Abstract

In response to the recent global financial crisis, the regulatory authorities in many countries have imposed stringent capital requirements in the form of the BASEL III Accord to ensure financial stability. On the other hand, bankers have criticized new regulation on the ground that it would enhance the cost of funds for bank borrowers and deteriorate the bank profitability. In this study, we examine the impact of capital requirements on the cost of financial intermediation and bank profitability using a panel dataset of 32 Bangladeshi banks over the period from 2000 to 2015. By employing a dynamic panel generalized method of moments (GMM) estimator, we find robust evidence that higher bank regulatory capital ratios reduce the cost of financial intermediation and increase bank profitability. The results hold when we use equity to total assets ratio as an alternative measure of bank capital. We also observe that switching from BASEL I to BASEL II has no measurable impact on the cost of financial intermediation and bank profitability in Bangladesh. In the empirical analysis, we further observe that higher bank management and cost efficiencies are associated with the lower cost of financial intermediation and higher bank profitability. These results have important implications for bank regulators, academicians, and bankers.

Keywords:

cost of intermediation; profitability; capital regulation; cost inefficiency; GMM estimation JEL Classifications:

G21; G32; D61; C2

1. Introduction

In this paper, we examine the impact of regulatory capital requirements on the cost of financial intermediation and the performance of Bangladeshi banks.

The first risk-based capital regulation, Basel-I Accord, was agreed by the Basel Committee on Banking Supervision (BCBS) in 1988. Basel-I mainly focused on bank credit risk and linked minimum capital requirements to the bank assets portfolio risk. Later on, Basel-II Accord was finalized in 2004 to overcome the shortcomings of Basel-I and to make risk-based capital regulation more effective. Several countries had incorporated Basel II guidelines in their national capital regulations while others were planning to do so that the global financial crisis hit the banking sectors throughout the world in 2008. This mega adverse banking event raised the questions against the viability of Basel-based capital regulation. In response, the Basel Committee on Banking Supervision (BCBS) issued a new Basel III Accord in 2010 in which, both the quantity and quality of regulatory capital requirements have been improved to ensure the future financial stability.

Since 1996, the Bangladesh Bank (BB) has adopted a risk-based capital regulation for Bangladeshi banks in line with the guidelines of Basel Accords. BB has revised risk-based capital regulation time-to-time to update it according to the amendments in the Basel Accords.

Although the capital regulation is likely to reduce the probability of the occurrence of future banking crises and arguably has been justified to avoid the forestalled losses (in terms of the level of GDP) caused by the financial crises [1,2,3], the regulation is not free of criticisms. The impact of capital regulation on the cost of bank credit and bank profitability is under severe debate.

The opponents (i.e., bankers and some academicians) of the regulation argue that holding higher capital would jeopardize the banks’ability to lend and would adversely affect the economic output [4,5,6]. For example, the Institute of International Finance [4] representing over 400 financial institutions across the world, predicted that the price of credit in the United States would be almost 5 percentage points higher as a result of the regulatory changes proposed by Basel III, while the GDP in the major economies would be about 3 percent smaller than they would be without the effects of comprehensive financial reforms. Similarly, Wong, Fong, Li and Choi [5] found that, for Hong Kong, a 1% increase in capital will reduce output by 4.2 basis points in the long run. In this context, Miles et al. [7] identify that the changes in capital may affect economic activity through their effect on the cost of financial intermediation. Based on the standard corporate finance theory of capital structure, bank equity is an expensive source of funding and a percentage increase in equity increases the overall weighted average cost of capital (WACC) for the banks. Consequently, the banks pass on this cost to the borrowers by charging higher interest rates on loans. Through this channel, if all else is equal, the higher capital requirements would translate into the higher cost of financial intermediation, which would, in turn, reduce the demand for bank loans because the borrowers are less likely to borrow expensive bank loans.

In contrast, the proponents of the regulation argue that the impact of new regulation would be small. This literature takes into account another aspect of the capital structure theory, the bankruptcy costs, and argues that bank shareholders would not always require a higher return on equity for well-capitalized banks and may indeed reduce their required return. The underlying logic is straightforward. With the increase in bank capital, the probability of bank default becomes remote, and the banks are considered safer. As a result, the shareholders’ risk-adjusted required return on equity would decrease. Another factor which is likely to neutralize the effect of capital requirements on the cost of financial intermediation is capital buffers. Banks usually hold higher capital than the minimum regulatory requirements, and a further increase in regulatory capital would not translate into the exactly equal increase in bank capital due to the capital buffers. As found earlier, the banks could respond to a tightening in capital requirements by partially cutting their capital buffers [6]. There are also other reasons to believe that the stringent regulatory capital requirements would have less effect on the cost of financial intermediation such as that banks would keep higher capital to get better credit ratings and a good share price in the stock market.

Building on this debate, we ask the question ‘How has the implementation of stringent capital requirements affected the cost of financial intermediation in Bangladesh?’

Similarly, the impact of strict capital regulation on bank profitability is uncertain. On the one hand, higher capital levels may adversely affect bank profits by reducing the debt in capital structure and, consequently, the tax shield provided by the deductibility of interest payments on the debt. Another way the higher capital requirements may reduce bank profits is that banks would reduce risk weighted assets to increase capital adequacy ratios [8]. A decrease in risk-weighted assets which are also considered interest earning assets would jeopardize banks’ earning capacity. While on the other hand, stringent capital regulation may encourage banks to be efficient by reducing operating costs, restructuring business activities, monitoring bank loans and rationing poor credit quality loans [9]. Further, banks may maintain higher capital levels to signal future better earnings prospects [10]. Both of these factors would result in higher capital ratios ahead of higher profitability. Thus, our second research question is ‘What is the impact of stringent capital requirements on the bank profitability in Bangladesh?’

To answer these two questions, we use a panel dataset of 32 Bangladeshi banks over the period from 2000 to 2015. By employing a dynamic panel generalized method of moments (GMM) estimator, we find robust evidence that higher regulatory capital ratios reduce the cost of financial intermediation and increase bank profitability. We apply several robustness tests to confirm these results.

Our study contributes to the literature in at least four ways: First, this study is the first that examines the impact of capital regulation on the banks’ cost of financial intermediation and profitability for Bangladesh and South Asian countries as well. Over the last two decades, the banking sector of Bangladesh has undergone several capital regulation reforms and is an ideal laboratory to examine our hypothesis. Bangladesh is an important emerging economy and findings reported here can be generalized to other developing and emerging economies with a similar economic condition. Moreover, in this debate, Bangladesh is a central benchmark economy because in the post-millennium period their consistent economic growth on an above 6% as well as reflect the Basel II (2007) and partial Basel III (2014–15) implementation effect on the 16 years sample period.

Second, this study examines the impact of capital requirements on the cost of financial intermediation and complements the recent studies. For example, Naceur and Kandil [11] examine the Egyptian bank, Soedarmono and Tarazi [12] consider publicly traded banks in Asia, and Maudos and Solís [13] examine Mexican banks and find a positive association between capital ratios and banks’ cost of financial intermediation. In contrast, Afzal and Mirza [14] consider the Pakistani banks and find a negative relationship. Our study adds to this literature by carrying out an analysis of Bangladeshi banking sector.

Third, we examine the impact of capital regulation on bank profitability and complement the studies such as Casu et al. [15] for Asian banks, Naceur and Kandil [11] for Egyptian banks, and Goddard et al. [16] and Altunbas et al. [17] for European countries and Ozili [18] for African banks. Among these studies, some find a positive association between bank capital and profitability some find a negative association, while some find mixed results. We add to this debate by examining the impact of capital on Bangladeshi banks.

Fourth, we include an influential variable off-balance activity (offsba) which was ignored in previous literature regarding the impact on the cost of intermediation.

2. Review of Related Literature

This study builds on two related strands of the existing literature. Among these, the first strand of the literature examines the impact of capital requirements on the banks’ cost of financial intermediation, while the second strand investigates the impact of capital requirements on bank profitability. Below is a brief review of both types of studies:

2.1. Bank Capital and the Cost of Financial Intermediation

The banking sector intermediates between savers (those who have excess funds) and borrowers (those who need funds) and thus play a crucial role in resource allocation and, consequently, the economic development of an economy [19]. The effectiveness of banking sector largely depends on the cost of financial intermediation. Typically, the banking sectors in developing countries demonstrate significantly higher and persistent interest spreads as compared to the interest spreads in developed countries [19,20,21]. From the 1970s until the start of the current century, many developing countries, such as in Asia, Latin America and Africa, implemented financial sector liberalization reforms to foster competition and efficiency in banking sectors [22]. However, previous literature suggests that developing countries are still categorized by banks’ high cost of intermediation after the implementation of costly capital reforms and remain several financial management systems problems in the cost of financial intermediaries because of financial underdevelopment [23]. Similarly, Tennant and Folawewo [24] concluded that among the developing economies middle and lower-income countries found significantly high bank interest margin due to the absence of financial development. Thus, the impact of bank capital on the cost of intermediation for developed and developing countries differences mainly causes the level of financial development among the other factors.

Several studies have examined the impact of these liberalization reforms on the cost of financial intermediation. For example, Demirguc-Kunt et al. [25] study the influence of bank regulations, banking industry concentration and institutional development on banks’ intermediation cost. They find that higher entry barriers and stringent banking regulations force banks to charge higher net interest margins. In another study, Demirgüç-Kunt and Huizinga [26] find a similar evidence that deregulation decreases bank net interest margins. Similarly, Ashraf [27] find that openness of emerging economies to international trade and capital flows can promote banking sector liberalization reforms and result in lower bank net interest margins.

However, in the aftermath of the global financial crisis of 2008, a new wave of re-regulation has captured the momentum. Basel III Accord was agreed by banking regulators in 2010 which specifically requires the banks to maintain higher capital ratios. In this context, the capital regulation and its impact on the cost of financial intermediation is under severe debate. For example, Miles, Yang and Marcheggiano [7] identify that the changes in capital may affect economic activity through their effect on the cost of financial intermediation.

In this direction, existing is largely inconclusive and reports both positive and negative impact of capital on the cost of financial intermediation. For instance, Naceur and Kandil [11] examine the Egyptian bank and find that higher capital ratios are positively associated with banks’ cost of financial intermediation. Soedarmono and Tarazi [12] consider publicly traded banks in Asia and Maudos and Solís [13] examine Mexican banks and find a similar positive association between capital ratios and banks’ cost of financial intermediation. In contrast, some studies, such as Afzal and Mirza [14] who consider Pakistani banks, have found a negative relationship. (See more detail of this literature in Table A1). In this study, we carry out an analysis to investigate the impact capital ratios on the banks’ cost of financial intermediation using the data of all Bangladeshi commercial banks.

H11:

Capital regulation has a significance adverse effect on the cost of intermediation.

2.2. Bank Capital and Profitability

The impact of higher capital on bank returns is uncertain. Traditional wisdom suggests a negative impact; that is, a higher level of capital in capital structure tends to reduce the risk of equity and therefore lowers the equilibrium expected a required return by the investors. Additionally, a higherlevel of capital reduces the interest payments and, consequently, lowers the bank returns by decreasing the tax shield provided by the interest deductibility. However, alternative explanations suggest a positive impact of capital on bank returns. For example, Berger [10] argue that higher capital may result in higher expected bank returns due to lower expected bankruptcy costs. Further, banks might maintain higher capital ratios to signal their future better performance. Thus, higher capital ratios might granger cause higher profitability ratios.

Existing empirical literature reports both negative and positive [11,15,28,29,30,31,32,33,34,35] impact of capital on bank earnings and is largely inconclusive. For example, Berger [10] find that the capital positively granger-causes the earnings of U.S. commercial banks over the period from 1983–1989. Iannotta, Nocera and Sironi [32] use a sample of 15 European countries and find a significant positive relationship between regulatory capital ratios and two indicators of bank performance. Similarly, Lee and Hsieh [34] examine a sample of banks from Asian countries and find that capital ratios are positively correlated with bank returns1. Demirguc-Kunt et al. [42] conclude that higher capital ratios have a positive effect on bank stock returns during the global financial crisis 2007–2008.

Contrary, some other studies either find negative or mix results. For example, Goddard, Liu, Molyneux and Wilson [16] explore a sample of banks from eight European countries and find a negative relationship between capital and profitability ratios. Similarly, Altunbas, Carbo, Gardener and Molyneux [17] examine that well-capitalized banks in Europe are inefficient. Ozili [18] examine a sample of African banks and conclude that regulatory capital has a significant and positive impact on profits of listed banks, while higher regulatory capital thresholds have an adverse impact on theprofits of non-listed banks. (See more literature in Table A2).

This inconclusive empirical evidence warrants further investigation of this important issue. In this study, we contribute to this debate by analyzing the impact of capital ratios on Bangladeshi bank profits.

H12:

There is a significant positive relationship between capital regulation and profitability.

3. Banking Industry Landscape in Bangladesh

At the time of liberation in 1971, the banking sector in Bangladesh had only eleven banks, including two state-owned specialized banks, six nationalized commercialized banks and three Foreign Banks. The industry started expanding in the 1980s when the private commercial banks were allowed to operate. Presently, banks in Bangladesh are mainly of two types: (i) Scheduled Banks: Those banks which get a license to operate under Bank Company Act, 1991 (Amended up to 2013). (ii) Non-Scheduled Banks: The banks which are established for particular and definite objective and operate under the acts that are enacted for meeting up those objectives. These banks cannot perform all functions of scheduled banks.

On 31 December 2016, there were 56 scheduled banks which operate under the supervision of Bangladesh Bank2, as per Bangladesh Bank Order, 1972 and Bank Company Act, 1991. The scheduled banks are classified into four major categories: State Owned Commercial Banks (SOCBs), Specialized Development Banks (SDBs), Private Commercial Banks (PCBs) and Foreign Commercial Banks (FCBs). Currently, there are 4 SOCBs which are wholly owned by the Government of Bangladesh. There are 4 SDBs which have been established to serve the specific objectives, such as the agricultural and industrial development. These banks are majorly owned by the Government of Bangladesh. There are 39 PCBs majorly owned by the shareholders and institutional owners. PCBs are further classified into two sub- groups: 31 conventional PCBs and 8 Islamic Shariah-based PCBs. Conventional PCBs function in a conventional manner where all transactions are madeon the base of interest rate. In contrast, Islamic Shariah-based PCBs follow Islamic Shariah principles where the transactionsare made on the base of profit-loss sharing policy. These are nine FCBs which work as the branches of international banks. On 31 December 2015, 56 scheduled banks had 9397 branches throughout the country3. In total, 30 banks are listed while 26 banks are non-listed. Moreover, there are three co-operative banks and one micro-finance bank (Grameen Bank) operating in Bangladesh.

Table 1 shows that the overall assets of banking industry amounted to BDT (the local currency of Bangladesh) 10,314.6 billion in 2015. The assets have observed an increase of 839.27 percent over the sample period. Similarly, the deposits grew by 858.50 percent from 2000, and the overall deposits in 2014 show BDT 7928.6 billion.

Table 1.

Banking Scenario of Bangladesh.

To ensure financial stability, the Guidelines on Risk-Based Capital Adequacy (RBCA) for banks has been introduced from 1 January 2009 (BRPD Circular No. 9) parallel to existing BRPD Circular No. 10, dated 25 November 2002. These guidelines are prepared based on BASEL II which has come fully into force on 1 January 2010 with its successive supplements. As per BASEL II, banks in Bangladesh maintain the Minimum Capital Requirement (MCR) or Capital Adequacy Ratio (CAR) at 10% of the Risk Weighted Assets (RWA) or Taka 4000 million in capitals, whichever is higher. According to Supervisory Review Process (SRP), banks are directed to maintain a sufficient level of capital which is greater than the minimum required capital and cover all possible risks in their business.

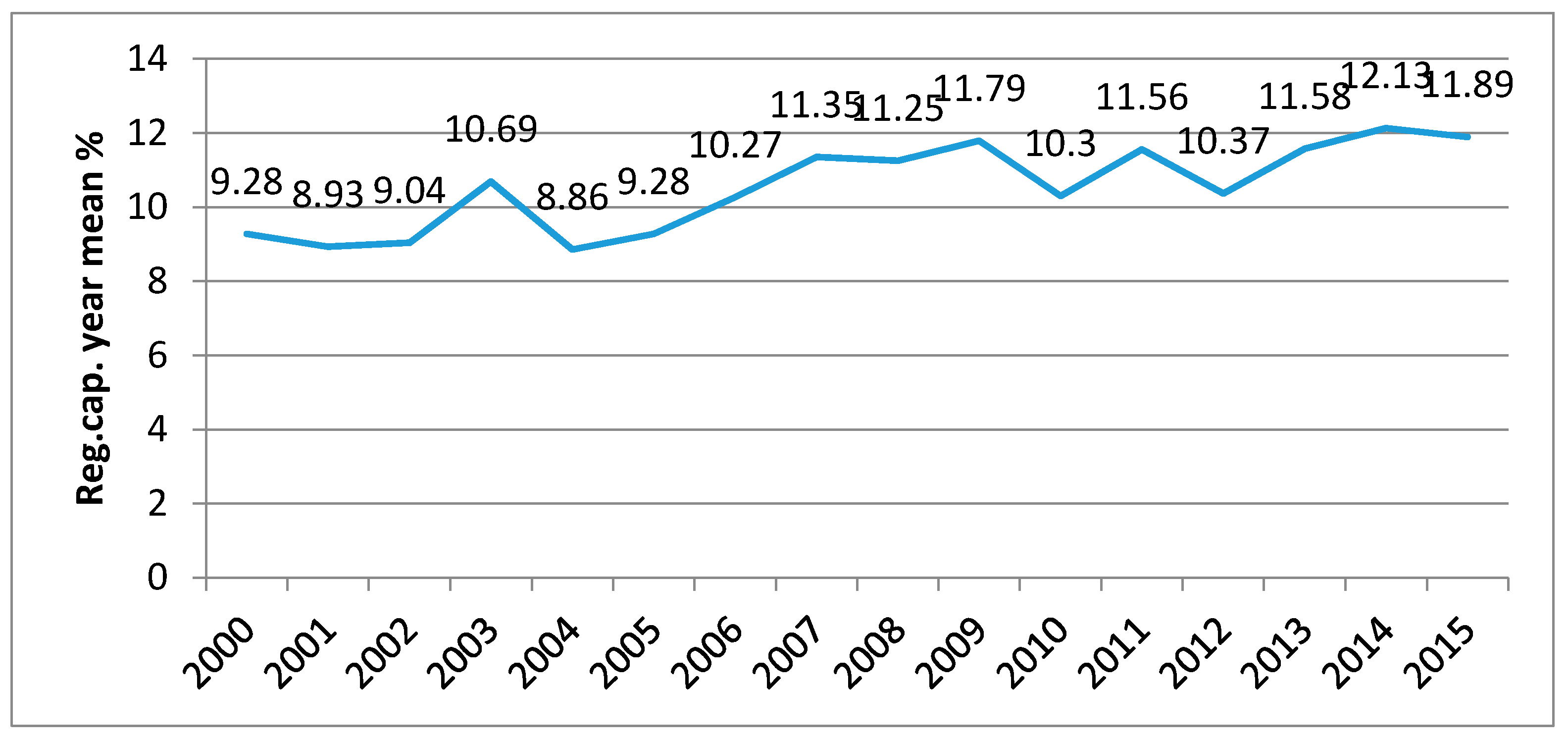

According to the Bangladesh Bank annual report, the State-owned Commercial Banks (SCBs), Development Financing Institutions (DFIs), Private Commercial Banks (PCBs) and Foreign Commercial Banks (FCBs) maintained CAR of 6.4, −34.01, 12.40, and 25.60 percent, respectively, on 31 December 2015. But only for 6 banks (including 2 SCBs, 2 PCBs, and 2 DFIs), the CAR was below regulatory minimum limits. Figure 1 shows the trend of the CAR of the banking industry. It was 11.89 percent at the end of December 2015 as against 9.28 percent at the start of the sample period. The foremost reason for an upsurge in CAR in 2014 was the enactment of a newly revised policy on loan rescheduling (BRPD Circular no.15/2013).

Figure 1.

Annual average capital adequacy ratios of all banks.

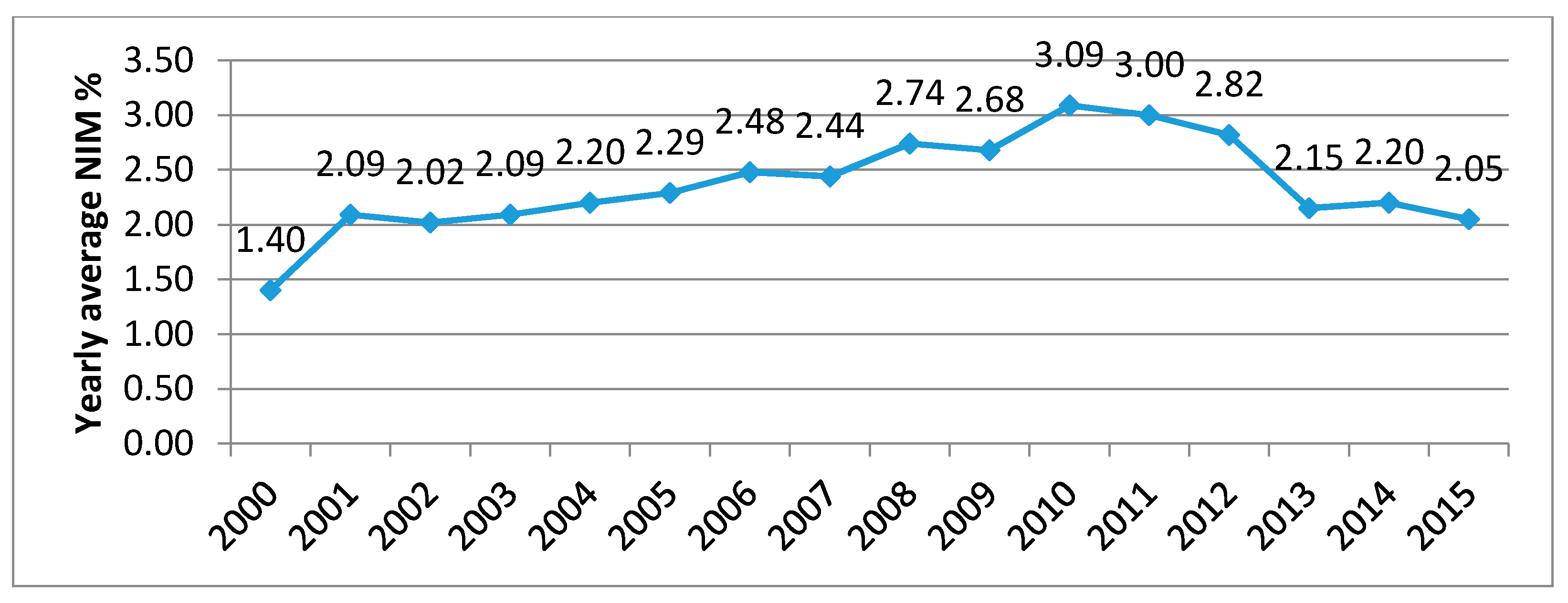

Figure 2 shows a trend of average net interest margins in Bangladeshi banking sector. As shown, the average margins increased from 2000 to 2010, however they decrease after 2010.

Figure 2.

The average yearly net interest margin of all banks.

As mentioned earlier, Bangladesh Bank has recently circulated a road map to implement Basel III capital accord (BRPD Circular No. 7, March 2014) as shown in Table 2.

Table 2.

Phase-in Arrangement of Minimum Capital Requirements (Basel III).

Moreover, Bangladesh Bank provides the instructions that the new regulation will be adopted in a phased manner starting from the January 2015 and the full implementation in 2019. Banks will maintain a common equity tier 1 capita ratio of at least 4.5% of the total RWA, tier 1 capital ratio of at least 6.0% of the total RWA and minimum CAR of 10% of the total RWA. In addition to minimum CAR, Capital Conservation Buffer (CCB) of 2.5% of the total RWA is being introduced which will be maintained in the form of CET1.

4. Econometric Model and Regression Analysis

4.1. Sample

The data used in this study was mainly collected from the Bureau Van Dijk’s Bank Scope database. Additionally, to fill missing values in data, we also collected data from the published annual consolidated financial statements of the banks. Our final sample is an unbalanced panel comprising 469 annual observations for 32 banks over the period 2000–2015. The below Table 3 is a detail description of variables that we have employed in our study.

Table 3.

Description of the Variables.

4.2. Variables Definitions

4.2.1. Main Dependent Variables

We use two alternative proxies to measure the cost of financial intermediation: the ratio of net interest revenue over average interest-bearing assets (nim1) and the ratio of net interest income over average total assets (nim2). Higher values of both of these measures represent the higher cost of financial intermediation and vice versa.

The bank profitability is also proxied by two alternative measures: the ratio of pre-tax profit to average total assets (roa1) and the ratio of pre-tax profit to average total earning assets (roa2). Higher values of both of these measures represent higher profitability and vice versa.

4.2.2. Main Independent Variables

We use three proxies to measure bank capital: first is the ratio of regulatory capital to total risk-weighted assets (car). Second is the ratio of shareholders equity to bank total assets (oetta). These variables have been widely used in the literature to measure bank capital [49,50]. The impact of both of these variables on the banks’ cost of financial intermediation and profitability is uncertain, as described in Section 2.

Third is a dummy variable to test the effects of the implementation of Basel II accord (capd). Since the Basel II Accord was implemented in 2007 in Bangladesh, the dummy variable equals 0 up to 2006 and 1 after that. If the switching to Basel II capital regulation impacts the banks’ cost of intermediation and profitability, then we expect a statistically significant coefficient on this dummy variable.

4.2.3. Control Variables

We include several other variables to control for the effects that can impact the banks’ cost of financial intermediation and profitability in addition to bank capital.

Management efficiency (maneff) is measured as the ratio of earning assets to total assets. The higher the ratio, the greater the management efficiency is. Efficient management can manage funds more effectively and we expect a lower cost of intermediation. Further, a better-managed bank is more likely to be more profitable. Thus, we expect a negative association between with the cost of intermediation and positive with banks’ performance.

Income diversification (id) is calculated as the annual noninterest income over total operating income. This variable represents the portion of revenue generated from other activities except interest-based investments. Higher non-interest income releases the pressure on interest income. So we expect a negative association between the non-interest income and the cost of financial intermediation.

The level of financial intermediation (find) is measured as the annual total gross loans to total deposits ratio. The higher levels of financial intermediation would increase the bank profits; however, it is only possible if banks reduce the cost of financial intermediation. Thus, we expect a negative relationship with the cost of intermediation and positive with performance.

Cost inefficiency (costineff) is measured using the stochastic frontier analysis (SFA). SFA approach takes into account different aspects of bank inefficiency and is considered better to measure firms’ inefficiency [51]. Cost-inefficient banks would pass on higher costs to customers and are likely to have a higher cost of financial intermediation. Similarly, increased cost would decrease the banks’ profitability. Thus we expect a positive impact of cost inefficiency on the cost of intermediation and a negative on performance.

Bank size (size) is measured with the log of annual total assets of each bank. The impact of size on the cost of financial intermediation is uncertain. On the one hand, big banks enjoy the economies of scale [52] and can charge lower margins on loans. On the other hand, big banks have the monopoly power which enables them to charge higher margins. Existing literature also reports a mixed evidence; some studies found economies of scale for large banks [52] while others found the diseconomies of scale [53]. For exposition purposes, we expect a negative impact of bank size on intermediation cost.

Off-balance activities (offsba) are measured as the amount of off-balance sheet operations to total assets ratio. Off-balance activities ease pressure on interest income and help banks to charge lower interests on loans. Off-balance sheet activities also help banks to raise their earnings without changing the capital structure [54]. We expect a negative relationship between off-balance sheet activities and intermediation cost.

Leverage (lev) is calculated as the annual total liabilities over total assets. We include leverage in profit equation. Higher leverage might both benefit and cost the banks. Since interest payments provide tax shield, the higher leverage might increase profit. In contrast, higher interest payments on debt linked with higher leverage put pressure on bank income. Thus the impact of leverage on bank profitability is uncertain. Labor efficiency (hreff) is measured as the bank income per employee. Higher values imply greaterlaborefficiency and profit earnings capacity of the bank. We expect a positive relationship with banks’ performance.

Implicit cost (implicost) is measured as the annual non-interest expenses to non-interest income ratio. The Higherimplicit cost would reduce bank profits.

4.2.4. Instrumental Variables

This study uses dynamic panel systems GMM estimation for the main specification. We observed some variables, called the instruments that are correlated with the outcomes and we assume that these instrumental variables have no causal effect on the outcome and treatment. So if the instruments have the clear correlation with the outcome, it’s because the treatment really did have an effect. The instrumental variables have some requirements as it should be correlated with the regressors, uncorrelated with the error term and not have a direct cause of dependent variable. As our equations are over-identified, we have more instruments than endogenous variables. In the case of cost of intermediation, the lag of dependent variable, leverage, labor efficiency, and implicit cost consider as instrumental variables along with regressors. For profitability model, the lag of dependent variable, income diversification, bank size, off-balance activities and regressors act as instrumental variables in our model. Variables names are reported in Table 3. Sargan test and Arellano–Bond first and second order correlation justify the authenticity and reliability of our findings.

4.3. Empirical Methodology

In this study, our main objective is to examine the impact of capital requirements on the banks’ cost of financial intermediation and profitability. We specify following baseline dynamic panel empirical model.

Here, i subscript represents the bank and t shows the year. Xi,t accounts for the dependent variables. We use different proxies of the banks’ cost of financial intermediation and profitability as dependent variables in alternative models. Xi,t−1 is the one period lag of the cost of intermediation and profitability, where the coefficient, δ, shows the speed of adjustment to equilibrium. The lag of dependent variable is introduced as an explanatory variable to account for the persistent in banks’ cost of financial intermediation and profitability. C is a constant term. Yi,t with superscript b denotes the bank-specific control variables, where management efficiency (maneff), the level of financial intermediation (find), cost inefficiency (costineff) are included in all models. In addition, income diversification (id), bank size (size) and off-balance sheet activities (offsba) are also included when the dependent variable is the banks’ cost of financial intermediation. Similarly, leverage (lev), labor efficiency (hreff) and implicit cost (implicost) are included as additional control variables when the dependent variable is bank profitability.

We use three alternative measures of capital regulation as main independent variable in alternative models as follows:

CAR is the regulatory capital to total risk-weighted assets ratio.

OETTA is the owners’ equity to total assets.

CAPD is a dummy variable equals 0 up to 2006 and 1 after that representing the years of the implementation of Basel II in Bangladesh.

Estimation of a dynamic model with standard OLS is not efficient because the estimated value of lagged coefficient is upward biased due to the correlation between the fixed effects and the lagged dependent variable [55]. Similarly, the estimated value would be downward biased if fixed effects model is employed (see Baltagi [56] for details). In such case, the generalized method of moments (GMM) developed by Arellano and Bond [57], Arellano and Bover [58] and Blundell and Bond [59] is deemed better. GMM approach provides estimates between OLS and fixed effects and is considered superior to dynamic panel models [60]. This method also helps to control for potential endogeneity between variables [61]. Two variations are available for GMM estimator: differenced GMM estimator and system GMM estimator. The differenced GMM, developed by Arellano and Bond [57], involves only lagged levels of Xi,t−1 as instruments in the first-differenced equation, the system GMM estimator, developed by Arellano and Bover [58] and Blundell and Bond [59], employs a system of first-differenced and level equations, where lags of levels and lags of the first differences are employed as instruments. In this study, we apply two-step system GMM estimator to estimate our models. We employ finite-sample correction [62] to report standard errors of the two-step estimation.

In this study, we tested the potential endogeneity through Eviews-8 in two ways: first, generating error term series of endogenous variables like the endogeneity of (nim1), (roa1) and (eroa1) then also in reverse (roa1), (nim1) and (enim1). Second, we check our first test validity with the option of regressor endogeneity test by converting the dataset in undated/unstructured. The null hypothesis is no endogeneity, and we accept the null hypothesis in the case of (oetta) as a proxy of capital regulation with the cost of intermediation. Similarly, we accept the null hypothesis in the case of (oetta) and (capd) as a proxy of capital with profitability. Moreover, we have performed the LM serial correlation test and White heteroskedasticity test. The null of LM and white test is there is no such in the model, and we reject the null across all models in our study. That leads us to run the regression with system GMM to ensure the trustworthiness of our findings. Finally, we have tested the Hausman fixed/random effect, and we accept the null of random effect exist in our model.

For calculating cost inefficiency, we use SFA developing the following model.

Here, the dependent variable is total cost (TC), which is defined as the sum of total interest and operating expenses. In the specification of the inputs and outputs, we follow the intermediation approach and specify input prices (p) as the price of labor (PL), the price of fixed asset (PF), and the price of funds (PF)5. The outputs (Y) are defined as total loans (TN) and other earning assets (OEA) [15].

4.4. Empirical Results

4.4.1. Summary Statistics and Correlations

Table 4 reports summary statistics of all variables. The mean value of the cost of financial intermediation variable (nim1) is 2% with a minimum value of −2% and a maximum of 7%. This statistics shows that some banks are unable to recover interest expense of deposits through the interest on lending activities. Likewise, the mean value of bank profitability variable (roa1) is 2% with a minimum value of −15% and a maximum of 8%. This shows some banks are making losses especially some state-owned banks in Bangladesh have negative profits6. Average capital adequacy ratio (car) is 10.64%, which is higher than the minimum requirements as stipulated in Basel II Accord. Negative minimum capital ratios indicate that some banks have negative capital as well. The mean value of owners’ equity to total assets (oetta) is 7%, but it is surprising that here minimum is negative. Banks with negative (oetta) are considered insolvent, and they may require assistance from bank regulators or the lender of last resort [12]. Other variables also show considerable variation across mean values.

Table 4.

Descriptive Statistics.

Table 5 reports Pearson correlations between variables. The correlation between (car) and (oetta) variables is 0.69, which shows that two alternative independent variables, to some extent, measure different aspects of bank capital. Correlations between other variables are also not that high, which suggests that the issue of multicollinearity is not undermining our result7.

Table 5.

Correlations between main variables.

4.4.2. The Determinants of the Banks’ Cost of Intermediation

Table 6 reports results when (nim1) representing the cost of financial intermediation is used as dependent variable in Equations (2)–(4). (nim1) is measured as the ratio of annual net interest revenue to average interest-bearing assets of a bank. (car), (oetta) and (capd) are main independent variables.

Table 6.

Determinants of Cost of Intermediation a.

The lagged dependent variable is statistically significant across all models, indicating a high level of persistence characterizing the cost of intermediation and justifying the presence of autocorrelation in models.

For main independent variables, capital adequacy ratio (car) in first model and equity to total assets ratio (oetta) in the secondmodel enter negative and statistically significant. These results suggest that well-capitalized banks have a lower cost of financial intermediation in Bangladesh. These findings don’t support the view [11,12,13,66] that higher amount of expensive capital in overall bank capital structure would force banks to increase intermediation costs. In contrast, these results support the view [67] that well capitalized banks due to having lower default risk can benefit from lower funding costs and would not always charge higher intermediation cost.

In the third model, we find an insignificant relation between capital dummy (capd) and net interest margins. One reason behind this finding may be that the Basel II application from 1 January 2007, was voluntary, and not mandatory in Bangladeshi banking sector. It became mandatory only from 1 January 2010. So Basel II implementation has no significant impact on the banks’ cost of intermediation.

Results of control variables are largely consistent with our expectation. Management efficiency enters negative and significant in all models, indicating that efficient management team helps banks to charge lower intermediation cost.

Similarly, income diversification variable comes negative and statistically significant in all models suggesting that diversification in non-lending activities ease pressure on lending activities and enable banks to charge lower margins on loans.

Financial intermediation enters positive and statistically significant in all models. These results suggest that the banks which extend more loans as a percentage of deposits earn higher margins and are consistent with some earlier studies [11,44].

Consistent with the expectation, the cost inefficiency has a positive and statistically significant effect on the cost of intermediation across all three models. These results indicate that inefficient banks pass on higher costs to customers by charging higher intermediation costs.

Bank size has a significant adverse effect on the cost of intermediation. This reveals that large banks enjoy economies of scale and can charge the lower cost of financial intermediation as compared to their small counterparts.

Off-balance sheet activities show a negative association with intermediation cost. These findings indicate that higher involvement in off-balance activities reduces banks reliance on lending activities and help them to charge lower margins.

Diagnostic tests of two-step system GMM estimator in all models show that models are accurately specified. For example, the p-values of Sargan tests are insignificant, showing that the null hypothesis that instruments are not exogenous is not rejected and confirm that instruments used are valid. Likewise, significant p-values of AR(1) show that there is a first-order serial correlation in residuals, while the insignificant AR(2) p-values confirm that there is no second-order serial correlation in residuals. Similarly, the number of instruments (13 or 14) is quite low as compared to the number of banks (32).

4.4.3. The Determinants of Banks’ Profitability

Table 7 reports results when (roa1) representing the bank performance is used as dependent variable in Equations (2)–(4). (roa1) is measured as the ratio of annual pre-tax profit to average total assets of a bank. Again, (car), (oetta) and (capd) are main independent variables.

Table 7.

Determinants of Bank Profitability b.

The lagged dependent variable is statistically significant across all models except (oetta) and indicates some persistence in banks’ profitability.

For main independent variables, capital adequacy ratio (car) in first model and equity to total assets ratio (oetta) in the secondmodel enter positive and statistically significant. These results suggest that well-capitalized banks are more profitable. These findings don’t support the view that higher amount of expensive capital in overall bank capital structure would jeopardize banks’ performance. In contrast, these results support the view [11,15,28,29,30,31,32,33,34,35] that banks maintain higher capital ratios to signal future better performance.

In the third model, we find an insignificant relation between capital dummy (capd) and bank profits. One reason behind this finding as described earlier also that the Basel II application from 1 January 2007, was voluntary, and not mandatory in Bangladeshi banking sector. It became mandatory only from 1 January 2010.

Results of control variables are largely consistent with our expectation. (nim1) enterspositive and significant showing that banks earning higher margins are more profitable. Efficient management and labor of a bank have significant positive effects on banks’ profitability as shown by positive and significant coefficients on management efficiency (maneff) and labor efficiency (hreff). Similarly, cost inefficiency has a statistically significant negative effect on profitability, showing that higher costs eat up bank revenues leaving very less in profits. Impact of (find) and (lev) variables on bank profitability are not consistent across different models. Results of diagnostic tests are also consistent with expectation and indicate that models are largely accurately specified. The Sargan test statistic is insignificant, AR(1) is significant, AR(2) is insignificant and the number of instruments (13 or 14) are somewhat lower than the number of banks (32).

4.4.4. Robustness Tests: Alternative Proxies of Dependent Variables

We check the robustness of the main results reported above by using the alternative proxies of both dependent variables. (nim2) is used as an alternative measure of banks’ cost of financial intermediation and is calculated as the ratio of annual net interest income to average total assets of a bank. (roa2) is used as an alternative measure of bank profitability and is calculated as the ratio of annual pre-tax profits to average earning assets.

Table 8 and Table 9 reports the robustness results when (nim2) and (roa2), respectively, are used as dependent variables in Equations (2)–(4). As shown the results largely remain same. Two bank capital ratio variables enter negative and significant with the intermediation cost in first two models in Table 8, while the Basel II dummy variable comes insignificant in the thirdmodel. Similarly, two bank capital ratio variables are positive and significant with bank profitability in the first two models in Table 9, while the Basel II dummy variable is insignificant. Results of other control variables also largely remain same. Additionally, the diagnostic tests of system GMM also show that models are accurately specified; the Sargan test statistic is insignificant, AR(1) is significant, AR(2) is insignificant and the number of instruments (13 or 14) are quite lower than the number of banks (32). Together, these results confirm the main results reported in Table 6 and Table 7.

Table 8.

Determinants of Cost of Intermediation c.

Table 9.

Determinants of Bank Profitability d.

4.4.5. Robustness Tests: Check with VECM (Vector Error Correction Model) Analysis

Next, we employ the VECM model to examine the long and short term relationships between main variables. For applying the VECM model, we need to go through four sequential processes [68]; stationarity test, determination of lags, Johansen cointegration test and finally run the VECM. Time series stationarity is the statistical features of a series such as its mean and variance over time. If both are constant over time, then the series is said to be a stationary process (i.e., is not a random walk/has no unit root), otherwise the series is termed as being a non-stationary process (i.e., a random walk/has unit root).

We have tested our variables with ADF (augmented dickey fuller test-fisher type) and none were selected as an option to be included in the test equation. We found that our tested variables are non-stationary at level and stationary after first differencing. Thus, the variables are stationary and integrated of the same order, i.e., I (1). The lag selection criteria led us to select three-period lags for conducting the Johansen cointegration test. In the third step, we performed a cointegration test and found the cointegration between regulatory capital requirement with banks’ cost of intermediation and performance, see Table 10 and Table 11.

Table 10.

Johansen Cointegration Test Regarding Capital and Banks’ Intermediation Cost (Trace and Maximum Eigen value).

Table 11.

Johansen Cointegration Test Regarding Capital and Banks’ Performance (Trace and Maximum Eigen value).

The identified model is a three-variable model which hypothesizes the cost of intermediation (nim1) as a function of capital regulation (car, oetta). Similarly, for banks’ performance (roa1) is a function of capital regulation (car, oetta)

nim1t = f (cart, oettat)

roa1t = f (cart, oettat)

The existence of cointegration between variables recommends a long-term relationship among the variables under consideration. Then, the VECM model can be applied. The long run and short run relationship between capital regulations, the cost of financial intermediation and bank performance of cointegrating vector for the Bangladesh in the period 2000–2015 is displayed below.

VECM model for capital and cost of intermediation

D(NIM1) = C(1)*(NIM1(−1) − 0.0183850414053*CAR(−1) + 1.71628109795*OETTA(−1) + 0.051427523201) + C(2)*D(NIM1(−1)) + C(3)*D(NIM1(−2)) + C(4)*D(CAR(−1)) + C(5)*D(CAR(−2)) + C(6)*D(OETTA(−1)) + C(7)*D(OETTA(−2)) + C(8)

VECM model for capital and performance

D(ROA1) = C(1)*(ROA1(−1) − 0.0115205859267*CAR(−1) + 0.88912554764*OETTA(−1) + 0.0374269333405) + C(2)*D(ROA1(−1)) + C(3)*D(ROA1(−2)) + C(4)*D(CAR(−1)) + C(5)*D(CAR(−2)) + C(6)*D(OETTA(−1)) + C(7)*D(OETTA(−2)) + C(8)

In Table 12, the C(1) regressor is the co-integrated variable that shows us that the long run association exists in the case of capital regulation, the cost of financial intermediation and banks performance. The negative coefficient with 1% level of significant shows a strong long-term bonding within our model [69]. Further, we have employed the Wald test to find out the joint lag short term association between the cost of intermediation (nim1) and banks’ performance (roa1) with capital regulation (car, oetta). This evidence rejects the null hypothesis of C(4)=C(5)=0 and C(6)=C(7)=0 and tell us that there is a short term relationship we can derive from (car) and (oetta) with (nim1). Similarly, we also reject the null hypothesis of C(4)=C(5)=0 that shows a short-term association between (roa1) and (car), but we accept the null hypothesis in case of relationship between (roa1) and (oetta) that tell us there is no short term association in this way. Finally, the F-statistics coefficient and p-value confirm that our model is well fitted without any downward biased. The VECM model findings support our Arellano–Bond order 1 (2) are tests for first (second) order correlation.

Table 12.

Vector Error Correction Model (VECM) Analysis of Capital Regulation, Cost of Financial Intermediation and Banks Performance e.

4.4.6. Robustness Tests: Industry and Macroeconomic Control Variables

Further, we include banking industry concentration and macroeconomic variables to eliminate the concern that our results are not biased due to these omitted variables. Banking industry concentration is measured with Herfindahl index (hhi) where higher values of this index represent higher industry concentration and vice versa. Recent literature finds that competition is detrimental to banking sector [70]. We include inflation and GDP growth as macroeconomic variables. Equations (2)–(4) are re-estimated by adding these three additional control variables with both the cost of intermediation and profitability dependent variables. To further test the robustness of results, we use an alternative method, fixed-effects estimator, to estimate the results in Table 13 and Table 14.

Table 13.

Determinants of Cost of Intermediation f.

Table 14.

Determinants of Bank Profitability g.

As shown, the results remained consistent. Two bank capital ratio variables were shown to be negative and significant with the intermediation cost in first two models in Table 13, while the Basel II dummy variable is insignificant in the thirdmodel. Similarly, two bank capital ratio variables are shown to be positive and significant with bank profitability in first two models in Table 14, while the Basel II dummy variable is insignificant. These results confirm that our main results are not biased due to omitted banking industry or macroeconomic variables.

5. Conclusions

The aim of this paper is to investigate the impact of capital regulation on banks’ cost of intermediation and profitability in Bangladesh.

We measure banks’ cost of financial intermediation with bank annual net interest margins. Bank profitability is measuredbyannual bank return on assets ratios.

Capital regulation is measured with three alternative measures: annual capital adequacy ratio of each bank, annual equity to total ratio of each bank and a dummy variable that captures the structural break marking the implementation of Basel II in 2006 for the banking sector of Bangladesh.

Using a panel dataset of 32 commercial banks over the period 2000–2015, we find robust evidence that higher bank capital ratios reduce the cost of financial intermediation and increase bank profitability. We also observe that switching from BASEL I to BASEL II in 2006 has no measurable impact on the cost of financial intermediation and bank profitability in later years in Bangladesh.

In the empirical analysis, we further observe that bank management, income diversification, size and off-balance activities are negatively associated with the cost of financial intermediation. Similarly, we observe that management and labor efficiencies have a positive impact on banks’ profitability whereas the cost inefficiency, financial intermediation, and implicit cost have a significant adverse effect.

We perform several robustness tests to confirm the main results including the use of alternative proxies of the banks’ cost of financial intermediation and profitability, VECM (Vector Error Correction Model) analysis and finally the fixed-effect model estimations with industry and macroeconomic indicators as additional control variables.

These results have important implications. Bankers and some academics have also criticized capital regulation on the ground that it would enhance the cost of funds for bank borrowers and deteriorate the bank profitability. However, we do not find any evidence of adverse effects of an increase in capital ratios of Bangladeshi banks on their cost of financial intermediation and profitability. In contrast, we find that higher bank capital ratios truly have a statistically significant negative association with bank net interest margins and a positive association with bank profitability. Finally, our findings support the Central Bank’s initiative to enforce capital regulation to ensure the stability and competitiveness of the banking sector in Bangladesh. Hence, Basel III implementation was deemed to be urgently warranted in the banking industry of Bangladesh.

Future research may examine the extensions of our model, including the impact of capital buffers and ownership structures. Last but not least, similar analysis can be conducted for other developed countries, especially the South Asian economies.

Acknowledgments

This paper is funded by the project of National Natural Science Foundation of China (NSFC) (Grant No. 71173077).

Author Contributions

Mohammed Mizanur Rahman and Munni Begum contributed to the conceptualization of the paper and the policy analysis. Mohammed Mizanur Rahman also drafted the paper and performed the empirical analysis. Changjun Zheng contributed to idea generation, and Badar Nadeem Ashraf helped to improve the draft and empirical analysis in revisions of the journal.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Literature on Capital and the Cost of Intermediation.

| Author’s | Methodologies | Findings |

|---|---|---|

| Naceur and Kandil [11] | One-step GMM (consider the data from 1989–2004 in Egypt) | Higher capital adequacy requirements increase the cost of intermediation. |

| Santos [71] | A review of the literature | Increase regulatory pressure induces the overhead cost resulting increase net interest margin. |

| Jackson et al. [72] | A review of the literature | Stringent capital requirements may have had the effect of constraining bank lending behavior. |

| Barajas et al. [20] | 3SLS, OLS (consider the data from 1974–1996 in Colombia) | No changes in interest rates spread between pre-liberalization (1974–1988) and post-liberalization (1991–1996) periods. |

Table A2.

Literature on Capital and Banks’ Profitability.

| Author’s | Methodologies | Findings |

|---|---|---|

| Dietrich and Wanzenried [73] | GMM estimation (consider the data from 1999–2009 in Switzerland) | The link to be absent (before the global crisis 2007–2008) and negative during the crisis. |

| Chiuri et al. [74] | OLS panel regression | Higher capital requirement induce a reduction in bad loan supply foster performance. |

| Pasiouras and Kosmidou [75] | Fixed Effects Regression (consider the data from 1995–2001 in Europe) | Capital is positively related to profitability. Capital is the most significant determinant of profitability. |

| Naceur and Omran [76] | GMM estimation (consider the data from 1989–2005 in Africa) | Bank capitalization has a significant positive impact on profitability. |

References

- Basel Committee on Banking Supervision. An Assessment of the Long-Term Impact of Stronger Capital and Liquidity. Basel: Bank for International Settlements (BIS), 2010. [Google Scholar]

- Paolo Angelini, Laurent Clerc, Vasco Cúrdia, Leonardo Gambacorta, Andrea Gerali, Alberto Locarno, Roberto Motto, Werner Roeger, Skander Van den Heuvel, and Jan Vlček. “Basel III: Long-Term Impact on Economic Performance and Fluctuations.” The Manchester School 83 (2015): 217–51. [Google Scholar] [CrossRef]

- Meilan Yan, Maximilian J. B. Hall, and Paul Turner. “A Cost–Benefit Analysis of Basel III: Some Evidence from the UK.” International Review of Financial Analysis 25 (2012): 73–82. [Google Scholar] [CrossRef]

- Institute of International Finance. The Cumulative Impact on the Global Economy of Changes in the Financial Regulatory Framework. Washington: Institute of International Finance, 2011. [Google Scholar]

- T. C. Wong, Tom Fong, Ka-Fai Li, and Henry Choi. An Assessment of the Long-Term Economic Impact of the New Regulatory Reform on Hong Kong; Hong Kong: Hong Kong Monetary Authority, 2010.

- Patrick Slovik, and Boris Cournède. Macroeconomic Impact of Basel III. Paris: Organization for Economic Co-Operation and Development, 2011. [Google Scholar]

- David Miles, Jing Yang, and Gilberto Marcheggiano. “Optimal Bank Capital.” The Economic Journal 123 (2013): 1–37. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf, Sidra Arshad, and Yuancheng Hu. “Capital Regulation and Bank Risk-Taking Behavior: Evidence from Pakistan.” International Journal of Financial Studies 4 (2016): 16. [Google Scholar] [CrossRef]

- Mr Andre Santos, and Douglas Elliott. Estimating the Costs of Financial Regulation. Washington: International Monetary Fund, 2012. [Google Scholar]

- Allen N. Berger. “The Profit-Structure Relationship in Banking—Tests of Market-Power and Efficient-Structure Hypotheses.” Journal of Money, Credit and Banking 27 (1995): 404–31. [Google Scholar] [CrossRef]

- Samy Ben Naceur, and Magda Kandil. “The Impact of Capital Requirements on Banks’ Cost of Intermediation and Performance: The Case of Egypt.” Journal of Economics and Business 61 (2009): 70–89. [Google Scholar] [CrossRef]

- Wahyoe Soedarmono, and Amine Tarazi. “Bank Opacity, Intermediation Cost and Globalization: Evidence from a Sample of Publicly Traded Banks in Asia.” Journal of Asian Economics 29 (2013): 91–100. [Google Scholar] [CrossRef]

- Joaquin Maudos, and Liliana Solís. “The Determinants of Net Interest Income in the Mexican Banking System: An Integrated Model.” Journal of Banking & Finance 33 (2009): 1920–31. [Google Scholar]

- Ayesha Afzal, and Nawazish Mirza. “Interest Rate Spreads in an Emerging Economy: The Case of Pakistan’s Commercial Banking Sector.” Economic Research-Ekonomska Istraživanja 25 (2012): 987–1004. [Google Scholar] [CrossRef]

- Barbara Casu, Bimei Deng, and Alessandra Ferrari. “Post-Crisis Regulatory Reforms and Bank Performance: Lessons from Asia.” The European Journal of Finance, 2016, 1–28. [Google Scholar] [CrossRef]

- John Goddard, Hong Liu, Phil Molyneux, and John O. S. Wilson. “Do Bank Profits Converge? ” European Financial Management 19 (2013): 345–65. [Google Scholar] [CrossRef]

- Yener Altunbas, Santiago Carbo, Edward PM Gardener, and Philip Molyneux. “Examining the Relationships between Capital, Risk and Efficiency in European Banking.” European Financial Management 13 (2007): 49–70. [Google Scholar] [CrossRef]

- Peterson K. Ozili. “Bank Profitability and Capital Regulation: Evidence from Listed and Non-Listed Banks in Africa.” Journal of African Business 18 (2017): 143–68. [Google Scholar] [CrossRef]

- Ephraim W. Chirwa, and Montfort Mlachila. “Financial Reforms and Interest Rate Spreads in the Commercial Banking System in Malawi.” IMF Staff Papers 51 (2004): 96–122. [Google Scholar] [CrossRef]

- Adolfo Barajas, Roberto Steiner, and Natalia Salazar. “Interest Spreads in Banking in Colombia, 1974–96.” IMF Staff Papers 46 (1999): 196–224. [Google Scholar]

- Heiko Hesse. Financial Intermediation in the Pre-Consolidated Banking Sector in Nigeria. Washington: World Bank Publications, 2007, vol. 4267. [Google Scholar]

- Niels Hermes, and Vu Thi Hong Nhung. “The Impact of Financial Liberalization on Bank Efficiency: Evidence from Latin America and Asia.” Applied Economics 42 (2010): 3351–65. [Google Scholar] [CrossRef]

- Thomas S. Y. Ho, and Anthony Saunders. “The Determinants of Bank Interest Margins: Theory and Empirical Evidence.” Journal of Financial and Quantitative analysis 16 (1981): 581–600. [Google Scholar] [CrossRef]

- David Tennant, and Abiodun Folawewo. “Macroeconomic and Market Determinants of Interest Rate Spreads in Low-and Middle-Income Countries.” Applied Financial Economics 19 (2009): 489–507. [Google Scholar] [CrossRef]

- Asli Demirguc-Kunt, Luc Laeven, and Ross Levine. Regulations, Market Structure, Institutions, and the Cost of Financial Intermediation. Cambridge: National Bureau of Economic Research, 2003. [Google Scholar]

- Ash Demirgüç-Kunt, and Harry Huizinga. “Determinants of Commercial Bank Interest Margins and Profitability: Some International Evidence.” The World Bank Economic Review 13 (1999): 379–408. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf. “Trade and Capital Openness: Impact on Bank Net Interest Margins, Lending and Risk-Taking Behavior.” 2015. Available online: http://ssrn.com/abstract=2665888 (accessed on 23 December 2016).

- Allen N. Berger, Richard J. Herring, and Giorgio P. Szegö. “The Role of Capital in Financial Institutions.” Journal of Banking & Finance 19 (1995): 393–430. [Google Scholar]

- Kevin Jacques, and Peter Nigro. “Risk-Based Capital, Portfolio Risk, and Bank Capital: A Simultaneous Equations Approach.” Journal of Economics and Business 49 (1997): 533–47. [Google Scholar] [CrossRef]

- Asli Demirgüç-Kunt, and Harry Huizinga. Financial Structure and Bank Profitability. World Bank Policy Research Working Paper; Washington: World Bank, 2000. [Google Scholar]

- Bertrand Rime. “Capital Requirements and Bank Behaviour: Empirical Evidence for Switzerland.” Journal of Banking & Finance 25 (2001): 789–805. [Google Scholar]

- Giuliano Iannotta, Giacomo Nocera, and Andrea Sironi. “Ownership Structure, Risk and Performance in the European Banking Industry.” Journal of Banking & Finance 31 (2007): 2127–49. [Google Scholar]

- Maria Psillaki, and Emmanuel Mamatzakis. “What Drives Bank Performance in Transitions Economies? The Impact of Reforms and Regulations.” Research in International Business and Finance 39 (2017): 578–94. [Google Scholar] [CrossRef]

- Chien-Chiang Lee, and Meng-Fen Hsieh. “The Impact of Bank Capital on Profitability and Risk in Asian Banking.” Journal of International Money and Finance 32 (2013): 251–81. [Google Scholar] [CrossRef]

- Khemaies Bougatef, and Nidhal Mgadmi. “The Impact of Prudential Regulation on Bank Capital and Risk-Taking: The Case of Mena Countries.” The Spanish Review of Financial Economics 14 (2016): 51–56. [Google Scholar] [CrossRef]

- Changjun Zheng, and Badar Nadeem Ashraf. “National Culture and Dividend Policy: International Evidence from Banking.” Journal of Behavioral and Experimental Finance 3 (2014): 22–40. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf. “Political institutions and bank risk-taking behavior.” Journal of Financial Stability 29 (2017): 13–35. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf, Changjun Zheng, and Sidra Arshad. “Effects of National Culture on Bank Risk-Taking Behavior.” Research in International Business and Finance 37 (2016): 309–26. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf. “Foreign Bank Subsidiaries’ Risk-Taking Behavior: Impact of Home and Host Country National Culture.” 2015. Available online: https://ssrn.com/abstract=2761736 (accessed on 28 March 2017).

- Joel F. Houston, Chen Lin, Ping Lin, and Yue Ma. “Creditor Rights, Information Sharing, and Bank Risk Taking.” Journal of Financial Economics 96 (2010): 485–512. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf, and Changjun Zheng. “Shareholder Protection, Creditor Rights and Bank Dividend Policies.” China Finance Review International 5 (2015): 161–86. [Google Scholar] [CrossRef]

- Asli Demirguc-Kunt, Enrica Detragiache, and Ouarda Merrouche. “Bank Capital: Lessons from the Financial Crisis.” Journal of Money, Credit and Banking 45 (2013): 1147–64. [Google Scholar] [CrossRef]

- Mine Aysen Doyran. “Net Interest Margins and Firm Performance in Developing Countries: Evidence from Argentine Commercial Banks.” Management Research Review 36 (2013): 720–42. [Google Scholar] [CrossRef]

- Shahidul Islam, and Shin-Ichi Nishiyama. The Determinants of Bank Net Interest Margins: A Panel Evidence from South Asian Countries. Discussions Paper; Sendai: Tohoku Economics Research Group, 2015. [Google Scholar]

- Khurshid Djalilov, and Jenifer Piesse. “Determinants of Bank Profitability in Transition Countries: What Matters Most? ” Research in International Business and Finance 38 (2016): 69–82. [Google Scholar] [CrossRef]

- Wahyoe Soedarmono, and Amine Tarazi. “Competition, Financial Intermediation, and Riskiness of Banks: Evidence from the Asia-Pacific Region.” Emerging Markets Finance and Trade 52 (2016): 961–74. [Google Scholar] [CrossRef]

- Chien-Chiang Lee, Meng-Fen Hsieh, and Shih-Jui Yang. “The Relationship between Revenue Diversification and Bank Performance: Do Financial Structures and Financial Reforms Matter? ” Japan and the World Economy 29 (2014): 18–35. [Google Scholar] [CrossRef]

- Yong Tan, and Christos Floros. “Risk, Capital and Efficiency in Chinese Banking.” Journal of International Financial Markets, Institutions and Money 26 (2013): 378–93. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf, Sidra Arshad, Mohammad Morshedur Rahman, Muhammad Abdul Kamal, and Khalid Khan. “Regulatory Hypothesis and Bank Dividend Payouts: Empirical Evidence from Italian Banking Sector.” Journal of Financial Engineering 2 (2015): 1550009. [Google Scholar] [CrossRef]

- Badar Nadeem Ashraf, Bushra Bibi, and Changjun Zheng. “How to Regulate Bank Dividends? Is Capital Regulation an Answer? ” Economic Modelling 57 (2016): 281–93. [Google Scholar] [CrossRef]

- Subal C. Kumbhakar, and C. A. Knox Lovell. Stochastic Frontier Analysis. Cambridge: Cambridge University Press, 2003. [Google Scholar]

- Allen N. Berger, and David B. Humphrey. “Efficiency of Financial Institutions: International Survey and Directions for Future Research.” European Journal of Operational Research 98 (1997): 175–212. [Google Scholar] [CrossRef]

- Rudi Vander Vennet. “Cost and Profit Dynamics in Financial Conglomerates and Universal Banks in Europe.” 1998. Available online: https://ssrn.com/abstract=160493 (accessed on 23 December 2016).

- Tara Deelchand, and Carol Padgett. The Relationship between Risk, Capital and Efficiency: Evidence from Japanese Cooperative Banks. Reading: ICMA Centre, 2009. [Google Scholar]

- Stephen Nickell. “Biases in Dynamic Models with Fixed Effects.” Econometrica 49 (1981): 1417–26. [Google Scholar] [CrossRef]

- Badi H. Baltagi. Econometric Analysis of Panel Data. Chichester: John Wiley and Sons, 2008. [Google Scholar]

- Manuel Arellano, and Stephen Bond. “Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations.” The Review of Economic Studies 58 (1991): 277–97. [Google Scholar] [CrossRef]

- Manuel Arellano, and Olympia Bover. “Another Look at the Instrumental Variable Estimation of Error-Components Models.” Journal of Econometrics 68 (1995): 29–51. [Google Scholar] [CrossRef]

- Richard Blundell, and Stephen Bond. “GMM Estimation with Persistent Panel Data: An Application to Production Functions.” Econometric Reviews 19 (2000): 321–40. [Google Scholar] [CrossRef]

- Stephen R. Bond. “Dynamic Panel Data Models: A Guide to Micro Data Methods and Practice.” Portuguese Economic Journal 1 (2002): 141–62. [Google Scholar] [CrossRef]

- Nadia Doytch, and Merih Uctum. “Does the Worldwide Shift of Fdi from Manufacturing to Services Accelerate Economic Growth? A Gmm Estimation Study.” Journal of International Money and Finance 30 (2011): 410–27. [Google Scholar] [CrossRef]

- Frank Windmeijer. “A Finite Sample Correction for the Variance of Linear Efficient Two-Step Gmm Estimators.” Journal of Econometrics 126 (2005): 25–51. [Google Scholar] [CrossRef]

- Franco Fiordelisi, David Marques-Ibanez, and Phil Molyneux. “Efficiency and Risk in European Banking.” Journal of Banking & Finance 35 (2011): 1315–26. [Google Scholar]

- Damodar N. Gujarati. “Sangeetha (2007) Basic Econometrics.” Tata McGraw Hill Publishing Company Limited, New Delhi 110 (2007): 451–52. [Google Scholar]

- Peter Kennedy. A Guide to Econometrics. Cambridge: MIT Press, 2003. [Google Scholar]

- Kyriaki Kosmidou, Sailesh Tanna, and Fotios Pasiouras. “Determinants of Profitability of Domestic Uk Commercial Banks: Panel Evidence from the Period 1995–2002.” In Paper presented at the Money Macro and Finance (MMF) Research Group Conference 2005, Rethymno, Greece, 1–3 September 2005. [Google Scholar]

- Tigran Poghosyan. “Financial Intermediation Costs in Low Income Countries: The Role of Regulatory, Institutional, and Macroeconomic Factors.” Economic Systems 37 (2013): 92–110. [Google Scholar] [CrossRef]

- F. F. A. H. Asari, Nurul Syuhada Baharuddin, Nurmadihah Jusoh, Zuraida Mohamad, Norazidah Shamsudin, and Kamaruzaman Jusoff. “A Vector Error Correction Model (Vecm) Approach in Explaining the Relationship between Interest Rate and Inflation Towards Exchange Rate Volatility in Malaysia.” World Applied Sciences Journal 12 (2011): 49–56. [Google Scholar]

- M. Hashem Pesaran, Yongcheol Shin, and Richard J. Smith. “Structural Analysis of Vector Error Correction Models with Exogenous I (1) Variables.” Journal of Econometrics 97 (2000): 293–343. [Google Scholar] [CrossRef]

- Boubacar Diallo. “Bank Competition and Crises Revisited: New Results.” Economics Letters 129 (2015): 81–86. [Google Scholar] [CrossRef]

- Joao A. C. Santos. “Bank Capital Regulation in Contemporary Banking Theory: A Review of the Literature.” Financial Markets, Institutions & Instruments 10 (2001): 41–84. [Google Scholar]

- Patricia Jackson, Craig Furfine, Hans Groeneveld, Diana Hancock, David Jones, William Perraudin, Lawrence Radecki, and Masao Yoneyama. Capital Requirements and Bank Behaviour: The Impact of the Basle Accord. Basel: Bank for International Settlements, 1999. [Google Scholar]

- Andreas Dietrich, and Gabrielle Wanzenried. “Determinants of Bank Profitability before and During the Crisis: Evidence from Switzerland.” Journal of International Financial Markets, Institutions and Money 21 (2011): 307–27. [Google Scholar] [CrossRef]

- Maria Concetta Chiuri, Giovanni Ferri, and Giovanni Majnoni. “The Macroeconomic Impact of Bank Capital Requirements in Emerging Economies: Past Evidence to Assess the Future.” Journal of Banking & Finance 26 (2002): 881–904. [Google Scholar]

- Fotios Pasiouras, and Kyriaki Kosmidou. “Factors Influencing the Profitability of Domestic and Foreign Commercial Banks in the European Union.” Research in International Business and Finance 21 (2007): 222–37. [Google Scholar] [CrossRef]

- Sami Ben Naceur, and Mohammed Omran. “The Effects of Bank Regulations, Competition, and Financial Reforms on Banks’ Performance.” Emerging Markets Review 12 (2011): 1–20. [Google Scholar] [CrossRef]

- 1Recent literature reports that banking practices in different countries are influenced by the national culture, legal institutions and political institutions [36,37,38,39,40,41]. Therefore, generalizing results of studies in one country for the banks in another country might be misleading sometime.

- 2Annual Report of Bangladesh Bank 2015–2016.

- 3Available online: https://www.bb.org.bd/fnansys/bankfi.php (accessed on 5 December 2016).

- 4Percentage change determined by considering 2000 as base year.

- 5Price of labor = personal expenses/total assets, price of fixed assets = depreciation cost/total assets, price of fund = total interest expenses/total deposits [63].

- 6Please see the audited annual report of Sonali, Janata, Agrani, and Rupali bank limited.

- 7Gujarati et al. and Kennedy [64,65] indicate that multicollinearity is a serious problem if correlation coefficient between two independent variables is above 0.80, which is not the case here.

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).