Patients’ Intention to Adopt Fintech Services: A Study on Bangladesh Healthcare Sector

Abstract

1. Introduction

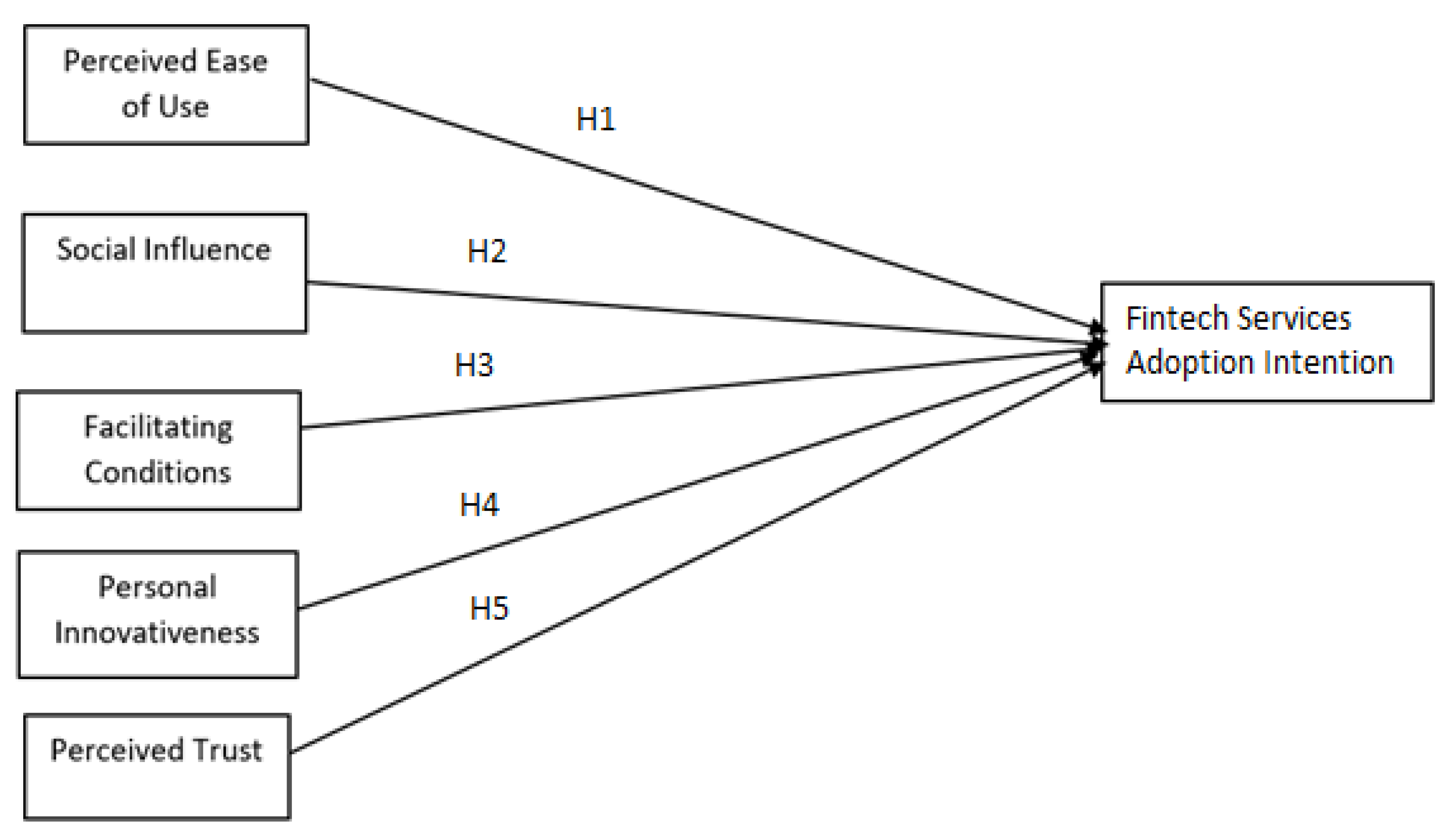

2. Literature Review and Hypothesis Development

2.1. Behavioral Intention to Adopt Fintech Services

2.2. Perceived Ease of Use

2.3. Social Influence

2.4. Facilitating Conditions

2.5. Personal Innovativeness

2.6. Perceived Trust

3. Methodology

3.1. Sample and Data Collection

3.2. Data Analysis

4. Findings and Analysis

4.1. Demographic Profile

4.2. Measurement Model

4.3. Structural Model Assessment

4.4. Discussion

5. Conclusions

5.1. Managerial Implications

5.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Measurement Constructs of the Variables

| Variables | Measurement Constructs |

| Behavioral Intention to Adopt Fintech Services (BI) | BI1: I expect to accept fintech services in the future for healthcare payments. BI2: To perform healthcare transactions I predict to use fintech services in future BI3: I will recommend others to use fintech services for healthcare payments. |

| Perceived Ease of Use (PEOU) | PEOU1: It is easy to use fintech services for healthcare related transactions PEOU2: I think the operation interface of Fintech is friendly and understandable PEOU3: It is easy to have device to use Fintech services PEOU4: I find fintech apps to be flexible to interact with |

| Social Influence (SI) | SI1: People who are valuable to me feel that I should use Fintech Services for healthcare payments. SI2: People who affect my behavior feel that I should use Fintech Services for healthcare payments. SI3: People whose thoughts I value prefer that I use Fintech Services for healthcare related payments. |

| Facilitating Conditions (FC) | FC1: I have necessary resources to use Fintech Services FC2: I have the necessary knowledge to use Fintech Services FC3: Fintech Services is compatible with other system that I use |

| Personal Innovativeness (PI) | PI1: If I heard about new fintech payment options for healthcare payment, I would look for ways to experiment with it. PI2: I like to experiment new fintech services. PI3: In general, I am not hesitant to try out new fintech services |

| Perceived Trust (PT) | PT1: I trust fintech systems to be reliable. PT2: I trust fintech systems to be secure. PT3: I believe fintech systems are trustworthy |

References

- Kim, Y.; Park, Y.J.; Choi, J. The Adoption of Mobile Payment Services for “Fintech”. Int. J. Appl. Eng. Res. 2016, 11, 1058–1061. [Google Scholar]

- Statista. Fintech—Statistics & Facts. 2021. Available online: https://www.statista.com/statistics/893954/number-fintech-startups-by-region/ (accessed on 22 June 2022).

- EY Global Financial Services. Global FinTech Adoption Index 2019. 2021. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-global-fintech-adoption-index.pdf (accessed on 22 June 2022).

- Rana, A. How FinTech is Enhancing Growth in Healthcare Industry. 2021, Cogneesol. Available online: https://www.cogneesol.com/blog/fintech-is-enhancing-growth-in-healthcare/#:~:text=Innovations%20in%20Fintech%20Helping%20Healthcare%20Sector&text=Fintech%20companies%20are%20targeting%20the,easy%20%E2%80%93%20single%2Dclick%20option (accessed on 22 June 2022).

- BIDA. Healthcare. 2022. Available online: https://bida.gov.bd/healthcare (accessed on 25 June 2022).

- Beckar’s Hospital Review. Top 4 Challenges to Obtain Patients Payment. 2017. Available online: https://www.beckershospitalreview.com/finance/top-4-challenges-of-obtaining-patient-payments.html (accessed on 5 September 2022).

- Keystone Healthcare Studies. What Healthcare And Fintech Have in Common. 2018. Available online: https://www.healthcarestudies.com/article/what-healthcare-and-fintech-have-in-common/ (accessed on 5 September 2022).

- Surf. How to Build Fintech Trust with App Users: Top 5 UX Design Practices. 2022. Available online: https://surf.dev/how-to-build-fintech-trust-with-app-users-top-5-ux-design-practices/ (accessed on 5 September 2022).

- Mailizar, M.; Almanthari, A.; Maulina, S. Examining teachers’ behavioral intention to use E-learning in teaching of mathematics: An extended TAM model. Contemp. Educ. Technol. 2021, 13, 298. [Google Scholar] [CrossRef]

- Kwateng, K.O.; Atiemo, K.A.O.; Appiah, C. Acceptance and use of mobile banking: An application of UTAUT2. J. Enterp. Inf. Manag. 2018, 32, 118–151. [Google Scholar] [CrossRef]

- Ali, M.; Raza, S.A.; Puah, C.H.; Amin, H. Consumer acceptance toward takaful in Pakistan: An application of diffusion of innovation theory. Int. J. Emerg. Mark. 2019, 14, 620–638. [Google Scholar] [CrossRef]

- Slawinski, S. 5 Reasons Why Fintech Is Important. Global Fintech News. 2021. Available online: https://globalfintechnews.com/5-reasons-why-fintech-is-important/ (accessed on 28 June 2022).

- Singh, S.; Sahni, M.M.; Kovid, R.K. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag. Decis. 2020, 58, 675–1697. [Google Scholar] [CrossRef]

- Ryu, H.S. Understanding benefit and risk framework of fintech adoption: Comparison of early adopters and late adopters. In Proceedings of the 51st Hawaii International Conference on System Sciences, Waikoloa Village, HI, USA, 3–6 January 2018. [Google Scholar]

- Setiawan, B.; Nugraha, D.P.; Irawan, A.; Nathan, R.J.; Zoltan, Z. User innovativeness and fintech adoption in Indonesia. J. Open Innov. Technol. Mark. Complex. 2021, 7, 188. [Google Scholar] [CrossRef]

- Chan, R.; Troshani, I.; Rao Hill, S.; Hoffmann, A. Towards an understanding of consumers’ FinTech adoption: The case of Open Banking. Int. J. Bank Mark. 2022, 40, 886–917. [Google Scholar] [CrossRef]

- Bureshaid, N.; Lu, K.; Sarea, A. Adoption of FinTech Services in the Banking Industry. In Applications of Artificial Intelligence in Business, Education and Healthcare; Springer: Berlin/Heidelberg, Germany, 2021; pp. 125–138. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Rahmi, B.A.K.I.; Birgoren, B.; Aktepe, A. A meta-analysis of factors affecting perceived usefulness and perceived ease of use in the adoption of e-learning systems. Turk. Online J. Distance Educ. 2018, 19, 4–42. [Google Scholar] [CrossRef]

- Nangin, M.A.; Barusi, R.G.; Wahyoedi, S. The Effects of Perceived Ease of Use, Security, and Promotion on Trust and Its Implications on Fintech Adoption. J. Consum. Sci. 2020, 5, 124–138. [Google Scholar] [CrossRef]

- Moslehpour, M.; Pham, V.K.; Wong, W.K.; Bilgiçli, İ. E-purchase intention of Taiwanese consumers: Sustainable mediation of perceived usefulness and perceived ease of use. Sustainability 2018, 10, 234. [Google Scholar] [CrossRef]

- Wicaksono, A.; Maharani, A. The effect of perceived usefulness and perceived ease of use on the technology acceptance model to use an online travel agency. J. Bus. Manag. Rev. 2020, 1, 313–328. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Yusof, H.; Munir, M.F.M.B.; Zolkaply, Z.; Jing, C.L.; Hao, C.Y.; Ying, D.S.; Leong, T.K. Behavioral intention to adopt blockchain technology: Viewpoint of the banking institutions in Malaysia. Int. J. Adv. Sci. Res. Manag. 2018, 3, 274–279. [Google Scholar]

- Prabhakaran, S.; Vasantha, D.S.; Sarika, P. Effect of social influence on intention to use the mobile wallet with the mediating effect of promotional benefits. J. Xi’an Univ. Archit. Technol. 2020, 12, 3003–3019. [Google Scholar]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Brown, S.A.; Venkatesh, V. A model of adoption of technology in the household: A baseline model test and extension incorporating household life cycle. Manag. Inf. Syst. Q. 2005, 29, 11. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Triandis, H.C. Attitudes, values, and interpersonal behaviour. In 1979 Nebraska Symposium on Motivation; Bison Books: Winnipeg, MB, Canada, 1980; pp. 195–260. [Google Scholar]

- Khan, I.U.; Hameed, Z.; Khan, S.U. Understanding online banking adoption in a developing country: UTAUT2 with cultural moderators. J. Glob. Inf. Manag. (JGIM) 2017, 25, 43–65. [Google Scholar] [CrossRef]

- Widodo, M.; Irawan, M.I.; Sukmono, R.A. Extending UTAUT2 to explore digital wallet adoption in Indonesia. In Proceedings of the 2019 International Conference on Information and Communications Technology (ICOIACT), Yogyakarta, Indonesia, 24–25 July 2019; pp. 878–883. [Google Scholar] [CrossRef]

- Megadewandanu, S. Exploring mobile wallet adoption in Indonesia using UTAUT2: An approach from a consumer perspective. In Proceedings of the 2016 2nd International Conference on Science and Technology-Computer (ICST), Yogyakarta, Indonesia, 27–28 October 2016; pp. 11–16. [Google Scholar] [CrossRef]

- Marpaung, F.K.; Dewi, R.S.; Grace, E.; Sudirman, A.; Sugiat, M. Behavioural Stimulus for Using Bank Mestika Mobile Banking Services: UTAUT2 Model Perspective. Gold. Ratio Mark. Appl. Psychol. Bus. 2021, 1, 61–72. [Google Scholar] [CrossRef]

- Khazaei, H. The influence of personal innovativeness and price value on intention to use electric vehicles in Malaysia. Eur. Online J. Nat. Soc. Sci. 2019, 8, 483. [Google Scholar]

- Turan, A.; Tunç, A.Ö.; Zehir, C. A theoretical model proposal: Personal innovativeness and user involvement as antecedents of the unified theory of acceptance and use of technology. Procedia-Soc. Behav. Sci. 2015, 210, 43–51. [Google Scholar] [CrossRef]

- Agarwal, R.; Prasad, J. A conceptual and operational definition of personal innovativeness in the domain of information technology. Inf. Syst. Res. 1998, 9, 204–215. [Google Scholar] [CrossRef]

- Lu, J. Are personal innovativeness and social influence critical to continue with mobile commerce? Internet Res. 2014, 24, 134–159. [Google Scholar] [CrossRef]

- Cao, Q.; Niu, X. Integrating context-awareness and UTAUT to explain Alipay user adoption. Int. J. Ind. Ergon. 2019, 69, 9–13. [Google Scholar] [CrossRef]

- Suebtimrat, P.; Vonguai, R. An Investigation of Behavioral Intention Towards QR Code Payment in Bangkok, Thailand. J. Asian Financ. Econ. Bus. 2021, 8, 939–950. [Google Scholar] [CrossRef]

- Damghanian, H.; Zarei, A.; Siahsarani Kojuri, M.A. Impact of perceived security on trust, perceived risk, and acceptance of online banking in Iran. J. Internet Commer. 2016, 15, 214–238. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Stewart, H.; Jürjens, J. Data security and consumer trust in FinTech innovation in Germany. Inf. Comput. Secur. 2018, 26, 109–128. [Google Scholar] [CrossRef]

- Arkorful, V.E.; Lugu, B.K.; Hammond, A.; Basiru, I.; Afriyie, F.A.; Mohajan, B. Examining quality, value, satisfaction and trust dimensions: An empirical lens to understand health insurance systems actual usage. Public Organ. Rev. 2021, 21, 471–489. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research; Addison-Wesley: Reading, MA, USA, 1975. [Google Scholar]

- Ajzen, I. The theory of planned behavior. In Handbook of Theories of Social Psychology; Lawrence Erlbaum Associates: New York, NY, USA, 2012. [Google Scholar] [CrossRef]

- Al Nawayseh, M.K. Fintech in COVID-19 and beyond: What factors are affecting customers’ choice of fintech applications? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- Hassan, M.S.; Islam, M.A.; Sobhani, F.A.; Nasir, H.; Mahmud, I.; Zahra, F.T. Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information 2022, 13, 349. [Google Scholar] [CrossRef]

- Wilson, N. The impact of perceived usefulness and perceived ease-of-use toward repurchase intention in the Indonesian e-commerce industry. J. Manaj. Indones. 2019, 19, 241–249. [Google Scholar] [CrossRef]

- Mokhtar, S.A.; Katan, H.; Hidayat-ur-Rehman, I. Instructors’ behavioural intention to use learning management system: An integrated TAM perspective. TEM J. 2018, 7, 513. [Google Scholar] [CrossRef]

- Sun, Y.; Gao, F. An investigation of the influence of intrinsic motivation on students’ intention to use mobile devices in language learning. Educ. Technol. Res. Dev. 2020, 68, 1181–1198. [Google Scholar] [CrossRef]

- Patel, K.J.; Patel, H.J. Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. Int. J. Bank Mark. 2018, 36, 147–169. [Google Scholar] [CrossRef]

- Zhou, M.; Huang, J.; Wu, K.; Huang, X.; Kong, N.; Campy, K.S. Characterizing Chinese consumers’ intention to use live e-commerce shopping. Technol. Soc. 2021, 67, 101767. [Google Scholar] [CrossRef]

- Blaise, R.; Halloran, M.; Muchnick, M. Mobile commerce competitive advantage: A quantitative study of variables that predict m-commerce purchase intentions. J. Internet Commer. 2018, 17, 96–114. [Google Scholar] [CrossRef]

- Simarmata, M.T.; Hia, I.J. The role of personal innovativeness on the behavioral intention of Information Technology. J. Econ. Bus. 2020, 1, 18–29. [Google Scholar] [CrossRef]

- Grandison, T.; Sloman, M. A survey of trust in internet applications. IEEE Commun. Surv. Tutor. 2000, 3, 2–16. [Google Scholar] [CrossRef]

- Wang, S.W.; Ngamsiriudom, W.; Hsieh, C.H. Trust disposition, trust antecedents, trust, and behavioral intention. Serv. Ind. J. 2015, 35, 555–572. [Google Scholar] [CrossRef]

- Mahwadha, W.I. The behavioral intention of young consumers towards E-wallEt adoption: An empirical study among Indonesian users. Russ. J. Agric. Socio-Econ. Sci. 2019, 85, 79–93. [Google Scholar]

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to casual modelling: Personal computer adoption and use as an Illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Chen, W.-C.; Chen, C.-W.; Chen, W.-K. Drivers of Mobile Payment Acceptance in China: An Empirical Investigation. Information 2019, 10, 384. [Google Scholar] [CrossRef]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption intention of fintech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Patil, P.; Tamilmani, K.; Rana, N.P.; Raghavan, V. Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. Int. J. Inf. Manag. 2020, 54, 102144. [Google Scholar] [CrossRef]

- Chin, A.G.; Harris, M.A.; Brookshire, R. An Empirical Investigation of Intent to Adopt Mobile Payment Systems Using a Trust-based Extended Valence Framework. Inf. Syst. Front. 2020, 24, 329–347. [Google Scholar] [CrossRef]

- Jiang, Q.; Chen, J.; Wu, Y.; Gu, C.; Sun, J. A Study of Factors Influencing the Continuance Intention to the Usage of Augmented Reality in Museums. Systems 2022, 10, 73. [Google Scholar] [CrossRef]

- Eutsler, J.; Lang, B. Rating scales in accounting research: The impact of scale points and labels. Behav. Res. Account. 2015, 27, 35–51. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Thiele, K.O. Mirror on the Wall: A Comparative Evaluation of Composite-based Structural Equation Modeling Methods. J. Acad. Mark. Sci. 2017, 45, 616–632. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modelling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- The World Bank. Current Health Expenditure (% of GDP)—Bangladesh. 2022. Available online: https://data.worldbank.org/indicator/SH.XPD.CHEX.GD.ZS?locations=BD (accessed on 10 August 2022).

- Macrotrends. Bangladesh Healthcare Spending 2000–2022. Available online: https://www.macrotrends.net/countries/BGD/bangladesh/healthcare-spending#:~:text=Bangladesh%20healthcare%20spending%20for%202019,a%205.24%25%20increase%20from%202015 (accessed on 10 August 2022).

- Statista. Digital Markets Fintech Bangladesh. 2022. Available online: https://www.statista.com/outlook/dmo/fintech/bangladesh (accessed on 10 August 2022).

| Demographic Variable | Frequency | Percentage |

|---|---|---|

| Are you aware of the fintech services provided by the healthcare sector? | ||

| Yes | 259 | 92.8 |

| No | 20 | 7.2 |

| Total | 279 | 100.0 |

| Gender | ||

| Male | 173 | 62.1 |

| Female | 106 | 37.9 |

| Total | 279 | 100.0 |

| Age | ||

| 16–25 | 31 | 11.1 |

| 26–35 | 125 | 44.8 |

| 36–45 | 68 | 24.4 |

| 46–55 | 43 | 15.4 |

| 55 above | 12 | 4.3 |

| Total | 279 | 100.0 |

| Employment Status | ||

| Employed | 210 | 75.3 |

| Un-Employed | 32 | 11.5 |

| Self Employed | 22 | 7.9 |

| Student | 8 | 2.9 |

| Others | 7 | 2.4 |

| Total | 279 | 100.0 |

| BI | FC | PEOU | PI | PT | SI | |

|---|---|---|---|---|---|---|

| BI1 | 0.896 | |||||

| BI2 | 0.890 | |||||

| BI3 | 0.865 | |||||

| FC1 | 0.824 | |||||

| FC2 | 0.866 | |||||

| FC3 | 0.717 | |||||

| PEOU1 | 0.889 | |||||

| PEOU2 | 0.842 | |||||

| PEOU3 | 0.885 | |||||

| PEOU4 | 0.842 | |||||

| PI1 | 0.777 | |||||

| PI3 | 0.848 | |||||

| PI4 | 0.780 | |||||

| PT1 | 0.914 | |||||

| PT2 | 0.932 | |||||

| PT3 | 0.861 | |||||

| SI1 | 0.880 | |||||

| SI2 | 0.880 | |||||

| SI3 | 0.811 |

| Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) | |

|---|---|---|---|

| BI | 0.860 | 0.915 | 0.782 |

| FC | 0.729 | 0.846 | 0.648 |

| PEOU | 0.887 | 0.922 | 0.748 |

| PI | 0.722 | 0.844 | 0.644 |

| PT | 0.887 | 0.930 | 0.815 |

| SI | 0.819 | 0.893 | 0.735 |

| BI | FC | PEOU | PI | PT | SI | |

|---|---|---|---|---|---|---|

| BI | 0.884 | |||||

| FC | 0.706 | 0.805 | ||||

| PEOU | 0.709 | 0.712 | 0.865 | |||

| PI | 0.706 | 0.641 | 0.633 | 0.802 | ||

| PT | 0.766 | 0.626 | 0.637 | 0.642 | 0.903 | |

| SI | 0.752 | 0.660 | 0.647 | 0.620 | 0.666 | 0.857 |

| BI | FC | PEOU | PI | PT | SI | |

|---|---|---|---|---|---|---|

| BI | ||||||

| FC | 0.877 | |||||

| PEOU | 0.810 | 0.874 | ||||

| PI | 0.895 | 0.859 | 0.788 | |||

| PT | 0.870 | 0.756 | 0.711 | 0.796 | ||

| SI | 0.896 | 0.853 | 0.760 | 0.805 | 0.777 |

| VIF | |

|---|---|

| BI1 | 2.316 |

| BI2 | 2.345 |

| BI3 | 1.976 |

| FC1 | 1.463 |

| FC2 | 1.646 |

| FC3 | 1.347 |

| PEOU1 | 2.726 |

| PEOU2 | 2.058 |

| PEOU3 | 2.761 |

| PEOU4 | 2.081 |

| PI1 | 1.345 |

| PI3 | 1.641 |

| PI4 | 1.430 |

| PT1 | 2.802 |

| PT2 | 3.241 |

| PT3 | 2.167 |

| SI1 | 2.212 |

| SI2 | 2.241 |

| SI3 | 1.519 |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p Values | |

|---|---|---|---|---|---|

| FC → BI | 0.128 | 0.128 | 0.061 | 2.087 | 0.037 |

| PEOU → BI | 0.141 | 0.142 | 0.061 | 2.313 | 0.021 |

| PI → BI | 0.173 | 0.174 | 0.058 | 2.954 | 0.003 |

| PT → BI | 0.310 | 0.307 | 0.065 | 4.806 | 0.000 |

| SI → BI | 0.263 | 0.263 | 0.067 | 3.941 | 0.000 |

| H1: Perceived ease of use is positively related to behavioral intention to use fintech services. | Supported |

| H2: Social influence is positively related to behavioral intention to use fintech services. | Supported |

| H3: Facilitating conditions are positively related to behavioral intention to use fintech services. | Supported |

| H4: Personal innovativeness is positively related to behavioral intention to use fintech services. | Supported |

| H5: Perceived trust is positively related to behavioral intention to use fintech services. | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassan, M.S.; Islam, M.A.; Sobhani, F.A.; Hassan, M.M.; Hassan, M.A. Patients’ Intention to Adopt Fintech Services: A Study on Bangladesh Healthcare Sector. Int. J. Environ. Res. Public Health 2022, 19, 15302. https://doi.org/10.3390/ijerph192215302

Hassan MS, Islam MA, Sobhani FA, Hassan MM, Hassan MA. Patients’ Intention to Adopt Fintech Services: A Study on Bangladesh Healthcare Sector. International Journal of Environmental Research and Public Health. 2022; 19(22):15302. https://doi.org/10.3390/ijerph192215302

Chicago/Turabian StyleHassan, Md. Sharif, Md. Aminul Islam, Farid Ahammad Sobhani, Md. Maruf Hassan, and Md. Arif Hassan. 2022. "Patients’ Intention to Adopt Fintech Services: A Study on Bangladesh Healthcare Sector" International Journal of Environmental Research and Public Health 19, no. 22: 15302. https://doi.org/10.3390/ijerph192215302

APA StyleHassan, M. S., Islam, M. A., Sobhani, F. A., Hassan, M. M., & Hassan, M. A. (2022). Patients’ Intention to Adopt Fintech Services: A Study on Bangladesh Healthcare Sector. International Journal of Environmental Research and Public Health, 19(22), 15302. https://doi.org/10.3390/ijerph192215302