Special Economic Zone, Carbon Emissions and the Mechanism Role of Green Technology Vertical Spillover: Evidence from Chinese Cities

Abstract

:1. Introduction

2. Literature Review

3. Policy Background and Hypotheses

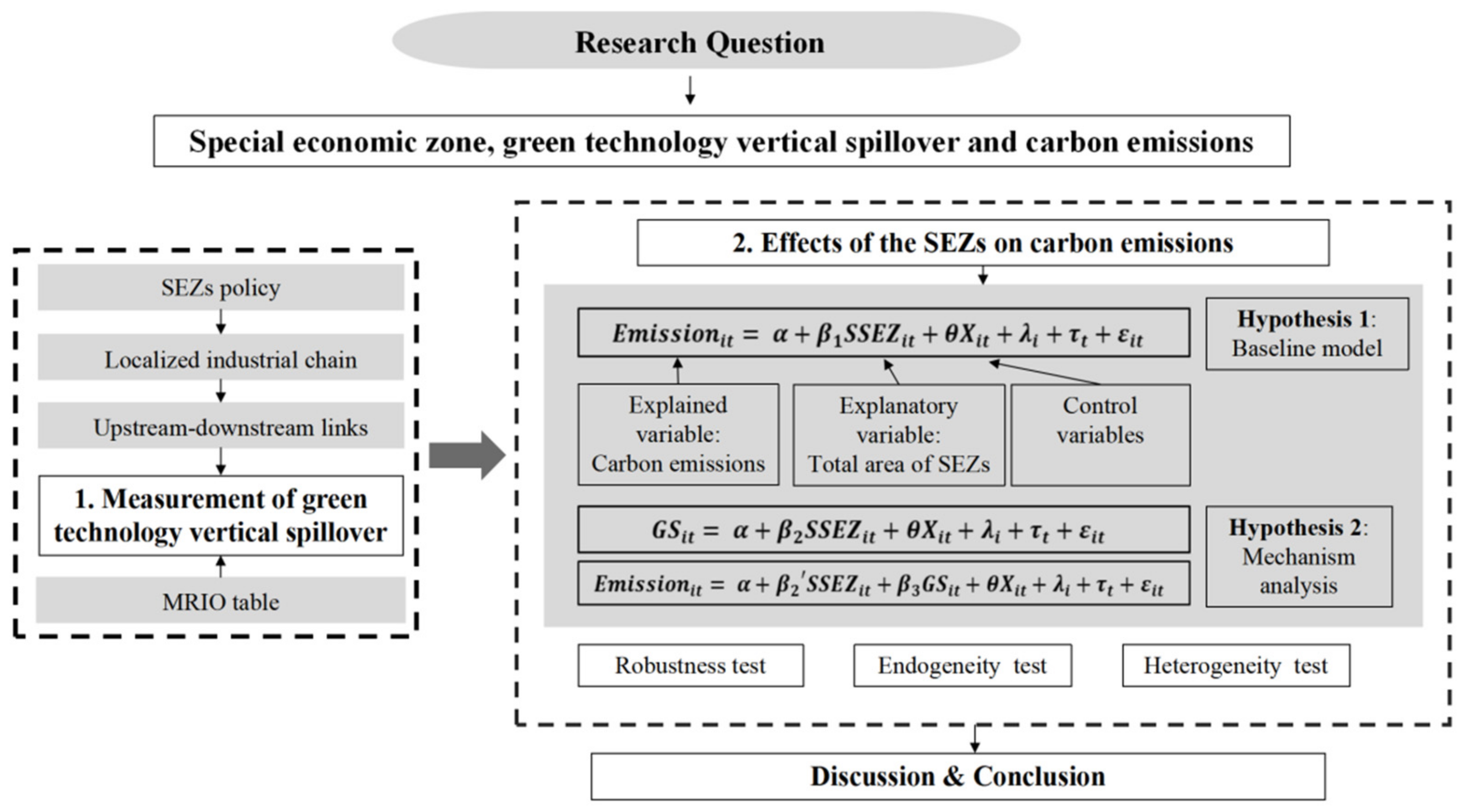

4. Research Design

4.1. Econometric Model

4.2. Variable Construction

- (1)

- Explained variable

- (2)

- Explanatory variable

- (3)

- Mechanism variable: green technology vertical spillover

- (4)

- Control variables

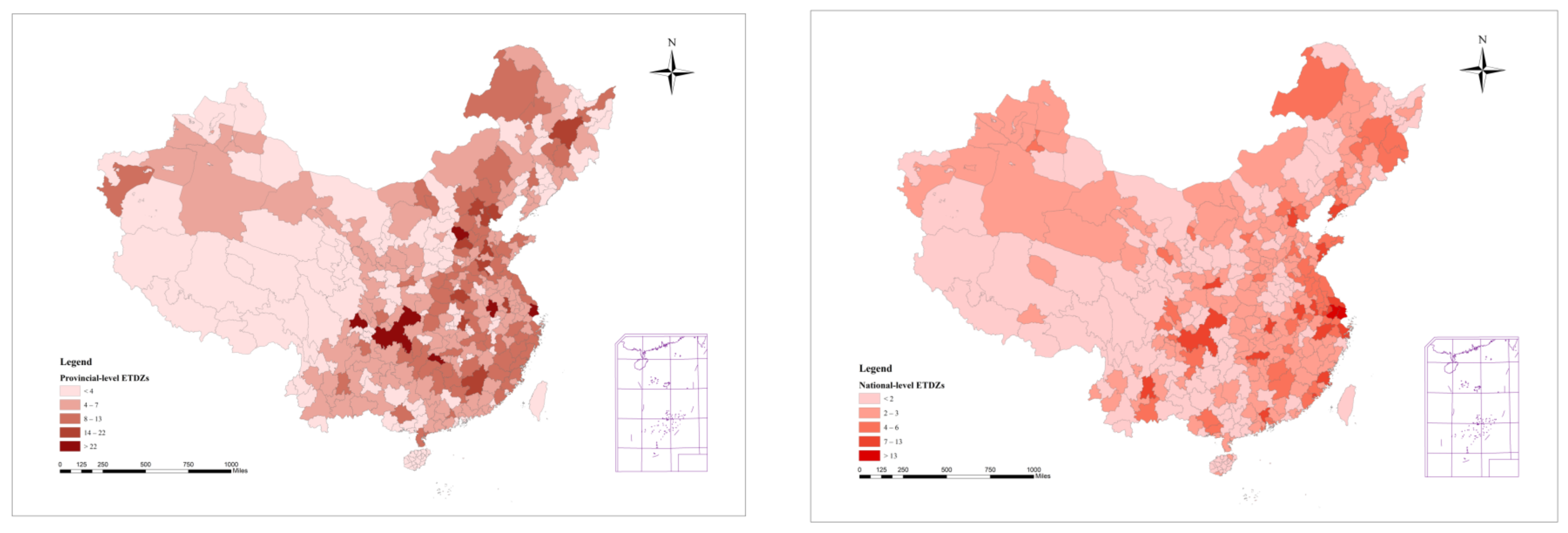

4.3. Data Description

5. Empirical Results and Analysis

5.1. Baseline Model

5.2. Mechanism Examination

5.3. Robustness Check

5.4. Endogenous Issues

5.5. Heterogeneity Analysis

5.5.1. Heterogeneity Analysis by Industry Structure

5.5.2. Heterogeneity Analysis by Green Technology Stock

5.5.3. Heterogeneity Analysis by Administration Hierarchy of SEZs

6. Discussions

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- World Bank. World Development Report 2020: Trading for Development in the Age of Global Value Chains; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Zeng, D.Z. The Dos and Don’ts of Special Economic Zones. 2021. Available online: https://ssrn.com/abstract=4007621 (accessed on 4 May 2022).

- World Bank. Special Economic Zones: An Operational Review of Their Impacts; The World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Ge, W. Special economic zones and the opening of the Chinese economy: Some lessons for economic liberalization. World Dev. 1999, 27, 1267–1285. [Google Scholar] [CrossRef]

- World Bank. Special Economic Zones: Performance, Lessons Learned and Implications for Zone Development; The Multi-Donor Investment Climate Advisory Service of the World Bank Group: Washington, DC, USA, 2008. [Google Scholar]

- Alder, S.; Shao, L.; Zilibotti, F. Economic reforms and industrial policy in a panel of Chinese cities. J. Econ. Growth 2016, 21, 305–349. [Google Scholar] [CrossRef]

- Wang, J. The economic impact of special economic zones: Evidence from Chinese municipalities. J. Dev. Econ. 2013, 101, 133–147. [Google Scholar] [CrossRef]

- Demurger, S.; D SACHS, J.; Woo, W.T.; Shuming, B.; Chang, G. The relative contributions of location and preferential policies in China’s regional development: Being in the right place and having the right incentives. China Econ. Rev. 2002, 13, 444–465. [Google Scholar] [CrossRef]

- Lu, Y.; Wang, J.; Zhu, L. Place-based policies, creation, and agglomeration economies: Evidence from China’s economic zone program. Am. Econ. J. Econ. Policy 2019, 11, 325–360. [Google Scholar] [CrossRef]

- Mohiuddin, M.; Regnière, M.; Su, A.; Su, Z. The special economic zone as a locomotive for green development in China. Asian Soc. Sci. 2014, 10, 109. [Google Scholar] [CrossRef]

- Yang, M.; Yang, F.; Sun, C. Factor market distortion correction, resource reallocation and potential productivity gains: An empirical study on China’s heavy industry sector. Energy Econ. 2018, 69, 270–279. [Google Scholar] [CrossRef]

- Chen, Y.; Ma, J.; Miao, C.; Ruan, X. Occurrence and environmental impact of industrial agglomeration on regional soil heavy metalloid accumulation: A case study of the Zhengzhou Economic and Technological Development Zone (ZETZ), China. J. Clean. Prod. 2020, 245, 118676. [Google Scholar] [CrossRef]

- Shi, H.; Chertow, M.; Song, Y. Developing country experience with eco-industrial parks: A case study of the Tianjin Economic-Technological Development Area in China. J. Clean. Prod. 2010, 18, 191–199. [Google Scholar] [CrossRef]

- Tian, X.; Bai, F.; Jia, J.; Liu, Y.; Shi, F. Realizing low-carbon development in a developing and industrializing region: Impacts of industrial structure change on CO2 emissions in southwest China. J. Environ. Manag. 2019, 233, 728–738. [Google Scholar] [CrossRef]

- Rachapalli, S. Learning between Buyers and Sellers Along the Global Value Chain; Working Paper; Centre for Economic Performance: London, UK, 2021. [Google Scholar]

- Zeng, S.; Li, G.; Wu, S.; Dong, Z. The impact of green technology innovation on carbon emissions in the context of carbon neutrality in China: Evidence from spatial spillover and nonlinear effect analysis. Int. J. Environ. Res. Public Health 2022, 19, 730. [Google Scholar] [CrossRef]

- Jiao, J.; Chen, C.; Bai, Y. Is green technology vertical spillovers more significant in mitigating carbon intensity? Evidence from Chinese industries. J. Clean. Prod. 2020, 257, 120354. [Google Scholar]

- Pan, X.; Wei, Z.; Han, B.; Shahbaz, M. The heterogeneous impacts of interregional green technology spillover on energy intensity in China. Energy Econ. 2021, 96, 105133. [Google Scholar] [CrossRef]

- Del Brío González, J.; Barba-Sánchez, V. The mediating effect of environmental proactivity on the influence of stakeholder pressure and environmental strategy of wineries in Spain. Int. J. Environ. Res. 2020, 14, 771–783. [Google Scholar] [CrossRef]

- Schminke, A.; Van Biesebroeck, J. Using export market performance to evaluate regional preferential policies in China. Rev. World Econ. 2013, 149, 343–367. [Google Scholar] [CrossRef]

- Verhoef, E.T.; Nijkamp, P. Externalities in urban sustainability: Environmental versus localization-type agglomeration externalities in a general spatial equilibrium model of a single-sector monocentric industrial city. Ecol. Econ. 2002, 40, 157–179. [Google Scholar] [CrossRef]

- Hu, Q.-G.; Zhou, Y.-F. Environmental effects of industrial agglomeration in development zones: Aggravating pollution or promoting governance? China Popul. Resour. Environ. 2020, 30, 64–72. (In Chinese) [Google Scholar]

- Wang, B.; Nie, X. Industrial agglomeration and environmental governance:Boost or resistance—Evidence from a quasi-natural experiment on the establishment of development zones. China Ind. Econ. 2016, 12, 75–89. (In Chinese) [Google Scholar] [CrossRef]

- Grant, R.; Carmody, P.; Murphy, J.T. A green transition in South Africa? Sociotechnical experimentation in the Atlantis Special Economic Zone. J. Mod. Afr. Stud. 2020, 58, 189–211. [Google Scholar]

- Liu, W.; Tian, J.; Chen, L. Greenhouse gas emissions in China’s eco-industrial parks: A case study of the Beijing Economic Technological Development Area. J. Clean. Prod. 2014, 66, 384–391. [Google Scholar] [CrossRef]

- Ślusarczyk, B.; Grondys, K. The Concept of Sustainable Development in the Functioning of Municipalities Belonging to Special Economic Zones in Poland. Sustainability 2018, 10, 2169. [Google Scholar] [CrossRef]

- Yang, X.; Yang, Z.; Jia, Z. Effects of technology spillover on CO2 emissions in China: A threshold analysis. Energy Rep. 2021, 7, 2233–2244. [Google Scholar] [CrossRef]

- Ilkay, S.C.; Yilanci, V.; Ulucak, R.; Jones, K. Technology spillovers and sustainable environment: Evidence from time-series analyses with Fourier extension. J. Environ. Manag. 2021, 294, 113033. [Google Scholar] [CrossRef]

- Reganati, F.; Sica, E. Horizontaland vertical spillovers from FDI: Evidence from panel data for the Italian manufacturing sector. J. Bus. Econ. Manag. 2007, 8, 259–266. [Google Scholar] [CrossRef]

- Smarzynska Javorcik, B. Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am. Econ. Rev. 2004, 94, 605–627. [Google Scholar]

- Blalock, G.; Gertler, P. Technology Diffusion from Foreign Direct Investment through Supply Chain; Work Paper; Haas School of Business, University of California Berkeley: Berkeley, CA, USA, 2002. [Google Scholar]

- Le, H.Q.; Pomfret, R. Technology spillovers from foreign direct investment in Vietnam: Horizontal or vertical spillovers? J. Asia Pac. Econ. 2011, 16, 183–201. [Google Scholar] [CrossRef]

- Du, K.; Li, P.; Yan, Z. Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Chang. 2019, 146, 297–303. [Google Scholar] [CrossRef]

- Zhu, Y.; Wang, Z.; Yang, J.; Zhu, L. Does renewable energy technological innovation control China’s air pollution? A spatial analysis. J. Clean. Prod. 2020, 250, 119515. [Google Scholar]

- Toebelmann, D.; Wendler, T. The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 2020, 244, 118787. [Google Scholar] [CrossRef]

- Hu, J.; Wang, Z.; Huang, Q.; Zhang, X. Environmental regulation intensity, foreign direct investment, and green technology spillover—An empirical study. Sustainability 2019, 11, 2718. [Google Scholar] [CrossRef]

- Ghisetti, C.; Quatraro, F. Green technologies and environmental productivity: A cross-sectoral analysis of direct and indirect effects in Italian regions. Ecol. Econ. 2017, 132, 1–13. [Google Scholar] [CrossRef]

- Costantini, V.; Crespi, F.; Marin, G.; Paglialunga, E. Eco-innovation, sustainable supply chains and environmental performance in European industries. J. Clean. Prod. 2017, 155, 141–154. [Google Scholar] [CrossRef]

- Bi, K.; Huang, P.; Ye, H. Risk identification, evaluation and response of low-carbon technological innovation under the global value chain: A case of the Chinese manufacturing industry. Technol. Forecast. Soc. Chang. 2015, 100, 238–248. [Google Scholar] [CrossRef]

- Costantini, V.; Crespi, F. Environmental regulation and the export dynamics of energy technologies. Ecol. Econ. 2008, 66, 447–460. [Google Scholar] [CrossRef]

- Franco, C.; Marin, G. The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environ. Resour. Econ. 2017, 66, 261–291. [Google Scholar] [CrossRef]

- Chen, J.; Shen, Y.; Lin, S. Compilation of a city-level and four-digit industry code MRIO table based on firm-level data. Appl. Sci. 2022, 12, 8298. [Google Scholar] [CrossRef]

- Hausmann, R.; Obach, J.; Santos, M.A. Special Economic Zones in Panama: Technology Spillovers from a Labor Market Perspective; Center for International Development at Harvard University: Cambridge, MA, USA, 2016. [Google Scholar]

- Warr, P.; Menon, J. Cambodia’s special economic zones. J. Southeast Asian Econ. 2016, 33, 273–290. [Google Scholar] [CrossRef]

- Li, X.; Wu, X.; Tan, Y. Impact of special economic zones on firm performance. Res. Int. Bus. Financ. 2021, 58, 101463. [Google Scholar] [CrossRef]

- Zeng, D.Z. Global Experiences with Special Economic Zones: Focus on China and Africa; World Bank Policy Research Working Paper (7240); The World Bank: Washington, DC, USA, 2015. [Google Scholar]

- Zeng, D.Z. Building Engines for Growth and Competitiveness in China: Experience with Special Economic Zones and Industrial Clusters; World Bank Publications: Washington, DC, USA, 2010. [Google Scholar]

- Yang, L.; Luo, X.; Ding, Z.; Liu, X.; Gu, Z. Restructuring for Growth in Development Zones, China: A Systematic Literature and Policy Review (1984–2022). Land 2022, 11, 972. [Google Scholar] [CrossRef]

- Moberg, L. The political economy of special economic zones. J. Inst. Econ. 2015, 11, 167–190. [Google Scholar] [CrossRef]

- Zhang, Y. Institutions, firm characteristics, and FDI spillovers. Emerg. Mark. Financ. Trade 2019, 55, 1109–1136. [Google Scholar] [CrossRef]

- Hu, Y.; Fisher-Vanden, K.; Su, B. Technological spillover through industrial and regional linkages: Firm-level evidence from China. Econ. Model. 2020, 89, 523–545. [Google Scholar] [CrossRef]

- Zheng, J.H.; Gao, Y.Y.; Hu, S.W. Enterprise “clustering”, technological upgrading and economic performance: An empirical analysis of clustering effect in development zones. Econ. Res. 2008, 5, 33–46. (In Chinese) [Google Scholar]

- Lin, B.; Zhu, J. The role of renewable energy technological innovation on climate change: Empirical evidence from China. Sci. Total Environ. 2019, 659, 1505–1512. [Google Scholar] [CrossRef]

- Jiao, J.; Jiang, G.; Yang, R. Impact of R&D technology spillovers on carbon emissions between China’s regions. Struct. Chang. Econ. Dyn. 2018, 47, 35–45. [Google Scholar]

- Quatraro, F.; Scandura, A. Academic inventors and the antecedents of green technologies. A regional analysis of Italian patent data. Ecol. Econ. 2019, 156, 247–263. [Google Scholar]

- Persico, N.; Postlewaite, A.; Silverman, D. The effect of adolescent experience on labor market outcomes: The case of height. J. Political Econ. 2004, 112, 1019–1053. [Google Scholar] [CrossRef]

- Ren, X.S.; Liu, Y.J.; Zhao, G.H. Impact of economic agglomeration on carbon emission intensity and transmission mechanism. China Popul. Resour. Environ. 2020, 30, 95–106. (In Chinese) [Google Scholar]

- Hu, X.; Chen, J.; Lin, S. Influence from highways’ development on green technological innovation: The case of Yangtze River economic belt in China. Environ. Dev. Sustain. 2022, 1–26. [Google Scholar] [CrossRef]

- Braun, F.G.; Schmidt-Ehmcke, J.; Zloczysti, P. Innovative activity in wind and solar technology: Empirical evidence on knowledge spillovers using patent data. SSRN Electron. J. 2010, 3, 993. [Google Scholar] [CrossRef]

- Jiang, X.; Lu, X.; Xu, J. How do interregional spillovers influence the distribution of technology? The case of Chinese manufacturing. Econ. Syst. Res. 2018, 30, 219–237. [Google Scholar] [CrossRef]

- Gonçalves, E.; Perobelli, F.S.; de Araújo, I.F. Estimating intersectoral technology spillovers for Brazil. J. Technol. Transf. 2017, 42, 1377–1406. [Google Scholar] [CrossRef]

- Zheng, H.; Többen, J.; Dietzenbacher, E.; Moran, D.; Meng, J.; Wang, D.; Guan, D. Entropy-based Chinese city-level MRIO table framework. Econ. Syst. Res. 2021, 1–26. [Google Scholar] [CrossRef]

- You, Z.; Feng, Z.M.; Yang, Y.Z. Relief degree of land surface dataset of China (1 km). J. Glob. Chang. Data Discov. 2018, 2, 151–155. [Google Scholar]

- Angrist, J.D.; Keueger, A.B. Does compulsory school attendance affect schooling and earnings? Q. J. Econ. 1991, 106, 979–1014. [Google Scholar] [CrossRef]

- Ghisetti, C.; Quatraro, F. Is green knowledge improving environmental productivity? Sectoral Evidence from Italian Regions. SEEDS Work. Pap. 2014, 10, 2014. [Google Scholar]

- Sun, C.-W.; Luo, Y.; Yao, X. Transportation infrastructure and urban air pollution—Empirical evidence from China. Econ. Res. 2019, 54, 136–151. (In Chinese) [Google Scholar]

- Hao, Y.; Ba, N.; Ren, S.; Wu, H. How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain. Prod. Consum. 2021, 25, 577–590. [Google Scholar]

- Zhang, S.; Collins, A.R.; Etienne, X.L.; Ding, R. The Environmental Effects of International Trade in China: Measuring the Mediating Effects of Technology Spillovers of Import Trade on Industrial Air Pollution. Sustainability 2021, 13, 6895. [Google Scholar] [CrossRef]

- Chen, J.; Hu, X.; Huang, J.; Lin, R. Market integration and green economic growth—recent evidence of China’s city-level data from 2004–2018. Environ. Sci. Pollut. Res. 2022, 29, 44461–44478. [Google Scholar] [CrossRef]

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | n | Max | Min | Mean | Sd | Data Sources |

| Emission | 1584 | 357.5 | 0.731 | 32.95 | 36.91 | China Energy Statistics Yearbook |

| 1584 | 78.60 | 0 | 5.484 | 7.294 | China Development Zone Review Announcement Catalogue (2018) | |

| GS | 1584 | 607.0 | 0.000424 | 12.32 | 39.86 | MRIO table [42] |

| gdp | 1584 | 50.63 | 0.618 | 5.316 | 5.078 | China City Statistical Yearbook |

| structure | 1584 | 89.30 | 14.90 | 49.45 | 10.11 | China City Statistical Yearbook |

| tech_exp | 1584 | 1.048 | 0.000627 | 0.0176 | 0.0433 | China City Statistical Yearbook |

| open | 1584 | 1.876 | 0 | 0.283 | 0.276 | China City Statistical Yearbook |

| consume | 1584 | 14.58 | 0.0481 | 1.875 | 1.697 | China City Statistical Yearbook |

| population | 1584 | 26.48 | 0.0509 | 4.413 | 3.421 | China City Statistical Yearbook |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| −1.003 *** | −0.953 *** | −0.921 *** | −0.937 *** | −0.938 *** | −0.914 *** | −0.882 ** | |

| (−2.80) | (−2.72) | (−2.70) | (−2.76) | (−2.76) | (−2.66) | (−2.52) | |

| gdp | −0.302 | −0.488 * | −0.344 | −0.344 | −0.148 | −0.182 | |

| (−1.17) | (−1.81) | (−1.22) | (−1.22) | (−0.45) | (−0.55) | ||

| structure | 0.120 *** | 0.112 *** | 0.113 *** | 0.095 *** | 0.080 *** | ||

| (4.64) | (4.35) | (4.28) | (2.99) | (2.67) | |||

| tech_exp | −11.315 *** | −11.293 *** | −11.885 *** | −29.918 *** | |||

| (−2.72) | (−2.71) | (−2.87) | (−3.40) | ||||

| open | −0.099 | −0.192 | 0.049 | ||||

| (−0.25) | (−0.50) | (0.12) | |||||

| consume | −0.569 | −0.360 | |||||

| (−1.32) | (−0.77) | ||||||

| population | 3.608 *** | ||||||

| (2.88) | |||||||

| Constant | 38.447 *** | 39.778 *** | 34.662 *** | 34.566 *** | 34.572 *** | 35.387 *** | 20.049 *** |

| (19.51) | (16.12) | (15.14) | (15.12) | (15.08) | (14.84) | (3.05) | |

| Obs | 1584 | 1584 | 1584 | 1584 | 1584 | 1584 | 1584 |

| N | 264 | 264 | 264 | 264 | 264 | 264 | 264 |

| Adj− | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 | 0.996 |

| City FE | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| D | −175.390 ** | −152.985 ** | |

| (−2.50) | (−2.11) | ||

| −129.875 | |||

| (−1.10) | |||

| −132.027 | |||

| (−1.03) | |||

| −248.595 ** | |||

| (−2.22) | |||

| −172.852 * | |||

| (−1.69) | |||

| −154.308 * | |||

| (−1.85) | |||

| Constant | 8387.736 *** | 12,356.931 *** | 8545.559 *** |

| (239.20) | (8.81) | (168.09) | |

| Obs | 1566 | 1566 | 522 |

| N | 261 | 261 | 261 |

| Adj− | 0.987 | 0.988 | 0.0256 |

| Control | NO | YES | YES |

| City FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | GS | GS | Emission | Emission |

| 5.083 *** | 3.459 *** | −0.751 *** | −0.718 ** | |

| (3.82) | (3.04) | (−2.62) | (−2.53) | |

| GS | −0.049 *** | −0.056 *** | ||

| (−4.31) | (−3.55) | |||

| Constant | −15.555 ** | −37.213 *** | 37.678 *** | 16.731 ** |

| (−2.13) | (−3.64) | (22.90) | (2.57) | |

| Obs | 1584 | 1584 | 1584 | 1584 |

| N | 264 | 264 | 264 | 264 |

| Adj- | 0.903 | 0.930 | 0.996 | 0.996 |

| Control | NO | YES | NO | YES |

| City FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| (1) Exclude the Sample of Cities without New Zones | (3) Change the Indicator for GS | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | Emission | GS | Emission | Emission | GS | Emission | Emission | GS | Emission |

| −1.003 *** | 4.007 *** | −0.767 *** | −0.886 ** | 3.458 *** | −0.721 ** | −0.882 ** | 1.961 ** | −0.768 *** | |

| (−2.72) | (3.57) | (−2.86) | (−2.53) | (3.02) | (−2.54) | (−2.52) | (2.35) | (−2.59) | |

| GS | −0.066 *** | −0.057 *** | −0.068 *** | ||||||

| (−2.75) | (−3.56) | (−3.19) | |||||||

| Constant | 20.961 *** | −35.458 *** | 17.682 ** | 16.196 ** | −22.425 ** | 13.559 ** | 20.049 *** | −33.162 *** | 17.043 *** |

| (2.92) | (−3.50) | (2.50) | (2.56) | (−2.47) | (2.13) | (3.05) | (−4.51) | (2.63) | |

| Obs | 1182 | 1182 | 1182 | 1566 | 1566 | 1566 | 1584 | 1584 | 1584 |

| N | 197 | 197 | 197 | 261 | 261 | 261 | 264 | 264 | 264 |

| Adj- | 0.997 | 0.935 | 0.997 | 0.996 | 0.930 | 0.996 | 0.996 | 0.917 | 0.996 |

| Control | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| First Stage | First Stage | Second Stage | Second Stage | Second Stage | |

| Variables | GS | Emission | GS | Emission | |

| I_rdls × 2011 | −0.005 *** | ||||

| (−6.03) | |||||

| I_rdls × 2012 | −0.003 *** | ||||

| (−3.63) | |||||

| I_rdls × 2013 | −0.001 | ||||

| (−1.00) | |||||

| I_rdls × 2014 | −0.001 | ||||

| (−1.41) | |||||

| I_rdls × 2015 | −0.001 | ||||

| (−0.67) | |||||

| 1.022 *** | |||||

| (162.35) | |||||

| −5.181 *** | 11.168 ** | −4.539 *** | |||

| (−4.22) | (2.56) | (−3.77) | |||

| −0.055 *** | |||||

| (−5.09) | |||||

| Obs | 1584 | 1320 | 1320 | 1320 | 1320 |

| N | 264 | 264 | 264 | 264 | 264 |

| F-statistics | 10.18 | 5348.76 | |||

| Control | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Low-Ratio Group | High-Ratio Group | |||||

| Variables | Emission | GS | Emission | Emission | GS | Emission |

| −0.035 | 0.515 ** | 0.058 | −1.323 *** | 4.404 *** | −1.144 *** | |

| (−0.36) | (2.54) | (0.45) | (−2.80) | (2.89) | (−2.79) | |

| −0.209 * | −0.044 *** | |||||

| (−1.93) | (−3.42) | |||||

| Constant | −1.194 | −4.408 * | −3.353 | 34.007 *** | −57.654 *** | 30.715 *** |

| (−0.12) | (−1.70) | (−0.32) | (4.90) | (−2.73) | (4.44) | |

| Obs | 780 | 780 | 780 | 765 | 765 | 765 |

| N | 169 | 169 | 169 | 174 | 174 | 174 |

| Adj- | 0.995 | 0.899 | 0.995 | 0.996 | 0.931 | 0.997 |

| Control | YES | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Low Green Technology Stock Group | High Green Technology Stock Group | |||||

| Variables | Emission | GS | Emission | Emission | GS | Emission |

| −0.127 | 0.694 *** | −0.025 | −1.187 *** | 3.812 *** | −1.038 *** | |

| (−1.10) | (2.79) | (−0.20) | (−2.77) | (2.72) | (−2.82) | |

| −0.159 *** | −0.043 *** | |||||

| (−2.59) | (−3.35) | |||||

| Constant | −15.281 | −3.261 | −16.967 * | 46.813 *** | −69.387 *** | 43.287 *** |

| (−1.49) | (−1.36) | (−1.66) | (7.63) | (−3.35) | (7.36) | |

| Obs | 860 | 860 | 860 | 715 | 715 | 715 |

| N | 167 | 167 | 167 | 147 | 147 | 147 |

| Adj- | 0.994 | 0.771 | 0.994 | 0.997 | 0.932 | 0.997 |

| Control | YES | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| National Zones | Provincial Zones | |||||

| Variables | Emission | GS | Emission | Emission | GS | Emission |

| −1.904 *** | 7.057 *** | −1.589 *** | −0.360 | 1.723 | −0.282 | |

| (−2.85) | (4.19) | (−2.73) | (−1.01) | (1.24) | (−0.94) | |

| −0.051 *** | −0.063 *** | |||||

| (−3.77) | (−3.19) | |||||

| Constant | 18.242 *** | −30.601 *** | 15.529 ** | 16.903 *** | −24.024 ** | 13.789 ** |

| (2.84) | (−3.45) | (2.39) | (2.60) | (−2.33) | (2.13) | |

| Obs | 1566 | 1566 | 1566 | 1566 | 1566 | 1566 |

| N | 261 | 261 | 261 | 261 | 261 | 261 |

| Adj- | 0.996 | 0.932 | 0.997 | 0.996 | 0.927 | 0.996 |

| Control | YES | YES | YES | YES | YES | YES |

| City FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Long, X.; Lin, S. Special Economic Zone, Carbon Emissions and the Mechanism Role of Green Technology Vertical Spillover: Evidence from Chinese Cities. Int. J. Environ. Res. Public Health 2022, 19, 11535. https://doi.org/10.3390/ijerph191811535

Chen J, Long X, Lin S. Special Economic Zone, Carbon Emissions and the Mechanism Role of Green Technology Vertical Spillover: Evidence from Chinese Cities. International Journal of Environmental Research and Public Health. 2022; 19(18):11535. https://doi.org/10.3390/ijerph191811535

Chicago/Turabian StyleChen, Jieping, Xianpeng Long, and Shanlang Lin. 2022. "Special Economic Zone, Carbon Emissions and the Mechanism Role of Green Technology Vertical Spillover: Evidence from Chinese Cities" International Journal of Environmental Research and Public Health 19, no. 18: 11535. https://doi.org/10.3390/ijerph191811535

APA StyleChen, J., Long, X., & Lin, S. (2022). Special Economic Zone, Carbon Emissions and the Mechanism Role of Green Technology Vertical Spillover: Evidence from Chinese Cities. International Journal of Environmental Research and Public Health, 19(18), 11535. https://doi.org/10.3390/ijerph191811535