Revisiting the Existence of EKC Hypothesis under Different Degrees of Population Aging: Empirical Analysis of Panel Data from 140 Countries

Abstract

:1. Introduction

2. Literature Review

2.1. Research on the Relationship between Economic and Environmental Pressure

2.2. Research on the Relationship between GDP and Ecological Footprint

2.3. Summary of Literature

3. Materials and Methods

3.1. Variable Selection and Data Descriptive Analysis

- (1)

- Explained variable: The Ecological Footprint Index is an index used to measure the geographical area required for local biological production and human activities [41], which are provided by the dataset, in units of global hectares. Since this indicator takes into account multiple dimensions such as species diversity and ecological degradation, it is regarded as a reliable indicator for assessing the sustainable development of a region [42].

- (2)

- Explanatory variable: GDP per capita is an indicator that reflects the state of economic development from the perspective of social macroeconomic operation. This calculation did not deduct asset depreciation or natural resource depletion and degradation. The data of per capita GDP are selected from the World Bank, with constant 2010 US$ as the unit.

- (3)

- Threshold variable: Population aging (AG) is the percentage of the population aged 65 and over to the total population, which is selected from the World Bank, and the population is determined according to the actual population definition.

- (4)

- Control variable: Industrial value added (IND) reflects the net results obtained by social industrial enterprises after all social production activities, selected from the World Bank, with constant 2010 US$ as the unit. Urban population to total population (URB): the unit is % of total population. Trade (TR) reflects the degree to which a region’s commodities are opened to the outside world. The unit is % of GDP.

3.2. Construction of Threshold Regression Model

3.3. Threshold Regression of Panel Data

4. Empirical Study

4.1. Data Preprocessing

4.1.1. Descriptive Analysis

4.1.2. Unit Root Test

4.2. Cross-Sectional Dependence Analysis of 140 Countries

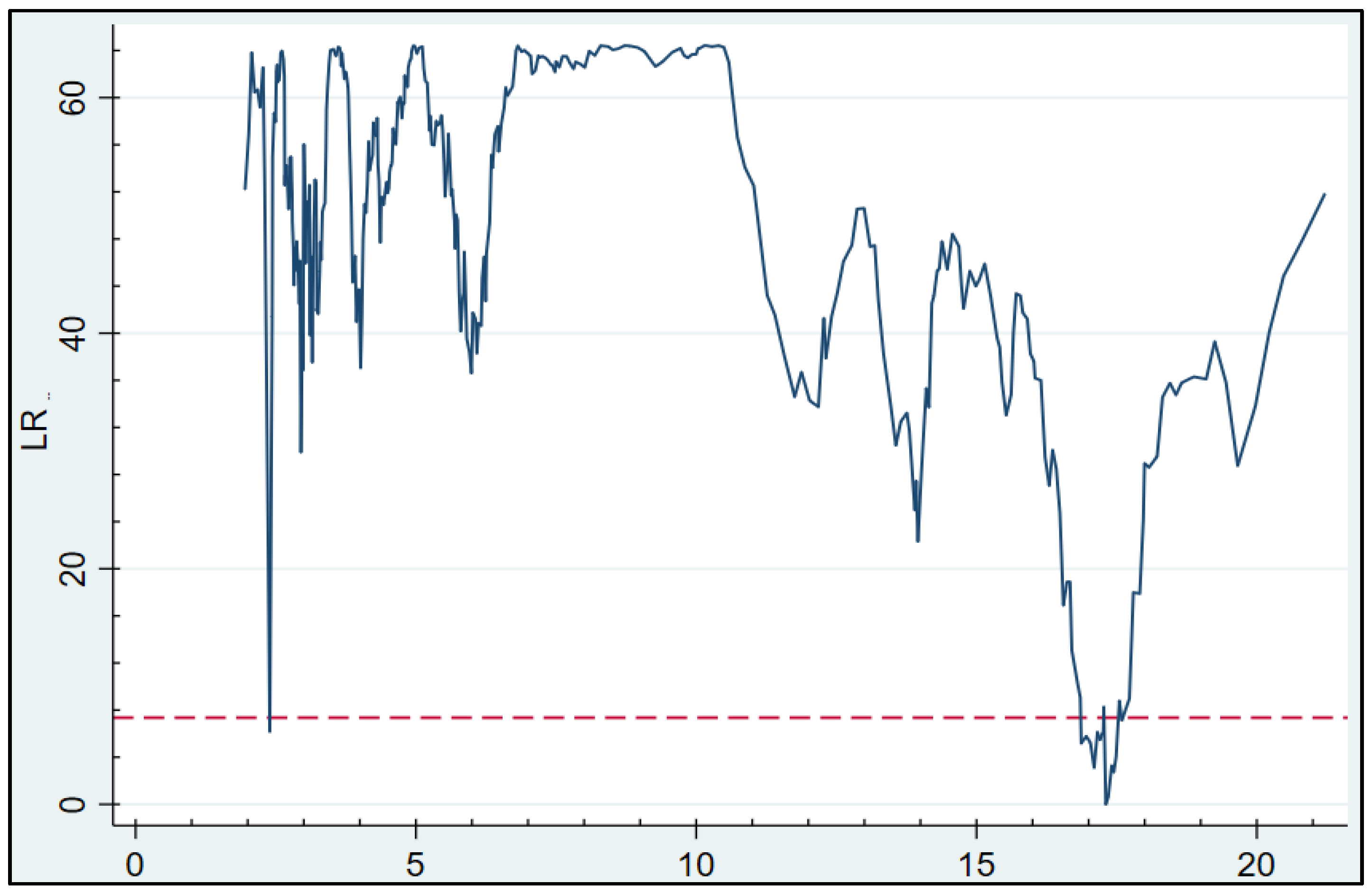

4.2.1. Threshold Effect Test

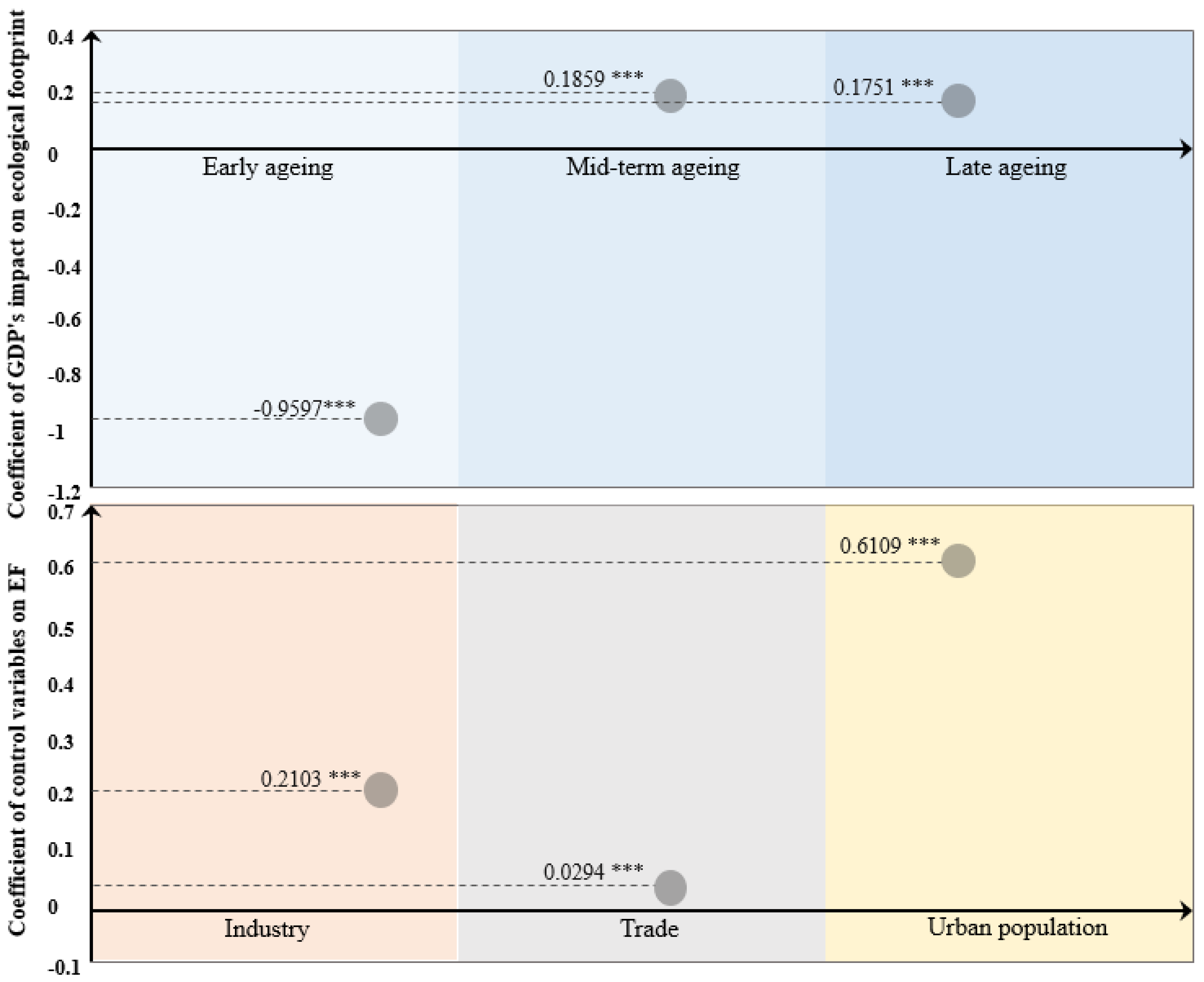

4.2.2. Threshold Panel Regression Results

4.3. Heterogeneity Analysis of Four Income Groups

4.3.1. Threshold Effect Test

4.3.2. Threshold Panel Regression Results

5. Results Discussion

5.1. Discussion of Global Panel Regression Results for 140 Countries

5.2. Discussion of Panel Regression Results by Different Income Groups

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| EKC | Environmental Kuznets Curve |

| R&D | Research and Development |

| LLC | Levin-Lin-Chu test |

| IPS | Im-Pesaran-Shin test |

| ARDL | Autoregressive distributed lagged model |

| CO2 | Carbon emissions |

| HI | High income group |

| UMI | Upper middle income group |

| BRICs | Brazil, Russia, India, China |

| EF | Ecological footprint |

| GDP | Gross Domestic Product |

| AG | Population Aging degree |

| IND | Industry value added |

| URB | Urban population |

| MT | Merchandise trade |

| LMI | Lower middle income |

| LI | Low income |

| G7 | Group of Seven |

Appendix A

| Income Group Category | Countries |

|---|---|

| High income | ARE; AUS; AUT; BEL; CHE; CHL; CYP; CZE; DEU; DNK; ESP; EST; FIN; FRA; GBR; GRC; HRV; HUN; IRL; ISR; ITA; JPN; LTU; LUX; LVA; MUS; NLD; NOR; NZL; PAN; POL; PRT; ROU; SAU; SGP; SVK; SVN; SWE; TTO; URY; USA |

| Upper-middle income | ALB; ARG; AZE; BGR; BLR; BRA; BWA; CHN; COL; CRI; CUB; DOM; ECU; FJI; GAB; GEO; GRD; GTM; GUY; IDN; IRN; IRQ; JAM; JOR; KAZ; LBN; LCA; MEX; MKD; MYS; PER; PRY; RUS; SUR; THA; TON; TUR; VEN; WSM; ZAF |

| Lower-middle income | AGO; BEN; BGD; BOL; BTN; CMR; COG; COM; CPV; DZA; EGY; HND; IND; KEN; KGZ; KHM; LAO; LKA; LSO; MAR; MDA; MMR; MNG; MRT; NGA; NIC; NPL; PAK; PHL; SEN; SLV; STP; SWZ; TLS; TUN; TZA; UKR; UZB; ZMB; ZWE |

| Low income | BDI; BFA; COD; ETH; GIN; GMB; GNB; HTI; MDG; MLI; MOZ; MWI; NER; RWA; SLE; TGO; TJK; UGA; YEM |

References

- United Nations. 2020 Protect the Earth Report. Available online: https://www.un.org/zh/property-cards-by-og-global-category/27326/13203 (accessed on 19 May 2021).

- Kaika, D.; Zervas, E. The Environmental Kuznets Curve (EKC) theory—Part A: Concept, causes and the CO2 emissions case. Energy Policy 2013, 62, 1392–1402. [Google Scholar] [CrossRef]

- United Nations. World Population Outlook. Available online: https://www.un.org/zh/ (accessed on 28 August 2019).

- Bloom, D.E.; Canning, D.; Fink, G. Population aging and economic growth. Glob. Growth 2010, 297, 1–38. [Google Scholar]

- Rowles, G.D. Aging in Rural Environments. In Elderly People and the Environment; Springer: New York, NY, USA, 1984; pp. 129–157. [Google Scholar]

- Vadén, T.; Lähde, V.; Majava, A.; Järvensivu, P.; Toivanen, T.; Hakala, E.; Eronen, J.T. Decoupling for ecological sustainability: A categorisation and review of research literature. Environ. Sci. Policy 2020, 112, 236–244. [Google Scholar] [CrossRef] [PubMed]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Apeaning, R.W. Technological constraints to energy-related carbon emissions and economic growth decoupling: A retrospective and prospective analysis. J. Clean. Prod. 2021, 291, 125706. [Google Scholar] [CrossRef]

- Dogan, E.; Ulucak, R.; Kocak, E.; Isik, C. The use of ecological footprint in estimating the environmental Kuznets curve hypothesis for BRICST by considering cross-section dependence and heterogeneity. Sci. Total Environ. 2020, 723, 138063. [Google Scholar] [CrossRef]

- Riti, J.S.; Song, D.; Shu, Y.; Kamah, M. Decoupling CO2 emission and economic growth in China: Is there consistency in estimation results in analyzing environmental Kuznets curve? J. Clean. Prod. 2017, 166, 1448–1461. [Google Scholar] [CrossRef]

- Jiang, J.-J.; Ye, B.; Zhou, N.; Zhang, X.-L. Decoupling analysis and environmental Kuznets curve modelling of provincial-level CO2 emissions and economic growth in China: A case study. J. Clean. Prod. 2019, 212, 1242–1255. [Google Scholar] [CrossRef]

- Gao, C.; Ge, H.; Lu, Y.; Wang, W.; Zhang, Y. Decoupling of provincial energy-related CO2 emissions from economic growth in China and its convergence from 1995 to 2017. J. Clean. Prod. 2021, 297, 126627. [Google Scholar] [CrossRef]

- Li, R.; Jiang, R. Investigating effect of R&D investment on decoupling environmental pressure from economic growth in the global top six carbon dioxide emitters. Sci. Total Environ. 2020, 740, 140053. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M. Drivers of decoupling economic growth from carbon emission—An empirical analysis of 192 countries using decoupling model and decomposition method. Environ. Impact Assess. Rev. 2020, 81, 106356. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. The effects of trade openness on decoupling carbon emissions from economic growth—Evidence from 182 countries. J. Clean. Prod. 2021, 279, 123838. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. Does increasing investment in research and development promote economic growth decoupling from carbon emission growth? An empirical analysis of BRICS countries. J. Clean. Prod. 2020, 252, 119853. [Google Scholar] [CrossRef]

- Neves, S.A.; Marques, A.C. The substitution of fossil fuels in the US transportation energy mix: Are emissions decoupling from economic growth? Res. Transp. Econ. 2021, 101036. [Google Scholar] [CrossRef]

- Sheng, P.; Li, J.; Zhai, M.; Majeed, M.U. Economic growth efficiency and carbon reduction efficiency in China: Coupling or decoupling. Energy Rep. 2021, 7, 289–299. [Google Scholar] [CrossRef]

- Sanyé-Mengual, E.; Secchi, M.; Corrado, S.; Beylot, A.; Sala, S. Assessing the decoupling of economic growth from environmental impacts in the European Union: A consumption-based approach. J. Clean. Prod. 2019, 236, 117535. [Google Scholar] [CrossRef]

- Siping, J.; Wendai, L.; Liu, M.; Xiangjun, Y.; Hongjuan, Y.; Yongming, C.; Haiyun, C.; Hayat, T.; Alsaedi, A.; Ahmad, B. Decoupling environmental pressures from economic growth based on emissions monetization: Case in Yunnan, China. J. Clean. Prod. 2019, 208, 1563–1576. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, M.; Yang, R.; Li, X.; Zhang, L.; Li, M. Decoupling water environment pressures from economic growth in the Yangtze River Economic Belt, China. Ecol. Indic. 2021, 122, 107314. [Google Scholar] [CrossRef]

- Yu, Y.; Zhou, L.; Zhou, W.; Ren, H.; Kharrazi, A.; Ma, T.; Zhu, B. Decoupling environmental pressure from economic growth on city level: The Case Study of Chongqing in China. Ecol. Indic. 2017, 75, 27–35. [Google Scholar] [CrossRef]

- Zhang, X.; Geng, Y.; Shao, S.; Song, X.; Fan, M.; Yang, L.; Song, J. Decoupling PM2.5 emissions and economic growth in China over 1998–2016: A regional investment perspective. Sci. Total Environ. 2020, 714, 136841. [Google Scholar] [CrossRef]

- Altıntaş, H.; Kassouri, Y. Is the environmental Kuznets Curve in Europe related to the per-capita ecological footprint or CO2 emissions? Ecol. Indic. 2020, 113, 106187. [Google Scholar] [CrossRef]

- Chen, Y.; Lu, H.; Yan, P.; Yang, Y.; Li, J.; Xia, J. Analysis of water–carbon–ecological footprints and resource–environment pressure in the Triangle of Central China. Ecol. Indic. 2021, 125, 107448. [Google Scholar] [CrossRef]

- Mrabet, Z.; Alsamara, M. Testing the Kuznets Curve hypothesis for Qatar: A comparison between carbon dioxide and ecological footprint. Renew. Sustain. Energy Rev. 2017, 70, 1366–1375. [Google Scholar] [CrossRef]

- Pata, U.K. Linking renewable energy, globalization, agriculture, CO2 emissions and ecological footprint in BRIC countries: A sustainability perspective. Renew. Energy 2021, 173, 197–208. [Google Scholar] [CrossRef]

- Alvarado, R.; Ortiz, C.; Jiménez, N.; Ochoa-Jiménez, D.; Tillaguango, B. Ecological footprint, air quality and research and development: The role of agriculture and international trade. J. Clean. Prod. 2021, 288, 125589. [Google Scholar] [CrossRef]

- Sarkodie, S.A. Environmental performance, biocapacity, carbon & ecological footprint of nations: Drivers, trends and mitigation options. Sci. Total Environ. 2021, 751, 141912. [Google Scholar] [CrossRef]

- Usman, M.; Makhdum, M.S.A.; Kousar, R. Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustain. Cities Soc. 2021, 65, 102590. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Umar, M.; Khan, Z.; Muhammad, S. The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resour. Policy 2020, 69, 101817. [Google Scholar] [CrossRef]

- Charfeddine, L. The impact of energy consumption and economic development on Ecological Footprint and CO2 emissions: Evidence from a Markov Switching Equilibrium Correction Model. Energy Econ. 2017, 65, 355–374. [Google Scholar] [CrossRef]

- Wang, X. Determinants of ecological and carbon footprints to assess the framework of environmental sustainability in BRICS countries: A panel ARDL and causality estimation model. Environ. Res. 2021, 197, 111111. [Google Scholar] [CrossRef]

- Charfeddine, L.; Mrabet, Z. The impact of economic development and social-political factors on ecological footprint: A panel data analysis for 15 MENA countries. Renew. Sustain. Energy Rev. 2017, 76, 138–154. [Google Scholar] [CrossRef]

- Yao, X.; Yasmeen, R.; Hussain, J.; Hassan Shah, W.U. The repercussions of financial development and corruption on energy efficiency and ecological footprint: Evidence from BRICS and next 11 countries. Energy 2021, 223, 120063. [Google Scholar] [CrossRef]

- Ahmed, Z.; Zhang, B.; Cary, M. Linking economic globalization, economic growth, financial development, and ecological footprint: Evidence from symmetric and asymmetric ARDL. Ecol. Indic. 2021, 121, 107060. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Murshed, M.; Shehzad, K.; Akram, R.; Cui, L.; Khan, Z. Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: Does financial globalization matter? Sustain. Cities Soc. 2021, 70, 102881. [Google Scholar] [CrossRef]

- Wang, Q.; Guo, J.; Li, R. Official development assistance and carbon emissions of recipient countries: A dynamic panel threshold analysis for low- and lower-middle-income countries. Sustain. Prod. Consum. 2022, 29, 158–170. [Google Scholar] [CrossRef]

- Data.world. National Footprint Accounts 2016 Edition. Available online: https://data.world/footprint/nfa-2016-edition (accessed on 17 September 2016).

- The World Bank. World Bank Open Data. Available online: https://data.worldbank.org.cn/ (accessed on 19 March 2021).

- Wackernagel, M.; Rees, W. Our Ecological Footprint: Reducing Human Impact on the Earth. Available online: https://escholarship.org/uc/item/7730w81q (accessed on 19 May 2021).

- Lenzen, M.; Murray, S.A.J. A modified ecological footprint method and its application to Australia. Ecol. Econ. 2004, 37, 229–255. [Google Scholar] [CrossRef]

- Ekeocha, D.O. Urbanization, inequality, economic development and ecological footprint: Searching for turning points and regional homogeneity in Africa. J. Clean. Prod. 2021, 291, 125244. [Google Scholar] [CrossRef]

- Chan, K.S. Consistency and Limiting Distribution of the Least Squares Estimator of a Threshold Autoregressive Model. Ann. Stat. 1993, 21, 520–533. [Google Scholar] [CrossRef]

- Seo, M.H.; Linton, O. A smoothed least squares estimator for threshold regression models. J. Econom. 2007, 141, 704–735. [Google Scholar] [CrossRef] [Green Version]

- Huang, B.N.; Hwang, M.J.; Yang, C.W. Does more energy consumption bolster economic growth? An application of the nonlinear threshold regression model. Energy Policy 2008, 36, 755–767. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effects in Non-Dynamic Panels: Estimation, Testing, and Inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Pinheiro, P.; Silva, J.M.A.e.; Centeno, M.d.L. Bootstrap Methodology in Claim Reserving. J. Risk Insur. 2010, 70, 701–714. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, X.; Li, R. Does urbanization redefine the environmental Kuznets curve? An empirical analysis of 134 Countries. Sustain. Cities Soc. 2022, 76, 103382. [Google Scholar] [CrossRef]

- Leal, P.H.; Marques, A.C. Rediscovering the EKC hypothesis for the 20 highest CO2 emitters among OECD countries by level of globalization. Int. Econ. 2020, 164, 36–47. [Google Scholar] [CrossRef]

- Al-mulali, U.; Weng-Wai, C.; Sheau-Ting, L.; Mohammed, A.H. Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 2015, 48, 315–323. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Abbreviation | Data Sources |

|---|---|---|---|

| Explained variable | Ecological footprint | EF | Data.world |

| Explanatory variable | GDP per capita | GDP | World Bank |

| Threshold variable | Aging degree | AG | World Bank |

| Control variable | Industry value added | IND | World Bank |

| Urban population | URB | World Bank | |

| Merchandise trade | MT | World Bank |

| Variables | Mean | Sd | Min | Median | Max |

|---|---|---|---|---|---|

| LN_EF | 16.9886 | 1.7928 | 12.0760 | 16.9489 | 22.3834 |

| AG | 7.8836 | 5.3988 | 0.6856 | 5.6422 | 26.0193 |

| LN_GDP | 8.3932 | 1.4879 | 5.2723 | 8.3318 | 11.6260 |

| LN_IND | 23.1171 | 2.4106 | 16.6347 | 22.9901 | 29.0568 |

| LN_TR | 4.0313 | 0.5163 | 2.0549 | 4.0160 | 5.8391 |

| LN_URB | 3.9067 | 0.4934 | 2.1097 | 4.0388 | 4.6052 |

| Correlation | LN_GDP | LN_IND | LN_TR | LN_URB |

|---|---|---|---|---|

| LN_GDP | / | 0.624787 | 0.272504 | 0.657178 |

| LN_IND | 0.624787 | / | 0.000737 | 0.580836 |

| LN_TR | 0.272504 | 0.000737 | / | 0.223213 |

| LN_URB | 0.657178 | 0.580836 | 0.223213 | / |

| Variable | At Level | At 1st Difference | At 2nd Difference | ||||||

|---|---|---|---|---|---|---|---|---|---|

| t-Statistic | Prob. | Stability | t-Statistic | Prob. | Stability | t-Statistic | Prob. | Stability | |

| LN_EF | 471.754 | 0.000 | YES | 1544.46 | 0.000 | YES | 2387.88 | 0.000 | YES |

| AG | 134.939 | 1.000 | NO | 209.403 | 0.999 | NO | 746.274 | 0.000 | YES |

| LN_GDP | 275.842 | 0.559 | YES | 803.140 | 0.000 | YES | 1982.65 | 0.000 | YES |

| LN_IND | 275.807 | 0.559 | NO | 1034.93 | 0.000 | YES | 2180.68 | 0.000 | YES |

| LN_TR | 373.144 | 0.000 | YES | 1411.88 | 0.000 | YES | 2467.75 | 0.000 | YES |

| LN_URB | 590.928 | 0.000 | YES | 875.738 | 0.000 | YES | 1101.56 | 0.000 | YES |

| Threshold Variables | Threshold Number | F-Value | p-Value | Bootstrap Number | Critical Value | ||

|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | |||||

| AG | Single | 76.061 *** | 0.010 | 500 | 75.443 | 41.485 | 19.339 |

| Double | 64.417 *** | 0.000 | 500 | 40.302 | 24.598 | 15.402 | |

| Triple | 60.191 ** | 0.013 | 300 | 67.590 | 33.978 | 19.603 | |

| Variables | Fixed Effect Model | Threshold Model |

|---|---|---|

| AG | ||

| LN_GDP | 0.0499 (0.106) | −0.9597 *** (q ≤ 1.871) (0.000) |

| 0.1859 *** (1.871 < q < 17.593) (0.000) | ||

| 0.1751 *** (q ≥ 17.593) (0.000) | ||

| LN_IND | 0.2889 *** (0.000) | 0.2103 *** (0.000) |

| LN_TR | 0.0227(0.101) | 0.0294 *** (0.030) |

| LN_URB | 0.6241 *** (0.000) | 0.6109 *** (0.000) |

| Constant | 7.3594 *** (0.000) | 8.1572 *** (0.000) |

| R-squared within | 0.4566 | 0.4891 |

| R-squared between | 0.6296 | 0.2082 |

| R-squared overall | 0.6276 | 0.2097 |

| F-test | 287.86 | 304.04 |

| Prob > F | 0.0000 | 0.0000 |

| Number of observations | 2240 | 2240 |

| Number of groups | 140 | 140 |

| Group | Threshold Variables | Threshold Number | F-Value | p-Value | Bootstrap Number | Critical Value | ||

|---|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||||

| HI | AG | Single | 38.730 *** | 0.006 | 500 | 34.464 | 19.816 | 13.886 |

| Double | 84.204 *** | 0.000 | 500 | 28.882 | 6.237 | −6.719 | ||

| Triple | 40.707 *** | 0.000 | 300 | 29.892 | 19.560 | 14.136 | ||

| UMI | AG | Single | 17.587 | 0.118 | 500 | 49.714 | 29.062 | 19.470 |

| Double | 17.621 * | 0.082 | 500 | 64.367 | 25.424 | 14.482 | ||

| Triple | 12.950 | 0.163 | 300 | 34.740 | 25.259 | 17.751 | ||

| LMI | AG | Single | 115.386 *** | 0.000 | 500 | 100.894 | 35.747 | 25.009 |

| Double | 37.176 ** | 0.018 | 500 | 41.387 | 25.704 | 18.641 | ||

| Triple | 23.432 * | 0.070 | 300 | 45.436 | 31.898 | 20.665 | ||

| LI | AG | Single | 44.610 *** | 0.000 | 500 | 38.670 | 21.882 | 15.278 |

| Double | 44.828 *** | 0.010 | 500 | 45.100 | 25.714 | 18.335 | ||

| Triple | 15.142 * | 0.097 | 300 | 33.401 | 21.971 | 15.105 | ||

| Variable | Regression Coefficients and Significance Levels | |||

|---|---|---|---|---|

| HI | UMI | LMI | LI | |

| LN_GDP | −1.0009 *** (q ≤ 2.937) (0.000) | 0.1032 (q ≤ 3.837) (0.205) | 0.4263 *** (q ≤ 2.432) (0.000) | 0.2887 *** (q ≤ 2.138) (0.000) |

| 3.3680 *** (2.937 < q < 3.021) (0.000) | 0.0810 (3.837 < q < 6.111) (0.319) | 0.3619 *** (2.432 < q < 4.388) (0.000) | 0.3347 *** (2.138 < q < 2.461) (0.000) | |

| −0.1121 * (q ≥ 3.021) (0.099) | 0.0908 (q ≥ 6.111) (0.263) | 0.3457 *** (q ≥ 4.388) (0.000) | 0.3669 *** (q ≥ 2.461) (0.000) | |

| LN_IND | 0.3999 *** (0.000) | 0.2815 *** (0.000) | 0.0658 ** (0.028) | 0.0647 *** (0.098) |

| LN_TR | 0.0152 (0.584) | −0.0900 *** (0.002) | 0.1480 *** (0.000) | 0.0833 *** (0.000) |

| LN_URB | −1.0608 *** (0.000) | 0.5114 *** (0.000) | 0.7806 *** (0.000) | 1.1213 *** (0.000) |

| Constant | 12.7952 *** (0.000) | 7.9065 *** (0.000) | 9.1302 *** (0.000) | 8.5953 *** (0.000) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, S.; Li, R. Revisiting the Existence of EKC Hypothesis under Different Degrees of Population Aging: Empirical Analysis of Panel Data from 140 Countries. Int. J. Environ. Res. Public Health 2021, 18, 12753. https://doi.org/10.3390/ijerph182312753

Li S, Li R. Revisiting the Existence of EKC Hypothesis under Different Degrees of Population Aging: Empirical Analysis of Panel Data from 140 Countries. International Journal of Environmental Research and Public Health. 2021; 18(23):12753. https://doi.org/10.3390/ijerph182312753

Chicago/Turabian StyleLi, Shuyu, and Rongrong Li. 2021. "Revisiting the Existence of EKC Hypothesis under Different Degrees of Population Aging: Empirical Analysis of Panel Data from 140 Countries" International Journal of Environmental Research and Public Health 18, no. 23: 12753. https://doi.org/10.3390/ijerph182312753

APA StyleLi, S., & Li, R. (2021). Revisiting the Existence of EKC Hypothesis under Different Degrees of Population Aging: Empirical Analysis of Panel Data from 140 Countries. International Journal of Environmental Research and Public Health, 18(23), 12753. https://doi.org/10.3390/ijerph182312753