Can the Carbon Emissions Trading System Improve the Green Total Factor Productivity of the Pilot Cities?—A Spatial Difference-in-Differences Econometric Analysis in China

Abstract

:1. Introduction

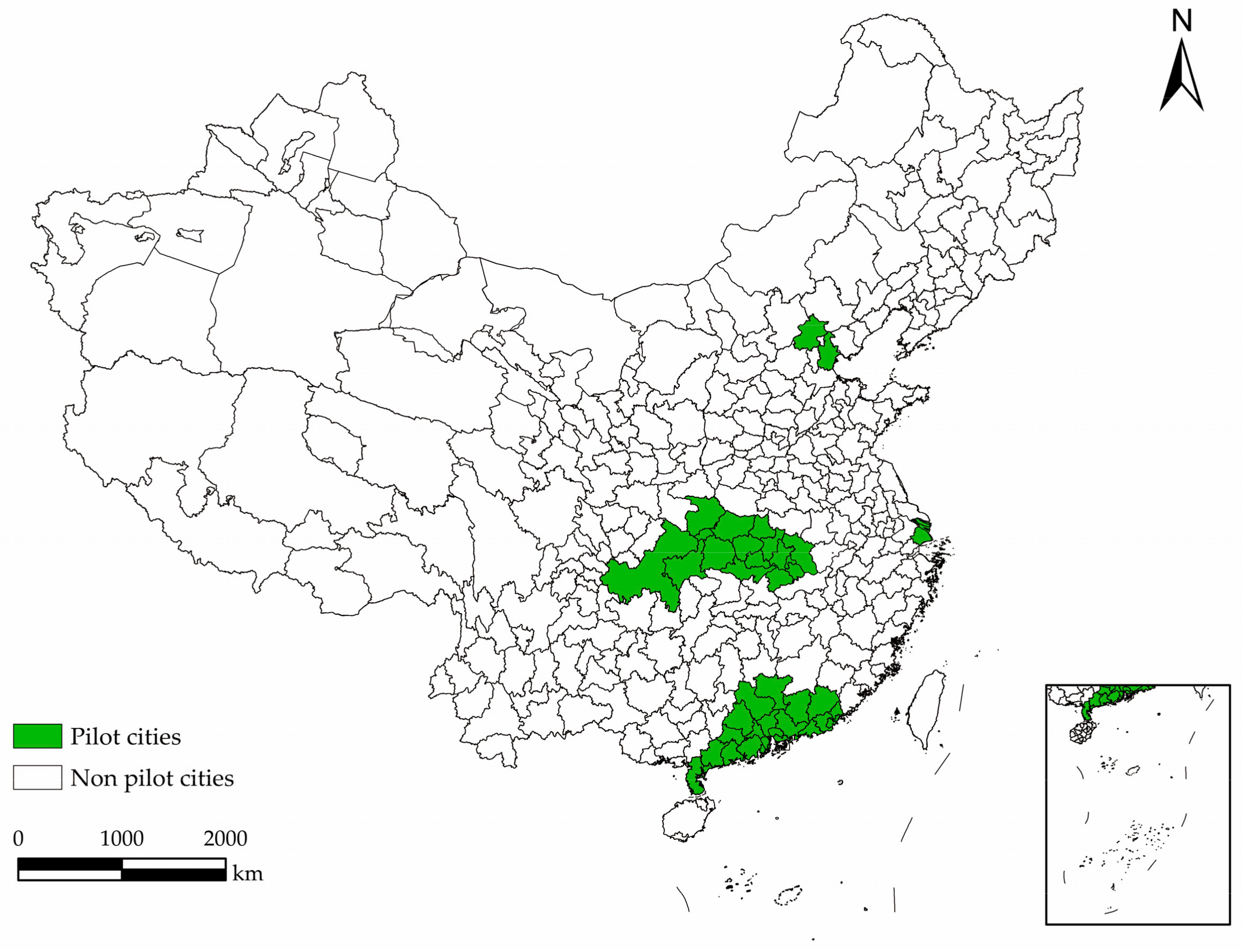

2. China’s Carbon Emission Trading System

3. Methodology and Data

3.1. Methodology

3.2. Samples and Data

4. Empirical Results

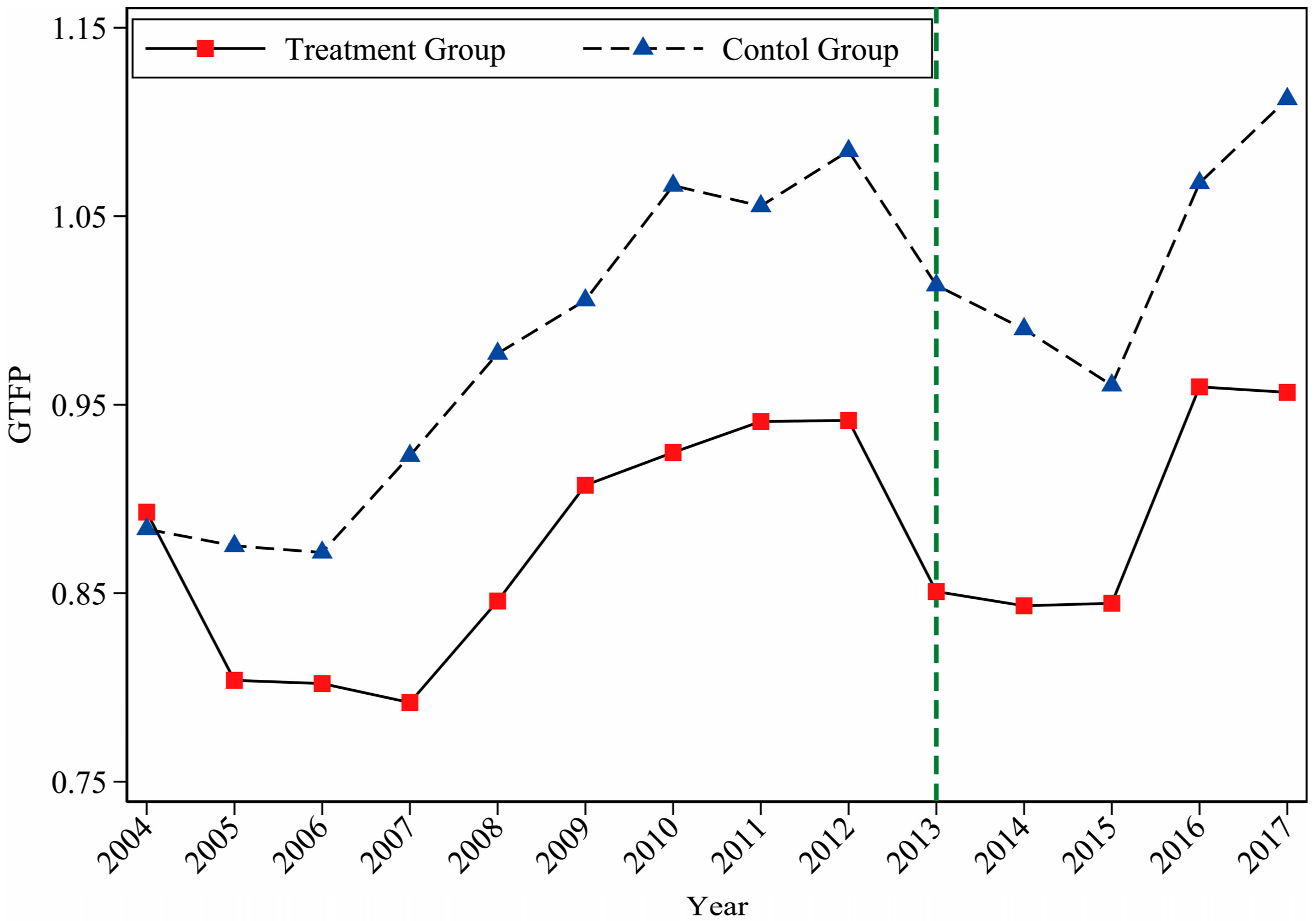

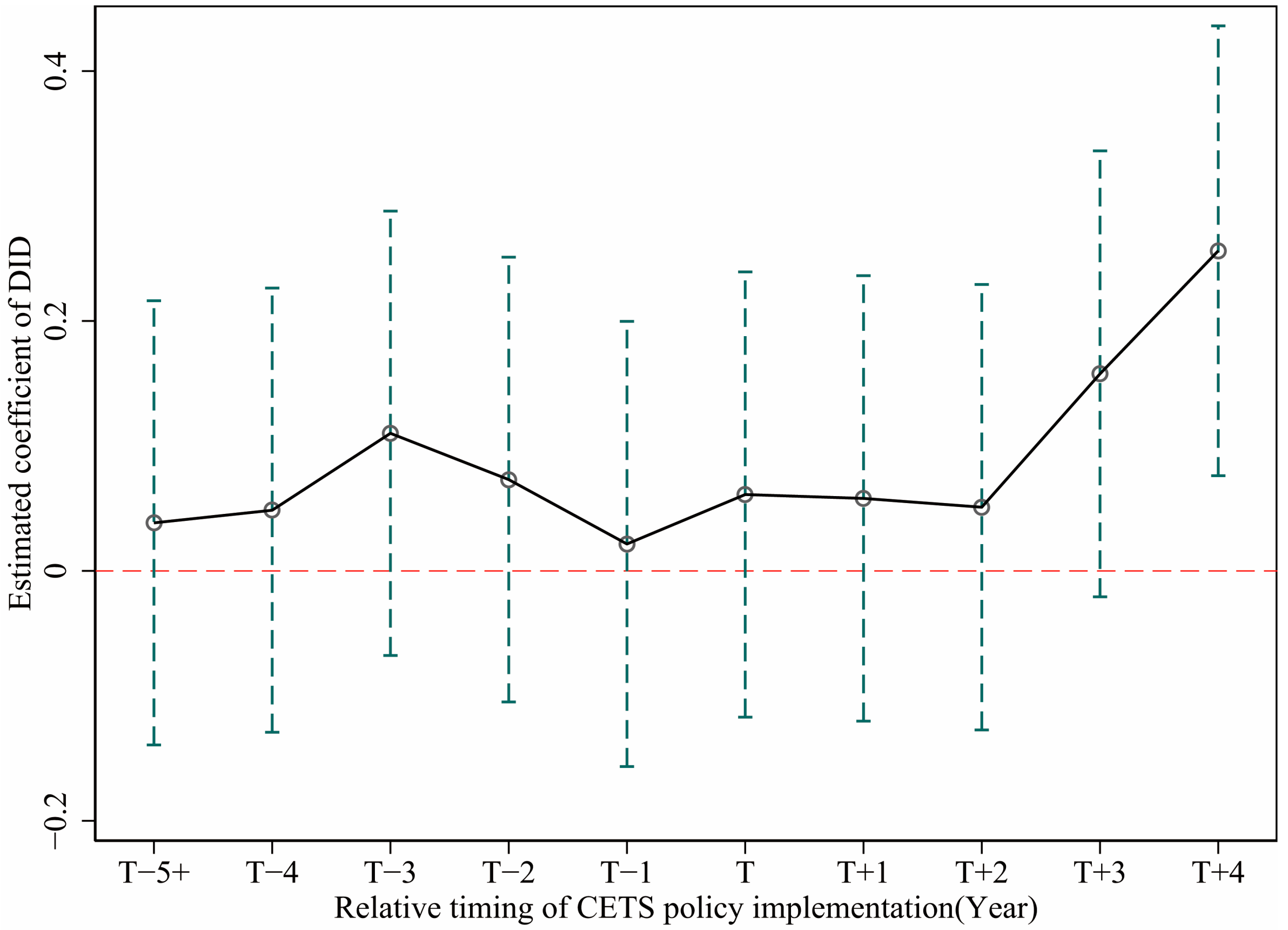

4.1. Parallel Trend Test

4.2. Benchmark Results

4.3. Robustness Tests

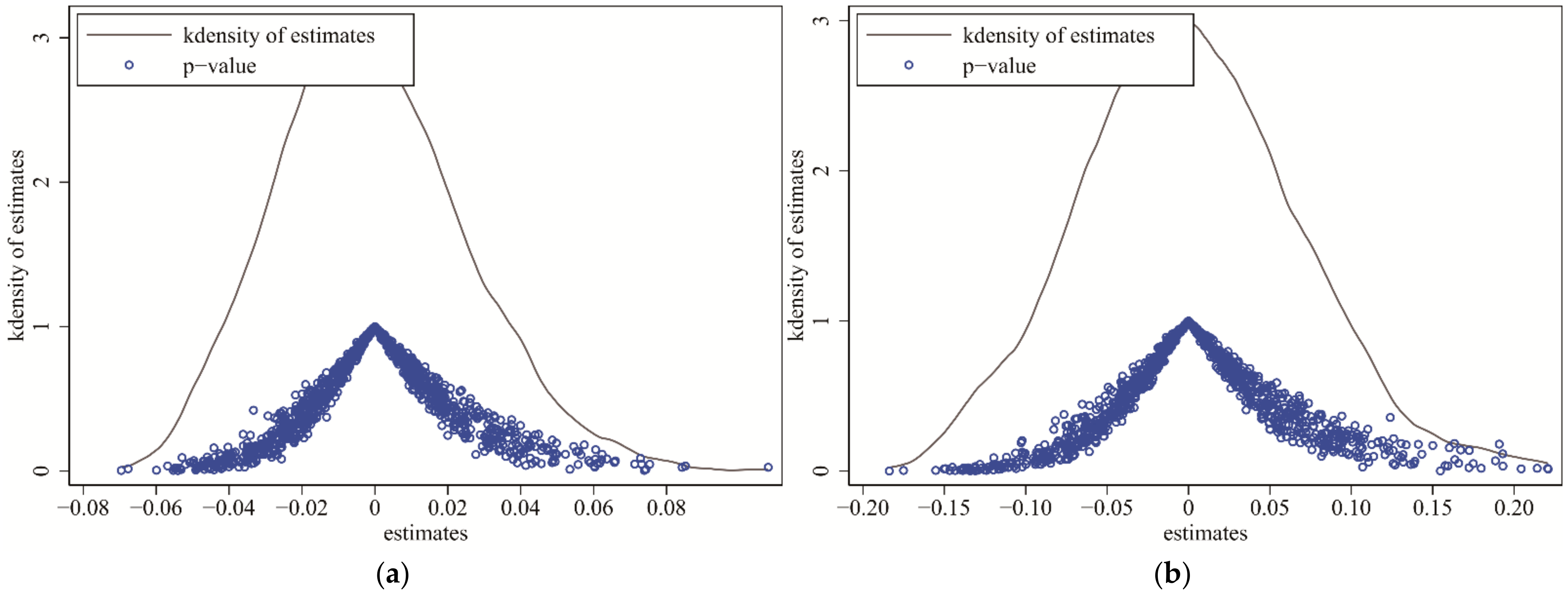

4.3.1. Placebo Test

4.3.2. PSM-SDID Estimation

4.3.3. The Difference-in Difference-in-Differences (DDD)

5. Mechanism Analysis

5.1. Re-Examination of Traditional Mechanisms

5.1.1. Energy Efficiency Effect

5.1.2. Low-Carbon Innovation Effect

5.1.3. Industry Structure Effect

5.2. Financial Agglomeration Effect

6. Heterogeneity Analysis

7. Discussion and Conclusions

7.1. Discussion

7.2. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Akadiri, S.S.; Bekun, F.V.; Taheri, E.; Akadiri, A.C. Carbon emissions, energy consumption and economic growth: A causality evidence. Int. J. Energy Technol. Policy 2019, 15, 320–336. [Google Scholar] [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Su, C.W.; Naqvi, B.; Shao, X.F.; Li, J.-P.; Jiao, Z. Trade and technological innovation: The catalysts for climate change and way forward for COP21. J. Environ. Manag. 2020, 269, 110774. [Google Scholar] [CrossRef] [PubMed]

- Lashof, D.A.; Ahuja, D.R. Relative contributions of greenhouse gas emissions to global warming. Nature 1990, 344, 529–531. [Google Scholar] [CrossRef]

- Meinshausen, M.; Meinshausen, N.; Hare, W.; Raper, S.C.; Frieler, K.; Knutti, R.; Frame, D.J.; Allen, M.R. Greenhouse-gas emission targets for limiting global warming to 2 °C. Nature 2009, 458, 1158–1162. [Google Scholar] [CrossRef]

- Wyser, K.; Kjellström, E.; Koenigk, T.; Martins, H.; Doescher, R. Warmer climate projections in EC-Earth3-Veg: The role of changes in the greenhouse gas concentrations from CMIP5 to CMIP6. Environ. Res. Lett. 2020, 15, 054020. [Google Scholar] [CrossRef]

- Shi, X.; Zheng, Y.; Lei, Y.; Xue, W.; Yan, G.; Liu, X.; Cai, B.; Tong, D.; Wang, J. Air quality benefits of achieving carbon neutrality in China. Sci. Total Environ. 2021, 795, 148784. [Google Scholar] [CrossRef] [PubMed]

- Tan, J.; Wang, R. Research on evaluation and influencing factors of regional ecological efficiency from the perspective of carbon neutrality. J. Environ. Manag. 2021, 294, 113030. [Google Scholar] [CrossRef]

- Murray, B.C.; Maniloff, P.T. Why have greenhouse emissions in RGGI states declined? An econometric attribution to economic, energy market, and policy factors. Energy Econ. 2015, 51, 581–589. [Google Scholar] [CrossRef] [Green Version]

- Chan, N.W.; Morrow, J.W. Unintended consequences of cap-and-trade? Evidence from the Regional Greenhouse Gas Initiative. Energy Econ. 2019, 80, 411–422. [Google Scholar] [CrossRef]

- Bayer, P.; Aklin, M. The European Union emissions trading system reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Flachsland, C.; Pahle, M.; Burtraw, D.; Edenhofer, O.; Elkerbout, M.; Fischer, C.; Tietjen, O.; Zetterberg, L. How to avoid history repeating itself: The case for an EU Emissions Trading System (EU ETS) price floor revisited. Clim. Policy 2020, 20, 133–142. [Google Scholar] [CrossRef]

- Choi, Y.; Qi, C. Is South Korea’s emission trading scheme effective? An analysis based on the marginal abatement cost of coal-fueled power plants. Sustainability 2019, 11, 2504. [Google Scholar] [CrossRef] [Green Version]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef] [Green Version]

- Weng, Q.; Xu, H. A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 2018, 91, 613–619. [Google Scholar] [CrossRef]

- Qi, S.; Zhou, C.; Li, K.; Tang, S.-Y. The impact of a carbon trading pilot policy on the low-carbon international competitiveness of industry in China: An empirical analysis based on a DDD model. J. Clean. Prod. 2021, 281, 125361. [Google Scholar] [CrossRef]

- Schneider, L.; La Hoz Theuer, S. Environmental integrity of international carbon market mechanisms under the Paris Agreement. Clim. Policy 2019, 19, 386–400. [Google Scholar] [CrossRef] [Green Version]

- Arimura, T.H.; Abe, T. The impact of the Tokyo emissions trading scheme on office buildings: What factor contributed to the emission reduction? Environ. Econ. Policy Stud. 2021, 23, 517–533. [Google Scholar] [CrossRef] [Green Version]

- Wang, S.S.; Chen, G.; Han, X. An Analysis of the impact of the emissions trading system on the green total factor productivity based on the spatial difference-in-differences approach: The Case of China. Int. J. Environ. Res. Public Health 2021, 18, 9040. [Google Scholar] [CrossRef]

- Shao, L.; Li, Y.; Feng, K.; Meng, J.; Shan, Y.; Guan, D. Carbon emission imbalances and the structural paths of Chinese regions. Appl. Energy 2018, 215, 396–404. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.C.; Klemeš, J.J.; Wang, Y.; Dong, X.; Wei, H.; Xu, Z.; Varbanov, P. Water-Energy-Carbon Emissions nexus analysis of China: An environmental input-output model-based approach. Appl. Energy 2020, 261, 114431. [Google Scholar] [CrossRef]

- Mi, Z.; Meng, J.; Zheng, H.; Shan, Y.; Wei, Y.-M.; Guan, D. A multi-regional input-output table mapping China’s economic outputs and interdependencies in 2012. Sci. Data 2018, 5, 180155. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yang, Z.; Fan, M.; Shao, S.; Yang, L. Does carbon intensity constraint policy improve industrial green production performance in China? A quasi-DID analysis. Energy Econ. 2017, 68, 271–282. [Google Scholar] [CrossRef]

- Hu, Y.; Ren, S.; Wang, Y.; Chen, X. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Wen, F.; Wu, N.; Gong, X. China’s carbon emissions trading and stock returns. Energy Econ. 2020, 86, 104627. [Google Scholar] [CrossRef]

- Dai, H.; Xie, Y.; Liu, J.; Masui, T. Aligning renewable energy targets with carbon emissions trading to achieve China’s INDCs: A general equilibrium assessment. Renew. Sustain. Energy Rev. 2018, 82, 4121–4131. [Google Scholar] [CrossRef]

- Zhu, J.; Fan, Y.; Deng, X.; Xue, L. Low-carbon innovation induced by emissions trading in China. Nat. Commun. 2019, 10, 4088. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Du, K.; Li, J. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Zhu, B.; Zhang, M.; Huang, L.; Wang, P.; Su, B.; Wei, Y.-M. Exploring the effect of carbon trading mechanism on China’s green development efficiency: A novel integrated approach. Energy Econ. 2020, 85, 104601. [Google Scholar] [CrossRef]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Wu, P.; Jin, Y.; Shi, Y.; Shyu, H. The impact of carbon emission costs on manufacturers’ production and location decision. Int. J. Prod. Econ. 2017, 193, 193–206. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, C.; Zhang, Z. Pollution haven or porter? The impact of environmental regulation on location choices of pollution-intensive firms in China. J. Environ. Manag. 2019, 248, 109248. [Google Scholar] [CrossRef]

- Lu, J.; Li, H. The impact of government environmental information disclosure on enterprise location choices: Heterogeneity and threshold effect test. J. Clean. Prod. 2020, 277, 124055. [Google Scholar] [CrossRef]

- Li, J.; Du, Y.X. Spatial effect of environmental regulation on green innovation efficiency: Evidence from prefectural-level cities in China. J. Clean. Prod. 2021, 286, 125032. [Google Scholar] [CrossRef]

- Karplus, V. China’s CO2 Emissions Trading System: History, Status, and Outlook; Harvard Project on Climate Agreements: Cambridge, MA, USA, June 2021. [Google Scholar]

- Hou, B.; Wang, B.; Du, M.; Zhang, N. Does the SO2 emissions trading scheme encourage green total factor productivity? An empirical assessment on China’s cities. Environ. Sci. Pollut. Res. 2020, 27, 6375–6388. [Google Scholar] [CrossRef]

- Yao, S.; Yu, X.; Yan, S.; Wen, S. Heterogeneous emission trading schemes and green innovation. Energy Policy 2021, 155, 112367. [Google Scholar] [CrossRef]

- Shi, D.; Li, S.L. Emissions Trading System and Energy Use Efficiency—Measurements and Empirical Evidence for Cities at and above the Prefecture Level. China Ind. Econ. 2020, 9, 5–23. [Google Scholar]

- Candau, F.; Dienesch, E. Pollution haven and corruption paradise. J. Environ. Econ. Manag. 2017, 85, 171–192. [Google Scholar] [CrossRef] [Green Version]

- Guan Qingyou Team: China Carbon Emission Trading Handbook. Available online: http://finance.sina.com.cn/zl/china/2021-07-16/zl-ikqcfnca7187313.shtml (accessed on 20 November 2021).

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Li, Y.; Chen, Y. Development of an SBM-ML model for the measurement of green total factor productivity: The case of pearl river delta urban agglomeration. Renew. Sustain. Energy Rev. 2021, 145, 111131. [Google Scholar] [CrossRef]

- Liu, C.Q.; Li, L.; Wei, P. Measurement of capital stock in Chinese cities at prefecture level and above. Urban Issues 2017, 10, 67–72. [Google Scholar] [CrossRef]

- Qiao, Z.; Li, Z. Do foreign institutional investors enhance firm innovation in China? Appl. Econ. Lett. 2019, 26, 1125–1128. [Google Scholar] [CrossRef]

- Marcus, M.; Sant’Anna, P.H.C. The role of parallel trends in event study settings: An application to environmental economics. J. Assoc. Environ. Resour. Econ. 2021, 8, 235–275. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, Y.; Hao, Y.; Liu, Z. Shooting two hawks with one arrow: Could China’s emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ. 2021, 101, 105412. [Google Scholar] [CrossRef]

- Ren, S.G.; Zheng, J.J.; Liu, D.H.; Chen, X.H. Does Emissions Trading System Improve Firm’s Total Factor Productivity—Evidence from Chinese Listed Companies. China Ind. Econ. 2019, 05, 5–23. [Google Scholar] [CrossRef]

- Wang, S.S.; Chen, G.; Huang, D. Can the New Energy Vehicle Pilot Policy Achieve Green Innovation and Emission Reduction?—A Difference-in-Differences Analysis on the Evaluation of China’s New Energy Fiscal Subsidy Policy. Sustainability 2021, 13, 8643. [Google Scholar] [CrossRef]

- MacGill, I.; Outhred, H.; Nolles, K. National Emissions Trading for Australia: Key design issues and complementary policies for promoting energy efficiency, infrastructure investment and innovation. Australas. J. Environ. Manag. 2004, 11, 78–87. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Sun, X.; Guo, X. Environmental regulation and green productivity growth: Empirical evidence on the Porter Hypothesis from OECD industrial sectors. Energy Policy 2019, 132, 611–619. [Google Scholar] [CrossRef]

- Xie, R.; Fu, W.; Yao, S.; Zhang, Q. Effects of financial agglomeration on green total factor productivity in Chinese cities: Insights from an empirical spatial Durbin model. Energy Econ. 2021, 101, 105449. [Google Scholar] [CrossRef]

- Liu, C.; Ma, C.; Xie, R. Structural, Innovation and Efficiency Effects of Environmental Regulation: Evidence from China’s Carbon Emissions Trading Pilot. Environ. Resour. Econ. 2020, 75, 741–768. [Google Scholar] [CrossRef]

- Li, R.; Ramanathan, R. Exploring the relationships between different types of environmental regulations and environmental performance: Evidence from China. J. Clean. Prod. 2018, 196, 1329–1340. [Google Scholar] [CrossRef]

| Pilot Area | Trading Varieties | Covered Industries | Cumulative Trading Volume | Cumulative Turnover (100 Million Yuan) | Current [Lowest, Highest] Price (Yuan/Ton) |

|---|---|---|---|---|---|

| Beijing | CO2 | Heating power, electric power, cement, petrochemical | 0.15 | 9.04 | 50.30 [24.00, 102.96] |

| Tianjin | CO2 | Steel, fossil, electric power, thermal power, petrochemical, oil and gas extraction | 0.19 | 4.08 | 29.86 [7.00, 62.38] |

| Shanghai | CO2 | Steel, petrochemical, chemical, electric power, non-ferrous metals, building materials, textiles, paper, rubber, chemical fiber, aviation, airports, ports, railways, commerce | 0.17 | 5.18 | 39.00 [4.21, 49.93] |

| Chongqing | CO2, CH4, etc. | Electrolytic aluminum, titanium alloy, calcium carbide, caustic soda, cement, steel | 0.09 | 0.42 | 32.67 [1.00, 44.86] |

| Shenzhen | CO2 | Electricity, taxation, construction, manufacturing, transportation | 0.49 | 11.80 | 13.34 [3.12, 122.97] |

| Guangdong | CO2 | Electricity, cement, steel, petrochemical, ceramics, textile, paper, non-ferrous metals | 1.68 | 33.02 | 43.44 [1.27, 77.00] |

| Hubei | CO2 | Steel, electricity, cement, chemicals, petrochemicals, automobile manufacturing, non-ferrous metals, glass building materials, papermaking, chemical fiber, pharmaceuticals, food and beverages | 0.75 | 17.02 | 31.81 [9.38, 54.64] |

| Model | Panel-DID | SDID-SDM | |

|---|---|---|---|

| Variables | (1) | (2) | (3) |

| DID | −1.235 *** | 0.083 * | |

| (−9.85) | (1.80) | ||

| W × DID | −0.172 *** | ||

| (−3.04) | |||

| Treat × year13 | 0.028 | ||

| (0.33) | |||

| Treat × year14 | 0.025 | ||

| (0.29) | |||

| Treat × year15 | 0.018 | ||

| (0.21) | |||

| Treat × year16 | 0.125 | ||

| (1.46) | |||

| Treat × year17 | 0.223 *** | ||

| (2.58) | |||

| W × treat × year13 | −0.096 | ||

| (−0.90) | |||

| W × treat × year14 | −0.069 | ||

| (−0.65) | |||

| W × treat × year15 | −0.027 | ||

| (−0.26) | |||

| W × treat × year16 | −0.189 * | ||

| (−1.78) | |||

| W × treat × year17 | −0.489 *** | ||

| (−4.58) | |||

| Control | Y | Y | Y |

| Year-FE | Y | Y | Y |

| City-FE | Y | Y | Y |

| Obs. | 3934 | 3934 | 3934 |

| R2 | 0.351 | 0.112 | 0.111 |

| Variable | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|

| DID | 0.081 ** | −0.179 *** | −0.098 *** |

| (1.75) | (−3.13) | (−3.02) |

| Model | PSM-SDID | ETS |

|---|---|---|

| Variables | (1) | (2) |

| DID | 0.140 *** | |

| (2.91) | ||

| W × DID | −0.232 *** | |

| (−3.99) | ||

| DDD | 0.145 *** | |

| (3.03) | ||

| W × DDD | −0.233 *** | |

| (−4.02) | ||

| Control | Y | Y |

| Year-FE | Y | Y |

| City-FE | Y | Y |

| Obs. | 3934 | 3934 |

| R2 | 0.123 | 0.271 |

| Model | Energy Efficiency | Low Carbon Innovation | Industry Structure | Financial Agglomeration |

|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) |

| DID × ee | −0.177 *** | |||

| (−3.69) | ||||

| W × DID × ee | 0.526 *** | |||

| (6.20) | ||||

| DID × lci | 0.886 ** | |||

| (2.24) | ||||

| W × DID × lci | −8.628 * | |||

| (−1.74) | ||||

| DID × str | −1.202 *** | |||

| (−4.19) | ||||

| W × DID × str | 2.093 *** | |||

| (3.69) | ||||

| DID × fa | 0.046 *** | |||

| (3.21) | ||||

| W × DID × fa | −0.092 *** | |||

| (−3.50) | ||||

| Control | Y | Y | Y | Y |

| Year-FE | Y | Y | Y | Y |

| City-FE | Y | Y | Y | Y |

| Obs. | 3934 | 3934 | 3934 | 3372 |

| R2 | 0.177 | 0.117 | 0.118 | 0.119 |

| Model | Marketization Level | MRV Capability | Energy Consumption Endowment | Financial Endowment |

|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) |

| DID × Mar | 0.956 *** | |||

| (5.25) | ||||

| W × DID × Mar | −0.289 ** | |||

| (−1.96) | ||||

| DID × Mrv | 0.227 *** | |||

| (2.62) | ||||

| W × DID × Mrv | −0.402 *** | |||

| (−3.64) | ||||

| DID × ECE | 0.155 * | |||

| (1.81) | ||||

| W × DID × ECE | −0.386 *** | |||

| (−3.89) | ||||

| DID × Fin | 0.049 *** | |||

| (3.41) | ||||

| W × DID × Fin | −0.092 *** | |||

| (−3.50) | ||||

| Control | Y | Y | Y | Y |

| Year-FE | Y | Y | Y | Y |

| City-FE | Y | Y | Y | Y |

| Obs. | 3934 | 3934 | 3934 | 3372 |

| R2 | 0.110 | 0.117 | 0.121 | 0.098 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, D.; Chen, G. Can the Carbon Emissions Trading System Improve the Green Total Factor Productivity of the Pilot Cities?—A Spatial Difference-in-Differences Econometric Analysis in China. Int. J. Environ. Res. Public Health 2022, 19, 1209. https://doi.org/10.3390/ijerph19031209

Huang D, Chen G. Can the Carbon Emissions Trading System Improve the Green Total Factor Productivity of the Pilot Cities?—A Spatial Difference-in-Differences Econometric Analysis in China. International Journal of Environmental Research and Public Health. 2022; 19(3):1209. https://doi.org/10.3390/ijerph19031209

Chicago/Turabian StyleHuang, Dawei, and Gang Chen. 2022. "Can the Carbon Emissions Trading System Improve the Green Total Factor Productivity of the Pilot Cities?—A Spatial Difference-in-Differences Econometric Analysis in China" International Journal of Environmental Research and Public Health 19, no. 3: 1209. https://doi.org/10.3390/ijerph19031209