Effects of Carbon Tax on Urban Carbon Emission Reduction: Evidence in China Environmental Governance

Abstract

1. Introduction

2. Materials and Methods

2.1. Non-Competitive Carbon Emission Input-Output Table

2.2. Analysis of the Impact of Carbon Tax

2.2.1. Impact of Carbon Tax on Price

2.2.2. The Impact of a Carbon Tax on GDP

2.2.3. The Impact of Carbon Tax on Employment

2.2.4. The Impact of Carbon Tax on Carbon Emissions Reduction

2.3. Data Source

3. Results

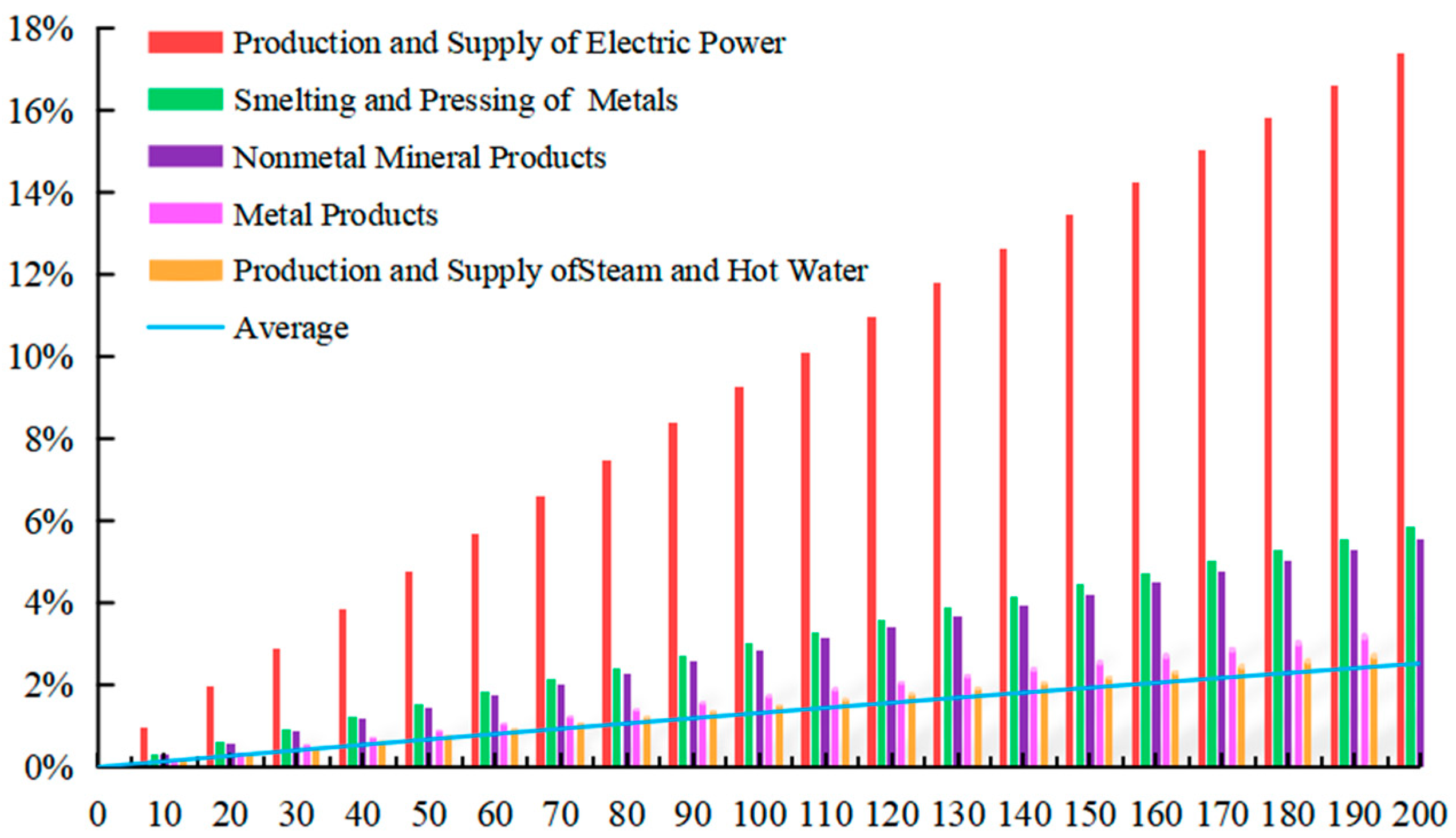

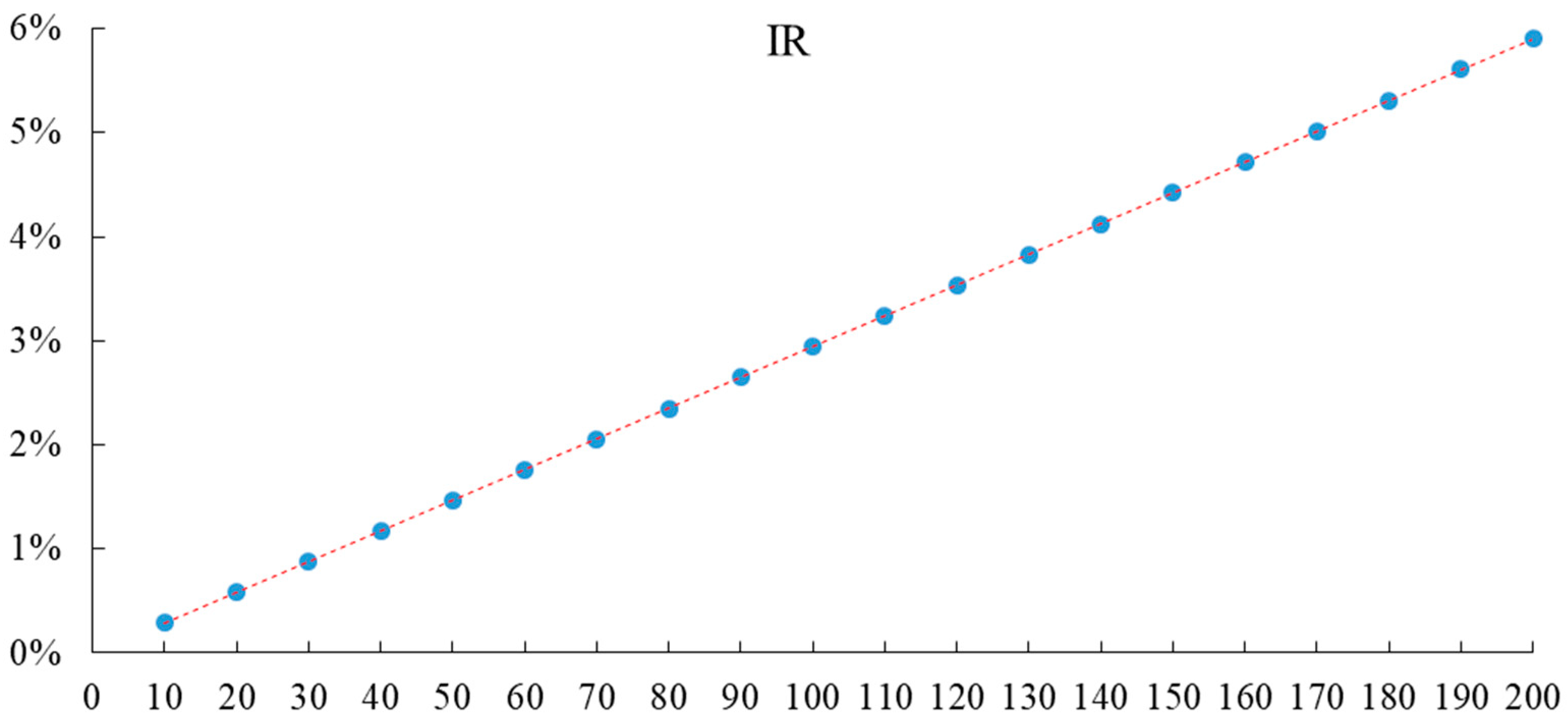

3.1. Price-Effect Measurement of Carbon Tax

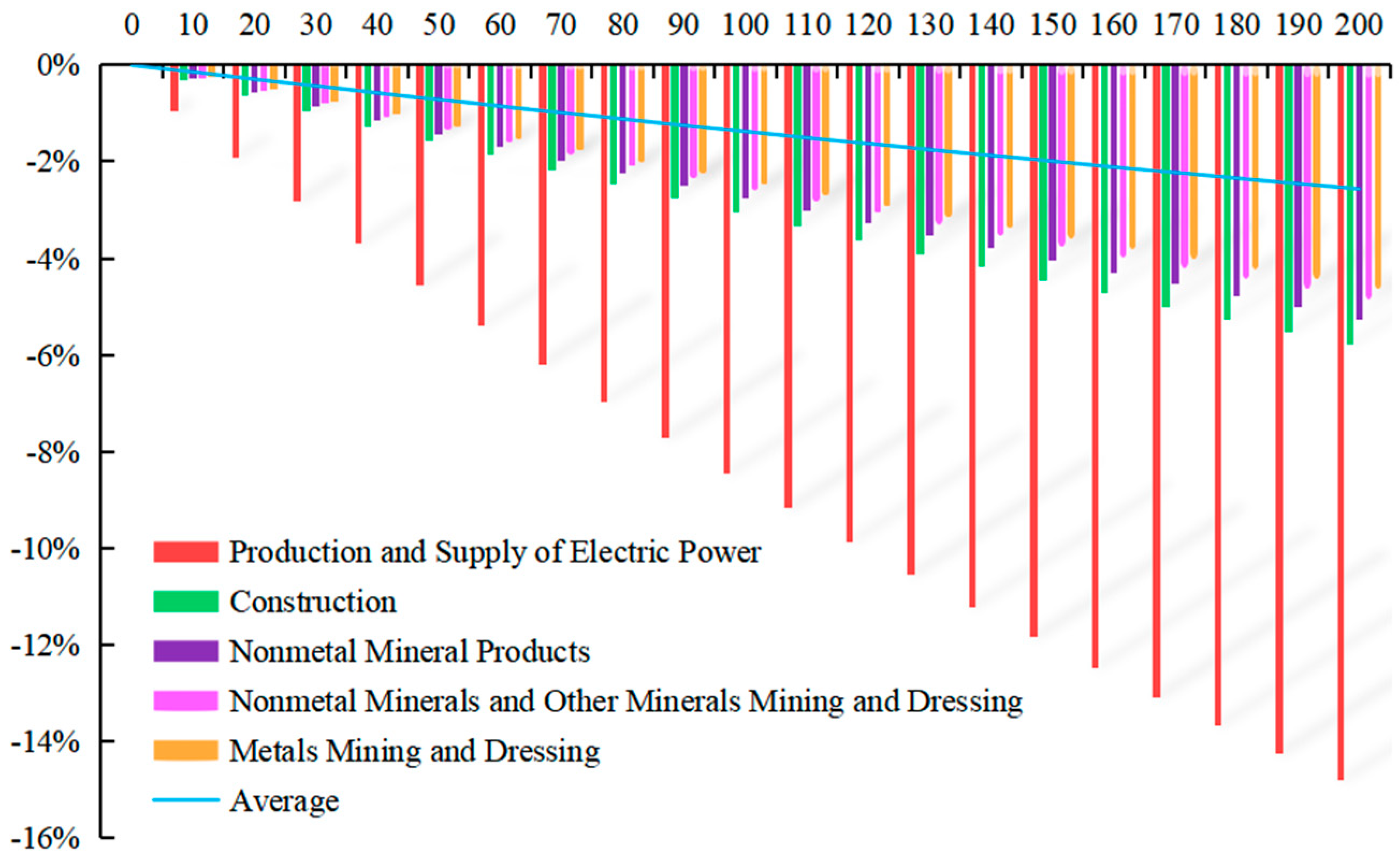

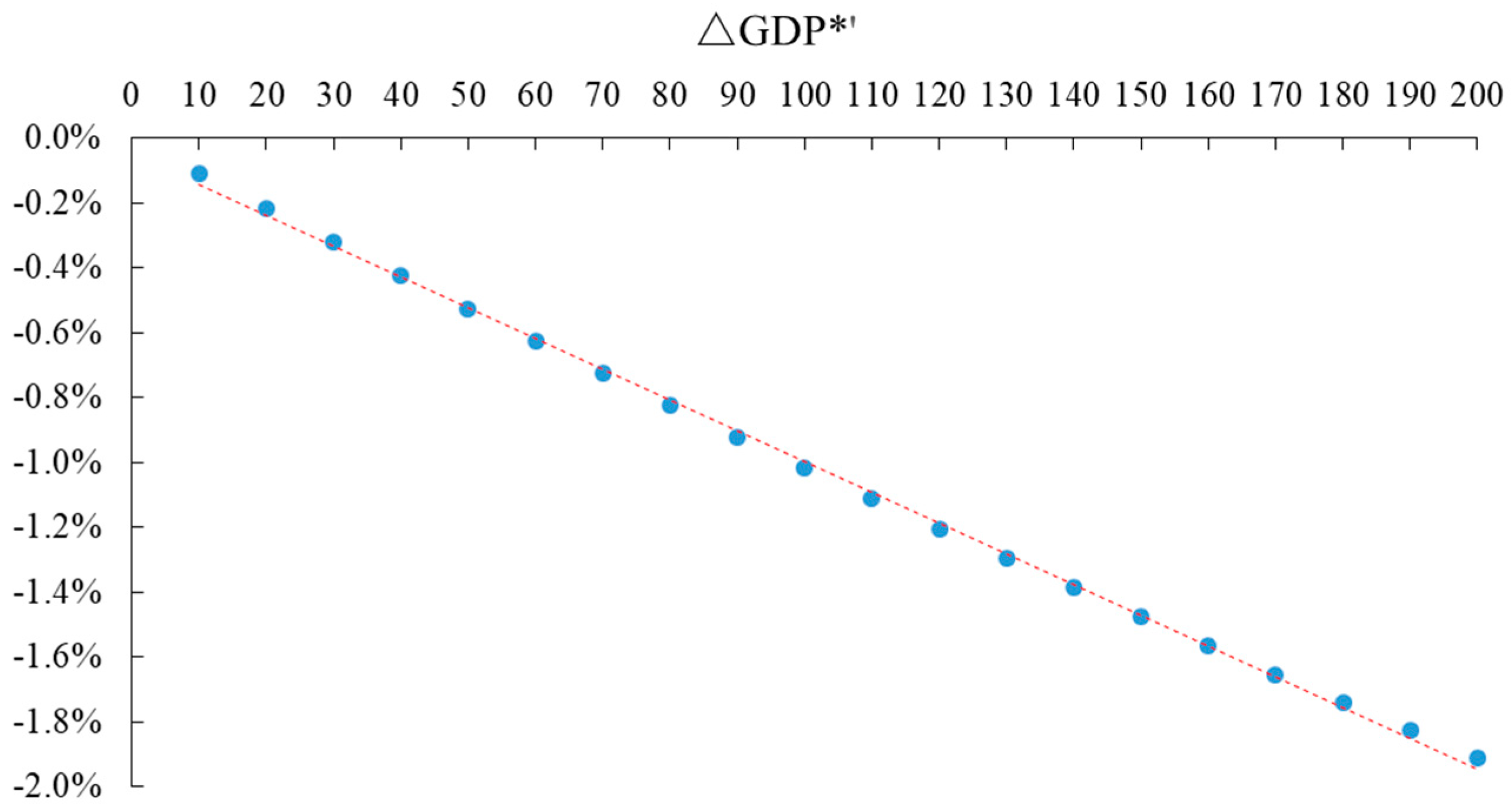

3.2. Economic Effect Measurement of Carbon Tax

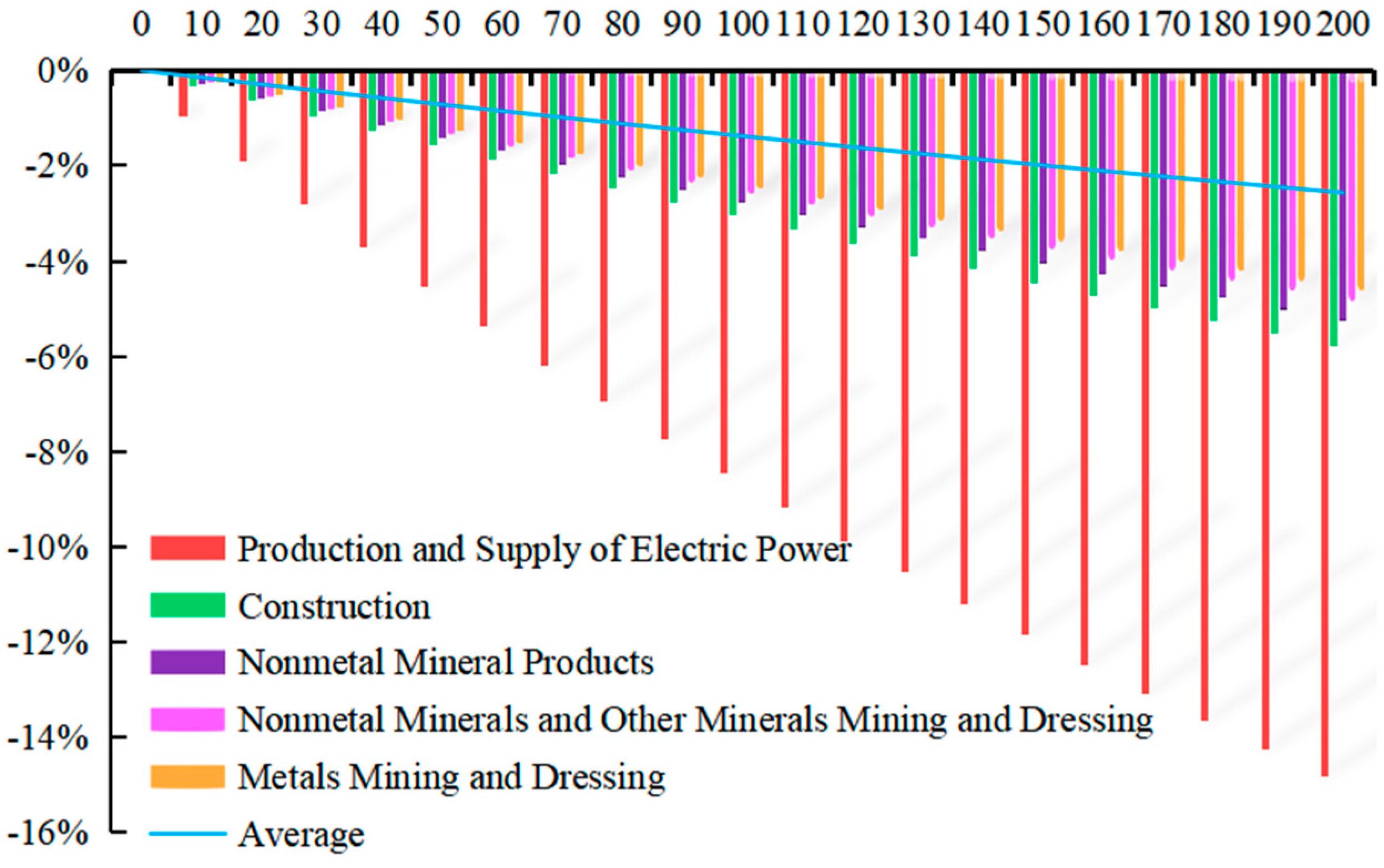

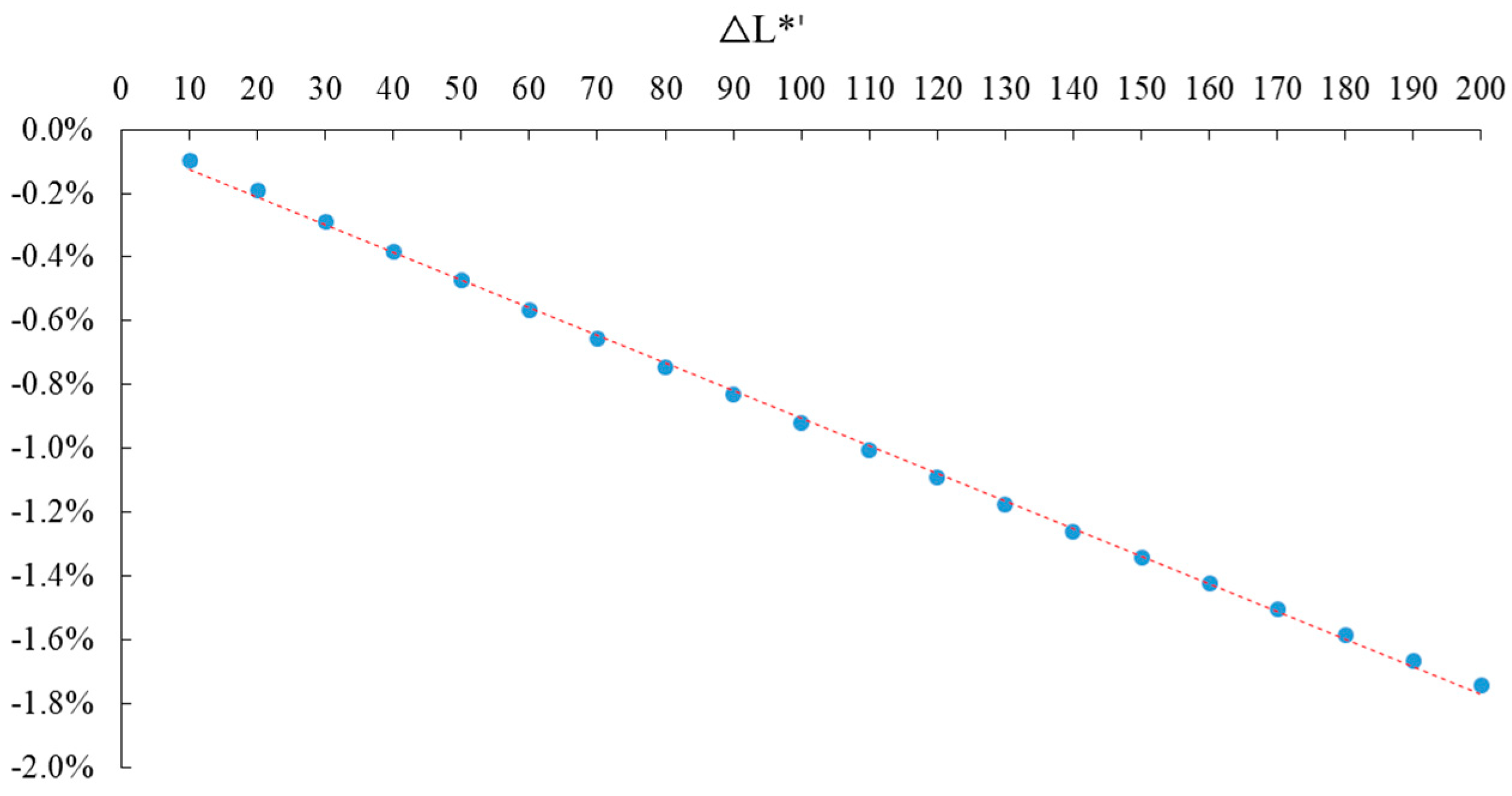

3.3. Employment-Effect Measures of Carbon Taxes

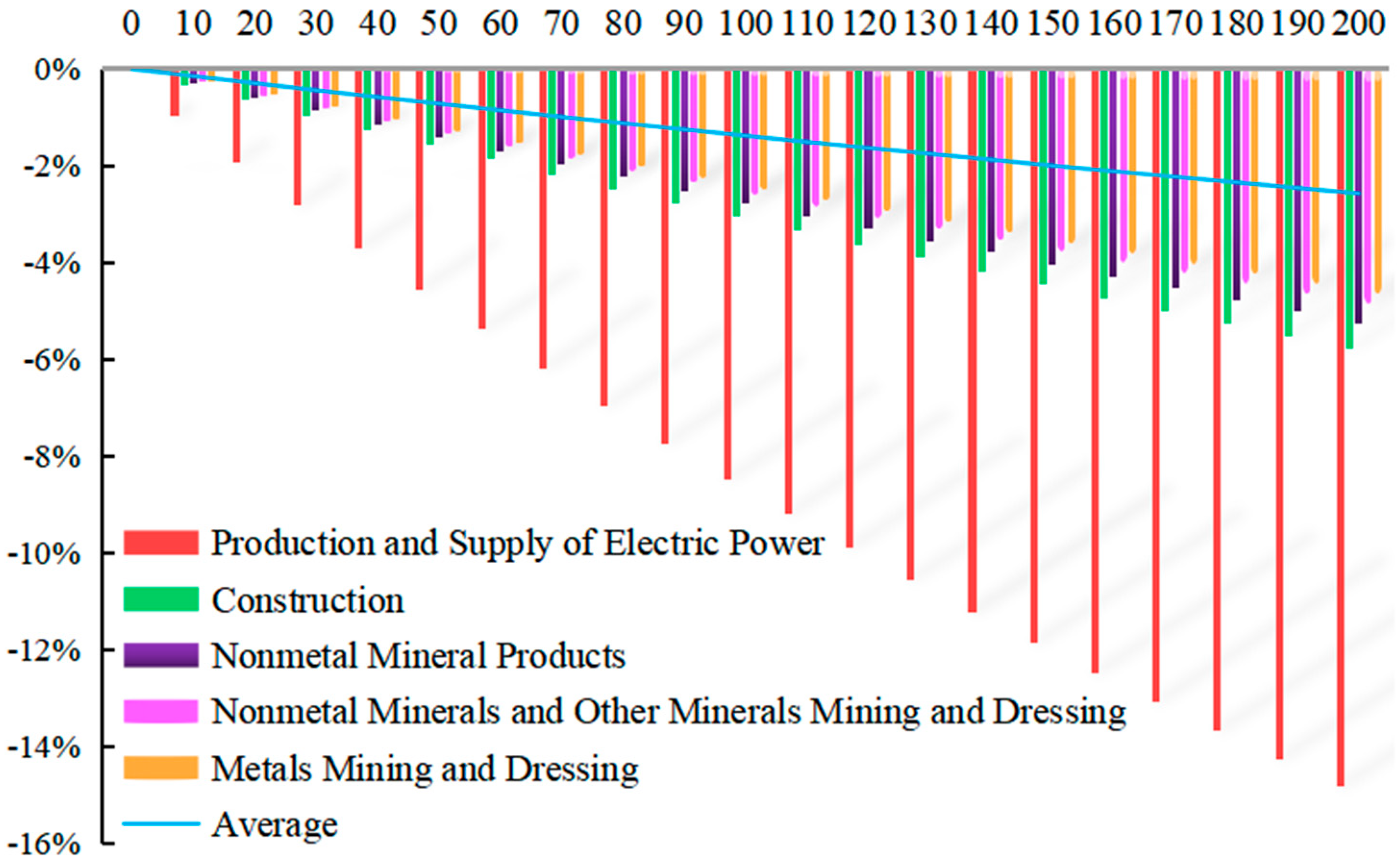

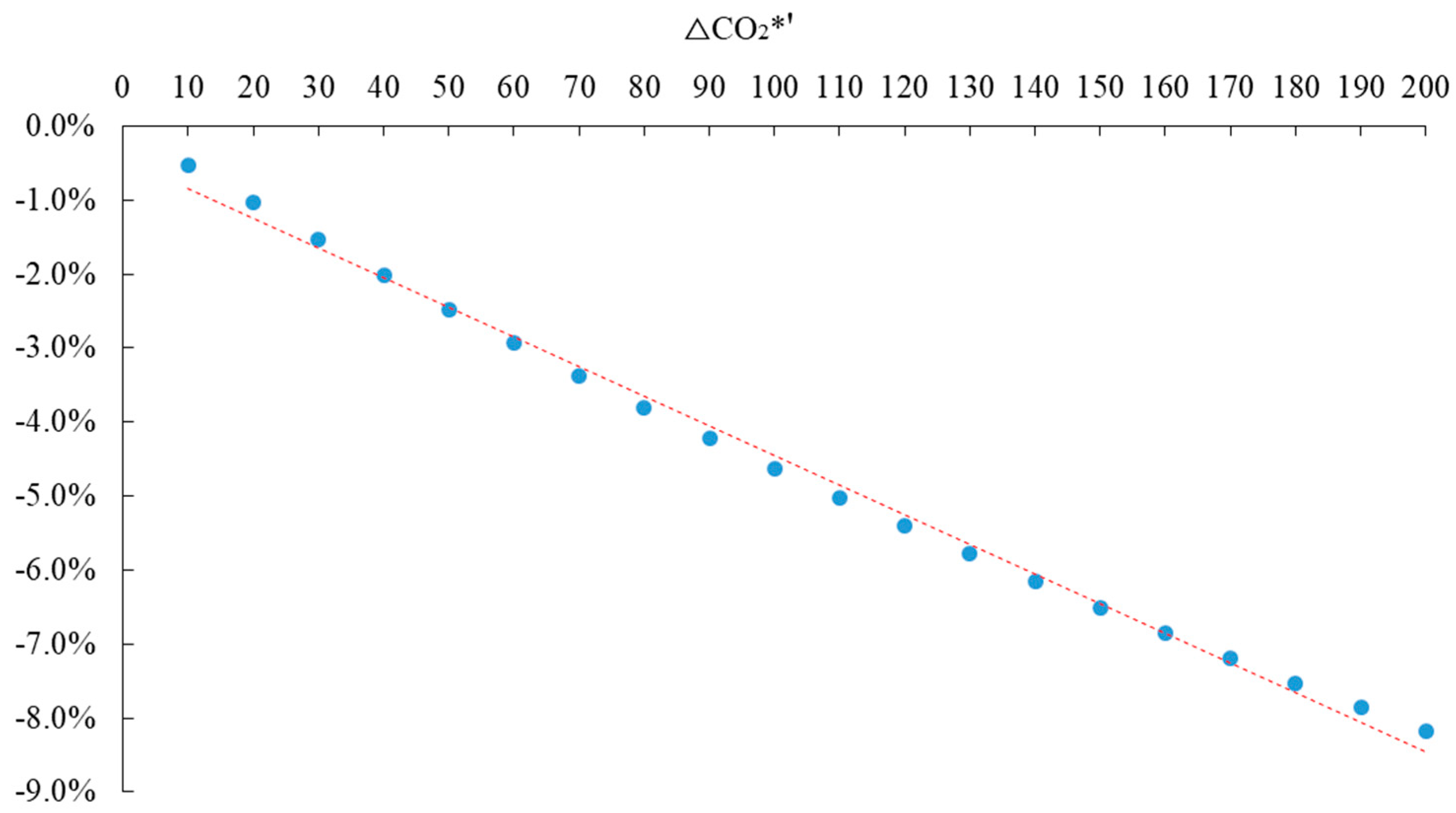

3.4. Reduction Effect Measurement of Carbon Taxes

4. Discussion

4.1. Combination of Carbon Tax and Carbon Trading

4.2. Establishment of Dynamic Adjustment Mechanism for Carbon Tax Rate

4.3. Keep Tax Neutrality Using Carbon Taxes to Make Less Impact on Employment

4.4. Force Enterprises Shift from Passive to Active Carbon Emission Reduction

5. Conclusions

- (1)

- Levying the carbon tax will raise the product prices of 28 sectors to varying degrees. The continuous increases in the carbon tax rate lead to an increase in the product prices of all of these sectors. The top five sectors whose product price rise the highest are, successively, Electric Power Station, Production and Supply, Heating, Smelting and Pressing of Metals, and Nonmetal Mineral Production.

- (2)

- When the carbon tax is levied, the GDP, the number of employees, and the carbon emissions in 28 sectors will all decline to varying degrees. With the increase in carbon tax rate, the decline degree in GDP, the number of employees, and carbon emissions the top five sectors ranked from high to low are Electric Power, Heating, Production and Supply, Construction, and Nonmetal Mineral Products.

- (3)

- The inflation rate has a positive correlation with the carbon tax rate, while the change rate of the GDP and the change rate of carbon emission have a negative correlation with the carbon tax rate.

- (4)

- Levying a low tax rate and establishing a dynamic adjustment mechanism is recommended, considering the impact of carbon tax on inflation and GDP, as well as the pressure of the current economic downturn.

- (5)

- The EU carbon border regulation mechanism (i.e., carbon tariff) will be implemented from 1 October 2023, which means that China’s carbon price needs to be consistent with the international level in the future. The introduction of carbon tax is an effective measure for China to deal with the European and American carbon border regulation mechanism (CBAM).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Working Guidance for Carbon Dioxide Peaking and Carbon Neutrality in Full and Faithful Implementation of the New Development Philosophy. The People’s Daily, 25 October 2021.

- Hu, A. China’s Goal of Achieving Carbon Peak by 2030 and Its Main Approaches. J. Beijing Univ. Technol. Soc. Sci. Ed. 2021, 21, 1–15. [Google Scholar]

- Xinhua. Available online: http://www.xinhuanet.com/english/2018-04/12/c_137104171.htm (accessed on 12 April 2018).

- Pigou, A. The Economics of Welfare; Palgrave Macmillan: New York, NY, USA, 2013. [Google Scholar]

- Coase, R.H. The problem of social cost. J. Law Econ. 1960, 3, 837–877. [Google Scholar] [CrossRef]

- Gerbeti, A. Market Mechanisms for Reducing Emissions and the Introduction of a Flexible Consumption Tax. Glob. J. Flex. Syst. Manag. 2021, 22 (Suppl. S2), 161–178. [Google Scholar] [CrossRef]

- Dresner, S.; Jackson, T.; Gilbert, N. History and social responses to environmental tax reform in the United Kingdom. Energy Policy 2006, 34, 930–939. [Google Scholar] [CrossRef]

- Dong, H.; Dai, H.; Geng, Y.; Fujita, T.; Liu, Z.; Xie, Y.; Wu, R.; Fujii, M.; Masui, T.; Tang, L. Exploring impact of carbon tax on China’s CO2 reductions and provincial disparities. Renew. Sustain. Energy Rev. 2017, 77, 596–603. [Google Scholar] [CrossRef]

- Hopkin, M. Emissions trading: The carbon game. Nature 2004, 432, 268–271. [Google Scholar] [CrossRef]

- Heindl, P. The impact of administrative transaction costs in the EU emissions trading system. Clim. Pol. 2017, 17, 314–329. [Google Scholar] [CrossRef]

- Perino, G.; Pioch, T. Banning incandescent light bulbs in the shadow of the EU Emissions Trading Scheme. Clim. Pol. 2017, 17, 678–686. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, Y. Research on carbon tax system based on carbon emission rights trading market. Taxat. Res. 2019, 2, 46–52. [Google Scholar]

- Du, M.; Liu, S. The application of Carbon tax and the carbon trading mechanism under the objectives of the Paris Agreement. J. Hunan Taxat. Coll. 2018, 31, 8–11. [Google Scholar]

- Gerlagh, R.; Lise, W. Carbon taxes: A drop in the ocean, or a drop that erodes the stone? The effect of carbon taxes on technological change. Ecol. Econ. 2005, 54, 241–260. [Google Scholar] [CrossRef]

- CAFS Research Group. Selecting Appropriate Opportunities to Levy Carbon Tax While Actively Promoting Carbon Emissions Trading. Public Financ. Res. 2018, 4, 2–19. [Google Scholar]

- Cao, J.; Ho, M.S.; Jorgenson, D.W.; Nielsen, C.P. China’s emissions trading system and an ETS-carbon tax hybrid. Energy Econ. 2019, 81, 741–753. [Google Scholar] [CrossRef]

- Chen, X.; Lin, B. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 112510. [Google Scholar] [CrossRef]

- Song, G.; Wang, Y.; Jiang, Y. Carbon emission control policy design based on the targets of carbon peak and carbon neutrality. China Popul. Resour. Environ. 2021, 31, 55–63. [Google Scholar]

- Shi, M.; Yuan, Y.; Zhou, S.; Li, N. Carbon tax, cap-and-trade or mixed policy: Which is better for carbon mitigation? J. Manag. Sci. China 2013, 16, 9–19. [Google Scholar]

- Li, J.; Liu, Z. Design of China’s Carbon Tax System: Collection Basis, Foreign Reference and General Conception. Sub. Nat. Fiscal Res. 2021, 7, 29–34. [Google Scholar]

- Metcalf, G.E. Market-based policy options to control US greenhouse gas emissions. J. Econ. Perspect. 2009, 23, 5–27. [Google Scholar] [CrossRef]

- Pope, J.; Owen, A.D. Emission trading schemes: Potential revenue effects, compliance costs and overall tax policy issues. Energy Policy 2009, 37, 4595–4603. [Google Scholar] [CrossRef]

- Solilová, V.; Nerudová, D. Overall approach of the EU in the question of emissions: EU emissions trading system and CO2 taxation. Procedia Econ. Financ. 2014, 12, 616–625. [Google Scholar] [CrossRef]

- Li, C.S.; Fan, Y.; Zhu, L. The study of carbon dioxide emission intensity abatement mechanism of iron and steel industry based on two-stage game model. Chin. J. Manag. Sci. 2012, 20, 93–100. [Google Scholar] [CrossRef]

- Liao, P.; Zheng, S. Environment, life expectancy and economic development: The optimal environmental tax. Manag. Rev. 2016, 28, 39. [Google Scholar]

- Zhang, J.J.; Ding, L.L.; Sun, L.C. Research on enterprise carbon emission decision considering the substitution effect of stepped carbon tax and carbon trading. China Popul. Resour. Environ. 2019, 29, 41–48. [Google Scholar]

- Liu, Q. Theoretical Basis and Institutional Design of Carbon Tax Under the “Double Carbon” Target. J. Huazhong Univ. Sci. Technol. Soc. Sci. Ed. 2022, 36, 108–116. [Google Scholar]

- Chen, X. The mechanism, comparison and institutional choice of carbon emissions trading and carbon taxation. Fujian Trib. Human Soc. Sci. Ed. 2022, 1, 75–86. [Google Scholar]

- Liu, L.; Zhang, Y.Q.; Zhou, Q.H. Policy Suggestions on China’s Carbon Tax from the Perspective of Policy Coordination. Taxat. Res. 2022, 121–126. [Google Scholar]

- Chiu, F.; Kuo, H.; Chen, C.; Hsu, C. The energy price equivalence of carbon taxes and emissions trading—Theory and evidence. Appl. Energy 2015, 160, 164–171. [Google Scholar] [CrossRef]

- Speck, S. Energy and carbon taxes and their distributional implications. Energy Policy 1999, 27, 659–667. [Google Scholar] [CrossRef]

- Zhang, Z.; Baranzini, A. What do we know about carbon taxes? An inquiry into their impacts on competitiveness and distribution of income. Energy Policy 2004, 32, 507–518. [Google Scholar] [CrossRef]

- Wier, M.; Birr-Pedersen, K.; Jacobsen, H.K.; Klok, J. Are CO2 taxes regressive? Evidence from the Danish experience. Ecol. Econ. 2005, 52, 239–251. [Google Scholar] [CrossRef]

- Edenhofer, O. Climate Change 2014: Mitigation of Climate Change; Cambridge University Press: Cambridge, UK, 2015; Volume 3. [Google Scholar]

- Chen, Y.; Nie, P.; Wang, C.; Meng, Y. Effects of corporate social responsibility considering emission restrictions. Energy Strategy Rev. 2019, 24, 121–131. [Google Scholar] [CrossRef]

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emissions. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Fu, M.; Sun, M. The impacts of carbon tax on energy intensity and economic growth–a dynamic evolution analysis on the case of China. Appl. Energy 2013, 110, 17–28. [Google Scholar] [CrossRef]

- Cabalu, H.; Koshy, P.; Corong, E.; Rodriguez, U.P.E.; Endriga, B.A. Modelling the impact of energy policies on the Philippine economy: Carbon tax, energy efficiency, and changes in the energy mix. Econ. Anal. Pol. 2015, 48, 222–237. [Google Scholar] [CrossRef]

- Liu, Y.; Lu, Y. The economic impact of different carbon tax revenue recycling schemes in China: A model-based scenario analysis. Appl. Energy 2015, 141, 96–105. [Google Scholar] [CrossRef]

- Sajeewani, D.; Siriwardana, M.; McNeill, J. Household distributional and revenue recycling effects of the carbon price in Australia. Clim. Change Econ. 2015, 6, 1550012. [Google Scholar] [CrossRef]

- Qian, F.; Gao, W.; Yu, D.; Yang, Y.; Ruan, Y. An Analysis of the Potential of Hydrogen Energy Technology on Demand Side Based on a Carbon Tax: A Case Study in Japan. Energ. 2023, 16, 342. [Google Scholar] [CrossRef]

- Ekins, P. European environmental taxes and charges: Recent experience, issues and trends. Ecol. Econ. 1999, 31, 39–62. [Google Scholar] [CrossRef]

- Baranzini, A.; Goldemberg, J.; Speck, S. A future for carbon taxes. Ecol. Econ. 2000, 32, 395–412. [Google Scholar] [CrossRef]

- Gurtu, A.; Vyas, V.; Gurtu, A. Emissions Reduction Policies and Their Effects on Economy. J. Risk Financ. Manag. 2022, 15, 404. [Google Scholar] [CrossRef]

- Fan, Y.; Zhang, H. The Effect of Carbon Tax System-Based on the Application Analysis in China; China Tax Press: Beijing, China, 2013. [Google Scholar]

- Chen, Y.; Mu, D. Carbon Tax Modes and the Optimal Tax in the Supply Chains. J. Syst. Manag. 2016, 25, 752–758, 766. [Google Scholar]

- Goto, N. Macroeconomic and sectoral impacts of carbon taxation: A case for the Japanese economy. Energy Econ. 1995, 17, 277–292. [Google Scholar] [CrossRef]

- Wissema, W.; Dellink, R. AGE analysis of the impact of a carbon energy tax on the Irish economy. Ecol. Econ. 2007, 61, 671–683. [Google Scholar] [CrossRef]

- Weng, Z.; Wu, Y.; Li, B.; Gu, Y. Impact of differentiated industrial carbon taxes on China’s economy and environment. China Popul. Resour. Environ. 2021, 31, 75–86. [Google Scholar]

- Pearce, D. The role of carbon taxes in adjusting to global warming. Econ. J. 1991, 101, 938–948. [Google Scholar] [CrossRef]

- Goulder, L. Environmental taxation and the double dividend: A reader’s guide. Int. Tax Public Financ. 1995, 2, 157–183. [Google Scholar] [CrossRef]

- Bye, B. Environmental tax reform and producer foresight: An intertemporal computable general equilibrium analysis. J. Policy Model. 2000, 22, 719–752. [Google Scholar] [CrossRef]

- Takeda, S. The double dividend from carbon regulations in Japan. J. Japan. Int. Econ. 2007, 21, 336–364. [Google Scholar] [CrossRef]

- Freire-González, J.; Ho, M. Carbon taxes and the double dividend hypothesis in a recursive-dynamic CGE model for Spain. Econ. Syst. Res. 2019, 31, 267–284. [Google Scholar] [CrossRef]

- Jiang, X.; Li, G.; Fan, X. Environmental Protection Fee-to-Tax and Corporate Environmental Social Responsibility: A Test Based on Corporate Life Cycle Theory. Sustain. 2023, 15, 2128. [Google Scholar] [CrossRef]

- Petroleum, B. Statistical Review of World Energy; P British Petroleum Company: London, UK, 2021. [Google Scholar]

- Li, Y.; Shi, W.; Hu, Z. Research on Double Dividend of Carbon Tax Policy Based on CGE Model. Theory Pract. Financ. Econ. 2021, 42, 82–89. [Google Scholar]

- Wesseh, P.K., Jr.; Lin, B. Optimal carbon taxes for China and implications for power generation, welfare, and the environment. Energy Policy 2018, 118, 1–8. [Google Scholar] [CrossRef]

- Orlov, A.; Grethe, H.; McDonald, S. Carbon taxation in Russia: Prospects for a double dividend and improved energy efficiency. Energy Econ. 2013, 37, 128–140. [Google Scholar] [CrossRef]

- Dong, C. Input-Output Theory; China Statistics Press: Beijing, China, 2012. [Google Scholar]

- Chen, Q. Accounting and Decomposition of Carbon Emissions in Chinese Industries: Based on the Perspective of Input-Output Structure Decomposition Analysis; Economic Science Press: Beijing, China, 2019. [Google Scholar]

- Su, M.; Fu, Z. Levying Carbon Tax in China: Theory and Policy; China Environmental Science Press: Beijing, China, 2011. [Google Scholar]

- Liu, Q. Input-Output Analysis; China Renmin University Press: Beijing, China, 2020. [Google Scholar]

- Yang, C.; Wang, F.; Men, M. Analyzing the Impacts of Carbon Taxes on CO2 Emissions and Macroeconomics. Stat. Res. 2011, 28, 45–54. [Google Scholar]

- CEADs. Carbon Emission Accounts & Datasets for Emerging Economies. Available online: https://www.ceads.net.cn/ (accessed on 3 November 2022).

- Eviews. Statistical Analysis and Application; China Machine Press: Beijing, China, 2019. [Google Scholar]

- Nordhaus, W.D. Revisiting the social cost of carbon. Proc. Nat. Acad. Sci. USA 2017, 114, 1518–1523. [Google Scholar] [CrossRef] [PubMed]

- Arndt, C.; Davies, R.; Gabriel, S.; Makrelov, K.; Merven, B.; Hartley, F.; Thurlow, J. A sequential approach to integrated energy modeling in South Africa. Appl. Energy 2016, 161, 591–599. [Google Scholar] [CrossRef]

- Li, T. International experience for the design and implementation of carbon tax policy in China. Taxat. Res. 2022, 7, 86–90. [Google Scholar]

- Jia, X.; Wang, Z. Taking the opportunity of levying carbon tax to build up a recombination mechanism of carbon emission reduction in China. Taxat. Res. 2021, 8, 18–21. [Google Scholar]

- Shao, S. Building up a synergistic and complementary mechanism between carbon tax and carbon trading. Social Sciences in China, 18 May 2022. [Google Scholar]

- Brown, M.A.; Li, Y.; Soni, A. Are all jobs created equal? Regional employment impacts of a US carbon tax. Appl. Energy 2020, 262, 114354. [Google Scholar] [CrossRef]

- Zhu, Y. Carbon tax in China is not designed for the purpose of collecting taxes. China Energy News, 28 March 2022. [Google Scholar]

- Song, X.; Geng, Y.; Li, K.; Zhang, X.; Wu, F.; Pan, H.; Zhang, Y. Does environmental infrastructure investment contribute to emissions reduction? A case of China. Front. Energy 2020, 14, 57–70. [Google Scholar] [CrossRef]

- Song, X.; Geng, Y.; Dong, H.; Chen, W. Social network analysis on industrial symbiosis: A case of Gujiao eco-industrial park. J. Clean. Prod. 2018, 193, 414–423. [Google Scholar] [CrossRef]

| Input-Output | Intermediate Use | Final Use + Carbon Tax | Total Domestic Output + Carbon Tax Or Import | |||

|---|---|---|---|---|---|---|

| Energy Sector | Non-Energy Sector | |||||

| 1, 2, 3, 4 | 5, 6, …, 28 | |||||

| Interme-diate input of domestic products | Energy Sector | 1. Coal Mining and Dressing CO2 Emissions (10,000 Tons) | ||||

| 2. Petroleum and Natural Gas Extraction CO2 Emissions (10,000 Tons) | ||||||

| 3. Refined Petroleum and Nuclear Fuel Processing CO2 Emissions (10,000 Tons) | ||||||

| 4. Production and Supply of Gas CO2 Emissions (10,000 Tons) | ||||||

| Non- Energy Sector | 5. Farming, Forestry, Animal Husbandry, Fishery, and Water Conservancy | |||||

| 6 | ||||||

| … | ||||||

| 28 | ||||||

| Interme-diate Input of Imports | Energy Sector | 1. Coal Mining and Dressing | ||||

| 2. Petroleum and Natural Gas Extraction | ||||||

| 3. Refined Petroleum and Nuclear Fuel Processing | ||||||

| 4. Production and Supply of Gas | ||||||

| Non- Energy Sector | 5. Farming, Forestry, Animal Husbandry, Fishery, and Water Conservancy | |||||

| 6 | ||||||

| … | ||||||

| 28 | ||||||

| Added value | Remuneration of workers (V) | |||||

| Net Production Tax (T) | ||||||

| Carbon Tax (T*) | ||||||

| Depreciation of Fixed Assets (D) | ||||||

| Operating Surplus (S) | ||||||

| The Added Value Totals after Carbon Tax (GDP′) | ||||||

| Total Input + Carbon Tax | ||||||

| Carbon Tax Rate (T*) (CNY/ton) | T* = 10 | T* = 20 | T* = 30 | T* = 40 | T* = 50 | T* = 60 | T* = 70 | T* = 80 | T* = 90 | T* = 100 |

| Inflation Rate (IR) | 0.293% | 0.586% | 0.880% | 1.174% | 1.468% | 1.762% | 2.057% | 2.352% | 2.647% | 2.942% |

| Carbon Tax Rate (T*) (CNY/ton) | T* = 110 | T* = 120 | T* = 130 | T* = 140 | T* = 150 | T* = 160 | T* = 170 | T* = 180 | T* = 190 | T* = 200 |

| Inflation Rate (IR) | 3.238% | 3.533% | 3.829% | 4.125% | 4.422% | 4.718% | 5.015% | 5.312% | 5.610% | 5.907% |

| Carbon Tax Rate (T*) (CNY/ton) | T* = 10 | T* = 20 | T* = 30 | T* = 40 | T* = 50 | T* = 60 | T* = 70 | T* = 80 | T* = 90 | T* = 100 |

| Change Rate of Total GDP (ΔGDP*′) | −0.108% | −0.215% | −0.320% | −0.424% | −0.526% | −0.627% | −0.727% | −0.825% | −0.921% | −1.017% |

| Carbon Tax Rate (T*) (CNY/ton) | T* = 110 | T* = 120 | T* = 130 | T* = 140 | T* = 150 | T* = 160 | T* = 170 | T* = 180 | T* = 190 | T* = 200 |

| Change Rate of Total GDP (ΔGDP*′) | −1.111% | −1.204% | −1.296% | −1.387% | −1.477% | −1.566% | −1.653% | −1.740% | −1.826% | −1.910% |

| Carbon Tax Rate (T*) (CNY/ton) | T*10 | T*20 | T*30 | T*40 | T*50 | T*60 | T*70 | T*80 | T*90 | T*100 |

| Change Rate of Labor Force (ΔL*′) | −0.097% | −0.193% | −0.288% | −0.381% | −0.474% | −0.565% | −0.655% | −0.745% | −0.833% | −0.920% |

| Carbon Tax Rate (T*) (CNY/ton) | T*110 | T*120 | T*130 | T*140 | T*150 | T*160 | T*170 | T*180 | T*190 | T*200 |

| Change Rate of Labor Force (ΔL*′) | −1.006% | −1.092% | −1.176% | −1.260% | −1.343% | −1.425% | −1.506% | −1.586% | −1.665% | −1.744% |

| Carbon Tax Rate (T*) (CNY/ton) | T* = 10 | T* = 20 | T* = 30 | T* = 40 | T* = 50 | T* = 60 | T* = 70 | T* = 80 | T* = 90 | T* = 100 |

| Change Rate of Total Carbon Dioxide Emission (ΔCO2*′) | −0.526% | −1.035% | −1.530% | −2.011% | −2.477% | −2.931% | −3.372% | −3.801% | −4.218% | −4.625% |

| Carbon Tax Rate (T*) (CNY/ton) | T* = 110 | T* = 120 | T* = 130 | T* = 140 | T* = 150 | T* = 160 | T* = 170 | T* = 180 | T* = 190 | T* = 200 |

| Change Rate of Total Carbon Dioxide Emission (ΔCO2*′) | −5.021% | −5.406% | −5.782% | −6.149% | −6.507% | −6.855% | −7.196% | −7.529% | −7.854% | −8.171% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, A.; Song, X.; Li, J.; Yuan, Q.; Pei, Y.; Li, R.; Hitch, M. Effects of Carbon Tax on Urban Carbon Emission Reduction: Evidence in China Environmental Governance. Int. J. Environ. Res. Public Health 2023, 20, 2289. https://doi.org/10.3390/ijerph20032289

Zhao A, Song X, Li J, Yuan Q, Pei Y, Li R, Hitch M. Effects of Carbon Tax on Urban Carbon Emission Reduction: Evidence in China Environmental Governance. International Journal of Environmental Research and Public Health. 2023; 20(3):2289. https://doi.org/10.3390/ijerph20032289

Chicago/Turabian StyleZhao, Aiwen, Xiaoqian Song, Jiajie Li, Qingchun Yuan, Yingshun Pei, Ruilin Li, and Michael Hitch. 2023. "Effects of Carbon Tax on Urban Carbon Emission Reduction: Evidence in China Environmental Governance" International Journal of Environmental Research and Public Health 20, no. 3: 2289. https://doi.org/10.3390/ijerph20032289

APA StyleZhao, A., Song, X., Li, J., Yuan, Q., Pei, Y., Li, R., & Hitch, M. (2023). Effects of Carbon Tax on Urban Carbon Emission Reduction: Evidence in China Environmental Governance. International Journal of Environmental Research and Public Health, 20(3), 2289. https://doi.org/10.3390/ijerph20032289