Environmental Compliance and Enterprise Innovation: Empirical Evidence from Chinese Manufacturing Enterprises

Abstract

1. Introduction

2. Theoretical Model

2.1. Consumer Equation

2.2. Producter Equation

2.3. In Equilibrium

3. Methodology and Data

3.1. Research Methods and Models

3.2. Variable Definition

3.2.1. Enterprise Innovation

3.2.2. Environmental Compliance Index

3.3. Data source and Processing

3.4. Descriptive Statistical Analysis

4. Empirical Analysis and Findings

4.1. Benchmark Results Analysis

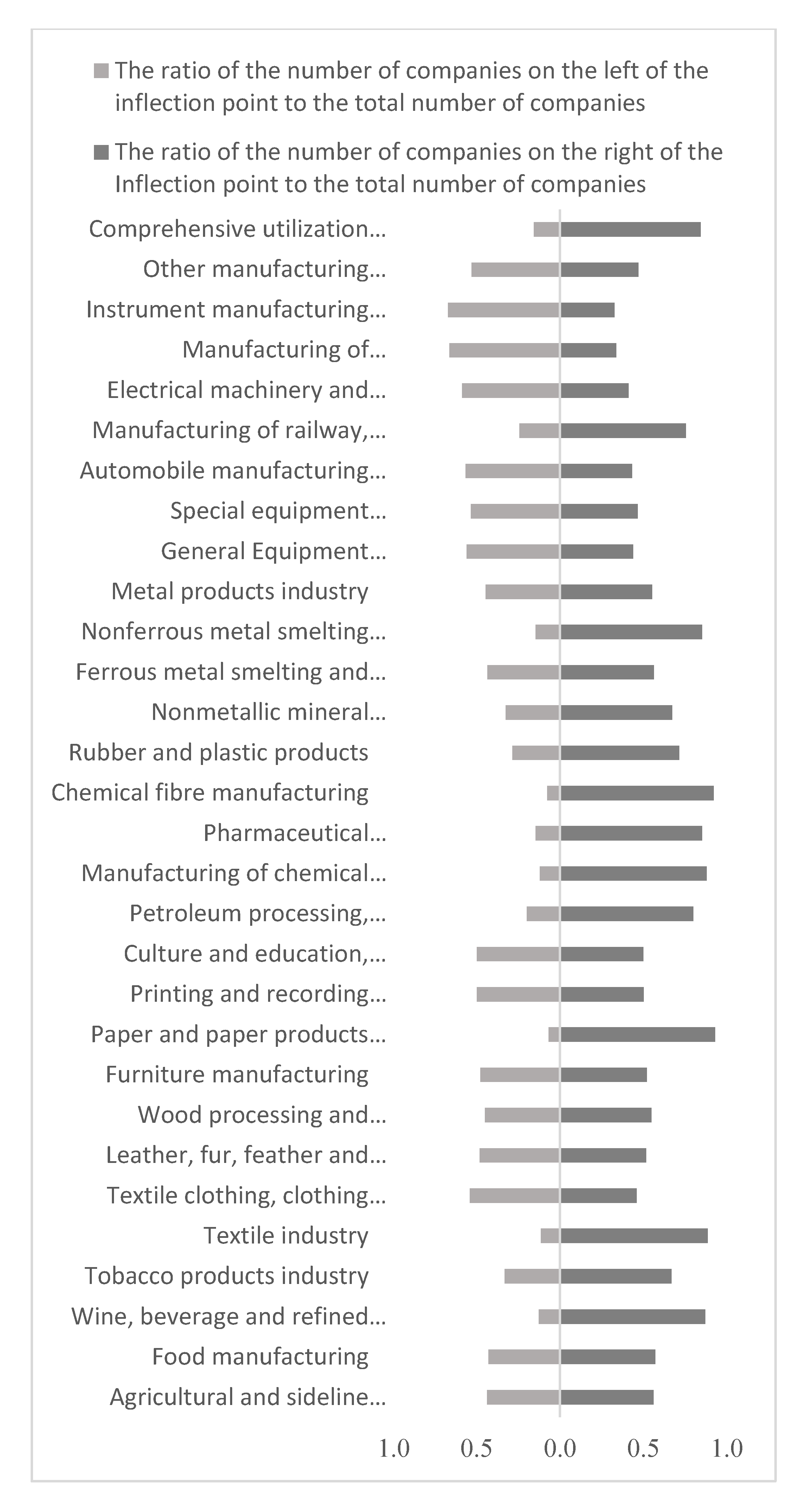

4.2. Heterogenous Texts

4.3. Robustness Test

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Shabbir, M.S.; Wisdom, O. The Relationship Between Corporate Social Responsibility, Environmental Investments and Financial Performance: Evidence from Manufacturing Companies. Environ. Sci. Pollut. Res. 2020, 27, 39946–39957. [Google Scholar] [CrossRef]

- Bitat, A. Environmental regulation & eco-innovation: The Porter hypothesis refined. Eurasian Bus. Rev. 2018, 8, 299–321. [Google Scholar]

- Nordhaus, W. Designing A Friendly Space for Technological Change to Slow Global Warming. Energy Econ. 2011, 33, 665–673. [Google Scholar] [CrossRef]

- Porter, M.E. America’s green strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward A New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Fadhilah, M.A. Strategic Implementation of Environmentally Friendly Innovation of Small and Medium-Sized Enterprises in Indonesia. Eur. Res. Stud. J. 2017, 20, 134–148. [Google Scholar] [CrossRef][Green Version]

- Hashmi, R.; Alam, K. Dynamic Relationship among Environmental Regulation, Innovation, CO2 Emissions, Population, and Economic Growth in OECD Countries: A Panel Investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar] [CrossRef]

- Weiss, J.; Stephan, A.; Anisimova, T. Well-Designed Environmental Regulation and Firm Performance: Swedish Evidence on the Porter Hypothesis and the Effect of Regulatory Time Strategies. J. Environ. Plan. Manag. 2019, 62, 342–363. [Google Scholar] [CrossRef]

- Liu, H.Y.; Owen, K.A.; Yang, K.; Zhang, C.H. Pollution Abatement Costs and Technical Changes Under Different Environmental Regulations. China Econ. Rev. 2020, 62, 2–13. [Google Scholar] [CrossRef]

- Li, S.H.; Xu, B.C. Environmental Regulation and Technological Innovation: Empirical Evidence from China’s Prefecture-level Cities. Mod. Econ. Res. 2020, 11, 31–40, (In China CSSCI). [Google Scholar]

- Zhao, X.; Sun, B. The Influence of Chinese Environmental Regulation on Corporation Innovation and Competitiveness. J. Clean. Prod. 2016, 112, 1528–1536. [Google Scholar] [CrossRef]

- Shi, B.; Qiu, M.; Feng, C.; Ekeland, A. Innovation Suppression and Migration Effect: The Unintentional Consequences of Environmental Regulation. China Econ. Rev. 2018, 49, 1–23. [Google Scholar] [CrossRef]

- Chen, L. How Does Environmental Regulation Affect Different Approaches of Technical Progress? Evidence from China’s industrial sectors from 2005 to 2015. Clean. Prod. 2019, 209, 572–580. [Google Scholar]

- Yang, L.X.; Liu, Y.C. Environmental Regulation and Regional Innovation Efficiency: Quasi-natural Experimental Evidence based on Carbon Emission Trading Pilot. Commer. Res. 2020, 9, 11–24, (In China CSSCI). [Google Scholar]

- Chi, C.J.; Wu, Y.J. An Empirical Study on The Influence of Environmental Regulation on Process Innovation and Product Innovation. Stat. Decis. 2020, 36, 174–178, (In China CSSCI). [Google Scholar]

- Su, X.; Zhou, S.S. Dual Environmental Regulation, Government Subsidy and Enterprise Innovation Output. China Popul. Resour. Environ. 2019, 29, 31–39, (In China CSSCI). [Google Scholar]

- Long, X.N.; Wan, W. Environmental Regulation, Corporate Profit Margins and Compliance Cost Heterogeneity of Different Scale Enterprises. China Ind. Econ. 2017, 6, 155–174, (In China CSSCI). [Google Scholar]

- Kang, Z.Y.; Tang, X.L.; Liu, X. Environmental Regulation, Enterprise Innovation and Export of Chinese Enterprises Retest Based on Porter Hypothesis. J. Int. Trade 2020, 2, 125–141, (In China CSSCI). [Google Scholar]

- Sharif, H. Panel Estimation for CO2 Emissions, Energy Consumption, Economic Growth, Trade Openness and Urbanization of Newly Industrialized Countries. Energy Policy 2011, 29, 6991–6999. [Google Scholar] [CrossRef]

- Melitz, M.J.; Ottaviano, G.I.P. Market Size, Trade, and Productivity. Rev. Econ. Stud. 2008, 75, 295–316. [Google Scholar] [CrossRef]

- Rocha, R.; Ulyssea, G.; Rachter, L. Do Lower Taxes Reduce Informality? Evidence from Brazil. J. Dev. Econ. 2018, 4, 134. [Google Scholar]

- Heckman, J.; Macurdy, T. A Life Cycle Model of Female Labor Supply. Rev. Econ. Stud. 1980, 47, 47–74. [Google Scholar] [CrossRef]

- Ramanathan, R.; Black, A.; Nath, P.; Muyldermans, L. Impact of Environmental Regulations on Innovation and Performance in the UK Industrial Sector. Manag. Decis. 2010, 48, 1493–1513. [Google Scholar] [CrossRef]

- Fan, Z.Y.; Wang, Q. The Inefficiency of Financial Subsidies: From the perspective of Tax Surplus. China Ind. Econ. 2019, 12, 23–41, (In China CSSCI). [Google Scholar]

- Richardson, S. Overinvestment of Free Cash Flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Berry, S.; Levinsohn, J.; Pakes, A. Differentiated Products Demand Systems from a Combination of Micro and Macro Data: The New Car Market. Political Econ. 2004, 112, 68–105. [Google Scholar] [CrossRef]

- Brandt, L.; Van Biesebroeck, J.; Zhang, Y. Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing. Dev. Econ. 2012, 97, 339–351. [Google Scholar] [CrossRef]

- Liu, X.; Li, S. Determinants of the Relative Efficiency of China’s Manufacturing Enterprises (2000–2004). China Econ. Q. 2008, 3, 843–868, (In China CSSCI). [Google Scholar]

- Scherer, F. Firm Size, Market Structure Opportunity and The Output of Patented. Am. Econ. Rev. 1965, 55, 1097–1125. [Google Scholar]

- Lind, J.; Mehlum, H. With or without U? The Appropriate Test for A U-Shaped Relationship. Oxf. Bull. Econ. Stat. 2010, 72, 109–118. [Google Scholar] [CrossRef]

- Peters, M.E. Heterogeneous Mark-Ups, Growth and Endogenous Misallocation. Econometrica 2020, 88, 2037–2073. [Google Scholar] [CrossRef]

- Midrifan, V.; Xu, D.Y. Finance and Misallocation: Evidence from Plant-Level Data. Am. Econ. Rev. 2014, 104, 422–458. [Google Scholar] [CrossRef]

- Melitz, M. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Hirano, K.; Imbens, G.W. The propensity score with continuous treatments. Appl. Bayesian Model. Causal Inference Incomplete-Data Perspect. 2004, 226164, 73–84. [Google Scholar]

| Variable Types | Variable Code | Variable Name | Explanation | Expected Symbol |

|---|---|---|---|---|

| Explained variable | Enterprise innovation | Pnovc,i,t | The ratio of new product sales revenue to the total product sales revenue. | |

| Explanatory variables | Environmental compliance index | Hc,i,t-1 | Calculated using the calculation equation in this research. See Equation (11) for details, and 1 period lag. | + |

| Control variables | Enterprise size | lnSizec,i,t-1 | The total fixed assets take logarithm, and 1 period lag. | + |

| Total factor productivity (TFP) | lnTfpc,i,t-1 | LP method is used to calculate, and 1 period lag. | + | |

| The age of operation | lnAgec,i,t-1 | The age of enterprise operation take logarithm, and 1 period lag. | + | |

| The number of employees | lnLc,i,t-1 | The number of employees in an enterprise takes the logarithm, and 1 period lag. | + | |

| Asset-labor ratio | lnKLc,i,t-1 | The ratio of assets to labor is logarithmic, and 1 period lag. | + | |

| Current ratio | Currentc,i,t-1 | The ratio of current assets to current liabilities, and 1 period lag. | +/− | |

| Financing constraints | Finc,i,t-1 | The ratio of interest expense to fixed asset net value, and 1 period lag. | + | |

| Subsidies income | lnSubsidyc,i,t-1 | The ratio of Subsidy income to sales income ratio, and 1 period lag. | + | |

| Export intensity | lnExportc,i,t-1 | Take the logarithm of export delivery value, and 1 period lag. | + |

| Labor-Intensive Industry | Capital-Intensive Industry | Technology-Intensive Industry |

|---|---|---|

| Agricultural and sideline food processing industry (13) Food manufacturing industry (14) Wine, beverage and refined tea manufacturing industry (15) Tobacco Products industry (16) Textile industry (17) Textile clothing, clothing industry (18) Leather, fur, feather and their products and footwear (19) Wood processing and wood, bamboo, rattan, palm, grass products industry (20) Furniture manufacturing (21) Paper and paper products industry (22) Printing and recording media reproduction industry (23) Culture and education, industrial beauty, sports and entertainment manufacturing (24) Rubber and plastic products (29) Other manufacturing industries (41) Comprehensive utilization of waste resources (42) | Petroleum processing, coking and nuclear fuel processing industries (25) Non-metallic mineral products industry (30) Ferrous metal smelting and calendering industry (31) Non-ferrous metal smelting and calendering industry (32) Metal products industry (33) General equipment manufacturing (34) Special equipment manufacturing (35) Manufacturing of railway, shipping, aerospace and other transportation equipment(37) Instrumentation and culture, office machinery manufacturing (40) | Manufacturing of chemical raw materials and chemical products (26) Pharmaceutical manufacturing (27) Chemical fiber manufacturing (28) Automobile manufacturing industry (36) Electrical machinery and equipment manufacturing (38) Manufacturing of computers, communications and other electronic equipment (39) |

| Variables | Observations | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Pnovc,i,t | 3,317,975 | 0.027 | 0.083 | 0 | 0.339 |

| Hc,i,t-1 | 2,586,771 | 0.736 | 0.342 | 0 | 1 |

| lnAgec,i,t-1 | 2,506,420 | 1.869 | 0.880 | 0 | 7.602 |

| lnSizec,i,t-1 | 2,574,927 | 8.695 | 1.708 | −0.095 | 18.94 |

| lnTfpc,i,t-1 | 2,563,855 | 8.154 | 1.033 | 2.957 | 16.54 |

| lnLc,i,t-1 | 2,585,580 | 4.930 | 1.108 | 0 | 12.29 |

| lnKLc,i,t-1 | 2,563,874 | 5.164 | 1.678 | −9.879 | 9.245 |

| Currentc,i,t-1 | 2,537,542 | 2.157 | 5.624 | 0.001 | 64.09 |

| Finc,i,t-1 | 2,486,844 | 0.066 | 0.167 | −0.056 | 1.633 |

| lnSubsidyc,i,t-1 | 2,255,394 | 0.787 | 2.070 | 0 | 15.39 |

| lnExportc,i,t-1 | 2,274,359 | 2.974 | 4.575 | 0 | 19.04 |

| Variable | Random-Effect Tobit Model | Double Hurdle | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | Willingness | Level | |

| Hc,i,t-1 | −0.114 *** | −0.119 *** | −0.103 *** | −0.104 *** | −0.122 *** | −0.128 *** | −1.448 *** | −0.194 *** |

| (0.001) | (0.001) | (0.000) | (0.000) | (0.001) | (0.001) | (0.025) | (0.008) | |

| Hc,i,t-12 | 0.109 *** | 0.113 *** | 0.091 *** | 0.096 *** | 1.251 *** | 0.145 *** | ||

| (0.001) | (0.001) | (0.001) | (0.001) | (0.021) | (0.006) | |||

| lnAgec,i,t-1 | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.144 *** | −0.001 | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.002) | (0.001) | |||

| lnSizec,i,t-1 | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | 0.043 *** | −0.006 *** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.001) | (0.000) | |||

| lnTfpc,i,t-1 | −0.004 *** | −0.004 *** | −0.004 *** | −0.004 *** | −0.088 *** | −0.002 *** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.0017) | (0.001) | |||

| lnLc,i,t-1 | 0.002 *** | 0.002 *** | 0.002 *** | 0.002 *** | 0.176 *** | 0.001 * | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.002) | (0.001) | |||

| lnKLc,i,t-1 | 0.011 *** | 0.011 *** | 0.011 *** | 0.011 *** | 0.100 *** | 0.012 *** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.001) | (0.000) | |||

| Currentc,i,t-1 | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | −0.005 *** | −0.000 ** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.000) | (≈0) | |||

| Finc,i,t-1 | −0.033 *** | −0.034 *** | −0.034 *** | −0.034 *** | 0.239* ** | −0.03 8*** | ||

| (0.000) | (0.000) | (0.000) | (0.000) | (0.009) | (0.003) | |||

| lnSubsidyc,i,t-1 | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.041 *** | 0.002 *** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.001) | (0.000) | |||

| lnExportc,i,t-1 | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.022 *** | 0.000 | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (0.000) | (≈0) | |||

| Constant | 0.011 *** | 0.020 *** | 0.013 *** | 0.021 *** | 0.016 *** | 0.024 *** | −2.459 *** | 0.224 *** |

| (0.000) | (0.000) | (0.001) | (0.001) | (0.001) | (0.001) | (0.0130) | (0.004) | |

| Industry characteristics | Control 1 | Control 2 | Control 1 | Control 2 | Control 1 | Control 2 | Control 1 | Control 2 |

| /sigma_u | 0.050 *** | 0.050 *** | 0.055 *** | 0.055 *** | 0.055 *** | 0.055 *** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | |||

| /sigma_e | 0.047 *** | 0.047 *** | 0.049 *** | 0.049 *** | 0.049 *** | 0.049 *** | ||

| (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | |||

| sigma | 0.151 *** | |||||||

| (0.0003) | ||||||||

| ρ | 0.534 | 0.532 | 0.558 | 0.556 | 0.558 | 0.555 | ||

| Log-L | 3,707,020.7 | 3,623,543.7 | 2,785,268.5 | 2,721,770.2 | 2,785,418.5 | 2,721,995.2 | 3,163,286.3 | 3,164,526.4 |

| Observations | 2,586,729 | 2,531,584 | 2,023,259 | 1,979,583 | 2,023,259 | 1,979,583 | 2,418,112 | 2,418,112 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| State-Owned | Non-State-Owned | Mature | Immature | Core Areas | Non-Core Areas | Export | Non-Export | |

| Hc,i,t-1 | −0.123 *** | −0.114 *** | −0.123 *** | −0.114 *** | −0.122 *** | −0.121 *** | −0.133 *** | −0.118 *** |

| (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | (0.003) | (0.002) | (0.001) | |

| Hc,i,t-12 | 0.117 *** | 0.112 *** | 0.117 *** | 0.112 *** | 0.117 *** | 0.116 *** | 0.123 *** | 0.116 *** |

| (0.001) | (0.002) | (0.001) | (0.002) | (0.001) | (0.002) | (0.002) | (0.001) | |

| Constant | 0.014 *** | −0.005 *** | 0.014 *** | −0.005 *** | 0.020 *** | 0.002 | 0.002 | 0.019 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.002) | (0.002) | (0.001) | |

| Control variables | Control | Control | Control | Control | Control | Control | Control | Control |

| Industry characteristics | Control 1 | Control 1 | Control 1 | Control 1 | Control 1 | Control 1 | Control 1 | Control 1 |

| sigma_u | 0.055 *** | 0.054 *** | 0.055 *** | 0.054 *** | 0.054 *** | 0.058 *** | 0.064 *** | 0.055 *** |

| (≈0) | (0.0001) | (≈0) | (0.000) | (≈0) | (0.000) | (0.000) | (≈0) | |

| sigma_e | 0.050 *** | 0.041 *** | 0.050 *** | 0.041 *** | 0.048 *** | 0.051 *** | 0.059 *** | 0.041 *** |

| (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | (≈0) | |

| ρ | 0.552 | 0.632 | 0.552 | 0.632 | 0.552 | 0.567 | 0.536 | 0.641 |

| Log-L | 2,082,950.3 | 684,766.71 | 2,082,950.3 | 684,766.71 | 2,173,377.8 | 615,479.08 | 744,259.07 | 1,963,919.6 |

| Observations | 1,535,020 | 488,239 | 1,535,020 | 488,239 | 1,560,682 | 462,577 | 621,838 | 1,323,456 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Random-Effect Tobit Model | Double Hurdle Model | Random-Effect Tobit Model | Random-Effect Tobit Model | GPSM | |

| Pnovc,i,t-1 | 0.564 *** | ||||

| (0.001) | |||||

| Hc,i,t-1 | −0.122 *** | −0.194 *** | −0.140 *** | −0.995 *** | |

| (0.001) | (0.008) | (0.001) | (0.022) | ||

| Hc,i,t-12 | 0.091*** | 0.145 *** | 0.10 5*** | 0.151 *** | |

| (0.001) | (0.006) | (0.001) | (0.019) | ||

| Pscorec,i,t-1 | −0.121 *** | ||||

| (0.001) | |||||

| Pscorec,i,t-12 | 0.118 *** | ||||

| (0.001) | |||||

| Constant | 0.224 *** | 0.224 *** | −0.016 *** | 0.361 *** | −0.005 *** |

| (0.004) | (0.004) | (0.000) | (0.016) | (0.001) | |

| Control variables | Control | Control | Control | Control | Control |

| Industry characteristics | Control 1 | Control 1 | Control 1 | Control 1 | Control 1 |

| /sigma_u | 0.055 *** | 0.0137 *** | 3.075 *** | 0.056 *** | |

| (≈0) | (0.000) | (0.003) | (≈0) | ||

| /sigma_e | 0.049 *** | 0.052 *** | 0.791 *** | 0.049 *** | |

| (≈0) | (≈0) | (0.000) | (≈0) | ||

| sigma | 0.151*** | ||||

| (0.0003) | |||||

| ρ | 0.558 | 0.065 | 0.940 | 0.492 | |

| Log-L | 2,785,418.5 | 3,164,526.4 | −3,511,470.2 | −3,443,592 | 1,894,004.5 |

| Observations | 2,023,259 | 2,418,112 | 2,023,259 | 1,991,203 | 1,389,267 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, M.; Liu, Y.; Zhao, Y. Environmental Compliance and Enterprise Innovation: Empirical Evidence from Chinese Manufacturing Enterprises. Int. J. Environ. Res. Public Health 2021, 18, 1924. https://doi.org/10.3390/ijerph18041924

Liu M, Liu Y, Zhao Y. Environmental Compliance and Enterprise Innovation: Empirical Evidence from Chinese Manufacturing Enterprises. International Journal of Environmental Research and Public Health. 2021; 18(4):1924. https://doi.org/10.3390/ijerph18041924

Chicago/Turabian StyleLiu, Meng, Yun Liu, and Yongliang Zhao. 2021. "Environmental Compliance and Enterprise Innovation: Empirical Evidence from Chinese Manufacturing Enterprises" International Journal of Environmental Research and Public Health 18, no. 4: 1924. https://doi.org/10.3390/ijerph18041924

APA StyleLiu, M., Liu, Y., & Zhao, Y. (2021). Environmental Compliance and Enterprise Innovation: Empirical Evidence from Chinese Manufacturing Enterprises. International Journal of Environmental Research and Public Health, 18(4), 1924. https://doi.org/10.3390/ijerph18041924