Artificial Intelligence Analysis of Outdoor Sports Risk Self-Assessment on Insurance Psychology

Abstract

:1. Introduction

2. Artificial Intelligence Analysis Method of Outdoor Sports Risk Self-Assessment on Insurance Psychology

2.1. Artificial Intelligence and Psychological Prediction

2.2. Risks of Outdoor Sports

2.3. Psychological Prediction Algorithm Based on Artificial Intelligence

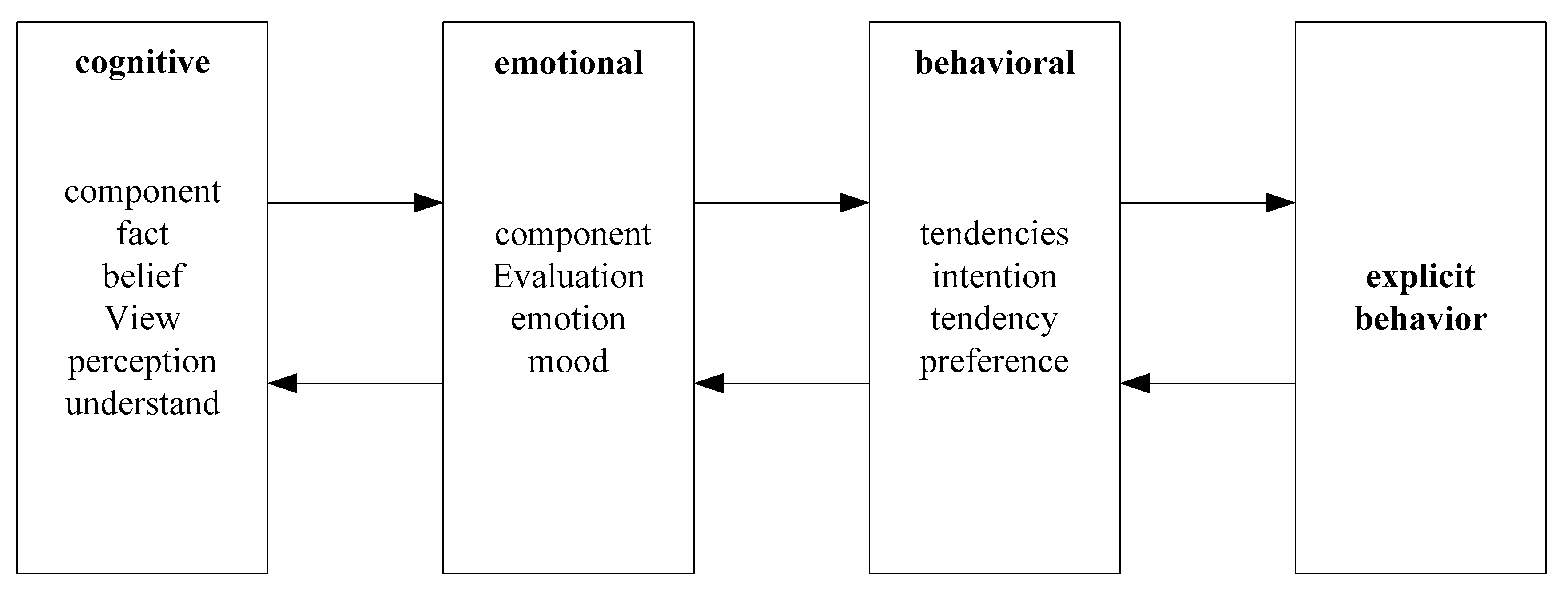

2.4. General Law of Consumption Behavior and Its Performance in Insurance Consumption

3. Artificial Intelligence Experiment of Outdoor Sports Risk Self-Assessment on Insurance Psychology

3.1. Variable Selection

3.2. Model Construction

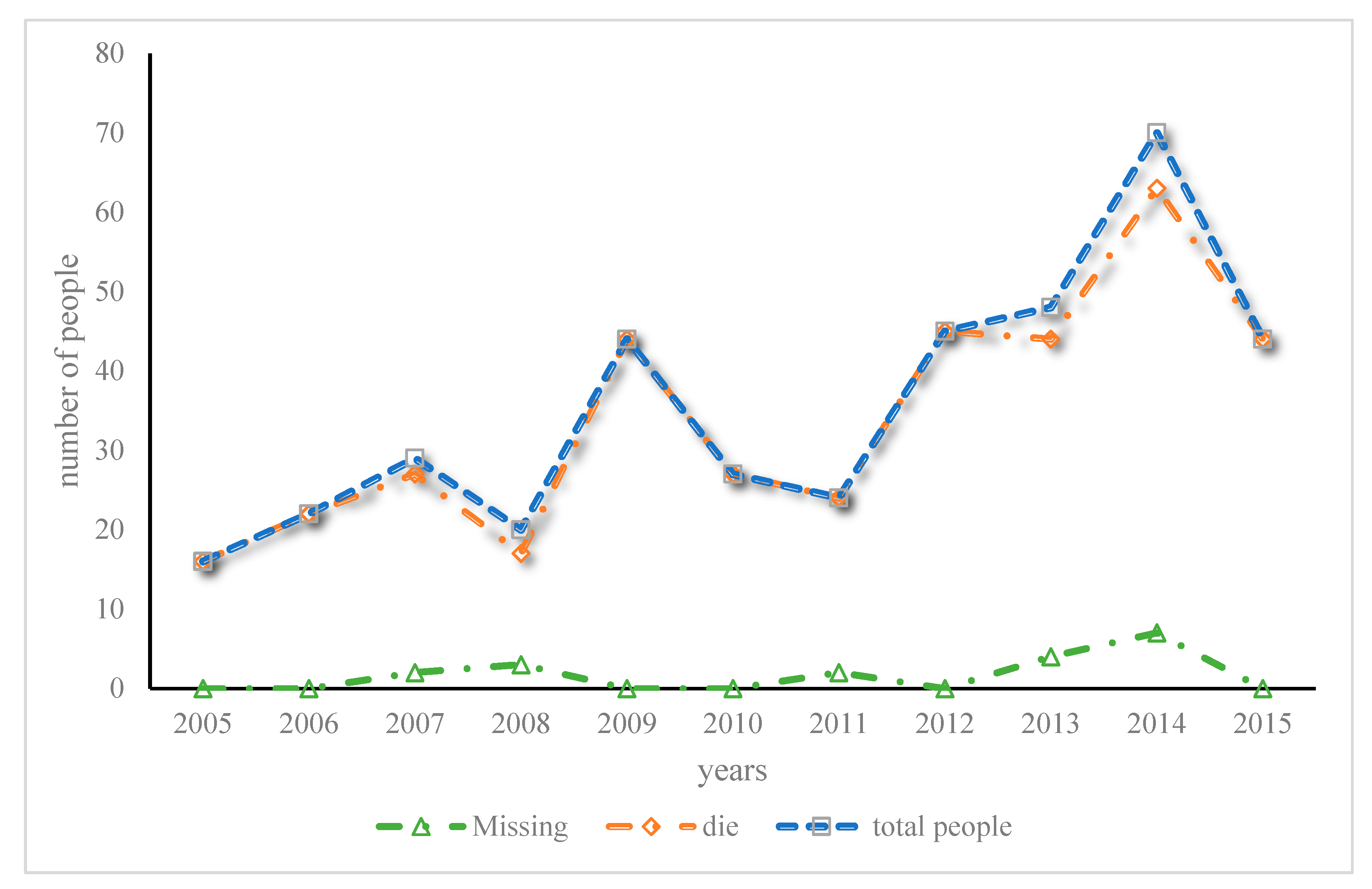

3.3. Deconstruction of Outdoor Sports Medical Insurance Results

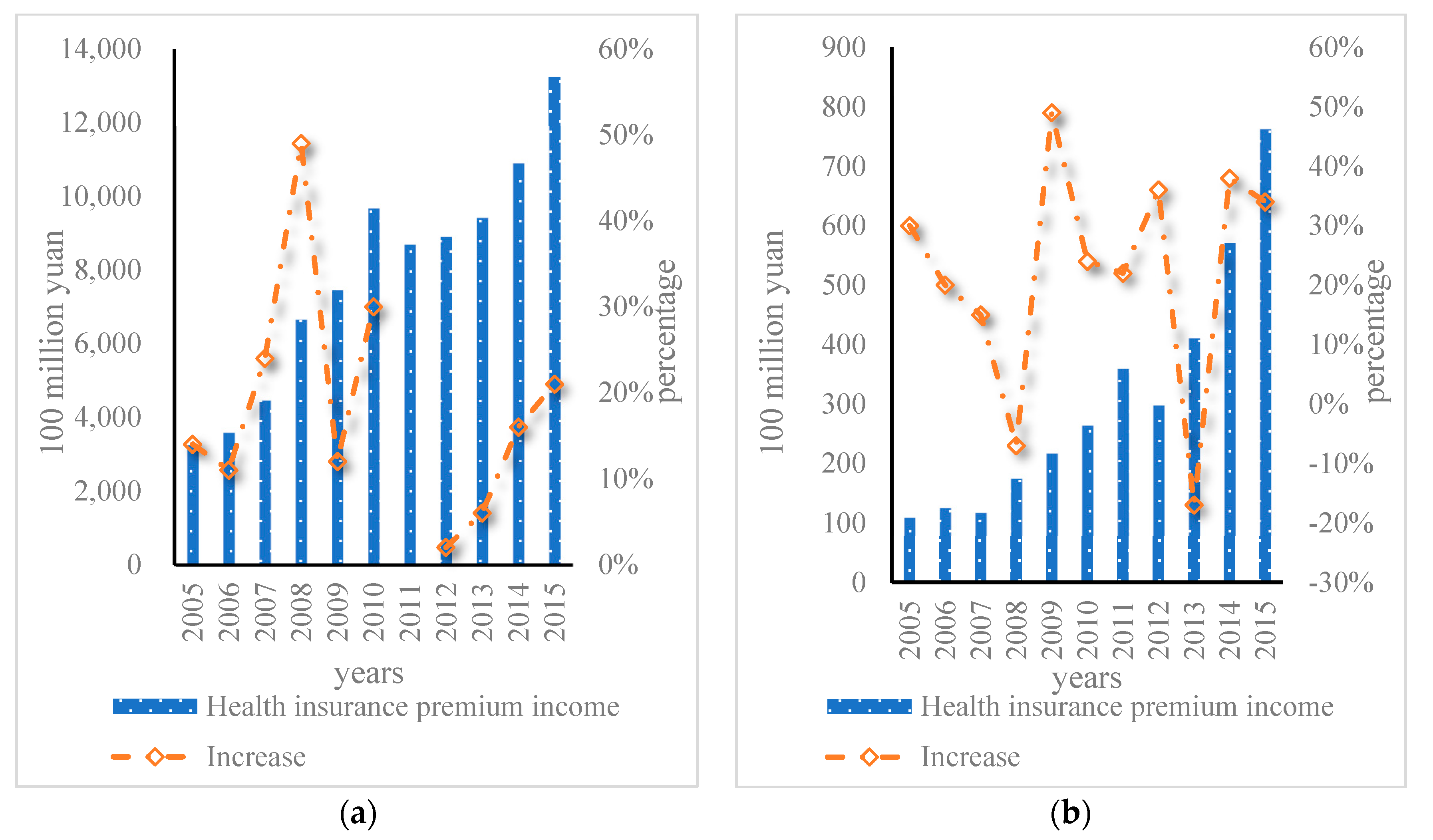

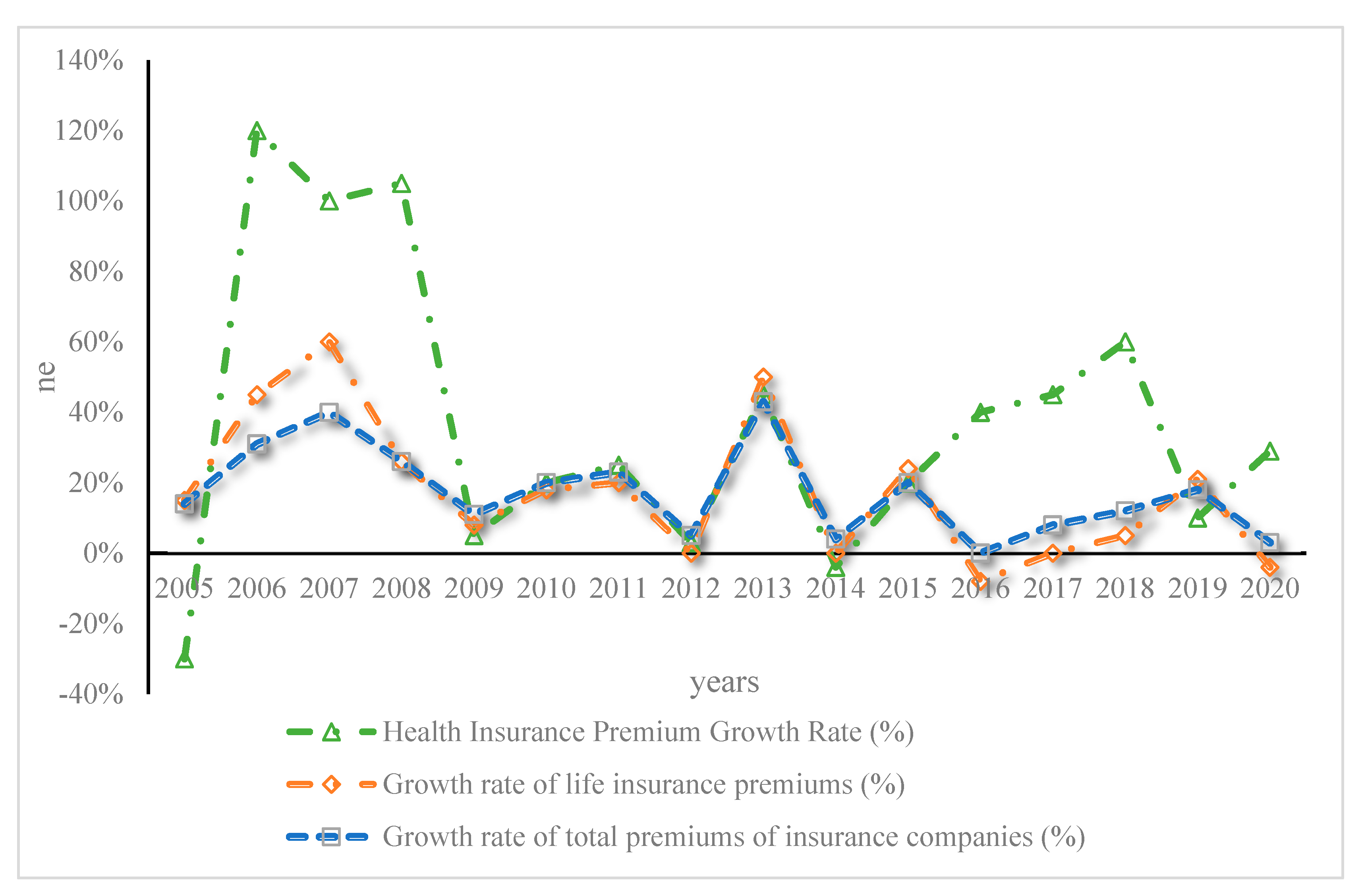

3.4. Deconstruction of the Psychology and Behavior of Insurance Consumers

3.5. Process and Impact of Insurance Consumer Decision Making

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, Y.; Wang, Y.; Hu, H.; Xue, B.H.; Zhang, Z.L.; Yin, L. The history and trend of Chinese outdoor sports development. J. Shangqiu Norm. Univ. 2017, 33, 88–90. [Google Scholar]

- Richter, A.; Ruß, J.; Schelling, S. Insurance customer behavior: Lessons from behavioral economics. Risk Manag. Insur. Rev. 2019, 22, 183–205. [Google Scholar] [CrossRef]

- Harikrishnan, R.; Jebakumar, R.; Kumar, S.G.; Tha, A. Insurance Customer Authentication Using SVM and Financial Time Series Analysis for Mobile Applications. Webology 2020, 17, 945–956. [Google Scholar] [CrossRef]

- Tseng, L.M. Customer insurance frauds: The influence of fraud type, moral intensity and fairness perception. Manag. Financ. 2019, 45, 452–467. [Google Scholar] [CrossRef]

- Fang, T.Y. Explanation on the application of artificial intelligence in Internet insurance. Times Econ. Trade 2021, 18, 33–36. [Google Scholar]

- Zhuang, K.; Wu, S.; Gao, X. Auto Insurance Business Analytics Approach for Customer Segmentation Using Multiple Mixed-Type Data Clustering Algorithms. Teh. Vjesn. 2018, 25, 1783–1791. [Google Scholar]

- Fernandez, M.P.; Ernst, K.; Bron, G.; Berry, K.; Diuk-Wasser, M.A.; Hayden, M.H. Outdoor Activity Associated with Higher Self-Reported Emotional Well-Being During COVID-19. EcoHealth 2022, 19, 154–158. [Google Scholar] [CrossRef]

- Ouyang, Q.H. On the Positive Influence of Outdoor Sports on the Health of Contemporary College Students under the Background of Construction of Sports Power. Sport Sci. Technol. 2020, 41, 49–50. [Google Scholar]

- Jackson, S.B.; Stevenson, K.; Larson, L.; Peterson, M.N.; Seekamp, E. Outdoor Activity Participation Improves Adolescents’ Mental Health and Well-Being during the COVID-19 Pandemic. Int. J. Environ. Res. Public Health 2021, 18, 2506. [Google Scholar] [CrossRef]

- Al-Anouti, F.; Thomas, J.; Karras, S.; El-Asswad, N. Outdoor Activity in the Daytime, but Not the Nighttime, Predicts Better Mental Health Status During the COVID-19 Curfew in the United Arab Emirates. Front. Public Health 2022, 10, 829362. [Google Scholar] [CrossRef]

- Barron, C.M.; Emmett, M.J. Back gardens and friends the impact of COVID-19 on children and adolescents use of, and access to, outdoor spaces. Ir. Geogr. 2021, 53, 173–177. [Google Scholar]

- Ma, X.X.; Tian, Z. Clarification and Definition of Concepts on Outdoor Sports. China Sport Sci. Technol. 2015, 51, 140–145. [Google Scholar]

- Liu, H.R.; He, Q.L. Construction and Operation of Risk Prevention and Control System for Outdoor Sports in Universities from the Perspective of System Safety Management. J. Zhaotong Univ. 2022, 44, 91–100. [Google Scholar]

- Chow, H.W.; Wu, D.R. Outdoor Fitness Equipment Usage Behaviors in Natural Settings. Int. J. Environ. Res. Public Health 2019, 16, 391. [Google Scholar] [CrossRef]

- Lu, P.F. Survey and analysis of risk awareness of outdoor sports participant in Xi’an. J. Anhui Sport. Sci. 2014, 35, 25–28. [Google Scholar]

- Petrovic, M.D.; Radovanovic, M.; Vyklyuk, Y.; Milenkovic, M.; Tretiakova, T.N. The Conditionality of Outdoor Sports Events on Weather-Induced Impacts and Possible Solution. J. Hosp. Tour. Res. 2021, 45, 1303–1323. [Google Scholar] [CrossRef]

- Zhou, K.W.; Yang, H.Z. Multiple model soft sensor with relevance vector machine based on Bayesian classifier. Comput. Eng. Appl. 2011, 47, 24–26. [Google Scholar]

- Liu, Q.; Xu, Y.; Niu, Z.Y. Marginal Probability Ratio Based on Method of Maneuver Sequential Test. Command. Control. Simul. 2017, 39, 54–57. [Google Scholar]

- Zhang, L.J. A New Interpretation of People’s Pursuit of Utility Maximization. J. Guangzhou Univ. 2018, 17, 50–56. [Google Scholar]

- Xu, X.; Song, H.H. The Impact of Change in Age Structure of Population on the Consumption Level of Urban and Rural Residents in China. J. Cap. Univ. Econ. Bus. 2019, 21, 15–23. [Google Scholar]

- Zhang, L.J. The normative impact of reference group on attraction effect. Theory Pract. Financ. Econ. 2015, 36, 123–127. [Google Scholar]

- AlNemer, H.A.; Ansari, Z.A. Protection and Savings Insurance Consumer Behaviour in Saudi Arabia. Eur. J. Bus. Manag. 2016, 8, 27–38. [Google Scholar]

- Chowdhury, S.; Mayilvahanan, P.; Govindaraj, R. Optimal feature extraction and classification-oriented medical insurance prediction model: Machine learning integrated with the internet of things. Int. J. Comput. Appl. 2022, 44, 278–290. [Google Scholar] [CrossRef]

- Setiawan, A.; Sugiarto, S.; Ugut, G.; Hulu, E. Fair pricing: A framework towards sustainable life insurance products. Accounting 2021, 7, 1–12. [Google Scholar] [CrossRef]

| Variable | Mean | Standard Deviation | Minimum | Maximum Value |

|---|---|---|---|---|

| gender | 0.547293 | 0.497789 | 0 | 1 |

| age | 59.48504 | 9.433346 | 20.8333 | 102.5 |

| mar | 0.859634 | 0.347387 | 0 | 1 |

| edu | 4.290662 | 1.7738 | 0 | 10 |

| logassets | 11.2682 | 1.710257 | 4.605 I 7 | 23.4316 |

| R/T | 0.022244 | 0.093455 | 0 | 0.972179 |

| sub7 | 4.077147 | 1.161387 | 0 | 5 |

| mem | 3.292116 | 1.999013 | 0 | 10 |

| treatm | 0.244883 | 0.430044 | 0 | 1 |

| Variable | High-Insurance-Coverage Model | Low-Insurance-Rate Model | ||||

|---|---|---|---|---|---|---|

| gender | 0.0839 * | 0.0811 * | 0.099 ** | 0.0145 | 0.0324 | 0.0208 |

| age | −0.0023 | −0.0017 | −0.0036 | −0.0188 *** | −0.0169 *** | −0.0192 *** |

| mar | 0.016 | 0.0057 | 0.0188 | 0.2235 ** | 0.2099 ** | 0.2242 ** |

| edu | 0.0299 ** | 0.0163 | 0.03 ** | 0.0786 *** | 0.0578 *** | 0.0807 *** |

| logassets | −0.0198 * | −0.0215 * | −0.0167 | 0.0703 *** | 0.0694 *** | 0.0732 *** |

| R/T | −0.7328 ** | - | - | −0.5614 *** | 0.0394 | −0.0479 |

| Constant | 1.6127 *** | - | 1.6047 *** | −2.177 *** | −2.5166 *** | 0.0523 |

| goodness of fit | 0.044 | 0.045 | 0.041 | 0.042 | 0.048 | 0.044 |

| Variable | Low-Insurance-Rate Model | Variable | Low-Insurance-Rate Model |

|---|---|---|---|

| age | −0.0186 *** | R/T | −0.5742 ** |

| gender | 0.0142 | treatm | 0.1971 |

| mar | 0.2241 ** | S_ ins | −0.0427 |

| edu | 0.0791 *** | Treatm*s_ ins | −0.2640 |

| logassets | 0.0235 *** | Constant | −2.1335 *** |

| goodness of fit | 0.036 | 0.035 | 0.032 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Z.; Dai, X.; Tan, Z. Artificial Intelligence Analysis of Outdoor Sports Risk Self-Assessment on Insurance Psychology. Int. J. Environ. Res. Public Health 2023, 20, 3140. https://doi.org/10.3390/ijerph20043140

Chen Z, Dai X, Tan Z. Artificial Intelligence Analysis of Outdoor Sports Risk Self-Assessment on Insurance Psychology. International Journal of Environmental Research and Public Health. 2023; 20(4):3140. https://doi.org/10.3390/ijerph20043140

Chicago/Turabian StyleChen, Zhiling, Xinghong Dai, and Zhigang Tan. 2023. "Artificial Intelligence Analysis of Outdoor Sports Risk Self-Assessment on Insurance Psychology" International Journal of Environmental Research and Public Health 20, no. 4: 3140. https://doi.org/10.3390/ijerph20043140

APA StyleChen, Z., Dai, X., & Tan, Z. (2023). Artificial Intelligence Analysis of Outdoor Sports Risk Self-Assessment on Insurance Psychology. International Journal of Environmental Research and Public Health, 20(4), 3140. https://doi.org/10.3390/ijerph20043140