Drivers of CO2 Emissions: A Debt Perspective

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Theoretical Framework

- Investment and consumption through public and private debt.

- 2.

- Financial market development and carbon lock-in effect.

3.2. Model

3.3. Data

4. Results and Discussion

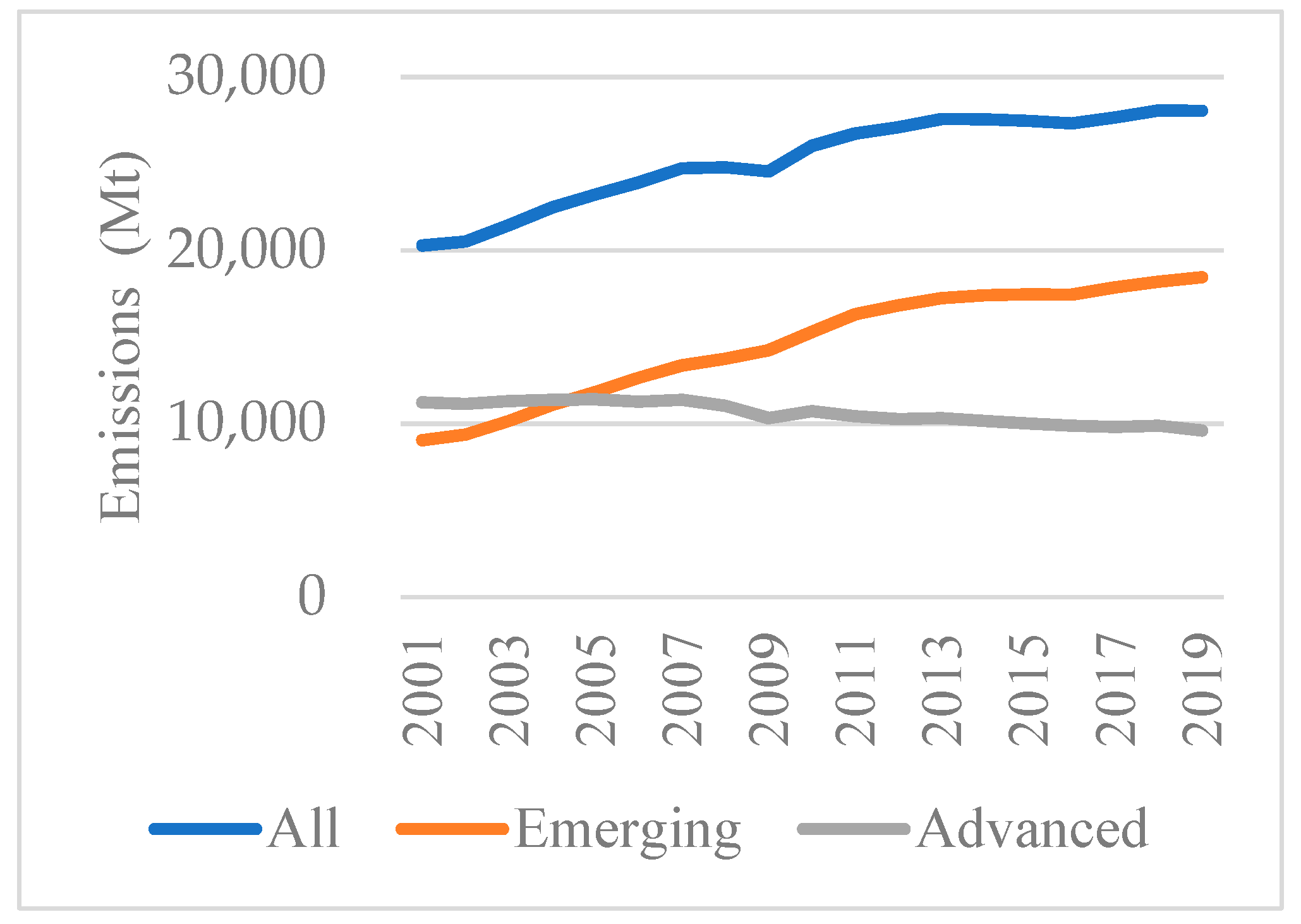

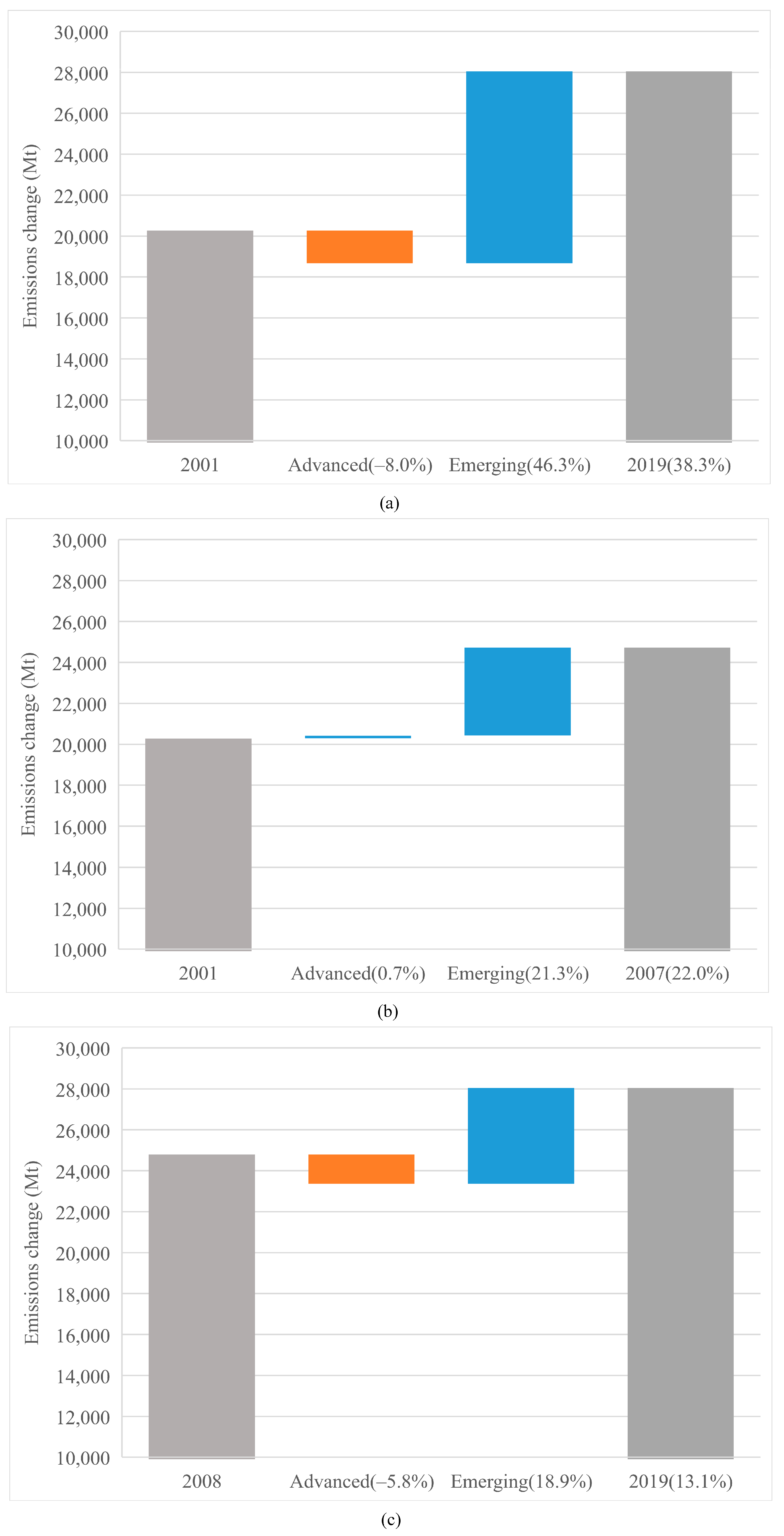

4.1. Analysis of CO2 Emission Changes

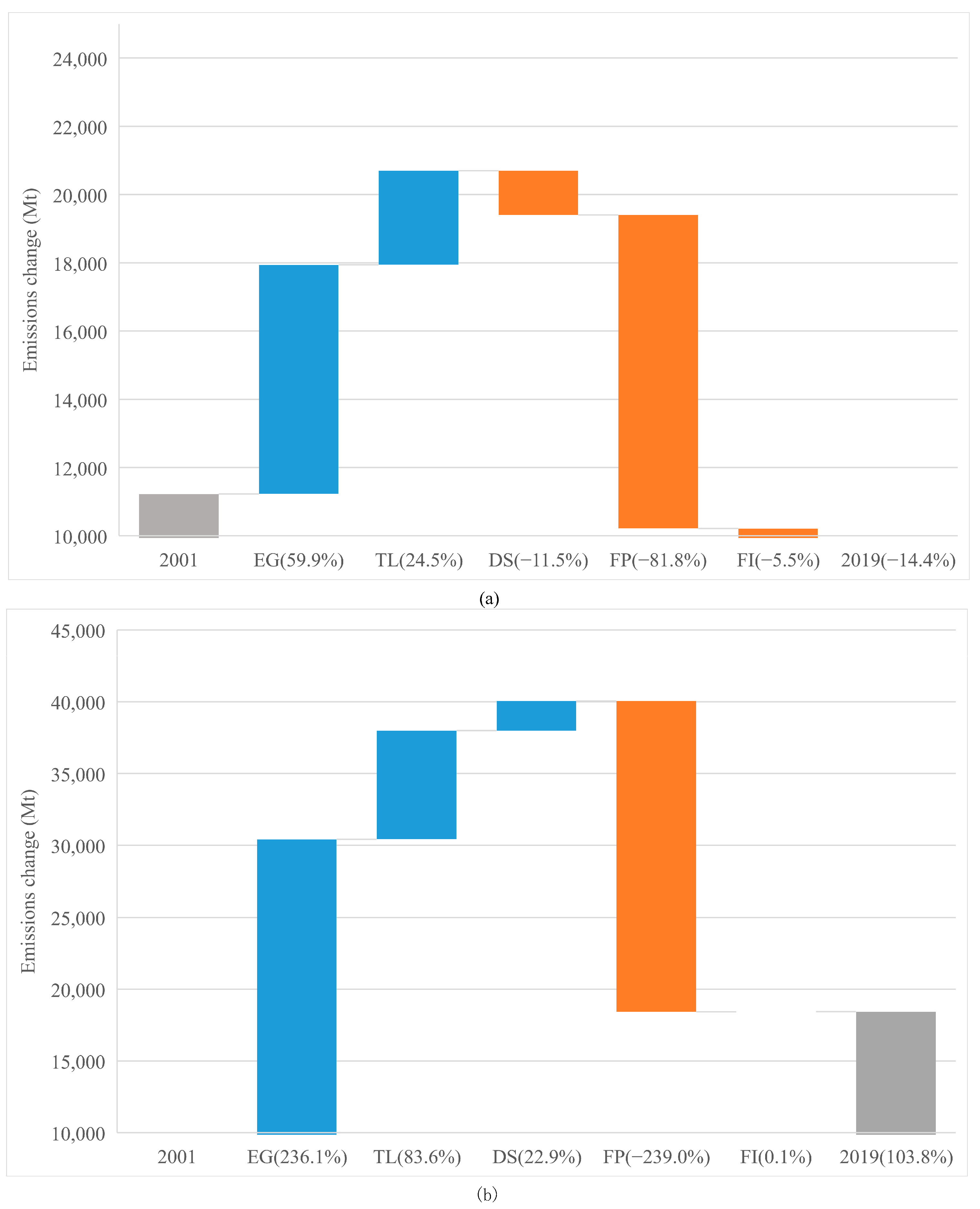

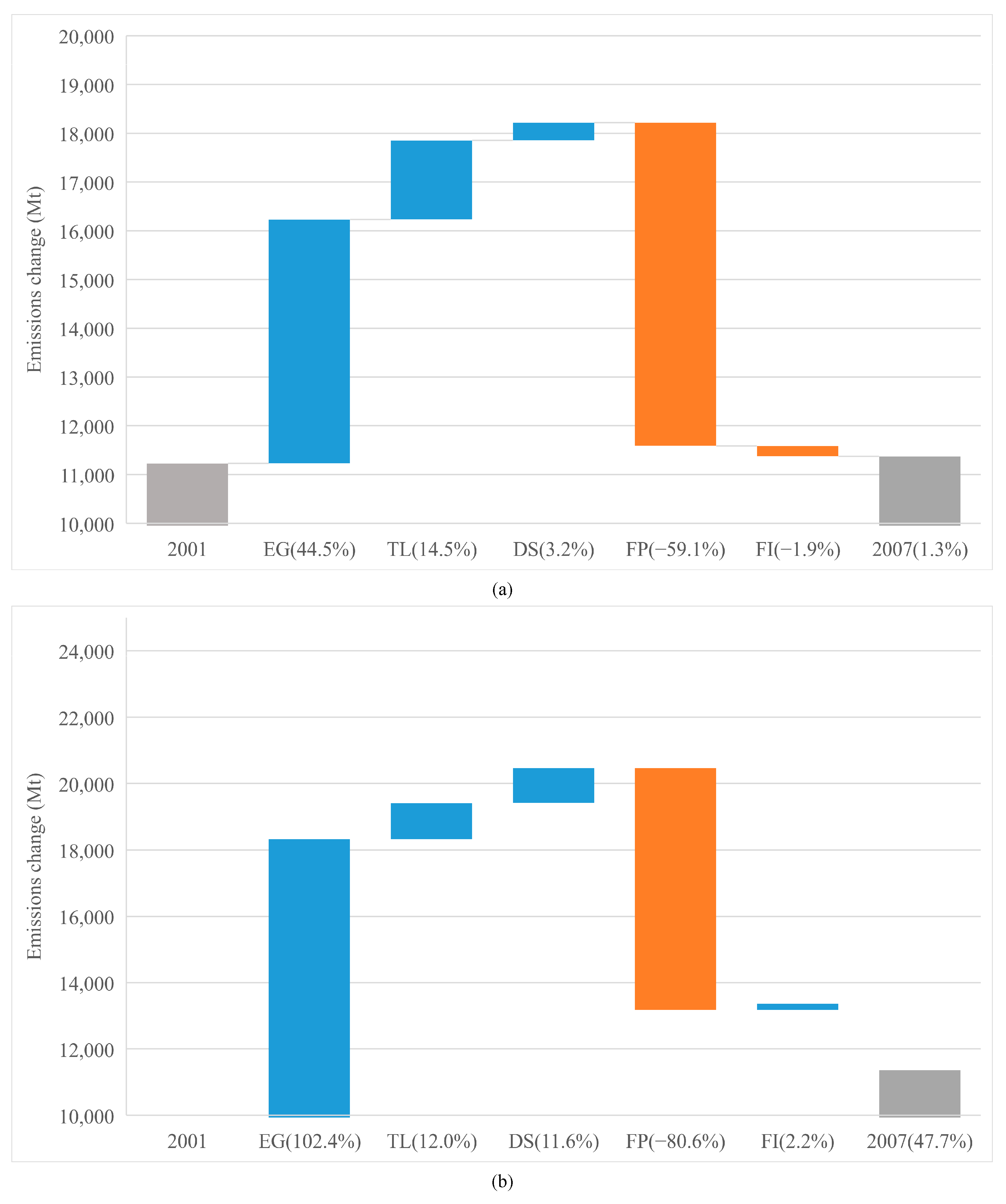

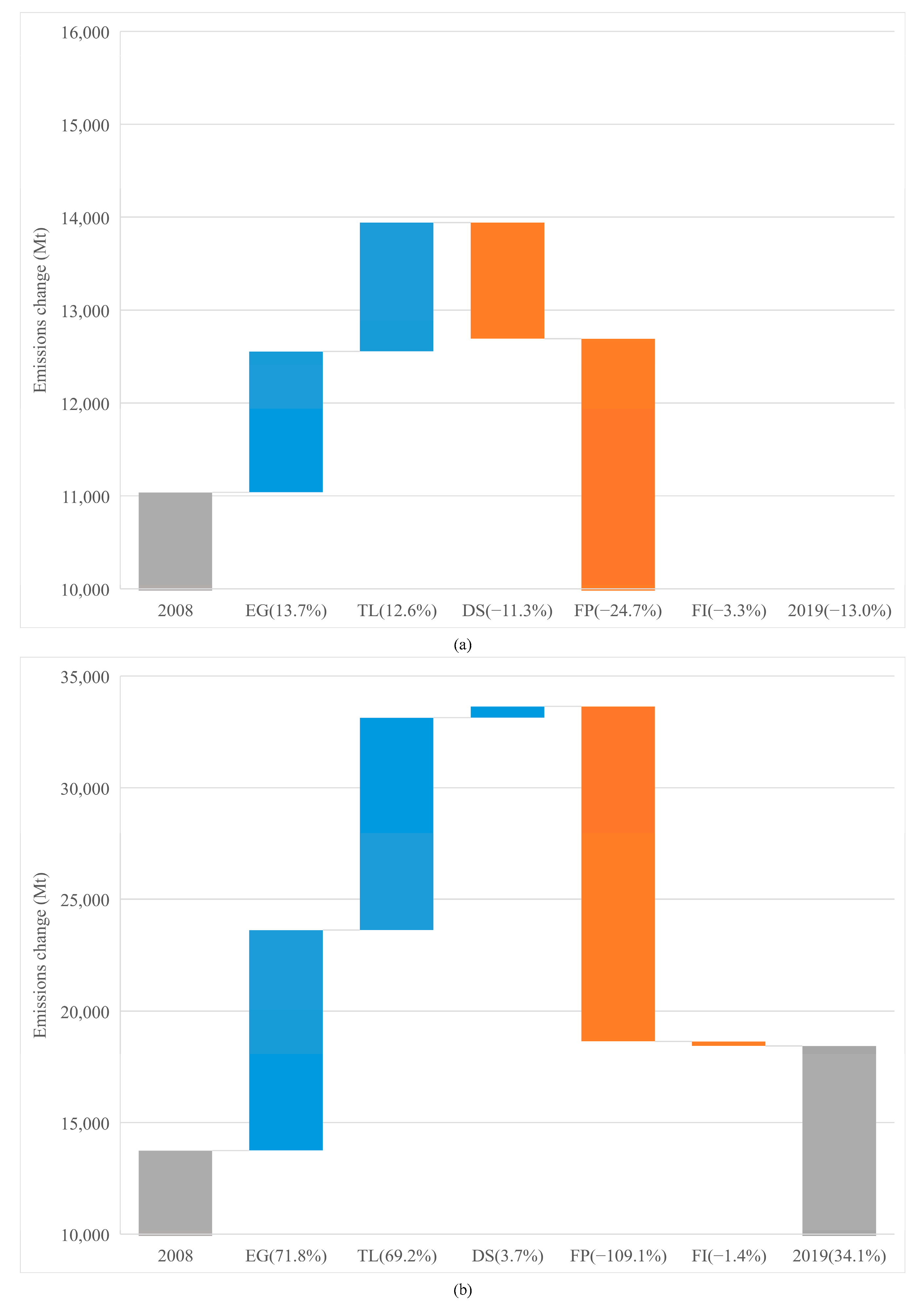

4.2. Decomposition Results of Overall CO2 Emission Changes

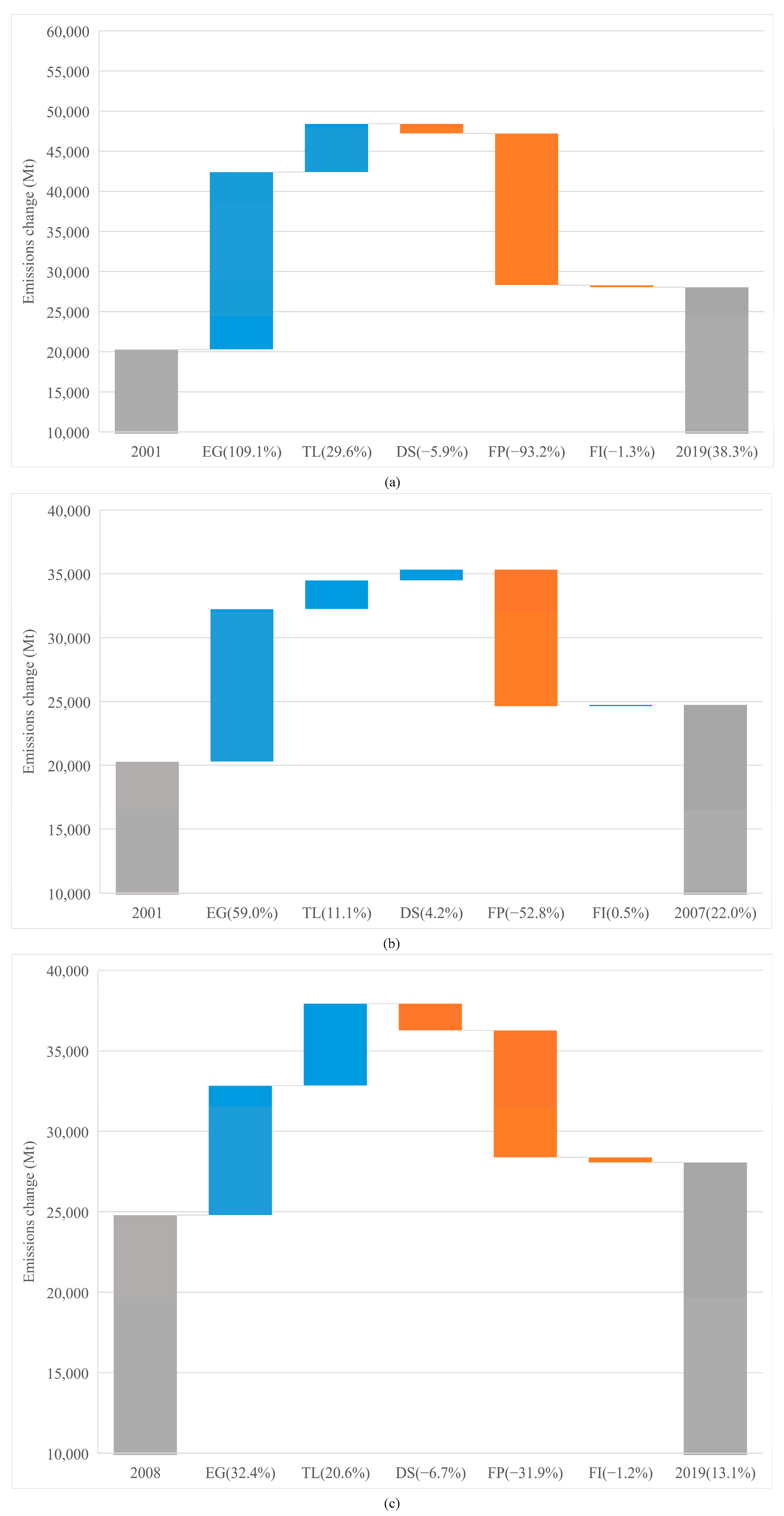

4.3. Decomposition Results in Different Country Groups

4.3.1. Economic Growth

4.3.2. Total Debt-to-GDP Ratio

4.3.3. Debt Structure

4.3.4. Private Debt Financing of Fossil Fuels

4.3.5. Fossil CO2 Intensity

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Period | 2001–2007 | 2008–2019 | 2001–2019 |

|---|---|---|---|

| Emissions change (Mt) | |||

| Overall change | 4457.5497 | 3258.6302 | 7770.3296 |

| EG | 11,956.55778 | 8033.500576 | 22,129.67539 |

| TL | 2245.826263 | 5100.799726 | 5996.376564 |

| DS | 857.0272277 | −1665.344649 | −1194.180518 |

| FP | −10,707.84426 | −7900.809573 | −18,904.83463 |

| FI | 105.9826914 | −309.5158801 | −256.7072098 |

| Contribution (%) | |||

| Growth rate | 21.98118938 | 13.14460529 | 38.31725903 |

| EG | 58.96050042 | 32.40539359 | 109.1264525 |

| TL | 11.07467908 | 20.57551639 | 29.56949394 |

| DS | 4.226195795 | −6.717638009 | −5.8887752 |

| FP | −52.80281061 | −31.87014695 | −93.22403071 |

| FI | 0.522624708 | −1.248519723 | −1.265881521 |

| Period | 2001–2007 | 2008–2019 | 2001–2019 |

|---|---|---|---|

| Emissions change (Mt) | |||

| Overall change | 144.3742 | −1432.0529 | −1620.9299 |

| EG | 5000.371759 | 1516.8455 | 6719.956381 |

| TL | 1628.094023 | 1386.408945 | 2753.796994 |

| DS | 361.2583292 | −1248.306826 | −1293.506313 |

| FP | −6632.332388 | −2728.045923 | −9189.208458 |

| FI | −213.0175232 | −358.9545966 | −611.9685034 |

| Contribution (%) | |||

| Growth rate | 1.28590544 | −12.97318793 | −14.43722338 |

| EG | 44.53707966 | 13.74133716 | 59.85299635 |

| TL | 14.50103246 | 12.55969231 | 24.52739157 |

| DS | 3.21763896 | −11.30860392 | −11.52094214 |

| FP | −59.07255103 | −24.71378846 | −81.84601643 |

| FI | −1.897294613 | −3.251825013 | −5.450652731 |

| Period | 2001–2007 | 2008–2019 | 2001–2019 |

|---|---|---|---|

| Emissions change (Mt) | |||

| Overall change | 4313.1755 | 4690.6831 | 9391.2595 |

| EG | 9273.185272 | 9869.018593 | 21,372.98472 |

| TL | 1088.954524 | 9512.143944 | 7567.51289 |

| DS | 1047.766564 | 509.9134932 | 2068.455571 |

| FP | −7293.868647 | −15,006.58231 | −21,630.9509 |

| FI | 197.1377872 | −193.8106167 | 13.25721402 |

| Contribution (%) | |||

| Growth rate | 47.6515345 | 34.10892446 | 103.7537021 |

| EG | 102.4492298 | 71.763878 | 236.1266122 |

| TL | 12.03066141 | 69.16881664 | 83.60513073 |

| DS | 11.57562092 | 3.707903614 | 22.85209169 |

| FP | −80.58193631 | −109.1223542 | −238.9765969 |

| FI | 2.177958692 | −1.409319612 | 0.146464384 |

References

- Guerriero, C.; Haines, A.; Pagano, M. Health and sustainability in post-pandemic economic policies. Nat. Sustain. 2020, 3, 494–496. [Google Scholar] [CrossRef]

- IMF How Big Is the Current Debt Problem and How Is the COVID-19 Pandemic Affecting Countries’ Debt Burdens? Available online: https://www.imf.org/en/About/FAQ/sovereign-debt (accessed on 3 December 2020).

- Hourcade, J.-C.; Dasgupta, D.; Ghersi, F. Accelerating the speed and scale of climate finance in the post-pandemic context. Clim. Policy 2021, 21, 1383–1397. [Google Scholar] [CrossRef]

- Bain, P.G.; Kroonenberg, P.M.; Johansson, L.O.; Milfont, T.L.; Crimston, C.R.; Kurz, T.; Bushina, E.; Calligaro, C.; Demarque, C.; Guan, Y.; et al. Public views of the Sustainable Development Goals across countries. Nat. Sustain. 2019, 2, 819–825. [Google Scholar] [CrossRef] [Green Version]

- Chatterjee, S.; Gibson, J.; Rioja, F. Public investment, debt, and welfare: A quantitative analysis. J. Macroecon. 2018, 56, 204–217. [Google Scholar] [CrossRef]

- Ulucak, R.; Danish; Kassouri, Y. An assessment of the environmental sustainability corridor: Investigating the non-linear effects of environmental taxation on CO2 emissions. Sustain. Dev. 2020, 28, 1010–1018. [Google Scholar] [CrossRef]

- D’Alessandro, S.; Cieplinski, A.; Distefano, T.; Dittmer, K. Feasible alternatives to green growth. Nat. Sustain. 2020, 3, 329–335. [Google Scholar] [CrossRef]

- Le Quéré, C.; Korsbakken, J.I.; Wilson, C.; Tosun, J.; Andrew, R.; Andres, R.J.; Canadell, J.G.; Jordan, A.; Peters, G.P.; van Vuuren, D.P. Drivers of declining CO2 emissions in 18 developed economies. Nat. Clim. Chang. 2019, 9, 213–217. [Google Scholar] [CrossRef] [Green Version]

- Thacker, S.; Adshead, D.; Fay, M.; Hallegatte, S.; Harvey, M.; Meller, H.; O’Regan, N.; Rozenberg, J.; Watkins, G.; Hall, J.W. Infrastructure for sustainable development. Nat. Sustain. 2019, 2, 324–331. [Google Scholar] [CrossRef]

- Pereira, R.M.; Pereira, A.M. The Economic and Budgetary Impact of Climate Policy in Portugal: Carbon Taxation in a Dynamic General Equilibrium Model with Endogenous Public Sector Behavior. Environ. Resour. Econ. 2016. [Google Scholar] [CrossRef]

- Lamperti, F.; Bosetti, V.; Roventini, A.; Tavoni, M. The public costs of climate-induced financial instability. Nat. Clim. Chang. 2019, 9, 829–833. [Google Scholar] [CrossRef] [Green Version]

- Palea, V.; Drogo, F. Carbon emissions and the cost of debt in the eurozone: The role of public policies, climate-related disclosure and corporate governance. Bus. Strat. Environ. 2020, 29, 2953–2972. [Google Scholar] [CrossRef]

- Bovari, E.; Lecuyer, O.; Isaac, F.M. Debt and damages: What are the chances of staying under the 2 °C warming threshold? Int. Econ. 2018, 155, 92–108. [Google Scholar] [CrossRef]

- Bertram, C.; Luderer, G.; Creutzig, F.; Bauer, N.; Ueckerdt, F.; Malik, A.; Edenhofer, O. COVID-19-induced low power demand and market forces starkly reduce CO2 emissions. Nat. Clim. Chang. 2021, 11, 193–196. [Google Scholar] [CrossRef]

- IMF. Predicting Fiscal Crises; International Monetary Fund: Washington, DC, USA, 2018. [Google Scholar] [CrossRef]

- IMF. Analyzing and Managing Fiscal Risks-Best Practices; International Monetary Fund: Washington, DC, USA, 2016. [Google Scholar]

- Katircioglu, S.; Celebi, A. Testing the role of external debt in environmental degradation: Empirical evidence from Turkey. Environ. Sci. Pollut. Res. 2018, 25, 8843–8852. [Google Scholar] [CrossRef]

- Li, R.; Li, S. Carbon emission post-coronavirus: Continual decline or rebound? Struct. Chang. Econ. Dyn. 2021, 57, 57–67. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, S.; Jiang, X. Preventing a rebound in carbon intensity post-COVID-19-lessons learned from the change in carbon intensity before and after the 2008 financial crisis. Sustain. Prod. Consum. 2021, 27, 1841–1856. [Google Scholar] [CrossRef]

- Bachner, G.; Bednar-Friedl, B. The Effects of Climate Change Impacts on Public Budgets and Implications of Fiscal Counterbalancing Instruments. Environ. Model. Assess. 2019, 24, 121–142. [Google Scholar] [CrossRef] [Green Version]

- Clootens, N. Public Debt, Life Expectancy, and the Environment. Environ. Model. Assess. 2017, 22, 267–278. [Google Scholar] [CrossRef]

- Fodha, M.; Seegmuller, T. Environmental Quality, Public Debt and Economic Development. Environ. Resour. Econ. 2014, 57, 487–504. [Google Scholar] [CrossRef] [Green Version]

- Fernández, E.; Pérez, R.; Ruiz, J. Optimal green tax reforms yielding double dividend. Energy Policy 2011, 39, 4253–4263. [Google Scholar] [CrossRef]

- Rausch, S. Fiscal consolidation and climate policy: An overlapping generations perspective. Energy Econ. 2013, 40, S134–S148. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Eddie, I.; Liu, J. Carbon emissions and the cost of capital: Australian evidence. Rev. Account. Financ. 2014, 13, 400–420. [Google Scholar] [CrossRef]

- Fonseka, M.; Rajapakse, T.; Richardson, G. The effect of environmental information disclosure and energy product type on the cost of debt: Evidence from energy firms in China. Pacific Basin Financ. J. 2019, 54, 159–182. [Google Scholar] [CrossRef]

- Kumar, P.; Firoz, M. Impact of carbon emissions on cost of debt-evidence from India. Manag. Financ. 2018, 44, 1401–1417. [Google Scholar] [CrossRef]

- Fernández-Cuesta, C.; Castro, P.; Tascón, M.T.; Castaño, F.J. The effect of environmental performance on financial debt. European evidence. J. Clean. Prod. 2019, 207, 379–390. [Google Scholar] [CrossRef]

- Kempa, K.; Moslener, U.; Schenker, O. The cost of debt of renewable and non-renewable energy firms. Nat. Energy 2021, 6, 135–142. [Google Scholar] [CrossRef]

- Kahn, J.R.; McDonald, J.A. Third-world debt and tropical deforestation. Ecol. Econ. 1995, 12, 107–123. [Google Scholar] [CrossRef]

- Shandra, J.M.; Shor, E.; London, B. Debt, Structural Adjustment, and Organic Water Pollution: A Cross-National Analysis. Organ. Environ. 2008, 21, 38–55. [Google Scholar] [CrossRef]

- Aubourg, R.W.; Good, D.H.; Krutilla, K. Debt, democratization, and development in Latin America: How policy can affect global warming. J. Policy Anal. Manag. 2008, 27, 7–19. [Google Scholar] [CrossRef]

- Jalles, J.T. Crises and emissions: New empirical evidence from a large sample. Energy Policy 2019, 129, 880–895. [Google Scholar] [CrossRef] [Green Version]

- Pacca, L.; Antonarakis, A.; Schröder, P.; Antoniades, A. The effect of financial crises on air pollutant emissions: An assessment of the short vs. medium-term effects. Sci. Total Environ. 2020, 698, 133614. [Google Scholar] [CrossRef] [PubMed]

- Xu, S.-C.; He, Z.-X.; Long, R.-Y.; Chen, H.; Han, H.-M.; Zhang, W.-W. Comparative analysis of the regional contributions to carbon emissions in China. J. Clean. Prod. 2016, 127, 406–417. [Google Scholar] [CrossRef]

- Sumabat, A.K.; Lopez, N.S.; Yu, K.D.; Hao, H.; Li, R.; Geng, Y.; Chiu, A.S.F. Decomposition analysis of Philippine CO2 emissions from fuel combustion and electricity generation. Appl. Energy 2016, 164, 795–804. [Google Scholar] [CrossRef]

- Shao, S.; Yang, L.; Gan, C.; Cao, J.; Geng, Y.; Guan, D. Using an extended LMDI model to explore techno-economic drivers of energy-related industrial CO2 emission changes: A case study for Shanghai (China). Renew. Sustain. Energy Rev. 2016, 55, 516–536. [Google Scholar] [CrossRef] [Green Version]

- Cansino, J.M.; Sánchez-Braza, A.; Rodríguez-Arévalo, M.L. Driving forces of Spain’s CO2 emissions: A LMDI decomposition approach. Renew. Sustain. Energy Rev. 2015, 48, 749–759. [Google Scholar] [CrossRef]

- Zhao, M.; Tan, L.; Zhang, W.; Ji, M.; Liu, Y.; Yu, L. Decomposing the influencing factors of industrial carbon emissions in Shanghai using the LMDI method. Energy 2010, 35, 2505–2510. [Google Scholar] [CrossRef]

- Hammond, G.P.; Norman, J.B. Decomposition analysis of energy-related carbon emissions from UK manufacturing. Energy 2012, 41, 220–227. [Google Scholar] [CrossRef] [Green Version]

- Zhao, Y.; Wang, S.; Zhang, Z.; Liu, Y.; Ahmad, A. Driving factors of carbon emissions embodied in China–US trade: A structural decomposition analysis. J. Clean. Prod. 2016, 131, 678–689. [Google Scholar] [CrossRef]

- Yagi, M.; Managi, S. Decomposition analysis of corporate carbon dioxide and greenhouse gas emissions in Japan: Integrating corporate environmental and financial performances. Bus. Strateg. Environ. 2018, 27, 1476–1492. [Google Scholar] [CrossRef]

- Rendall, M. Public debt and intergenerational ethics: How to fund a clean technology ‘Apollo program’? Clim. Policy 2021, 21, 976–982. [Google Scholar] [CrossRef]

- Halkos, G.E.; Papageorgiou, G.J. Pollution, environmental taxes and public debt: A game theory setup. Econ. Anal. Policy 2018, 58, 111–120. [Google Scholar] [CrossRef]

- IMF. Macroeconomic Developments and Prospects in Low-Income Developing Countries; International Monetary Fund: Washington, DC, USA, 2018. [Google Scholar]

- Sun, X.; Liu, X. Decomposition analysis of debt’s impact on China’s energy consumption. Energy Policy 2020, 146, 111802. [Google Scholar] [CrossRef]

- Tong, D.; Zhang, Q.; Zheng, Y.; Caldeira, K.; Shearer, C.; Hong, C.; Qin, Y.; Davis, S.J. Committed emissions from existing energy infrastructure jeopardize 1.5 °C climate target. Nature 2019, 572, 373–377. [Google Scholar] [CrossRef] [PubMed]

- Wang, P.; Ryberg, M.; Yang, Y.; Feng, K.; Kara, S.; Hauschild, M.; Chen, W.-Q. Efficiency stagnation in global steel production urges joint supply- and demand-side mitigation efforts. Nat. Commun. 2021, 12, 2066. [Google Scholar] [CrossRef]

- Dynan, K.; Mian, A.; Pence, K.M. Is a Household Debt Overhang Holding Back Consumption? [with Comments and Discussion]. In Brookings Papers on Economic Activity; Brookings Institution Press: Washington, DC, USA, 2012; pp. 299–362. [Google Scholar]

- Unruh, G.C. Understanding carbon lock-in. Energy Policy 2000, 28, 817–830. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R. Industry growth and capital allocation: Does having a market- or bank-based system matter? J. Financ. Econ. 2002, 64, 147–180. [Google Scholar] [CrossRef]

- Kim, J.; Park, K. Financial development and deployment of renewable energy technologies. Energy Econ. 2016, 59, 238–250. [Google Scholar] [CrossRef]

- Ang, B.W. Decomposition analysis for policymaking in energy: Which is the preferred method? Energy Policy 2004, 32, 1131–1139. [Google Scholar] [CrossRef]

- Ang, B.W. The LMDI approach to decomposition analysis: A practical guide. Energy Policy 2005, 33, 867–871. [Google Scholar] [CrossRef]

- Yagi, M.; Kokubu, K. Waste decomposition analysis in Japanese manufacturing sectors for material flow cost accounting. J. Clean. Prod. 2019, 224, 823–837. [Google Scholar] [CrossRef] [Green Version]

- Ang, B.W. LMDI decomposition approach: A guide for implementation. Energy Policy 2015, 86, 233–238. [Google Scholar] [CrossRef]

- Peters, G.P.; Marland, G.; Le Quéré, C.; Boden, T.; Canadell, J.G.; Raupach, M.R. Rapid growth in CO2 emissions after the 2008–2009 global financial crisis. Nat. Clim. Chang. 2012, 2, 2–4. [Google Scholar] [CrossRef]

- Jiang, X.; Guan, D. The global CO2 emissions growth after international crisis and the role of international trade. Energy Policy 2017, 109, 734–746. [Google Scholar] [CrossRef] [Green Version]

- Jiang, X.; Green, C. The Impact on Global Greenhouse Gas Emissions of Geographic Shifts in Global Supply Chains. Ecol. Econ. 2017, 139, 102–114. [Google Scholar] [CrossRef]

- Peters, G.P.; Andrew, R.M.; Boden, T.; Canadell, J.G.; Ciais, P.; Le Quéré, C.; Marland, G.; Raupach, M.R.; Wilson, C. The challenge to keep global warming below 2 °C. Nat. Clim. Chang. 2013, 3, 4–6. [Google Scholar] [CrossRef]

- Leitão, J.; Ferreira, J.; Santibanez-González, E. New insights into decoupling economic growth, technological progress and carbon dioxide emissions: Evidence from 40 countries. Technol. Forecast. Soc. Change 2022, 174, 121250. [Google Scholar] [CrossRef]

- Mi, Z.; Meng, J.; Guan, D.; Shan, Y.; Song, M.; Wei, Y.M.; Liu, Z.; Hubacek, K. Chinese CO2 emission flows have reversed since the global financial crisis. Nat. Commun. 2017, 8, 1712. [Google Scholar] [CrossRef]

- Mohan, P.; Strobl, E. The impact of tropical storms on the accumulation and composition of government debt. Int. Tax Public Financ. 2021, 28, 483–496. [Google Scholar] [CrossRef]

- Hanna, R.; Xu, Y.Y.; Victor, D.G. After COVID-19, green investment must deliver jobs to get political traction. Nature 2020, 582, 178–180. [Google Scholar] [CrossRef]

- Przychodzen, W.; Przychodzen, J. Determinants of renewable energy production in transition economies: A panel data approach. Energy 2020, 191, 116583. [Google Scholar] [CrossRef]

- Lis, E.M.; Nickel, C. The impact of extreme weather events on budget balances. Int. Tax Public Financ. 2010, 17, 378–399. [Google Scholar] [CrossRef]

- Albala-Bertrand, J.M. Natural disaster situations and growth: A macroeconomic model for sudden disaster impacts. World Dev. 1993, 21, 1417–1434. [Google Scholar] [CrossRef]

- Melecky, M.; Raddatz, C. How Do Governments Respond after Catastrophes? Natural-Disaster Shocks and the Fiscal Stance; The World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Klomp, J.; de Haan, J. Bank regulation and financial fragility in developing countries: Does bank structure matter? Rev. Dev. Financ. 2015, 5, 82–90. [Google Scholar] [CrossRef] [Green Version]

- Klomp, J. Flooded with debt. J. Int. Money Financ. 2017, 73, 93–103. [Google Scholar] [CrossRef]

- Granoff, I.; Hogarth, J.R.; Miller, A. Nested barriers to low-carbon infrastructure investment. Nat. Clim. Chang. 2016, 6, 1065–1071. [Google Scholar] [CrossRef]

- Lee, S.-Y. Corporate Carbon Strategies in Responding to Climate Change. Bus. Strateg. Environ. 2012, 21, 33–48. [Google Scholar] [CrossRef]

- Abdullah, S.; Morley, B. Environmental taxes and economic growth: Evidence from panel causality tests. Energy Econ. 2014, 42, 27–33. [Google Scholar] [CrossRef] [Green Version]

- Edenhofer, O.; Knopf, B.; Bak, C.; Bhattacharya, A. Aligning climate policy with finance ministers’ G20 agenda. Nat. Clim. Chang. 2017, 7, 463–465. [Google Scholar] [CrossRef]

- Anton, S.G.; Afloarei Nucu, A.E. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Halkos, G.E.; Polemis, M.L. Does Financial Development Affect Environmental Degradation? Evidence from the OECD Countries. Bus. Strateg. Environ. 2017, 26, 1162–1180. [Google Scholar] [CrossRef]

- Brunnschweiler, C.N. Finance for renewable energy: An empirical analysis of developing and transition economies. Environ. Dev. Econ. 2010, 15, 241–274. [Google Scholar] [CrossRef] [Green Version]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, T.; Liu, Z. Drivers of CO2 Emissions: A Debt Perspective. Int. J. Environ. Res. Public Health 2022, 19, 1847. https://doi.org/10.3390/ijerph19031847

Zhao T, Liu Z. Drivers of CO2 Emissions: A Debt Perspective. International Journal of Environmental Research and Public Health. 2022; 19(3):1847. https://doi.org/10.3390/ijerph19031847

Chicago/Turabian StyleZhao, Tian, and Zhixin Liu. 2022. "Drivers of CO2 Emissions: A Debt Perspective" International Journal of Environmental Research and Public Health 19, no. 3: 1847. https://doi.org/10.3390/ijerph19031847

APA StyleZhao, T., & Liu, Z. (2022). Drivers of CO2 Emissions: A Debt Perspective. International Journal of Environmental Research and Public Health, 19(3), 1847. https://doi.org/10.3390/ijerph19031847