4.1. Direct Effects

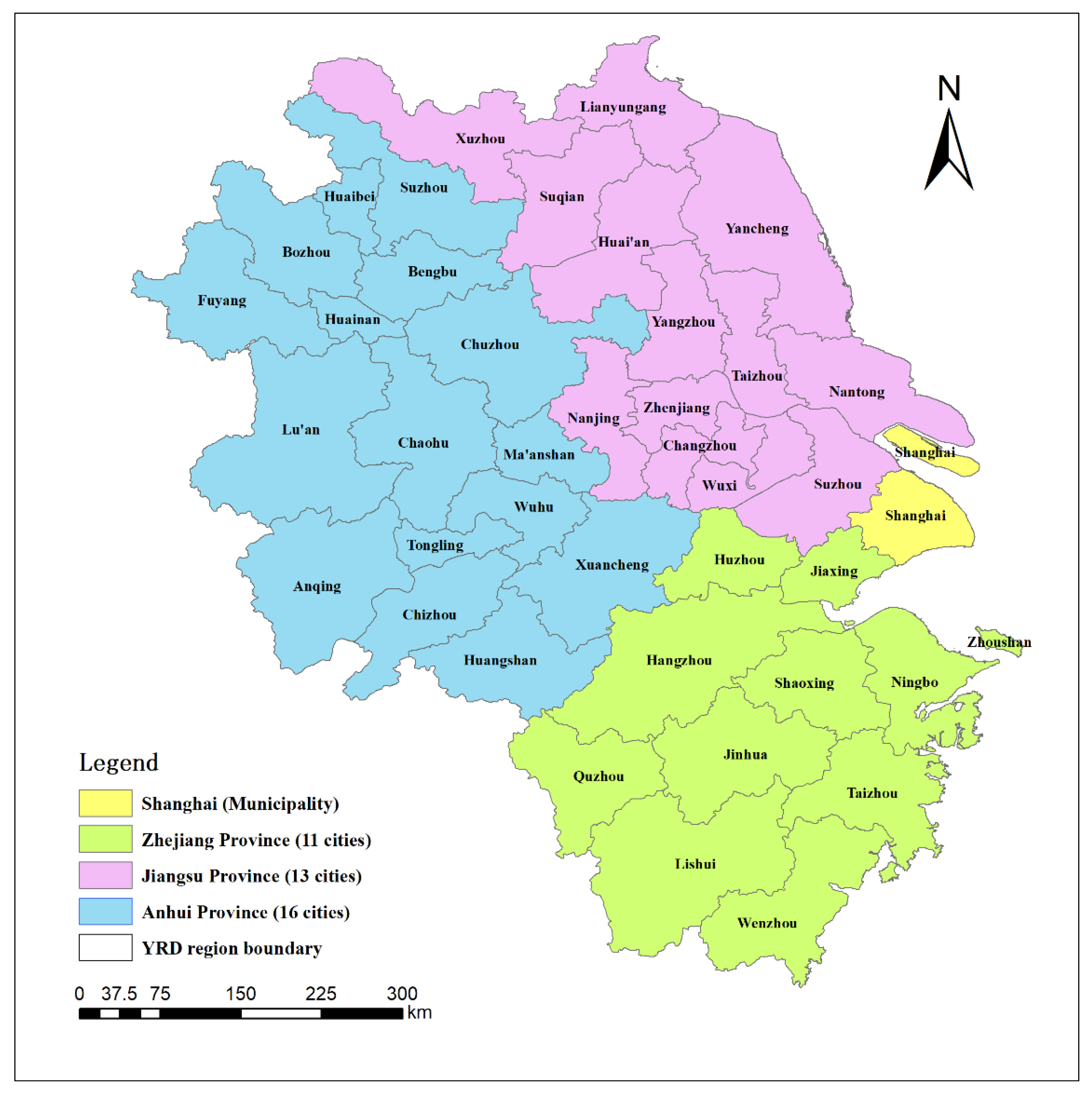

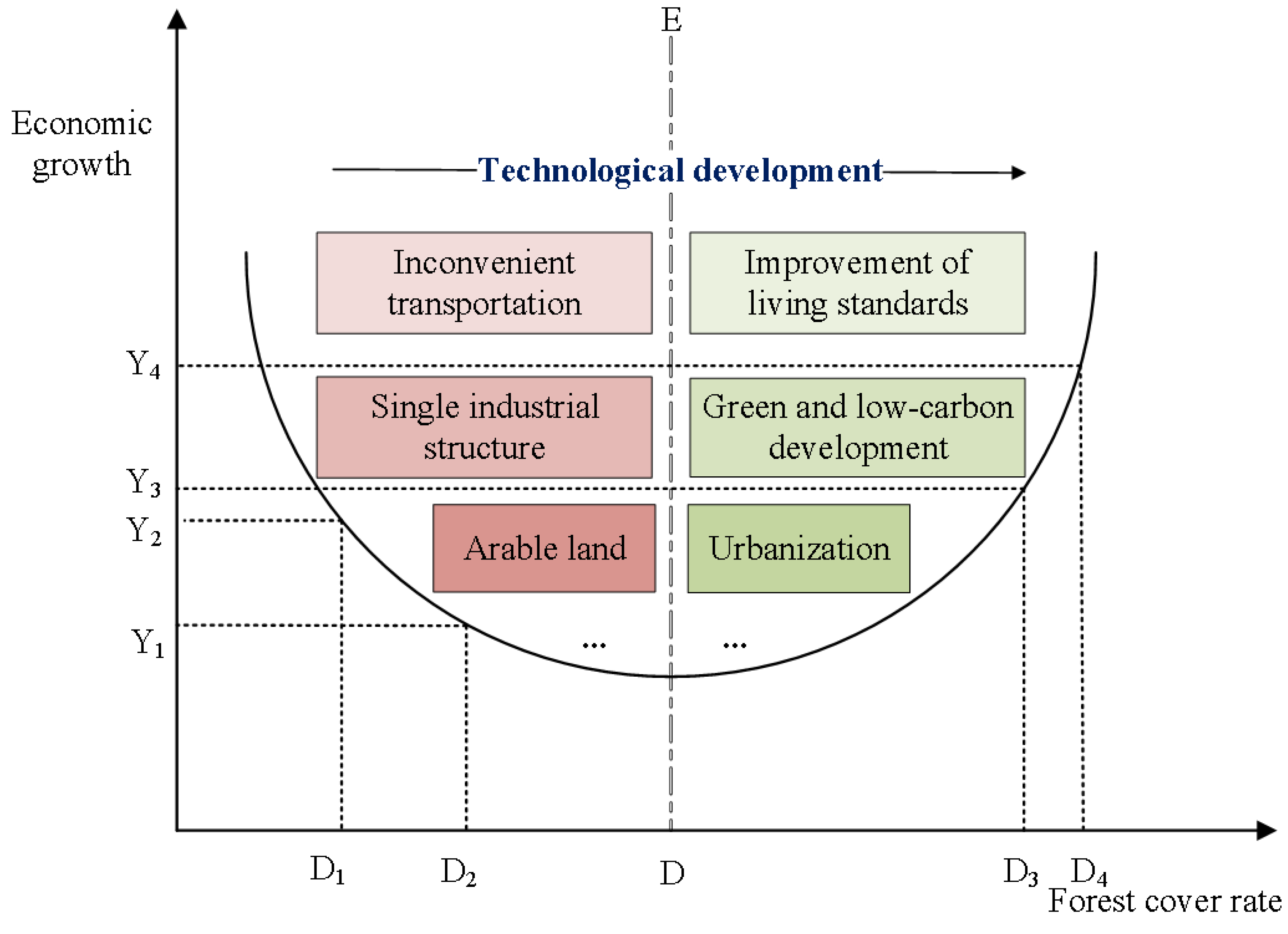

Table 5 shows the forest resource abundance has a U-shaped non-linear effect on regional economic development. The impact of forest resource abundance on the level of economic development is negative and significant at the 10% level. Still, the relationship between the square of forest coverage and per capita GDP is positive and significant at the 1% level. It shows that in the initial stage of economic development, the abundance of forest resources negatively impacts economic growth. The main reason is that in the early stage of economic development, cities with rich forest resources often have inconvenient transportation and a single industry. The more abundant forest resources, the greater the impact on transportation and arable land. Therefore, the abundance of forest resources will inhibit economic development. However, when the economy develops to a certain extent, abundant forest resources can promote economic level improvement. This is mainly because with technology advancement, improving living standards, and people’s changing ideologies, developing the advanced service industry will be faster. Forest resources can provide better spiritual, cultural, and related products and services and improve the ecological environment. The impact of forest resources on economic development mainly includes direct, indirect, and induced effects. The direct effect is reflected in the jobs created by the forest sector, which produces indirect and induced economic added value in other sectors [

14].

The first-order lag term of the explained variable is significantly negative, indicating that the phenomenon of economic convergence exists in the YRD region. If the initial state of the economy is relatively underdeveloped, there will be more room for improvement in economic development [

55]. This aspect is particularly evident in Anhui Province, which is relatively underdeveloped in the YRD region. Moreover, with the Nanjing metropolitan area’s development strategy, Anhui’s economic development is relatively fast.

In terms of carbon sequestration, the impact of carbon sequestration per GDP on the level of economic development is negative and significant. Moreover, carbon sequestration has a certain social cost [

56]. Economic development needs to consume a lot of resources and energy, and the production process will cause more carbon dioxide emissions. However, carbon dioxide can be absorbed through carbon sinks such as vegetation and land. The more carbon emissions, the more pollution it brings, which may ultimately inhibit regional economic development. Especially in the Anhui area, it is necessary to do a good job in the strategic layout of the low-carbon economy and circular economy development while undertaking the industrial transfer. In addition, in terms of carbon sequestration methods, there are generally two ways to increase carbon sequestration, one is by technology, and the other is by afforestation. Presently, carbon sequestration through scientific and technological means is costly. However, carbon sequestration through afforestation is currently the most economical and reliable method. Notwithstanding, large-scale afforestation may generate a lot of opportunity costs, such as land use and forestry industry development.

In terms of resources and the environment, the impact of industrial sulfur dioxide emissions per GDP on the level of economic development is positive, but the results are not significant. In addition, the impact of water resource carrying capacity on the level of economic development is negative. The more developed the economic level is, the greater the demand for resources will be and the weaker the resource-carrying capacity will be.

The impact of electricity consumption per GDP on economic development is significantly negative. Electricity consumption can reflect the economic development level of a region. However, electricity consumption and industrial structure are closely related. Generally, the demand for electricity consumption in primary and tertiary industries is not as large as that of the secondary industry. Although Jiangsu is a large manufacturing province, other industries such as finance, technology, and services are also very developed. In 2020, Shanghai’s GDP ranked among the top ten in the country, although Shanghai’s economy is relatively developed. Electricity consumption in Shanghai ranks low due to the developed tertiary industry, especially the financial industry. Industrial structure often determines electricity use, but high-tech industries typically generate much more GDP with less energy than low-end manufacturing. Especially after the implementation of power integration development, cities in the YRD gradually developed a mode of sharing and interoperability. The efficiency of energy utilization in economic development is getting higher and higher.

The YRD region is committed to industrial restructuring, optimization, and upgrading. The industry shows a trend of cluster development and can realize the integrated development of modern service and advanced manufacturing industries.

The impact of urbanization on economic development is significantly positive. Improving the urbanization level will help to improve the level of economic development. Urbanization is essentially a process of agglomeration of manpower, capital, and resources. It is also one of the important driving forces for upgrading and transforming the economic structure. The first step is the transformation of the population; that is, the rural population is transformed into an urban population and participates in non-agricultural production activities. The spatial transformation of the population residence was gradually realized after the population transformation. The transfer of rural surplus labor and the construction of cities and towns will gradually promote the development of local enterprises, thereby promoting the continuous improvement of the local economy. However, the way that accompanies economic growth is often extensive. With the continuous improvement of urbanization, higher requirements are put forward on land, culture, society, and other aspects. Ultimately, urbanization will gradually achieve coordinated development with the economy, and economic growth will gradually transit from an extensive development model to an intensive growth model.

Investment in scientific research and education has an obvious role in promoting economic development, and the estimated coefficient of the model is above 0.2. It shows that scientific and technological innovation is very important to realize the economic development of the YRD region.

Government intervention has suppressed the economic development in YRD, but the results are not significant. China’s economy has adopted a “government-led market economy” for a long time. The government intervenes deeply in the process of regional economic growth. It suppresses the role of the regional market mechanism, which may lead to imbalances in the economic structure and cannot be adjusted in time. In addition, government intervention may also bring about mistakes in decision-making and improper resources allocation. This will make the economic micro-subjects lose the initiative and vitality of economic activities. Moreover, excessive government intervention can easily lead to rent-seeking. Under modern economic conditions, the government’s main role should carry out reasonable macro-intervention and moderate guidance on economic activities through laws and regulations. However, excessive intervention may inhibit economic development.

Foreign direct investment positively impacts economic development. The more foreign direct investment, the higher the level of economic development. First, foreign investment has brought about the application and promotion of advanced green technologies and improved the production efficiency of enterprises. Second, foreign investment will also relatively impact the overall corporate environment positively through production scale expansion, industrial structure adjustment, and talent introduction. Third, by absorbing FDI, the YRD region can accelerate the accumulation of regional capital, accelerate capital formation, and further improve investment level. Meanwhile, it can promote the level of employment in the region.

In terms of consumption, the model results show that the per capita total retail sales of consumer goods positively impact economic development. The average retail sales of social consumption are generally affected by income level, price level, and consumption environment. Only with economic development, continuous improvement of residents’ income level, stable price level, and the good consumption environment can the growth of total retail sales of social consumer goods be stimulated. Conversely, the growth of consumer demand will also play a direct and final decisive role in economic growth. Investment demand and aggregate demand depend on consumption demand to some extent. From a medium and long-term perspective, only investment supported by consumer demand is effective, and effective investment and consumption make a greater contribution to economic growth.

4.2. Effects of Decomposition

The effects of spatial econometric models can be divided into direct effects, indirect effects (spatial effects), total effects, and feedback effects. The direct effect is the impact of an independent variable in a certain region on the dependent variable. The feedback effect is the direct effect coefficient minus the regression coefficient of the estimated result. The feedback effect means that the explanatory variables in a certain area will impact the explained variables in the surrounding area, which will affect the explained variables in the local area. Indirect effects are the effects of an explanatory variable on other regions, which is the influence of an explanatory variable in a neighboring area on the explained variable in the local area. The total effect is the sum of the direct and indirect effects.

Table 6 is calculated according to the spatial Durbin model of GDP per capita as the explained variable. The results show that the magnitude and significance of the coefficients of the direct effect are almost consistent with the coefficients and significance of the model estimates. The relationship between forest resource abundance and economic growth always maintains a U-shaped non-linear relationship. Forest resources can inhibit the initial stage of economic development. However, when the economy develops to a certain level, the abundance of forest resources and economic growth will develop together. Moreover, it has a positive pulling effect on the economic development of the YRD region.

Table 6 shows that the spatial effect exists. The impact of the abundance of forest resources in neighboring cities on the region’s economic development presents a non-linear inverted U-shaped trend. In the initial state, the more abundant forest resources are in neighboring cities, the more the level of economic development in the region will be promoted. When it reaches a certain level, the excessively abundant forest resources in neighboring regions will inhibit the level of economic development in the region. One reason is that the growth of trees requires material conditions such as land. Efforts to massively increase vegetation cover are increasing to alleviate climate conditions and achieve the grand vision of carbon neutrality. Excessive expansion of forest areas may seriously damage biodiversity. Cutting down old forests and planting new ones may break the original ecological balance. This will eventually crowd out the production and living resources of the region and affect economic development.

From the perspective of the feedback effect, the relationship between the abundance of forest resources of the surrounding areas and the region’s economic development again shows a non-linear U-shaped trend. It means that the direct consumption of forest resources has different impacts at different stages of economic development. With the continuous economic improvement, the sustainable development of forest resources has gradually been paid attention to. The ecological, economic, and social values of the forest have been continuously excavated. For example, after the Three Plenary Sessions of the Eleventh Session, Zhejiang entered a period of revitalization and restoration of forestry, which has been vigorously developed. While striving to develop the economy, efforts should be made to realize the sustainable utilization of forest resources. The YRD region gradually realizes the coordinated development of the environment and economy and finally promotes the sustainable development of the economy.