Environmental Information Disclosure, Digital Transformation, and Total Factor Productivity: Evidence from Chinese Heavy Polluting Listed Companies

Abstract

:1. Introduction

2. Literature Review

3. Mechanism Analysis

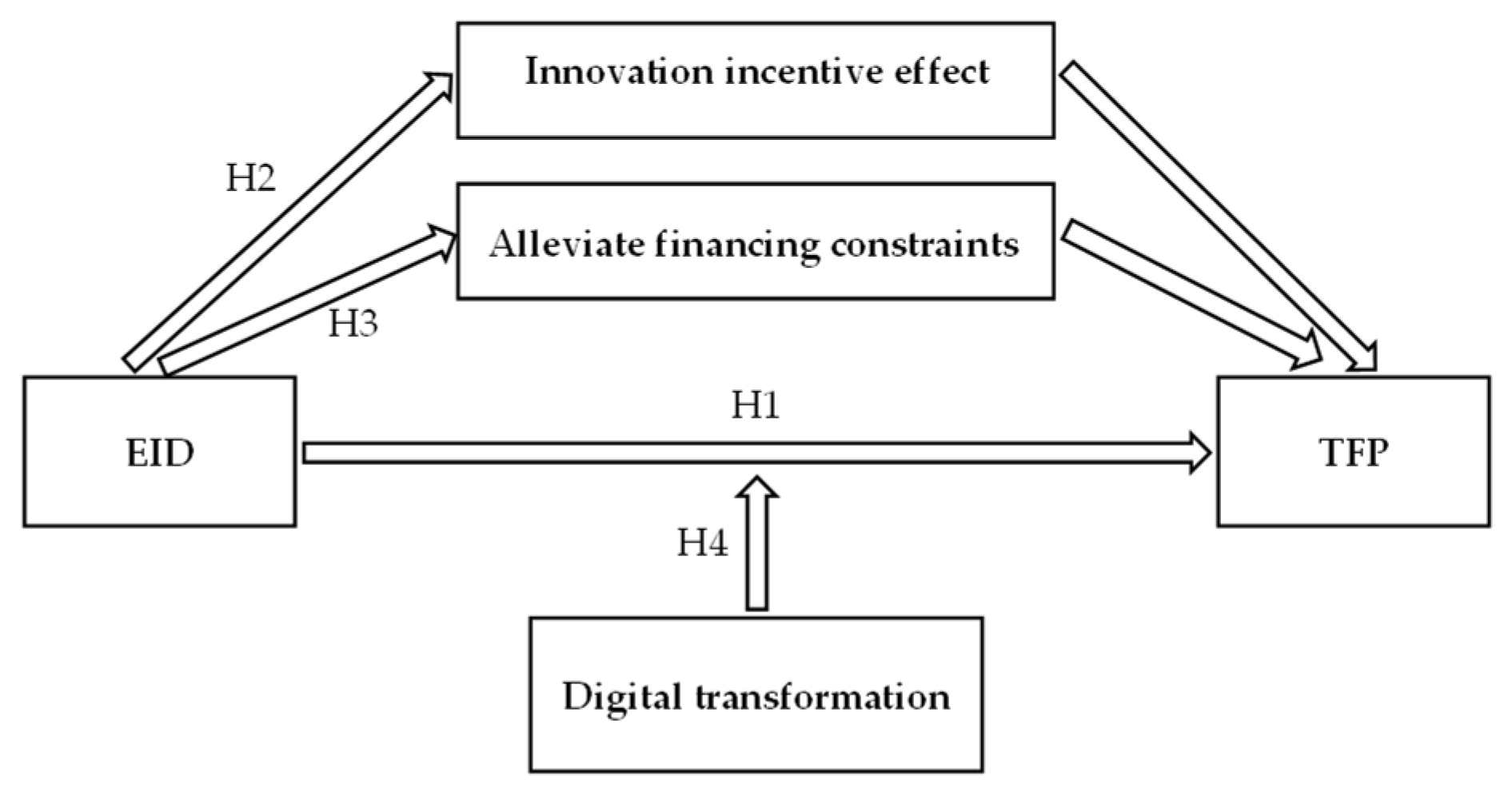

3.1. Environmental Information Disclosure and Enterprise Total Factor Productivity

3.2. Impact Mechanism of Environmental Information Disclosure on the Total Factor Productivity of Enterprises

3.2.1. Innovative Effects of Environmental Information Disclosure

3.2.2. Financing Effects of Environmental Information Disclosure

3.3. Environmental Information Disclosure, Digital Transformation, and Enterprise Total Factor Productivity

4. Data and Methodology

4.1. Data Samples and Sources

4.2. Variable Definition and Data Description

4.2.1. Explained Variable

4.2.2. Primary Explanatory Variable

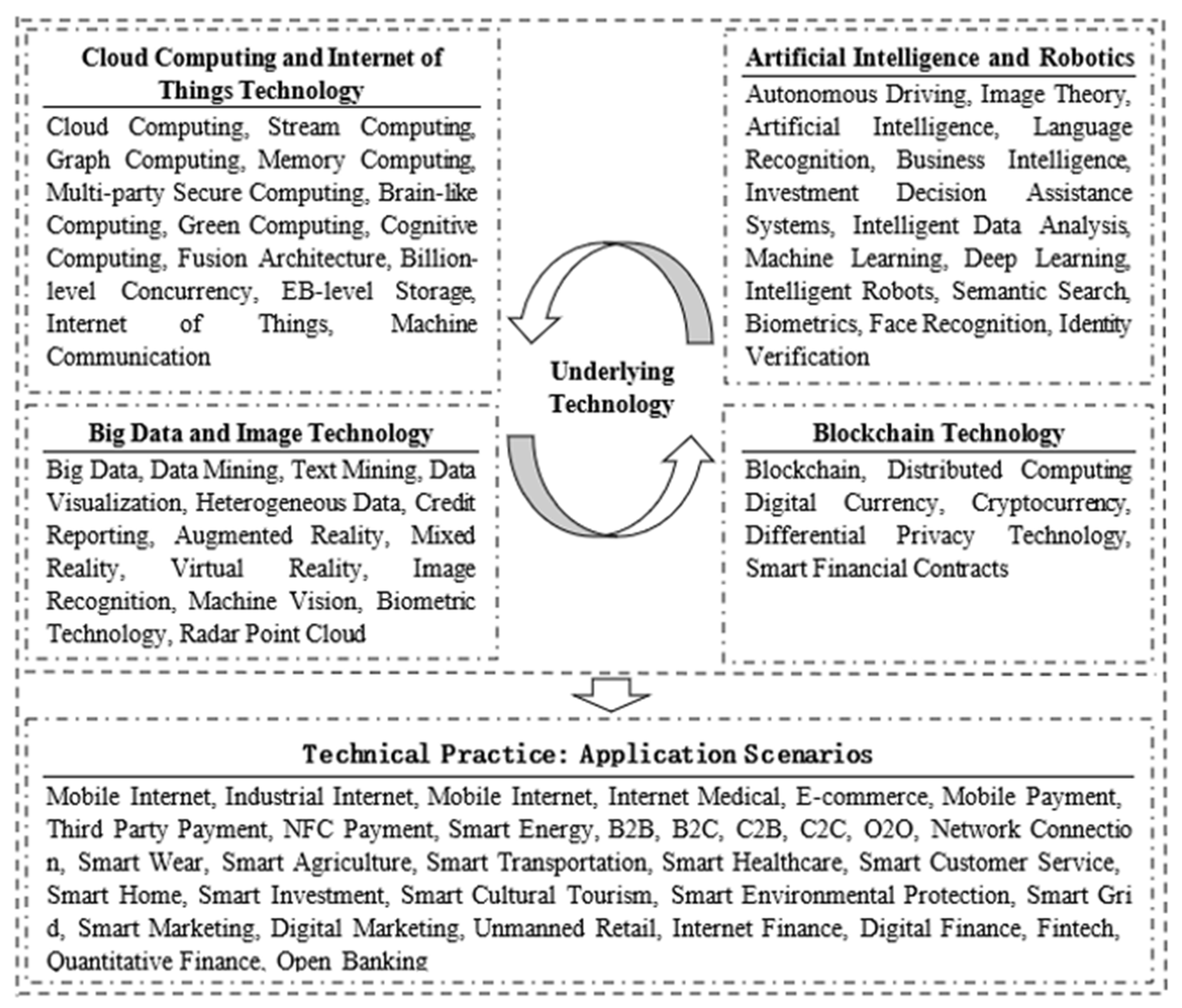

4.2.3. Moderator Variables

4.2.4. Mediator Variables

4.2.5. Control Variables

4.3. Benchmark Measurement Model

5. Empirical Results and Analysis

5.1. Benchmark Regression Results

5.2. Robustness Test

5.2.1. Replace the Explained Variable

5.2.2. Add City-Level Control Variables

5.2.3. The Method of Instrumental Variables

5.3. Heterogeneity Analysis

5.3.1. Heterogeneity of Enterprise Property Rights

5.3.2. Heterogeneity of Enterprise Scale

5.3.3. Geographical Heterogeneity of Enterprises

5.4. Moderating Effect of the Digital Transformation of Enterprises

6. Further Analysis: Mechanism Test

6.1. Innovation Incentive Effect Test

6.2. Test of Financing Constraints

7. Conclusions

7.1. Discussion

7.2. Main Conclusions

- (1)

- EID significantly improves TFP, suggesting that EID should not be considered simply as a cost expenditure but rather as an important way for companies to gain a competitive position and achieve green and sustainable development.

- (2)

- Digital transformation has an inhibitory moderating effect on the impact of EID on TFP. With the development of enterprises’ digital transformation, EID is no longer the only source for the public to understand enterprises’ environmental information. This may cause substitution and crowding-out effects on EID. In addition, some enterprises blindly pursue digitalization and intelligence, while ignoring the intrinsic correlation between the digital economy, technological change, and the operation mode of enterprises. This, in turn, leads to the misplacement of digital resources.

- (3)

- Heterogeneity tests show that the positive effect of EID on TFP varies across property rights, firm size, and geographical location. Specifically, EID has the strongest effect on non-state enterprises, large enterprises, and enterprises located in the east-central region. Therefore, enterprises should fully consider heterogeneous differences and formulate the most suitable strategies when responding to relevant policies.

- (4)

- Further tests on the mechanism suggest that the impacts of EID are transmitted through innovation incentive and financing promotion effects. These results provide useful references for a comprehensive understanding of the productivity effects of EID and the moderating effect of market-oriented transformation, which is conducive to stimulating the vitality of green and sustainable development among enterprises.

7.3. Policy Implications

- (1)

- As a reflection of enterprises’ active fulfillment of social responsibility, EID is of great significance to achieve a green economy and sustainable development. The government should improve the EID system and evaluation system to avoid false disclosure and to improve EID quality. A series of incentive policies and public monitoring could help implement environmental policies.

- (2)

- The development of the digital economy has created unprecedented opportunities for enterprises. The rational formulation of a digital transformation strategy, as well as an accurate understanding of the timing of the digital economy, are key to enterprise victory in this new era of technological revolution. Enterprise competitiveness improvement should be based on efficient digital transformation. It is important to correctly understand the connotation of digital transformation and to use it as an important strategy to guide the sustainable development of enterprises.

- (3)

- Enterprises should be fully aware of the heterogeneous characteristics and long-term benefits of EID and should actively fulfill their EID responsibilities. Through the innovative compensation effect, EID covers up-front expenditure. EID improves the financing ability of enterprises and improves TFP. However, the effect of EID on TFP is weak in the western region, where there are small and state-owned enterprises. Therefore, the government should be aware of the regional gap and develop differentiated environmental systems. More support should be given to small enterprises to reduce institutional pressure and financial risks. The effect of EID on TFP was stronger in non-state enterprises, while the effect on state-owned enterprises was not significant. On the one hand, this may be because state-owned enterprises are more conscientious, and the EID incremental effect is not significant. On the other hand, it may be due to the lack of political burden on non-state-owned enterprises, making their strategies more in line with the economic hypothesis of the “rational man”. If we can determine the underlying explanations, we can better achieve a win–win situation.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Disclosure Type | Disclosure Items | Scoring Description |

|---|---|---|

| Environmental Management | Environmental Protection Concept | Disclosure: 1 None: 0 |

| Environmental Goals | ||

| Environmental Management System | ||

| Environmental Education and Training | ||

| Environmental Protection Special Action | ||

| Environmental Incident Response Mechanism | ||

| Environmental Honors or Awards | ||

| The “Three Simultaneous” System | ||

| Environmental Regulation and Certification | Key Pollution Monitoring Units | Disclosure: 1 None: 0 |

| Pollutant Emission Compliance | ||

| Sudden Environmental Accidents | ||

| Environmental Violations | ||

| Environmental Petition Letter Cases | ||

| Is Pass ISO14001 Certification | Pass: 1 None: 0 | |

| Is Pass ISO9001 Certification | ||

| Environmental Information Disclosure Carrier | Annual Reports | Disclosure: 1 None: 0 |

| Corporate Social Responsibility Reports | ||

| Environmental Report | ||

| Environmental Liabilities | Wastewater Emissions | Quantitative Description: 2 Qualitative Description: 1 None: 0 |

| COD Emissions | ||

| SO2 Emissions | ||

| CO2 Emissions | ||

| Soot and Dust Emissions | ||

| Industrial Solid Waste Emissions | ||

| Environmental Performance and Governance | Waste Gas Emission Reduction and Treatment | Quantitative Description: 2 Qualitative Description: 1 None: 0 |

| Wastewater Emission Reduction and Treatment | ||

| Dust and Fume Control | ||

| Solid Waste Utilization and Disposal | ||

| Noise, Light Pollution, Radiation and other Governance | ||

| Cleaner Production Implementation |

References

- Wartick, S.L.; Cochran, P.L. The Evolution of the Corporate Social Performance Model. Acad Manag. Rev. 1985, 10, 758–769. [Google Scholar] [CrossRef]

- Lindgreen, A.; Swaen, V.; Johnston, W.J. Corporate Social Responsibility: An Empirical Investigation of U.S. Organizations. J. Bus. Ethics 2009, 85, 303–323. [Google Scholar] [CrossRef]

- Hartmann, J.; Uhlenbruck, K. National Institutional Antecedents to Corporate Environmental Performance. J. World Bus. 2015, 50, 729–741. [Google Scholar] [CrossRef]

- Cheng, Z.; Wang, F.; Keung, C.; Bai, Y. Will Corporate Political Connection Influence the Environmental Information Disclosure Level? Based on the Panel Data of A-Shares from Listed Companies in Shanghai Stock Market. J. Bus. Ethics 2017, 143, 209–221. [Google Scholar] [CrossRef]

- Li, Y.; Wong, C.W.Y.; Miao, X. Political Connection, Political Promotion and Corporate Environmental Information Disclosure in China. Chin. Manag. Stud. 2022, 16, 78–101. [Google Scholar] [CrossRef]

- Aerts, W.; Cormier, D. Media Legitimacy and Corporate Environmental Communication. Account. Org. Soc. 2009, 34, 1–27. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Yin, H.T.; Tam, C.M. Factors That Drive Chinese Listed Companies in Voluntary Disclosure of Environmental Information. J. Bus. Ethics 2012, 109, 309–321. [Google Scholar] [CrossRef]

- Li, L.; Xia, X.H.; Chen, B.; Sun, L. Public Participation in Achieving Sustainable Development Goals in China: Evidence from the Practice of Air Pollution Control. J. Clean. Prod. 2018, 201, 499–506. [Google Scholar] [CrossRef]

- Gerged, A.M. Factors Affecting Corporate Environmental Disclosure in Emerging Markets: The Role of Corporate Governance Structures. Bus. Strateg. Environ. 2021, 30, 609–629. [Google Scholar] [CrossRef]

- Iatridis, G.E. Environmental Disclosure Quality: Evidence on Environmental Performance, Corporate Governance and Value Relevance. Emerg. Mark. Rev. 2013, 14, 55–75. [Google Scholar] [CrossRef]

- Giannarakis, G.; Andronikidis, A.; Sariannidis, N. Determinants of Environmental Disclosure: Investigating New and Conventional Corporate Governance Characteristics. Ann. Oper. Res. 2020, 294, 87–105. [Google Scholar] [CrossRef]

- Lewis, B.W.; Walls, J.L.; Dowell, G.W.S. Difference in Degrees: CEO Characteristics and Firm Environmental Disclosure: Research Notes and Commentaries. Strateg. Manag. J. 2014, 35, 712–722. [Google Scholar] [CrossRef] [Green Version]

- Clarkson, P.M.; Overell, M.B.; Chapple, L. Environmental Reporting and Its Relation to Corporate Environmental Performance: Corporate Environmental Reporting and Performance. Abacus 2011, 47, 27–60. [Google Scholar] [CrossRef]

- Wang, S.; Wang, H.; Wang, J.; Yang, F. Does Environmental Information Disclosure Contribute to Improve Firm Financial Performance? An Examination of the Underlying Mechanism. Sci. Total Environ. 2020, 714, 136855. [Google Scholar] [CrossRef]

- Fonseka, M.; Rajapakse, T.; Richardson, G. The Effect of Environmental Information Disclosure and Energy Product Type on the Cost of Debt: Evidence from Energy Firms in China. Pac.-Basin Financ. J. 2019, 54, 159–182. [Google Scholar] [CrossRef]

- Luo, W.; Guo, X.; Zhong, S.; Wang, J. Environmental Information Disclosure Quality, Media Attention and Debt Financing Costs: Evidence from Chinese Heavy Polluting Listed Companies. J. Clean. Prod. 2019, 231, 268–277. [Google Scholar] [CrossRef]

- Yang, Y.; Wen, J.; Li, Y. The Impact of Environmental Information Disclosure on the Firm Value of Listed Manufacturing Firms: Evidence from China. Int. J. Environ. Res. Public Health 2020, 17, 916. [Google Scholar] [CrossRef] [Green Version]

- Tang, Y.; Ma, W.; Xia, L. Quality of Environmental Information Disclosure, Internal Control “Level” and Enterprise Value—Empirical Evidence from Listed Companies in Heavy Polluting Industries. Account. Res. 2021, 7, 69–84. [Google Scholar]

- Huang, R.; Chen, D. Does Environmental Information Disclosure Benefit Waste Discharge Reduction? Evidence from China. J. Bus. Ethics 2015, 129, 535–552. [Google Scholar] [CrossRef]

- Shi, D.; Bu, C.; Xue, H. Deterrence Effects of Disclosure: The Impact of Environmental Information Disclosure on Emission Reduction of Firms. Energy Econ. 2021, 104, 105680. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter Hypothesis at 20: Can Environmental Regulation Enhance Innovation and Competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef] [Green Version]

- Jaffe, A.B.; Palmer, K. Environmental Regulation and Innovation: A Panel Data Study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Fang, J.; Liu, C.; Gao, C. The Impact of Environmental Regulation on Firm Exports: Evidence from Environmental Information Disclosure Policy in China. Environ. Sci. Pollut. R 2019, 26, 37101–37113. [Google Scholar] [CrossRef] [PubMed]

- Lu, J.; Li, B.; Li, H.; Zhang, Y. Sustainability of Enterprise Export Expansion from the Perspective of Environmental Information Disclosure. J. Clean. Prod. 2020, 252, 119839. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Green and Competitive: Ending the Stalemate. Long Range Plann 1995, 28, 128–129. [Google Scholar]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental Regulation and Competitiveness: Empirical Evidence on the Porter Hypothesis from European Manufacturing Sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef] [Green Version]

- Cai, W.; Ye, P. How Does Environmental Regulation Influence Enterprises’ Total Factor Productivity? A Quasi-Natural Experiment Based on China’s New Environmental Protection Law. J. Clean. Prod. 2020, 276, 124105. [Google Scholar] [CrossRef]

- Albrizio, S.; Kozluk, T.; Zipperer, V. Environmental Policies and Productivity Growth: Evidence across Industries and Firms. J. Environ. Econ. Manag. 2017, 81, 209–226. [Google Scholar] [CrossRef]

- Zhao, L.; Chen, L. Research on the Impact of Government Environmental Information Disclosure on Green Total Factor Productivity: Empirical Experience from Chinese Province. Int. J. Environ. Res. Public Health 2022, 19, 729. [Google Scholar] [CrossRef]

- Lin, S. Can Environmental Information Disclosure Improve Urban Green Economic Efficiency? New Evidence From the Mediating Effects Model. Front. Environ. Sci. 2022, 10, 747. [Google Scholar] [CrossRef]

- Birkey, R.N.; Michelon, G.; Patten, D.M.; Sankara, J. Does Assurance on CSR Reporting Enhance Environmental Reputation? An Examination in the U.S. Context. Account. Forum. 2016, 40, 143–152. [Google Scholar] [CrossRef]

- Toms, J. Quantity versus Quality: The Impact of Environmental Disclosures on the Reputations of UK Plcs. Br. Account. Rev. 2005, 37, 231–248. [Google Scholar]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Fisk, J.M.; Good, A.J. Information Booms and Busts: Examining Oil and Gas Disclosure Policies across the States. Energy Policy 2019, 127, 374–381. [Google Scholar] [CrossRef]

- Istrate, C.; Robu, I.-B.; Pavaloaia, L.; Herghiligiu, I.V. Analysis of companies sustainability under the influence of environmental information disclosure. Environ. Eng. Manag. J. 2017, 16, 957–967. [Google Scholar]

- Abel, T.D.; Kraft, S. Environmental Information Disclosure and Risk Reduction among the States. State Local Gov. Rev. 2007, 39, 153–165. [Google Scholar] [CrossRef]

- Li, L.; Su, F.; Zhang, W.; Mao, J.-Y. Digital Transformation by SME Entrepreneurs: A Capability Perspective. Inf. Syst. J. 2018, 28, 1129–1157. [Google Scholar] [CrossRef]

- Vial, G. Understanding Digital Transformation: A Review and a Research Agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Choi, D.-H.; Shin, D.-H. Exploring Political Compromise in the New Media Environment: The Interaction Effects of Social Media Use and the Big Five Personality Traits. Personal. Individ. Differ. 2017, 106, 163–171. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating Production Functions Using Inputs to Control for Unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Li, Z.; Li, P.; Zhao, X.; Tu, Z. Business Strategy and Environmental Information Disclosure Quality: Empirical Evidence from Chinese Heavy Pollution Listed Firms. Int. J. Environ. Res. Public Health 2022, 19, 8325. [Google Scholar] [CrossRef] [PubMed]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144+10. [Google Scholar]

- Cumming, D.; Rui, O.; Wu, Y. Political Instability, Access to Private Debt, and Innovation Investment in China. Emerg. Mark. Rev. 2016, 29, 68–81. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial Constraints Risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, M.; Qiao, Y.; Li, X.; Li, S. Does Improvement of Environmental Information Transparency Boost Firms’ Green Innovation? Evidence from the Air Quality Monitoring and Disclosure Program in China. J. Clean. Prod. 2022, 357, 131921. [Google Scholar] [CrossRef]

- Hong, J.; Jiang, M.; Zhang, C. Digital Transformation, Innovation and the Improvement of Enterprises’ Export Quality. J. Int. Trade 2022, 48, 1–15. [Google Scholar]

- Faccio, M.; Marchica, M.-T.; Mura, R. Large Shareholder Diversification and Corporate Risk-Taking. Rev. Financ. Stud. 2011, 24, 3601–3641. [Google Scholar] [CrossRef] [Green Version]

- Fairchild, A.J.; MacKinnon, D.P. A General Model for Testing Mediation and Moderation Effects. Prev. Sci. 2009, 10, 87–99. [Google Scholar] [CrossRef] [Green Version]

| Variables | Observations | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| TFP_LP | 5010 | 17.893 | 1.130 | 13.381 | 23.359 |

| EID | 5010 | 10.318 | 7.830 | 1.000 | 37.000 |

| EID_H | 5010 | 5.214 | 5.331 | 0.000 | 24.000 |

| EID_S | 5010 | 5.104 | 3.060 | 1.000 | 15.000 |

| Digital | 5010 | 0.591 | 0.904 | 0.000 | 4.654 |

| Exist | 5010 | 2.135 | 0.748 | 0.693 | 3.332 |

| Inst | 5010 | 0.425 | 0.245 | 0.000 | 1.870 |

| Growth | 5010 | 0.241 | 1.993 | −0.825 | 84.992 |

| Lev | 5010 | 0.384 | 0.185 | 0.011 | 0.925 |

| Cashflow | 5010 | 0.069 | 0.066 | −0.470 | 0.600 |

| Board | 5010 | 2.169 | 0.200 | 1.099 | 2.890 |

| HHI | 5010 | 0.071 | 0.071 | 0.014 | 1.000 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| TFP_LP | TFP_LP | TFP_LP | TFP_LP | TFP_LP | TFP_LP | |

| EID | 0.003 ** (2.071) | 0.002 * (1.892) | ||||

| EID_H | 0.002 * (1.744) | 0.002 * (1.675) | ||||

| EID_S | 0.009 ** (2.565) | 0.007 ** (2.179) | ||||

| Exist | 0.175 *** (4.219) | 0.175 *** (7.519) | 0.175 *** (4.226) | |||

| Inst | 0.028 (0.658) | 0.028 (0.921) | 0.028 (0.664) | |||

| Growth | 0.046 *** (6.993) | 0.046 *** (21.609) | 0.046 *** (6.974) | |||

| Lev | 0.598 *** (6.311) | 0.597 *** (11.405) | 0.596 *** (6.314) | |||

| Cashflow | 0.654 *** (6.267) | 0.652 *** (8.638) | 0.656 *** (6.279) | |||

| Board | 0.272 *** (3.792) | 0.271 *** (6.469) | 0.274 *** (3.807) | |||

| HHI | 0.593 ** (2.080) | 0.603 *** (3.297) | 0.594 ** (2.086) | |||

| Constant terms | 17.864 *** (1284.571) | 16.567 *** (87.093) | 17.880 *** (2169.980) | 16.579 *** (155.092) | 17.846 *** (980.720) | 16.550 *** (85.844) |

| Firm-fixed effects | YES | YES | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES | YES | YES |

| Time-fixed effects | YES | YES | YES | YES | YES | YES |

| Observations | 5010 | 5010 | 5010 | 5010 | 5010 | 5010 |

| R-squared | 0.001 | 0.193 | 0.001 | 0.192 | 0.003 | 0.193 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| TFP_OP | TFP_OP | TFP_OP | TFP_LP | TFP_LP | TFP_LP | |

| EID | 0.001 ** (2.257) | 0.003 ** (2.105) | ||||

| EID_H | 0.001 ** (2.511) | 0.003 ** (2.010) | ||||

| EID_S | 0.001 (0.934) | 0.008 ** (2.266) | ||||

| City control variables | NO | NO | NO | YES | YES | YES |

| Firm control variables | YES | YES | YES | YES | YES | YES |

| Constant terms | 4.838 *** (94.009) | 4.841 *** (95.275) | 4.841 *** (92.581) | 16.352 *** (27.283) | 16.362 *** (37.468) | 16.346 *** (27.343) |

| Firm-fixed effects | YES | YES | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES | YES | YES |

| Year-fixed effects | YES | YES | YES | YES | YES | YES |

| Observations | 5010 | 5010 | 5010 | 4868 | 4868 | 4868 |

| R-squared | 0.092 | 0.092 | 0.091 | 0.196 | 0.196 | 0.197 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| EID | TFP_LP | EID | TFP_LP | |

| EID | 0.038 * (1.882) | 0.011 # (1.630) | ||

| IV1 | 0.776 *** (49.168) | |||

| IV2 | 0.540 *** (34.626) | |||

| Firm control variables | YES | YES | YES | YES |

| Firm-fixed effects | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES |

| Year-fixed effects | YES | YES | YES | YES |

| Observations | 5010 | 5010 | 5010 | 5010 |

| R-squared | 0.145 | 0.178 | ||

| Kleibergen-Paap rk LM | 161.014 *** | 58.726 *** | ||

| Cragg-Donald Wald F | 2417.509 | 195.529 | ||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| SOEs | Non-SOEs | |||||

| EID | 0.001 (0.426) | 0.004 ** (2.475) | ||||

| EID_H | 0.001 (0.418) | 0.004 (1.568) | ||||

| EID_S | 0.001 (0.289) | 0.013 *** (2.994) | ||||

| Firm control variables | YES | YES | YES | YES | YES | YES |

| Constant terms | 17.477 *** (45.799) | 17.481 *** (45.863) | 17.475 *** (45.527) | 16.564 *** (87.604) | 16.588 *** (88.068) | 16.535 *** (86.473) |

| Firm-fixed effects | YES | YES | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES | YES | YES |

| Time-fixed effects | YES | YES | YES | YES | YES | YES |

| Observations | 1876 | 1876 | 1876 | 3120 | 3120 | 3120 |

| R-squared | 0.129 | 0.129 | 0.129 | 0.162 | 0.160 | 0.164 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Large Scale Enterprise | Small Scale Enterprise | |||||

| EID | 0.003 * (1.914) | 0.000 (0.231) | ||||

| EID_H | 0.003 * (1.841) | −0.001 (−0.214) | ||||

| EID_S | 0.008 * (1.800) | 0.004 (1.092) | ||||

| Firm control variables | YES | YES | YES | YES | YES | YES |

| Constant terms | 17.477 *** (0.382) | 17.481 *** (0.381) | 17.475 *** (0.384) | 16.564 *** (0.189) | 16.588 *** (0.188) | 16.535 *** (0.191) |

| Firm-fixed effects | YES | YES | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES | YES | YES |

| Time-fixed effects | YES | YES | YES | YES | YES | YES |

| Observations | 2388 | 2388 | 2388 | 2476 | 2476 | 2476 |

| R-squared | 0.133 | 0.131 | 0.133 | 0.182 | 0.182 | 0.183 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| East | Central | West | |||||||

| EID | 0.003 * (1.916) | 0.017 *** (2.670) | 0.001 (0.151) | ||||||

| EID_H | 0.038 *** (7.580) | 0.024 *** (2.627) | −0.001 (−0.310) | ||||||

| EID_S | 0.010 *** (2.689) | 0.004 (0.411) | 0.008 (0.970) | ||||||

| Control variables | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Firm-fixed | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Industry-fixed | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Time-fixed | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 3271 | 3341 | 3271 | 946 | 946 | 929 | 807 | 807 | 807 |

| R-squared | 0.222 | 0.467 | 0.224 | 0.437 | 0.438 | 0.314 | 0.191 | 0.191 | 0.193 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| TFP_LP | |||

| EID | 0.003 ** (2.531) | ||

| EID_H | 0.004 ** (2.157) | ||

| EID_S | 0.009 ** (2.439) | ||

| Digital | 0.037 ** (2.250) | 0.032 ** (2.224) | 0.032 * (1.899) |

| EID × Digital | −0.002 ** (−2.072) | ||

| EID_H × Digital | −0.003 ** (−2.221) | ||

| EID_S × Digital | −0.003 * (−1.794) | ||

| Firm control variables | YES | YES | YES |

| Constant terms | 16.560 *** (87.369) | 16.573 *** (87.973) | 16.541 *** (153.906) |

| Firm-fixed effects | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES |

| Time-fixed effects | YES | YES | YES |

| Observations | 5010 | 5010 | 5010 |

| R-squared | 0.195 | 0.194 | 0.194 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RD | TFP_LP | WW_index | TFP_LP | |

| EID | 0.015 ** (1.965) | 0.003 ** (2.288) | −0.000 ** (−2.083) | 0.001 (1.005) |

| RD | 0.025 *** (4.086) | |||

| WW_index | −6.143 *** (−10.138) | |||

| Firm control variables | YES | YES | YES | YES |

| Constant terms | 3.394 *** | 16.659 *** | −0.979 *** | 10.535 *** |

| (4.570) | (85.458) | (−63.214) | (16.477) | |

| Firm-fixed effects | YES | YES | YES | YES |

| Industry-fixed effects | YES | YES | YES | YES |

| Year-fixed effects | YES | YES | YES | YES |

| Observations | 5010 | 5010 | 5010 | 5010 |

| R-squared | 0.013 | 0.217 | 0.168 | 0.383 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Liu, W.; Chen, G. Environmental Information Disclosure, Digital Transformation, and Total Factor Productivity: Evidence from Chinese Heavy Polluting Listed Companies. Int. J. Environ. Res. Public Health 2022, 19, 9657. https://doi.org/10.3390/ijerph19159657

Liu H, Liu W, Chen G. Environmental Information Disclosure, Digital Transformation, and Total Factor Productivity: Evidence from Chinese Heavy Polluting Listed Companies. International Journal of Environmental Research and Public Health. 2022; 19(15):9657. https://doi.org/10.3390/ijerph19159657

Chicago/Turabian StyleLiu, Hongnan, Weili Liu, and Guangchun Chen. 2022. "Environmental Information Disclosure, Digital Transformation, and Total Factor Productivity: Evidence from Chinese Heavy Polluting Listed Companies" International Journal of Environmental Research and Public Health 19, no. 15: 9657. https://doi.org/10.3390/ijerph19159657

APA StyleLiu, H., Liu, W., & Chen, G. (2022). Environmental Information Disclosure, Digital Transformation, and Total Factor Productivity: Evidence from Chinese Heavy Polluting Listed Companies. International Journal of Environmental Research and Public Health, 19(15), 9657. https://doi.org/10.3390/ijerph19159657