4.1. ARMAX Model Identification and Estimation

Before identifying the structure of the ARMAX model, it was necessary to select appropriate exogenous variables. Although we had preliminarily identified two non-core exogenous variables, they were not necessarily conducive to model estimation. Here, we inspected the multicollinearity and stationarity to filter variables.

Severe multicollinearity can impair the performance of the model. We calculated the variance inflation factor (VIF) values of independent variables, which were 1.31 (CRI), 4.31 (CPI) and 1.06 (SR), respectively. Since the VIF values of all variables were less than 5, the multicollinearity problem could be rejected.

The ARMAX model was only suitable for stationary time series, so the unit root test was needed before properly identifying the ARMAX model. We conducted four different unit root tests, namely the augmented Dickey-Fuller (ADF), the Dickey-Fuller GLS (DF-GLS), the Phillips-Perron (PP) and the Kwiatkowski-Phillips-Schmidt-Shin (KPSS). The results of the unit root tests are reported in

Table 2. According to

Table 2, the variables

lnURS,

CRI,

CPI and

SR were stationary in at least one case with or without trend. Therefore, the next steps could be conducted.

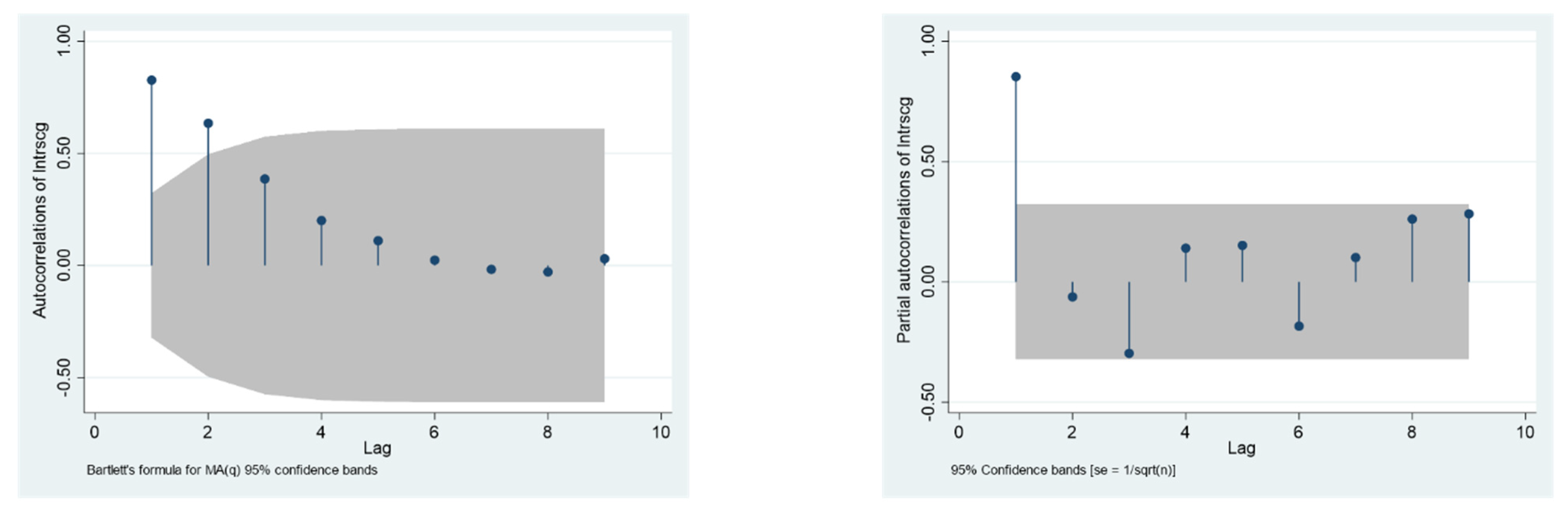

The second step was to determine the model structure, that is, to determine the orders

p and

q in the ARMA (

p,

q). According to the Box–Jenkins’ method [

47], one could calculate the series autocorrelation coefficient (AC) and partial autocorrelation coefficient (PAC) to determine the orders

p and

q of the ARMA models. A pure MA (

q) process exhibits a cut-off in its AC function (ACF) for lags greater than

q, and its PAC function (PACF) tails off to zero. On the other hand, the ACF of pure AR (

p) tails off to zero, and its PACF exhibits a cut-off for lags greater than

p. Besides, both the ACF and PACF of ARMA (

p,

q) tail off to zero.

Figure 1 shows the ACF and PACF diagram of the dependent variable

LnURS.

As can be seen from

Figure 1, the ACF evidently tailed off to zero, and the PACF evidently presented a cut-off, which is completely in accordance with the condition of AR (

p). Since the PAC in the first-order lag was significantly not 0 at the level of 5%,

p was determined to be 1. The lag order of independents was determined by the significance of regression coefficients.

The next step was to determine the lag order of independents. Here we directly estimated the ARMAX model. The lag orders of independent variables and their coefficients were simultaneously determined according to the significance of regression coefficients. We used the stepwise elimination method of multiple linear regression to find the optimal ARMAX model. For parameter estimation techniques, referring to Li, Su and Shu [

40], we used maximum-likelihood estimates. First, all independent variables and their

k-order lag terms were included in the model.

k is the maximum lag order of the independent variables that must be determined initially. Based on the lag order of the autoregression term of the dependent variable (that is, 1), we appropriately expanded the search range of the lag order of the independent variables, and thus we set all independent variables’

k to 3. Then, the term with the largest

p-value in the t-test of coefficients was gradually eliminated. Finally, the optimal model could be obtained until the coefficients of all terms are significant at the level of 5%.

Table 3 reports the regression process and results of the ARMAX model estimate.

The coefficients of the third-order lag terms of

CRI (denoted as

CRIt−3) were always significant in models (1)–(10), whereas the coefficients of

CPIt−3 and AR(1) were gradually significant. All models performed well in terms of quality of fit, which were in the range of 0.86–0.90. In addition, we calculated the information value of the model and found that the AIC and BIC of the model (10) were the lowest. So far, model (10) seemed to be the best ARMAX model. Finally, to evaluate if the residual series was white noise, the Ljung-Box Q test was performed on the residual of the model (10). The Ljung-Box test P-value was 0.1054 and higher than 0.05, which did not show any autocorrelation in the residual of the model. Therefore, we could confidently determine that model (10) was the optimal ARMAX model. Accordingly, the relationship between climate change risks and residential consumption could be obtained as follows:

4.2. Analysis on the Impact of Climate Risk on Residential Consumption

In the final determined model, the lag orders of the independent variables

CRI and

CPI were determined as 3. Another independent variable

SR was removed because the coefficients of all its lag terms were not significant. This also showed that stock market volatility had no significant impact on household consumption, possibly for the reason, as pointed out by Xue [

46], that the overall scale of China’s stock market is still very small, the proportion of stock assets in residential wealth is low, and the continuous fluctuation trend of stock market value is unstable, which affects market expectations. Therefore, the return ratio of the stock market iwas not enough to affect residential consumption.

Although the lag order of CPI was 3 in the final model, the lag order of CPI was not absolute. For example, in model (8), the coefficient of the one-order lag term of CPI was significant at 5% level. In fact, by replacing CPIt−3 in model (10) with CPIt−1, a robust estimation could also be obtained. However, the significance of CPIt−1 changes with the removal of some variables in the model. Therefore, it can be concluded that the price level of consumer goods can promote residential consumption, but the promotion effect will suffer interference from other factors.

The impact of climate change risks on residential consumption is significantly positive but has apparent hysteresis. The lag period is three months, which can also be intuitively seen in

Figure 2. The reason may have two aspects. First, many residential consumption activities that are sensitive to climate change risks, such as home decoration and travel, are severely restricted and accumulated when the climate risk is high. Once the climate risk is mitigated, the demand for consumption is gradually released. On the other side, climate events will also cause great damage to agricultural production, resulting in the decline of agricultural products (especially fresh food) output and the rise of agricultural products’ prices, which will increase residential expenditure on agricultural products’ consumption during the climate events. After the mitigation of climate risk, the residential expenditure on agricultural products will decrease with the fall of prices and the recovery of production. This means that there is no time lag in the residential consumption of agricultural products. However, the residential expenditure on agricultural products is far less than those restricted consumption activities. Therefore, in general, the impact of residential consumption by climate risk is positive and lagging behind.

In addition, although we have confirmed a statistically significant positive effect on residential consumption, the effect is very small. The coefficient of CRIt−3 is 0.0129, which indicates that every one unit increase in the climate change risks index will increase residential consumption by 1.2984% after three months.

4.3. Heterogeneous Effects of Different Climate Risk Types

There are big differences between subdivided climate risks. From

Figure 2, the main climate risks in China are waterlogging by rain and high temperature, which will reach a high-risk level every summer. The next is typhoon. However, the typhoon risk is highly uncertain. For example, the highest typhoon risk index in 2018 reached 10, but in 2017 it was only 2.65. It is followed by drought. The drought risk index in the sample period reached 5.85 only in September 2016, and in other months they were all lower than three. The last is cryogenic freezing, which mainly occurs in parts of the northeast and northwest, and the overall risk is relatively low.

Different types of climate risks may have different impacts on residential consumption. Using the form of the ARMAX model determined by basic regression, we replaced the core independent variable

CRIt−3 with subdivided climate risks indices and performed the regression analysis again.

Table 4 reports the regression result of the different impacts of different types of climate risks on residential consumption.

It can be seen from

Table 4 that the coefficients of

WRIt−3,

DIt−3 and

HIt−3 are significantly positive at 1% level, whereas the coefficients of

DIt−3 and

TIt−3 are not statistically significant. This result is essentially consistent with the duration and coverage of various types of climate change risks. Typhoons occur only along with the coastal provinces and usually last a short time, and thus have no obvious effect on national residential consumption. Cryogenic freezing lasted for a long time in northeast and northwest China, but is limited to partial regions, which often belong to low consumption areas. Therefore, the impact of cryogenic freezing on national residential consumption is also not significant. In summer, high-temperature weather generally occurs in most of China, waterlogging by rain is widely distributed in the south of China, and drought often occurs in the north. These three climate types tend to last for several months, so their impact on national residential consumption is significant.

4.4. Granger Causality Test of Climate Change Risks on Residential Consumption

Table 3 shows that

SR had no significant impact on residential consumption. Therefore, the Granger causality test in this section only considered the interaction between

lnURS,

CRI and

CPI. At the same time, the ARMAX model as finally identified only contained the AR term, which is internally consistent with the Granger causality test based on the VAR model.

The unit root test in

Table 2 shows that the integration orders of

lnURS,

CRI and

CPI are 0; thus we determined the maximal order of integration to be 0 (

d = 0). Next, we determined the optimal lag length. We used five different criteria to determine the lag length, namely the likelihood ratio (LR) test, Akaike information criterion (AIC), Hannan–Quinn information criterion (HQIC) and Structural Bayesian information criterion (SBIC). The lag length selection results were reported in

Table 5. LR and AIC suggested the optimum lag length of 4, although FPE, HQIC and SBIC pointed out the optimum lag length of 3. Here, we chose the latter (

p = 3). Therefore, we estimated the augmented VAR (3) (

p +

d = 3) and conducted a series of diagnostic tests.

Firstly, the Wald test was carried out on the joint significance of the coefficients of each order of the three equations and all equations in the VAR (3) system. The results are shown in

Table 6. Although some order coefficients of a single equation were not significant, the coefficients of each order for the whole VAR (3) system were highly significant. Further,

Table 7 shows that the values of the adjusted R

2 were rather high, and thus the explanatory power of all equations was robust. The Jarque-Bera test results showed that the residuals of all equations obeyed normal distribution. The Lagrange-Multiplier (LM) test results showed that the residual is white noise, and there was no autoregressive conditional heteroscedasticity. In addition,

Figure 3 showed that all eigenvalues are within the unit circle, indicating that the VAR (3) system was stable.

These diagnostic test results showed the accuracy of the VAR (3) system. We proceeded with the Granger causality test, and the results are shown in

Table 8. We found the existence of unidirectional Granger-causality running from

CRI to

lnURS and bidirectional Granger-causality between

CPI and

lnURS. This was consistent with our expectations. The climate change risks had indeed become a cause of changes in residential consumption. This result strengthened the credibility of the impact of climate change risks on residential consumption based on the ARMAX model.