Equity in Out-of-Pocket Payments for Healthcare Services: Evidence from Malaysia

Abstract

:1. Introduction

2. Materials and Methods

2.1. Study Setting and Design

2.2. Study Sample

2.3. Study Variables

2.3.1. Out-of-Pocket Payments for Healthcare

- (i)

- Pharmaceuticals: all payments made for prescriptive and non-prescriptive medicine, medicine for health upkeep, such as vitamins, health supplements, purchase of traditional and complementary medicine, etc.

- (ii)

- Medical products, appliances and equipment: all payments made for health-related products or medical appliances, such as contraceptives, pregnancy test kits, vision aids, dentures, orthopedic braces, prostheses, face masks, etc.

- (iii)

- Outpatient-based services: all payments incurred from outpatient treatment in government and private clinics, dental services and paramedical services, such as those for laboratory tests, as well as payments made for traditional or alternative medicine such as homeopathy, acupuncture, etc.

- (iv)

- Hospital/inpatient-based services: all payments incurred from inpatient treatment in government or private hospitals, such as those from registration fees, ward charges, treatment fees including specialist/consultant fees, etc.

2.3.2. Household’s Ability to Pay (ATP)

2.4. Progressivity Analysis of OOP Payments for Healthcare

- (i)

- The line of equality, in which the ATP of all households are equal (45-degree blue line);

- (ii)

- (iii)

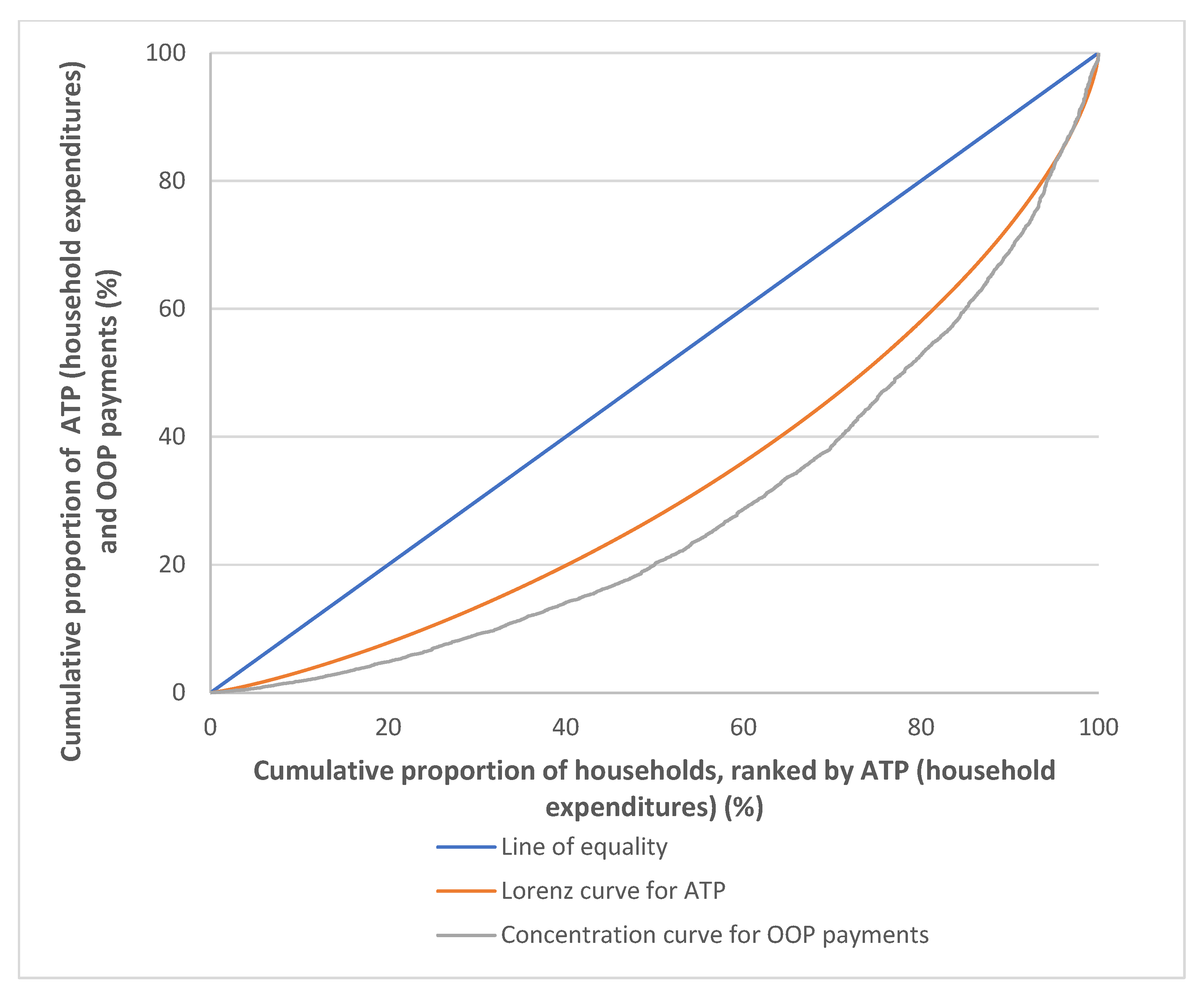

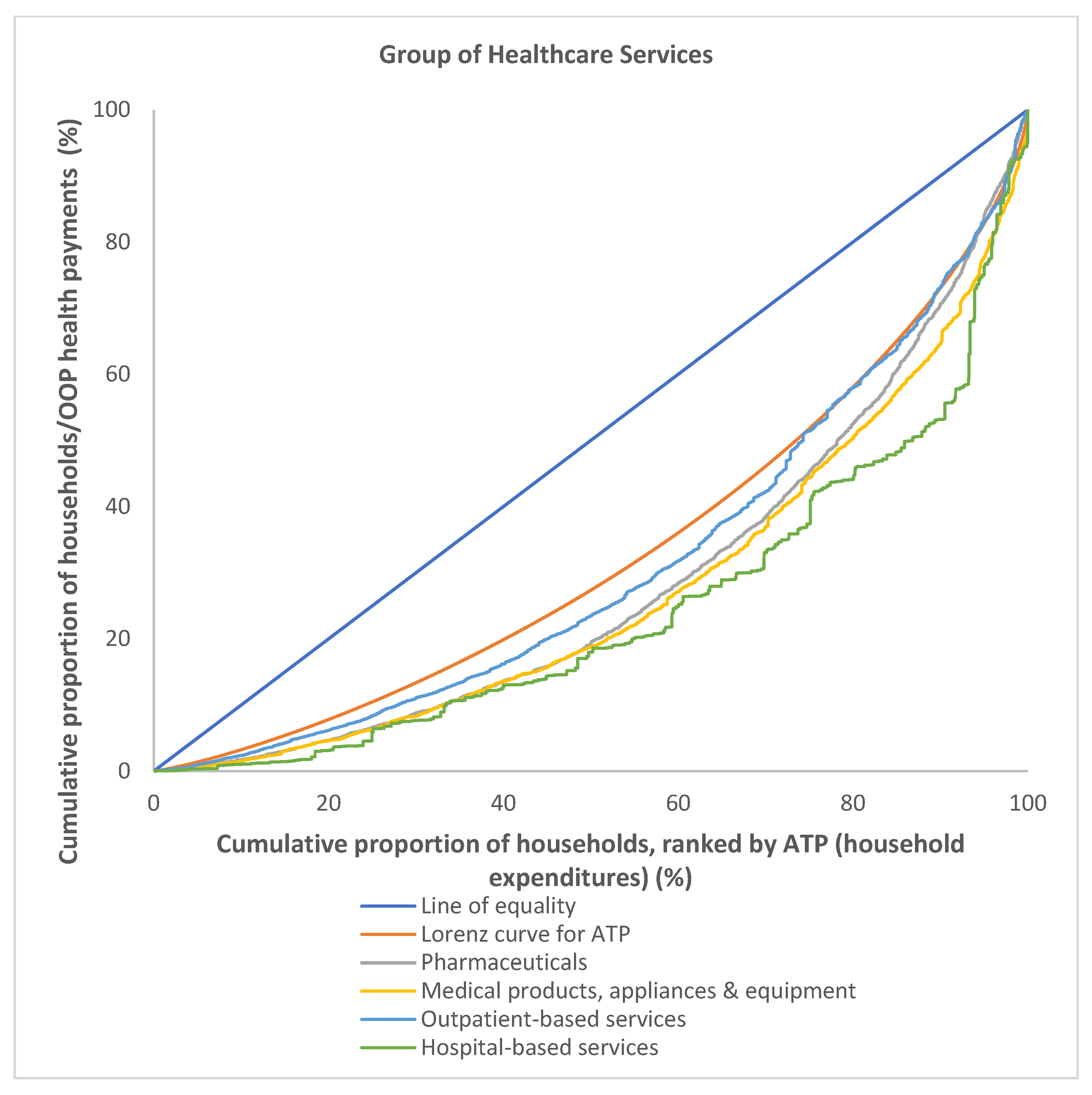

- The concentration curve for OOP payments, LH(r), plots the cumulative percentage of OOP payments against the cumulative percentage of the households, ranked by ATP. Two indexes can be derived from the Lorenz curve, (Lx(r), and the concentration curve for OOP payments, LH(r), which is the Gini coefficient for ATP, Gx, and the concentration index for OOP payments, Ch for the latter. The Gx is twice the area between the Lx(r) and the line of equality, in which Gx ranges from 0 to +1, where a value of +1 implies a case of perfect inequality in the distribution of ATP, while a value of 0 implies perfect equality in the ATP distribution. As for Ch, it is twice the area between the LH(r) and the line of equality. The Ch ranges from −1 to +1, where a value of −1 implies that the poorest household contributes all OOP payments and a value of +1 is where all OOP payments are made by the richest household. A negative Ch value is when the LH(r) lies above the line of equality, which implies that OOP payments are more concentrated among the poorer household, while a positive value is when the LH(r) lies below the line of equality, which implies that OOP payments are more concentrated among the richer household [6,7].

2.5. Data Analysis

3. Results

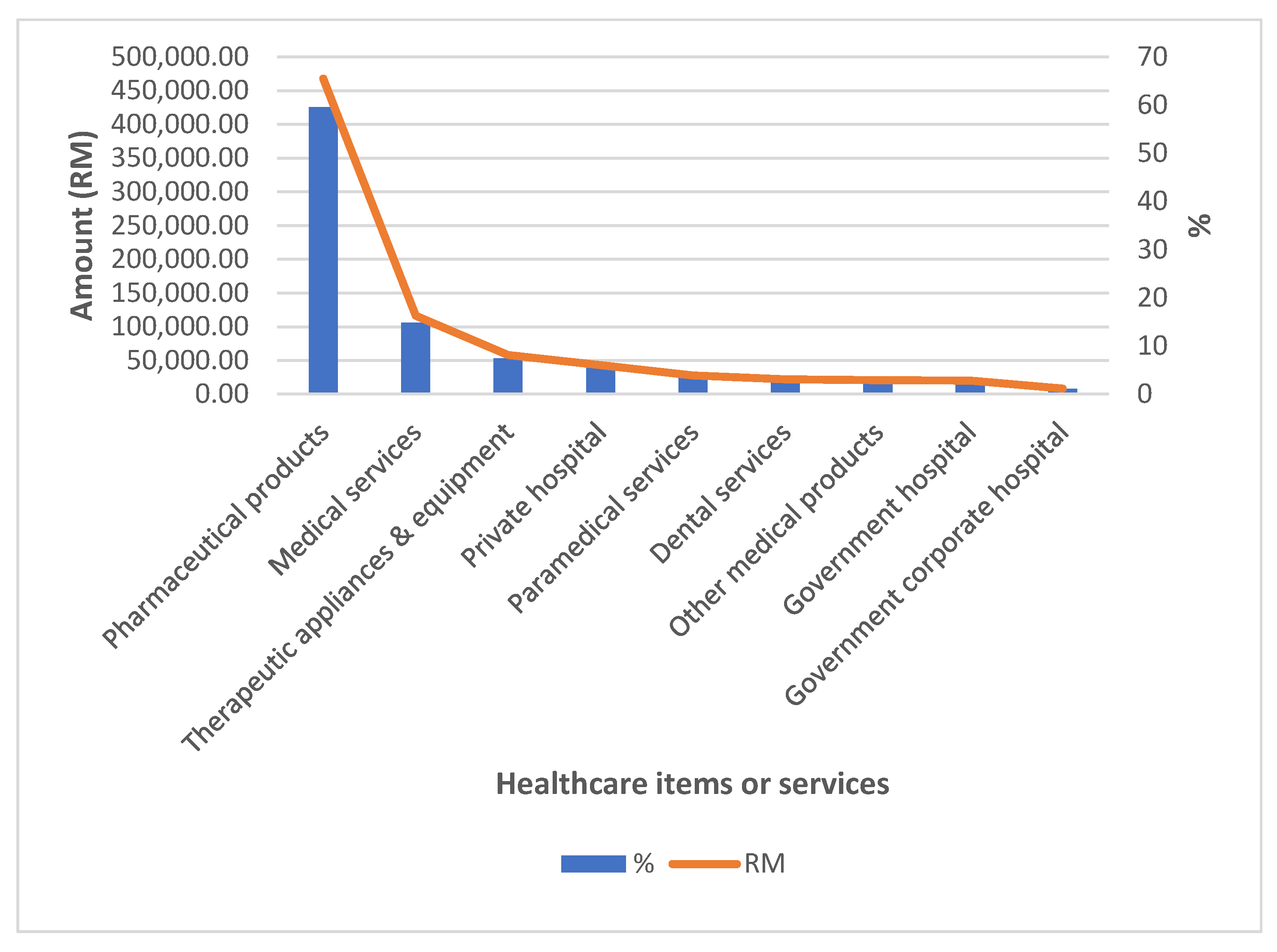

3.1. Distribution of Household Out-of-Pocket Payments for Healthcare Services or Items in Malaysia, 2014/2015

3.2. Distribution and Progressivity of OOP Payments for Healthcare by Household ATP Quintiles in Malaysia, 2014/2015

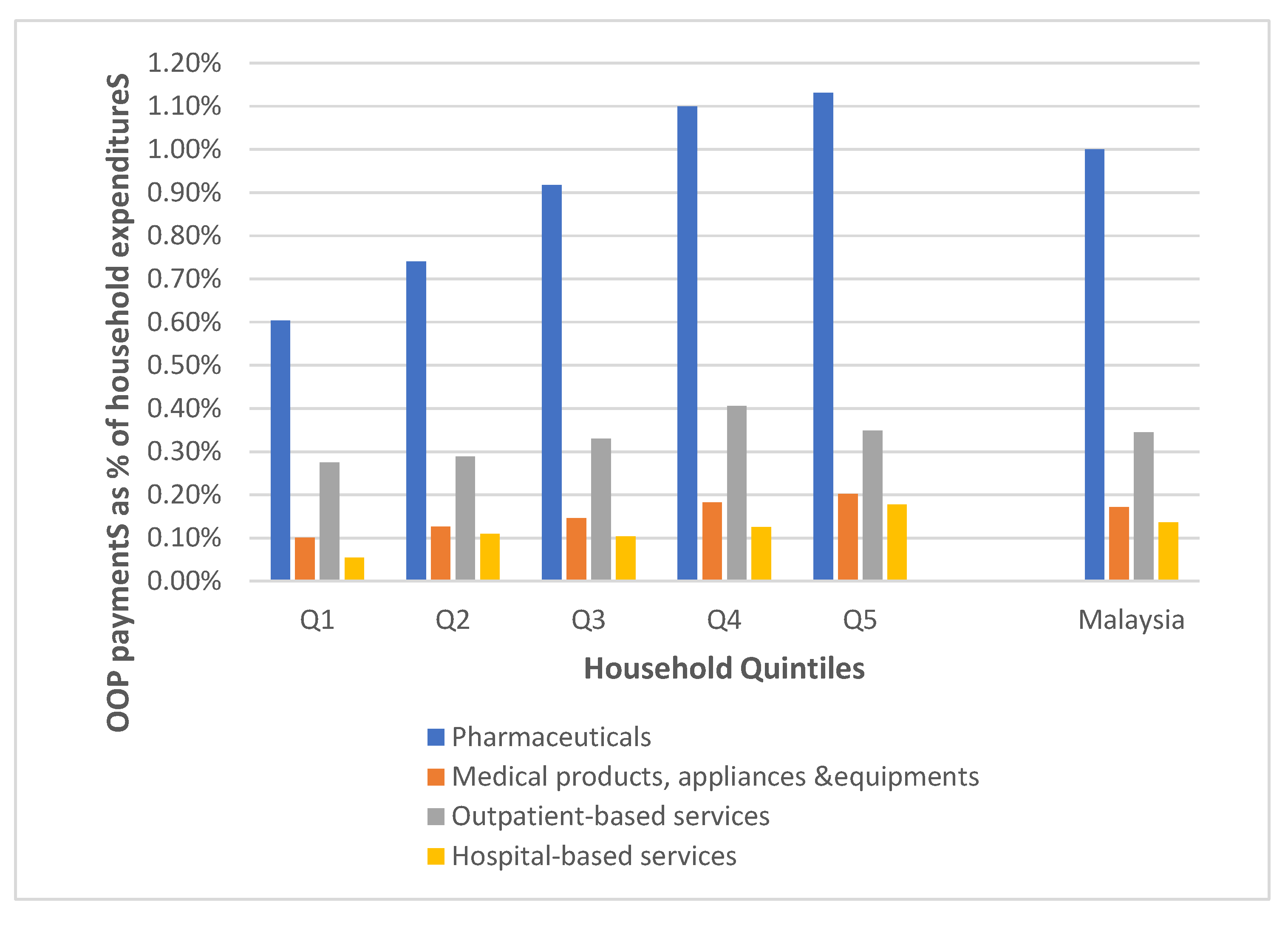

3.3. Distribution and Progressivity of OOP Payments among Different Group of Healthcare Services in Malaysia, 2014/2015

4. Discussion

5. Study Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wagstaff, A.; Flores, G.; Hsu, J.; Smitz, M.-F.; Chepynoga, K.; Buisman, L.R.; van Wilgenburg, K.; Eozenou, P. Progress on catastrophic health spending in 133 countries: A retrospective observational study. Lancet Glob. Health 2018, 6, e169–e179. [Google Scholar] [CrossRef] [Green Version]

- OECD. Financial hardship and out-of-pocket expenditure. In Health at a Glance 2019: OECD Indicators; OECD Publishing: Paris, France, 2019. [Google Scholar]

- Xu, K. Catastrophic health expenditure. Lancet 2003, 362, 997. [Google Scholar] [CrossRef]

- Malaysian Ministry of Health. Malaysia National Health Accounts: Health Expenditure Report 1997–2019; Ministry of Health Malaysia: Putrajaya, Malaysia, 2021.

- The World Bank. Out-of-Pocket Expenditure (% of Current Health Expenditure)—Malaysia; World Bank Publications: Washington, DC, USA, 2022. [Google Scholar]

- Wagstaff, A.; O’Donnell, O.; Van Doorslaer, E.; Lindelow, M. Analyzing Health Equity using Household Survey Data: A Guide to Techniques and their Implementation; World Bank Publications: Washington, DC, USA, 2007; ISBN 0821369342. [Google Scholar]

- Ataguba, J.E.; Asante, A.D.; Limwattananon, S.; Wiseman, V. How to do (or not to do)… A health financing incidence analysis. Health Policy Plan. 2018, 33, 436–444. [Google Scholar] [CrossRef] [Green Version]

- Iloka, C.E.; Edeme, R.; Edeh, H.C.; Ikeagu, U.F. Equity in financing health care services in Nigeria. J. Econ. Sustain. Dev. 2018, 9, 30–36. [Google Scholar]

- Sarker, A.R.; Sultana, M.; Alam, K.; Ali, N.; Sheikh, N.; Akram, R.; Morton, A. Households’ out-of-pocket expenditure for healthcare in Bangladesh: A health financing incidence analysis. Int. J. Health Plan. Manag. 2021, 36, 2106–2117. [Google Scholar] [CrossRef]

- Chowdhury, S.; Gupta, I.; Trivedi, M.; Prinja, S. Inequity & burden of out-of-pocket health spending: District level evidences from India. Indian J. Med. Res. 2018, 148, 180. [Google Scholar] [PubMed]

- Zhou, G.; Chen, R.; Chen, M. Equity in health-care financing in China during the progression toward universal health coverage. China Econ. Rev. 2020, 61, 101427. [Google Scholar] [CrossRef]

- Abdi, Z.; Hsu, J.; Ahmadnezhad, E.; Majdzadeh, R.; Harirchi, I. An analysis of financial protection before and after the Iranian Health Transformation Plan. East. Mediterr. Health J. 2020, 26, 1025–1033. [Google Scholar] [CrossRef]

- Rostampour, M.; Nosratnejad, S. A systematic review of equity in healthcare financing in low-and middle-income countries. Value Health Reg. Issues 2020, 21, 133–140. [Google Scholar] [CrossRef]

- Yu, C.P.; Whynes, D.K.; Sach, T.H. Assessing progressivity of out-of-pocket payment: With illustration to Malaysia. Int. J. Health Plan. Manag. 2006, 21, 193–210. [Google Scholar] [CrossRef]

- Yu, C.P.; Whynes, D.K.; Sach, T.H. Equity in health care financing: The case of Malaysia. Int. J. Equity Health 2008, 7, 15. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ng, C.W. Assessing Fair Financing of Health Care in Malaysia. Ph.D. Thesis, University of Malaya, Kuala Lumpur, Malaysia, 2012. [Google Scholar]

- Zhang, Y.; Guan, Y.; Hu, D.; Vanneste, J.; Zhu, D. The basic vs. ability-to-pay approach: Evidence from china’s critical illness insurance on whether different measurements of catastrophic health expenditure matter. Front. Public Health 2021, 9, 116. [Google Scholar] [CrossRef] [PubMed]

- Bank Negara. Malaysia Exchange Rates. Available online: https://www.bnm.gov.my/exchange-rates?p_p_id=bnm_exchange_rate_display_portlet&p_p_lifecycle=0&p_p_state=normal&p_p_mode=view&_bnm_exchange_rate_display_portlet_monthStart=2&_bnm_exchange_rate_display_portlet_yearStart=2022&_bnm_exchange_rate_display_port (accessed on 25 March 2022).

- Investopedia. Lorenz Curve. Available online: https://www.investopedia.com/terms/l/lorenz-curve.asp#citation-3 (accessed on 26 March 2022).

- Gastwirth, J.L. A General Definition of the Lorenz Curve. Available online: https://www.jstor.org/stable/1909675 (accessed on 26 March 2022).

- Kakwani, N.; Wagstaff, A.; Van Doorslaer, E. Socioeconomic inequalities in health: Measurement, computation, and statistical inference. J. Econ. 1997, 77, 87–103. [Google Scholar] [CrossRef] [Green Version]

- Mohd Hassan, N.Z.A.; Mohd Nor Sham Kunusagaran, M.S.J.; Zaimi, N.A.; Aminuddin, F.; Ab Rahim, F.I.; Jawahir, S.; Abdul Karim, Z. The inequalities and determinants of Households’ Distress Financing on Out-off-Pocket Health expenditure in Malaysia. BMC Public Health 2022, 22, 449. [Google Scholar] [CrossRef] [PubMed]

- Chee, H.L.; Barraclough, S. Health Care in Malaysia: The Dynamics of Provision, Financing and Access; Routledge: Oxfordshire, UK, 2007; ISBN 1134112955. [Google Scholar]

- Ahmad, D. Enhancing sustainability in healthcare delivery—A challenge to the New Malaysia. Malaysian J. Med. Sci. MJMS 2019, 26, 1. [Google Scholar] [CrossRef]

- Institute for Public Health. National Health and Morbidity Survey (NHMS) 2019: Non-Communicable Diseases, Healthcare Demand, and Health Literacy—Key Findings; Ministry of Health Malaysia: Putrajaya, Malaysia, 2020.

- Tan, C.N.-L.; Ojo, A.O.; Cheah, J.-H.; Ramayah, T. Measuring the influence of service quality on patient satisfaction in Malaysia. Qual. Manag. J. 2019, 26, 129–143. [Google Scholar] [CrossRef]

- Rannan-Eliya, R.P.; Anuranga, C.; Manual, A.; Sararaks, S.; Jailani, A.S.; Hamid, A.J.; Razif, I.M.; Tan, E.H.; Darzi, A. Improving health care coverage, equity, and financial protection through a hybrid system: Malaysia’s experience. Health Aff. 2016, 35, 838–846. [Google Scholar] [CrossRef] [Green Version]

- Bakar, N.S.A.; MAnuAl, A.; Ab HAMid, J. Socioeconomic status affecting inequity of healthcare utilisation in Malaysia. Malaysian J. Med. Sci. MJMS 2019, 26, 79. [Google Scholar]

- Cheng, Q.; Asante, A.; Susilo, D.; Satrya, A.; Man, N.; Fattah, R.A.; Haemmerli, M.; Kosen, S.; Novitasari, D.; Puteri, G.C. Equity of health financing in Indonesia: A 5-year financing incidence analysis (2015–2019). Lancet Reg. Health Pacific 2022, 21, 100400. [Google Scholar] [CrossRef]

- Tangcharoensathien, V.; Limwattananon, S.; Patcharanarumol, W.; Thammatacharee, J.; Jongudomsuk, P.; Sirilak, S. Achieving universal health coverage goals in Thailand: The vital role of strategic purchasing. Health Policy Plan. 2015, 30, 1152–1161. [Google Scholar] [CrossRef]

- Tangcharoensathien, V.; Tisayaticom, K.; Suphanchaimat, R.; Vongmongkol, V.; Viriyathorn, S.; Limwattananon, S. Financial risk protection of Thailand’s universal health coverage: Results from series of national household surveys between 1996 and 2015. Int. J. Equity Health 2020, 19, 163. [Google Scholar] [CrossRef] [PubMed]

- Suphanchaimat, R.; Kunpeuk, W.; Phaiyarom, M.; Nipaporn, S. The effects of the health insurance card scheme on out-of-pocket expenditure among migrants in Ranong Province, Thailand. Risk Manag. Healthc. Policy 2019, 12, 317. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Rezaei, S.; Woldemichael, A.; Ebrahimi, M.; Ahmadi, S. Trend and status of out-of-pocket payments for healthcare in Iran: Equity and catastrophic effect. J. Egypt. Public Health Assoc. 2020, 95, 29. [Google Scholar] [CrossRef] [PubMed]

- Jalali, F.S.; Jafari, A.; Bayati, M.; Bastani, P.; Ravangard, R. Equity in healthcare financing: A case of Iran. Int. J. Equity Health 2019, 18, 92. [Google Scholar] [CrossRef] [PubMed]

- Kundu, J.; Bharadwaz, M.P.; Kundu, S.; Bansod, D.W. The interregional disparity in the choice of health care utilization among elderly in India. Clin. Epidemiol. Glob. Health 2022, 13, 100929. [Google Scholar] [CrossRef]

- Lee, T.-J.; Hwang, I.; Kim, H.-L. Equity of health care financing in South Korea: 1990–2016. BMC Health Serv. Res. 2021, 21, 1327. [Google Scholar] [CrossRef]

- Sanwald, A.; Theurl, E. Out-of-pocket expenditures for pharmaceuticals: Lessons from the Austrian household budget survey. Eur. J. Health Econ. 2017, 18, 435–447. [Google Scholar] [CrossRef] [Green Version]

- Citoni, G.; De Matteis, D.; Giannoni, M. Vertical Equity in Healthcare Financing: A Progressivity Analysis for the Italian Regions. Healthcare 2022, 10, 449. [Google Scholar] [CrossRef] [PubMed]

| Household ATP Quintiles | Per Capita Household Expenditure 1 (MYR *) | Per Capita OOP Payments 2 (MYR *) | OOP Payments as % of Household Expenditures |

|---|---|---|---|

| Q1 | 536.86 | 5.55 | 1.03 |

| Q2 | 830.60 | 10.51 | 1.27 |

| Q3 | 1111.26 | 16.65 | 1.50 |

| Q4 | 1517.49 | 27.51 | 1.81 |

| Q5 | 2891.77 | 53.77 | 1.86 |

| Total population | 1365.93 | 22.56 | 1.65 |

| Household ATP Quintiles | Household Expenditures (%) | OOP Healthcare Payments (%) |

|---|---|---|

| Q1 | 7.72 | 4.91 |

| Q2 | 12.27 | 9.13 |

| Q3 | 16.13 | 14.87 |

| Q4 | 21.82 | 24.11 |

| Q5 | 42.06 | 46.98 |

| Total population | 100.00 | 100.00 |

| Gini coefficient/Concentration index | 0.3386 | 0.4296 |

| Kakwani Progressivity Index | 0.0910 |

| Groups of Healthcare Services | Per Capita OOP Payments 1 (MYR *) | OOP Payments as % of Household Expenditures |

|---|---|---|

| Pharmaceuticals | 13.65 | 1.00 |

| Medical products, appliances and equipment | 2.34 | 0.17 |

| Outpatient-based services | 4.72 | 0.35 |

| Hospital-based services | 1.86 | 0.15 |

| Total population | 22.56 | 1.65 |

| Groups of Healthcare Services | Household Consumption | OOP Health Payments |

|---|---|---|

| Pharmaceuticals | ||

| Gini coefficient/Concentration Index | 0.3386 | 0.4311 |

| Kakwani Progressivity Index | 0.0925 | |

| Medical products, appliances and equipment | ||

| Gini coefficient/Concentration Index | 0.3386 | 0.4578 |

| Kakwani Progressivity Index | 0.1192 | |

| Outpatient-based services | ||

| Gini coefficient/Concentration Index | 0.3386 | 0.3780 |

| Kakwani Progressivity Index | 0.0394 | |

| Hospital-based services | ||

| Gini coefficient/Concentration Index | 0.3386 | 0.5142 |

| Kakwani Progressivity Index | 0.1756 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baharin, M.F.A.; Juni, M.H.; Abdul Manaf, R. Equity in Out-of-Pocket Payments for Healthcare Services: Evidence from Malaysia. Int. J. Environ. Res. Public Health 2022, 19, 4500. https://doi.org/10.3390/ijerph19084500

Baharin MFA, Juni MH, Abdul Manaf R. Equity in Out-of-Pocket Payments for Healthcare Services: Evidence from Malaysia. International Journal of Environmental Research and Public Health. 2022; 19(8):4500. https://doi.org/10.3390/ijerph19084500

Chicago/Turabian StyleBaharin, Mohamed Fakhri Abu, Muhamad Hanafiah Juni, and Rosliza Abdul Manaf. 2022. "Equity in Out-of-Pocket Payments for Healthcare Services: Evidence from Malaysia" International Journal of Environmental Research and Public Health 19, no. 8: 4500. https://doi.org/10.3390/ijerph19084500

APA StyleBaharin, M. F. A., Juni, M. H., & Abdul Manaf, R. (2022). Equity in Out-of-Pocket Payments for Healthcare Services: Evidence from Malaysia. International Journal of Environmental Research and Public Health, 19(8), 4500. https://doi.org/10.3390/ijerph19084500