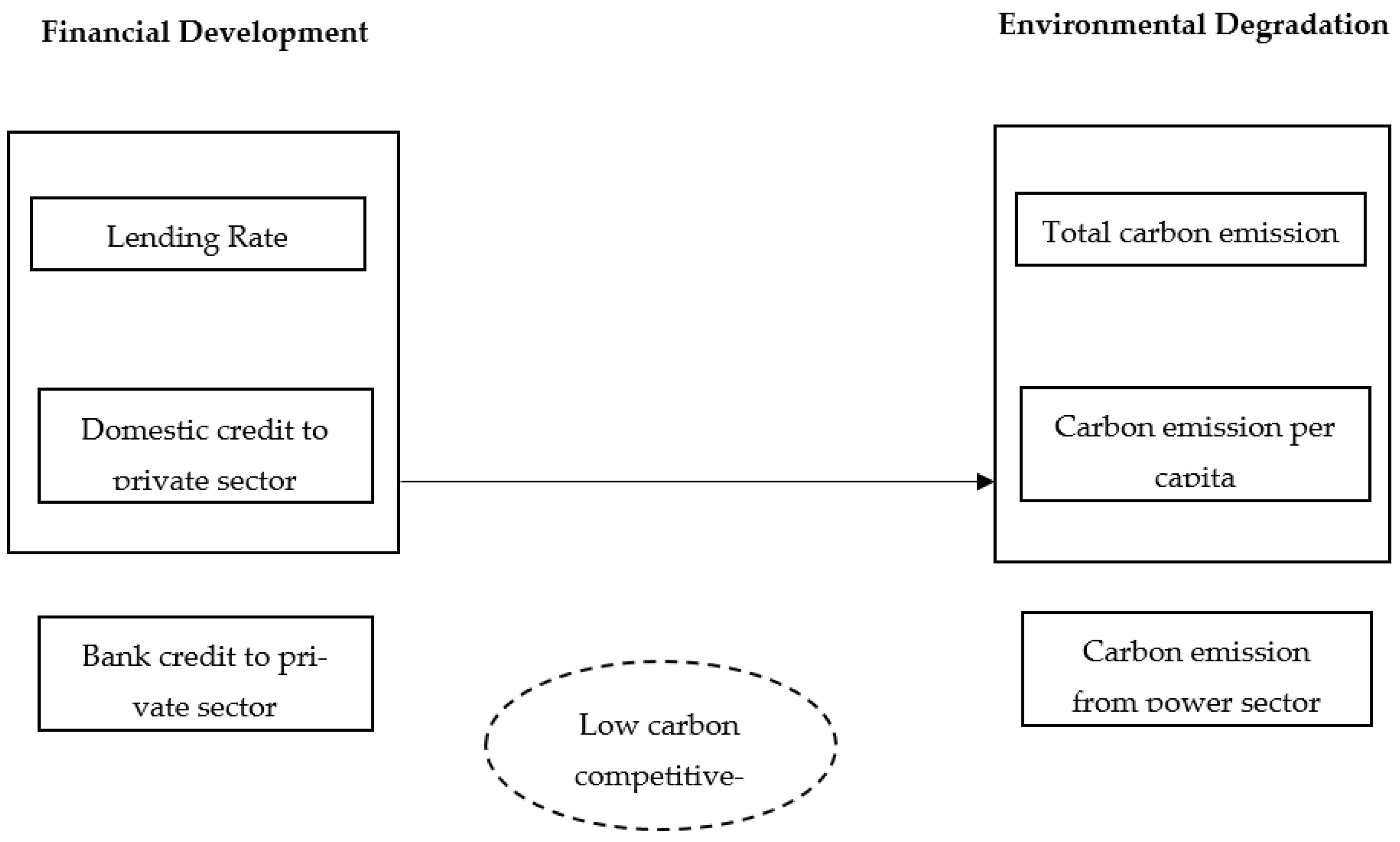

Financial Development and Environmental Degradation: Promoting Low-Carbon Competitiveness in E7 Economies’ Industries

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Data Collection

3.2. Empirical Models

E[EDi,t−s ∗ (εi,t − εi,t−1)] = 0, for s ≥ 2005

4. Results and Discussion

4.1. Empirical Results

4.2. Robustness Analysis

4.3. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Mensah, C.N.; Long, X.; Boamah, K.B.; Bediako, I.A.; Dauda, L.; Salman, M. The effect of innovation on CO2 emissions of OCED countries from 1990 to 2014. Environ. Sci. Pollut. Res. 2018, 25, 29678–29698. [Google Scholar] [CrossRef] [PubMed]

- Mikolajczak, M.; Brasseur, S.; Fantini-Hauwel, C. Measuring intrapersonal and interpersonal EQ: The Short Profile of Emotional Competence (S-PEC). Pers. Individ. Dif. 2014, 65, 42–46. [Google Scholar] [CrossRef]

- Hassan, S.A.; Zaman, K.; Zaman, S.; Shabir, M. Measuring health expenditures and outcomes in saarc region: Health is a luxury? Qual. Quant. 2014, 48, 1421–1437. [Google Scholar] [CrossRef]

- Mafauzy, M. The problems and challenges of the aging population of Malaysia. Malays. J. Med. Sci. MJMS 2000, 7, 1–3. [Google Scholar] [PubMed]

- Gregersen, F.A. The impact of ageing on health care expenditures: A study of steepening. Eur. J. Health Econ. 2014, 15, 979–989. [Google Scholar] [CrossRef]

- Shakoor, U.; Rashid, M.; Baloch, A.A.; Ul Husnain, M.I.; Saboor, A. How Aging Population Affects Health Care Expenditures in Pakistan? A Bayesian VAR Analysis. Soc. Indic. Res. 2021, 153, 585–607. [Google Scholar] [CrossRef]

- Khan, M.A. Financial Analysis of Dairy Companies in India A Comparative Study of Selected Companies. Available online: https://www.shin-norinco.com/article/financial-analysis-of-dairy-companies-in-india-a-comparative-study-of-selected-companies (accessed on 21 June 2021).

- De Meijer, C.; Wouterse, B.; Polder, J.; Koopmanschap, M. The effect of population aging on health expenditure growth: A critical review. Eur. J. Ageing 2013, 10, 353–361. [Google Scholar] [CrossRef]

- Khan, M.A.; Kamal, T.; Illiyan, A.; Asif, M. School students’ perception and challenges towards online classes during COVID-19 pandemic in india: An econometric analysis. Sustainability 2021, 13, 4786. [Google Scholar] [CrossRef]

- Khan, M.A.; Hussain, M.M.; Pervez, A.; Atif, M.; Bansal, R.; Alhumoudi, H.A. Intraday Price Discovery between Spot and Futures Markets of NIFTY 50: An Empirical Study during the Times of COVID-19. J. Math. 2022, 2022, 2164974. [Google Scholar] [CrossRef]

- Arshad Khan, M.; Alhumoudi, H.A. Performance of E-Banking and the Mediating Effect of Customer Satisfaction: A Structural Equation Model Approach. Sustainability 2022, 14, 7224. [Google Scholar] [CrossRef]

- Khan, M.A.; MINHAJ, S.M. Performance of online banking and direct effect of service quality on consumer retention and credibility of consumer and mediation effect of consumer satisfaction. Int. J. Bus. Inf. Syst. 2021, 1, 7224. [Google Scholar] [CrossRef]

- Bloom, D.E.; Williamson, J.G. Demographic transitions and economic miracles in emerging Asia. World Bank Econ. Rev. 1998, 12, 419–455. [Google Scholar] [CrossRef]

- Dormont, B.; Grignon, M.; Huber, H. Health expenditure growth: Reassessing the threat of ageing. Health Econ. 2006, 15, 947–963. [Google Scholar] [CrossRef] [PubMed]

- Hoffman, M. Does higher income make you more altruistic? evidence from the holocaust. Rev. Econ. Stat. 2011, 93, 876–887. [Google Scholar] [CrossRef]

- Khan, M.A.; Zeeshan, K.; Ahmad, M.F.; Alakkas, A.A.; Farooqi, M.R. A Study of Stock Performance of Select Ipos in India. Acad. Account. Financ. Stud. J. 2021, 25, 1–11. [Google Scholar]

- Dhillon, P.; Ladusingh, L. Implications of age structural transition and longevity improvement on healthcare spending in India. In Applied Demography and Public Health in the 21st Century; Springer: Berlin/Heidelberg, Germany, 2017; pp. 251–267. [Google Scholar]

- Khan, M.A.; Minhaj, S.M. Dimensions of E-Banking and the mediating role of customer satisfaction: A structural equation model approach. Int. J. Bus. Innov. Res. 2022, 1, 10045447. [Google Scholar] [CrossRef]

- Khan, M.A.; Roy, P.; Siddiqui, S.; Alakkas, A.A. Systemic Risk Assessment: Aggregated and Disaggregated Analysis on Selected Indian Banks. Complexity 2021, 2021, 8360778. [Google Scholar] [CrossRef]

- Khan, M.A.; Khan, M.I.; Illiyan, A.; Khojah, M. The economic and psychological impacts of COVID-19 pandemic on Indian migrant workers in the Kingdom of Saudi Arabia. Healthcare 2021, 9, 1152. [Google Scholar] [CrossRef]

- Felder, S.; Werblow, A. Does the age profile of health care expenditure really steepen over time? New evidence from Swiss Cantons. Geneva Pap. Risk Insur. Pract. 2008, 33, 710–727. [Google Scholar] [CrossRef]

- Gonzalez-Eiras, M.; Niepelt, D. Ageing, government budgets, retirement, and growth. Eur. Econ. Rev. 2012, 56, 97–115. [Google Scholar] [CrossRef]

- Mason, A. Demographic transition and demographic dividends in developed and developing countries. In Proceedings of the United Nations Expert Group Meeting on Social and Economic Implications of Changing Population Age Structures, Mexico City, Mexico, 31 August–2 September 2005; Volume 31, p. 5. [Google Scholar]

- Seshamani, M.; Gray, A. Time to death and health expenditure: An improved model for the impact of demographic change on health care costs. Age Ageing 2004, 33, 556–561. [Google Scholar] [CrossRef]

- Chomik, R.; Piggott, J. Population ageing and social security in Asia. Asian Econ. Policy Rev. 2015, 10, 199–222. [Google Scholar] [CrossRef]

- Panda, B.K.; Mohanty, S.K. Spatial Pattern of Population Ageing and Household Health Spending in India. Ageing Int. 2021, 47, 72–88. [Google Scholar] [CrossRef]

- Tosun, M.S. Population aging and economic growth: Political economy and open economy effects. Econ. Lett. 2003, 81, 291–296. [Google Scholar] [CrossRef]

- Zweifel, P.; Felder, S.; Meiers, M. Ageing of population and health care expenditure: A red herring? Health Econ. 1999, 8, 485–496. [Google Scholar] [CrossRef]

- Hodgson, D. Orthodoxy and revisionism in American demography. Popul. Dev. Rev. 1988, 14, 541–569. [Google Scholar] [CrossRef]

- Lee, R.D.; Mason, A. Population Aging and the Generational Economy: A Global Perspective; Edward Elgar Publishing: Cheltenham, UK, 2011. [Google Scholar]

- Ke, X.U.; Saksena, P.; Holly, A. The determinants of health expenditure: A country-level panel data analysis. Geneva World Health Organ. 2011, 26. [Google Scholar]

- Das, S.K.; Ladusingh, L. Why is the inpatient cost of dying increasing in India? PLoS ONE 2018, 13, e0203454. [Google Scholar] [CrossRef]

- Nagarajan, N.R.; Teixeira, A.A.C.; Silva, S.T. Ageing Population: Identifying the Determinants of Ageing in the Least Developed Countries. Popul. Res. Policy Rev. 2021, 40, 187–210. [Google Scholar] [CrossRef]

- Rajpal, S.; Kumar, A.; Joe, W. Economic burden of cancer in India: Evidence from cross-sectional nationally representative household survey, 2014. PLoS ONE 2018, 13, e0193320. [Google Scholar] [CrossRef] [PubMed]

- Braouezec, Y.; Joliet, R. Time to invest in corporate social responsibility and the value of CSR operations: The case of environmental externalities. Manag. Decis. Econ. 2019, 40, 539–549. [Google Scholar] [CrossRef]

- Allayannis, G.; Lel, U.; Miller, D.P. The use of foreign currency derivatives, corporate governance, and firm value around the world. J. Int. Econ. 2012, 87, 65–79. [Google Scholar] [CrossRef]

- Sinha, A.; Shah, M.I.; Sengupta, T.; Jiao, Z. Analyzing technology-emissions association in Top-10 polluted MENA countries: How to ascertain sustainable development by quantile modeling approach. J. Environ. Manag. 2020, 267, 110602. [Google Scholar] [CrossRef] [PubMed]

- Geyer-Klingeberg, J.; Hang, M.; Rathgeber, A.W. What drives financial hedging? A meta-regression analysis of corporate hedging determinants. Int. Rev. Financ. Anal. 2019, 61, 203–221. [Google Scholar] [CrossRef]

- Flammer, C. Green Bonds: Effectiveness and Implications for Public Policy. Environ. Energy Policy Econ. 2020, 1, 95–128. [Google Scholar] [CrossRef]

- Sharif, A.; Afshan, S.; Qureshi, M.A. Idolization and ramification between globalization and ecological footprints: Evidence from quantile-on-quantile approach. Environ. Sci. Pollut. Res. 2019, 26, 11191–11211. [Google Scholar] [CrossRef]

- Sharma, R.; Shahbaz, M.; Sinha, A.; Vo, X.V. Examining the temporal impact of stock market development on carbon intensity: Evidence from South Asian countries. J. Environ. Manag. 2021, 297, 113248. [Google Scholar] [CrossRef]

- Zerbib, O.D. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Jia, L.; Sun, H.; Zhou, Q.; Zhao, L.; Wu, W. Pilot-scale two-stage constructed wetlands based on novel solid carbon for rural wastewater treatment in southern China: Enhanced nitrogen removal and mechanism. J. Environ. Manag. 2021, 292, 112750. [Google Scholar] [CrossRef]

- Luo, H.; Xing, G.; Li, M.; Jia, X. Dynamic multi-resolution data dissemination in storage-centric wireless sensor networks. In Proceedings of the 10th ACM Symposium on Modeling, Analysis, and Simulation of Wireless and Mobile Systems (MSWiM’07), New York, NY, USA, 22–26 October 2007; pp. 78–85. [Google Scholar] [CrossRef]

- Malerba, D.; Gaentzsch, A.; Ward, H. Mitigating poverty: The patterns of multiple carbon tax and recycling regimes for Peru. Energy Policy 2021, 149, 111961. [Google Scholar] [CrossRef]

- Xie, Q.; Liu, R.; Qian, T.; Li, J. Linkages between the international crude oil market and the Chinese stock market: A BEKK-GARCH-AFD approach. Energy Econ. 2021, 102, 105484. [Google Scholar] [CrossRef]

- Ullah, K.; Rashid, I.; Afzal, H.; Iqbal, M.M.W.; Bangash, Y.A.; Abbas, H. SS7 Vulnerabilities—A Survey and Implementation of Machine Learning vs Rule Based Filtering for Detection of SS7 Network Attacks. IEEE Commun. Surv. Tutor. 2020, 22, 1337–1371. [Google Scholar] [CrossRef]

- Campello, M.; Lin, C.; Ma, Y.; Zou, H. The Real and Financial Implications of Corporate Hedging. J. Financ. 2011, 66, 1615–1647. [Google Scholar] [CrossRef]

- Shao, X.; Zhong, Y.; Liu, W.; Li, R.Y.M. Modeling the effect of green technology innovation and renewable energy on carbon neutrality in N-11 countries? Evidence from advance panel estimations. J. Environ. Manag. 2021, 296, 113189. [Google Scholar] [CrossRef] [PubMed]

- Bae, S.C.; Kim, H.S.; Kwon, T.H. Currency derivatives for hedging: New evidence on determinants, firm risk, and performance. J. Futur. Mark. 2018, 38, 446–467. [Google Scholar] [CrossRef]

- Dykes, B.J.; Kolev, K.D. Entry Timing in Foreign Markets: A Meta-analytic Review and Critique. J. Int. Manag. 2018, 24, 404–416. [Google Scholar] [CrossRef]

- Hadian, A.; Adaoglu, C. The effects of financial and operational hedging on company value: The case of Malaysian multinationals. J. Asian Econ. 2020, 70, 101232. [Google Scholar] [CrossRef]

- Knopf, J.D.; Nah, J.; Thornton, J.H. The volatility and price sensitivities of managerial stock option portfolios and corporate hedging. J. Financ. 2002, 57, 801–813. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, Y.; Ali, S.; Shahzad, U.; Cui, L. Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manag. 2021, 292, 112779. [Google Scholar] [CrossRef]

- Adam, T.R.; Fernando, C.S.; Salas, J.M. Why do firms engage in selective hedging? Evidence from the gold mining industry. J. Bank. Financ. 2017, 77, 269–282. [Google Scholar] [CrossRef]

- Zafar, M.W.; Sinha, A.; Ahmed, Z.; Qin, Q.; Zaidi, S.A.H. Effects of biomass energy consumption on environmental quality: The role of education and technology in Asia-Pacific Economic Cooperation countries. Renew. Sustain. Energy Rev. 2021, 142, 110868. [Google Scholar] [CrossRef]

- Froot, K.A.; Scharfstein, D.S.; Stein, J.C. Risk Management: Coordinating Corporate Investment and Financing Policies. J. Financ. 1993, 48, 1629–1658. [Google Scholar] [CrossRef]

- Bartram, S.M. Corporate hedging and speculation with derivatives. J. Corp. Financ. 2019, 57, 9–34. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424. [Google Scholar] [CrossRef]

- Gooding, R.Z.; Wagner, J.A., III. A Meta-Analytic Review of the Relationship between Size and Performance: The Productivity and Efficiency of Organizations and Their Subunits. Adm. Sci. Q. 1985, 30, 462. [Google Scholar] [CrossRef]

- Du, J. Examining the Inter-relationship between RMB Markets. Procedia Comput. Sci. 2018, 139, 313–320. [Google Scholar] [CrossRef]

- Troster, V.; Shahbaz, M.; Uddin, G.S. Renewable energy, oil prices, and economic activity: A Granger-causality in quantiles analysis. Energy Econ. 2018, 70, 440–452. [Google Scholar] [CrossRef]

- Haushalter, G.D. Financing policy, basis risk, and corporate hedging: Evidence from oil and gas producers. J. Financ. 2000, 55, 107–152. [Google Scholar] [CrossRef]

- García-Meca, E.; Śnchez-Ballesta, J.P. The association of board independence and ownership concentration with voluntary disclosure: A meta-analysis. Eur. Account. Rev. 2010, 19, 603–627. [Google Scholar] [CrossRef]

- Ramírez, F.J.; Honrubia-Escribano, A.; Gómez-Lázaro, E.; Pham, D.T. Combining feed-in tariffs and net-metering schemes to balance development in adoption of photovoltaic energy: Comparative economic assessment and policy implications for European countries. Energy Policy 2017, 102, 440–452. [Google Scholar] [CrossRef]

- Jiang, Z.; Yoon, S.-M. Dynamic co-movement between oil and stock markets in oil-importing and oil-exporting countries: Two types of wavelet analysis. Energy Econ. 2020, 90, 104835. [Google Scholar] [CrossRef]

- Urban, F.; Siciliano, G.; Wallbott, L.; Lederer, M.; Dang Nguyen, A. Green transformations in Vietnam’s energy sector. Asia Pac. Policy Stud. 2018, 5, 558–582. [Google Scholar] [CrossRef]

- Lokhandwala, S.; Gautam, P. Indirect impact of COVID-19 on environment: A brief study in Indian context. Environ. Res. 2020, 188, 109807. [Google Scholar] [CrossRef]

- Emrouznejad, A.; Yang, G. liang CO2 emissions reduction of Chinese light manufacturing industries: A novel RAM-based global Malmquist-Luenberger productivity index. Energy Policy 2016, 96, 397–410. [Google Scholar] [CrossRef]

- De Oliveira-De Jesus, P.M. Effect of generation capacity factors on carbon emission intensity of electricity of Latin America & the Caribbean, a temporal IDA-LMDI analysis. Renew. Sustain. Energy Rev. 2019, 101, 516–526. [Google Scholar] [CrossRef]

- Kong, Q.; Sun, H.; Xu, G.; Sun, P. A limit theorem for the core of Betrand oligopoly games with externalities. Econ. Lett. 2019, 185, 108747. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Inagaki, Y.; Morgan, P.J. Analyzing the factors influencing the demand and supply of solar modules in Japan–Does financing matter. Int. Rev. Econ. Financ. 2021, 74, 1–12. [Google Scholar] [CrossRef]

- Petrović-Ranđelović, M.; Mitić, P.; Zdravković, A.; Cvetanović, D.; Cvetanović, S. Economic growth and carbon emissions: Evidence from CIVETS countries. Appl. Econ. 2020, 52, 1806–1815. [Google Scholar] [CrossRef]

- Dalheimer, B.; Herwartz, H.; Lange, A. The threat of oil market turmoils to food price stability in Sub-Saharan Africa. Energy Econ. 2021, 93, 105029. [Google Scholar] [CrossRef]

- Aly, A.; Jensen, S.S.; Pedersen, A.B. Solar power potential of Tanzania: Identifying CSP and PV hot spots through a GIS multicriteria decision making analysis. Renew. Energy 2017, 113, 159–175. [Google Scholar] [CrossRef]

- Goh, T.; Ang, B.W. Tracking economy-wide energy efficiency using LMDI: Approach and practices. Energy Effic. 2019, 12, 829–847. [Google Scholar] [CrossRef]

- Chica-Olmo, J.; Salaheddine, S.H.; Moya-Fernández, P. Spatial relationship between economic growth and renewable energy consumption in 26 European countries. Energy Econ. 2020, 92, 104962. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Balances: An Overview; International Energy Agency: Paris, France, 2019. [Google Scholar]

- Khan, Z.; Ali, S.; Dong, K.; Li, R.Y.M. How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 2021, 94, 105060. [Google Scholar] [CrossRef]

- Ang, B.W. LMDI decomposition approach: A guide for implementation. Energy Policy 2015, 86, 233–238. [Google Scholar] [CrossRef]

- Venkatraja, B. Does renewable energy affect economic growth? Evidence from panel data estimation of BRIC countries. Int. J. Sustain. Dev. World Ecol. 2020, 27, 107–113. [Google Scholar] [CrossRef]

- Baek, S.; Mohanty, S.K.; Glambosky, M. COVID-19 and stock market volatility: An industry level analysis. Financ. Res. Lett. 2020, 37, 101748. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S. Modeling undesirable factors in efficiency evaluation: Comment. Eur. J. Oper. Res. 2004, 57, 242–245. [Google Scholar] [CrossRef]

- He, W.; Shen, R. ISO 14001 Certification and Corporate Technological Innovation: Evidence from Chinese Firms. J. Bus. Ethics 2019, 158, 97–117. [Google Scholar] [CrossRef]

| Parameters | Mean | SD | CV |

|---|---|---|---|

| TCE | 6.42 | 0.338 | 4.518 |

| CEPC | 15.14 | 2.303 | 16.219 |

| CEPPS | 10.452 | 6.014 | 14.686 |

| LR | 4.582 | 3.258 | 5.741 |

| DC | 0.245 | 0.472 | 0.016 |

| BC | 0.395 | 5.044 | 8.629 |

| DV = Environmental Degradation | [1] |

|---|---|

| Parameters | |

| ln(TCE)it | 0.503 * |

| ln(CEPC)it | 0.244 * |

| ln(CEPPS)it | 2.355 * |

| ln(LR)it | 0.515 * |

| ln(DC)it | 0.224 * |

| ln(BC)it | 0.4118 * |

| Adjusted R-square | 0.719 * |

| Structural Change Tests | |

| Chow Test (F test) | F(3.194) = 3.19 [0.0036] |

| Wald Test (Chi-Square Test) | 8.9165 [0.0079] |

| LM Test (Chi-Square Test) | 8.2661 [0.0081] |

| Country fixed effect | Yes |

| Parameter | 2005–2011 | 2012–2018 |

|---|---|---|

| ln(TCE)it | 0.5498 | 0.9814 |

| ln(CEPC)it | 0.4706 | 0.0652 |

| ln(CEPPS)it | 0.1298 | 0.0032 |

| ln(LR)it | 0.8623 | 0.1836 |

| ln(DC)it | 0.00026 | 0.3102 |

| ln(BC)it | 0.2459 | 0.0681 |

| China | India | Brazil | Turkey | Russia | Mexico | Indonesia | |

|---|---|---|---|---|---|---|---|

| ln(TCE)it | 0.1267 * | 0.1179 * | 0.4652 * | 0.1705 * | 0.0026 * | 0.0698 | 0.070 * |

| (0.1112) | (0.1231) | (0.0604) | (0.002) | (0.0097) | (0.0757) | (0.0981) | |

| ln(CEPC)it | 0.1714 * | 0.1508 * | 0.0583 * | 0.1302 * | 0.02128 | 0.02134 * | 0.1417 * |

| (0.1128) | (0.0561) | (0.0781) | (0.0198) | (0.0485) | (0.0131) | (0.0397) | |

| ln(CEPPS)it | 0.3547 * | 0.017 * | 0.0467 * | 0.2226 * | 0.1672 | 0.27448 | 0.2295 |

| (0.0442) | (0.0048) | (0.8082) | (0.7953) | (0.1438) | (0.1534) | (0.0194) | |

| ln(LR)it | 0.1464 * | 0.0907 * | 0.0547 * | 0.4759 * | 0.1447 * | 0.8897 * | 0.0545 |

| (0.45457) | (0.3197) | (0.0431) | (0.1808) | (0.1801) | (0.1296) | (0.0312) | |

| ln(DC)it | 0.2401 * | 0.1383 * | 0.0385 * | 0.1904 * | 0.1411 * | 0.1183 * | 0.0058 * |

| (0.1359) | (0.1762) | (0.0036) | (0.5967) | (0.0007) | (0.0301) | (0.18813) | |

| ln(BC)it | 0.3098 * | 0.52268 | 0.0182 * | 0.0542 * | 0.0014 * | 0.9162 * | 0.2113 * |

| (0.5034) | (0.5273) | (0.0766) | (0.9344) | (0.0256) | (0.1939) | (0.3117) | |

| Constant | 0.8187 * | 0.0643 * | 0.1208 * | 0.0407 * | 0.9451 * | 0.1827 * | 0.7087 * |

| Country Fixed Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.7694 | 0.5223 | 0.8727 | 0.8934 | 0.5735 | 0.1412 | 0.5673 |

| DV: Environmental Degradation | ||

|---|---|---|

| Variable | GMM [1] | GMM [2] |

| ln(TCE)it | 0.0099 * | 0.6754 * |

| ln(CEPC)it | 0.1809 * | 0.4969 * |

| ln(CEPPS)it | 0.6732 * | 0.5445 * |

| ln(LR)it | 0.9196 * | 0.0894 * |

| ln(DC)it | 0.0417 * | 0.4031 * |

| ln(BC)it | 0.0054 * | 0.8777 * |

| Year—2005 | 0.7568 * | 0.2545 * |

| Year—2006 | 0.3439 * | 0.0488 * |

| Year—2007 | 0.1207 * | 0.5042 |

| Year—2008 | 0.3363 * | 0.0036 |

| Year—2009 | 0.1477 * | 0.4131 * |

| Year—2010 | 0.0459 * | 0.2316 * |

| Year—2011 | 0.1123 * | 0.3484 * |

| Year—2012 | 0.0204 * | 0.5101 * |

| Year—2013 | 0.2328 * | 0.7832 * |

| Year—2014 | 0.46948 | 0.0027 |

| Year—2015 | 0.5385 | 0.7812 * |

| Year—2016 | 0.2298 * | 0.00876 * |

| Year—2017 | 0.2871 * | 0.5557 * |

| Year—2018 | 0.0229 * | 0.9886 * |

| Sargan test for over-identification | 0.0595 | 0.00186 |

| Dependent Variable Estimate | GMM [1] | GMM [2] |

|---|---|---|

| Short-run estimate (Environmental Degradation) | 0.016452 | 0.00219 |

| Long-run estimate (Environmental Degradation) | 0.007666 | 0.002211 |

| China | India | Brazil | Turkey | Russia | Mexico | Indonesia | |

|---|---|---|---|---|---|---|---|

| ln(TCE)it | 0.0828 * | 0.5195 * | 0.9675 | 0.7684 * | 0.1163 * | 0.2036 * | 0.2899 * |

| (0.7245) | (0.0939) | (0.3902) | (0.0143) | (0.6214) | (0.0144) | (0.4484) | |

| ln(CEPC)it | 0.1605 * | 0.1675 | 0.0459 * | 0.0202 * | 0.0189 * | 0.2361 * | 0.1559 * |

| (0.0879) | (0.0017) | (0.8537) | (0.0354) | (0.0947) | (0.1481) | (0.0993) | |

| ln(CEPPS)it | 0.1012 * | 0.0151 * | 0.0594 | 0.0614 * | 0.2562 * | 0.0464 * | 0.0599 * |

| (0.0757) | (0.7305) | (0.1169) | (0.1505) | (0.0511) | (0.6614) | (0.0052) | |

| ln(LR)it | 0.3934 * | 0.0748 | 0.0605 * | 0.0116 * | 0.0089 * | 0.7494 * | 0.1203 * |

| (0.2272) | (0.0162) | (0.2208) | (0.9663) | (0.0026) | (0.0779) | (0.7038) | |

| ln(DC)it | 0.0297 * | 0.9315 * | 0.9905 * | 0.6799 * | 0.1396 * | 0.8013 * | 0.0309 * |

| (0.2315) | (0.1309) | (0.0312) | (0.1957) | (0.0869) | (0.3161) | (0.0572) | |

| ln(BC)it | 0.0922 * | 0.0519 * | 0.0666 * | 0.7225 * | 0.0644 * | 0.1229 * | 0.3738 * |

| (0.8945) | (0.0097) | (0.3278) | (0.0485) | (0.5605) | (0.2773) | (0.1043) | |

| Constant | 0.0325 * | 0.2969 * | 0.7676 * | 0.0738 * | 0.2213 * | 0.6603 * | 0.7882 * |

| Country Fixed Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, G.; Khan, M.A.; Haider, A.; Uddin, M. Financial Development and Environmental Degradation: Promoting Low-Carbon Competitiveness in E7 Economies’ Industries. Int. J. Environ. Res. Public Health 2022, 19, 16336. https://doi.org/10.3390/ijerph192316336

Liu G, Khan MA, Haider A, Uddin M. Financial Development and Environmental Degradation: Promoting Low-Carbon Competitiveness in E7 Economies’ Industries. International Journal of Environmental Research and Public Health. 2022; 19(23):16336. https://doi.org/10.3390/ijerph192316336

Chicago/Turabian StyleLiu, Guohua, Mohammed Arshad Khan, Ahsanuddin Haider, and Moin Uddin. 2022. "Financial Development and Environmental Degradation: Promoting Low-Carbon Competitiveness in E7 Economies’ Industries" International Journal of Environmental Research and Public Health 19, no. 23: 16336. https://doi.org/10.3390/ijerph192316336

APA StyleLiu, G., Khan, M. A., Haider, A., & Uddin, M. (2022). Financial Development and Environmental Degradation: Promoting Low-Carbon Competitiveness in E7 Economies’ Industries. International Journal of Environmental Research and Public Health, 19(23), 16336. https://doi.org/10.3390/ijerph192316336