Groups, Pricing, and Cost of Debt: Evidence from Turkey

Abstract

1. Introduction

2. A Brief Overview of the Turkish Economy and Turkish Business Groups

3. Hypotheses Development

3.1. Group Affiliation Extent (Ownership %)

3.2. Having a Group Bank and Being a Financial Firm

3.3. Foreign Ownership and Foreign Group Affiliation

3.4. Government Ownership

3.5. Being Cross-Listed

3.6. Diversification

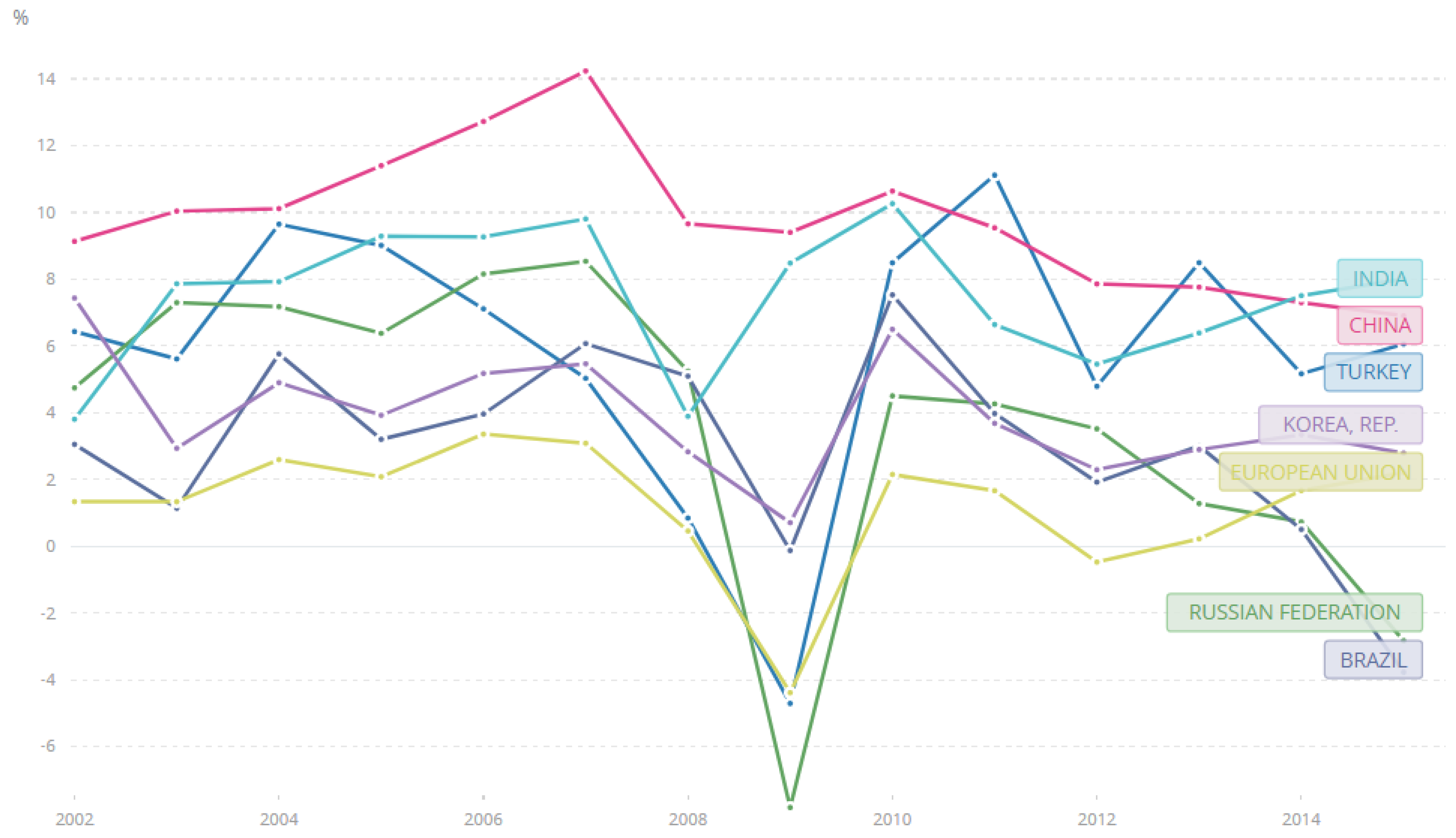

4. Sample and Methodology

4.1. Sample

4.2. Variables

4.2.1. Loan Term Variables

4.2.2. Organizational Structure Variables

4.2.3. Operational Strategy Variables

4.2.4. Internationalization Variable

4.2.5. Firm Characteristics Variables

4.2.6. Other Control Variables

4.3. Summary Statistics

5. Tests and Empirical Results

6. Conclusions

Author Contributions

Conflicts of Interest

Nomenclature

| Variable | Definition |

| Ln (Spread) | Natural log of the loan spread. This is a loan pricing measure (“All-in Spread Drawn” from the Dealscan database. It is the amount that borrower pays in basis points over LIBOR or the LIBOR equivalent for each dollar drawn down). |

| Ln (Maturity) | Natural log of the loan maturity. Maturity is measured in months. |

| Ln (Deal Amount) | Natural log of the loan deal amount. (Amount is measured in millions of dollars). |

| Group Affiliation Extent (%) | Measure for organizational structure. (Group’s ownership percentage in borrower firms). |

| Foreign Ownership | Measure for organizational structure. (Foreign ownership exists or not). |

| Government Ownership | Measure for organizational structure. (Government ownership exists or not). |

| Group Bank | Measure for operating strategy. (Affiliated group has a group bank or not). |

| Diversified | Measure for operating strategy. (Borrower firm operates as a focused or diversified firm). |

| Financial Firm | Measure for organizational structure. (Borrower firm is a financial firm or not). |

| Cross-listed | Measure for internationalization. (Borrower firm is listed in other markets besides ISE, or not). |

| Foreign Group | Measure for organizational structure. (Affiliated group is foreign-based or not). |

| Ln (Assets) | Natural log of total assets. Measure for firm size. |

| Profitability | Measuring firm profitability (net income/total assets) |

| Tobin’s Q | Measure for investment and growth opportunities. (Market value of assets (book value of assets minus book value of equity plus market value of equity) over the book value of assets). |

| Leverage | Measuring firm leverage (debt/total assets) |

| Tangibility | Measuring firm tangibility (value of plant, property, and equipment/total assets) |

Appendix A

References

- Almeida, Heitor V., and Daniel Wolfenzon. 2006. A theory of pyramidal ownership and family business groups. Journal of Finance 61: 2637–81. [Google Scholar] [CrossRef]

- Aslan, Hadiye, and Praveen Kumar. 2012. Strategic Ownership Structure and the Cost of Debt. Review of Financial Studies 25: 2257–99. [Google Scholar] [CrossRef]

- Bae, Kee-Hong, and Vidhan K. Goyal. 2009. Creditor rights, enforcement, and bank loans. Journal of Finance 84: 823–60. [Google Scholar] [CrossRef]

- Bae, Kee-Hong, and Seok Woo Jeong. 2007. The value-relevance of earnings and book value, ownership structure, and business group affiliation: Evidence from Korean business groups. Journal of Business Finance & Accounting 34: 740–66. [Google Scholar]

- Bae, Kee-Hong, Jun-Koo Kang, and Jin-Mo Kim. 2002. Tunneling or value added? Evidence from mergers by Korean business groups. Journal of Finance 57: 2695–740. [Google Scholar] [CrossRef]

- Bebchuk, Lucian, Reinier Kraakman, and George Triantis. 1999. Stock pyramids, cross-ownership, and the dual class equity: The creation and agency costs of separating control from cash flow rights. In Concentrated Corporate Ownership. Edited by Randall K. Morck. Chicago: University of Chicago Press. [Google Scholar]

- Berger, Philip G., and Eli Ofek. 1995. Diversification’s effect on firm value. Journal of Financial Economics 37: 39–65. [Google Scholar] [CrossRef]

- Bertrand, Marianne, Simon Johnson, Krislert Samphantharak, and Antoinette Schoar. 2008. Mixing family with business: A study of Thai business groups and the families behind them. Journal of Financial Economics 88: 466–98. [Google Scholar] [CrossRef]

- Bertrand, Marianne, Paras Mehta, and Sendhil Mullainathan. 2002. Ferreting out tunneling: An application to Indian business groups. Quarterly Journal of Economics 117: 121–48. [Google Scholar] [CrossRef]

- Bianco, Magda, and Giovanna Nicodano. 2006. Pyramidal groups and debt. European Economic Review 50: 937–61. [Google Scholar] [CrossRef]

- Chang, Sea Jin, and Jaebum Hong. 2002. How much does the business group matter in Korea? Strategic Management Journal 23: 265. [Google Scholar] [CrossRef]

- Chava, Sudheer, Dmitry Livdan, and Amiyatosh K. Purnanandam. 2009. Do shareholder rights affect the cost of bank loans? Review of Financial Studies 22: 2973–3004. [Google Scholar] [CrossRef]

- Chernykh, Lucy. 2008. Ultimate ownership and control in Russia. Journal of Financial Economics 88: 169–92. [Google Scholar] [CrossRef]

- Claessens, Stijn, Simeon Djankov, and Larry Lang. 2000. The separation of ownership and control in East Asian corporations. Journal of Financial Economics 58: 81–112. [Google Scholar] [CrossRef]

- Claessens, Stijn, Simeon Djankov, Joseph P. H. Fan, and Larry Lang. 2002. Disentangling the incentive and entrenchment effects of large shareholdings. Journal of Finance 57: 2741–71. [Google Scholar] [CrossRef]

- Comment, Robert, and Gregg A. Jarrell. 1995. Corporate focus and stock returns. Journal of Financial Economics 37: 67–87. [Google Scholar] [CrossRef]

- Davydenko, Sergei A., and Ilya A. Strebulaev. 2007. Strategic Actions and Credit Spreads: An Empirical Investigation. Journal of Finance 62: 2633–71. [Google Scholar] [CrossRef]

- DeLong, Gayle L. 2001. Stockholder gains from focusing versus diversifying bank mergers. Journal of Financial Economics 59: 221–52. [Google Scholar] [CrossRef]

- DeYoung, Robert, and Karin P. Roland. 2001. Product mix and earnings volatility at commercial banks: Evidence from a degree of leverage model. Journal of Financial Intermediation 10: 54–84. [Google Scholar] [CrossRef]

- Demirguc-Kunt, Asli, and Ross Levine. 2001. Financial Structure and Economic Growth: A Cross-Country Comparison of Banks, Markets, and Development. Cambridge: MIT Press. [Google Scholar]

- Denis, David J., Diane K. Denis, and Atulya Sarin. 1997. Agency problems, equity ownership, and corporate diversification. Journal of Finance 52: 135–60. [Google Scholar] [CrossRef]

- Diamond, Douglas W. 1984. Financial intermediation and delegated monitoring. Review of Economic Studies 59: 393–414. [Google Scholar] [CrossRef]

- Diamond, Douglas W. 2004. Committing to commit: Short-term debt when enforcement is costly. AFA Presidential Address. Journal of Finance 59: 1447–80. [Google Scholar] [CrossRef]

- Doidge, Craig, G. Andrew Karolyi, and René M. Stulz. 2004. Why are foreign firms listed in the U.S. worth more? Journal of Financial Economics 71: 205–38. [Google Scholar] [CrossRef]

- Easley, David, and Maureen O’Hara. 2004. Information and the cost of capital. Journal of Finance 59: 1553–83. [Google Scholar] [CrossRef]

- Esty, Benjamin C., and William L. Megginson. 2003. Creditor rights, enforcement, and debt ownership structure: Evidence from the global syndicated loan market. Journal of Financial and Quantitative Analysis 38: 37–59. [Google Scholar] [CrossRef]

- Ferris, Stephen P., Kenneth A. Kim, and Pattanaporn Kitsabunnarat. 2003. The costs (and benefits?) of diversified business groups: The case of Korean chaebols. Journal of Banking & Finance 27: 251–73. [Google Scholar]

- Foerster, Stephen R., and G. Andrew Karolyi. 1999. The effects of market segmentation and investor recognition on asset prices: evidence from foreign stocks listing in the U.S. Journal of Finance 54: 981–1014. [Google Scholar] [CrossRef]

- Francis, Bill, Hasan Iftekhar, Koetter Michael, and Qiang Wu. 2012a. Corporate Boards and Bank Loan Contracting. Journal of Financial Research 35: 521–53. [Google Scholar] [CrossRef]

- Francis, Bill, Iftekhar Hasan, and Liang Song. 2012b. Are Firm- and Country-Specific Governance Substitutes? Evidence from Financial Contracts in Emerging Markets. Journal of Financial Research 35: 343–75. [Google Scholar] [CrossRef]

- Francis, Bill, Hasan Iftekhar, Melih Küllü, and Mingming Zhou. 2018. Should Banks Diversify or Focus? Know Thyself, the Role of Abilities. Economic Systems 42: 106–18. [Google Scholar] [CrossRef]

- Freixas, Xavier, and Jean-Charles Rochet. 1997. Microeconomics of Banking. Cambridge: MIT Press. [Google Scholar]

- Gomes, Armando. 2000. Going Public without Governance: Managerial Reputation Effects. Journal of Finance 55: 15–46. [Google Scholar] [CrossRef]

- Gonenc, Halit, Ozgur B. Kan, and Ece C. Karadagli. 2007. Business groups and internal capital markets. Emerging Markets Finance and Trade 43: 63–81. [Google Scholar] [CrossRef]

- Gopalan, Radhakrishnan, Vikram Nanda, and Amit Seru. 2007. Affiliated firms and financial support: Evidence from Indian business groups. Journal of Financial Economics 86: 759–95. [Google Scholar] [CrossRef]

- Graham, John R., Si Li, and Jiaping Qiu. 2008. Corporate misreporting and bank loan contracting. Journal of Financial Economics 89: 44–61. [Google Scholar] [CrossRef]

- Guillen, Mauro F. 2000. Business groups in emerging economies: A resource-based view. Academy of Management Journal 43: 362–80. [Google Scholar] [CrossRef]

- Gul, Ferdinand A., Jeong-Bon Kim, and Annie A. Qiu. 2010. Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: Evidence from China. Journal of Financial Economics 95: 425–42. [Google Scholar] [CrossRef]

- Gunduz, Lokman, and Ekrem Tatoglu. 2003. A comparison of the financial characteristics of group affiliated and independent firms in Turkey. European Business Review 15: 48. [Google Scholar] [CrossRef]

- Guner, A. Burak. 2006. Loan Sales and the Cost of Borrowing. Review of Financial Studies 19: 687–716. [Google Scholar] [CrossRef]

- Kang, Jun-Koo, and Rene Stulz. 1997. Why Is There a Home Bias? An Analysis of Foreign Portfolio Equity Ownership in Japan. Journal of Financial Economics 46: 3–28. [Google Scholar] [CrossRef]

- Karolyi, G. Andrew. 2012. Corporate Governance, Agency Problems and International Cross-listings: A Defense of the Bonding Hypothesis. Emerging Markets Review 13: 516–47. [Google Scholar] [CrossRef]

- Khanna, Tarun, and Krishna Palepu. 2000a. Is group affiliation profitable in emerging markets: An analysis of Indian diversified business groups. Journal of Finance 55: 867–91. [Google Scholar] [CrossRef]

- Khanna, Tarun, and Krishna Palepu. 2000b. The future of business groups: Long run evidence from Chile. Academy of Management Journal 43: 268–85. [Google Scholar] [CrossRef]

- Khanna, Tarun, and Jan W. Rivkin. 2001. Estimating the performance effects of business groups in emerging markets. Strategic Management Journal 22: 45–74. [Google Scholar] [CrossRef]

- Khanna, Tarun, and Yishay Yafeh. 2005. Business groups and risk sharing around the world. Journal of Business 78: 301–40. [Google Scholar] [CrossRef]

- Khanna, Tarun, and Yishay Yafeh. 2007. Business groups in emerging markets: Paragons or parasites? Journal of Economic Literature 45: 331–72. [Google Scholar] [CrossRef]

- Küllü, Melih, Doug Dyer, Gokhan Yilmaz, and Zenu Sharma. 2018. The Impact of Business Group Affiliation on Stock Price Informativeness: Evidence from an Emerging Market. Financial Markets, Institutions and Instruments. forthcoming. [Google Scholar]

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 1998. Law and finance. Journal of Political Economy 106: 1113–55. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, and Andrei Shleifer. 1999. Corporate ownership around the world. Journal of Finance 54: 471–517. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 2002. Investor protection and corporate valuation. Journal of Finance 57: 1147–70. [Google Scholar] [CrossRef]

- Laeven, Luc, and Ross Levine. 2007. Is there a diversification discount in financial conglomerates? Journal of Financial Economics 85: 331–67. [Google Scholar] [CrossRef]

- Lang, Larry H. P., and Rene M. Stulz. 1994. Tobin’s q, corporate diversification, and firm performance. Journal of Political Economy 102: 1248–80. [Google Scholar]

- Lin, Chen, Yue Ma, Paul Malatesta, and Yuhai Xuan. 2011. Ownership structure and the cost of corporate borrowing. Journal of Financial Economics 100: 1–23. [Google Scholar] [CrossRef]

- Lins, Karl, Deon Strickland, and Marc Zenner. 2005. Do non-U.S. firms issue equity on U.S. exchanges to relax capital constraints? Journal of Financial and Quantitative Analysis 40: 109–33. [Google Scholar] [CrossRef]

- Love, Inessa, Lorenzo A. Preve, and Virginia Sarria-Allende. 2007. Trade credit and bank credit: Evidence from recent financial crises. Journal of Financial Economics 83: 453–69. [Google Scholar] [CrossRef]

- Manos, Ronny, Victor Murinde, and Christopher J. Green. 2007. Leverage and business groups: Evidence from Indian firms. Journal of Economics and Business 59: 443–65. [Google Scholar] [CrossRef]

- Masulis, Ronald W., Peter Kien Pham, and Jason Zein. 2011. Family Business Groups around the World: Financing Advantages, Control Motivations, and Organizational Choices. Review of Financial Studies 24: 3556–600. [Google Scholar] [CrossRef]

- Montgomery, Cynthia A. 1994. Corporate diversification. Journal of Economic Perspectives 8: 163–78. [Google Scholar] [CrossRef]

- Morck, Randall, Bernard Yeung, and Wayne Yu. 2000. The information content of stock markets: Why do emerging markets have synchronous stock price movements? Journal of Financial Economics 58: 215–60. [Google Scholar] [CrossRef]

- Qian, Jun, and Philip E. Strahan. 2007. How laws and institutions shape financial contracts: The case of bank loans. Journal of Finance 62: 2803–34. [Google Scholar] [CrossRef]

- Rajan, Raghuram, Henri Servaes, and Luigi Zingales. 2000. The cost of diversity: The diversification discount and inefficient investment. Journal of Finance 55: 35–80. [Google Scholar] [CrossRef]

- Scharfstein, David S., and Jeremy C. Stein. 2000. The dark side of internal capital markets: Divisional rent-seeking and inefficient investment. The Journal of Finance 55: 2537–64. [Google Scholar] [CrossRef]

- Shleifer, Andrei. 1998. State versus Private Ownership. The Journal of Economic Perspectives 12: 133–50. [Google Scholar] [CrossRef]

- Shumilov, Andrey. 2008. Performance of Business Groups: Evidence from Post-Crisis Russia. BOFIT Discussion Paper 24/2008. Finland: Bank of Finland, Institute for Economies in Transition. [Google Scholar]

- Stiroh, Kevin J. 2004. Diversification in banking: Is noninterest income the answer? Journal of Money, Credit and Banking 36: 853–82. [Google Scholar] [CrossRef]

- Strahan, Philip E. 1999. Borrower Risk and the Price and Nonprice Terms of Bank Loans. Working Paper. Boston: Boston College. [Google Scholar]

- Sufi, Amir. 2007. Information asymmetry and financing arrangements: Evidence from syndicated loans. Journal of Finance 62: 629–68. [Google Scholar] [CrossRef]

- Turhan, Ibrahim. 2012. IMKB’nin Gorunumu ve Gelecek Vizyonu. President’s Press Release on 21 May 2012. Istanbul: Borsa Istanbul. [Google Scholar]

- Weinstein, David E., and Yishay Yafeh. 1995. Japan’s corporate groups: Collusive or competitive? An empirical investigation of keiretsu behavior. Journal of Industrial Economics 43: 359–76. [Google Scholar] [CrossRef]

- Yurtoglu, B. Burcin. 2000. Ownership, control and performance of Turkish listed firms. Empirica 27: 193–222. [Google Scholar] [CrossRef]

| 1 | Corporate finance theory advocates that firms need to focus in order to lessen possible agency problems and employ management expertise (Denis et al. 1997). Moreover, many diversification studies find that membership in diversified conglomerates destroys value (Lang and Stulz 1994; Berger and Ofek 1995), and focus leads to superior performance compared to diversifying (DeLong 2001; Laeven and Levine 2007). On the other hand, Khanna and Palepu (2000b) argue that emerging market settings differ, and diversification may not destroy value in those settings. |

| 2 | Unlike widely-held US conglomerates, emerging market business groups tend to have concentrated corporate control (La Porta et al. 1998). They can be private family firms, or public, but governed with a very limited number of major shareholders. |

| 3 | Performance impact of group affiliation (Khanna and Rivkin 2001), the groups’ role of circumventing market inefficiencies (Chang and Hong 2002) and comparisons of affiliated and unaffiliated firms (Khanna and Palepu 2000a; Manos et al. 2007) are related subjects of study. |

| 4 | Business groups have been studied in various emerging market settings such as Chili (Khanna and Palepu 2000b), Thailand (Bertrand et al. 2008), South Korea (Bae and Jeong 2007; Bae et al. 2002), India (Khanna and Palepu 2000a; Bertrand et al. 2002; Gopalan et al. 2007), Russia (Chernykh 2008; Shumilov 2008), and in cross-country studies (Guillen 2000; Khanna and Rivkin 2001; Khanna and Yafeh 2005; Claessens et al. 2000). |

| 5 | Information asymmetry between borrowers and lenders is highly important in the lending process (Sufi 2007). Banks have access to proprietary information, and they are more effective monitors than equity and bond holders (Diamond 1984). |

| 6 | For example, these groups enjoy exceptional access to government and foreign loans. |

| 7 | Qian and Strahan (2007) study the creditor protection concept in syndicate lending. Bae and Goyal (2009) examine judicial efficiency in terms of lending structure and loan pricing, and Esty and Megginson (2003) examine project finance loans. |

| 8 | Existing theoretical literature shows that corporate governance and debt policies are highly related (Diamond 2004). Empirical studies show that both firm-level governance characteristics (Sufi 2007; Francis et al. 2012a; Chava et al. 2009), and country-level regulatory environment and business firm characteristics are highly important factors regarding bank loans and loan contract terms (Qian and Strahan 2007; Bae and Goyal 2009). Firm-level corporate governance has been found to have an impact on bank loan contracting (Francis et al. 2012b). The ability of controlling shareholders to expropriate from minority shareholders and creditors is a major concern (Claessens et al. 2000), and a main source of corporate credit risk is strategic actions of self-interested dominant shareholders (Aslan and Kumar 2012). |

| 9 | Khanna and Rivkin (2001) look at Turkish business groups in a cross-country study. Yurtoglu (2000) studies concentrated ownership structure, and its negative effects on firm performance. Gunduz and Tatoglu (2003) examine affiliated and unaffiliated firm performance in the Turkish market, and find that performance of these firms does not differ. Gonenc et al. (2007) examine the performance of affiliated and unaffiliated firms in Turkey, and show that internal capital markets are important, and that group affiliation improves accounting but does not improve market performance. |

| 10 | Effective corporate governance is expected to decrease the risks that are associated with information asymmetries. Easley and O’Hara (2004) argue that disclosure of information lowers the informational risk, and therefore decreases the cost of capital. |

| 11 | The Turkish economy is the fifteenth largest in the world, and the sixth largest in Europe based on World Bank gross domestic product (GDP) rankings. (Figure A1) Its economy has been steadily growing despite several crises it has faced in the last decade. It experienced an average growth rate of 6.8% from 2002 to 2007. After the 2008 global crisis, growth reached 9.2% in 2010, and 8.5% in 2011. |

| 12 | Borsa Istanbul, President’s Press Release on 21 May 2012. |

| 13 | Banks of several business groups had collapsed or were taken over by the government during the 1994, 1999 and 2001 financial crises. |

| 14 | In addition to these variables, covenants, secured or not, and other terms are also used in the literature. However, due to missing data, which is also common in some other emerging markets, these variables cannot be included in the analysis. |

| 15 | Not all group firms are public. In contrast, there are many private group firms, and dominant shareholders have a significant control in terms of group firm management. |

| 16 | Here we use 0.50 as the benchmark to define “high correlations” and “relatively high correlations.” Although this benchmark is rather arbitrary, it is a practical one for discussions. |

| Variable | Obs. | Mean | Median | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| Maturity | 278 | 20.74 | 12 | 20.60 | 9 | 156 |

| Ln Maturity | 278 | 2.80 | 2.48 | 0.58 | 2.20 | 5.05 |

| Spread | 278 | 107.15 | 80 | 83.22 | 5.25 | 450 |

| Ln Spread | 278 | 4.44 | 4.38 | 0.69 | 1.66 | 6.11 |

| Deal Amount * | 278 | 384.34 | 250 | 415.98 | 15 | 3000 |

| Ln Deal Amount | 278 | 5.43 | 5.52 | 1.10 | 2.71 | 8.01 |

| Group Aff Extent | 278 | 57.20 | 52 | 21.30 | 25.33 | 99 |

| Ln Grp Aff Ext | 278 | 3.97 | 3.95 | 0.39 | 3.23 | 4.60 |

| Group Bank | 278 | 0.95 | 1 | 0.22 | 0 | 1 |

| Diversified | 278 | 0.86 | 1 | 0.35 | 0 | 1 |

| Foreign Group | 278 | 0.05 | 0 | 0.21 | 0 | 1 |

| Foreign Ownership | 278 | 0.40 | 0 | 0.49 | 0 | 1 |

| Financial | 278 | 0.83 | 1 | 0.38 | 0 | 1 |

| Cross-listed | 278 | 0.60 | 1 | 0.49 | 0 | 1 |

| Gov. Ownership | 278 | 0.03 | 0 | 0.17 | 0 | 1 |

| Total Assets * | 278 | 20,811.11 | 11,613.77 | 23,340.96 | 227.40 | 97,299.87 |

| Ln Assets | 278 | 16.11 | 16.27 | 1.36 | 12.33 | 18.39 |

| Tobin’s Q | 278 | 1.50 | 1.33 | 0.54 | 1.03 | 4.52 |

| Tangibility | 278 | 0.07 | 0.03 | 0.12 | 0.0004 | 0.67 |

| Leverage | 278 | 0.28 | 0.26 | 0.16 | 0.05 | 0.85 |

| Profitability | 278 | 0.03 | 0.02 | 0.03 | −0.13 | 0.18 |

| Variables | {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | {9} | {10} | {11} | {12} | {13} | {14} | {15} | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| {1} | LnMaturity | 1 | ||||||||||||||

| {2} | LnSpread | 0.42 * | 1 | |||||||||||||

| {3} | LnDeal Amt | 0.20 * | −0.01 | 1 | ||||||||||||

| {4} | LnGrpAffExt | −0.14 | 0.09 | −0.35 * | 1 | |||||||||||

| {5} | Group Bank | −0.38 * | −0.33 * | −0.18 * | 0.13 | 1 | ||||||||||

| {6} | Diversified | −0.21 * | −0.24 * | 0.13 | −0.38 * | 0.24 * | 1 | |||||||||

| {7} | ForeignGrp | 0.15 | 0.21 * | 0.19 * | 0.18 * | −0.30 * | −0.38 * | 1 | ||||||||

| {8} | ForeignOwn | 0.12 | 0.03 | 0.22 * | −0.36 * | −0.09 | −0.21 * | 0.36 * | 1 | |||||||

| {9} | Financial | −0.50 * | −0.49 * | −0.07 | −0.06 | 0.53 * | 0.39 * | −0.11 | −0.04 | 1 | ||||||

| {10} | Gov Own | −0.04 | −0.03 | 0.04 | 0.05 | 0.06 | 0.11 | −0.10 | −0.26 * | 0.09 | 1 | |||||

| {11} | Crosslisted | −0.17 * | −0.26 * | 0.23 * | −0.28 * | 0.37 * | 0.20 * | −0.11 | 0.39 * | 0.39 * | 0.40 * | 1 | ||||

| {12} | Ln Assets | −0.16 | −0.23 * | 0.56 * | −0.41 * | 0.23 * | 0.43 * | 0.08 | 0.22 * | 0.41 * | 0.12 | 0.59 * | 1 | |||

| {13} | Tobin’s Q | 0.45 * | 0.05 | 0.09 | −0.19 * | −0.28 * | −0.08 | 0.00 | 0.00 | −0.52 * | −0.27 * | −0.17 | −0.17 | 1 | ||

| {14} | Tangibility | 0.33 * | 0.18 | 0.06 | −0.19 * | −0.34 * | −0.02 | 0.04 | −0.10 | −0.61 * | −0.31 * | −0.26 * | −0.14 | 0.46 * | 1 | |

| {15} | Leverage | 0.07 | 0.07 | −0.11 | 0.13 | 0.04 | −0.15 | −0.02 | 0.03 | −0.04 | −0.07 | −0.17 * | −0.15 | −0.13 | −0.17 * | 1 |

| {16} | Profitability | 0.21 * | 0.10 | −0.11 | −0.21 * | −0.20 * | 0.00 | 0.11 | 0.07 | −0.23 * | −0.27 * | −0.13 | −0.24 * | 0.51 * | 0.27 * | −0.2 * |

| Ln Spread | Ln Maturity | Ln DealAmount | |

|---|---|---|---|

| {1} | {2} | {3} | |

| Ln Group Aff. Extent | 0.145 ** | −1.137 *** | −0.182 ** |

| (0.072) | (0.129) | (0.073) | |

| Constant | 3.983 *** | 9.905 *** | 3.695 *** |

| (0.294) | (0.519) | (0.303) | |

| Loan Type Controls | No | No | No |

| Industry Controls | No | No | No |

| Year Controls | No | No | No |

| Observations | 448 | 580 | 540 |

| R-Square | 0.006 | 0.108 | 0.007 |

| Ln Spread | ||||||||

|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | |

| Ln Group Aff. Extent | 0.183 * | |||||||

| (0.09) | ||||||||

| Group Bank | 0.021 | |||||||

| (0.55) | ||||||||

| Foreign Group | 0.193 | |||||||

| (0.16) | ||||||||

| Foreign Ownership | −0.130 * | |||||||

| (0.08) | ||||||||

| Government Ownership | 0.178 * | |||||||

| (0.10) | ||||||||

| Financial Firm | 0.092 | |||||||

| (0.17) | ||||||||

| Cross-listed | −0.151 | |||||||

| (0.15) | ||||||||

| Diversified | −0.060 | |||||||

| (0.11) | ||||||||

| Ln Assets t−1 | −0.033 | −0.0718 * | −0.066 | −0.052 | −0.0747 * | −0.0759 ** | −0.035 | −0.062 |

| (0.05) | (0.04) | (0.04) | (0.05) | (0.04) | (0.04) | (0.05) | (0.04) | |

| Profitability t−1 | 3.618 *** | 3.549 *** | 3.550 *** | 3.415 *** | 3.559 *** | 3.512 *** | 3.524 *** | 3.569 *** |

| (0.79) | (0.81) | (0.82) | (0.75) | (0.80) | (0.83) | (0.81) | (0.79) | |

| Tobin’s Q t−1 | −0.193 | −0.234 | −0.223 * | −0.228 | −0.231 * | −0.233 * | −0.203 | −0.230 * |

| (0.13) | (0.16) | (0.13) | (0.14) | (0.13) | (0.13) | (0.14) | (0.13) | |

| Leverage t−1 | −0.200 | −0.319 | −0.304 | −0.287 | −0.279 | −0.326 | −0.307 | −0.322 |

| (0.32) | (0.25) | (0.28) | (0.31) | (0.29) | (0.28) | (0.29) | (0.29) | |

| Tangibility t−1 | 0.347 | 0.236 | 0.192 | 0.239 | 0.266 | 0.241 | 0.340 | 0.236 |

| (0.62) | (0.57) | (0.62) | (0.59) | (0.61) | (0.60) | (0.63) | (0.60) | |

| Ln Deal Amount | −0.014 | −0.009 | −0.012 | −0.013 | −0.005 | −0.009 | −0.004 | −0.012 |

| (0.06) | (0.06) | (0.07) | (0.06) | (0.07) | (0.07) | (0.07) | (0.06) | |

| Ln Maturity | 0.470 *** | 0.445 *** | 0.456 *** | 0.458 *** | 0.450 *** | 0.437 *** | 0.456 *** | 0.442 *** |

| (0.09) | (0.10) | (0.10) | (0.09) | (0.10) | (0.10) | (0.10) | (0.09) | |

| Constant | 3.454 *** | 5.070 *** | 4.666 *** | 4.901 *** | 5.008 *** | 4.572 *** | 4.309 *** | 4.884 *** |

| (1.15) | (0.72) | (0.77) | (0.74) | (0.70) | (0.87) | (1.10) | (0.81) | |

| Loan Type Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Square | 0.653 | 0.647 | 0.65 | 0.654 | 0.649 | 0.648 | 0.651 | 0.648 |

| Adj. R-Square | 0.596 | 0.59 | 0.593 | 0.597 | 0.592 | 0.59 | 0.594 | 0.59 |

| Ln Maturity | ||||||||

|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | |

| Ln Group Aff. Extent | −0.257 *** | |||||||

| (0.08) | ||||||||

| Group Bank | −0.274 | |||||||

| (0.27) | ||||||||

| Foreign Group | −0.291 *** | |||||||

| (0.06) | ||||||||

| Foreign Ownership | 0.111 | |||||||

| (0.07) | ||||||||

| Government Ownership | −0.219 *** | |||||||

| (0.05) | ||||||||

| Financial Firm | 0.338 | |||||||

| (0.25) | ||||||||

| Cross-listed | 0.160 | |||||||

| (0.11) | ||||||||

| Diversified | −0.063 | |||||||

| (0.12) | ||||||||

| Ln Assets t−1 | −0.0707 * | −0.009 | −0.026 | −0.034 | −0.014 | −0.037 | −0.057 | −0.010 |

| (0.04) | (0.04) | (0.04) | (0.04) | (0.03) | (0.04) | (0.04) | (0.04) | |

| Profitability t−1 | −3.918 *** | −3.859 *** | −3.873 *** | −3.794 *** | −3.918 *** | −3.954 *** | −3.871 *** | −3.896 *** |

| (1.15) | (1.05) | (1.16) | (1.30) | (1.22) | (1.20) | (1.20) | (1.18) | |

| Tobin’s Q t−1 | 0.260 ** | 0.360 *** | 0.306 ** | 0.319 *** | 0.322 *** | 0.307 ** | 0.292 ** | 0.324 *** |

| (0.11) | (0.11) | (0.11) | (0.11) | (0.11) | (0.12) | (0.11) | (0.11) | |

| Leverage t−1 | −0.024 | 0.171 | 0.121 | 0.116 | 0.093 | 0.101 | 0.130 | 0.133 |

| (0.18) | (0.15) | (0.15) | (0.19) | (0.15) | (0.15) | (0.15) | (0.16) | |

| Tangibility t−1 | −0.288 | −0.090 | −0.064 | −0.137 | −0.169 | −0.125 | −0.244 | −0.139 |

| (0.30) | (0.29) | (0.27) | (0.33) | (0.30) | (0.32) | (0.31) | (0.30) | |

| Ln Deal Amount | 0.033 | 0.014 | 0.031 | 0.031 | 0.022 | 0.029 | 0.021 | 0.026 |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | |

| Ln Spread | 0.321 *** | 0.310 *** | 0.316 *** | 0.322 *** | 0.315 *** | 0.300 *** | 0.319 *** | 0.311 *** |

| (0.09) | (0.09) | (0.09) | (0.08) | (0.09) | (0.09) | (0.08) | (0.09) | |

| Constant | 4.256 *** | 1.748 ** | 2.183 *** | 2.265 *** | 1.724 ** | 1.881 * | 2.933 *** | 1.663 * |

| (1.03) | (0.76) | (0.74) | (0.75) | (0.74) | (0.93) | (0.86) | (0.82) | |

| Loan Type Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Square | 0.676 | 0.664 | 0.667 | 0.666 | 0.663 | 0.668 | 0.666 | 0.66 |

| Adj. R-Square | 0.622 | 0.608 | 0.613 | 0.611 | 0.608 | 0.614 | 0.611 | 0.605 |

| Ln Deal Amount | ||||||||

|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | |

| Ln Group Aff. Extent | 0.079 | |||||||

| (0.12) | ||||||||

| Group Bank | −0.716 *** | |||||||

| (0.17) | ||||||||

| Foreign Group | 0.094 | |||||||

| (0.15) | ||||||||

| Foreign Ownership | −0.039 | |||||||

| (0.09) | ||||||||

| Government Ownership | −0.305 ** | |||||||

| (0.12) | ||||||||

| Financial Firm | −0.045 | |||||||

| (0.12) | ||||||||

| Cross-listed | 0.139 | |||||||

| (0.11) | ||||||||

| Diversified | −0.170 | |||||||

| (0.12) | ||||||||

| Ln Assets t−1 | 0.536 *** | 0.529 *** | 0.523 *** | 0.526 *** | 0.524 *** | 0.524 *** | 0.486 *** | 0.544 *** |

| (0.05) | (0.03) | (0.03) | (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | |

| Profitability t−1 | −2.838 * | −2.733 ** | −2.882 * | −2.915 * | −2.914 * | −2.879 * | −2.890 * | −2.812 * |

| (1.51) | (1.20) | (1.47) | (1.45) | (1.48) | (1.50) | (1.48) | (1.38) | |

| Tobin’s Q t−1 | 0.164 | 0.247 ** | 0.153 | 0.149 | 0.149 | 0.151 | 0.125 | 0.150 |

| (0.10) | (0.10) | (0.11) | (0.11) | (0.11) | (0.11) | (0.11) | (0.10) | |

| Leverage t−1 | −1.091 *** | −1.013 *** | −1.135 *** | −1.133 *** | −1.194 *** | −1.136 *** | −1.141 *** | −1.150 *** |

| (0.22) | (0.21) | (0.19) | (0.20) | (0.19) | (0.20) | (0.19) | (0.20) | |

| Tangibility t−1 | −1.221 | −1.109 | −1.293 * | −1.269 * | −1.308 * | −1.272 * | −1.360 * | −1.271 * |

| (0.75) | (0.67) | (0.73) | (0.73) | (0.72) | (0.72) | (0.73) | (0.68) | |

| Ln Maturity | 0.079 | 0.032 | 0.073 | 0.072 | 0.050 | 0.069 | 0.050 | 0.059 |

| (0.12) | (0.10) | (0.12) | (0.12) | (0.11) | (0.11) | (0.12) | (0.12) | |

| Ln Spread | −0.023 | −0.014 | −0.020 | −0.021 | −0.008 | −0.015 | −0.006 | −0.020 |

| (0.11) | (0.09) | (0.12) | (0.11) | (0.12) | (0.11) | (0.12) | (0.11) | |

| Constant | −2.860 | −2.955 ** | −2.377 * | −2.235 | −2.267 | −2.571 ** | −1.634 | −2.531 * |

| (1.82) | (1.19) | (1.24) | (1.31) | (1.36) | (1.06) | (1.38) | (1.35) | |

| Loan Type Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Square | 0.78 | 0.787 | 0.78 | 0.78 | 0.781 | 0.779 | 0.781 | 0.781 |

| Adj. R-Square | 0.744 | 0.752 | 0.743 | 0.743 | 0.745 | 0.743 | 0.745 | 0.745 |

| Ln Maturity | Ln Spread | Ln DealAmount | |||||||

|---|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | {9} | |

| Ln Group Aff. Extent | −0.257 *** | −0.241 *** | 0.427 | 0.183 * | 0.187 *** | −1.055 | 0.0785 | 0.144 | 0.879 |

| (0.08) | (0.09) | (0.40) | (0.09) | (0.06) | (0.68) | (0.12) | (0.10) | (0.82) | |

| Group Bank | −0.17 | 2.464 * | −0.0517 | −4.949 * | −0.768 *** | 2.142 | |||

| (0.27) | (1.44) | (0.53) | (2.44) | (0.18) | (3.42) | ||||

| GrpAff * GroupBank | −0.678 * | 1.262 * | −0.749 | ||||||

| (0.39) | (0.70) | (0.87) | |||||||

| Ln Assets t−1 | −0.0707 * | −0.0611 | −0.0635 | −0.0328 | −0.03 | −0.0247 | 0.536 *** | 0.557 *** | 0.553 *** |

| (0.04) | (0.04) | (0.04) | (0.05) | (0.04) | (0.04) | (0.05) | (0.04) | (0.05) | |

| Profitability t−1 | −3.918 *** | −3.876 *** | −3.771 *** | 3.618 *** | 3.624 *** | 3.423 *** | −2.838 * | −2.615 ** | −2.511 ** |

| (1.15) | (1.03) | (0.93) | (0.79) | (0.80) | (0.90) | (1.51) | (1.21) | (1.12) | |

| Tobin’s Q t−1 | 0.260 ** | 0.286 ** | 0.284 ** | −0.193 | −0.185 | −0.181 | 0.164 | 0.281 *** | 0.279 *** |

| (0.11) | (0.12) | (0.12) | (0.13) | (0.16) | (0.16) | (0.10) | (0.09) | (0.09) | |

| Leverage t−1 | −0.0237 | 0.00624 | −0.0667 | −0.2 | −0.191 | −0.0537 | −1.091 *** | −0.913 *** | −0.991 *** |

| (0.18) | (0.19) | (0.19) | (0.32) | (0.27) | (0.31) | (0.22) | (0.23) | (0.29) | |

| Tangibility t−1 | −0.288 | −0.249 | −0.311 | 0.347 | 0.359 | 0.471 | −1.221 | −1.005 | −1.072 |

| (0.30) | (0.30) | (0.26) | (0.62) | (0.57) | (0.62) | (0.75) | (0.68) | (0.67) | |

| Ln Deal Amount | 0.0329 | 0.024 | 0.0219 | −0.0139 | −0.0166 | −0.0127 | |||

| (0.05) | (0.05) | (0.05) | (0.06) | (0.05) | (0.05) | ||||

| Ln Spread | 0.321 *** | 0.318 *** | 0.322 *** | −0.0229 | −0.0262 | −0.0202 | |||

| (0.09) | (0.09) | (0.10) | (0.11) | (0.09) | (0.09) | ||||

| Ln Maturity | 0.470 *** | 0.469 *** | 0.472 *** | 0.0794 | 0.0558 | 0.051 | |||

| (0.09) | (0.10) | (0.10) | (0.12) | (0.10) | (0.11) | ||||

| Constant | 4.256 *** | 3.600 *** | 1.078 | 3.454 *** | 3.495 *** | 8.123 *** | −2.86 | −4.081 ** | −6.127 * |

| (1.03) | (1.11) | (1.72) | (1.15) | (1.08) | (2.56) | (1.82) | (1.53) | (3.41) | |

| Loan Type Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Square | 0.678 | 0.679 | 0.680 | 0.648 | 0.648 | 0.652 | 0.784 | 0.792 | 0.793 |

| Adj. R-Square | 0.623 | 0.623 | 0.623 | 0.588 | 0.587 | 0.589 | 0.747 | 0.756 | 0.756 |

| Ln Maturity | Ln Spread | Ln Deal Amount | |||||||

|---|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | {9} | |

| Ln Group Aff. Extent | −0.257 *** | −0.270 *** | −1.619 *** | 0.183 * | 0.179 * | −0.284 | 0.0785 | 0.0567 | −1.446 ** |

| (0.08) | (0.09) | (0.54) | (0.09) | (0.10) | (0.40) | (0.12) | (0.12) | (0.57) | |

| Diversified | −0.105 | −6.295 ** | −0.0289 | −2.123 | −0.16 | −6.955 *** | |||

| (0.11) | (2.34) | (0.11) | (1.80) | (0.12) | (2.43) | ||||

| GrpAff * Diversified | 1.420 ** | 0.48 | 1.558 *** | ||||||

| (0.52) | (0.42) | (0.55) | |||||||

| Ln Assets t−1 | −0.0707 * | −0.0568 | −0.0371 | −0.0328 | −0.0291 | −0.0235 | 0.536 *** | 0.554 *** | 0.554 *** |

| (0.04) | (0.04) | (0.04) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | |

| Profitability t−1 | −3.918 *** | −3.865 *** | −3.833 *** | 3.618 *** | 3.625 *** | 3.532 *** | −2.838 * | −2.775 * | −2.932 ** |

| (1.15) | (1.07) | (0.94) | (0.79) | (0.79) | (0.76) | (1.51) | (1.41) | (1.27) | |

| Tobin’s Q t−1 | 0.260 ** | 0.257 ** | 0.224 ** | −0.193 | −0.193 | −0.198 | 0.164 | 0.16 | 0.138 |

| (0.11) | (0.10) | (0.08) | (0.13) | (0.13) | (0.13) | (0.10) | (0.10) | (0.10) | |

| Leverage t−1 | −0.0237 | −0.0422 | −0.284 | −0.2 | −0.206 | −0.287 | −1.091 *** | −1.113 *** | −1.346 *** |

| (0.18) | (0.19) | (0.22) | (0.32) | (0.33) | (0.34) | (0.22) | (0.21) | (0.25) | |

| Tangibility t−1 | −0.288 | −0.299 | −0.553 * | 0.347 | 0.344 | 0.25 | −1.221 | −1.234 * | −1.495 ** |

| (0.30) | (0.28) | (0.30) | (0.62) | (0.62) | (0.63) | (0.75) | (0.71) | (0.68) | |

| Ln Deal Amount | 0.0329 | 0.0289 | −0.00203 | −0.0139 | −0.015 | −0.0247 | |||

| (0.05) | (0.05) | (0.05) | (0.06) | (0.06) | (0.06) | ||||

| Ln Spread | 0.321 *** | 0.318 *** | 0.282 *** | −0.0229 | −0.0245 | −0.0393 | |||

| (0.09) | (0.09) | (0.08) | (0.11) | (0.11) | (0.12) | ||||

| Ln Maturity | 0.470 *** | 0.468 *** | 0.444 *** | 0.0794 | 0.0697 | −0.00508 | |||

| (0.09) | (0.09) | (0.09) | (0.12) | (0.12) | (0.12) | ||||

| Constant | 4.256 *** | 3.639 *** | 10.42 *** | 3.454 *** | 3.431 *** | 5.627 ** | −2.86 | −2.967 | 4.312 |

| (1.03) | (1.00) | (2.78) | (1.15) | (1.17) | (2.27) | (1.82) | (1.82) | (3.61) | |

| Loan Type Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Square | 0.676 | 0.677 | 0.699 | 0.653 | 0.653 | 0.655 | 0.78 | 0.781 | 0.788 |

| Adj. R-Square | 0.622 | 0.623 | 0.646 | 0.596 | 0.595 | 0.595 | 0.744 | 0.744 | 0.751 |

| Ln Maturity | Ln Spread | Ln Deal Amount | |||||||

|---|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {5} | {6} | {7} | {8} | {9} | |

| Ln Group Aff. Extent | −0.257 *** | −0.230 *** | −0.230 ** | 0.183 * | 0.166 * | 0.159 * | 0.0785 | 0.0701 | 0.0763 |

| (0.08) | (0.08) | (0.08) | (0.09) | (0.09) | (0.08) | (0.12) | (0.13) | (0.13) | |

| Foreign Group | −0.215 *** | −0.169 | 0.143 | −3.273 | 0.0735 | 3.301 | |||

| (0.07) | (2.10) | (0.17) | (3.67) | (0.16) | (3.43) | ||||

| GrpAff * ForeignGrp. | −0.0103 | 0.779 | −0.736 | ||||||

| (0.48) | (0.85) | (0.77) | |||||||

| Ln Assets t−1 | −0.0707 * | −0.0701 * | −0.0701 * | −0.0328 | −0.0325 | −0.0346 | 0.536 *** | 0.536 *** | 0.537 *** |

| (0.04) | (0.04) | (0.04) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | |

| Profitability t−1 | −3.918 *** | −3.879 *** | −3.881 *** | 3.618 *** | 3.611 *** | 3.732 *** | −2.838 * | −2.833 * | −2.954 * |

| (1.15) | (1.11) | (1.15) | (0.79) | (0.80) | (0.77) | (1.51) | (1.51) | (1.56) | |

| Tobin’s Q t−1 | 0.260 ** | 0.254 ** | 0.254 ** | −0.193 | −0.19 | −0.198 | 0.164 | 0.165 | 0.173 |

| (0.11) | (0.11) | (0.11) | (0.13) | (0.13) | (0.13) | (0.10) | (0.10) | (0.11) | |

| Leverage t−1 | −0.0237 | −0.0203 | −0.0204 | −0.2 | −0.202 | −0.19 | −1.091 *** | −1.092 *** | −1.100 *** |

| (0.18) | (0.19) | (0.18) | (0.32) | (0.32) | (0.32) | (0.22) | (0.22) | (0.23) | |

| Tangibility t−1 | −0.288 | −0.218 | −0.219 | 0.347 | 0.302 | 0.39 | −1.221 | −1.243 | −1.324 |

| (0.30) | (0.28) | (0.29) | (0.62) | (0.64) | (0.67) | (0.75) | (0.77) | (0.81) | |

| Ln Deal Amount | 0.0329 | 0.0342 | 0.0342 | −0.0139 | −0.015 | −0.0131 | |||

| (0.05) | (0.05) | (0.05) | (0.06) | (0.06) | (0.06) | ||||

| Ln Spread | 0.321 *** | 0.322 *** | 0.322 *** | −0.0229 | −0.0249 | −0.0216 | |||

| (0.09) | (0.09) | (0.09) | (0.11) | (0.12) | (0.11) | ||||

| Ln Maturity | 0.470 *** | 0.477 *** | 0.475 *** | 0.0794 | 0.0836 | 0.0834 | |||

| (0.09) | (0.10) | (0.10) | (0.12) | (0.12) | (0.11) | ||||

| Constant | 4.256 *** | 3.832 *** | 4.340 *** | 3.454 *** | 3.349 *** | 3.288 *** | −2.86 | −2.906 | −2.853 |

| (1.03) | (1.02) | (1.04) | (1.15) | (1.11) | (1.13) | (1.82) | (1.80) | (1.81) | |

| Loan Type Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Square | 0.676 | 0.68 | 0.68 | 0.653 | 0.654 | 0.656 | 0.78 | 0.78 | 0.78 |

| Adj. R-Square | 0.622 | 0.626 | 0.624 | 0.596 | 0.596 | 0.596 | 0.744 | 0.743 | 0.742 |

| Ln Spread | Ln Maturity | Ln Deal Amount | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| {1} | {2} | {3} | {4} | {1} | {2} | {3} | {4} | {1} | {2} | {3} | {4} | |

| Ln GrpAffExt. | 0.108 | 0.175 * | 0.189 * | 0.184 * | −0.247 ** | −0.248 *** | −0.237 *** | −0.256 *** | 0.067 | 0.092 | 0.077 | 0.075 |

| −0.19 | −0.09 | −0.1 | −0.1 | −0.09 | −0.08 | −0.07 | −0.08 | −0.11 | −0.12 | −0.12 | −0.11 | |

| Foreign | −0.088 | 0.012 | −0.013 | |||||||||

| −0.13 | −0.06 | −0.09 | ||||||||||

| Gov. Own. | 0.152 | −0.176 *** | −0.316 ** | |||||||||

| −0.11 | −0.05 | −0.12 | ||||||||||

| Financial | 0.122 | 0.284 | −0.032 | |||||||||

| −0.16 | −0.23 | −0.11 | ||||||||||

| Cross-listed | −0.152 | 0.158 | 0.137 | |||||||||

| −0.14 | −0.11 | −0.11 | ||||||||||

| Constant | 4.015 ** | 3.521 *** | 3.069 ** | 2.745 ** | 3.665 *** | 4.135 *** | 3.596 *** | 4.874 *** | −2.772 | −2.998 | −3.145 * | −2.242 |

| −1.69 | −1.13 | −1.27 | −1.12 | −1.16 | −1.08 | −1.02 | −1.14 | −1.69 | −1.79 | −1.57 | −1.83 | |

| Borr. Cont. | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Loan Cont. | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Ind. Cont. | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Cont. | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Obs. | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 | 278 |

| R-Sq. | 0.655 | 0.654 | 0.654 | 0.657 | 0.676 | 0.678 | 0.682 | 0.681 | 0.78 | 0.782 | 0.78 | 0.781 |

| Adj. R-Sq. | 0.597 | 0.596 | 0.595 | 0.599 | 0.621 | 0.623 | 0.628 | 0.627 | 0.743 | 0.745 | 0.743 | 0.744 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Küllü, A.M.; Raymar, S. Groups, Pricing, and Cost of Debt: Evidence from Turkey. J. Risk Financial Manag. 2018, 11, 14. https://doi.org/10.3390/jrfm11010014

Küllü AM, Raymar S. Groups, Pricing, and Cost of Debt: Evidence from Turkey. Journal of Risk and Financial Management. 2018; 11(1):14. https://doi.org/10.3390/jrfm11010014

Chicago/Turabian StyleKüllü, A. Melih, and Steven Raymar. 2018. "Groups, Pricing, and Cost of Debt: Evidence from Turkey" Journal of Risk and Financial Management 11, no. 1: 14. https://doi.org/10.3390/jrfm11010014

APA StyleKüllü, A. M., & Raymar, S. (2018). Groups, Pricing, and Cost of Debt: Evidence from Turkey. Journal of Risk and Financial Management, 11(1), 14. https://doi.org/10.3390/jrfm11010014