Geo-Economic Linkages between China and the Countries along the 21st-Century Maritime Silk Road and Their Types

Abstract

1. Introduction

2. Literature Review

3. Methods and Data

3.1. Geo-Economic Flow Linkage Intensity Mode

3.2. Extreme Random Forest Regression

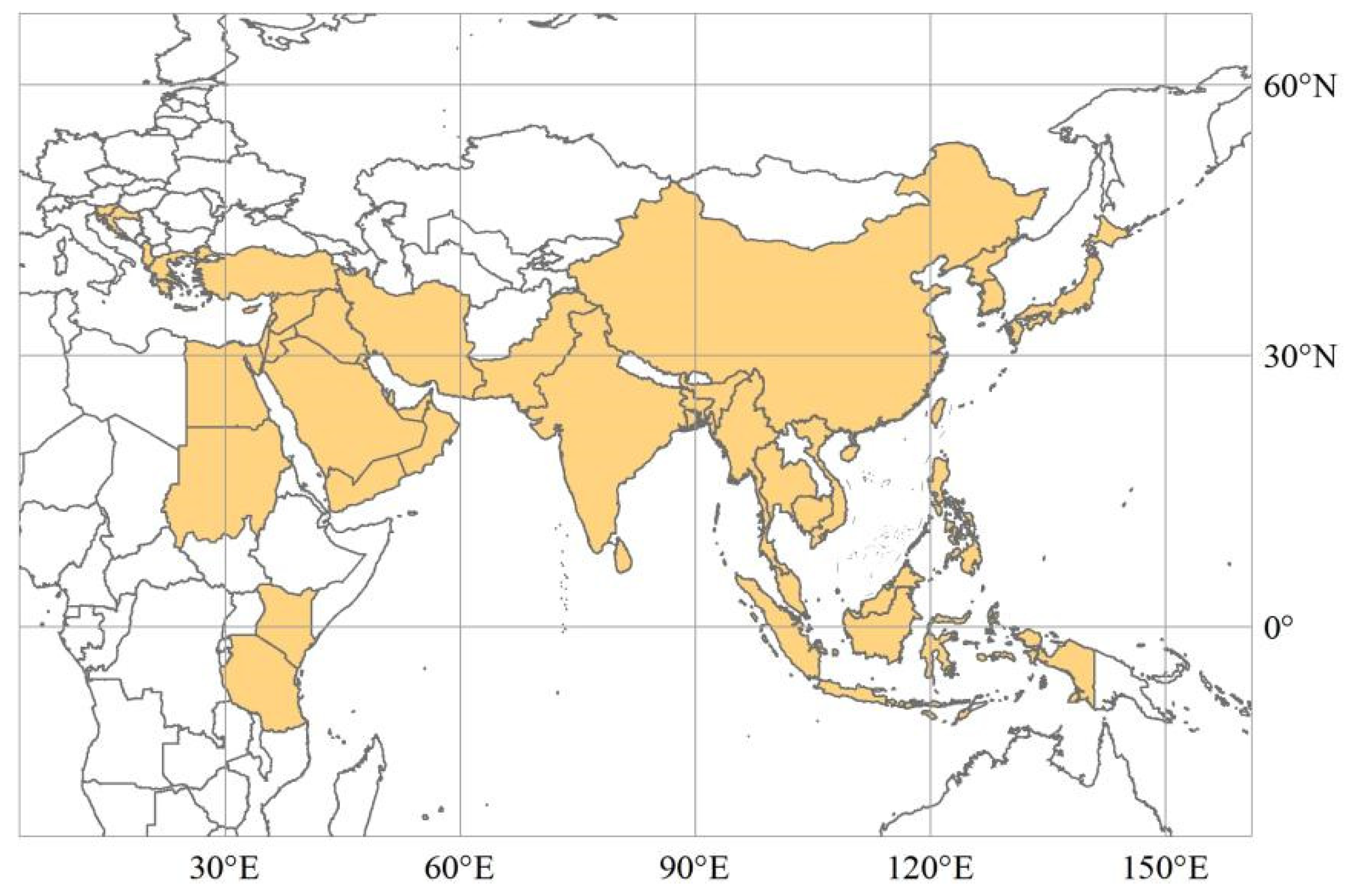

3.3. Research Area and Data Sources

4. Results

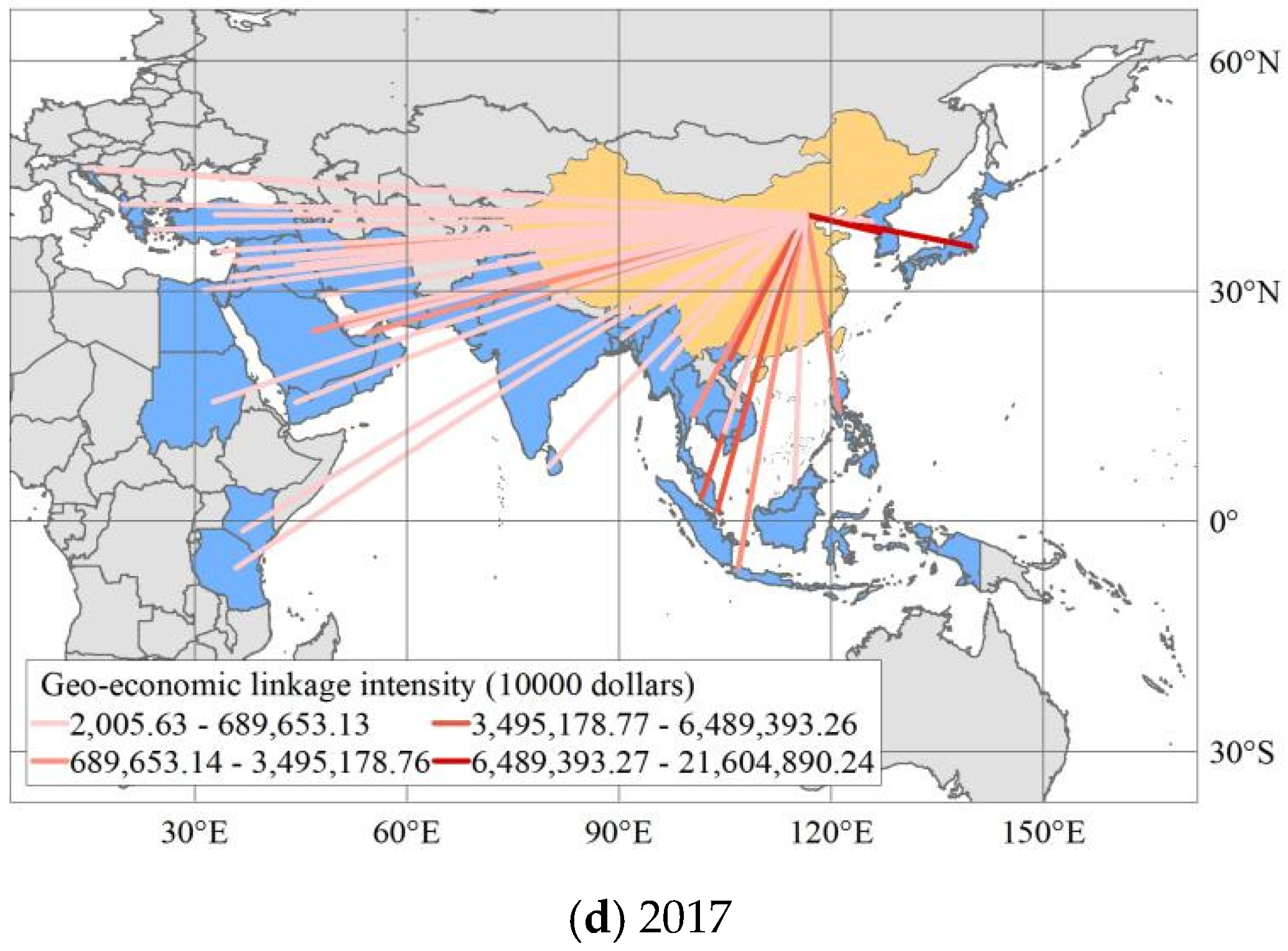

4.1. Analysis of Geo-Economic Linkage Intensity between China and MSRCs

4.1.1. The Unbalanced Development of Investment and Trade between China and MSRCs Hinders the Enhancement of the Intensity of Bilateral Geo-Economic Linkages

4.1.2. The “Matthew Effect” of China’s Geo-Economic Linkage with MSRCs Is Significant

4.2. Analysis of Geo-Economic Relation Types between China and the MSRCs

4.2.1. Index System of Geo-Economic Relation Types

4.2.2. Measurement of Geo-Economic Relation Types

4.2.3. Classification of Geo-Economic Relations between China and the MSRCs

5. Conclusions and Policy Implications

- (1)

- China should focus on regional powers along the Maritime Silk Road in bilateral geo-economic cooperation. The importance of MSRCs to China’s geo-economic development is not indiscriminate, and regional powers have a greater say in regional geo-economic affairs. Regional powers such as Japan, South Korea, and India occupy important positions in the regional geo-economic development; and Singapore, Pakistan, Egypt, and other countries are the hubs of the shipping channels of the Maritime Silk Road, which are of great significance to China’s construction of the 21st-Century Maritime Silk Road. Therefore, China should be guided by regional powers in its bilateral geo-economic cooperation with MSRCs, maximize the advantage of its economic scale, and continue to promote the steady growth of trade and investment between itself and the regional powers along the Maritime Silk Road. At the same time, China should improve the geo-economic cooperation mechanisms and strengthen political and economic cooperation with countries along the Maritime Silk Road as transportation hubs.

- (2)

- Strengthening geopolitical cooperation with MSRCs. The importance of geo-economic relation type indices indicates that geopolitics indices have a strong effect on geo-economic relations. Although the construction of the 21st-Century Maritime Silk Road has been actively supported by many countries, regional powers such as Japan, India, and Turkey have not signed an inter-governmental document on jointly building the Belt and Road with China, and suspicion and vigilance about the construction of China’s Maritime Silk Road still continue. Therefore, China should strengthen geopolitical exchanges with MSRC, reduce or eliminate geopolitical suspicions, and strengthen geopolitical cooperation.

- (3)

- Formulating cooperation plans according to the types of geo-economic relations. Due to the differences in geo-economic elements, there are different types of geo-economic relations between China and MSRC, and the cooperation demands of different geo-economic relation types are different. In deepening geo-economic cooperation with MSRC, China should formulate cooperation plans according to geo-economic relation types, take into account the characteristics of the geo-economic development of the cooperative countries, improve the degree of compatibility of geo-economic cooperation between the two sides, and promote potential geo-economic cooperation in practice.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dicken, P. Global Shift: Mapping the changing Contours of the World Economy; The Guilford Press: New York, NY, USA, 2015. [Google Scholar]

- Xinhuanet. Xiplomacy: Xi Promotes High-Quality Mutual-Beneficial BRI Cooperation. Available online: http://www.xinhuanet.com/english/2021-06/18/c_1310015591.htm (accessed on 18 June 2021).

- Liu, W.D.; Dunford, M.; Gao, B.Y. A discursive construction of the Belt and Road Initiative: From neo-liberal to inclusive globalization. J. Geogr. Sci. 2018, 36, 1321–1331. [Google Scholar] [CrossRef]

- Zhang, L.G.; Luo, M.F.; Yang, D.; Li, K. Impacts of trade liberalization on Chinese economy with Belt and Road initiative. Marit. Policy Manag. 2018, 45, 301–318. [Google Scholar] [CrossRef]

- Yu, K.H. Energy cooperation in the Belt and Road Initiative: EU experience of the trans-European networks for energy. Asia Eur. J. 2018, 16, 251–265. [Google Scholar] [CrossRef]

- Blanchard, J.M.F.; Flint, C. The geopolitics of China’s Maritime Silk Road Initiative. Geopolitics 2017, 22, 223–245. [Google Scholar] [CrossRef]

- Jacob, J.T. China’s Belt and Road Initiative: Perspectives from India. China World Econ. 2017, 25, 78–100. [Google Scholar] [CrossRef]

- Luttwak, E. From geopolitics to geo-economics: Logic of conflict, grammar of commerce. Natl. Interest 1990, 20, 17–23. [Google Scholar]

- Blackwill, R.D.; Harris, J.M. War by Other Means: Geoeconomics and Statecraft; Harvard University Press: Cambridge, MA, USA, 2017. [Google Scholar]

- Vihma, A. Geoeconomics defined and redefined. Geopolitics 2017, 23, 47–49. [Google Scholar] [CrossRef]

- Hudson, V.M.; Ford, R.E.; Pack, D.; Giordano, E.R. Why the third world matters, why Europe probably won’t: The geoeconomics of circumscribed engagement. J. Strateg. Stud. 1991, 14, 255–298. [Google Scholar] [CrossRef]

- Baru, S. Geo-economics and strategy. Survival 2012, 54, 47–58. [Google Scholar] [CrossRef]

- Pedersen, T. Cooperative hegemony: Power, ideas and institutions in regional integration. Rev. Int. Stud. 2002, 28, 677–696. [Google Scholar] [CrossRef]

- Anderson, J. German Unification and the Union of Europe: The Domestic Politics of Integration Policy; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Keohane, R.O.; Nye, J.S. Power and Interdependence: World Politics in Transition; Little, Brown and Company: New York, NY, USA, 1977. [Google Scholar]

- Krugman, P. Increasing returns, monopolistic competition and international trade. J. Int. Econ. 1979, 9, 469–479. [Google Scholar] [CrossRef]

- Scholvina, S.; Wigellb, M. Power politics by economic means: Geoeconomics as an analytical approach and foreign policy practice. Comp. Strateg. 2018, 37, 73–84. [Google Scholar] [CrossRef]

- Castells, M. The Rise of the Network Society, the Information Age: Economy, Society and Culture; Wiley-Blackwell: Hoboken, NJ, USA, 1996. [Google Scholar]

- Hu, W.; Ge, Y.J.; Dang, Q.; Huang, Y.; Hu, Y.; Ye, S.; Wang, S. Analysis of the development level of geo-economic relations between China and countries along the Belt and Road. Sustainability 2020, 12, 816. [Google Scholar] [CrossRef]

- Wang, Z. The impact of China’s WTO accession on trade and economic relations across the Taiwan Strait. Econ. Transit. 2001, 9, 743–785. [Google Scholar] [CrossRef]

- Udeala, S.O. Nigeria-China economic relations under the South-South cooperation. Afr. J. Int. Aff. 2010, 13, 61–88. [Google Scholar]

- Wong, J.; Chan, S. China-Asean free trade agreement: Shaping future economic relations. Asian Surv. 2003, 43, 507–526. [Google Scholar] [CrossRef]

- Yoon, S.H.; Lee, S.O. From old comrades to new partnerships: Dynamic development of economic relations between China and North Korea. Geogr. J. 2013, 179, 19–31. [Google Scholar] [CrossRef]

- Mendez, A.; Alden, C. China in Panama: From peripheral diplomacy to grand strategy. Geopolitics 2021, 26, 838–860. [Google Scholar] [CrossRef]

- Tabata, S. The booming Russo-Japanese economic relations. Eurasian Geogr. Econ. 2012, 53, 422–441. [Google Scholar] [CrossRef]

- Chandra, P.; Long, C. Anti-dumping duties and their impact on exporters: Firm level evidence from China. World Dev. 2013, 51, 169–186. [Google Scholar] [CrossRef]

- Chow, D.C.K. China’s response to the global financial crisis: Implications for U.S.-China economic relations. Glob. Bus. Law Rev. 2010, 47, 47–81. [Google Scholar]

- Carter, D.B.; Goemans, H.E. International trade and coordination: Tracing border effects. World Politics 2018, 70, 1–52. [Google Scholar] [CrossRef]

- Maoz, Z. Networks of Nations: The Evolution, Structure, and Impact of International Networks, 1816–2001; Cambridge University Press: New York, NY, USA, 2011. [Google Scholar]

- Strüver, G. China’s partnership diplomacy: International alignment based on interests or ideology. Chin. J. Int. Politics 2017, 10, 31–65. [Google Scholar] [CrossRef]

- Pang, X.; Liu, L.C.; Xu, Y.Q. A Bayesian alternative to synthetic control for comparative case studies. Political Anal. 2021, 30, 269–288. [Google Scholar] [CrossRef]

- Getmansky, A.; Grossman, G.; Wright, A.L. Border walls and smuggling spillovers. Q. J. Political Sci. 2019, 14, 329–347. [Google Scholar] [CrossRef]

- Chen, N. Intra-national versus international trade in the European Union: Why do national borders matter? J. Int. Econ. 2004, 63, 93–118. [Google Scholar] [CrossRef]

- Antoniades, A. The new resilience of emerging and developing countries: Systemic interlocking, currency swaps and geoeconomics. Glob. Policy 2015, 8, 170–180. [Google Scholar] [CrossRef][Green Version]

- Kurecic, P. Geoeconomic and geopolitical conflicts: Outcomes of the geopolitical economy in a contemporary world. World Rev. Political Econ. 2015, 6, 522–543. [Google Scholar]

- Masoudi, S.M.; Ezzati, E.; Rashidnejad-Omran, N.; Moradzadehc, A. Geoeconomics of fluorspar as strategic and critical mineral in Iran. Resour. Policy 2017, 52, 100–106. [Google Scholar] [CrossRef]

- Finley-Brook, M. Geoeconomic assumptions, insecurity, and ’free’ trade in central America. Geopolitics 2012, 17, 629–657. [Google Scholar] [CrossRef]

- Chandra, P. Impact of temporary trade barriers: Evidence from China. China Econ. Rev. 2016, 38, 24–48. [Google Scholar] [CrossRef]

- Huotari, M.; Heep, S. Learning geoeconomics: China’s experimental financial and monetary initiatives. Asia Eur. J. 2016, 14, 153–171. [Google Scholar] [CrossRef]

- Drezner, D.W. State structure, technological leadership and the maintenance of hegemony. Rev. Int. Stud. 2001, 27, 3–25. [Google Scholar] [CrossRef]

- Khan, Y.; Bin, Q.; Hassan, T. The impact of climate changes on agriculture export trade in Pakistan: Evidence from time-series analysis. Growth Chang. 2019, 50, 1568–1589. [Google Scholar] [CrossRef]

- Beeson, M. Geoeconomics with Chinese characteristics: The BRI and China’s evolving grand strategy. Econ. Political Stud. 2018, 6, 240–256. [Google Scholar] [CrossRef]

- Lim, K.F. On China’s growing geo-economic influence and the evolution of variegated capitalism. Geoforum 2010, 41, 677–688. [Google Scholar] [CrossRef]

- O’Callaghan, B.A.; Nicolas, F. Complementarity and rivalry in EU-China economic relations in the twenty-first century. Eur. Foreign Aff. Rev. 2007, 2, 13–38. [Google Scholar] [CrossRef]

- Zhu, Z.H.; Wang, L.; Liu, W.B. Relationship between urban economic connections and geoeconomic relations in Northeast China. Complexity 2020, 2020, 1–12. [Google Scholar] [CrossRef]

- He, S.B.; Yao, H.L.; Ji, Z. Direct and indirect effects of business environment on BRI countries’ global value chain upgrading. Int. J. Environ. Res. Public Health 2021, 18, 12492. [Google Scholar] [CrossRef] [PubMed]

- Pardo, R.P. Europe’s financial security and Chinese economic statecraft: The case of the Belt and Road Initiative. Asia. Eur. J. 2018, 16, 237–250. [Google Scholar] [CrossRef]

- Liu, H.; Wang, Y.; Jiang, J.; Wu, P. How green is the ’Belt and Road Initiative?’–Evidence from Chinese OFDI in the energy sector. Energy Policy 2020, 145, 111709. [Google Scholar] [CrossRef]

- Hu, Z.H. Data-driven analytics for China’s overseas construction projects in the contexts of the Maritime Silk Road and global maritime network. Complexity 2020, 2020, 8129172. [Google Scholar] [CrossRef]

- Egger, P. An econometric view on the estimation of gravity models and the calculation of trade potentials. World Econ. 2002, 25, 297–312. [Google Scholar] [CrossRef]

- Taylor, P.J.; Derudder, B. World City Network: A Global Urban Analysis; Routledge: London, UK, 2015. [Google Scholar]

- Breiman, L. Random Forest. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Iverson, L.R.; Prasad, A.M.; Matthews, S.N.; Peters, M. Estimating potential habitat for 134 eastern US tree species under six climate scenarios. For. Ecol. Manag. 2008, 254, 390–406. [Google Scholar] [CrossRef]

- Yang, W.L.; Du, D.B.; Liu, C.L.; Ma, Y.H. Study on the spatial-temporal evolution and internal mechanism of geo-economic connections of China. Acta Geogr. Sin. 2016, 71, 956–969. [Google Scholar]

- Wigell, M. Conceptualizing regional powers’ geoeconomic strategies: Neo-imperialism, neo-mercantilism, hegemony, and liberal institutionalism. Asia Eur. J. 2016, 14, 135–151. [Google Scholar] [CrossRef]

- Wang, F.; Wu, M. The Impacts of COVID-19 on China’s economy and energy in the context of trade protectionism. Int. J. Environ. Res. Public Health 2021, 18, 12768. [Google Scholar] [CrossRef]

- Huang, Y.; Ge, Y.J.; Liu, X.F. Calculation of the geoeconomic relationships between China, the USA and Japan based on Coulomb force model. Acta Geogr. Sin. 2019, 74, 285–296. [Google Scholar]

| Regional | Countries |

|---|---|

| three East Asian countries | Japan, South Korea, North Korea |

| nine Southeast Asia countries | Indonesia, Thailand, Malaysia, Vietnam, Singapore, Philippines, Myanmar, Cambodia, Brunei |

| four South Asian countries | India, Bangladesh, Pakistan, Sri Lanka |

| fourteen West Asia countries | Saudi Arabia, United Arab Emirates, Oman, Iran, Turkey, Israel, Kuwait, Iraq, Qatar, Jordan, Lebanon, Bahrain, Yemen, Syria |

| five Balkans countries | Greece, Slovenia, Croatia, Albania, Cyprus |

| four African countries | Egypt, Kenya, Tanzania, Sudan |

| Country | 2006 | 2008 | 2010 | 2012 | 2014 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|

| Japan | 121,513.73 | 171,436.02 | 194,132.62 | 184,474.52 | 208,243.62 | 201,161.28 | 216,048.90 |

| Proportion of Japan | 42.96% | 39.52% | 37.29% | 29.78% | 27.49% | 27.33% | 25.91% |

| South Korea | 66,582.57 | 100,299.76 | 120,787.34 | 146,936.85 | 200,639.03 | 183,689.56 | 209,850.48 |

| Proportion of South Korea | 23.54% | 23.12% | 23.20% | 23.72% | 26.49% | 24.96% | 25.17% |

| Malaysia | 15,640.65 | 24,219.31 | 32,595.01 | 48,803.47 | 74,553.03 | 62,286.53 | 59,824.88 |

| Proportion of Malaysia | 5.53% | 5.58% | 6.26% | 7.88% | 9.84% | 8.46% | 7.17% |

| Singapore | 18,594.64 | 27,143.75 | 31,435.97 | 38,490.34 | 45,284.99 | 45,990.28 | 52,755.06 |

| Proportion of Singapore | 6.57% | 6.26% | 6.04% | 6.21% | 5.98% | 6.25% | 6.33% |

| India | 9264.93 | 20,653.39 | 24,371.74 | 25,780.00 | 25,683.86 | 19,007.20 | 29,906.09 |

| Proportion of India | 3.28% | 4.76% | 4.68% | 4.16% | 3.39% | 2.58% | 3.59% |

| Saudi Arabia | 6795.62 | 14,772.61 | 15,010.70 | 27,422.44 | 26,419.75 | 20,672.96 | 23,199.67 |

| Proportion of Saudi Arabia | 2.40% | 3.41% | 2.88% | 4.43% | 3.49% | 2.81% | 2.78% |

| Egypt | 635.56 | 1228.17 | 1852.24 | 2778.66 | 2961.26 | 2416.36 | 3111.35 |

| Proportion of Egypt | 0.22% | 0.28% | 0.36% | 0.45% | 0.39% | 0.33% | 0.37% |

| Dominant fFactors | Index | Unit | Variable Name |

|---|---|---|---|

| Distance | Distance between capitals Common boundary (yes/no) Shipping time (days) | Km / Day | X1 X2 X3 |

| Geopolitics | Conflict goldenstein factor Cooperative goldenstein factor Geo-economic cooperation documents | / / / | X4 X5 X6 |

| Market | GDP GDP per capita Population | $ $/ | X7 X8 X9 |

| Resource | Fuel exports as a percentage of merchandise exports Total rent of natural resources as a percentage of GDP Ore and metal exports as a percentage of merchandise exports Value of oil and gas exported to China | % % % $ | X10 X11 X12 X13 |

| Country | R2 | MSE | MAE | EVS |

|---|---|---|---|---|

| Japan | 1 | 0.00000000126033000 | 0.010369 | 1 |

| North Korea | 1 | 0.00000000000002964 | 0.000038 | 1 |

| South Korea | 1 | 0.00000000071889800 | 0.007218 | 1 |

| Indonesia | 1 | 0.00000000001375170 | 0.000949 | 1 |

| Thailand | 1 | 0.00000000001528910 | 0.000982 | 1 |

| Malaysia | 1 | 0.00000000005340960 | 0.002030 | 1 |

| Vietnam | 1 | 0.00000000002046850 | 0.000114 | 1 |

| Singapore | 1 | 0.00000000003645810 | 0.000169 | 1 |

| Philippines | 1 | 0.00000000000366551 | 0.000045 | 1 |

| Myanmar | 1 | 0.00000000000025831 | 0.000111 | 1 |

| Cambodia | 1 | 0.00000000000001940 | 0.000030 | 1 |

| Brunei | 1 | 0.00000000000000191 | 0.000012 | 1 |

| Saudi Arabia | 1 | 0.00000000001467870 | 0.000099 | 1 |

| United Arab Emirates | 1 | 0.00000000000782794 | 0.000667 | 1 |

| Oman | 1 | 0.00000000000059885 | 0.000199 | 1 |

| Iran | 1 | 0.00000000000457951 | 0.000568 | 1 |

| Turkey | 1 | 0.00000000000114745 | 0.000272 | 1 |

| Israel | 1 | 0.00000000000044109 | 0.000175 | 1 |

| Kuwait | 1 | 0.00000000000023910 | 0.000132 | 1 |

| Iraq | 1 | 0.00000000000054151 | 0.000187 | 1 |

| Qatar | 1 | 0.00000000000009229 | 0.000008 | 1 |

| Jordan | 1 | 0.00000000000001364 | 0.000029 | 1 |

| Lebanon | 1 | 0.00000000000001485 | 0.000031 | 1 |

| Bahrain | 1 | 0.00000000000000068 | 0.000007 | 1 |

| Yemen | 1 | 0.00000000000002779 | 0.000045 | 1 |

| Syria | 1 | 0.00000000000000332 | 0.000015 | 1 |

| India | 1 | 0.00000000001486080 | 0.001102 | 1 |

| Pakistan | 1 | 0.00000000000070024 | 0.000228 | 1 |

| Bangladesh | 1 | 0.00000000000049083 | 0.000159 | 1 |

| Sri Lanka | 1 | 0.00000000000010705 | 0.000082 | 1 |

| Slovenia | 1 | 0.00000000000000080 | 0.000023 | 1 |

| Croatia | 1 | 0.00000000000000330 | 0.000017 | 1 |

| Albania | 1 | 0.00000000000000003 | 0.000004 | 1 |

| Cyprus | 1 | 0.00000000000000219 | 0.000013 | 1 |

| Greece | 1 | 0.00000000000006996 | 0.000075 | 1 |

| Egypt | 1 | 0.00000000000031988 | 0.000147 | 1 |

| Kenya | 1 | 0.00000000000000610 | 0.000006 | 1 |

| Tanzania | 1 | 0.00000000000001063 | 0.000003 | 1 |

| Sudan | 1 | 0.00000000000001721 | 0.000035 | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, W.; Ge, Y.; Hu, Z.; Ye, S.; Yang, F.; Jiang, H.; Hou, K.; Deng, Y. Geo-Economic Linkages between China and the Countries along the 21st-Century Maritime Silk Road and Their Types. Int. J. Environ. Res. Public Health 2022, 19, 12946. https://doi.org/10.3390/ijerph191912946

Hu W, Ge Y, Hu Z, Ye S, Yang F, Jiang H, Hou K, Deng Y. Geo-Economic Linkages between China and the Countries along the 21st-Century Maritime Silk Road and Their Types. International Journal of Environmental Research and Public Health. 2022; 19(19):12946. https://doi.org/10.3390/ijerph191912946

Chicago/Turabian StyleHu, Wei, Yuejing Ge, Zhiding Hu, Shuai Ye, Feng Yang, Haining Jiang, Kun Hou, and Yun Deng. 2022. "Geo-Economic Linkages between China and the Countries along the 21st-Century Maritime Silk Road and Their Types" International Journal of Environmental Research and Public Health 19, no. 19: 12946. https://doi.org/10.3390/ijerph191912946

APA StyleHu, W., Ge, Y., Hu, Z., Ye, S., Yang, F., Jiang, H., Hou, K., & Deng, Y. (2022). Geo-Economic Linkages between China and the Countries along the 21st-Century Maritime Silk Road and Their Types. International Journal of Environmental Research and Public Health, 19(19), 12946. https://doi.org/10.3390/ijerph191912946