1. Introduction

A perennial question for the pharmaceutical industry has been the excessive drug prices [

1,

2,

3,

4,

5,

6,

7,

8,

9]. Drug price has a direct impact on affordability and access to drugs, particularly in countries where out-of-pocket spending accounts for a large share of pharmaceutical spending, such as in China [

10]. Recent years have seen an increase in criticism regarding the rising cost of certain drugs. One result of this public clamor is that the pricing structure of this industry has once again been scrutinized by government authorities and the media. Without a doubt, excessive drug prices have become a critical issue in accessing healthcare. Controlling high drug prices is an important objective for healthcare policymakers [

11].

It is sometimes claimed that these exorbitant charges are unjustifiable. It is believed that pharmaceutical companies could supply less expensive drugs. Possible explanations include the complicated market structure or information asymmetry, as well as the division of duty between patients and purchasing decision makers who bear the expense [

10,

12,

13]. For instance, some scholars argue that drug prices in the United States are significantly higher than in other countries as a result of the free market in America and the oligopolistic nature of the pharmaceutical industry [

12]. Using case studies from Australia, China, India, Malaysia, New Zealand, and South Korea, some experts believe that the absence of more affordable medicine pricing is due to insufficient competition [

10]. In China, a significant amount of the total costs of drugs is derived mainly from commercial promotion activities and profits generated by numerous levels of distribution [

10,

14]. As a result, many opponents argue that the way to rectify this inequity may be through government regulation.

In practice, authorities have attempted to implement a variety of reformatory pharmaceutical pricing policies in order to reduce patients’ burden of high medical costs and raise the affordability of medicines [

10]. China is no exception [

14,

15,

16,

17,

18,

19,

20]. On 9 January 2017, the Medical Reform Office of the State Council, in collaboration the National Health and Family Planning Commission of the People’s Republic of China, the China Food and Drug Administration, the National Development and Reform Commission, the Ministry of Industry and Information Technology of the People’s Republic China, the Ministry of Commerce, the State Administration of Taxation, and the State Administration of Traditional Chinese Medicine, issued the notice on the implementation opinions of the Two-Invoice System (TIS) in drug procurement for public medical institutions. The purpose of this notice is to reduce the links of drug circulation, to make the middle price transparent, to further promote the reduction in falsely high drug prices, and to alleviate the burden of drug use [

21]. The TIS refers to the mechanism where only up to two invoices are issued along the chain of pharmaceutical product procurement, with one issued by the pharmaceutical manufacturer and the only other issued by the distributor to the medical service providers, which is an important reform in drugs circulation.

The influence of TIS has garnered increasing academic attention [

17,

18,

19,

20]. Not only is the TIS reform designed to lower drug costs, but also to attempt to cut drug prices by minimizing the links in drug circulation, thereby promoting the development of the sector of drug circulation. However, it has been discovered that implementing the TIS policy has a detrimental effect on the performance of pharmaceutical firms. Pharmaceutical marketing is one of the important ways for pharmaceutical firms to create value. Clearly, the TIS policy has shortened the marketing channels of pharmaceutical manufacturers, which may result in lower drug prices. What impact will it have on the marketing activities of pharmaceutical manufacturers? If the TIS policy significantly increases the selling expenses of pharmaceutical manufacturers, the effect may be the inverse of what was anticipated. This is because a portion of the price increases are passed on to consumers. The majority of research conducted in the aftermath of the implementation of the TIS policy has concentrated on the influence of the policy on drug pricing, patient medication, and the pharmaceutical industry. Additionally, a few empirical studies have systematically investigated the relationship between the TIS reform and the selling expenses of pharmaceutical companies. Therefore, focusing on this subject has practical implications at the level of institutional design, providing policy guidance for the institutional reform of drug marketing channels but also theoretical implications at the level of academic research, supplementing empirical evidence on the relationship between institutions and corporate marketing activities.

Our study aims to investigate the impact of the TIS reform on pharmaceutical manufacturers’ selling expenses, which are defined as the costs associated with distributing, marketing, and selling a product or service. This study employs the Difference-in-Difference (DID) approach to examine the effect of the TIS on pharmaceutical manufacturers’ selling expenses. It is based on assessments of a sample of A-share pharmaceutical companies listed on the Shanghai and Shenzhen stock markets. Our study makes three contributions. First, this paper expands the literature on pharmaceutical policy in the emerging economy by conducting the first empirical examination of the effect of China’s TIS on pharmaceutical manufacturers’ selling expenses. Second, we employed DID methodology to alleviate some of the endogenous problems of general regression analysis and increase the credibility of the research conclusion [

22]. Finally, this study also contributes to the marketing studies by revealing the impact of the TIS on the selling expenses of pharmaceutical manufacturers depending on the previous drug circulation mode.

This paper proceeds as follows. In

Section 2, we review the institutional background of the TIS and develop the hypothesis.

Section 3 describes our data collection procedure and variable construction and outlines the empirical method used to investigate the hypothesis.

Section 4 presents the results and a discussion of the empirical analysis.

Section 5 concludes by offering discussion, interesting implications, and the limitations of the findings.

2. Theory and Hypothesis

2.1. Instituational Background the Two-Invoice System

The most prominent feature of the Chinese pharmaceutical industry’s marketing channels is multiple layers of distribution [

10]. The pharmaceutical supply chain includes manufacturing, distribution, wholesalers, retailers, hospitals, and patients [

14].

Previously, under the Multi-Invoice System, pharmaceutical manufacturers could sell their products directly to hospitals in addition to wholesalers and retailers. Meanwhile, larger distributors can sell to smaller distributors. In other words, the pharmaceutical distribution sector is highly fragmented due to the presence of several distribution layer [

10,

14,

15]. There were over 13,100 distributors in 2017, and the top four Chinese distributors controlled 37.6% of the market. As a result of this fragmentation, various purchase quantities may result in different wholesale prices, resulting in a significant imbalance within the pharmaceutical distribution industry. Additionally, drugs were distributed through multiple layers of distribution before reaching the patient, resulting in inefficiencies and higher drug prices [

10]. On the other hand, pharmaceutical manufacturers have a strong motivation to actively promote their drugs through commercial promotion efforts and profit sharing with various levels of distribution. For instance, advertising for competing over-the-counter drugs or employing a large number of salespersons or medical representatives to promote prescriptions [

10].

Therefore, prior to the implementation of TIS, the pharmaceutical industry’s marketing channels were extremely complex, with a mix of distributions, wholesalers, and retailers, significantly increasing the difficulty of supervision in terms of relevant departments’ direct supervision capability and the degree of information opacity [

11,

16,

18,

19]. Simultaneously, the multi-invoice system makes it more difficult to improve the industry’s concentration, and the fragmented market environment exacerbates the difficulty of supervision [

11]. With the help of the multiple layers of distribution, manufacturing firms can entrust the selling expenses to the distributions (e.g., pay the commission fee to the distributions) by transferring profits at a low price, thereby obtaining a sufficient profit while avoiding supervision. Thus, all these contribute to a substantial proportion of the total costs of drugs.

The Chinese government has reformed the pharmaceutical distribution network in order to decrease drug circulation links, make the middle price increase transparent, promote the reduction in high medicine prices, and alleviate the burden of drug use. On 9 January 2017, the Medical Reform Office of the State Council, in collaboration with the other seven agencies, issued a notice regarding the implementation opinions of the TIS in drug procurement for public medical institutions. This notice clearly defines TIS, which means that two invoices are issued along the chain of pharmaceutical product procurement, with one issued by the pharmaceutical manufacturer and the other issued by the distributor to the medical service providers. In addition, the notice requires public medical institutions to gradually implement the TIS in drug procurement, while encouraging other medical institutions to do so [

21]. By the end of 2017, all 31 provinces, municipalities, and autonomous regions on the Chinese mainland have formally released a notification on the TIS ‘s implementation opinions. According to collected data, a total of 30 provinces began implementing the TIS formally by the end of 2017, and the whole Chinese mainland began doing so in 2018, with the exception of 1 province.

Accordingly, the implementation of TIS forces the pharmaceutical industry to reduce redundant distributions in marketing channels, directly cutting off the multi-invoice marketing channels, and has a huge lash on the marketing channels of the pharmaceutical distribution industry.

2.2. The Two-Invoice System and Pharmaceutical Manufacturers’ Selling Expenses

Pharmaceutical marketing is widely recognized as a critical channel for pharmaceutical makers to create value. Pharmaceutical firms can create value by increasing product popularity and market share through marketing. Distributors benefit from a comparative advantage in marketing activities when using the Multi-Invoice System. As a result, pharmaceutical producers can outsource sales to distributors by sacrificing profits at a low price, lowering the gross profit margin of drugs [

10,

14]. Correspondingly, the book-selling expenses of pharmaceutical manufacturers are likewise relatively low.

However, the TIS highlights the hidden selling expenditures and increases the transaction costs of the pharmaceutical manufacturers. Firstly, as mentioned above, the purpose of the implementation of the TIS is to make the intermediate price increase transparent, to promote the reduction in falsely high prices of drugs, and to minimize the burden of drug use by reducing the links of drug circulation. The implementation of the TIS directly influenced the drug marketing model of pharmaceutical manufacturers, so that pharmaceutical manufacturers had to integrate the multi-level marketing channels under the original multi-invoice system into one level, and even afford some marketing activities by themselves. According to some studies, only about 12.5% of pharmaceutical manufacturers in China had established marketing teams prior to the implementation of TIS. Due to the limited human and financial resources, the majority of pharmaceutical manufacturers distribute their products via marketing networks and agents. As a result of the TIS implementation and channel compression, pharmaceutical manufacturers must expand downstream of the value chain. Therefore, selling expenses will increase rapidly.

In conclusion, we propose that the TIS highlights the hidden selling expenses and increases the transaction costs of the pharmaceutical manufacturers. These conclusions lead us to the following hypothesis:

Hypothesis 1. The implementation of the TIS will increase the selling expense of pharmaceutical manufacturers.

5. Conclusions

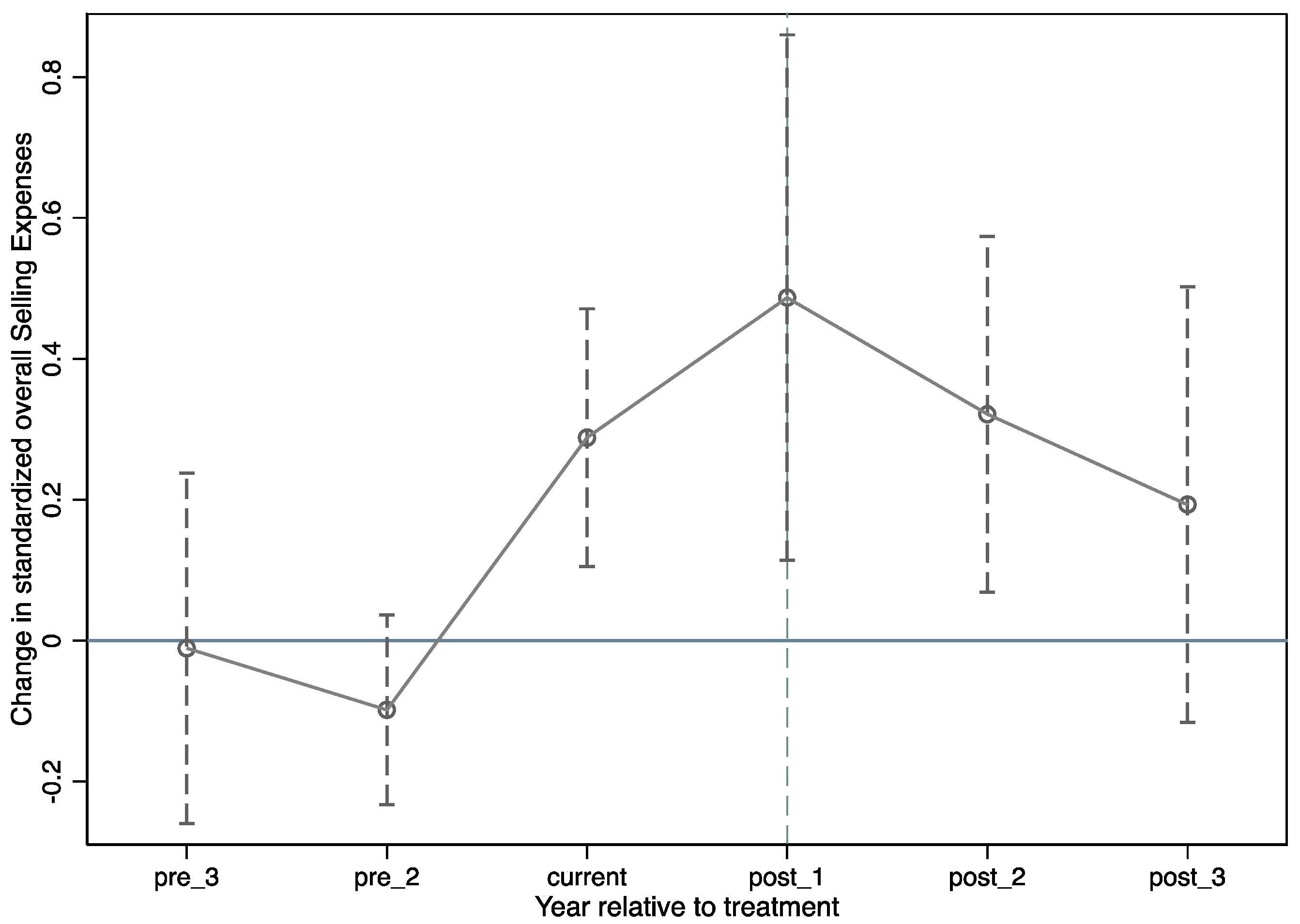

This study investigates whether the major policy of the pharmaceutical industry, the TIS reform, increases the selling expenses of pharmaceutical manufacturers. We used the DID approach to empirically examine the effect of the TIS reform on pharmaceutical firms’ selling expenses both before and after the policy’s implementation. The results indicate that implementing the TIS increases pharmaceutical manufacturers’ selling expenses significantly, although the rise steadily diminishes over time. Additionally, we further explore whether the impact of the TIS on pharmaceutical manufacturers’ selling expenses is affected by the pharmaceutical manufacturers’ previous drug circulation mode. The findings suggest that the TIS has the potential to significantly increase pharmaceutical manufacturers’ selling expenses in the agency mode group. However, there is no evidence to support the TIS having the same effect in the direct sales office model group.

These results are counterintuitive, as most views believe that China’s implementation of the TIS can reduce the falsely high drug prices by reducing the overall distribution cost of the whole pharmaceutical industry [

17,

18,

19,

20]. Because the TIS shortens the drug marketing channels, improves the transparency of drug marketing channels, and then improves the government’s ability to supervise drug marketing channels. However, the implementation of the TIS makes the pharmaceutical manufacturers assume marketing and sales functions, which highlights the hidden selling expenses of the traditional pharmaceutical distribution system. Thus, in the short term, it increases the selling expense of pharmaceutical manufacturers. However, this does not mean that the TIS policy is ineffective. Our results show that while the TIS policy initially raises pharmaceutical manufacturers’ selling expenses, this effect does not persist in the long run. It is indicated that TIS will gradually cut drug prices. Although the selling expenses of pharmaceutical manufacturers will increase in the short term, in the long run, the TIS policy standardizes the circulation of pharmaceutical products, purifies the pharmaceutical market environment, and promotes the long-term development of pharmaceutical manufacturers.

Additionally, it should be noted that initial stage of policy implementation may result in an increase in pharmaceutical makers’ selling expenses, posing tax-related risks. For example, a large number of CSOs (contract sales organizations), which are professional institutions that provide customers with market research, product design, and promotion services, are pouring out, and the authenticity and rationality of the cooperation between the pharmaceutical manufacturers and these CSO companies has become critical to the tax-related risks of pharmaceutical manufacturers. In this vein, the government should take other auxiliary measures to cooperate with the implementation of the TIS policy, such as improving the drug approval system and promoting the implementation of “consistency evaluation” of generic drugs, so that the selling expenses can be reduced, and doctors will no longer be required to listen to the opinions of agents to ensure the quality and efficacy of drugs.

Our study has the following implications. First, this paper expands the literature on pharmaceutical policy in the emerging economy by conducting the first empirical examination of the effect of China’s TIS on pharmaceutical manufacturers’ selling expenses. Second, our study advances evidence-informed and evidence-based policymaking [

31,

32]. A policy can be strongly evidence-informed if its advocates act effectively and empirical studies help explain when, how, and why such a policy works in a given context. In this study, we demonstrated empirically when, how, and why the TIS affects pharmaceutical manufacturers’ selling expenses. On the other hand, by evaluating the success of the TIS policy in the pharmaceutical industry, this study assists the government in making pertinent counselling policy decisions in the future. Finally, this study also contributes to the marketing studies by revealing the impact of the TIS on the selling expenses of pharmaceutical manufacturers depending on preceding drug circulation mode.

This study also has some limitations. Firstly, this study focused exclusively on the direct impact of the TIS policy on pharmaceutical manufacturers’ selling expenses. In fact, there is an indirect impact of the TIS policy on the innovation investment of pharmaceutical manufacturers. Future studies should focus on the impact of the TIS policy on the innovation of pharmaceutical manufacturers since innovation is critical for pharmaceutical companies [

33]. Secondly, when considering the moderator variables, this study only focuses on the impact of the drug circulation mode. Actually, the mode of corporate value creation (marketing-orientation versus innovation-orientation) will also have an effect the relationship between the TIS policy and pharmaceutical manufacturers’ selling expenses. Additional moderators can be added in future studies to better investigate the moderating effect. Finally, the TIS policy has a considerable impact on the entire sector of drug circulation. In this study, we only focus on the pharmaceutical manufacturers, but the influence of TIS policy on agents and intermediates, such as CSO firms, can be considered in future studies.