How the COVID-19 Pandemic Affected the Functioning of Tourist Short-Term Rental Platforms (Airbnb and Vrbo) in Polish Cities

Abstract

:1. Introduction

2. Literature Review

2.1. Airbnb (and STRs) during the Pandemic

2.2. Scenarios for the Future of Airbnb and STR

2.3. Airbnb and Tourist STR in Poland

| Scenario of Change | Author(s) (Date of Publication) | |

|---|---|---|

| S1 | Airbnb’s active rentals volume and popularity drop | Bugalski (2020) [83]; Dolnicar, Zare (2020) [49]; Polisetty, Kurian (2021) [80]; Gerwe (2021) [46] |

| S2 | Transition/return to long-term rental | Boros, Dudás, Kovalcsik, (2020) [66]; Bugalski (2020) [83]; Celata, Romano, (2020) [87]; Dolnicar, Zare, (2020) [49]; Farmaki et al. (2020) [75]; Rubino, Coscia, Curto (2020) [84]; Gyódi (2021) [64]; Yiu, Cheung (2021) [74] |

| S3 | Decrease in rental offers of flats and shared rooms; growth in entire apartments | Hu, Lee (2020) [78]; Lim et al. (2020) [30]; Bresciani et al. (2021) [47]; Benítez-Aurioles (2021) [70] |

| S4 | Changes in host breakdown—a decline in capitalist hosts | Dolnicar, Zare (2020) [49]; Boros, Dudás, Kovalcsik (2020) [66] |

| S5 | Fall in demand for offers in cities | Bresciani et al. (2021) [47]; Gerwe (2021) [46]; Tomal, Helbich (2022) [97] |

| S6 | Fall in demand for offers in city centres; turn towards peripheral districts | Rubino, Coscia, Curto (2020) [84]; Bresciani et al. (2021) [47]; Boros, Kovalcsik (2021) [72]; Liang et al. (2021) [41]; Gerwe (2021) [46]; Zare, Dolnicar (2020) [49]; Polisetty, Kurian (2021) [80]; Tomal, Helbich (2022) [97] |

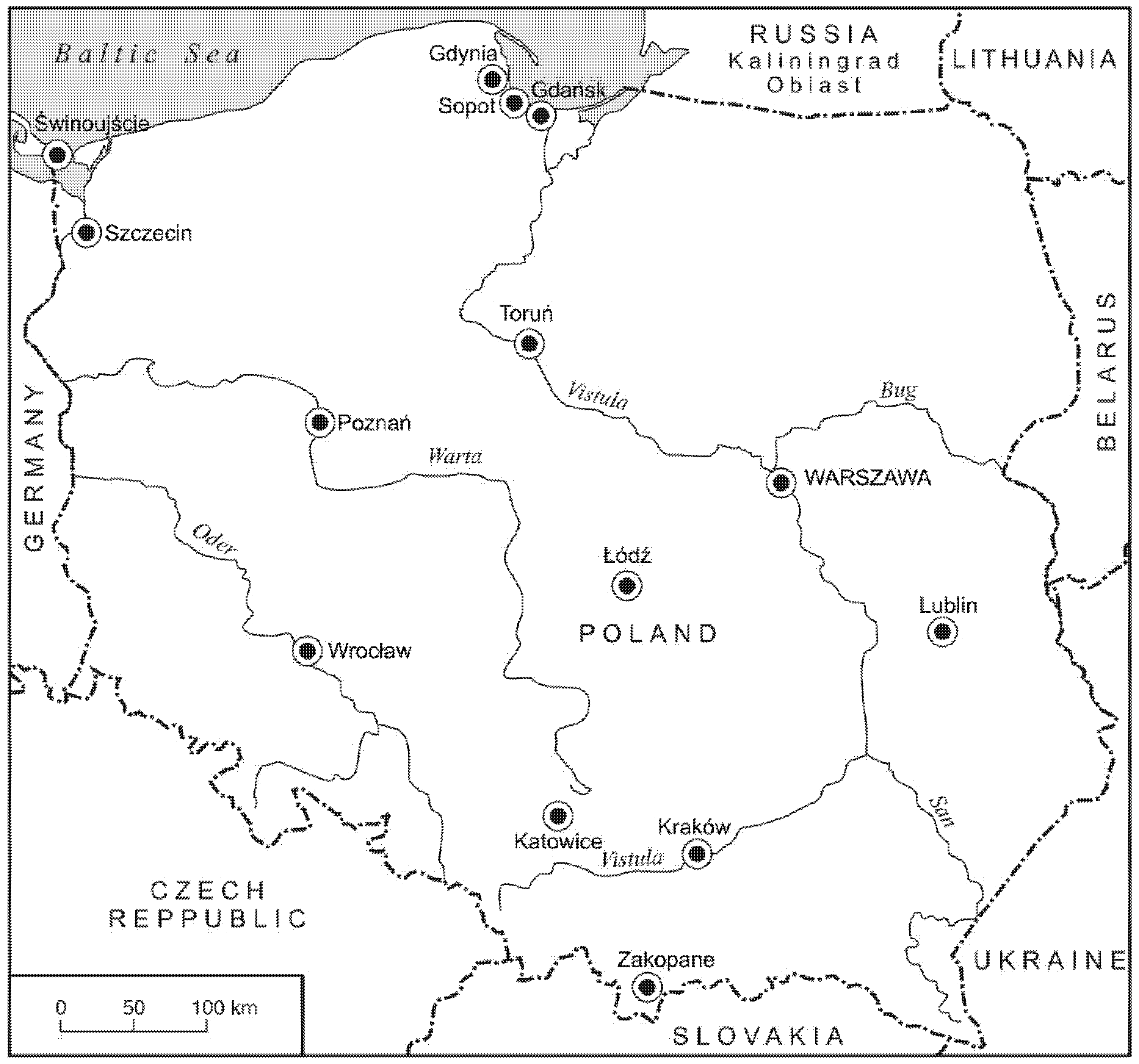

3. Study Area

4. Materials and Methods

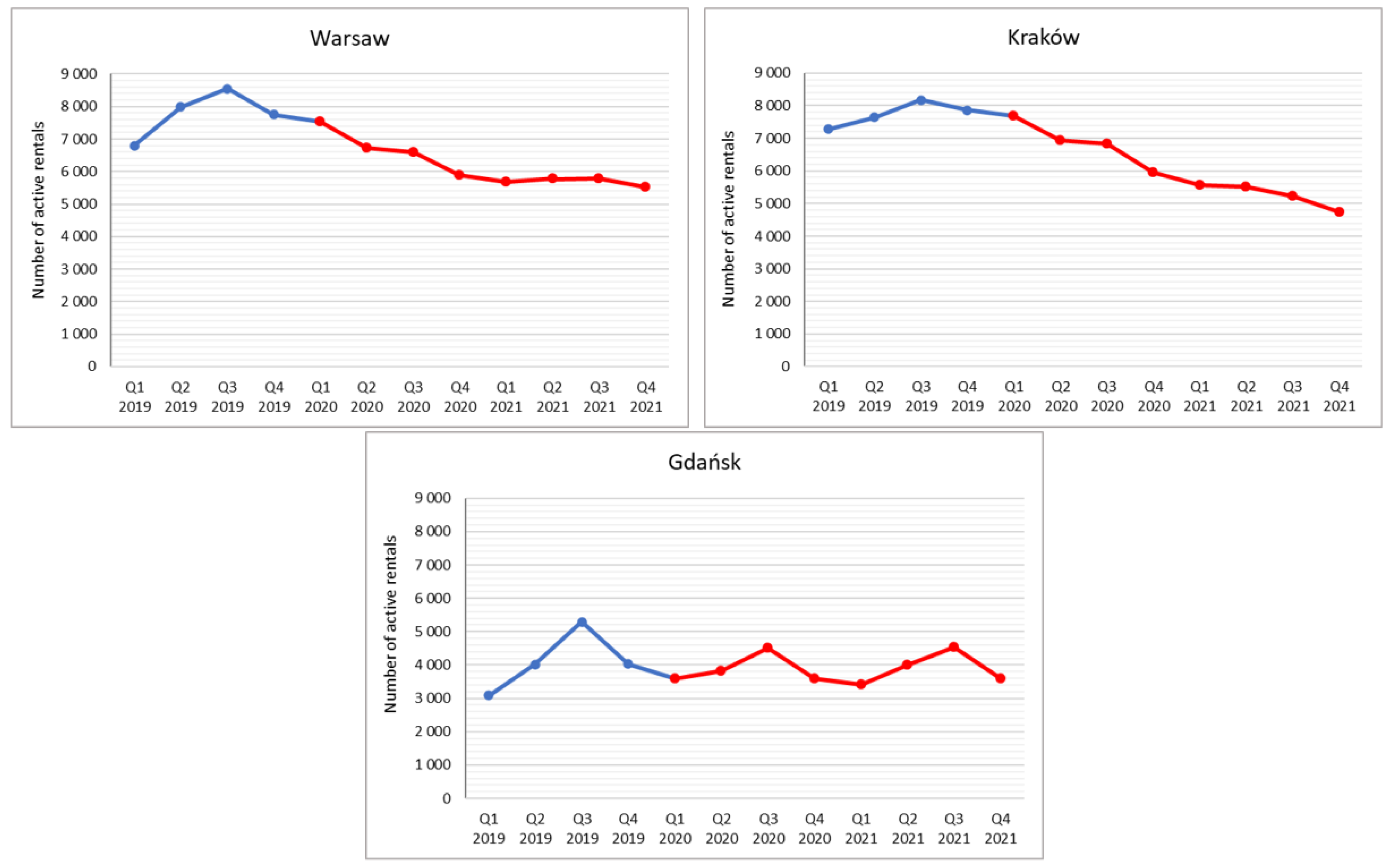

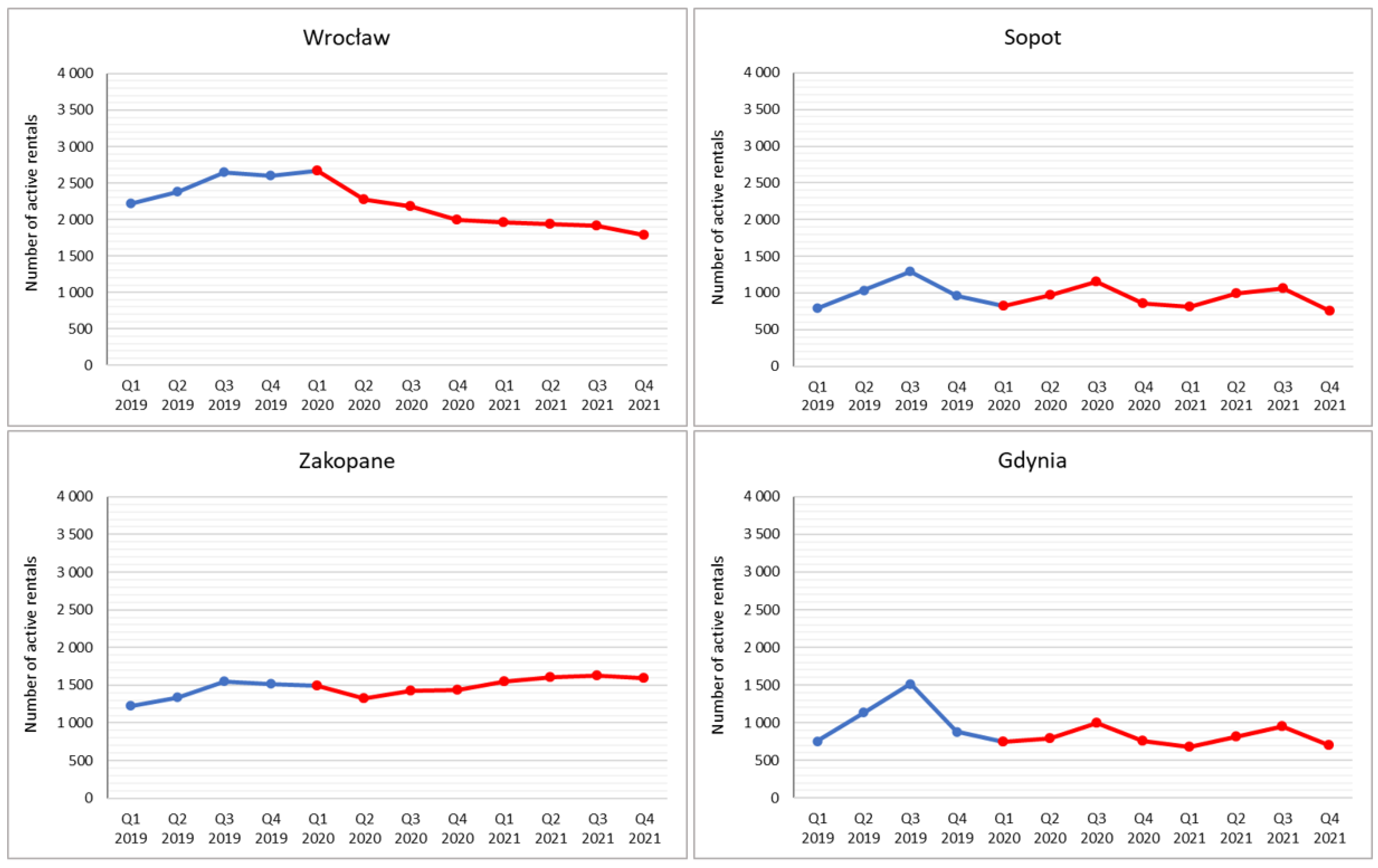

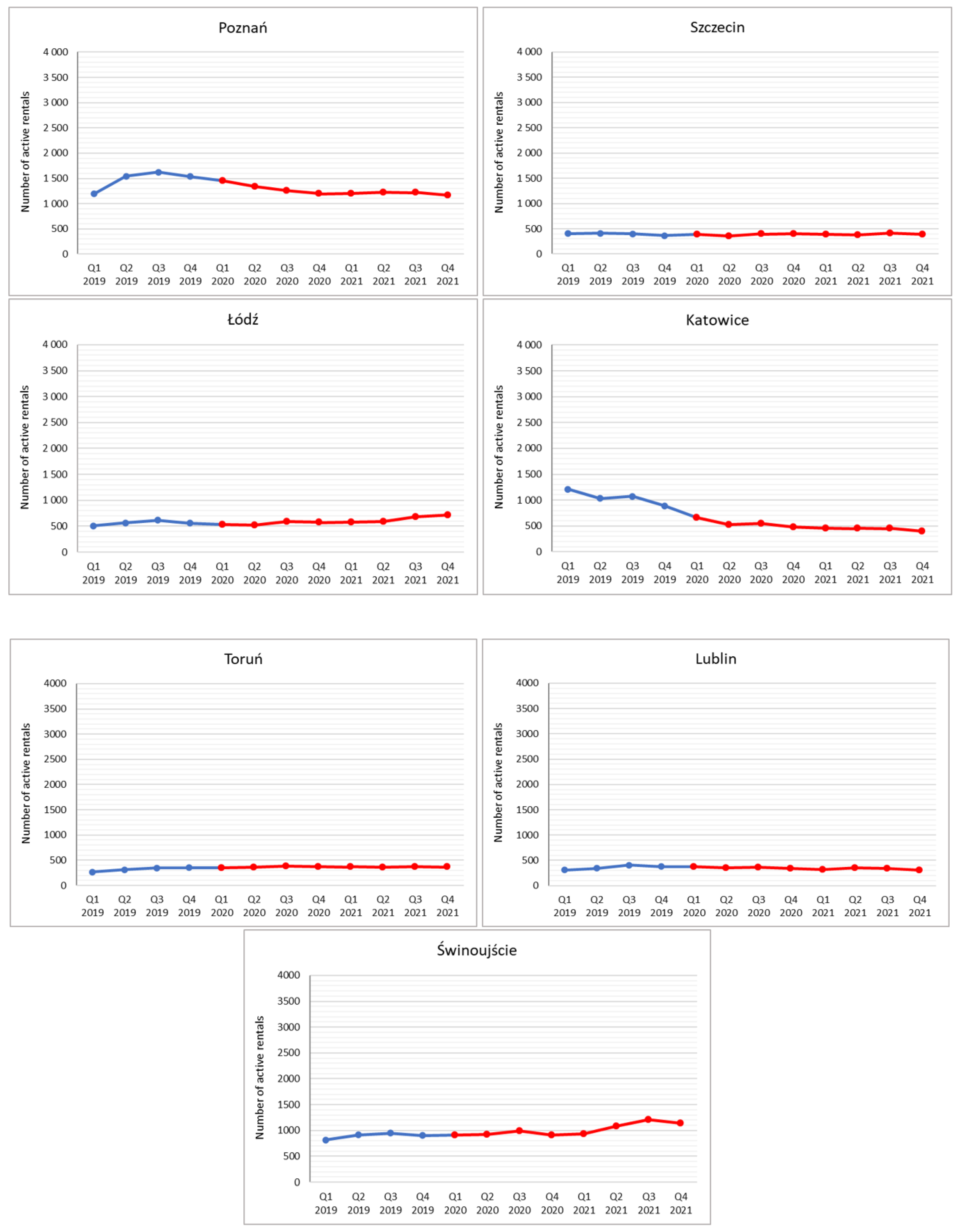

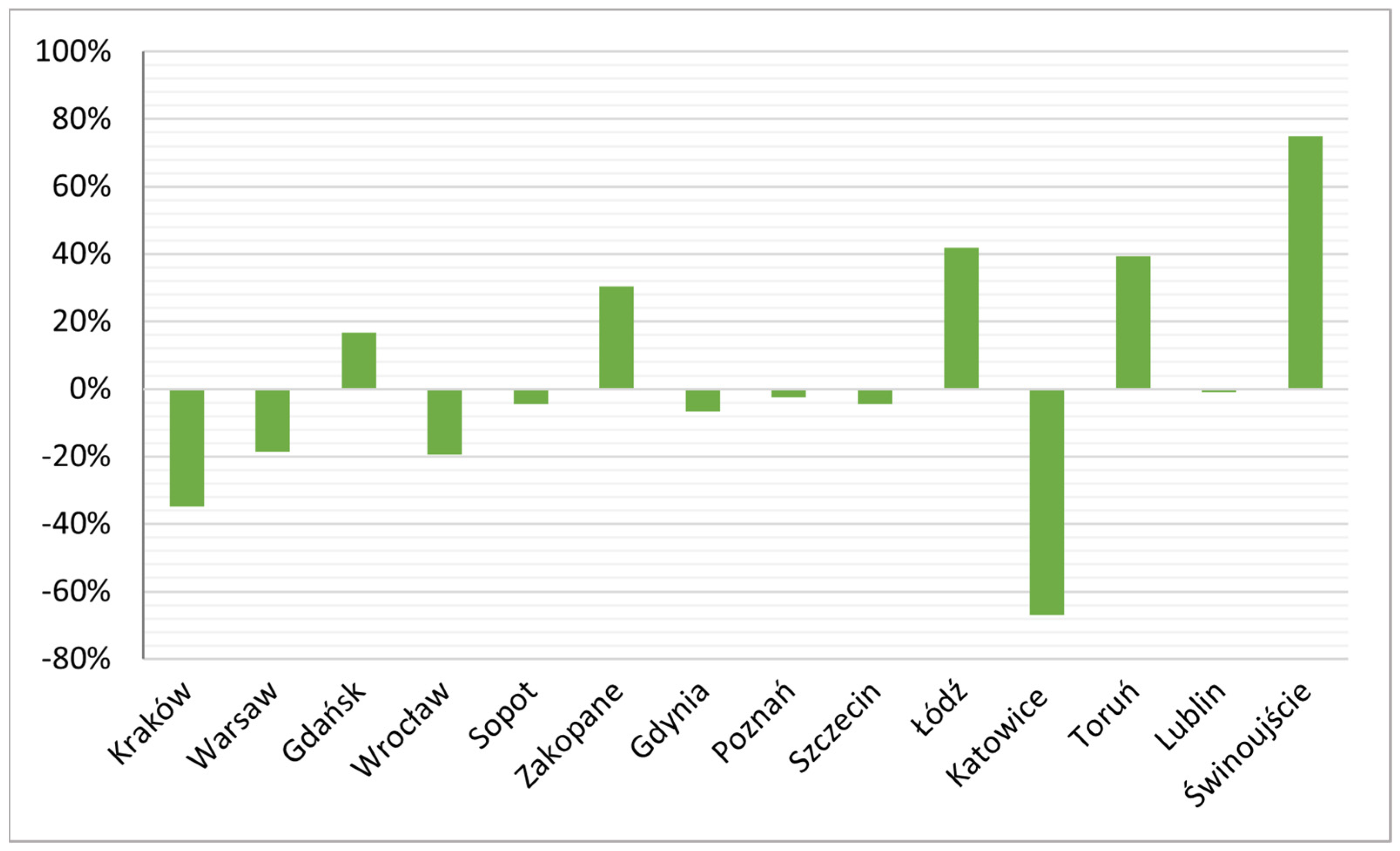

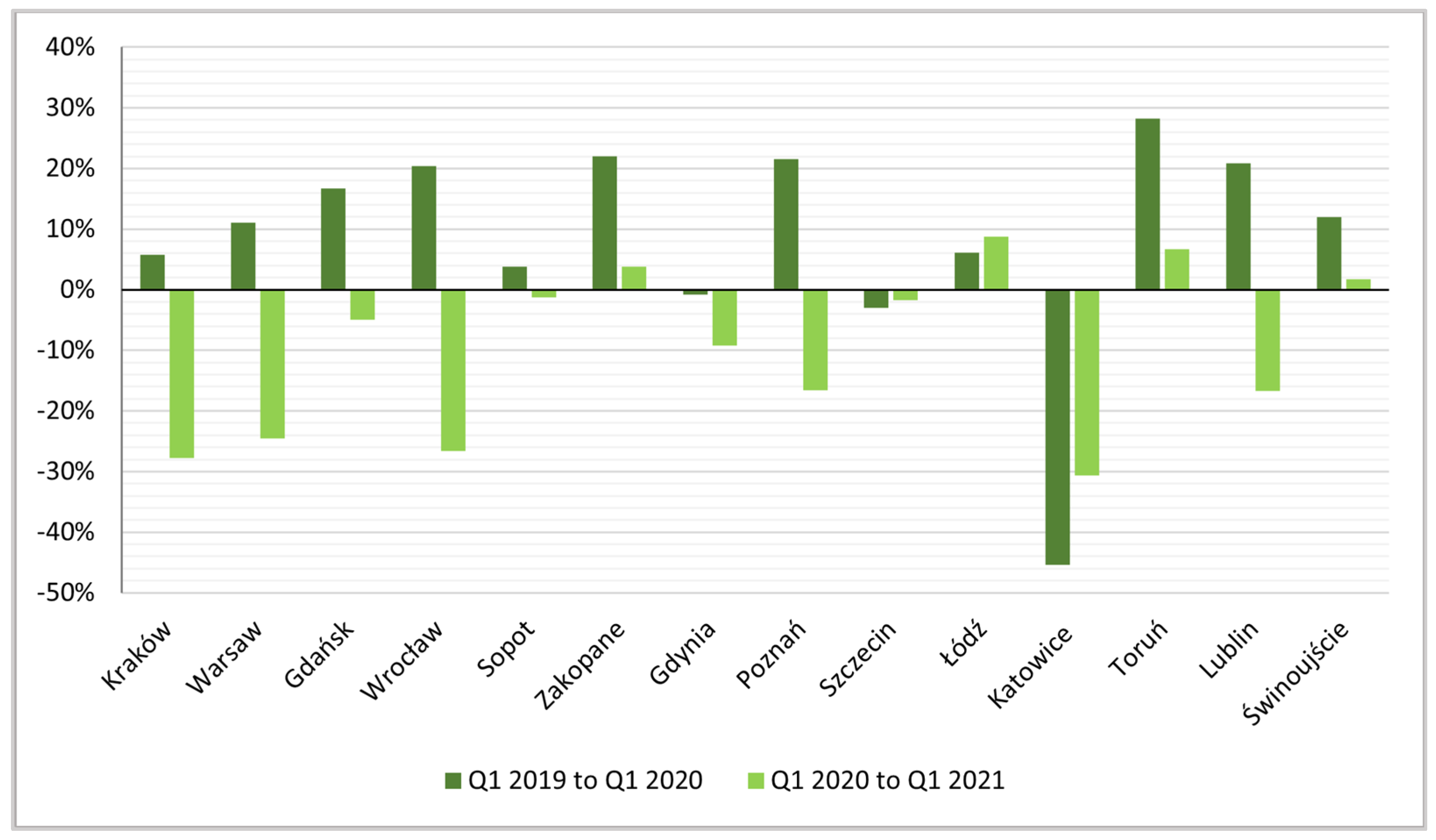

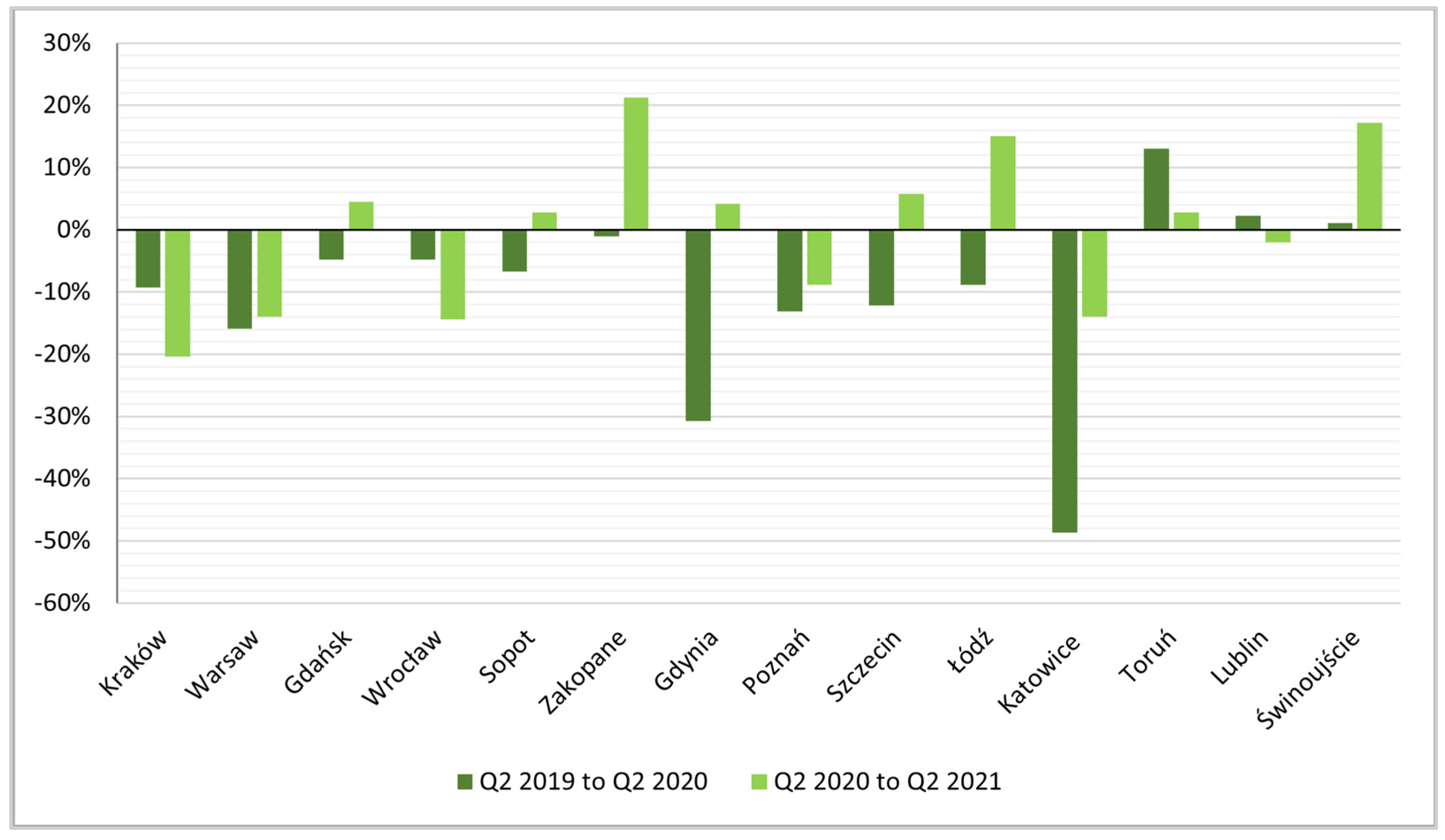

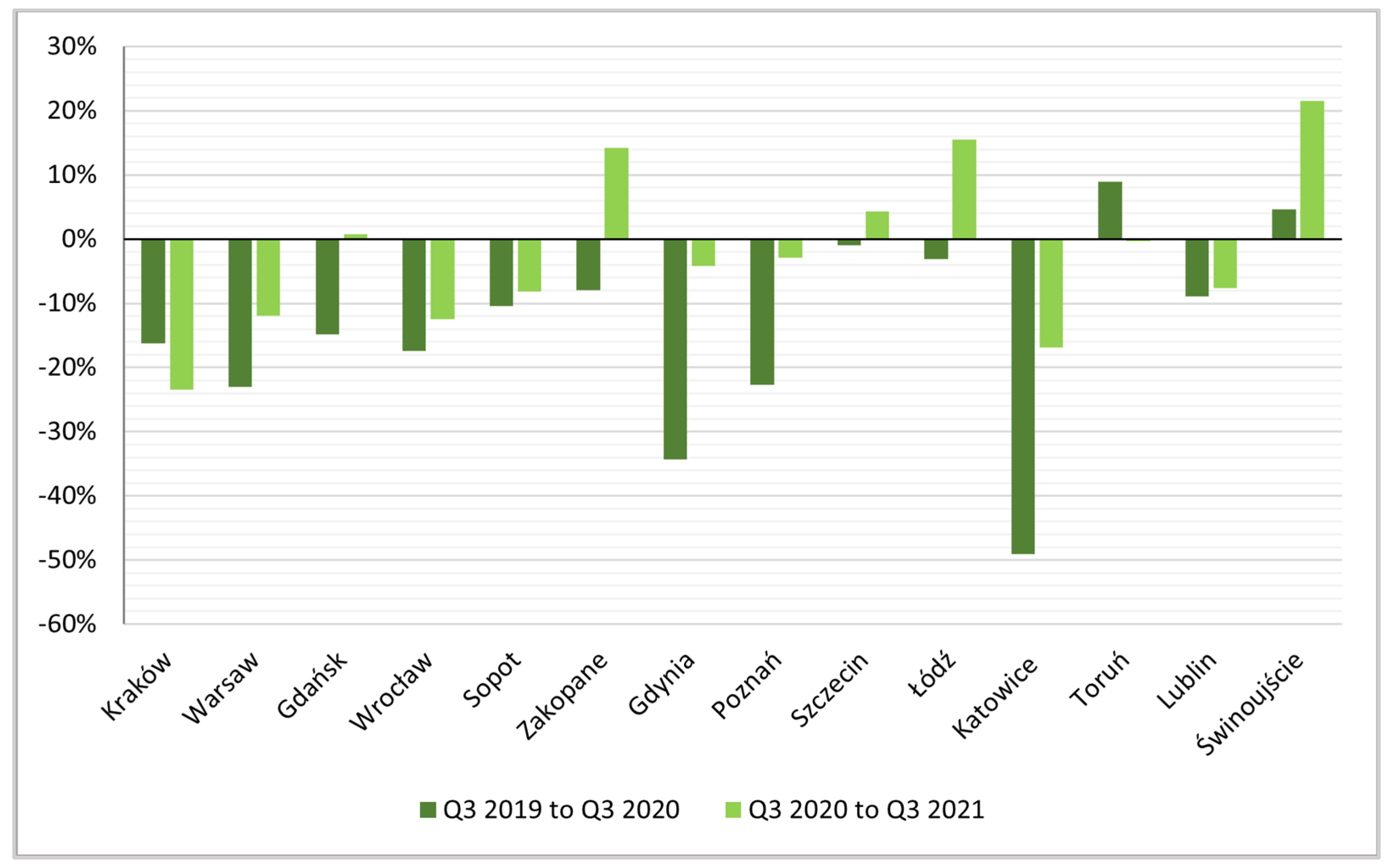

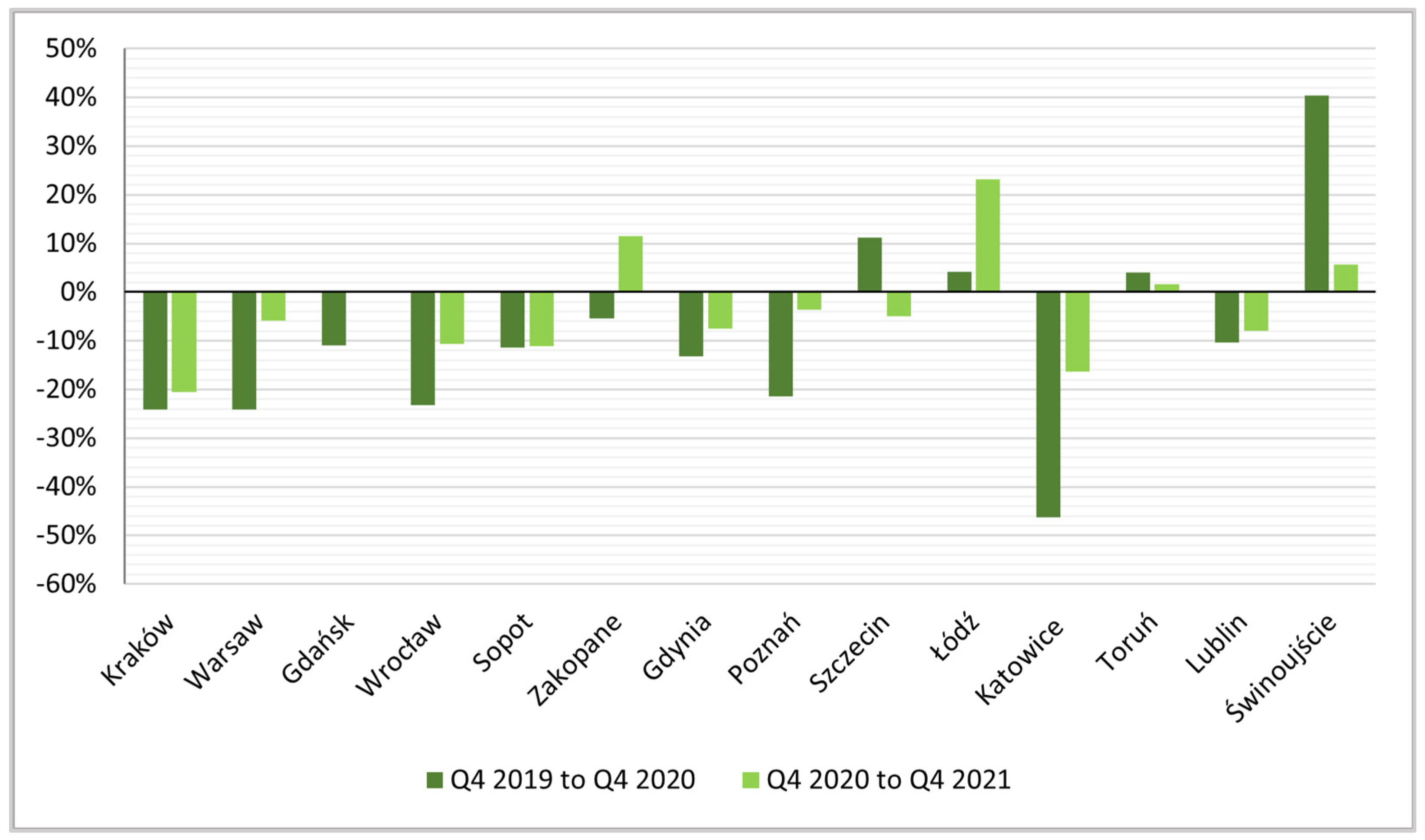

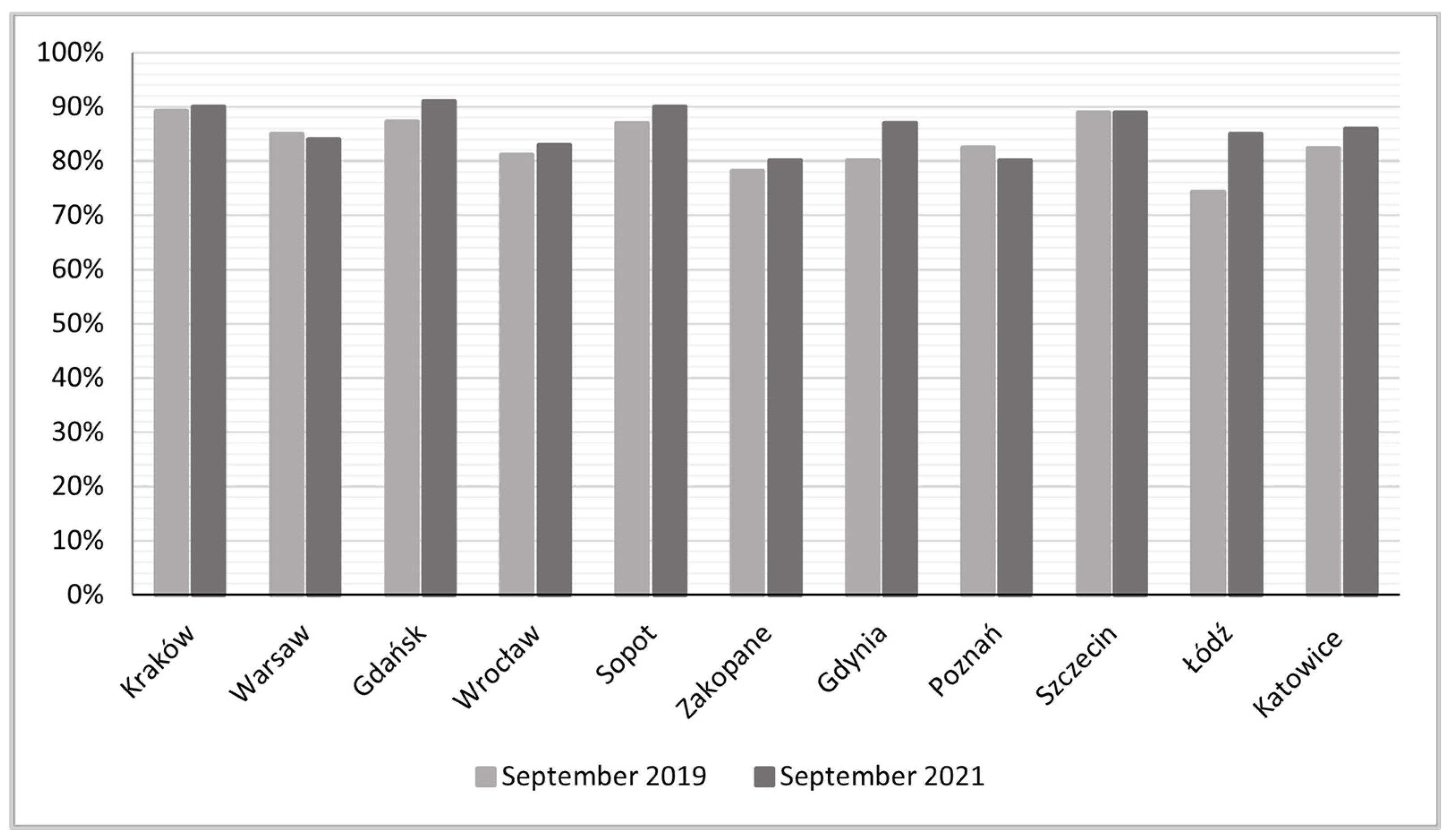

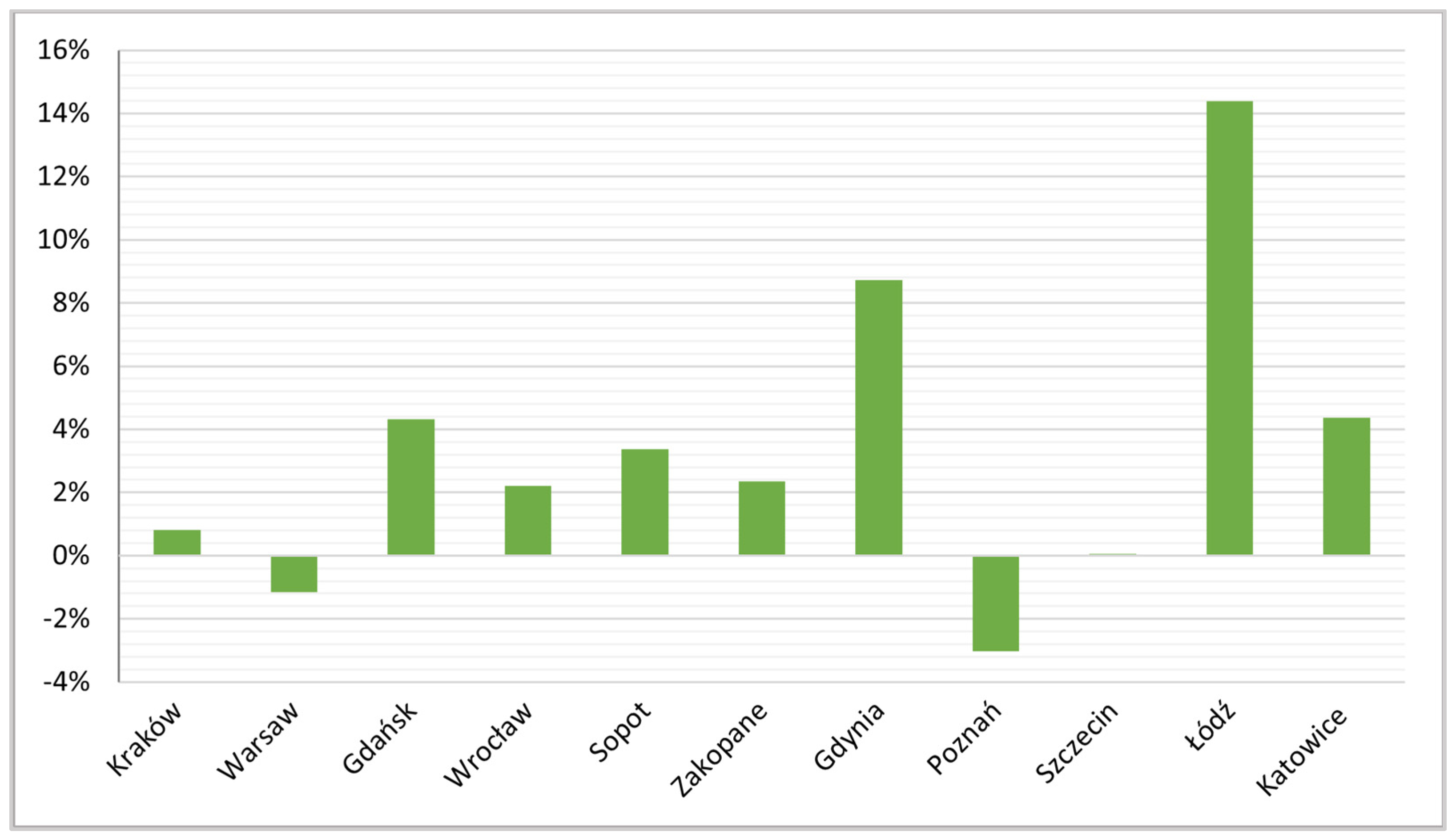

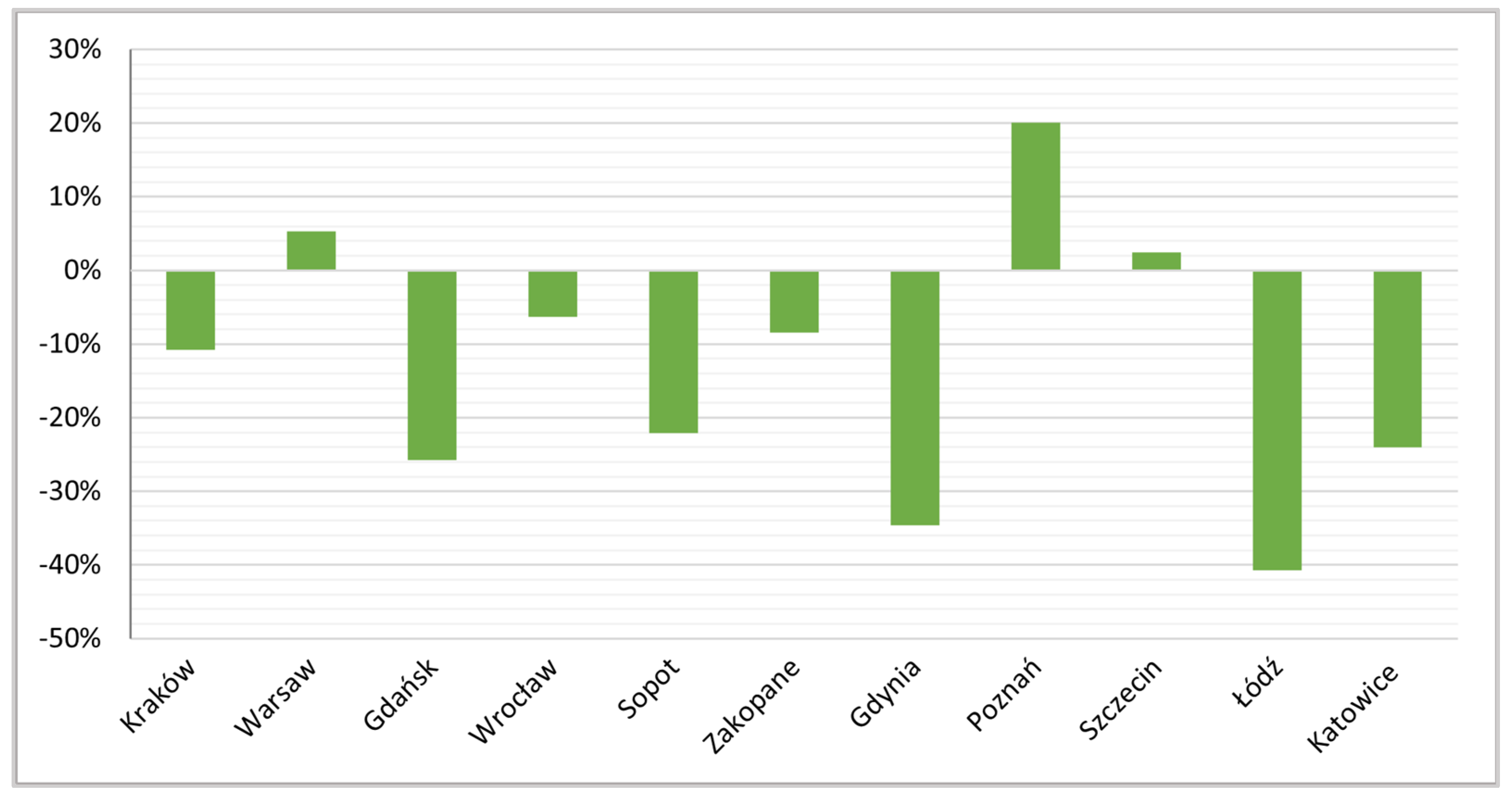

5. Results

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Maitland, R. Everyday Life as a Creative Experience in Cities. Int. J. Cult. Tour. Hosp. Res. 2010, 4, 176–185. [Google Scholar] [CrossRef]

- Dirksmeier, P.; Helbrecht, I. Resident Perceptions of New Urban Tourism: A Neglected Geography of Prejudice. Geogr. Compass 2015, 9, 276–285. [Google Scholar] [CrossRef]

- Kowalczyk-Anioł, J.; Łaszkiewicz, E.; Warwas, I. Is the Sharing Economy Inclusive? The Age-Related Segmentation of Polish Inhabitants from the Perspective of the Sharing Economy in Tourism. Innov. Eur. J. Soc. Sci. Res. 2021, 1–21. [Google Scholar] [CrossRef]

- Guttentag, D. Progress on Airbnb: A Literature Review. J. Hosp. Tour. Technol. 2019, 10, 233–263. [Google Scholar] [CrossRef]

- Guttentag, D. Airbnb: Disruptive Innovation and the Rise of an Informal Tourism Accommodation Sector. Curr. Issues Tour. 2015, 18, 1192–1217. [Google Scholar] [CrossRef]

- Paulauskaite, D.; Powell, R.; Coca-Stefaniak, J.A.; Morrison, A.M. Living like a Local: Authentic Tourism Experiences and the Sharing Economy. Int. J. Tour. Res. 2017, 19, 619–628. [Google Scholar] [CrossRef]

- Liang, L.J.; Choi, H.C.; Joppe, M. Exploring the Relationship between Satisfaction, Trust and Switching Intention, Repurchase Intention in the Context of Airbnb. Int. J. Hosp. Manag. 2018, 69, 41–48. [Google Scholar] [CrossRef]

- Shuqair, S.; Pinto, D.C.; Mattila, A.S. Benefits of Authenticity: Post-Failure Loyalty in the Sharing Economy. Ann. Tour. Res. 2019, 78, 102741. [Google Scholar] [CrossRef]

- Attanasi, G.; Casoria, F.; Centorrino, S.; Urso, G. Cultural Investment, Local Development and Instantaneous Social Capital: A Case Study of a Gathering Festival in the South of Italy. J. Socio. Econ. 2013, 47, 228–247. [Google Scholar] [CrossRef] [Green Version]

- Attanasi, G.; Passarelli, F.; Urso, G.; Cosic, H. Privatization of a Tourism Event: Do Attendees Perceive It as a Risky Cultural Lottery? Sustainability 2019, 11, 2553. [Google Scholar] [CrossRef] [Green Version]

- Adamiak, C. Mapping Airbnb Supply in European Cities. Ann. Tour. Res. 2018, 71, 67–71. [Google Scholar] [CrossRef]

- Pawlusiński, R. Ekonomia Współdzielenia—Istota Zjawiska Oraz Wyzwania Dla Sektora Turystyki w Miastach; Uniwersytet Jagielloński w Krakowie: Kraków, Poland, 2017. [Google Scholar]

- Braje, I.N.; Pechurina, A.; Bıçakcıoğlu-Peynirci, N.; Miguel, C.; del Mar Alonso-Almeida, M.; Giglio, C. The Changing Determinants of Tourists’ Repurchase Intention: The Case of Short-Term Rentals during the COVID-19 Pandemic. Int. J. Contemp. Hosp. Manag. 2022, 34, 159–183. [Google Scholar] [CrossRef]

- Adamiak, C. Changes in the Global Airbnb Offer during the COVID-19 Pandemic. Oikonomics 2021, 15, 1–11. [Google Scholar] [CrossRef]

- Oskam, J.A. The Future of Airbnb and the Sharing Economy; Channel View Publications: Bristol, UK, 2019. [Google Scholar]

- Gil, J.; Sequera, J. The Professionalization of Airbnb in Madrid: Far from a Collaborative Economy. Curr. Issues Tour. 2020, 1–20. [Google Scholar] [CrossRef]

- Xue, C.; Tian, W.; Zhao, X. The Literature Review of Platform Economy. Sci. Program. 2020, 2020, 8877128. [Google Scholar] [CrossRef]

- Wachsmuth, D.; Weisler, A. Airbnb and the Rent Gap: Gentrification through the Sharing Economy. Environ. Plan. A 2018, 50, 1147–1170. [Google Scholar] [CrossRef]

- Kowalczyk-Anioł, J. Tourismification of the Housing Resources of Historical Inner Cities. The Case of Kraków. Stud. Miej. 2019, 35, 9–25. [Google Scholar] [CrossRef]

- Jaremen, D.E.; Nawrocka, E.; Żemła, M. Externalities of Development of the Sharing Economy in Tourism Cities. Int. J. Tour. Cities 2020, 6, 138–157. [Google Scholar] [CrossRef]

- Walas, B. Turystyczny Najem Krótkoterminowy w Ocenie Interesariuszy Lokalnych. Biul. KPZK PAN 2019, 275, 49–62. [Google Scholar]

- Rutkowska-Gurak, A.; Adamska, A. Sharing Economy and the City. Int. J. Manag. Econ. 2019, 55, 346–368. [Google Scholar] [CrossRef]

- Minoia, P.; Jokela, S. Platform-Mediated Tourism: Social Justice and Urban Governance before and during Covid-19. J. Sustain. Tour. 2021, 30, 951–965. [Google Scholar] [CrossRef]

- Del Romero Renau, L. Touristification, Sharing Economies and the New Geography of Urban Conflicts. Urban Sci. 2018, 2, 104. [Google Scholar] [CrossRef] [Green Version]

- Cocola-Gant, A.; Gago, A. Airbnb, Buy-to-Let Investment and Tourism-Driven Displacement: A Case Study in Lisbon. Environ. Plan. A 2021, 53, 1671–1688. [Google Scholar] [CrossRef] [Green Version]

- Kaźmierczyk, A. Issues of Short-Term Rental in Light of EU and Member States’ Regulations. Probl. Współcz. Prawa Międzynar. Eur. Porównawczego 2019, 17, 180–198. [Google Scholar]

- Marques Pereira, S. Regulation of Short-Term Rentals in Lisbon: Strike a Balance between Tourism Dependence and Urban Life. Urban Res. Pract. 2020, 1–28. [Google Scholar] [CrossRef]

- Falk, M.T.; Yang, Y. Hotels Benefit from Stricter Regulations on Short-Term Rentals in European Cities. Tour. Econ. 2021, 27, 1526–1539. [Google Scholar] [CrossRef] [Green Version]

- Kosiura, M. Mieszkania Wynajmowane Turystom Wracają Do Gry? Available online: https://inwestycjewkurortach.pl/okiem-eksperta,mieszkania-hotele-airbnb-przepisy-nowelizacja (accessed on 30 April 2022).

- Lim, S.; Nakazato, H. The Emergence of Risk Communication Networks and the Development of Citizen Health-Related Behaviors during the COVID-19 Pandemic: Social Selection and Contagion Processes. Int. J. Environ. Res. Public Health 2020, 17, 4148. [Google Scholar] [CrossRef]

- Alifano, M.; Attanasi, G.; Iannelli, F.; Cherikh, F.; Iannelli, A. COVID-19 Pandemic: A European Perspective on Health Economic Policies. J. Behav. Econ. Policy 2020, 4, 35–43. [Google Scholar]

- Anderson, J.; Tagliapietra, S.; Wolff, G.B. A Framework for a European Economic Recovery After COVID-19. Intereconomics 2020, 55, 209–215. [Google Scholar] [CrossRef]

- Baddeley, M. COVID-19 2020: A Year of Living Dangerously. J. Behav. Econ. Policy 2020, 4, 5–9. [Google Scholar]

- Banai, R. Pandemic and the Planning of Resilient Cities and Regions. Cities 2020, 106, 102929. [Google Scholar] [CrossRef] [PubMed]

- Sharifi, A.; Khavarian-Garmsir, A.R. The COVID-19 Pandemic: Impacts on Cities and Major Lessons for Urban Planning, Design, and Management. Sci. Total Environ. 2020, 749, 142391. [Google Scholar] [CrossRef] [PubMed]

- Śleszyński, P.; Legutko-Kobus, P.; Rosenberg, M.; Pantyley, V.; Nowak, M. Assessing Urban Policies in a COVID-19 World. Int. J. Environ. Res. Public Health 2022, 19, 5322. [Google Scholar] [CrossRef] [PubMed]

- Dockerill, B.; Hess, D.B.; Lord, A.; Sturzaker, J.; Sykes, O. Putting the COVID-19 Pandemic into Perspective: Urban Planning Scholars React to a Changed World. Town Plan. Rev. 2021, 92, 1–2. [Google Scholar] [CrossRef]

- Goniewicz, K.; Khorram-Manesh, A.; Hertelendy, A.J.; Goniewicz, M.; Naylor, K.; Burkle, F.M. Current Response and Management Decisions of the European Union to the COVID-19 Outbreak: A Review. Sustainability 2020, 12, 3838. [Google Scholar] [CrossRef]

- Baker, E.; Daniels, L.; Pawson, H.; Baddeley, M.; Vij, A.; Stephens, M.; Phibbs, P.; Clair, A.; Beer, A.; Power, E.; et al. Rental Insights A COVID-19 Collection. AHURI Final Rep. 2020, 1–48. [Google Scholar] [CrossRef]

- Yang, M.; Han, C.; Cui, Y.; Zhao, Y. COVID-19 and Mobility in Tourism Cities: A Statistical Change-Point Detection Approach. J. Hosp. Tour. Manag. 2021, 47, 256–261. [Google Scholar] [CrossRef]

- Liang, S.; Leng, H.; Yuan, Q.; Yuan, C. Impact of the COVID-19 Pandemic: Insights from Vacation Rentals in Twelve Mega Cities. Sustain. Cities Soc. 2021, 74, 103121. [Google Scholar] [CrossRef]

- Lim, W.M.; To, W.M. The Economic Impact of a Global Pandemic on the Tourism Economy: The Case of COVID-19 and Macao’s Destination- and Gambling-Dependent Economy. Curr. Issues Tour. 2022, 25, 1258–1269. [Google Scholar] [CrossRef]

- Collins-Kreiner, N.; Ram, Y. National Tourism Strategies during the Covid-19 Pandemic. Ann. Tour. Res. 2021, 89, 103076. [Google Scholar] [CrossRef]

- Vargas, A. Covid-19 Crisis: A New Model of Tourism Governance for a New Time. Worldw. Hosp. Tour. Themes 2020, 12, 691–699. [Google Scholar] [CrossRef]

- Adamiak, C. Najem Krótkoterminowy w Polsce w Czasie Pandemii COVID-19. Czas. Geogr. 2022, 93, 9–32. [Google Scholar] [CrossRef]

- Gerwe, O. The Covid-19 Pandemic and the Accommodation Sharing Sector: Effects and Prospects for Recovery. Technol. Forecast. Soc. Chang. 2021, 167, 120733. [Google Scholar] [CrossRef]

- Bresciani, S.; Ferraris, A.; Santoro, G.; Premazzi, K.; Quaglia, R.; Yahiaoui, D.; Viglia, G. The Seven Lives of Airbnb. The Role of Accommodation Types. Ann. Tour. Res. 2021, 88, 103170. [Google Scholar] [CrossRef]

- Zoğal, V.; Domènech, A.; Emekli, G. Stay at (Which) Home: Second Homes during and after the COVID-19 Pandemic. J. Tour. Futur. 2022, 8, 125–133. [Google Scholar] [CrossRef]

- Dolnicar, S.; Zare, S. COVID19 and Airbnb—Disrupting the Disruptor. Ann. Tour. Res. 2020, 83, 102961. [Google Scholar] [CrossRef] [PubMed]

- Medeiros, M.; Xie, J.; Severt, D. Exploring Relative Resilience of Airbnb and Hotel Industry to Risks and External Shocks. Scand. J. Hosp. Tour. 2022, 22, 274–283. [Google Scholar] [CrossRef]

- Pawlicz, A.; Prentice, C. Understanding short-term rental data sources—A variety of second-best solutions. Tour. South. East. Eur. 2021, 6, 573–585. [Google Scholar] [CrossRef]

- Kowalczyk-Anioł, J.; Pawlusiński, R. Sharing Economy w Przestrzeni Polskich Metropolii i Miast Turystycznych Na Przykładzie Airbnb. Konwersatorium Wiedzy O Mieście 2018, 31, 15–22. [Google Scholar] [CrossRef]

- Pawlicz, A. Ekonomia Współdzielenia Na Rynku Usług Hotelarskich Niedoskonałości-Pośrednicy-Regulacje; Wydawnictwo Naukowe Uniwersytetu Szczecińskiego: Szeciń, Polans, 2019; ISBN 9788379722730. [Google Scholar]

- Adamiak, C. Current State and Development of Airbnb Accommodation Offer in 167 Countries. Curr. Issues Tour. 2019, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Gyódi, K. Airbnb in European Cities: Business as Usual or True Sharing Economy? J. Clean. Prod. 2019, 221, 536–551. [Google Scholar] [CrossRef]

- Trojanek, R.; Gluszak, M.; Hebdzynski, M.; Tanas, J. The COVID-19 Pandemic, Airbnb and Housing Market Dynamics in Warsaw. Crit. Hous. Anal. 2021, 8, 72–84. [Google Scholar] [CrossRef]

- InwestycjewKurortach.pl APARTHOTELE/CONDOHOTELE w Największych Miastach w Polsce. Available online: https://inwestycjewkurortach.pl/dane/web_articles_files/4946/raport_miasta_wynajem_krotkoterminowy_wrzesien_2019_official.pdf (accessed on 28 April 2022).

- Falagas, M.E.; Pitsouni, E.I.; Malietzis, G.A.; Pappas, G. Comparison of PubMed, Scopus, Web of Science, and Google Scholar: Strengths and Weaknesses. FASEB J. 2008, 22, 338–342. [Google Scholar] [CrossRef] [PubMed]

- Hall, C.M. A Citation Analysis of Tourism Recreation Research. Tour. Recreat. Res. 2010, 35, 305–309. [Google Scholar] [CrossRef]

- Romero-García, L.E.; Aguilar-Gallegos, N.; Morales-Matamoros, O.; Badillo-Piña, I.; Tejeida-Padilla, R. Urban Tourism: A Systems Approach—State of the Art. Tour. Rev. 2019, 74, 679–693. [Google Scholar] [CrossRef]

- Kacprzak, K. Wpływ Pandemii Na Funkcjonowanie Platformy Wynajmu Krótkoterminowego Airbnb w Miastach—Przegląd Literatury. Konwersatorium Wiedzy O Mieście 2021, 34, 41–50. [Google Scholar] [CrossRef]

- Kadi, J.; Schneider, A.; Seidl, R. Short-Term Rentals, Housing Markets and Covid-19: Theoretical Considerations and Empirical Evidence from Four Austrian Cities. Crit. Hous. Anal. 2020, 7, 47–57. [Google Scholar] [CrossRef]

- Hossain, M. The Effect of the Covid-19 on Sharing Economy Activities. J. Clean. Prod. 2021, 280, 124782. [Google Scholar] [CrossRef]

- Gyódi, K. Airbnb and Hotels during COVID-19: Different Strategies to Survive. Int. J. Cult. Tour. Hosp. Res. 2021, 16, 168–192. [Google Scholar] [CrossRef]

- Kostynets, V.; Kostynets, I.; Olshanska, O. Pent-up Demand’s Realization in the Hospitality Sector in the Context of COVID-19. J. Int. Stud. 2021, 14, 89–102. [Google Scholar] [CrossRef]

- Boros, L.; Dudás, G.; Kovalcsik, T. The Effects of COVID-19 on Airbnb. Hung. Geogr. Bull. 2020, 69, 363–381. [Google Scholar] [CrossRef]

- Chen, G.; Cheng, M.; Edwards, D.; Xu, L. COVID-19 Pandemic Exposes the Vulnerability of the Sharing Economy: A Novel Accounting Framework. J. Sustain. Tour. 2021, 30, 1141–1158. [Google Scholar] [CrossRef]

- Bang Nong, N.; Ha, V.H.T. Impact of Covid-19 on Airbnb: Evidence from Vietnam. J. Sustain. Financ. Investig. 2021, 1–14. [Google Scholar] [CrossRef]

- Muschter, S.; Caldicott, R.W.; von der Heidt, T.; Che, D. Third-Party Impacts of Short-Term Rental Accommodation: A Community Survey to Inform Government Responses. J. Sustain. Tour. 2021, 30, 1–21. [Google Scholar] [CrossRef]

- Benítez-Aurioles, B. Recent Trends in the Peer-to-Peer Market for Tourist Accommodation. e-Rev. Tour. Res. 2021, 18, 478–494. [Google Scholar]

- Buckle, C.; Phibbs, P. Challenging the Discourse around the Impacts of Airbnb through Suburbs Not Cities: Lessons from Australia and Covid-19. Crit. Hous. Anal. 2021, 8, 141–149. [Google Scholar] [CrossRef]

- Boros, L.; Kovalcsik, T. A COVID-19-Járvány Hatása a Budapesti Airbnb-Piacra [Effects of the COVID-19 Pandemic on the Airbnb Market in Budapest]. Terul. Stat. 2021, 61, 380–402. [Google Scholar] [CrossRef]

- Zhu, X.; Liu, K. A Systematic Review and Future Directions of the Sharing Economy: Business Models, Operational Insights and Environment-Based Utilities. J. Clean. Prod. 2021, 290, 125209. [Google Scholar] [CrossRef]

- Yiu, C.Y.; Cheung, K.S. Urban Zoning for Sustainable Tourism: A Continuum of Accommodation to Enhance City Resilience. Sustainability 2021, 13, 7317. [Google Scholar] [CrossRef]

- Farmaki, A.; Miguel, C.; Drotarova, M.H.; Aleksić, A.; Časni, A.Č.; Efthymiadou, F. Impacts of Covid-19 on Peer-to-Peer Accommodation Platforms: Host Perceptions and Responses. Int. J. Hosp. Manag. 2020, 91, 102663. [Google Scholar] [CrossRef]

- Gassmann, S.E.; Nunkoo, R.; Tiberius, V.; Kraus, S. My Home Is Your Castle: Forecasting the Future of Accommodation Sharing. Int. J. Contemp. Hosp. Manag. 2021, 33, 467–489. [Google Scholar] [CrossRef]

- Sigala, M. Tourism and COVID-19: Impacts and Implications for Advancing and Resetting Industry and Research. J. Bus. Res. 2020, 117, 312–321. [Google Scholar] [CrossRef] [PubMed]

- Hu, M.R.; Lee, A.D. Airbnb, COVID-19 Risk and Lockdowns: Global Evidence. SSRN Electron. J. 2020, 1–70. [Google Scholar] [CrossRef]

- Wood, C. Airbnb Is Establishing New Cleaning Protocol to Limit Spread of COVID-19. Available online: https://www.businessinsider.com/airbnb-24-hours-between-rentals-limit-covid-spread-2020-4?IR=T (accessed on 30 April 2022).

- Polisetty, A.; Kurian, J.S. The Future of Shared Economy: A Case Study on Airbnb. FIIB Bus. Rev. 2021, 10, 1–10. [Google Scholar] [CrossRef]

- Ndaguba, E.A. Economic Impediment of Covid-19 Lockdown on Airbnb Performance in Cape Town Neighbourhood. Acad. Strateg. Manag. J. 2021, 20, 1–16. [Google Scholar]

- Meenakshi, N. Post-COVID Reorientation of the Sharing Economy in a Hyperconnected World. J. Strateg. Mark. 2021, 1–25. [Google Scholar] [CrossRef]

- Bugalski, Ł. The Undisrupted Growth of the Airbnb Phenomenon between 2014–2020. The Touristification of European Cities before the Covid-19 Outbreak. Sustainability 2020, 12, 9841. [Google Scholar] [CrossRef]

- Rubino, I.; Coscia, C.; Curto, R. Identifying Spatial Relationships between Built Heritage Resources and Short-Term Rentals before the Covid-19 Pandemic: Exploratory Perspectives on Sustainability Issues. Sustainability 2020, 12, 4533. [Google Scholar] [CrossRef]

- Airbnb Introducing the Airbnb 2021 Winter Relase: 50+ Upgrades and Innovations across Our Entire Service. Available online: https://news.airbnb.com/2021-winter-release/ (accessed on 19 January 2022).

- Brian Chesky (@bchesky)/Twitter. Available online: https://twitter.com/bchesky (accessed on 7 January 2022).

- Celata, F.; Romano, A. Overtourism and Online Short-Term Rental Platforms in Italian Cities. J. Sustain. Tour. 2020, 30, 1–20. [Google Scholar] [CrossRef]

- Martínez Nadal, A. COVID-19, Vacation Rentals and Cancellation Policies: Is There an Emergency, in These Times of Pandemic, Regarding the Hidden Nature of Digital Platforms? IDP. Rev. Internet Derecho Y Política 2021, 1–13. [Google Scholar] [CrossRef]

- Vinod, P.P.; Sharma, D. COVID-19 Impact on the Sharing Economy Post-Pandemic. Australas. Account. Bus. Financ. J. 2021, 15, 37–50. [Google Scholar] [CrossRef]

- Kowalczyk-Anioł, J.; Grochowicz, M.; Pawlusiński, R. How a Tourism City Responds to Covid-19: A Cee Perspective (Kraków Case Study). Sustainability 2021, 13, 7914. [Google Scholar] [CrossRef]

- Gyódi, K. Airbnb and the Hotel Industry in Warsaw: An Example of the Sharing Economy? Cent. Eur. Econ. J. 2017, 2, 23–34. [Google Scholar] [CrossRef] [Green Version]

- Derek, M.; Dycht, K. Lokalizacja Usług Noclegowych w Otoczeniu Rynku Starego Miasta w Warszawie. Pr. Geogr. 2018, 152, 55–66. [Google Scholar] [CrossRef] [Green Version]

- Plichta, G. The Problem of Short-Term Rental as a Manifestation of the Overtourism Effect on the Housing Market in the Historical City of Krakow. Świat Nieruchom. 2018, 4, 57–64. [Google Scholar]

- Pawlicz, A.; Vrtodusic Hrgovic, A.M. Spatial Issues of Sharing Economy in Polish Accommodation Market. Ekon. I Sr. 2020, 1, 87–106. [Google Scholar] [CrossRef]

- Kowalczyk-Anioł, J. Hipertrofia Turystyki Miejskiej—Geneza i Istota Zjawiska. Konwersatorium Wiedzy O Mieście 2019, 4, 7–18. [Google Scholar] [CrossRef]

- Żemła, M. Home-Sharing and Overtourism in the Eyes of Residents of a Tourism City–the Case of Cracow, Poland. In Reviving Tourism, in the Post-Pandemic Era; Christou, E., Fotiadis, A., Eds.; International Hellenic University, School of Economics and Business: Sindos, Greece, 2022; pp. 603–612. [Google Scholar]

- Tomal, M.; Helbich, M. The Private Rental Housing Market before and during the COVID-19 Pandemic: A Submarket Analysis in Cracow, Poland. Environ. Plan. B Urban Anal. City Sci. 2022, 49, 1646–1662. [Google Scholar] [CrossRef]

- Warsaw Tourist Office Tourism in Warsaw. Available online: https://warsawtour.pl/wp-content/uploads/2021/10/Tourism_in_Warsaw_Report_2018.pdf (accessed on 4 May 2022).

- Małopolska Organizacja Turystyczna. Available online: http://www.mot.krakow.pl/badanie-ruchu-turystycznego.html (accessed on 4 May 2022).

- Official Website of Łódź. Available online: https://uml.lodz.pl/ (accessed on 4 May 2022).

- Official Website of Poznań. Available online: https://www.poznan.pl/mim/omiescie/en/host-city-poznan,p,20892.html? (accessed on 4 May 2022).

- Official Website of Wrocław. Available online: https://www.wroclaw.pl/en/ (accessed on 4 May 2022).

- Official Website of Toruń. Available online: https://www.torun.pl/en/torunpl/miasto/city-en# (accessed on 4 May 2022).

- Official Website of Katowice. Available online: https://welcome.katowice.eu (accessed on 4 May 2022).

- Official Website of Gdańsk. Available online: https://www.gdansk.pl/turystyka/o-gdansku,a,12058 (accessed on 4 May 2022).

- Official Website of Gdynia. Available online: https://www.gdynia.pl/turystyczna-pl (accessed on 4 May 2022).

- Official Website of Szczecin. Available online: https://www.szczecin.eu/en (accessed on 4 May 2022).

- Lublin City Office. Available online: https://lublin.eu/en/lublin/about-the-city/ (accessed on 4 May 2022).

- Sopot Tourism Organisation. Available online: https://visit.sopot.pl/en/sopot-tourist-organization/ (accessed on 4 May 2022).

- Official Website of Świnoujście. Available online: https://www.swinoujscie.pl/pl/artykul/227/2345/kraina-44-wysp (accessed on 4 May 2022).

- Official Website of Zakopane. Available online: https://www.zakopane.pl/en/tourist-area/zakopane-the-hub-of-the-world (accessed on 4 May 2022).

- AirDNA. Available online: https://www.airdna.co/about (accessed on 13 January 2022).

- Kwok, L.; Xie, K.L. Pricing Strategies on Airbnb: Are Multi-Unit Hosts Revenue Pros? Int. J. Hosp. Manag. 2019, 82, 252–259. [Google Scholar] [CrossRef]

- Ministry of Health—Service of the Republic of Poland. Available online: https://www.gov.pl/web/zdrowie/pierwszy-przypadek-koronawirusa-w-polsce (accessed on 2 May 2022).

- Związek Przedsiębiorców i Pracodawców. Podsumowanie Lockdown-u w Polsce. Available online: https://zpp.net.pl/wp-content/uploads/2021/01/25.01.2021-Business-Paper-Podsumowanie-lockdownu-w-Polsce.pdf (accessed on 2 May 2022).

- Stróżyk, A. Pandemia Koronawirusa Na Świecie i w Polsce|Kalendarium Pandemii. Available online: https://www.medicover.pl/o-zdrowiu/pandemia-koronawirusa-na-swiecie-i-w-polsce-kalendarium,7252,n,192 (accessed on 2 May 2022).

- EU Digital COVID Certificate|European Commission. Available online: https://ec.europa.eu/info/live-work-travel-eu/coronavirus-response/safe-covid-19-vaccines-europeans/eu-digital-covid-certificate_en (accessed on 2 May 2022).

- AirDNA. Available online: https://www.airdna.co/ (accessed on 13 January 2022).

- Gabryjończyk, K.; Gabryjończyk, P. Zmiany Stopnia Wykorzystania Turystycznych Obiektów Noclegowych w Okresie Zwalczania Pandemii COVID-19 w Polsce. Tur. I Rozw. Reg. 2021, 15, 43–58. [Google Scholar] [CrossRef]

- Kuqi, B.; Elezaj, E.; Millaku, B.; Dreshaj, A.; Hung, N.T. The Impact of COVID-19 (SARS-CoV-2) in Tourism Industry: Evidence of Kosovo during Q1, Q2 and Q3 Period of 2020. J. Sustain. Financ. Investig. 2021, 1–12. [Google Scholar] [CrossRef]

- Seyfi, S.; Hall, C.M.; Shabani, B. COVID-19 and International Travel Restrictions: The Geopolitics of Health and Tourism. Tour. Geogr. 2020, 1–17. [Google Scholar] [CrossRef]

- Polish Tourist Voucher. Available online: http://bonturystyczny.gov.pl/ (accessed on 2 May 2022).

- BON TURYSTYCZNY—Raport Podsumowujący Wakacje 2021. Available online: https://bonturystyczny.polska.travel/download/raporty/wakacje-2021.pdf (accessed on 2 May 2022).

- GUS: Jak Pandemia Wpłynęła Na Uzdrowiska? Available online: https://politykazdrowotna.com/artykul/gus-jak-pandemia-wplynela-na-uzdrowiska/826403 (accessed on 26 June 2022).

- Lokalny Rynek Nieruchomości w Świnoujściu. Available online: https://www.swinoujskie.info/2021/11/09/lokalny-rynek-nieruchomosci-w-swinoujsciu/ (accessed on 26 June 2022).

- Gössling, S.; Scott, D.; Hall, C.M. Pandemics, Tourism and Global Change: A Rapid Assessment of COVID-19. J. Sustain. Tour. 2021, 29, 1–20. [Google Scholar] [CrossRef]

- OECD. Tourism Trends and Policies 2020. Available online: https://www.oecd-ilibrary.org/urban-rural-and-regional-development/oecd-tourism-trends-and-policies-2020_6b47b985-en (accessed on 7 April 2022).

- Panasiuk, A. Przyczynek Do Badań Nad Wpływem Pandemii Na Stan Gospodarki Turystycznej. In Turystyka w Naukach Społecznych; Nessel, K., Ed.; Instytut Przedsiębiorczości Uniwersytetu Jagiellońskiego: Kraków, Poland, 2020; pp. 55–70. [Google Scholar]

- Baddeley, M. Hoarding in the Age of COVID-19. J. Behav. Econ. Policy 2020, 4, 69–75. [Google Scholar]

- Ntounis, N.; Parker, C.; Skinner, H.; Steadman, C.; Warnaby, G. Tourism and Hospitality Industry Resilience during the Covid-19 Pandemic: Evidence from England. Curr. Issues Tour. 2022, 25, 46–59. [Google Scholar] [CrossRef]

- Foth, M.; Bilandzic, A.; Guaralda, M. The Impact of Peer-to-Peer Accommodation on Place Authenticity: A Placemaking Perspective. In Shaping Smart for Better Cities: Rethinking and Shaping Relationships between Urban Space and Digital Technologies; Aurigi, A., Odendaal, N., Eds.; Academic Press: Cambridge, MA, USA, 2020; pp. 283–306. ISBN 9780128186367. [Google Scholar]

- Jang, S.; Kim, J.; Kim, J.; Kim, S. Spatial and Experimental Analysis of Peer-to-Peer Accommodation Consumption during COVID-19. J. Destin. Mark. Manag. 2021, 20, 100563. [Google Scholar] [CrossRef]

| Population (2020) | Area (km2) (2021) | Number of Active Rentals in the End of Q2 2021 * Per 1000 Inhabitants | Number of Tourist Beds in the End of Q2 2021 * Per 1000 Inhabitants | |

|---|---|---|---|---|

| Warsaw | 1,794,166 | 517.2 | 3.2 | 20.9 |

| Kraków | 779,966 | 326.9 | 7.1 | 38.5 |

| Łódź | 672,185 | 293.3 | 0.9 | 9.8 |

| Wrocław | 641,928 | 292.8 | 3.0 | 21.3 |

| Poznań | 532,048 | 261.9 | 2.3 | 16.6 |

| Gdańsk | 470,805 | 262 | 8.5 | 41.4 |

| Szczecin | 398,255 | 300.6 | 1.0 | 18.8 |

| Lublin | 338,586 | 147.5 | 1.0 | 14.4 |

| Katowice | 290,553 | 164.6 | 1.6 | 16.6 |

| Gdynia | 244,969 | 135.1 | 3.3 | 14.0 |

| Toruń | 198,613 | 115.7 | 1.8 | 20.3 |

| Świnoujście | 40,948 | 202.1 | 26.5 | 257.7 |

| Sopot | 35,286 | 17.3 | 28.1 | 196.8 |

| Zakopane | 26,846 | 84.3 | 59.8 | 540.9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kowalczyk-Anioł, J.; Kacprzak, K.; Szafrańska, E. How the COVID-19 Pandemic Affected the Functioning of Tourist Short-Term Rental Platforms (Airbnb and Vrbo) in Polish Cities. Int. J. Environ. Res. Public Health 2022, 19, 8730. https://doi.org/10.3390/ijerph19148730

Kowalczyk-Anioł J, Kacprzak K, Szafrańska E. How the COVID-19 Pandemic Affected the Functioning of Tourist Short-Term Rental Platforms (Airbnb and Vrbo) in Polish Cities. International Journal of Environmental Research and Public Health. 2022; 19(14):8730. https://doi.org/10.3390/ijerph19148730

Chicago/Turabian StyleKowalczyk-Anioł, Joanna, Karolina Kacprzak, and Ewa Szafrańska. 2022. "How the COVID-19 Pandemic Affected the Functioning of Tourist Short-Term Rental Platforms (Airbnb and Vrbo) in Polish Cities" International Journal of Environmental Research and Public Health 19, no. 14: 8730. https://doi.org/10.3390/ijerph19148730

APA StyleKowalczyk-Anioł, J., Kacprzak, K., & Szafrańska, E. (2022). How the COVID-19 Pandemic Affected the Functioning of Tourist Short-Term Rental Platforms (Airbnb and Vrbo) in Polish Cities. International Journal of Environmental Research and Public Health, 19(14), 8730. https://doi.org/10.3390/ijerph19148730