Abstract

Green innovation is one of the most important approaches to prevent environmental pollution and foster sustainable development. Embedded in the global production networks, manufacturing firms have been found not only to be the main drivers of innovation but also the main polluters in developing countries. However, relatively few studies have systematically considered the effect of global value chain (GVC) participation on green innovation in the context of developing countries. By using a panel dataset of Chinese listed manufacturing firms, this study conducts panel data fixed-effect analyses and uses the instrumental variable two-stage least square model to investigate the effect of GVC participation on firms’ green innovation performance. The results show that increased GVC participation leads to improved green innovation performance of Chinese firms. Meanwhile, further heterogeneity analyses show that the impact of GVC participation on green innovation is more pronounced for firms with greater financial constraints, state-owned firms and firms in labor- or pollution-intensive industries, located in the eastern regions of China. Therefore, this study sheds light on the implication that actively participating in GVC is the key to promoting sustainable growth when facing the need for transformation in developing countries.

1. Introduction

With the acceleration of economic globalization and international trade liberalization, the manufacturing firms in developing countries have realized transformation and upgrading by participating in global value chain (GVC), which becomes an indispensable economic development paradigm. However, the longstanding conflict between economic development and environmental protection poses a challenge to sustainable development focusing on emission reduction and energy conservation. In recent years, Chinese manufacturing firms have not only contributed to rapid economic development but have also severely polluted the natural environment. Meanwhile, green innovation that integrates technological progress and green development is an important indicator that reflects sustainable development. In view of the fact that the environmental agenda has become a crucial and inevitable topic, whether GVC participation plays a role in affecting green innovation performance and environmental outcomes is worth investigating.

The emergence of GVC has considerably transformed and modernized the global manufacturing industry and international trade. Participation in GVC particularly helps firms in developing countries improve their productivities and competencies [1]. However, the issues of energy consumption and the environment, as well as GVC participation, have garnered increased attention both academically and practically in recent years. Evidence suggests that GVC has resulted in the transfer of carbon emissions and pollutant emissions from industrialized countries to developing countries [2]. There is an urgent need to resolve the conflict between economic development and environmental protection. Green innovation has recently attracted much attention, as it provides new technologies, goods, services and production processes that can help prevent environmental pollution and foster sustainable development [3]. In the context of China, manufacturing firms are not only the main drivers of innovation and development but also the main polluters during the development process. Therefore, green innovation within manufacturing firms facilitates the environmental improvement and industrial transformation of the economy.

There remains a research gap regarding how GVC participation affects enterprises’ green innovation performance, although there are several studies focusing on GVC participation and industrial upgrading or environmental issues. To address this research gap, we analyze a panel dataset of Chinese listed manufacturing firms from 2008 to 2014. Combining this with China’s customs database, we refer to the recent literature and calculate the GVC participation index for each firm [4]. The empirical analysis is then carried out using ordinary least squares and two-stage least squares (2SLS) estimations. Finally, our findings also highlight important heterogeneity in how GVC participation affects various types of firms’ green innovation.

The main contributions of this study are threefold. First, this paper sheds light on the relationship between GVC participation and green innovation in the context of developing countries. We seek to unpack the underlying mechanism through which the level of GVC participation affects green innovation performance. Specifically, GVC participation can introduce advanced green production technologies and increase the absorptive capacity of technology spillovers among various firms, which in turn boosts green innovation. Second, this study contributes to the existing literature by examining the environmental consequences of participating in GVC. Therefore, it provides new insights into the interrelationship between economic globalization, environmental protection and sustainable growth. Our findings reinforce the important role of GVC participation in shaping the environmental outcomes. In addition, we employ an instrumental variable (IV) approach to address potential endogeneity issues and establish a cause–effect relationship in the empirical study. Third, this study explores whether heterogeneity across firms, industries and regions influences the impacts of GVC participation on green innovation. The heterogeneity analysis allows policymakers to utilize targeted policies to enhance manufacturing firms’ capability of green innovation and sustainable development. It provides a useful tool for future research investigating longstanding conflicts between economic development and environmental protection, as well as the means to leverage green innovation and environmental performance in developing countries in the era of globalization.

The remainder of the paper is organized as follows. Section 2 provides the literature review. Section 3 describes the data and methodology, including data sources, measurements of variables, stylized facts and model specifications. Section 4 presents the results, including baseline findings and robustness checks. Section 5 shows the heterogeneity analysis based on firm, industry and region level. Section 6 illustrates the implications and limitations of the research. Finally, Section 7 concludes the paper.

2. Literature Review

Two strands of literature are related to this study: (a) GVC participation and industrial upgrading and (b) GVC participation and environmental issues in developing countries.

Previous research has demonstrated the significance of GVC participation in the economic growth and industrial upgrading of developing countries [5,6,7]. There is a growing consensus that the emergence of GVC represents a remarkable opportunity for promoting the ongoing transformations in developing countries [8,9]. GVC provides firms in developing countries with increased access to international markets, higher-quality inputs and technology transfer, which can give rise to research and development (R&D) spillovers, productivity improvements and growth [10,11]. Specifically, increased GVC participation allows firms to effectively and efficiently utilize the diverse knowledge they could acquire from their GVC partners, which can be considered as one of the most valuable resources in upgrading their technology and strengthening innovation capacity [12,13,14]. Meanwhile, inward-sourcing capability is critical for technical upgrade in GVC for emerging-economy firms [15]. It has been well documented in the literature that GVC participation boosts productivity and innovation efficiency [1], provides opportunities to modernize the industrial structure [16] and results in economic upgrading [17] for developing countries. Moreover, it is found that the business environment and foreign direct investment (FDI) significantly promote the status elevation on GVC, especially for labor-intensive industries [18]. The existing literature has suggested different channels through which GVC participation influences industrial upgrading and economic development of developing countries. The key underlying mechanisms include improved access to global markets, increased availability and quality of imported inputs, advanced technology and knowledge transfers and enhanced innovation capacity. Nevertheless, all of these major transmission channels are essentially theoretical, and the materialization of the above-mentioned theoretical effects is still uncertain. Hence, empirical studies are of vital importance to test the theoretical predictions in the context of developing countries. In addition, investigating the relationship between GVC participation and industrial upgrading in China could provide lessons for other developing countries to foster economic development in this age of globalization.

Another strand of the literature has focused on the environmental and energy consequences of GVC [19,20,21]. Two opposing hypotheses emerged with the advancement of globalization. The first “pollution haven hypothesis” states that developing countries increase pollution emissions when embedded in GVC. In particular, previous studies provided supportive evidence for this hypothesis [2,22]. The other “pollution halo hypothesis” indicates that developing countries may reduce pollution emissions when embedded in GVC because industrialized countries may diffuse their advanced technology and experience into developing countries. GVC participation has been found to reduce carbon emissions and environmental pollution in developing countries [23,24]. Meanwhile, it has been demonstrated that there is an inverted U-shaped relationship between GVC participation and energy intensity [25]. To summarize, there is still no clear consensus in the literature regarding the relationship between GVC participation and environmental outcomes in developing countries. It appears that the existing studies have three major shortcomings: (1) they have mostly relied on GVC participation indicators at the aggregate country or industry level, as opposed to detailed measures of GVC participation at the disaggregate firm level, which may result in measurement errors; (2) they have not systematically addressed the potential endogeneity problem, which could suffer from biases due to reverse causality; and (3) they have not fully considered the heterogeneity across firms, industries and regions, which might ignore the important heterogeneous effects of GVC participation in developing countries. As the largest emerging economy, China has actively participated in GVC through forward and backward linkages. Thus, whether Chinese firms’ GVC participation plays a role in shaping the environmental outcomes remains to be further studied.

Green innovation has not yet been adequately investigated as a critical bridge to resolve conflicts between economic expansion and environmental protection. Although the economic and environmental effects of GVC participation in developing countries have been extensively studied in the existing literature, relatively scarce research has systematically examined the effect of GVC participation on green innovation. To fill this critical gap, this study aimed to explore the impact of GVC participation on firms’ green innovation performance using a panel dataset of listed Chinese manufacturing firms, which sheds empirical light on the role of GVC participation on green innovation in the largest developing country.

In the era of globalization, green innovation performance typically hinges on the import and export of intermediate goods, and the implication of GVC participation is the share of foreign value added in total exports [4]. With the gradual deepening of the “new development philosophy” in China, featuring innovative, coordinated, green, open and shared growth, Chinese manufacturing firms are at the critical moment of transformation from extensive development to intensive development. Increasing attention has been paid to green innovation performance of Chinese manufacturing firms, which could consider both economic development and environmental protection. Specifically, GVC participation can bring about advanced green production technologies and enhance the absorptive capacity of technology spillovers, which in turn promotes green innovation. Therefore, the objective of this study is to examine the influencing mechanism of GVC participation on Chinese manufacturing firms’ green innovation performance.

3. Data and Methodology

3.1. Data and Sample

To investigate the relationship between manufacturing firms’ GVC participation and green innovation performance, we merge two databases: (1) firm-level green innovation data and (2) firm-product level trade data.

The first database is the listed firms’ database sourced from the China Stock Market Accounting Research (CSMAR) database. It provides detailed information of each listed firm’s financial, operating and corporate governance information, among others. This database has been widely used in previous studies regarding Chinese listed firms’ green innovation performance [26,27].

We also use international trade data from China’s Customs Database, which covers Chinese exporters and importers and provides detailed information on the firm–product–country–trade mode level transaction, including trade values, quantities, units, product codes (i.e., 8-digit harmonized system (HS)), importing or exporting countries, contact information, firm ownership type and trade mode. This is by far the most detailed international trade database in China, which enables us to calculate the GVC participation index [4,10].

The focus of this study is Chinese listed manufacturing firms, and all indicators are constructed at the firm level. To calculate firm-level GVC participation, we match these two databases by their contact information (i.e., firm names and contact details). After removing observations with missing data and winsorizing extreme values at the 1% level, we obtain an unbalanced dataset with 4577 firm–year observations from 2008 to 2014 as the final sample.

3.2. Variables

3.2.1. Dependent Variable

The dependent variable is green innovation performance within firms (GI). Green innovation reflects the comprehensive ecological, economic and social development of the firm. It is beneficial for enhancing the competitiveness of the firm, thus promoting the upgrading of industrial structures and high-quality economic growth [28]. Following previous studies [29,30,31], it is calculated by the total number of green invented patent applications, which reflects the firm’s dedication and effort in terms of green innovation for that year.

3.2.2. Independent Variable

The independent variable of this study is GVC participation of the firm (GVC). A wide variety of approaches to GVC participation calculation rely on World Input-Output Database, which are based on the industry level, and they tend to ignore the heterogeneity of firms. Following previous studies [4,32], GVC is measured by the proportion of foreign value added in total export in this study. As shown in the Equation (1), and represent the firms’ export foreign value added and export value, respectively. The customs dataset is employed to calculate export trade value (EX) and import trade value (IM), whereas domestic sales (D) are calculated by subtracting income from export value.

where the subscripts o and p denote the ordinary trade and the processing trade, respectively. We assume that processing imports consist of foreign value added, and ordinary imports consist of intermediate goods and final goods, where the former is used only for foreign value added. We classify product categories into intermediate inputs, capital goods and consumer goods, as suggested by the relevant literature [4]. Intermediate inputs of ordinary imports are treated as an input for producing foreign value added. The numerator of the right-hand side consists of value added created by processing trade (IMAp), which is measured by inputs via processing import; foreign value added created by processing trade (, which assumes that the intermediate input via ordinary trade is used in proportion to domestic sales and exports.

3.2.3. Control Variables

Following previous studies [26,27], we control a comprehensive set of variables that may affect the green innovation performance.

- Income (Revenue), measured by the natural logarithm of operating revenue in the year.

- Firm age (Age), measured by the natural logarithm of firm age.

- Government subsidy (Subsidy), measured by the natural logarithm of government subsidy.

- Firm size (Asset), measured by the natural logarithm of the total net asset.

- Firm financial development potential (Tobinq), measured by the ratio of firm market value to capital replacement cost.

- Industry competition (HHI), measured by the Herfindahl–Hirschman index within the industry.

3.3. Stylized Facts

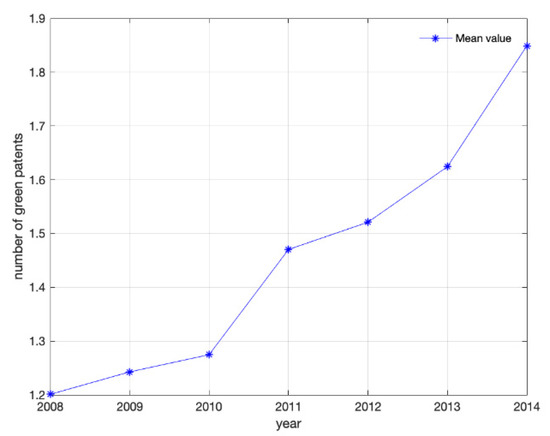

The descriptive statistics of all the variables are shown in Table 1. As indicated therein, the mean of green innovation is 1.5045, which implies that the current green innovation of China’s listed firms needs to be improved. Moreover, all the other variables have large variations over time, which enables us to exploit these variations and conduct the regression analysis.

Table 1.

Descriptive statistics.

Furthermore, Figure 1 plots the mean of green invention of listed Chinese firms from 2008 to 2014. It shows that green innovation grew from 1.2011 in 2008 to 1.8488 in 2014, which reflects that firms are paying considerable attention to green development. During this period, the Chinese government also promulgated a series of policy measures to promote green growth. For example, in the 12th Five-Year Plan of 2011, it was proposed to focus on energy conservation and emission reduction to promote green and low-carbon development.

Figure 1.

Green innovation performance trend (2008 to 2014).

3.4. Empirical Model Specification

To test the relationship between GVC participation and green innovation performance, we estimate the following specification:

where f represents the firm, t denotes the year, and i characterizes industry. The dependent variable GI denotes the green innovation, and the independent variable GVC represents the degree of firm participation in GVC. is a set of control variables that may affect green innovation. is a vector of estimated coefficients of control variables. , and denote the firm, industry and year fixed effects, respectively, which are included to control for unobservable characteristics at firm, industry and year levels. Finally, represents a random error term. For all the estimates, robust standard errors are reported.

4. Results

4.1. Baseline Regression Results

The baseline results are presented in Columns 1 and 2 of Table 2. As shown in Column 1, the regression coefficient of GVC participation is 0.2537 and statistically significant at the 5% level, which indicates that GVC participation has a positive effect on the firms’ green innovation performance. In Column 2, we add other control variables, and the coefficient of GVC participation remains positive and significant. Among the control variables, the estimated coefficients of revenue (Revenue) and size (Asset) are positive and significant, suggesting that these factors would promote green innovation performance. One possible reason is that green innovation activities usually require huge capital investment; thus, large firms have sufficient financial ability to carry out green research and development.

Table 2.

Baseline regression and robust checks I.

4.2. Robustness Checks

4.2.1. Alternative Sample

The 2008 financial crisis was an important event that affected the world economy, and it inevitably had a damaging effect on the development of firms participating in the GVC. Considering this circumstance, this study excluded the sample of 2008 and the adjacent year 2009 and only retained the sample from 2010 to 2014 to re-estimate the baseline model. According to the results shown in Column 3 of Table 2, the coefficient of GVC remains positive and significant at the 5% level, which is qualitatively consistent with the baseline result.

4.2.2. Endogeneity

The endogeneity concern occurs when GVC activities may be influenced by green innovation, or both of these could be jointly affected by other factors. To solve this problem, we refer to the literature [33] and utilize the cube of the difference between a firm’s GVC participation and its mean value within the same industry or the same province as instrumental variables. Moreover, these two instrumental variables are used to test the robustness of the baseline regression using the 2SLS method. As reported in Table 3, Columns 1 and 2 show the results of the cube of the difference between a firm’s GVC participation and its mean value within the same industry as the instrumental variable (IV1), and Columns 3 and 4 represent the cube of the same difference value within the same province as the other instrumental variable (IV2). The F-value of the instrument variable in the first stage is greater than 10, which reflects that the instruments are not weak. Both instrumental variables are highly correlated with GVC, which indicates the relativeness of the instrumental variables. After accounting for the endogeneity, the coefficients of GVC are still significantly positive at 5%, demonstrating the robustness of the baseline findings.

Table 3.

Robustness checks II: 2SLS estimation.

5. Further Analysis: Heterogeneity Analysis

5.1. Firm Heterogeneity

The existing literature confirmed that different types of firms have different financial conditions and institutional logics [26,34], which may heterogeneously affect green innovation. Thus, the firm heterogeneity analysis is reported in this subsection.

5.1.1. Firm Heterogeneity by Financial Constraints

Since green innovation is associated with a substantial investment, it requires the firms to have good financial conditions. To investigate the consequences of financial condition heterogeneity, we refer to a relevant study [26] and divide the sample into two groups: high and low financial constraints. When calculating financial constraints, we refer to previous literature to calculate the size–age (SA) index [35]. A higher SA index value means that the firm is more financially constrained. Then, a firm is placed in the high financial constraints group if the SA index is larger than the median value; otherwise, it is treated as belonging to the low financial constraints group. As shown in Table 4, the regression coefficient of GVC participation in the high financial constraints group is positive and statistically significant. It indicates that GVC participation has a positive effect on green innovation only for firms with high financial constraints.

Table 4.

Firm heterogeneity analysis: Financial constraints.

5.1.2. Firm Heterogeneity by Ownership

As the major economic players, state-owned enterprises play an important role in the economic development of emerging markets [34]. In particular, there are differences in government regulation between state-owned and non-state-owned enterprises. Therefore, this study classifies the sample into state-owned enterprises and non-state-owned enterprises according to their ownership forms. As reported in Table 5, the coefficients of GVC in the two groups are both positive and statistically significant, although the coefficient in stated-owned firms is higher. It indicates that compared with non-state-owned enterprises, state-owned enterprises participating in GVC may promote green innovation more strongly.

Table 5.

Firm heterogeneity analysis: Ownership.

5.2. Industry Heterogeneity

Firms in different industries may experience different energy utilization efficiencies, production environments, etc.; thus, it is necessary to investigate the heterogeneity across industries.

5.2.1. Industry Heterogeneity by Factor Intensity

Firstly, we classify the sample according to their factor intensity, i.e., the labor-intensive industry, capital-intensive industry and technology-intensive industry [36]. The classification of the industries is presented in the Appendix A, Table A1. As shown in Table 6, the coefficient of GVC participation in the labor-intensive industry sample is 0.4344 and statistically significant at the 5% level. Meanwhile, the coefficients of capital-intensive and technology-intensive industries are insignificant. These results show that only GVC participation by firms in the labor-intensive industry can promote green innovation.

Table 6.

Industry heterogeneity analysis: Factor intensity.

5.2.2. Industry Heterogeneity by Pollution Intensity

Relying on first-mover advantages, the developed countries at the high end of GVC transfer the processing and assembly sectors to developing countries, and developing countries are forced to take over these industries with high pollution and high energy consumption [37]. Thus, it is necessary to explore the heterogeneous effects across industries with different pollution intensities. Following previous research [38], we divide the sample into pollution-intensive industries and non-pollution-intensive industries. The pollution-intensive industries consist of eight “severe pollution” industries, such as textile, paper and paper products manufacturing. The classification of the industries is presented in the Appendix A, Table A1. Table 7 shows the estimation results, and the coefficients are 0.3477 and 0.2119 for pollution-intensive and non-pollution-intensive industries, respectively. Both coefficients are significantly positive, and the coefficient of GVC in the pollution-intensive industry is positive at the 5% level and larger than that in non-pollution-intensive industries. It reflects that companies in the pollution-intensive industry participating in GVC have a greater positive impact on green innovation.

Table 7.

Industry heterogeneity analysis: Pollution intensity.

5.3. Regional Heterogeneity

The geographical imbalance is a significant characteristic of China’s economic development [39], where the eastern region is more economically developed. Benefiting from superior geographical location, the eastern region reformed and opened earlier, resulting in the establishment of a large number of firms. Therefore, we divide listed firms into eastern, central, western and northeastern regions according to their geographic locations. According to the results in Table 8, only the coefficient of GVC participation in the eastern region is positive and significant. It shows that the effect of GVC participation on green innovation performance is unbalanced.

Table 8.

Regional heterogeneity analysis.

6. Discussion

6.1. Empirical Results Discussion

This study takes Chinese listed manufacturing firms from 2008 to 2014 as final sample to analyze the effect of participating in GVC on green innovation. The baseline result and robust test support the hypothesis and reveal that intense participation in GVC is conducive to green innovation. International trade, FDI and outward FDI are the key means of GVC participation for Chinese firms [40]. When firms participate in GVC, they would not only import advanced intermediate products but also learn advanced management experience from multinational enterprises [18,41]. In addition, it facilitates the transmission of sophisticated technology and management experience across regions and nations, thereby promoting green innovation. Moreover, other studies have found that developing countries, such as China, could improve their innovation competitiveness related to high value added from the process of production fragmentation [42].

In addition, considering China’s economic development characteristic, we conduct heterogeneity analysis at the firm, industry and region levels.

In the firm heterogeneity analysis, the analysis based on classification by financial constraints provides an interesting finding: participation in GVC by firms with high financial constraints has a positive effect on green innovation. A possible explanation could be that firms with high financial constraints are inclined to participate in GVC and build up cooperative relationships with international trading partners [43]. GVC participation could help firms broaden capital sources, which could mitigate the negative effects of financial constraints on green innovation. In addition, the group regressions by ownership demonstrate that compared with non-state-owned enterprises, the promotion effect of participating in GVC on green innovation is more pronounced in state-owned enterprises. This could be due to the fact that state-owned enterprises are part of China’s political system and have closer ties to the government [44]. On the one hand, state-owned enterprises may face strict state governance [34]; thus, their managers have a stronger green awareness. Previous study also confirmed that institutional pressure is an important driving factor for green innovation [45]. On the other hand, many environment-related projects promoted by the state government usually require green technologies, and if enterprises have obtained green patents, it would be conducive to cooperate with the government [44].

In the industry heterogeneity analysis, the regression results by factor intensity reveal that only the coefficient of GVC participation in labor-intensive industry is positive and significant. Labor-intensive industries include processing of food from agricultural products, manufacture of textiles, etc., and China has accumulated ample production and management experience in these industries. Compared with other industries, labor-intensive industries have relatively lower technical barriers. Therefore, firms are more likely to promote green innovation through learning effects and technology spillovers in the GVC network. In contrast, firms engaging in capital-intensive and technology-intensive activities may face low-end locking by industrialized countries, such that they are limited in absorbing and upgrading technology [46,47], which may impede green innovation. The heterogeneous analysis across industries with different pollution intensities shows that the positive effect of GVC participation on green innovation is more pronounced in the pollution-intensive industry. This could be explained by the fact that firms in these pollution-intensive industries have stronger motivation to promote green growth to break through resource limitation and environmental constraints [38].

In the region heterogeneity analysis, the coefficient of GVC participation in the eastern region is positive and significant. A possible explanation could be that large numbers of firms are concentrated in the eastern region, and the communication among firms is more frequent [48], which promotes the spillover effect through information sharing and is ultimately conducive for green innovation.

6.2. Implications

Green innovation has attracted the attention of scholars and practitioners, in that it is one of the most important means for firms to manage the environmental concerns and achieve sustainability. The manufacturing sector plays a significant role in economic development and environmental protection. Manufacturing firms in developing countries are also the main participants in GVC activities. Thus, it is critical to understand the effect of GVC participation on green innovation performance.

These findings have important theoretical and policy implications for researchers, practitioners and policymakers. First, this study systematically investigates the impact of GVC participation on green innovation in China. Our paper provides supportive evidence for the research hypothesis that GVC participation has a positive effect on Chinese manufacturing firms’ green innovation performance, which is in accordance with the theoretical framework developed in the recent literature [40,41,42]. This study not only expands research on resolving conflicts between economic expansion and environmental protection but also provides theoretical support for Chinese manufacturing firms to participate actively in GVC. It contributes to a better understanding of utilizing GVC participation to improve green innovation in developing countries. Second, this study demonstrates that, in practice, critical knowledge, important skills and advanced technologies related to the process of green innovation flow across countries through GVC participation. Hence, economic globalization plays a significant role in facilitating the diffusion of green technology and elevating the performance of green innovation. It sheds light on how integrating into the process of economic globalization promotes environmental performance and sustainable growth for developing countries. Third, this study reveals the external and internal barriers to green innovation by scrutinizing the level of GVC participation and firm characteristics. It enables the managers of manufacturing firms to better understand and cope with the potential barriers to the green innovation they want to practice, which will enhance the firm’s capability of sustainable development in the era of globalization. Finally, this study explores the heterogeneous effects stemming from GVC participation across firms, industries and regions. Policymakers in developing countries could utilize targeted policies to incentivize firms, industries and regions to acquire advanced knowledge and technologies, thereby creating a favorable environment in which to transfer green technology and improve green innovation performance.

6.3. Limitations and Future Research Directions

Although this study makes several contributions to the literature, there are still some limitations to be addressed in future research. First, our sample is based on China, one of the largest developing countries in the world, but it would be conducive to investigate whether our findings are generalizable to manufacturers from other developing countries in Asia, while accounting for heterogeneity and complexity across countries. Future research can study the positive externalities and mechanisms of GVC activities on green innovation in more developing countries. It contributes to realizing economic transformation in developing countries and provides more empirical experience for relevant theories in development economics and environmental economics. Second, due to data limitation, our research sample is restricted to Chinese listed firms. However, small and medium enterprises are also active participants in economic development and globalization. It can also be a fruitful direction for future research to determine the differences between listed firms and those small and medium enterprises in terms of GVC participation and green innovation performance with more in-depth survey data. Third, this study is based on firm-level data, and we are unable to observe how firms organize internal resources to drive green innovation. In future research, we can employ qualitative methodology to conduct field research in specific companies. Combined with corporate management theory and organization theory, it is valuable to provide qualitative insights into the relationship between GVC participation and green innovation. Finally, as the digital economy has developed rapidly around the world, the organization of GVC and its mechanisms on manufacturing firms may have changed. It would be interesting to investigate the relationship between GVC participation and green innovation in the context of the digital era with more recent data.

7. Conclusions

This study investigates the effect of GVC participation on green innovation performance. Using a panel dataset of Chinese listed manufacturing firms from 2008 to 2014, we conduct panel data analyses, 2SLS estimation and heterogeneity analyses and test the mechanisms. The results show that GVC participation increases green innovation, with the positive effect being more pronounced for firms with greater financial constraints, state ownership, in labor-intensive industries, in pollution-intensive industries and in the eastern regions of China. These findings are attributed to the specific characteristics of the Chinese context. In sum, this study demonstrates that actively participating in GVC is the key to promoting sustainable growth when facing the need for transformation in developing countries.

Author Contributions

Conceptualization, S.M. and H.Y.; methodology, H.Y. and J.Y.; software, H.Y.; validation, S.M. and J.Y.; formal analysis, H.Y.; investigation, S.M. and J.Y.; resources, S.M.; data curation, H.Y.; writing—original draft preparation, H.Y. and J.Y.; writing—review and editing, S.M.; visualization, H.Y. and J.Y.; supervision, S.M.; project administration, S.M.; funding acquisition, S.M. and J.Y. All authors have read and agreed to the published version of the manuscript. Authors are in alphabetical order and have contributed equally to the paper.

Funding

This research was funded by Fundamental Research Funds for the Central Universities; and the Humanities and Social Science Fund of Ministry of Education of China [20YJC790099].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available in the chargeable databases China Security Market and Accounting Research (CSMAR) database and China Customs Database.

Conflicts of Interest

The authors declare no conflict of interest.

Abbreviations

| GVC | Global value chain |

| GI | Green innovation |

| 2SLS | Two-stage least squares |

| IV | Instrumental variable |

| R&D | Research and development |

| FDI | Foreign direct investment |

| CSMAR | China Stock Market Accounting Research |

| HS | Harmonized system |

| HHI | Herfindahl–Hirschman Index |

| SA | Size–Age |

Appendix A

Table A1.

Industry classification.

Table A1.

Industry classification.

| Code | Industry Name | Factor Intensity | Pollution- Intense Industry |

|---|---|---|---|

| C13 | Processing of food from agricultural products | Labor | Yes |

| C14 | Manufacture of foods | Capital | No |

| C15 | Manufacture of wine, drinks and refined tea | Capital | No |

| C17 | Manufacture of textiles | Labor | Yes |

| C18 | Manufacture of textile wears and apparel | Labor | No |

| C19 | Manufacture of leather, fur, feather and related products and footwear | Labor | No |

| C20 | Processing of timber, manufacture of wood, bamboo, rattan, palm and straw products | Labor | No |

| C21 | Manufacture of furniture | Labor | No |

| C22 | Manufacture of paper and paper products | Capital | Yes |

| C23 | Printing, reproduction of recorded media | Capital | No |

| C24 | Manufacture of artwork and articles for culture, education, sports and recreation | Capital | No |

| C25 | Processing of petroleum, coking, processing of nuclear fuel | Capital | Yes |

| C26 | Manufacture of raw chemical material and chemical products | Capital | Yes |

| C27 | Manufacture of medicines | Technology | No |

| C28 | Manufacture of chemical fibers | Technology | No |

| C29 | Manufacture of rubber and plastic | Capital | No |

| C30 | Manufacture of non-metallic mineral products | Capital | Yes |

| C31 | Smelting and pressing of ferrous metals | Capital | Yes |

| C32 | Smelting and pressing of non-ferrous metals | Capital | Yes |

| C33 | Manufacture of metals products | Capital | No |

| C34 | Manufacture of general-purpose machinery | Capital | No |

| C35 | Manufacture of special-purpose machinery | Technology | No |

| C36 | Manufacture of automobiles | Technology | No |

| C37 | Manufacture of railway, ship, aerospace and other transport equipment | Technology | No |

| C38 | Manufacture of electrical machinery and equipment | Technology | No |

| C39 | Manufacture of computer, communications and other electronic equipment | Technology | No |

| C40 | Manufacture of measuring instruments | Technology | No |

| C41 | Other manufactures | Technology | No |

| C42 | Utilization of waste resources | Capital | No |

| C43 | Repairs services of metal products, machinery and equipment | Capital | No |

References

- Constantinescu, C.; Mattoo, A.; Ruta, M. Does vertical specialisation increase productivity? World Econ. 2019, 42, 2385–2402. [Google Scholar] [CrossRef] [Green Version]

- Gyamfi, B.A.; Bein, M.A.; Udemba, E.N.; Bekun, F.V. Investigating the pollution haven hypothesis in oil and non-oil sub-Saharan Africa countries: Evidence from quantile regression technique. Resour. Policy 2021, 73, 102119. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Lu, Y.; Lu, Y.; Xie, R.; Yu, X. Does global value chain engagement improve firms’ wages: Evidence from China. World Econ. 2019, 42, 3065–3085. [Google Scholar] [CrossRef]

- Morrison, A.; Pietrobelli, C.; Rabellotti, R. Global value chains and technological capabilities: A framework to study learning and innovation in developing countries. Oxford Dev. Stud. 2008, 36, 39–58. [Google Scholar] [CrossRef]

- Tian, K.; Dietzenbacher, E.; Jong-A-Pin, R. Measuring industrial upgrading: Applying factor analysis in a global value chain framework. Econ. Syst. Res. 2019, 31, 642–664. [Google Scholar] [CrossRef]

- Pahl, S.; Timmer, M.P. Do global value chains enhance economic upgrading? A long view. J. Dev. Stud. 2020, 56, 1683–1705. [Google Scholar] [CrossRef] [Green Version]

- Kowalski, P.; Gonzalez, J.L.; Ragoussis, A.; Ugarte, C. Participation of developing countries in global value chains: Implications for trade and trade-related policies. In OECD Trade Policy Papers; OECD Publishing: Paris, France, 2015; Volume 179. [Google Scholar] [CrossRef]

- Pipkin, S.; Fuentes, A. Spurred to upgrade: A review of triggers and consequences of industrial upgrading in the global value chain literature. World Dev. 2017, 98, 536–554. [Google Scholar] [CrossRef]

- Ge, J.; Fu, Y.; Xie, R.; Liu, Y.; Mo, W. The effect of GVC embeddedness on productivity improvement: From the perspective of R&D and government subsidy. Technol. Forecast Soc. Chang. 2018, 135, 22–31. [Google Scholar] [CrossRef]

- Jangam, B.P.; Rath, B.N. Do global value chains enhance or slog economic growth? Appl Econ. 2021, 53, 4148–4165. [Google Scholar] [CrossRef]

- Epede, M.B.; Wang, D. Global value chain linkages: An integrative review of the opportunities and challenges for SMEs in developing countries. Int. Bus. Rev. 2022, 101993. [Google Scholar] [CrossRef]

- Lee, K.; Szapiro, M.; Mao, Z. From global value chains (GVC) to innovation systems for local value chains and knowledge creation. Eur. J. Dev. Res. 2018, 30, 424–441. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Rabellotti, R. Global value chains meet innovation systems: Are there learning opportunities for developing countries? World Dev. 2011, 39, 1261–1269. [Google Scholar] [CrossRef] [Green Version]

- Zhou, W.C.; Yan, D.; Sun, S.L. Climbing the ladder: Inward sourcing as an upgrading capability in global value chains. Res. Policy. 2022, 51, 104439. [Google Scholar] [CrossRef]

- Tian, K.; Dietzenbacher, E.; Jong-A-Pin, R. Global value chain participation and its impact on industrial upgrading. World Econ. 2022, 45, 1362–1385. [Google Scholar] [CrossRef]

- Hagemejer, J.; Mućk, J. Export-led growth and its determinants: Evidence from Central and Eastern European countries. World Econ. 2019, 42, 1994–2025. [Google Scholar] [CrossRef]

- He, S.; Yao, H.; Ji, Z. Direct and indirect effects of business environment on BRI countries’ global value chain upgrading. Int. J. Environ. Res. Public Health 2021, 18, 12492. [Google Scholar] [CrossRef]

- De Marchi, V.; Alford, M. State policies and upgrading in global value chains: A systematic literature review. J. Int. Bus. Policy 2022, 5, 88–111. [Google Scholar] [CrossRef]

- De Marchi, V.; Di Maria, E.; Micelli, S. Environmental strategies, upgrading and competitive advantage in global value chains. Bus. Strategy Env. 2013, 1, 62–72. [Google Scholar] [CrossRef]

- Liu, H.; Li, J.; Long, H.; Li, Z.; Le, C. Promoting energy and environmental efficiency within a positive feedback loop: Insights from global value chain. Energy Policy 2018, 121, 175–184. [Google Scholar] [CrossRef]

- Duan, Y.; Ji, T.; Yu, T. Reassessing pollution haven effect in global value chains. J. Clean. Prod. 2021, 284, 124705. [Google Scholar] [CrossRef]

- Hua, Y.; Lu, Y.; Zhao, R. Global value chain engagement and air pollution: Evidence from Chinese firms. J. Econ. Surv. 2021, 36, 708–727. [Google Scholar] [CrossRef]

- Yang, N.; Liu, Q. The Interaction Effects of GVC involvement and domestic R&D on carbon emissions: Evidence from China’s industrial sectors. Technol. Anal. Strateg. Manag. 2022, 34, 687–702. [Google Scholar] [CrossRef]

- Wang, S.; He, Y.; Song, M. Global value chains, technological progress, and environmental pollution: Inequality towards developing countries. J. Environ. Manag. 2021, 277, 110999. [Google Scholar] [CrossRef] [PubMed]

- Tang, C.; Xu, Y.; Hao, Y.; Wu, H.; Xue, Y. What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Econ. 2021, 103, 105576. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, J.; Zhang, Y. Environmental regulations and corporate green innovation in China: The role of city leaders’ promotion pressure. Int. J. Environ. Res. Public Health 2021, 18, 7774. [Google Scholar] [CrossRef]

- Du, J.L.; Liu, Y.; Diao, W.X. Assessing regional differences in green innovation efficiency of industrial enterprises in China. Int. J. Environ. Res. Public Health 2019, 16, 940. [Google Scholar] [CrossRef] [Green Version]

- Ma, J.; Hu, Q.; Shen, W.; Wei, X. Does the low-carbon city pilot policy promote green technology innovation? Based on green patent data of Chinese A-share listed companies. Int. J. Environ. Res. Public Health 2021, 18, 3695. [Google Scholar] [CrossRef]

- Xu, L.; Fan, M.; Yang, L.; Shao, S. Heterogeneous green innovations and carbon emission performance: Evidence at China’s city level. Energy Econ. 2021, 99, 105269. [Google Scholar] [CrossRef]

- Zhao, X.Z.; Chen, J.; Chen, F.W.; Wang, W.; Xia, S. How high-polluting firms suffer from being distracted form intended purpose: A corporate social responsibility perspective. Int. J. Environ. Res. Public Health. 2020, 17, 9197. [Google Scholar] [CrossRef]

- Upward, R.; Wang, Z.; Zheng, J. Weighing China’s export basket: The domestic content and technology intensity of Chinese exports. J. Comp. Econ. 2013, 41, 527–543. [Google Scholar] [CrossRef]

- Lewbel, A. Constructing instruments for regressions with measurement error when no additional data are available, with an application to patents and R&D. Econometrica 1997, 65, 1201–1213. [Google Scholar] [CrossRef]

- Genin, A.L.; Tan, J.; Song, J. State governance and technological innovation in emerging economies: State-owned enterprise restructuration and institutional logic dissonance in China’s high-speed train sector. J. Int. Bus. Stud. 2020, 52, 621–645. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Xu, X.L.; Shen, T.; Zhang, X.; Chen, H.H. The role of innovation investment and executive incentive on financial sustainability in tech-capital-labor intensive energy company: Moderate effect. Energy Rep. 2020, 6, 2667–2675. [Google Scholar] [CrossRef]

- Dam, L.; Scholtens, B. The curse of the haven: The impact of multinational enterprise on environmental regulation. Ecol. Econ. 2012, 78, 148–156. [Google Scholar] [CrossRef]

- Wang, C.; Li, J. The evaluation and promotion path of green innovation performance in Chinese pollution-intensive industry. Sustainability 2020, 12, 4198. [Google Scholar] [CrossRef]

- Dunford, M.; Bonschab, T. Chinese regional development and policy. Reg. Mag. 2013, 289, 10–13. [Google Scholar] [CrossRef]

- Qu, C.; Shao, J.; Cheng, Z. Can embedding in global value chain drive green growth in China’s manufacturing industry? J. Clean. Prod. 2020, 268, 121962. [Google Scholar] [CrossRef]

- Ndubuisi, G.; Owusu, S. How important is GVC participation to export upgrading? World Econ. 2019, 44, 2887–2908. [Google Scholar] [CrossRef]

- Hu, D.; Jiao, J.; Tang, Y.; Han, X.; Sun, H. The effect of global value chain position on green technology innovation efficiency: From the perspective of environmental regulation. Ecol. Indic. 2021, 121, 107195. [Google Scholar] [CrossRef]

- Minetti, R.; Murro, P.; Rotondi, Z.; Zhu, S.C. Financial constraints, firms’ supply chains, and internationalization. J. Eur. Econ. Assoc. 2019, 17, 327–375. [Google Scholar] [CrossRef] [Green Version]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Saunila, M.; Ukko, J.; Rantala, T. Sustainability as a driver of green innovation investment and exploitation. J. Clean. Prod. 2018, 179, 631–641. [Google Scholar] [CrossRef]

- Shen, C.; Zheng, J. Does global value chains participation really promote skill-biased technological change? Theory and evidence from China. Econ. Model. 2020, 86, 10–18. [Google Scholar] [CrossRef]

- Tschang, F.T.; Goldstein, A. The outsourcing of “creative” work and the limits of capability: The case of the Philippines’ animation industry. IEEE Trans. Eng. Manag. 2010, 57, 132–143. [Google Scholar] [CrossRef]

- Zhang, Q.; Felmingham, B. The role of FDI, exports and spillover effects in the regional development of China. J. Dev. Stud. 2002, 38, 157–178. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).