Abstract

In the current turbulent market, firms spend lots of tangible and intangible resources to gain competitive advantage and superior performance. Prior studies have discussed several determinants of competitive advantage and performance, particularly in developed economies, whereas small- and medium-sized enterprises (SMEs) in emerging economies have received minor attention. This study examines the mediating role of competitive advantage between enterprise risk management practices and SME performance and the moderating role of financial literacy between enterprise risk management practices and competitive advantage. A structured questionnaire is used to collect data from 304 SMEs operating in the emerging market of Pakistan. The hypotheses of the proposed study are tested through Structural Equation Modeling (SEM) in Analysis of a Moment Structures (AMOS). The results indicate that enterprise risk management practices significantly influence competitive advantage and SME performance. Competitive advantage partially mediates the relationship between enterprise risk management practices and SME performance. Additionally, financial literacy significantly moderates the relationship between enterprise risk management practices and competitive advantage. Firms are advised to implement formal enterprise risk management practices to gain competitive advantage and superior performance. Top managers need to have enough financial education that they will be able to perform risk management practices in an efficient way to gain a competitive position in the market. Implications for practices have been discussed in detail.

1. Introduction

Interest in Enterprise Risk Management (ERM) has been growing since the 1990s as businesses face several shocks in competitive environments (Arena et al. 2010). In response to unexpected threats, one school of thought believed in the direct impact of ERM on firm performance (Callahan and Soileau 2017; Florio and Leoni 2017; Zou and Hassan 2017) while another group of researchers claimed that the relationship of ERM and firm performance could be affected by some internal factors (Khan and Ali 2017; Wang et al. 2010). Much research has discussed the importance of ERM practices among businesses (Eckles et al. 2014; Florio and Leoni 2017; Yilmaz and Flouris 2017). In fact, most of the studies have been conducted particularly in developed economies (Florio and Leoni 2017) while SMEs in emerging economies have received comparatively limited attention. Additionally, empirical studies on the relationship between ERM and SME performance are still lacking (Farrell and Gallagher 2015). Therefore, this study aims to check the impact of ERM practices on SME performance with the mediating role of Competitive Advantage (CA). A manager cannot gain competitive position by using ERM approaches until he/she is aware of financial regulations and financial policies. Hereafter, this study also examines the moderating role of Financial Literacy (FL) between ERM practices and CA. To put it into another way, FL has been unexamined by researchers despite its significant role in the implementation of ERM practices and in the survival of SMEs.

ERM is defined in many ways but the accepted definition is:

“a process, effected by an entity’s board of directors, management and other personnel, applied in strategy setting and across the enterprise, designed to identify potential events that may affect the entity, and manage risks to be within its risk appetite, to provide reasonable assurance regarding the achievement of the entity’s objectives”.(COSO 2004)

ERM is supposed to minimize direct and indirect costs of financial distress, earnings volatility, and negative shocks in financial markets, as well as improve the decision-making process to select the best investment opportunities (Beasley et al. 2008; Hoyt and Liebenberg 2011; Paape and Speklè 2012). Numerous internal fences and lack of resources compel SMEs to approach ERM practices to avoid poor performance and to enhance their survival in competitive markets (Unnikrishnan et al. 2015). SMEs, due to the lack of management capabilities and lack of resources, are more likely focused on ERM practices. In fact, ERM practices enable a firm to reduce different types of costs associated with firms’ operational and non-operational activities (Khan et al. 2016). However, in contrast, many small firms are unable to support risk management activities due to lack of resources and capabilities (Brustbauer 2016). ERM is crucial for everyday business activities and organizational practices in the current era as it facilitates business firms to control their internal system. Risk management is deemed a core factor for business competitiveness. It facilitates a firm to develop a unique strategy to minimize the potential losses and open a door for the exploitation of new opportunities (Radner and Shepp 1996). ERM helps top management to manage different types of risk effectively (Annamalah et al. 2018). Effective ERM practices help to reply to unexpected threats, to ensure flexibility and to take the benefits of opportunities which in turn facilitate firms to gain competitive advantage (Armeanu et al. 2017). It is doubtless that organizations with risk-related practices can smooth their income volatility and decrease the impact of financial crises to enhance their performance (Ashraf et al. 2017). Meanwhile, especially in SMEs, top management needs to have enough financial knowledge to smooth operation in the dynamic markets (Bongomin et al. 2017). In the current churning market, ERM practices and financial literacy are required to acquire a sustainable competitive position and high profitability.

The novelty of this paper can be demonstrated in two major ways. First, this study assesses the moderating role of FL between ERM and CA, which has been ignored in prior studies. Second, the mediating role of CA between ERM and SME performance is checked to establish whether ERM practices facilitate in gaining competitive advantage. Furthermore, this research contributes to the existing literature in several ways. For instance, this study uses empirical evidence collected from SMEs operating in the emerging market of Pakistan to test the model. Resource Based View (RBV) theory suggests that a firm’s tangible and intangible resources have a significant influence on its performance (Barney 1991). This study assesses that the theory (RBV) in term of risk management and competitive advantage and clarifies the understanding of these capabilities toward SME performance. The findings of this study enable owners and managers of SMEs to focus on ERM practices and financial education and competitive strategy to gain superior performance in the intense markets.

Theoretical Background

ERM has quite similar meanings to business risk management, corporate risk management, holistic risk management, enterprise-wide risk management, integrated risk management, and strategic risk management (Daud and Yazid 2009; Manab et al. 2010).

Risk management theory demonstrates the reduction of different accounting costs which help in the improvement of a firm performance. This evidence posits that in reality, ERM is based on competitive advantage (Stulz 1996). Academia, in this regard, has favored the arguments that ERM practices reduce costs associated with a business operation and facilitate competitive advantage and superior performance (Krause and Tse 2016). This research discusses how ERM practices facilitate a firm competitive advantage and performance in the presence of top management financial awareness. A few studies such as (Abd Razak et al. 2016; Bogodistov and Wohlgemuth 2017; Krause and Tse 2016) have claimed that ERM practices are aligned with firm resources and capabilities; however, they have missed the actual relationship between ERM and SME performance. In fact, a business firm operates for the main purpose of earning a profit, thus using different strategies to achieve this goal. As posited by RBV theory, a firm with unique resources (tangible and intangible) acquires competitiveness and superior performance over other firms which lack resources and capabilities (Barney 1991). Studies agree (Porter 1980) that competitive strategy, where a firm can reduce different costs and offer unique products to their customers, is the main tool to gain a competitive advantage in a turbulent market (Anwar 2018; Lechner and Gudmundsson 2014). We hereby suggest that ERM practices are the internal capabilities through which a firm can reduce different types of costs related to material, operational, supply and marketing to increase its value. The same theme has emerged in RBV theory where business organizations are engaged in the achievement of competitive advantage and superior profitability by reducing financial costs. However, as aforementioned, ERM practices do not always lead directly to superior performance; some internal managerial capabilities are also required. From this perspective, Standard and Poor’s (2008) developed an ERM framework which demonstrates that ERM practices are significantly aligned with managers behaviors in everyday decision-making. In fact, ERM practices are influenced by managerial mindsets and behaviors when they face uncertainty in turbulent markets (Arena et al. 2010). We argue that top management financial education is associated with ERM practices, which in turn can influence a firm’s competitiveness and performance.

2. Hypothesis Development

2.1. ERM and Firm Performance

ERM practices are not only essential for the improvement of a firm’s performance but also help to reduce different types of risk exposure (Florio and Leoni 2017). Successful ERM practices enable firms to enhance their values and manage risk in an effective way (Lechner and Gatzert 2018). It increases a firm’s profitability by reducing different operational and marginal costs as well as reduce the uncertainty of stock market returns (Eckles et al. 2014). A firm that has a formal implementation of ERM practices can enjoy the high operational performance and earns over those who have lack of ERM practices (Callahan and Soileau 2017). Hence, managers are strongly encouraged and advised to work in the implementation of ERM practices to improve the firm values and performance (Lajili 2009; Liu et al. 2017). It is doubtless that there is a significant positive association between ERM practices and firm performance (Callahan and Soileau 2017; Florio and Leoni 2017; Zou and Hassan 2017). Therefore, the first hypothesis is proposed:

Hypothesis 1 (H1).

ERM practices are significantly related to firm performance.

2.2. ERM and Competitive Advantage

An organization develops different strategies to enhance its reputation and to reduce its risk. To do that, implementation of ERM is indispensable in terms of building a strategy (Yilmaz and Flouris 2017). For decision-making, planning and organization control system, ERM is essential within an organization. In addition, ERM practices are not only vital for financial performance but also improve the non-financial performance of firms (Rasid et al. 2014). The top management team is responsible for organizational strategy, cost reduction and long-term planning, and from this perspective, they need to be aware of ERM practices, which had a direct influence on the organizational strategic decision-making process, costs, and activities (Meidell and Kaarbøe 2017). It is argued that implementation of ERM practices can move an organization toward different means of success. For instance, it reduces accounting costs, efficiently manages the operational costs, and can take responsibility for accounting accuracy (Soin and Collier 2013). To respond to challenges and unexpected loss, top management needs long-range planning, strategy and effective ERM practices (Krause and Tse 2016). In short, a firm performs several practices to gain CA, though ERM practices are used fundamentally for the reduction of different types of risk and facilitate firms to enhance their sustainable CA (Elahi 2013). Therefore, the second hypothesis is:

Hypothesis 2 (H2).

ERM practices are significantly related to competitive advantage.

2.3. Competitive Advantage and SME Performance

Porter (1980) suggested that a firm can gain cost leadership-based advantage by reducing different operational, marketing, management, and material cost. Similarly, a firm can acquire differentiation-based competitive advantage by differentiating its products and services from competitors. In an intense market, competitive advantage is necessary for SME operation, especially in the emerging market, to sustain high performance (Anwar 2018). Both competitive strategies are associated with high performance of SMEs but not always (Parnell 2010). For instance, Chinese firms often tend to follow cost-based competitive strategies instead of a differentiating-based strategy which may require high financial capabilities and resources (Parnell et al. 2015). Both strategies of Porter—cost leadership and differentiation-based—have a significant influence on the financial and non-financial performance of SMEs (Oyewobi et al. 2015). Empirical evidence indicated that competitive strategy has a significant influence on firm performance (Anwar et al. 2018; González-Rodríguez et al. 2018; Lechner and Gudmundsson 2014). Therefore, the third hypothesis is:

Hypothesis 3 (H3).

Competitive advantage is significantly related to firm performance.

2.4. Mediating Role of CA between ERM and SMEs Performance

SMEs either follow passive or active ERM approaches that can influence their outcomes. In fact, ERM practices have a significance impact on strategic decisions which in turn may influence a firms’ performance (Brustbauer 2016). From this perspective, (Chang et al. 2015) claimed that ERM practices do not always have a direct influence on firm values but some internal factors such as corporate governance can affect the relationship. Managers use different earning management activities (accrual-based and real-based) when they are engaged in equity financing activities. However, weak ERM practices can result in systemically poor approaches to earning control mechanism, which can affect firms’ values in long run (Wang et al. 2018). As suggested by Porter (1980), a firm can gain cost-based and differentiation-based competitive advantage by reducing different types of costs related to material, labor, and operation etc. as well as by differentiating its products and services from its competitors. We assume that competitive advantage can be easily gained through the implementation of effective ERM practices. For instance, a firm with strong ERM practices can reduce different types of operational cost including cost management, asset management, inventory management and cash flow management. The reduction of the aforementioned costs can enhance and improve the performance of firms (Zou and Hassan 2017).

However, ERM is not only concerned with reduction of cost but also aligned with different strategic postures of organizations which may directly or indirectly influence the organization’s outcomes (Wang et al. 2010). In a slightly similar approach, it is argued that ERM is a significant mediator between business strategy and firm performance. However, it plays a significant mediating role between cost strategy and firm performance while it does not mediate the relationship between differentiation strategy and firm performance (Soltanizadeh et al. 2016). In fact, ERM practices facilitate a firm to reduce different types of costs during operation, which in turn enhance the performance of the firm (Wang et al. 2018; Zou and Hassan 2017). For instance, ERM allows firms to minimize unnecessary costs which in turn facilitate the achievement of competitive advantage and superior performance. Therefore, based on the above statement we can say that:

Hypothesis 4 (H4).

Competitive advantage mediates the relationship between ERM and firm performance.

2.5. Moderating Role of Financial Literacy between ERM and CA

ERM is considered a major source to achieve competitive advantage for a firm. However, simple ERM practices do not always ensure competitive advantage of a firm (Standard and Poor’s 2008) but need some capabilities to facilitate and achieve organizations goals (Arena et al. 2010). Organizations often implement good ERM approaches to link ERM with their strategy, cost management, policies, accounting, and long-term planning, for the purpose of adjusting everything in an efficient way (Arena et al. 2010). Financially educated managers and directors are encouraged to participate in different risk reduction strategies including hedging and corporate financial policies. In other way, high performance of firms can be feasible by high financially educated managers who reduce risk by modifying risk management strategies (Dionne and Triki 2005). It may be reasonable to say that business education (hereby deemed financial education) can help entrepreneurs to be aware of risk regulations and policies. Therefore, the alternative influence of the education, through which an entrepreneur adjusts risks in a better way, leads to the high performance of a firm (Hommel and King 2013). It is claimed that managers’ education can influence the firms’ strategies and risk management practices (Shanahan and McParlane 2005). We argue that entrepreneurs’ financial education can influence the relationship of ERM and firm performance, as noted by Herbane (2010), and that entrepreneur’s perception about risk can influence the overall approach of risk toward firm operational activities. Therefore, the hypothesis can be stated as:

Hypothesis 5 (H5).

Financial literacy moderates the relationship between ERM and competitive advantage in the way that the relationship will be stronger when there is high financial literacy.

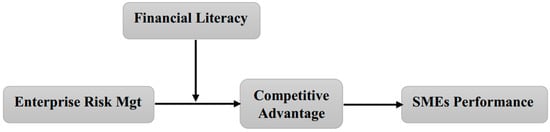

The hypothesized relationship and the variables are shown in Figure 1.

Figure 1.

Research Model.

3. Methodology

3.1. Sample and Population

The study used a structured questionnaire to collect data from SMEs. Since there is no single definition of SMEs, we surveyed only those firms having less than 250 employees, lying in the definition of SMEs by Small and Medium Enterprises Authority (SMEDA) Pakistan. Three big cities of Pakistan have been targeted, namely Rawalpindi, Islamabad, and Karachi. Registered firm lists were obtained from the Rawalpindi Chamber of Commerce and Industry, the Islamabad Chamber of Commerce and Industry and the Karachi Chamber of Commerce and Industry. We requested the owners and top managers as they are more responsible for strategic planning and performance of their firms (Anwar 2018). 900 questionnaires were distributed of which 336 were received back. Some questionnaires were completed incorrectly, so those were excluded from analyses. 304 usable responses were received, with a response rate of 33.78%.

The firms participating in the study have shown in Table 1. The most number of firms is from trading, followed by manufacturing and services respectively. A majority of the firms had 20 to 50 employees and only 69 firms were those where 101 to 250 employees were working. It is also clear from the sample that a majority of the firms were established in the past 20 years.

Table 1.

Profile of the Firms.

3.2. Measurement of Variables

Enterprise Risk Management Practices: it is true that ERM practices have been measured with different dimensions. However, in case of SMEs, it is vital to consider major dimensions of risk. Therefore, this research relied on the measure of ERM practices used by (Sax and Torp 2015) in their study using 6 items. A sample item indicates “We have standard procedures in place for launching risk-reducing measures”.

Competitive Advantage: The most-used proxy for competitive advantage is the Porter (1980) competitive strategy. Porter suggested two major competitive strategies, namely cost leadership strategy and differentiation-based strategy. In this study, we used Porter’s strategy as a competitive advantage and measures were adopted from prior study of (Su et al. 2017). 8 items were used, of which 4 were items for differentiation strategy with a sample item “We took great efforts in building a strong brand name, and nobody could easily copy that” and 4 were items for cost leadership strategy which having a sample item of “Our economy of scale enabled us to achieve a cost advantage”.

Financial Literacy: In prior studies, financial literacy is often measured by asking questions about inflation, interest rate and future value. However, in the case of SMEs, it is important for managers to manage the financial matter in an effective way. Hence, we relied on more suitable measures related to SMEs. To measure financial literacy of a top management team, we used 13 items that have validated in the prior study conducted by Bongomin et al. (2017) in SME sector. A sample item indicates “The firm is able to correctly calculate interest rates on my loan payments”.

All the measures were based on five-point Likert scale ranging from strongly disagree 1 to strongly agree 5.

SME performance: measurement of SME performance is a challenge for researchers, because of the non-existence of financial data (Anwar 2018). However, where data are not available, researchers have recommended the use of self-reported measures. Additionally, it is argued that self-reported measures give more reliable results in emerging economies such as China and India etc. (Semrau et al. 2016). Hence, we relied on self-reported measures where managers were asked to rate their performance based on Return On Equity (ROE) and Return On Assets (ROA) etc. compared to performance in the past three years. 8 items were used of which 4 items for financial performance and 4 for non-financial performance are adopted from Kantur (2016). To measure financial performance, items such as ROE, ROA and return on investment etc. are used whereas, for non-financial performance, customer satisfaction, employees’ satisfaction and employees’ loyalty are used. Five Likert scales were used representing extremely declined 1 to extremely improved 5.

3.3. Control Variables

For the purpose of minimizing spurious results, we controlled for firm size, age, and nature of the industry. The size and age of firms were assessed directly in models while the nature of the industry is a categorical variable, and this study created a separate group for manufacturing, trading, and services. After analysis, we compared each group with another to check if there was any significant difference. The results found no significant difference between the results; hence this study dropped the nature of industry because of its insignificant role in the study.

4. Data Analyses

We executed Confirmatory Factor Analysis (CFA) and structural models in AMOS to analyze the data for creating results. Several screening tests including normality and multicollinearity were executed, which are shown in Table 2.

Table 2.

Descriptive Statistics.

Descriptive statistics of Statistical Package for the Social Sciences (SPSS) analyzed are shown in Table 2. The table shows that all the items have their mean values above 3 and standard deviation (SD) values above 0.40. It shows that data are normal as none of the items has skewness and kurtosis values greater than ±2 as recommended by George and Mallery (2010).

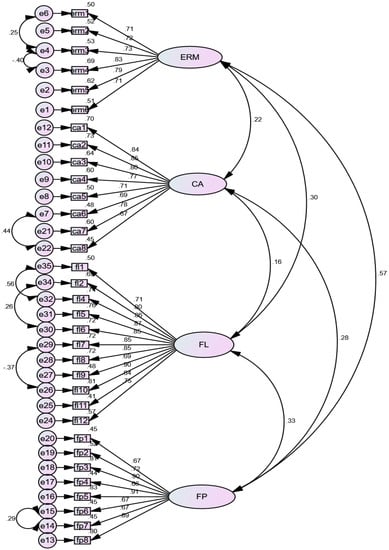

4.1. Confirmatory Factor Analysis

The study executed CFA to check standardized factor loading, validity and reliability of the variables and concepts. Figure 2 shows the measurement model, where all the items are presented related to their specific constructs with factor loading, after dropping two items from financial literacy due to low factor loading. The study found acceptable model fits after drawing covariance among the error terms of the few redundant items. Chisq/df = 2.04 is acceptable as suggested by Hair et al. (2010) and Hu and Bentler (1999), in that the value less than 3 indicates acceptable model fits. Goodness of Fit Index (GFI) = 0.84, Adjusted Goodness of Fit Index (AGFI) = 0.81 and Normative Fit Index (NFI) = 0.88 gave acceptable model fit as per recommended by Hair et al. (2010) and Hu and Bentler (1999). RMR = 0.012 and RMSEA = 0.059 also provided acceptable values as suggested by Hair et al. (2010) and Hu and Bentler (1999).

Figure 2.

Measurement Model.

Additionally, the current study checked convergent validity (see Table 3) to establish if the items explained sufficient variance in their respective constructs. The results found that all the constructs have convergent validity above 0.50, hereby ensuring sufficient Average Variance Explained (AVE) Hair et al. (2010) and Hu and Bentler (1999). The study also concluded acceptable value of discriminant validity for all the factors as recommended by Hair et al. (2010) that the value of discriminant validity will be above 0.70.

Table 3.

Factor loadings, Validity and Reliability.

The composite reliability is also has been checked (see Table 3) to assess the internal consistency of the constructs. All the factors provided acceptable CR as suggested by Nunnally and Bernstein (1994) that the value of CR will be above 0.70 to acquire acceptable CR. Thus, the study moved to a structural model to test the hypotheses.

4.2. Correlation

This particular study executed Pearson correlation in SPSS to test the relationship among the variables. The Pearson correlation values provide initial support for the proposed hypotheses. The results are shown in Table 4. The results indicate that there is a significant relationship between ERM and firm performance (r = 0.606, p < 0.01), a significant positive relationship is found between CA and firm performance (r = 0.302, p < 0.01) and there is a significant positive relationship between ERM and CA (r = 0.319, p < 0.01).

Table 4.

Correlation Coefficient.

4.3. Common Method Bias

Common Method Bias (CMB) may arise when data is collected from a single source and at the same time from the same respondent (Podsakoff and Organ 1986). Since there is a chance of CMB in this data as the data is collected through questionnaire from the same respondent at the same time. Harmon’s One Factor test is executed in SPSS to check for the potential problem of CMB. Our results revealed that the first factor explains only 31.00% variance which is less than 50% hereby confirmed the absence of CMB in our data. Additionally, we checked the impact of a latent factor in the measurement model to establish if CMB exists. The results confirmed that CMB does not exist in the data.

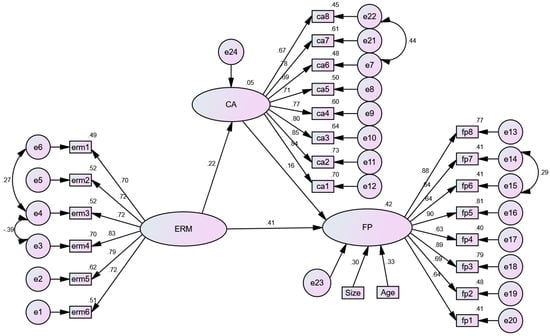

4.4. Structural Model (Mediation Test)

To test the hypothesis, we executed a structural model in AMOS. Though we have a mediator and a moderator in the model, to gain more clear results, separate models for the mediator and for the moderator were assessed. The mediator model is as shown below in Figure 3, where the influence of ERM on firm performance in the presence of CA as a mediator is checked. We found acceptable model fits as Chisq/df = 2.455, GFI = 0.86, AGFI = 0.83 and NFI = 0.88 as per the recommendation of Hair et al. (2010) and Hu and Bentler (1999). RMR = 0.027 and RMSEA = 0.069 also provided acceptable values suggested by Hair et al. (2010) and Hu and Bentler (1999).

Figure 3.

Structural Model.

The results shown in Table 5 indicate that the direct impact of ERM on firm performance remained significant (β = 0.401, p < 0.05) which supported the first hypothesis (H1) of the study. The direct influence of CA on firm performance is also significant (β = 0.193, p < 0.05) which supported the second hypothesis (H2) of the proposed study. The indirect influence of ERM on firm performance is significant (β = 0.033, p < 0.05) (while the direct influence has also remained significant), so the third hypothesis (H3) of the study is partially supported. Age and size of the firms as control variables plays a significant role in the model. R-square value indicates that ERM, through CA, accounts for 42% variance in firm performance.

Table 5.

Hypotheses testing (with mediation).

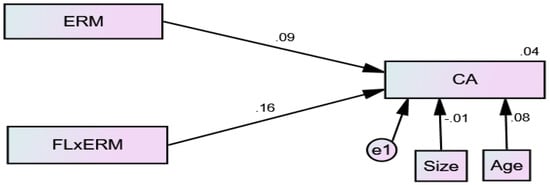

4.5. Structural Model 2 (Moderation Test)

The model in Figure 4 is performed to check the moderating role of financial literacy between ERM and CA in the presence of the two control variables size and age of the firms. The results (see Table 6) indicate that FL significantly moderates the relationship between ERM and CA (β = 0.029, p < 0.05) which supported the fifth hypothesis (H5) of this study. Both the control variables e.g., size and age of the firms have not significantly influenced CA in this model.

Figure 4.

Structural Model.

Table 6.

Hypotheses testing (with Moderation).

5. Discussion

Steered by the growing interest of ERM in SMEs, this study examined the role of ERM practices on SME performance with competitive advantage as a mediator and financial literacy as a moderator. We collected empirical evidence from SMEs operating in the emerging market Pakistan.

Our findings indicate that ERM practices have a significant influence on SME performance, which supported H1 of this study. This is consistent with Florio and Leoni (2017), who examined those SMEs who succeed in the markets which have formal policies and ERM practices. Therefore, in the competitive environment, SMEs need to focus on risk reduction approaches to gain superior performance (Callahan and Soileau 2017; Florio and Leoni 2017). Our results strongly support Zou and Hassan (2017) who argued that in emerging economies, the performance of SMEs is significantly positively related to ERM practices.

We found that ERM practices have a significant influence on CA, which supported H2 of this study. This is in line with Meidell and Kaarbøe (2017) who revealed that ERM reduces different types of cost related to operation, material, and supply, which in turn leads to production of products and services at lower cost; thus, the firm can gain competitive advantage. Similarly, Yilmaz and Flouris (2017) also claimed that ERM practices facilitate SMEs to gain a competitive position in the market by offering lower-priced products. Our findings strongly favor Soltanizadeh et al. (2016) who argued that there is a significant relationship between ERM and business strategy.

Our results revealed that CA has a significant influence on firm performance, thus H3 of the study is positively supported. Our findings strongly supported Anwar (2018) who found that CA is a significant factor that can enhance the performance of SMEs in Pakistan. Similarly, Parnell et al. (2015) also argued that a firm with a sustainable competitive position in the market enjoys superior profitability.

The study found that CA partially mediates the relationship between ERM and firm performance, which partially supported H4 of our study. We reveal that ERM influences firm performance more than competitive advantage first. Unlike Wang et al. (2010) who argued that ERM first reduce the cost and then improve SME performance, our results favor Chang et al. (2015) who claimed that ERM is not significantly leading a firm to gain competitive position but in fact it facilities a firm to gain superior performance.

Finally, our results show that financial literacy significantly moderates the relationship between ERM and CA, which supported the H5 of the study. This is in the line with Dionne and Triki (2005) who found that managers with high financial education are familiar with different approaches of risk and financial concepts; hence, they can achieve a better position in the markets over those who have low financial education. Additionally, Hommel and King (2013) and Shanahan and McParlane (2005) claimed that top management teams with high financial education can reduce different types of accounting costs and are more likely inclined towards competitive advantage.

5.1. Contributions and Implications

The contributions made by the prior studies in the field of ERM practices, CA and SMEs performance are significant. In fact, prior studies have examined the direct impact of ERM on performance and mix results have been generated. However, this study contributes to the existing literature in several ways. For instance, this research examines the mediating role of CA between ERM and firm performance that has been rarely touched especially in the SME sector. Similarly, the moderating role of FL between ERM and CA has remained untouched. Moreover, many studies in terms of ERM and CA are focused on European regions while emerging markets have received minor attention. This research is examined in the emerging market of Pakistan by testing the hypotheses using AMOS. Our findings reveal that firms, where there are formal ERM practices, can achieve a competitive position and enjoy superior performance. Unlike prior studies, where often financial performance has been targeted, this study reveals that ERM practices are essential for gaining financial and non-financial performance. Additionally, this research supports the RBV theory and claims that ERM practices and financial literacy, as firm internal skills can facilitate sustainable competitive advantage and performance.

This study suggests several practical implications for owners, top management, and CEOs of business organizations to give considerable attention to ERM practices and financial education to gain competitive advantage and high profit. It is undoubted that every business organization is inclined towards profit earning. For this purpose, every small-, large- or medium-sized firm is persistently struggling to gain an advantageous position in the market and therefore better performance. To achieve this goal, a firm may need huge resources which may lead high to risk. From this perspective, small firms in particular, due to limited resources, are looking for less risky attempts to achieve their goals. This study advised owners and managers to give enough time to ERM to reduce different types of costs related to material, supply, and wages. It is also argued that ERM does not automatically give proper results until top management are aware of financial affairs and policies. Hence, firms are advised to consider highly financially literate managers for their strategic policies and planning. Additionally, the Small and Medium Enterprise Authority (SMEDA), being a responsible authority of SMEs in Pakistan, is advised to formulate its strategies and is recommended to initiate programs for top management to educate them in ERM and financial literacy. The implications are not only limited to emerging economies; other developed economies can benefit equally from the findings of this research.

5.2. Limitations and Future Research Directions

Despite the fact that this study has several important contributions to the existing literature, it is still not beyond limitations that can be addressed in future studies. We focused on SMEs operating in the emerging market of Pakistan, which may not be a suitable representative of the whole world including emerging and developed markets. Hence, the model can be tested in other emerging and developed economies to gain more fruitful insights. Moreover, researchers are advised to do a comparative study between emerging and developed economies to explore more useful results. This study can be extended in large firms where CEO and audit committee policies can be considered as suggest by Ludin et al. (2017) so that there is a significant relationship between CEO characteristics, audit work and risk management. Though we examined the moderating role of financial literacy between ERM and CA, future researchers can test the moderator between ERM practices and firm performance. Further research is needed to check the mediating role of each competitive strategy, e.g., cost leadership strategy and differentiation strategy, to disclose how ERM provides cost-based and differentiation-based competitive advantage.

6. Conclusions

This study examines the impact of ERM practices on SME performance with the mediating role of CA between ERM and SME performance as well as the moderating role of financial literacy between ERM practices and CA. Data were collected from 304 Pakistani SMEs using a structured questionnaire. The hypotheses of the research were tested through AMOS. The results indicate that ERM practices have a significant influence on CA and SME performance. CA partially mediates the relationship between ERM practices and SMEs performance. Financial literacy significantly moderates the relationship between ERM and CA. SMEs in emerging economies such as Pakistan are advised to implement formal ERM practices as well as they are advised to financially educate their top management teams to gain CA and superior performance. ERM framework seems to be well suited for gaining a sustainable competitive position and superior performance in dynamic markets. Similarly, financially educated owners and managers can enjoy unbeatable status in a turbulent market which in turn can help to increase their profitability. Implications have been discussed in detail.

Author Contributions

S.Y. supervised the paper, wrote literature review and proofread the paper. M.I. Performed the data analyses, worked on the introduction and theoretical framework and revised the whole paper. M.A. collect the data and conceived it. All the authors have proofread final version of the paper and finalized for publication.

Funding

School of Management and Economics, Beijing University of Technology.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abd Razak, Noraznira, Zuriah Ab Rahman, and Halimahton Borhan. 2016. Modeling firm resources–Enterprise risk management relationships: An empirical finding using PLS-SEM. World Journal of Entrepreneurship, Management and Sustainable Development 12: 35–49. [Google Scholar] [CrossRef]

- Annamalah, Sanmugam, Murali Raman, Govindan Marthandan, and Arvindan Kalisri Logeswaran. 2018. Implementation of Enterprise Risk Management (ERM) Framework in Enhancing Business Performances in Oil and Gas Sector. Economies 6: 4. [Google Scholar] [CrossRef]

- Anwar, Muhammad. 2018. Business model innovation And SMEs Performance—Does competitive advantage mediate? International Journal of Innovation Management. [Google Scholar] [CrossRef]

- Anwar, Muhammad, Sher Khan Zaman, and Najeeb Ullah Khan. 2018. Intellectual Capital, Entrepreneurial Strategy and New Venture Performance: Mediating Role of Competitive Advantage. Business Economic Review 10: 63–94. [Google Scholar] [CrossRef]

- Arena, Marika, Michela Arnaboldi, and Giovanni Azzone. 2010. The organizational dynamics of enterprise risk management. Accounting, Organizations and Society 35: 659–75. [Google Scholar] [CrossRef]

- Armeanu, Danial Ştefan, Georgeta Vintilă, Ştefan Cristian Gherghina, and Dan Cosmin Petrache. 2017. Approaches on Correlation between Board of Directors and Risk Management in Resilient Economies. Sustainability 9: 173. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem, Sidra Arshad, and Lliang Yan. 2017. Trade openness and bank risk-taking behavior: Evidence from emerging economies. Journal of Risk and Financial Management 10: 15. [Google Scholar] [CrossRef]

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Beasley, Mark, Donald Pagach, and Richard Warr. 2008. Information conveyed in hiring announcements of senior executives overseeing enterprise-wide risk management processes. Journal of Accounting, Auditing Finance 23: 311–32. [Google Scholar] [CrossRef]

- Bogodistov, Yevgen, and Veit Wohlgemuth. 2017. Enterprise risk management: a capability-based perspective. The Journal of Risk Finance 18: 234–51. [Google Scholar] [CrossRef]

- Bongomin, G. Okello Candiya, Joseph Mpeera Ntayi, John C. Munene, and Charles Akol Malinga. 2017. The relationship between access to finance and growth of SMEs in developing economies: Financial literacy as a moderator. Review of International Business and Strategy 27: 520–38. [Google Scholar] [CrossRef]

- Brustbauer, Johannes. 2016. Enterprise risk management in SMEs: Towards a structural model. International Small Business Journal 34: 70–85. [Google Scholar] [CrossRef]

- Callahan, Carolyan, and Jared Soileau. 2017. Does Enterprise risk management enhance operating performance? Advances in Accounting 37: 122–39. [Google Scholar] [CrossRef]

- Chang, Chen Shan, Shang Wu Yu, and Cheng Huang Hung. 2015. Firm risk and performance: the role of corporate governance. Review of Managerial Science 9: 141–73. [Google Scholar] [CrossRef]

- Committee of Sponsoring Organizations of the Treadway Commission (COSO). 2004. Enterprise Risk Management Framework. New York: American Institute of Certified Public Accountants. [Google Scholar]

- Daud, Wan Norhayate Wan, and Ahmad Shukri Yazid. 2009. A conceptual framework for the adoption of enterprise risk management in government-linked companies. International Review of Business Research Papers 5: 229–38. [Google Scholar]

- Dionne, Georages, and Thouraya Triki. 2005. Risk management and corporate governance: The importance of independence and financial knowledge for the board and the audit committee. Cahier de Recherche/Working Paper 5: 15. [Google Scholar] [CrossRef]

- Eckles, Davud L., Robert E. Hoyt, and Steve M. Miller. 2014. Reprint of: The impact of enterprise risk management on the marginal cost of reducing risk: Evidence from the insurance industry. Journal of Banking Finance 49: 409–23. [Google Scholar] [CrossRef]

- Elahi, Ehsan. 2013. Risk management: the next source of competitive advantage. Foresight 15: 117–31. [Google Scholar] [CrossRef]

- Florio, Cristina, and Giulia Leoni. 2017. Enterprise risk management and firm performance: The Italian case. The British Accounting Review 49: 56–74. [Google Scholar] [CrossRef]

- Farrell, Mark, and Ronan Gallagher. 2015. The valuation implications of enterprise risk management maturity. Journal of Risk and Insurance 82: 625–57. [Google Scholar] [CrossRef]

- George, Derren, and Paul Mallery. 2010. SPSS for Windows Step by Step. A Simple Study Guide and Reference (10. Baskı). New York: Pearson. [Google Scholar]

- González-Rodríguez, Maria Rosario, Jose Luis Jiménez-Caballero, Rosario Carmen Martín-Samper, Mehmet Ali Köseoglu, and Fevzi Okumus. 2018. Revisiting the link between business strategy and performance: Evidence from hotels. International Journal of Hospitality Management 72: 21–31. [Google Scholar] [CrossRef]

- Hair, Joseph F., Rolph E. Anderson, Barry J. Babin, and Willium C. Black. 2010. Multivariate Data Analysis: A Global Perspective. Upper Saddle River: Pearson, vol. 7. [Google Scholar]

- Herbane, Brahim. 2010. Small business research: Time for a crisis-based view. International Small Business Journal 28: 43–64. [Google Scholar] [CrossRef]

- Hommel, Ulrich, and Roger King. 2013. The emergence of risk-based regulation in higher education: Relevance for entrepreneurial risk taking by business schools. Journal of Management Development 32: 537–47. [Google Scholar] [CrossRef]

- Hoyt, Robert E., and Andre P. Liebenberg. 2011. The value of enterprise risk management. Journal of Risk and Insurance 78: 795–822. [Google Scholar] [CrossRef]

- Hu, Litze T., and Ppeter M. Bentler. 1999. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling 6: 1–55. [Google Scholar] [CrossRef]

- Kantur, Deniz. 2016. Strategic entrepreneurship: mediating the entrepreneurial orientation-performance link. Management Decision 54: 24–43. [Google Scholar] [CrossRef]

- Khan, Majid Jamal, Dildar Hussain, and Waqar Mehmood. 2016. Why do firms adopt enterprise risk management (ERM)? Empirical evidence from France. Management Decision 54: 1886–907. [Google Scholar] [CrossRef]

- Khan, Sajjad Nawaz, and Engku Ismail Engku Ali. 2017. The Moderating Role of Intellectual Capital between Enterprise Risk Management and Firm Performance: A Conceptual Review. American Journal of Social Sciences and Humanities 2: 9–15. [Google Scholar] [CrossRef]

- Krause, Timothy A, and Yiuman Tse. 2016. Risk management and firm value: recent theory and evidence. International Journal of Accounting and Information Management 24: 56–81. [Google Scholar] [CrossRef]

- Lajili, Kaouthar. 2009. Corporate risk disclosure and corporate governance. Journal of Risk and Financial Management 2: 94–117. [Google Scholar] [CrossRef]

- Lechner, Christian, and Sveinn Vidar Gudmundsson. 2014. Entrepreneurial orientation, firm strategy and small firm performance. International Small Business Journal 32: 36–60. [Google Scholar] [CrossRef]

- Lechner, Philipp, and Nadine Gatzert. 2018. Determinants and value of enterprise risk management: empirical evidence from Germany. The European Journal of Finance 24: 867–87. [Google Scholar] [CrossRef]

- Liu, Chiung Lin, Kuo Chung Shang, Taih Cherng Lirn, Kee Hung Lai, and Y. H. Venus Lun. 2017. Supply chain resilience, firm performance, and management policies in the liner shipping industry. Transportation Research Part A: Policy and Practice 110: 202–19. [Google Scholar] [CrossRef]

- Ludin, Khairul Rizan Mat, Zakiah Muhammaddun Mohamed, and Norman Mohd-Saleh. 2017. The association between CEO characteristics, internal audit quality and risk-management implementation in the public sector. Risk Management 19: 281–300. [Google Scholar] [CrossRef]

- Manab, Norlida Abdul, Isahak Kassim, and Mohd Rashid Hussin. 2010. Enterprise-wide risk management (EWRM) practices: Between corporate governance compliance and value. International Review of Business Research Papers 6: 239–52. [Google Scholar]

- Meidell, Anita, and Katarina Kaarbøe. 2017. How the enterprise risk management function influences decision-making in the organization–A field study of a large, global oil and gas company. The British Accounting Review 49: 39–55. [Google Scholar] [CrossRef]

- Nunnally, Jum, and Ira Bernstein. 1994. Psychometric Theory, 3rd ed. New York: McGraw-Hill. [Google Scholar]

- Oyewobi, Luqman Oyewobi, Abimbola Oluwakemi Windapo, and Rotimi Olabode Bamidele James. 2015. An empirical analysis of construction organisations’ competitive strategies and performance. Built Environment Project and Asset Management 5: 417–31. [Google Scholar] [CrossRef]

- Paape, Leen, and Roland F. Speklè. 2012. The adoption and design of enterprise risk management practices: An empirical study. European Accounting Review 21: 533–64. [Google Scholar] [CrossRef]

- Parnell, John A. 2010. Strategic clarity, business strategy and performance. Journal of Strategy and Management 3: 304–24. [Google Scholar] [CrossRef]

- Parnell, John A., Zhang Long, and Don Lester. 2015. Competitive strategy, capabilities and uncertainty in small and medium sized enterprises (SMEs) in China and the United States. Management Decision 53: 402–31. [Google Scholar] [CrossRef]

- Podsakoff, Philip M., and Dennis W. Organ. 1986. Self-reports in organizational research: problems and prospects’. Journal of Management 12: 531–44. [Google Scholar] [CrossRef]

- Porter, Michael E. 1980. Industry structure and competitive strategy: Keys to profitability. Financial Analysts Journal 36: 30–41. [Google Scholar] [CrossRef]

- Radner, Roy, and Larry Shepp. 1996. Risk vs. profit potential: A model for corporate strategy. Journal of Economic Dynamics Control 20: 1373–93. [Google Scholar] [CrossRef]

- Rasid, Siti Zaleha Abdul, Che Ruhana Isa, and Wan Khairuzzaman Wan Ismail. 2014. Management accounting systems, enterprise risk management and organizational performance in financial institutions. Asian Review of Accounting 22: 128–44. [Google Scholar] [CrossRef]

- Stulz, Rene M. 1996. Rethinking risk management. Journal of Applied Corporate Finance 9: 8–25. [Google Scholar] [CrossRef]

- Sax, Johanna, and Simon S. Torp. 2015. Speak up! Enhancing risk performance with enterprise risk management, leadership style and employee voice. Management Decision 53: 1452–68. [Google Scholar] [CrossRef]

- Semrau, Thorsten, Tina Ambos, and Sascha Kraus. 2016. Entrepreneurial orientation and SME performance across societal cultures: An international study. Journal of Business Research 69: 1928–32. [Google Scholar] [CrossRef]

- Shanahan, Peter, and Jenny McParlane. 2005. Serendipity or strategy? An investigation into entrepreneurial transnational higher education and risk management. On the Horizon 13: 220–28. [Google Scholar] [CrossRef]

- Soin, Kim, and Paul Collier. 2013. Risk and risk management in management accounting and control. Management Accounting Research 24: 82–87. [Google Scholar] [CrossRef]

- Soltanizadeh, Sara, Siti Zaleha Abdul Rasid, Nargess Mottaghi Golshan, and Wan Khairuzzaman Wan Ismail. 2016. Business strategy, enterprise risk management and organizational performance. Management Research Review 39: 1016–33. [Google Scholar] [CrossRef]

- Standard and Poor’s. 2008. Standard & Poor’s Rating Services Us Rating Fees Disclosure. Press Release. Available online: http://www2.standardandpoors.com/spf/pdf/fixedincome/RatingsFees2008.pdfS (accessed on 10 June 2018).

- Su, Zhongfeng, Hai Guo, and Wei Sun. 2017. Exploration and Firm Performance: The Moderating Impact of Competitive Strategy. British Journal of Management 28: 357–71. [Google Scholar] [CrossRef]

- Unnikrishnan, Seema, Rauf Iqbal, Anju Singh, and Indrayani M. Nimkar. 2015. Safety management practices in small and medium enterprises in India. Safety and Health at Work 6: 46–55. [Google Scholar] [CrossRef] [PubMed]

- Wang, Peng Fei, Shi Li, and Jian Zhou. 2010. Financial risk management and enterprise value creation: Evidence from non-ferrous metal listed companies in China. Nankai Business Review International 1: 5–19. [Google Scholar] [CrossRef]

- Wang, Teng Shih, Yi Mian Lin, Edward M. Werner, and Hsihui Chang. 2018. The relationship between external financing activities and earnings management: Evidence from enterprise risk management. International Review of Economics Finance. [Google Scholar] [CrossRef]

- Yilmaz, Ayse Kucuk, and Triant Flouris. 2017. Enterprise risk management in terms of organizational culture and its leadership and strategic management. In Corporate Risk Management for International Business. Singapore: Springer, pp. 65–112. [Google Scholar]

- Zou, Xiang, and Che Hashim Hassan. 2017. Enterprise risk management in China: the impacts on organizational performance. International Journal of Economic Policy in Emerging Economies 10: 226–39. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).