1. Introduction

Dealing with climate change has become an urgent task for all countries around the world. According to the IPCC report, realizing substantial cuts in carbon emissions by 2030 and net-zero carbon emissions by 2050 could limit global warming to 1.5 °C, hence avoiding the irreversible negative impacts on ecosystems and human society. Given the importance of reducing carbon emissions in dealing with climate change, China, as a major carbon emitter, has committed to a carbon peak by 2030 and carbon neutrality by 2060. Hence, it is of great significance to investigate how to promote the carbon peak and carbon neutrality in China.

Considering the strong relationships between economic development, carbon emissions, and energy consumption [

1,

2,

3], it is important to reasonably evaluate the regional comprehensive carbon emission performance (CCEP). CCEP represents the low-carbon development level, that is, fully considering the regional economic development and resource allocation capacity in the process of evaluating the regional CO

2 emission level. Promoting comprehensive carbon emission performance (namely, increasing resources utilization rate alongside economic development to reduce CO

2 emissions) could contribute to the carbon peak and carbon neutrality, and it is also the inevitable choice for China’s low-carbon development. Numerous studies have investigated how to promote carbon emission performance from the perspective of environmental policies [

4,

5,

6], city characteristics [

7], urbanization [

8,

9], FDI [

10,

11], and innovation [

12,

13]. The importance of finance in reducing carbon emissions and promoting efficiency has also been a widely discussed topic in recent years. Demertzis, et al. [

14], Jalil and Feridun [

15], and Acheampong [

16] find that financial development contributes to reducing carbon emissions through technological development and corporate governance promotion. However, financial development may have a negative influence on carbon emission, since it enables households and enterprises to obtain cheaper credit, thus forcing them to purchase household equipment or machines that are energy-consuming [

16,

17,

18]. Overall, among existing studies, the conclusions about the influence of financial development on carbon emission are conflicting.

The Chinese traditional financial system is insufficient as the resource allocation is influenced by the government, which excludes many enterprises and households from the financial system [

19]. The shortcoming of China’s financial system fosters the birth and development of new financial models to some extent. In recent years, through online payment, big data, and cloud computing technology, digital finance improves people’s well-being by providing more inclusive financial support. Numerous studies have investigated the economic consequences of digital finance from the perspective of enterprise financial behavior [

20], household consumption [

21], financial stability [

22,

23], entrepreneurship [

24], and innovation [

25,

26,

27]. Their overall conclusion is that digital finance can supplement the traditional financial system to a large extent. Moreover, some studies also focus on exploring the impact of digital financial inclusion on the environment and regional sustainable development. Ullah, et al. [

28] found that financial inclusion had a positive impact on the sustainable development of countries in the one belt and road initiative (OBRI) region; and based on data from 103 countries, Renzhi and Baek [

29] found that digital financial inclusion can mitigate CO

2 emissions. On the contrary, Ozturk and Ullah [

30] found that digital financial inclusion can significantly boost the economic growth of countries in the OBRI region, but decrease environmental quality. Le, et al. [

31] found that financial inclusion led to increased CO

2 emissions based on 31 economies in Asia. Nevertheless, few studies have investigated how digital finance influences carbon emission performance.

Compared with the traditional finance, digital finance performs better in reducing information asymmetry and identifying borrowers’ default risks [

22,

32]. Therefore, under the model of digital finance, green innovative projects and small and micro-sized enterprises in the tertiary industry, which are generally excluded from the traditional financial system, could more easily obtain financial support. Extensive evidence shows that green innovation is positively correlated with carbon emissions [

33,

34], while the tertiary industry share is negatively correlated with carbon emissions [

35]. Hence, we hypothesize that digital finance could promote comprehensive carbon emission performance.

Using city-level data from China’s mainland, we investigate how digital finance influences comprehensive carbon emission performance. We first introduce a super-SBM method based on a total factor analysis framework to assess the CCEP of China’s cities, which can effectively evaluate the urban green and low-carbon development level considering economic factors and avoid the influence of censored data on empirical analysis. In addition, our estimation results show that the digital finance index is positively correlated with carbon emission performance. After conducting a set of robustness tests and addressing the endogeneity issue, the above conclusion is robust. Our channel tests indicate that digital finance improves urban CCEP by promoting green innovation and the development of the tertiary industry. We finally investigate how the urban development characteristics and the degree of policy control influence the relationship between digital finance and CCEP. Our results show that digital finance has a stronger impact on CCEP in cities with more developed traditional finance systems, and the positive effect is significant in non-old industrial base cities and a two-control zone.

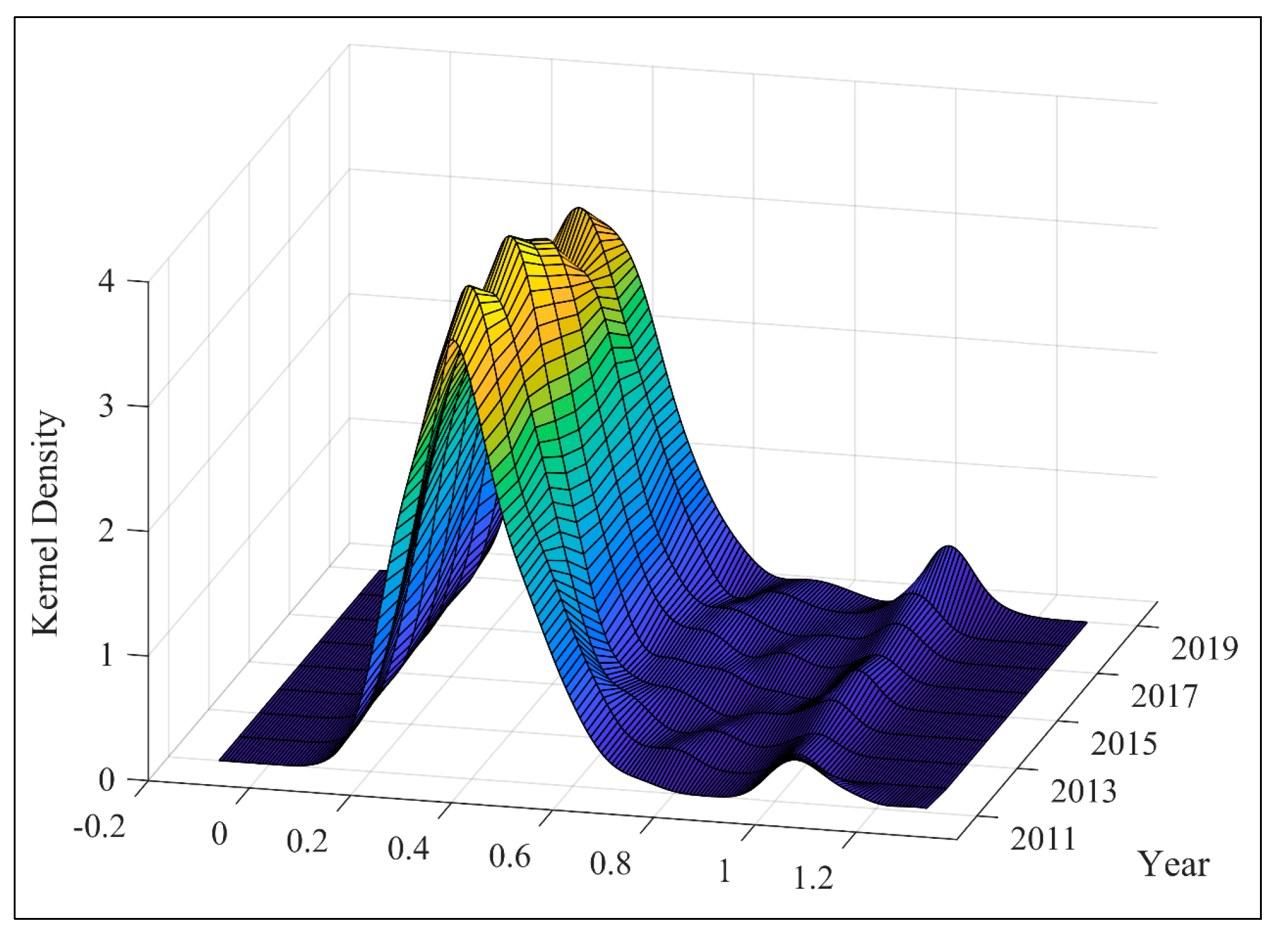

We contribute to the existing literature in the following aspects. First, we provide more reliable results on how digital finance influences carbon emission performance. Different from the previous studies, we focus on urban low-carbon development and empirically examine how digital finance influences carbon emission performance based on city-level data. Additionally, we conduct more comprehensive channel tests, endogeneity tests, and cross-sectional tests. Our above empirical framework enables us to precisely identify the causal relationship between digital finance and carbon emission performance. Second, we also present the dynamic evolution of comprehensive carbon emission performance of China’s 281 cities from 2011 to 2019, which could help the policymakers comprehend the characteristics of urban CCEP and know the gains and losses in China’s low carbon development. Thirdly, our results contribute to reconciling how financial development influences carbon emission performance. Existing studies show conflicting conclusions on how financial development influences carbon emissions. In this paper, we reveal that, when combined with digital technology, financial development could promote urban CCEP.

Furthermore, in

Section 2, we further analyze the theoretical channels about how digital finance influences CCEP and propose several hypotheses. In

Section 3, we introduce the methodology and present the descriptive statistics of our data. Then, in

Section 4, we report and discuss our estimation results. We finally discuss our conclusions and implications in

Section 5.

5. Conclusions and Policy Implications

Controlling CO2 emission has been an urgent job for the whole world facing climate change. As a major carbon emitter, China has proposed the goals of achieving a carbon peak and carbon neutrality. Considering that there are strong relationships among economic development, carbon emissions, and energy consumption, promoting urban comprehensive carbon emission performance could contribute to realizing the CO2 emissions reduction, and it is also the inevitable choice for China’s low-carbon development. Meanwhile, in recent years, relying on new technologies, digital finance improves people’s well-being by providing more inclusive financial support. However, few pieces of literature are contributing to exploring the relationship between digital finance and urban low-carbon development. Therefore, to identify the economic consequences of digital financial development, and to systematically explore the impact of digital financial development on urban CCEP, based on data of 281 cities from 2011 to 2019 in China, this paper empirically identifies the casual relationship between digital finance and urban low-carbon development after accurately assessing Chinese urban comprehensive carbon emission performance. In addition, we further conduct a set of robustness tests and address the endogeneity issue. Finally, we explore the channels of digital finance affecting urban carbon emission performance and conduct heterogeneity tests based on urban development characteristics.

The results show that, from 2011 to 2019, the average CCEP of China’s cities shows an upward trend, and the increase in the eastern area is more obvious, suggesting that urban economic activities tend to be more efficient, highly productive, and produce less CO2 emissions. Secondly, the regression results suggest that digital finance significantly improves urban carbon emission performance. Meantime, for the different sub-indicators, there is a U-shaped relationship between the coverage breadth and carbon emission performance, reflecting that when the coverage breadth reaches a certain scale, the urban carbon emissions performance can be effectively improved, and the deepening usage of digital finance and the improvement of digital support services could significantly improve CCEP. In addition, after conducting a set of robustness tests and addressing the endogeneity issue, the above conclusion is robust. Thirdly, through channel tests, we find that digital finance mainly improves urban CCEP by promoting green innovation and the development of the urban tertiary industry. Finally, cross-tests show that digital finance has a stronger impact on improving carbon emission performance in High-FD cities, and the positive effect is significant in non-old industrial base cities and the two-control zone.

Our research provides some enlightenment for China’s low-carbon sustainable development planning and environmental policy. From the perspective of macro mechanism, the government should continuously promote the healthy growth of digital finance and accelerate the perfection of the digital financial system. Specifically, the government should firstly focus on accelerating the construction of digital infrastructure, improving the coverage breadth, and increasing the development scale of digital finance. Secondly, the government needs to improve urban digital financial functions and services, and realize the potential of digital finance in payment, credit, insurance, and other aspects. Thirdly, the government should vigorously support the integration of technology and finance and improve the service efficiency. For microeconomic entities, the government should pay attention to guiding the flow of financial funds. On the one hand, digital financial funds should be invested in innovative enterprises to promote green technology innovation. On the other hand, it is worthy to attach importance to allocating digital financial resources into the service industry to promote the development of the service industry. Considering the heterogeneity of urban development characteristics, the central government should draft differentiated digital finance development strategies. For cities with more developed traditional finance, we should fully recognize the positive emission reduction effect of digital finance. As most eastern coastal cities and developed cities have a high level of financial development and relatively large CO2 emissions, hence promoting the development of digital finance in the above regions could further achieve more positive effects in terms of promoting the low-carbon development. Finally, the government should grasp the development characteristics of digital finance and recognize the synergy between digital finance and the government’s environmental control policies, to help the relevant environmental policies achieve good environmental governance effects.

Although this paper fills the gap in the extant research on how digital finance affects the urban carbon emission performance, there are still some limitations. First, whether it is the urban digital finance development or urban carbon emission performance, there is a possibility of spatial correlation, that is, the local development of digital finance (or local carbon emission performance) can significantly influence the development of digital finance (or carbon emission performance) in surrounding cities. Therefore, in future research, considering the characteristics of spatial correlation can provide a more realistic and meaningful reference for urban low-carbon development. Secondly, although the city-level data are used, the data in this paper are still based on the macro level. Considering that the digital finance can significantly boost green innovation, therefore, exploring the impact of digital finance on enterprise green innovation and enterprise pollutant emission based on microenterprise data can further analyze the economic consequences of the digital finance development and offer a valuable reference for promoting the development of digital finance.