1. Introduction

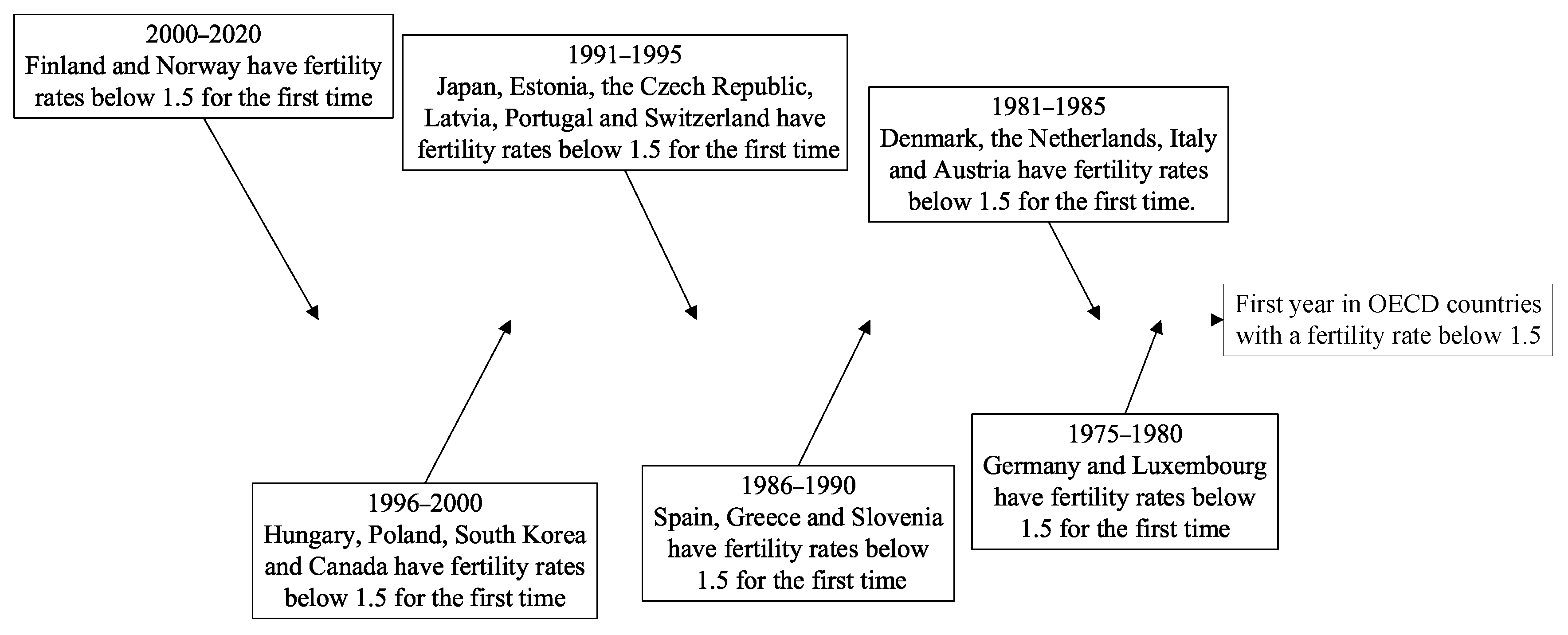

As industrialization and urbanization have progressively deepened, the demand for labor tends to be reduced, and the cost of childbirth has risen, thus causing lower fertility rates. As a result, population issues have turned out to be a common issue in numerous countries. The global fertility rate will drop to 2.2 in 2050, and population growth will generally be decelerated in the decade ahead, as estimated by the United Nations World Population Outlook. Global population issues are becoming increasingly exacerbated. The OECD average fertility rates were already below the replacement level of 2.1 in 1984. The average fertility rate declined from 2.06 to 1.65 between 1984 and 2003, and it has rebounded since 2003 to roughly 1.69. However, the average fertility rate has been constantly below the population replacement level. As of 2019, fertility rates in 21 countries of the organization were lower than the international population threshold of 1.5 (

Figure 1). To be specific, the fertility rate of Germany was less than 1.5 in 1975, such that Germany has been recognized as the first of the OECD countries to achieve a fertility rate below the international alert line. The second is Luxembourg, which achieved a fertility rate of 1.48 in 1976. From 1980 to 1999, 18 countries achieved fertility rates below 1.5, as well as Finland in 2017 and Norway in 2020. Currently, the industrialization level of China has lagged behind that of developed countries, whereas the number of births has been falling sharply since 2017. The data originating from China’s seventh census suggested that China’s total fertility rate fell to 1.3 in 2020, significantly below the international warning line. As revealed by the above-described result, a considerable number of countries are subjected to the dilemma of a long-term declining population (Van De Kaa, DJ, 1987 [

1]). A sustained low fertility rate will result in a reduced working-age population, impose increased pressure on social security, and cause a lack of innovation in society, thus impeding economic growth and triggering other issues. Lastly, economic and social development cannot be sustained. Accordingly, raising the fertility rate has become an urgent problem to be solved in many countries.

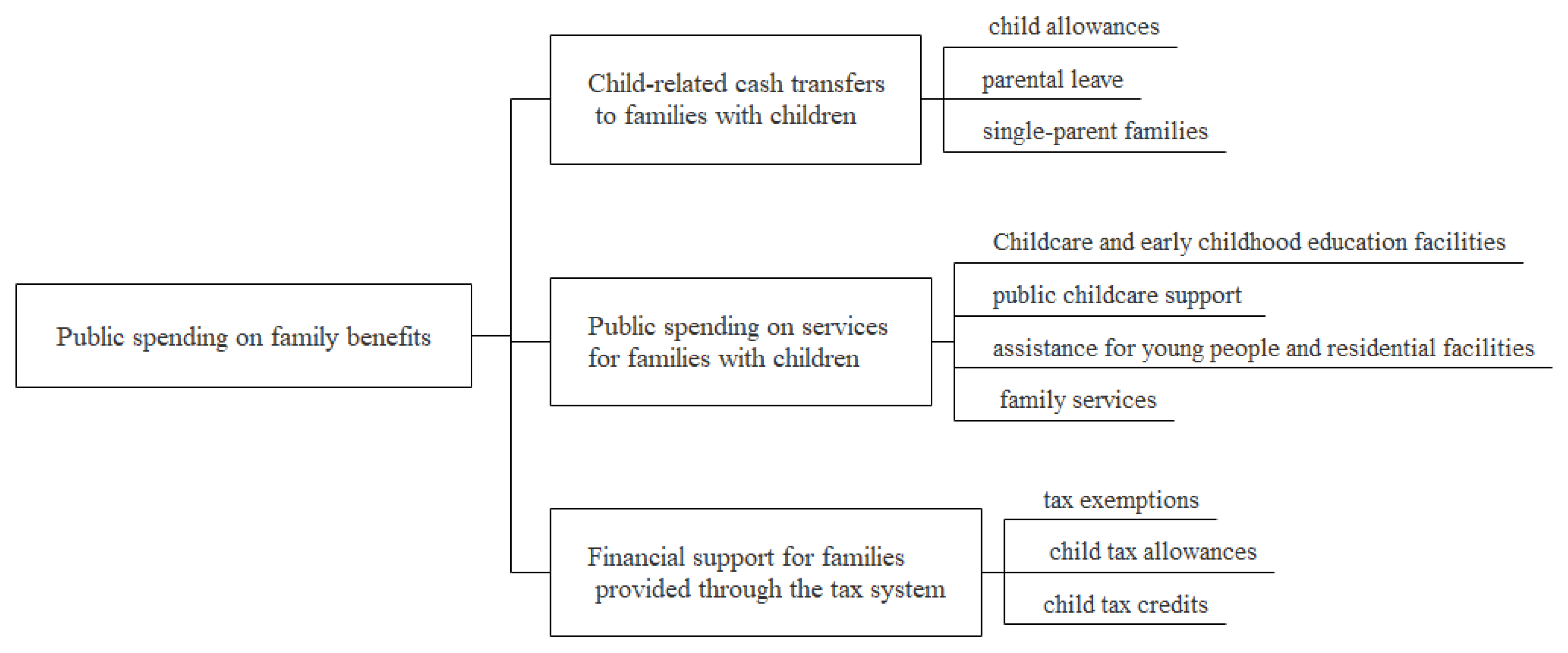

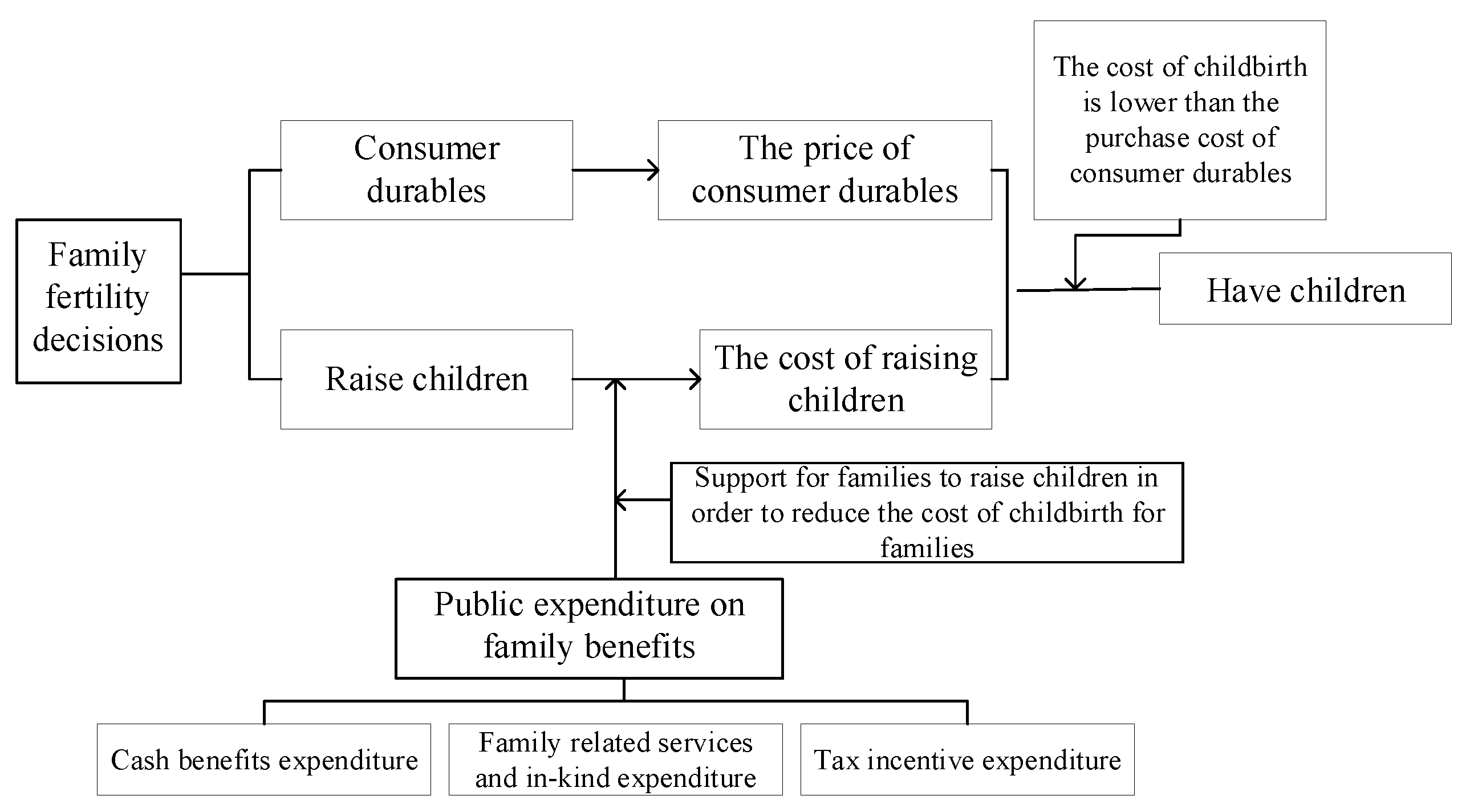

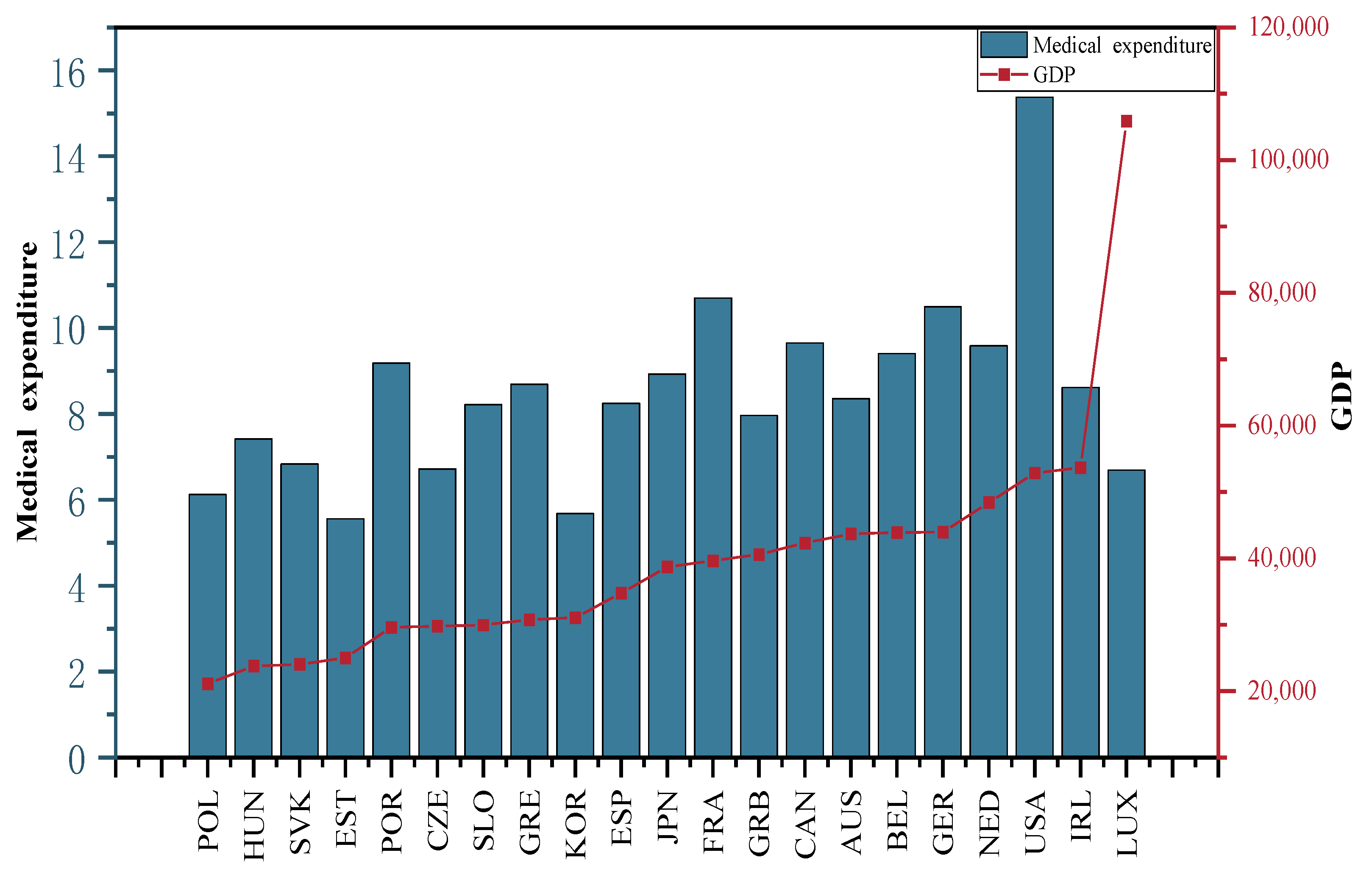

OECD countries have formulated and implemented a series of welfare policies to stimulate fertility, so as to cope with the long-term population decline. A complete family welfare policy system has been formed based on long-term practice (

Figure 2). Family benefit policies fall into three major types. The first type is cash benefits for family support, which comprise child allowances, benefits during parental leave, and benefits for single-parent families. The second type refers to relevant service subsidies (e.g., child care and early education facilities, child care services, and public spending on family services). The third is related tax incentives, which cover tax exemptions, child tax exemptions, and child tax credits.

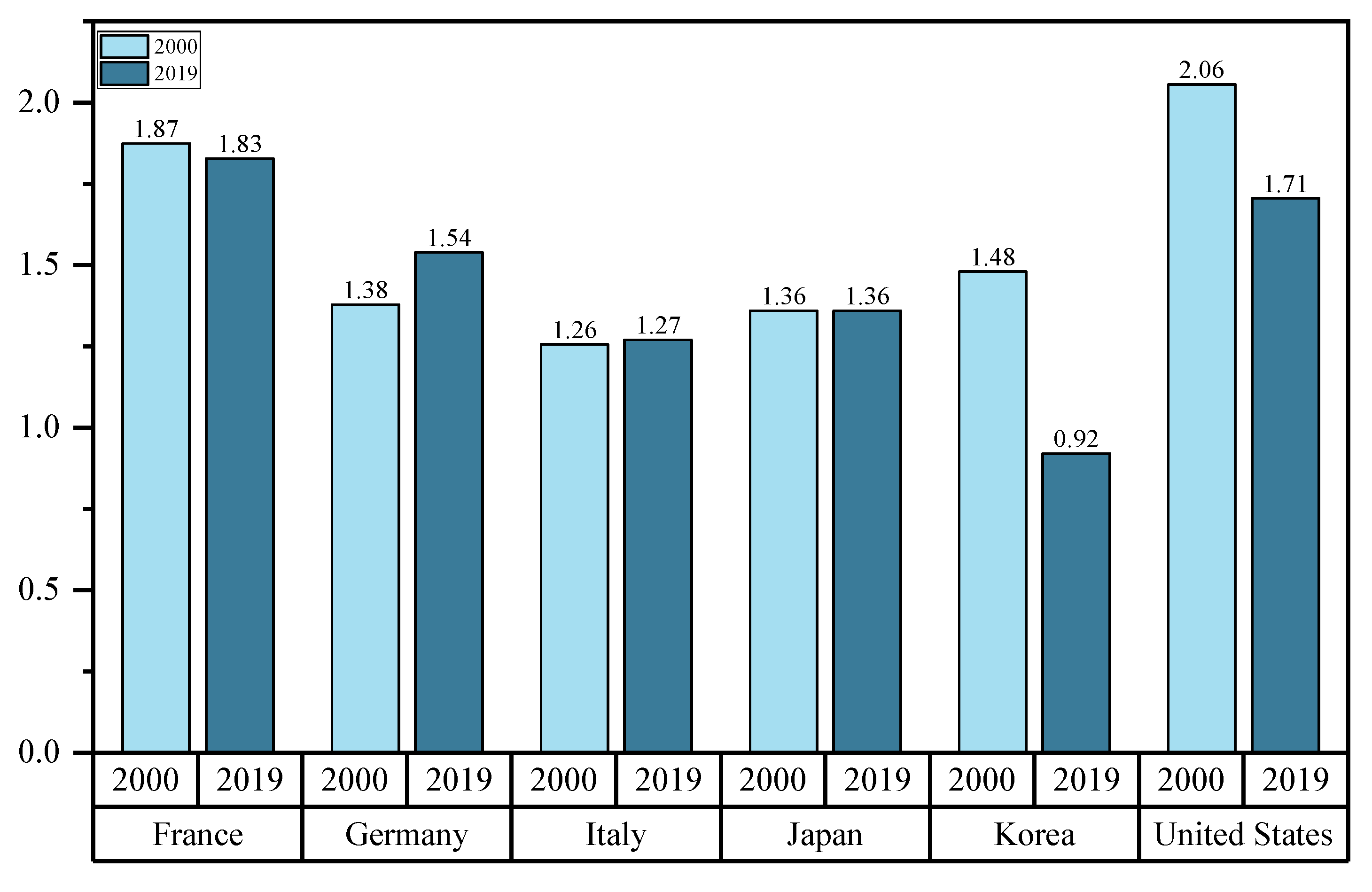

However, the family welfare policies developed and implemented in OECD countries have different policy priorities and vary in their effectiveness. As depicted in

Figure 3, the fertility rates in Germany, Italy, Japan and Korea were all lower than 1.5 in 2000. The fertility rates in all three countries fluctuated upwards and downwards from 2000 to 2019. After 20 years of development and policy adjustments, Germany’s fertility rate has reached over 1.5 in 2019, whereas Japan and Italy’s fertility rates remain below the alert level. Notably, Korea’s fertility rate is even below 1. In contrast, the fertility rates in the United States have been above the alert level, whereas the above-described rates have tended to decline over the past few years. In France, the fertility rates have remained largely stable. As revealed by the above-mentioned analysis, different countries have different policy priorities, and the effects of their policies vary significantly.

China, subjected to a declining birth rate, has begun to take measures to actively tackle the problem of low fertility. There are two main aspects of the measures: one is to lift birth restrictions, and the other is to provide tax incentives. The policy stipulating that couples who are both only children can have two children was rolled out in China in November 2011 to liberalize birth control. The implementation of the policy of allowing a couple to have two children if one of them is the only child in their family, i.e., the “separate two-child” policy, was launched on 15 November 2013, as clearly stated by the “Decision of the Central Committee of the Communist Party of China on Several Major Issues of Comprehensively Deepening Reform”. In 2015, the fifth plenary session of the 18th Central Committee decided to fully implement the policy that a couple can have two children, which is recognized as the aim to fully liberalize the “two-child policy”. Moreover, a couple of childbearing age can have three children, as stipulated by the “Decision on Optimizing the Fertility Policy for Long-term Balanced Population Development” of the political bureau meeting of the CPC Central Committee in 2021. In terms of tax benefits, the standing committee of the 13th National People’s Congress adopted a decision on amending the Individual Income Tax law in 2018, in which a deduction of CNY 1000 per person per month was stipulated for children’s education. Effective 1 January 2022, expenses regarding the care of taxpayers under the age of three would be deducted at a flat rate of CNY 1000 per month per taxpayer, as provided by the “Notice of the State Council on the Establishment of Special Additional Deductions for Personal Income Taxes for the Care of Infants and Children Under the Age of 3” on 28 March 2022.

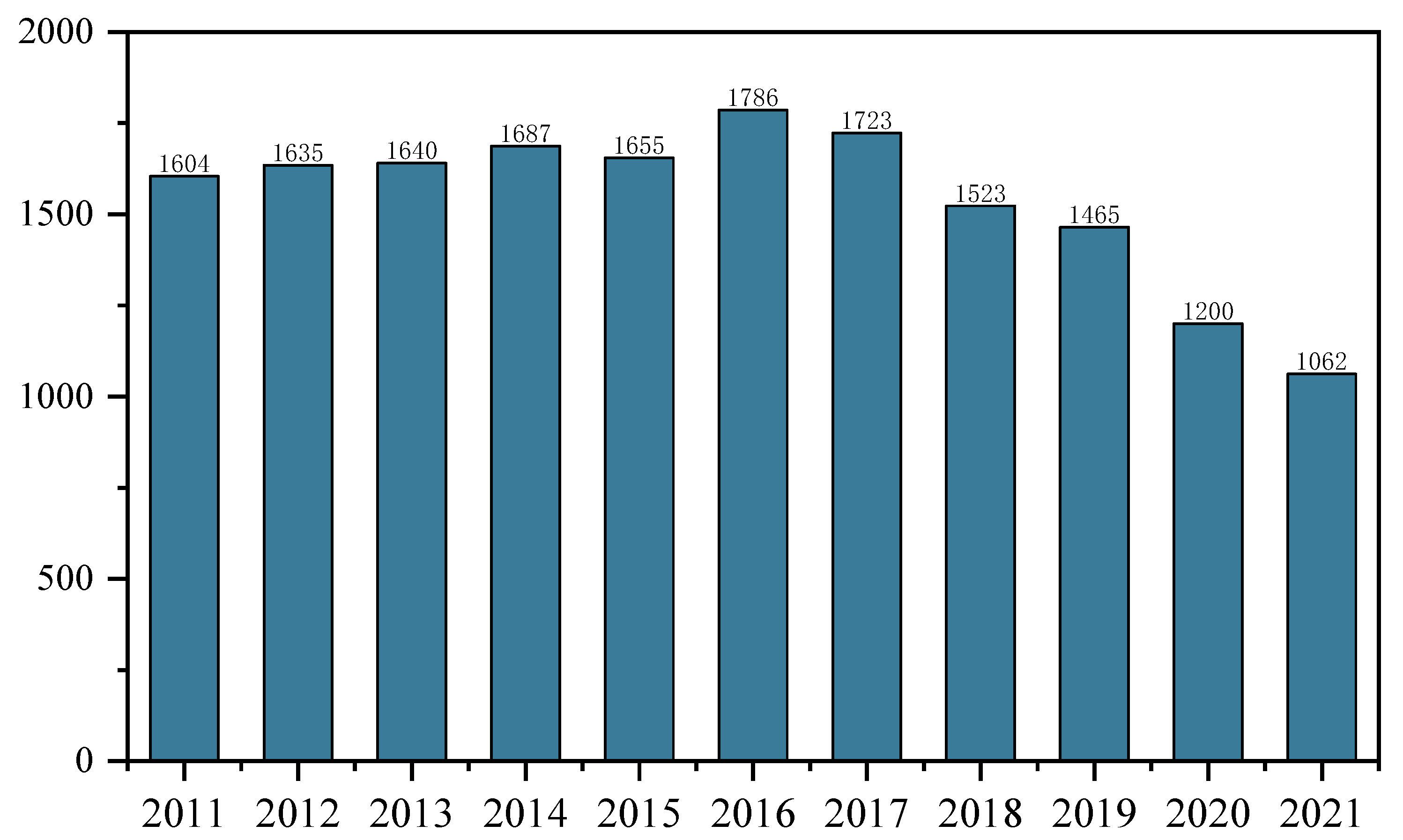

The implementation of the above-described policies has had some effect (

Figure 4). After the change in the birth limitation policy in 2011, the number of births in 2012 increased by 310,000 compared with 2011. After the implementation of the “separate two-child policy”, the number of births in 2014 increased by 470,000 compared with 2013. The number of births in 2016 increased by 1.31 million compared with 2015 after the full liberalization of the “two-child policy”. Nevertheless, China’s births fell off a cliff starting in 2017, down 630,000 from 2016, and in 2018, down 2 million from 2017, with another record-low birth rate in 2019, down 580,000 from 2018. This policy effect is short-term in nature, and the long-term effect is slight. Among women in China of childbearing age, 77.4% do not plan to have more children due to the heavy financial burden, as indicated by the results of the National Health Planning Commission’s 2017 sample survey on the national fertility status. The tax policies introduced in 2019 to reduce the economic burden of childbirth have not curbed the decline in births. This is a decline of 2.65 million in 2020 and 1.38 million in 2021. Notably, this policy has failed to address the root of the low fertility problem. Thus, policies that reduce the cost of childbearing for families should be urgently formulated to effectively address this challenge.

In brief, despite the similar welfare policies of OECD countries in response to fertility challenges, their policy effects vary considerably. Accordingly, when formulating future fertility support policies in China, the following issues should be considered.

- (1)

Whether family welfare policies have a boosting effect on fertility and whether the effect is long-term.

- (2)

From a holistic perspective, this study analyzes how the combination of fertility support policies in different countries works better under different economic development conditions.

- (3)

The formulation of relevant fertility support policies considering China’s actual situation.

Based on the above issues, the effect of family welfare policies on fertility is studied by regression analyses; the contribution of each policy to fertility is investigated through grey correlation, and then the optimal policy combination is found through a fuzzy set qualitative comparative analysis from a holistic perspective. In light of China’s actual situation, this provides experience and inspiration for the formulation and systematic construction of China’s welfare policy.

The rest of this study is organized as follows. In

Section 2, the literature is reviewed. In

Section 3, a theoretical framework and hypotheses are presented. In

Section 4, the methods adopted in this study are introduced (e.g., regression analysis, grey relation analysis, and the fsQCA method). In

Section 5, the results and discussions are presented. Lastly, in

Section 6, the conclusions of this study are drawn.

6. Conclusions and Policy Implications

In this study, the effect of family welfare policies on boosting fertility is analyzed based on a systematic analysis of the panel data originating from OECD countries between 2001 and 2015 using several methods (e.g., regression analysis, grey correlation, and fuzzy set qualitative comparative analysis). The results of this study are presented as follows:

- (1)

Family welfare policies are capable of significantly enhancing fertility status (see

Table 3 for results). Moreover, the long-term sustainability of the fertility promotion effect of family welfare policies is verified by moving-mean regression (

Table 4). The heterogeneity analysis suggests that differences exist in the boosting effects of family welfare policies under different fertility statuses. To be specific, family welfare policies have higher boosting effects in high-fertility countries than in low-fertility countries (

Table 5).

- (2)

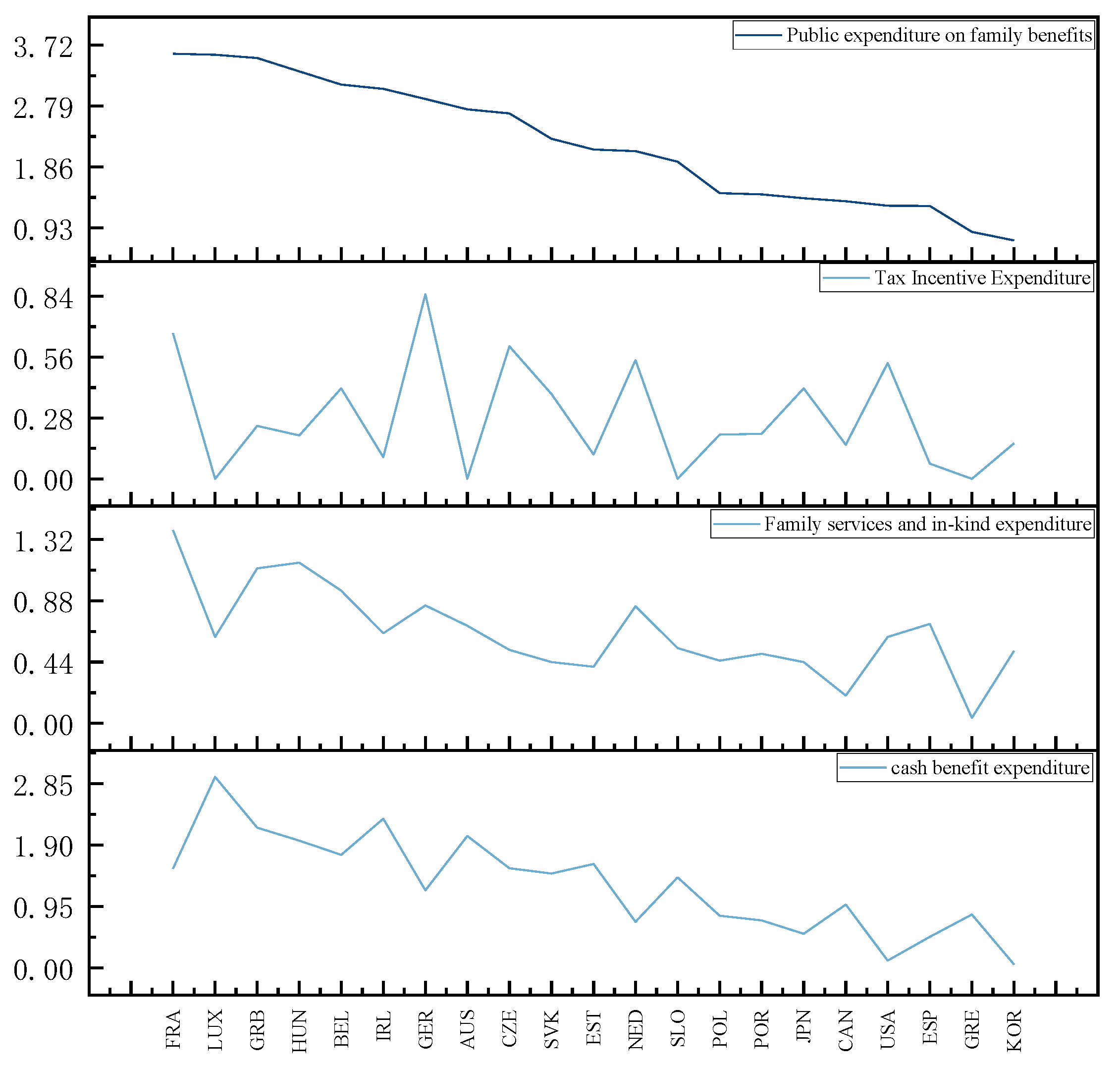

The correlation degree between three types of family welfare policy and the fertility rate is calculated using the method of grey correlation degree analysis. In other words, cash welfare expenditure, relevant services and in-kind expenditure, and tax incentives and the fertility rate. It was found that cash benefit expenditure made the largest contribution to fertility improvement in 12 of 21 countries, relevant services and in-kind expenditure made the largest contribution to fertility improvement in 6 of 21 countries, and tax concessions made the largest contribution to fertility improvement in 3 of 21 countries (

Table 6).

- (3)

Through the qualitative analysis of fuzzy sets, three policy combinations are found to improve fertility status. As depicted in

Table 9, expenditure on cash benefits and relevant services and expenditure in kind are the core conditions. Cash welfare expenditure appears in C1 and C3, and relevant service and physical expenditure appear in C1 and C2. The policy mix to improve fertility also varies in different social contexts.

In brief, increasing government subsidies to families can be conducive to increasing the total fertility rate. A grey correlation analysis and fsQCA qualitative analysis can be employed in the practice of family benefits policy to indicate the types of policies that public expenditure on family benefits should orientate towards. As indicated by the results of a grey relation analysis and fsQCA qualitative analysis, cash allowance expenditure, family service expenditure, and in-kind expenditure significantly increase the fertility rate, and they serve as the core conditions in the grouping of fertility rate enhancement as well. Accordingly, the support of cash benefits to families and that of family-associated services should be emphasized more considerably in practice. Furthermore, the policy mix should be adjusted dynamically in accordance with the macro-environment to curb the decline of the fertility rate.

OECD countries had an earlier start to deal with low fertility, and their policy systems and response measures are more refined. Thus, the measures taken by OECD countries can bring great enlightenment to China to assist China in addressing the problem of low fertility, though there are some differences between China and OECD countries in terms of the macro-environment when China faces its population problem.

- (1)

In the face of increasingly serious population issues, a family welfare policy system should be established as early as possible to improve the fertility situation. Because of the heterogeneity and long-term nature of the uplifting effects of family welfare policies, China’s early formulation and improvement of family welfare policies can have a greater effect in encouraging fertility.

- (2)

The development of a family welfare policy requires an increase in expenditure on cash benefits and relevant services and in-kind expenditure. As indicated by the results of

Section 5, cash benefit expenditure most significantly boosts fertility, such that cash support to families should be increased. Fertility rates can be more significantly elevated by increasing quality childcare services, childcare and early education facilities, and youth assistance to reduce family-associated expenditures and the financial pressure on families to raise children.

- (3)

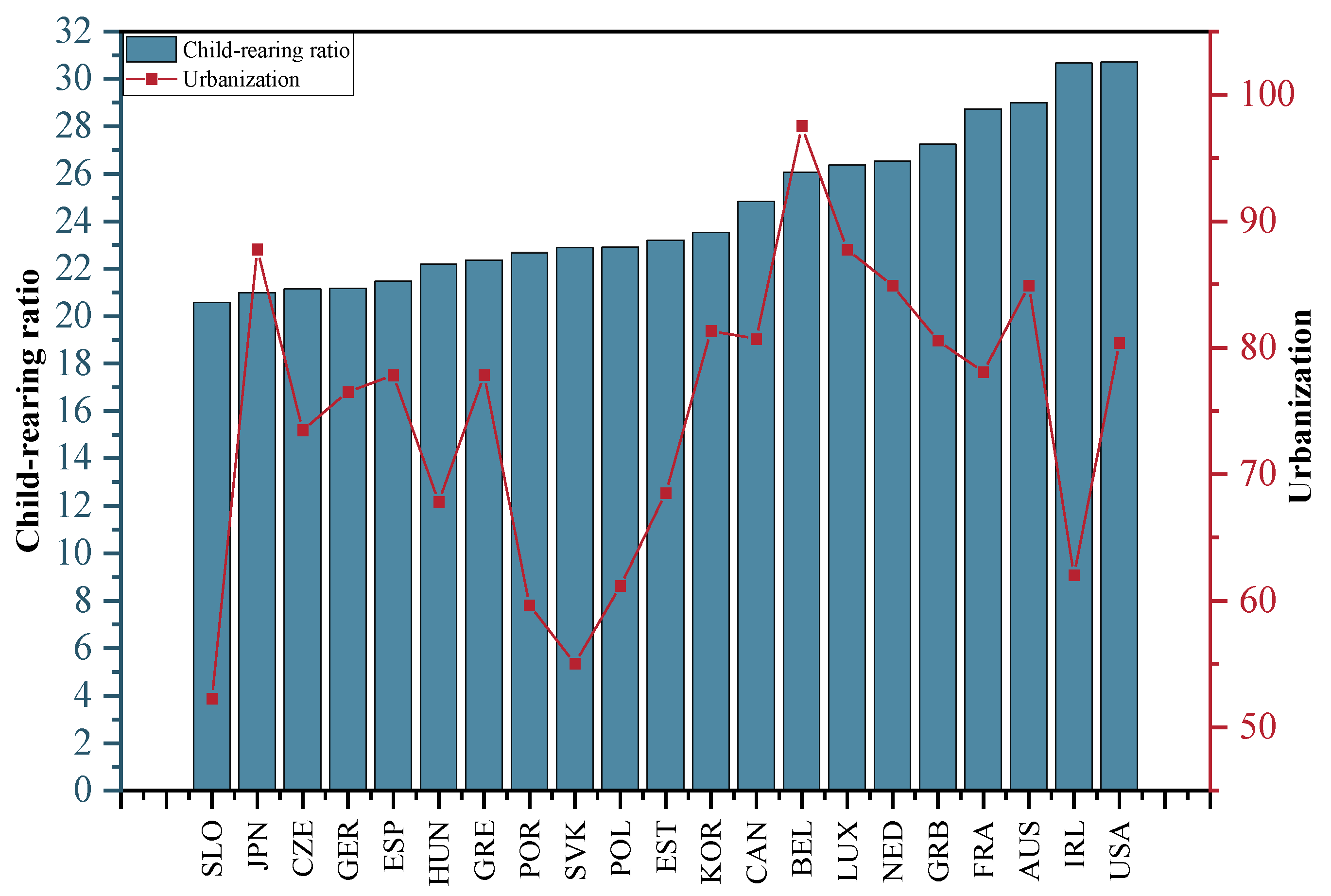

According to the macro-environment, the amount of the three types of public expenditure on family welfare should be dynamically adjusted. From the results of

Table 10, it can be seen that the best mix of policies to promote fertility varies with unemployment and child support burdens. Against the background of a low unemployment rate, we need to choose the type of combination of family welfare public expenditure according to the context of the child-support burden. High child-support burdens require increased spending on services and in-kind and tax incentives to increase fertility, while low child-support burdens require increased spending on cash benefits and tax incentives. Different social contexts, therefore, require a constant refocusing of policy spending to respond effectively to the decline in fertility.

Despite the certain practical significance of this study, there are still certain defects and limitations. First, the research subject of this study is OECD countries with certain specificity. Given the applicability of the results of this study, this study should be considered in the context of the national conditions of the respective country. Second, there are numerous factors involved in fertility decision-making. Lastly, the factors involved in family fertility decision-making change at different stages of development, such that the formulation and implementation of welfare policies should be dynamically adjusted. Accordingly, the above-described three aspects can be studied in depth in subsequent research.