Spatial Effects of Digital Transformation, PM2.5 Exposure, Economic Growth and Technological Innovation Nexus: PM2.5 Concentrations in China during 2010–2020

Abstract

1. Introduction

2. Literature Review

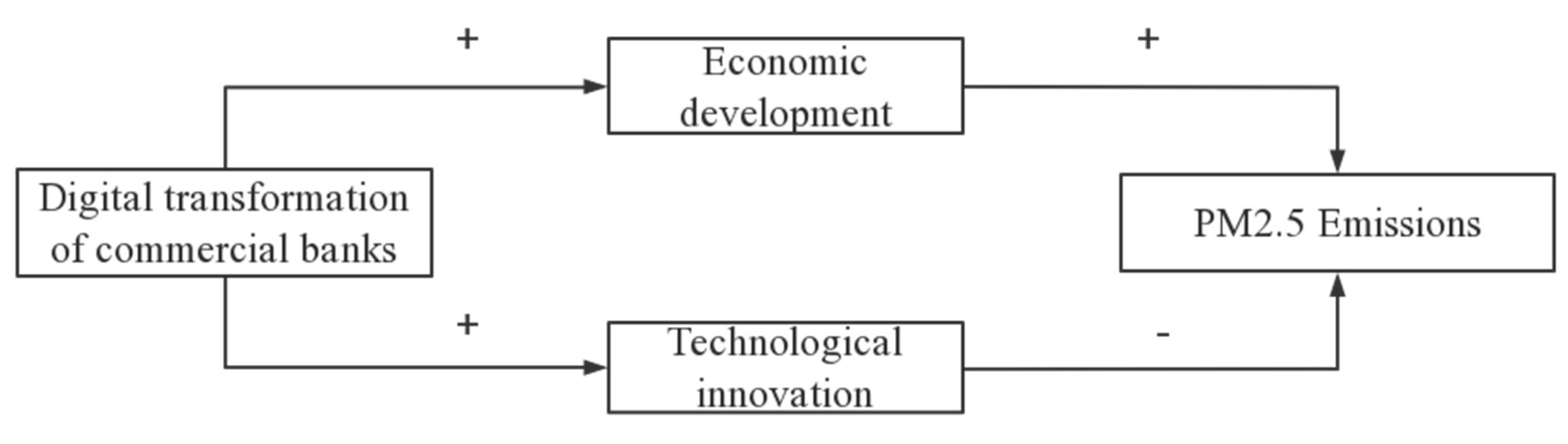

DTCB Impact Mechanism and Air Pollution

- The impact of DTCB on commercial banks’ lending

- 2.

- The impact of increasing lending on air pollution

- 3.

- The impact of DTCB on air pollution

- 4.

- Heterogeneity of innovation ability

- 5.

- Heterogeneity of the degree of digital economy development

3. Methodology

3.1. Empirical Model

3.2. Variables

- (1)

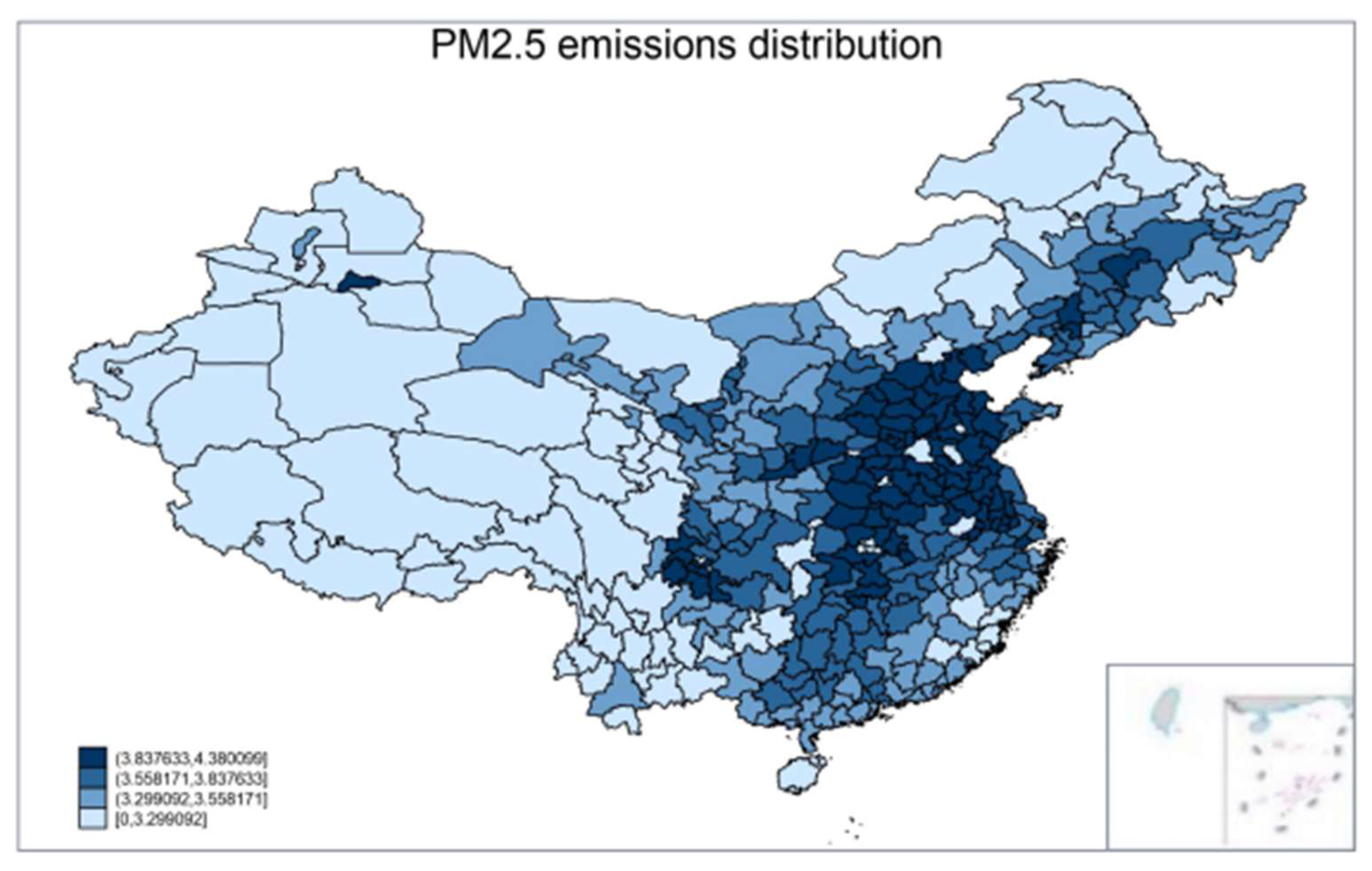

- The explained variable: air pollution (PM2.5). Following Zhang et al. (2022) [34], we use the logarithmic values of PM2.5 concentration to measure PM2.5. Since PM2.5 concentration is the most hazardous air pollutant for people’s health, we chose each region’s annual average PM2.5 concentration to measure air pollution, expressed as PM2.5.

- (2)

- The core explanatory variable: digital transformation of commercial banks (DTCB). This study follows the methods of studies [35,36] to measure DTCB. Firstly, this article measures the degree of DTCB at the commercial bank level by the quantity of patent permission connected to DTCB. Then, the degree of DTCB at the city level is constructed based on the degree of DTCB at the commercial bank level and the geographic distribution data of the commercial bank branches.

- (3)

- Control variables

- (4)

- Weight matrix

3.3. Data Sources

4. Results

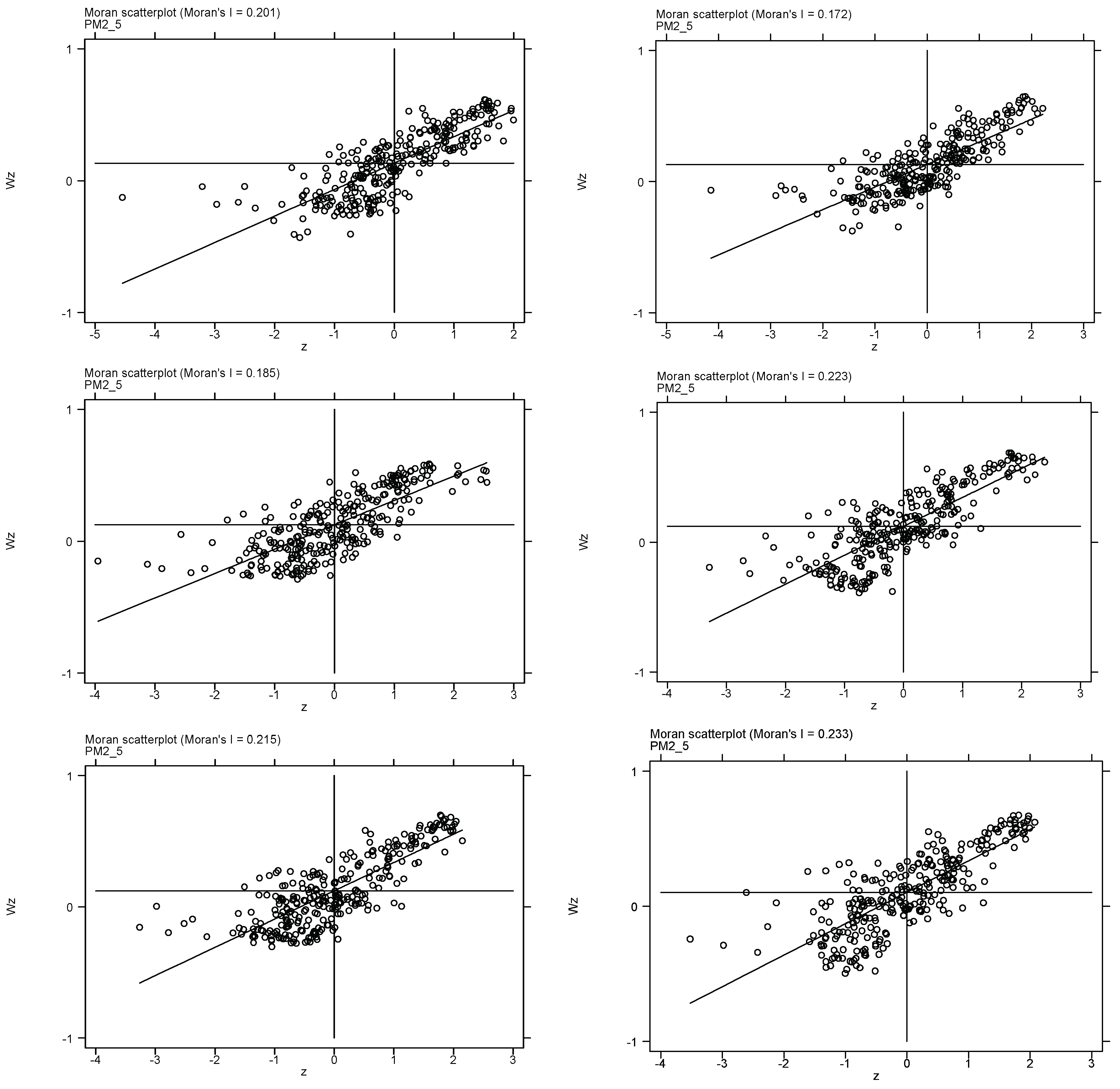

4.1. Spatial Correlation Test

4.2. The Baseline Results

4.3. The Robustness Test

4.3.1. Replace the Measurement Method of DTCB

4.3.2. Use Different Spatial Weight Matrix

4.3.3. Treatment of Endogeneity with the First-Order Lagged Value of DTCB

4.3.4. Treatment of Endogeneity with the First-Order Lagged Value of PM2.5

4.4. Heterogeneity Test

4.4.1. Heterogeneity of Innovation Ability

4.4.2. Heterogeneity of the Degree of Development of the Digital Economy

4.5. Mechanism Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Vlachokostas, C.; Achillas, C.; Moussiopoulos, N.; Kalogeropoulos, K.; Sigalas, G.; Kalognomou, E.-A.; Banias, G. Health effects and social costs of particulate and photochemical urban air pollution: A case study for Thessaloniki, Greece. Air Qual. Atmos. Health 2012, 5, 325–334. [Google Scholar] [CrossRef]

- Wen, M.; Gu, D. Air pollution shortens life expectancy and health expectancy for older adults: The case of China. J. Gerontol. Ser. A Biol. Sci. Med. Sci. 2012, 67, 1219–1229. [Google Scholar] [CrossRef]

- Kaiser, R.; Romieu, I.; Medina, S.; Schwartz, J.; Krzyzanowski, M.; Künzli, N. Air pollution attributable postneonatal infant mortality in U.S. metropolitan areas: A risk assessment study. Environ. Health A Glob. Access Sci. Source 2004, 3, 4. [Google Scholar] [CrossRef] [PubMed]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Bencivenga, V.R.; Smith, B.D. Financial Intermediation and Economic Growth. Rev. Econ. Stud. 1991, 58, 195–209. [Google Scholar] [CrossRef]

- Nanda, R.; Nicholas, T. Did bank distress stifle innovation during the Great Depression? J. Financ. Econ. 2014, 114, 273–292. [Google Scholar] [CrossRef]

- Xuezhou, W.; Manu, E.K.; Akowuah, I.N. Financial development and environmental quality: The role of economic growth among the regional economies of Sub-Saharan Africa. Environ. Sci. Pollut. Res. 2022, 29, 23069–23093. [Google Scholar] [CrossRef]

- Ren, L.; Zhu, D. Is China’s financial development green?—Also discuss on the hypothesis of environmental Kuznets curve in China. Econ. Perspect. 2017, 681, 58–73. [Google Scholar]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Cai, Y.; Hu, Z. Industrial agglomeration and industrial SO2 emissions in China’s 285 cities: Evidence from multiple agglomeration types. J. Clean. Prod. 2022, 353, 131675. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.-A.; Siering, M. Digital Finance and FinTech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Cheng, M.; Qu, Y. Does bank FinTech reduce credit risk? Evidence from China. Pac.-Basin Financ. J. 2020, 63, 101398. [Google Scholar] [CrossRef]

- Almeida, H.; Wolfenzon, D. The effect of external finance on the equilibrium allocation of capital. J. Financ. Econ. 2005, 75, 133–164. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Huang, H.; Mbanyele, W.; Fan, S.; Zhao, X. Digital financial inclusion and energy-environment performance: What can learn from China. Struct. Chang. Econ. Dyn. 2022, 63, 342–366. [Google Scholar] [CrossRef]

- Guo, F.; Xiong, Y. Measurement of digital financial Inclusion in China and its impact: A literature review. Chin. Rev. Financ. Stud. 2021, 13, 12–23+117–118. [Google Scholar]

- Stiglitz, J.; Weiss, A. Credit Rationing in Markets With Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Goldstein, I.; Jiang, W.; Karolyi, G.A. To FinTech and Beyond. Rev. Financ. Stud. 2019, 32, 1647–1661. [Google Scholar] [CrossRef]

- Cornée, S. The Relevance of Soft Information for Predicting Small Business Credit Default: Evidence from a Social Bank. J. Small Bus. Manag. 2019, 57, 699–719. [Google Scholar] [CrossRef]

- Xu, H. Financial Intermediation and Economic Growth in China: New Evidence from Panel Data. Emerg. Mark. Financ. Trade 2016, 52, 724–732. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shahzad, S.J.H.; Ahmad, N.; Alam, S. Financial development and environmental quality: The way forward. Energy Policy 2016, 98, 353–364. [Google Scholar] [CrossRef]

- Fahad, S.; Nguyen-Thi-Lan, H.; Nguyen-Manh, D.; Tran-Duc, H.; To-The, N. Analyzing the status of multidimensional poverty of rural households by using sustainable livelihood framework: Policy implications for economic growth. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Foss, N.J. Higher-order industrial Capabilities and competitive advantage. J. Ind. Stud. 1996, 3, 1–20. [Google Scholar] [CrossRef]

- Furman, J.L.; Porter, M.E.; Stern, S. The determinants of national innovative capacity. Res. Policy 2002, 31, 899–933. [Google Scholar] [CrossRef]

- Tang, J.; Tang, Q. R&D Investment and Frictions of R&D Resource Acquisition of Enterprise: Based on a Questionnaire Research. Contemp. Econ. Manag. 2010, 32, 20–27. [Google Scholar]

- Qi, h.; Cao, X.; Liu, Y. The impact of digital economy on Corporate Governance: From the perspective of information asymmetry and managers’ irrational behavior. Reform 2020, 4, 50–64. [Google Scholar]

- Sun, F.; Zheng, J. Research on Intelligent Assessment of accounting Information Quality of listed companies based on “Internet +”. Account. Res. 2018, 3, 86–90. [Google Scholar]

- Zhang, X.; Wu, Y. Research progress of empirical asset pricing based on network Big data mining. Econ. Perspect. 2018, 6, 129–140. [Google Scholar]

- Tobler, W.R. A Computer Movie Simulating Urban Growth in the Detroit Region. Econ. Geogr. 1970, 46 (Suppl. S1), 234–240. [Google Scholar] [CrossRef]

- Anselin, L.; Varga, A.; Acs, Z. Local Geographic Spillovers between University Research and High Technology Innovations. J. Urban Econ. 1997, 42, 422–448. [Google Scholar] [CrossRef]

- Lesage, J.P.; Fischer, M.M. Spatial Growth Regressions: Model Specification, Estimation and Interpretation. Spat. Econ. Anal. 2008, 3, 275–304. [Google Scholar] [CrossRef]

- Zhang, X.; Nan, S.; Lu, S.; Wang, M. Spatial Effects of Air Pollution on the Siting of Enterprises: Evidence from China. Int. J. Env. Res. Public Health 2022, 19, 14484. [Google Scholar] [CrossRef]

- Li, X.; Wang, C.; Fang, J. Bank Fintech, commercial credit and Private enterprise export: An empirical analysis based on panel data of prefecture-level cities in China. Financ. Econ. Res. 2022, 37, 1–18. [Google Scholar]

- Li, Y.; Li, M.; Li, J. Bank-Fintech, Credit Allocation and Enterprises’ Short-term Debt for Long-term Use. China Ind. Econ. 2022, 10, 137–154. [Google Scholar]

- You, W.; Zhang, Y.; Lee, C.-C. The dynamic impact of economic growth and economic complexity on CO2 emissions: An advanced panel data estimation. Econ. Anal. Policy 2022, 73, 112–128. [Google Scholar] [CrossRef]

- Zhu, H.-M.; You, W.-H.; Zeng, Z.-f. Urbanization and CO2 emissions: A semi-parametric panel data analysis. Econ. Lett. 2012, 117, 848–850. [Google Scholar] [CrossRef]

- Nan, S.; Huang, J.; Wu, J.; Li, C. Does globalization change the renewable energy consumption and CO2 emissions nexus for OECD countries? New evidence based on the nonlinear PSTR model. Energy Strategy Rev. 2022, 44, 100995. [Google Scholar] [CrossRef]

- You, W.; Lv, Z. Spillover effects of economic globalization on CO2 emissions: A spatial panel approach. Energy Econ. 2018, 73, 248–257. [Google Scholar] [CrossRef]

- Nan, S.; Huo, Y.; You, W.; Guo, Y. Globalization spatial spillover effects and carbon emissions: What is the role of economic complexity? Energy Econ. 2022, 112, 106184. [Google Scholar] [CrossRef]

- You, W.-H.; Zhu, H.-M.; Yu, K.; Peng, C. Democracy, Financial Openness, and Global Carbon Dioxide Emissions: Heterogeneity Across Existing Emission Levels. World Dev. 2015, 66, 189–207. [Google Scholar] [CrossRef]

- Wang, W.; Rehman, M.A.; Fahad, S. The dynamic influence of renewable energy, trade openness, and industrialization on the sustainable environment in G-7 economies. Renew. Energy 2022, 198, 484–491. [Google Scholar] [CrossRef]

- Hu, G.; Wang, J.; Fahad, S.; Li, J. Influencing factors of farmers’ land transfer, subjective well-being, and participation in agri-environment schemes in environmentally fragile areas of China. Environ. Sci. Pollut. Res. 2022, 30, 4448–4461. [Google Scholar] [CrossRef] [PubMed]

- Hu, G.; Wang, J.; Laila, U.; Fahad, S.; Li, J. Evaluating households’ community participation: Does community trust play any role in sustainable development? Front. Environ. Sci. 2022, 10, 951262. [Google Scholar] [CrossRef]

- Su, F.; Song, N.; Shang, H.; Fahad, S. The impact of economic policy uncertainty on corporate social responsibility: A new evidence from food industry in China. PLoS ONE 2022, 17, e0269165. [Google Scholar] [CrossRef] [PubMed]

- Song, J.; Peng, R.; Qian, L.; Yan, F.; Ozturk, I.; Fahad, S. Households Production Factor Mismatches and Relative Poverty Nexus: A Novel Approach. Pol. J. Environ. Stud. 2022, 31, 3797–3807. [Google Scholar] [CrossRef]

- Song, J.; Geng, L.; Fahad, S. Agricultural factor endowment differences and relative poverty nexus: An analysis of. macroeconomic and social determinants. Environ. Sci. Pollut. Res. 2022, 29, 52984–52994. [Google Scholar] [CrossRef]

- Fahad, S.; Su, F.; Wei, K. Quantifying households’ vulnerability, regional environmental indicators, and climate change mitigation by using a combination of vulnerability frameworks. Land Degrad. Dev. 2023. [Google Scholar] [CrossRef]

- Zhang, J.; Li, K.; Zhang, J. How does Bank FinTech Impact Structural Deleveraging of Firms? J. Financ. Econ. 2022, 48, 64–77. [Google Scholar]

- Corrado, L.; Fingleton, B. Where is the economics in spatial econometrics? J. Reg. Sci. 2012, 52, 210–239. [Google Scholar] [CrossRef]

- Meng, L.; Huang, B. Shaping the Relationship Between Economic Development and Carbon Dioxide Emissions at the Local Level: Evidence from Spatial Econometric Models. Environ. Resour. Econ. 2018, 71, 127–156. [Google Scholar] [CrossRef]

| Variables | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| PM2.5 | 3157 | 3.687 | 0.354 | 2.241 | 4.687 |

| DTCB | 3157 | 0.733 | 0.476 | 0 | 1.683 |

| Rain | 3157 | 6.855 | 0.477 | 5.217 | 7.917 |

| Wind | 3157 | 0.744 | 0.238 | −0.030 | 1.515 |

| Sun | 3157 | 7.556 | 0.269 | 6.609 | 8.128 |

| Pop | 3157 | 5.733 | 0.927 | 1.609 | 7.882 |

| FDI | 3157 | 0.003 | 0.00270 | 0.001 | 0.030 |

| Indus | 3157 | 1.007 | 0.570 | 0.109 | 5.348 |

| Tech | 3157 | 7.176 | 1.773 | 0.693 | 12.31 |

| GDP | 3157 | 5.830 | 0.553 | 4.103 | 8.345 |

| 2010 | 2012 | 2014 | 2016 | 2018 | 2020 | |

|---|---|---|---|---|---|---|

| PM2.5 | 0.201 *** | 0.172 *** | 0.185 *** | 0.223 *** | 0.215 *** | 0.233 *** |

| p-Value | ||

|---|---|---|

| SDM versus SLM | 310.32 | 0.0000 |

| SDM versus SEM | 368.14 | 0.0000 |

| Variables | Coefficient | Std. Err |

|---|---|---|

| DTCB | 0.006 | (1.34) |

| Rain | 0.010 | (0.48) |

| Wind | −0.065 *** | (−2.63) |

| Sun | −0.131 *** | (−3.64) |

| Pop | −0.041 | (−0.80) |

| FDI | −2.196 ** | (−2.17) |

| Indus | −0.012 | (−1.00) |

| W*DTCB | 0.143 ** | (2.17) |

| W*Rain | −0.357 *** | (−4.60) |

| W*Wind | −0.944 *** | (−5.29) |

| W*Sun | 0.326 *** | (2.62) |

| W*Pop | −1.999 *** | (−4.35) |

| W*FDI | 5.146 | (0.62) |

| W*Indus | 0.272 *** | (3.46) |

| 0.977 *** | (699.19) | |

| N | 3157 | |

| R2 | 0.2951 |

| Variables | Direct Effect | Indirect Effect | Total Effect | |||

|---|---|---|---|---|---|---|

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| DTCB | 0.028 ** | (2.42) | 6.313 ** | (2.22) | 6.341 ** | (2.22) |

| Rain | −0.045 *** | (−3.30) | −15.021 *** | (−5.56) | −15.066 *** | (−5.59) |

| Wind | −0.222 *** | (−7.93) | −44.637 *** | (−5.96) | −44.860 *** | (−5.97) |

| Sun | −0.099 *** | (−3.68) | −8.910 ** | (−2.17) | −8.811 ** | (−2.15) |

| Pop | −0.363 *** | (−5.86) | −89.493 *** | (−5.04) | −89.856 *** | (−5.04) |

| FDI | −1.598 | (−1.03) | 142.157 | (0.39) | 140.558 | (0.39) |

| Indus | 0.029 * | (1.76) | 11.334 *** | (3.34) | 11.363 *** | (3.34) |

| Variables | Direct Effects | Spillover Effects | Total Effects | |||

|---|---|---|---|---|---|---|

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| DTCB | 0.007 * | (1.75) | 0.166 * | (1.84) | 0.173 * | (1.93) |

| Rain | −0.027 | (−1.20) | −0.139 | (−1.33) | −0.166 * | (−1.70) |

| Wind | −0.067 *** | (−3.18) | −0.561 | (−1.59) | −0.628 * | (−1.73) |

| Sun | −0.042 | (−1.17) | −0.101 | (−0.51) | −0.143 | (−0.75) |

| Pop | −0.030 | (−0.67) | −0.853 | (−0.77) | −0.883 | (−0.78) |

| FDI | −2.423 *** | (−2.64) | −7.300 | (−0.48) | −9.723 | (−0.61) |

| Indus | −0.001 | (−0.07) | 0.149 | (0.87) | 0.148 | (0.82) |

| Variables | Direct Effects | Spillover Effects | Total Effects | |||

|---|---|---|---|---|---|---|

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| DTCB | 0.006 * | (1.91) | 0.488 ** | (2.09) | 0.493 ** | (2.03) |

| Rain | −0.046 *** | (−4.12) | 0.092 | (0.69) | 0.046 | (0.34) |

| Wind | −0.163 *** | (−6.99) | 0.366 | (0.36) | 0.203 | (0.20) |

| Sun | −0.131 *** | (−5.68) | −0.584 *** | (−2.58) | −0.715 *** | (−3.10) |

| Pop | 0.033 | (0.53) | 2.035 | (1.51) | 2.068 | (1.54) |

| FDI | −2.990 *** | (−3.13) | 35.855 | (0.77) | 32.865 | (0.71) |

| Indus | −0.021 * | (−1.73) | −0.592 | (−1.10) | −0.613 | (−1.14) |

| Variables | Direct Effects | Spillover Effects | Total EFFECTs | |||

|---|---|---|---|---|---|---|

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| 0.029 ** | (2.39) | 8.121 *** | (2.91) | 8.150 *** | (2.91) | |

| Rain | −0.038 *** | (−2.74) | −12.732 *** | (−4.65) | −12.770 *** | (−4.67) |

| Wind | −0.256 *** | (−9.54) | −54.713 *** | (−7.75) | −54.970 *** | (−7.77) |

| Sun | −0.071 *** | (−2.66) | 9.651 ** | (2.27) | 9.581 ** | (2.26) |

| Pop | −0.620 *** | (−8.47) | −148.739 *** | (−7.85) | −149.360 *** | (−7.86) |

| FDI | −0.768 | (−0.44) | 480.467 | (1.14) | 479.698 | (1.14) |

| Indus | 0.024 | (1.44) | 10.734 *** | (3.35) | 10.757 *** | (3.35) |

| Variables | Direct Effects | Spillover Effects | Total Effects | |||

|---|---|---|---|---|---|---|

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| 0.278 *** | (7.99) | 0.088 ** | (2.08) | 0.366 *** | (7.04) | |

| 0.009 * | (1.74) | 0.053 * | (1.86) | 0.061 * | (1.78) | |

| Rain | −0.012 | (−0.78) | 0.004 | (0.16) | −0.008 | (−0.27) |

| Wind | −0.058 *** | (−3.01) | 0.168 * | (1.95) | 0.110 | (1.30) |

| Sun | −0.076 *** | (−2.70) | 0.039 | (0.85) | −0.037 | (−0.66) |

| Pop | −0.020 | (−0.43) | 0.078 | (0.34) | 0.058 | (0.27) |

| FDI | −2.394 *** | (−2.67) | −0.099 | (−0.02) | −2.493 | (−0.58) |

| Indus | −0.009 | (−0.95) | −0.014 | (−0.36) | −0.024 | (−0.66) |

| Variables | Direct Effects | Spillover Effects | Total Effects | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | ||||

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| DTCB | 0.036 *** | (2.88) | 8.093 *** | (2.58) | 8.129 *** | (2.58) |

| DTCB*Digital | −0.121 *** | (−3.76) | −25.813 *** | (−3.57) | −25.934 *** | (−3.57) |

| Rain | −0.043 *** | (−3.19) | −16.980 *** | (−6.34) | −17.024 *** | (−6.37) |

| Wind | −0.241 *** | (−8.75) | −49.070 *** | (−6.65) | −49.310 *** | (−6.67) |

| Sun | −0.098 *** | (−3.63) | 6.240 | (1.53) | 6.142 | (1.51) |

| Pop | −0.317 *** | (−4.89) | −81.028 *** | (−4.33) | −81.345 *** | (−4.34) |

| FDI | −2.895 ** | (−1.96) | −157.164 | (−0.44) | −160.059 | (−0.45) |

| Indus | 0.023 | (1.35) | 10.154 *** | (3.08) | 10.177 *** | (3.08) |

| Variables | Direct Effects | Spillover Effects | Total Effects | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | ||||

| Coefficients | Std. Err | Coefficients | Std. Err | Coefficients | Std. Err | |

| DTCB | 0.045 *** | (3.59) | 9.895 *** | (3.08) | 9.939 *** | (3.09) |

| DTCB*Innovation | −0.075 *** | (−4.18) | −16.796 *** | (−3.73) | −16.870 *** | (−3.73) |

| Rain | −0.047 *** | (−3.54) | −17.608 *** | (−6.39) | −17.655 *** | (−6.42) |

| Wind | −0.258 *** | (−8.84) | −54.475 *** | (−7.06) | −54.734 *** | (−7.07) |

| Sun | −0.105 *** | (−3.84) | 4.318 | (1.05) | 4.213 | (1.02) |

| Pop | −0.425 *** | (−6.81) | −105.759 *** | (−5.96) | −106.184 *** | (−5.97) |

| FDI | −2.200 | (−1.49) | 15.324 | (0.04) | 13.125 | (0.04) |

| Indus | 0.020 | (1.21) | 9.372 *** | (2.85) | 9.392 *** | (2.84) |

| Variables | GDP | Tech | ||||

|---|---|---|---|---|---|---|

| Direct Effects | Spillover Effects | Total Effects | Direct Effects | Spillover Effects | Total Effects | |

| (1) | (2) | (3) | (4) | |||

| DTCB | 0.046 *** | 8.489 *** | 8.535 *** | −0.049 | −0.713 | −0.761 |

| (3.18) | (2.91) | (2.91) | (−1.15) | (−0.44) | (−0.46) | |

| Pop | 0.008 | −24.774 | −24.766 | 0.735 | 30.239 | 30.974 |

| (0.04) | (−1.13) | (−1.13) | (1.18) | (1.35) | (1.38) | |

| FDI | 11.763 *** | 2267.869 *** | 2279.632 *** | 7.892 | 184.438 | 192.330 |

| (4.48) | (4.03) | (4.04) | (0.76) | (0.73) | (0.76) | |

| Indus | −0.171 *** | −17.670 *** | −17.841 *** | −0.021 | 1.514 | 1.493 |

| (−7.28) | (−4.18) | (−4.21) | (−0.19) | (0.68) | (0.68) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, F.; Fahad, S.; Wang, M.; Nassani, A.A.; Haffar, M. Spatial Effects of Digital Transformation, PM2.5 Exposure, Economic Growth and Technological Innovation Nexus: PM2.5 Concentrations in China during 2010–2020. Int. J. Environ. Res. Public Health 2023, 20, 2550. https://doi.org/10.3390/ijerph20032550

Ma F, Fahad S, Wang M, Nassani AA, Haffar M. Spatial Effects of Digital Transformation, PM2.5 Exposure, Economic Growth and Technological Innovation Nexus: PM2.5 Concentrations in China during 2010–2020. International Journal of Environmental Research and Public Health. 2023; 20(3):2550. https://doi.org/10.3390/ijerph20032550

Chicago/Turabian StyleMa, Fenfen, Shah Fahad, Mancang Wang, Abdelmohsen A. Nassani, and Mohamed Haffar. 2023. "Spatial Effects of Digital Transformation, PM2.5 Exposure, Economic Growth and Technological Innovation Nexus: PM2.5 Concentrations in China during 2010–2020" International Journal of Environmental Research and Public Health 20, no. 3: 2550. https://doi.org/10.3390/ijerph20032550

APA StyleMa, F., Fahad, S., Wang, M., Nassani, A. A., & Haffar, M. (2023). Spatial Effects of Digital Transformation, PM2.5 Exposure, Economic Growth and Technological Innovation Nexus: PM2.5 Concentrations in China during 2010–2020. International Journal of Environmental Research and Public Health, 20(3), 2550. https://doi.org/10.3390/ijerph20032550