Does Overseas Investment Raise Corporate Environmental Protection? Evidence from Chinese A-List Companies

Abstract

1. Introduction

2. Theoretical Analysis and Hypothesis Formulation

Foundational Theoretical Hypotheses

3. Variables, Data, and Methodology

3.1. Variables Selection and Data Sources

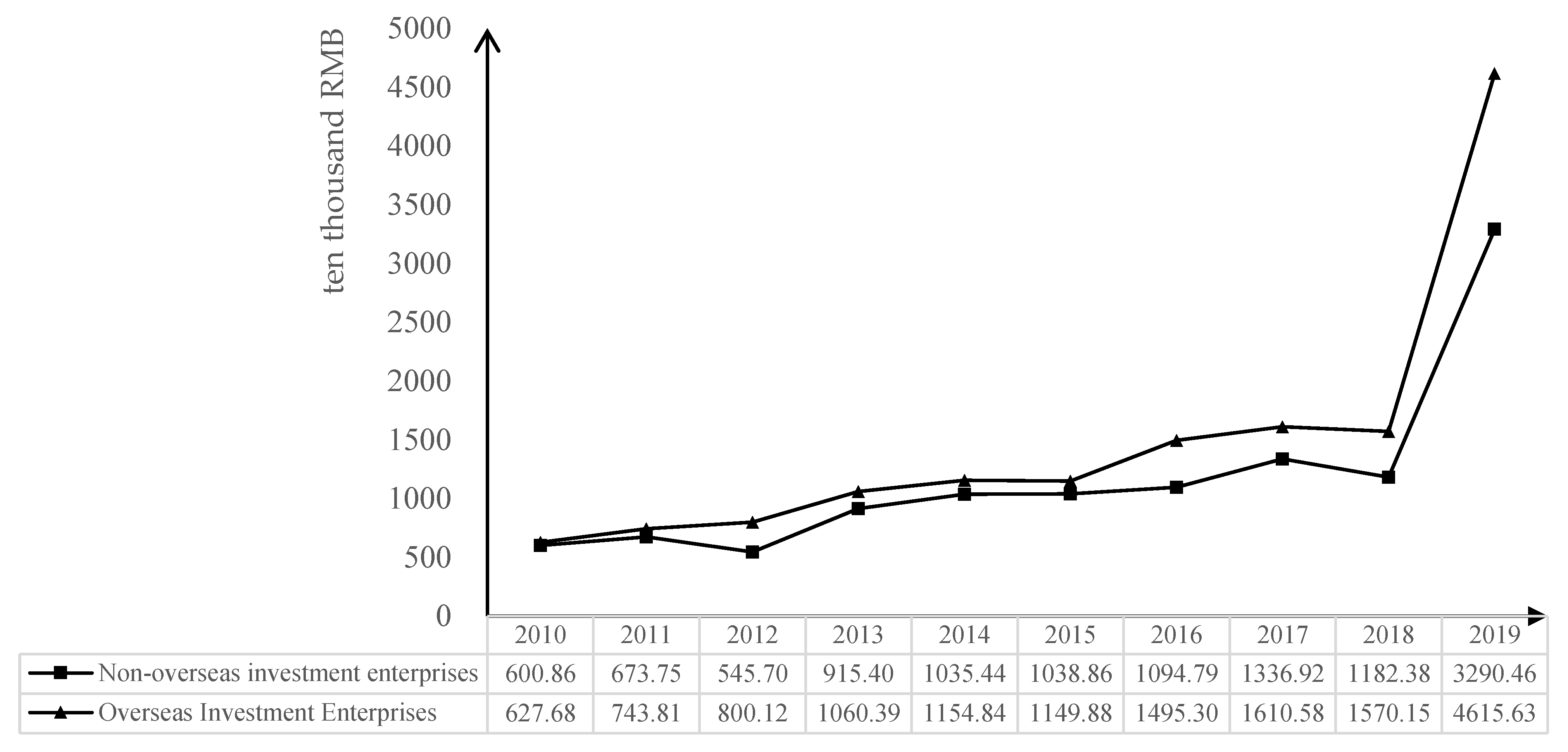

3.2. Data

3.3. Estimating Methods

3.3.1. Full Sample Regression

3.3.2. PSM-DID Regression

- (1)

- Propensity Score Matching Method (PSM)

- (2)

- Difference-in-differences model (DID)

4. Estimating Results

4.1. T-Test between Groups

4.2. Two-Way Fixed Effects Results

4.3. Robustness Examination

4.3.1. Changing the Explained Variables

4.3.2. PSM-DID Estimation Results

4.3.3. Results of Dynamic Effect Estimates

5. Conclusions and Policy Implications

5.1. Research Conclusions

5.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Dong, B.; Gong, J.; Zhao, X. FDI and environmental regulation: Pollution haven or a race to the top? J. Regul. Econ. 2012, 41, 216–237. [Google Scholar] [CrossRef]

- Yang, J.; Li, Y.; Liu, W.; Wen, L. Does fdi presence make domestic firms greener in an emerging economy? The effect of media attention. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2019; Volume 2019, p. 16388. [Google Scholar]

- Hanna, R. US environmental regulation and FDI: Evidence from a panel of US-based multinational firms. Am. Econ. J. Appl. Econ. 2010, 2, 158–189. [Google Scholar] [CrossRef]

- Manderson, E.; Kneller, R. Environmental regulations, outward FDI and heterogeneous firms: Are countries used as pollution havens? Environ. Resour. Econ. 2012, 51, 317–352. [Google Scholar] [CrossRef]

- An, T.; Xu, C.; Liao, X. The impact of FDI on environmental pollution in China: Evidence from spatial panel data. Environ. Sci. Pollut. Res. 2021, 28, 44085–44097. [Google Scholar] [CrossRef] [PubMed]

- Madsen, P.M. Does corporate investment drive a “race to the bottom” in environmental protection? A reexamination of the effect of environmental regulation on investment. Acad. Manag. J. 2009, 52, 1297–1318. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.; Shimamoto, K. Globalization, firm-level characteristics and environmental management: A study of Japan. Ecol. Econ. 2006, 59, 312–323. [Google Scholar] [CrossRef]

- Zhang, J.; Qu, Y.; Zhang, Y.; Li, X.; Miao, X. Effects of FDI on the efficiency of government expenditure on environmental protection under fiscal decentralization: A spatial econometric analysis for China. Int. J. Environ. Res. Public Health 2019, 16, 2496. [Google Scholar] [CrossRef] [PubMed]

- Wang, Q.-J.; Feng, G.-F.; Wang, H.-J.; Chang, C.-P. The impacts of democracy on innovation: Revisited evidence. Technovation 2021, 108, 102333. [Google Scholar] [CrossRef]

- Spatareanu, M. Searching for pollution havens: The impact of environmental regulations on foreign direct investment. J. Environ. Dev. 2007, 16, 161–182. [Google Scholar] [CrossRef]

- Marano, V.; Kostova, T. Unpacking the institutional complexity in adoption of CSR practices in multinational enterprises. J. Manag. Stud. 2016, 53, 28–54. [Google Scholar] [CrossRef]

- Cheung, Y.-L.; Kong, D.; Tan, W.; Wang, W. Being good when being international in an emerging economy: The case of China. J. Bus. Ethics 2015, 130, 805–817. [Google Scholar] [CrossRef]

- Marano, V.; Tashman, P.; Kostova, T. Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprises. J. Int. Bus. Stud. 2017, 48, 386–408. [Google Scholar] [CrossRef]

- Wang, D.T.; Gu, F.F.; David, K.T.; Yim, C.K.B. When does FDI matter? The roles of local institutions and ethnic origins of FDI. Int. Bus. Rev. 2013, 22, 450–465. [Google Scholar] [CrossRef]

- Gorodnichenko, Y.; Svejnar, J.; Terrell, K. When does FDI have positive spillovers? Evidence from 17 transition market economies. J. Comp. Econ. 2014, 42, 954–969. [Google Scholar] [CrossRef]

- Pomares, J.C.; González, A.; Saura, P. Simple and resistant construction built with concrete voussoirs for developing countries. J. Constr. Eng. Manag. 2018, 144, 04018076. [Google Scholar] [CrossRef]

- Bautista, A.; Pomares, J.C.; González, M.D.; Velasco, F. Influence of the microstructure of TMT reinforcing bars on their corrosion behavior in concrete with chlorides. Constr. Build. Mater. 2019, 229, 116899. [Google Scholar] [CrossRef]

- Zomorrodi, A.; Zhou, X. Impact of FDI on environmental quality of China. Int. J. Bus. Econ. Manag. 2017, 4, 1–15. [Google Scholar] [CrossRef][Green Version]

- Araya, M. FDI and the Environment: What Empirical Evidence Does and Does not Tell Us? In International Investment for Sustainable Development; Routledge: London, UK, 2012; pp. 59–86. [Google Scholar]

- Aung, T.S.; Overland, I.; Vakulchuk, R. Environmental performance of foreign firms: Chinese and Japanese firms in Myanmar. J. Clean. Prod. 2021, 312, 127701. [Google Scholar] [CrossRef]

- Wang, S. Impact of FDI on energy efficiency: An analysis of the regional discrepancies in China. Nat. Hazards 2017, 85, 1209–1222. [Google Scholar] [CrossRef]

- Morck, R.; Yeung, B.; Zhao, M. Perspectives on China’s outward foreign direct investment. J. Int. Bus. Stud. 2008, 39, 337–350. [Google Scholar] [CrossRef]

- Abdo, A.B.; Li, B.; Zhang, X.; Lu, J.; Rasheed, A. Influence of FDI on environmental pollution in selected Arab countries: A spatial econometric analysis perspective. Environ. Sci. Pollut. Res. 2020, 27, 28222–28246. [Google Scholar] [CrossRef]

- Liu, Q.; Wang, S.; Zhang, W.; Zhan, D.; Li, J. Does foreign direct investment affect environmental pollution in China’s cities? A spatial econometric perspective. Sci. Total Environ. 2018, 613, 521–529. [Google Scholar] [CrossRef] [PubMed]

- Ning, L.; Wang, F. Does FDI bring environmental knowledge spillovers to developing countries? The role of the local industrial structure. Environ. Resour. Econ. 2018, 71, 381–405. [Google Scholar] [CrossRef]

- Sapkota, P.; Bastola, U. Foreign direct investment, income, and environmental pollution in developing countries: Panel data analysis of Latin America. Energy Econ. 2017, 64, 206–212. [Google Scholar] [CrossRef]

- Bhujabal, P.; Sethi, N.; Padhan, P.C. ICT, foreign direct investment and environmental pollution in major Asia Pacific countries. Environ. Sci. Pollut. Res. 2021, 28, 42649–42669. [Google Scholar] [CrossRef]

- Bildirici, M.; Gokmenoglu, S.M. The impact of terrorism and FDI on environmental pollution: Evidence from Afghanistan, Iraq, Nigeria, Pakistan, Philippines, Syria, Somalia, Thailand and Yemen. Environ. Impact Assess. Rev. 2020, 81, 106340. [Google Scholar] [CrossRef]

- Blanco, L.; Gonzalez, F.; Ruiz, I. The impact of FDI on CO2 emissions in Latin America. Oxf. Dev. Stud. 2013, 41, 104–121. [Google Scholar] [CrossRef]

- Albulescu, C.T.; Tiwari, A.K.; Yoon, S.M.; Kang, S.H. FDI, income, and environmental pollution in Latin America: Replication and extension using panel quantiles regression analysis. Energy Econ. 2019, 84, 104504. [Google Scholar] [CrossRef]

- Demena, B.A.; Afesorgbor, S.K. The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy Policy 2020, 138, 111192. [Google Scholar] [CrossRef]

- Hao, Y.; Wu, Y.; Wu, H.; Ren, S. How do FDI and technical innovation affect environmental quality? Evidence from China. Environ. Sci. Pollut. Res. 2020, 27, 7835–7850. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Muye, I.M.; Kaita, R.A. The effects of FDI and energy consumption on environmental pollution in predominantly resource-based economies of the GCC. Sustain. Energy Technol. Assess. 2018, 25, 126–137. [Google Scholar] [CrossRef]

- Sabir, S.; Qayyum, U.; Majeed, T. FDI and environmental degradation: The role of political institutions in South Asian countries. Environ. Sci. Pollut. Res. 2020, 27, 32544–32553. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Dong, Z.Y.; Tam, V.W. Towards corporate environmental information disclosure: An empirical study in China. J. Clean. Prod. 2010, 18, 1142–1148. [Google Scholar] [CrossRef]

- Jiang, X.; Akbar, A. Does increased representation of female executives improve corporate environmental investment? Evidence from China. Sustainability 2018, 10, 4750. [Google Scholar] [CrossRef]

- Zhou, D.; Li, S.; David, K.T. The impact of FDI on the productivity of domestic firms: The case of China. Int. Bus. Rev. 2002, 11, 465–484. [Google Scholar] [CrossRef]

- Hoang, D.T.; Do, A.D.; Trinh, M.V. Spillover effects of FDI on technology innovation of vietnamese enterprises. J. Asian Financ. Econ. Bus. 2021, 8, 655–663. [Google Scholar]

| Variable Type | Variable Name | Variable Symbol | Variable Definition |

|---|---|---|---|

| Explained variables | Corporate environmental expenditure | Envirpro | Environmental expenditure of the enterprise for the year as a percentage of the enterprise’s asset size |

| Explanatory variables | Overseas direct investment | Oversea | If a firm makes an overseas investment in a given year, the firm is defined as an overseas investment firm for that year and subsequent years with Oversea = 1; otherwise, Oversea = 0. |

| Control variables | Enterprise level | ||

| Concentration of shareholding | CR | Sum of the number of shares held by the top ten shareholders for the year/total number of shares | |

| Number of Directors | DSRS | Number of all directors on the board at the end of the year | |

| Number of Independent directors | DDRS | Number of independent directors at the end of the year | |

| Separation of powers rate | LQFL | Extent of separation of ownership and operation of the enterprise | |

| Dual employment | LZHY | Whether the chairman and general manager are the same person, if yes, LZHY = 1, otherwise, LZHY = 0 | |

| Return on net assets (ROAN) | ROE | Total EBITDA for the year/Average total net assets | |

| Financial leverage | CWGG | Total liabilities/total assets of the enterprise at the end of the year | |

| Enterprise risk | ZHGG | Rate of change in profit per ordinary share of the enterprise for the year/rate of change in sales volume | |

| Current ratio | LDR | Current assets/current liabilities at the end of the year | |

| Business Size | Size | Natural logarithm of the total assets of the enterprise at the end of the year | |

| Business Attributes | Nature | Generate dummy variables based on the nature of the actual controller of the business | |

| Industry level | |||

| Industry concentration | HHI | Based on the dichotomous industry codes disclosed by the CSRC, the Herfindahl index is calculated year by year using the operating revenues of companies in the industry to measure industry concentration, which is used as an inverse indicator of industry concentration and is denoted as HHI | |

| Industry Total Return on Assets | INDROA | Based on the dichotomous industry codes disclosed by the CSRC, the compensation rate of total assets of companies in the industry is weighted year by year to take the average value, using total assets as the weighting | |

| Total industry gearing ratio | INDLEV | Based on the dichotomous industry codes disclosed by the CSRC, the total gearing ratio of enterprises in the industry is weighted year by year to take the average value, using total assets as the weighting |

| Variable | N | Mean | SD | Min | Median | Max | Correlation Coefficient |

|---|---|---|---|---|---|---|---|

| Envirpro | 4069 | 14.58 | 1.92 | 0.00 | 14.66 | 20.15 | |

| Oversea | 4069 | 0.10 | 0.30 | 0.00 | 0.00 | 1.00 | 0.07 *** |

| CR | 4012 | 57.21 | 15.73 | 22.41 | 57.59 | 94.44 | 0.07 *** |

| DSRS | 4031 | 8.89 | 1.83 | 4.00 | 9.00 | 19.00 | 0.16 *** |

| DDRS | 4031 | 3.24 | 0.65 | 0.00 | 3.00 | 8.00 | 0.17 *** |

| LQFL | 3855 | 5.58 | 8.31 | −35.09 | 0.00 | 40.18 | 0.10 *** |

| LZHY | 3986 | 1.79 | 0.41 | 1.00 | 2.00 | 2.00 | 0.09 *** |

| ROE | 4042 | −0.01 | 1.90 | −74.76 | 0.06 | 26.68 | 0.03 |

| CWGG | 3991 | 1.56 | 1.39 | −0.73 | 1.12 | 7.59 | 0.01 |

| ZHGG | 3991 | 2.83 | 3.60 | −2.50 | 1.69 | 18.64 | 0.01 |

| LDR | 4042 | 2.08 | 2.94 | 0.00 | 1.34 | 68.97 | −0.20 *** |

| Size | 3955 | 22.22 | 1.18 | 18.64 | 22.14 | 27.67 | 0.53 *** |

| Nature | 3728 | 0.52 | 0.50 | 0.00 | 1.00 | 1.00 | 0.18 *** |

| HHI | 4069 | 0.10 | 0.10 | 0.02 | 0.07 | 1.00 | 0.02 |

| Indroa | 4069 | 0.04 | 0.05 | −0.23 | 0.04 | 0.87 | −0.08 *** |

| Indlev | 4069 | 0.45 | 0.11 | 0.17 | 0.43 | 1.46 | 0.09 *** |

| Variable | N (0) | Mean (0) | N (1) | Mean (1) | Mean-Diff | t |

|---|---|---|---|---|---|---|

| Envirpro | 3664 | 14.54 | 405 | 14.95 | −0.40 *** | −4.02 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Oversea | 0.31 ** | 0.32 ** | 0.31 ** | 0.23 * | 0.23 * |

| (2.42) | (2.43) | (2.38) | (1.72) | (1.77) | |

| CR | 0.01 | 0.01 | −0.01 | −0.01 | |

| (0.05) | (0.38) | (−1.12) | (−1.19) | ||

| DSRS | 0.01 | −0.01 | −0.01 | 0.01 | |

| (0.02) | (−0.19) | (−0.00) | (0.04) | ||

| DDRS | 0.02 | 0.03 | 0.01 | −0.01 | |

| (0.21) | (0.38) | (0.02) | (−0.00) | ||

| LQFL | 0.01 | 0.01 | 0.01 | −0.01 | |

| (0.77) | (0.73) | (0.01) | (−0.00) | ||

| LZHY | −0.06 | −0.09 | −0.09 | −0.10 | |

| (−0.76) | (−1.16) | (−1.19) | (−1.20) | ||

| ROE | 0.01 | −0.01 | −0.01 | ||

| (0.79) | (−0.38) | (−0.38) | |||

| CWGG | −0.01 | −0.01 | −0.01 | ||

| (−1.23) | (−0.96) | (−0.96) | |||

| ZHGG | 0.01 | 0.01 | 0.01 | ||

| (1.22) | (0.97) | (0.97) | |||

| LDR | −0.01 ** | −0.01 | −0.01 | ||

| (−2.22) | (−1.03) | (−1.05) | |||

| Size | 0.48 *** | 0.48 *** | |||

| (5.81) | (5.76) | ||||

| Nature | −0.38 | −0.38 | |||

| (−1.32) | (−1.32) | ||||

| HHI | 0.59 | ||||

| (1.42) | |||||

| Indroa | −0.35 | ||||

| (−1.19) | |||||

| Indlev | 0.05 | ||||

| (0.11) | |||||

| Year | control | control | control | control | control |

| Individual | control | control | control | control | control |

| Cons | 14.37 *** | 14.54 *** | 14.58 *** | 4.25 ** | 4.22 ** |

| (231.85) | (38.44) | (37.95) | (2.29) | (2.23) | |

| N | 4069 | 3798 | 3753 | 3449 | 3449 |

| R2 | 0.02 | 0.02 | 0.04 | 0.26 | 0.25 |

| F | 4.36 | 3.17 | 3.10 | 4.08 | 3.65 |

| (i) GI t + 1 | (ii) GI t + 2 | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Oversea | 0.25 *** | 0.27 *** | 0.23 *** | 0.21 ** |

| (3.21) | (2.65) | (2.92) | (2.01) | |

| CR | 0.01 | 0.01 | ||

| (0.04) | (0.85) | |||

| DSRS | −0.01 | 0.10 *** | ||

| (−0.40) | (3.01) | |||

| DDRS | 0.15 ** | −0.17 ** | ||

| (2.14) | (−2.31) | |||

| LQFL | −0.02 *** | −0.02 *** | ||

| (−3.89) | (−3.75) | |||

| LZHY | 0.18 * | 0.06 | ||

| (1.85) | (0.56) | |||

| ROE | −0.02 | −0.05 | ||

| (−0.59) | (−1.31) | |||

| CWGG | −0.01 | 0.03 | ||

| (−0.82) | (1.46) | |||

| ZHGG | 0.01 | −0.01 | ||

| (0.85) | (−1.50) | |||

| LDR | −0.01 | −0.02 ** | ||

| (−0.91) | (−1.96) | |||

| Size | 0.52 *** | 0.54 *** | ||

| (8.36) | (7.19) | |||

| Nature | −0.65 ** | −0.31 | ||

| (−2.14) | (−0.93) | |||

| HHI | −0.66 | −1.14 ** | ||

| (−1.47) | (−2.39) | |||

| Indroa | 0.12 | −0.27 | ||

| (0.58) | (−1.50) | |||

| Indlev | 1.06 *** | −0.06 | ||

| (4.19) | (−0.24) | |||

| Year | control | control | control | control |

| Individual | control | control | control | control |

| N | 4422 | 3752 | 3666 | 3141 |

| Wald | 1230.34 | 808.00 | 679.46 | 598.08 |

| P | 0.01 | 0.01 | 0.01 | 0.01 |

| Variable Name | Average Value | Standard Deviation (%) | Reduction in Standard Deviation (%) | t-Statistic | t-Test P > T | ||

|---|---|---|---|---|---|---|---|

| Processing Group | Control Group | ||||||

| CR | pre-match | 59.34 | 62.18 | −17.10 | −0.82 | 0.42 | |

| post-match | 59.34 | 58.81 | 3.20 | 81.30 | 0.19 | 0.85 | |

| DSRS | pre-match | 9.36 | 9.04 | 17.10 | 1.15 | 0.25 | |

| post-match | 9.36 | 9.19 | 8.90 | 47.60 | 0.43 | 0.67 | |

| DDRS | pre-match | 3.29 | 3.28 | 1.50 | 0.10 | 0.92 | |

| post-match | 3.29 | 3.29 | 0.00 | 100.00 | 0.00 | 1.00 | |

| LQFL | pre-match | 8.21 | 5.09 | 36.00 | 2.50 | 0.01 | |

| post-match | 8.21 | 10.17 | −22.60 | 37.10 | −0.90 | 0.37 | |

| LZHY | pre-match | 1.91 | 1.77 | 36.70 | 2.04 | 0.04 | |

| post-match | 1.91 | 1.88 | 6.50 | 82.20 | 0.35 | 0.73 | |

| ROE | pre-match | 0.11 | 0.08 | 8.70 | 0.40 | 0.69 | |

| post-match | 0.11 | 0.11 | 1.40 | 83.40 | 0.32 | 0.75 | |

| CWGG | pre-match | 0.75 | 1.29 | −24.50 | −2.94 | 0.01 | |

| post-match | 0.75 | 0.91 | −7.20 | 70.50 | −0.31 | 0.76 | |

| ZHGG | pre-match | 0.94 | 2.04 | −24.70 | −2.15 | 0.03 | |

| post-match | 0.94 | 1.07 | −2.90 | 88.20 | −0.12 | 0.90 | |

| LDR | pre-match | 3.36 | 4.70 | −23.30 | −0.86 | 0.39 | |

| post-match | 3.36 | 3.64 | −4.80 | 79.40 | −0.26 | 0.80 | |

| Size | pre-match | 22.02 | 21.59 | 37.70 | 2.56 | 0.01 | |

| post-match | 22.02 | 21.98 | 3.70 | 90.10 | 0.16 | 0.87 | |

| Nature | pre-match | 0.38 | 0.51 | −26.10 | −1.65 | 0.10 | |

| post-match | 0.38 | 0.36 | 4.80 | 81.60 | 0.22 | 0.82 | |

| HHI | pre-match | 0.12 | 0.08 | 29.70 | 1.80 | 0.08 | |

| post-match | 0.12 | 0.12 | −1.80 | 94.00 | −0.11 | 0.91 | |

| Indroa | pre-match | 0.05 | 0.06 | −9.20 | −0.38 | 0.70 | |

| post-match | 0.05 | 0.05 | 6.20 | 32.60 | 0.48 | 0.63 | |

| Indlev | pre-match | 0.52 | 0.48 | 18.60 | 0.99 | 0.32 | |

| post-match | 0.52 | 0.52 | −0.90 | 95.20 | −0.06 | 0.95 | |

| (i) Static Effect | (ii) Dynamic Effect | |||

|---|---|---|---|---|

| (1) PSM 1:1 | (2) PSM 1:3 | (3) PSM 1:1 | (4) PSM 1:3 | |

| Before1 | −0.20 | −0.17 | −0.16 | −0.15 |

| (−1.15) | (−1.25) | (−0.95) | (−1.10) | |

| Before2 | −0.07 | −0.16 | −0.04 | −0.15 |

| (−0.39) | (−1.20) | (−0.24) | (−1.10) | |

| Treat | −0.06 | 0.01 | 0.06 | 0.07 |

| (−0.42) | (0.03) | (0.45) | (0.63) | |

| Time | −0.17 | 0.02 | −0.01 | 0.10 |

| (−0.90) | (0.17) | (−0.04) | (0.76) | |

| Treat*Time | 0.45 ** | 0.36 ** | ||

| (2.16) | (2.14) | |||

| After_0 | −0.29 | −0.25 | ||

| (−1.07) | (−1.04) | |||

| After_1 | 0.11 | 0.06 | ||

| (0.43) | (0.27) | |||

| After_2 | 0.31 | 0.26 | ||

| (1.15) | (1.03) | |||

| After_3 | 0.65 ** | 0.69 ** | ||

| (2.26) | (2.46) | |||

| After_4 | 0.93 *** | 1.10 *** | ||

| (2.88) | (3.15) | |||

| After_5 | 0.87 ** | 1.15 *** | ||

| (2.41) | (2.87) | |||

| Control variables/time | control | control | control | control |

| N | 947 | 1539 | 947 | 1539 |

| R2 | 0.29 | 0.33 | 0.30 | 0.34 |

| F | 43.13 | 52.80 | 36.97 | 45.38 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.-J.; Shen, Q.; Geng, Y.; Li, D.-Y. Does Overseas Investment Raise Corporate Environmental Protection? Evidence from Chinese A-List Companies. Int. J. Environ. Res. Public Health 2022, 19, 837. https://doi.org/10.3390/ijerph19020837

Wang Q-J, Shen Q, Geng Y, Li D-Y. Does Overseas Investment Raise Corporate Environmental Protection? Evidence from Chinese A-List Companies. International Journal of Environmental Research and Public Health. 2022; 19(2):837. https://doi.org/10.3390/ijerph19020837

Chicago/Turabian StyleWang, Quan-Jing, Qiong Shen, Yong Geng, and Dan-Yang Li. 2022. "Does Overseas Investment Raise Corporate Environmental Protection? Evidence from Chinese A-List Companies" International Journal of Environmental Research and Public Health 19, no. 2: 837. https://doi.org/10.3390/ijerph19020837

APA StyleWang, Q.-J., Shen, Q., Geng, Y., & Li, D.-Y. (2022). Does Overseas Investment Raise Corporate Environmental Protection? Evidence from Chinese A-List Companies. International Journal of Environmental Research and Public Health, 19(2), 837. https://doi.org/10.3390/ijerph19020837