Exchange Rate Volatility and Disaggregated Manufacturing Exports: Evidence from an Emerging Country

Abstract

1. Introduction

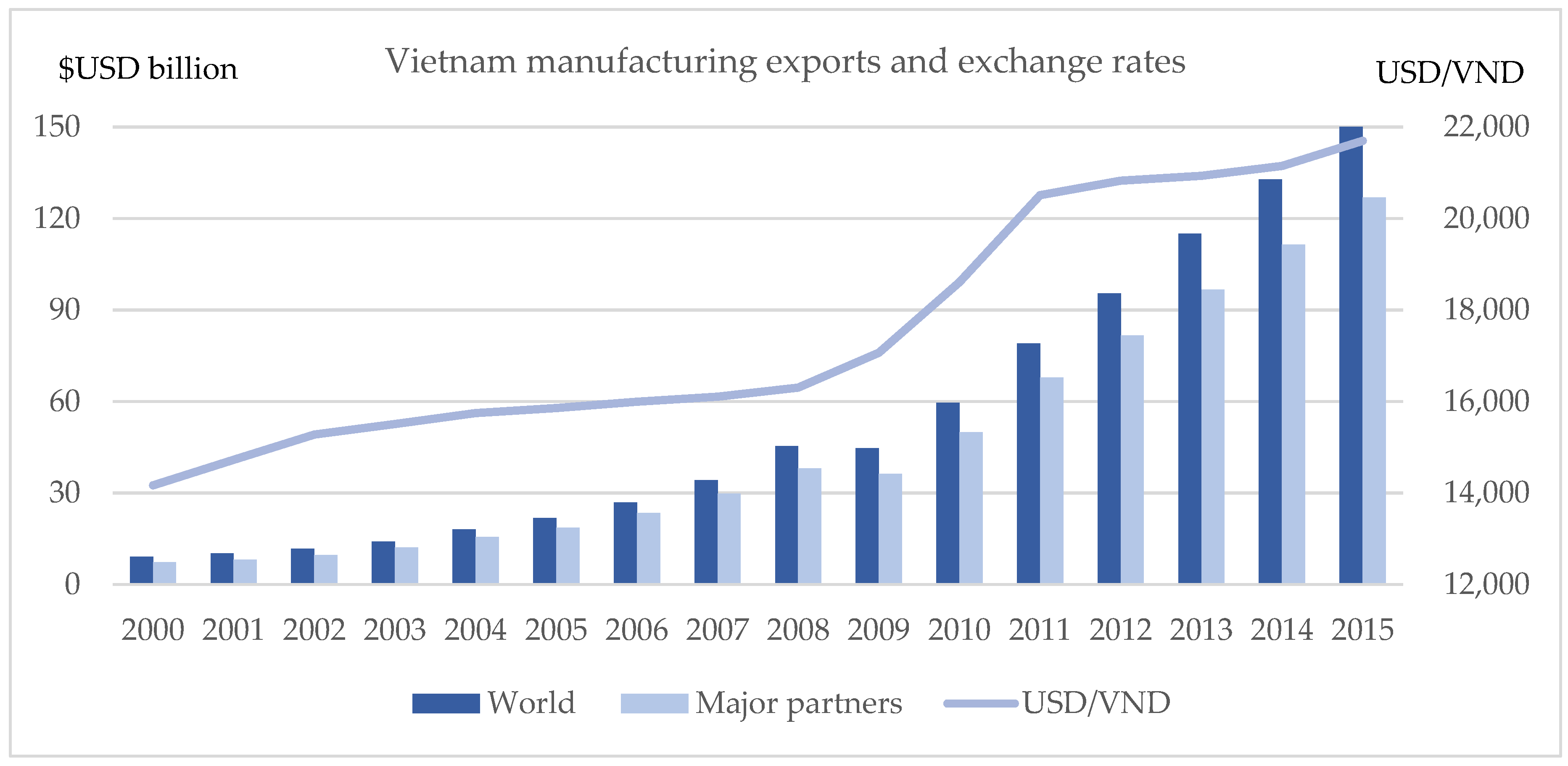

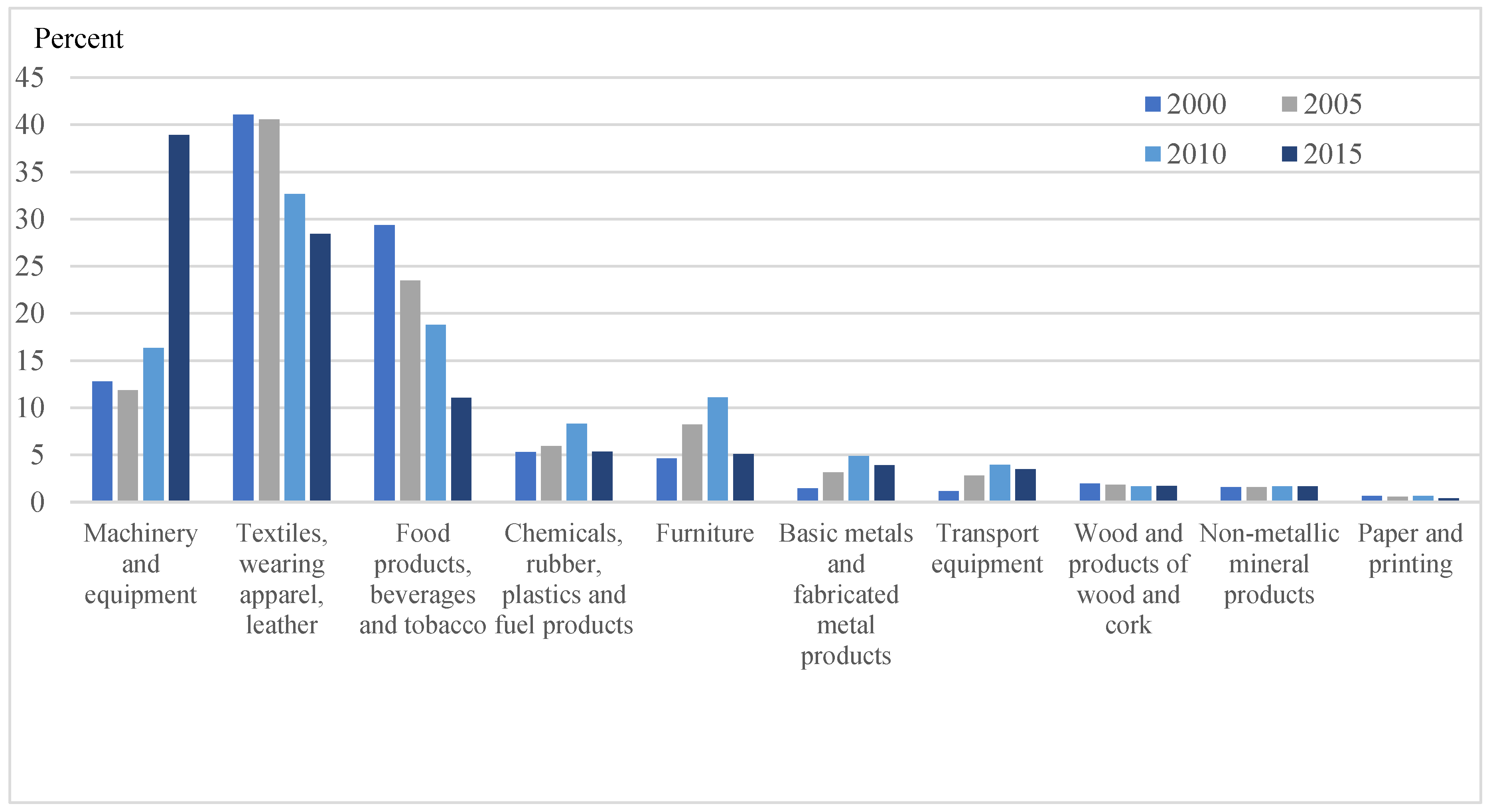

2. Overview of Vietnam’s Exports and Exchange Rate

3. Literature Review

4. Model Specifications

5. Empirical Results

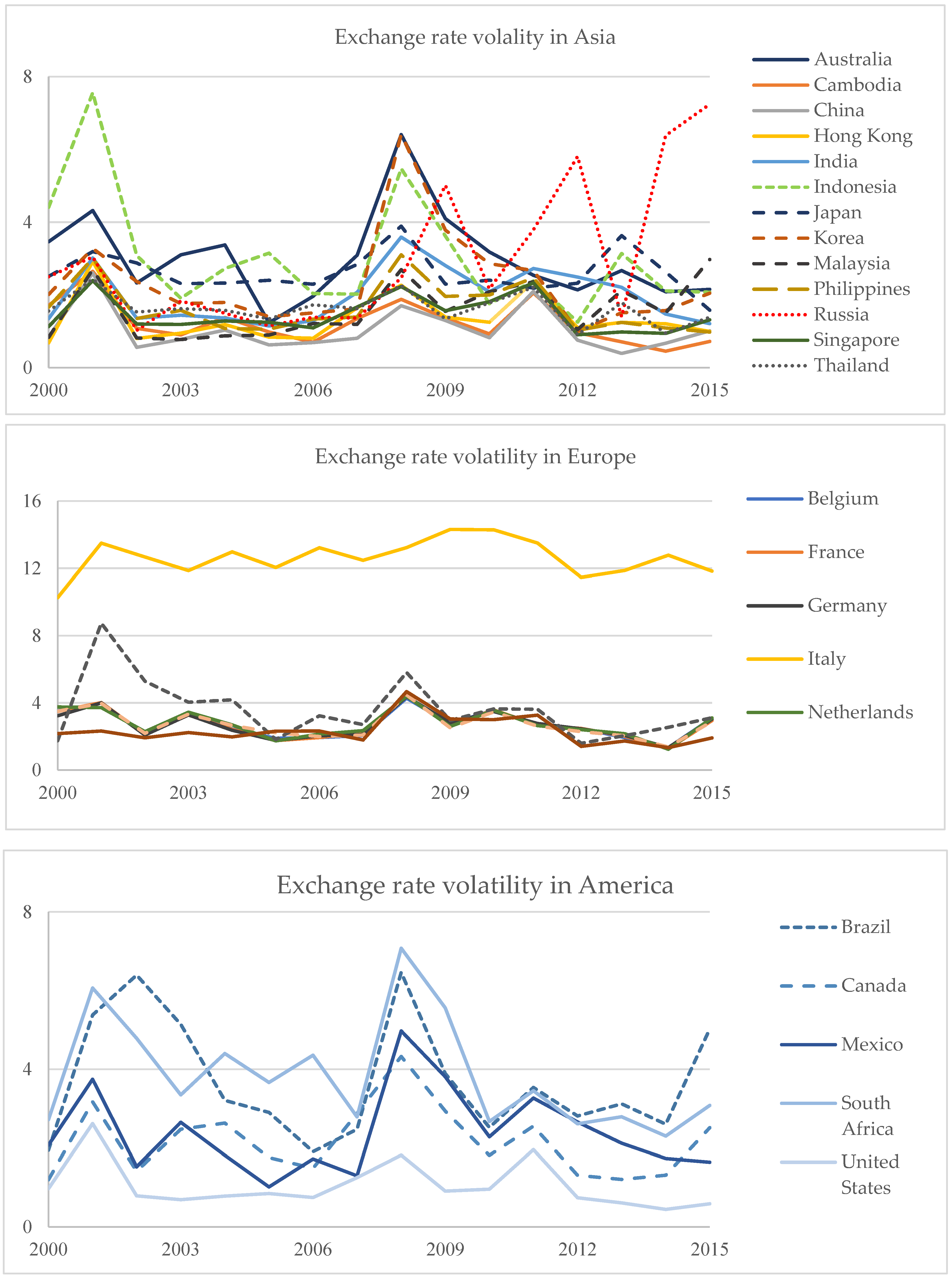

5.1. Volatility Measurement

5.2. Effects of Exchange Rate Volatility on Exports

6. Concluding Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix

| Code | OECD | SIC | Sector |

|---|---|---|---|

| EX | D10T32 | D10-D32 | Manufacturing exports |

| EX1 | D10T12 | D10, D11, D12 | Food products, beverages and tobacco |

| EX2 | D13T15 | D13, D14, D15 | Textiles, wearing apparel, leather and related products |

| EX3 | D16 | D16 | Wood and products of wood and cork, except furniture |

| EX4 | D17T18 | D17, D18 | Paper and printing |

| EX5 | D19T22 | D19, D20, D21, D22 | Chemicals, rubber, plastics and fuel products |

| EX6 | D23 | D23 | Non-metallic mineral products |

| EX7 | D24T25 | D24, D25 | Basic metals and fabricated metal products, except machinery and equipment |

| EX8 | D26T28 | D26, D27, D28 | Machinery and equipment |

| EX9 | D29T30 | D29, D30 | Transport equipment |

| EX10 | D31T32 | D31, D32 | Furniture and other manufacturing |

| Regions | Countries |

|---|---|

| Asia | Australia, Cambodia, Hong Kong, China, India, Indonesia, Japan, Korea, Malaysia, Philippines, Russian, Singapore, Thailand |

| Europe | Belgium, France, Germany, Italy, Netherlands, Spain, Turkey, United Kingdom |

| America | Brazil, Canada, Mexico, South Africa, United States |

| Parameter | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 0.00 | (0.002) | 0.289 *** | (0.094) | 0.235 *** | (0.082) | 0.283 | (0.292) | 17.08 | 14.53 | 19.31 |

| Belgium | −0.002 | (0.002) | 0.321 *** | (0.071) | 0.024 | (0.031) | 0.92 *** | (0.075) | 12.54 | 16.15 | 19.51 |

| Brazil | −0.001 | (0.003) | 0.334 *** | (0.079) | 0.329 *** | (0.114) | 0.110 | (0.210) | 18.93 | 12.34 | 23.99 |

| Cambodia | 0.00 | (0.001) | −0.127 | (0.104) | 0.488 *** | (0.158) | −0.009 | (0.162) | 22.25 | 13.91 | 10.79 |

| Canada | −0.001 | (0.002) | 0.288 *** | (0.085) | 0.124 *** | (0.039) | 0.763 *** | (0.097) | 21.66 | 9.72 | 14.69 |

| Hong Kong | −0.002 ** | (0.001) | −0.117 | (0.100) | 0.599 *** | (0.192) | 0.332 ** | (0.133) | 30.51 | 6.03 | 10.34 |

| China | 0.00 | (0.001) | 0.045 | (0.128) | 0.147 ** | (0.062) | 0.334 | (0.266) | 16.14 | 6.85 | 7.48 |

| France | −0.002 | (0.002) | 0.322 *** | (0.071) | 0.043 | (0.038) | 0.903 *** | (0.077) | 10.86 | 17.62 | 20.84 |

| Germany | −0.002 | (0.002) | 0.319 *** | (0.071) | 0.040 | (0.041) | 0.903 *** | (0.095) | 15.03 | 17.17 | 21.47 |

| India | 0.00 | (0.001) | 0.082 | (0.086) | 0.165 * | (0.091) | 0.703 *** | (0.139) | 45.44 | 9.74 | 12.10 |

| Indonesia | 0.00 | (0.002) | 0.149 * | (0.090) | 0.826 *** | (0.169) | 0.136 | (0.084) | 19.09 | 17.55 | 9.93 |

| Italy | 0.005 | (0.090) | −0.280 *** | (0.002) | −0.216 *** | (0.050) | 0.359 | (0.698) | 9.97 | 24.63 | 22.22 |

| Japan | −0.003 * | (0.002) | 0.119 | (0.081) | 0.077 | (0.110) | 0.502 | (0.749) | 13.73 | 21.67 | 12.47 |

| Korea | 0.00 | (0.001) | 0.242 *** | (0.082) | 0.218 *** | (0.075) | 0.708 *** | (0.109) | 12.52 | 9.09 | 11.02 |

| Malaysia | −0.002 | (0.001) | 0.143 | (0.088) | 0.261 ** | (0.104) | 0.567 *** | (0.144) | 17.80 | 5.31 | 6.95 |

| Mexico | −0.003 * | (0.001) | 0.173 ** | (0.081) | 0.343 *** | (0.070) | 0.603 *** | (0.068) | 28.09 | 11.49 | 8.84 |

| Netherlands | −0.002 | (0.002) | 0.319 *** | (0.074) | 0.013 | (0.029) | 0.931 *** | (0.059) | 11.95 | 18.72 | 19.32 |

| Philippines | 0.00 | (0.001) | 0.118 | (0.094) | 0.134 *** | (0.048) | 0.833 *** | (0.051) | 17.34 | 14.54 | 11.32 |

| Russian Federation | 0.004 ** | (0.002) | 0.260 *** | (0.079) | 0.449 *** | (0.114) | 0.58 *** | (0.074) | 13.31 | 12.40 | 13.79 |

| Singapore | −0.001 | (0.001) | 0.065 | (0.085) | 0.180 *** | (0.065) | 0.726 *** | (0.086) | 20.80 | 13.36 | 19.78 |

| South Africa | −0.004 | (0.003) | 0.267 *** | (0.095) | 0.085 ** | (0.040) | 0.85 *** | (0.063) | 21.50 | 16.71 | 17.08 |

| Spain | −0.002 | (0.002) | 0.292 *** | (0.069) | 0.033 | (0.037) | 0.916 *** | (0.078) | 13.39 | 19.43 | 25.17 |

| Thailand | −0.001 | (0.001) | 0.188 ** | (0.074) | 0.081 *** | (0.030) | −0.88 *** | (0.104) | 16.92 | 6.96 | 6.57 |

| Turkey | 0.001 | (0.002) | 0.237 *** | (0.068) | 0.601 *** | (0.145) | 0.236 | (0.151) | 17.71 | 13.42 | 17.83 |

| United Kingdom | −0.001 | (0.002) | 0.094 | (0.081) | 0.336 ** | (0.153) | 0.144 | (0.265) | 14.07 | 15.81 | 15.18 |

| United States | −0.002 *** | (0.000) | −0.047 | (0.099) | 0.620 *** | (0.210) | 0.354 ** | (0.151) | 35.47 | 6.86 | 10.62 |

| Panel | Ex1 | Ex2 | Ex3 | Ex4 | Ex5 | Ex6 | Ex7 | Ex8 | Ex9 | Ex10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: The whole sample | −0.9% | na | −1.17% | −0.93% | na | −0.88% | −0.78% | −0.89% | −0.69% | −1.20% |

| Panel B: Asian region | na | na | na | −0.85% | na | na | na | na | na | na |

| Panel C: European region | na | na | na | na | na | na | na | na | na | na |

| Panel D: American region | na | −1.83% | −2.17% | na | −2.48% | na | −2.32% | −1.42% | na | na |

References

- Aftab, Muhammad, Karim Bux Shah Syed, Rubi Ahmad, and Izlin Ismail. 2015. Exchange-rate variability and industry trade flows between Malaysia and Japan. The Journal of International Trade & Economic Development 25: 453–78. [Google Scholar]

- Aftab, Muhammad, Karim Bux Shah Syed, and Naveed Akhter Katper. 2017. Exchange-rate volatility and Malaysian-Thai bilateral industry trade flows. Journal of Economic Studies 44: 99–114. [Google Scholar] [CrossRef]

- Aristotelous, Kyriacos. 2001. Exchange-rate volatility, exchange-rate regime, and trade volume: Evidence from the UK–US export function (1889–1999). Economics Letters 72: 87–94. [Google Scholar] [CrossRef]

- Asteriou, Dimitrios, Kaan Masatci, and Keith Pılbeam. 2016. Exchange rate volatility and international trade: International evidence from the MINT countries. Economic Modelling 58: 133–40. [Google Scholar] [CrossRef]

- Atif, Rao Muhammad, Liu Haiyun, and Haider Mahmood. 2017. Pakistan’s agricultural exports, determinants and its potential: An application of stochastic frontier gravity model. The Journal of International Trade & Economic Development 26: 257–76. [Google Scholar]

- Bahmani-Oskooee, Mohsen, and Yongqing Wang. 2007. United States-China trade at the commodity level and the Yuan-Dollar exchange rate. Contemporary Economic Policy 25: 341–61. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, Marzieh Bolhassani, and Scott Hegerty. 2012. Exchange-rate volatility and industry trade between Canada and Mexico. The Journal of International Trade & Economic Development 21: 389–408. [Google Scholar]

- Bahmani-Oskooee, Mohsen, Hanafiah Harvey, and Scott W. Hegerty. 2013. The effects of exchange-rate volatility on commodity trade between the US and Brazil. The North American Journal of Economics and Finance 25: 70–93. [Google Scholar] [CrossRef]

- Chit, Myint Moe. 2008. Exchange rate volatility and exports: Evidence from the ASEAN-China Free Trade Area. Journal of Chinese Economic and Business Studies 6: 261–77. [Google Scholar] [CrossRef]

- Chit, Myint Moe, Marian Rizov, and Dirk Willenbockel. 2010. Exchange rate volatility and exports: New empirical evidence from the emerging East Asian economies. The World Economy 33: 239–63. [Google Scholar] [CrossRef]

- Choi, In. 2001. Unit Root Tests for Panel Data. Journal of International Money and Finance 20: 249–72. [Google Scholar] [CrossRef]

- Choudhry, Taufiq, and Syed S. Hassan. 2015. Exchange rate volatility and UK imports from developing countries: The effect of the global financial crisis. Journal of International Financial Markets, Institutions and Money 39: 89–101. [Google Scholar] [CrossRef]

- Clark, Peter B. 1973. Uncertainty, exchange risk, and the level of international trade. Western Economic Journal 6: 302–13. [Google Scholar] [CrossRef]

- De Grauwe, Paul. 1988. Exchange rate variability and the slowdown in growth of international trade. IMF Staff Papers 35: 63–84. [Google Scholar] [CrossRef]

- De Vita, Glauco, and Andrew Abbott. 2004. The impact of exchange rate volatility on UK exports to EU countries. Scottish Journal of Political Economy 51: 62–81. [Google Scholar] [CrossRef]

- Erdem, Ekrem, Saban Nazlioglu, and Cumhur Erdem. 2010. Exchange rate uncertainty and agricultural trade: Panel cointegration analysis for Turkey. Agricultural Economics 41: 537–43. [Google Scholar] [CrossRef]

- Hansen, Peter R., and Asger Lunde. 2005. A forecast comparison of volatility models: Does anything beat a GARCH(1,1)? Journal of Applied Econometrics 20: 873–89. [Google Scholar] [CrossRef]

- Hayakawa, Kazunobu, and Fukunari Kimura. 2009. The effect of exchange rate volatility on international trade in East Asia. Journal of the Japanese and International Economies 23: 395–406. [Google Scholar] [CrossRef]

- Hooper, Peter, and Steven W. Kohlhagen. 1978. The effect of exchange rate uncertainty on the prices and volume of international trade. Journal of International Economics 8: 483–511. [Google Scholar] [CrossRef]

- Hooy, Chee-Wooi, Law Siong-Hook, and Chan Tze-Haw. 2015. The impact of the Renminbi real exchange rate on ASEAN disaggregated exports to China. Economic Modelling 47: 253–59. [Google Scholar] [CrossRef]

- Hsu, Kuang-Chung, and Hui-Chu Chiang. 2011. The threshold effects of exchange rate volatility on exports: Evidence from US bilateral exports. The Journal of International Trade & Economic Development 20: 113–28. [Google Scholar]

- Ilzetzki, Ethan, Carmen M. Reinhart, and Kenneth S. Rogoff. 2017. Exchange arrangements entering the 21st century: Which anchor will hold? National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Im, Kyung So, M. Hashem Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Kandilov, Ivan T. 2008. The effects of exchange rate volatility on agricultural trade. American Journal of Agricultural Economics 90: 1028–43. [Google Scholar] [CrossRef]

- Maddala, Gangadharrao S., and Shaowen Wu. 1999. A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61: 631–52. [Google Scholar] [CrossRef]

- Narayan, Seema, and Tri Tung Nguyen. 2016. Does the trade gravity model depend on trading partners? Some evidence from Vietnam and her 54 trading partners. International Review of Economics & Finance 41: 220–37. [Google Scholar]

- Nguyen, Dong Xuan. 2016. Trade liberalization and export sophistication in Vietnam. The Journal of International Trade & Economic Development 25: 1071–89. [Google Scholar]

- Nishimura, Yusaku, and Kenjiro Hirayama. 2013. Does exchange rate volatility deter Japan-China trade? Evidence from Pre-and Post-exchange rate reform in China. Japan and the World Economy 25: 90–101. [Google Scholar] [CrossRef]

- Pedroni, Peter. 1999. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics 61: 653–70. [Google Scholar] [CrossRef]

- Pedroni, Peter. 2001. Purchasing power parity tests in cointegrated panels. The Review of Economics and Statistics 83: 727–31. [Google Scholar] [CrossRef]

- Prasad, Eswar, Kenneth Rogoff, Shang-Jin Wei, and M. Ayhan Kose. 2003. Effects of financial globalization on developing countries: Some empirical evidence. IMF Occasional Paper 220: 201–28. [Google Scholar]

- Sercu, Piet. 1992. Exchange risk, exposure, and the option to trade. Journal of International Money and Finance 11: 579–93. [Google Scholar]

- Sercu, Piet, and Cynthia Vanhulle. 1992. Exchange rate volatility, international trade, and the value of exporting firms. Journal of Banking and Finance 16: 155–82. [Google Scholar] [CrossRef]

- Soleymani, Abdorreza, and Soo Y. Chua. 2014. Effect of exchange rate volatility on industry trade flows between Malaysia and China. The Journal of International Trade & Economic Development 23: 626–55. [Google Scholar]

- Viaene, Jean-Marie, and Casper De Vries. 1992. International trade and exchange rate volatility. European Economic Review 36: 1311–21. [Google Scholar] [CrossRef]

- Vieira, Flavio Vilela, and Ronald MacDonald. 2016. Exchange rate volatility and exports: A panel data analysis. Journal of Economic Studies 43: 203–21. [Google Scholar] [CrossRef]

- Xiong, Bo. 2017. The Impact of TPP and RCEP on tea exports from Vietnam: The case of Tariff elimination and pesticide policy cooperation. Agricultural Economics 8: 413–24. [Google Scholar] [CrossRef]

- Xuan, Nguyen Thanh, and Yuqing Xing. 2008. Foreign Direct Investment and exports: The experiences of Vietnam. Economics of Transition 16: 183–97. [Google Scholar] [CrossRef]

| 1 | We would like to thank an anonymous referee for his/her suggestion to use the real bilateral exchange rate. Many of the countries in the sample had varying inflation rates relative to Vietnam. |

| 2 | For minimizing space, the estimated results will be provided upon request. The findings for the 10 subsectors are similar to those for the manufacturing sector. The long-run relationship is confirmed for all 10 subsectors. |

| 3 | Table A4 presented in indicates the percent change in exports for the manufacturing subsectors resulting from a 1% increase in exchange rate volatility. |

| Time | Feb.-1999 | Jun.-2002 | Jan.-2007 | Dec.-2007 | Mar.-2008 | Jun.-2008 | Nov.-2008 | Mar.-2009 | Nov.-2009 | Feb.-2011 | Aug.-2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bands (%) | + 0.1 | +/− 0.25 | +/− 0.5 | +/− 0.75 | +/− 1 | +/− 2 | +/− 3 | +/− 5 | +/− 3 | +/− 1 | +/− 3 |

| Variable | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Partner’s GDP | 416 | 6.78 | 1.43 | 1.65 | 9.72 |

| Bilateral real exchange rate | 416 | 7.71 | 2.66 | 0.39 | 10.71 |

| VOL_GARCH | 416 | 0.03 | 0.02 | 0.00 | 0.14 |

| Manufacturing exports | 416 | 13.45 | 1.48 | 9.06 | 17.30 |

| Food products, beverages and tobacco | 415 | 11.52 | 1.73 | 3.91 | 14.95 |

| Textiles, wearing apparel, leather and related products | 416 | 11.99 | 1.66 | 6.99 | 16.64 |

| Wood and products of wood and cork | 414 | 8.72 | 1.80 | 3.71 | 13.70 |

| Paper and printing | 406 | 7.43 | 2.00 | −1.43 | 11.52 |

| Chemicals, rubber, plastics and fuel products | 415 | 10.45 | 1.72 | 5.86 | 14.10 |

| Non-metallic mineral products | 412 | 9.85 | 2.06 | 0.00 | 13.54 |

| Basic metals and fabricated metal products | 411 | 8.99 | 1.86 | 2.33 | 12.55 |

| Machinery and equipment | 416 | 11.35 | 2.20 | 4.45 | 15.82 |

| Transport equipment | 406 | 9.21 | 2.21 | 2.15 | 14.46 |

| Furniture and other manufacturing | 413 | 10.09 | 1.90 | 3.99 | 15.10 |

| Variable | IPS | Maddala and Wu | Choi | |||

|---|---|---|---|---|---|---|

| PP | ADF | Z | L | Pm | ||

| Levels | ||||||

| GDP | 0.83 | 0.97 | 0.77 | 0.90 | 0.89 | 0.77 |

| Bilateral real exchange rate | 0.95 | 0.99 | 0.34 | 0.96 | 0.98 | 0.36 |

| VOL_GARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.06 | 0.42 | 0.00 | 0.00 | 0.00 | 0.00 |

| 1st difference | ||||||

| GDP | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Bilateral real exchange rate | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| VOL_GARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Variable | IPS | Maddala and Wu | Choi | |||

|---|---|---|---|---|---|---|

| PP | ADF | Z | L | Pm | ||

| Panel A: Asia | Levels | |||||

| GDP | 0.77 | 0.78 | 0.91 | 0.93 | 0.93 | 0.90 |

| Bilateral real exchange rate | 0.19 | 0.93 | 0.02 | 0.09 | 0.13 | 0.01 |

| VOLGARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.12 | 0.47 | 0.00 | 0.04 | 0.02 | 0.00 |

| Panel A: Asia | 1st difference | |||||

| GDP | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Bilateral real exchange rate | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| VOLGARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Panel B: Europe | Levels | |||||

| GDP | 0.46 | 0.89 | 0.32 | 0.38 | 0.33 | 0.35 |

| Bilateral real exchange rate | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.98 |

| VOLGARCH | 0.00 | 0.00 | 0.73 | 0.50 | 0.51 | 0.75 |

| Manufacturing exports | 0.19 | 0.46 | 0.12 | 0.29 | 0.39 | 0.11 |

| Panel B: Europe | 1st difference | |||||

| GDP | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Bilateral real exchange rate | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| VOLGARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Panel C: America | Levels | |||||

| GDP | 0.87 | 0.90 | 0.50 | 0.79 | 0.84 | 0.56 |

| Bilateral real exchange rate | 0.71 | 0.28 | 0.47 | 0.67 | 0.68 | 0.52 |

| VOLGARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.29 | 0.31 | 0.00 | 0.00 | 0.00 | 0.00 |

| Panel C: America | 1st difference | |||||

| GDP | 0.05 | 0.06 | 0.08 | 0.06 | 0.06 | 0.06 |

| Bilateral real exchange rate | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 |

| VOLGARCH | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Manufacturing exports | 0.00 | 0.00 | 0.01 | 0.05 | 0.01 | 0.00 |

| Sample | Panel v-stat | Panel rho-stat | Panel t-stat | Panel ADF-stat | Group rho-stat | Group t-stat | Group ADF-stat |

|---|---|---|---|---|---|---|---|

| Full sample | 0.29 | 2.26 ** | 0.53 | 4.55 *** | 4.35 *** | 1.43 | 6.21 *** |

| Asia | 0.04 | 1.53 | 0.14 | 3.35 *** | 3.05 *** | 0.87 | 5.11 *** |

| Europe | 0.16 | 1.60 | 1.49 | 3.87 *** | 2.63 *** | 2.19 ** | 4.02 *** |

| America | 0.42 | 0.64 | −1.24 | −0.26 | 1.67 | −0.91 | 0.84 |

| Variable | Full Sample | Asia | Europe | America |

|---|---|---|---|---|

| LnGDP | 0.415 *** | 0.222 * | 0.831 *** | 0.598 |

| (0.054) | (0.119) | (0.296) | (0.441) | |

| LnREXR | −0.065 ** | −0.045 | −0.305 | −0.163 |

| (0.029) | (0.066) | (0.551) | (0.354) | |

| LnVOL | −0.829 *** | −0.312 | −0.476 | −1.854 ** |

| (0.127) | (0.463) | (0.350) | (0.805) | |

| Constant | 7.961 *** | 11.236 *** | 8.779 * | 2.916 |

| (0.658) | (2.203) | (5.079) | (2.435) | |

| Observations | 413 | 205 | 125 | 77 |

| R-squared | 0.23 | 0.16 | 0.41 | 0.62 |

| Variables | Full Sample | Asia | Europe | America |

|---|---|---|---|---|

| ΔLnEXit−1 | 0.111 ** | 0.250 *** | 0.180 * | −0.013 |

| (0.053) | (0.076) | (0.108) | (0.123) | |

| ΔLnGDPit | 1.351 ** | 1.324 * | 3.607 *** | 0.369 |

| (0.553) | (0.728) | (0.696) | (2.390) | |

| ΔLnGDPit−1 | −0.527 | −0.186 | −1.562 ** | −2.393 |

| (0.516) | (0.700) | (0.769) | (1.955) | |

| ΔLnREXRit | 0.322 ** | 0.794 *** | −0.150 | 0.398 |

| (0.154) | (0.265) | (0.131) | (0.464) | |

| ΔLnREXRit−1 | 0.210 | −0.159 | 0.195 | 0.653 |

| (0.166) | (0.272) | (0.149) | (0.478) | |

| ΔLnVOLit | 0.024 | 0.045 | 0.042 | 0.072 |

| (0.031) | (0.041) | (0.037) | (0.095) | |

| ΔLnVOLit−1 | −0.007 | 0.018 | 0.019 | −0.025 |

| (0.031) | (0.038) | (0.041) | (0.086) | |

| DWTO | 0.029 | 0.068 * | 0.008 | −0.044 |

| (0.027) | (0.038) | (0.029) | (0.081) | |

| DCrisis | −0.186 *** | −0.301 *** | −0.118 | 0.118 |

| (0.062) | (0.081) | (0.074) | (0.201) | |

| ECt−1 | −0.234 *** | −0.257 *** | −0.185 *** | −0.716 *** |

| (0.036) | (0.055) | (0.059) | (0.151) | |

| Constant | 0.166 *** | 0.084 * | 0.130 *** | 0.369 *** |

| (0.030) | (0.047) | (0.031) | (0.098) | |

| Observations | 364 | 182 | 112 | 70 |

| Number of id | 26 | 13 | 8 | 5 |

| Variable | Ln(ex1) | Ln(ex2) | Ln(ex3) | Ln(ex4) | Ln(ex5) | Ln(ex6) | Ln(ex7) | Ln(ex8) | Ln(ex9) | Ln(ex10) |

|---|---|---|---|---|---|---|---|---|---|---|

| LnGDP | 0.449 *** | 0.668 *** | 0.416 *** | 0.211 *** | 0.570 *** | 0.306 ** | 0.591 *** | 0.824 *** | 0.150 *** | 0.267 * |

| (0.085) | (0.125) | (0.144) | (0.047) | (0.169) | (0.127) | (0.146) | (0.141) | (0.024) | (0.149) | |

| LnREXR | −0.099 ** | 0.027 | −0.121 | −0.213 *** | 0.118 | 0.016 | −0.163 ** | −0.005 | −0.139 *** | −0.184 ** |

| (0.046) | (0.067) | (0.077) | (0.026) | (0.092) | (0.068) | (0.079) | (0.076) | (0.013) | (0.079) | |

| LnVOL | −0.946 *** | −0.421 | −1.175 *** | −0.930 *** | −0.491 | −0.879 *** | −0.776 ** | −0.888 *** | −0.693 *** | −1.202 *** |

| (0.203) | (0.297) | (0.341) | (0.113) | (0.403) | (0.301) | (0.349) | (0.337) | (0.057) | (0.356) | |

| Constant | 5.447 *** | 5.640 *** | 5.142 *** | 7.102 *** | 3.431 | 3.425 ** | 3.486 * | −0.222 | 7.255 *** | 2.421 |

| (1.050) | (1.535) | (1.766) | (0.583) | (2.091) | (1.569) | (1.802) | (1.745) | (0.293) | (1.842) | |

| Observations | 413 | 413 | 412 | 412 | 410 | 408 | 403 | 411 | 409 | 403 |

| R-squared | 0.15 | 0.37 | 0.24 | 0.23 | 0.26 | 0.12 | 0.17 | 0.42 | 0.12 | 0.19 |

| Variable | Ln(ex1) | Ln(ex2) | Ln(ex3) | Ln(ex4) | Ln(ex5) | Ln(ex6) | Ln(ex7) | Ln(ex8) | Ln(ex9) | Ln(ex10) |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Asian region | ||||||||||

| LnGDP | 0.284 | 0.477 ** | 0.274 * | 0.101 | 0.294 | 0.107 | 0.355 * | 0.901 *** | −0.081 | −0.063 |

| (0.189) | (0.186) | (0.145) | (0.117) | (0.286) | (0.176) | (0.214) | (0.193) | (0.179) | (0.152) | |

| LnREXR | 0.074 | −0.102 | −0.005 | −0.141 ** | 0.071 | 0.062 | −0.102 | 0.066 | −0.109 | 0.040 |

| (0.106) | (0.104) | (0.081) | (0.066) | (0.161) | (0.097) | (0.120) | (0.109) | (0.101) | (0.085) | |

| LnVOL | 0.015 | −0.347 | −0.389 | −0.853 * | 0.316 | 0.019 | 0.055 | −0.968 | 0.300 | 0.173 |

| (0.739) | (0.726) | (0.566) | (0.461) | (1.133) | (0.688) | (0.849) | (0.761) | (0.704) | (0.597) | |

| Panel B: European region | ||||||||||

| LnGDP | 1.351 *** | 0.700 ** | 0.738 * | 0.811 ** | 1.014 ** | 0.639 | 1.363 *** | 0.880 *** | 0.581 ** | 1.239 *** |

| (0.448) | (0.279) | (0.442) | (0.344) | (0.404) | (0.509) | (0.335) | (0.278) | (0.227) | (0.297) | |

| LnREXR | −2.317 *** | 0.262 | −0.393 | −1.516 ** | 0.585 | 0.489 | 0.008 | 0.191 | −0.820 * | −0.211 |

| (0.834) | (0.520) | (0.823) | (0.641) | (0.753) | (0.947) | (0.628) | (0.518) | (0.425) | (0.547) | |

| LnVOL | −0.690 | −0.438 | −0.285 | −0.305 | −0.487 | −0.543 | −0.218 | −0.409 | −0.287 | −0.082 |

| (0.529) | (0.329) | (0.522) | (0.406) | (0.477) | (0.600) | (0.396) | (0.328) | (0.270) | (0.343) | |

| Panel C: American region | ||||||||||

| LnGDP | 1.119 ** | 0.807 *** | 0.354 | 1.210 *** | 0.198 | 0.361 | 0.387 | 0.440 | 0.225 | 1.181 |

| (0.531) | (0.309) | (0.655) | (0.363) | (0.713) | (0.585) | (0.511) | (0.389) | (0.750) | (0.941) | |

| LnREXR | −0.615 | −0.175 | 0.071 | −0.402 | 0.315 | 0.898 * | 0.182 | 0.461 | 0.267 | −0.195 |

| (0.426) | (0.248) | (0.519) | (0.291) | (0.572) | (0.470) | (0.405) | (0.312) | (0.602) | (0.686) | |

| LnVOL | −1.039 | −1.833 *** | −2.166 * | −0.075 | −2.482 * | −0.873 | −2.319 ** | −1.420 ** | −1.617 | −1.064 |

| (0.970) | (0.564) | (1.214) | (0.662) | (1.301) | (1.073) | (0.951) | (0.713) | (1.374) | (1.862) | |

| Variable | ΔLnEX1 | ΔLnEX2 | ΔLnEX3 | ΔLnEX4 | ΔLnEX5 | ΔLnEX6 | ΔLnEX7 | ΔLnEX8 | ΔLnEX9 | ΔLnEX10 |

|---|---|---|---|---|---|---|---|---|---|---|

| ΔLnEXit−1 | 0.169 *** | 0.124 *** | 0.042 | 0.056 | 0.030 | 0.087 * | 0.068 | 0.024 | −0.040 | 0.047 |

| (0.050) | (0.044) | (0.050) | (0.049) | (0.043) | (0.049) | (0.048) | (0.051) | (0.043) | (0.050) | |

| ΔLnGDPit | 2.967 *** | 2.118 *** | −0.389 | 2.223 *** | 2.098 ** | 4.597 *** | 3.854 ** | 4.289 *** | 2.859 ** | 5.465 *** |

| (1.142) | (0.467) | (1.185) | (0.844) | (0.871) | (1.070) | (1.853) | (0.878) | (1.417) | (1.797) | |

| ΔLnGDPit−1 | −3.374 *** | −0.682 | 0.510 | −0.436 | −0.348 | −0.175 | −0.721 | −0.902 | −0.609 | −1.603 |

| (1.041) | (0.435) | (1.073) | (0.773) | (0.790) | (0.984) | (1.732) | (0.808) | (1.302) | (1.628) | |

| ΔLnREXRit | 0.062 | 0.049 | 0.159 | −0.262 | 0.291 | 0.269 | 0.845 | 0.023 | −0.166 | −0.912 * |

| (0.318) | (0.130) | (0.331) | (0.238) | (0.245) | (0.300) | (0.516) | (0.247) | (0.388) | (0.500) | |

| ΔLnREXRit−1 | 0.175 | 0.297 ** | −0.129 | 0.219 | −0.014 | −0.325 | −0.270 | 0.189 | 0.401 | 1.619 *** |

| (0.333) | (0.136) | (0.344) | (0.246) | (0.261) | (0.313) | (0.543) | (0.255) | (0.419) | (0.527) | |

| ΔLnVOLit | 0.030 | −0.033 | −0.037 | 0.062 | 0.088 * | −0.078 | 0.098 | −0.053 | 0.273 *** | −0.080 |

| (0.065) | (0.027) | (0.068) | (0.048) | (0.050) | (0.062) | (0.106) | (0.050) | (0.079) | (0.102) | |

| ΔLnVOLit−1 | −0.041 | 0.018 | −0.089 | 0.028 | −0.091 * | −0.063 | 0.108 | 0.040 | 0.092 | 0.041 |

| (0.063) | (0.026) | (0.066) | (0.047) | (0.051) | (0.060) | (0.107) | (0.049) | (0.080) | (0.100) | |

| DWTO | 0.093 * | −0.015 | −0.122 ** | −0.050 | −0.052 | −0.039 | 0.064 | 0.035 | −0.036 | 0.077 |

| (0.056) | (0.023) | (0.058) | (0.041) | (0.043) | (0.052) | (0.090) | (0.043) | (0.068) | (0.089) | |

| DCrisis | −0.005 | −0.061 | −0.014 | −0.189 ** | −0.047 | 0.045 | −0.607 *** | −0.134 | −0.840 *** | 0.101 |

| (0.126) | (0.052) | (0.132) | (0.095) | (0.097) | (0.119) | (0.203) | (0.097) | (0.155) | (0.200) | |

| ECt−1 | −0.255 *** | −0.262 *** | −0.431 *** | −0.357 *** | −0.309 *** | −0.345 *** | −0.452 *** | −0.385 *** | −0.378 *** | −0.422 *** |

| (0.036) | (0.030) | (0.045) | (0.041) | (0.040) | (0.038) | (0.047) | (0.046) | (0.048) | (0.050) | |

| Constant | 0.239 *** | 0.139 *** | 0.243 *** | 0.190 *** | 0.159 *** | 0.073 | 0.197 ** | 0.034 | 0.313 *** | −0.032 |

| (0.061) | (0.025) | (0.063) | (0.046) | (0.048) | (0.057) | (0.100) | (0.047) | (0.077) | (0.097) | |

| Observations | 364 | 364 | 363 | 363 | 361 | 359 | 353 | 362 | 360 | 349 |

| Variable | ΔLnEX1 | ΔLnEX2 | ΔLnEX3 | ΔLnEX4 | ΔLnEX5 | ΔLnEX6 | ΔLnEX7 | ΔLnEX8 | ΔLnEX9 | ΔLnEX10 |

|---|---|---|---|---|---|---|---|---|---|---|

| ΔLnEXit−1 | 0.227 *** | 0.052 | 0.333 *** | 0.005 | −0.031 | 0.135 ** | 0.125 * | −0.005 | −0.122 * | 0.213 *** |

| (0.069) | (0.063) | (0.069) | (0.068) | (0.064) | (0.069) | (0.070) | (0.073) | (0.067) | (0.063) | |

| ΔLnGDPit | 2.943 ** | 1.375 ** | 0.543 | 2.411 ** | 1.480 | 2.747 | 4.327 * | 5.482 *** | 3.961 ** | 3.711 ** |

| (1.408) | (0.662) | (1.144) | (1.001) | (0.928) | (1.691) | (2.563) | (1.401) | (1.827) | (1.791) | |

| ΔLnGDPit−1 | −2.216 * | 0.648 | −0.280 | −0.385 | −0.121 | 0.735 | −2.043 | −1.957 | −1.578 | −2.116 |

| (1.320) | (0.605) | (1.074) | (0.926) | (0.863) | (1.562) | (2.421) | (1.317) | (1.702) | (1.655) | |

| ΔLnREXRit | 0.364 | 0.264 | 1.265 *** | 0.634 * | 1.014 *** | 0.992 | −0.232 | 0.427 | 0.229 | 0.205 |

| (0.510) | (0.234) | (0.414) | (0.372) | (0.343) | (0.624) | (0.942) | (0.520) | (0.676) | (0.645) | |

| ΔLnREXRit−1 | −0.489 | −0.137 | −0.004 | 0.160 | −0.219 | 0.045 | 1.020 | 0.640 | 1.222 * | 0.815 |

| (0.510) | (0.233) | (0.422) | (0.364) | (0.354) | (0.609) | (0.935) | (0.510) | (0.691) | (0.643) | |

| ΔLnVOLit | 0.053 | −0.003 | −0.048 | 0.108 * | 0.107 ** | −0.074 | 0.050 | −0.037 | 0.318 *** | −0.172 * |

| (0.081) | (0.037) | (0.065) | (0.057) | (0.053) | (0.098) | (0.145) | (0.080) | (0.103) | (0.103) | |

| ΔLnVOLit−1 | −0.010 | −0.030 | 0.054 | 0.101 * | 0.035 | −0.019 | 0.136 | 0.066 | 0.097 | 0.040 |

| (0.074) | (0.034) | (0.061) | (0.053) | (0.050) | (0.089) | (0.136) | (0.074) | (0.098) | (0.095) | |

| DWTO | 0.133 * | 0.030 | 0.040 | −0.018 | −0.003 | −0.026 | 0.063 | 0.138 * | −0.037 | 0.019 |

| (0.073) | (0.033) | (0.059) | (0.051) | (0.048) | (0.087) | (0.132) | (0.072) | (0.093) | (0.094) | |

| DCrisis | −0.027 | −0.077 | −0.089 | −0.162 | −0.283 *** | 0.226 | −0.471 * | −0.158 | −0.967 *** | −0.338 * |

| (0.153) | (0.070) | (0.125) | (0.111) | (0.101) | (0.183) | (0.276) | (0.152) | (0.203) | (0.196) | |

| ECt−1 | −0.251 *** | −0.162 *** | −0.708 *** | −0.266 *** | −0.370 *** | −0.388 *** | −0.468 *** | −0.424 *** | −0.277 *** | −0.435 *** |

| (0.048) | (0.044) | (0.075) | (0.052) | (0.068) | (0.053) | (0.072) | (0.069) | (0.064) | (0.066) | |

| Constant | 0.099 | 0.084 ** | 0.067 | 0.133 ** | 0.183 *** | 0.107 | 0.195 | −0.023 | 0.333 *** | 0.075 |

| (0.091) | (0.042) | (0.073) | (0.065) | (0.061) | (0.109) | (0.167) | (0.090) | (0.119) | (0.119) | |

| Observations | 182 | 182 | 182 | 181 | 179 | 178 | 177 | 181 | 180 | 179 |

| Variable | ΔLnEX1 | ΔLnEX2 | ΔLnEX3 | ΔLnEX4 | ΔLnEX5 | ΔLnEX6 | ΔLnEX7 | ΔLnEX8 | ΔLnEX9 | ΔLnEX10 |

|---|---|---|---|---|---|---|---|---|---|---|

| ΔLnEXit−1 | 0.223 ** | 0.426 *** | −0.134 * | 0.116 | −0.152 * | 0.194 ** | −0.123 | 0.223 ** | −0.016 | 0.029 |

| (0.099) | (0.095) | (0.081) | (0.094) | (0.082) | (0.097) | (0.093) | (0.107) | (0.056) | (0.109) | |

| ΔLnGDPit | 7.087 *** | 2.848 *** | 6.238 *** | 5.563 *** | 5.233 *** | 6.088 *** | 2.002 | 4.141 *** | 0.445 | 4.602 |

| (2.364) | (0.737) | (1.825) | (1.797) | (1.125) | (1.193) | (4.198) | (1.207) | (2.561) | (4.079) | |

| ΔLnGDPit−1 | −6.557 *** | −2.943 *** | 0.289 | 1.943 | −0.239 | 0.027 | −0.269 | −1.274 | −0.214 | 0.700 |

| (1.910) | (0.675) | (1.420) | (1.408) | (0.838) | (1.099) | (3.299) | (0.919) | (2.021) | (3.104) | |

| ΔLnREXRit | −0.604 | −0.117 | −1.276 *** | 0.087 | −0.268 | −0.154 | 2.072 *** | −0.218 | −0.675 | −0.725 |

| (0.446) | (0.142) | (0.345) | (0.336) | (0.223) | (0.227) | (0.784) | (0.225) | (0.465) | (0.771) | |

| ΔLnREXRit−1 | 0.232 | 0.380 ** | −0.161 | −0.522 | −0.521 ** | −0.402 | −0.026 | −0.146 | 0.732 | 0.801 |

| (0.512) | (0.165) | (0.398) | (0.388) | (0.242) | (0.261) | (0.953) | (0.253) | (0.549) | (0.896) | |

| ΔLnVOLit | 0.015 | 0.035 | 0.052 | −0.165 * | 0.085 | −0.179 *** | 0.275 | −0.045 | 0.275 ** | −0.034 |

| (0.128) | (0.039) | (0.097) | (0.096) | (0.060) | (0.066) | (0.216) | (0.064) | (0.130) | (0.225) | |

| ΔLnVOLit−1 | −0.017 | 0.134 *** | −0.340 *** | −0.171 | −0.099 | −0.178 ** | −0.016 | −0.121 | 0.390 ** | −0.012 |

| (0.143) | (0.045) | (0.111) | (0.109) | (0.089) | (0.074) | (0.294) | (0.074) | (0.175) | (0.248) | |

| DWTO | 0.098 | −0.032 | −0.214 *** | −0.085 | −0.074 | 0.028 | 0.075 | 0.002 | −0.011 | 0.243 |

| (0.102) | (0.030) | (0.074) | (0.072) | (0.047) | (0.049) | (0.166) | (0.048) | (0.102) | (0.173) | |

| DCrisis | 0.057 | −0.088 | 0.588 *** | 0.011 | 0.026 | −0.050 | −0.456 | 0.057 | −1.215 *** | 0.424 |

| (0.259) | (0.080) | (0.194) | (0.192) | (0.125) | (0.129) | (0.443) | (0.128) | (0.260) | (0.437) | |

| ECt−1 | −0.430 *** | −0.261 *** | −0.632 *** | −0.645 *** | −0.290 *** | −0.227 *** | −0.448 *** | −0.401 *** | −0.409 *** | −0.411 *** |

| (0.091) | (0.061) | (0.104) | (0.111) | (0.086) | (0.063) | (0.104) | (0.089) | (0.096) | (0.111) | |

| Constant | 0.182 * | 0.124 *** | 0.153 * | 0.110 | 0.070 | −0.058 | 0.244 | −0.008 | 0.348 *** | −0.235 |

| (0.104) | (0.033) | (0.081) | (0.082) | (0.056) | (0.054) | (0.191) | (0.054) | (0.119) | (0.186) | |

| Observations | 112 | 112 | 112 | 112 | 112 | 112 | 108 | 112 | 111 | 111 |

| Variable | ΔLnEX1 | ΔLnEX2 | ΔLnEX3 | ΔLnEX4 | ΔLnEX5 | ΔLnEX6 | ΔLnEX7 | ΔLnEX8 | ΔLnEX9 | ΔLnEX10 |

|---|---|---|---|---|---|---|---|---|---|---|

| ΔLnEXit−1 | 0.130 | 0.134 | 0.088 | 0.102 | 0.134 | −0.076 | 0.174 | 0.020 | 0.006 | −0.152 |

| (0.124) | (0.100) | (0.134) | (0.119) | (0.104) | (0.116) | (0.118) | (0.120) | (0.132) | (0.118) | |

| ΔLnGDPit | −0.737 | 2.376 | −4.055 | 4.259 | 0.168 | 10.412 ** | 6.723 | −0.085 | 9.043 | 26.903 *** |

| (4.799) | (1.818) | (7.342) | (3.717) | (5.163) | (4.251) | (6.912) | (3.239) | (6.431) | (10.124) | |

| ΔLnGDPit−1 | −3.140 | −2.437 | 5.179 | −5.242 * | −1.020 | −7.540 ** | 0.025 | 3.905 | 1.298 | −3.896 |

| (3.990) | (1.540) | (5.591) | (3.022) | (4.120) | (3.458) | (5.721) | (2.558) | (5.168) | (8.156) | |

| ΔLnREXRit | −0.357 | −0.053 | 2.859 ** | −0.880 | 1.308 | 0.900 | 0.139 | 0.209 | 1.222 | −5.376 *** |

| (0.960) | (0.351) | (1.336) | (0.692) | (0.947) | (0.782) | (1.289) | (0.600) | (1.197) | (1.792) | |

| ΔLnREXRit−1 | 0.302 | 0.666 ** | −1.484 | 1.383 ** | 0.794 | −0.830 | −0.498 | 0.593 | −0.526 | 4.882 *** |

| (0.877) | (0.325) | (1.169) | (0.618) | (0.902) | (0.738) | (1.158) | (0.539) | (1.098) | (1.620) | |

| ΔLnVOLit | 0.006 | −0.117 | 0.323 | 0.339 ** | 0.285 | 0.242 | −0.157 | −0.169 | 0.637 ** | −0.007 |

| (0.189) | (0.074) | (0.262) | (0.145) | (0.198) | (0.164) | (0.268) | (0.126) | (0.253) | (0.353) | |

| ΔLnVOLit−1 | −0.178 | 0.137 * | 0.013 | 0.099 | −0.294 | 0.089 | 0.355 | 0.120 | 0.223 | 0.098 |

| (0.173) | (0.075) | (0.246) | (0.131) | (0.194) | (0.151) | (0.259) | (0.117) | (0.231) | (0.338) | |

| DWTO | −0.086 | −0.126 ** | −0.170 | 0.067 | −0.070 | −0.123 | −0.087 | −0.049 | 0.016 | 0.231 |

| (0.165) | (0.064) | (0.226) | (0.122) | (0.170) | (0.141) | (0.229) | (0.112) | (0.212) | (0.331) | |

| DCrisis | 0.118 | −0.126 | −0.000 | −0.119 | 0.661 | 0.054 | −1.191 ** | −0.293 | 0.390 | 1.513 * |

| (0.396) | (0.152) | (0.550) | (0.311) | (0.413) | (0.339) | (0.548) | (0.256) | (0.522) | (0.799) | |

| ECt−1 | −0.618 *** | −0.520 *** | −0.516 *** | −0.514 *** | −0.393 *** | −0.315 ** | −0.596 *** | −0.411 *** | −0.656 *** | −0.605 *** |

| (0.141) | (0.089) | (0.115) | (0.126) | (0.112) | (0.130) | (0.127) | (0.116) | (0.164) | (0.163) | |

| Constant | 0.531 *** | 0.312 *** | 0.389 | 0.235 | 0.265 | 0.258 | 0.301 | 0.113 | 0.089 | −0.546 |

| (0.198) | (0.076) | (0.266) | (0.151) | (0.210) | (0.179) | (0.287) | (0.140) | (0.270) | (0.399) | |

| Observations | 70 | 70 | 69 | 70 | 70 | 69 | 68 | 69 | 69 | 59 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vo, D.H.; Vo, A.T.; Zhang, Z. Exchange Rate Volatility and Disaggregated Manufacturing Exports: Evidence from an Emerging Country. J. Risk Financial Manag. 2019, 12, 12. https://doi.org/10.3390/jrfm12010012

Vo DH, Vo AT, Zhang Z. Exchange Rate Volatility and Disaggregated Manufacturing Exports: Evidence from an Emerging Country. Journal of Risk and Financial Management. 2019; 12(1):12. https://doi.org/10.3390/jrfm12010012

Chicago/Turabian StyleVo, Duc Hong, Anh The Vo, and Zhaoyong Zhang. 2019. "Exchange Rate Volatility and Disaggregated Manufacturing Exports: Evidence from an Emerging Country" Journal of Risk and Financial Management 12, no. 1: 12. https://doi.org/10.3390/jrfm12010012

APA StyleVo, D. H., Vo, A. T., & Zhang, Z. (2019). Exchange Rate Volatility and Disaggregated Manufacturing Exports: Evidence from an Emerging Country. Journal of Risk and Financial Management, 12(1), 12. https://doi.org/10.3390/jrfm12010012