Whether Green Finance Improves Green Innovation of Listed Companies—Evidence from China

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

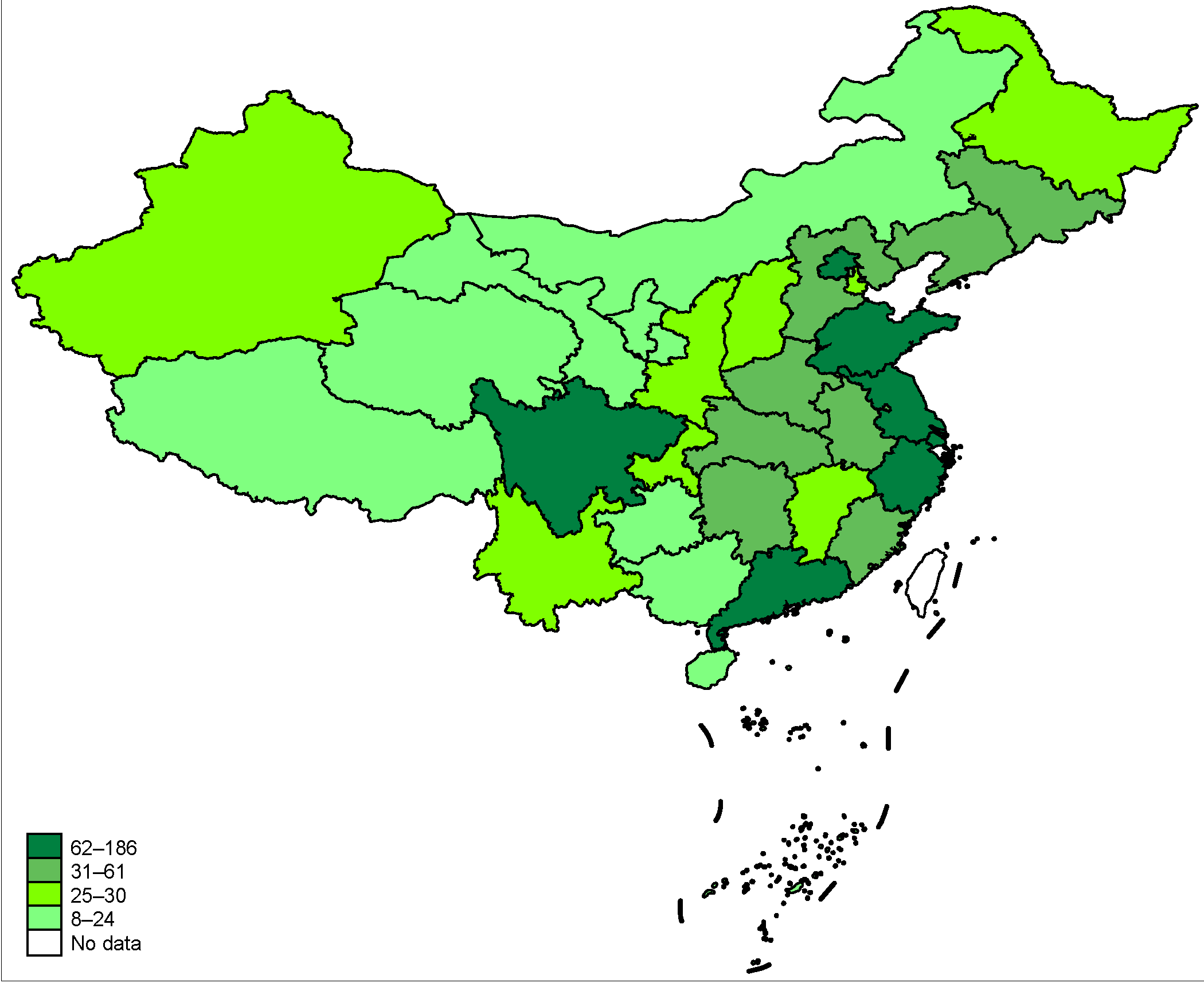

3.1. Variables and Data

3.2. Methods and Model Design

4. Results

4.1. Benchmark Regression Analysis

4.2. Robustness Test

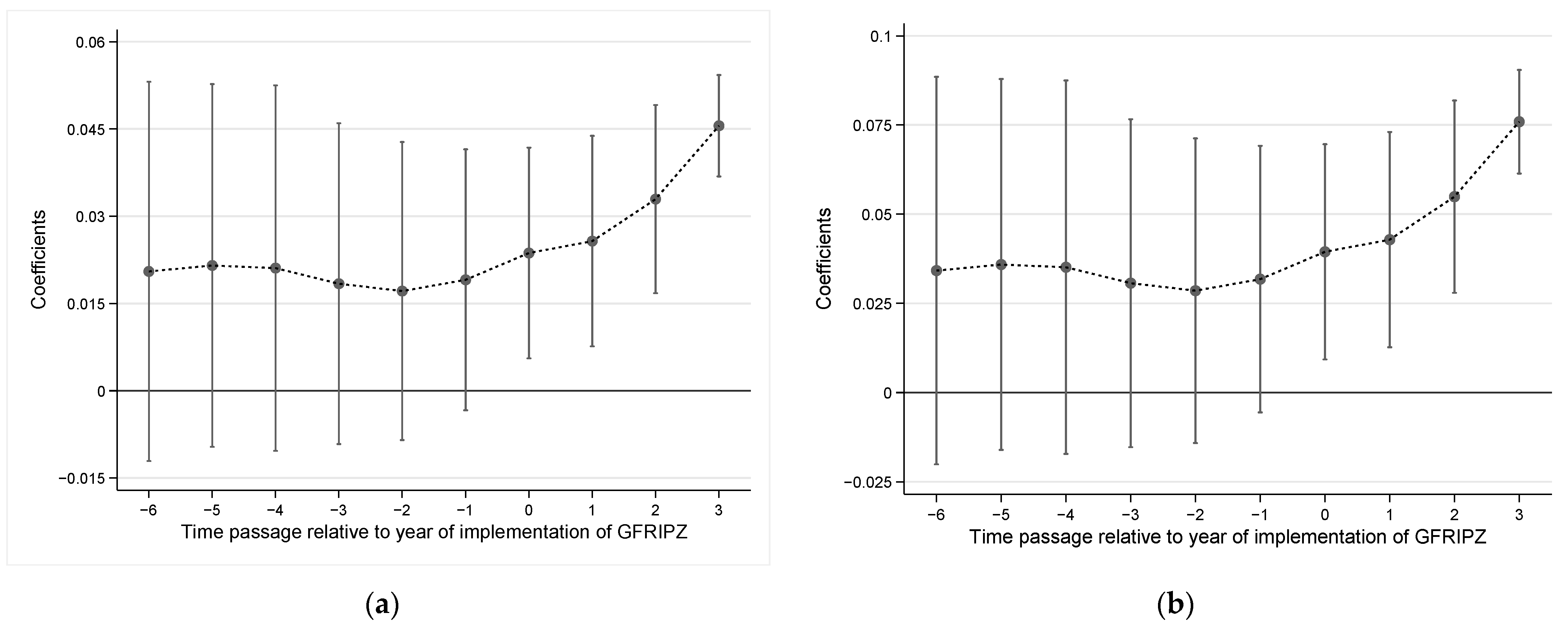

4.2.1. Parallel Trend Test

4.2.2. Placebo Test

4.2.3. PSM-DID Estimation

4.2.4. Replace the Explained Variables

4.3. Heterogeneity Analysis

4.3.1. Heterogeneity Analysis of Different Pilot Zones

4.3.2. Heterogeneity Analysis of Listed Company Characteristics

4.3.3. Heterogeneity Analysis of Specific Industry Qualifications

4.4. Mechanism Analysis

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Scholtens, B. Why finance should care about ecology. Trends Ecol. Evol. 2017, 32, 500–505. [Google Scholar]

- Ziolo, M.; Bak, I.; Cheba, K. The role of sustainable finance in achieving sustainable development goals: Does it work? Technol. Econ. Dev. Econ. 2020, 27, 45–70. [Google Scholar] [CrossRef]

- Falcone, P.M.; Morone, P.; Sica, E. Greening of the financial system and fuelling a sustainability transition. Technol. Forecast. Soc. Change 2018, 127, 23–37. [Google Scholar] [CrossRef]

- Saeed Meo, M.; Karim, M.Z.A. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 2022, 22, 169–178. [Google Scholar] [CrossRef]

- Jeucken, M.H.; Bouma, J.J. The changing environment of banks. Greener Manag. Int. 1999, 27, 20–35. [Google Scholar] [CrossRef]

- Wang, F.; Wang, K. Connotation evolution, development model and promotion path of green finance—Based on the perspective of green transformation. Theor. J. 2018, 3, 59–66. [Google Scholar]

- Deng, Y.; Wang, L.; Zhou, W. Does environmental regulation promote green innovation capability?—Empirical evidence from China. Stat. Res. 2021, 38, 76–86. [Google Scholar]

- Central People’s Government of the People’s Republic of China. China Will Establish Green Financial Reform and Innovation Pilot Zone. 2017. Available online: http://www.gov.cn/zhengce/2017-06/14/content_5202609.htm (accessed on 7 May 2022).

- Li, R.; Liu, L. Green finance and green innovation of listed companies. J. Wuhan Univ. Philos. Soc. Sci. 2021, 74, 126–140. [Google Scholar]

- Sun, Y.; Meng, Y. Green finance policy and green technology innovation: Evidence from the green finance reform and innovation pilot zone. Fujian Forum (Humanit. Soc. Sci. Ed.) 2021, 11, 126–138. [Google Scholar]

- Zhang, Z.; Xu, H.; Shan, S.; Lu, Y.; Duan, H. The impact of ecological civilization construction on environment and public health—Evidence from the implementation of ecological civilization demonstration area in China. Int. J. Environ. Res. Public Health 2022, 19, 5361. [Google Scholar] [CrossRef]

- Wang, K.; Sun, X.; Wang, F. Green financial development, debt maturity structure and green corporate investment. Financ. Forum 2019, 24, 9–19. [Google Scholar]

- Al Mamun, M.; Boubaker, S.; Nguyen, D.K. Green finance and decarbonization: Evidence from around the world. Financ. Res. Lett. 2022, 46, 102807. [Google Scholar] [CrossRef]

- Mzoughi, H.; Urom, C.; Guesmi, K. Downside and upside risk spillovers between green finance and energy markets. Financ. Res. Lett. 2022, 47, 102612. [Google Scholar] [CrossRef]

- Jiang, H.; Wang, W.; Wang, L. Research on the carbon emission reduction effect of green financial development in China—Taking green credit and green venture capital as examples. Financ. Forum 2020, 25, 39–48+80. [Google Scholar]

- Beck, T. Finance and Growth: Too Much of a Good Thing? Rev. D’économie Du Dév. 2014, 22, 67–72. [Google Scholar] [CrossRef]

- Li, W.; Hu, M. An overview of the environmental finance policies in China: Retrofitting an integrated mechanism for environmental management. Front. Environ. Sci. Eng. 2014, 8, 316–328. [Google Scholar] [CrossRef]

- Lian, L. Does green credit affect corporate debt financing costs?—A comparative study of green firms and “two high” firms. Financ. Econ. Res. 2015, 30, 83–93. [Google Scholar]

- Liu, J.; Xia, Y.; Fan, Y.; Lin, S.; Wu, J. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 2017, 163, 293–302. [Google Scholar] [CrossRef]

- Su, D.; Lian, L. Does green credit affect the investment and financing behavior of heavy polluters? J. Financ. Res. 2018, 12, 123–137. [Google Scholar]

- He, L.; Wu, C.; Zhong, Z.; Zhu, J. Green credit, internal and external policies and commercial banks’ competitiveness—An empirical study based on nine listed commercial banks. Financ. Econ. Res. 2018, 33, 91–103. [Google Scholar]

- Wu, S.; Wu, L.; Lv, H. Research on the impact mechanism of green credit on corporate eco-innovation. Soft Sci. 2019, 33, 53–56. [Google Scholar]

- Chen, H.; Liu, C.; Xie, F.; Zhang, T.; Guan, F. Green credit and company R&D level: Empirical research based on threshold effects. Sustainability 2019, 11, 1918. [Google Scholar]

- Lin, D.; Chen, J.; Qiu, G. Research on green financial support factors for China’s environmental protection industry—Empirical analysis based on CSI environmental protection industry 50 index constituents. J. Ind. Technol. Econ. 2018, 37, 129–135. [Google Scholar]

- Yang, X.; Shi, B. Factors affecting the pricing of green bond issues. Financ. Forum 2020, 25, 72–80. [Google Scholar]

- Jiang, F.; Fan, L. Green premium or green discount?—A study based on credit spreads of Chinese green bonds. Mod. Manag. 2020, 40, 11–15. [Google Scholar]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Wu, D. Domestic and international research developments in green innovation. Friends Account. 2019, 16, 2–7. [Google Scholar]

- Wang, X.; Wang, Y. Research on the green innovation effect of environmental information disclosure—A quasi-natural experiment based on “Ambient Air Quality Standards”. Financ. Stud. 2021, 10, 134–152. [Google Scholar]

- Tao, F.; Zhao, J.; Zhou, H. Has environmental regulation achieved the incremental improvement of green technology innovation? Evidence from the environmental protection target responsibility system. China Ind. Econ. 2021, 2, 136–154. [Google Scholar]

- Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The impact of green credit on the green innovation level of heavy-polluting listed companies—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. [Google Scholar] [CrossRef]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate governance and green innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Qi, S.; Lin, Q.; Cui, J. Can the environmental rights trading market induce green innovation?—Evidence from green patent data of listed companies in China. Econ. Stud. 2018, 53, 129–143. [Google Scholar]

- Fang, X.; Na, J. Research on green innovation premiums of GEM listed companies. Econ. Stud. 2020, 55, 106–123. [Google Scholar]

- Xu, J.; Cui, J. Low-carbon city and green technology innovation of listed companies. China Ind. Econ. 2020, 12, 178–196. [Google Scholar]

- Mbanyele, W.; Muchenje, L. The dark side of weakening shareholder litigation rights: Evidence from green patenting activities. Financ. Res. Lett. 2022, 47, 102779. [Google Scholar] [CrossRef]

- Wang, L.; Yan, Y. Environmental regulation intensity, carbon footprint and green total factor productivity of manufacturing industries. Int. J. Environ. Res. Public Health 2022, 19, 553. [Google Scholar] [CrossRef]

- Wagner, M. On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Res. Policy 2007, 36, 1587–1602. [Google Scholar] [CrossRef]

- Wang, J.; Liu, B. Environmental regulation and total factor productivity of enterprises—Empirical analysis based on data from Chinese industrial firms. China Ind. Econ. 2014, 3, 44–56. [Google Scholar]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Zeng, Y.; Feng, Z.; Zhang, X. Geographical location, environmental regulation and innovation transformation of firms. J. Financ. Econ. 2016, 42, 87–98. [Google Scholar]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Y. Effect of environmental regulation and R&D investment on green technology innovation. Sci. Technol. Prog. Policy 2017, 34, 111–119. [Google Scholar]

- Peng, X.; Wei, J. Stakeholder environmental orientation and corporate eco-innovation—The moderating effect of executives’ environmental awareness. Stud. Sci. Sci. 2015, 33, 1109–1120. [Google Scholar]

- Tian, D.; Yu, Q. The influence of top management background characteristics on corporate green innovation. Res. Financ. Econ. Issues 2017, 6, 108–113. [Google Scholar]

- Xu, J.; Guan, J.; Lin, Y. Institutional pressure, executive environmental awareness and corporate green innovation practices—Based on the perspectives of new institutionalism theory and higher order theory. Manag. Rev. 2017, 29, 72–83. [Google Scholar]

- Hu, J.; Li, J.; Li, X.; Liu, Y.; Wang, W.; Zheng, L.S. Will green finance contribute to a green recovery? Evidence from green finance pilot zone in China. Front. Public Health 2021, 9, 794195. [Google Scholar] [CrossRef]

- Huang, H.; Zhang, J. Research on the environmental effect of green finance policy based on the analysis of pilot zone for green finance reform and innovations. Sustainability 2021, 13, 3754. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X. The impact of the green finance reform and innovation pilot zone on the green innovation—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 7330. [Google Scholar] [CrossRef]

- Chinese Research Data Services Platform (CNRDS). Available online: https://www.cnrds.com (accessed on 10 May 2022).

- IPC Green Inventory Issued by World Intellectual Property Organization (WIPO) in 2010. Available online: https://www.wipo.int/classifications/ipc/en/ (accessed on 10 May 2022).

- Wurlod, J.D.; Noailly, J. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Ma, Y.; Zhao, L.; Yang, H.; Tang, G. Air pollution and green innovation of listed companies: Evidence from A-share listed companies of heavy-polluting industries in China. Ind. Econ. Res. 2021, 6, 116–128. [Google Scholar]

- Brav, A.; Jiang, W.; Ma, S.; Tian, X. How does hedge fund activism reshape corporate innovation? J. Financ. Econ. 2018, 130, 237–264. [Google Scholar] [CrossRef]

- CSMAR Database. Available online: http://www.cndata1.csmar.com (accessed on 10 May 2022).

- Wang, X.; Liu, J.; Zhao, Y. Effectiveness measurement of green finance reform and innovation pilot zone. J. Quant. Tech. Econ. 2021, 38, 107–127. [Google Scholar]

- Cao, H.; Li, M.; Lu, Y.; Xu, Y. The impact of strengthening government auditing supervision on fiscal sustainability: Evidence from China’s auditing vertical management reform. Financ. Res. Lett. 2022, 47, 102825. [Google Scholar] [CrossRef]

- Lu, Y.; Tao, Z.; Zhu, L. Identifying FDI Spillovers. J. Int. Econ. 2017, 107, 75–90. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks: The winners and losers from bank deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Pan, A.; Liu, X.; Qiu, J.; Shen, Y. Can green M&A under media pressure promote substantial transformation of heavy-polluting listed companies. China Ind. Econ. 2019, 2, 174–192. [Google Scholar]

- Guidelines for Industry Classification of Listed Companies. Available online: http://www.csrc.gov.cn/csrc/c100103/c1452025/content.shtml (accessed on 21 May 2022).

- List of Industry Classification Management of Listed Companies for Environmental Protection Verification. Available online: http://www.gov.cn/gzdt/2008-07/07/content_1038083.htm (accessed on 21 May 2022).

- Yuan, D.; Zhang, J.; Han, J. Differences in resident consumption, fiscal expenditure and regional effects: An empirical analysis based on dynamic panel data model. Stat. Stud. 2010, 27, 44–52. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Mediating effect analysis: Method and model development. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

| GFRIPZ | Details in Contents and Tasks of GFRIPZ |

|---|---|

| Contents | In June 2017, Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang were selected as the green finance reform and innovation pilot zone.The authorities will step up efforts to motivate the financial institutions on the issuance of green credit, green insurance, and green bonds. A “one-vote veto” system for environmental protection has been implemented in the financing process. There are more long-term loans with low interest provided to green enterprises. Heavily polluting enterprises are restricted on the application of credit, and China has made further exploration on the establishment of environmental rights trading market. Enterprises in the pilot zones are encouraged to resolve excess capacity and eliminate backward production capacity through the limitation or withdrawal from high energy consumption, heavy pollution projects, and the establishment of a “white list” and a “black list” in the field of environmental protection. |

| Each Pilot Zone | Details in Differences between the Pilot Zones |

| Guangdong Pilot Zone | Guangdong will make more efforts to explore the establishment of a new development model in line with green financial reform and economic growth. According to the overall plan, the authorities will encourage the establishment of financial institutions that maintaining new energy vehicles, developing financial product innovations of new energy vehicles, issuing green bonds financing green, circular, and low-carbon projects. The Guangdong pilot zone will work on the following tasks, namely, cultivating the green financial organization system, supporting green industries to expand financing channels, building a trading market for green financial products, accelerating the development of green insurance, establishing a mechanism targeting green financial risk prevention. |

| Jiangxi Pilot Zone | By 2020, the growth rate of green credit balances in the pilot zone will be higher than the growth rate of other types of loans, and the proportion of green credit increments in total loan increments will be increased, according to the overall plan. The scale of direct financing, such as equity financing, is planned to expand continuously. By the end of 2020, the green credit volume of the pilot zone in Jiangxi will reach 300 billion CNY, accounting for a proportion of various loans that exceeds the national average, and the scale of green bond issuance will reach 30 billion CNY. |

| Zhejiang Pilot Zone | The scale of green finance is planned to attain a rapid growth in five years. The scale of financing for “high-pollution and high-emission” industries will decrease, and the non-performing loan ratio of green loans should not be higher than the average non-performing loan of small business loans. The Zhejiang pilot zone plans to build a green financial organization system, expanding financing channels for green industry, exploring and promoting the construction of an environmental rights trading market in a stable and orderly manner, developing green insurance, building a financial service mechanism for the transformation and upgrade of green industries, establishing a green financial system to support the development of small and medium-sized cities and featured small towns. |

| Guizhou Pilot Zone | According to the overall plan, Guizhou will establish a multi-level organizational system, a diversified product and service system, a multi-level support service system and an efficient and flexible market operation mechanism by 2022, and the scale of green credit issuance will increase. Practically, the pilot zone in Guizhou province will establish a multi-level green financial organization system to expedite the design of green financial products and services, to promote the benefits from energy-saving projects, government–private partnership projects (PPP), pollution discharge rights, and energy use rights. Efforts are needed to develop green credit products that benefit farmers and support agricultural industrial projects, such as organic ecological agriculture, rural water conservancy projects, and agricultural production sewage treatments. At the same time, local authorities should guide qualified green enterprises to issue green bonds, promote small and medium-sized green enterprises to issue green collective bonds, and explore the issuance of green project income bills. |

| Xinjiang Pilot Zone | It aims to increase the proportion of green credit, green bonds, green equity financing, etc., in the total financing, reduce the scale of loans to industries with “high pollution and high emissions” in about five years, and build a preliminary green financial system with regional characteristics, as stated in the overall plan. The pilot zone in the Xinjiang autonomous region will support financial institutions to carry out green finance strategies in line with financial institution headquarters or branches, to develop green credit products such as water-saving, energy-saving, and emission-reduction loans for green mine construction. More efforts are needed to support financial institutions, enterprises with long-term green projects to issue green bonds or project-supporting bonds, and to support heating supplemented by clean and renewable energy. |

| Variable Types | Variable Statistics | Variable Definition | Observations | Means | Standard Deviation | Min | Max |

|---|---|---|---|---|---|---|---|

| Explained variables | Grepatent | Ln (number of green patent applications +1) | 20,254 | 1.1707 | 1.6026 | 0 | 6.1399 |

| Greinva | Ln (number of green invention patent applications +1) | 20,254 | 0.3371 | 0.7851 | 0 | 3.8918 | |

| Greuma | Ln (number of green utility model patent applications +1) | 20,254 | 1.1163 | 1.5611 | 0 | 6.0235 | |

| Explanatory variable | D | Policy dummy variable | 20,254 | 0.0766 | 0.2660 | 0 | 1 |

| Control variables | Top | Shareholding ratio of the largest shareholder | 20,216 | 34.424 | 15.268 | 8.41 | 74.98 |

| Cash | Ending balance of cash and cash equivalents/current liability | 20,237 | 0.5542 | 0.8313 | 0 | 5.524 | |

| LAR | Ending balance of total liability/total asset | 20,238 | 0.5629 | 0.2622 | 0.7775 | 1.6865 | |

| RD | R&D cost/total expenditure | 20,254 | 2.9253 | 3.4703 | 0 | 20.8 | |

| ROE | The ratio of net income to total average equity | 20,238 | 0.0414 | 0.2063 | −1.3407 | 0.4132 | |

| Size | Ending balance of total asset of listed companies | 20,238 | 31 | 133 | 0.153 | 1170 | |

| Tobin | (Market value of tradable shares + par value of non-tradable shares)/(total asset—net intangible asset—net goodwill) | 18,132 | 2.1308 | 1.7796 | 0.8614 | 12.627 | |

| Capital | The ratio of total asset to sales revenue | 20,254 | 2.8947 | 3.9988 | 0.3483 | 29.803 | |

| Ret | Annual return of individual shares | 17,099 | 0.3976 | 1.7730 | −0.7865 | 14.971 |

| Variables | Grepatent | Greinva | Greuma | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| D | 0.031 ** | 0.073 ** | 0.016 | 0.045 * | 0.021 ** | 0.066 *** |

| (0.051) | (0.090) | (0.031) | (0.055) | (0.049) | (0.088) | |

| Green × post | 0.069 * (0.237) | 0.092 *** (0.028) | 0.024 (0.016) | 0.064 (0.042) | 0.037 ** (0.034) | 0.085 ** (0.062) |

| Top | −0.119 ** | −0.164 * | −0.088 | |||

| (0.035) | (0.019) | (0.034) | ||||

| Cash | 0.043 | 0.032 * | 0.042 | |||

| (0.032) | (0.017) | (0.031) | ||||

| LAR | −0.051 | −0.041 | −0.028 | |||

| (0.159) | (0.087) | (0.153) | ||||

| RD | 0.021 ** | 0.015 *** | 0.018 * | |||

| (0.010) | (0.005) | (0.010) | ||||

| ROE | 0.144 | 0.066 | 0.137 | |||

| (0.097) | (0.049) | (0.095) | ||||

| Size | 0.507 | 0.326 * | 0.496 | |||

| (0.109) | (0.022) | (0.058) | ||||

| Tobin | 0.056 *** | 0.019 ** | 0.052 *** | |||

| (0.015) | (0.008) | (0.014) | ||||

| Capital | 0.032 *** | 0.016 *** | 0.027 *** | |||

| (0.011) | (0.005) | (0.010) | ||||

| Ret | 0.361 * | 0.091 ** | 0.332 *** | |||

| (0.079) | (0.042) | (0.079) | ||||

| Constant | 0.879 *** | 1.490 *** | 0.181 *** | 0.347 *** | 0.843 *** | 1.394 *** |

| (0.022) | (0.183) | (0.012) | (0.100) | (0.021) | (0.176) | |

| Firm-fixed effect | Control | Control | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control | Control | Control |

| Observations | 20,254 | 17,099 | 20,254 | 17,099 | 20,254 | 17,099 |

| R-squared | 0.637 | 0.753 | 0.739 | 0.775 | 0.636 | 0.749 |

| Variables | Kernel Matching | Caliper Matching | Neighbor Matching | ||||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| D | 0.027 ** | 0.313 | 0.016 ** | 0.041 *** | 0.121 | 0.066 * | 0.016 ** | 0.157 | 0.035 *** |

| (0.145) | (0.120) | (0.031) | (0.008) | (0.047) | (0.088) | (0.011) | (0.026) | (0.077) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 1.748 *** | 0.463 *** | 1.672 *** | 1.777 *** | 0.445 *** | 0.443 *** | 1.701 *** | 0.910 *** | 1.779 *** |

| (0.024) | (0.013) | (0.024) | (0.037) | (0.020) | (0.019) | (0.037) | (0.126) | (0.038) | |

| Firm-fixed effect | Control | Control | Control | Control | Control | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control | Control | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control | Control | Control | Control | Control | Control |

| Observations | 17,099 | 17,099 | 17,099 | 17,099 | 17,099 | 17,099 | 17,099 | 17,099 | 17,099 |

| R-squared | 0.705 | 0.689 | 0.786 | 0.653 | 0.658 | 0.638 | 0.757 | 0.824 | 0.726 |

| Statistic | Unit | Observations | Means | Standard Deviation | Min | Max |

|---|---|---|---|---|---|---|

| Rpatent | - | 20,254 | 0.10812 | 0.20397 | 0 | 0.645 |

| Rinva | - | 20,254 | 0.88979 | 0.20598 | 0 | 0.321 |

| Ruma | - | 20,254 | 0.05511 | 0.08587 | 0 | 0.405 |

| Variables | Rpatent | Rinva | Ruma | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| D | 0.021 ** | 0.014 *** | 0.031 | 0.032 | 0.027 ** | 0.043 ** |

| (0.010) | (0.019) | (0.028) | (0.017) | (0.028) | (0.036) | |

| Top | −0.053 | −0.429 *** | −0.442 *** | |||

| (0.036) | (0.040) | (0.065) | ||||

| Cash | 0.032 *** | 0.019* | 0.022 | |||

| (0.017) | (0.011) | (0.035) | ||||

| LAR | −0.070 *** | −0.042 | −0.013 | |||

| (0.020) | (0.059) | (0.096) | ||||

| RD | 0.524 *** | 0.117 | 0.089 *** | |||

| (0.025) | (0.108) | (0.033) | ||||

| ROE | 0.023 | 0.020 | 0.027 | |||

| (0.061) | (0.031) | (0.040) | ||||

| Size | 0.355 *** | 0.317 *** | 0.324 *** | |||

| (0.054) | (0.027) | (0.051) | ||||

| Tobin | 0.036 * | 0.014 | 0.034 * | |||

| (0.011) | (0.005) | (0.015) | ||||

| Capital | 0.368 | 0.300 | 0.331 | |||

| (0.037) | (0.035) | (0.037) | ||||

| Ret | 0.402 *** | 0.433 *** | 0.469 *** | |||

| (0.060) | (0.035) | (0.058) | ||||

| Constant | 0.086 *** | 0.182 *** | 0.077 *** | 0.563 *** | 0.093 *** | 0.183 ** |

| (0.011) | (0.271) | (0.062) | (0.056) | (0.083) | (1.200) | |

| Firm-fixed effect | Control | Control | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control | Control | Control |

| Observations | 20,254 | 17,099 | 20,254 | 17,099 | 20,254 | 17,099 |

| R-squared | 0.689 | 0.692 | 0.695 | 0.658 | 0.791 | 0.728 |

| Variables | Guangdong | Jiangxi | Zhejiang | Guizhou | Xinjiang |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| D | 0.158 *** | 0.139 * | 0.263 ** | 0.116 *** | 0.081 * |

| (0.061) | (0.096) | (0.206) | (0.098) | (0.064) | |

| Green × post | 0.187 ** | 0.170 * | 0.392 * | 0.133 ** | 0.109 ** |

| (0.416) | (0.194) | (0.315) | (0.361) | (0.058) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Constant | 0.014 | 0.051 *** | 0.055 *** | 0.058 *** | 0.012 |

| (0.027) | (0.016) | (0.015) | (0.015) | (0.022) | |

| Firm-fixed effect | Control | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control | Control |

| Observations | 2418 | 351 | 1599 | 247 | 403 |

| R-squared | 0.816 | 0.805 | 0.785 | 0.774 | 0.817 |

| Variables | Ownership Attributes | Degree of Pollution | Scale of Listed Companies | Region Where Listed Companies Are Located |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| D | 0.020 *** | −0.104 ** | 0.026 * | 0.344 ** |

| (0.104) | (0.114) | (0.120) | (0.242) | |

| D× Owner | 0.264 * | |||

| (0.154) | ||||

| D× Industry | 0.390 *** | |||

| (0.144) | ||||

| D× Scale | 0.189 * | |||

| (0.148) | ||||

| D× Region | 0.309 ** | |||

| (0.248) | ||||

| Control variables | Yes | Yes | Yes | Yes |

| Constant | 1.498 *** | 1.506 *** | 1.593 *** | 1.362 *** |

| (0.182) | (0.109) | (0.095) | (0.079) | |

| Firm-fixed effect | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control |

| Observations | 17,099 | 17,099 | 17,099 | 17,099 |

| R-squared | 0.539 | 0.595 | 0.586 | 0.549 |

| Variables | Services | Manufacturing | Energy | Processing | Engineering |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| D | 0.074 | 0.202 ** | 0.277 *** | 0.186 * | 0.094 ** |

| (0.063) | (0.133) | (0.141) | (0.165) | (0.135) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Constant | 2.427 | 3.603 | 3.214 * | 3.516 ** | 4.696 |

| (5.431) | (2.787) | (1.754) | (1.683) | (3.296) | |

| Firm-fixed effect | Control | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control | Control |

| Observations | 3770 | 5863 | 3107 | 3510 | 4004 |

| R-squared | 0.848 | 0.867 | 0.834 | 0.820 | 0.859 |

| Variable Statistics | Variable Definition | Observations | Means | Standard Deviation | Min | Max |

|---|---|---|---|---|---|---|

| Debt | Financial expenses/interest- bearing liability | 17,757 | 0.0766 | 0.1715 | −0.0378 | 0.8926 |

| LDR | Long-term debt/total liability | 17,099 | 0.0551 | 0.0859 | −0.0063 | 0.4051 |

| Variables | Model (7) | Model (8) | Model (9) | ||

|---|---|---|---|---|---|

| Grepatent | Debt | LDR | Grepatent | Grepatent | |

| (1) | (2) | (3) | (4) | (5) | |

| D | 0.073 ** | −0.034 *** | 0.093 ** | 0.072 * | 0.145 * |

| (0.090) | (0.009) | (0.010) | (0.090) | (0.098) | |

| Debt | −0.225 *** | ||||

| (0.441) | |||||

| LDR | 0.104 ** | ||||

| (0.510) | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Constant | 1.490 *** | −0.035 *** | −0.011 | 1.473 *** | 1.489 *** |

| (0.183) | (0.012) | (0.010) | (0.108) | (0.182) | |

| Firm-fixed effect | Control | Control | Control | Control | Control |

| Year-fixed effect | Control | Control | Control | Control | Control |

| Province-fixed effect | Control | Control | Control | Control | Control |

| Observations | 17,099 | 17,099 | 17,099 | 17,099 | 17,099 |

| R-squared | 0.753 | 0.732 | 0.706 | 0.768 | 0.719 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, Z.; Xu, H.; Zhang, Z.; Lyu, Y.; Lu, Y.; Duan, H. Whether Green Finance Improves Green Innovation of Listed Companies—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 10882. https://doi.org/10.3390/ijerph191710882

Dong Z, Xu H, Zhang Z, Lyu Y, Lu Y, Duan H. Whether Green Finance Improves Green Innovation of Listed Companies—Evidence from China. International Journal of Environmental Research and Public Health. 2022; 19(17):10882. https://doi.org/10.3390/ijerph191710882

Chicago/Turabian StyleDong, Zhao, Haodong Xu, Zhifeng Zhang, Yipin Lyu, Yuqi Lu, and Hongyan Duan. 2022. "Whether Green Finance Improves Green Innovation of Listed Companies—Evidence from China" International Journal of Environmental Research and Public Health 19, no. 17: 10882. https://doi.org/10.3390/ijerph191710882

APA StyleDong, Z., Xu, H., Zhang, Z., Lyu, Y., Lu, Y., & Duan, H. (2022). Whether Green Finance Improves Green Innovation of Listed Companies—Evidence from China. International Journal of Environmental Research and Public Health, 19(17), 10882. https://doi.org/10.3390/ijerph191710882