyeva, Alena, and Klaus Reiner Schenk-Hoppé. 2010. The role of country, regional and global market risks in the dynamics of Latin American yield spreads. Journal of International Financial Markets, Institutions and Money 20: 404–22. [Google Scholar] [CrossRef]

- Auty, Richard M. 2007. Natural resources, capital accumulation and the resource curse. Ecological Economics 61: 627–34. [Google Scholar] [CrossRef]

- Baek, In-Mee, Arindam Bandopadhyaya, and Chan Du. 2005. Determinants of market-assessed sovereign risk: Economic fundamentals or market risk appetite? Journal of International Money and Finance 24: 533–48. [Google Scholar] [CrossRef]

- Baldacci, Emanuele, and Manmohan Kumar. 2010. Fiscal Deficits, Public Debt and Sovereign Bond Yields. IMF Working Paper WP/10/184. Washington, DC: International Monetary Fund, pp. 1–29. [Google Scholar]

- Baldacci, Emanuele, Sanjeev Gupta, and Amine Mati. 2011. Political and fiscal risk determinants of sovereign spreads in Emerging markets. Review of Development Economics 15: 251–63. [Google Scholar] [CrossRef]

- Baldini, Alfredo, Jaromir Benes, Andrew Berg, Mai Dao, and Rafael Portillo. 2012. Monetary Policy In Low Income Countries in the Face of the Global Crisis: The Case of Zambia. IMF Working paper, WP/12/94. Washington, DC: International Monetary Fund, pp. 1–47. [Google Scholar]

- Banerjee, Anindya. 1999. Panel data unit roots and cointegration: An overview. Oxford Bulletin of Economics and Statisics 61: 607–29. [Google Scholar] [CrossRef]

- Barro, Robert. 1999. Notes on optimal debt management. Journal of Applied Economics 2: 281–89. [Google Scholar] [CrossRef]

- Bellas, Dimtri, Michael Papaioannou, and Iva Petrova. 2010. Determinants of Emerging market Sovereign Bond Spreads: Fundamentals vs. Financial Stress. IMF Working paper, WP/10/281. Washington, DC: International Monetary Fund, pp. 1–24. [Google Scholar]

- Bernoth, Kerstin, and Burcu Erdogan. 2012. Sovereign bond yield spreads: A time-varying coefficient approach. Journal of International Money and Finance 31: 639–56. [Google Scholar] [CrossRef]

- Bernoth, Kerstin, Jürgen Von Hagen, and Ludger Schuknecht. 2012. Sovereign risk premiums in the European government bond market. Journal of International Money and Finance 31: 975–95. [Google Scholar] [CrossRef]

- Bi, Huixin. 2012. Sovereign default risk premia, fiscal limits, and fiscal policy. European Economic Review 56: 389–410. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bordo, Michael D., Christopher M. Meissner, and David Stuckler. 2010. Foreign currency debt, financial crises and economic growth: A long-run view. Journal of International Money and Finance 29: 642–65. [Google Scholar] [CrossRef]

- Borensztein, Eduardo, and Ugo Panizza. 2009. The costs of sovereign default. IMF Economic Review 56: 683–741. [Google Scholar]

- Bound, John, David A. Jaeger, and Regina M. Baker. 1995. Problems with instrumental variables estimation when the correlation between the instruments and the endogenous explanatory variable is weak. Journal of the American Statistical Association 90: 1–443. [Google Scholar] [CrossRef]

- Boyd, John H., Ross Levine, and Bruce D. Smith. 2001. The impact of inflation on financial sector performance. Journal of Monetary Economics 47: 221–48. [Google Scholar] [CrossRef]

- Bruckner, Markus, and Antonio Ciccone. 2010. International commodity prices, growth and the outbreak of civil war in Sub-Saharan Africa. The Economic Journal 120: 519–34. [Google Scholar] [CrossRef]

- Bruno, Michael, and William Easterly. 1998. Inflation crises and long-run growth. Journal of Monetary Economics 41: 3–26. [Google Scholar] [CrossRef]

- Bua, Giovanna, Juan Pradelli, and Andrea F. Presbitero. 2014. Domestic public debt in Low-Income Countries: Trends and structure. Review of Development Finance 4: 1–19. [Google Scholar] [CrossRef]

- Bunda, Irina, A. Javier Hamann, and Subir Lall. 2009. Correlations in emerging market bonds: The role of local and global factors. Emerging Markets Review 10: 67–96. [Google Scholar] [CrossRef]

- Calvo, Guillermo, and Carmen Reinhart. 2002. Fear of floating. Quarterly Journal of Economics 116: 379–408. [Google Scholar] [CrossRef]

- Calvo, Guillermo, Leornado Leiderman, and Carmen Reinhart. 1996. Inflows of capital to Developing countries in the 1990s. Journal of Economic Perspectives 10: 123–39. [Google Scholar] [CrossRef]

- Cassard, Marcel, and David Folkerts-Landau. 1997. Risk Management of Sovereign Assets and Liabilities. IMF Working Paper, WP/97/166. Washington, DC: International Monetary Fund, pp. 1–53. [Google Scholar]

- Christensen, Jakob. 2005. Domestic debt markets in sub-Saharan Africa. IMF Staff Papers 52: 518–38. [Google Scholar] [CrossRef]

- Claessens, Stijn, and Ying Qian. 1992. Risk Management in Sub-Saharan Africa. IMF Working Paper, WPS 593. Washington DC: International Monetary Fund, pp. 1–58. [Google Scholar]

- Claessens, Stijn, Daniela Klingebiel, and Sergio L. Schmukler. 2007. Government bonds in domestic and foreign currency: The Role of institutional and macroeconomic factors. Review of International Economics 15: 370–413. [Google Scholar] [CrossRef]

- Collier, Paul. 2007. Managing commodity booms: Lessons of international experience. In Centre for the Study of African Economics. Oxford: Oxford University, pp. 1–16. [Google Scholar]

- Comelli, Fabio. 2012. Emerging market sovereign bond spreads: Estimation and back-testing. Emerging Markets Review 13: 598–625. [Google Scholar] [CrossRef]

- Csonto, Balazs, and Iryna Ivaschenko. 2013. Determinants of Sovereign Bond Spreads in Emerging Markets: Local Fundamentals and Global Factors vs. Ever-Changing Misalignments. IMF Working Paper, WP/13/164. Washington, DC: International Monetary Fund, pp. 1–42. [Google Scholar]

- Cuadra, Gabriel, Juan M. Sanchez, and Horacio Sapriza. 2010. Fiscal policy and default risk in emerging markets. Review of Economic Dynamics 13: 452–69. [Google Scholar] [CrossRef]

- Cukierman, Alex, Miguel Kiguel, and Nissan Liviatan. 1992. How much to commit to an exchange rate rule? Balancing credibility and flexibility. Economic Analysis Review 7: 73–90. [Google Scholar]

- Dailami, Mansoor, Paul Masson, and Jean Jose Padou. 2008. Global monetary conditions versus country-specific factors. Journal of International Money and Finance 27: 1325–36. [Google Scholar] [CrossRef]

- Deme, Mamit, and Bichaka Fayissa. 1995. Inflation, money, interest rate, exchange rate, and casuality: The case of Egypt, Morocco, and Tunisia. Applied Economics 27: 1219–24. [Google Scholar] [CrossRef]

- Devereux, Michael B., and Philip R Lane. 2003. Understanding Bilateral Exchange Rate Volatility. Journal of International Economics 60: 109–32. [Google Scholar] [CrossRef]

- Dreher, Axel, and Roland Vaubel. 2009. Foreign exchange intervention and the political business cycle: A panel data analysis. Journal of International Money and Finance 28: 755–75. [Google Scholar] [CrossRef]

- Ebner, André. 2009. An empirical analysis on the determinants of CEE government bond spreads. Emerging Markets Review 10: 97–121. [Google Scholar] [CrossRef]

- Edwards, Sebastian. 1984. LDC foreign borrowing and default risk: An empirical investigation. American Economic Review 74: 726–34. [Google Scholar]

- Eichengreen, B., R. Hausmann, and H. Panizza. 2002. Original Sin: The Pain, the Mystery, and the Road To Redemption.Currency and Maturity Matchmaking: Redeeming Debt from Original Sin. Washington, DC: Inter-American Development Bank, pp. 1–56. [Google Scholar]

- Ferrucci, Gianluigi. 2003. Empirical Determinants of Emerging Market Economies’ Sovereign Bond Spreads. IMF Working Paper (205). Washington DC: International Monetary Fund, pp. 1–38. [Google Scholar]

- Fischer, Stanley. 1993. The role of macroeconomic factors in growth. Journal of Monetary Economics 32: 485–511. [Google Scholar] [CrossRef]

- Furceri, David, and Aleksandra Zdzienicka. 2012. How costly are debt crises? Journal of International Money and Finance 31: 726–42. [Google Scholar] [CrossRef]

- Galindo, Arturo, Ugo Panizza, and Fabio Schiantarelli. 2003. Debt composition and balance sheet effects of currency depreciation: A summary of the micro evidence. Emerging Markets Review 4: 330–39. [Google Scholar] [CrossRef]

- Gelos, R. Gaston, Ratna Sahay, and Guido Sandleris. 2011. Sovereign borrowing by developing countries: What determines market access? Journal of International Economics 83: 243–54. [Google Scholar] [CrossRef]

- Gonzalez-Rozada, Martin, and Eduardo Levy-Yeyati. 2008. Global factors and emerging market spreads. The Economic Journal 118: 1917–36. [Google Scholar] [CrossRef]

- De Grauwe, Paul, and Yuemei Ji. 2012. Mispricing of sovereign risk and macroeconomic stability in the Eurozone. Journal of Common Market Studies 50: 866–80. [Google Scholar] [CrossRef]

- Guerrero, Federico. 2006. Does inflation cause poor long-term growth performance? Japan and the World Economy 18: 72–89. [Google Scholar] [CrossRef]

- Guillaumont, Patrick, Sylviane Guillaumont Jeanneney, and Jean-Francois Brun. 1999. How instability lowers African growth. Journal of African Economies 8: 87–107. [Google Scholar] [CrossRef]

- Gumus, Inci. 2011. Exchange rate policy and sovereign spreads in emerging market economies. Review of International Economics 19: 649–63. [Google Scholar] [CrossRef]

- Gylfason, Thorvaldur. 1991. Inflation, growth, and external debt: A View of the landscape. The World Economy 14: 279–97. [Google Scholar] [CrossRef]

- Hatchondo, Juan Carlos, Francisco Roch, and Leonardo Martinez. 2012. Fiscal Rules and the Sovereign Default Premium. IMF Working Paper WP/12/30. Washington, DC: International Monetary Fund, pp. 1–38. [Google Scholar]

- Hegerty, W. Scott. 2016. Commodity-price volatility and macroeconomic spillovers: Evidence from nine emerging markets. North American Journal of Economics and Finance 35: 23–37. [Google Scholar] [CrossRef]

- Heinemann, Friedrich, Steffen Osterloh, and Alexander Kalb. 2014. Sovereign risk premia: The link between fiscal rules and stability culture. Journal of International Money and Finance 41: 110–27. [Google Scholar] [CrossRef]

- Hilscher, Jens, and Yves Nosbusch. 2010. Determinants of sovereign risk: Macroeconomic fundamentals and the pricing of sovereign debt. Review of Finance 14: 235–62. [Google Scholar] [CrossRef]

- Iara, Anna, and Guntram Wolff. 2014. Rules and risk in the Euro area. European Journal of Political Economy 34: 222–36. [Google Scholar] [CrossRef]

- Im, Kyung So, Hashem Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Jankovic, Irena, and Bosko Zivkovic. 2014. An analysis of the effect of currency mismatch on a country’s default risk. Economic Annals 59: 85–121. [Google Scholar] [CrossRef]

- Jeanne, Olivier, and Romain Ranciere. 2011. The optimal level of international reserves for emerging market countries: A new formula and some applications. The Economic Journal 121: 905–30. [Google Scholar] [CrossRef]

- Judson, Ruth, and Ann Owen. 1999. Estimating dynamic panel data models: A guide for macroeconomists. Economics Letters 65: 9–15. [Google Scholar] [CrossRef]

- Julius, Bitok, Kiplangat Andrew, Tenai Joel, and Rono Lucy. 2010. Determinants of investor confidence for firms listed at the Nairobi stock exchange, Kenya. International Journal of Finance and Management 1: 160–73. [Google Scholar]

- Kallon, Kelfala. 1994. An econometric analysis of inflation in Sierra Leone. Journal of African Economies 3: 201–30. [Google Scholar] [CrossRef]

- Kamin, Steven, and Karsten von Kleist. 1999. The Evolution and Determinants of Emerging Market Credit Spreads in the 1990s. BIS Working Paper No. 68. Washington, DC: Federal Reserve System, pp. 1–40. [Google Scholar]

- Kaminsky, Graciela, and Sergio Schmukler. 1999. What triggers market jitters? A chronicle of the Asian crisis. Journal of International Money and Finance 18: 537–60. [Google Scholar] [CrossRef]

- Kao, Chihwa. 1999. Spurious regression and residual based tests for cointegration in panel data. Journal of Econometrics 90: 1–44. [Google Scholar] [CrossRef]

- Kennedy, Peter. 1998. A guide to Econometrics. Cambridge: MIT Press. [Google Scholar]

- Korinek, Anton. 2011. Foreign currency debt, risk premia and macroeconomic volatility. European Economic Review 55: 371–85. [Google Scholar] [CrossRef]

- Kyereboah-Coleman, Anthony. 2012. Inflation targeting and inflation management in Ghana. Financial Economic Policy 4: 25–40. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien-Fu Lin, and Chia-Shang James Chu. 2002. Unit root tests in panel data: Asymptotic and finite sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Malikane, Christopher, and Tshepo Mokoka. 2012. Monetary policy credibility: A Phillips curve view. The Quarterly Review of Economics and Finance 52: 266–71. [Google Scholar] [CrossRef]

- Maltritz, Dominik. 2012. Determinants of sovereign yield spreads in the Eurozone: A Bayesian approach. Journal of International Money and Finance 31: 657–72. [Google Scholar] [CrossRef]

- Maltritz, Dominik, and Alexander Molchanov. 2013. Analyzing determinants of bond yield spreads with Bayesian model averaging. Journal of Banking and Finance 37: 5275–84. [Google Scholar] [CrossRef]

- Martinez, Lisana, Antonio Terceno, and Mercedes Terruel. 2013. Sovereign bond spreads determinants in Latin American countries: Before and during the XXI financial crisis. Emerging Markets Review 17: 60–75. [Google Scholar] [CrossRef]

- McCoskey, Suzanne, and Chihwa Kao. 1998. A residual-based test for the null of cointegration in panel data. Econometric Reviews 17: 57–84. [Google Scholar] [CrossRef]

- Mendonca, Helder Ferreira de, and Marcio Nunes. 2011. Public debt and risk premium: An analysis from an emerging economy. Journal of Economic Studies 38: 203–17. [Google Scholar] [CrossRef]

- Min, Hong-Ghi, Duk-Hee Lee, Changi Nam, Myeong Cheol Park, and Sang-Ho Nam. 2003. Determinants of emerging-market bond spreads: Cross-country evidence. Global Finance Journal 14: 271–86. [Google Scholar] [CrossRef]

- Morgan, Wallet. 2001. Commodity futures markets in LDCs: A review and prospects. Progress in Development Studies 1: 139–50. [Google Scholar] [CrossRef]

- Muhanji, Stella, and Kalu Ojah. 2011. External shocks and persistence of external debt in open vulnerable economies: The case of Africa. Economic Modelling 28: 1615–28. [Google Scholar] [CrossRef]

- Nkurunziza, Janvier. 2001. Exchange rate policy and the parallel market for foreign currency in Burundi. African Journal of Economic Policy 8: 69–121. [Google Scholar]

- Nkurunziza, Janvier. 2005. Political instability, inflation tax and asset substitution in Burundi. Journal of African Development 7: 42–72. [Google Scholar]

- Odhiambo, Nicholas. 2012. The impact of inflation on financial sector development: Experience from Zambia. The Journal of Applied Business Research 28: 1497–508. [Google Scholar] [CrossRef]

- Olabisi, Michael, and Howard Stein. 2015. Sovereign bond issues: Do African countries pay more to borrow? Journal of African Trade 2: 87–109. [Google Scholar] [CrossRef]

- Ouyang, Alice, and Ramkishen Rajan. 2014. What determines external debt tipping points? Journal of Macroeconomics 39: 215–25. [Google Scholar] [CrossRef]

- Özatay, Fatih, Erdal Özmen, and Gulbin Şahinbeyoğlu. 2009. Emerging market sovereign spreads, global financial conditions and U.S. macroeconomic news. Economic Modelling 26: 526–31. [Google Scholar] [CrossRef]

- Pedroni, Peter. 1999. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics 61: 653–70. [Google Scholar] [CrossRef]

- Pedroni, Peter. 2004. Panel Cointegration; Asymptotic and Finite Sample Properties of Pooled Time Series Tests, with an Application to the PPP Hypothesis. Econometric Theory 20: 597–625. [Google Scholar] [CrossRef]

- Reinhart, Carmen, and Kenneth Rogoff. 2011. From financial crisis to debt crisis. American Economic Review 101: 1676–706. [Google Scholar] [CrossRef]

- Roodman, David. 2009. A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics 71: 135–58. [Google Scholar] [CrossRef]

- Sachs, Jeffrey, and Andrew Warner. 1999. The Big push, natural resource booms and growth. Journal of Development Economics 59: 43–76. [Google Scholar] [CrossRef]

- Sargan, John Denis. 1958. The estimation of economic relationships using instrumental variables. Econometrica 26: 393–415. [Google Scholar] [CrossRef]

- Senhadji, Abdelhak. 1997. Sources of Debt Accumulation in a Small Open Economy. Washington, DC: International Monetary Fund, IMF Working Paper, WP/97/146. pp. 1–26. [Google Scholar]

- Siklos, Pierre. 2011. Emerging market yield spreads: Domestic, external determinants, and volatility spillovers. Global Finance Journal 22: 83–100. [Google Scholar] [CrossRef]

- Stock, James, Jonathan Wright, and Motohiro Yogo. 2002. A survey of weak instruments and weak identification in Generalized Method of Moments. Journal of Business and Economic Statistics 20: 518–29. [Google Scholar] [CrossRef]

- Strauss, Jack, and Taner Yigit. 2003. Shortfalls of panel unit root testing. Economics Letters 81: 309–13. [Google Scholar] [CrossRef]

- Sturzenegger, Federico. 2004. Tools for the analysis of debt problems. Journal of Restructuring Finance 1: 201–23. [Google Scholar] [CrossRef]

- Teles, Vladimir Kuhl, and Maria Carolina Leme. 2010. Fundamentals or market sentiment: What causes country risk? Applied Economics 42: 2577–85. [Google Scholar] [CrossRef]

- Teles, Vladimir Kuhl, and Caio Cesar Mussolini. 2014. Public debt and the limits of fiscal policy to increase economic growth. European Economic Review 66: 1–15. [Google Scholar] [CrossRef]

- Tkalec, Marina, Maruska Vizek, and Miroslav Verbic. 2014. Balance sheet effects and original sinners’ risk premiums. Economic Systems 38: 597–613. [Google Scholar] [CrossRef]

- Uribe, Martin. 2006. A fiscal theory of sovereign risk. Journal of Monetary Economics 53: 1857–75. [Google Scholar] [CrossRef]

- Zinna, Gabriele. 2013. Sovereign default risk premia: Evidence from the default swap market. Journal of Empirical Finance 21: 15–35. [Google Scholar] [CrossRef]

| Variables | Risk Premium | Reserves/GDP | M2/GDP | Inflation Rate | Real GDP | Exchange Rate | Public Debt/GDP | Consumer Sentiment | Current Account/GDP Ratio |

|---|---|---|---|---|---|---|---|---|---|

| Risk Premium | 1 | ||||||||

| Reserves/GDP | −0.176 ** | 1 | |||||||

| M2/GDP | 0.648 ** | −0.416 ** | 1 | ||||||

| Inflation rate | 0.165 ** | −0.032 *** | 0.186 ** | 1 | |||||

| Real GDP | −0.216 ** | 0.149 ** | 0.163 ** | −0.152 ** | 1 | ||||

| Real exchange rate | −0.723 ** | −0.518 ** | 0.893 ** | 0.146 ** | 0.02 *** | 1 | |||

| Public debt/GDP | 0.006 *** | −0.637 ** | 0.088 ** | 0.09 ** | 0.702 ** | 0.18 ** | 1 | ||

| Consumer sentiment | 0.203 ** | −0.229 ** | −0.355 ** | −0.267 ** | −0.17 ** | −0.30 ** | 0.400 ** | 1 | |

| Current account/GDP | −0.431 ** | −0.44 ** | 0.85 ** | 0.009 *** | 0.057 *** | 0.842 ** | 0.134 ** | −0.223 ** | 1 |

| Level (Without Trend) | Difference (With Trend) | |||

|---|---|---|---|---|

| Variables | Levin, Lin, and Chu | Im, Pesaran, and Shin | Levin, Lin, and Chu | Im, Pesaran, and Shin |

| GDP | −22.38 ** | −21.06 ** | −19.66 ** | −19.63 ** |

| Exchange rate | 1.86 *** | 5.51 *** | −9.03 ** | −5.03 ** |

| Inflation rate | −17.57 ** | −14.24 ** | −16.85 ** | −12.71 ** |

| M2/GDP | 0.01 *** | 2.05 *** | −25.03 ** | −29.26 ** |

| Public debt/GDP | −23.00 ** | −24.34 ** | ||

| Foreign exchange reserves | −10.27 ** | −13.41 ** | ||

| Risk premium | −2.29 ** | −2.79 ** | ||

| Market sentiment | −6 ** | −7.8 ** | ||

| Trade/GDP | −11.03 ** | −18.77 ** | ||

| Commodity price | −3.09 ** | −7.29 ** | ||

| Variable | Without Deterministic Trend | With Deterministic Trend |

|---|---|---|

| Sovereign risk premium | −2.66 ** | −2.38 ** |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Riskt−1 | 0.65(0.04) ** | 0.72(0.03) ** | 0.63(0.04) ** |

| GDP | 0.07(0.01) ** | 0.04(0.01) ** | 0.07(0.01) ** |

| Exchange rate | −0.06(0.09) | ||

| Inflation rate | 0.04(0.01) ** | 0.03(0.01) ** | 0.04(0.01) ** |

| M2/GDP | 0.06(0.06) | ||

| Public debt/GDP | 0.03(0.007) ** | 0.01(0.007) ** | 0.03(0.007) ** |

| Foreign exchange reserves | −0.06(0.01) ** | −0.06(0.01) ** | −0.06(0.017) ** |

| Market sentiment | 0.19(0.09) ** | 0.21(0.10) ** | 0.17(0.09) *** |

| Trade/GDP | −0.07(0.05) ** | −0.11(0.05) ** | |

| Commodity price | −0.11(0.03) ** | −0.15(0.03) ** | −0.12(0.03) ** |

| D1979 | 0.16(0.04) ** | ||

| D1980 | 0.16(0.04) ** | ||

| D2001 | 0.17(0.04) ** | ||

| D2007 | 0.20(0.04) ** | ||

| D2008 | 0.13(0.04) ** | ||

| R2 | 0.64 | 0.61 | 0.67 |

| Durbin–Watson statistics | 1.79 | 1.65 | 1.83 |

| Observations | 344 | 344 | 344 |

| Prob(F-statistics) | 0.0000 | 0.0000 | 0.0000 |

| Variables | Inflation Rate | GDP | Public Debt/GDP | Reserves | Sentiment | Trade/GDP | Commodity Price |

|---|---|---|---|---|---|---|---|

| Burundi | 0.14(0.04) ** | 0.02(0.01) *** | −0.5(0.18) ** | ||||

| Egypt | 0.12(0.07) ** | 3.44(0.57) ** | |||||

| Gambia | −0.31(0.13) ** | ||||||

| Kenya | 0.97(0.5) *** | 4.18(2.24) *** | |||||

| Mauritania | −0.31(0.15) ** | 0.99(0.34) ** | |||||

| Nigeria | −0.26(0.09) ** | 0.86(0.21) ** | |||||

| Sierra Leone | 0.47(0.10) ** | 0.97(0.18) ** | 1.64(0.87) *** | ||||

| Swaziland | −0.19(0.05) ** | −0.32(0.09) ** | |||||

| South Africa | |||||||

| Zambia | 0.73(0.11) ** | 0.29(0.10) ** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mpapalika, J.; Malikane, C. The Determinants of Sovereign Risk Premium in African Countries. J. Risk Financial Manag. 2019, 12, 29. https://doi.org/10.3390/jrfm12010029

Mpapalika J, Malikane C. The Determinants of Sovereign Risk Premium in African Countries. Journal of Risk and Financial Management. 2019; 12(1):29. https://doi.org/10.3390/jrfm12010029

Chicago/Turabian StyleMpapalika, Jane, and Christopher Malikane. 2019. "The Determinants of Sovereign Risk Premium in African Countries" Journal of Risk and Financial Management 12, no. 1: 29. https://doi.org/10.3390/jrfm12010029

APA StyleMpapalika, J., & Malikane, C. (2019). The Determinants of Sovereign Risk Premium in African Countries. Journal of Risk and Financial Management, 12(1), 29. https://doi.org/10.3390/jrfm12010029