Impacts of Supply Chain Competition on Firms’ Carbon Emission Reduction and Social Welfare under Cap-and-Trade Regulation

Abstract

:1. Introduction

2. Literature Review

2.1. Low-Carbon Supply Chain

2.2. Supply Chain Competition

2.3. Methodology and Contribution

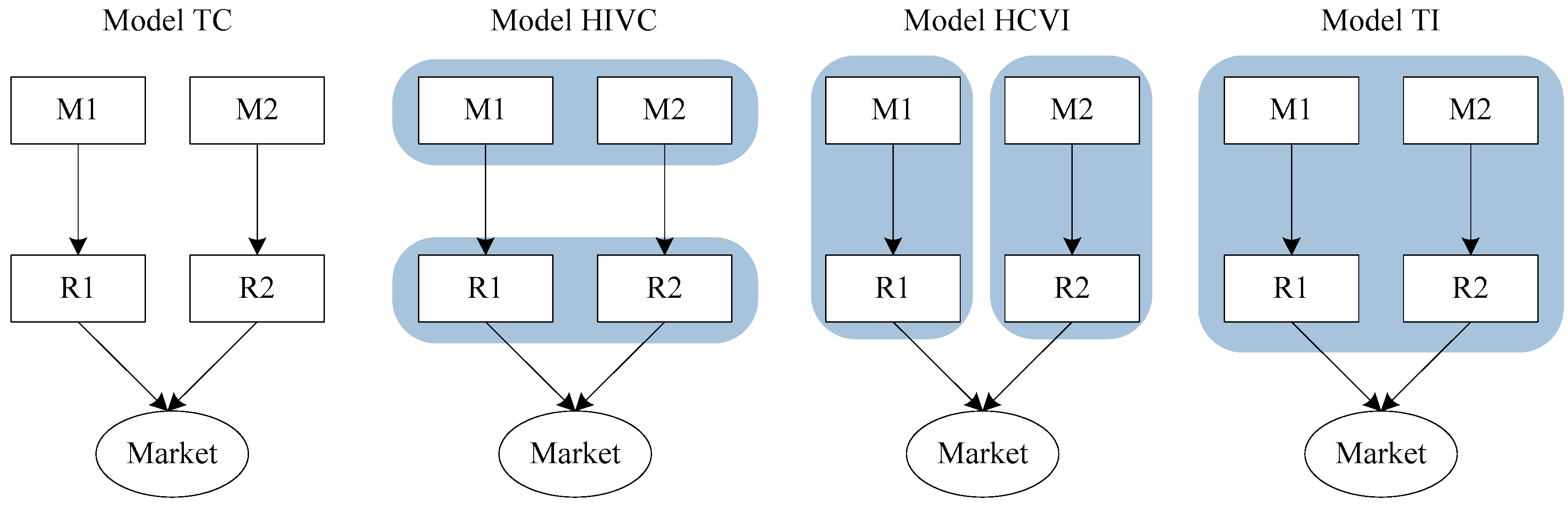

3. Model Descriptions

- Model TC. Two supply chains are perfectly competitive, and each supply chain is vertically decentralized. All firms act independently to maximize their respective profit. We describe this scenario as total competition (TC);

- Model HIVC. Two supply chains are horizontally integrated and vertically competitive. Two upstream manufacturers and two downstream retailers are integrated as one firm, respectively. This system corresponds to a single decentralized supply chain with one upstream firm and one downstream firm. We describe this scenario as horizontal integration and vertical competition (HIVC);

- Model HCVI. Two supply chains are horizontally competitive and vertically integrated. This chain-to-chain competition scenario is equivalent to a duopoly market case. This scenario is described as horizontal competition and vertical integration (HIVC);

- Model TI. Two supply chains are totally integrated into both horizontal and vertical directions. All firms in two supply chains act as one single firm and make decisions to maximize their mutual profit. This scenario is described as total integration (TI).

4. Equilibrium Solutions

4.1. Model TC

- (i)

- The optimal profit of each supply chain is

- (ii)

- The carbon emissions amount of each supply chain is

- (iii)

- The social welfare is

- (i)

- ;

- (ii)

- If , then ; If , then ; If , then .

4.2. Model HIVC

- (i)

- The optimal profit of each supply chain is

- (ii)

- The carbon emissions amount of each supply chain is

- (iii)

- The social welfare is

- (i)

- (ii)

- If, then; If, then, wheresatisfying.

4.3. Model HCVI

- (i)

- The optimal profit of each supply chain is

- (ii)

- The carbon emissions amount of each supply chain is

- (iii)

- The social welfare is

4.4. Model TI

- (i)

- The optimal profit of each supply chain is

- (ii)

- The carbon emissions amount of each supply chain is

- (iii)

- The social welfare is

- (i)

- ;

- (ii)

- If, then ; If , then , where satisfying.

5. Comparisons and Analyses

5.1. Impacts of Horizontal Competition between Two Supply Chains

- (i)

- (ii)

- (i)

- If, then

- (ii)

- If,

- (iii)

- If,.

- (i)

- (ii)

- When, then; When, then there exitssatisfying, if,, if,.

5.2. Impacts of Vertical Competition in the Supply Chain

- (i)

- (ii)

- (iii)

- (i)

- (ii)

- When, then; When, then there exitssatisfying, if,, otherwise,.

5.3. Impacts of Competition on the Equilibrium Decisions of Supply Chain

- (i)

- If, then ; If , ;

- (ii)

5.4. Impacts of Competition on the Economy and Environment

5.4.1. Comparison of Supply Chain Profits in Four Models

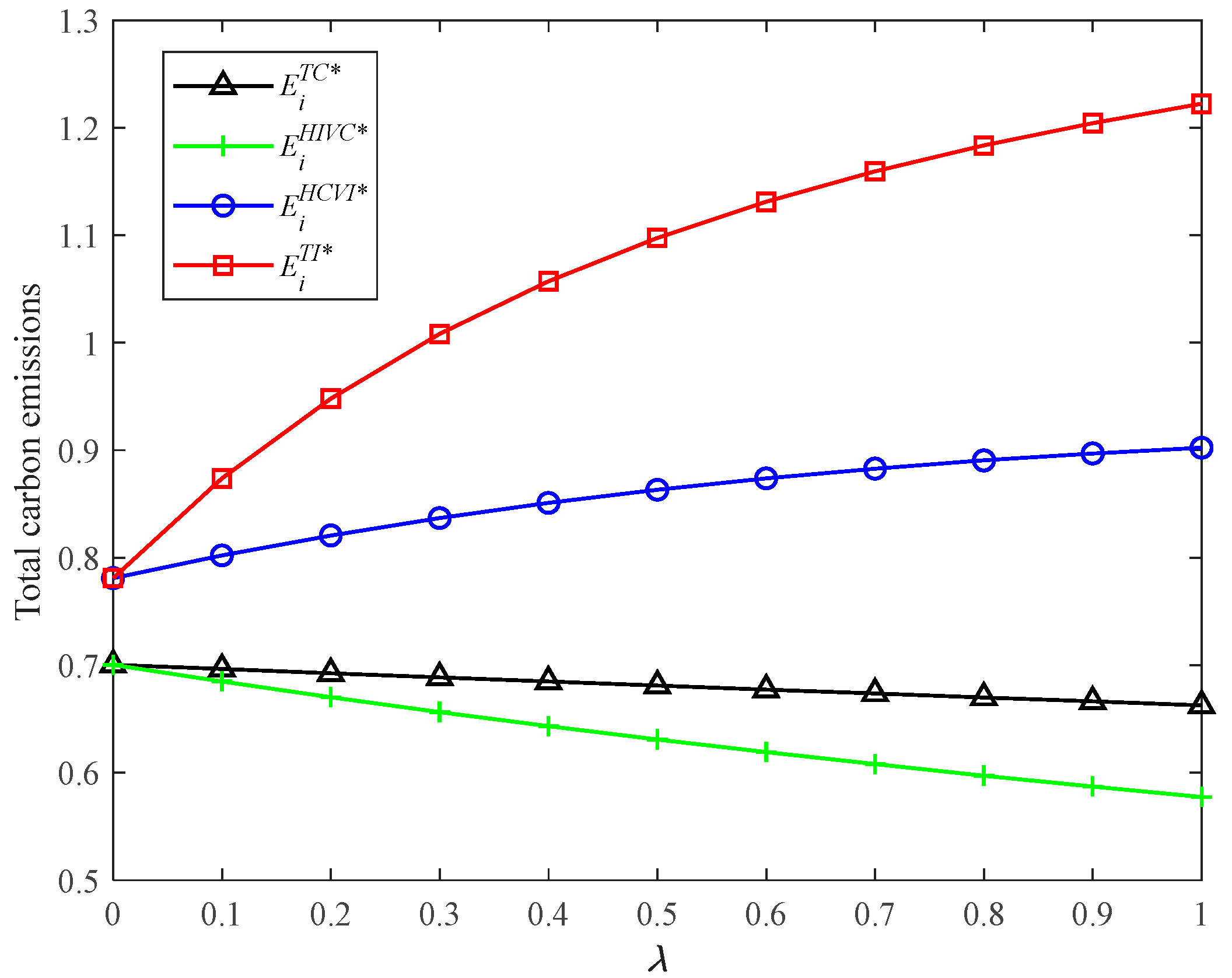

5.4.2. Comparison of Total Carbon Emissions in Four Models

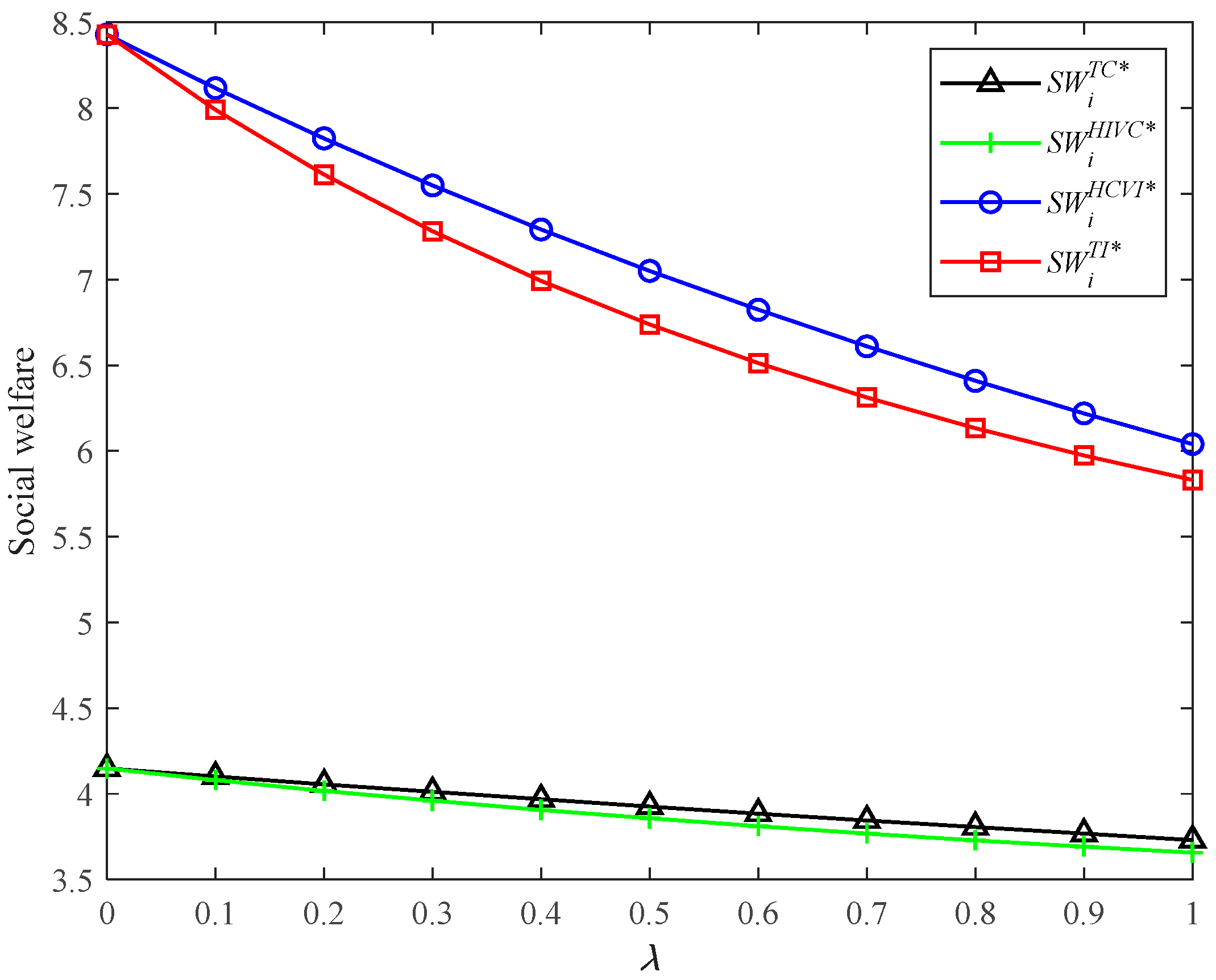

5.4.3. Comparison of Social Welfare in Four Models

6. Discussions

7. Conclusions

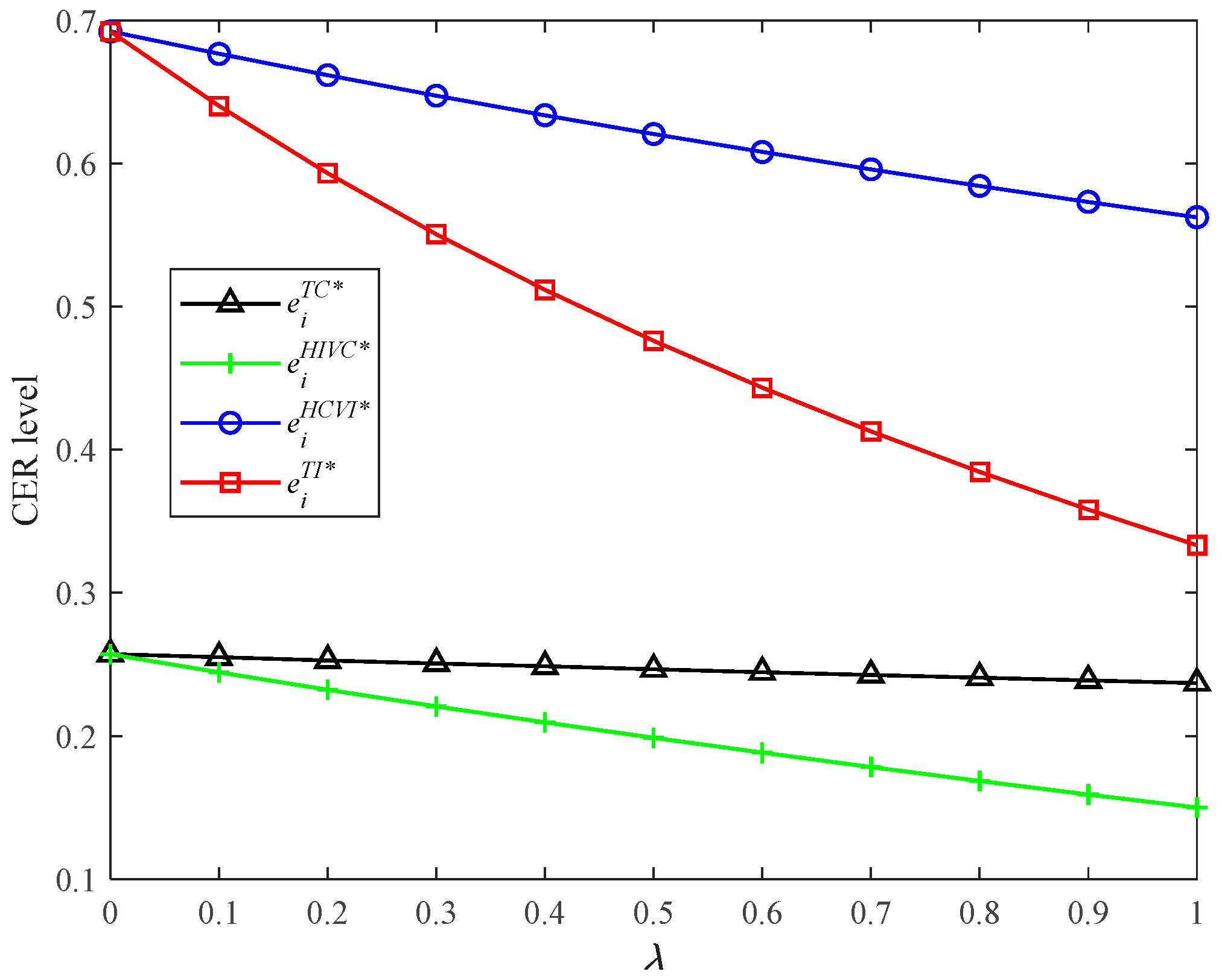

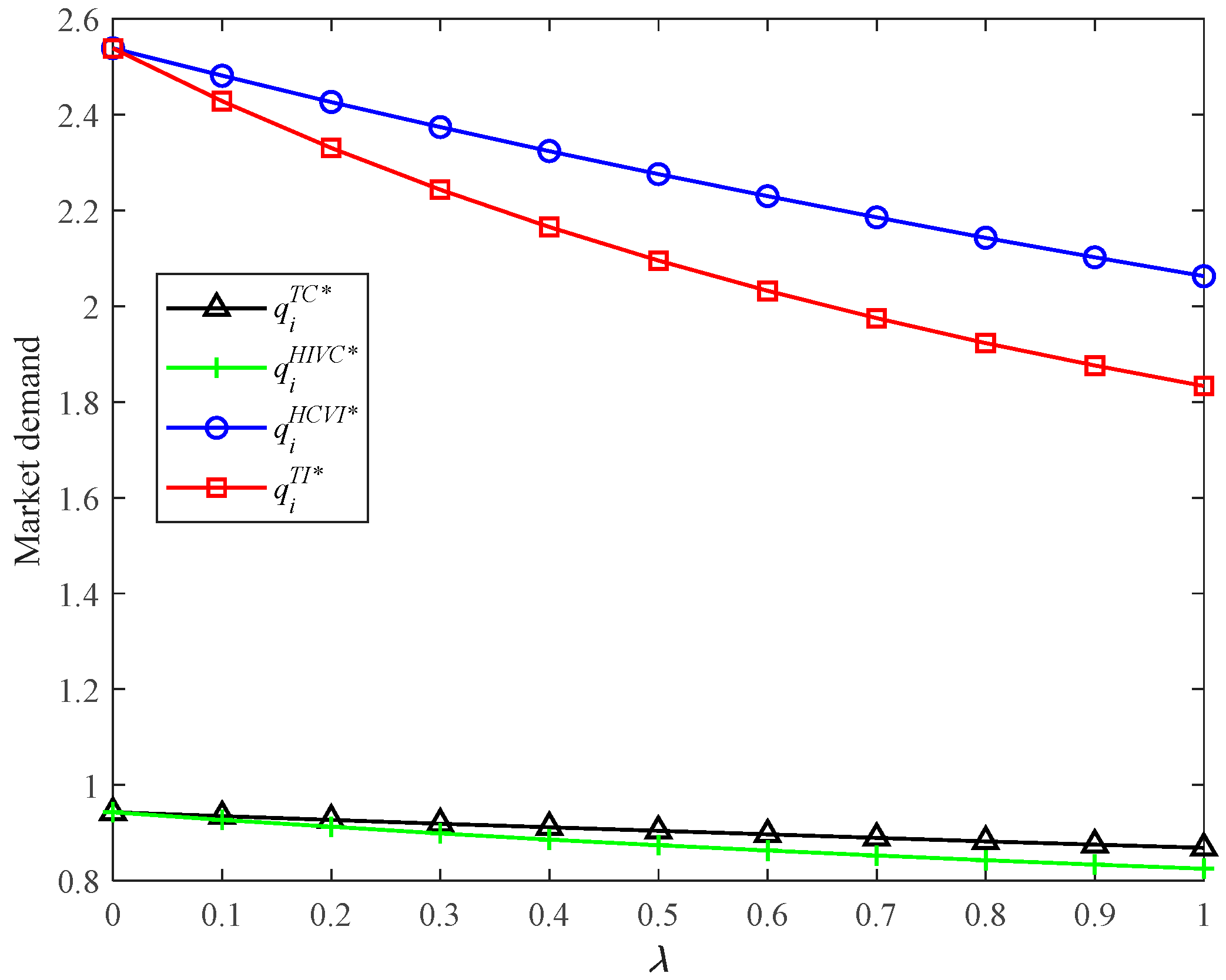

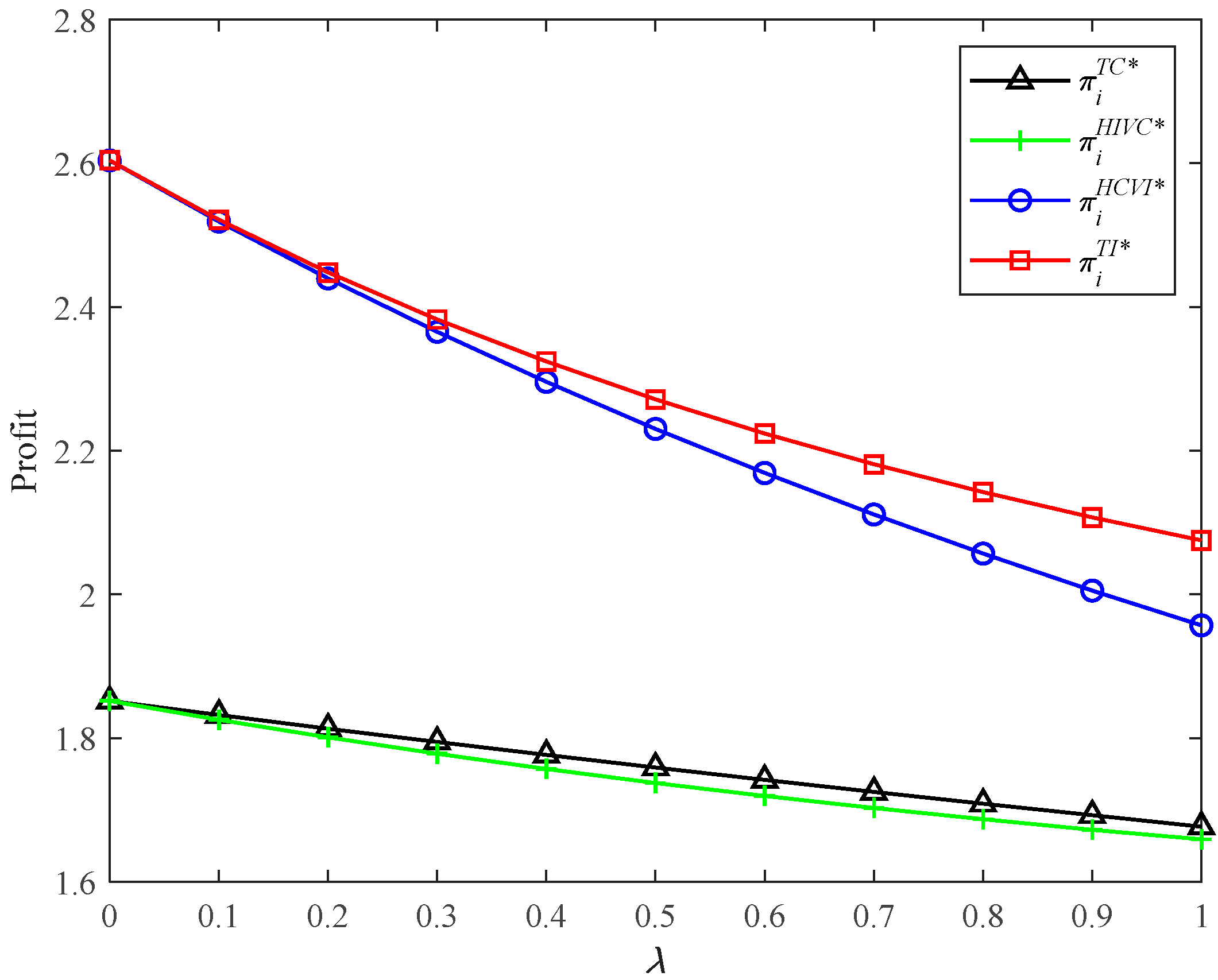

- (1)

- In four supply chain structures, the more intense the supply chain competition, the lower motivation of the firm to invest in CER technology. The less CER technology investment also leads to lower market demand, supply chain profit, and total social welfare. Under cap-and-trade regulation, the whole supply chain in each of the four market structures benefits from the carbon quota given by the government, which does not affect the equilibrium decisions of the supply chain. A larger carbon quota can bring more gross profit for the whole supply chain and more social welfare;

- (2)

- The presence of horizontal competition or vertical integration will inevitably bring more CER levels and market demand. Under certain conditions, horizontal competition or vertical integration can also generate more profit and social welfare. The underlying managerial insight is that firms should cooperate with their upstream or downstream supply chain partners to reduce carbon emissions while maximizing profits;

- (3)

- When the firm has to face competition from its upstream or downstream partners, horizontal cooperation is never a good choice as it always brings lower CER levels and market demand. In most cases, horizontal cooperation also brings lower profits and social welfare. This finding is important and counter-intuitive. Traditional wisdom is that integration is always of benefit to the supply chain system [48]. However, we find that horizontal competition benefits the supply chain system. When different firms face CER competition, their mutual cooperation will not solve their conflicts, nor will it bring more profits and social welfare;

- (4)

- When the firm has a choice to cooperate with its upstream or downstream partners, vertical integration is always a better choice [54]. Vertical integration always brings a higher CER level, market demand, and more profit and social welfare. The equilibrium supply chain structure, from a comprehensive perspective of the economy and environment, does not exist. The horizontal competition and vertical integration (HCVI) strategy cannot bring the greatest profits but can bring the most environmentally friendly social welfare.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Cai, Y.-J.; Choi, T.-M.; Feng, L.; Li, Y. Producer’s choice of design-for-environment under environmental taxation. Eur. J. Oper. Res. 2022, 297, 532–544. [Google Scholar] [CrossRef]

- Cai, Y.J.; Choi, T.M. A United Nations’ Sustainable Development Goals perspective for sustainable textile and apparel supply chain management. Transp. Res. Part E Logist. Transp. Rev. 2020, 141, 102010. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.; Wan, M.-D.; Zheng, X.-X.; Koh, S.C.L. Fairness concerns and extended producer responsibility transmission in a circular supply chain. Ind. Mark. Manag. 2022, 102, 216–228. [Google Scholar] [CrossRef]

- Vieira, L.C.; Longo, M.; Mura, M. Are the European manufacturing and energy sectors on track for achieving net-zero emissions in 2050? An empirical analysis. Energy Policy 2021, 156, 112464. [Google Scholar] [CrossRef]

- Xi Announces China Aims to Achieve Carbon Neutrality before 2060. Available online: https://www.bbc.com/news/world-europe-56828383 (accessed on 10 January 2022).

- Climate Change: EU to Cut CO2 Emissions by 55% by 2030. Available online: https://www.bbc.com/news/world-europe-56828383 (accessed on 10 January 2022).

- Yang, L.; Ji, J.N.; Wang, M.Z.; Wang, Z.Z. The manufacturer’s joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. J. Clean. Prod. 2018, 193, 506–523. [Google Scholar] [CrossRef]

- Qin, J.J.; Fu, H.P.; Wang, Z.P.; Xia, L.J. Financing and carbon emission reduction strategies of capital-constrained manufacturers in E-commerce supply chains. Int. J. Prod. Econ. 2021, 241, 108271. [Google Scholar] [CrossRef]

- Liu, Z.; Li, K.W.; Tang, J.; Gong, B.; Huang, J. Optimal operations of a closed-loop supply chain under a dual regulation. Int. J. Prod. Econ. 2021, 233, 107991. [Google Scholar] [CrossRef]

- EU Emissions Trading System (EU ETS). Available online: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en (accessed on 10 January 2022).

- Qi, Q.; Zhang, R.Q.; Bai, Q.G. Joint decisions on emission reduction and order quantity by a risk-averse firm under cap-and-trade regulation. Comput. Ind. Eng. 2021, 162, 107783. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Ji, J. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Xia, L.; Hao, W.; Qin, J.; Ji, F.; Yue, X. Carbon emission reduction and promotion policies considering social preferences and consumers’ low-carbon awareness in the cap-and-trade system. J. Clean. Prod. 2018, 195, 1105–1124. [Google Scholar] [CrossRef]

- Xue, K.L.; Sun, G.H.; Wang, Y.Y.; Niu, S.Y. Optimal Pricing and Green Product Design Strategies in a Sustainable Supply Chain Considering Government Subsidy and Different Channel Power Structures. Sustainability 2021, 13, 12446. [Google Scholar] [CrossRef]

- JD Released a Report on Green Consumption Development Titled “Green Momentum” to Create a New Ecosystem of Openness. Available online: http://finance.ce.cn/gsxw/201710/13/t20171013_26524031.shtml (accessed on 10 January 2022).

- Sun, L.; Cao, X.; Alharthi, M.; Zhang, J.; Taghizadeh-Hesary, F.; Mohsin, M. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 2020, 264, 121664. [Google Scholar] [CrossRef]

- Yu, Y.; Zhou, S.; Shi, Y. Information sharing or not across the supply chain: The role of carbon emission reduction. Transp. Res. Part E Logist. Transp. Rev. 2020, 137, 101915. [Google Scholar] [CrossRef]

- Sun, J.S.; Li, G. Optimizing emission reduction task sharing: Technology and performance perspectives. Ann. Oper. Res. 2021, 1–22. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon Footprint and the Management of Supply Chains: Insights from Simple Models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- He, P.; Zhang, W.; Xu, X.Y.; Bian, Y.W. Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. J. Clean. Prod. 2015, 103, 241–248. [Google Scholar] [CrossRef]

- Li, X.; Shi, D.; Li, Y.J.; Zhen, X.P. Impact of Carbon Regulations on the Supply Chain With Carbon Reduction Effort. IEEE Trans. Syst. Man Cybern. Syst. 2019, 49, 1218–1227. [Google Scholar] [CrossRef]

- Xia, L.; Guo, T.; Qin, J.; Yue, X.; Zhu, N. Carbon emission reduction and pricing policies of a supply chain considering reciprocal preferences in cap-and-trade system. Ann. Oper. Res. 2017, 268, 149–175. [Google Scholar] [CrossRef]

- Chen, X.; Yang, H.; Wang, X.J.; Choi, T.M. Optimal carbon tax design for achieving low carbon supply chains. Ann. Oper. Res. 2020, 1–28. [Google Scholar] [CrossRef]

- Fang, Y.; Yu, Y.; Shi, Y.; Liu, J. The effect of carbon tariffs on global emission control: A global supply chain model. Transp. Res. Part E Logist. Transp. Rev. 2020, 133, 101818. [Google Scholar] [CrossRef]

- Xu, J.T.; Chen, Y.Y.; Bai, Q.G. A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J. Clean. Prod. 2016, 135, 42–56. [Google Scholar] [CrossRef]

- Xu, X.P.; He, P.; Xu, H.; Zhang, Q.P. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Bai, Q.G.; Xu, J.T.; Zhang, Y.Y. Emission reduction decision and coordination of a make-to-order supply chain with two products under cap-and-trade regulation. Comput. Ind. Eng. 2018, 119, 131–145. [Google Scholar] [CrossRef]

- Yang, H.X.; Chen, W.B. Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus Cost-sharing. Omega 2018, 78, 179–191. [Google Scholar] [CrossRef]

- Bai, Q.G.; Xu, J.T.; Chauhan, S.S. Effects of sustainability investment and risk aversion on a two-stage supply chain coordination under a carbon tax policy. Comput. Ind. Eng. 2020, 142, 106324. [Google Scholar] [CrossRef]

- Qian, X.H.; Chan, F.T.S.; Zhang, J.H.; Yin, M.Q.; Zhang, Q.Y. Channel coordination of a two-echelon sustainable supply chain with a fair-minded retailer under cap-and-trade regulation. J. Clean. Prod. 2020, 244, 118715. [Google Scholar] [CrossRef]

- Wu, D.D.; Yang, L.P.; Olson, D.L. Green supply chain management under capital constraint. Int. J. Prod. Econ. 2019, 215, 3–10. [Google Scholar]

- Zhao, H.; Song, S.J.; Zhang, Y.L.; Liao, Y.; Yue, F. Optimal decisions in supply chains with a call option contract under the carbon emissions tax regulation. J. Clean. Prod. 2020, 271, 122199. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. Trade credit financing and coordination for an emission-dependent supply chain. Comput. Ind. Eng. 2018, 119, 50–62. [Google Scholar] [CrossRef]

- Cao, E.B.; Du, L.X.; Ruan, J.H. Financing preferences and performance for an emission-dependent supply chain: Supplier vs. bank. Int. J. Prod. Econ. 2019, 208, 383–399. [Google Scholar] [CrossRef]

- Tang, R.H.; Yang, L. Impacts of financing mechanism and power structure on supply chains under cap-and-trade regulation. Transp. Res. Part E Logist. Transp. Rev. 2020, 139, 101957. [Google Scholar] [CrossRef]

- Huang, S.; Fan, Z.P.; Wang, X.H. Optimal financing and operational decisions of capital-constrained manufacturer under green credit and subsidy. J. Ind. Manag. Optim. 2021, 17, 261. [Google Scholar] [CrossRef] [Green Version]

- Huang, S.; Fan, Z.-P.; Wang, N. Green subsidy modes and pricing strategy in a capital-constrained supply chain. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101885. [Google Scholar] [CrossRef]

- Yang, D.X.; Chen, Z.Y.; Yang, Y.C.; Nie, P.Y. Green financial policies and capital flows. Physica A 2019, 522, 135–146. [Google Scholar] [CrossRef]

- Kang, H.; Jung, S.-Y.; Lee, H. The impact of Green Credit Policy on manufacturers’ efforts to reduce suppliers’ pollution. J. Clean. Prod. 2020, 248, 119271. [Google Scholar] [CrossRef]

- Li, B.; Geng, Y.; Xia, X.Q.; Qiao, D. The Impact of Government Subsidies on the Low-Carbon Supply Chain Based on Carbon Emission Reduction Level. Int. J. Environ. Res. Public Health 2021, 18, 7603. [Google Scholar] [CrossRef]

- An, S.M.; Li, B.; Song, D.P.; Chen, X. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Oper. Res. 2021, 292, 125–142. [Google Scholar] [CrossRef]

- Zhu, W.; He, Y. Green product design in supply chains under competition. Eur. J. Oper. Res. 2017, 258, 165–180. [Google Scholar] [CrossRef]

- Guo, S.; Choi, T.-M.; Shen, B. Green product development under competition: A study of the fashion apparel industry. Eur. J. Oper. Res. 2020, 280, 523–538. [Google Scholar] [CrossRef]

- Shen, B.; Zhu, C.; Li, Q.; Wang, X. Green technology adoption in textiles and apparel supply chains with environmental taxes. Int. J. Prod. Res. 2020, 59, 4157–4174. [Google Scholar] [CrossRef]

- Liu, L.; Feng, L.; Jiang, T.; Zhang, Q. The impact of supply chain competition on the introduction of clean development mechanisms. Transp. Res. Part E Logist. Transp. Rev. 2021, 155, 102506. [Google Scholar] [CrossRef]

- Wang, J.; Wan, Q.; Yu, M. Green supply chain network design considering chain-to-chain competition on price and carbon emission. Comput. Ind. Eng. 2020, 145, 106503. [Google Scholar] [CrossRef]

- Li, X.; Li, Y. Chain-to-chain competition on product sustainability. J. Clean. Prod. 2016, 112, 2058–2065. [Google Scholar] [CrossRef]

- Sim, J.; El Ouardighi, F.; Kim, B. Economic and environmental impacts of vertical and horizontal competition and integration. Nav. Res. Logist. 2019, 66, 133–153. [Google Scholar] [CrossRef]

- Deng, W.; Feng, L.; Zhao, X.; Lou, Y. Effects of supply chain competition on firms’ product sustainability strategy. J. Clean. Prod. 2020, 275, 124061. [Google Scholar] [CrossRef]

- Sheu, J.-B.; Chen, Y.J. Impact of government financial intervention on competition among green supply chains. Int. J. Prod. Econ. 2012, 138, 201–213. [Google Scholar] [CrossRef]

- Wei, J.; Zhao, J.; Li, Y.J. Price and warranty period decisions for complementary products with horizontal firms’ cooperation/noncooperation strategies. J. Clean. Prod. 2015, 105, 86–102. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2000, 2, 372–391. [Google Scholar] [CrossRef]

- Xie, G. Cooperative strategies for sustainability in a decentralized supply chain with competing suppliers. J. Clean. Prod. 2016, 113, 807–821. [Google Scholar] [CrossRef]

| Articles | SCM | SCC | Demand Function | Cap-and-Trade | Focus Point |

|---|---|---|---|---|---|

| Bai et al. [30] | M, R | × | PS, SS | × | Profit |

| Chen et al. [24] | M, R | × | PS | × | Profit |

| Xue et al. [15] | M, R | × | PCS | × | Profit, Social welfare |

| Yang et al. [7] | M, R | × | PS | √ | Profit |

| Bai et al. [28] | S, M | × | PCS | √ | Profit |

| Qian et al. [31] | M, R | × | PS, SS | √ | Profit |

| Qi et al. [11] | S, Firm | × | PS, CS | √ | Profit |

| Li et al. [22] | M, R | × | PS, CS | √ | Profit |

| Xu et al. [27] | M, R | × | PS, CS | √ | Profit |

| Xia et al. [23] | M, R | × | PS, CS | √ | Profit |

| Tang and Yang [36] | M, R | × | PS, CS | √ | Profit, Social welfare |

| Guo et al. [44] | M, R | √ | SS | × | Profit |

| Liu et al. [13] | M, R | √ | SS | × | Profit |

| Shen et al. [45] | M, Buyer | √ | PS, SS | × | Profit, Social welfare |

| Sheu and Chen [51] | M, R | √ | PS | × | Profit, Social welfare |

| Zhu and He [43] | M, R | √ | PS, SS | × | Profit |

| Li and Li [48] | S, M | √ | SS | × | Profit |

| Sim et al. [49] | S, M | √ | PS | × | Profit, Social welfare |

| Deng et al. [50] | S, M | √ | SS | × | Profit |

| Yang et al. [12] | M, R | √ | PS, CS | √ | Profit |

| Liu et al. [46] | M, R | √ | PS | × | Profit |

| Our paper | M, R | √ | PS, CS | √ | Profit, Social welfare |

| Notations | Descriptions |

|---|---|

| Initial market demand potential for product | |

| Demand sensitivity coefficient | |

| Market demand in supply chain | |

| Demand sensitivity coefficient to the rival’s carbon emission reduction level | |

| Cost coefficient of CER technology investment | |

| Production cost of manufacturer | |

| Initial carbon emissions of unit product | |

| Carbon emissions of manufacturer | |

| Total carbon quota from the government | |

| Carbon trading amount of manufacturer | |

| the profit of in supply chain in model | |

| Social welfare in model | |

| Subscript | denote the manufacturer, retailer, supply chain, respectively; denote the supply chain 1 and 2, respectively |

| Superscript | denote total competition, horizontal integration and vertical competition, horizontal competition and vertical integration, and total integration, respectively |

| Decision Variables | |

| Carbon emission reduction level of manufacturer | |

| The wholesale price of product | |

| Retail price of product |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, K.; Sun, G. Impacts of Supply Chain Competition on Firms’ Carbon Emission Reduction and Social Welfare under Cap-and-Trade Regulation. Int. J. Environ. Res. Public Health 2022, 19, 3226. https://doi.org/10.3390/ijerph19063226

Xue K, Sun G. Impacts of Supply Chain Competition on Firms’ Carbon Emission Reduction and Social Welfare under Cap-and-Trade Regulation. International Journal of Environmental Research and Public Health. 2022; 19(6):3226. https://doi.org/10.3390/ijerph19063226

Chicago/Turabian StyleXue, Kelei, and Guohua Sun. 2022. "Impacts of Supply Chain Competition on Firms’ Carbon Emission Reduction and Social Welfare under Cap-and-Trade Regulation" International Journal of Environmental Research and Public Health 19, no. 6: 3226. https://doi.org/10.3390/ijerph19063226

APA StyleXue, K., & Sun, G. (2022). Impacts of Supply Chain Competition on Firms’ Carbon Emission Reduction and Social Welfare under Cap-and-Trade Regulation. International Journal of Environmental Research and Public Health, 19(6), 3226. https://doi.org/10.3390/ijerph19063226