Does Human Capital Matter for China’s Green Growth?—Examination Based on Econometric Model and Machine Learning Methods

Abstract

:1. Introduction

2. Literature Review and Hypothesis Proposal

2.1. Human Capital and Green Growth

2.2. Human Capital, Green Innovation and Green Economic Efficiency

2.3. Human Capital, Industrial Upgrading, and Green Growth

3. Methodology and Data

3.1. Variable Measurement and Selection

3.1.1. Dependent Variable: Green Economic Efficiency (GEE)

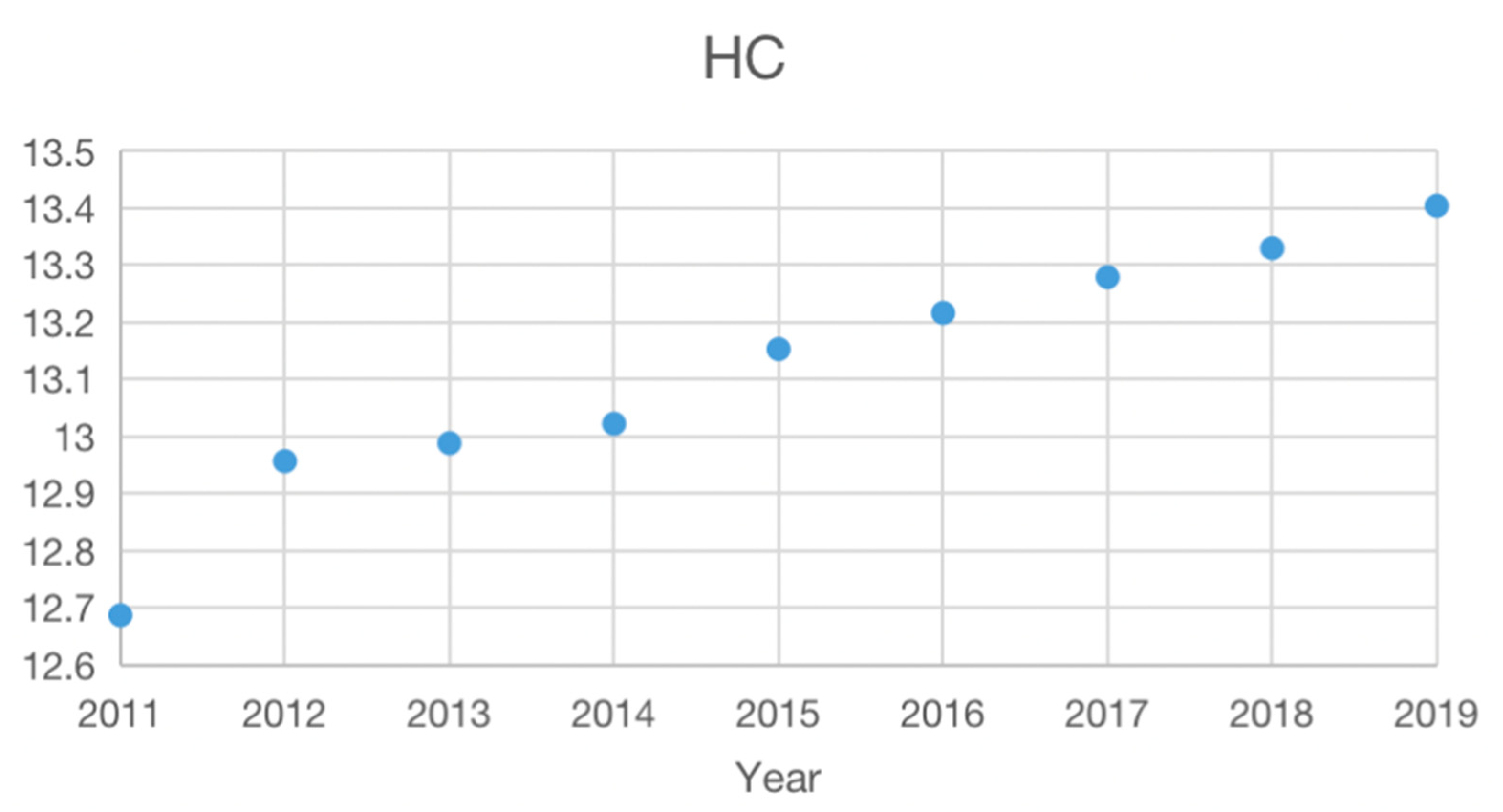

3.1.2. Independent Variable and Intermediate Variables

- (1)

- Core Independent Variable: Measurement of Human Capital

- (2)

- Intermediate Variable: Green Innovation (GIN)

- (3)

- Intermediate Variable: Industrial Upgrading

3.1.3. Control Variables

- (1)

- Free Trade Zone (FTZ)

- (2)

- Level of Economic Development (LED)

- (3)

- Government Intervention (GI)

- (4)

- City Size (CS)

- (5)

- Foreign Direct Investment (FDI)

- (6)

- Fiscal Decentralization (FD)

3.2. Research Methods and Model Resign

3.2.1. Combines Econometric Model and LightGBM Machine Learning Algorithm

3.2.2. Benchmark Model and Intermediary Effect Model

3.2.3. LightGBM Algorithm

3.3. Data Source

4. Empirical Results

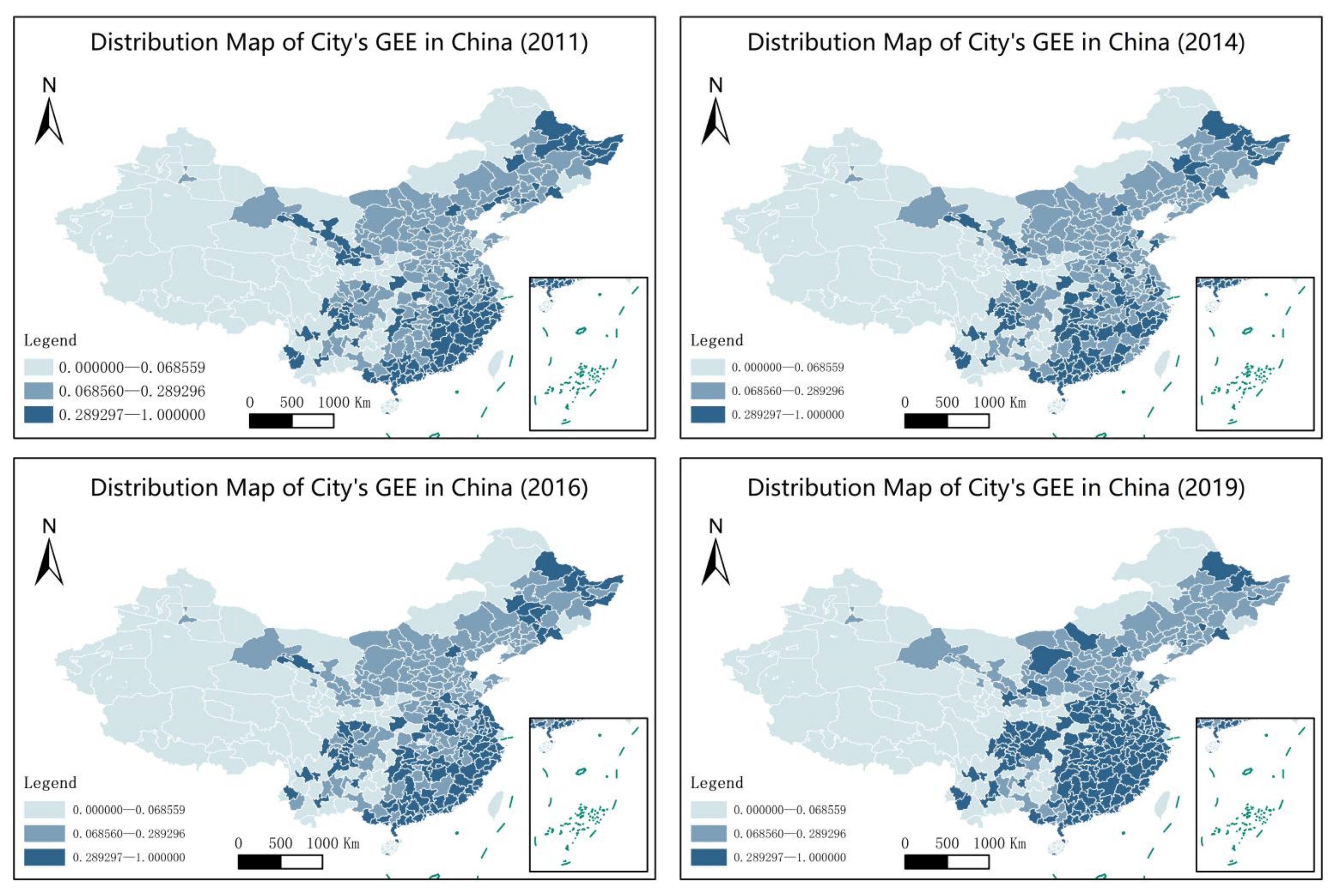

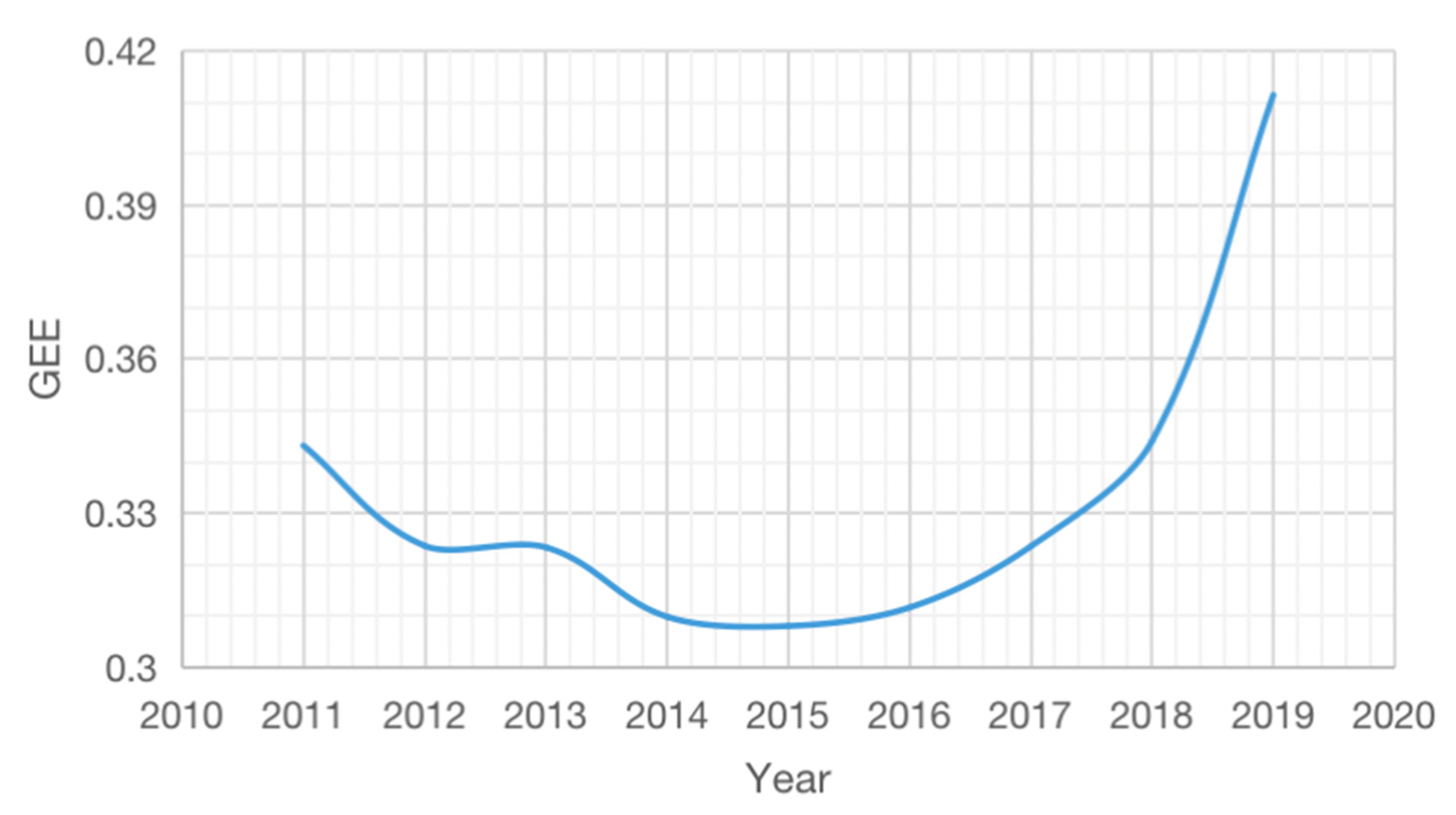

4.1. Spatiotemporal Characteristics of GEE

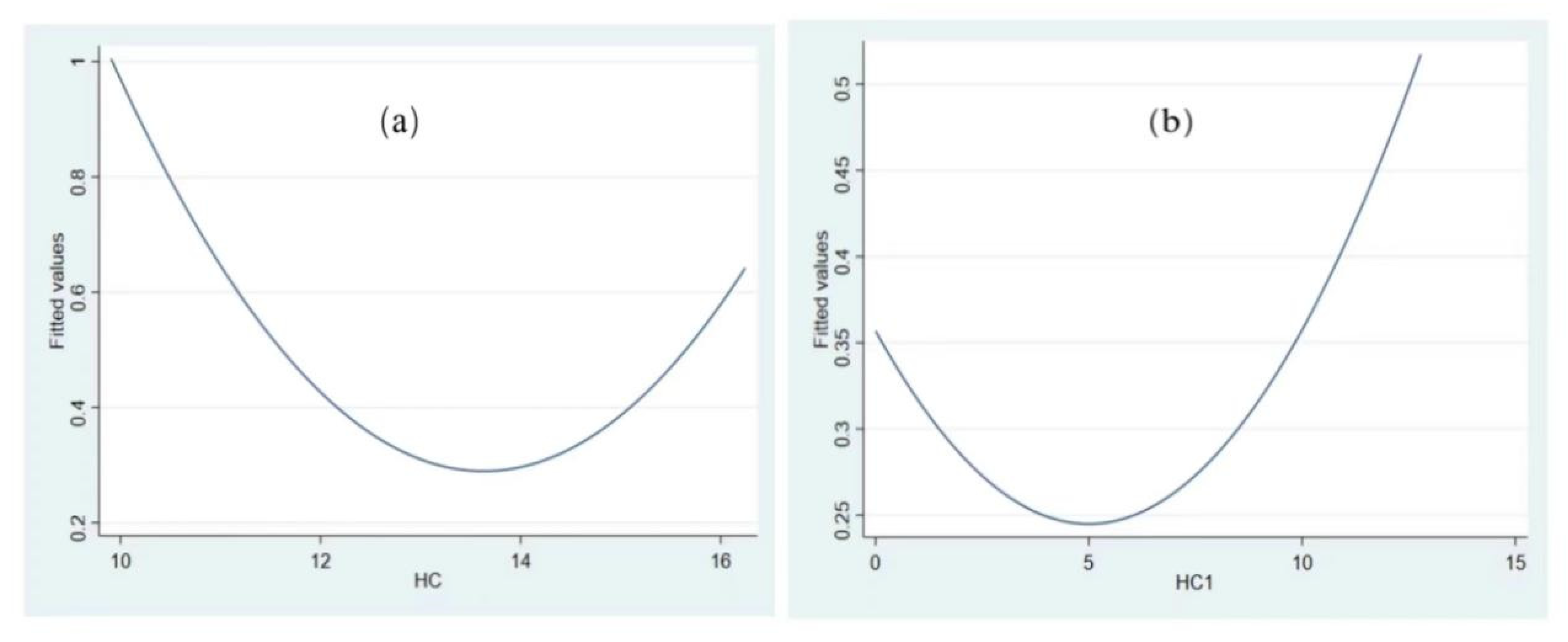

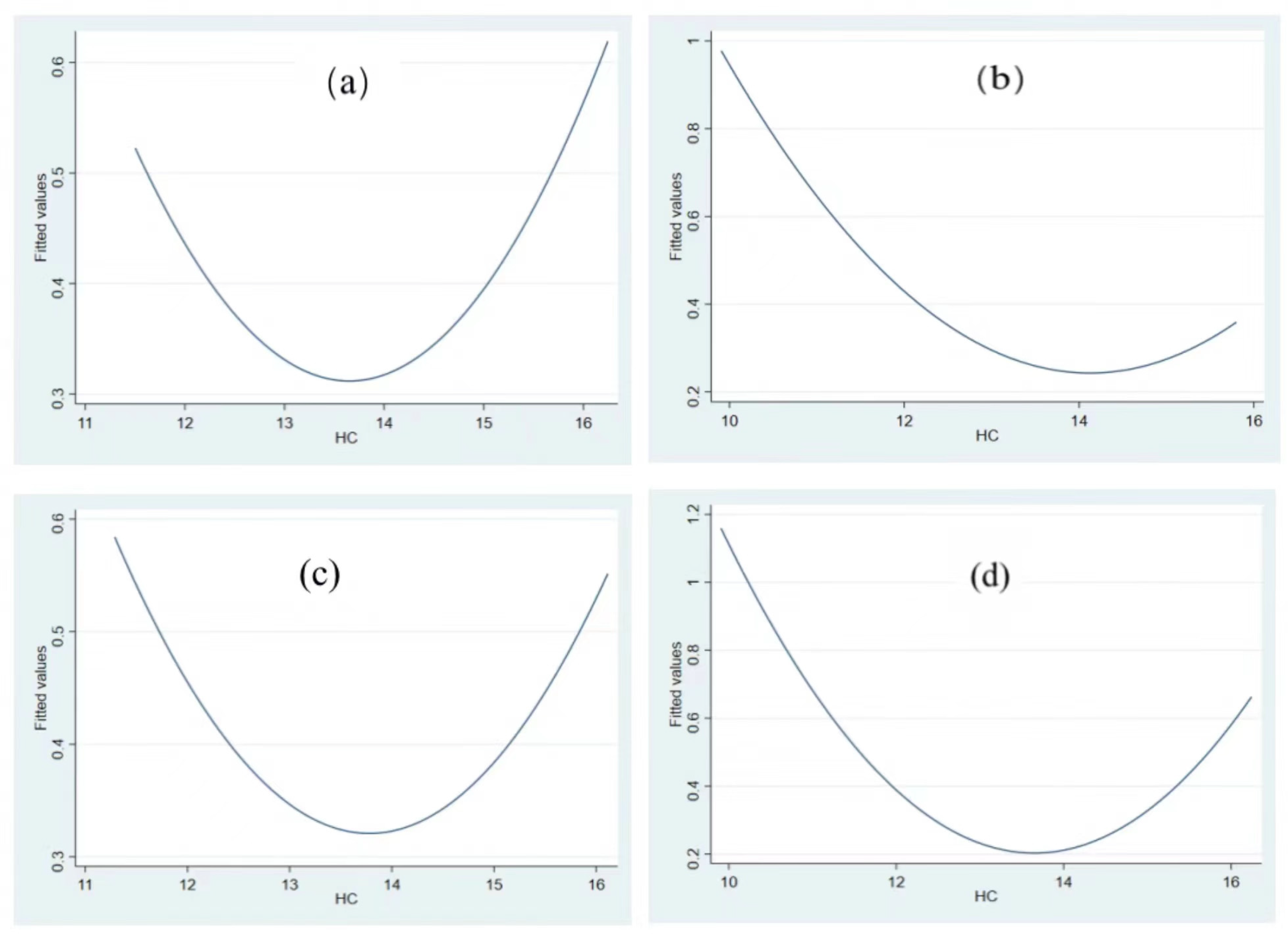

4.2. Test of Nonlinear Relationship between HC and GG

| Variables | GEE |

|---|---|

| HC | −0.932 *** |

| (−7.71) | |

| HC2 | 0.0370 *** |

| (8.03) | |

| FTA | 0.0010 |

| (0.14) | |

| LED | 0.0260 |

| (1.57) | |

| GI | −0.8730 *** |

| (−3.67) | |

| CS | 0.1150 *** |

| (2.85) | |

| FDI | 0.1610 |

| (0.14) | |

| FD | 0.1280 *** |

| (2.72) | |

| U test | 12.469 *** |

| (5.95) | |

| U test lower bound interval | 9.9060 |

| U test upper bound interval | 16.2460 |

| _cons | 4.892 *** |

| (5.57) | |

| Year | controlled |

| City | controlled |

| N | 2493 |

| R2 | 0.7640 |

4.3. The Mechanism Test Results Analysis

4.3.1. Human Capital, Green Innovation, and Green Growth

4.3.2. Human Capital, Industrial Upgrading and Green Growth

4.4. Robustness Test

4.4.1. Using Substitute Variables of Human Capital

4.4.2. Using Substitute Variables of GEE

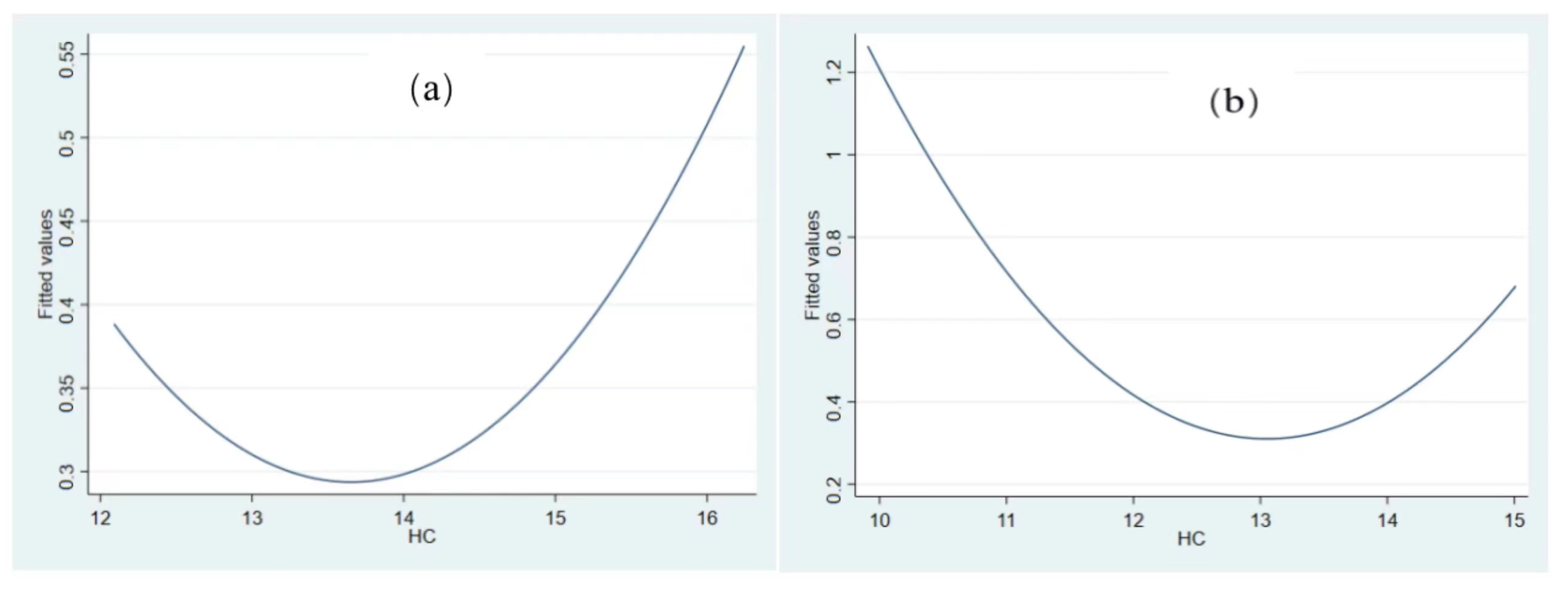

4.5. Heterogeneity Analysis

4.5.1. Heterogeneity Analysis Based on Different Location of Cities

4.5.2. Heterogeneity Analysis of Different Size of Cities

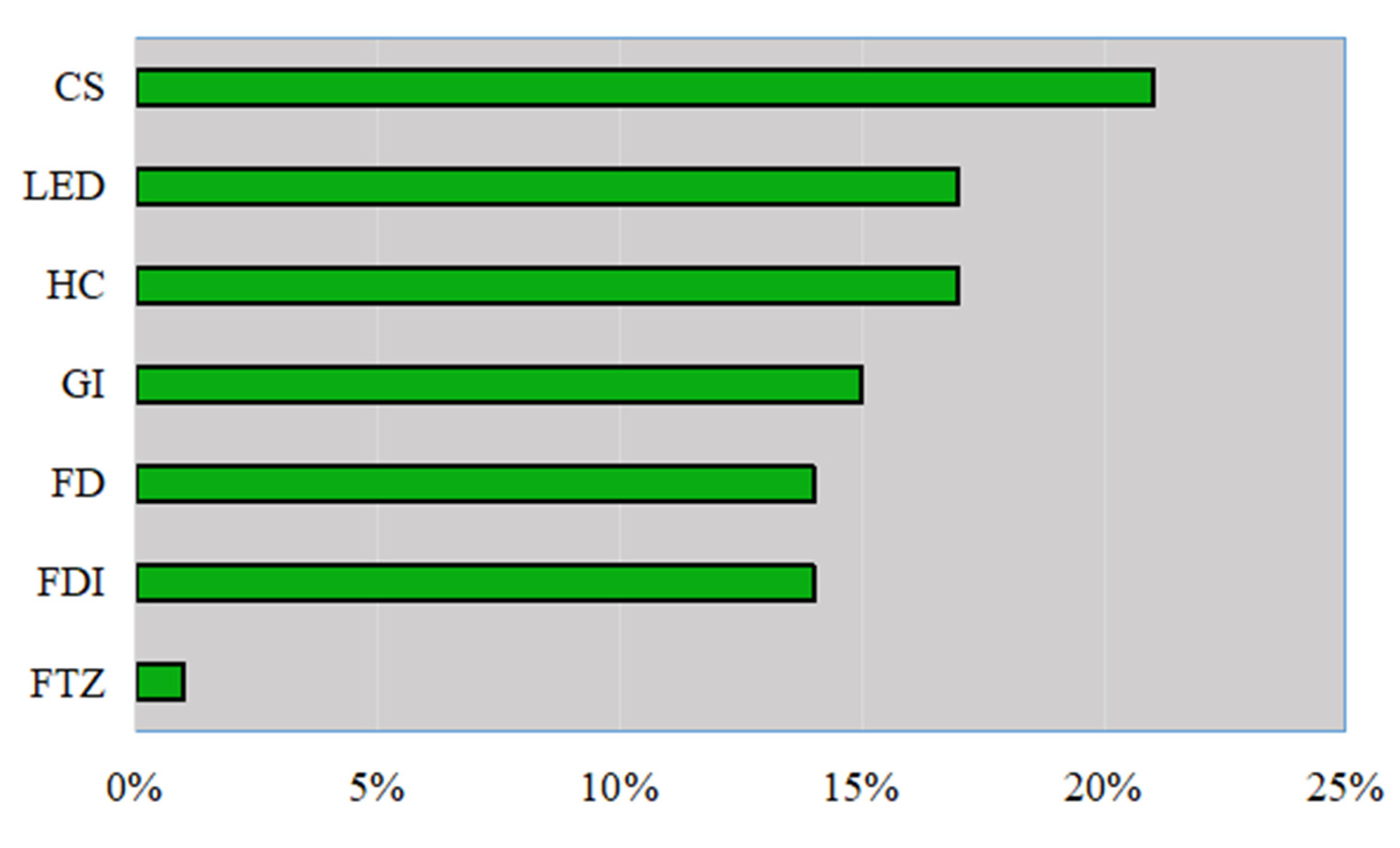

4.6. Contribution of HC to GEE

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

- (1)

- Developing economies should pay full attention to the important value of education investment and talent cultivation in green transformation. Decision makers should regularly and dynamically assess human capital stock, accurately estimate human capital, and classify different talent development levels in various regions. They then can formulate matching talent development strategies and industrial policies to help improve human capital development levels and promote green growth.

- (2)

- Companies (especially environmentally sensitive companies) should work hard to shape a corporate culture centred on knowledge management, green innovation, and people-orientation. They should spare no effort to build a talent echelon, greatly enhance the training of employees’ skills, give full play to talents’ subjective initiative, motivate employees’ innovative practices, and realize the marginal incremental effect of human capital on companies’ GTFP, promoting the transformation of green innovation achievements and industrial upgrading.

- (3)

- Urban governance authorities in northern, central and western regions and small and medium-sized cities should rationally recognize the current shortcomings of HC development. On the one hand, they should increase the ratio of education expenditure in public expenditure, and gradually improve local population’s education and skill level, so as to promote human capital development to a high level. On the other hand, given the location characteristics and resource endowments, they should actively explore the talent introduction policy for sustainable development and improve the supporting software and hardware infrastructure to attract top talents and value conversion. By adopting these measures, they can gradually use top talents to promote local green growth so as to narrow the regional gap of green growth with the eastern, southern regions and large cities.

5.3. Limitations of This Paper

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Number | Full Term | Abbreviation | Number | Full Term | Abbreviation |

|---|---|---|---|---|---|

| 1 | Green economic efficiency | GEE | 12 | Years of education | HC1 |

| 2 | green growth | GG | 13 | carbon dioxide emissions | CO2 |

| 3 | Human capital | HC | 14 | green total factor productivity | GTFP |

| 4 | Green innovation | GIN | 15 | sulfur dioxide | SO2 |

| 5 | Industrial upgrading | IU | 16 | total factor productivity | TFP |

| 6 | Free trade zone | FTA | 17 | data envelopment analysis | DEA |

| 7 | Level of economic development | LED | 18 | non-radial direction distance function | NDDF |

| 8 | Government intervention | GI | 19 | machine learning | ML |

| 9 | City scale | CS | 20 | Shephard distance function | SDF |

| 10 | Foreign direct investment | FDI | 21 | directional distance function | DDF |

| 11 | Fiscal decentralization | FD |

Appendix B

| Parameter | Parameter Value |

|---|---|

| Training time | 0.219 s |

| Data segmentation | 0.8 |

| Data shuffle | Yes |

| Base learner | GBDT |

| Base learner number | 130 |

| Learning rate | 0.1 |

| L1 regular term | 0 |

| L2 regular term | 1 |

| Sample sign sampling rate | 1 |

| Tree feature sampling rate | 1 |

| Maximum depth of tree | 10 |

| Leaf node minimum sample | 15 |

References

- Huang, J.; Chen, X.; Yu, K.; Cai, X. Effect of technological progress on carbon emissions: New evidence from a decomposition and spatiotemporal perspective in China. J. Environ. Manag. 2020, 274, 110953. [Google Scholar] [CrossRef] [PubMed]

- Kwakwa, P.A.; Alhassan, H.; Aboagye, S. Environmental Kuznets curve hypothesis in a financial development and natural resource extraction context: Evidence from Tunisia. Quant. Financ. Econ. 2018, 2, 981–1000. [Google Scholar] [CrossRef]

- Lorek, S.; Spangenberg, J.H. Sustainable consumption within a sustainable economy beyond green growth and green economies. J. Clean. Prod. 2014, 63, 33–44. [Google Scholar] [CrossRef]

- Xu, G.; Dong, H.; Xu, Z.; Bhattarai, N. China can reach carbon neutrality before 2050 by improving economic development quality. Energy 2022, 243, 123087. [Google Scholar] [CrossRef]

- Wang, Y.; Xie, M.; Wu, Y.; Zhang, X.; Wang, M.; Zhang, Y.; Xie, Y. Ozone-related co-benefits of China’s climate mitigation Policy. Resour. Conserv. Recycl. 2022, 182, 106288. [Google Scholar] [CrossRef]

- Li, J.; Dong, X.; Jiang, Q.; Dong, K.; Liu, G. Natural gas trade network of countries and regions along the belt and road: Where to go in the future? Resour. Policy 2021, 71, 101981. [Google Scholar] [CrossRef]

- Kasztelan, A. Green growth, green economy and sustainable development: Terminological and relational discourse. Prague Econ. Pap. 2017, 26, 487–499. [Google Scholar] [CrossRef]

- Zhang, Z. Evolution paths of green economy modes and their trend of hypercycle economy. Chin. J. Popul. Resour. Environ. 2022, 20, 1–11. [Google Scholar] [CrossRef]

- Pegels, A.; Altenburg, T. Latecomer development in a “greening” world: Introduction to the special issue. World Dev. 2020, 135, 105084. [Google Scholar] [CrossRef]

- Shuai, S.; Fan, Z. Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit model. J. Environ. Manag. 2020, 261, 110227. [Google Scholar] [CrossRef]

- Shen, F.; Liu, B.; Luo, F.; Wu, C.; Chen, H.; Wei, W. The effect of economic growth target constraints on green technology innovation. J. Environ. Manag. 2021, 292, 112765. [Google Scholar] [CrossRef] [PubMed]

- Wang, K.; Zhao, B.; Fan, T.; Zhang, J. Economic growth targets and carbon emissions: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 8053. [Google Scholar] [CrossRef] [PubMed]

- Li, G.; Gao, D.; Li, Y. Dynamic environmental regulation threshold effect of technical progress on green total factor energy efficiency: Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 8804–8815. [Google Scholar] [CrossRef]

- Lee, C.; Wang, C.; Ho, S. The dimension of green economy: Culture viewpoint. Econ. Anal. Policy 2022, 74, 122–138. [Google Scholar] [CrossRef]

- Yuan, Y.; Zhang, Y.; Wang, L.; Wang, L. Coping Decisions of production enterprises under low-carbon economy. Sustainability 2022, 14, 9593. [Google Scholar] [CrossRef]

- Zhou, X.; Jia, M.; Wang, L.; Sharma, G.D.; Zhao, X.; Ma, X. Modelling and simulation of a four-group evolutionary game model for green innovation stakeholders: Contextual evidence in lens of sustainable development. Renew. Energy 2022, 197, 500–517. [Google Scholar] [CrossRef]

- Nehrebecka, N. Climate risk with particular emphasis on the relationship with credit-risk Assessment: What we learn from Poland. Energies 2021, 14, 8070. [Google Scholar] [CrossRef]

- Becker, G.S. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education; University of Chicago Press: Chicago, IL, USA, 2009. [Google Scholar]

- Sulaiman, C.; Bala, U.; Tijani, B.A.; Waziri, S.I.; Maji, I.K. Human capital, technology, and economic growth: Evidence from Nigeria. Sage Open 2015, 5, 1474538686. [Google Scholar] [CrossRef]

- Sultana, T.; Dey, S.R.; Tareque, M. Exploring the linkage between human capital and economic growth: A look at 141 developing and developed countries. Econ. Syst. 2022, 2022, 101017. [Google Scholar] [CrossRef]

- Sun, X.; Li, H.; Ghosal, V. Firm-level human capital and innovation: Evidence from China. China Econ. Rev. 2020, 59, 101388. [Google Scholar] [CrossRef]

- Wang, M.; Xu, M.; Ma, S. The effect of the spatial heterogeneity of human capital structure on regional green total factor productivity. Struct. Chang. Econ. D 2021, 59, 427–441. [Google Scholar] [CrossRef]

- Fleisher, B.; Li, H.; Zhao, M.Q. Human capital, economic growth, and regional inequality in China. J. Dev. Econ. 2010, 92, 215–231. [Google Scholar] [CrossRef]

- Ahmed, Z.; Zafar, M.W.; Ali, S. Linking urbanization, human capital, and the ecological footprint in G7 countries: An empirical analysis. Sustain. Cities Soc. 2020, 55, 102064. [Google Scholar] [CrossRef]

- Akram, V.; Jangam, B.P.; Rath, B.N. Examining the linkage between human capital and energy consumption: Cross-country evidence. OPEC Energy Rev. 2020, 44, 3–26. [Google Scholar] [CrossRef]

- Huang, C.; Zhang, X.; Liu, K. Effects of human capital structural evolution on carbon emissions intensity in China: A dual perspective of spatial heterogeneity and nonlinear linkages. Renew. Sustain. Energy Rev. 2021, 135, 110258. [Google Scholar] [CrossRef]

- Mahmood, N.; Wang, Z.; Hassan, S.T. Renewable energy, economic growth, human capital, and CO2 emission: An empirical analysis. Environ. Sci. Pollut. Res. 2019, 26, 20619–20630. [Google Scholar] [CrossRef]

- Nathaniel, S.P.; Yalçiner, K.; Bekun, F.V. Assessing the environmental sustainability corridor: Linking natural resources, renewable energy, human capital, and ecological footprint in BRICS. Resour. Policy 2021, 70, 101924. [Google Scholar] [CrossRef]

- Sheraz, M.; Deyi, X.; Ahmed, J.; Ullah, S.; Ullah, A. Moderating the effect of globalization on financial development, energy consumption, human capital, and carbon emissions: Evidence from G20 countries. Environ. Sci. Pollut. Res. 2021, 28, 35126–35144. [Google Scholar] [CrossRef]

- Bano, S.; Zhao, Y.; Ahmad, A.; Wang, S.; Liu, Y. Identifying the impacts of human capital on carbon emissions in Pakistan. J. Clean. Prod. 2018, 183, 1082–1092. [Google Scholar] [CrossRef]

- Bayar, Y.; Smirnov, V.; Danilina, M.; Kabanova, N. Impact of institutions and human capital on CO2 emissions in EU Transition Economies. Sustainability 2021, 14, 353. [Google Scholar] [CrossRef]

- Haini, H. Examining the impact of ICT, human capital and carbon emissions: Evidence from the ASEAN economies. Int. Econ. 2021, 166, 116–125. [Google Scholar] [CrossRef]

- Li, P.; Ouyang, Y. The dynamic impacts of financial development and human capital on CO2 emission intensity in China: An ARDL approach. J. Bus. Econ. Manag. 2019, 20, 939–957. [Google Scholar] [CrossRef]

- Cakar, N.D.; Gedikli, A.; Erdogan, S.; Yildirim, D.C. Exploring the nexus between human capital and environmental degradation: The case of EU countries. J. Environ. Manag. 2021, 295, 113057. [Google Scholar] [CrossRef]

- Chen, S.; Ma, J.; Ding, D.; Yu, S.; Tang, Y. The impact of green R&D cctivities on SO2 emissions: Evidence from China. Math. Probl. Eng. 2021, 2021, 6680560. [Google Scholar] [CrossRef]

- Liu, F.; Lv, N. The threshold effect test of human capital on the growth of agricultural green total factor productivity: Evidence from China. Int. J. Electr. Eng. Educ. 2021, 1486192314. [Google Scholar] [CrossRef]

- Maranzano, P.; Cerdeira Bento, J.P.; Manera, M. The role of education and income inequality on environmental quality: A panel data analysis of the EKC hypothesis on OECD countries. Sustainability 2022, 14, 1622. [Google Scholar] [CrossRef]

- Melton, R.B. Schultz’s theory of “human capital”. Southwest. Soc. Sci. Q. 1965, 46, 264–272. [Google Scholar]

- Zafar, M.W.; Zaidi, S.A.H.; Khan, N.R.; Mirza, F.M.; Hou, F.; Kirmani, S.A.A. The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resour. Policy 2019, 63, 101428. [Google Scholar] [CrossRef]

- Fleisher, B.M. Human capital and labor markets. China Econ. Rev. 2016, 38, 250. [Google Scholar] [CrossRef]

- Timothy, V.L. The effect of top managers’ human capital on SME productivity: The mediating role of innovation. Heliyon 2022, 8, e9330. [Google Scholar] [CrossRef]

- Benos, N.; Karagiannis, S. Do education quality and spillovers matter? Evidence on human capital and productivity in Greece. Econ. Model. 2016, 54, 563–573. [Google Scholar] [CrossRef]

- Wallenius, J. Human capital accumulation and the intertemporal elasticity of substitution of labor: How large is the bias? Rev. Econ. Dynam. 2011, 14, 577–591. [Google Scholar] [CrossRef]

- Danquah, M.; Amankwah-Amoah, J. Assessing the relationships between human capital, innovation and technology adoption: Evidence from sub-Saharan Africa. Technol. Forecast. Soc. Chang. 2017, 122, 24–33. [Google Scholar] [CrossRef]

- Chang, C.; Wang, P.; Liu, J. Knowledge spillovers, human capital and productivity. J. Macroecon. 2016, 47, 214–232. [Google Scholar] [CrossRef]

- Aina, C.; Sonedda, D. Sooner or later? The impact of child education on household consumption. Empir. Econ. 2022, 1–29. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Li, J.; Zhang, D. Efficiency snakes and energy ladders: A (meta-) frontier demand analysis of electricity consumption efficiency in Chinese households. Energy Policy 2016, 91, 383–396. [Google Scholar] [CrossRef]

- Campbell, S.G.; Ungor, M. Revisiting human capital and aggregate income differences. Econ. Model. 2020, 91, 43–64. [Google Scholar] [CrossRef]

- Schanes, K.; Giljum, S.; Hertwich, E. Low carbon lifestyles: A framework to structure consumption strategies and options to reduce carbon footprints. J. Clean. Prod. 2016, 139, 1033–1043. [Google Scholar] [CrossRef]

- Shahbaz, M.; Gozgor, G.; Hammoudeh, S. Human capital and export diversification as new determinants of energy demand in the United States. Energy Econ. 2019, 78, 335–349. [Google Scholar] [CrossRef]

- Fernandes, C.I.; Veiga, P.M.; Ferreira, J.J.; Hughes, M. Green growth versus economic growth: Do sustainable technology transfer and innovations lead to an imperfect choice? Bus. Strat. Environ. 2021, 30, 2021–2037. [Google Scholar] [CrossRef]

- Dong, J.; Dou, Y.; Jiang, Q.; Zhao, J. How Does Industrial structure upgrading affect the global greenhouse effect? Evidence from RCEP and non-RCEP Countries. Front. Energy Res. 2021, 9, 683166. [Google Scholar] [CrossRef]

- Capozza, C.; Divella, M. Human capital and firms’ innovation: Evidence from emerging economies. Econ. Innov. New Technol. 2019, 28, 741–757. [Google Scholar] [CrossRef]

- Chang, C.; Nguyen-Van, D. Human capital and firm innovation: New Evidence from Asean Countries. J. Econ. Forecast. 2021, 3, 52–71. [Google Scholar]

- Buenechea-Elberdin, M.; Sáenz, J.; Kianto, A. Exploring the role of human capital, renewal capital and entrepreneurial capital in innovation performance in high-tech and low-tech firms. Knowl. Manag. Res. Pract. 2017, 15, 369–379. [Google Scholar] [CrossRef]

- Ibarra, E.R.B.; Herrera, L. Innovation capability and organizational resources configuration. Intang. Cap. 2009, 5, 301–320. [Google Scholar]

- Aalbers, R.; Dolfsma, W.; Koppius, O. Individual connectedness in innovation networks: On the role of individual motivation. Res. Policy 2013, 42, 624–634. [Google Scholar] [CrossRef]

- Suseno, Y.; Standing, C.; Kiani-Mavi, R.; Jackson, P. National innovation performance: The role of human capital and social capital. Innov. Eur. J. Soc. Sci. Res. 2020, 33, 296–310. [Google Scholar] [CrossRef]

- Hu, Y.; Fisher-Vanden, K.; Su, B. Technological spillover through industrial and regional linkages: Firm-level evidence from China. Econ. Model. 2020, 89, 523–545. [Google Scholar] [CrossRef]

- Lin, J.; Liao, W.; Tseng, C. Effects of technology flows on industrial performance: The contingent role of diversity of R&D human capital. J. Bus. Bus. Mark. 2016, 23, 111–133. [Google Scholar]

- Chen, L.; Huo, C. Impact of green innovation efficiency on carbon emission reduction in the Guangdong-Hong Kong-Macao GBA. Sustainability 2021, 13, 13450. [Google Scholar] [CrossRef]

- Shi, T.; Si, S.; Chan, J.; Zhou, L. The carbon emission reduction effect of technological innovation on the transportation industry and its spatial heterogeneity: Evidence from China. Atmosphere 2021, 12, 1169. [Google Scholar] [CrossRef]

- Hu, S.; Zeng, G.; Cao, X.; Yuan, H.; Chen, B. Does technological innovation promote green development? A case study of the Yangtze River Economic Belt in China. Int. J. Environ. Res. Public Health 2021, 18, 6111. [Google Scholar] [CrossRef] [PubMed]

- Gao, Y.; Hafsi, T. R & D spending among Chinese SMEs: The role of business owner’s characteristics. Manag. Decis 2015, 53, 1714–1735. [Google Scholar]

- Liu, Y.; Li, Z.; Yin, X. Environmental regulation, technological innovation and energy consumption—A cross-region analysis in China. J. Clean. Prod. 2018, 203, 885–897. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, P. Industrialization, urbanization, and carbon emission efficiency of Yangtze River Economic—Empirical analysis based on stochastic frontier model. Environ. Sci. Pollut. Res. 2021, 28, 66914–66929. [Google Scholar] [CrossRef] [PubMed]

- Fang, W.; Liu, Z.; Putra, A.R.S. Role of research and development in green economic growth through renewable energy development: Empirical evidence from South Asia. Renew Energy 2022, 194, 1142–1152. [Google Scholar] [CrossRef]

- Liu, J.; Hull, V.; Godfray, H.C.J.; Tilman, D.; Gleick, P.; Hoff, H.; Pahl-Wostl, C.; Xu, Z.; Chung, M.G.; Sun, J. Nexus approaches to global sustainable development. Nat. Sustain. 2018, 1, 466–476. [Google Scholar] [CrossRef]

- Qin, X.; Wang, J.; Liu, Y. Efficiency measurement and inefficiency environmental factors of China’s green economy. Prague Econ. Pap. 2022, 31, 25–57. [Google Scholar] [CrossRef]

- Shi, L. Labor industry allocation, industrial structure optimization, and economic growth. Discret. Dyn. Nat. Soc. 2021, 2021, 5167422. [Google Scholar] [CrossRef]

- Lo, K.L.; Zhang, J.; Xia, F. Does digital technology innovation work better for industrial upgrading? An empirical analysis of listed Chinese manufacturing firms. Appl. Econ. Lett. 2022, 1–6. [Google Scholar] [CrossRef]

- Zhou, Y. Human capital, institutional quality and industrial upgrading: Global insights from industrial data. Econ. Chang. Restruct. 2018, 51, 1–27. [Google Scholar] [CrossRef]

- Wu, N.; Liu, Z. Higher education development, technological innovation and industrial structure upgrade. Technol. Forecast. Soc. Chang. 2021, 162, 120400. [Google Scholar] [CrossRef]

- Zhao, Y.; He, F.; Feng, Y. Research on the industrial structure upgrading effect of the employment mobility of graduates from China “double first-class” colleges and universities. Sustainability 2022, 14, 2353. [Google Scholar] [CrossRef]

- He, D.; Zheng, M.; Cheng, W.; Lau, Y.Y.; Yin, Q. Interaction between higher education outputs and industrial structure evolution: Evidence from Hubei province, China. Sustainability 2019, 11, 2923. [Google Scholar] [CrossRef]

- Sun, H.; Sun, W.; Geng, Y.; Kong, Y. Natural resource dependence, public education investment, and human capital accumulation. Pet. Sci. 2018, 15, 657–665. [Google Scholar] [CrossRef] [Green Version]

- Kusi-Sarpong, S.; Mubarik, M.S.; Khan, S.A.; Brown, S.; Mubarak, M.F. Intellectual capital, blockchain-driven supply chain and sustainable production: Role of supply chain mapping. Technol. Forecast. Soc. Chang. 2022, 175, 121331. [Google Scholar] [CrossRef]

- Muafi, M.; Sulistio, J. A nexus between green intellectual capital, supply chain integration, digital supply chain, supply chain agility, and business performance. J. Ind. Eng. Manag. 2022, 15, 275–295. [Google Scholar]

- Zhu, W.; Zhu, Y.; Lin, H.; Yu, Y. Technology progress bias, industrial structure adjustment, and regional industrial economic growth motivation—Research on regional industrial transformation and upgrading based on the effect of learning by doing. Technol. Forecast. Soc. Chang. 2021, 170, 120928. [Google Scholar] [CrossRef]

- Wei, W.; Zhang, M. The non-linear impact of industrial structure on CO2 emissions in China. Appl. Econ. Lett. 2020, 27, 576–579. [Google Scholar] [CrossRef]

- Liang, G.; Yu, D.; Ke, L. An empirical study on dynamic evolution of industrial structure and green economic growth—Based on data from china’s underdeveloped areas. Sustainability 2021, 13, 8154. [Google Scholar] [CrossRef]

- Yang, Y.; Wei, X.; Wei, J.; Gao, X. Industrial structure upgrading, green total factor productivity and carbon emissions. Sustainability 2022, 14, 1009. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, J.; Song, J. Analysis of the threshold effect of agricultural industrial agglomeration and industrial structure upgrading on sustainable agricultural development in China. J. Clean. Prod. 2022, 341, 130818. [Google Scholar] [CrossRef]

- Lu, S. Research on innovation-driven development strategy, comparative advantage and industrial transformation and upgrading. Risus-J. Innov. Sustain. 2019, 10, 146–152. [Google Scholar]

- Xi, B.; Zhai, P. Economic growth, industrial structure upgrading and environmental pollution: Evidence from China. Kybernetes 2022. [Google Scholar] [CrossRef]

- Song, T.; Wang, E.; Lu, X.; Chen, H.; Zhang, J. Research on the calculation and influencing factors of the green development of regional industry in China. Reg. Econ. Dev. Res. 2020, 1, 33–43. [Google Scholar] [CrossRef]

- Cheong, T.S.; Wu, Y. The impacts of structural transformation and industrial upgrading on regional inequality in China. China Econ. Rev. 2014, 31, 339–350. [Google Scholar] [CrossRef]

- Xiao, H.; You, J. The heterogeneous impacts of human capital on green total factor productivity: Regional diversity perspective. Front. Environ. Sci. 2021, 9, 3562. [Google Scholar] [CrossRef]

- Han, Y.; Zhang, F.; Huang, L.; Peng, K.; Wang, X. Does industrial upgrading promote eco-efficiency? ─A panel space estimation based on Chinese evidence. Energy Policy 2021, 154, 112286. [Google Scholar] [CrossRef]

- Qi, G.; Wang, Z.; Wang, Z.; Wei, L. Has industrial upgrading improved air pollution?—Evidence from China’s digital economy. Sustainability 2022, 14, 8967. [Google Scholar] [CrossRef]

- Sun, J.; Tang, D.; Kong, H.; Boamah, V. Impact of industrial structure upgrading on green total factor productivity in the Yangtze River Economic Belt. Int. J. Environ. Res. Public Health 2022, 19, 3718. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, X.; Wang, M. Resource curse and green economic growth. Resour. Policy 2021, 74, 102325. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, X. Natural resource endowment and ecological efficiency in China: Revisiting resource curse in the context of ecological efficiency. Resour. Policy 2020, 66, 101610. [Google Scholar] [CrossRef]

- Xie, X.; Li, K.; Liu, Z.; Ai, H. Curse or blessing: How does natural resource dependence affect city level economic development in China? Aust. J. Agric. Resour. Econ. 2021, 65, 413–448. [Google Scholar] [CrossRef]

- Hf, A.; Wlw, B. A directional slacks-based measure of technical inefficiency. Socio-Econ. Plan. Sci. 2009, 43, 274–287. [Google Scholar]

- Zhou, P.; Ang, B.W.; Wang, H. Energy and CO2 emission performance in electricity generation: A non-radial directional distance function approach. Eur. J. Oper. Res. 2012, 221, 625–635. [Google Scholar] [CrossRef]

- Zhang, M.; Li, B. How to design regional characteristics to improve green economic efficiency: A fuzzy-set qualitative comparative analysis approach. Environ. Sci. Pollut. Res. 2022, 29, 6125–6139. [Google Scholar] [CrossRef]

- Li, C.; Ji, J. Spatial-temporal characteristics and driving factors of green economic efficiency in China. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Xiang, J. The Estimation of the Chinese Cities’ Fixed Capital Stock. Master’s Thesis, Hunan University, Changsha, China, 2011. (In Chinese). [Google Scholar]

- Cheng, D.; Xue, Q.; Hubacek, K.; Fan, J.; Shan, Y.; Zhou, Y.; Coffman, D.M.; Managi, S.; Zhang, X. Inclusive wealth index measuring sustainable development potentials for Chinese cities. Glob. Environ. Chang. 2022, 72, 102417. [Google Scholar] [CrossRef]

- Annabi, N.; Harvey, S.; Lan, Y. Public expenditures on education, human capital and growth in Canada: An OLG model analysis. J. Policy Model. 2011, 33, 852–865. [Google Scholar] [CrossRef]

- Atems, B.; Blankenau, W. The ‘time-release’, crime-reducing effects of education spending. Econ. Lett. 2021, 209, 110143. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. The nonlinear impacts of industrial structure on China’s energy intensity. Energy 2014, 69, 258–265. [Google Scholar] [CrossRef]

- Liao, H.; Fan, Y.; Wei, Y. What induced China’s energy intensity to fluctuate: 1997–2006? Energy Policy 2007, 35, 4640–4649. [Google Scholar] [CrossRef]

- Yao, Y.; Ivanovski, K.; Inekwe, J.; Smyth, R. Human capital and energy consumption: Evidence from OECD countries. Energy Econ. 2019, 84, 104534. [Google Scholar] [CrossRef]

- Liu, Z.K.; Cao, F.F.; Dennis, B. Does the China-Korea Free Trade Area Promote the Green Total Factor Productivity of China’s Manufacturing Industry? J. Korea Trade 2019, 23, 27–44. [Google Scholar] [CrossRef]

- Yuan, H.; Feng, Y.; Lee, C.; Cen, Y. How does manufacturing agglomeration affect green economic efficiency? Energy Econ. 2020, 92, 104944. [Google Scholar] [CrossRef]

- Dhahri, S.; Omri, A. Entrepreneurship contribution to the three pillars of sustainable development: What does the evidence really say? World Dev. 2018, 106, 64–77. [Google Scholar] [CrossRef]

- Droste, N.; Hansjurgens, B.; Kuikman, P.; Otter, N.; Antikainen, R.; Leskinen, P.; Pitkanen, K.; Saikku, L.; Loiseau, E.; Thomsen, M. Steering innovations towards a green economy: Understanding government intervention. J. Clean. Prod. 2016, 135, 426–434. [Google Scholar] [CrossRef]

- Park, S.; Yoo, S.H. Government intervention in environmental performance considering working capital issues: Control the supplier or the buyer? Comput. Ind. Eng. 2022, 163, 107790. [Google Scholar] [CrossRef]

- Fang, W.; Wu, T.; Chang, T.; Hung, C. What could entrepreneurial vision do for sustainable development? Explore the cross-level impact of organizational members’ green shared vision on green creativity. Sustainability 2021, 13, 5364. [Google Scholar] [CrossRef]

- Islam, R.; Ghani, A. Link among energy consumption, carbon dioxide emission, economic growth, population, poverty, and forest area Evidence from ASEAN country. Int. J. Soc. Econ. 2018, 45, 275–285. [Google Scholar] [CrossRef]

- Song, Y.; Hao, F.; Hao, X.; Gozgor, G. Economic policy uncertainty, outward foreign direct investments, and green total factor productivity: Evidence from firm-level data in China. Sustainability 2021, 13, 2339. [Google Scholar] [CrossRef]

- Cong, T.P.; Jain, V.; Purnomo, E.P.; Islam, M.M.; Mughal, N.; Guerrero, J.W.G.; Ullah, S. Controlling environmental pollution: Dynamic role of fiscal decentralization in CO2 emission in Asian economies. Environ. Sci. Pollut. Res. 2021, 28, 65150–65159. [Google Scholar]

- You, D.; Zhang, Y.; Yuan, B. Environmental regulation and firm eco-innovation: Evidence of moderating effects of fiscal decentralization and political competition from listed Chinese industrial companies. J. Clean. Prod. 2019, 207, 1072–1083. [Google Scholar] [CrossRef]

- Fan, S.; Liu, X.; Sun, G. Evaluating the performance of inclusive growth based on the BP neural network and machine learning approach. Comput. Intell. Neurosci. 2022, 2022, 9491748. [Google Scholar] [CrossRef]

- Liu, S.; Hou, P.; Gao, Y.; Tan, Y. Innovation and green total factor productivity in China: A linear and nonlinear investigation. Environ. Sci. Pollut. Res. 2022, 29, 12810–12831. [Google Scholar] [CrossRef]

- Barro, R.J.; Lee, J.W. International data on educational attainment: Updates and implications. Oxf. Econ. Pap. 2001, 53, 541–563. [Google Scholar] [CrossRef]

- Barro, R.J.; Lee, J.W. A new data set of educational attainment in the world, 1950–2010. J. Dev. Econ. 2013, 104, 184–198. [Google Scholar] [CrossRef]

| Variable Type | Definition | Code | Calculation Method |

|---|---|---|---|

| Dependent variable | Green economic efficiency | GEE | Measured by the NDDF-DEA model |

| Independent variable | Human capital | HC | Logarithm of financial education expenditures in prefecture-level cities at the end of each year |

| Intermediary variable | Green innovation | GIN | Logarithm of green invention patent applications in prefecture-level cities |

| Industrial upgrading | IU | The output value of secondary industry plus output value of tertiary industry, divided by GDP | |

| Control variable | Free trade zone | FTA | The variable is equal to one if the city is a free trade zone; otherwise, it is zero |

| Level of economic development | LED | Logarithm of per capita GDP | |

| Government intervention | GI | Public budget expenditure divided by GDP | |

| City scale | CS | Logarithm of the total population of each city at the end of the year | |

| Foreign direct investment | FDI | The total amount of foreign capital divided by GDP | |

| Fiscal decentralization | FD | The ratio of the fiscal revenue in the municipal budget to the fiscal expenditure in the municipal budget | |

| Other variables | Years of education | HC1 | (number of university students in city/number of university students in province) × ln(6 × the proportion of labour force in the sample with no higher than primary school education +9* the proportion of labour force with no higher than junior middle school education +12 × the proportion of labour force with no higher than senior high school education +16* the proportion of labour force with college education) (Wang et al. 2021) [22] |

| Carbon dioxide emissions | CO2 | Logarithm of carbon dioxide emissions | |

| Year | Year | a dummy variable | |

| City | City | a dummy variable according to China Urban Statistical Yearbook |

| Variable | Obs | Mean | Std. Dev. | Min | Max | Skewness | Kurtosis | VIF |

|---|---|---|---|---|---|---|---|---|

| GEE | 2297 | 0.3341 | 0.1623 | 0.1107 | 1.0000 | 2.6018 | 10.8540 | |

| HC | 2297 | 13.1288 | 0.7805 | 9.9059 | 16.2456 | 2.4250 | 9.0127 | 8.6100 |

| FTA | 2297 | 0.2037 | 0.4029 | 0 | 1.0000 | 1.5530 | 3.4119 | 7.8900 |

| LED | 2297 | 10.7171 | 0.5790 | 8.8416 | 13.0557 | 0.2192 | 2.8621 | 5.5300 |

| GI | 2297 | 0.0793 | 0.0281 | 0.0234 | 0.2273 | 1.1885 | 5.6820 | 4.5200 |

| CS | 2297 | 5.9025 | 0.6963 | 2.9704 | 8.1362 | −0.5567 | 4.0910 | 2.3700 |

| FDI | 2297 | 0.0027 | 0.0027 | 0 | 0.0299 | 2.2460 | 13.5210 | 1.3500 |

| FD | 2297 | 0.4790 | 0.2255 | 0.0680 | 1.5413 | 0.5302 | 2.6254 | 1.2400 |

| GIN | 2297 | 4.3325 | 1.7641 | 0 | 10.1825 | 0.4849 | 2.9046 | 4.2300 |

| IU | 2297 | 4.4730 | 0.1035 | 3.6618 | 4.6049 | −2.1419 | 11.1377 | 2.0000 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| GEE | GIN | GEE | |

| HC | −0.932 *** | 0.332 *** | |

| (−7.71) | (3.94) | ||

| HC2 | 0.037 *** | ||

| (8.03) | |||

| GIN | −0.051 *** | ||

| (−6.97) | |||

| GIN2 | 0.008 *** | ||

| (10.17) | |||

| FTA | 0.001 | −0.021 | 0.001 |

| (0.14) | (−0.63) | (0.21) | |

| LED | 0.026 | 0.467 *** | 0.034 ** |

| (1.57) | (5.67) | (2.27) | |

| GI | −0.873 *** | 2.168 * | −0.788 *** |

| (−3.67) | (1.82) | (−3.46) | |

| CS | 0.115 *** | 0.576 *** | 0.097 ** |

| (2.85) | (2.87) | (2.56) | |

| FDI | 0.161 | −1.049 | 0.805 |

| (0.14) | (−0.18) | (0.70) | |

| FD | 0.128 *** | −0.134 | 0.123 *** |

| (2.72) | (−0.57) | (2.66) | |

| U test | 12.469 *** | 3.073 *** | |

| (5.95) | (6.97) | ||

| U test lower bound interval | 9.906 | 0 | |

| U test upper bound interval | 16.246 | 10.182 | |

| _cons | 4.892 *** | −6.294 *** | −0.726 ** |

| (5.57) | (−3.88) | (−2.26) | |

| N | 2493.000 | 2493.000 | 2493.000 |

| R2 | 0.764 | 0.950 | 0.768 |

| (1) | (2) | (3) | |

|---|---|---|---|

| GEE | IU | GEE | |

| HC | −0.932 *** | 0.039 *** | |

| (−7.71) | (4.65) | ||

| HC2 | 0.037 *** | ||

| (8.03) | |||

| IU | −5.770 *** | ||

| (−3.90) | |||

| IU2 | 0.708 *** | ||

| (4.01) | |||

| FTA | 0.001 | 0.008 ** | 0.002 |

| (0.14) | (2.42) | (0.37) | |

| LED | 0.026 | 0.059 *** | 0.033 *** |

| (1.57) | (7.19) | (1.98) | |

| GI | −0.873 *** | −0.228 * | −0.478 ** |

| (−3.67) | (−1.92) | (−2.02) | |

| CS | 0.115 *** | −0.065 *** | 0.216 *** |

| (2.85) | (−3.27) | (5.70) | |

| FDI | 0.161 | 0.012 | −0.598 |

| (0.14) | (0.02) | (−0.46) | |

| FD | 0.128 *** | 0.119 *** | 0.042 |

| (2.72) | (5.04) | (0.87) | |

| U test | 12.469 *** | 4.074 ** | |

| (5.95) | (3.07) | ||

| U test lower bound interval | 9.906 | 3.66 | |

| U test upper bound interval | 16.246 | 4.60 | |

| _cons | 4.892 *** | 3.702 *** | 10.279 ** |

| (5.57) | (22.90) | (3.28) | |

| N | 2493.000 | 2417.000 | 2417.000 |

| R2 | 0.764 | 0.862 | 0.757 |

| Variables | GEE | CO2 |

|---|---|---|

| (1) | (2) | |

| HC1 | −0.028 | 1.294 *** |

| (−1.25) | (3.39) | |

| HC12 | 0.007 *** | −0.046 *** |

| (3.29) | (−3.31) | |

| FTZ | 0.005 | 0.038 * |

| (0.76) | (1.86) | |

| LED | 0.065 *** | 0.192 *** |

| (4.09) | (3.66) | |

| GI | −0.543 ** | −0.035 |

| (−2.24) | (−0.05) | |

| CS | 0.207 *** | 0.162 |

| (5.33) | (1.27) | |

| FDI | −0.207 | −10.045 *** |

| (−0.16) | (−2.74) | |

| FD | 0.074 | −0.105 |

| (1.52) | (−0.71) | |

| U test | 2.018 * | 14.051 ** |

| (1.25) | (1.80) | |

| U test lower bound interval | 0 | 9.906 |

| U test upper bound interval | 12.782 | 16.256 |

| _cons | −2.334 *** | −2.852 |

| (−5.93) | (−1.03) | |

| N | 2297.000 | 2482.000 |

| R2 | 0.758 | 0.952 |

| Variables | East | Centre | West | South | North |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| GEE | GEE | GEE | GEE | GEE | |

| HC | −0.749 *** | −0.609 ** | −1.026 *** | −0.933 *** | −1.115 *** |

| (−4.37) | (−2.18) | (−4.06) | (−6.44) | (−4.73) | |

| HC2 | 0.027 *** | 0.030 *** | 0.041 *** | 0.033 *** | 0.046 *** |

| (4.23) | (2.75) | (4.13) | (6.07) | (4.95) | |

| FTZ | −0.001 | −0.026 ** | 0.048 *** | −0.011 | 0.007 |

| (−0.11) | (−1.98) | (3.24) | (−1.47) | (0.55) | |

| LED | 0.066 *** | 0.078 ** | −0.161 *** | 0.025 | −0.087 *** |

| (3.28) | (2.23) | (−4.25) | (1.16) | (−2.75) | |

| GI | −0.642 ** | −2.309 *** | −1.491 *** | −0.500 * | −0.899 ** |

| (−2.01) | (−5.05) | (−2.87) | (−1.68) | (−2.11) | |

| CS | 0.460 *** | 0.086 | −0.234 ** | 0.145 *** | −0.089 |

| (5.35) | (1.54) | (−2.55) | (3.15) | (−0.94) | |

| FDI | −0.189 | 4.157 * | 0.162 | −4.781 *** | 3.683 * |

| (−0.13) | (1.77) | (0.04) | (−2.90) | (1.79) | |

| FD | 0.048 | 0.405 *** | 0.188 | 0.112 ** | 0.087 |

| (0.74) | (4.68) | (1.53) | (2.00) | (0.94) | |

| U test | 13.635 ** | 10.238 | 12.457 *** | 14.176 *** | 12.066 *** |

| (2.98) | (0.28) | (3.44) | (3.22) | (3.61) | |

| U test lower bound interval | 9.906 | 9.906 | 9.906 | 9.906 | 9.906 |

| U test upper bound interval | 16.246 | 16.246 | 16.246 | 16.246 | 16.246 |

| _cons | 1.536 | 1.622 | 9.716 *** | 5.561 *** | 8.399 *** |

| (1.08) | (0.86) | (5.20) | (5.23) | (4.76) | |

| N | 956.000 | 759.000 | 702.000 | 1607.000 | 810.000 |

| R2 | 0.839 | 0.759 | 0.771 | 0.737 | 0.804 |

| Variables | Big Cities | Small and Medium−Sized Cities |

|---|---|---|

| GEE | GEE | |

| HC | −1.166 *** | −1.020 *** |

| (−6.54) | (−3.55) | |

| HC2 | 0.043 *** | 0.044 *** |

| (6.45) | (3.80) | |

| FTZ | −0.015 ** | 0.021 * |

| (−2.15) | (1.85) | |

| LED | 0.113 *** | −0.041 |

| (4.88) | (−1.63) | |

| GI | −1.354 *** | −0.624 * |

| (−4.43) | (−1.75) | |

| CS | −0.197 *** | 0.111 * |

| (−2.63) | (1.84) | |

| FDI | −0.722 | 2.376 |

| (−0.57) | (1.22) | |

| FD | 0.213 *** | 0.065 |

| (3.70) | (0.88) | |

| U test | 13.665 *** | 11.566 *** |

| (5.11) | (2.37) | |

| U test lower bound interval | 9.906 | 9.906 |

| U test upper bound interval | 16.256 | 16.256 |

| _cons | 8.490 *** | 5.914 *** |

| (5.94) | (3.10) | |

| N | 1323.000 | 1159.000 |

| R2 | 0.732 | 0.789 |

| MSE | RMSE | MAE | MAPE | R2 | |

|---|---|---|---|---|---|

| training set | 0.003 | 0.054 | 0.034 | 9.834 | 0.886 |

| test set | 0.007 | 0.082 | 0.059 | 16.618 | 0.695 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, X.; Cao, F.; Fan, S. Does Human Capital Matter for China’s Green Growth?—Examination Based on Econometric Model and Machine Learning Methods. Int. J. Environ. Res. Public Health 2022, 19, 11347. https://doi.org/10.3390/ijerph191811347

Liu X, Cao F, Fan S. Does Human Capital Matter for China’s Green Growth?—Examination Based on Econometric Model and Machine Learning Methods. International Journal of Environmental Research and Public Health. 2022; 19(18):11347. https://doi.org/10.3390/ijerph191811347

Chicago/Turabian StyleLiu, Xiaoxue, Fuzhen Cao, and Shuangshuang Fan. 2022. "Does Human Capital Matter for China’s Green Growth?—Examination Based on Econometric Model and Machine Learning Methods" International Journal of Environmental Research and Public Health 19, no. 18: 11347. https://doi.org/10.3390/ijerph191811347

APA StyleLiu, X., Cao, F., & Fan, S. (2022). Does Human Capital Matter for China’s Green Growth?—Examination Based on Econometric Model and Machine Learning Methods. International Journal of Environmental Research and Public Health, 19(18), 11347. https://doi.org/10.3390/ijerph191811347